Research Article: 2020 Vol: 21 Issue: 2

An Econometric Study of the Impact of Inflation, Exchange Rate and Interest Rate on Public Debt Using Four Panels of Countries

Saoussen Ouhibi, University of Sfax

Sami Hammami, University of Sfax

Abstract

This study attempts to investigate the impact of inflation, exchange rate and interest rate on public debt for the period 1990–2017 by using dynamic panel data model estimated by Generalized Method of Moments (GMM). The main objective of this article is to examine the relationship between inflation, exchange rate, economic growth and public debt. This research structured around two hypotheses, the first assumes that these determinants have a positive and statistically significant effect on public debt and the second assumes these determinants have a negative and statistically significant effect on public debt. In fact, empirical evidence indicates a significant positive impact of inflation on public debt for three panels. Exchange rates have a positive and statistically significant (European countries) and negative and statistically significant (sub-Saharan region) effect on public debt. Finally, interest rate have a positive and statistically significant effect on public debt in two panels.

Keywords

Inflation, exchange rate, interest rate, public debt, Generalized Method of Moments

JEL Classifications

E32, E31, E43, E62. C32

Introduction

Over the past two decades, the study of the causal relationship between public debt and macroeconomics variables has been a subject of a large academic research. For this end, many researches were focused in the nexus (Pak H (2001); Edsel Beja (2007), Aïda WADE (2014), Reinhart & Rogoff (2010)). The concept public debt is used to lead debates on the financial sector, sustainable development, macroeconomic development and economic growth.

The beginning of the 1980s was marked by falling public revenues and an excessive increase in external debt. Moreover, the international economic context played an important role in the worsening crisis (exchange rate fluctuations, lower prices of raw materials and deterioration of the terms of trade, rising interest rates and declining lending). Economic reforms calling into question the intervention of the State were implemented through the structural regulation and liberalization of the economy to guide the macroeconomic stabilization policy in order to achieve an efficient management of public finances. These reforms aim to create a new dynamic that can reduce economic and financial dependence on the outside world.

In addition, this crisis has negative effects on the internal policies of the countries, the most significant of these effects are mismanagement of public debt, moving resource allocation, and lack of rigorous financial discipline. In the long run the economic and financial weakness has led in the long run to excess of debt over the debt service capacity of the highly indebted poor countries. In light of this event, European sovereign debt and financial crises are more than ever at the heart of the debate. Nevertheless, the exchange rate and interest rate volatility is linked to the deterioration of the public accounts linked to both increased government spending and declining tax revenues. The classical theories of the macroeconomics support the view that exchange rate, interest rate and public debt are closely linked.

Regarding the linkage between the exchange rate, interest rate, inflation and public debt, where the hypothesis assumes that these determinants have a positive and statistically significant effect on public debt. However, the alternative hypothesis assumes these determinants have a negative and statistically significant effect on public debt. Due to the importance of inflation, exchange rate, interest rate, and public debt, the understanding of these controversial nexuses seen as a priority in the different countries. For this reason, i selected four panels of countries to highlight a comparative study.

The relationship between inflation, exchange rate, economic growth and public debt has been an active research area (Bhattarai, S., Lee, J. W., & Park, W. Y. (2014); Bildirici, M., & Ersin,O. (2007); Harmon, E.Y. (2012); Hilscher, J., Raviv, A., & Reis, R. (2014).). Our objective in this paper is to investigate the impact of inflation, exchange rate and interest rate on public debt during 1990–2017 for the four panels of countries. For this purpose, we used a dynamic panel data model. To the best of our knowledge, none of the previous studies deal with this question in the four panels of countries (MENA region, European countries, sub-Saharan region, and Southern Mediterranean countries) context through the use of the GMM technique.

This paper is organized in to three sections. Section one presents a literature review. The second section discusses the methodology and the econometric specification. The section third reports and discusses the results and finally presents the conclusion and the implications.

Literature Review

The subject of the effect of economic growth and public debt has been well-documented in the economic public literature. Different studies have focused on different countries, time periods, proxy variables and the different econometric methodologies used. The empirical outcomes of these studies have been varied and sometimes conflicting.

This literature review deals with three major axes, can be divided into sub title to explain how each variable affects public debt: What are the impacts of inflation on public debt? What are the effects of exchange rate on public debt? What are the effects of interest rate on public debt?

How Inflation affects Public Debt?

