Review Article: 2024 Vol: 28 Issue: 1

Assessment of Customer Adoption of Digital Payment Using UTAUT Model

Mohammad Wasiq, Saudi Electronic University, Riyadh

Citation Information: Wasiq, M. (2024). Assessment of customer adoption of digital payment using utaut model. Academy of Marketing Studies Journal, 28(1), 1-15.

Abstract

This research aims to assess the impact of consumer perception, Satisfaction, and their Environmental Economic concern on adoption of digital payment in India and also assessed their relationships with several observed variables and In order to examine consumer behaviour in the context of digital payment technology, this research use the integrated UTAUT model, which takes into account factors like ease of use, trust, security, self-efficacy, etc. The paper demonstrates why the suggested model is Useful for analyzing consumer behaviour in India. Several factors in the research had a great deal of sway, including a sense of safety, and confidence Satisfaction and adoption of digital payment among North Indian consumers. The study's findings and recommended methodology have important implications for future research and practice using digital payment. Several standardized measures were included in this investigation. The data was analyzed using a variety of statistical methods, including Structural equation modeling and regression, in addition to more basic descriptive statistics. Perception, environmental economic impact and satisfaction data were gathered using three distinct questionnaires. This paper also identifies one more crucial factor i.e., “environmental economic concern of digital payment” which is not discussed extensively in the literature, this study primary keeping mobile wallet in the consider among multiple sources of digital payment. Overall, these results suggest that Perception is the most important predictor of Adoption, followed by Satisfaction and Environmental Economic Impact.

Keywords

Digital Payment, Consumer perception, Consumer satisfaction, Environmental Economic Impact, SEM Model, UTAUT Model.

Introduction

We may conduct transactions for products and services using a mobile device, such as a cell phone, smartphone, etc., thanks to mobile payments. We may benefit from these wireless communication technologies in a number of ways, including payments, tickets, and electronically paying fees and price. One of the mobile payment methods that may be utilised for a variety of financial transactions is the mobile wallet. Mobile payment services provide consumers a variety of options and a range of technological advances for improved convenience (Price and Pilorge, 2009). Mobile apps provide a platform to address a broader demographic in developing countries that has no bank account but a mobile phone (Cox, 2013). The customer profile in India has seen a considerable transformation. They are more drawn to technology, better connected, and make the most of the resources at their disposal. Nearly 94% of Indians use their mobile phones for both personal and business purposes. India now has about 150 million mobile phone users, and over the next five years, that number is predicted to increase by almost 3.5 times. Additionally, data indicates that between 2015 and 2019 the Indian mobile wallet industry would rise by 30% (Bureau, 2016).

Young Indians are more drawn to new mobile technologies like mobile wallets, etc. since they love using them and use them for all of their financial requirements (Varghese, 2012). Due to its accessibility and convenience, mobile payment systems have seen substantial growth in India during the last several years. There haven't been many research done to examine the extent of mobile payment services in India and determine what influences how customers see and utilise this new technology (Gupta and Tahilyani, 2013; Dasgupta et al., 2011). Additionally, there is relatively little study on North Indian customers that takes into account different user characteristics including environmental economic impact. Due to the inclusion of previously unresearched factors, our study is special. The research also establishes the link between customers in North India's perception, environmental economic impact concern and satisfaction regarding the usage of digital payments. Consumers in North India were the subject of a poll to find out how they felt about mobile wallets. North India is a diverse nation that exhibits the traditions of many different lands and is based in Indo-Aryan culture. It has a lower literacy rate than southern India. Consumers in North India are wealthy and are affected by internet services and digital advancements (Bhasker, 2016).

Over the last several years, customers in North India have seen a significant shift in their lives and habits; nowadays, they prefer to shop, pay for things, and do other kinds of business online. As a consequence, mobile wallets are becoming more and more popular in this region's tier 2 and tier 3 cities, including Delhi and Noida in North India. People in urban areas have begun utilising online payment programmes like mobile 945 thanks to enhanced security measures and user-friendly software. M-wallets are popular among and satisfy their users. One of the largest regions in North India, Delhi/NCR, has a sizable proportion of young people who are proficient in technology. Data indicated that these customers preferred wallets and online banking over cash transactions for shopping, movie tickets, and other transactions (Bhasker, 2016). The opportunity to assess customers' perceptions and the adoption rate of mobile wallets was provided by the rising relevance of mobile wallets in North India. Researcher conducted a poll of North Indian customers to gauge their acceptability of this trend (Sankaran, 2016). In order to investigate numerous aspects impacting customer satisfaction in North India, the current research creates a conceptual model. It analyses consumer intention using the integrated UTAUT model (Shin, 2009) and a further variable (environmental economic impact). It seeks to ascertain the connection between customer perception, environmental economic impact and satisfaction.

This study has been designed in a way, where An overview of the literature on mobile wallets and digital payment have been given in first section of the study after introduction. A conceptual model and intriguing hypotheses are described in after literature part. A research design is explained in next Section followed by Data analysis and hypothesis testing. Results and conclusions are covered in second last Section. Finally, last Section offers a few consequences for professionals and academics, a few constraints, and room for more investigation.

Literature Review

Digital Payment in India

A significant body of research has examined the impact of perception and satisfaction on the adoption of digital payments in India. This research has provided insights into the factors that influence individuals' willingness to adopt digital payment systems.

