Research Article: 2024 Vol: 28 Issue: 4S

Attributes Affecting Member Engagement in Loyalty Programs: An Empirical Study

Rajamani K, Mepco Schlenk Engineering College, Sivakasi

Ajith Kumar S, Mepco Schlenk Engineering College, Sivakasi

Prateeba Devi J, Mepco Schlenk Engineering College, Sivakasi

Ayyanar P, Mepco Schlenk Engineering College, Sivakasi

Citation Information: Rajamani, K., Ajith Kumar, S., Prateeba Devi, J., & Ayyanar, P. (2024). Attributes affecting member engagement in loyalty programs: an empirical study. Academy of Marketing Studies Journal, 28(S4), 1-10.

Abstract

Companies often implement LPs in an effort to foster client loyalty and increase revenue. While effective at attracting fresh participants to the LP, they generally fall short when it comes to retaining those members. To that end, this article will define "LP engagement," discuss possible metrics for it, and explain how it connects to the engagement of organizations. Recent research has demonstrated that traditional measures of LP engagement, such as customer card usage or point redemption, significantly understate the true level of LP engagement. The author identifies four observable actions as indicators of LP participation: app use, point accumulation, point redemption, and benefit receipt. Members of the loyalty program are the only ones to be counted if we want a true headcount. All 318 carpenters in our survey regularly use adhesives and are participants in customer loyalty programs. A structural equation model (SEM) was used to determine a connection between the variables under consideration. Factors such as app usage, redemptions, and benefits were found to affect LP Engagement. User frequency is the sole variable that can change LP satisfaction. Moreover, LP Satisfaction has an impact on LP Engagement.

Keywords

Loyalty Program, LP Engagement, LP Satisfaction, LP Application usage, Point banking, point redemption, LP Benefits.

Introduction

Consumer brand engagement is a prominent topic due to the high cost of client acquisition and the shift toward analytics and data-driven marketing. About 60% of organizations regard it as their top priority (Bluewolf, 2013), and managers consider it vital (Tierney, 2015). Customer engagement is defined as an active presence in the connection (De Villiers, 2015; Kumar and Pansari, 2016; Raes, Mühlbacher, & Raïes et al., 2015). Businesses can improve sales, word-of-mouth, transaction costs, and financial results by using marketing resources to build customer relationships (Angulo-Ruiz et al., 2013; Beatty, 1996; Palmatier et al., 2007). Engagement increases marketing efficiency, predicts client loyalty, and may increase profitability (Dwivedi, 2015; Kumar et al., 2010; Pansari and Kumar, 2016; Vivek et al., 2014). Thus, it may anticipate and explain important customer behaviors Hollebeek et al. (2014).

Loyalty programs (LPs) offer financial incentives and social and interactive benefits to boost consumer involvement. US companies spend $50 billion on LPs (Shaukat and Auerbach, 2011). US LP enrollments climbed 26% between 2012 and 2014 Berry (2015). Due to customer inactivity, active members dropped from 46% to 42% between 2010 and 2014 Berry (2015). US households use cards in 12 of their 29 LPs to get points and incentives (Berry, 2015). 60% of French consumers have 3–10 loyalty cards, while only 50% use them (Passebois, Trinquecoste, & Viot, 2012). These findings suggest that corporations can recruit new members but not engage customers in LP-based relationships.

LP consumer involvement is also misunderstood. Practitioners and scholars agree that engaging customers in relationships is a crucial program goal (Berry, 2015; Sharp and Sharp, 1997), but no measurements exist. LP efficacy is assessed through behavioral cues such card usage or point redemption (Bridson et al., 2008; Evanschitzky et al., 2012). Card usage and redemption do not lead to relationships (Berry, 1995; Henderson et al., 2011), so firms' efforts to build social bonds (e.g., personally contacting customers) may not be enough to describe LP engagement. LP members' Loyalty Program involvement is the study's main goal. How application usage, point banking, point redemption, and benefits will affects loyalty program enrollment. The study also seeks to uncover elements that affect LP satisfaction and participation. This includes point accumulation, redemption, redemption help, and member preferences for incentives.