The link between public debt and inflation, which occupies an important place in the present research, generally is used to lead debates on the determinants of public debt. According to Nguyen van bon (2015), the relationship between inflation and public debt in some developing countries over the 1990/2014 period. This research revealed the negative relationship between inflation and economic growth. In this context, the rise of the inflation is an indicator of resilience of the developing economy and a huge macroeconomic imbalance and fragility. More recently, in the G7 countries, Akitoby et al. (2014) have investigated the impact of inflation on public debt over the 1980-2013 period, using the generalized method of moments (GMM). The applications of this method suggest that when the inflation increases by 6 percent points, the average net debt-to-GDP ratio decreases by about 11percentage points.

Emmanuel Harmon (2011) analysed the impact of interest rate, inflation and GDP growth on public debt in Kenya over the 1996 to 2011. Using the three simple linear regression models, we found that the positive relationship between the dependent variable (public debt) and the independent variables (GDP, inflation and Interest rate). In addition, the results obtained suggest that the debt accumulated by Kenya between 1996 and 2011 decreased its economic growth.

Recently, Jens Hilscher and al (2014) studied the evolutions of public debt and inflation. In this paper, the inflation has a positive effect on government debt in an environment conducive to growing income inequalities. The Income inequalities raise not only social and political concernes but also economic ones. Actually, they weigh heavily on the public debt growth.

Akitoby and al (2014) studied the impact of inflation on public debt in G7 countries. The simulations in this paper suggest that public debt ratio can explained by inflation in the analyzed period. Moreover, the inflation has a significant negative effect on public debt ratio. The coefficient is 0.14 and this indicates that inflation by 0.14 % when there is an increase of 5% debt to GDP.

In study about U.S. economy, Joshua A and Nancy M (2011) studied the relationship between inflation and debt/GDP ratio for the period 1946-2008 using time series data. Using a panel data to macroeconomic variables (debt/GDP, inflation, economic growth rate %, CPI inflation, foreign direct investment, exchange rate). Based on multiple regression technique, we found that inflation and foreign direct investment can limited the risks for public debt in this country. In fact, the US sought to improve the performance and efficiency of their debt sectors to ameliorate their overall economic performance.

More recently, Carmen R Belen S (2011) used macroeconomic variables (public debt/GDP ratios, real interest rates, nominal interest rates, inflation, and domestic public debt/GDP) to examine the impact of inflation on public debt. The results of the regression revealed that inflation and financial repression contributed significantly to the reduction in public debt of the advanced countries between 1945-1960(Austrlia, Belgium, Italy, Sweeden, US, and United Kingdom). Moreover, Laurence Ball (2013) reported that financial development; economic growth and population are driving forces in the increased energy demand in Malaysia. A feedback effect is also reported between financial development and energy consumption in long run but financial development has a Granger cause energy demand in the short run.

How Does Exchange Rate Affect Public Debt?

Lim Chia Yien and al (2017) examined the causal relationship between inflation, debt and exchange Rate in Malaysia over the period 1960-2014 though a cointegration and granger causality test. The long-run estimates show the existence of a unidirectional relationship from exchange rate to public debt. These results show that there is a bi-directional causal relationship between foreign investment and economic growth domestic debt and inflation. In the same vein, Quilent (2015), used the Ordinary Least Squares (OLS) to examine the relationship between exchange rate volatility and external public debt in Kenya between 1993 to 2013. The results of the regression revealed that the exchange rate volatility can generally lead to an excessive public debt growth. In study about some Middle East and North Africa countries (Morocco, Egypt, Jordon, Turkey and Tunisia) Neaime (2009), used causality granger test to investigate the links between foreign debt and exchange rate. The links between foreign debt and exchange rate. Based on the panel data, Neaime observed a positive effect between external public debt and exchange rate.

Richard (1991) studied the interactions of External Debt, exchange Rates, domestic price, Government expenditure, real interest rates and nominal interest rates between 1975- 1986 in Nigiria. The author showed that the exchange rate coefficient was negative and statistically significant. When the exchange rate increases by one percent points, external debt decreases by about 0.01 percentage point per year.

In a study about South American Countries, Céline Breton (2004) used small open economy to investigate the existence of a long-term relationship between Public Debt and Real Exchange Rate. They found a positive long-run relationship between the variables. Similarly and in Thailand, Pichit Patrawimolporn (2011) studied the effects of exchange rates on debt, debt services and public debt management between1980-1989. Their results show that Public Debt Management became more articulated in the second half of the 1980s largely because of the increased volatility in exchange rates among key currencies.

