Research Article: 2021 Vol: 25 Issue: 1

Adoption of Contactless Payments during Covid 19 Pandemic An Integration of Protection Motivation Theory (PMT) and Unified Theory of Acceptance and Use of Technology (UTAUT)

Chetan Srivastava, Associate Professor, School of Management Studies, University of Hyderabad, India

G. Mahendar, Madanapalle Institute of Technology and Science, Andhra Pradesh, India

Vishnu Vandana, School of Business Management, Anurag University, Hyderabad, India

Abstract

Understanding individual’s perceived threat and coping behaviour are critical components in the adoption of new technologies. Contactless payment services have witnessed a rapid surge and have become the new norm to avoid health/life threat during the COVID-19 pandemic scenario. However, there has been little attention on the adoption of contactless payments. The purpose of the research is to understand the antecedents of contactless payment services adoption based on the dimensions of protection motivation theory (PMT) and unified theory of acceptance and use of technology (UTAUT). The research model was tested empirically among 387 Indian users of contactless payment services during the pandemic. The results revealed that threat appraisal (perceived vulnerability and perceived susceptibility) as well as coping appraisal (self-efficacy and response efficacy) demonstrated positive effect on intention to use contactless payments. Moreover, both trust and effort expectancy significantly influenced the behavioural intention towards contactless payment services. The study provides theoretical and practical insights to enrich the understanding of the consumer shift towards contactless payment services during COVID-19 pandemic.

Keywords

Contactless payment services, COVID-19 pandemic, Protection motivation theory, Unified theory of acceptance and use of technology.

Introduction

WHO (World Health Organisation) declared COVID-19 as international health emergency on January 30, 2020 (Sohrabi et al., 2020). The current pandemic posed a severe life threat to people life never before in the history of humankind. It spreads through physical contact of the affected person (Liu et al., 2020) and from objects through fomites (World Health Organization, 2020). It has created devastating effect and havoc on people’s life style and on global economy. People are forced to alter their lifestyle due to the threat of pandemic transmission. One of the most effective preventive measures is to avoid physical contact and to maintain social distance (World Health Organization report 70, 2020) leading to drastic behavioural changes in individuals. Initiatives taken across the world by the State and other voluntary organizations to inculcate social distancing habits among the people.

Contactless payments are the revolutionary technologies altering the consumer payment options in the current digital and COVID era. It’s the non-cash payment technology for future years (Turban et al., 2018). Broadly, majority of the digital payments are under the umbrella of contactless payments. These payment services enable the users to make payment without physical contact requirement either with currency or with payment point (Paysafe Insights, 2020; Alliance, 2007). Contactless payments comprise proximity cards based on near field communication (NFC) technology (Henry et al., 2015), QR codes (Jenkins & Ophoff, 2016), mobile application-based payments such as Apple pay, Google pay (Julia Kagan, 2020).

Technology acceptance model has been predominantly employed to capture the adoption of various technologies. Research has been done on the adoption and usage of contactless payment services. For instance, Jenkins & Ophoff (2016) and Cocosila & Trabelsi (2016) employed TAM to study influences on adoption of NFC based mobile payments. Further, recently Wang & Lin (2019) studied the adoption intention of contactless cards with the support of TAM in Taiwan. The current research integrates two well accepted theories i.e. protection motivation theory (PMT) and unified theory of acceptance and use of technology (UTAUT). PMT is employed in the current study as in the current COVID context, adoption of contactless payment services is triggered by perceived health threat. Research proves that individuals exhibit certain behaviour and adopt/ avoid certain goods or services when they face health threats in case of anti-spyware software (Liang & Xue, 2010), mobile health services (Lv et al., 2012), healthcare wearable devices (Wang et al., 2015). Accordingly, the constructs adopted from PMT namely, perceived vulnerability, perceived severity, self- efficacy and response efficacy which found to be apt to study the intention of contactless payment services in the current pandemic scenario. Hence, self-efficacy and response efficacy the coping mechanism enables the users to avoid physical contact when they use contactless payment mechanism during the pandemic period. In addition, unified theory of acceptance and use of technology has been extensively validated research theory in the adoption of various information systems such as near field communication technology in smartphone (Chen & Chang, 2013), smart watch (Wu et al., 2016), online shopping (Celik, 2016), mobile banking (Alalwanet al., 2017). The study includes effort expectancy and social influence from UTAUT to evaluate individual’s adoption of contactless payment services. The study also included the construct trust as it is a critical factor in the payment services (Alalwan et al., 2017). The current study was performed in the context of COVID-19 pandemic with respect to the adoption of contactless payment services, hence the blend of PMT and UTAUT derived from TAM presumed to be a suitable framework to study the adoption of contactless payment services. Research on the adoption of contactless payments during the COVID context is scarce. Therefore, the present study performed with the objective to examine the factors affecting the adoption of contactless payment services during the COVID-19 pandemic era.

The study provides contribution in the area of contactless payment services. It studies the usage of contactless payment services from health protection perspective by incorporating a key influential factor perceived health threat (perceived vulnerability and perceived severity). It also integrates two well-established models – PMT and UTAUT – to examine the user adoption of contactless payment services. The remainder of the paper is structured as follows: the next section throws light on theoretical foundations of the study, later it discusses the research model and hypotheses development. Further the study deals with data analysis and discussion. Finally, it provides implications and conclusion of the study (APPENDIX A).

Contactless Payments During COVID-19 Pandemic

The contactless payments are one of the preferred alternatives in the present COVID- 19 pandemic situation primarily because of their convenience and contactless nature so as to avoid virus transmission. These payment services enable the users to make payment without physical contact requirement either with currency or with payment point (Paysafe Insights, 2020; Alliance, 2007). The usage of mobile devices allow two types of contactless payments approaches – remote payments and proximity payments (Chen & Lee, 2008). Remote payment approach enables the users to pay the amount from anywhere and anytime using SMS based, WAP/Internet based mobile payments. Whereas proximity mobile payment or contactless mobile payments is similar to near field communication technology (NFC) (Chen & Lee, 2008) enables the user to pay the small amounts by just tapping or waving the mobile in front of the point of sale terminal upto a distance of around 20 cm thus avoiding any contact with the point of sale transactions (Liu et al., 2013). It is relatively faster and convenient compared to other swiping and internet banking (Hayashi, 2012). The provision of these contactless payment options increases the perceived security of the consumers today and also results in a convenient and fast check out and is expected to experience a huge growth and considered “future of mobile payment services” (Ondrus & Pigneur, 2007).

There is a rapid surge in the adoption of contactless payments in the last few months. Preference for contactless payment platforms is increasing among both consumer and merchants in the present COVID scenario. With the emphasis currently on safety and social distance, enabling contactless payments will be a significant factor to influence behavioural intention of adopting mobile payments. Nearly 42% Indians spiked the usage of digital payment options during lockdown (PTI, April, 2020) which shows a strong interest among the users to adoption these services.

Theoretical Background of the Study

Unified Theory of Acceptance and Use of Technology

Unified theory of acceptance and use of technology (UTAUT) propounded by Venkatesth et al. (2003) is one of the widely accepted models to explain an individual’s usage behaviour towards a specific technology. This model is an amalgamation of eight behavioural research models, these include, technology acceptance model (TAM), the theory of reasoned action, the theory of planned behaviour, the motivational theory, the theory of personal computer utilization, theory of diffusion innovation, the combined technology acceptance model and theory of planned behaviour and social cognition theory (Oshlyansky et al., 2007). According to UTAUT, an individual’s intention to accept/use a technology is influenced by performance expectancy, effort expectancy, social influence and facilitating conditions, in turn, behavioural intention affects actual behaviour. These dimensions have a direct relationship with the behavioural intention of technology acceptance and usage.

