Review Article: 2023 Vol: 27 Issue: 1

Antecedents and Consequences of Firm's Green Performance: The Moderation Role of Institutional Environment in West Azerbaijan Province, Iran

Ramin Bashir Khodaparasti, University of Urmia

Hooshmand Bagheri Garbollagh, Semnan University

Citation Information: Bashir Khodaparasti, R., & Bagheri Garbollagh, H. (2023). Antecedents and consequences of firm's green performance: the moderation role of institutional environment in west azerbaijan province, iran. Academy of Marketing Studies Journal, 27(1), 1-15.

Abstract

The purpose of the present study is to investigate the antecedents and consequences of firm's green performance with the moderation role of the institutional environment in the province of West Azerbaijan, Iran. This study is applied in terms of its purpose and descriptive in terms of its method. The statistical population of this study was 600 employees of food processing firms in West Azerbaijan Province who were selected by Cochran's sampling method. In order to analyze the data, the partial least squares method and Smart-PLS3 software were used. Results indicated that environmental, social and governance factors had a positive and significant effect on the green performance of firms. The results also confirmed the positive and significant effect of green firm's performance on the environment, society and firm value. In addition, the institutional environment moderates the relationship between all those three factors.

Keywords

Green Firm's Performance; Environmental Factors; Social Factors; governance Factors; Institutional Environment.

Introduction

The issue of environmental sustainability and green organizations is increasingly considered in management programs and brings about a green revolution in traditional principles such as human resources and operations management. Sustainability in operations management has also attracted considerable attention and is becoming a new competitive dimension. Issues such as corporate green performance are becoming increasingly important, mobilizing the scientific community de Sousa Jabbour et al. (2018). The adoption of environmentally friendly approaches by industry has always been significant from the perspective of corporate social responsibility to sustainable investment. Researchers have shown a growing interest in stakeholder actions towards the environment and corporate social responsibility Nguyen et al. (2021) and often seek to establish a clear mechanism that links corporate social performance with green corporate performance Yadav et al. (2016).

However, companies can create competitive advantages by increasing efficiency and creating unrepeatable innovations of environmental initiatives Sudaryati et al. (2020), while the opposite side of discussion considers them as a cost to companies which can never be compensated. In addition, companies are deprived of other productive investment opportunities Aslam et al. (2021). With an increasing application of stricter international regulations and conventions to prevent environmental degradation, companies implement programs and policies to conduct environmentally friendly business operations and, therefore, comply with environmental regulations by demonstrating social responsibility to differentiate themselves from competitors which some authors refer to this as "investing in value" Balachandran & Faff (2015).

Most of these studies use the event study method to examine self-reported or third-party environmental performance announcements, but as far as we know, none of these studies have shown the effect of improving environmental performance. Under growing public concern for environmental protection and increased environmental regulation, it is not only important to take environmental initiatives, but is equally important to ensure that they are sustainable. One of the ways for investors to achieve the sustainability of environmental investment can be to include environmental and social factors in their financial and decision-making processes Wamba (2022). Amato & Amato (2012) and Lyon & Shimshak (2015) used the companies' green rankings in announcing the environmental performance in Newsweek's green ranking in 2009 and found that the top ranked companies performed better in the market. Klassen and McLaughlin (1996) argue that companies increase their green performance by increasing revenues and reducing costs by increasing environmental performance. Green score is considered as a measure of environmental performance because the real level reflects a green company's efforts to protect the environment, while the ratings show the relative performance of the ranked companies, and any change in the green score reflects the company's attitude towards the environment Li et al. (2022).

On the other hand, increasing environmental problems will demand companies shoulder significant responsibilities for the environment and society Liu et al. (2022); de Azevedo Rezende et al. (2021). Therefore, the performance of environmental and communal responsibilities by a company has become a fundamental criterion for determining its sustainability Adebanjo et al. (2016). Hence, little study has been done on specific pathways through which the sustainable management activities of green companies have a positive effect on their performance Giese et al. (2019); Sepasi et al. (2021).

The main contribution of the present study is that it Provides food employees with a more comprehensive insight into the environmental aspects and green performance of the company. At the same time, it causes strategic differentiation of companies and leads to better performance and company value. Also, Governance aspects can significantly affect stakeholder perception. The innovative aspect of this research is the use of institutional environment variable as a moderating role in firm's performance and its impact on firm's value, society and corporate environment. As an inherent feature of a business, institutional environments affect the relationship between actions and the strategic performance of companies. However, there are few studies on the effect of various institutional pressures on the relationship between sustainable management activities and corporate performance Rahdari et al. (2020). Based on studies, the present study seeks to answer the following questions: through what parameters, and under what conditions do the environmental, social, and governance aspects of companies have a positive effect on a green function in an integrated model? Finally, the present study examines the moderating effect of the institutional environment on the relationship between environmental, social, and governance aspects and the green performance of the company.

With the suggestions and results of the present study, companies will be able to plan environmental, social, and governance aspects more effectively to improve their green performance and increase their value. Therefore, by analyzing the performance of a green company around announcing the environmental performance, this study examines the antecedents and consequences of green performance of food companies and attempts to establish a link between the sustainability of environmental initiatives, society, and company value.

A Review of The Theoretical Foundations of Research

Environmental, Social and Governance aspects of Firm's Green Performance

Environmental aspects mean a part of the activities, products, or services of an organization that can interact with the environment. In other words, the environmental aspect is based on various interactions through activity or service for which a specific change is made taking into account multiple laws and regulations to benefit and improve the environment for the society. Also, a company interacts with the environment through business activity, which defines the environmental aspect. This influence can be beneficial or can cause harm to nature Smetana et al. (2021). The environmental, social, and governance aspects of the firm have become an essential competitive tool for sustainable management to ensure competition Stead & Stead (2014). Due to the impact of environmental, social and governance aspects of companies on their green performance, the activities performed by a company in response to environmental regulations, unlike in the past, has become an opportunity to improve performance Kramer & Porter (2011). A green company can reduce costs through business operations that comply with environmental regulations, reduce risk, and improve performance through environmentally friendly business opportunities Singh et al. (2020). Because, Companies in West Azerbaijan Province that actively respond to environmental issues can take advantage of opportunities for long-term sustainability.

