Review Article: 2023 Vol: 27 Issue: 5S

Application of Machine Learning Techniques to Identify the Business Financial Risks

Arshi Naim, King Khalid University, Saudi Arabia

Citation Information: Naim, A (2023). Application of machine learning techniques to identify the business financial risks. Academy of Marketing Studies Journal, 27(S5), 1-11.

Abstract

The success of any business is based on financial wellness. Therefore, if the financial risks (FR) are reduced or prevented the chances of profitability will increase for the firms. Businesses apply different technological techniques to resolve the issue of FR. In the current scenario the relevance and effective of Machine learning (ML) is greatly realized in all the sectors of businesses. FR is also one of the important areas that have received potential benefits from the applications of ML. Researchers in ML often find difficulty in understanding the concepts and taxonomy of FR. This research paper will facilitate the researchers to correlate the ML types and methods for solving different FR in businesses. A survey is conducted through online medium from Computer Science (CS) specialists in Information Technology (IT) firms to measure their understanding for FR concepts. These CS specialists are asked to apply their critical thinking for the application of the types of ML in solving types of FR in businesses. This study is an empirical research and recommendations for correlation are completely based on observations and findings from the survey.

Keywords

Financial Risks, Machine Learning, Computer Science, Empirical, Taxonomy, Information Technology.

Introduction

Machine learning (ML) is not a substitute to Artificial Intelligence (AI) rather a subfield of AI (Naim & Malik, 2022).

In general terms AI is defined like am ability of system to act, behave and respond like a human. Most important benefit of AI is to facilitate in complex decision making which is comparable to the actions and intellect of humans (Leo et al., 2019). ML can be understood as a tool for transforming (Naim, 2022) the system to think and respond like a human. To accomplish this objective ML uses neural networks which practice sequences of algorithm that make system to respond and acts like human.

ML has a great relevance in businesses especially in financial analysis (Naim, 2022).

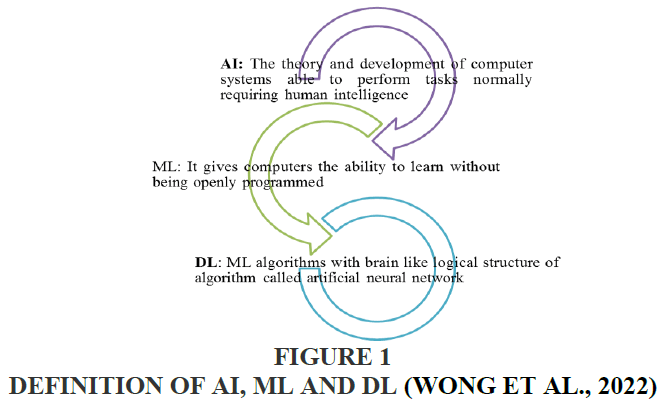

ML has given a new and varied direction to finance in achieving feasibility in business operations (Lahmiri & Bekiros 2019). Many firms have achieved competitive advantages after applying ML in their business practices (Leo et al., 2019). In the current scenario, it is found that firms are using AI, ML and Deep Learning (DL) at diverse level of business procedures and are realizing significant attainment and returns. Figure 1 shows the level and definition of AL, ML and DL (Wong et al., 2022).

Figure 1 Definition of AI, ML and DL (Wong et al., 2022)

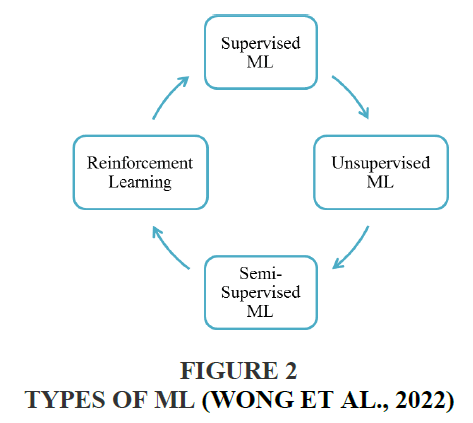

ML has received over whelming acceptance from users from all disciplines such financial analysts, social media analyst, advertising and media experts (Lahmiri & Bekiros 2019). This is because of ML’s advancements in using Natural Language Processing, Computer Vision, and Robotics. The business practices which are based on quantitative analysis and have big data set extensively use ML types for solutions (Lahmiri & Bekiros 2019) ML has four types and Figure 2 shows the general depiction.

