Research Article: 2025 Vol: 29 Issue: 3

An Empirical Analysis of Consumer Payment Choices in Indian E-commerce: Domestic vs. International

Samir Ul Hassan, Narsee Monjee Institute of Management Studies (NMIMS) University, India

Joel Basumatary, Bharathidasan Govt College for Women, India

Citation: Hassan SU, Basumatary J. (2025). An Empirical Analysis of Consumer Payment Choices in Indian E-commerce: Domestic vs. International. Academy of Marketing Studies Journal, 29(3), 1-23.

Abstract

This study thoroughly investigated E-commerce's payment ecosystem, analyzing all facets. The main goal was to understand India's digital payment ecosystem attributes, motivators and influencers across domestic and international E-commerce. A Google form collected primary data on E-commerce consumer payment behavior. The questionnaire addressed payment choices, platform preferences, reasons for avoiding digital payments and perceptions. Multinomial logit model analyzed the determinants of mode of payment. Our study revealed that demographic characteristics significantly influence a person's payment choices (digital or cash). These factors exert different effects on domestic and international E-commerce platforms, with consumers being more hesitant about using digital payments for domestic E-commerce. The findings indicate that not only affluent, privileged, urban and educated groups opt for digital payments, but also factors like platform viability, accessibility, security and trust play crucial roles in shaping payment preferences. This study is the first to empirically demonstrate that the rise in digital payments is influenced not only by factors like convenience, habit, trust, security and awareness of online payment platforms but also by a negative perception regarding cash payments in both domestic and international E-commerce platforms.

Keywords

Trust, Digital payments, Ecommerce, FinTech, Domestic, International JEL classification: L81, D11, E42.

Introduction

The internet and technological advancements have given rise to a new era of commerce, fueling the rapid growth and transformation of e-commerce worldwide (Chen, et al., 2020; Dholakia, 2021). E-commerce is the process of buying and selling of goods and services using an electronic medium like the internet. Among other features, the e-commerce operates 24 hours a day and is accessible anytime and from anywhere. There are various types of e-commerce models viz., Business-to-Business (B2B) model that operates between two companies, Business-to-Consumers (B2C e-commerce) model, that retails transactions between businesses to consumers or shoppers, Consumer-to-Consumer (C2C) model, where transactions take place between customers and the Customer-to-Business (C2B) model where the customers sell their products and services to businesses. In this study we are interested in the Business-to-Consumer (B2C) e-commerce model, where the businesses sell their products and services to the consumers or shoppers. The examples of B2C e-commerce models that are operational in India are Amazon.in; Flipkart; Myntra; Tatacliq; Pepperfry; Paytmmall; Nykaa; 1mg; Firstcry; AJIO; Bigbasket; Grofers; Shopclues; Makemytrip; Bookmyshow; Koovs; Lenskart; Meesho; and Zomato. In India the e-commerce business has grown tremendously in recent years especially during post-COVID-19 pandemic (international trade administration, 2024). For instance, according to the international trade administration (2024) the value of Indian e-commerce could reach $136.47 billion by 2026 from mere $46.2 billion in 2020. In other words, the value of e-commerce will rise by 18.29 percent by 2026.

India, with its vast population and increasing digitalization, has emerged as a significant player in the global e-commerce landscape (Statista, 2021). The country's favorable regulatory environment, coupled with a large consumer base and expanding internet penetration, has contributed to the exponential growth of both domestic and international e-commerce activities in India (McKinsey and Company, 2020). The Indian government has actively fostered a conducive digital ecosystem to facilitate the digitization process, including digital payments. Consequently, multiple e-payment gateways have emerged, encompassing banking cards like ATM debit and credit cards, Unified Payment Interface (UPI) for smartphones, Unstructured Supplementary Service Data (USSD), mobile wallets, point of sales systems, Aadhaar Enabled Payment System (AEPS), micro ATMs and other innovative solutions. Further, the government introduced the Pradhan Mantri Jan-DhanYojana scheme in 2014 to enhance financial inclusion. This scheme provides RuPay debit cards to bank account holders through commercial banks like State Bank of India, Canara Bank, HDFC, Central Bank of India, among others, thus enabling digital payments. The UPI payments through mobile phones launched in 2016 has become a game-changer in the digital payment ecosystem in India. In the fiscal year 2023 the UPI transaction was worth $1.7 trillion (Ojha, 2023). The digital payment through UPI has bridged the gap between rural and urban areas in the digital payment ecosystem and this is done without any transaction charges from the users.

Therefore, over the past decade, India has experienced a remarkable digital transformation, driven by factors like widespread smartphone use, affordable data plans and government initiatives like Digital India (Government of India, 2015). This has led to a significant increase in e-commerce adoption, with consumers drawn to the convenience, variety and competitive pricing of online shopping (Bharadwaj, 2019). The COVID-19 pandemic further accelerated this trend as people sought contactless alternatives during lockdowns (McKnight, et al., 2020). Additionally, Indian consumers have shown growing interest in purchasing products from international markets through cross-border e-commerce platforms due to unique offerings, attractive deals and improved logistics (Gupta, et al., 2018).

The payment behavior of consumers in the e-commerce sector, however, plays a crucial role in determining the success and sustainability of online businesses (Haque, et al., 2019). As India's e-commerce market continues to evolve, it becomes imperative for e-commerce platforms, financial institutions and policymakers to understand the preferences, habits and challenges faced by consumers when making online payments (Ramayah, et al., 2016).

Digitization of various sectors aims to bring about several benefits, such as combating corruption, promoting financial inclusion and convenience, reducing currency management costs, tracking transactions and preventing tax evasion and fraud (Mazzotta, et al., 2019; Sumathy, et al., 2017).

However, achieving full digitization in every economy is a challenge due to factors like mindset, culture, habits, illiteracy and security concerns. Despite these challenges, economies worldwide are striving to expand digitization, including the financial sector. India, for instance, has been promoting digital payments through the DigiDhan Mission since 2017, offering various payment systems like UPI, IMPS, BHIM Aadhaar pay, debit cards and net banking. This effort has led to an increasing trend in digital payment transactions in India, with data showing significant growth in recent years (RBI, 2020). Keeping the digitalization mission in consideration, the high-level committee on deepening digital payments also recommends periodic surveys to understand user experiences and attitudes towards digital payments.

In 2011, B2C e-commerce turnover in India was estimated at US $9.9 billion (Upasna, et al., 2014). Their research looked into the growth and opportunities of e-commerce in the Indian market through penetration of the internet. The introduction of 4G internet, digital payment options like debit/credit cards, UPI and easy access to smartphones have fueled the growth of digital transactions on platforms like Flipkart, Amazon India, Alibaba, Myntra and others (Ernst, et al., 2019). However, cash payments still remain prevalent in the country despite this progress (Maqableh M, 2015; Arango-Arango, et al., 2018). For instance, Shree, et al., argued that there is still an increasing usage of cash in India. Their survey found that, although usage of digital mode of payment is growing, its acceptance is influenced by perception of the payment instruments, trust in the overall payments framework and banking system in general.