In other words, a company's environmental activities can be a key factor in reducing the cost of inefficiency and strengthening the company's ability to attract and take advantage of new business opportunities. From this perspective, the performance of green companies that fully comply with environmental standards and actively participate in environmental activities improves, while the performance of companies that do not actively respond to environmental issues may decline Stahn et al. (2017). A company must bear the human and financial costs of communicating with different stakeholders. However, the financial benefits of stakeholder management are likely to outweigh the costs. Companies that communicate with various internal and external stakeholders based on social activities and interests achieve high performance Harrison et al. (2020). Recently, the interest in social responsibility activities of Iranian companies has been steadily increasing. In terms of social aspects, performing aspects that comply with the rules and regulations related to social values and ethical activities of business management can have a positive impact and ultimately improve the performance of the company Brammer & Pavelin (2008). Finally, corporate governance refers to a mechanism that monitors and controls the overall management process of a company (Blachandran and Faff, 2015). Weak corporate governance hurts the company's profitability and credibility, while transparent and fair governance improves the performance of green companies and generates sustainable profits. (Snouper et al., 2021). Shaikh (2022) in a study examining environmental activity on company performance showed that environmental performance index has a significant relationship with company performance index. Mohammad & Wasiuzzaman (2021) by examining the effect of environmental, social and governance disclosure on the competitive advantage of companies in Malaysia showed that environmental, social and governance disclosure improves the competitive advantage of the company. They also found solid evidence that increasing unit environmental, social and governance disclosures by one unit increases the value of the company by approximately 4% in Malaysia. In addition, Doque-Grisales and Aguilera-Caracuel (2021) in their study entitled Environmental, Social and Governance Scores on Performance with the Modifying Effects of International Geographical Diversity and Financial Recession found that financial recession is the relationship between environmental, social and governance scores enhances the financial performance of the company Li et al. (2022).

Hence, the following hypotheses can be proposed:

H1: Environmental aspects have a positive and significant relationship with green performance of the firm.

H2: Social aspects have a positive and significant relationship with the green performance of the firm.

H3: Governance aspects have a positive and significant relationship with the green performance of the firm.

Institutional Theory and Environmental, Social and Governance Aspects

A company is motivated to connect with internal and external stakeholders to adapt to a changing environment and seize opportunities Sepasi et al. (2021). This process can be explained in the context of the theories of "legitimacy", "stakeholders" and "institutional" (Deegan, 1990). The theory of legitimacy states that there is a social contract between the company and society and this is a fundamental factor for the sustainable growth and survival of the company. Conversely, a company offers goods and services to the community Mahmud (2020), which, if not in accordance with the "social contract", may increase the cost of capital and make it difficult to obtain resources. In addition, the company may face various sanctions from regulators that may even threaten its existence Scott (2008). In stakeholder theory, stakeholders are defined as "a group with the power to participate in decision-making in managerial activities." A company has an incentive to effectively manage relationships between different employees on an ethical basis to create value Harrison et al. (2020). The institutional theory defines an institutional environment as an environment containing regulatory mechanisms that create unique participants and procedures as a common system of representative and normative rules Scott (2008). Certain organizations such as governance, public opinion, and the media are typical institutional environments Bansal (2005). The institutional environment creates a set of implicit or explicit rules in several areas such as organizational structure and behavior. According to institutional theory, a green company must gain social legitimacy for its existential value Chu et al. (2018). A company is dependent on external resources, especially for a company that is difficult to be self-sufficient with all the resources needed to operate. A company that responds effectively to institutional pressures can easily gain the external resources necessary for survival and growth by providing social legitimacy. Accordingly, for smooth and sustainable operations, the firm must respond to institutional pressure Rathert (2016), the level of which affects the firm's strategic choices and effectiveness (Mathiesen & Salzman, 2017). For example, the firm must strengthen the environmental, social, and governance aspects to respond to stakeholder pressure Colwell & Joshi (2013).

However, the level of environmental, social, and governance aspects performed may vary depending on the level of organizational pressure on the environmental, social, and governance aspects. Therefore, there is a need to examine the impact of any institutional pressure that can be divided into coercive, normative and imitative on performance through interaction with the environmental, social and governance aspects of the company. First, coercive pressure is defined as "formal or informal pressure created by the institutions and regulations of the society to which the company belongs" (DiMaggoui and Powell, 1983, p.149). Coercive pressure from those in power, such as regulations by government agencies, can set standards for corporate behavior and encourage firms to adopt or reinforce certain behaviors Chu et al. (2018). In this regard, policies and regulations related to the environmental, social and governance aspects of governance act as a coercive pressure on companies and affect social demands and expectations for sustainable operations. Accordingly, they strengthen the impact of environmental, social and governance aspects on the reputation, reputation and brand value of the company and thus on the green performance of the company Phan & Baird (2015). Therefore, the following hypotheses are further proposed:

H4: The institutional environment moderates the relationship between the environmental aspect and the green performance of the firm.

H5: The institutional environment moderates the relationship between the social aspect and the green performance of the firm.

H6: The institutional environment moderates the relationship between the governance aspects of the firm's green performance.

