Review Article: 2023 Vol: 27 Issue: 3S

An Empirical Study Examining the Special Event of J&K′s Adoption of Digital Financial Inclusion

Suhail Gupta, Shri Mata Vaishno Devi University

Syeda Shazia Bukhari, Shri Mata Vaishno Devi University

Prerna Katoch, Shri Mata Vaishno Devi University

Citation Information: Gupta, S Bukhari., & Azam, M.S. (2023). An empirical study examining the special event of j&k's adoption of digital financial inclusion. Academy of Marketing Studies Journal, 27(S3), 1-17.

Abstract

The adoption of the ongoing digital revolution among the residents of different regions across the world especially in a country like India has been the primary focus of many researchers. The study here attempts to identify the differences occurring in two regions in digitally evolving country. The study involves a total of 450 primary data sets collected from both regions based on their population proportion. There are a number of statistical tools applied to arrive at the results of the study. It has been found that both regions exhibit differences in terms of digital awareness and factors influencing the process. It is interesting to note that digital divide and health awareness plays a significant mediating role in the adoption of digitalisation in both the regions.

Keywords

Adoption, Digitalisation, India, Digital, Region.

Introduction

People now consider digital transactions to be the new standard. Digital transactions are those that take place without the exchange of physical money. This type of transaction is carried out digitally between two accounts without the usage of currency. Digital transactions make it comfortable and simple to check transactions, which reduce and fix errors. The phrase “digital transaction” serves as a catch-all for a variety of payment methods. These transactions take place via a variety of methods (Barik & Sharma, 2019). Unified Payment Interface (UPI), Electronic Clearing Service (ECS), credit cards, debit cards, internet banking, National Electronic Fund Transfer (NEFT), mobile banking, etc. are the most widely utilized methods in India.

Using digital transactions has made paying bills simple. Nowadays, it is simple for people to conduct transactions without carrying cash. Payments for goods and services can be made simply by using a card or a mobile application. Cyber-attacks against Indian organisations more than doubled in March 2020, according to a PwC (2020) analysis. In order to preserve the enormous potential of digital financial services, it is crucial that providers of digital transaction services meet consumer demand and maintain a healthy balance between technological improvements, financial stability, and cyber-security (Singhraul & Garwal, 2018; Athique, 2019). At this moment, interoperability of digital transaction services and dealing with potential hurdles will help achieve the objective of a self-sufficient India. Digital transactions have the potential to play an increasingly crucial role in enhancing connectivity and financial inclusion in India's rural areas, which are currently underserved, with the majority of rural areas ranking in the bottom ten of the CRISIL Inclusix score (CRISIL, 2018). However, according to TRAI data, there has been an increase in internet and mobile phone adoption in the region.

The global pandemic has accelerated the usage of digital transaction services and highlighted the role they can play in completely altering the delivery of financial services as the entire globe starts to experience the new normal. Measures including quarantining bank notes in Kuwait, South Korea, Hungary, and other countries, raising the threshold for digital transactions in Egypt, and using digital platforms to broadcast stimulus packages in Africa have been put in place to stop the spread of the virus (Arner et al., 2016). The Jan Dhan-Aadhar-Mobile infrastructure was also utilised by the Indian government during the trying times of the shutdown in order to survive the financial vulnerabilities among the last mile population.

To increase financial innovation and lessen exclusion of the most disadvantaged, FinTechs, incumbents, and the government must work together to increase financial inclusion and increase transparency. The widespread use of mobile devices and acceptance of digital payments would encourage their use (Anitharaj, 2019). The number of Unified Payment Interface (UPI) transactions increased by 333.55 percent in March 2022 compared to March 2020, further supporting this. Additionally, when compared to the quarter ended in June 2020, the total number of internet users in India climbed by 10.71 percent. 2020 and 2021 (Telecom Regulatory Authority of India [TRAI]). Thus, the exponential growth and shifting preferences toward technology-based financial services have made it critical to increase inclusion during and after the crisis. This leads to the motivation of the study which attempts to address the following research questions –

RQ1: What are the factors that influence the usage of digital transactions in rural areas?

RQ2: What are the hindrances that are encountered by the rural consumers with respect to digital transaction?

In order to establish further requirements with respect to the above research questions, a detailed literature review has been conducted in the next section.

Review Of Literature

Digital transactions are those that take place without the exchange of paper currency. This type of transaction transfers funds from one account to another digitally and without the usage of currency. Digital transactions provide the convenience and ease of checking transactions, which aids in the reduction and correction of errors. A digital transaction is an umbrella word for a variety of payment methods. These exchanges take place in a variety of ways (Chavda, 2018; Gupta & Singal, 2021). Unified Payment Interface (UPI), Electronic Clearing Service (ECS), credit cards, debit cards, online banking, National Electronic Fund Transfer (NEFT), mobile banking, and so on are the most regularly utilised forms in India. The adoption of digital payment by the government is an important step in eradicating black money and increasing cashless trade. The Payment Bank is an Indian digital banking business that provides migratory labourers and those with low incomes with basic financial services via mobile phones. Despite the government's efforts to promote digital transactions, illiteracy and a lack of trust in digital payments remain significant impediments to widespread adoption of cashless transactions (Joshi, 2017). Consumers that are technologically knowledgeable prefer cash transactions over digital payment methods because they believe it will reveal their identities. However, as cyber-attacks have become increasingly common around the world, regulators have been pushed to enact data privacy standards and focus on compliance issues (Selvaraj & Ragesh, 2018).

Everybody's life now includes essential digital transactions. This became more obvious following two significant occurrences in India. Demonetization of the Rs. 1000 and Rs. 500 notes in 2016 and the Corona virus outbreak that shook the world in 2020 are two events that come to mind. These two occasions increased India's use of digital commerce (Shankar, 2017; Aggarwal et al., 2021). The rural parts of India are also familiar with this hike. In India's rural areas, however, there has been a relatively little percentage growth in the use of digital transactions. These can be attributed to a variety of causes. The population in the rural areas are proportionately high as compared to the population in the urban areas of India. It is therefore necessary to develop the rural areas of the country in order to have a holistic development of the country’s economy (Balaji & Vijayakuamr, 2018; Kumar et al., 2019; Gupta & Singhal, 2021).

Numerous elements have been identified in the literature as having an effect on the adoption of digital methods. In their research study, Agarwal (2020) used the UTAUT method to investigate the factors that had an impact on Indian customers' adoption of digital payments. The facet of social influence was found to have the greatest impact on consumers' impressions of digital transactions out of all the UTAUT components. There is a good chance that a customer will use digital transactions when purchasing goods and services if that means of payment is seen as socially acceptable by that consumer's social circle.