Although some studies have been done on digital payments of the consumers in various platforms since the advancement of FinTech, large mobile penetrations and internet usage in India, there is a gap to understand the consumer behavior in making payments while doing transactions in e-commerce platforms. Therefore, the objective of this study is to understand the factors influencing consumers' decisions to use cash or digital payment modes in the context of e-commerce transactions in India. Further, we also look into the consumer’s payment behavior while doing transactions in the domestic and international e-commerce platforms. This will help us to understand the determinants of consumer behavior in e-commerce transactions. Thereby, we can drive technological advancements and policy reforms to encourage larger adoption of digital payment technologies. To address this area of analysis, an extensive and diverse online survey was conducted, exploring various aspects of the subject previously unexplored.

The paper is divided into six sections: Section II reviews the literature, section III covers materials and methods, section IV presents results and discussions, section V is policy implications and suggestions, sections VI is the conclusion and the last section is the limitations of the study and scope for further research.

Consumer behavior in e-commerce settings is a critical area of study, as it provides insights into the factors driving payment choices. Studies on consumer behavior highlight various determinants such as convenience, trust, security and familiarity. For instance, Liang and Huang emphasized the significance of trust in online transactions and its impact on payment method selection. Understanding these factors is essential for comprehending why consumers opt for specific payment methods in the context of Indian e-commerce.

Payment preferences in developing economies like India exhibit unique characteristics influenced by accessibility, cost and infrastructure. Gupta and Sharma explored the determinants of payment method choices among Indian consumers, shedding light on factors shaping their decisions. Comparing domestic and international payment methods reveals variations in consumer behavior. Bhargava and Aneja investigated differences in payment choices between domestic and international e-commerce transactions in India, highlighting factors such as currency conversion fees, exchange rates and perceived security concerns.

Technological advancements play a pivotal role in shaping payment preferences. Mishra, et al., examined the impact of digital wallet adoption on payment behavior in Indian e-commerce, indicating how technology influences consumer perceptions and preferences. Additionally, the regulatory environment significantly influences payment choices. Jain and Ramachandran analyzed the regulatory challenges faced by cross-border e-commerce transactions in India and their implications for payment choices, underscoring the importance of regulatory frameworks.

Cross-cultural studies comparing payment behavior across different countries provide valuable insights. Kim, et al., compared consumer payment preferences in e-commerce between India and other Asian countries, highlighting cultural influences and their implications for domestic and international payment choices. Moreover, security and trust are critical factors influencing payment decisions. Gupta, et al., investigated the role of security perceptions in shaping payment behavior among Indian e-commerce consumers, emphasizing the importance of trust and data security.

The growth of India's digital payments ecosystem has been phenomenal, especially after the 2016 demonetization (Bagnall, et al., 2014; Cagan, 1958). The cash shortage during that time compelled people to shift towards digital payments. However, digital payments declined as cash circulation returned to pre-demonetization levels (Chen, et al., 2020; Pal, et al., 2018). Nevertheless, demonetization introduced electronic payment systems to the people of India, leading to increased digital literacy and awareness (Rastogi, et al., 2020). Socioeconomic factors also influenced the mode of payment adopted for E-commerce transactions (Chen, et al., 2020; Vinitha, et al., 2017; Tanzi, 1983). Empirical research indicates that post demonetization, there has been a growing trend in E-commerce business in India, attributed to increased usage of ATM cards and mobile wallets for transactions (Sreejith, et al., 2019).

The Indian economy experienced two significant shocks recently demonetization and the COVID-19 pandemic both of which greatly accelerated the digitalization process in India (Rastogi, et al., 2020). Despite efforts to promote digital payments, cash usage remains widespread, with less than 5 percent of the population using electronic modes for payments (Thirupathi, et al., 2019). Reasons for this could include population illiteracy, lack of financial knowledge and limited awareness about e-payment systems. Sreejith and Soubhagya found that demonetization popularized digital payment systems, especially in E-commerce transactions, with an increase in business transactions through ATM debit cards and mobile wallets. Both, demonetization and the COVID-19 pandemic further accelerated India's digitalization in payment systems, with people becoming more skeptical about accepting cash and opting for mobile payment systems like Paytm, Phonepe and Google Pay (Rastogi, et al., 2020).

The growth of cashless transactions in various sectors of the Indian economy was influenced by people's perception that it would combat corruption and illegal activities (Das, et al., 2010; Garg, et al., 2017). This indicates that awareness of reducing corruption and illegal activities also drives India's digitalization process. Siby conducted a study in Kerala, finding that high digital literacy, mobile penetration and internet facilities contributed to increased digital payments during the COVID-19 pandemic across all demographic groups. This highlights the importance of sufficient infrastructure to promote the digital payment system in India. However, Fatonah, et al., found in their study on E-commerce sites that there was a lack of trust in the digital payment system among people.

Critical Overview of Existing Literature and Research Gaps

The literature presented provides a comprehensive overview of the factors influencing consumer payment choices in the context of Indian e-commerce. It highlights significant determinants such as convenience, trust, security and familiarity, underscoring their importance in shaping consumer behavior. Moreover, studies by Liang and Huang, Gupta and Sharma and Bhargava and Aneja offer valuable insights into the nuanced differences between domestic and international payment preferences, emphasizing factors like currency conversion fees, exchange rates and regulatory frameworks.

However, despite the wealth of research on consumer behavior and payment preferences, several critical gaps persist. Firstly, while the literature acknowledges the impact of technological advancements on payment preferences, there's a lack of in-depth exploration into emerging technologies such as blockchain and cryptocurrencies and their potential influence on consumer behavior in Indian e-commerce.

Secondly, the literature predominantly focuses on macro-level factors influencing payment choices, such as trust and regulatory environments, but overlooks micro-level factors like individual preferences, attitudes and socio-cultural influences. Understanding these nuanced factors is crucial for developing targeted strategies to promote digital payments and address barriers to adoption effectively.

Furthermore, while studies like those by Rastogi and Damle and Sreejith and Soubhagya highlight the impact of significant events like demonetization and the COVID-19 pandemic on India's digitalization process, there's a lack of longitudinal research to assess the sustained effects of these events on consumer payment behavior over time.

Additionally, while some studies touch upon the importance of infrastructure in promoting digital payments, there is limited research exploring the role of government policies, financial literacy programs and public-private partnerships in facilitating digital payment adoption, particularly in rural and marginalized communities. Furthermore, it has been observed through the literature review that no study has been conducted to explicitly understand payment preferences (cash vs. digital) in the Indian e-commerce transactions.

Lastly, there's a need for more empirical research assessing the effectiveness of interventions aimed at enhancing trust and security perceptions in digital payment systems, especially in light of findings by Fatonah, et al., regarding lingering trust issues among consumers.

Addressing these research gaps can provide a more nuanced understanding of consumer payment behavior in Indian e-commerce, informing policymakers, businesses and other stakeholders in developing targeted strategies to promote digital payment adoption and foster inclusive economic growth.

Therefore, this study seeks to assess the individual level factors such as preferences, attitudes and socio-economic influences to understand their role in shaping consumer payment choices while performing e-commerce transactions. Thus, this study aims to fill aforementioned research gaps by exploring individual consumer behavior and payment choices in E-commerce from the customers' perspective. By pursuing these objectives, we may be able to contribute to a more comprehensive understanding of consumer payment behavior in Indian e-commerce while conveying policymakers, businesses and other stakeholders to develop strategies which promote digital payment adoption.

