Research Article: 2019 Vol: 23 Issue: 4

An Enhancement of Takaful Marketing in Malaysia in the 21st Century

Dr. Yusuff Jelili Amuda, Prince Sultan University

Wan Nuraini Binti Wan Din, Faculty of Law and International Relations Sultan Zainal Abidin University

Nursyafiqah Binti Ibrahim, Faculty of Law and International Relations Sultan Zainal Abidin University

Nurdiyanah Afiqah Binti Noraman, Faculty of Law and International Relations Sultan Zainal Abidin University

Abstract

Islamic insurance is known as takaful which specifically attempts to bring both social and economic benefits to participants as well as to the emerging economy of Malaysia. Takaful is expected to be compliant with Islamic principles. However, there is an insufficient academic research in the recent time investigating policy on marketing takaful in emerging economy in Malaysia in the 21st Century. The motivation for this paper is to clarify misconception about Islamic takaful and practice of conventional insurance in Malaysian context. The primary objective of this paper is to explore policy on marketing takaful in enhancing the economic development in the Muslim nations. Critical content analysis as an integral part of qualitative research is employed. In other words, qualitative descriptive content analysis is used as methodology of the paper specifically by using secondary data of extant literature on takaful. Theoretical framework of takaful is explicated. The findings indicated that, development of takaful proves to be crucial especially to the economic development in many countries with emerging takaful market. Nonetheless, there are many barriers or hindrances to the rapid growth of takaful that are largely depend on the lack of proper marketing and handling of takaful operations by the takaful operators. The paper also identifies certain factors that hinder effective and efficient marketing of takaful operations. Of such hindrance for takaful in being marketed successfully are: lack of proper enlightenment, the quality customer service, the lack of exposure of local takaful insurance businesses to the international market, the compliance of new takaful products with Islamic principles and difficulties faced by takaful insurers to meet the participants’ expectation of gaining higher returns from their investment. In conclusion, it is important that marketing agents of takaful must be able to explain the features of a product to the customers in order for them to feel that they have fairly been treated by takaful operators. In so doing, the paper will provide suggestions in addressing multifarious challenges or hindrances to the development and enhancement of Takaful businesses in the context of Malaysia.

Keywords

Islamic Insurance, Takaful, Policy, Economy and Marketing.

Introduction

There are various Islamic economic concepts such as musharakah, mudarabah, murabaha, takaful among others that emphatically stress to improve the economy system of the Muslim community through partnership in business transaction and wealth creation which are important for sustainable human and material development. Onwards, takaful as an Islamic insurance brings about sustainable social and economic development especially among the participants. Hence, takaful is one of an important parameters to measure economic development of predominant Muslim countries like Malaysia. Thus, the transaction of takaful must be compliant with Islamic principles. The motivation for this paper is to clarify misconception about Islamic takaful and practice of conventional insurance in Malaysian context. It is therefore essential to clarify the misconception in order to elucidate the benefit of takaful. More importantly, takaful is explored in this paper in order to enhance marketing takaful by fostering the economic development in the Muslim nations such as Malaysia. The practical application of takaful must make it go beyond juristic theoretical conception and historical explanation as literature expounds (Adnan, 2017; Cader, 2014). In other words, takaful has been explained by the jurists, however, its practical application is needed by demonstrating essential values attributed to the Islamic financial system such as Islamic insurance as to fulfil the economic needs of Malaysia in the 21st Century.

Moreover, it is important to explain on the concept of takaful. Takaful is an Islamic insurance, where participants contribute money into a pool of premium which tends to guarantee each other against loss or damage. Islamic insurance known as takaful attempts to bring both social and economic benefits to participants and consequently meant to improve the emerging economies of many predominant Muslim countries specifically meant for sustainable economic development. Though, it is expected to be compliant with Islamic principles as literature contends (Batcha, n.d.). Takaful was introduced as an alternative to the conventional insurance without the elements of usury (riba), gambling (maysir) and uncertainty (gharar) (Billah, 2007).

Historically, the ancient Arab civilization was under a tribal system and the doctrine of “Aqilah” which is payment of blood money conceptually employed or used to maintain peace and harmony among tribes (Adnan, 2017; Cader, 2014). With regard to a complaint against a member of the Huzail Tribe, the Prophet (S.A.W.) in his judgment reaffirmed the foundation of the doctrine of Aqilah. This scenario could be consequently regarded as evolution of takaful Insurance (Adnan, 2017; Cader, 2014).