UTAUT has been extensively applied and validated in various contexts such as Near field communication technology in smartphone (Chen & Chang, 2013), smart watch (Wu et al., 2016), online shopping (Celik, 2016), mobile banking (Alalwan et al., 2017). UTAUT has predicted almost 70% variance in individuals’ behaviour (Min et al., 2008). The present research found UTAUT as a suitable framework to examine the various factors affecting individual’s usage intention of contactless payment services during the COVID-19 period. ‘Performance expectancy’ is excluded in the study, as it is synonymous to response efficacy of protection motivation theory. The construct facilitating conditions is excluded as it is close to the construct self-efficacy of protection motivation theory.

Protection Motivation Theory

Protection motivation theory (PMT) posited by Rogers, (1975) has been a suitable framework to study the individuals social and health behaviour (Siponen et al., 2014). Protection motivation theory encompasses two dimensions: threat appraisal and coping appraisal (Rippetoe & Rogers, 1987). In other words, individuals’ protection motivation behaviour from the perceived threat is influenced by threat appraisal and coping appraisal. Threat appraisal consists of perceived vulnerability and perceived severity. Coping appraisal is the synthesis of response efficacy and self-efficacy to cope with the perceived threat (Rogers, 1975). Protection motivation theory has been widely employed and validated to assess an individual’s protective behaviour in various contexts such as online harassment (Lwin et al., 2012); anti-spyware software (Liang & Xue, 2010); healthcare systems (Chen, & Lee, 2008); mobile health services (Lv et al., 2012).The present research incorporated perceived vulnerability, perceived severity, response efficacy and self-efficacy to examine an individual’s protective behaviour in the usage of contactless payment services during COVID-19. For instance, during the COVID-19 period a person believes that physical contact may affect his/her health seriously and likely to avoid or intend to practice a specific behaviour.

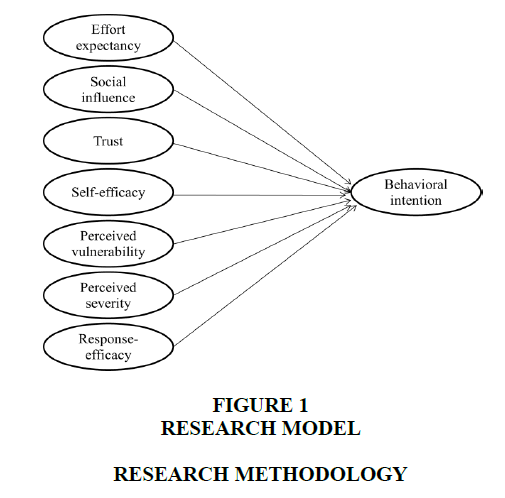

Our research model is an integration of protection motivation theory and unified theory of acceptance and use of technology to study the various factors affecting individuals to adopt contactless payment services in order to avoid perceived health threat from the COVID-19. The research model is presented in Figure 1.

Hypotheses Development

Effort Expectancy

Effort expectancy (EE) is defined as ‘‘the degree of ease associated with the use of the system’’ (Venkatesh et al., 2003) and is akin to ease of use as per TAM (Davis, 1989). Effort expectancy is identified as an important determinant to behaviour intention in the UTAUT model. Several studies have studied the positive relationship between ease of use and intention to adopt a service (Koo & Choi, 2010; Alalwan et al., 2016; Karjaluoto et al., 2010). Venkatesh & Zhang (2010) observed the relationship between effort expectancy to indirectly influence performance expectancy leading to influence behavioural intention. Effort expectancy is described to be dependent on experience of the user, ease of learning facility in new system and impact of disability. Kijsanayotin et al. (2009) predicted that effort expectancy is a major factor in use of health information technology, Venkatesh et al., (2003) stated that though effort expectancy influences adoption at early stages, its impact reduces over a continued usage. Therefore, we hypothesize that,

H1: Effort expectancy has a positive effect on individuals’ intention to adopt contactless payment services during COVID-19.

Social Influence

Social influence is defined as “the degree to which an individual perceives that important others believe he or she should use the new system” (Venkatesh et al., 2003). The social influence concept is analogous to the influence exerted on the individual behaviour by subjective norms, desired image in the society and one's reference groups etc. (Thompson et al., 1991). Earlier researches observed the influence of social influence on behaviour intention in various situations including mobile banking and payment (Zhou et al., 2010, Govender & Sihlali, 2014), online banking channels (Karjaluoto et al., 2010), health care technology (Slade et al., 2013), web-based learning (Chiu & Wang, 2008), ICT (Gupta et al., 2008) high tech innovations (Kulviwat et al., 2009). It was observed that peer influence was significant factor in impacting usage of health technology for all age groups (Slade et al., 2013). Venkatesh et al. (2003) ascertained that social influence is one of are the main factors determining user adoption whereas Gu et al. (2009), Govender & Sihlali, (2014) identified that it has not much effect on user adoption of mobile application usage and banking. Social influence is experienced through compliance towards others perception, internalization, and identification (Warshaw, 1980). The enhanced positive impact of social influence in influencing behavioural intention is studied in TAM2 and UTAUT theories (Venkatesh et al., 2003, 2012).

H2: Social influence has a positive effect on individuals’ intention to adopt contactless payment services during COVID-19.

Trust

Trust is defined as

“Individual’s willingness to accept vulnerability on the grounds of positive expectations about the intentions or behaviour of another in a situation characterized by interdependence and risk” (Ennew & Sekhon, 2007).

Trust is a complex concept and is described as views about ability, benevolence and integrity of another party (Ridings et al., 2002). Lee & Choi (2017) studied about various factors inducing trust. Trust is a belief that products match user expectations and creates a feeling of safety and security. This feeling of security impacts the behavioural intention (Siau & Shen, 2003). In a study done on chatbots it is observed that ability, reliability, social presence and informativeness influenced trust which further impacted the user buying intention (Yen & Chiang, 2020). An indication of trust having a well-founded relationship with purchase behaviour is found in online environment (Jarvenpaa et al., 2000, Lee & Turban 2001) and technology adoption (Venkatesh et al., 2012). Uncertainty prevailing in the present pandemic situations effect perceived risk which can be reduced by trust in the service (Zhou, 2012). Studies have ascertained that trust is determining factor in building relations under uncertainty (Pavlou & Gefen, 2004). In the present uncertain conditions due to the pandemic, we believe trust in the services acts as a determining factor towards behavioural intention of the user. Therefore, we hypothesize that,

H3: Trust has a positive effect on individuals’ intention to adopt contactless payment services during COVID-19.