How does Interest Rate Affect Public Debt?

In recent years, the relationship between interest rate and public debt has drown much interest in recent years. For exemple, Paolo Paesani et al. (2006) examined the impact of the accumulation of government debt on the long-term interest rates in the Germany, Italy and USA. Their results support the idea that the debt accumulation can generally lead to long-term interest rates. Indeed, Peter Claeys (2012) by using the spatial modeling techniques for the EU, OECD countries and emerging markets, over the period 1990–2005, asserted that the level of public debt influences the use of domestic long term interest rates. A 1% increase in the debt ratio pushes up domestic rates by 2 points.

Furthermore, Robert ford & Douglas Laxton (1999) studied the relationship between public debt and real interest rate in nine industrial countries. They found that the wide government debt was influenced by the increase in the real interest rate. In this vein, Ines A (2016) studied the causal relationship between public debt, monetary policy and economic growth in the Tunisia over the 2002/2013 period. This author used the SVECM model and Granger causality. The results show that there is a bidirectional causal relationship between public debt, economic growth and monetary policy. Eric Engen and R. Glenn Hubbard (2004) have analyzed the evolutions of government debt and interest rates. Their results revealed that when government debt increases by one percent points, the real interest rate increases by about two to three basis points.

Thomas Laubach (2003) analyzed the effect of interest rate on budget deficit and debt. The authors showed a statistically and economically significant: The increase of the real interest rate can generally lead to raise the budget deficit and debt.

Data

Some researchers on public debt, such as Peter Claeys (2012), Douglas Laxton (1999) , Thomas Laubach (2003), Ines A (2016), Céline Breton (2004), Quilent (2015), Neaime (2009), Emmanuel Harmon (2011) , Bernardin Akitoby et al (2014), Nguyen van bon (2015) among others, included inflation, exchange rate, economic growth, capital stock, total population, foreign direct investment, and exportations .

As mentioned earlier, most existing literature supposes that inflation, exchange rate and interest rate are likely to lead to changes public debt. It also establishes that these variables are often key determinants of public debt. Hence, the interrelationship between inflation, exchange rate interest rate and public debt should be considered simultaneous in a modeling framework.

PD: Public debt.

RER: Real exchange rate.

POP: Population.

FDI: Foreign direct Investment.

INF: inflation.

UR: unemployment rate.

IR: interest rate.

Our study covers 83 countries and is determined by data availability. They include four panels: MENA countries, sub-Saharan region, southern Mediterranean countries, and European countries. Data are collected from the World Bank Development Indicators.

Table (1) presents the number of countries.

| Table 1 List of Country | |

| List of country | Number of countries |

| MENA countries | 13 countries |

| Sub-Saharan region | 33 countries |

| Southern Mediterranean countries | 9 countries |

| European countries | 28 countries |

Methodology

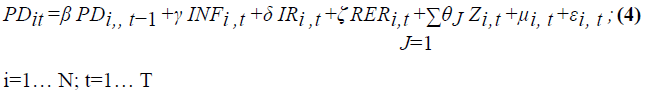

To assess the determinants of public debt, we use the Generalized Method of Moments (GMM) dynamic panel, which helps resolve the problems of simultaneity bias, measurement errors, and the risk of the omitted variables. This method enables us to control for both individual and time-specific effects and bearing through endogeneity of variables especially when there is one or more lags of the dependent variable included as an explanatory one. This empirical work use the dynamic panel GMM proposed by Arellano and Bond (1991) and developed by Arellano and Bover (1995) and Blundell and Bond(1998), which can be expressed as follows :

DBT =f ( INF , IR , EXH , UR, POP, FDI ) + μt (1)

After logarithmic transformation of Eq. (1) is written as follows:

log (PDt)=α0+ α1 log ( INF )+ α2 log (IR )+α3 log ( RER )+α4 log ( UR )+ α5 Log (POP )+α6 log ( FDI )+ μt (2)

We then transform the function Eq. (2), into regression equations to derive the empirical models to simultaneously examine the impact of inflation, exchange rate and interest rate on public debt. These simultaneous equations are constructed on the basis of theoretical and empirical insights of the recent literature.