It is further reiterated according to the European Council for Fatwa and Research that, Islamic insurance was firstly established in the early second century of the Islamic era when Muslim Arabs expanding trade into Asia which had mutually agreed to contribute to a fund to cover anyone in the group that incurred mishaps or robberies along the numerous sea voyages or called as marine insurance as literature expounds (Wassem, 2007).

Onwards, Al Wazani (2011) in his treatise “The Report: Jordan” mentioned that the first Takaful Company was the ‘Islamic Insurance Company of Sudan’ which was established in 1979. Therefore, it is stressed that the takaful system is very much based on moral and ethical values. Normally, the dealings are required to be conducted in an open, transparent manner, with honest intention (in good faith), truthfully and with fairness (Cader, 2014).

In this paper, an attempt is made to explore marketing of Takaful businesses in Malaysia with specific focus on juristic basis of classical and modern discourse of takaful, issues and challenges, enhancing takaful marketing in Malaysia. In addition, an attempt is also made to highlight some major hindrances that prevent Takaful from being marketed to its full potential of marketability. In so doing, the paper provides suggestions in addressing multifarious challenges or hindrances to the development and enhancement of Takaful businesses in the context of Malaysia.

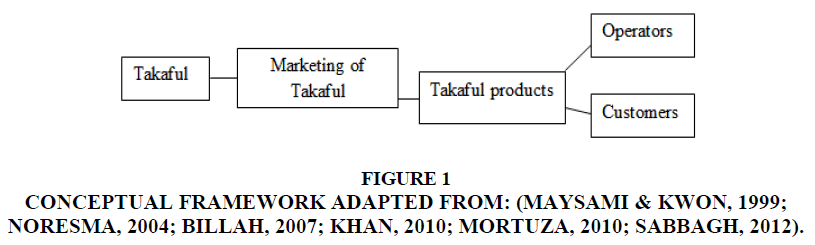

Qualitative descriptive analysis is used as methodology of the paper. Based on the extant literature, various dimensions as hindrances to the prospects of marketing takaful such as: lack of proper enlightenment on marketability of takaful; lack of the quality customer service; lack of exposure of local takaful insurance businesses to the international market and difficulties faced by takaful insurers to meet the participants’ expectations are identified. The dimensions are regarded as themes of the paper. For instance, theoretical framework is developed to investigate Takaful marketing in Malaysia. In so doing, this paper largely relies on review of secondary data as found in the extant literature (Maysami & Kwon, 1999; Yusof, 2011; Fakhri, 2016) with different segments of the coverage. Literature identifies that the participation in Takaful is voluntary as literature expounds (Fakhri, 2016). Also, juristic explanation establishes legality of Takaful which are free elements found in conventional insurance such as usury and uncertainty (Sabbagh, 2012). The discourse of theoretical framework is largely extracted from extant literature (Kwon, 2007) where takaful is regarded as rejuvenation of economy which serves as a complementary role to Zakat. More importantly, the database from which most ideas were extracted from were on takaful in modern economy was first introduced by the Al Baraka Insurance Company established in 1979 in Sudan; the enactment of Takaful Act 1984 (revised in 1999) in Malaysia and Takaful Company under the Takaful Act 1984 was Syarikat Takaful Malaysia (Takaful Malaysia) in 1985 (Kwon, 2007). Other themes considered in this paper were challenges on the following: takaful policy (Asian Insurance Review, 1997); customer service of takaful insurers (Khan, 2010); lack of exposure in takaful insurance businesses (Maysami & Kwon, 1999); lack of fulfilling the expectations of the participants on their investment. Critical analysis of these themes were done and the literature were used as justification to buttress this. This part explore literature review of this paper. The review are done under five sub-headings namely: Conceptual framework of takaful, Juristic basis of classical and modern discourse of takaful, issues and challenges, enhancing takaful marketing in Malaysia and discussion of major findings. Each of these is presented in the subsequent subheadings.

Conceptual Framework of Takaful

Takaful is literarily derived from an Arabic word “kafala” which means “guaranteeing each other”. Basically, takaful is technically referred to as an Islamic insurance. The concept of Islamic insurance which is related to mutual assistance (ta’awun) and donation (tabarru’) has been explored by many promoters of Islamic banking and finance. However, the risk that is associated with takaful is expected to be shared among a group of people that voluntarily agree to participate in takaful scheme (Jamaldeen, 2017; Fakhri, 2016).