Figure 2 Types of ML (Wong et al., 2022)

Financial Risks (FR) is measured by the applications of ML and financial analyst take decisions to reduce risks and improve profit and financial efficiency (Naim & Hassan, 2022).

Financial Risk (FR) is a concept explains the ability of any business to take care and deal the financial instabilities. These instabilities can be described as the liabilities and financial commitments any firm has to pay back. FR mostly ascends because of loss in business and financial markets, changes in stock market and in process, change in the currency value, etc.

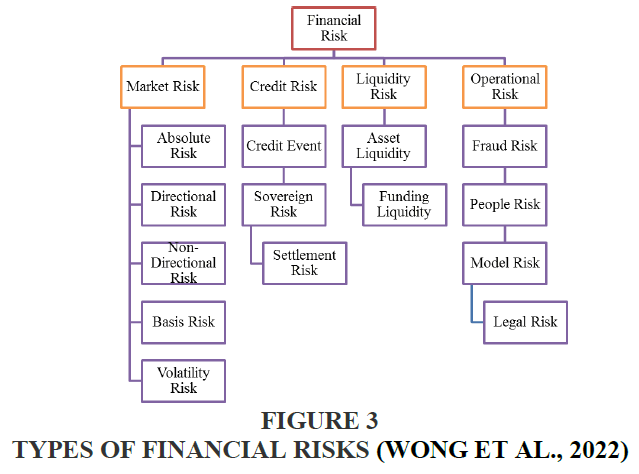

FR is important not only for financial analyst, business organizations but also for general economic scenario because it supports, synchronize and device commercial statistics and progressions. Also it offers clear policies for exploring financial openings and assesses the performance of any firm. Figure 3 gives the types of financial risks with further segmentation.

Figure 3 Types of Financial Risks (Wong et al., 2022)

FR is always a demanding area of research and application of ML to meet the challenge is not a new approach, (Naim et al., 2023) however the application has used efforts and time in measuring, studying and identifying the FR clearly due to lack of conceptual knowledge in financial management in general and FR in specifically. In the current scenario taxonomy to correlate and discover ML types to measure the FR has not been streamlined effectively (Wong et al., 2022).

Many past research have used ML and explained the benefits of using ML in FR for specific firms but a general framework is yet to be explained that can be functional for any firm (Naim et al., 2022). FR is broadly segmented into four types for the understanding and conceptual distinction (Wong et al., 2022).

These distinctions helped the research to define the types of FR in more specific manner so that definite type of ML can be identified to reduce the type of FR (Sanni et al., 2021).

Reducing risk as well as managing risk is mostly a quantitative approach for the organizations (Naim et al, 2021). For large organizations this issues is not complex however for small scale firms, managing risks and reducing risk have always been a challenge. Big organizations can apply sophistical statistical methods to manage and reduce FR but for small firms it’s also financial problems. In past many studies have focused on measuring the FR but this research paper explains the correlation and between ML and FR so that small firms can easily apply the types of ML to measure the FR (Naim et al, 2023). Big organizations are also benefitted by this easy and effective framework (Bhatore et al., 2020).

We present a comprehensive taxonomy of major FR tasks and establish their connection with relevant machine learning problems. This taxonomy would help machine learning researchers navigate the complex domain of financial risks.

Literature Review

AI is facilitated by ML, as this tools helps to leverage the objectives of technologies. Many times ML is synonymously used in place of AI due to the decision making capabilities until 1970s (Sanni et al., 2021).

In later years ML grew as a separate branch and continues to become a popular tool for aiding various processes in business, medicine and other disciplines (Bhatore et al., 2020). ML is witnessed to be applied for business research and modern techniques in business (Sanni et al., 2021).

ML uses the algorithms and neural network models to help computer systems in cultivating and an enhancing the performance of business at all levels (Bhatore et al., 2020). In the year 1952, Arthur Samuel developed the concept of ML when he marked a principal processor culturing codes. The codes were for checker’s game and later the firm IBM enhanced the game by applying ML technologies (Hoepner et al., 2021).