Review of Literature and Hypothesis Development

Loyalty Programs

Businesses that want to keep customers have turned to loyalty programs. Loyalty cards, reward programs, and relationship marketing programs are LPs. LPs are marketing incentives like reward cards, gifts, tiered service levels, and dedicated support contacts designed to build long-term customer relationships (Henderson et al., 2011). These programs reward brand loyalty. Loyalty programs want satisfied members because they promote repeat business and favorable word-of-mouth. LPs are crucial to organizations' marketing strategy, and customers are carrying more loyalty cards than ever before, but actual data on their impact on customer loyalty is conflicting. Keh and Lee, 2006; Lewis, 2004; Liu, 2007 show beneficial effects, however Mägi, 2003; Meyer-Waarden and Benavent, 2009; Sharp and Sharp, 1997) show no effects or mixed results. LP involvement can indicate whether a client is actively involved in the relationship.

LP Engagement

Most LP effect studies compare LP members to non-members and evaluate program performance exclusively based on participation. Several researches propose more complex program-related behavior categorization. Evanschitzky et al. (2012) suggest that card usage indicates program loyalty, and various studies have examined customer reward redemption behavior (Bridson et al., 2008; Dorotic et al., 2011). Steinhoff and Palmatier (2014) assess program engagement based on LP rewards. Flacking is a broad indicator of LP consumer interaction. Proactive card usage and point redemption can indicate LP participation, but when corporations strive to establish tailored ties with programme participants, card usage and point redemption are not the only consumer replies. App usage, point banking, point redemption, and LP benefits determine LP satisfaction, which affects customer LP engagement.

H1: There is a significant relationship between Application Usage and LP Engagement.

H2: There is a significant relationship between Points Banking and LP Engagement.

H3: There is a significant relationship between Point Redemption and LP Engagement.

H4: There is a significant relationship between Benefits and LP Engagement.

H5: There is a significant relationship between LP Satisfaction and LP Engagement.

LP Satisfaction

Loyalty programs are a popular marketing tool used by businesses to incentivize consumer loyalty and increase purchase behavior. Frequently, the degree of customer satisfaction generated by these programs is used to measure their effectiveness. Perceived program value is a significant factor in loyalty program satisfaction. According to research, customers are more satisfied with loyalty programs when they perceive the rewards to be valuable and pertinent to their requirements (Agnihotri, et al., 2017; Kumar & Shah, 2009). Additionally, usability is a significant factor in program satisfaction. Easy-to-use programs make customers happier and more engaged (Nunes & Drèze, 2006). Customers that feel connected to a brand and program are more satisfied and loyal to an organization (Muniz & O'Guinn, 2001). Lastly, research indicates that program design affects customer fulfillment. Programs with several reward possibilities, clear regulations, and personalized experiences are more likely to satisfy (Agnihotri, Rapp, & Singh, 2017).

H6: There is a significant relationship between Application Usage and LP Satisfaction.

H7: There is a significant relationship between Points Banking and LP Satisfaction.

H8: There is a significant relationship between Point Redemption and LP Satisfaction.

H9: There is a significant relationship between Benefits and LP Satisfaction.

Loyalty program Application usage

Businesses frequently implement loyalty programs to increase customer retention and loyalty. In an effort to cultivate brand loyalty, these initiatives provide incentives or rewards to consumers who make repeated purchases from the company (Bolton et al., 2000). As a result of the evolution of mobile technology, loyalty programs now provide mobile applications that make it easier for users to access and manage their rewards. Using mobile loyalty program applications can increase consumer loyalty and retention, according to research. Customers can use these applications to monitor their rewards, receive personalized offers, and interact with the company via multiple touchpoints. Mobile loyalty programs can also give organizations with vital consumer behavior and preference data to improve client segmentation and marketing campaigns (Hanna et al., 2011). Mobile loyalty schemes have downsides.

Point Banking

Once upon a time, a fad called "points banking" took the adhesives market by storm. Retail, hospitality, and banking are just a few examples of industries that use loyalty programs to keep customers coming back. Points banking is a component of many loyalty programs that allows customers to accrue points or prizes that can be redeemed for discounts, free products, or other perks. An individual's participation in the loyalty program will be affected by the regularity with which they bank points. Bombaij and Dekimpe (2019) claim that loyalty programs, especially those based on points, have a favorable effect on customer behavior.

Point Redemption

Earlier, we discussed how the adhesives sector offered a consumer loyalty program that awarded points for repeat purchases. The next step is to study up on how to cash in Points. The advantages of an LP become most obvious when a member redeems a reward (Dorotic et al., 2014). Grewal et al. (2020) found that allowing customers to redeem their points for prizes was a significant motivator of consumer happiness and loyalty programs.