Can be written in panel data form as follows Eq. (2) because since our study is a panel data study:

log (PDit)=α0 +α1 log(INFit)+α2 log (IRit)+ α3 log (EXHit)+ α4 log (URit)+ α5 log (POPit)+ α6 log (FDIit)+ μt (3)

Where the subscript i=1………., N denotes the country (in your study we have 75countries) and t=1. T denotes the time period (the period of study is 1990-2017). Our study covers the

Southern Mediterranean countries, and then we use annual data over the period of 1990-2017.

Results and Interpretations

Descriptive Statistics

In Table (2), we present a descriptive analysis of different variables (dependent and independent). This table presents a mean, standard deviation (Std. Dev.) and the coefficient of variation (CV) of these variables for each country.

| Table 2 Descriptive Statistics | |||

| Variables | Mean | Std. dev | CV |

| MENA countries | |||

| PD | 4,156 | 26,234 | 12,92 |

| RER | 2,345 | 33,213 | 14,21 |

| POP | 4,126 | 38,123 | 9,83 |

| FDI | 6,678 | 42,321 | 18,91 |

| INF | 5,123 | 48,321 | 25,23 |

| UR | 4,095 | 54,123 | 43,98 |

| IR | 3,345 | 12,452 | 31,8 |

| Sub-Saharan region | |||

| PD | 12,241 | 15,213 | 16,93 |

| RER | 3,231 | 17,65 | 17,21 |

| POP | 16,321 | 22,46 | 9,93 |

| FDI | 5,321 | 27,90 | 8,24 |

| INF | 22,874 | 31,94 | 17,91 |

| UR | 11,345 | 32,94 | 15,92 |

| IR | 9,153 | 12,94 | 13,43 |

| Southern Mediterranean Countries | |||

| PD | 3,143 | 54,93 | 32,43 |

| RER | 9,342 | 79,93 | 17,45 |

| POP | 15,543 | 42,12 | 15,32 |

| FDI | 15,543 | 44,14 | 12,13 |

| INF | 21,342 | 32,41 | 11,45 |

| UR | 12,564 | 64,91 | 22,31 |

| IR | 9,245 | 30,12 | 12,41 |

| European countries | |||

| PD | |||

| RER | 14,356 | 29,82 | 10,43 |

| POP | 13,213 | 41,71 | 8,15 |

| FDI | 9,321 | 44,91 | 12,34 |

| INF | 7, 231 | 59,92 | 2,32 |

| UR | 9,342 | 78,12 | 7,16 |

| IR | 14,321 | 81,14 | 15,65 |

| 12,421 | 88,24 | 10,43 | |

The highest means of public debt are (14,356) in European countries and (12,241) in Sub- Saharan region, whereas the highest means of exchange rate (13,213) and (9,342) is in European countries and Southern Mediterranean countries, respectively. However, the highest means of inflation is 22,874 in Sub-Saharan region.

Table 3 shows the correlation matrix of all sample countries. In fact, all the correlation coefficients between the explanation variables and the dependent variable are statistically significant at 5% at least. Accordingly, public debt, inflation and unemployment rates are negatively correlated with economic growth while trade openness, foreign direct investment, population and exportations are positively linked to economic growth.

| Table 3 Correlation Matrix | |||||||

| Variables | PD | RER | POP | FDI | INF | UR | IR |

| PD | 1.000 | ||||||

| RER | -0,07213 | 1.000 | |||||

| POP | -0,17821* | 0,4213 | 1.000 | ||||

| FDI | -0,0465* | 0,2134 | 0,1342 | 1.000 | |||

| INF | 0,1476* | 0,4293 | 0,0213 | 0,7651 | 1.000 | ||

| UR | 0,0321* | 0,0432 | 0,08103 | -0,1342 | 0,2134 | 1.000 | |

| IR | 0,7325* | 0,1673 | 0,614 | -0,9013* | 0,324 | 0,4712 | 1.000 |

In addition, all the correlation coefficients between the independent variables are relatively low, which helps to eliminate the possibility of co-linearity between these variables.