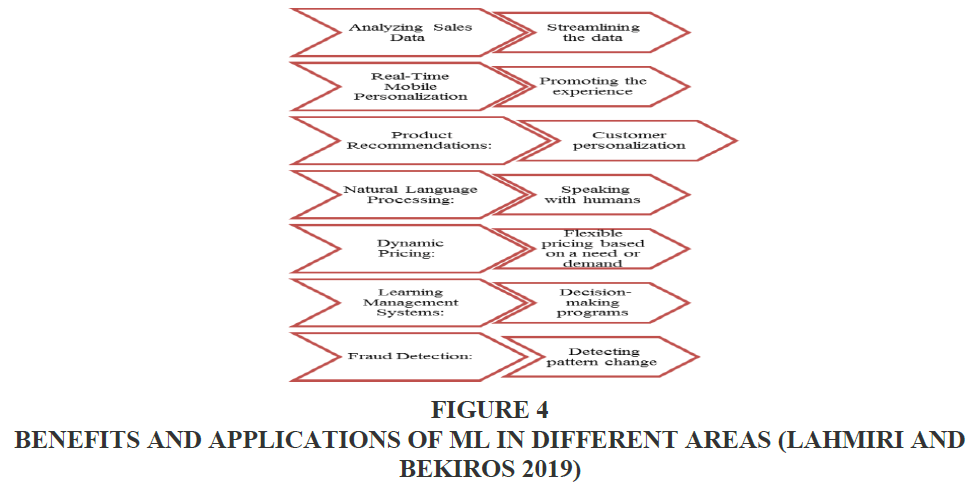

In the late 1970s and early 1980s, AI research had focused on using logical, knowledge-based approaches rather than algorithms. Additionally, neural network research was abandoned by CS and AI researchers (Hoepner et al., 2021). Therefore ML was considered to be a practicing program for AI and there was no clear demarcation between ML and AI until then (Lahmiri & Bekiros 2019). Presently ML is applied by many areas and disciplines for success and profit maximizations. Some of the breakthrough advancements occurred by the ML are self-driving vehicles, discovering the galaxy, and many more which are mentioned in Figure 4.

Figure 4 Benefits and Applications of ML in Different Areas (Lahmiri and Bekiros 2019)

Another major contribution made by Stanford University while defining ML as “the discipline to make systems work without being programmed "(Lahmiri & Bekiros 2019). ML has encouraged a new collection of concepts and technologies such as chatbot, IOT, algorithms for robots, supervised and unsupervised learning, etc, (Lahmiri & Bekiros 2019).

The term finance is as old as the start of civilization. The first finance application was in about 3000 BC. Empires like Babylonians Empire was the first ones to give the concept of banking and centuries later in 2013 the Nobel laureate Eugene F. Fama, explained the term modern finance in economics. He is popularly known as father of modern finance (Lahmiri & Bekiros 2019). There are three broad categories of finance and later two more were added, so currently 5 categories of finance exist. These categories are public finance, corporate finance, and personal finance, social finance and behavioral finance (Leo et al., 2019).

(Mashrur, et al., 2020) explained ML for FR through the survey method but did not specified the target the computer science and ML expert for the responses for identifying the ML techniques for FR. (Lin, et al. 2011) illustrated the results of ML for Financial crisis and predicted the solutions through the survey but the research did not cover the FR through the types of ML.

Researchers in Machine Learning often find difficulty in understanding the concepts and taxonomy of Business Financial Risks. This research paper will facilitate the researchers to correlate the ML types and methods for solving different Business Financial Risks. The target group for this research is the experts in Machine Learning, Computer Science Specialists and Software Engineers.

Research Methodology

The current study is based on the survey results from the computer science specialists and software engineers. The respondents were academicians from the southern universities in Saudi Arabia and professionals from Information Technology firms in Saudi Arabia. The survey questions have identified four types of ML types which are supervised, unsupervised, semi – supervised and reinforcement learning. The different types of FR were explained in the questionnaire and respondents, where asked to identify the ML types to assess the specific type of FR. Based on the responses the results show the methods of ML to measure the type of FR.

Discussion

Most of the financial issues based on quantitative analysis are solved by M, these issues are mostly related to profit maximization, predictive analysis, return on investments and FR. This research paper focuses on general understanding of FR types and ML types and the taxonomy of Business FR to identify ML types for measuring specific types of FR (Song, et al. 2014).

There are four types of FR which are given in the earlier part of the paper. Each type of FR is segmented into sub parts of FR based on applications and conceptual understanding. These four types are market risk, credit risk, liquidity risk and operational risk

Market Risk has five subparts namely Absolute Risk, Directional Risks, Non directional Risks, Basis risk and Volatile risk (Leo et al., 2019).

Absolute financial risk is measured by the total debt for certain or definite events. Directional risks explain the financial forfeiture ascends due to actual assets in the market. Non-Directional may occur because of any unexpected incidence. Basis risk happens due to mismatch in a hedging situation. Volatility risk is caused during the change of price of a collection. This brings financial instability.