Singh & Srivastava (2020), focused their research on determining the intention of the consumers to use digital modes of payment for a transaction. According to the researchers, human beings have the tendency to follow social norms and trends and this is even applicable while adoption of digital modes of transaction among the people. The researcher established a strong association between social influence and consumers’ intention to adopt digital payments in the future. Social influence, is therefore, considered to be a very important factor in the adoption of digital modes of payment among the consumers.

Gupta & Arora (2020), in their research study determined the intention of the consumers to accept mobile payments. The researcher used the UTAUT model for identifying the same. The researcher identified social influence as an important factor and it was observed that if the application is used by most of the people in the consumers’ social circle, then they tend to adopt the same for their transactions. Social Influence tends to act as a very important factor in influencing the intend of the consumer to use digital modes of payments. Prabhakaran et al. (2020) conducted an empirical study to analyse the effect that social influence has on the intention of the consumer to adopt digital transactions. The researchers observed that social influence is an important factor in determining the intend of the consumer to repeatedly use digital modes of payment for their future transactions. Consumers have a tendency to follow socially acceptable behaviour and this is also true in terms of the adoption of digital modes of payment by the consumers for completing their transactions. Saini (2019) conducted an empirical inquiry in their research study to uncover the aspects that operate as contributing factors and impediments to the adoption of digital payments in rural India. The researcher emphasised the idea of technological accessibility as a key factor in the rural Indian population's adoption of digital payments. The availability of this component encourages people in remote areas to use digital transactions, whilst the difficulty in getting it discourages them from doing so.

In their research study, Schuetz & Venkatesh (2020) conducted an empirical analysis to identify the elements that serve as both enablers and barriers for the adoption of digital payments in rural India. The researcher emphasised the idea of technological accessibility as a key factor in the rural Indian population's adoption of digital payments. People in rural areas are more likely to employ digital transactions because of the element's accessibility than because of how challenging it is to acquire. Ye & Yang (2020) looked at how the availability of technology affected their research. The researchers found that technical limitations have a substantial impact in this area, impacting people's adoption of digital payment methods in rural India. If technological impediments are not addressed and rectified, people will avoid using digital ways of payment for transactions, which must be handled immediately. Liébana-Cabanillas et al. (2020) assessed the adoption of mobile technology in the emerging market of India. The researchers focused on m-payment services. The researchers identified perceived compatibility as an important factor influencing the adoption behaviour of individuals residing in India. The researcher was able to identify the constructs that influence how digital transactions are employed. According to the findings of this study, one of the most important elements affecting whether customers used digital transactions was their view of the service's acceptability. According to experts, there are several important criteria that influence adoption, but perceived compatibility is one of the most important.

Singh & Sinha (2020) analysed how the factor perceived compatibility influenced the behaviour of an individual in using digital wallets. The researcher was able to pinpoint the constructs that have an impact on how digital transactions are used. In this study, it was discovered that one of the key factors influencing whether customers used digital transactions was their perception of the service's acceptability. There are various essential aspects influencing adoption, according to experts, but perceived compatibility is one of the most critical influencing factors used. Singh & Srivastava (2020), in their research study focused on understanding the intention of the people to use mobile banking for transaction during buying and selling a product or for making payment and transfers. The researchers observed that the dimension ease of use was an important influencing factor that impacted the future use of a mode of payment by the people while making a transaction. If the digital mode of payment is considered too easy to use by the customer, then there is a possibility of repeating this behaviour and use it in their future transactions. Koul et al. (2021), in their research study, employed the Technology Acceptance Model (TAM) to analyze the elements that impacted the acceptance of digital payments among the rural retailers in India. It was discovered that of the TAM elements, the dimension - perceived ease of use has the most influence on customers' perceptions of digital transactions. If a mode of payment is considered to be easy to use by the consumer, then there is a high possibility that the consumer will adopt digital transaction while buying products and services. Manrai et al. (2021), in their research study examined the adoption of digital payments by semi-rural population of India. The researchers used the UTAUT-2 model to analyse the adoption of digital payments among the rural population. The researchers observed that the ease of use acted as a very important factor in the adoption of digital modes of payments by the rural population. Most of the people on the rural population are not technologically advanced and therefore if the mode of payment is not easy to use it is not considered to use in the next transaction. Ahmed & Sur (2021), in their research study examined the pattern of usage of digital transactions or digital modes of payment in rural India. The researchers observed that a number of people were forced to use digital modes of transactions during the pandemic and demonetisation in the year 2016 but however, if the consumers of the rural areas did not perceive the online modes of payment to be easy to use, they avoid such modes in their future use. The researcher suggested that the interface that is used for payment should be user friendly and customer from any location and age should find it easy to use in order to continue using it in the future. Rana et al. (2019), in their research study examined the influence of trust on the adoption of mobile wallets among individuals. The researchers identified that if an individual is satisfied with the previous transactions, then the individual start building trust with the mobile wallet and this helps in continuing to use digital payment modes and increasing the adoption if digital transactions.

Tiwari et al. (2021) investigated the impact of trust and risk on individual m-banking adoption in their research study. The researchers discovered that if an individual is satisfied with past transactions, the individual begins to create confidence with the mobile wallet, which aids in the continuation of digital payment modes and the acceptance of digital transactions. Kumar et al. (2018), in their study, explored the role of perceived usefulness in the adoption of digital wallets in India. The researcher was able to identify the constructs that influence how digital transactions are employed. The user's perceived acceptability of the service was one of the primary elements driving customer adoption of digital transactions in this study. According to experts, perceived usefulness is one of the most important influencing variables, but there are many other key aspects that also have an impact on adoption. Ozili (2018), in their study, identified the impact of perceived costs on the digital payment systems adoption among the individuals. It was identified that the plethora of cashback offers available when a payment is done digitally has a very important impact on the individual’s decision to use digital payment platforms. Due to the absence of intermediaries in the online mode of payment companies can give huge cash back offers to a user of the digital transaction. The financial cost perceived to be associated with a payment method has a huge impact on the adoption of the payment method by the user. Aziz & Naima (2021) revealed in their research study that because tangibility elements are lacking while using online platforms of payment, financial cost related play a motivational aspect in the use of online channels of payments. The financial expense is mostly associated with the risk associated with making payments via digital means. People prefer to avoid using digital payment methods in the future if they are perceived to be more expensive than what is reasonable to anticipate paying.