Materials and Methods

Data Collection

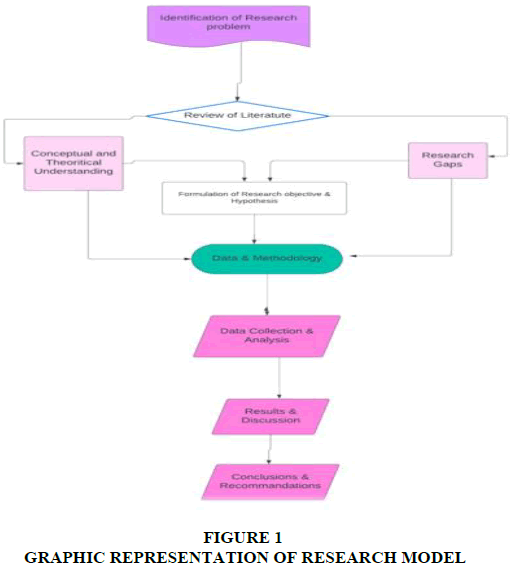

A structured questionnaire in the form of a Google form was designed to collect primary data on consumer payment behavior in the E-commerce market. The questionnaire covered payment choices, preferred E-commerce sites and the impact of COVID-19 on digital payments. Socio-economic and demographic variables like education, location, age, occupation and income were also collected. The study targeted regular online shoppers using mixed sampling methods, including snowball sampling. The survey was conducted from February 26th, 2022, to March 31st, 2022. Out of 500 mailed questionnaires, 450 were received, resulting in a response rate of 90%. After excluding incomplete responses, 425 valid responses remained for analysis (Figure 1).

Operational Definitions

E-commerce sites: These are online shopping platforms accessible to Indian customers within India, including Flipkart, Amazon India, Alibaba, Snapdeal, Myntra, IndiaMART, Nykaa, First Cry, 1mg, AJIO and MyGlamm.

Regional division of states/union territories: India's states are divided into North, North-East and South regions. North includes Jammu and Kashmir, Ladakh, Delhi, Punjab, Haryana, Himachal Pradesh, etc. North-East includes Assam, Sikkim, Meghalaya, etc. South consists of Andhra Pradesh, Telangana, Kerala, etc. Union territories without Legislative Assembly are excluded.

Rural and urban areas: Classified as per Ashok Mitra's 1961 census commissioner definition. Urban has >5000 people, density 4000/sq km and >75% non-farm sector engagement. Rural has <5000 people, density <4000/sq km and higher farm sector engagement.

Payment methods: Two main options - payment in advance (digital) and payment on delivery. Digital includes credit card, net banking, UPI, EMI. Payment on delivery can be cash or digital.

Occupation: Includes salaried individuals, self-employed, students, unemployed and others.

Digital payment: Online payment methods like credit card, net banking, UPI, EMI, pay later.

Cash payment: Paying in cash upon product delivery. Contrasts with digital payment which can occur online or on delivery.

International ecommerce: Platforms operating across countries, like Myntra, Amazon, eBay.

Domestic ecommerce: Indian platforms operating only within India, e.g., Flipkart, Snapdeal, IndiaMART, AJIO, 1 mg etc.

Analytical Model

The study employed descriptive methods and regression analysis to explore how Indian online shoppers perceive and engage with digital payments in E-commerce. Socio-economic factors like gender, region, age and education level were investigated for their impact on payment choice between cash and digital methods.

The dependent variable was the payment mode (cash or digital payment), with independent variables aligned with hypotheses. An initial baseline model examined payment trends for both methods in domestic and international E-commerce.

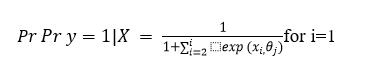

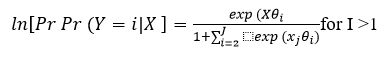

A model was developed to understand factors influencing the choice between digital and cash payments. Insights into Indian E-commerce payment preferences emerged from participant responses. For the categorical dependent variable with multiple categories, multinomial logistic regression was utilized. This method accommodates more than two categories in a non-specific order. Parameters were estimated using maximum likelihood estimation, obtaining coefficients (b1, b2, b3) for each outcome (i=1, 2, ..., i) of the dependent variable y, with X representing independent variables.

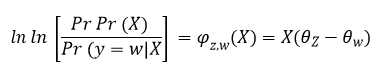

Putting i=1 as the reference category i.e., b1=0, we have the following form of regression:

The ratio of effects for each category or the likelihood effect of one category upon others can be estimated by odd ratios by following equation:

The above multinomial logistic probability model and its parameters are interpreted in odd or log odd ratio form. Therefore, any categories for a dependent variable the ratio will be:

The above equation can be written as:

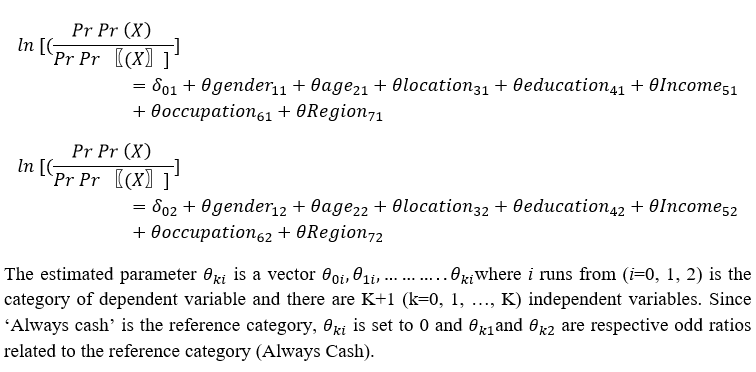

Where (θz-θw) is the magnitude of impact of X on odds when its z vs. w categories of a variable. For other parameters of outcome categories, similar computation approach has been applied. Our study has taken ‘always cash’ as a reference category and how movement from this category takes place given the variable is our primary objective. With our objective in focus, we initiate by forming a baseline logistic regression model. This model incorporates socio-economic and demographic factors like gender, age, education, location, family income, occupation and region as categorical independent variables with multiple categories. The dependent variable comprises three categories in our study.

Y=0 Always Cash (AC) reference category

Y=1 Always Digital (AD)

Y=2 Sometimes cash sometimes digital (SCSD)

Given the above categorization of our variable, the estimated baseline model is as follows:

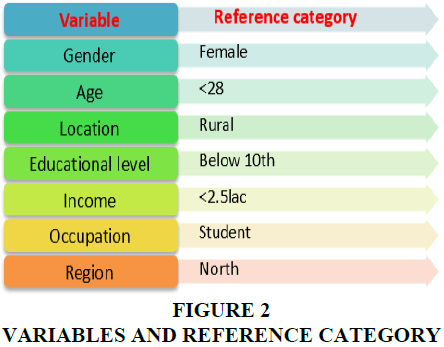

As discussed that all the independent variables are in category form, therefore they have been reported in dummy variable form. The reference categories for each of the independent variables used in the baseline model is given in the chart below:

Post analyzing the baseline model for socio-economic and demographic variables, reasons for not choosing digital payments and perceptions of cash and digital modes are examined. Additional variables are gradually introduced one by one. Reasons for not opting for digital payments are on a four-point scale: '0' for 'Habit of cash purchase,' '1' for 'No trust in digital payments,' '3' for 'bad past experience' and '4' for 'not aware of digital payment platforms.' Dummy variables adapt the baseline regression model.

