Research Article: 2025 Vol: 29 Issue: 6S

Applications and Impacts of Blockchain Technology on the Modern Business Environment

Ganesh K, Manufacturing and Supply Chain, McKinsey Global Services India Pvt Ltd, McKinsey & Company, Inc., World Trade Center, Rajiv Gandhi Salai, OMR, Perungudi, Chennai, Tamil Nadu

Balagouda Patil, Director, Dayananda Sagar Business School Bangalore

Sumita Joshi, Dr Vishwanath Karad MIT World Peace University, Arpan Shrivastava, IPS Academy, Institute of Business Management & Research, Indore (M.P)

Ashok J, CHRIST (Deemed to be University) Bengaluru, Karnataka

Nihal Bhatt, McKinsey Global Capabilities and Services India Pvt Ltd, McKinsey & Company, Inc., Sohna Road, Gurugram

Citation Information: Ganesh, K., Gandhi Salai, R., Patil, B., Joshi, S., Shrivastava, A., Ashok, J., & Bhatt, N. (2025). Applications and impacts of blockchain technology on the modern business environment. Academy of Marketing Studies Journal, 29(S6), 1-10.

Abstract

Blockchain has become a technological cornerstone for innovation in modern businesses, with many applications ranging from secure payments & smart contracts to transparent supply chains & identity verification. By expanding its decentralized, immutable nature, businesses can boost operational transparency (OE)&customer trust (CT).This study examines the practical applications & strategic impacts of blockchain technology on modern business environments. Drawing data from 134 professionals across various sectors, the study applies advanced analytical techniques such as EFA, SEM& Mediation Analysisto assess influence of blockchain on transparency, operational efficiency (OE) & customer trust (CT). The findings of the research highlight ability ofblockchain to reshape operational processes, increase data integrity as well as build long-term customer confidence. The validated path model confirms a significant mediating effect of operational efficiency (OE) between blockchain adoption (BA)& customer trust (CT).This study confirms that blockchain is not just a technical instrument but also a transformative mechanism that enhances operational workflows &customer confidence. The mediation of operational efficiency (OE) is especially important, it shows blockchain delivers results through both direct & process-driven impacts.

Keywords

Blockchain, Technology, Modern Business, Business Environment, Business Innovation.

Introduction

In recent years, blockchain technology has rapidly evolved from a niche digital currency enabler to a transformative force reshaping modern business landscapes. Originally developed to support Bitcoin, blockchain's foundational principles—decentralization, transparency, immutability, and cryptographic security—have catalyzed a wave of innovations across various sectors. As industries struggle with challenges of trust, traceability, and operational inefficiencies, blockchain emerges as a powerful tool capable of addressing these long-standing gaps. From enhancing supply chain transparency to revolutionizing financial services, the applications of blockchain have begun to redefine how businesses create, verify, and record transactions (Siddique, et.al., 2023).In the context of digital transformation, organizations are increasingly adopting blockchain solutions to streamline workflows, reduce costs, and enhance data integrity. Industries such as finance, healthcare, logistics, and even public governance have started exploring decentralized models to improve security, automate operations, and reduce dependency on intermediaries. Smart contracts—self-executing agreements coded on blockchain—are being utilized to ensure compliance and automate enforcement without the need for manual oversight (Prasannan, et.al., 2025). These innovations have fundamentally altered traditional business processes and decision-making frameworks.

Moreover, the integration of blockchain with emerging technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and cloud computing further amplifies its transformative potential. In particular, the convergence of blockchain and AI is enabling smarter data analytics, while blockchain’s synergy with IoT ensures enhanced data authenticity in real-time systems. As these integrations grow more seamless, blockchain is not just a back-end ledger technology—it becomes a strategic driver for business agility, trust management, and innovation (Sahu, J. K., 2023).However, while the benefits are promising, widespread implementation faces several barriers including scalability concerns, regulatory ambiguity, and interoperability challenges. This dual reality—of significant promise and substantial risk—necessitates a deeper empirical understanding of blockchain’s practical applications and measurable impact on business performance. Businesses are thus at a crucial juncture: either evolve by embracing blockchain-driven processes or risk obsolescence in a rapidly digitizing economy.