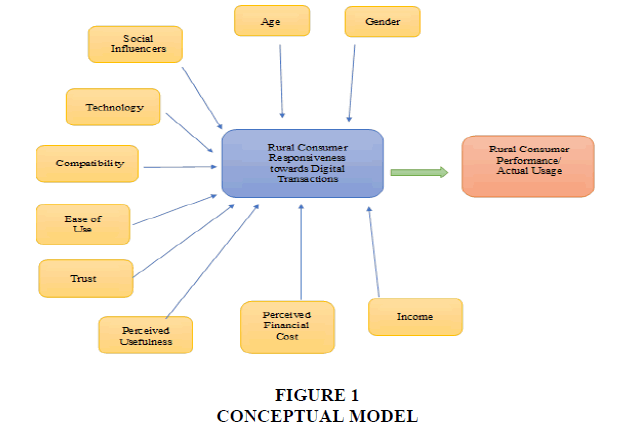

Based on the above literature, the factors have been selected for including in the conceptual model are – technology, social influence, ease of use, compatibility, complexity, trust, perceived financial cost, perceived usefulness, digital adoption, digital divide and health awareness.

Research Methodology

The study here is based on empirical evidences and is quantitative in nature. Two regions namely Jammu and Ramban have been selected to draw a comparative analysis. A structured questionnaire has been designed which includes the scales used to measure the mentioned considered variables. Using purposive sampling techniques, a total of 450 responses are collected, out of which 200 are from Ramban and 250 are from Jammu. The study uses statistical methods such as Principal Component Analysis, Multiple Linear Regression and Mediation Analysis to arrive at the results of the study. The study has used SPSS to determine the statistical analysis and the results are shown in the next section.

Data Analysis & Interpretation

The final analysis would be considered in this section, however before moving on to the final section, the demographic representation of the samples from both regions is provided below.

The below Tables 1-3 represent the overall situation in the two areas through the collected samples and hence the results could significantly imply to the entire region.

| Table 1 Demographic Variables For Ramban |

||

|---|---|---|

| Demographic Variables | Frequency | Percentage |

| Gender | ||

| Male | 120 | 60.0 |

| Female | 80 | 40.0 |

| Age Group (in years) | ||

| 18-25 | 48 | 24.0 |

| 26-33 | 64 | 32.0 |

| More than 33 | 88 | 44.0 |

| Education Level | ||

| Up to Primary | 44 | 22.0 |

| Up to Class 10 | 64 | 32.0 |

| Up to Class 12 | 40 | 20.0 |

| Graduate | 32 | 16.0 |

| Post Graduate | 20 | 10.0 |

| Occupation | ||

| Agricultural Labourer | 40 | 20.0 |

| Cultivator | 32 | 16.0 |

| Workers in Household Industries | 52 | 26.0 |

| Other Workers | 76 | 38.0 |

| Marital Status | ||

| Married | 136 | 68.0 |

| Unmarried | 64 | 32.0 |

| Income per month (in Rupees) | ||

| Less than 10000 | 72 | 36.0 |

| 10000-15000 | 96 | 48.0 |

| More than 15000 | 32 | 16.0 |

| Table 2 Demographic Variables For Jammu |

||

|---|---|---|

| Demographic Variables | Frequency | Percentage |

| Gender | ||

| Male | 146 | 58.4 |

| Female | 104 | 41.6 |

| Age Group (in years) | ||

| Less than 18 | 146 | 58.4 |

| 18-25 | 44 | 17.6 |

| 26-33 | 33 | 13.2 |

| More than 33 | 27 | 10.8 |

| Education Level | ||

| Up to Primary | 26 | 10.4 |

| Up to Class 10 | 136 | 54.4 |

| Up to Class 12 | 28 | 11.2 |

| Graduate | 58 | 22.0 |

| Post Graduate | 5 | 2.0 |

| Occupation | ||

| Agricultural Labourer | 106 | 42.4 |

| Cultivator | 25 | 10.0 |

| Workers in Household Industries | 100 | 40.0 |

| Other Workers | 19 | 7.6 |

| Marital Status | ||

| Married | 180 | 72.0 |

| Unmarried | 70 | 28.0 |

| Income per month (in Rupees) | ||

| Less than 10000 | 160 | 64 |

| 10000-15000 | 38 | 15.2 |

| More than 15000 | 52 | 20.8 |

The questionnaire included a 47-item scale for identifying the factors. As these factors have been adopted from different sources in the first stage of the analysis, a principal component analysis (PCA) would be conducted to determine the factors and the significant items contributing towards them. The PCA would also be accompanied by the Kaiser-Meyer-Olkin and Bartlett’s test of Sphericity which would determine the sampling adequacy of the components.

The above Table 3 shows the extracted factors which have an eigen value of more than 1 According to Hair et al. (2006), factor loadings above 0.4 are considered acceptable for a sample size of more than 200. Here, a total of 11 factors have been extracted which signify different aspect of digital adoption. The KMO test results show an overall value of 0.713 and the Bartlett’s test of sphericity has significant p-value. This reflects sampling adequacy for the study and the final analysis can be hereby conducted.

| Table 3 Factor Loadings |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Factor | ||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | Uniqueness | |