Self-Efficacy

Self-efficacy measures the ability to use technology to accomplish a task (Venkatesh et al., 2003). In this research, self-efficacy is the measurement of an individual's assessment of his/her ability to use a mobile banking application. Self-efficacy affects perceived behavioural control, rather than having an impact on behavioural intention to adopt mobile banking (Yu, 2014). Furthermore, self-efficacy indirectly influences internet banking adoption (Chan, 2004). In some studies, self-efficacy was found to exert direct influence on mobile banking adoption (Dasgupta et al., 2011; Luarn & Lin, 2005). Self-efficacy is deemed to be an influential determinant in mobile banking adoption in Bangkok, in conjunction with subjective norms and perceived usefulness (Sripalawat et al., 2011). Self-efficacy in mobile banking application has an indirect effect on mobile banking intention, as it is mediated by hedonic motivation (enjoyment). Basoglu et al. (2017) investigated usefulness, ease of use, involvement, self-efficacy, risk-task characteristics, anxiety and enjoyment the adoption factors of smart glasses. Further, the study by Potnis et al. (2017) explored that facilitating conditions, effort expectancy, social influence and trusting beliefs are the main drivers of intention to use wearable devices). Several studies have demonstrated that technology self- efficacy plays a key role in the acceptance and usage of technology (Hsu et al., 2004; Ifinedo, 2006). A study by Schaper & Pervan (2007), in which the technology self-efficacy construct exhibited a higher level of significance in respect of intention to use innovations by their respondents.

H4: Self-efficacy has a positive effect on individuals’ intention to adopt contactless payment services during COVID-19.

Perceived Vulnerability and Perceived Severity

Threat, a multidimensional concept derived from theory of protection motivation posited by (Rogers, 1975) causes changes in individual’s behaviour (Neuberg et al., 2011). Perceived severity of the threat and perceived vulnerability towards a threat combinely determine individuals’ perceived threat towards objects or technologies. Perceived severity refers “to the degree of physical harm that may arise from unhealthy behaviour (Rogers, 1975).” Further it is explained as the

“The degree of physical harm, psychological harm, social threats, economic harm, dangers to others rather than oneself, and even threats to other species (Rogers & Prentice-Dunn, 1997).”

While perceived vulnerability is “the assessment of the likelihood that individuals will encounter a threat to their health (Rogers, 1975).” In addition, it is conceptualised as

“The conditional probability that the threatening event will occur provided that no adaptive behaviour is performed or there is no modification of an existing behavioural disposition (Rogers and Prentice-Dunn, 1997).”

Individuals who perceive the severity of the threat and being susceptible to the threat likely to avoid or intend to exhibit certain behaviour towards objects or information systems (Sunet al., 2013; Prentice-Dunn & Rogers, 1986). Perceived vulnerability and severity haves exerted a positive influence on intention to use in case of anti-spyware software (Liang & Xue, 2010), mobile health services (Lv et al., 2012), healthcare wearable devices (Wang et al., 2015), cyber security (Carpenter et al., 2019). In the present research individuals expected to adopt contactless payments due to the health threat posed by COVID-19. Hence, we hypothesize that,

H5: Perceived vulnerability has a positive effect on individuals’ intention to adopt contactless payment services during COVID-19.

H6: Perceived severity has a positive effect on individuals’ intention to adopt contactless payment services during COVID-19.

Response Efficacy

Response efficacy refers to the beliefs that a recommended response will effectively protect a user from a threat (Rogers, 1975). It is the individuals’ belief that that the adoption of a response measure may protect them from undesirable threat (Rogers & Prentice-Dunn, 1997). People consider any safeguarding measure based on how effectively it counters the perceived threat and protects them (Bandura, 1982), and are motivated to such safeguard practices (Ng et al., 2009). In the context of current research, individuals likely to adopt contactless payments to avoid physical contact with other people or objects that may substantially reduce the COVID health/ life threat. Previous research revealed a significant relationship between response efficacy and intention regarding, healthcare information systems (Chen & Lee, 2008), wearable technology devices (Sergueeva & Shaw, 2017; Wang et al., 2015), online harassment (Lwin, 2012), cyber security (Carpenter et al., 2019). A recent study performed by Liang & Xue (2010) in the context of anti-spyware software usage to protect their computer, with 166 business student sample in a US university indicated that response efficacy shown a significant positive effect on behavioural intention. Hence, we hypothesize that,

H7: Response efficacy has a positive effect on individuals’ intention to adopt contactless payment services during COVID-19.

Research Methodology

Data Collection and Respondents

In order to examine the adoption intention of contactless payments, data were obtained using online survey instrument for over a period of one month from April-May, 2020 during COVID-19 pandemic. Responses were recorded on five-point Likert scale responses ranging from ‘strongly disagree’ to ‘strongly agree.’ Respondents comprise all segments of the customers from India. 850 respondents were approached on convenience mode through online contacts. 412 samples were received with 48.57% response rate, out of which 25 invalid responses were eliminated, as these were not suitable for data analysis. Finally, 387 usable responses were considered for data analysis. Demographic details are detailed in Tables 1A, 1B and 1C.

| Table 1A Demographic Analysis: Gender, Age & Marital Status | |||

| Measure | Category | Frequency | Percentage |

| Gender | Male | 224 | 57.88 |

| Female | 163 | 42.12 | |

| Age | < 20 | 55 | 14.21 |

| 20-29 | 105 | 27.13 | |

| 30-39 | 127 | 32.82 | |

| 40-49 | 61 | 15.76 | |

| 50-60 | 27 | 6.98 | |

| Above 60 | 12 | 3.10 | |

| Marital status | Married | 242 | 62.53 |

| Unmarried | 145 | 37.47 | |

| Table 1B Demographic Analysis: Education, Family Monthly Income & Occupation | |||

| Measure | Category | Frequency | Percentage |

| Education | High school | 45 | 11.63 |

| Intermediate | 57 | 14.73 | |

| UG | 124 | 32.04 | |

| PG | 145 | 37.47 | |

| Others | 16 | 4.13 | |

| Family Monthly income | Less than 20,000 | 34 | 8.79 |

| 20,000-40,000 | 75 | 19.38 | |

| 40,000-60,000 | 97 | 25.06 | |

| 60,000-One lakh | 115 | 29.72 | |

| Above one lakh | 66 | 17.05 | |

| Occupation | Student | 117 | 30.23 |

| Home maker | 52 | 13.44 | |

| Employee | 124 | 32.04 | |

| Business | 69 | 17.83 | |

| Retired | 25 | 6.46 | |

| Table 1C Experience of Using Contactless Payments | |||

| Measure | Category | Frequency | Percentage |

| Experience using contactless payments | Less than one month | 18 | 4.65 |

| 1-3 months | 36 | 9.30 | |

| 3 months - one year | 95 | 24.55 | |

| 1-3 years | 127 | 32.82 | |

| 3-5 years | 78 | 20.16 | |

| More than 5 yrs. | 33 | 8.53 | |

Measurement Development

The purpose of the research was to investigate the factors affecting adoption intention of contactless payments during COVID-19 Pandemic. For this, data were collected using a survey instrument comprised of three different sections: i. demographic details ii. questions on usage experience of contactless payments iii. UTAUT and PMT dimensions. Measurement items were culled out from extensively validated research studies and customised to fit the present research context. Effort expectancy and social influence were adapted from (Venkatesh et al., 2012). The measurement items for trust from Gefen et al, (2003) and Alalwan (2017); perceived vulnerability from Saleeby (2000); perceived severity from Johnston & Warkentin (2010); Liang & Xue (2010); self-efficacy from Kim & Mirusmonov (2010); response efficacy from Woon et. al. (2005); Nandakumar et al. (2017); Carpenter et al. (2019); and behavioural intention from (Davis, 1989 & Venkatesh et al., 2012).

Data Analysis

From the Table 1, close to 58% belong to males. Major usage group for contactless payment services in the age bracket of 20-39 years. Majority of the respondents are either graduates or postgraduates. 14% of the respondents started using contactless payment services for the past three months which indicates the contextual impact of COVID-19 and more than 60% of the respondents using contactless payment options for more than a year.