Green Performance of Firms and Environment, Society and Firms Value

Green performance is defined as reducing the environmental impact of companies, which is achieved through coordination and cooperation between business and environmental concerns Forés (2019). Environmental performance is a set of company operations that have been synchronized and compatible with the environment. Hence, the environmental performance of the company is defined as the effectiveness of a company in estimating and advancing society's expectations regarding environmental concerns Kim et al. (2019). While, Sustainability is a balance between environmental requirements and development needs, which is effective in two ways: reducing pressure and increasing capacities by maintaining the desirability and facilities available at the time, by creating a proper connection with the external environment, and internal functioning Mathur & Vayas (2013). Creating green performance is essential to gain a competitive advantage and the survival of a company Syafri et al. (2021). Thus, to date, many green performance studies have been considered as basic criteria for determining sustainability Lin et al. (2021). Green performance is about evaluating the relationship between business and the environment. Green performance can be estimated from a variety of indicators that assess the reduction of the firm's environmental impact in categories, each of which is measured by individual commodity variables Wagner et al. (2021). In other words, green performance is one of the most important determinants in improving the company's competitiveness and performance. Green performance recognizes that the various areas of departments and subordinate areas in the company should act as part of an integrated process that is expected to be performance-related Xue et al. (2019). Through sustainable management activities, the green company can improve its reputation and increase its chances of long-term survival. Also, a positive corporate reputation can generate loyal customers for a company's products and services, which can help improve the value and environment of the green company Zhao et al. (2018). In addition, Allur et al. (2018) suggested that companies achieve environmental performance with high levels of green activity adaptation. Companies can strengthen their competitive environment by improving green performance to comply with environmental regulations. Integrating environmental concerns into management activities is very important for the company to achieve competitive advantage and brand value Rashid et al. (2019).

On the other hand, today product development is vital for companies that want to compete in existing markets as well as in new markets. Therefore, companies can improve the green image of their company by improving their environmental performance, which in turn helps to create new business opportunities, improve the company's competitive advantage and brand value. Yoon et al. (2018) in a study examining the impact of environmental aspects on the value of the company found that corporate social responsibility measures positively and significantly on the value of a company, according to previous studies in developed countries. However, its impact on the company environment can vary depending on the characteristics of the company. Using the study of financial performance as a mediating variable and the impact of environmental performance and environmental management on the value of the company, Soedjatmiko et al. (2021) concluded that there is no direct effect that has a significant effect on environmental performance and company value and found that there is a direct impact of environmental management variables on the value of the company. It has been proven that improving environmental management by the company directly increases the value of the company. Wu et al. (2022) in a study entitled, “Is investing in a green company good for society?” found that green innovation helps improve the company's environmental results and raises public awareness, without adversely affecting performance.

Therefore, the following hypotheses can also be proposed:

H7: The green performance of the firm has a positive and significant relationship with the firm environment.

H8: The green performance of the firm has a positive and significant relationship with society.

H9: The green performance of the firm has a positive and significant relationship with the value of the firm.

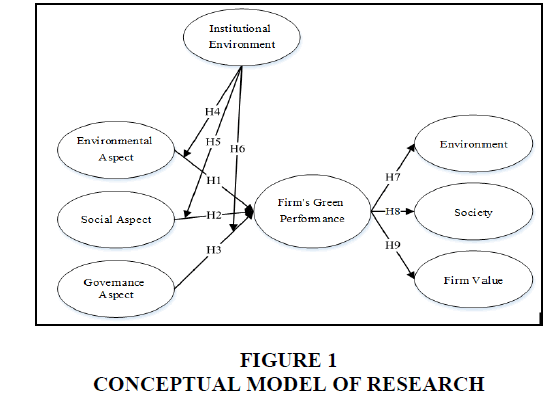

Conceptual Model

According to the developed hypotheses, the research model in the Antecedents and Consequences of firm's Green Performance: The Moderation Role of Institutional Environment in West Azerbaijan Province, Iran is presented in Figure 1.

Research Method

Purpose of the present study is applied; in terms of strategy it is a survey; in terms of research method, it is quantitative; in terms of time horizon, it is one-section; and in terms of data collection method, it uses a standard questionnaire and seeks to describe and explain the antecedents and consequences of green performance of food firms; according to the moderating role management it is institutional. The statistical population in this study is the employees of food firms in West Azerbaijan Province. To explain the sample size, assuming sampling from a limited community, the Cochran's formula was used: to estimate the variance of the measures, 30 distributed prototypes were obtained and their variance was 0.38. Taking into account the accuracy of 0.05 and the confidence level of 95%, the required sample of 583 was identified, which was distributed and analyzed for more accurate calculations of 600 questionnaires. For this purpose, 600 employees of 103 companies active in the production and distribution of green food in the industrial estates of West Azerbaijan province were selected as a random stratified method. Green food companies produce products that cause the least damage to the environment. Also, the important issues in green products are attention to the environment and consumer health. A 28-item questionnaire based on sequential scale and a five-point Likert scale was used to collect data. The questionnaire of this research consists of two parts. The first part includes demographic questions and the second one includes the main questions of the questionnaire which are based on the research hypotheses whose validity and reliability were confirmed. The questionnaire includes 8 dimensions (environmental aspect, social aspect, governance aspect, institutional environment, green performance of the company, company environment, society and company value). Questions related to the environmental, social and governance aspects of the Jamil & Siddiqui (2020) Questionnaire, the institutional environment dimension made by the researcher, the green performance of the company from the Muisyo & Qin (2021) questionnaire, the corporate environment dimension of Zhang (2015), the community dimension was collected from Christakopoulou et al. (2001) and the company dimension value questions were collected by the researcher. The questions were controlled by some professors and expert opinions; also, convergent validity and divergent validity were used by the software to measure validity, and Cronbach's alpha and combined reliability were used to fit the reliability. Cronbach's alpha coefficient for all research constructs was greater than 0.7 Table 1 and Smart PLS 3 software was used for data analysis Matthiesen & Salzmann (2017).