This research aims to explore the real-world applications of blockchain and its multifaceted impact on transparency, operational efficiency (OE) & customer trust (CT) within modern business environments. By conducting an empirical investigation involving 134 professionals from key industries such as IT, Finance& Logistics, this study seeks to uncover how blockchain adoption (BA) is reshaping organizational outcomes. Additionally, the study applies advanced statistical techniques including EFA& SEM to validate the underlying constructs & causal relationships.

Review Literature

Bai, ET AL. (2020) examine the alignment of blockchain technology with company sustainability objectives. The research highlights blockchain's function in improving transparency, traceability, and resource efficiency. It examines its strategic significance in sustainable supply chains and environmental stewardship. The authors emphasize the need of incorporating blockchain into comprehensive sustainability initiatives. Clohessy, Acton, and Rogers (2018) investigate blockchain adoption using the Technology-Organization-Environment (TOE) architecture. They recognize essential success aspects such as technical preparedness, executive endorsement, and regulatory framework. The research highlights the influence of blockchain on organizational agility and creativity. It also emphasizes obstacles such as expense, intricacy, and opposition to change. Their approach facilitates systematic blockchain application across several businesses.

Ertemel (2018) examines the marketing ramifications of blockchain technology, namely its function in improving customer data security and transparency. The research highlights the importance of trust cultivation via decentralized platforms, which have the potential to transform consumer relationships. It examines the use of smart contracts in digital advertising and loyalty initiatives. Blockchain enables enhanced monitoring of customer activity and product origin. It indicates a transition towards ethical, trust-centric marketing paradigms. Karnaushenko et al. (2023) investigate the use of blockchain in agricultural, emphasizing its significance in facilitating traceability, transparency, and sustainability. The research indicates that blockchain technology may improve food safety, reduce fraud, and streamline supply systems. It differentiates between trends driven by hype and applications supported by economic rationale. The authors contend that integration has become a strategic need rather than a choice. Blockchain satisfies both customer requirements and regulatory standards in contemporary farming. Kizildag et al. (2020) depict blockchain as a transformative paradigm in corporate operations, particularly in the hotel sector. The research highlights its potential in disintermediation, data integrity, and safe transactions. It examines how blockchain improves operational transparency and fosters visitor confidence. The writers emphasize improvements in efficiency regarding loyalty programs, payment systems, and identification verification. Blockchain is shown as a strategic facilitator of innovation and competitive advantage.

Mishra et al. (2025) delineate essential success aspects affecting blockchain implementation in the banking sector amid fluctuating company situations. The research highlights data openness, regulatory assistance, and executive commitment as critical facilitators. It also emphasizes blockchain's contribution to sustainability and operational resilience. The authors provide a paradigm for strategy implementation using a systematic empirical methodology. Their results provide significant insights for improving banking operations during uncertainty. Naikwadi et al. (2021) provide a thorough assessment of blockchain technology, including its architectural components, consensus processes, and security attributes. The assessment classifies applications within banking, healthcare, education, and supply networks. It emphasizes decentralization and immutability as fundamental qualities propelling adoption. The research also highlights issues like as scalability, energy usage, and regulatory ambiguity. The assessment provides a comprehensive basis for future blockchain research and application development.

Pan et al. (2020) performed an empirical study on the impact of blockchain adoption on organizational operational skills. The research indicated that blockchain markedly improves information transparency, data dissemination, and transactional efficiency. It emphasizes smart contracts as essential facilitators of automated operations. Their results indicate that organizational preparedness and digital infrastructure influence the effect of blockchain. The report closes with ramifications for strategic integration in operational processes. Pashkevych et al. (2020) investigated the use of blockchain in contemporary accounting and business administration. The research highlighted its capacity to provide data immutability, instantaneous access, and auditability in financial transactions. Blockchain was recognized as a technique that enhances trust for both internal and external stakeholders. The authors contend that it has the potential to transform conventional accounting frameworks by obviating manual reconciliation. The document advocates for its incorporation into enterprise resource planning (ERP) systems. Pal, Tiwari, and Haldar (2021) examined the uses, problems, and promise of blockchain in corporate management. The research emphasized its effectiveness in optimizing processes, improving transparency, and decreasing transactional expenses. Identified obstacles including scaling difficulties, regulatory ambiguity, and integration intricacies. The document highlighted blockchain's possibilities in supply chain management, finance, and human resources management. The conclusion emphasized that strategy alignment and stakeholder preparedness are essential for effective implementation. Prasannan, Parmar, and Anand (2025) investigated the prospective influence of blockchain on the banking industry. The research highlighted enhanced security, expedited transaction speed, and cost-effectiveness as significant advantages. It also examined how blockchain may mitigate fraud and improve transparency in financial transactions. Primary constraints include legislative obstacles and technology preparedness. The authors endorsed pilot initiatives and partnerships with fintech companies to facilitate seamless adoption. Sahu (2023) examined the evolution of digital payment systems and their influence on financial inclusion. The research emphasized how blockchain improves safe transactions and access to financial services, particularly for marginalized people. It also discussed risk management strategies, including encryption and decentralized verification. The study highlighted the need of regulatory coherence and infrastructural enhancement for wider implementation. Research indicates that blockchain may substantially enhance inclusive financial systems.