Results of the GMM Estimates

To study the impact of inflation and other macroeconomic variables on public debt for 83 countries, we examined how inflation, exchange rate, interest rate and unemployment rate… have an importance on public debt increase. The absence of an economically meaningful relationship between the inflation, the interest rate, the unemployment rate found in our prior analysed might be an indication of the absence of joint management of public debt. It is necessary to adopt reforms in debt services to minimize the risks of debt. Our results relating to relationship between public debt and other macroeconomic variables are estimated to be pretty large in magnitude. Therefore, we intend to investigate the consistency of the findings through an alternative estimator of Arellano & Bond’s (1991) GMM. The choice of this technique is made because this method can deal with the potential endogeneity arising from the inclusion of the lagged dependent variables and other potentially endogenous variables and is accurate and effective method allowing take into account the unobserved specific effects. This model can be written in panel data form as follows Eq. (4):

PDit is the observation of the dependent variable for country i at time t; β0 is the parameter to be estimated, γ , δ , ζ captures respectively (Inflation, interest rate and exchange rate), Z is vector of explanatory variables (foreign direct investment, unemployment rate and population). Finally μ is country-specific effects; and ε is the error term.

The results of the analysis using GMM model are presented in following tables. The first test in this model is Sargan/Hansen to provide some evidence of the instruments' validity; we notice that the p-values in the tests are greater than 0.1, indicating that over identifying restrictions are valid. Thus, this model is correct. Then, the p-values for AR (2) are higher than 0.10. Therefore, the null hypothesis is not rejected. This implies that the empirical model is consistent and there is a good specification of instruments. In addition, using Hansen J statistic tests to check the validity of the instruments, we notice that the p-values in the tests are greater than 0.1, indicating that over identifying restrictions are valid. Thus, this model is correct. Then, the autocorrelation of Arellano and Bond (1991), tracks the existence of the second order autocorrelation in first differences. In fact, the null hypothesis indicates the absence of first and second order autocorrelation in the equation. This implies that the empirical model is consistent and there is a good specification of instruments.

Table 4 presents the empirical methods for the assessment of the determinants of public debt in the MENA countries. This table shows that the impact of the inflation on public debt is negative and significant at the 1% level. Which indicates that an increase of inflation by one percent leads to a decrease of public debt by 0,134%. This confirms the results showed by van bon (2015), Joshua A and Nancy M (2011), Laurence Ball (2013). The inflation can reduce public debt through the tax revenues of countries. If prices rise, tax revenues also increase, which in turn increases budget revenues. A budget surplus of 1% of GDP causes a decrease in the debt when inflation increases.

| Table 4 Results for the Mena Countries | ||

| Variables | Coefficients | Prob. Value |

| PDt-1 | 0,0032* | 0,002 |

| INF | -0, 134* | 0,000 |

| IR | 0,321** | 0,04 |

| RER | 0,921 | 0,194 |

| Pop | 0,854 | 0,91 |

| UR | 0,632 | 0,12 |

| FDI | 0,003 | 0,986 |

| Const | 1, 345 | 0, 723 |

| Sargan test | 29,532 | 0,321 |

| AR(2) | -2,73 | 0,421 |

*Coefficient significantat1% level.

**Coefficient significantat5% level.

On the other hand, the interest rate has a positive and significant effect on public debt. The coefficient is 0.321, which indicates a decrease of interest rate by 0,321 can raise public debt by 5%. The high interest rate may decrease the investment, which can increase the debt deficit. For the MENA countries, investment has become an important source of private external funding. Unlike the other major types of external private capital flows, FDI driven mainly by the prospect of long-term profits which investors hope to achieve in their directly managed production activities.

Table 5 shows the relationship between macroeconomic and public debt in the sub-Saharan region. In this context, we try to explain how public debt acts in the presence of exchange rate, inflation, interest rate… The coefficient of exchange rate indicates that this determinant has a significant and negative effect on public debt at the 10% level. An increase of real exchange rate by 10% leads to a decrease of public debt by 0,178%. This finding supports the view of Richard (1991). The exchange rate depreciation can be explained by the trade deficit, the decline in government revenues and the limited intervention of the central bank in the foreign exchange market, which raises the percentage of public debt.

| Table 5 Results for the Sub-Saharan Region | ||

| Variables | Coefficients | Prob. Value |

| PDt-1 | -0,8653* | 0,003 |

| INF | -0,706 | 0,115 |

| IR | 0,987 | 0,742 |

| RER | -0,178*** | 0,096 |

| Pop | 0,876* | 0,002 |

| UR | 0,132** | 0,041 |

| FDI | 0,923 | 0,372 |

| Const | 0,283 | 0,417 |

| Sargan test | 21,321 | 0,473 |

| AR(2) | -1,73 | 0,451 |

*Coefficient significantat1% level.

