Research Article: 2024 Vol: 28 Issue: 3

An Exploratory Study on Different Factors Influencing the Continuance Intention of the Consumer towards Digital Payment Systems

Rohit Garg, Panipat Institute of Engineering & Technology

Shivani Shukla, Panipat Institute of Engineering & Technology

Citation Information: Garg, R., & Shukla, S. (2024). An exploratory study on different factors influencing the continuance intention of the consumer towards digital payment systems. Academy of Marketing Studies Journal, 28(3), 1-6.

Abstract

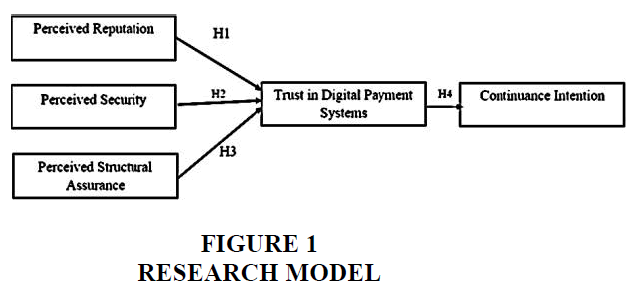

With the advancement in technology, this digital evolution has brought a challenge for conventional payment system of financial institution and tremendous opportunities for the developing countries. Empirical research on digital payment system and its continuance intention is very less and to address this research gap, researcher has examined a research model. The result will examine about Perceived Reputation, Perceived Security, and Perceived Structural Assurance with digital payment systems that will have an impact on trust and Continuance Intention. The findings of this research work will provide valuable evidence for policy makers and banks to foster their work practices in the field of digital payment systems in India.

Keywords

Demonetization, Digital payment, Digital wallet, Financial Institutions, Intention.

Introduction

The definition of money has evolved with digitalization. From metal to paper money and with the remonetized and digitalized era it is the time of electronic or plastic money, this medium of exchange has adapted with the advancement in the technology and commercial activity (König, 2001). This advancement played an important role in stimulating the economic and technological growth in the countries across the world.

In the past 50 years, the speedy proliferation of digital payments has changed the way buyers pay for their purchases, merchants pay while managing their day to day transactions. Digital payments provide customers with expedient and safe access to their funds, reduction in cash handling for traders (Zandi, et al. 2016). Significantly, Digital Payment Systems also helps in promoting greater financial inclusion, i.e. introducing formal financial services to those who does not have access to the proper banking system. That, in turn, generates a virtuous economic cycle whereby increased consumption transforms into more production, more jobs, and better incomes.

In today era, clients can make digital payments with all types of prepaid cards and postpaid cards —and also, using all types of gadgets, from wristwatches to cellular phones. It is a very long journey from being a cash based economy to become a cashless economy. According to (Thomas, Jain, & Angus, 2013) there are four levels in the process of evolution from cash based economy to cashless: Inception, Transitioning, Tipping Point and Nearly Cashless. Inception stage refers to those countries which accounts for more than 90 percent of cash based payments by volume. India belongs to this category as 96 percent of all payments being cash based. Those economies which have cash transactions between 70 – 90 percent belongs to transitioning stage like Brazil, China, Malaysia, Spain and Poland. Tipping Point stage refers to those developed economies which have reduced the use of cash around 50 to 70 percent of the total volume of consumer payments. Less than 50 percent of the volume of consumer transactions use cash in countries like Sweden, Canada, France and Belgium, which have been categorized as cashless economy.

The Drivers of Digital Evolution

Digitalization is the complex process and it is the outcome of the four drivers and its related factors. There are four drivers that administer a country’s digital evolution:

Supply Conditions

It refers to the level of development of the infrastructure to simplify digital interaction and transactions. This determines the value of tangible infrastructure needed for the digital development like access to financial institutions; digital payment options, Quality of transportation infrastructure, logistics performance, Communications sophistication.

Demand Conditions

It refers to the willingness of the consumers to engage in the digital ecosystem. High demands indicate that there is untapped market potential for the investors. It also includes the level of financial inclusion and usage of electronic form of money, technology, and internet, and mobile connection uptake, digital consumption.

Institutional Environment

It refers to the rules and regulation, government policies regarding dispute settlement, investor protections and bureaucracy, government acceptance and use of digital technology.