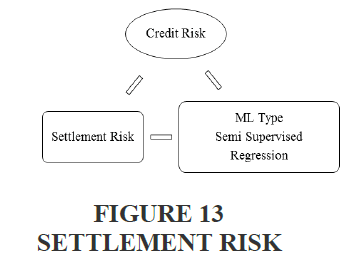

Credit risk has three sub parts such as credit event, sovereign risk and settlement risk. (Leo et al., 2019). A credit event is an adverse variation in a debtor's ability when he is unable to payback and this prompts for credit default swap (CDS) contract. Sovereign risk is a national risk where the government has an obligation to pay back the debt due to risk in making investment in other nations.

Settlement risk arises when one entity is unable to hold the cash for financial transaction and that eventually cause financial instability (Gotoh, et al.,2014).

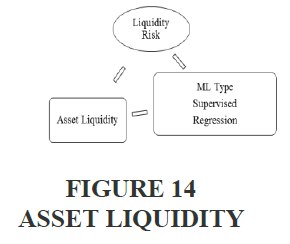

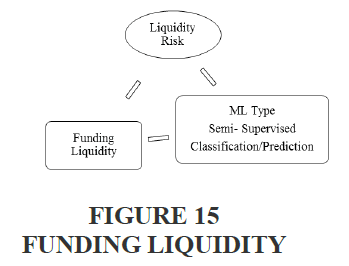

Liquidity risk has two subparts such as asset liquidity and funding liquidity (Leo et al., 2019). Asset Liquidity arise when the asset is unable to be converted to cash when need for financial transaction or to pay debt. Funding liquidity risk is correlated to the financial institutions, where they are incompetent to settle debt or financial commitments. (Li et al., 2009)

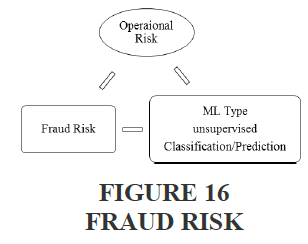

Operational risk has four subparts namely, fraud risk, people risk, model risk and legal risk. Fraud risk depends on internal or external factors for illegal activity that can damage the image of the firm (Naim, 2022) People risk also depends on internal and external factors when there is lack of human resources or negative behavior or lack of motivation or contribution that cause loss or errors in the process. Model risk is due to errors in designing that cause financial damage (Kou et al., 2019). Legal risk is caused due to ethical issues or non-compliance regulations from the government.

The FR cause uncertainty to all types of firms and it is very important to reduce and implement a strategy. ML has successfully helped several firms for profit maximization and this research will focus on types of ML for measuring FR.

ML is a computational method which is generally dependent on improving the functions and reducing the errors and losses. ML can be classified into supervised learning, unsupervised learning, semi supervised learning and reinforcement learning (Leo et al., 2019).

Supervised Learning is a type of ML as well as AI that apply the labeled dataset to practice algorithms which aid in classification and eventually predicting the results for the discipline of areas where it is implemented (Gao, 2021)

Unsupervised Learning initiates ML algorithms without any human intervention. This ML sub category prompts to study and cluster unlabeled datasets and the algorithms applied here determine the concealed designs or data groups (Xuan, 2021)

Reinforcement learning is a ML practicing technique created on having required outcomes and removing irrelevant aspects. This subpart is very helpful in identifying the errors and it is focused on trial and error approach (Naim et al., 2022).

Semi-supervised is a type of ML which is a blend of supervised as well as unsupervised type of ML and AI. The combination is based on the application of small type of labeled data and large unlabeled dataset (Hoepner et al., 2021).