**Coefficient significantat5% level.

***Coefficient significantat10% level.

In fact, the depreciation of the exchange rate for the sub-Saharan region generates a budget deficit, a decline in tourism receipts and FDI, a rise in public spending and inflation. Moreover, according to IMF, this depreciation has a significant positive effect on exportation. This means that the decrease of exportation can improve the price competitiveness of products.

Moreover, the unemployment rate has a positive and significant effect on public debt which fell by 0,132% following a 5 % increase of unemployment rate. A few years ago, the decision of countries of the sub-Saharan region to liberalize their national policies to create a welcoming regulatory framework for investment and reduce unemployment rate. Given that these investors are satisfied with their presence in these countries, they will advertise them by encouraging new investors to establish themselves in these countries while showing them the financial or budgetary incentives that are put in place Padma M & Karl P (1999).

Moreover, the coefficient of the population indicates that population has a significant and positive effect on public debt at the 1% level. A 1% increase in the population raises public debt by 0,876%.

Table 6 contains results for the southern Mediterranean countries. The negative and significant coefficient of inflation in the southern Mediterranean countries, suggests that the increase in inflation rate decreases the public debt. Akitoby and al (2014) found that an acceleration of inflation would help reduce the public debt. It would, therefore be more effective of central banks do not tighten their monetary policy. Our results confirm the result for the MENA countries in this estimation.

| Table 6 Results for the Southern Mediterranean Countries | ||

| Variables | Coefficients | Prob. Value |

| PDt-1 | -0,042 | 0,521 |

| INF | -0,731* | 0,09 |

| IR | 0,893* | 0,045 |

| RER | 0,154 | 0,763 |

| Pop | -0,721 | 0,091 |

| UR | 0,164* | 0,084 |

| FDI | 0,932 | 0,621 |

| Const | -12,562 | 0,423 |

| Sargan test | 31,71 | 0,521 |

| AR(2) | -0,75 | 0,936 |

* Coefficient significantat1% level.

** Coefficient significantat5% level.

***Coefficient significantat10% level.

Regarding the interest rate, this has a positive and significant effect on the public debt. This suggests that the increase in interest rates will lead to a gradual increase in the debt ratio. This rise of the rate makes it possible to increase the debt-to-GDP ratio, which presents a risk for public finances. In addition, if a central bank finances the state at a lower rate than that of commercial banks, the impact on the fiscal deficit is null. These results confirm the finding of Thomas Laubach (2003). For the panel estimation, the variable of unemployment rate has a significant and positive effect on public debt at the 1% level. This suggests that a 1% increase in unemployment rate raises public debt directly and indirectly by 0,164 %. This suggests that unemployment rate is a determinant of public debt in the southern Mediterranean countries and the sub-Saharan region. Furthermore, the variable of real exchange rate, population and foreign direct investment has an insignificant impact on public debt for the southern Mediterranean countries in Table 7.

| Table 7 Results for the European Countries | ||

| Variables | Coefficients | Prob value |

| PDt-1 | -0,00962** | 0,047 |

| INF | 0,0851 | 0,742 |

| IR | -0,938* | 0,043 |

| RER | 0,0056* | 0,001* |

| Pop | 0,0179 | 0,763 |

| UR | 0,855 | 0,716 |

| FDI | -0,0124* | 0,084 |

| Const | -11,75 | 0,049 |

| Sargan test | 29,042 | 0,964 |

| AR(2) | -0,162 | 0,381 |

*Coefficient significantat1% level.

**Coefficient significantat5% level.

***Coefficient significantat10% level.

The results for the European countries are reported in Table 6. The value of PDt-1 (-0, 00962) implies that public debt is corrected by (0.962) percent each year.

The negative and significant coefficient of interest rate, suggests that increases in interest rate decreases the percentage of public debt. Carmen Reinhart & Belen Sbrancia (2011) found that interest rates fixed by central Bank and financial repression (which refers to all the measures by which governments require residents to buy and hold government securities) have contributed significantly to the public debt reductions of advanced countries between 1945 and 1970. Similar findings were obtained by the results for the southern Mediterranean countries. Regarding the impact of real exchange rate on public debt for the European countries, we find that there a positive and significant effect. This suggests that exchange rate is a determinant of public debt. This also suggests that rise of the deficits automatically results in a rise of foreign assets to the real exchange rate and in particular in a rise of the public debt (Céline Breton (2004)).