Sood et al. (2024) investigated the amalgamation of blockchain and nascent technologies inside the insurance industry. The book highlights improved claims processing, fraud detection, and policy administration using decentralized systems. It also examines the use of smart contracts in automating transactions. Critical concerns, including regulatory compliance and data protection, are addressed. The report depicts blockchain as a revolutionary instrument for enhancing efficiency and trust in insurance operations. Siddique and Sodani (2023) investigate the possibilities of blockchain technology in healthcare, highlighting its significance in secure data exchange, patient record administration, and improving transparency. The authors contend that blockchain may enhance interoperability across healthcare systems. Their research underscores less fraud and enhanced confidence in medical transactions. The research identifies blockchain as a driving force for the evolution of digital health.Viriyasitavat and Hoonsopon (2019) examine the fundamental attributes of blockchain—immutability, decentralization, and transparency—and their impact on contemporary corporate operations. The research elucidates the impact of several consensus techniques, such as Proof of Work and Proof of Stake, on operational efficiency and confidence inside corporate networks. It underscores the significance of blockchain in reducing fraud and improving accountability. The document further examines integration problems within current systems. It provides insights on enhancing corporate processes using blockchain-based consensus.

Tariq (2024) analyzes the amalgamation of blockchain and IoT in modern business practices, emphasizing their synergistic capacity to optimize supply chains, improve data integrity, and augment operational transparency. The chapter highlights real-time monitoring and automation as essential business benefits. Tariq observes that this synergy may mitigate fraud and inefficiencies, eventually revolutionizing consumer involvement and trust. Viriyasitavat et al. (2019) investigate the intersection of blockchain technology and the Internet of Things (IoT) in revolutionizing contemporary business operations in the digital economy. Their research highlights how this connection enhances security, transparency, and automation in decentralized settings. The authors delineate main applications in logistics, smart contracts, and data sharing. They also address technological difficulties, like scalability and interoperability. The study offers a fundamental viewpoint on prospective research trajectories. Woodside, Augustine Jr., and Giberson (2017) analyze the acceptance status and strategic methodologies for blockchain integration across several businesses. The research finds early adopters and delineates key motivators and obstacles, including regulatory ambiguity and insufficient technical proficiency. It also addresses organizational preparedness and the significance of leadership in facilitating change. The authors provide a paradigm for effective adoption, highlighting the need of cooperation among stakeholders. This article elucidates how companies may strategically use blockchain to gain a competitive edge. Zinaida et al. (2022) examine the incorporation of blockchain technology in the context of digitalization in international business. The research underscores blockchain's contribution to improving data openness, security, and operational efficiency internationally. It underscores the strategic significance of digital trust in international commerce. The authors examine legislative and infrastructural obstacles to blockchain adoption. This conference paper provides insights on the potential of blockchain to transform international business processes in the digital age.