Innovation and Change

This driver of digital evolution includes options of getting finances and prospect; ability of a start-up; capability to entice and maintain talent, penetration of mobile engagement; scope of invention; use of social linkages and digital recreation.

With the advancement in technology, this digital evolution has brought a challenge for conventional payment system of financial institution and tremendous opportunities for the developing countries. As a result, there is a noteworthy growth in the digital payment systems around the globe. The mobile payment by volume around the globe in 2015 was US$450 billion and has surpassed US$4 trillion in 2018 (Statista, 2018). Though, currently in India, electronic payments form an infinitesimal part of the nation’s overall electronic payments industry. According to the report, the electronic payments market globally has garnered $601.3 billion in 2016, and is anticipated to reach $4,573.8 billion by 2023, cataloguing a CAGR of 33.8% from 2017 to 2023. The report offers a detailed analysis of market player positioning, drivers & opportunities, market size & forecast, and product portfolio & business performance of industry players (Sonawane, 2018). Regardless of the intrinsic advantages of Digital payment systems, the volume of concrete consumers of this facility has continued to be low.

The elementary problem lies in the continuance intentions and trust of the consumers whose acceptance of electronic or digital wallets would be able to provide the prerequisite level of scale and cost-effectiveness to this comparatively novel technology (Agarwal, 2016). This research paper expects to comprehend the factors that have an effect on electronic wallet users’ continuance intentions when accepting digital payments, so that digital payment services provider firms, cellular device companies and governing bodies can generate the obligatory premeditated structure to increase their acceptance and adoption.

Literature Review and Development of Hypotheses

Mobile payments have been defined as “a transfer of funds in return for a good or service, where the mobile phone is involved in both the initiation and confirmation of the payment.” (De Bel, J. & Gâza, 2011). In order to use the mobile phones for payments, customer must have the financial literacy towards making the financial transactions and the trust that their money is safe and secure. In this section researcher has formulated the hypothesis on the basis of constructs found out after reviewing the literature.

Perceived Reputation

Reputation plays a very important role in business engagements among different firms, as this is the major factor for assessing the firms’ trustworthiness (Kim & Prabhakar, 2004). Service providers having good reputation in the market among the customers are expected to invite more transactions (Grazioli & Jarvenpaa, 2000; Teo & Liu, 2007) and service providers’ with unscrupulous repute tends to lose their potential customers easily (Ba, 2001) In the background of digital payments also many investigators have indicated the importance of perceived reputation in nurturing the clients trust towards its usage. So the hypotheses have been framed as:

H1: Perceived Reputation influences Trust in digital payment systems. Perceived Security.

In the context of digital payment systems, perceived security indicates clients’ perception about safe and secure environment without any fear of compromise (Belanche-Gracia, et al. 2015; Suh, et al. 2015; Yang, et al. 2015). As digital payment platform deals with financial transaction services, so security is of utmost important for the users. Although the concept of Perceived security is not new in this context but (Shneiderman, 2000) argues that for sustaining in digital payment systems, improvement in the positive security is of prior importance. (Nayak, et al. 2019) has tried to categorize several types of perceived risk in the framework of mobile banking usage. So, Perceived Security has been cited as an important inhibiting factor in digital payment systems as well. Therefore, the following hypothesis has been framed:

H2: Perceived Security influences Trust in digital payment systems. Perceived Structural Assurance.

As compared to traditional ways of banking, digital payments systems are more exposed to hacker attack and outflow of information. As per (Harrison et al., 2002), Digital payment system is completely based on networks that are further prone to virus attacks. According to (Benamati, et al. 2010) assurance includes three aspects of trust namely: Integrity, ability and goodwill. (Zhou, 2011) Stated that structural assurance can be defined as existence of a technical structure that gives the assurance of the payments on digital platform, taking into account the legal aspects as well. Lack of trust from digital payment system providers affects clients’ expectations for developing a positive attitude towards digital payment system. Thus, Perceived Structural Assurance is linked with the conviction and trust of clienteles to depend on a service and service provider. Consumer is expected to trust the digital payment system service providers who give assurance of providing a secure and protected environment (Harrison McKnight, et al. 2002). Hence, research has stated that structural assurance (SA) is important to form the faith among the consumers. Accordingly, this study proposes the following hypotheses: H3: Perceived Structural Assurance influences Trust in digital payment systems.