From the demographic data analysis (Table 1A), it can be observed that, when it comes to understanding the role of gender, age and marital status on the adoption of contactless payments, during COVID-19 pandemic, it can be noted that the men are more adoptive than women and this is more in the age group of 20 years - 39 years. The married have more propensity to adopt the contactless payments, which can be seen as care and concern for the safety of the family.

From the demographic profile of the sample (Table 1B), it is evident that education, family monthly income and occupation are the critical aspects of adoption of contactless payments, during COVID-19 pandemic. Education of the respondents plays a pivotal role in the adoption, which can be due to their awareness of contactless payment methods, as the undergraduates and the postgraduates have shown the tendency of adoption of these technologies. Further, the lower income groups are less likely to use the contactless payment methods, which can be attributed to their limited disposable incomes, which may prevent them in adopting the varied contactless methods since they prefer carrying physical money. The employees and business personnel have more propensities to adopt the contactless payments, which can be attributed to their exposure to and influence of their peers to varied contactless payment systems.

From the demographic details of the respondents (Table 1C), it can be observed that, most of the respondents have the experience of using this mode even before the pandemic, though it was quite limited, but now it has become more frequent and wide spread.

Common Method Bias

In our study, we used Harman’s single factor test (Harman, 1976) as prescribed by Podsakoff et al. (2003) to test the common method bias with all eight factors namely, EE, SI, SE, PV, PS, RE and BI. For this, we run factor analysis with single factor. Results revealed that 29.342% variance is explained by a single factor, which is below the threshold value (< 50%) which confirms that the data is free from common method bias issue.

Reliability and Validity analysis

Reliability of the constructs was tested using average variance extracted (AVE) and composite reliability (CR). All the constructs with factor loadings surpass 0.70 as recommended by (Hair et al., 2010). AVE and CR values exceed the threshold values prescribed by (Fornell & Larcker, 1981) ensures construct reliability and construct validity. (Table 2). In addition, from Table VI, it is noticed all the diagonal values are more than the cross loadings between the respective constructs, confirms discriminant validity (Table 3).

| Table 2 Factor Loadings, Cronbach’s ALPHA, CR, and AVE | |||||

| Factor | Item code | Item loading | Cronbach's Alpha (α) | Composite reliability (CR) | Average variance extracted (AVE) |

| Effort expectancy (EE) | EE1 | 0.874 | 0.923 | 0.917 | 0.740 |

| EE2 | 0.824 | ||||

| EE3 | 0.834 | ||||

| EE4 | 0.887 | ||||

| Social influence (SI) | SI1 | 0.844 | 0.854 | 0.858 | 0.669 |

| SI2 | 0.889 | ||||

| SI3 | 0.899 | ||||

| Trust (TR) | TR1 | 0.816 | 0.918 | 0.918 | 0.739 |

| TR2 | 0.85 | ||||

| TR3 | 0.873 | ||||

| TR4 | 0.899 | ||||

| Perceived vulnerability (PV) | PV1 | 0.897 | 0.932 | 0.933 | 0.778 |

| PV2 | 0.903 | ||||

| PV3 | 0.879 | ||||

| PV4 | 0.934 | ||||

| Perceived severity (PS) | PS1 | 0.831 | 0.925 | 0.922 | 0.704 |

| PS2 | 0.862 | ||||

| PS3 | 0.807 | ||||

| PS4 | 0.785 | ||||

| PS5 | 0.868 | ||||

| Self-efficacy (SE) | SE1 | 0.857 | 0.934 | 0.934 | 0.781 |

| SE2 | 0.908 | ||||

| SE3 | 0.911 | ||||

| SE4 | 0.903 | ||||

| Response efficacy (RE) | RE1 | 0.851 | 0.958 | 0.957 | 0.786 |

| RE2 | 0.866 | ||||

| RE3 | 0.877 | ||||

| RE4 | 0.876 | ||||

| RE5 | 0.868 | ||||

| RE6 | 0.862 | ||||

| Behavioural intention (BI) | BI1 | 0.798 | 0.912 | 0.908 | 0.768 |

| BI2 | 0.822 | ||||

| BI3 | 0.854 | ||||

| BI4 | 0.852 | ||||

| Table 3 Discriminant Validity | ||||||||

| PS | BI | TR | SE | EE | PV | SI | RE | |

| PS | 0.839 | |||||||

| BI | 0.345 | 0.876 | ||||||

| TR | 0.011 | 0.284 | 0.859 | |||||

| SE | 0.087 | 0.246 | 0.273 | 0.883 | ||||

| EE | 0.060 | 0.356 | 0.487 | 0.276 | 0.859 | |||

| PV | 0.211 | 0.174 | 0.054 | 0.106 | -0.022 | 0.882 | ||

| SI | 0.070 | 0.049 | 0.125 | -0.025 | 0.075 | 0.033 | 0.708 | |

| RE | 0.553 | 0.434 | 0.151 | 0.132 | 0.130 | 0.167 | 0.045 | 0.886 |

Measurement Model

We conducted confirmatory factor analysis to test the measurement model using AMOS version 20. Confirmatory factor analysis was conducted with all the eight constructs namely, effort expectancy, social influence, trust, self-efficacy, perceived vulnerability, perceived severity, response efficacy and behavioural intention. Results of the model fit indices: CMID/df = 1.718, RMR = 0.026, RMSEA = 0.043, CFI = 0.97, NFI = 0.931, TLI = 0.966, GFI = 0.889, within the threshold values as recommended by (Bentler, 1990; Hu & Bentler, 1999; Hair et al., 2010; Kim & Sundar, 2014). The results displayed in Table 4.

| Table 4 Measurement Model | |||||||

| CMID/df | RMR | RMSEA | CFI | NFI | TLI | GFI | |

| Cut-off value | <3 | <0.5 | <0.08 | >0.9 | >0.9 | >0.9 | >0.8 |

| Actual value | 1.718 | 0.026 | 0.043 | 0.97 | 0.931 | 0.966 | 0.889 |

Structural Model

Table 5 and Table 6, reports the results of structural model. The goodness of fit indices of the model, CMID/df = 2.542, RMR = 0.106, RMSEA = 0.063, CFI = 0.932, NFI = 0.893, TLI = 0.927, GFI = 0.833, within the threshold values and the data fits with the model. Furthermore, structural equation modeling with the support of AMOS was used to understand the hypothetical relationships among various construct. The results of the study demonstrated significant positive relationship in all cases except hypothesis H2: Effort expectancy (β = 0.266, t = 5.354, p <0.001), trust (β = 0.098, t = 1.979, p <0.05), perceived vulnerability (β = 0.099, t = 2.006, p <0.05), perceived severity (β = 0.146, t = 2.913, p <0.001), self-efficacy (β = 0.105, t =2.111, p <0.001), response efficacy (β = 0.316, t = 6.149, p <0.001).