Research Methodology

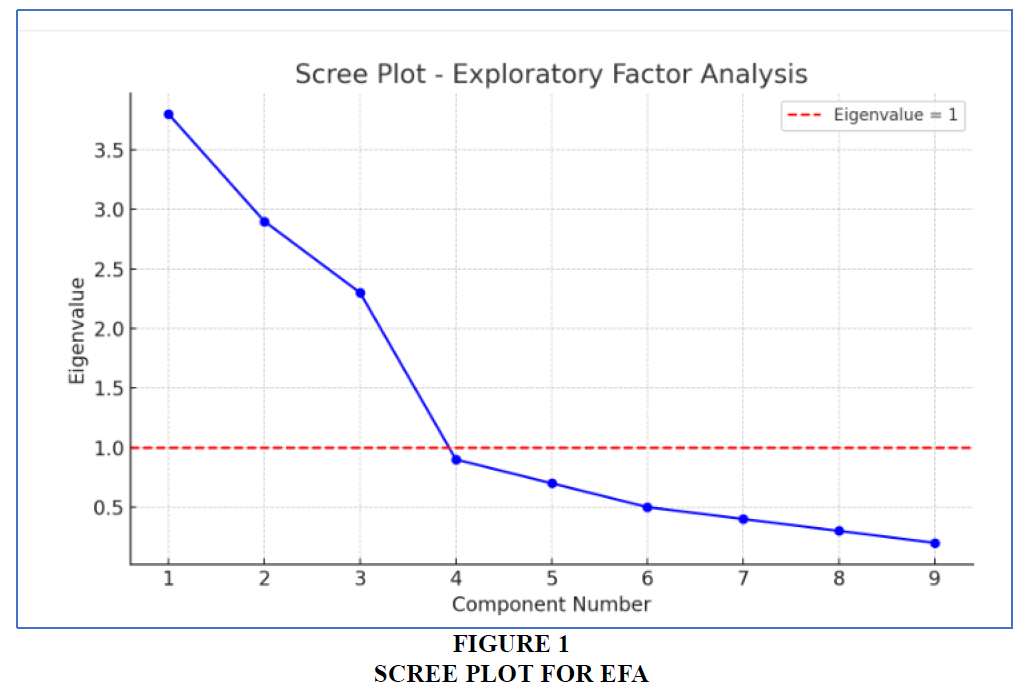

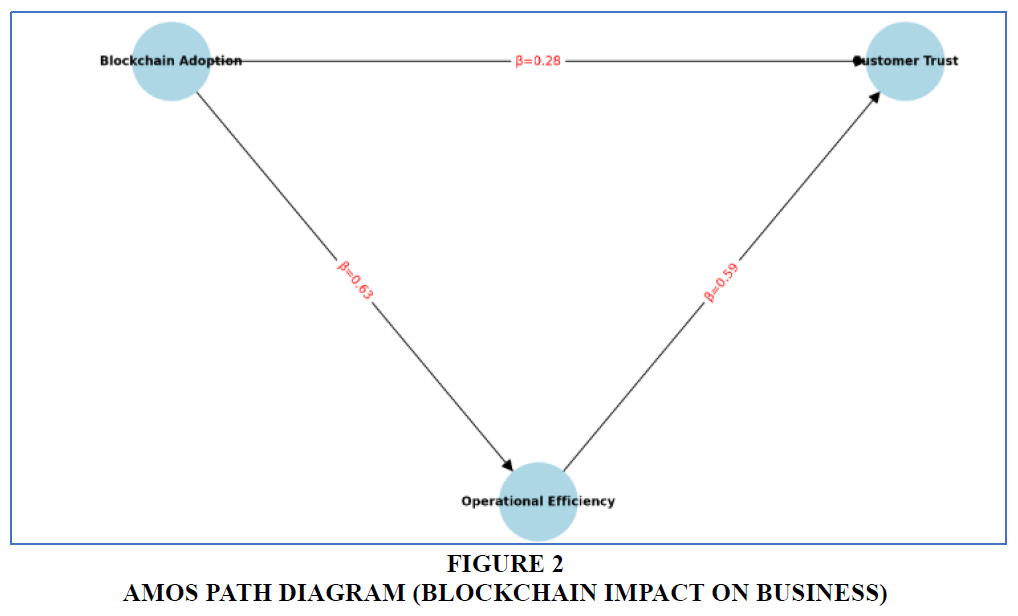

The present research adopts a descriptive as well as analytical research design to evaluate the applications& impacts of blockchain technology on the modern business environment. The study follows a quantitative approach, allowing for statistical analysis of relationships between variables &objective measurement. Total of 134 respondents, comprising professionals from the various sectors such as IT, Finance& Logistics sectors, participated in the study. Purposive sampling technique was applied to select individuals those have relevant exposure to blockchain technologies within their business functions. The data was collected by using a structured questionnaire based on a 5-point Likert scale, which is designed to capture perceptions related to blockchain adoption (BA), operational efficiency (OE), transparency as well as customer trust (CT). To ensure accurate analysis, SPSS was used for data preprocessing alogwith Exploratory Factor Analysis (EFA), while AMOS was also employed for Structural Equation Modeling (SEM). Additionally, statistical tests included the KMO test, Bartlett’s Test of Sphericity& Mediation Analysis to gain the understanding about indirect effects of operational efficiency on trust. Such methodological framework enabled the validation of both the measurement and structural models of the study Tables 1-8; Figures 1-2.