Perceptions of E-commerce payments are assessed through parameters like convenience, no need for ATM and incentives, scored from 0 (bad) to 2 (good). These scores are averaged for a continuous total score, added to the baseline model.

Hypothesis

• Socio-demographic factors less likely effect the perception of mode of payments for domestic and international e-commerce.

• Convenience, trust, security and habit are core factors to determine the selection of mode of payments in e-commerce.

• Consumers have different behavior in the choice of making payments for domestic and international e-commerce platforms.

Results and Discussion

Sample Summary Statistics

Table 1 presents the socio-economic and demographic characteristics of the sample. The majority of respondents (73.176 percent) are aged between 18-28 and belong to the student cohort (61.882 percent). The salaried group comprises 28.706 percent of the respondents. In terms of education, most respondents hold a university-level degree (46.118 percent), followed by a bachelor's degree and 10+2. No illiterate respondents participated due to the online survey format. The income levels of the respondents vary, with representation from all income brackets, but the majority earn below 2,50,000, as many are students. Regional distribution shows 30.824 percent from the Northern region, 36 percent from the North-East region and 33.176 percent from the Southern region, making the sample representative of the entire India. Urban respondents make up 66.118 percent, while rural respondents account for 33.882 percent.

| Table 1 Demographic Characteristics of the Respondents | |||

| Age | 18-28 | 311 | 73.176 |

| 29-39 | 63 | 14.824 | |

| 40-50 | 28 | 6.588 | |

| 51-61 | 23 | 5.412 | |

| Gender | Male | 168 | 39.5 |

| Female | 257 | 60.5 | |

| Occupation | Salaried | 122 | 28.706 |

| Self employed | 14 | 3.294 | |

| Student | 263 | 61.882 | |

| Unemployed | 15 | 3.529 | |

| Other | 11 | 2.588 | |

| Education Level | Upto 10+2 | 63 | 14.824 |

| Upto bachelor degree | 166 | 39.059 | |

| University level | 196 | 46.118 | |

| Income Level | Below 250000 | 285 | 67.059 |

| 250001-500000 | 54 | 12.706 | |

| 500001-1000000 | 48 | 11.294 | |

| 1000001-2500000 | 38 | 8.941 | |

| Region | North | 131 | 30.824 |

| North-East | 153 | 36 | |

| South | 141 | 33.176 | |

| Location | Rural | 144 | 33.882 |

| Urban | 281 | 66.118 | |

| Total respondents | 425 | 100 | |

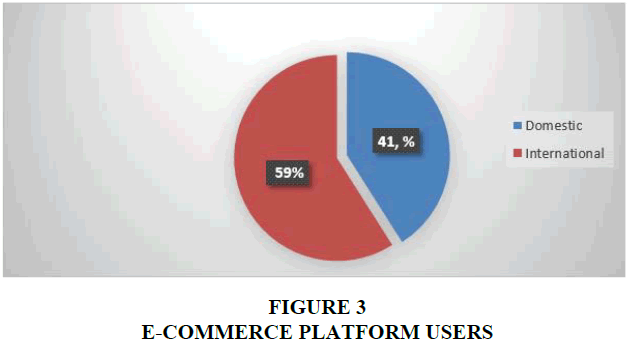

Regarding shopping from e-commerce sites, Amazon was the most popular choice among respondents (42.824 percent), followed by Flipkart (30.353 percent) and Myntra (16.706 percent). While MyGlamm and AJIO were not listed as options, a few respondents mentioned purchasing from these sites as well (Table 2 and Figure 3).

| Table 2 Ecommerce Shopping Sites and Usage by the Respondents | ||

| Amazon | 182 | 42.824 |

| Flipkart | 129 | 30.353 |

| Myntra | 71 | 16.706 |

| Meesho | 15 | 3.529 |

| Nykaa | 15 | 3.529 |

| Snapdeal | 4 | 0.941 |

| 1mg | 3 | 0.706 |

| AJIO | 3 | 0.706 |

| MyGlamm | 2 | 0.471 |

| IndiaMART | 1 | 0.235 |

| Total | 425 | 100 |

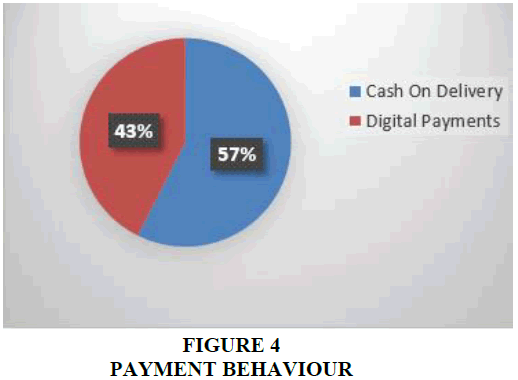

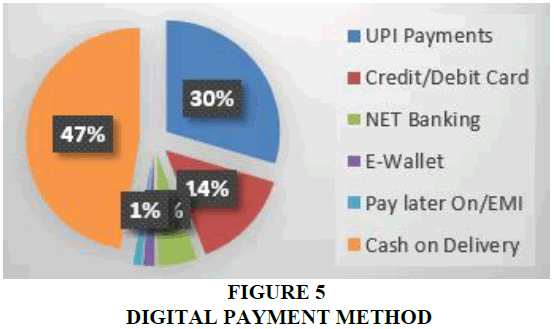

Choice of Making Payments

This paper aims to understand consumer behavior in making payments in e-commerce and its implications for policymakers. The supply side factors include internet accessibility, mobile/PC availability, E-commerce site presence, trust in digital payment systems, user experience, incentives and awareness. On the demand side, consumer habits play a crucial role. In product ordering, 57.41 percent opted for cash on delivery, while 42.59 percent used digital payments. Interestingly, 42 percent of those who chose cash on delivery actually made digital payments during product delivery. This means that a total of 283 consumers (66.59 percent of 425 respondents) effectively used digital payments.

Why do Consumers make Cash on Delivery or Payment on Delivery?

The reasons for choosing cash on delivery or payment on delivery include people's cash usage habits, trust in the payment system, past experiences and digital literacy. For instance, 32 percent preferred cash on delivery due to their familiarity with cash payments, while 26.35 percent lacked trust in digital payments and 2.5 percent had bad past experiences with digital payment systems. Therefore, negative experiences can impact consumer trust, but they constitute a small percentage (2.5 percent). Thus, improving the reliability and security of online payments can enhance consumer trust. Additionally, 1.17 percent of consumers opted for cash on delivery due to a lack of awareness about digital payments. Nonetheless, we argue that it is possible to shift from cash payment to digital mode of payment through increasing trust in digital payments systems that are associated with the various e-commerce platforms and creating awareness about their benefits.