One study found that individuals' perceptions of the usefulness, satisfaction, ease of use, and perceived risk of digital payment systems significantly influenced their adoption intentions (Sahu, Mishra, & Kumar, 2020). The study suggested that service providers should focus on improving the usability and safety of their digital payment systems to encourage adoption.

Another study found that individuals' satisfaction with digital payment systems was a critical factor in their continued use of these systems (Gupta & Sharma, 2018). The study suggested that service providers should focus on providing high-quality services and addressing customer complaints to increase satisfaction levels and encourage continued usage.

Furthermore, research has shown that individuals' trust and perception in digital payment systems is also a crucial factor in adoption (Bhatia, 2019). The study suggested that service providers should focus on building trust with customers by improving security measures and providing clear information about the safety of their systems.

In conclusion, research has demonstrated the importance of perceptions, satisfaction, and trust in the adoption of digital payment systems in India. Service providers should focus on improving the usability and safety of their systems, providing high-quality services, and building trust with customers to encourage adoption and continued use.

Mobile Wallets in India

Mobile wallet technology is a relatively new innovation in today's society; it may be conceptualized as a digital wallet that facilitates instantaneous payments and currency swaps through a mobile device. This state-of-the-art infrastructure facilitates the expansion of both traditional financial institutions and non-traditional enterprises by providing clients with access to new types of financial services. The use of mobile payment systems is having a significant effect in low-income countries. Since the proliferation of smartphones in India, M-wallet applications have become more widely available. The government of India has developed a wide variety of partnership models with IT companies, banks, and retailers in an effort to increase M-wallet adoption and use among the country's consumers. A wide variety of partnerships are represented in the cyclical structure. Examples of such partnerships include the 2009 agreement between Tata Teleservices and ICICI Bank to provide mobile payment services, the 2010 partnership between payment service provider Obopay India and YES Bank to conduct mobile money business, and the 2007 partnership between Bharti Airtel and Western Union to provide mobile money services (Price and Pilorge, 2009). Banks and telecom companies in India may collaborate to provide mobile money services and increase mobile wallet use with the advent of third-generation and fourth-generation mobile network technologies. Mobile wallets are rapidly growing in popularity in developing countries like India since they are widely accepted by consumers. For people who don't have smartphones or who reside in rural areas, new collaborations between banks and other solution providers, enhanced networks, infrastructure support, and mobile capabilities will make it simpler to utilise mobile-based financial services.

In M-wallets, customers may save sensitive information such as bank account details, purchase histories, payment information, and more. Mobile wallets facilitate the use of debit and credit cards for a wide range of transactions, including purchases, discounts, movie ticket reservations, and money transfers. These services represent an emerging market trend that will benefit businesses across several industries, including IT, telecom, and finance. Mobile wallets have been more popular among consumers, who utilise them for a wide variety of purposes including monetary transfers, various bill/card payments, stored money services, shopping, taking advantage of discounts, and more. Through the use of a mobile wallet, customers get easier and faster access to a wide range of services (Rowland and Shrauger, 2013).

In terms of mobile consumers, India is one of the largest markets (Rowland and Shrauger, 2013). Even though there are more than 400 million mobile phone customers, barely 4% to 5% of Indians use their phones for financial transactions, and only 10% actively utilise mobile money services. Service providers need to be aware of the significance of each of these issues as well as the needs of tech-savvy customers who need flexibility from new technologies (Varghese, 2012). These topics will be addressed in this research, along with the significance of other behavioural aspects including attitude, security, and trust, as well as the connection between consumer perception and satisfaction levels in North India.

Consumer Perception, Preference and Satisfaction

Rust and Oliver (1994) were interested in gauging how satisfied customers were with new technologies. They noted that product quality and convenience determine consumers' perceptions, which in turn affect consumers' satisfaction levels and preferences. Numerous studies have been conducted to gauge how customers feel about and react to new technologies based on factors such its adaptability, usefulness, simplicity of use, joys, social impact, convenience, and advantages (Dabholkar and Bagozzi, 2002), but more in-depth study of Indian customers is still required to determine the factors that affect how they view innovative technologies like mobile wallets. As an added complication, North Indian consumers' needs and perspectives have received comparatively less attention in the study. Previous research has attempted to establish a connection between customers' perceptions and satisfaction with new technologies (Rust and Kannan, 2003).

In order to assess the customers' opinions on the use of internet banking, Mansumitrchai (2011) conducted a poll of Indian consumers. Security, trust, and privacy concerns were identified to be the most important aspects by Vinayagamoorthy and Sankar (2012) since Indian customers are still unaware of the significance and effects of these variables while adopting new technology. Similar findings were made by Amin (2009) for Malaysian customers, who discovered that security and social identity are the main determining factors. In their 2013 study of online health services, Sun et al. (2013) identified trust as the most important factor. Numerous research supported the correlation between customers' perceptions of new technologies and their contentment with such technologies (Agus et al., 2007; Yang and Lee, 2010). These investigations indicated that the factors most impacting the adoption and use of technology are simplicity, security, trust, and effectiveness. Low ratings of these factors might result in low preferences and low levels of adoption satisfaction for any new mobile technology (Suls and Wallston, 2008). This suggests that perception affects a person's choice for and usage of a technology. Our research intends to ascertain the connection of specified factors on the use and preference of mobile wallets in North India as an expansion of the current literature for Indian customers.