The results show for the FDI is statistically significant at the 1% level. The magnitude of 0, 0124 implies that a 1% increase of the foreign direct investment decreases the public debt for the European countries by 0.0124%. For the developing countries, FDI has become an important source of private external funding. Unlike the other major types of external private capital flows, FDI is driven mainly by the prospect of long-term profits which investors hope to achieve in their directly managed production activities. On the macroeconomic level, the inflation, population and employment rates have an insignificant impact on public debt for the European countries.

Table 8 presents the results for four panels concerning the determinant of public debt. First, we have found that the effect of inflation on public debt is negative and statistically significant in the three panels. This indicates that an increase in inflation implies a decrease public debt. Second, interest rates have a positive and statistically significant effect on public debt in the two panels (MENA countries, southern Mediterranean countries). Third, we found that real exchange rate has a negative and statistically significant effect on public debt for the sub-Saharan region, but a positive and statistically significant effect for European countries. Only for the sub-Saharan region, the population has a positive and statistically significant effect. Moreover, unemployment rate has a positive and statistically significant effect on public debt in two panels (southern Mediterranean countries, sub-Saharan region). Finally, foreign direct investment has a positive and statistically significant effect on public debt only for European countries.

| Table 8 Results for Four Panels | ||||

| MENA countries |

sub-Saharan region | southern Mediterranean countries | European countries | |

| INF | ✔ (-) | ✔ (-) | ||

| IR | ✔ (+) | ✔ (+) | ✔ (-) | |

| RER | ✔ (-) | ✔ (+) | ||

| POP | ✔ (+) | |||

| UR | ✔ (+) | ✔ (+) | ||

| FDI | ✔ (-) | |||

Conclusion

Although the literature on public debt, inflation, exchange rate and interest rate has improved over last few years, there is no study that examined the effect of these determinants on public debt using a simultaneous equation models on a global panel consisting of 83 countries. The results are based on time data panel from 1990 to 2017.

The objective of this empirical work is to investigate the impact of inflation, exchange rate and interest rate on public debt. To solve this issue, a series of country and macroeconomic variables are combined to explain the determinants of public debt. Our results show that first, the effect of inflation on public debt is positive and statistically significant in the three panels. Second, exchange rates have a positive and statistically significant (European countries) and negative and statistically significant (the sub-Saharan region) effect on public debt. Finally, effect of interest rate on public debt is positive and statistically significant in two panels (MENA countries, southern Mediterranean countries). We also show that the inflation, exchange rate, and interest rate are the determinants of public debt.

These results have important theoretical and practical implications. First, the significant presence of the foreign direct investment calls into question the development of the economy in the developing countries consists in creating a more predictable environment for foreign direct investment and innovation, and providing opportunities for sustainable economic growth. Second, the body of literature on inflation, exchange rate as well as interest rate on public debt has strong implications for economic policies. Third, an indebtedness that may generate conflicts of interest between the human value of production and management (restructuring, job losses...). It also presents the risk that lies in the possibility to see one’s returns go down. Lower returns may be also caused by a decline of the real estate market value in general.

Future research should focus on the impact of liquidity risks on public debt during the global financial crisis and the European sovereign debt debacle. The present paper provides empirical results which are useful for the understanding of this type of national economy in the region as well as in determining the most effective economic policies in order to increase economic development. However, we believe that this paper is intended to help economic decision makers to improve the economic outlook by controlling the debts risks.

It also helps economic decision makers to understand how the macroeconomic determinant affect public debt to improve the economic and financial situation of a country, this minimizing the risks of debts to achieve economic development.

References

- Akitoby, B., Takuji,K., & Ariel, B.(2014). Inflation and public debt reversals in the G7 countries. IMF working paper, 14(96).1-28.

- Akitoby, M.B., Komatsuzaki, M.T., & Binder, M.A.J. (2014). Inflation and public debt reversals in the G7 Countries. International Monetary Fund, 1(14).

- Ball, L. (2013). The case for Four Percent Inflation. Central Bank Review (Central Bank ofthe Republic of Turkey), 13(2).

- Bernardin, A., Takuji, K., & Ariel, B. (2014). Inflation and Public Debt Reversals in the G7 Countries. IMF Working Paper, 14(96).

- Bhattarai, S., Lee, J. W., & Park, W.Y. (2014). Inflation dynamics: The role of public debt and policy regimes. Journal of Monetary Economics, 67, 93-108

- Bildirici, M., & Ersin, O. (2007). Domestic debt, inflation and economic crises: A panel cointegration application to emerging and developed economies. Applied Econometrics and International Development, 7(1), 31-47.