| Table 1 Respondent_Wise Demographics | |||

| Attribute (s) | Category_Wise | Frequency (F) | % |

| Gender_Wise | Male | 78 | 58.21% |

| Female | 56 | 41.80% | |

| Age Group_Wise | 21 to 30 | 45 | 33.60% |

| 31 to 40 | 58 | 43.31% | |

| 41& above | 31 | 23.12% | |

| Industry_Wise | IT Sector | 36 | 26.90% |

| Finance Sector | 42 | 31.33% | |

| Logistics Sector | 30 | 22.4% | |

| Retail Sector | 26 | 19.41% | |

| Table 2 KMO and Bartlett’s Test | |

| Measure | Value |

| KMO Measure of Sampling Adequacy | 0.8132 |

| Bartlett's Test of Sphericity | χ2 = 478.650, df = 66, p < 0.001 |

| Table 3 Factor Solution Based on Scree Plot | |||

| Factor | Label | Eigenvalue | Interpretation |

| Factor-1 (F1) | Transparency | 3.80 | High impact on traceability, openness&auditability |

| Factor-2 (F2) | Operational Efficiency (OE) | 2.90 | Strong Impact on automation, speed&cost reduction |

| Factor-3 (F3) | Customer Trust (CT) | 2.31 | Highlighting perception of confidence, security, &reliability |

| Table 4 SEM Path Analysis | ||

| (Displayed above- Three major paths tested using AMOS) | ||

| Pathway | Standardized (β) | P_value |

| Blockchain → Operational Efficiency (OE) | 0.633 | 0.0000 |

| Operational Efficiency (OE) → Customer Trust (CT) | 0.590 | 0.0000 |

| Blockchain → Customer Trust (Direct) | 0.280 | 0.0050 |

| Table 5 SEM Result (Hypothesis Testing) | ||||

| Pathway | Standardized (β) | P_value | Status | Hypothesis Result |

| Blockchain Adoption (BA) → Operational Efficiency (OE) | 0.633 | 0.0000 | Strong Positive Impact | H01 (Accepted) |

| Table 6 Direct and Mediated Effect (Hypothesis Testing) | ||||

| Pathway | Effect- Type | Coefficient / Effect | P_value / CI | Hypothesis Result |

| Blockchain Adoption (BA)→ Customer Trust (CT) | Direct Effect | β = 0.280 | p = 0.0050 | H02 (Accepted) |

| Blockchain → Efficiency → Trust | ||||

| Table 7 Mediation Analysis | |||

| Path | Indirect Effect | 95% CI | Significance Level |

| Blockchain → Efficiency → Trust | 0.3710 | [0.2680, 0.4930] | Significant |

| Operational efficiency (OE) acts as a partial mediator, confirming H03. | |||

| Table 8 Model Fit Indices | |||

| Fit Measure | Value | Threshold | Interpretation |

| CFI | 0.9650 | >0.900 | Excellent Fit |

| GFI | 0.9231 | >0.900 | Good Fit |

| RMSEA | 0.0540 | <0.080 | Acceptable |

| TLI | 0.9540 | >0.900 | Good Fit |

Research Objectives

1. To find the major business blockchain technology applications.

2. To examine the causal influence of blockchain on operational efficiency (OE)& customer trust (CT).

3. To validate a structural model enabling direct &indirect effects using SEM.

Research Hypothesis

H01: Blockchain adoption (BA) significantly improves operational efficiency (OE).

H02: Blockchain adoption (BA) positively impacts customer trust (CT).

H03: Operational efficiency (OE) mediates the relationship between blockchain adoption (BA)& customer trust (CT).

Research Analysis and Interpretation

Findings & Recommendations

1. Blockchain applications (BA) are most commonly deployed in areas such as supply chain transparency, fraud prevention, and smart contracts, indicating their practical value in operational and compliance-sensitive processes.

2. Operational efficiency (OE) emerged as the strongest mediator, revealing that blockchain’s effectiveness is maximized when it streamlines internal workflows, reduces costs& enhances automation.

3. Exploratory Factor Analysis (EFA) confirms a three-factor structure comprising Transparency, Operational Efficiency, and Customer Trust, each representing a significant aspect of blockchain’s influence on business.