Indian customers were polled by Thakur (2013) and Singh (2014), who discovered a significant relationship between the key variables and satisfaction levels. Their analysis was based on the TAM, and aspects like user-friendliness, convenience, social impact, security, etc. were taken into account. Our research draws on the literature, but it is special in that it explores consumers' perceptions of mobile wallets as well as the reasons why they favour or utilise them. We focused on the demands of North Indian customers to ascertain the relationship between their perception—which included seven variables—and how it affects satisfaction. Mobile technology is regarded as secure and efficient. If it is simple to use and meets their demands, Indian shoppers prefer making their purchases online or by mobile (Kumar and Seri, 2014). If customers are happy with the services and think a new technology is useful and effective, they will prefer it and spread the advantages to their friends and the wider community (Light, 2013). Dahlberg et al. (2008) showed a high correlation between customer satisfaction and preferences and also identified a few favoured transactions of consumers including bill payment, cash transfer, and shopping that are done using the electronic mobile payment system. Dahlberg et al. (2008) also said that people only utilise new technologies frequently if they can profit from them, get something from using them, and have their requirements met. In their research, Karnouskos and Fokus (2004) also covered certain aspects of the mobile money system that customers appreciate and find to be very satisfying.

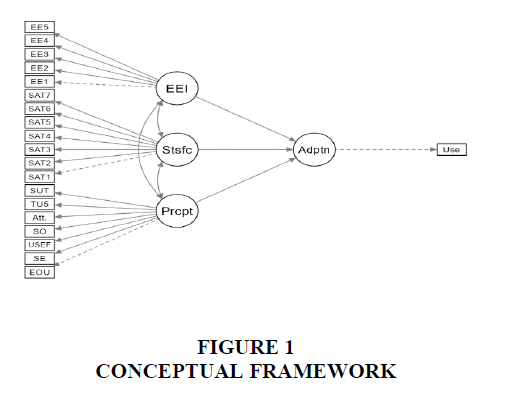

The Model

The example in order to pinpoint the behavioural elements influencing the adoption of any new technology, Davis et al. (1989) created the TAM model. This model, which explains consumers' intentions to use and the adoption process of any technology, was developed with two crucial dimensions: ease of use and utility. TAM is regarded as the most useful approach to assess variables influencing the acceptance and use of any new technology. These factors have been used in a number of research, but it has been determined (Li et al., 2014) that they are insufficient to understand how customers would react to new technologies. This methodology does not examine customer trust and security issues, which are dependent on how they are perceived (Shaw, 2014). The societal elements that affect the acceptance of new technologies were not included in this model. The TAM is not seen as a useful tool when discussing mobile wallet especially. In order to analyses consumer behaviour regarding the use of mobile wallets, Shin (2009) suggested an integrated UTAUT model, which is seen as an extension of the TAM model. Several other factors were incorporated in this model, including social norms, trust, self-efficacy, attitude, security, etc. We discovered that Shin's (2009) integrated UTAUT model was suitable for examining North Indian customers' perceptions of mobile wallets. The view of North Indian customers is radically altering as a result of M-wallets. North Indian consumers are often stylish and appreciate using new technologies. Originally thought of as a payment tool, customers are increasingly adopting it as a tool for engagement by connecting all of their financial activities to it. The poll revealed that North Indians love using mobile wallet and are constantly eager to explore new things. We have determined that this calls for the addition of one additional variable, environment concern. In order to understand consumer preferences in North India, it is proposed in this research to look at a number of variables that have contributed to the adoption of mobile wallets in India. This research adds to the body of knowledge by identifying a number of variables that affect customers' opinions about and happiness with North India. Karnouskos and Fokus (2004) mentioned, mobile money services are often more affordable for customers, owing to privacy and trust concerns, relatively few people actually utilise them. There is a tone of information systems research accessible to comprehend these elements, which may aid business and researchers in improving mobile wallet services for its customers. Based on the material that is currently accessible and taking into account North Indian customers, we provide the following conceptual framework, hypotheses and objectives Figure 1:

Research Hypotheses

H1. There is a significant and a positive impact of consumers’ perception on adoption of digital payment.

H2. There is a significant and a positive impact of consumers’ satisfaction on adoption of digital payment.

H3. There is a significant and a positive impact of environmental economic concern on adoption of digital payment.

Objectives of the Study

The primary objective of this study is to assess the significant and a positive impact of consumers’ perception, consumers’ satisfaction and environmental economic concern on adoption of digital payment in India.

Research design

In this study, researcher has used structural equation modeling (SEM) analysis. The model includes four latent variables (Perception, Satisfaction, Environmental Economic Impact, and Adoption) and their relationships with several observed variables. The model uses maximum likelihood estimation (ML) and non-linear optimization (NLMINB) methods to estimate the 65 free parameters. The analysis was performed on 400 Consumers in North India manually and online for the final survey data. The data was collected between February 2022 to September 2022 particularly in Delhi NCR Region, where most of the respondent having higher volume using the digital payment services.