| Table 1 Statistics Of Samples By Organizations |

|||||

|---|---|---|---|---|---|

| Item | Factor Loading |

t-Value | AVE | CR | Cronbach’s α |

| Environmental Aspect | - | ||||

| Resource use (efficient use of resources, waste minimization etc.) | 0.759 | 6.456 | 0.668 | 0.808 | 0.790 |

| Innovation (implements new ideas improve services and create dynamic products) | 0.905 | 7.347 | |||

| Emissions (reductions in the emissions of pollutants) | 0.767 | 7.195 | |||

| Social Aspect | - | ||||

| Product Responsibility (healthy product, product safety and instructions should be provided) | 0.831 | 3.888 | 0.709 | 0.821 | 0.800 |

| Workforce (promote ethical and responsible behavior) | 0.889 | 3.634 | |||

| Community (wellbeing of society, positively benefiting society etc.) | 0.832 | 3.523 | |||

| Governance Aspect | - | ||||

| Management (facilitate effective, prudent and entrepreneurial management etc.) | 0.868 | 7.454 | 0.644 | 0.813 | 0.796 |

| Shareholders (growth in dividend policy, voting rights etc.) | 0.837 | 3.331 | |||

| CSR strategy (Strengthening Transparency, Upholding ethical Market Practices etc.) | 0.817 | 6.930 | |||

| Firm's Green Performance | - | ||||

| Our company is very concerned about waste reduction | 0.868 | 2.349 | 0.587 | 0.788 | 0.750 |

| Our company is committed to pollution reduction | 0.832 | 2.065 | |||

| Our company is keen on economic consumption of resources | 0.814 | 6.910 | |||

| Our company is concerned about environmental accidents reduction | 0.845 | 4.972 | |||

| Institutional Environment | - | ||||

| Government organizations assist individuals in starting their own social ventures | 0.905 | 6.987 | 0.607 | 0.733 | 0.711 |

| Even after failing, government assists social entrepreneurs in starting again | 0.790 | 7.102 | |||

| In this country, innovative and creative thinking is viewed as a route to success |

0.808 | 10.451 | |||

| Turning new ideas into social ventures is admired in this country |

0.789 | 8.969 | |||

| The Government sponsors organizations that help new social ventures develop | 0.812 | 7.654 | |||

| People in this country greatly admire those who start their own social ventures | 0.888 | 9.708 | |||

| Environment | - | ||||

| Our company is famous for its diversity and breadth | 0.779 | 4.209 | 0.711 | 0.864 | 0.830 |

| In this company, I am satisfied in terms of job security | 0.850 | 2.639 | |||

| Our company has a healthy work environment | 0.883 | 2.659 | |||

| Society | - | ||||

| Different support for each environmental landscape among different society | 0.805 | 10.688 | 0.603 | 0.799 | 0.722 |

| The needs of today's society are the protection of the environment | 0.849 | 8.813 | |||

| In all respects, People in society should consider the environment as a vital phenomenon | 0.886 | 11.563 | |||

| Firm Value | - | ||||

| Our company has recently focused on improving the nutritional value of its products | 0.777 | 6.989 | 0.745 | 0.806 | 0.793 |

| Our company value can fluctuate over time in response to a multitude of factors that can be difficult or impossible to predict | 0.723 | 7.773 | |||

| Firm's that experience significant declines in their performance and competitive position will see their market values decline | 0.848 | 2.311 | |||

Research Findings

The results of descriptive analysis of the data showed that 82% were male and 18% were female. Also, the frequency distribution of respondents by age was 20.5%, 7.5%, 20-39, 54.6%, 40-49, 29.3%, 50-59, 6.16%, and most people. They had a teaching experience of 10 to 15 years and have a bachelor's degree.

Checking the Fit of the External Model

PLS modeling was done in two stages. In the first stage, the measurement model (external model) was examined through validity and reliability analysis and confirmatory factor analysis, and in the second stage, the structural model (internal model) was examined by estimating the path between variables. The fit of the measurement models was evaluated using three criteria of index reliability (factor load coefficients, Cronbach's alpha coefficients, combined reliability and the average variance extracted). The results of these coefficients are presented in Table 1.

Based on the results of Table 1, Cronbach's alpha values, combined reliability and convergent validity for the research variables were calculated higher than 0.7 and 0.5, respectively, indicating the appropriate reliability and validity of the data collection tool. Factor loads equal to or greater than 0.7 confirm that the variance between the structure and its indices was greater than the variance of the measurement error of the structure and the reliability of the measurement model was acceptable Hair et al. (2013). In the present research model, as shown in Table 1, all numbers of factor load coefficients of the questions were greater than 0.7, which means that the variance of the indicators with their respective structures was acceptable and shows the appropriateness of this criterion.

Three types of evaluation validity were used to confirm the validity of the measurement tool: content validity, convergent validity and divergent validity. Content validity was obtained by a survey of experts. Also in this study, to determine the reliability of the questionnaire, two criteria (Cronbach's alpha coefficient and combined reliability coefficient) have been used. Cronbach's alpha coefficients of all variables in this study are more than the minimum value (0.7). Based on the discussion above and the results of software outputs shown in Tables 1 and 2, it becomes clear that the measurement tools have validity (content, convergent and divergent) and appropriate reliability. To examine the divergent validity, the degree of relationship of a structure with its characteristics in comparison with the relationship between that structure and other structures is shown by the Fornell-Larcker matrix. In this method, only the first degree hidden variables are entered in the matrix. Table 2 shows the results of this study.

| Table 2 Descriptive Statistics And Divergent Validity (Fornell & Larcker) |

||||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 0.817 | ||||||

| 0.711 | 0.842 | |||||

| 0.603 | 0.608 | 0.802 | ||||

| 0.480 | 0.588 | 0.664 | 0.766 | |||

| 0.298 | 0.412 | 0.555 | 0.516 | 0.843 | ||

| 0.433 | 0.549 | 0.430 | 0.377 | 0.714 | 0.776 | |

| 0.344 | 0.277 | 0.397 | 0.289 | 0.447 | 0.521 | 0.863 |

To calculate this matrix, the value of the AVE root of the latent variables in the present study, which are located in the main diameter of the matrix, must be greater than the value of the correlation between them, which are located in the lower and left cells of the main diameter. Therefore, based on the results of Table 2, it can be stated that in the present study, the structures (latent variables) in the model have more interaction with their indicators than with other structures. In other words, the divergent validity of the model is adequate. The internal model indicates the relationship between the latent variables of the research. Using the internal model, research hypotheses can be examined. Table 3 shows the fitting results of the internal model.