| Table 5 Structural Model | |||||||

| CMID/df | RMR | RMSEA | CFI | NFI | TLI | GFI | |

| Cut-off value | <3 | <0.5 | <0.08 | >0.9 | >0.9 | >0.9 | >0.8 |

| Actual value | 2.542 | 0.106 | 0.063 | 0.932 | 0.893 | 0.927 | 0.833 |

| Table 6 Hypotheses Testing | |||||

| Hypothesis | Path | Beta value | t value | P-value | Result |

| H1 | EE → BI | 0.266 | 5.354 | *** | Supported |

| H2 | SI → BI | -0.001 | -0.018 | 0.986 | Not supported |

| H3 | TR → BI | 0.098 | 1.979 | 0.048 | Supported |

| H4 | PV → BI | 0.099 | 2.006 | 0.045 | Supported |

| H5 | PS → BI | 0.146 | 2.913 | 0.004 | Supported |

| H6 | SE → BI | 0.105 | 2.111 | 0.035 | Supported |

| H7 | RE → BI | 0.316 | 6.149 | *** | Supported |

Discussion

The primary objective of the study was to examine the consumer’s adoption of contactless payment options in the current pandemic conditions. The study revealed the effects of effort expectancy, social influence, trust, perceived vulnerability, perceived severity, self efficacy and response efficacy on behaviour intention towards contactless payments. The results of this study indicate the need for looking at an alternative perspective of the existing payment options with context of perceived severity and perceived vulnerability which have not been considered earlier. The results of the study also enable the researchers to understand the role of new factors perceived severity and perceived vulnerability as a motivation for contactless payments along with effort expectancy, trust, self-efficacy response efficacy and social influences. The results also enable the researchers to measure the relative contribution of these severity factors to adoption of contactless payments.

Firstly, effort expectancy was found to be significant influencer of behaviour intention towards adoption of contactless payments. This is in accord with earlier studies that have acknowledged effort expectancy as an important dimension in behaviour intention (Lin, 2011; Alalwan et al., 2016; Martins et al., 2014; Davis, 1989). The swift growth of mobile technology over the years has resulted in the customers gaining experience in usage resulting in perceived ease of use (Yu, 2014).

Secondly, social influence as a factor was found to be non-insignificant with respect to behavioural intention of adoption of contactless payments. While, Zhou et al. (2010) found social influence to be a significant impact factor towards behavioural intention, studies by (Gu et al., 2009; Govender & Sihlali, 2014; Wang & Yi, 2012; Shin, 2010) observe that social influence does not have any impact on behavioural intention. It may be because the decision to use contactless payments due to personal choice in the current situation and also increased awareness of the pandemic.

Next, trust was proven to be significant influencer of behaviour intention of contactless payments. This is in agreement with the studies by (Venkatesh et al., 2012; Alalwan et al., 2016). This is due to the feeling of safety it provides in the adoption of a specific technology. Perceived vulnerability and perceived severity exhibited a positive relationship with adoption intention of contactless payments. This is in line with the previous research by Lv (Guo et al., 2012; Wang et al., 2015; Liang & Xue, 2010). A possible explanation for this phenomenon is that when individuals perceive any health/life threat they tend to avoid or intent to exhibit certain behaviour. In the current study, individuals intend to adopt contactless payments to avoid COVID-19 infection.

Subsequently, relationship between self-efficacy and behavioural intention found significant. This outcome is in agreement with earlier researches by (Luarn & Lin, 2005; Schaper & Pervan, 2007) the impact of self-efficacy on adoption of new technology. While, Yu (2014) posits that self-efficacy affects behavioural control relatively higher than the behavioural intention. Venkatesh et al. (2003) opined that the impact of self-efficacy is mostly nullified due to the effort expectancy factor. However, the present results match with the findings of Hsu et al. (2004), Maillet et al. (2015) and Tella (2011) about the influence of self-efficacy on behavioural intention either directly or indirectly.

Lastly, a positive relationship between response efficacy and behavioural intention is identified. This phenomenon is in matched with the outcomes of (Chen & Lee, 2008; Lwin, 2012). This can be attributed to the need felt by the individuals to adopt a technology that may safeguard them from the threat of COVID-19 pandemic thorough contactless payments.

Hypotheses Tested Analysis

The research data analysis and testing of the hypotheses indicates that the effort expectancy, trust, self-efficacy have positive effect on the individuals’ intention to adopt the contactless payment services during the COVID-19 pandemic. The perceived vulnerability, perceived severity and response efficacy have a significantly positive influence on the individuals’ intention to adopt the contactless payment services during the COVID-19 pandemic. However, the social influence has no significant influence, on the individuals’ intention to adopt the contactless payment services during the COVID-19 pandemic.

PMT and UTAUT Verification

The dimensions of threat and coping appraisal as proposed by the protection motivation theory (PMT) have been found to hold good, when it comes to the individuals’ social and health behaviour influencing the adoption of the contactless payment modes in the COVID- 19 pandemic situation, as during this pandemic situation, the research reinforces the role of protection motivation behaviour, which influences the individuals’ behavioural intentions, thus the PMT is verified.

Since the contactless payment modes are technology solutions for the payment, the adoption of these modes in the COVID-19 pandemic is strongly influenced by the performance, efforts and social influence, which has been verified by the research data analysis, the only factor, which was not taken into consideration is the facilitating conditions, as it is close to the construct self-efficacy of protection motivation theory.

The current research reinforces the unified theory of acceptance and use of technology (UTAUT) as the varied factors, which have a strong influence on the intentions to adopt the contactless payment services during the COVID-19 period fall in line with this theory, thereby verifying the UTAUT.

Implications

Theoretical Implications

The present study offers several implications to academicians and practioners. For academicians, this research acts as a foundational study to understand the user behaviour towards contactless payments during the COVID-19 pandemic as physical contact has become a major threat for purchase payment during this crisis. Safer payment mechanism is the remedy to handle the pandemic problem. Previous studies adopted focused the adoption of contactless payment services such as NFC based mobile payments based on TAM and theory of diffusion of innovation (Pham & Ho, 2015), QR code-based payments using TAM (Liébana-Cabanillas et. al., 2015), mobile wallet payment using UTAUT (Shin, 2009). However, research on contactless payment from protective behavioural perspective is scarce. The study attempted to address this major gap to integrate two established theories, UTAUT and PMT to understand the technology acceptance and protection behaviour of individuals towards the usage of contactless payment services during COVID-19 pandemic. To the best of our knowledge, this study is an initial attempt in the area of contactless payments with a comprehensive approach. The study tries to understand the influence of threat factors: severity and vulnerability perceived by individuals during the payment of the goods or products purchased online or offline mode. Perceived severity and perceived vulnerability found to have a strong positive effect towards the usage intention of contactless payments.

Practical Implications

With the widespread and apprehension of COVID-19 pandemic among the people, the use of contactless payment services is growing rapidly as these are the safe mode of payment. In the current scenario, contactless payment services in the form of mobile wallet payments, QR code-based payments, NFC mobile-based payments immensely contributed to the online payment industry. Business firms need to design and develop innovative solutions for contact-free payment services to leverage the benefits during the pandemic. User trust plays a critical role in contactless payment services as it is a personalized-based service and business firms need to focus on this element in future strategies. The direct effect of effort expectancy indicates that the users recognize the importance of the ease of using these services.

The Research Outcomes

After the thorough analysis of the empirical data collected, the major outcomes of the research are represented in the Table 7.

| Table 7 Research Outcomes | |

| Factor | Research Outcome - Intention towards contactless payments during Covid-19 pandemic |

| Effort expectancy | Significant influencer |

| Social influence | Non-significant |

| Trust | Significant influencer |

| Perceived vulnerability | Significant influencer |

| Perceived severity | Significant influencer |

| Self-efficacy | Significant influencer |

| Response efficacy | Significant influencer |

Thus, the adoption of contactless payments during COVID-19 pandemic confirms the behavioural intention in line with protection motivation theory (PMT) and unified theory of acceptance and use of technology (UTAUT)

Behavioural Intentions – Social, Economics & Technology Dimensions

Social influence is the influence of family members, peers and others on the adoption of a product (Venkatesh et al., 2003). In the current study, the adoption of contactless payments is not influenced by social influence of family members, peers and others. Thus the study incorporated the social dimension to examine the adoption of contactless payment services found no influence on the adoption.