Result and Analysis

Structural Equation Models

Table 1 Based on the information provided, this appears to be a structural equation modeling (SEM) analysis. The model includes four latent variables (Perception, Satisfaction, Environmental Economic Impact, and Adoption) and their relationships with several observed variables. The model uses maximum likelihood estimation (ML) and non-linear optimization (NLMINB) methods to estimate the 65 free parameters. The analysis was performed on 400 observations and the model converged after 72 iterations. The standard errors are reported as "standard" and there is no mention of a scaled test. The model indicates that Adoption is predicted by Perception, Satisfaction, and Environmental Economic Impact.

| Table 1 Models Info |

|

|---|---|

| Estimation Method | ML |

| Optimization Method | NLMINB |

| Number Of Observations | 400 |

| Free Parameters | 65 |

| Standard Errors | Standard |

| Scaled Test | None |

| Converged | TRUE |

| Iterations | 72 |

| Model | Perception=~Ease of Use + Self Efficacy + Usefulness + Social Perception + Attitude + Trust + Security |

| Satisfaction=~Sat1+Sat2+Sat3+Sat4+Sat5+Sat6+Sat7 | |

| Environmental Economic Impact =~Ee1+Ee2+Ee3+Ee4+Ee5 | |

| Adoption=~Use | |

| Adoption~ Perception+ Satisfaction+ Environmental Economic Impact | |

Overall Tests

The model tests Table 2 show that the User Model has a chi-square value of 1885 with 165 degrees of freedom and a p-value of less than .001, indicating that the model fits the data well. The Baseline Model, which is a comparison model that assumes no relationships between the variables, has a chi-square value of 4504 with 190 degrees of freedom and a p-value of less than .001, indicating a poor fit to the data. These results suggest that the User Model provides a better fit to the data than the Baseline Model.

| Table 2 Model Tests |

|||

|---|---|---|---|

| Label | X2 | Df | P |

| User Model | 1885 | 165 | < .001 |

| Baseline Model | 4504 | 190 | < .001 |

In Table 3 it is seen that SRMR value is 0.110, which suggests a good fit, as values below 0.08 are generally considered acceptable. The RMSEA value is 0.161, which is somewhat high and suggests a mediocre fit. However, the associated 95% confidence intervals (0.155 - 0.168) do not include 0.10, which is often used as a threshold for acceptable fit, indicating that the model fit may still be adequate. The p-value for RMSEA is less than .001, which also supports the conclusion that the fit of the model is statistically significant. It is worth noting that the fit indices should be considered in conjunction with other measures of model fit and the theoretical background of the model Table 4.

| Table 3 Fit Indices |

||||

|---|---|---|---|---|

| 95% Confidence Intervals | ||||

| Srmr | Rmsea | Lower | Upper | Rmsea P |

| 0.11 | 0.161 | 0.155 | 0.168 | <.001 |

| Table 4 User Model Versus Baseline Model |

|

|---|---|

| Model | |

| Comparative Fit Index (Cfi) | 0.601 |

| Tucker-Lewis Index (Tli) | 0.541 |

| Bentler-Bonett Non-Normed Fit Index (Nnfi) | 0.541 |

| Bentler-Bonett Normed Fit Index (Nfi) | 0.581 |

| Parsimony Normed Fit Index (Pnfi) | 0.505 |

| Bollen's Relative Fit Index (Rfi) | 0.518 |

| Bollen's Incremental Fit Index (Ifi) | 0.604 |

| Relative Noncentrality Index (Rni) | 0.601 |

The model comparison indices provided suggest that the User Model has a poorer fit than the Baseline Model. CFI is 0.601, which is below the threshold of 0.90 that is often used to indicate acceptable model fit while TLI and NNFI are both 0.541, which suggests a relatively poor fit. The NFI is 0.581, which is somewhat higher but still below the acceptable threshold. PNFI is 0.505, which is very low and suggests that the User Model is too complex for the amount of data available.

Overall, these indices suggest that the User Model does not have a better fit than the Baseline Model. However, it is important to consider other measures of fit as well as the theoretical basis for the model when interpreting these results Table 5.

| Table 5 Parameters Estimates |

||||||||

|---|---|---|---|---|---|---|---|---|

| 95% Confidence Intervals | ||||||||

| Dep | Pred | Estimate | Se | Lower | Upper | Β | Z | P |

| Adoption | Perception | 0.962 | 0.198 | 0.573 | 1.351 | 0.37 | 4.85 | < .001 |

| Adoption | Satisfaction | 0.273 | 0.226 | -0.171 | 0.7168 | 0.15 | 1.21 | 0.228 |

| Adoption | Environmental Economic Impact | -0.374 | 0.179 | -0.726 | -0.0232 | -0.247 | -2.09 | 0.037 |

The parameter estimates provided are for the relationships between the latent variables in the User Model. The estimates are presented as regression coefficients (Beta) with associated standard errors (SE), 95% confidence intervals, and p-values. The estimates suggest that Perception is the strongest predictor of Adoption, with a Beta of 0.962 and a p-value of less than .001. This indicates that higher levels of Perception are associated with higher levels of Adoption.

Satisfaction is also positively related to Adoption, with a Beta of 0.273, but the p-value is not statistically significant (p = 0.228). This suggests that Satisfaction may have a weaker effect on Adoption than Perception.

Environmental Economic Impact is negatively related to Adoption, with a Beta of -0.374 and a p-value of 0.037. This indicates that higher levels of Environmental Economic concern are associated with lower levels of Adoption.