Although, the concept of insurance is permissible under Shar’iah Law, nonetheless, certain practices in conventional insurance such as usury (riba), gambling (maysir) and uncertainty (gharar) are contradictory to the Shar’iah Law (Kassim, n.d.; Khan, 2010). The current takaful practice uses a combination of two types of contracts (‘Aqad) namely: the contract of donation (tabarru) and contract of agency (wakalah). These contracts are basically free from the elements of usury (riba), gambling (maysir) and uncertainty (gharar) as predominantly found in conventional insurance. This has clearly proven that a Shariah-based insurance policy would never involve the unlawful elements (Batcha, n.d).

It should be stressed that, Shariah-based insurance policy is viable, effective and efficient social institution. It is in the light of this assertion that Ahmed Adnan mentioned that the President of takaful in USA, Omar Fisher posits that

“Takaful is the second most important social institution that is expected to be well implemented” (Kwon, 2007).

“Takaful arrangements have the prospect of societal regeneration for economic development and it is considered a second to Zakat as a social institution.”

The study found that the takaful system very much emphasizes the spirit of co-operation and joint responsibility among the participants where it would be based on al-mudarabah in which the participants shall pay contribution to the takaful operator who runs a business with the accumulated money and then, the profits earned from such transaction shall be shared by both the participants and operator accordingly (Yusof, 2011). Through the spirit of cooperation and joint-responsibilities among participants, this system will allow participants the opportunity to obtain two forms of benefit which are: monetary and spiritual benefits (Fakhri, 2016). It is stressed in previous literature that, takaful is considered as a mechanism for cooperative insurance in helping individuals participating in the takaful (Maysami & Kwon, 1999). In so doing, an inference can be drawn that the takaful system is meant to benefit all participants, irrespective of their religious beliefs.

Based on the article “History and values” of takaful Islamic Insurance written by Cader (2014), it is emphasized that there is no reference to a ‘policyholder’ and instead the beneficiary is called participant in takaful system. The “Takaful operator” will collect the takaful fund and will issue the policy with the objective of sharing responsibility and indemnifying the losses and not to solely make profits. Hence, it is noteworthy to say that the principles of the Islamic Shariah are considered as a surplus fund in regards to the profits made by the Takaful Operator and to distribute the same in the proportionate manner among the participants (Cader, 2014).

Further still, the takaful insurance system will eventually work when at first; each participant contributes into a takaful fund, which is expected to be used to support one another in times of adversity (Riyazi, 2006). Literature further reiterates that, each participant contributes sufficient amounts to cover expected claims and the contributions depend on the coverage need (Riyazi, 2006). The policyholders are likely entitled to share any surplus that may exist in the pool at the end of the financial year (Jamaldeen, 2017). Thus, it is noteworthy to say that policyholders would be required to make additional contributions to cover deficits in the fund, if there is any.

Juristic Basis of Classical and Modern Discourse of Takaful

It is essential to explicate on the paramount importance of legality of takaful as a viable Islamic financial system in the Muslim community. The Holy Qur’an and hadith provide theoretical bases for the legality of takaful. For instance, Sabbagh (2012) contends that the majority of Muslim scholars who support takaful policy often quote Surah al-Maidah (Q5:2) to support their contention which reads thus:

“… and cooperate in righteousness and piety, but do not cooperate in sin and aggression…”

An inference can be drawn from the above quoted verse that, the Muslim scholars relate the principle of bearing losses together among the takaful participants on the principle of cooperation as contained in the verse. Because takaful is a policy based on Islamic principles, it is therefore free from elements that go against Islamic principles such as usury (riba) and gambling (maysir) as commonly found in conventional insurance as literature expounds (Cader, 2014). It is not doubtful to say that, the teachings of Islam come from Almighty Allah and whoever abides by it is said to be righteous. Thus, whoever abides by something that is in accordance with the Islamic teachings is a pious servant of Allah. In takaful policy, the system of the participants insuring each other from the premium gathered among them can be viewed as something where servants of Allah are cooperating to do something righteous and in line with Islamic principles instead of committing a criminal offence such as gambling which goes contrary to the teachings of Islam and it is therefore considered as a sinful act or abomination.

Apart from the Qur’anic injunction, the Muslim scholars such as: Sabbagh (2012) also backed their support for takaful policy with reported hadith like what was narrated from the Prophet (S.A.W.) which reads that: “God will always help his servant for as long as he helps others.” (Imam Ahmad bin Hanbali and Imam Abu Daud). This hadith, like the previously mentioned Qur’anic verse, encourages mankind to help each other and by helping each other, consequently, they will get help from Allah. Another hadith narrated from the Prophet (S.A.W that:

“One true Muslim (Mu’min) and another true Muslim are like a building, whereby every part in it strengthens the other part” (Imam al-Bukhari & Imam Muslim).