| TE1 | 0.799 | 0.0526 | ||||||||||

| TE2 | 0.531 | 0.1402 | ||||||||||

| TE3 | 0.848 | 0.052 | ||||||||||

| TE4 | 0.825 | 0.1688 | ||||||||||

| SI1 | 0.712 | 0.0488 | ||||||||||

| SI2 | 0.678 | 0.073 | ||||||||||

| SI3 | 0.665 | 0.0617 | ||||||||||

| SI4 | 0.679 | 0.1943 | ||||||||||

| SI5 | 0.701 | 0.1549 | ||||||||||

| EU1 | 0.612 | 0.1453 | ||||||||||

| EU2 | 0.767 | 0.1761 | ||||||||||

| EU3 | 0.794 | 0.1096 | ||||||||||

| EU4 | 0.635 | 0.181 | ||||||||||

| EU5 | 0.738 | 0.1464 | ||||||||||

| EU6 | 0.646 | 0.0356 | ||||||||||

| CI | 0.916 | 0.069 | ||||||||||

| C2 | 0.664 | 0.0244 | ||||||||||

| C3 | 0.91 | 0.059 | ||||||||||

| C4 | 0.851 | 0.4685 | ||||||||||

| C5 | 0.68 | 0.0197 | ||||||||||

| TR1 | 0.896 | 0.0469 | ||||||||||

| TR2 | 0.643 | 0.0645 | ||||||||||

| TR3 | 0.858 | 0.0816 | ||||||||||

| TR4 | 0.569 | 0.3408 | ||||||||||

| PFC1 | 0.706 | 0.1102 | ||||||||||

| PFC2 | 0.55 | 0.1467 | ||||||||||

| PFC3 | 0.72 | 0.0973 | ||||||||||

| PFC4 | 0.917 | 0.0149 | ||||||||||

| PU1 | 0.936 | 0.0479 | ||||||||||

| PU2 | 0.907 | 0.0376 | ||||||||||

| PU3 | 0.917 | 0.0149 | ||||||||||

| PU4 | 0.712 | 0.0633 | ||||||||||

| PU5 | 0.636 | 0.1457 | ||||||||||

| CO1 | 0.504 | 0.123 | ||||||||||

| CO2 | 0.672 | 0.055 | ||||||||||

| CO4 | 0.856 | 0.26 | ||||||||||

| CO5 | 0.421 | 0.0668 | ||||||||||

| AU1 | 0.845 | 0.0706 | ||||||||||

| AU2 | 0.858 | 0.081 | ||||||||||

| AU3 | 0.464 | 0.4754 | ||||||||||

| DDL2 | 0.734 | 0.3465 | ||||||||||

| DDL3 | 0.761 | 0.4167 | ||||||||||

| DDL4 | 0.974 | -0.0133 | ||||||||||

| HA1 | 0.1696 | |||||||||||

| HA2 | 0.1677 | |||||||||||

| HA3 | 0.4115 | |||||||||||

Note. 'Principal axis factoring' extraction method was used in combination with a 'varimax' rotation.

In the next stage, there is a multiple linear regression conducted to understand the relationship of the extracted factors with that of the adoption of digital modes. There would be two regression models formulated – one with respect to the respondents of the Ramban region and the other one with respect to the Jammu area. The models are being discussed below Tables 4-5.

| Table 4 Model Fit Measures |

|||||||

|---|---|---|---|---|---|---|---|

| Overall Model Test | |||||||

| Model | R | R² | Adjusted R2 | F | df1 | df2 | p |

| 1 | 0.897 | 0.804 | 0.793 | 75.4 | 10 | 184 | < .001 |

| Table 5 Model Coefficients - Actual Use |

||||

|---|---|---|---|---|

| Predictor | Estimate | SE | t | p |

| Intercept | 1.108 | 0.8077 | 1.3718 | 0.172 |

| Technology | 0.02387 | 0.0667 | 0.3579 | 0.721 |

| Social Influence | 0.30474 | 0.0901 | 3.3821 | < .001 |

| Ease of Use | 0.0035 | 0.0994 | -0.0352 | 0.972 |

| Compatibility | 0.36158 | 0.0936 | -3.8641 | < .001 |

| Trust | 0.09439 | 0.0949 | 0.9948 | 0.321 |

| Perceived Financial Cost | -0.24033 | 0.0886 | -2.7137 | 0.007 |

| Perceived Usefulness | 0.15588 | 0.0835 | 1.8663 | 0.064 |

| Complexity | 0.56526 | 0.1325 | 4.2666 | < .001 |

| Digital Divide | 0.20545 | 0.0782 | 2.6281 | 0.009 |

| Health Awareness | -0.1259 | 0.0544 | -2.3123 | 0.022 |

Interpretation

The first model is generated with respect to the Ramban area where the actual use or adoption of digital modes is taken as the dependent variable. In the first table it is seen that the model generated is statistically significant and the adjusted R2 value being generated is 0.793. This states that the significant independent factors are able because a difference of 79.3% on the actual use of digital modes with one unit changes in them. However, looking at the second table it is seen that not all independent factors are statistically significant. Social Influence, Compatibility, Perceived Financial Cost, Complexity, digital divide and health awareness are statistically significant determinants of actual usage. Perceived Financial Cost and Health Awareness are negatively associated and it is seen that out of these variables’ complexity has the maximum impact. It is interesting to note that technology, trust, ease of use and perceived usefulness are not the components causing any impact.

As the Ramban area have shown some interesting results, let’s look into the Jammu area and the significant factors around it Tables 6-9.

| Table 6 Model Fit Measures |

|||||||

|---|---|---|---|---|---|---|---|

| Overall Model Test | |||||||

| Model | R | R2 | Adjusted R2 | F | df1 | df2 | p |

| 1 | 0.855 | 0.732 | 0.718 | 53.5 | 10 | 196 | < .001 |

| Table 7 Model Coefficients - Actual Use |

||||

|---|---|---|---|---|

| Predictor | Estimate | SE | t | p |

| Intercept | -0.4743 | 0.3007 | -1.577 | 0.116 |

| Technology | -0.4819 | 0.0982 | -4.908 | < .001 |

| Social Influence | 0.6177 | 0.1156 | 5.343 | < .001 |

| Ease of Use | 0.683 | 0.1158 | 5.896 | < .001 |

| Compatibility | -0.0419 | 0.1036 | -0.405 | 0.686 |

| Trust | 0.1445 | 0.0754 | 1.916 | 0.057 |

| Perceived Financial Cost | -0.4496 | 0.0729 | -6.17 | < .001 |

| Perceived Usefulness | 0.2795 | 0.105 | 2.662 | 0.008 |

| Complexity | 0.5207 | 0.0704 | 7.402 | < .001 |

| Digital Divide | -0.1093 | 0.0903 | -1.21 | 0.228 |

| Health Awareness | 0.0679 | 0.0477 | 1.422 | 0.157 |

| Table 8 Ramban Region |

||||||||

|---|---|---|---|---|---|---|---|---|

| Indirect and Total Effects | ||||||||

| 95% C.I. (a) | ||||||||

| Type | Effect | Estimate | SE | Lower | Upper | β | z | P |

| Indirect | Technology ⇒ Digital Divide ⇒ Actual Use | 5.93E-05 | 0.0123 | -0.02396 | 0.02408 | 6.71E-05 | 0.00484 | 0.996 |

| Technology ⇒ Health Awareness ⇒ Actual Use | 0.03697 | 0.0188 | 5.58E-05 | 0.07388 | 0.04186 | 1.96292 | 0.05 | |

| Social Influence ⇒ Digital Divide ⇒ Actual Use | -0.07068 | 0.0305 | -0.1305 | -0.01085 | -0.05625 | -2.3155 | 0.021 | |

| Social Influence ⇒ Health Awareness ⇒ Actual Use | 0.02827 | 0.0184 | -0.00779 | 0.06433 | 0.0225 | 1.53682 | 0.124 | |

| Ease of Use ⇒ Digital Divide ⇒ Actual Use | 0.04029 | 0.0237 | -0.00615 | 0.08674 | 0.03694 | 1.70043 | 0.089 | |