Overall, these results suggest that Perception is the most important predictor of Adoption, followed by Satisfaction and Environmental Economic Impact. However, it is important to consider the theoretical basis for the model and other measures of fit when interpreting these results Table 6.

| Table 6 Measurement Model |

||||||||

|---|---|---|---|---|---|---|---|---|

| 95% Confidence Intervals | ||||||||

| Latent | Observed | Estimate | Se | Lower | Upper | Β | Z | P |

| Perception | Ease Of Use | 1 | 0 | 1 | 1 | 0.5054 | ||

| 0.7975 | 0.0958 | 0.61 | 0.985 | 0.5518 | 8.328 | < .001 | ||

| Usefulness | 0.958 | 0.1205 | 0.722 | 1.194 | 0.5133 | 7.95 | < .001 | |

| Social Perception | 1.2099 | 0.1268 | 0.961 | 1.458 | 0.7015 | 9.544 | < .001 | |

| Attitude | 1.2955 | 0.1405 | 1.02 | 1.571 | 0.6572 | 9.223 | < .001 | |

| Trust | 1.3808 | 0.1352 | 1.116 | 1.646 | 0.8116 | 10.216 | < .001 | |

| Security | 1.0502 | 0.0989 | 0.856 | 1.244 | 0.9038 | 10.615 | < .001 | |

| Satisfaction | Sat1 | 1 | 0 | 1 | 1 | 0.5706 | ||

| Sat2 | 0.3632 | 0.0548 | 0.256 | 0.471 | 0.3897 | 6.627 | < .001 | |

| Sat3 | 1.0747 | 0.1063 | 0.866 | 1.283 | 0.6843 | 10.109 | < .001 | |

| Sat4 | 1.0282 | 0.1077 | 0.817 | 1.239 | 0.6262 | 9.544 | < .001 | |

| Sat5 | 1.2543 | 0.1222 | 1.015 | 1.494 | 0.7011 | 10.261 | < .001 | |

| Sat6 | 0.6724 | 0.0783 | 0.519 | 0.826 | 0.5391 | 8.583 | < .001 | |

| Sat7 | 0.697 | 0.0708 | 0.558 | 0.836 | 0.6562 | 9.843 | < .001 | |

| Environmental Economic Impact | Ee1 | 1 | 0 | 1 | 1 | 0.6827 | ||

| Ee2 | 1.0359 | 0.0806 | 0.878 | 1.194 | 0.762 | 12.845 | < .001 | |

| Ee3 | 0.9652 | 0.0749 | 0.818 | 1.112 | 0.7657 | 12.891 | < .001 | |

| Ee4 | 0.6697 | 0.0634 | 0.545 | 0.794 | 0.6032 | 10.556 | < .001 | |

| Ee5 | 0.0179 | 0.0864 | -0.152 | 0.187 | 0.0112 | 0.207 | 0.836 | |

| Adoption | Use | 1 | 0 | 1 | 1 | 1 | ||

The model includes several latent constructs (Perception, Satisfaction, Environmental Economic Impact, and Adoption) and their corresponding observed variables (Ease of Use, Usefulness, Social Perception, Attitude, Trust, Security, and several Satisfaction and Environmental Economic Impact variables). For each observed variable, the table presents estimates of the corresponding factor loading (Estimate), which shows the relationship between the latent construct and the observed variable, with higher values indicating a stronger relationship. The table 6 also includes standardized regression coefficients (Β), which represent the change in standard deviations of the latent construct for a one-standard-deviation increase in the observed variable. For some variables, the table includes the corresponding t-statistic (Z) and p-value (P) for the factor loading estimate. These statistics can be used to test the null hypothesis that the true factor loading is zero (i.e., there is no relationship between the latent construct and the observed variable). A small p-value (typically less than 0.05) would suggest rejecting this null hypothesis and concluding that there is evidence of a significant relationship between the latent construct and the observed variable.

Overall, the table provides information about the strength and significance of the relationships between the latent constructs and their observed variables in the measurement model.

Table 7 is of estimates, standard errors, confidence intervals, and significance tests for various variables, including ease of use, self-efficacy, usefulness, social perception, attitude, trust, security, satisfaction, and adoption, among others. For each variable, the table provides an estimate of the effect size, the standard error of the estimate, the lower and upper bounds of the 95% confidence interval, the t-statistic, and the p-value.

| Table 7 Variances And Covariances |

||||||||

|---|---|---|---|---|---|---|---|---|

| 95% Confidence Intervals | ||||||||

| Variable 1 | Variable 2 | Estimate | Se | Lower | Upper | Β | Z | P |

| Ease Of Use | Ease Of Use | 0.2866 | 0.021 | 0.2454 | 0.3278 | 0.744 | 13.65 | < .001 |

| Self-Efficacy | Self-Efficacy | 0.1428 | 0.01057 | 0.122 | 0.1635 | 0.695 | 13.5 | < .001 |

| Usefulness | Usefulness | 0.2521 | 0.0185 | 0.2158 | 0.2883 | 0.736 | 13.62 | < .001 |

| Social Perception | Social Perception | 0.1484 | 0.01169 | 0.1255 | 0.1713 | 0.507 | 12.7 | < .001 |

| Attitude | Attitude | 0.2172 | 0.01667 | 0.1845 | 0.2499 | 0.568 | 13.03 | < .001 |

| Trust | Trust | 0.0975 | 0.00872 | 0.0804 | 0.1146 | 0.342 | 11.17 | < .001 |

| Security | Security | 0.0244 | 0.00322 | 0.0181 | 0.0307 | 0.184 | 7.57 | < .001 |

| Perception | Perception | 0.4123 | 0.03189 | 0.3498 | 0.4748 | 0.669 | 12.93 | < .001 |