Results

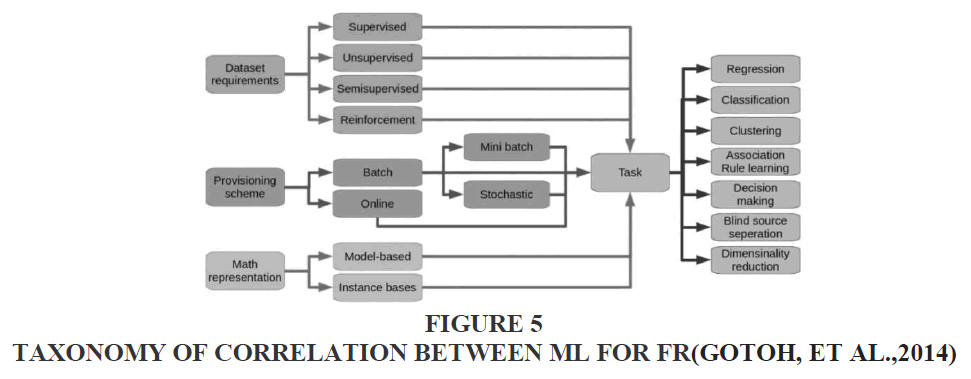

Types of ML can be applied in measuring FR and taxonomy can be developed to correlate ML types for FR. The results show the type of ML corresponding to the FR. Figure 5 shows the general scenario of Ml for FR with the correlated taxonomy.

Figure 5 Taxonomy of Correlation Between ML for FR(Gotoh, et al.,2014)

The closed ended survey was conducted for CS and ML experts, where the questionnaire explained the FR concepts and subparts and was asked to identify the ML types to measure a particular type of FR Wang et al. (2022).

The results will the show four types of FR and which ML types are correlated to reduce and measure the type of FR.

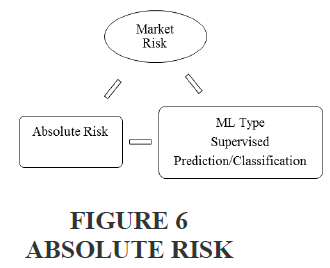

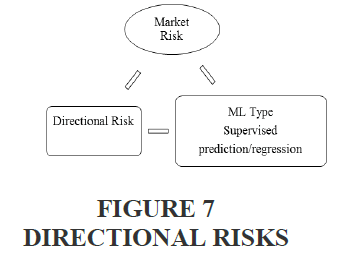

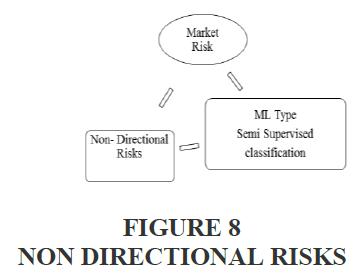

As mentioned in the four types of FR are further segmented into distinctive types. The four types included in the results are Market Risk, Credit Risk, Liquidity Risk and Operational Risk Figures 6-12.

Types of ML for Market Risk

The results show that for absolute risk and directional risk, supervised learning can be applied for the FR measurement and for non-directional, basis risk and volatile risk; the best ML type should be semi supervised learning.

The results show for subparts of credit risk that for credit event and settlement risk, semi supervised risk should be applied and for sovereign risk unsupervised ML type should be pragmatic for the measurement.

The results for subparts of liquidity risk, show that for asset liquidity supervised ML and for funding liquidity semi supervised ML type should be functional to measure the FR.

The Operational risk is measure under four subparts and results show that for fraud risk and people risk, unsupervised risk is more practical type and for model risk, semi supervised and for legal risk, supervised ML types are practical measurement tools Figures 13-18.

Conclusion

We studied the definition of ML types and FR types and developed taxonomy to develop a correlation between ML sub categories and FR types. The general scenario is developed that given a simple but definite framework for FR types to be assessed by specific ML types. This research has facilitated the CS experts to apply the ML types to measure FR without making extensive research and also they do not need to develop a financial understanding to implement the ML type. In future the study will be conducted for exemplary approach where the research will measure the effectiveness of the application of these ML subclasses for FR forms.

References

Bhatore, S., Mohan, L., & Reddy, Y. R. (2020). Machine learning techniques for credit risk evaluation: a systematic literature review. Journal of Banking and Financial Technology, 4, 111-138.

Indexed at, Google Scholar, Cross Ref

Gao, B. (2021). The use of machine learning combined with data mining technology in financial risk prevention. Computational Economics, 1-21.

Indexed at, Google Scholar, Cross Ref

Gotoh, J. Y., Takeda, A., & Yamamoto, R. (2014). Interaction between financial risk measures and machine learning methods. Computational Management Science, 11(4), 365-402.

Indexed at, Google Scholar, Cross Ref

Hoepner, A. G., McMillan, D., Vivian, A., & Wese Simen, C. (2021). Significance, relevance and explainability in the machine learning age: an econometrics and financial data science perspective. The European Journal of Finance, 27(1-2), 1-7.

Indexed at, Google Scholar, Cross Ref

Kou, G., Chao, X., Peng, Y., Alsaadi, F. E., & Herrera-Viedma, E. (2019). Machine learning methods for systemic risk analysis in financial sectors. Technological and Economic Development of Economy, 25(5), 716-742.