| Ease of Use ⇒ Health Awareness ⇒ Actual Use | -0.01947 | 0.0182 | -0.05513 | 0.01619 | -0.01785 | -1.07002 | 0.285 | |

| Compatibility ⇒ Digital Divide ⇒ Actual Use | -0.04033 | 0.0226 | -0.08461 | 0.00396 | -0.05077 | -1.78491 | 0.074 | |

| Compatibility ⇒ Health Awareness ⇒ Actual Use | 0.0428 | 0.0233 | -0.00295 | 0.08854 | 0.05387 | 1.83373 | 0.067 | |

| Trust ⇒ Digital Divide ⇒ Actual Use | -0.02826 | 0.0206 | -0.06872 | 0.01219 | -0.02217 | -1.36933 | 0.171 | |

| Trust ⇒ Health Awareness ⇒ Actual Use | -0.00961 | 0.0162 | -0.04136 | 0.02214 | -0.00754 | -0.59334 | 0.553 | |

| Perceived Financial Cost ⇒ Digital Divide ⇒ Actual Use | -0.04094 | 0.0222 | -0.08443 | 0.00254 | -0.0312 | -1.84546 | 0.065 | |

| Perceived Financial Cost ⇒ Health Awareness ⇒ Actual Use | 0.02751 | 0.0184 | -0.00851 | 0.06354 | 0.02096 | 1.49683 | 0.134 | |

| Perceived Usefulness ⇒ Digital Divide ⇒ Actual Use | 0.05094 | 0.0239 | 0.00407 | 0.0978 | 0.07573 | 2.13028 | 0.033 | |

| Perceived Usefulness ⇒ Health Awareness ⇒ Actual Use | 0.05263 | 0.0256 | 0.00248 | 0.10277 | 0.07824 | 2.05707 | 0.04 | |

| Complexity ⇒ Digital Divide ⇒ Actual Use | -0.0457 | 0.03 | -0.1045 | 0.01311 | -0.03962 | -1.52306 | 0.128 | |

| Complexity ⇒ Health Awareness ⇒ Actual Use | -0.00531 | 0.022 | -0.0484 | 0.03779 | -0.0046 | -0.24136 | 0.809 | |

| Component | Technology ⇒ Digital Divide | 2.88E-04 | 0.0597 | -0.11664 | 0.11721 | 6.61E-04 | 0.00484 | 0.996 |

| Digital Divide ⇒ Actual Use | 0.20545 | 0.0755 | 0.05747 | 0.35344 | 0.10145 | 2.72118 | 0.007 | |

| Technology ⇒ Health Awareness | -0.29364 | 0.0857 | -0.46152 | -0.12576 | -0.27127 | -3.42819 | < .001 | |

| Health Awareness ⇒ Actual Use | -0.1259 | 0.0526 | -0.22897 | -0.02284 | -0.1543 | -2.39426 | 0.017 | |

| Social Influence ⇒ Digital Divide | -0.34401 | 0.078 | -0.49697 | -0.19105 | -0.55447 | -4.40796 | < .001 | |

| Social Influence ⇒ Health Awareness | -0.22458 | 0.1121 | -0.4442 | -0.00495 | -0.14584 | -2.00418 | 0.045 | |

| Ease of Use ⇒ Digital Divide | 0.19613 | 0.09 | 0.01964 | 0.37261 | 0.36413 | 2.17805 | 0.029 | |

| Ease of Use ⇒ Health Awareness | 0.15465 | 0.1293 | -0.09876 | 0.40805 | 0.11568 | 1.19612 | 0.232 | |

| Compatibility ⇒ Digital Divide | -0.19629 | 0.083 | -0.35898 | -0.03359 | -0.50041 | -2.36468 | 0.018 | |

| Compatibility ⇒ Health Awareness | -0.33991 | 0.1192 | -0.57351 | -0.10631 | -0.34914 | -2.85195 | 0.004 | |

| Trust ⇒ Digital Divide | -0.13757 | 0.0868 | -0.30772 | 0.03259 | -0.21855 | -1.58457 | 0.113 | |

| Trust ⇒ Health Awareness | 0.07634 | 0.1247 | -0.16797 | 0.32065 | 0.04887 | 0.61244 | 0.54 | |

| Perceived Financial Cost ⇒ Digital Divide | -0.19928 | 0.0794 | -0.35482 | -0.04374 | -0.30754 | -2.5112 | 0.012 | |

| Perceived Financial Cost ⇒ Health Awareness | -0.21852 | 0.1139 | -0.44184 | 0.0048 | -0.13587 | -1.91783 | 0.055 | |

| Perceived Usefulness ⇒ Digital Divide | 0.24793 | 0.0724 | 0.106 | 0.38986 | 0.7465 | 3.42375 | < .001 | |

| Perceived Usefulness ⇒ Health Awareness | -0.41799 | 0.104 | -0.62178 | -0.2142 | -0.50707 | -4.02011 | < .001 | |

| Complexity ⇒ Digital Divide | -0.22242 | 0.121 | -0.4596 | 0.01477 | -0.39054 | -1.8379 | 0.066 | |

| Complexity ⇒ Health Awareness | 0.04215 | 0.1738 | -0.29841 | 0.38271 | 0.02982 | 0.24259 | 0.808 | |

| Direct | Technology ⇒ Actual Use | 0.02387 | 0.0648 | -0.10307 | 0.1508 | 0.02702 | 0.36852 | 0.712 |

| Social Influence ⇒ Actual Use | 0.30474 | 0.0871 | 0.13405 | 0.47543 | 0.24253 | 3.49913 | < .001 | |

| Ease of Use ⇒ Actual Use | -0.0035 | 0.0964 | -0.1925 | 0.1855 | -0.00321 | -0.03626 | 0.971 | |

| Compatibility ⇒ Actual Use | -0.36158 | 0.0905 | -0.53905 | -0.18412 | -0.45516 | -3.99335 | < .001 | |

| Trust ⇒ Actual Use | 0.09439 | 0.0922 | -0.08633 | 0.27512 | 0.07405 | 1.02369 | 0.306 | |

| Perceived Financial Cost ⇒ Actual Use | -0.24033 | 0.0858 | -0.40846 | -0.0722 | -0.18314 | -2.80157 | 0.005 | |

| Perceived Usefulness ⇒ Actual Use | 0.15588 | 0.0816 | -0.0041 | 0.31587 | 0.23175 | 1.90972 | 0.056 | |

| Complexity ⇒ Actual Use | 0.56526 | 0.1287 | 0.31299 | 0.81753 | 0.49008 | 4.3917 | < .001 | |