The afore-quoted hadith further emphasizes the paramount importance of helping each other among Muslims whereby one Muslim is equated with a pillar when helping another Muslim; the pillars support each other to create one strong and stable structure through unity and selflessness.

In a nutshell, both of the aforementioned ahadith promote the concept of helping one another in the society which is very similar to the underlying principles of takaful whereby the premium accumulated through investments made by the participants are in turn used to support any participant in need. This strengthens the bond between members of society who participate in takaful policy much like the visualization given in the aforementioned hadith.

The basis of responsibility in takaful policy is supported with a hadith narrated by Imam al-Bukhari and Imam Muslim which reads

“The place of relationships and feelings of people with faith, between each other, is just like the body; when one of its parts is afflicted with pain, then the rest of the body will be affected” (Sabbagh, 2012).

Meanwhile, the basis of mutual protection in takaful policy according to Khan (2010) is supported by a hadith narrated from the Prophet (S.A.W.) which reads

“By my life (which is in God's power), nobody will enter Paradise if he does not protect his neighbour who is in distress.” (Imam Ahmad bin Hanbali).

The policy of takaful in modern economy was first introduced in Sudan where the Al Baraka Insurance Company was established in 1979 (Kwon, 2007). Later in 1992, the enactment of the Insurance Law of 1992 (revised in 2003) required that all insurance companies in Sudan to transact insurance and reinsurance businesses only in Islamic ways which was particularly based on the wakalah model (Kwon, 2007).

More so, it should be emphatically stressed that, in Malaysia, the policy of takaful was first introduced through the enactment of Takaful Act 1984 (revised in 1999) which appointed Malaysia’s central bank popularly known as Bank Negara Malaysia, to supervise Islamic financial institutions. The first Takaful Company to obtain a license under the Takaful Act 1984 was Syarikat Takaful Malaysia (Takaful Malaysia) in 1985. Malaysian laws require Takaful insurance firms to establish and maintain a Shariah Supervisory Council to act as the overseer of the firm’s compliance with Islamic principles (Kwon, 2007). This is a means to monitor the firms in order to ensure that they are truly complying with Islamic principles in operating their takaful businesses. However, this can also backfire if the council itself is turning a blind eye to a firm’s activity that does not comply with Islamic principles. This is one of the issues regarding the operation of takaful business which will be discussed further in the subsequent subheading.

Issues and Challenges

Indeed, conventional insurance and takaful predominant in Malaysian market. The main difference between takaful and conventional insurance is that takaful is relatively free from elements of usury (riba) and (maysir) while having minimal elements of uncertainty (gharar) (Kassim, n.d.). However, once the takaful insurers start competing to come up with more innovative strategies to market their takaful policy more successfully, issues regarding the compliance of that new policy with Islamic principles may arise (Noresmabt, 2004; Mortuza, 2010). Thus, it can be construed that there exists a challenge of trying to develop new takaful products in order to compete with conventional insurance while still complying with Islamic principles.

With the growing interest in and proliferation of takaful insurance both domestically and globally, the growth of the takaful industry also thrives along with its accessibility (Rushdi, 2006). However, with proliferation of takaful insurance, there is bound to be hindrances and obstacles that need to be addressed in order to ensure a more stable footing for the takaful insurance to stand on especially by fostering takaful from jurisprudential explanation to practical applications as literature expounds (Sabbagh, 2012). Thereby, this paper identifies some of the issues and challenges that are hindering takaful insurance policy from being marketed more successfully specifically in Malaysia.

Firstly, the majority of Malaysians mostly think that conventional insurance is preferable compared to takaful policy. There exists a need for the public to be enlightened properly regarding insurance policies, both conventional and takaful. A survey research conducted in Malaysia has shown that 45% of the respondents were found to have little knowledge about life insurance (Asian Insurance Review, 1997). Another study further showed that some of the respondents indicated that they needed the insurance coverage but the majority of respondents disfavoured discussions on the subject of insurance coverage (Maysami& Kwon, 1999). Based on the findings from empirical studies, it is lucidly showed that, this scenario clearly poses a need for proper enlightenment about insurance coverage-both life and non-life- to the public to ensure that they are aware of the importance of having insurance coverage. Similarly, the public must not only be properly educated in conventional insurance policies alone but also in takaful insurance policies so that they can contrast and compare between the two policies and make their own decision based on their own judgment.