Indexed at, Google Scholar, Cross Ref

Lahmiri, S., & Bekiros, S. (2019). Can machine learning approaches predict corporate bankruptcy? Evidence from a qualitative experimental design. Quantitative Finance, 19(9), 1569-1577.

Indexed at, Google Scholar, Cross Ref

Leo, M., Sharma, S., & Maddulety, K. (2019). Machine learning in banking risk management: A literature review. Risks, 7(1), 29.

Indexed at, Google Scholar, Cross Ref

Li, N., Liang, X., Li, X., Wang, C., & Wu, D. D. (2009). Network environment and financial risk using machine learning and sentiment analysis. Human and Ecological Risk Assessment, 15(2), 227-252.

Indexed at, Google Scholar, Cross Ref

Lin, W. Y., Hu, Y. H., & Tsai, C. F. (2011). Machine learning in financial crisis prediction: a survey. IEEE Transactions on Systems, Man, and Cybernetics, Part C (Applications and Reviews), 42(4), 421-436.

Indexed at, Google Scholar, Cross Ref

Mashrur, A., Luo, W., Zaidi, N. A., & Robles-Kelly, A. (2020). Machine learning for financial risk management: a survey. IEEE Access, 8, 203203-203223.

Indexed at, Google Scholar, Cross Ref

Naim, A. (2022). Benefits of Artificial Intelligence (AI) in Financial Practices. International Journal of Studies in Business Management, Economics and Strategies, 1, 1-12.

Naim, A., & Malik, P. K. (2022). Competitive Trends and Technologies in Business Management. Competitive Trends and Technologies in Business Management.

Indexed at, Google Scholar, Cross Ref

Naim, A., Alahmari, F., & Rahim, A. (2021). Role of artificial intelligence in market development and vehicular communication. Smart Antennas: Recent Trends in Design and Applications, 2(28.2).

Indexed at, Google Scholar, Cross Ref

Naim, A., Muniasamy, A., Clementking, A., & Rajkumar, R. (2022). Relevance of Green Manufacturing and IoT in Industrial Transformation and Marketing Management. In Computational Intelligence Techniques for Green Smart Cities (pp. 395-419). Cham: Springer International Publishing.

Naim, A., Alqahtani, H., Muniasamy, A., Bilfaqih, S. M., Mahveen, R., & Mahjabeen, R. (2023). Applications of Information Systems and Data Security in Marketing Management. In Fraud Prevention, Confidentiality, and Data Security for Modern Businesses (pp. 57-83). IGI Global.

Sanni-Anibire, M. O., Mohamad Zin, R., & Olatunji, S. O. (2021). Developing a preliminary cost estimation model for tall buildings based on machine learning. International Journal of Management Science and Engineering Management, 16(2), 134-142.

Indexed at, Google Scholar, Cross Ref

Song, X. P., Hu, Z. H., Du, J. G., & Sheng, Z. H. (2014). Application of machine learning methods to risk assessment of financial statement fraud: evidence from China. Journal of Forecasting, 33(8), 611-626.

Indexed at, Google Scholar, Cross Ref

Wang, D., Wu, Z., & Zhu, B. (2022). Controlling Shareholder Characteristics and Corporate Debt Default Risk: Evidence Based on Machine Learning. Emerging Markets Finance and Trade, 58(12), 3324-3339.

Indexed at, Google Scholar, Cross Ref

Wong, L. W., Tan, G. W. H., Ooi, K. B., Lin, B., & Dwivedi, Y. K. (2022). Artificial intelligence-driven risk management for enhancing supply chain agility: A deep-learning-based dual-stage PLS-SEM-ANN analysis. International Journal of Production Research, 1-21.

Indexed at, Google Scholar, Cross Ref

Xuan, F. (2021). Regression analysis of supply chain financial risk based on machine learning and fuzzy decision model. Journal of Intelligent & Fuzzy Systems, 40(4), 6925-6935.

Indexed at, Google Scholar, Cross Ref

Received: 09-Feb-2023, Manuscript No. AMSJ-23-13213; Editor assigned: 10-Feb-2023, PreQC No. AMSJ-23-13213(PQ); Reviewed: 08-Mar-2023, QC No. AMSJ-23-13213; Revised: 20-May-2023, Manuscript No. AMSJ-23-13213(R); Published: 01-Jun-2023