| Total | Technology ⇒ Actual Use | 0.0609 | 0.0654 | -0.06722 | 0.18901 | 0.0689 | 0.93161 | 0.352 |

| Social Influence ⇒ Actual Use | 0.26233 | 0.0855 | 0.09473 | 0.42994 | 0.20863 | 3.06773 | 0.002 | |

| Ease of Use ⇒ Actual Use | 0.01733 | 0.0987 | -0.17605 | 0.21071 | 0.01587 | 0.17562 | 0.861 | |

| Compatibility ⇒ Actual Use | -0.35912 | 0.091 | -0.53738 | -0.18085 | -0.45174 | -3.94828 | < .001 | |

| Trust ⇒ Actual Use | 0.05652 | 0.0951 | -0.12993 | 0.24296 | 0.0443 | 0.59412 | 0.552 | |

| Perceived Financial Cost ⇒ Actual Use | -0.25376 | 0.087 | -0.42418 | -0.08333 | -0.19323 | -2.91833 | 0.004 | |

| Perceived Usefulness ⇒ Actual Use | 0.25945 | 0.0793 | 0.10393 | 0.41497 | 0.38545 | 3.26975 | 0.001 | |

| Complexity ⇒ Actual Use | 0.51425 | 0.1326 | 0.25436 | 0.77415 | 0.44555 | 3.8782 | < .001 | |

| Table 9 Jammu Region |

||||||||

|---|---|---|---|---|---|---|---|---|

| Type | Effect | 95% C.I. (a) | ||||||

| Estimate | SE | Lower | Upper | β | z | P | ||

| Indirect | Technology ⇒ Digital Divide ⇒ Actual Use | 0.057 | 0.04579 | -0.03275 | 0.14674 | 0.04571 | 1.24483 | 0.213 |

| Technology ⇒ Health Awareness ⇒ Actual Use | -0.00987 | 0.01083 | -0.0311 | 0.01136 | -0.00791 | -0.91122 | 0.362 | |

| Social Influence ⇒ Digital Divide ⇒ Actual Use | -0.06022 | 0.04854 | -0.15535 | 0.03492 | -0.03668 | -1.24053 | 0.215 | |

| Social Influence ⇒ Health Awareness ⇒ Actual Use | 0.02365 | 0.01894 | -0.01348 | 0.06077 | 0.0144 | 1.24851 | 0.212 | |

| Ease of Use ⇒ Digital Divide ⇒ Actual Use | 0.03448 | 0.02898 | -0.02231 | 0.09128 | 0.02259 | 1.19001 | 0.234 | |

| Ease of Use ⇒ Health Awareness ⇒ Actual Use | 8.51E-05 | 0.01125 | -0.02196 | 0.02213 | 5.57E-05 | 0.00757 | 0.994 | |

| Compatibility ⇒ Digital Divide ⇒ Actual Use | -0.07554 | 0.06033 | -0.19379 | 0.04271 | -0.0487 | -1.25208 | 0.211 | |

| Compatibility ⇒ Health Awareness ⇒ Actual Use | -0.00703 | 0.00959 | -0.02582 | 0.01176 | -0.00453 | -0.73328 | 0.463 | |

| Trust ⇒ Digital Divide ⇒ Actual Use | -0.03288 | 0.02648 | -0.08478 | 0.01902 | -0.02679 | -1.24162 | 0.214 | |

| Trust ⇒ Health Awareness ⇒ Actual Use | 0.05808 | 0.03959 | -0.01952 | 0.13568 | 0.04733 | 1.46699 | 0.142 | |

| Perceived Financial Cost ⇒ Digital Divide ⇒ Actual Use | 0.01209 | 0.01094 | -0.00936 | 0.03354 | 0.00938 | 1.10466 | 0.269 | |

| Perceived Financial Cost ⇒ Health Awareness ⇒ Actual Use | 0.05523 | 0.0378 | -0.01887 | 0.12932 | 0.04285 | 1.46085 | 0.144 | |

| Perceived Usefulness ⇒ Digital Divide ⇒ Actual Use | -0.01098 | 0.01222 | -0.03493 | 0.01296 | -0.00921 | -0.89921 | 0.369 | |

| Perceived Usefulness ⇒ Health Awareness ⇒ Actual Use | -0.04382 | 0.03125 | -0.10507 | 0.01743 | -0.03672 | -1.4021 | 0.161 | |

| Complexity ⇒ Digital Divide ⇒ Actual Use | -0.04403 | 0.0353 | -0.11321 | 0.02516 | -0.0355 | -1.24728 | 0.212 | |

| Complexity ⇒ Health Awareness ⇒ Actual Use | -0.00619 | 0.00736 | -0.02062 | 0.00824 | -0.00499 | -0.84114 | 0.4 | |

| Component | Technology ⇒ Digital Divide | -0.52141 | 0.06649 | -0.65172 | -0.39109 | -0.52203 | -7.84193 | < .001 |

| Digital Divide ⇒ Actual Use | -0.10932 | 0.0867 | -0.27926 | 0.06062 | -0.08757 | -1.26082 | 0.207 | |

| Technology ⇒ Health Awareness | -0.14543 | 0.12581 | -0.39201 | 0.10115 | -0.09594 | -1.15598 | 0.248 | |

| Health Awareness ⇒ Actual Use | 0.06786 | 0.04582 | -0.02195 | 0.15767 | 0.0825 | 1.48087 | 0.139 | |

| Social Influence ⇒ Digital Divide | 0.55082 | 0.07933 | 0.39534 | 0.70631 | 0.41884 | 6.9435 | < .001 | |

| Social Influence ⇒ Health Awareness | 0.34848 | 0.1501 | 0.05429 | 0.64268 | 0.17459 | 2.32163 | 0.02 | |

| Ease of Use ⇒ Digital Divide | -0.31544 | 0.08758 | -0.4871 | -0.14378 | -0.25794 | -3.60152 | < .001 | |

| Ease of Use ⇒ Health Awareness | 0.00125 | 0.16572 | -0.32356 | 0.32606 | 6.76E-04 | 0.00757 | 0.994 | |

| Compatibility ⇒ Digital Divide | 0.69102 | 0.06488 | 0.56386 | 0.81819 | 0.55616 | 10.65061 | < .001 | |

| Compatibility ⇒ Health Awareness | -0.10361 | 0.12276 | -0.34423 | 0.137 | -0.05495 | -0.84401 | 0.399 | |

| Trust ⇒ Digital Divide | 0.30077 | 0.04212 | 0.21822 | 0.38331 | 0.30597 | 7.14142 | < .001 | |