| Table 3 Results Of The Proposed Model |

|||||||

|---|---|---|---|---|---|---|---|

| H | Hypothesis Structural path | β | T-value | p-Value | Result | ||

| H1 | Environmental Aspect | ? | Firm’s Green Performance | 0.311 | 4.289 | < 0.05sig | Supported |

| H2 | Social Aspect | ? | Firm’s Green Performance | 0.387 | 6.752 | < 0.05sig | supported |

| H3 | Governance Aspect | ? | Firm’s Green Performance | 0.277 | 4.128 | < 0.05sig | Supported |

| H4 | Institutional Environment moderated the relationship between Environmental Aspect and Firm’s Green Performance. |

0.219 | 2.994 | < 0.05sig | Supported | ||

| H5 | Institutional Environment moderated the relationship between Social Aspect and Firm’s Green Performance. |

0.123 | 3.499 | < 0.05sig | Supported | ||

| H6 | Institutional Environment moderated the relationship between Governance Aspect and Firm’s Green Performance. |

0.184 | 2.071 | < 0.05sig | Supported | ||

| H7 | Firm’s Green Performance | ? | Environment | 0.397 | 3.028 | < 0.05sig | Supported |

| H8 | Firm’s Green Performance | ? | Society | 0.294 | 4.128 | < 0.05sig | Supported |

| H9 | Firm’s Green Performance | ? | Firm Value | 0.238 | 3.542 | < 0.05sig | Supported |

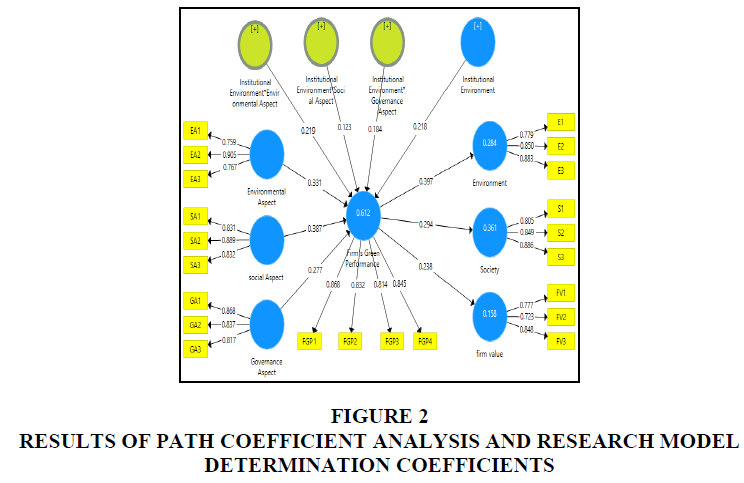

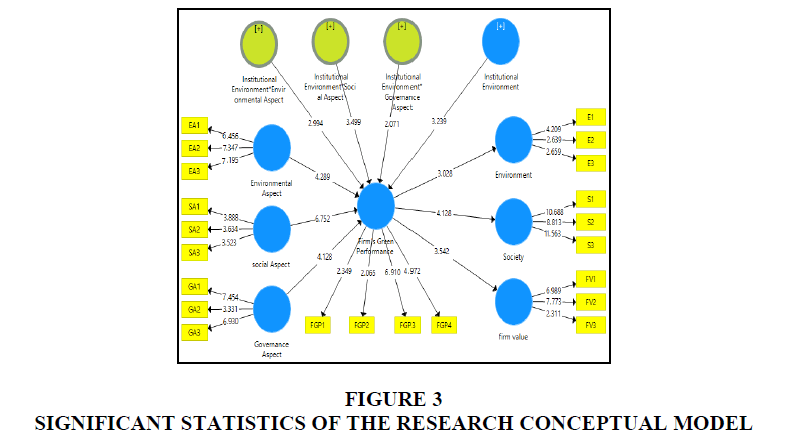

According to the findings of the test of hypotheses and significance coefficients of the conceptual model are reported in Figures 2 and 3, all hypotheses are confirmed at the 95% confidence level because the absolute value of the t-statistic of each of those structures which are greater than its critical value (1.96) and the values (p-value) between the relationships of those variables are less than 0.05. Figure no.2 shows the software output in the case of estimating path coefficients and determination coefficients (R2) and Figure 3 shows the statistical value of the research hypotheses.

The numbers written on the lines are actually beta coefficients from the regression equation between the variables, which is the same as the path coefficient, and the numbers inside each circle represent the value of R2 for the hidden endogenous variables of the model Snooper et al. (2021).

The dominant criterion for evaluating the model's ability to predict is the Q2 index. If the value of Q2 is greater than zero for a given intrinsic variable, their independent variables have a predictive relationship. Given the value of Q2 obtained in Table 4, it can be argued that the model predictive power for the dependent variable is strong. The general model includes both the measurement and structural parts of the model, and by confirming its fit, the fit of the model is checked.

| Table 4 Values R2 And Q2 Intrinsic Variables |

||

|---|---|---|

| Variable | R2 | Q2 |

| Firm’s Green Performance | 0.612 | 0.4536 |

| Environment | 0.284 | 0.3927 |

| Society | 0.361 | 0.3614 |

| Firm Value | 0.158 | 0.3120 |

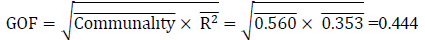

The goodness-of-fit of the research model was evaluated with the GOF criterion, three values of 0.01, 0.25 and 0.36 are introduced as weak, medium and strong values for this criterion. According to the values obtained in Table 5, the GOF of the general model is equal to 0.444, which indicates a strong fit of the present research model.