Trust in Digital Payment Systems and Continuance Intention

As defined by (Zhou, 2011) trust “is the willingness of the service provider to be loyal to the customers and having the positive expectations towards their behavior in the future.” Many previous researches have proved that trust is a significant element that determines the continuation of the provision or artifact (Gao, et al. 2015; Hsu & Lin, 2015; Santhanamery & Ramayah, 2013). According to (Harrison McKnight, et al. 2002), when customer perceives that the digital platform is providing a trustworthy system for digital mode of payments, their

Continuance intention towards that digital platform increases. It is essential to sustain a long term association with consumers and to maintain or retain this relationship; digital payment system providers must reduce risk and build trust that will help in enhancing users’ continuance intention (Farivar, et al. 2017). Accordingly, it is hence hypothesized as follows: H4: Trust in digital payment systems influences Continuance Intention towards digital payment systems.

Research Methodology

For determining the relationship between the factors SEM was used by the researcher. To apply SEM and finding out the relationships between the variable by using AMOS, sample size plays a very important role. Researcher has taken sample of 600 digital wallet users. After the pilot study, 560 was the usable questionnaires considered for the final research work. Research has used snowball sampling technique to collect the data.

For this research work, researcher has collected data from Delhi/NCR. Questionnaire method of data collection has been used.

Data Analysis

To identify the constructs, researcher has used exploratory factor analysis (EFA). Only those constructs were retained having eigenvalues greater than 1 and factor loading more than 0.6. In addition to EFA, confirmatory factor analysis (CFA) has also been executed to get assurance of the factor loadings and the factors identified. Finally, structural equation modeling (SEM) has been applied to further carry out the path analysis and to reconfirm the statistical association amongst the factors. In this process reliability of all the constructs are more than 0.7 and KMO value is 0.887, total variance explained is 71%.

In zero order, it was observed that the values of GFI & CFI were in the desired range. The value of CMIN/df is within the cutoff level and the value of RMSEA is also within the desired value bracket. So the model looks to be a good fit. For examining the full structural model which embraces both the measurement model and the structural model and along with that same to check whether the same model insinuates the hypothesized relationships amongst the variables, the originally proposed model was analyzed on the basis of (SEM) structural equation modeling technique. Subsequently, the original model was reworked considering the modification indices in the results. Overall fit indices for the originally presented model depicted an adequate fit with the data as shown in tables 1 and 2.

| Table 1 Path-Analysis Model Fit Indices | |||

| CFI | GFI | RMSEA | CMIN/df |

| 0.981 | 0.985 | 0.051 | 1.322 |

| Table 2 Testing the Proposed Model with Regression Weight | |||||

| Path | Beta | p-Value | |||

| T | <--- | PR | 0.031 | 0.015 | Significant |

| T | <--- | PS | 0.127 | 0.004 | Significant |

| T | <--- | PSA | 0.217 | 0.001 | Significant |

| T | <--- | CI | 0.016 | 0.011 | Significant |

| CI | <--- | T | 0.044 | 0.022 | Significant |

Conclusion

This research work makes a significant contribution in the literature of Digital payment systems. In this paper, researcher has empirically tested the impact of factors affecting the trust and continuance intention of the consumer towards digital payment systems. User continuance intention of Digital payment systems is of paramount significance to manufacturing practitioners, regulatory bodies, academicians and researchers. An in- depth analysis of digital payment systems and its continuance in an emerging market is requirement. This research work can also help banks and encourage them to take essential care while executing Digital payment technology. Policy makers and Banks which are convincingly interested in developing a Digital payment environment should cultivate innovative and novel strategies, which emphasize on improved perceived Reputation, perceived Security, and perceived Structural Assurance as drivers.

References

Agarwal, S. (2016). Initial euphoria of prepaid wallets dies down. The Economic Times.

Ba, S. (2001). Establishing online trust through a community responsibility system. Decision Support Systems, 31(3), 323–336.

Indexed at, Google Scholar, Cross Ref

Belanche-Gracia, D., Casaló-Ariño, L. V., & Pérez-Rueda, A. (2015). Determinants of multi-service smartcard success for smart cities development: A study based on citizens’ privacy and security perceptions., Government Information Quarterly 32(2), 154–163.

Indexed at, Google Scholar, Cross Ref

Benamati, J. S., Fuller, M. A., Serva, M. A., & Baroudi, J. (2010). Clarifying the integration of trust and TAM in E-commerce environments: Implications for systems design and management. IEEE Transactions on Engineering Management, 57(3), 380–393.