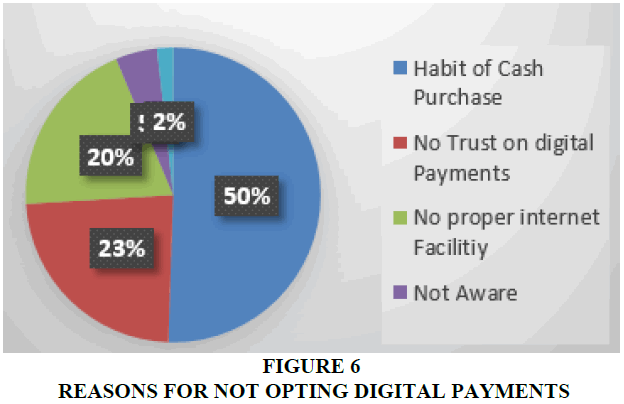

Why do Consumers make Cash Payments?

Out of 425 respondents, 57 percent opted for cash on delivery, but not all of them paid in cash. Some chose payment on delivery option, but during the product delivery time they made the payments in digital mode. Only 142 respondents (33.41 percent) actually paid in cash. The reasons for preferring payment on delivery include the habit of using cash, lack of trust in digital payments, inadequate internet facility and limited awareness about online payment. For instance, 33.88 percent cited the habit of using cash, 15.77 percent mentioned less trust in digital payments and 13.18 percent stated a lack of proper internet availability.

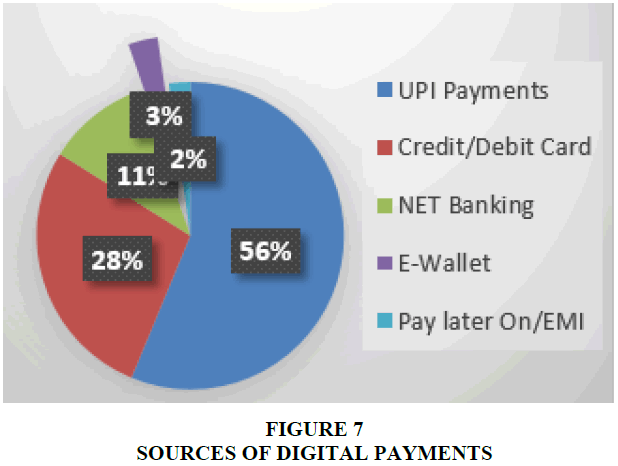

Why do Consumers make Digital Payment?

Various reasons drive the adoption of digital payments for e-commerce purchases. These factors include convenience, time and resource savings by avoiding ATM visits and incentives offered for digital payments. For instance, 42.58 percent of respondents prefer digital payments for the convenience of quick and easy transactions. Payment gateways like UPI, managed by the national payments corporation of India, enable e-wallet transactions (Paytm, Phonepe, Google Pay) through BHIM and QR code scanning are used for payments made in digital mode.

Furthermore, 20.94 percent of respondents opt for digital payments to save time and money, considering the fees associated with ATM transactions. The interchange ATM transaction fee is levied on bank customers for cash withdrawals and there are additional indirect costs like travel time and fuel expenses. Incentives also play a role in digital payment choices, with 6.35 percent of respondents mentioning rewards as a consideration. The Indian government encourages digital payments by offering incentives like cashback and reward points for BHIM users, making digital payments more cost-effective than cash transactions (Figures 4-7).

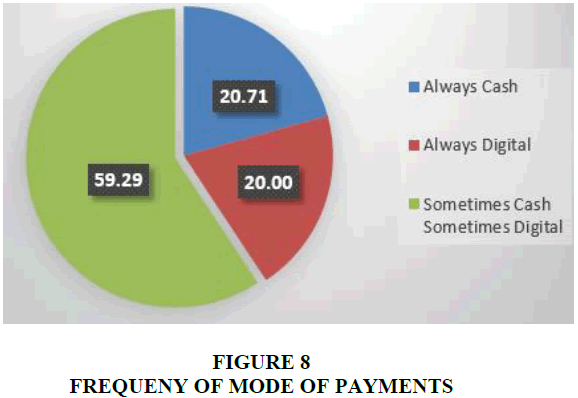

Frequency of Choice made in Different Payment Methods

In studying consumer behavior in e-commerce payments, we observed that the majority (59.29 percent) preferred a mixed payment method, combining both cash and digital options. Only 20 percent used solely digital payments, while 20.70 percent consistently opted for cash payments. Therefore, this indicates that the acceptance of digital payments in e-commerce transactions is still not very robust.

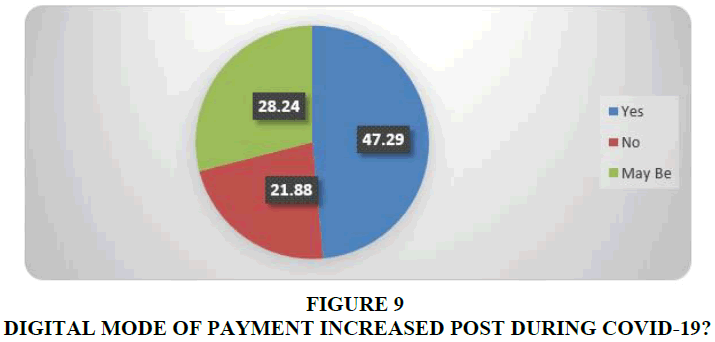

Have the Digital Payments for E-commerce Transactions Increased during COVID-19?

In our study, we examined if online shoppers had increased their digital payments during COVID-19. We discovered that 47.29 percent of respondents indeed raised their digital payments during this period. This finding aligns with empirical studies such as De, et al. (2020), which reported an increase in digital payment usage in physical stores during the pandemic. Therefore, we can conclude that just as digital payments surged in offline transactions, digital payments in e-commerce also experienced a notable increase (Figure 9).

Multinomial Logit Model

The findings reveal diverse digital payment behavior by socio-economic and regional groups. Online payment skepticism is shaped by several factors. Cash payments still dominate online purchases from e-commerce platforms. Given these patterns, studying socio-economic and regional influences on payment methods is vital. For this purpose, we utilized a multinomial logistic regression model to analyze how categorical variables impact payment modes (Table 3).

| Table 3 Estimated Results of Socio-Economic Factors and Mode of Payments for Ecommerce | ||