Further, individuals tend to use a certain technology when they perceive it to be easy to use. The construct effort expectancy (UTAUT) is similar to perceived ease of use (TAM) (Alwahaishi & Snásel, 2013). The present research tested the relationship between effort expectancy and adoption of contactless payment systems and found a positive effect on it. In the current COVID context the contactless payment services are used due to fear of transmission rather than based on economic value it provides to the users. Individual’s income has an influence on user’s adoption of contactless payment services (Table IB). However, future studies may assess the effect of economic value on contactless payment services.

Challenges, Limitations and Scope for Future Research

Research Challenges and Considerations

The research had to confront some major challenges owing to the ongoing COVID-19 pandemic and also the short time period for the data collection. These posed challenges, like on one hand, the responses based on the behaviour intentions due to the forced adoption to the contactless payment modes because of pandemic, which made many to adopt this as default payment mode owing to the fear of contracting the disease, which has come as a major challenge, and on the other hand the shorter time, which prevented research data collection spanning over the phases, so as to see the change in the pattern of the behaviour towards adoption of the contactless payment systems.

Considering these challenges, the data has been collected in hybrid format, with online and offline (wherever possible), and also absorbed the forced adoption criteria by balancing it with the length of experience with the use of contactless payment modes. Though the study would have more impact, if it were pre-COVID-19 and post-COVID-19, considering the short period, to overcome this challenge, the data were collected in initial, mid periods of COVID-19.

Limitations and Scope for Future Research

The study suffers from certain limitations, which could be addressed in future research works. The study was cross-sectional in nature, data were captured at a single point of time during COVID-19; however, future research could consider longitudinal studies to know the differences in users’ behaviour at different points of time i.e. pre-COVID-19 and post-COVID-19. The study integrated UTAUT2 and protection motivation theory to understand the user behaviour towards contactless payment, further research could extend these models for better validity. Users’ attitudinal dimensions could also be assessed. Further, the study may examine the effect of economic dimension of contactless payment services. Another constraint is the limited sample size; bigger sample size may yield better results. Replicated studies may be conducted in various geographical areas. The present research model may be examined in various sectors such as banking, healthcare, hospitality etc. during and/or post COVID-19 pandemic.

Conclusion

Contactless payments gained prominence during COVID-19, as they are the safest way of payment. Our research integrated UTAUT2 and protection motivation theory to understand the user behaviour towards contactless payments during COVID-19. The antecedents of user adoption intention studied, namely, effort expectancy, social influence, trust, perceived vulnerability, perceived severity, self-efficacy and response efficacy. The findings of the research revealed that, all the constructs except social influence have shown a significant effect on intention to adopt contactless payments. The study provided suggestions for both academics and practice.

Appendix A

| Factor | Item | Source |

| Effort expectancy | Learning how to use contactless payment services is easy for me. | Venkatesh et. al. (2012) |

| My interaction with contactless payment services is clear and understandable. | ||

| I find contactless payment services are easy to use | ||

| It is easy for me to become skilful at using contactless payment services. | ||

| Social influence | People who are important to me think that I should use contactless payment services. | Venkatesh et. al. (2012) |

| People who influence my behaviour think that I should use contactless payment services | ||

| People whose opinions that I value prefer that I use contactless payment services | ||

| Trust | I believe that contactless payment services to be reliable. | Gefen et al., (2003); Alalwan, (2017) |

| I believe that contactless payment services is trustworthy | ||

| I trust in contactless payment services. | ||

| Contactless payment services has the ability to fulfil its task. | ||

| Perceived vulnerability | My chances of getting affected by COVID 19 due to physical contact are great. | Saleeby (2000) |

| There is a possibility that I may get affected by COVID 19 due to physical contact | ||

| I feel that COVID 19 will affect my health. | ||

| It is extremely likely that COVID 19 affect my health. | ||

| Perceived severity | It would be severe if I suffered from COVID 19 through physical contact. | Johnston & Warkentin (2010); Liang & Xue (2010) |

| It would be serious if I suffered from COVID 19 through physical contact. | ||

| It would be significant if I suffered from COVID 19 through physical contact. | ||

| Physical contact during COVID 19 creates health problem. | ||

| Physical contact during COVID 19 affects my health. | ||

| Self-efficacy | I am confident of using contactless payment services if there is no one around me to show how to use it. | Kim & Mirusmonov (2010) |

| I am confident of using contactless payment services even if I have never used contactless payment services. | ||

| I prefer to use contactless payment services without anyone’s help | ||

| I feel comfortable using contactless payment services on my own. | ||

| Response efficacy | Adopting contactless payment services reduces the chance of getting affected by COVID 19. | Woon et al. (2005); Nandakumar et al. (2017); Carpenter et al. (2019) |

| Using contactless payment services increases my ability to protect my health from COVID 19. | ||

| Using contactless payment services is easy way to protect myself from COVID 19. | ||

| Using contactless payment services is the best way to avoid COVID 19. | ||

| Using contactless payment services drastically improve my chance of prevention to COVID 19. | ||

| Adopting the contactless payment services will prevent from getting affected by COVID 19. | ||

| Behavioural intention | It is likely that I will use/continue using contactless payment services in the future. | Davis (1989); Venkatesh et al. (2012) |

| I intend to use contactless payment services in the future. | ||

| I will always try to use contactless payment services in my daily life. | ||

| I plan to use contactless payment services frequently. | ||

References

- Alalwan, A.A., Dwivedi, Y.K., Rana, N.P., & Williams, M.D. (2016). Consumer adoption of mobile banking in Jordan. Journal of Enterprise Information Management.

- Alalwan, A.A., Dwivedi, Y.K., & Rana, N.P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 37(3), 99-110.

- Alliance, S.C. (2007). Contactless payments: Frequently asked questions. CPC-07001, February. Retrieved from: https://www.securetechalliance.org/resources/pdf/Contactless_Payments_FAQ.pdf

- Alwahaishi, S., & Snásel, V. (2013). Acceptance and use of information and communications technology: a UTAUT and flow based theoretical model. Journal of Technology Management & Innovation, 8(2), 61-73.

- Bandura, A. (1982). Self-efficacy mechanism in human agency. American Psychologist, 37, 122- 147.

- Basoglu, N., Ok, A.E., & Daim, T.U. (2017). What will it take to adopt smart glasses: A consumer choice-based review?. Technology in Society, 50, 50-56.

- Bentler, P.M. (1990). Comparative fit indexes in structural models. Psychological Bulletin, 107(2), 238.

- Carpenter, D., Young, D.K., Barrett, P., & McLeod, A.J. (2019). Refining technology threat avoidance theory. Communications of the Association for Information Systems, 44.

- Celik, H. (2016). Customer online shopping anxiety within the Unified Theory of Acceptance and Use Technology (UTAUT) framework. Asia Pacific Journal of Marketing and Logistics, 28(2), 278-307.

- Chan, S.C. (2004). Understanding internet banking adoption and use behavior: A Hong Kong perspective. Journal of Global Information Management (JGIM), 12(3), 21-43.