| Sat2 | Sat2 | 0.1476 | 0.01077 | 0.1264 | 0.1687 | 0.847 | 13.7 | < .001 |

| Sat3 | Sat3 | 0.2583 | 0.02175 | 0.2157 | 0.301 | 0.522 | 11.88 | < .001 |

| Sat4 | Sat4 | 0.3325 | 0.02639 | 0.2808 | 0.3842 | 0.615 | 12.6 | < .001 |

| Sat5 | Sat5 | 0.3285 | 0.02789 | 0.2738 | 0.3832 | 0.512 | 11.78 | < .001 |

| Sat6 | Sat6 | 0.2231 | 0.01694 | 0.1899 | 0.2563 | 0.715 | 13.16 | < .001 |

| Sat7 | Sat7 | 0.1295 | 0.01053 | 0.1089 | 0.1501 | 0.572 | 12.3 | < .001 |

| Ee1 | Ee1 | 0.3013 | 0.02611 | 0.2501 | 0.3525 | 0.485 | 11.54 | < .001 |

| Ee2 | Ee2 | 0.2141 | 0.02099 | 0.173 | 0.2552 | 0.386 | 10.2 | < .001 |

| Ee3 | Ee3 | 0.1814 | 0.01801 | 0.1461 | 0.2167 | 0.378 | 10.07 | < .001 |

| Ee4 | Ee4 | 0.2415 | 0.01859 | 0.205 | 0.2779 | 0.677 | 12.99 | < .001 |

| Ee5 | Ee5 | 0.7813 | 0.05527 | 0.673 | 0.8896 | 0.998 | 14.14 | < .001 |

| Use | Use | 0 | 0 | 0 | 0 | 0 | ||

| Perception | Perception | 0.0985 | 0.019 | 0.0612 | 0.1357 | 1 | 5.18 | < .001 |

| Satisfaction | Satisfaction | 0.2036 | 0.03484 | 0.1353 | 0.2719 | 1 | 5.84 | < .001 |

| Environmental Economic Impact | Environmental Economic Impact | 0.3197 | 0.04125 | 0.2388 | 0.4005 | 1 | 7.75 | < .001 |

| Adoption | Adoption | 0.5816 | 0.04255 | 0.4982 | 0.665 | 0.875 | 13.67 | < .001 |

| Perception | Satisfaction | 0.0872 | 0.01371 | 0.0603 | 0.1141 | 0.616 | 6.36 | < .001 |

| Perception | Environmental Economic Impact | 0.095 | 0.01482 | 0.066 | 0.1241 | 0.536 | 6.41 | < .001 |

| Satisfaction | Environmental Economic Impact | 0.2015 | 0.02568 | 0.1512 | 0.2518 | 0.79 | 7.85 | <.001 |

Overall, the table suggests that all of the variables included in the analysis are statistically significant predictors of the outcome variable, adoption. Some variables, such as ease of use and self-efficacy, have larger effect sizes than others, such as security and perception. However, all of the variables have non-zero effects on adoption and are statistically significant at the p<0.001 level.

Table 8 shows the intercept values and their respective standard errors, as well as the 95% confidence intervals, Z-values, and p-values for several variables. These variables are related to a study that is examining factors affecting the adoption of a technology or product. For each variable, the intercept represents the expected value of the dependent variable when all other independent variables are equal to zero. The standard error measures the variability or uncertainty of the estimated intercept value. The confidence interval provides a range of values within which the true population intercept is likely to fall with a 95% probability. The Z-value measures the number of standard deviations that the estimated intercept is away from the null hypothesis value (usually zero), and the p-value measures the probability of obtaining a Z-value as extreme as the one observed if the null hypothesis were true.

| Table 8 Intercepts |

||||||

|---|---|---|---|---|---|---|

| 95% Confidence Intervals | ||||||

| Variable | Intercept | Se | Lower | Upper | Z | P |

| Ease Of Use | 4.361 | 0.031 | 4.3 | 4.422 | 140.553 | < .001 |

| Self-Efficacy | 4.551 | 0.023 | 4.507 | 4.596 | 200.796 | < .001 |

| Usefulness | 4.303 | 0.029 | 4.245 | 4.36 | 147.023 | < .001 |

| Social Perception | 4.464 | 0.027 | 4.411 | 4.517 | 165.055 | < .001 |

| Attitude | 4.553 | 0.031 | 4.492 | 4.613 | 147.269 | < .001 |

| Trust | 4.643 | 0.027 | 4.59 | 4.695 | 174.017 | < .001 |

| Security | 4.699 | 0.018 | 4.663 | 4.734 | 257.866 | < .001 |

| Use | 4.497 | 0.041 | 4.418 | 4.577 | 110.304 | < .001 |

| Perception | 0 | 0 | 0 | 0 | ||

| Satisfaction | 0 | 0 | 0 | 0 | ||

| Environmental Economic Impact | 0 | 0 | 0 | 0 | ||

| Adoption | 0 | 0 | 0 | 0 | ||

In table 8, all variables except for Perception, Satisfaction, Environmental Economic Impact, and Adoption have non-zero intercept values, indicating that they contribute to the model's prediction of the dependent variable. Additionally, all variables have p-values less than 0.001, indicating strong evidence against the null hypothesis that the intercept is equal to zero.