Indexed at, Google Scholar, Cross Ref

De Bel, J. and Gâza, M. (2011). Mobile payments 2012 – my mobile, my wallet?”, Innopay, Version 1.01.

Farivar, S., Turel, O., & Yuan, Y. (2017). A trust-risk perspective on social commerce use: an examination of the biasing role of habit. Internet Research, 27(3), 586–607.

Indexed at, Google Scholar, Cross Ref

Gao, L., Waechter, K. A., & Bai, X. (2015). Understanding consumers’ continuance intention towards mobile purchase: A theoretical framework and empirical study - A case of China. Computers in Human Behavior, 53, 249–262.

Grazioli, S., & Jarvenpaa, S. L. (2000). Perils of Internet fraud: An empirical investigation of deception and trust with experienced Internet consumers. IEEE Transactions on Systems, Man, and Cybernetics Part A:Systems and Humans., 30(4), 395–410.

Indexed at, Google Scholar, Cross Ref

Harrison McKnight, D., Choudhury, V., & Kacmar, C. (2002). The impact of initial consumer trust on intentions to transact with a web site: A trust building model. Journal of Strategic Information Systems, 11(3–4), 297– 323.

Indexed at, Google Scholar, Cross Ref

Hsu, C. L., & Lin, J.C.C. (2015). What drives purchase intention for paid mobile apps?-An expectation confirmation model with perceived value. Electronic Commerce Research and Applications, 14(1), 46–57.

Indexed at, Google Scholar, Cross Ref

Kim, K.K., Prabhakar, B. (2004). Initial trust and the adoption of B2C e- commerce: The case of internet banking. ACM SIGMIS Database: the DATABASE for Advances in Information Systems, 35(2), 50-64.

Indexed at, Google Scholar, Cross Ref

König, S. (2001). The evolution of money: From Commodity Money to E-Money. UNICERT IV Program, 1–21.

Nayak, N., Nath, V., & Singhal, N. (2019). Predicting the Risk Factors Influencing the Behavioral Intention to Adopt Mobile Banking Services: An Exploratory Analysis. In Communications in Computer and Information Science (Vol. 958, pp. 176–191). Springer Verlag.

Indexed at, Google Scholar, Cross Ref

Santhanamery, T. & Ramayah, T.. (2013). The effect of trust on the continuance intention of e-filing usage: A review of literatures. Human- Centered System Design for Electronic Governance.

Shneiderman, B. (2000). Designing trust into online experiences. Communications of the ACM, 43(12), 57–59.

Statista. (2018). Mobile payment revenue worldwide 2015-2019.

Suh, Y. I., Ahn, T., Lee, J. K., & Pedersen, P. M. (2015). Effect of trust and risk on purchase intentions in online secondary ticketing: Sport consumers and ticket reselling. South African Journal for Research in Sport, Physical Education and Recreation, 37(2), 131–142.

Teo, T. S. H., & Liu, J. (2007). Consumer trust in e-commerce in the United States, Singapore and China. Omega, 35(1), 22–38.

Indexed at, Google Scholar, Cross Ref

Thomas, H., Jain, A., & Angus, M. (2013). MasterCard Advisors ’ Cashless Journey The Global Journey From Cash to Cashless. White Paper, (09) 1–15.

Yang, Y., Liu, Y., Li, H., & Yu, B. (2015). Understanding perceived risks in mobile payment acceptance. Industrial Management and Data Systems, 115(2), 253–269.

Indexed at, Google Scholar, Cross Ref

Zandi, M., Koropeckyj, S., Singh, V., & Matsiras, P. (2016). The impact of electronic payments on economic growth. Moody’s Analytics, 31.

Zhou, T. (2011). An empirical examination of initial trust in mobile banking. Internet Research, 21(5), 527-540.

Indexed at, Google Scholar, Cross Ref

Received: 03-Oct-2023, Manuscript No. AMSJ-23-14061; Editor assigned: 04-Oct-2023, PreQC No. AMSJ-23-14061(PQ); Reviewed: 29-Jan-2023, QC No. AMSJ-23-14061; Revised: 29-Feb-2024, Manuscript No. AMSJ-23-14061(R); Published: 22-Mar-2024