Secondly, the quality of customer service of takaful insurers is average compared to their conventional counterpart (Khan, 2010). In order to be able to compete more with conventional insurance businesses, takaful insurers would need to increase the quality of their customer service in order to gain interest and trust among members of the general public. Once the takaful insurers have gained the confidence of the general public, participation rates will steadily increase because investment and confidence naturally come hand in hand.

Thirdly, lack of exposure in takaful insurance businesses is commonly predominant among the Muslims as literature expounds (Maysami & Kwon, 1999). The majority of the takaful insurers only operate within their local market. The lack of exposure to the international market undeniably limits their ability in creating more innovative and interesting marketing strategies that can attract the attention of potential participants. This lack of exposure may also result in a situation whereby the general public is not aware that the business exists. Thus, there is a need for takaful insurers to improve in publicly introducing their business and further appeal and persuade the public to gain their interest in participating in the takaful insurance being offered (Abidin, 2013).

Fourthly, another challenge is in meeting the participants’ expectations of higher returns for their investment. Because the takaful insurers have to abide by Islamic principles, it might not be wise for them to invest in high risk situations using the takaful funds gathered. Due to this circumstance, they have to remain conservative in their investment. In other words, it might be hard for them to meet the participants’ expectation of gaining high returns from their takaful investment. This fact is also known to the potential participants who in turn will start to harbour doubts among them whether to participate in the takaful policies currently offered in the market or not.

Enhancing Takaful Marketing in Malaysia

Takaful has been introduced due to the fast growth of the Islamic financial and takaful development in Malaysia. Literally in general terminology, insurance is the equitable transfer of the risk of a loss, from one unit to another in exchange for payment where the insured parties transfer the risk to the insurer (i.e. the insurance company) and not in line with Islamic principles (Kassim, n.d.; Billah, 2007). In addition, takaful is obviously contrast from conventional insurance since the relationship between the parties is not an insured and insurer but it is between participants and takaful operator (Kwon, 2007). Guaranteeing each other is the central principle of takaful. Generally, Muslim jurists do agree that the takaful principle is in accordance with the Islamic principles, as it emphasizes the lawfulness(halal) concept of donation or contribution (tabarru’).Thus, both takaful operator and the participants are jointly helping each other for the purpose of financial protection (Billah, 2007).

Nowadays, Muslim consumers are able to choose takaful instead of conventional insurance policy due to development and growth of takaful as a Shari’ah compliant insurance (Noresma, 2004). Hence, the Muslim preferences on Takaful should be concerned by investigating the Muslims’ level of knowledge and understanding of takaful. Undeniably, the perception of takaful is influenced by their personal financial choices and the religious factor that comply with Shari’ah concept. The complete information on significance and benefits of takaful to a Muslim is required to ensure they have a clear and unblemished understanding of Takaful. Typically, Muslim consumer which engaged with Takaful will have some operative features on what lead them to choose Takaful. Muslim consumers’ preferences may be influenced by their religious consciousness since takaful is Shari’ah compliant (Noresma, 2004). There are numerous ways and suggestions that have been made in order to improve takaful marketing successfully.

Firstly, takaful companies must work to upsurge the awareness of takaful in order to achieve its full potential. It should be stressed that there is need to organize high-profile media enlightenment such as creating television advertisement and hiring famous and well-known celebrities to ratify takaful products (Mortuza, 2010). It is vital to ensure that takaful agents are well trained and recognized the advantages of takaful. In addition, social media also plays an important role in enlightening the populace about the benefits of takaful through expo, exhibition and road show for the purpose of public awareness.

Secondly, it is noteworthy to say that, Muslim consumers have an excellent perception towards takaful. Hence, it is expected of takaful companies to hold motivational talks on what they can offer to gradually increase and maintain consumers’ perception about takaful (Mortuza, 2010). Besides that, takaful company should stress on the advantages of takaful compared to conventional insurance in order to convince consumers about strong perception towards takaful services (Al-Wasani, 2011).

In addition, takaful companies should highlight the differences between takaful and conventional insurances in order to have better knowledge and understanding on takaful from the motivational program. A good insight can be reached by helping in giving an encouragement with regard to how Takaful services can grow one’s personal life by boosting existing participants to influence prospective consumers in their preferences towards takaful products (Mortuza, 2010). Takaful operator must ensure that all their concepts, mechanisms, materials and marketing activities must be in accordance with Shari’ah principles. This is very important to ensure that the image of Islamic financial institutions would stay clean in the eyes of the society. One of the important aspects in marketing activities that need to be considered is related to the products themselves and all products to be marketed must comply with Shari’ah and approved by the Shari’ah Advisors of the company (Mortuza, 2010).