- Chen, A.N., & Lee, Y.G. (2008). Healthcare Information Technology Adoption and Protection Motivation: A Study of Computerized Physicial Order Entry Systems. AMCIS 2008 Proceedings, 369.

- Chen, K.Y., & Chang, M.L. (2013). User acceptance of near field communication mobile phone service: an investigation based on the ‘unified theory of acceptance and use of technology’ model. The Service Industries Journal, 33(6), 609-623.

- Chiu, C.M., & Wang, E.T. (2008). Understanding Web-based learning continuance intention: The role of subjective task value. Information & Management, 45(3), 194-201.

- Cocosila, M., & Trabelsi, H. (2016). An integrated value-risk investigation of contactless mobile payments adoption. Electronic Commerce Research and Applications, 20, 159-170.

- Dasgupta, S., Paul, R., & Fuloria, S. (2011). Factors affecting behavioral intentions towards mobile banking usage: Empirical evidence from India. Romanian Journal of Marketing, (1), 6.

- Davis, F.D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 319-340.

- Ennew, C., & Sekhon, H. (2007). Measuring trust in financial services: The trust index. Consumer Policy Review, 17(2), 62.

- Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Gefen, D., Karahanna, E., & Straub, D.W. (2003). Trust and TAM in online shopping:An integrated model. MIS Quarterly, 27(1), 51-90.

- Govender, I., & Sihlali, W. (2014). A study of mobile banking adoption among university students using an extended TAM. Mediterranean Journal of Social Sciences, 5(7), 451.

- Gu, J.C., Lee, S.C., & Suh, Y.H. (2009). Determinants of behavioral intention to mobile banking. Expert Systems with Applications, 36(9), 11605-11616.

- Gupta, B., Dasgupta, S., & Gupta, A. (2008). Adoption of ICT in a government organization in a developing country: An empirical study. The Journal of Strategic Information Systems, 17(2), 140-154.

- Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2010). Multivariate Data Analysis: A Global Perspective, 7th ed., Pearson Prentice Hall, Upper Saddle River, NJ.

- Hayashi, F. (2012). The new debit card regulations: Initial effects on networks and banks. Economic Review-Federal Reserve Bank of Kansas City, 79.

- Henry, C.S., Huynh, K.P., & Shen, Q.R. (2015). 2013Methods-of-payment survey results (No. 2015-4). Bank of Canada discussion paper.

- Hsu, M.H., Chiu, C.M., & Ju, T.L. (2004). Determinants of continued use of the WWW: an integration of two theoretical models. Industrial Management & Data Systems.

- Hu, L.T., & Bentler, P.M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling: A Multidisciplinary Journal, 6(1), 1-55.

- Ifinedo, P. (2006). Acceptance and Continuance Intention of Web‐based Learning Technologies (WLT) Use among University Students in a Baltic Country. The Electronic Journal of Information Systems in Developing Countries, 23(1), 1-20.

- Jarvenpaa, S.L., Tractinsky, N., & Vitale, M. (2000). Consumer trust in an Internet store. Information Technology and Management, 1(1-2), 45-71.

- Jenkins, P., & Ophoff, J. (2016). Factors influencing the intention to adopt NFC mobile payments-A South African perspective. In CONF-IRM, (45).

- Johnston, A.C., & Warkentin, M. (2010). Fear appeals and information security behaviors: an empirical study. MIS Quarterly, 549-566.

- Julia Kagan (2020). Contactless Payment. Retrieved from:https://www.investopedia.com/terms/c/contactless-payment.asp

- Karjaluoto, H., Riquelme, H.E., & Rios, R.E. (2010). The moderating effect of gender in the adoption of mobile banking. International Journal of Bank Marketing.

- Kijsanayotin, B., Pannarunothai, S., & Speedie, S.M. (2009). Factors influencing health information technology adoption in Thailand's community health centers: Applying the UTAUT model. International Journal of Medical Informatics, 78(6), 404-416.

- Kim, C., & Mirusmonov, M. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior, 26, 310-322.

- Kim, K.J., & Sundar, S.S. (2014). Does screen size matter for smartphones? Utilitarian and hedonic effects of screen size on smartphone adoption. Cyberpsychology, Behavior, and Social Networking, 17(7), 466-473.

- Koo, D.M., & Choi, Y.Y. (2010). Knowledge search and people with high epistemic curiosity. Computers in Human Behavior, 26(1), 12-22.

- Kulviwat, S., Bruner II, G.C., & Al-Shuridah, O. (2009). The role of social influence on adoption of high-tech innovations: The moderating effect of public/private consumption. Journal of Business Research, 62(7), 706-712.

- Lee, M.K., & Turban, E. (2001). A trust model for consumer internet shopping. International Journal of Electronic Commerce, 6(1), 75-91.

- Lee, S., & Choi, J. (2017). Enhancing user experience with conversational agent for movie recommendation: Effects of self-disclosure and reciprocity. International Journal of Human-Computer Studies, 103, 95-105.

- Liang, H., & Xue, Y. (2010). Understanding security behaviors in personal computer usage: A threat avoidance perspective. Journal of the Association for Information Systems, 11(7), 394-413.

- Liébana-Cabanillas, F., Ramos de Luna, I., & Montoro-Ríos, F.J. (2015). User behaviour in QR mobile payment system: the QR Payment Acceptance Model. Technology Analysis & Strategic Management, 27(9), 1031-1049.

- Lin, H.F. (2011). An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. International Journal of Information Management, 31(3), 252-260.

- Liu, J., Liao, X., Qian, S., Yuan, J., Wang, F., Liu, Y., & Zhang, Z. (2020). Community transmission of severe acute respiratory syndrome coronavirus 2, Shenzhen, China, 2020.

- Luarn, P., & Lin, H.H. (2005). Toward an understanding of the behavioral intention to use mobile banking. Computers in Human Behavior, 21(6), 873-891.

- Lv, X., Guo, X., Xu, Y., Yuan, J., & Yu, X. (2012). Explaining the mobile health services acceptance from different age groups: a protection motivation theory perspective. International Journal of Advancements in Computing Technology, 4(3), 1-9.

- Lwin, M.O., Li, B., & Ang, R.P. (2012). Stop bugging me: An examination of adolescents’ protection behavior against online harassment. Journal of Adolescence, 35(1), 31-41.

- Maillet, É., Mathieu, L., & Sicotte, C. (2015). Modeling factors explaining the acceptance, actual use and satisfaction of nurses using an Electronic Patient Record in acute care settings: An extension of the UTAUT. International Journal of Medical Informatics, 84(1), 36-47.

- Martins, C., Oliveira, T., & Popovič, A. (2014). Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management, 34(1), 1-13.

- Min, Q., Ji, S., & Qu, G. (2008). Mobile Commerce User Acceptance Study in China: A Revised UTAUT Model. Tsinghua Science & Technology, 13(3), 257-264.

- Nandakumar, N., Sivakumaran, B., Kalro, A., & Sharma, P. (2017). Threat, efficacy and message framing in consumer healthcare. Marketing Intelligence & Planning.

- Ng, B.Y., Kankanhalli, A., & Xu, Y.C. (2009). Studying users' computer security behavior: A health belief perspective. Decision Support Systems, 46(4), 815-825.

- Neuberg, S.L., Kenrick, D.T., & Schaller, M. (2011). Human threat management systems: Self-protection and disease avoidance. Neuroscience & Biobehavioral Reviews, 35(4), 1042-1051.