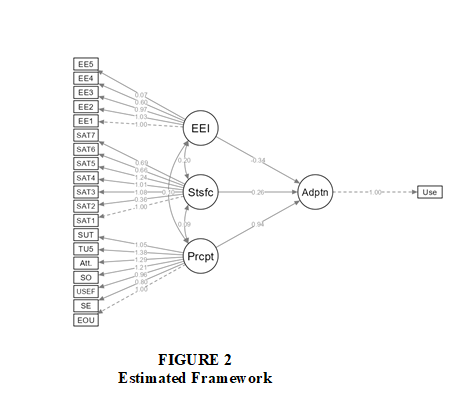

The research has suggested the following estimated framework based on the analysis mentioned above. The User Model's associations between the latent variables are represented by the parameter estimations. Regression coefficients (Beta), standard errors (SE), 95% confidence ranges, and p-values are used to display the estimates. The estimations indicate that Perception, which has a Beta of 0.962 and a p-value below .001, is the best predictor of Adoption. This suggests that higher Adoption levels are linked to higher Perception levels. With a beta of 0.273, satisfaction is also positively correlated with adoption, although the p-value is not statistically significant (p = 0.228). This implies that Satisfaction may influence Adoption less strongly than Perception. Adoption has a negative relationship with environmental economic impact, with a beta of -0.374 and a p-value of 0.037. This suggests that lower levels of adoption are linked to higher degrees of environmental and economic concern Figure 2.

Discussion and Conclusion

A positive perception of digital payment can have a significant impact on the adoption of digital payment. When consumers perceive digital payment methods as reliable, convenient, and secure, they are more likely to adopt these methods for their transactions (Sahu, et al. 2020). Studies have shown that positive perceptions of digital payment can increase consumer trust, which is a key factor in driving adoption. When consumers trust digital payment methods, they are more likely to adopt them, as they believe their financial information will be secure and protected (Bhatia, 2019). Moreover, a positive perception of digital payment can also increase the perceived usefulness of these methods, making consumers more likely to adopt them. If consumers believe that digital payment methods are easy to use and save them time, they are more likely to adopt them for their transactions (Rust and Kannan, 2003; Agus et al. 2007; Yang Lee, 2010 and Wasiq et al. 2022).

Customer satisfaction with digital payment methods is a critical factor in the adoption of digital payments. If customers are satisfied with their digital payment experience, they are more likely to continue using digital payments and recommend them to others. On the other hand, if customers are dissatisfied with their digital payment experience, they may be less likely to adopt digital payments and may revert to using cash or other traditional payment methods.

There are several reasons why environmental concerns have not been a significant driver of digital payment adoption in India, many people in India may not be aware of the environmental impact of cash-based transactions or the potential environmental benefits of digital payments. Educating consumers about the environmental benefits of digital payments could increase adoption.

Researcher concludes based upon the research findings that Perception is the strongest predictor of Adoption, This indicates that higher levels of Perception are associated with higher levels of Adoption. Satisfaction was also positively related to Adoption, while Environmental Economic Impact is negatively related to Adoption, this indicates that higher levels of Environmental Economic concern are associated with lower levels of Adoption.

Overall, these results suggest that Perception is the most important predictor of Adoption, followed by Satisfaction and Environmental Economic Impact. However, it is important to consider the theoretical basis for the model and other measures of fit when interpreting these results.

In summary, a positive perception of digital payment can have a significant impact on the adoption of digital payment, as it can increase consumer trust and perceived usefulness of digital payment methods. Overall, satisfaction with digital payments is critical to driving adoption. Companies that provide a seamless, easy-to-use, and secure digital payment experience are likely to see increased adoption and customer loyalty.

Research Implications

Studying the impact of customer perception and satisfaction on digital payment adoption in North India also has several practical implications.

Firstly, understanding the factors that influence digital payment adoption can help policymakers and service providers develop targeted strategies to increase adoption. For instance, if the study finds that customers are concerned about the security of digital payment systems, service providers can focus on improving security measures to address these concerns and increase adoption.

Secondly, the study can provide insights into how to improve customer satisfaction with digital payment systems. By identifying the factors that contribute to customer satisfaction, service providers can improve their services and address any issues that may be impacting customer satisfaction levels. Thirdly, the study can help service providers identify areas for improvement in their digital payment systems. By understanding customers' perceptions of digital payment systems, service providers can identify areas that need improvement and develop strategies to address these areas.

Overall, studying the impact of customer perception and satisfaction on digital payment adoption in North India has practical implications for policymakers and service providers. It can help them develop targeted strategies to increase adoption, improve customer satisfaction, and identify areas for improvement in their digital payment systems.

Limitations and Direction for Future Research

There are several future research areas related to digital payment adoption in India that could have been explored in this research study. While this study has explored digital payment adoption in India particularly in north India, there is scope for cross-cultural studies that compare digital payment adoption in India with other countries or regions. Such studies can help identify factors that are unique to India and those that are common across regions, moreover as technology continues to evolve, there is a need to study the impact of these advancements on digital payment adoption. For instance, the adoption of blockchain technology and cryptocurrencies can have a significant impact on digital payment adoption in India, and studying this can be a potential area of research.

India is a diverse country with varying levels of digital literacy and infrastructure across regions. Future studies can focus on exploring digital payment adoption in specific contexts, such as rural areas, to understand the unique challenges and opportunities., above all this study have explored the factors three factors only, that influence digital payment adoption, there is scope for behavioral studies that explore the reasons behind consumer behavior. Such studies can help service providers develop targeted interventions to address barriers to adoption.