Thirdly, the researchers have found that Muslim consumers have a high positive attitude towards takaful based on their religious factor. This will give an advantage for takaful companies or organization to have more space to spread its wings and take this positive acceptance of the Muslim consumer toward takaful (Noresma, 2004). Therefore, takaful companies need to promote the benefits of takaful product aggressively together with government initiative in infusing high Islamic values among Muslim consumers, especially to the Generation-Y (i.e. young generation). Marketing agents must be able to explain the features of a product so that it would be clearly understood by customers in order for the customers to feel that they had been treated fairly (Noresma, 2004). The principle behind treating customers fairly is basically to avoid fraud, to ensure fair terms and conditions and also not to restrict customers' freedom of choice. As been explicated, the customer is an important asset to the business industry.

Results and Discussion

It is important to explicitly present the major findings of this paper despite the fact that it is a conceptual paper. The result of this paper has demonstrated that the operation of takaful is devoid of elements such as uncertainty and usury found in the conventional insurance (Khan, 2010). It has been demonstrated that the practice of takaful in Malaysia are of two categories namely contract of donation and contract of agency. Studies have demonstrated that, takaful as a second social institution to Zakat which is essential in addressing the needs of customers (Kwon, 2007), however, it should be Shari’ah compliant. As a result, Cadre (2014) shows that the value of takaful is not to mainly make profit but to share responsibility and indemnify the losses. Nonetheless, literature such as Riyazi (2006) posit that participants in takaful are expected to contribute money which may be consequently used during the time of need and the role of policymakers could not be trivialized whereby they also get share from surplus at the end of financial year (Jamaldeen, 2017). This paper has demonstrated that the contemporary discourse of takaful in socio-economic development of Muslim countries was traceable to Al Baraka Insurance Company in Sudan in 1979 as literature explains (Kwon, 2007). Literature further contends that the evolvement of takaful was also complemented with the enactment of the Insurance Law of 1992 which was also revised in 2003 was emphatically stressed on contract of agency (wakalah model) in handling transaction of businesses relating to insurance without comprising Shari’ah compliance (Shafarin et al., 2013). Thus, in many gulf countries, literature shows the efficiency of takaful market (Khalid, 2015).

The paper has also demonstrated that, conventional insurance and takaful are in operation in Malaysia. However, the policies of operation of the two are different. The former operates certain elements such as uncertainty and usury and the later operates under Islamic legal system which devoid of the aforementioned elements found in conventional insurance. Marketability of takaful in Malaysia has been evolving (Malaysia Takaful Association, 2018). However, certain factors that hinder effective and efficient marketing of takaful operations specifically in the aspect of public awareness about the benefit of takaful. In other words, there are many barriers or hindrances to the rapid growth of takaful that are largely depend on the lack of proper marketing and handling of takaful operations by the takaful operators (Hani Kallil, 2014). In addition, the compliance of new takaful products with Islamic principles is important. Investment in takaful which specifically attempts to bring both social and economic benefits to participants and to economies of many predominant Muslim countries is expected to be consistent with Islamic principles. It is reiterated that, development of takaful proves to be crucial especially to the economic development in many Muslim countries.

The foregoing issues and challenges relating to takaful could be better addressed by formulating policy that will improve the understanding of consumers of takaful in Malaysian context in order to achieve financial protection of which it is the main focus of takaful (Billah, 2007). It is not doubtful to say that say that it is expected that companies providing takaful services are to provide avenues for exploring full potentialities of takaful market in the country. Hence, various means such as advertisement and popular celebrities could instrumental in advertising takaful products in Malaysia as literature expounds (Mortuza, 2010). Since majority of Muslims have good perceptions about takaful, it is thereby essential takaful companies take up the responsibility of creating more enlightenment through staging of motivational talks especially with focus of explaining the benefits of takaful over conventional insurance. It is noteworthy to say that religious orientation is predominant factor for Muslims’ preference of takaful over conventional insurance in Malaysia (Noresa, 2004).