- Ondrus, J., & Pigneur, Y. (2007). An assessment of NFC for future mobile payment systems. In International Conference on the Management of Mobile Business (ICMB 2007) (pp. 43-43). IEEE.

- Oshlyansky, L., Cairns, P., & Thimbleby, H. (2007). Validating the Unified Theory of Acceptance and Use of Technology (UTAUT) tool cross-culturally. In Proceedings of HCI 2007 The 21st British HCI Group Annual Conference University of Lancaster, UK 21 (pp. 1-4).

- Pavlou, P.A., & Gefen, D. (2004). Building effective online marketplaces with institution-based trust. Information Systems Research, 15(1), 37-59.

- Paysafe Insights/ Combating COVID-19: Contactless payments on the doorstep (2020). Retrieved from:https://www.paysafe.com/blog/combating-covid-19-contactless-payments-on-the-doorstep/

- Pham, T.T.T., & Ho, J.C. (2015). The effects of product-related, personal-related factors and attractiveness of alternatives on consumer adoption of NFC-based mobile payments. Technology in Society, 43, 159-172.

- Potnis, D., Demissie, D., & Deosthali, K. (2017). Students' intention to adopt Internet-based personal safety wearable devices: Extending UTAUT with trusting belief. First Monday.

- Prentice-Dunn, S., & Rogers, R.W. (1986). Protection motivation theory and preventive health: Beyond the health belief model. Health Education Research, 1(3), 153-161.

- PTI (2020). Lockdown impact: 42% Indians have increased use of digital payments, says report. Retrieved from: https://www.financialexpress.com/industry/banking-finance/lockdown-impact-42-indians-have-increased-use-of-digital-payments-says-report/1928252/

- Ridings, C.M., Gefen, D., & Arinze, B. (2002). Some antecedents and effects of trust in virtual communities. The Journal of Strategic Information Systems, 11(3-4), 271-295.

- Rippetoe, P.A., & Rogers, R.W. (1987). Effects of components of protection-motivation theory on adaptive and maladaptive coping with a health threat. Journal of Personality and Social Psychology, 52(3), 596.

- Rogers, RW. (1975). A protection motivation theory of fear appeals and attitude change, Journal of Psychology, (91), 93-114.

- Rogers, R.W., & Prentice-Dunn, S. (1997). Protection motivation theory. In D. S. Gochman (Ed.), Handbook of health behavior research 1: Personal and social determinants (p. 113–132). Plenum Press.

- Saleeby, J.R. (2000). Health beliefs about mental illness: an instrument development study, American Journal of Health Behavior, 24(2), 83-95.

- Schaper, L.K., & Pervan, G.P. (2007). An investigation of factors affecting technology acceptance and use decisions by Australian allied health therapists. In 2007 40th Annual Hawaii International Conference on System Sciences (HICSS'07) (pp. 141-141). IEEE.

- Sergueeva, K., & Shaw, N. (2017). Improving healthcare with wearables: overcoming the barriers to adoption. In International Conference on HCI in Business, Government, and Organizations (pp. 209-223). Springer, Cham.

- Shin, D.H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior, 25(6), 1343-1354.

- Shin, D.H. (2010). Modeling the interaction of users and mobile payment system: Conceptual framework. International Journal of Human-Computer Interaction, 26(10), 917-940.

- Siau, K., & Shen, Z. (2003). Building customer trust in mobile commerce. Communications of the ACM, 46(4), 91-94.

- Siponen, M., Mahmood, M.A., & Pahnila, S. (2014). Employees’ adherence to information security policies: An exploratory field study. Information & Management, 51(2), 217-224.

- Slade, E.L., Williams, M.D., & Dwivedi, Y. (2013). An extension of the UTAUT 2 in a healthcare context. In UKAIS, 55.

- Sripalawat, J., Thongmak, M., & Ngramyarn, A. (2011). M-banking in metropolitan Bangkok and a comparison with other countries. Journal of Computer Information Systems, 51(3), 67-76.

- Sohrabi, C., Alsafi, Z., O’Neill, N., Khan, M., Kerwan, A., Al-Jabir, A., ... & Agha, R. (2020). World Health Organization declares global emergency: A review of the 2019 novel coronavirus (COVID-19). International Journal of Surgery.

- Sun, Y., Wang, N., Guo, X., & Peng, Z. (2013). Understanding the acceptance of mobile health services: a comparison and integration of alternative models. Journal of Electronic Commerce Research, 14(2), 183.

- Tella, A. (2011). Predicting users’ acceptance of e-library from the perspective of technology acceptance model. International Journal of Digital Library Systems (IJDLS), 2(4), 34-44.

- Thompson, R.L., Higgins, C.A., & Howell, J.M. (1991). Personal computing: toward a conceptual model of utilization. MIS Quarterly, 125-143.

- Turban, E., Outland, J., King, D., Lee, J.K., Liang, T.P., & Turban, D.C. (2018). Electronic commerce payment systems. In Electronic Commerce 2018 (pp. 457-499). Springer, Cham.

- Venkatesh, V. et. al. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 425-478.

- Venkatesh, V., & Davis, F.D. (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science, 46(2), 186-204.

- Venkatesh, V., & Zhang, X. (2010). Unified theory of acceptance and use of technology: US vs. China. Journal of Global Information Technology Management, 13(1), 5-27.

- Venkatesh, V., Thong, J.Y.L., & Xu, X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157-178.

- Wang, X., White, L., Chen, X., Gao, Y., Li, H., & Luo, Y. (2015). An empirical study of wearable technology acceptance in healthcare. Industrial Management & Data Systems.

- Wang, Y.M., & Lin, W.C. (2019). Understanding consumer intention to pay by contactless credit cards in Taiwan. International Journal of Mobile Communications, 17(1), 1-23.

- Warshaw, P.R. (1980). A new model for predicting behavioral intentions: An alternative to Fishbein. Journal of Marketing Research, 17(2), 153-172.

- World Health Organization. (2020). Coronavirus disease 2019 (COVID-19): situation report, 70. Retrieved from: https://apps.who.int/iris/bitstream/handle/10665/331683/nCoVsitrep30Mar2020-eng.pdf

- World Health Organization. (2020). Modes of transmission of virus causing COVID-19: implications for IPC precaution recommendations: scientific brief, 27 March 2020 (No. WHO/2019-nCoV/Sci_Brief/Transmission_modes/2020.1). World Health Organization.

- Woon, I., Tan, G.W., & Low, R. (2005). A protection motivation theory approach to home wireless security. ICIS 2005 Proceedings, 31.

- Wu, L.H., Wu, L.C., & Chang, S.C. (2016). Exploring consumers’ intention to accept smartwatch. Computers in Human Behavior, 64, 383-392.

- Yen, C., & Chiang, M.C. (2020). Trust me, if you can: a study on the factors that influence consumers’ purchase intention triggered by chatbots based on brain image evidence and self-reported assessments. Behaviour & Information Technology, 1-18.

- Yu, C.S. (2014). Consumer switching behavior from online banking to mobile banking. International Journal of Cyber Society and Education, 7(1), 1-28.

- Zhou, T., Lu, Y., & Wang, B. (2010). Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior, 26(4), 760-767.

- Zhou, T. (2012). Examining location-based services usage from the perspectives of unified theory of acceptance and use of technology and privacy risk. Journal of Electronic Commerce Research, 13(2), 135.