| Intercept (AC) | - 8.037 (3.456) | -2.359 (1.726) |

| Intercept (AD) | -8.23 (10.24) | -2.226 (2.012) |

| Intercept (SCSD) | 1.012 (0.519) | 0.895 (1.120) |

| Female | 0 | 0 |

| Male (AC) | 1.034 (0.891) | 0.368 (0.727) |

| Male (AD) | 0.889*** (0.251) | 1.238*** (0.421) |

| Male (SCSD) | 1.021** (0.141) | 0.934*** (0.289) |

| Below 28 | 0 | 0 |

| 29-39 (AC) | -1.398** (0.644) | -1.880*** (0.675) |

| 29-39(AD) | 0.516 (0.791) | 0.572 (0.753)* |

| 29-39 (SCSD) | 0.156 (0.463)* | -0.895 (0.265) |

| 40-50 (AC) | 0.054 (0.266) | 0.658 (0.253) |

| 40-50 (AD) | 0.948 (0.748) | -0.749 (0.454) |

| 40-50 (SCSD) | -0.189 (0.354) | -0.641 (0.542) |

| 51-61 (AC) | 1.695 (0.903)** | 1.490 (1.018)** |

| 51-61 (AD) | 1.003 (0.704) | 2.021 (0.842) |

| 51-61 (SCSD) | -0.004 (0.352) | 0.824 (0.430) |

| Rural | 0 | 0 |

| Urban (AC) | -2.537** (0.413) | -1.859 **(0.356) |

| Urban(AD) | 1.103*** (0.221) | 1.450*** (0.222) |

| Urban (SCSD) | -0.124 (0.252) | 0.564 (0.330) |

| Completed 12th | 0 | 0 |

| Bachelors (AC) | 0.093 (0.350) | 0.242 (0.421) |

| Bachelors (AD) | 9.6555 (5.325) | 0.852** (0.235) |

| Bachelors (SCSD | 0.712** (0.385) | 1.960** (0.237) |

| University level (AC) | 0.963 (0.779) | -1.354** (0.690) |

| University Level (AD) | 1.255** (0.425) | 0.896** (0.423) |

| University Level (SCSD) | 1.011** (0.235) | 0.989** (0.421) |

| Below 2.5 lakhs | 0 | 0 |

| 2.51 -5 lakhs (AC) | 0.715 (0.786) | -1.312* (0.703) |

| 2.51-5 lakhs (AD) | 0.895 (0.798) | -0.795** (0.562) |

| 2.51-5 lakhs (SCSD) | -0.454(0.355) | -0.819 (0.806) |

| 5.1-10 lakhs (AC) | 0.462 (0.856) | 0.589 (0.265) |

| 5.1-10 lakhs (AD) | -1.323 (1.256) | -0.745 (0.722) |

| 5.1-10 lakhs (SCSD) | -0.895 (0.785) | -0.879 (0.453) |

| 10.1-25 lakhs (AC) | 0.224 (0.568) | 0.709 (0.702) |

| 10.1-25 lakhs (AD) | 0.865 (0.652) | 0.454 (0.552) |

| 10.1-25 lakhs (SCSD) | 1.203 (0.854) | -1.012 (0.623)) |

| Occupation (Student) | 0 | 0 |

| Salaried (AC) | 2.365 (1.026) | 0.965 (0.754) |

| Salaried (AD) | -1.455*** (0.595) | -0.930* (0.741) |

| Salaried (SCSD) | -0.963*** (0.386) | -1.265 (0.896) |

| Self Employed (AC) | 2.054 (0.964) | -1.635 (0.355) |

| Self Employed (AD) | -3.522 (0.986) | -1.020** (0.563) |

| Self Employed (SCSD) | -2.661** (0.235) | -0.951 (0.323) |

| Unemployed (AC) | -2.361*** (0.236) | -0.531 (0.365) |

| Unemployed (AD) | -0.363 (0.693) | -1.369 (0.958) |

| Unemployed (SCSD) | -0.222** (0.235) | -0.823*** (0.652) |

| Others (AC) | 0.600** (0.438) | -0.184** (0.539) |

| Others (AD) | 0.072 (0.418) | -0.636 (0.526) |

| Other (SCSD) | 1.366 (0.955) | 0.185 (0.748) |

| Region (North) | 0 | 0 |

| North East (AC) | 1.233** (0.232) | 2.369*** (0.563) |

| North East (AD) | 0.963 (0.633) | 0.236**(0.393) |

| North East (SCSD) | 1.965*(1.150) | 0.755 (0.855) |

| South (AC) | -2.965 (0.312) | -6.520(0.263) |

| South (AD) | -3.231** (0.432) | -1.020 (0.362) |

| South (SCSD) | -1.398** (0.644) | -1.880*** (0.675) |

| Observations | 425` | 425 |

| R2 | 0.391 | 0.435 |

| Log Likelihood | -256.75 | -351.56 |

| LR Test (df=28) | 95.362*** | 89.184*** |

| Note: *p<0.1 **p<0.05 ***p<0.01 | ||

Socio-Economic and Demographic Factors and Mode of Payment

Table 3 presents the effects of socio-economic and demographic factors on e-commerce payment methods in India for both domestic and international platforms. Males exhibit a higher inclination towards digital payments compared to females on both platforms. Females tend to be more skeptical and prefer cash payments for e-commerce transactions. Additionally, males prefer mixed payment methods more than females, possibly due to their higher ownership of bank accounts and financial control.

Regarding age, the use of cash decreases significantly for both domestic and international platforms up to the age of 50. However, the age group below 28 is less inclined to use cash for international e-commerce, potentially due to trust issues with domestic platforms. Older individuals above 51 are less likely to pay digitally and prefer cash, possibly because they are less tech-savvy and rely on others for transactions.

Place of residence also influences payment behavior. Table 4 suggests that respondents from rural areas favor cash payments, while urban residents lean towards digital payments. As people move from rural to urban areas, their preference for digital payments increases and cash usage decreases. This trend is attributed to better availability and accessibility of financial services and better internet services in urban areas, while rural residents may be more skeptical about online payments due to security concerns and financial services availability.

Education level also plays a crucial role in the shift from cash to digital payments on both domestic and international e-commerce platforms. We found that those with lower education (12th standard) tend to prefer cash payments compared to those with a bachelor's degree. At the university level, the inclination to always use digital payments significantly increases for both platforms. This may be because as the education level of people increases, they get better accessibility towards financial services like bank accounts and digital payment FinTech like UPI enabled Paytm, Google Pay, Phonepe etc which operate via smart phones. Furthermore, as education levels go up, there is a chance that the financial independence of the people will improve.

Similarly, income level influences payment methods for domestic and international e-commerce. Lower-income groups prefer cash for domestic platforms but opt for digital payments for international ones, possibly due to varying levels of trust and security. However, as income and trust in domestic platforms increase, the tendency to always pay digitally rises for both domestic and international platforms over time.

Occupation significantly influences the mode of payment in both domestic and international e-commerce platforms. Students and unemployed individuals show the least inclination towards digital payments, while salaried individuals prefer digital payments for both platforms. Self-employed individuals tend to use mixed payment methods. Regionally, people in the North East prefer cash payments, whereas the southern region leans towards digital payments for both platforms. However, North East residents opt for digital payments for international e-commerce due to the unavailability of cash on delivery option, which is available for domestic e-commerce.

Therefore, in conclusion, we argue that the choice of digital payment is not solely dependent on wealth, privilege, urbanization and education levels. The viability, accessibility and trust in e-commerce platforms also impact payment preferences in India. Thus, to promote digital payments, efforts should focus on ensuring safe and secure payment systems, increasing awareness, improving financial service infrastructure, delivery mechanisms in e-commerce and facilitating urbanization.

Reasons for not Opting to Digital Payments

Attitudes toward digital payments are gauged on a four-point scale: '0' for cash habit, '1' for no trust, '3' for bad past experiences and '4' for lack of awareness. The baseline regression model incorporates these dummy variables, yielding results shown in Table 5.

Findings indicate cash habit deters digital payment use for both domestic and international e-commerce, especially pronounced in international transactions. Reduced trust discourages digital payments in both contexts. Surprisingly, those with bad past experiences adopt mixed payment methods for both. Security, trust, habit and experience influence digital payment choice.