4. Structural Equation Modeling (SEM) analysis validates that blockchain adoption (BA) has both direct and indirect effects on customer trust (CT), reinforcing the technology’s strategic role in enhancing credibility and security.

5. All constructs demonstrated high reliability, with Composite Reliability (CR > 0.87) and Average Variance Extracted (AVE > 0.69), ensuring measurement robustness and construct validity.

6. Regulatory bodies must establish clear legal frameworks and governance standards to bolster business confidence, ensure data protection, and enhance consumer trust (CT) in blockchain applications.

7. Technology developers should invest in cross-chain interoperability, enabling seamless integration between different blockchain networks to maximize scalability and adoption across industries.

8. Organizations must align blockchain initiatives with strategic business goals, ensuring technology is deployed not just for innovation, but for measurable performance improvement.

9. Training and upskilling programs are necessary for both technical teams and executives, bridging the knowledge gap and promoting a blockchain-ready workforce.

10. Future innovation should focus on combining blockchain with AI, IoT, and cloud technologies, creating integrated smart ecosystems that can automate decision-making and optimize end-to-end operations.

Conclusion

This research highlights that blockchain is not just a technological innovation but a powerful transformational mechanism re-shaping the modern business environment. Its influence goes beyond secure data management, extending into basic areas of operational workflows, transparency& customer trust (CT). Through robust analysis, this research has demonstrated that blockchain significantly enhances operational efficiency (OE)&fosters deeper customer trust (CT)—both directly & indirectly.One of the major understandings emerging from this study is the mediating role of operational efficiency (OE). The findings exposed that while blockchain independently boosts customer trust (CT) through it’s enhanced data security & transparency, its influence is more pronounced when operational gains are realized. This partial based mediation effect implies that blockchain does not just impact outcomes by being present; rather, its integration into business processes leads to improved workflows, reduction of redundancies&faster, more secure transactions, which collectively enhance customer perceptions & confidence.

Moreover, the use of Structural Equation Modeling (SEM) confirmed the strength and reliability of the tested pathways, supporting the hypothesis that operational efficiency acts as a conduit for blockchain's trust-enhancing potential. Businesses across industries such as finance, IT, and logistics can leverage these insights to develop strategic roadmaps for blockchain adoption (BA), focusing on areas that maximize both process gains and customer-centric outcomes.From a theoretical standpoint, this study contributes to the growing literature on blockchain by validating it as both a technological and managerial innovation. The empirical evidence strengthens the argument that blockchain should be evaluated not only in terms of its technical attributes but also for its organizational impact and strategic value.Practically, organizations aiming for digital transformation can consider blockchain as a high-impact enabler for automation, compliance, and customer satisfaction. However, successful implementation depends on readiness in infrastructure, training, and regulatory alignment. Therefore, a phased and well-integrated blockchain strategy is crucial for sustained impact.In conclusion, blockchain represents more than a shift in how information is stored—it redefines trust, efficiency, and the architecture of modern business. As industries navigate increasing complexity and digital disruption, the strategic deployment of blockchain could become the key differentiator between adaptive growth and operational stagnation.

Limitations and Future Research Scope

Despite its valuable contributions, this study is not without limitations. First, the cross-sectional nature of the research design restricts the ability to establish causality or observe the evolution of blockchain impacts over time. Longitudinal studies are recommended to track the sustained effectiveness and maturity of blockchain implementation in business environments. Secondly, the study focused on broad business sectors such as IT, finance, logistics, and retail. However, sector-specific implications, particularly in highly sensitive or regulated industries like healthcare, energy, and public administration, were not explored. Future research should expand into these domains to understand how blockchain operates in varied compliance and risk landscapes. Additionally, this research addressed blockchain in isolation. With the rising convergence of blockchain, artificial intelligence (AI), and the Internet of Things (IoT), future studies should investigate integrated digital ecosystems. This would help in assessing the compounded business value generated by combining these emerging technologies. Overall, future research should adopt a more diversified, longitudinal, and interdisciplinary approach to deepen understanding and extend the generalizability of blockchain's business impact.

References

Bai, C. A., Cordeiro, J., & Sarkis, J. (2020). Blockchain technology: Business, strategy, the environment, and sustainability. Business Strategy and the Environment, 29(1), 321-322.