| Table 5 Criterion¬ Of Goodness-Of-Fit (Gof) |

||

|---|---|---|

| Variables | Communality | R Square |

| Firm’s Green Performance | 0.660 | 0.612 |

| Environment | 0.522 | 0.284 |

| Society | 0.489 | 0.361 |

| Firm Value | 0.570 | 0.158 |

|

||

Conclusion and Suggestions

According to the research findings in line with the first, second and third hypotheses, the relationship between environmental, social and governance aspects of green performance of companies was accepted: the results of this study to some extent corroborates with those of Shaikh (2022), Mohammad & Wasiuzzman (2021), Duque-Grisales & Aguilera-Caracuel (2021) and Teixeira et al. (2016). It can be argued that by showing a reduction in ambient greenhouse gas emissions and resulting penalties, a company increases its green performance. Russo and Fouts (1997) found that environmental rankings significantly enhance firm performance by supporting environmental performance to create non-imitation resources. Therefore, we believe that a green company should develop a long-term strategy for environmental management in business operations in order to improve its green performance in the long run and significantly increase the environmental image of its company. Using the 2009 Green Rankings, Lyon & Shimshak (2015) found a positive effect of environmental information disclosure on firm performance. They found that the top 100 companies in the top 500 listed companies showed higher stock returns. Meric et al. (2012) showed that there is no incentive for American companies to grow green. On the other hand, continuous efforts to improve environmental performance are essential for the development of accumulated expertise and the creation of unique environmental competencies for green performance. In addition, repeated identification of a company for environmentalism enhances the company's reputation and significantly increases the company's value. Therefore, due to improving environmental performance and maintaining environmental initiatives, we expect higher social responsibility for companies with green ratings. Therefore, it can be concluded that the more the food industry increases the level of empowerment potential of green employees, the green performance of the company in the field of green supply chain management and green purchasing will improve. If food industry workers become empowered in this area, they will go for green products, i.e. products that can be recycled and reused. Also, company managers make decisions and strategies that are relevant to environmental issues and its protection. According to the research results, it is recommended to the managers of food industry companies to empower their employees in the field of pursuing green tasks to ensure the success of the organization in the field of environment. It is also suggested that food companies encourage and empower logistics managers, product designers, production managers, etc. in order to achieve optimal use of resources, saving and using green raw materials. It is also suggested that employees cooperate and participate in green proposals and problem-solving groups, give employees freedom to come up with green ideas, green teams in environmental management or develop new organizational skills such as flexible job descriptions, participatory management, teamwork and delegation, create a broad organizational dialogue on green issues, and create an environment for research and make suggestions on environmental and workshop issues, provide creative thinking and ultimately maintain all these actions by establishing a system of encouragement, reward and promotion in the organization.

The results of testing the fourth, fifth and sixth hypotheses of the study showed that the institutional environment moderates the relationship between all three aspects of environmental, social and governance. In other words, as the amount of institutional factors increases, the green performance of companies increases. According to institutional theory, the external environment of companies encompasses a wide range of cognitive dimensions, rules and norms. In fact, institutional theory has been identified as a social influence that affects the structure of companies. In comparison with the findings of these hypotheses, Duque-Grisales & Aguilera-Caracuel (2021) used the moderating role of international geographical diversity and financial slump in the relationship between environmental, social and governance scores on performance with the firm and showed that slump Financial and geographic international diversity exacerbate the relationship between environmental, social, and governance concessions on a firm's financial performance. The environmental, social, and governance aspects of the green company are useful in areas such as reducing taxes, reducing operational risks, improving the ability to obtain favorable contracts, and maintaining a good reputation. Finally, governance aspects are key factors that can significantly affect the image formation of the company.

In addition, the results of the seventh, eighth and ninth hypotheses indicate that the green performance of companies has a positive and significant effect on the environment, society and the value of the company and to some extent corroborate the results of studies by Yoon et al. (2018), Soedjatmiko et al. (2021) and Wu et al. (2022). On the other hand, the findings of the present study are consistent with the findings of Liu et al. (2022), which are based on stakeholder theory, and state that a positive image and reputation can create loyal customers for the company's products and services, which in turn can help to increase the value of the company. In addition, it can be argued that a company can improve its image and reputation through its environmental, social and governance aspects. In other words, green companies that protect the environment promote the growth and prosperity of future generations and in this way can increase the credibility and performance of green companies.

With the ability to generalize the results of the research to more than one country or specific geographical region and beyond the theoretical scope of the literature, this research can include management and executive proposals that can be considered by policymakers and marketers at different levels. First, it is suggested that Central European audience in different departments, especially operational units, evaluate their operations based on environmental criteria, and also by monitoring the technology development program, development programs are based on working groups related to the environment. Also, it is suggested that due to the fact that the organization's human resources body has the potential for proper environmental performance, in this regard, it is suggested to further develop the employees through continuous training in order to improve the marketing performance. Accordingly, considering that the food industry is a mirror of the economic and industrial development of a country and its extensive operations from production to distribution and consumption, it plays a significant role in moving the economic wheel of any country.

Finally, this research has certain limitations that could create opportunities for future research. Since in this study the effect of the institutional environment variable has been tested as a moderator variable for the first time, the need for more studies in other Iranian provinces and countries and comparison of results is felt. Therefore, future researchers are suggested to study and test this model in other provinces and countries to increase the validity of the model. This study employs a cross-sectional research design, so it is suggested that future researchers consider the research design and longitudinal data collection as well. It is also suggested that future researchers examine the impact of other factors related to supply chain management operations, such as supplying chain length and supply chain type, on companies' competitive advantage and green performance.

References

Adebanjo, D., Teh, P.L., & Ahmed, P.K. (2016). The impact of external pressure and sustainable management practices on manufacturing performance and environmental outcomes.International Journal of Operations & Production Management.

Indexed at, Google Scholar, Cross Ref

Allur, E., Heras-Saizarbitoria, I., Boiral, O., & Testa, F. (2018). Quality and Environmental Management linkage: A review of the literature.Sustainability,10(11), 4311.

Indexed at, Google Scholar, Cross Ref

Amato, L.H., & Amato, C.H. (2012). Environmental policy, rankings and stock values.Business Strategy and the Environment,21(5), 317-325.

Indexed at, Google Scholar, Cross Ref

Aslam, S., Elmagrhi, M.H., Rehman, R.U., & Ntim, C.G. (2021). Environmental management practices and financial performance using data envelopment analysis in Japan: The mediating role of environmental performance.Business Strategy and the Environment,30(4), 1655-1673.

Indexed at, Google Scholar, Cross Ref

Balachandran, B., & Faff, R. (2015). Corporate governance, firm value and risk: Past, present, and future.Pacific-Basin Finance Journal,35, 1-12.