Overall, there are several future research areas related to digital payment adoption in India that can help us gain a better understanding of this phenomenon and inform policymaking and business strategies.

References

Agus, A., Barker, S. and Kandampully, J. (2007), “An exploratory study of service quality in the Malaysian public service sector”, International Journal of Quality & Reliability Management, Vol. 24 No. 2, pp. 177-190.

Indexed at, Google Scholar, Cross Ref

Amin, H. (2009),“An analysis of online banking usage intentions: an extension of the technology acceptance model”, International Journal of Business and Society, 10(1), 27-40, 547-568.

Bhasker, R.N. (2016), “F. India”,.

Bhatia, S. (2019). Examining Factors Influencing Consumer Adoption of Mobile Payments in India. Journal of Payments Strategy & Systems, 13(3), 234-251.

Bureau, E. (2016),“Internet”, The Economic Times, 4 February.

Cox, C. (2013). The mobile wallet: it’s not just about payments. Illinois Bankers Association, Chicago, IL.

Dahlberg, T., Mallat, N., Ondrus, J., & Zmijewska, A. (2008). Past, present and future of mobile payments research: A literature review. Electronic commerce research and applications, 7(2), 165-181.

Indexed at, Google Scholar, Cross Ref

Dasgupta, S. I. D. D. H. A. R. T. H. A., Paul, R. I. K., & Fuloria, S. (2011). Factors affecting behavioral intentions towards mobile banking usage: Empirical evidence from India. Romanian journal of marketing, (1), 6.

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management science, 35(8), 982-1003.

Gupta, M., & Sharma, S. (2018). Factors affecting the adoption of mobile payments: empirical evidence from India. Journal of Advances in Management Research, 15(1), 15-30.

Gupta, S., and Tahilyani, R. (2013), “Eko: Mobile Banking and Payments in India”, Harvard Business School, Case 513-053, January 2015.

Karnouskos, S. and Fokus, F. (2004), “Mobile payment: a journey through existing procedures and standardization initiatives”, IEEE Communications Surveys & Tutorials, Vol. 4 No. 6, pp. 1-23.

Kumar, A. and Seri, S.P. (2014), “Banking on mobile wallet-achieve significant benefits through proactive involvement in mobile wallet”, Infosys, Banglore.

Light, J. (2013), “Digital payments transformation from transactions to consumer interactions”, Accenture.

Price, K. and Pilorge, P. (2009), “Mobile money an overview for global telecommunications operators”, Ernst & Young.

Rowland, K. and Shrauger, S. (2013), “The coming new way to pay”, Aba Bank Marketing, Foster City, CA. Rust, R.T. and Kannan, P.K. (2003), “E-service: a new paradigm for business in the electronic environment”, Communications of the ACM, Vol. 46 No. 6, pp. 37-42.

Rust, R. T., & Oliver, R. L. (1994). Service quality: insights and managerial implications from the frontier. Service quality: New directions in theory and practice, 7(12), 1-19.

Sahu, R., Mishra, A. K., & Kumar, R. (2020). A study on factors influencing the adoption of digital payment systems in India. Journal of Financial Services Marketing, 25(4), 169-179.

Sankaran, A. (2016), “Mobile wallets: PayTM, MobiKwiK, Freecharge ringing in a payment revolution, concerns remain”, The Financial Express.

Shaw, N. (2014), “The mediating influence of trust in the adoption of the mobile wallet”, Journal of Retailing and Consumer Services, Vol. 21 No. 2014, pp. 449-459.

Indexed at, Google Scholar, Cross Ref

Shin, D.H. (2009), “Towards an understanding of the consumer acceptance of mobile wallet”, Computer in Human Behaviour, Vol. 25 No. 2009, pp. 1343-1354.

Indexed at, Google Scholar, Cross Ref

Singh, A. (2016), “The future of mobile wallets in India”, The Hindu Business Line, 10 March.

Singh, S. (1970). Customer perception of mobile banking: An empirical study in National Capital Region Delhi. The Journal of Internet Banking and Commerce, 19(3), 1-22.

Indexed at, Google Scholar, Cross Ref

Sun, Y., Wang, N., Guo, X., & Peng, Z. (2013). Understanding the acceptance of mobile health services: a comparison and integration of alternative models. Journal of electronic commerce research, 14(2), 183.

Thakur, R. (2013). Customer adoption of mobile payment services by professionals across two cities in India: An empirical study using modified technology acceptance model. Business Perspectives and Research, 1(2), 17-30.

Vinayagamoorthy, A. and Sankar, C. (2012), “Mobile banking – an overview”, Advances in Management, Vol. 5 No. 10, pp. 24-29.

Wasiq, M., Johri, A., & Singh, P. (2022). Factors affecting adoption and use of M-commerce services among the customers in Saudi Arabia. Heliyon, e12532.

Yang, K. and Lee, H.J. (2010), “Gender differences in using mobile data services: utilitarian and hedonic value approaches”, Journal of Research in Interactive Marketing, 4(2), 142-156.

Indexed at, Google Scholar, Cross Ref

Received: 11-Jun-2023, Manuscript No. AMSJ-23-13685; Editor assigned: 13-Jun-2023, PreQC No. AMSJ-23-13685(PQ); Reviewed: 26-Sep-2023, QC No. AMSJ-23-13685; Revised: 03-Oct-2023, Manuscript No. AMSJ-23-13685(R); Published: 06-Nov-2023