Skepticism is higher for domestic e-commerce, seen as less secure than international. Nonetheless, individuals with bad experiences shift more to mixed methods in international e-commerce.

| Table 4 Not Opting Digital Payments | ||

| Habit of cash purchase (AC) | 0 | 0 |

| Habit of cash purchase (AD) | -1.166** (0.541) | -1.891** (0.454) |

| Habit of cash purchase (SCSD) | -0.578 (0.501) | 1.927* (0.956) |

| No trust on DP (AC) | 0 | 0 |

| No trust on DP (AD) | -1.120** (0.341) | -0.167** (0.418) |

| No trust on DP (SCSD) | -0.336 (0.353) | 0.088 (0.452) |

| Bad experience in past (AC) | 0 | 0 |

| Bad experience in past (AD) | -1.454 (0.837) | -0.557 (0.398) |

| Bad experience in past (SCSD) | 0.386** (0.791) | 0.112** (0.505) |

| Not aware of any DP platforms (AC) | 0 | 0 |

| Not aware of any DP platforms (AD) | 0.086 (0.791) | -0.243 (0.508) |

| Not aware of any DP platforms (SCSD) | 0.601 (0.656) | 0.444 (0.469) |

| Observations | 425 | 425 |

| R2 | 0.311 | 0.255 |

| Log likelihood | -341.89 | -306.56 |

| LR Test (df=28) | 171.23*** | 89.42*** |

| Note: *p<0.1; **p<0.05; ***p < 0.01 | ||

Perception of Cash vs. Digital Payments

The uncertainty about e-commerce payment perceptions drove our study. We sought to grasp how perceptions shift with certain variables. Cash perception is gauged by convenience, no ATM need and incentives, scored 0 (bad) to 2 (good). This total score augments the baseline model. Table 6 illustrates that as cash perception betters (improves), digital payment probability decreases for both domestic and international e-commerce. The decrease is more pronounced domestically (-2.27) than internationally (-1.66).

Similarly, we assessed digital payment perception. Positive, significant coefficients imply improved perception raises 'always digital' probability for both platforms, especially impactful internationally (2.10) compared to domestically (1.45).

Overall, perceptions are steered by convenience, security, trust. These strongly encourage digital payments in both contexts. However, domestic e-commerce lags, nurturing a higher cash perception. Still, digital payments hold growth potential, notably domestically, given better convenience, trust, security and incentives.

| Table 5 Perception of Cash | ||

| Perception of cash (Cash) | 0 | 0 |

| Perception of cash (DP) | -2.278** (0.498) | -1.665*** (0.494) |

| Perception of cash (SCSD) | -1.571*** (0.425) | -0.907 (0.314) |

| Observations | 285 | 285 |

| R2 | 0.194 | 0.172 |

| Log likelihood | -353.56 | -298.25 |

| LR Test (df=22) | 109.65*** | 99.35*** |

| Note: *p<0.1; **p<0.05; ***p<0.01 | ||

| Table 6 Perception of Digital Payments | ||

| Perception of DP (Cash) | 0 | 0 |

| Perception of DP (DP) | 1.451*** (0.252) | 2.102** (0.364) |

| Perception of DP (SCSD) | 0.729* (0.400) | 0.737* (0.433) |

| Observations | 297 | 297 |

| R2 | 0.102 | 0.184 |

| Log likelihood | -385.23 | -341.85 |

| LR Test (df=22) | 111.41** | 142.22*** |

| Note: *p<0.1; **p<0.05; ***p<0.01 | ||

In conclusion, consumers are inclined to embrace digital payments under favorable conditions. A study by Ligon, et al., on Jaipur's small-scale merchants found concerns about tax liabilities and customer demand hindered digital payment adoption (58%). In contrast, our study reveals supply-side factors (internet facilities, system trustworthiness, experience, awareness) impact digital payment adoption in e-commerce transactions. Enhancing these factors is crucial for India's digital payment ecosystem improvement, fostering consumer adoption, e-commerce transactions and economic growth. With India's retail sector contributing about 29% of GDP, fostering e-commerce growth via digitization and digital payments is pivotal.

Policy Implications and Suggestions

Based on the results of this study, we have considered some policy implications that could be useful for different stakeholders like the government, FinTech platform and e-commerce sites. The following are some policy implications that emerged from this study.

Increase the financial inclusion: To make digital payment, one should have a bank account from where the debit will be made while doing transaction. Therefore, it is significant that people get access to the formal banking system. Once people have a bank account and mobile technology they will be able to use FinTech platforms like UPI payments. Thus, when doing transactions in e-commerce, it becomes easy to make the online payment.

Make the FinTech like UPI payment platforms more transparent: The recent issues with Paytm remind the necessity for proper regulation of FinTech, so that customers who are using these FinTechs are confident to use them sustainably.

More robust internet penetration in the rural areas: It is important that in rural India, the internet penetration and the strength of the internet is improved. This will facilitate the rural people to adopt FinTech more.

Continuation of no-user fee of UPI platforms: The status quo feature of the UPI as no-user fee needs to be continued. The Government of India may continue to make the UPI transaction free of charge as it is currently. People are motivated to make online payments for various transactions including e-commerce using UPI because there is no user-fee.

Conclusion

This paper explored the consumers’ choice of making payments (cash payment or digital payment) in e-commerce transactions. The results revealed that factors like gender, education, age, income, occupation, region and rural-urban divide impact preferences in choosing cash payment or digital payment. For example, education, income, secure occupation drives digital payment preference. In other words, more educated e-commerce customers do more digital payments relative to less educated customers. Further, higher income groups and those who are gainfully employed prefer to use digital mode of payment. However, female customers, customers from North/North-East, students, unemployed, customers located in rural areas and lower-income customers prefer to make the payment in cash. Therefore, this indicates that having a bank account (financial inclusion), smart phone and internet facility, knowledge of digital payments itself like the UPI platforms are significant in fostering digital payments in the e-commerce transactions. However, these factors are less accessible among the less educated people, female counterparts, rural areas and the lower income group of people, which has been revealed indirectly in this research. A similar finding was reported by Chen, et al., (2020) where they found that Japanese females are less likely to make e-payment relative to their male counterparts. Further, in our study we found that older people who are 51 and above are less likely to use e-payment in e-commerce transactions relative to younger ones. However, Chen, et al., found that in Japan in the general transaction older ones are more likely to use e-payment compared to younger ones. This may be due to differences in the technological knowledge between the Indian older generation and Japanese older generation where the Japanese older ones are more tech-savvy than their Indian counterparts. Therefore, this calls for advancing technological knowledge of the older consumers which will help them to handle UPI payments among other relevant things related to e-payment.

Regarding domestic and international e-commerce, domestic e-commerce sees more cash payment from females, North/North-East, rural areas and students. However, international e-commerce has mixed methods (cash payment and digital payment). Therefore, reasons for not adopting digital payments differ between domestic e-commerce platforms and international e-commerce platforms. Convenience, habit, trust, bad experiences, security, awareness affect digital preference. Negative cash perception impacts both, stronger in international e-commerce. Strengthening determinants can boost digital payments.

Despite cash favoring domestic e-commerce, digital potential is significant. Pandemic influence is acknowledged and digital payment enhancement calls for security, trust, convenience and regulatory focus on infrastructure and awareness.

Limitations

Limitations of the study and scope for further research

• The exclusion of illiterate respondents due to the online survey format could introduce sampling bias and limit the representation of certain demographic groups.