| Trust ⇒ Health Awareness | 0.85593 | 0.07969 | 0.69974 | 1.01212 | 0.57371 | 10.74085 | < .001 | |

| Perceived Financial Cost ⇒ Digital Divide | -0.11058 | 0.04825 | -0.20516 | -0.016 | -0.1071 | -2.29159 | 0.022 | |

| Perceived Financial Cost ⇒ Health Awareness | 0.81384 | 0.0913 | 0.63489 | 0.9928 | 0.51935 | 8.91344 | < .001 | |

| Perceived Usefulness ⇒ Digital Divide | 0.10048 | 0.07833 | -0.05304 | 0.25399 | 0.10512 | 1.28281 | 0.2 | |

| Perceived Usefulness ⇒ Health Awareness | -0.64574 | 0.1482 | -0.93621 | -0.35526 | -0.44514 | -4.35707 | < .001 | |

| Complexity ⇒ Digital Divide | 0.40272 | 0.04719 | 0.31024 | 0.49521 | 0.40538 | 8.53488 | < .001 | |

| Complexity ⇒ Health Awareness | -0.09125 | 0.08928 | -0.26624 | 0.08374 | -0.06052 | -1.02201 | 0.307 | |

| Direct | Technology ⇒ Actual Use | -0.48188 | 0.0947 | -0.66748 | -0.29627 | -0.38647 | -5.08855 | < .001 |

| Social Influence ⇒ Actual Use | 0.61774 | 0.11104 | 0.40012 | 0.83537 | 0.37628 | 5.56342 | < .001 | |

| Ease of Use ⇒ Actual Use | 0.68303 | 0.11263 | 0.46228 | 0.90378 | 0.44742 | 6.0644 | < .001 | |

| Compatibility ⇒ Actual Use | -0.04193 | 0.10081 | -0.23951 | 0.15566 | -0.02703 | -0.41589 | 0.677 | |

| Trust ⇒ Actual Use | 0.14447 | 0.07056 | 0.00617 | 0.28276 | 0.11773 | 2.04743 | 0.041 | |

| Perceived Financial Cost ⇒ Actual Use | -0.44958 | 0.07146 | -0.58964 | -0.30952 | -0.3488 | -6.29151 | < .001 | |

| Perceived Usefulness ⇒ Actual Use | 0.27953 | 0.10246 | 0.07871 | 0.48035 | 0.23427 | 2.72811 | 0.006 | |

| Complexity ⇒ Actual Use | 0.52072 | 0.06857 | 0.38633 | 0.65511 | 0.41987 | 7.59423 | < .001 | |

| Total | Technology ⇒ Actual Use | -0.43475 | 0.08402 | -0.59943 | -0.27007 | -0.34853 | -5.17419 | < .001 |

| Social Influence ⇒ Actual Use | 0.58118 | 0.10025 | 0.38469 | 0.77766 | 0.35386 | 5.79738 | < .001 | |

| Ease of Use ⇒ Actual Use | 0.7176 | 0.11068 | 0.50067 | 0.93453 | 0.46987 | 6.48358 | < .001 | |

| Compatibility ⇒ Actual Use | -0.1245 | 0.08199 | -0.2852 | 0.0362 | -0.08023 | -1.51848 | 0.129 | |

| Trust ⇒ Actual Use | 0.16967 | 0.05322 | 0.06536 | 0.27398 | 0.13821 | 3.18798 | 0.001 | |

| Perceived Financial Cost ⇒ Actual Use | -0.38227 | 0.06098 | -0.50178 | -0.26275 | -0.29646 | -6.26879 | < .001 | |

| Perceived Usefulness ⇒ Actual Use | 0.22473 | 0.09898 | 0.03073 | 0.41872 | 0.18826 | 2.27041 | 0.023 | |

| Complexity ⇒ Actual Use | 0.4705 | 0.05963 | 0.35363 | 0.58737 | 0.37923 | 7.89061 | < .001 | |

In case of the Jammu region, the regression model being formulated is found to be statistically significant where adjusted R2 is 0.718. This similarly indicates the variance of 71.8% on the adoption of digital modes with a unit change in the independent variables which are significant. Looking into the list of ten factors considered here, the significant contributors include Technology, Social Influence, Ease of Use, Perceived Financial Cost, Perceived Usefulness and Complexity. While there are some common factors with that of the Ramban region, there are certain unique factors being significant in case of Jammu area only. Social Influence here is seen to be the major influencer who was less effective in the previous model.

The two regression models have clearly established the relationships existing among the digital adoption and the other ten factors.

The two variables of digital divide and health awareness often occurs as a challenge in the adoption of the digital methods. The study here has further incorporated a mediation model in both Jammu & Ramban region to show the mediating role played by these two factors in the process of digital adoption. The results are as follows Figures 1,2.

In both the regions it is observed that there does exists the partial mediation of both the challenges included in the study i.e., digital divide and health awareness. The need to focus on these two aspects when it comes to increasing the digital usage among such respondents. The implications from such results derived in the study are discussed in the next section.

Conclusion

The main aim of the study has been to provide an idea about the status of digital adoption among the two regions located in Jammu and portray the picture of the entire rural India. The two models created for the two regions show some interesting results. The factors influencing the process of digital adoption are different across the two regions. While in case of Ramban it is social influence, compatibility, perceived financial cost, complexity along with the two challenges of digital divide and health awareness play a significant role, in case of Jammu, technology, ease of use, perceived usefulness is found to add while ignoring the challenges. Social influence is one factor which is found to commonly impact both the regions. It has been established by researchers such as about the positive impact of social influence on the adoption of digitalisation. The study here has generated results in concordance with the same. Perceived financial cost is another common factor observed among the two regions. The perception of cost in the digital adoption process is quite closely monitored by the users. It is important that proper awareness about the approximate cost of using digital methods is required when dealing with rural areas such as these. It is interesting to note that digital divide is still acting as a mediator in the process of digital adoption. India recorded a big digital divide especially among the rural and urban residents. The digital divide issue is one which is needed to be addressed with utmost seriousness if India wants to enhance the digital adoption process. The proper training and awareness about the various ways of using the digital modes needs to be propagated among the residents. The health awareness issue is one aspect that is rarely addressed when it comes to digital adoption process. This is due to the absence of direct relationship among the two.

However, the mediation analysis conducted has shown the strong presence of health awareness in the adoption of digital methods. The study here has put forward models based on the statistical analyses conducted and this has led to a number of opportunities for the future researchers to work in the field. The two challenges namely digital divide and health awareness must be investigated in detail in the future to know about its consequences in the process. The model generated can be further elaborated by adding more elements relevant to the field and knowing more about the aspect. The digital divide among the residents is one the areas that requires attention from the respondents to a large extent and needs to be considered for the future studies.