Theoretical and Practical Implications

There are two major implications (theoretical and practical) of this paper in order to foster takaful marketing in Malaysia. Theoretically, the paper provides explanations of scholars pertaining to efficient operation of takaful marketing in Malaysia of which many other Muslim countries can learn from its operation. However, there are issues and challenges pertaining to operation of takaful whereby it is misconstrued with conventional insurance which operates with element of usury and uncertainty. Practically, this paper may provide an alternative policy direction to stakeholders in Malaysia especially towards evolvement of takaful products in order to favourably compete with conventional insurance without compromising the Shari’ah compliance principles. It should be reiterated that as an integral part of innovative ideas and strategies appealing to human reasoning without comprising Shari’ah in order to promote universality of Divine Islamic legal system in different parts of the world. Based on the discourse of this paper, it is emphatically stresses that, the policy direction by the stakeholders should focus much on the enlightenment on the paramount importance of benefits derivable from takaful as compared to conventional insurance. Similarly, the policy direction should formulate policy that will clearly spell out the functions of customer service in order to motivation the customers regarding the viability and efficiency of takaful products. Also, the policy direction should explore the potential of international market rather than limiting it to local market. This can only be achieved by attracting the potential customers or participants especially by meeting up with their expectation while partaking in takaful which can only be achieved through effective policy. Nonetheless, takaful issuers are expected to strictly consider Islamic tenets in the operation of takaful. The aforementioned factors are essential to be taken into consideration for the operation of takaful in order to enhance its market in market. All the aforementioned factors are important and should be covered in policy formulation relating to takaful market in Malaysia which are important for the future marketability of takaful in Malaysia in particular and other Muslim countries in general. In spite of an effort to improve Takaful market in Malaysian context, there are still limitations ascribed with this particularly it is not a comparative paper despite the fact it examines different acts on Takaful. Also, there are different sources and expressions of ideas by experts in the field of Islamic finance with regard to operation of Takaful but legality of Takaful from Shariah point of view is not contestable. Different sources of data in exploring various dimensions of this paper can provide better validity and authenticity of ideas embodied in this paper. The policy operation of Takaful in Malaysia can be grounded well but it may not address the peculi arity of other Muslim countries. Therefore, it is important that this paper should be developed to investigate different dimensions empirically on real data set in order to concretize the central focus of this paper. This research will be guidelines for the Islamic Insurance companies, academicians, students, and policy makers of takaful practice in figure 1.

Figure 1 Conceptual Framework Adapted From: (Maysami & Kwon, 1999; Noresma, 2004; Billah, 2007; khan, 2010; Mortuza, 2010; Sabbagh, 2012).

Suggestions

This part provides suggestions toward enhancing marketability of takaful in the context of Malaysia. The following are suggestions in fostering marketing of takaful:

1. It is suggested that a study could be carried out on takaful company’s preferences towards marketing takaful or a study on corporate consumer like firms and organizations toward shifting their current practice toward takaful product. Since this will involve financial cost and other criteria which are fundamental for the income of the organization, the prominent factor in choosing takaful could be essential to the corporate consumer.

2. Promotion of takaful is essential to be done by the government agencies dealing with Islamic financial system. Without the support from the government, the regulatory authorities cannot play their dynamic functions for development of takaful Governmental support which is also necessary in order to protect the policyholders who used to purchase takaful products.

3. It is essential to explore opinions of consumers in order to have a more comprehensive explanation in helping them to make their decision to participate in takaful product. Instances of other adaptabilities that may have an impact or influence on customers’ decision are income level, location or environmental factor, security, and etc. Indeed, if there is a mutual agreement between the researcher and the takaful operators to use secondary data from their customers’ database, the finding might be more reliable and effective in predicting the actual reason in influencing the customers’ decision to participate in takaful products.

4. The scope of this paper could be expanded by empirically investigating the perceptions of takaful operators and customers with regard to the extent by which takaful has been marketed in the country. The respondents for the empirical assessment of marketing takaful could also be from those who are not customers of takaful product itself so that a better comprehension on the decision of participating in takaful product could be totally achieved. The following variables could be employed:

Conclusion

This paper has elaborately elucidated on the paramount importance of takaful insurance system is basically the scheme of mutual assistance, charity, mutual guarantee, cooperative risk-sharing and profit sharing. The paper has explored the classical and modern trends in explicating takaful. For instance, it is explained that the Holy Prophet underscored the importance of the mutual help along with the cooperation among Muslims. He then, further highlighted the importance of the duty cast upon the individuals to help and assist the fellow human beings who stand in need of such help. However, many issues and challenges in takaful operation nowadays which could slow down the Islamic insurance industry have been lucidly explained. Therefore, a number of suggestions have been provided to improve the takaful marketing in Malaysia. It is hoped that effective and efficient takaful marketing would foster takaful system in Malaysia which consequently would promote efficient and successful advancement of takaful to other Muslim countries.