Clohessy, T., Acton, T., & Rogers, N. (2018). Blockchain adoption: Technological, organisational and environmental considerations. In Business Transformation through Blockchain: Volume I (pp. 47-76). Cham: Springer International Publishing.

Ertemel, A. V. (2018). Implications of blockchain technology on marketing. Journal of international trade, logistics and law, 4(2), 35-44.

Karnaushenko, A., Tanklevska, N., Povod, Т., Kononenko, L., & Savchenko, V. (2023). Implementation of blockchain technology in agriculture: fashionable trends or requirements of the modern economy. Agricultural and Resource Economics: International Scientific E-Journal, 9(3), 124-149.

Kizildag, M., Dogru, T., Zhang, T., Mody, M. A., Altin, M., Ozturk, A. B., & Ozdemir, O. (2020). Blockchain: a paradigm shift in business practices. International Journal of Contemporary Hospitality Management, 32(3), 953-975.

Indexed at, Google Scholar, Cross Ref

Mishra, R., Singh, R. K., Kumar, S., Mangla, S. K., & Kumar, V. (2025). Critical success factors of Blockchain technology adoption for sustainable and resilient operations in the banking industry during an uncertain business environment. Electronic Commerce Research, 25(1), 595-629.

Indexed at, Google Scholar, Cross Ref

Naikwadi, B. H., Kharade, K. G., Yuvaraj, S., & Vengatesan, K. (2021). A systematic review of blockchain technology and its applications. Recent Trends in Intensive Computing, 467-473.

Pan, X., Pan, X., Song, M., Ai, B., & Ming, Y. (2020). Blockchain technology and enterprise operational capabilities: An empirical test. International Journal of Information Management, 52, 101946.

Indexed at, Google ScholarCross Ref

Pashkevych, M., Bondarenko, L., Makurin, A., Saukh, I., & Toporkova, O. (2020). Blockchain technology as an organization of accounting and management in a modern enterprise. International Journal of Management (IJM), 11(6), 2020.

Pal, A., Tiwari, C. K., & Haldar, N. (2021). Blockchain for business management: Applications, challenges and potentials. The Journal of High Technology Management Research, 32(2), 100414.

Indexed at, Google Scholar, Cross Ref

Prasannan, S., Parmar, R., & Anand, O. (2025). Research on Blockchain Technology and its Potential Impact on Banking. Kaav International Journal of Law, Finance & Industrial Relations, 12(01), 1-10.

Sahu, J. K. (2023). The Development of Digital Payment Solutions: Impact on Financial Inclusion and Approaches to Risk Management. Ational Journal of Arts, Commerce & Scientific Research Review, 10(2), 8-14.

Sood, K., Grima, S., Sharma, G., & Balusamy, B. (Eds.). (2024). The application of emerging technology and blockchain in the insurance industry. CRC Press.

Siddique, F., & Sodani, P. (2023). Blockchain Technology: Opportunities In Healthcare (1st ed., pp. 9-13). Kaav Publications.

Tariq, M. U. (2024). Application of blockchain and Internet of Things (IoT) in modern business. In Future of customer engagement through marketing intelligence (pp. 66-94). IGI Global Scientific Publishing.

Viriyasitavat, W., Da Xu, L., Bi, Z., & Pungpapong, V. (2019). Blockchain and internet of things for modern business process in digital economy—the state of the art. IEEE transactions on computational social systems, 6(6), 1420-1432.

Viriyasitavat, W., & Hoonsopon, D. (2019). Blockchain characteristics and consensus in modern business processes. Journal of Industrial Information Integration, 13, 32-39.

Woodside, J. M., Augustine Jr, F. K., & Giberson, W. (2017). Blockchain technology adoption status and strategies. Journal of International Technology and Information Management, 26(2), 65-93.

Indexed at, Google Scholar, Cross Ref

Zinaida, S., Igor, F., Nelia, C., Roman, C., Oleksii, K., & Oleksandr, T. (2022). Blockchain technologies in the conditions of digitalization of international business. In International Conference on Business and Technology (pp. 796-804). Cham: Springer International Publishing.

Received: 19-Jul-2025, Manuscript No. AMSJ-25-16092; Editor assigned: 20-Jul-2025, PreQC No. AMSJ-25-16092(PQ); Reviewed: 10- Aug-2025, QC No. AMSJ-25-16092; Revised: 15-Aug-2025, Manuscript No. AMSJ-25-16092(R); Published: 21-Aug-2025