- Carmen, R. B. (2011) . The liquidation of governement debt. NBER Working Paper series, 12(4), 1-66.

- Céline, B. (2004). Public Debt and Real Exchange Rate: the Case of the South American Countries within a framework of New Open Economy Macroeconomics. IMF working paper, 16(09).

- Claeys, S. (2012). Public debt and financial development: A theoretical exploration. Economics Letters ,115(3), 348-351.

- Douglas, L., & Robert, F. (1999). World public debt and real interest rates. Oxford review of economic policy, 15(2), 77-94.

- Edsel, B. (2007). Capital flight and economic performance. Munich Personal RePEc Archive.

- Emmanuel, Y. H. (2011). The impact of public debt on inflation, GDP Growth and interest rates in Kenya. Journal of economics. 10(2), 92-114.

- Eric, E., & Glenn, H. (2004). Federal Government Debt and Interest rates. NBER Working Paper No. 10681.

- Harmon, E.Y. (2012). The impact of public debt on inflation, GDP growth and interest rates in Kenya (Doctoral dissertation).

- Hilscher, J., Raviv, A., & Reis, R. (2014). Inflating Away the Public Debt? An Empirical Assessment. NBER Working Paper, (w20339).

- Inès, A. (2016). The relationship between public debt, economic growth, and monetary policy: empirical evidence from Tunisia. Journal of Knowledge Economy, 9(4), 1154-1167.

- Jens, H., Alon, R., & Ricardo, R .(2014). Inflating Away the Public Debt? An empirical Assessement. NBER Working Paper No. 20339.

- Joshua, A., & Nancy, M. (2011). Using Inflation to Erode the U.S. Public Debt. NBER Working Paper No. 15562

- Laurence, B. (2013) .The Distributional Effects of Fiscal Consolidation. IMF Working Paper 13(151).

- Lim, C.Y., Hussin, A., & Muhamed, A. (2017). Granger Causality Analysis between Inflation, Debt and Exchange Rate: Evidence from Malaysia. International journal of academic research in accounting, finance and management sciences, Vol 7, No1.

- Neaime, S. (2009). Sustainability of exchange rate policies and external public debt in the Mena region. Journal of Economics and International Finance. Vol.1, No 2.

- Nguyen,V.B. (2015). The relationship between public debt and inflation in developing countries ; empirical evidence based on difference panel GMM. Asian journal of empirical research, Vol 5, No 9.

- Padma M. & Karl P.S. 1999.Foreign Direct Investmentin Developing Countries.Financeand Development Geneva: UNCTAD

- Paolo, P., Rolf, S., & Manfred, K. (2006). Public debt and long –term interest rates the case of Germany, Italy and the USA. Working paper series, Vol.2, No 656.

- Pak H.M. (2001). Corruption and economic growth” Journal of Comparative Economics”, 2(7),66-79.

- Peter ,C.(2012). Rules, and their effects on fiscal policy .Sweden.Swedish Economic policy review.Vol.14, N°1.

- Pichit, P.(2011). Effects of Exchange Rates on Debt, Debt Services and Public Debt. Management in Thailand in the 1980s. IMF Working Papers, Vol1, No166. Pichit, P. (2004). Effects of Exchange Rates on Debt, Debt Services and Public Debt Management in Thailand in the 1980s. Asian economic journal banner, Vol.1, No 3.

- Quilent, A.O. (2015). Research Project Submitted in Partial Fulfillment of the Requirement for the Award of the Degree Masters of Arts in Economic Policy and Management of the University of Nairob. FMI, working paper, Vol 1, No1.

- Reinhart, C., & Kenneth S.R. (2013) . Financial and sovereign debt crises: Some lessons learned and those forgotten. FMI, working paper.

- Richard, A. (1991). On the Simultaneous Interactions of External Debt, Exchange Rates, and Other Macroeconomic Variables: The Case of Nigeria. Center for economic research on Africa, Montclair State University.

- Robert. Douglas L. (1999). World public debt and real interest rate. Oxford review policy, Vol .15, No .2.

- Thomas, L. (2003). New Evidence on the Interest Rate effects of Budget Deficits and Debt. Board of Governors of the Federal Reserve System.

- Van, B. (2015). The relationship between public debt and inflation in developing countries: Empirical evidence based on difference panel GMM Asian Journal of Empirical Research, Asian Economic and Social Society, vol. 5.