References

- Abidin, M.K.Z. (2013). Primary Insurance Models. Takaful and Insurance Mutual. The World Bank: Washington D.C

- Adnan, A. (2017). History of Takaful. Retrieved February 18, 2017, from https://www.scribd.com/doc/65272136/History-of-Takaful #

- Al-Wasani, A. (2011).The Report: Jordan Retrieved March 1, 2017, from https://books.google.com.my/books?id=lmPVOL9_r7MC&pg=PA82&lpg=PA82&dq

- Asian Insurance Review, (1997). Insurance Company of Sudan. Retrieved April 01, 2017, from the first https://takāfulCompany was the %E2%80%98Islamic Insurance Company of Sudan%E2%80%99 which was established in 1979&source=bl&ots=1d35QCUZPn&sig.

- Batcha, A.A. (n.d.). Takaful Operations: Issues and Recommendations on Marketing Takaful Successfully. Retrieved February 18, 2017, from https://www.scribd.com/doc/39308647/Takaful -Operations-Issues-and-Recommendations-on-Marketing-Takaful -Successfully.

- Billah, M.M. (2007). Applied Takaful and Modern Insurance: Law and Practice. Petaling Jaya, Selangor: Sweet & Maxwell Asia.

- Cader, S. (2014). History and values of Takaful Islamic Insurance, The Sundaytimes Sri Lanka. Retrieved February 18, 2017, from http://www.sundaytimes.lk/140309/business-times/history-and-values-of-takaful-islamic-insurance-87948.html

- Fakhri, M. (2016).The Concept and Benefits of Takaful .Retrieved March 01, 2017, from http://fakhrisobri.blogspot.my/2016/01/the-concept-and-benefits-of-takaful .html.

- Hani Kallil, M. (2014). Issues and Challenges of Takaful Industry in Malaysia's Dual Banking System, 4-5.

- Jamaldeen, F. (2017). The Islamic Principles behind Takaful. Retrieved March 01, 2017, from http://www.dummies.com/personal-finance/islamic-finance/the-islamic-principles-behind-takaful /.

- Kassim, Z.A.M. (n.d.). Takaful: the Islamic Way of Insurance, Malaysia: Mercer Zainal Consulting Sdn. Bhd., 542-543.

- Khalid, A. (2015). Takaful insurance efficiency in the GCC countries, humanomic, 344-352.

- Khan, Z.A. (2010). Hubpages. Retrieved March 3, 2017, from http://hubpages.com/hub/Islamic-Insurance-Takaful-Introduction-and-Present-Market.

- Kwon, W.J. (2007). Islamic Principle and Takaful Insurance: Re-evaluation, Kansas City: Journal of Insurance Regulation, 3, 70-71.

- Malaysia Takaful Association, (2018). Malaysian Takaful. Retrieved from http://www.malaysiantakaful.com.my/About-MTA/History-of-MTA.aspx on 24/4/2018

- Maysami, R.C., & Kwon, W.J. (1999).An Analysis of Islamic Takaful Insurance: A cooperative Insurance Mechanism, Kansas City: Journal of Insurance Regulation, 129.

- Mortuza, A.K.M. (2010). Key strategies that make a Takaful Company Succeed. Islamic Finance News, 7(22).

- Noresmabt, J. (2004). Factors that influence Muslim Consumer Preference towards Islamic Banking Products or Facilities, Master of Business Administration. University Sains Malaysia, 1-24.

- Rushdi, A. (2006). Islamic Financial System. Retrieved March 01, 2017, from https://islamicfinanceandbanking.wordpress.com/page/14/

- Sabbagh, A. M. (2012). Islamic Takaful Insurance: from Jurisprudents to Applications, Amman: The Author, pp. 21-22.

- Shafarin, I., Haidir, M., Ashraf, M., & Adawiyah, R. (2013). Shari’ah & Financial Issues of Takaful. Selangor: International Islamic University Malaysia.

- Waseem, A. (1970). Takaful Insurance. Retrieved March 01, 2017, from https://islami-finance.blogspot.my/2007/09/takaful -insurance.html

- Yusof, M.F. (2011). Takaful – Mudarabah Model. (n.d.). Retrieved March 01, 2017, from https://www.islamicbanker.com/education/takaful -%E2%80%93-mudarabah-model