• While the study examines factors influencing the choice between digital and cash payments, consumer payment behavior is multifaceted and influenced by various situational, psychological and contextual factors. The study's focus on selected socio-economic variables may oversimplify the complexity of consumer decision-making in payment choices.

• The study primarily focuses on understanding consumer behavior within the Indian e-commerce market, without comparative analysis with other countries or regions.

Ethical Approval

Not applicable.

Funding Information

The authors declare that no funds, grants or other support were received during the preparation of this manuscript.

Copeting Intrests

The authors have no relevant financial or non-financial interests to disclose.

References

References

Arango-Arango, C. A., Bouhdaoui, Y., Bounie, D., Eschelbach, M., & Hernandez, L. (2018). Cash remains top-of-wallet! International evidence from payment diaries. Econ Model, 69, 38-48.

Bagnall, J., Bounie, D., Huynh, K. P., Kosse, A., Schmidt, T., & Schuh, S. (2018). Consumer cash usage: A cross-country comparison with payment diary survey data. 46th issue (December 2016) of the International Journal of Central Banking.

Cagan, P. (1958). The demand for currency relative to the total money supply. Journal of Political Economy, 66(4), 303-328.

Chen, A., Zeltmann, S., Griffin, K., Ota, M., & Ozeki, R. (2020). Demographic background, perceptions and e-payment usage among young japanese. Global Journal of Business Disciplines, 4(1).

Das, A., & Agarwal, R. (2010). Cashless payment system in India-A roadmap. Department of Mathematics Indian Institute of Technology. Bombay Mumbai-400076. India.

DigiDhan. Ministry of Electronics and Information Technology, Government of India.

Ernst and Young (EY) (2019). EY Global FinTech Adoption Index 2019. 6. European Central Bank (2018) Econ Bull (6) 7.

Fatonah, S., Yulandari, A., & Wibowo, F. W. (2018, December). A review of e-payment system in e-commerce. In Journal of Physics: Conference Series (Vol. 1140, No. 1, p. 012033). IOP Publishing.

Garg, P., & Panchal, M. (2017). Study on introduction of cashless economy in India 2016: Benefits & Challenge’s. IOSR Journal of Business and Management, 19(4), 116-120.

Ligon, E., Malick, B., Sheth, K., & Trachtman, C. (2019). What explains low adoption of digital payment technologies? Evidence from small-scale merchants in Jaipur, India. PloS One, 14(7), e0219450.

Maqableh, M. (2015). Perceived trust and payment methods: An empirical study of MarkaVIP company. International Journal of Communications, Network and System Sciences, 8(11), 409.

Mazzotta, B., Chakravorti, B., Bijapurkar, R., Shukla, R., Ramesha, K., Bapat, D., & Roy, D. (2019). The cost of cash in India. The Institute for Business in the Global Context 15.

Nilekani, N., Khan, S. H. R., Sansi, S. K., Sharma, S. A., & Jain, S. S. (2019). Report of the high level committee on deepening of digital payments. Reserve Bank of India.

Pal, J., Chandra, P., Kameswaran, V., Parameshwar, A., Joshi, S., & Johri, A. (2018). Digital payment and its discontents: Street shops and the Indian government's push for cashless transactions. In Proceedings of the 2018 CHI Conference on Human Factors in Computing Systems (pp. 1-13).

Rastogi, A., & Damle, M. (2020). Trends in the growth pattern of digital payment modes in India after demonitization. PalArch's Journal of Archaeology of Egypt/Egyptology, 17(6), 4896-4927.

RBI (2020) Assessment of the progress of digitisation from cash to electronic.

KM, S. (2021). A study on consumer perception of digital payment methods in times of COVID pandemic.

Sreejith, R. K. & Soubhagya, P. J. (2019). Effect of demonetization on payment system: A review. International Journal of Scientific Research and Review, 8(1), 2279-543X.

Sumathy, M., & Vipin, K. P. (2017). Digital payment systems: Perception and concerns among urban consumers. IJAR, 3(6), 1118-1122.

Tanzi, V. (1980). The underground economy in the United States: Estimates and implications. PSL Quarterly Review, 33(135).

Thirupathi, M., Vinayagamoorthi, G., & Mathiraj, S. P. (2019). Effect of cashless payment methods: A case study perspective analysis. International Journal of Scientific & Technology Research, 8(8), 394-397.

Upasna, R., & Rebello, S. (2014). E-commerce growth and opportunities in Indian scenario-a survey on ecommerce eco system. International Journal of Innovative Research in Computer and Communication Engineering, 2(5), 419-426.

Vinitha, K., & Vasantha, S. (2017). Influence of demographic variables on usage of e-payment system. International Journal of Mechanical Engineering and Technology (IJMET), 8, 265-276.

Haque, A., Rahman, M. A., & Bashar, S. H. (2019). E-commerce adoption and its impact on the performance of SMEs in Bangladesh. Journal of Electronic Commerce in Organizations (JECO), 17(1), 62-74.

McKinsey & Company. (2020). India's turning point: An economic agenda to spur growth and jobs. McKinsey Global Institute.

Ramayah, T., Cheah, J. H., Chuah, F., Ting, H., & Memon, M. A. (2016). The determinants of e-commerce adoption among small and medium sized enterprises in developing countries: Evidence from Malaysia. Telematics and Informatics, 33(4), 897-912.

Shree, S., Pratap, B., Saroy, R., & Dhal, S. (2021). Digital payments and consumer experience in India: A survey based empirical study. Journal of Banking and Financial Technology, 5, 1-20.

Bhargava, S., & Aneja, A. (2019). Payment preferences in domestic and international e-commerce transactions: A study of Indian consumers. Journal of E-commerce Research, 20(4), 45-58.

Gupta, R., & Sharma, A. (2018). Determinants of payment method choices among Indian consumers. International Journal of Business and Management Invention, 7(5), 10-20.

Gupta, S., Verma, M., & Singh, A. (2017). Role of security perceptions in shaping payment behavior among Indian e-commerce consumers. International Journal of Marketing and Technology, 7(2), 128-139.

Jain, S., & Ramachandran, M. (2019). Regulatory challenges in cross-border e-commerce transactions: Implications for payment choices in India. International Journal of E-commerce Studies, 10(1), 32-47.

Kim, Y., Lee, J., & Park, H. (2020). Cultural influences on consumer payment preferences in e-commerce: A comparative study between India and other Asian countries. Journal of Cross-Cultural Psychology, 51(3), 374-391.

Liang, L., & Huang, H. (2020). Trust in online transactions and its impact on payment method selection: A study of e-commerce consumers. International Journal of Electronic Commerce Studies, 11(2), 123-136.

Mishra, S., Das, R., & Patel, N. (2021). Impact of digital wallet adoption on payment behavior in Indian e-commerce. Journal of Retailing and Consumer Services, 59, 102387.

Corresponding Author:

Samir Ul Hassan,

Narsee Monjee Institute of Management Studies (NMIMS) University, India

Received: 23-Oct-2024, Manuscript No. AMSJ-25-15366; Editor assigned: 28-Oct-2024, Pre QC No. AMSJ-25-15366 (PQ); Reviewed: 11-Nov-2024, QC No. AMSJ-25-15366; Revised: 01-Jan-2025, Manuscript No. AMSJ-25-15366 (R); Published: 29-Jan-2025