References

Agarwal, R. (2020). The role of effective factors in UTAUT model on behavioral intention.Business Excellence and Management,10(3), 5-23.

Aggarwal, K., Malik, S., Mishra, D. K., & Paul, D. (2021). Moving from cash to cashless economy: Toward digital India.The Journal of Asian Finance, Economics and Business,8(4), 43-54.

Indexed at, Google Scholar, Cross Ref

Ahmed, S., & Sur, S. (2021). Change in the uses pattern of digital banking services by Indian rural MSMEs during demonetization and Covid-19 pandemic-related restrictions.Vilakshan-XIMB Journal of Management.

Anitharaj, M. S. (2019). Role of financial inclusion in bridging the digital gender divide: problems and prospects.

Arner, D. W., Barberis, J., & Buckley, R. P. (2015). The evolution of fintech: A new post-crisis paradigm?. Georgetown Journal of International Law, 47(4), 1271-1319.

Athique, A. (2019). A great leap of faith: The cashless agenda in Digital India.New Media & Society,21(8), 1697-1713.

Indexed at, Google Scholar, Cross Ref

Aziz, A., & Naima, U. (2021). Rethinking digital financial inclusion: Evidence from Bangladesh.Technology in Society,64, 101509.

Indexed at, Google Scholar, Cross Ref

Balaji, R. P., & Vijayakumar, T. (2018). Diffusion of digital payment system in rural India.Global Journal of Management And Business Research.

Barik, R., & Sharma, P. (2019). Analyzing the progress and prospects of financial inclusion in India.Journal of Public Affairs,19(4), e1948.

Indexed at, Google Scholar, Cross Ref

Chavda, V. (2018). An empirical study on factors affecting consumer adoption of mobile payments in rural area.Sankalpa,8(1), 64-71.

Indexed at, Google Scholar, Cross Ref

Gupta, A., & Singhal, R. (2021). Impact of COVID-19 on digital payment services at towns and villages.IJCRT2106045 International Journal of Creative Research Thoughts (IJCRT).

Gupta, K., & Arora, N. (2020). Investigating consumer intention to accept mobile payment systems through unified theory of acceptance model: An Indian perspective.South Asian Journal of Business Studies,9(1), 88-114.

Hair, J. F., Black, W., Babin, B., Anderson, R., & Tatham, R. (2006). Multivariate Data Analysis (6th ed.). Pearson Education.

Joshi, M. (2017). Digital payment system: A feat forward of India.Research Dimension (ISSN: 2249-3867).

Koul, S., Singh Jasrotia, S., & Govind Mishra, H. (2021). Acceptance of digital payments among rural retailers in India.Journal of Payments Strategy & Systems,15(2), 201-213.

Kumar, A., Adlakaha, A., & Mukherjee, K. (2018). The effect of perceived security and grievance redressal on continuance intention to use M-wallets in a developing country.International Journal of Bank Marketing, 36 (7), 1170-1189.

Indexed at, Google Scholar, Cross Ref

Kumar, P. N. (2019). A comparative study on connecting rural areas through information technology for digital transactions.

Liébana-Cabanillas, F., Japutra, A., Molinillo, S., Singh, N., & Sinha, N. (2020). Assessment of mobile technology use in the emerging market: Analyzing intention to use m-payment services in India.Telecommunications Policy,44(9), 102009.

Indexed at, Google Scholar, Cross Ref

Manrai, R., Goel, U., & Yadav, P. D. (2021). Factors affecting adoption of digital payments by semi-rural Indian women: extension of UTAUT-2 with self-determination theory and perceived credibility.Aslib Journal of Information Management, 73(6), 814-838.

Indexed at, Google Scholar, Cross Ref

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability.Borsa Istanbul Review,18(4), 329-340.

Indexed at, Google Scholar, Cross Ref

Prabhakaran, S., Vasantha, D. S., & Sarika, P. (2020). Effect of social influence on intention to use mobile wallet with the mediating effect of promotional benefits.Journal of Xi’an University of Architecture & Technology,12(2), 3003-3019.

Rana, N. P., Luthra, S., & Rao, H. R. (2019). Key challenges to digital financial services in emerging economies: the Indian context.Information Technology & People, 33(1), 198-229.

Indexed at, Google Scholar, Cross Ref

Saini, S. (2019). Digital financial literacy: awareness and access.International Journal of Management, IT and Engineering,9(4), 201-207.

Schuetz, S., & Venkatesh, V. (2020). Blockchain, adoption, and financial inclusion in India: Research opportunities.International Journal of Information Management,52, 101936.

Indexed at, Google Scholar, Cross Ref

Selvaraj, P., & Ragesh, T. V. (2018). Innovative approach of a regional rural bank in adopting technology banking and improving service quality leading to better digital banking.Vinimaya,39(1), 22-32.

Shankar, K. U. (2017). Digital economy in India: Challenges and prospects.International Journal of Research in Management Studies,2(11), 6-11.

Singh, N., & Sinha, N. (2020). How perceived trust mediates merchant's intention to use a mobile wallet technology.Journal of Retailing and Consumer Services,52, 101894.

Indexed at, Google Scholar, Cross Ref

Singh, S., & Srivastava, R. K. (2020). Understanding the intention to use mobile banking by existing online banking customers: an empirical study.Journal of Financial Services Marketing,25(3), 86-96.

Indexed at, Google Scholar, Cross Ref

Singhraul, B. P., & Garwal, Y. S. (2018). Cashless economy–Challenges and opportunities in India.Pacific Business Review International,10(9), 54-63.

Indexed at, Google Scholar, Cross Ref

Tiwari, P., Tiwari, S. K., & Gupta, A. (2021). Examining the impact of customers’ awareness, risk and trust in m-banking adoption.FIIB Business Review,10(4), 413-423.

Indexed at, Google Scholar, Cross Ref

Ye, L., & Yang, H. (2020). From digital divide to social inclusion: A tale of mobile platform empowerment in rural areas.Sustainability,12(6), 2424.

Indexed at, Google Scholar, Cross Ref

Received: 05-Dec-2022, Manuscript No. AMSJ-22-12966; Editor assigned: 06-Dec-2022, PreQC No. AMSJ-22-12966(PQ); Reviewed: 12-Jan-2023, QC No. AMSJ-22-12966; Revised: 18-Jan-2023, Manuscript No. AMSJ-22-12966(R); Published: 05-Feb-2023