Bansal, P. (2005). Evolving sustainably: A longitudinal study of corporate sustainable development.Strategic management journal,26(3), 197-218.

Brammer, S., & Pavelin, S. (2008). Factors influencing the quality of corporate environmental disclosure.Business strategy and the environment,17(2), 120-136.

Indexed at, Google Scholar, Cross Ref

Christakopoulou, S., Dawson, J., & Gari, A. (2001). The community well-being questionnaire: Theoretical context and initial assessment of its reliability and validity.Social Indicators Research,56(3), 319-349.

Chu, Z., Xu, J., Lai, F., & Collins, B.J. (2018). Institutional theory and environmental pressures: The moderating effect of market uncertainty on innovation and firm performance.IEEE Transactions on Engineering Management,65(3), 392-403.

Indexed at, Google Scholar, Cross Ref

Colwell, S.R., & Joshi, A.W. (2013). Corporate ecological responsiveness: Antecedent effects of institutional pressure and top management commitment and their impact on organizational performance.Business Strategy and the Environment,22(2), 73-91.

Indexed at, Google Scholar, Cross Ref

de Azevedo Rezende, L., Bansi, A.C., Alves, M.F.R., & Galina, S.V.R. (2019). Take your time: Examining when green innovation affects financial performance in multinationals.Journal of Cleaner Production,233, 993-1003.

Indexed at, Google Scholar, Cross Ref

de Sousa Jabbour, A.B.L., Jabbour, C.J.C., Foropon, C., & Godinho Filho, M. (2018). When titans meet–Can industry 4.0 revolutionise the environmentally-sustainable manufacturing wave? The role of critical success factors.Technological Forecasting and Social Change,132, 18-25.

Indexed at, Google Scholar, Cross Ref

Duque-Grisales, E., & Aguilera-Caracuel, J. (2021). Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack.Journal of Business Ethics,168(2), 315-334.

Forés, B. (2019). Beyond gathering the ‘low-hanging fruit’of green technology for improved environmental performance: an empirical examination of the moderating effects of proactive environmental management and business strategies.Sustainability,11(22), 6299.

Indexed at, Google Scholar, Cross Ref

Giese, G., Lee, L.E., Melas, D., Nagy, Z., & Nishikawa, L. (2019). Foundations of ESG investing: How ESG affects equity valuation, risk, and performance.The Journal of Portfolio Management,45(5), 69-83.

Hair, J.F., Ringle, C.M., & Sarstedt, M. (2013). Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance.Long range planning,46(1-2), 1-12.

Harrison, J.S., Phillips, R.A., & Freeman, R.E. (2020). On the 2019 business roundtable “statement on the purpose of a corporation”.Journal of Management,46(7), 1223-1237.

Indexed at, Google Scholar, Cross Ref

Jamil, E., & Siddiqui, D.A. (2020). Assessing Firms’ Environmental, Social and Governance Performance (ESGP) and Its Effect on Financial Performance: Evidence from Pakistan.Social and Governance Performance (ESGP) and Its Effect on Financial Performance: Evidence from Pakistan (August 26, 2020).

Indexed at, Google Scholar, Cross Ref

Kim, Y.J., Kim, W.G., Choi, H.M., & Phetvaroon, K. (2019). The effect of green human resource management on hotel employees’ eco-friendly behavior and environmental performance.International Journal of Hospitality Management,76, 83-93.

Indexed at, Google Scholar, Cross Ref

Kramer, M.R., & Porter, M. (2011).Creating shared value(Vol. 17). Boston, MA, USA: FSG.

Li, Z., Wu, B., Wang, D., & Tang, M. (2022). Government mandatory energy-biased technological progress and enterprises' environmental performance: Evidence from a quasi-natural experiment of cleaner production standards in China.Energy Policy,162, 112779.

Indexed at, Google Scholar, Cross Ref

Lin, H., Chen, L., Yu, M., Li, C., Lampel, J., & Jiang, W. (2021). Too little or too much of good things? The horizontal S-curve hypothesis of green business strategy on firm performance.Technological Forecasting and Social Change,172, 121051.

Liu, Y., Kim, C.Y., Lee, E.H., & Yoo, J.W. (2022). Relationship between sustainable management activities and financial performance: Mediating effects of non-financial performance and moderating effects of institutional environment.Sustainability,14(3), 1168.

Indexed at, Google Scholar, Cross Ref

Lyon, T.P., & Shimshack, J.P. (2015). Environmental disclosure: Evidence from Newsweek’s green companies rankings.Business & Society,54(5), 632-675.

Indexed at, Google Scholar, Cross Ref

Mahmud, M.T. (2020). Quest for a Single Theory to Explain Managerial Motivations for Sustainability Disclosures: Legitimacy Theory, Stakeholder Theory or Institutional Theory.Bull. Jpn. Assoc. Int. Account. Stud,1, 135-159.

Mathur, A., & Vyas, D.K. (2013). Socio-ecological issues-eco-economic and sustainability status.Journal of Ecology and Environmental Sciences,4(1), 87.

Matthiesen, M.L., & Salzmann, A.J. (2017). Corporate social responsibility and firms’ cost of equity: how does culture matter?.Cross Cultural & Strategic Management.

Indexed at, Google Scholar, Cross Ref

Meric, I., Watson, C.D., & Meric, G. (2012). Company green score and stock price.International Research Journal of Finance and Economics,82(1), 15-23.

Mohammad, W.M.W., & Wasiuzzaman, S. (2021). Environmental, Social and Governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia.Cleaner Environmental Systems,2, 100015.

Indexed at, Google Scholar, Cross Ref

Muisyo, P.K., & Qin, S. (2021). Enhancing the FIRM’S green performance through green HRM: The moderating role of green innovation culture.Journal of cleaner production,289, 125720.

Indexed at, Google Scholar, Cross Ref

Nguyen, T.H., Elmagrhi, M.H., Ntim, C.G., & Wu, Y. (2021). Environmental performance, sustainability, governance and financial performance: Evidence from heavily polluting industries in China.Business Strategy and the Environment,30(5), 2313-2331.

Indexed at, Google Scholar, Cross Ref

Phan, T.N., & Baird, K. (2015). The comprehensiveness of environmental management systems: The influence of institutional pressures and the impact on environmental performance.Journal of environmental management,160, 45-56.

Indexed at, Google Scholar, Cross Ref

Rahdari, A., Sheehy, B., Khan, H.Z., Braendle, U., Rexhepi, G., & Sepasi, S. (2020). Exploring global retailers' corporate social responsibility performance.Heliyon,6(8), e04644.

Indexed at, Google Scholar, Cross Ref

Rashid, M.H.U., Zobair, S.A.M., Shadek, M.J., Hoque, M.A., & Ahmad, A. (2019). Factors influencing green performance in manufacturing industries.International Journal of Financial Research,10(6), 159-173.

Rathert, N. (2016). Strategies of legitimation: MNEs and the adoption of CSR in response to host-country institutions.Journal of International Business Studies,47(7), 858-879.

Scott, W.R. (2008). Approaching adulthood: the maturing of institutional theory.Theory and society,37(5), 427-442.

Sepasi, S., Rexhepi, G., & Rahdari, A. (2021). The changing prospects of corporate social responsibility in the decade of action: Do personal values matter?.Corporate Social Responsibility and Environmental Management,28(1), 138-152.

Indexed at, Google Scholar, Cross Ref

Shaikh, I. (2022). Environmental, social, and governance (ESG) practice and firm performance: an international evidence.Journal of Business Economics and Management,23(1), 218-237.

Indexed at, Google Scholar, Cross Ref

Singh, N., Tang, Y., & Ogunseitan, O.A. (2020). Environmentally sustainable management of used personal protective equipment.Environmental science & technology,54(14), 8500-8502.

Smetana, S., Spykman, R., & Heinz, V. (2021). Environmental aspects of insect mass production.Journal of Insects as Food and Feed,7(5), 553-571.

Snooper, A.F., Sadder, M., Al-Banna, L., Al-Sayeq, S., Al-Majali, E., Al-Shibly, A., & Al-Antary, T.M. (2021). Mining for Parasporin Toxin Genes in Jordanian Bacillus Thuringiensis Strains.FRESENIUS ENVIRONMENTAL BULLETIN,30(4), 3689-3703.

Soedjatmiko, S., Tjahjadi, B., & Soewarno, N. (2021). Do Environmental Performance and Environmental Management Have a Direct Effect on Firm Value?.The Journal of Asian Finance, Economics and Business,8(1), 687-696.

Indexed at, Google Scholar, Cross Ref

Stahn, P., Busch, S., Salzmann, T., Eichler-Löbermann, B., & Miegel, K. (2017). Combining global sensitivity analysis and multiobjective optimisation to estimate soil hydraulic properties and representations of various sole and mixed crops for the agro-hydrological SWAP model.Environmental Earth Sciences,76(10), 1-19.

Stead, J.G., & Stead, W.E. (2014). Building spiritual capabilities to sustain sustainability-based competitive advantages.Journal of Management, Spirituality & Religion,11(2), 143-158.

Indexed at, Google Scholar, Cross Ref

Sudaryati, E., Agustia, D., Tjaraka, H., & Rizki, A. (2020). The mediating role of green innovation on the effect of environment-based culture on company performance.International Journal of Innovation, Creativity and Change,11(11), 320-334.

Syafri, W., Prabowo, H., Nur, S.A., & Muafi, M. (2021). The Impact of Workplace Green Behavior and Green Innovation on Green Performance of SMEs: A Case Study in Indonesia.The Journal of Asian Finance, Economics and Business,8(5), 365-374.

Teixeira, A.A., Jabbour, C.J.C., de Sousa Jabbour, A.B.L., Latan, H., & De Oliveira, J.H.C. (2016). Green training and green supply chain management: evidence from Brazilian firms.Journal of Cleaner Production,116, 170-176.

Indexed at, Google Scholar, Cross Ref

Wagner, M., Schaltegger, S., Hansen, E.G., & Fichter, K. (2021). University-linked programmes for sustainable entrepreneurship and regional development: how and with what impact?.Small Business Economics,56(3), 1141-1158.

Wamba, L.D. (2022). The determinants of environmental performance and its effect on the financial performance of European-listed companies.Journal of General Management,47(2), 97-110.

Indexed at, Google Scholar, Cross Ref

Wu, J., Liu, B., Zeng, Y., & Luo, H. (2022). Good for the firm, good for the society? Causal evidence of the impact of equity incentives on a firm's green investment.International Review of Economics & Finance,77, 435-449.

Xue, M., Boadu, F., & Xie, Y. (2019). The penetration of green innovation on firm performance: Effects of absorptive capacity and managerial environmental concern.Sustainability,11(9), 2455.

Indexed at, Google Scholar, Cross Ref

Yadav, P.L., Han, S.H., & Rho, J.J. (2016). Impact of environmental performance on firm value for sustainable investment: Evidence from large US firms.Business strategy and the environment,25(6), 402-420.

Indexed at, Google Scholar, Cross Ref

Yoon, B., Lee, J.H., & Byun, R. (2018). Does ESG performance enhance firm value? Evidence from Korea.Sustainability,10(10), 3635.

Indexed at, Google Scholar, Cross Ref

Zhang, M. (2015).The analysis of organizational work environment factors affecting training transfer: A questionnaire survey in Chinese enterprises(Doctoral dissertation).

Zhao, C., Guo, Y., Yuan, J., Wu, M., Li, D., Zhou, Y., & Kang, J. (2018). ESG and corporate financial performance: Empirical evidence from China’s listed power generation companies.Sustainability,10(8), 2607.

Indexed at, Google Scholar, Cross Ref

Received: 13-Sep-2022, Manuscript No. AMSJ-22-12551; Editor assigned: 16-Sep-2022, PreQC No. AMSJ-22-12551(PQ); Reviewed: 07-Oct-2022, QC No. AMSJ-22-12551; Revised: 21-Oct-2022, Manuscript No. AMSJ-22-12551(R); Published: 13-Nov-2022