Benefits

Studies on the topic show that loyalty programs are beneficial for all parties involved Chen et al. (2021). Customer satisfaction, loyalty, and retention can all rise as a result of these perks Chen et al. (2021). Members of loyalty programs often report feeling a greater sense of pride in the brand as a result of the program Chen et al. (2021). It's vital to keep in mind, though, that loyalty programs' ability to keep customers may hinge on things including program design, client preferences, and the level of competition in the market Fook and Dastane (2021).

Research Methodology

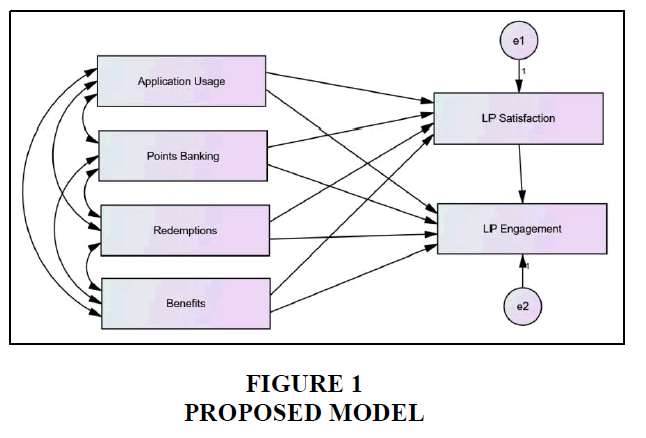

According to Mimouni-Chaabane and Volle (2010), respondents for loyalty program surveys should be drawn from loyalty program members. As a result, the author carried out a survey among participants in the loyalty program. Only members of the loyalty program are included in the population count. In this analysis, 318 carpenters were taken into account, all of them are regular buyers of adhesives and participants in loyalty programs. The researcher ran a test survey to familiarize themselves with the Loyalty Program and the LP Application's capabilities before launching the main survey. As a consequence, seven characteristics were selected for inclusion in the analysis. A survey was developed and sent out to LP participants based on this information. This study's proposed model is shown in Figure 1. The dependability of the factors was then examined with a reliability test. This proposed model has been used to create a structural equation model (SEM) to analyze the correlation between the dependent variables (LP Satisfaction and LP Engagement) and the variables that make up the model (Application Usage, Point Banking, Redemptions and Benefits).

Results and Discussion

Reliability Test

The internal consistency of the constructs in the study is measured by reliability. If the Alpha (∝) value of a construct is more than 0.70, it is considered dependable (Hair, 2013). Cronbach's Alpha was used to assess construct dependability. The Application Usage Scale with 3 items ( = 0.741), Points Banking Scale with 4 items ( = 0.804), Redemptions Scale with 2 items ( = 0.909), Benefits Scale with 3 items ( = 0.882), and LP Engagement Scale with 6 items ( = 0.879) were determined to be reliable Tables 1 & 2.

| Table 1 Reliability Test Analysis | ||

| Factors | No. of Items | Cronbach's alpha |

| Application Usage | 3 | 0.741 |

| Points Banking | 4 | 0.804 |

| Redemptions | 2 | 0.909 |

| Benefits | 3 | 0.882 |

| LP Engagement | 6 | 0.879 |

| Table 2 Socio-Economic Profile of the LP Members | |||

| Socio-economic Profile | Category | Frequency | Percentage |

| Age | 20-30 | 9 | 12.0 |

| 30-40 | 37 | 49.3 | |

| 40-50 | 20 | 26.7 | |

| Above 50 | 9 | 12.0 | |

| Profession | Carpenter | 51 | 68.0 |

| Painter | 24 | 32.0 | |

| Year of existence as a member of LP | 0-5 years | 64 | 85.3 |

| 10-15 years | 1 | 1.3 | |

| 5-10 years | 10 | 13.3 | |

According to the socioeconomic profile, 49.3 percent of LP members are between the ages of 30 and 40. In total, 68 percent of respondents are carpenters who are members of LP, and 32 percent are painters who are members of LP. 85.7 percent of LP members have been members for 0 to 5 years.

Professional Profile of the LP members

According to this table, 93.3 percent of LP members are persuaded to join the LP by company representatives. 46.7 percent of LP members are banking points weekly once. Furthermore, 78.7 percent of LP members redeem their points when they need something. 94.7 percent of LP members require the assistance of a company representative in order to redeem their points through the LP application. Finally, 46.7 percent of LP members prefer to receive rewards through point banking.

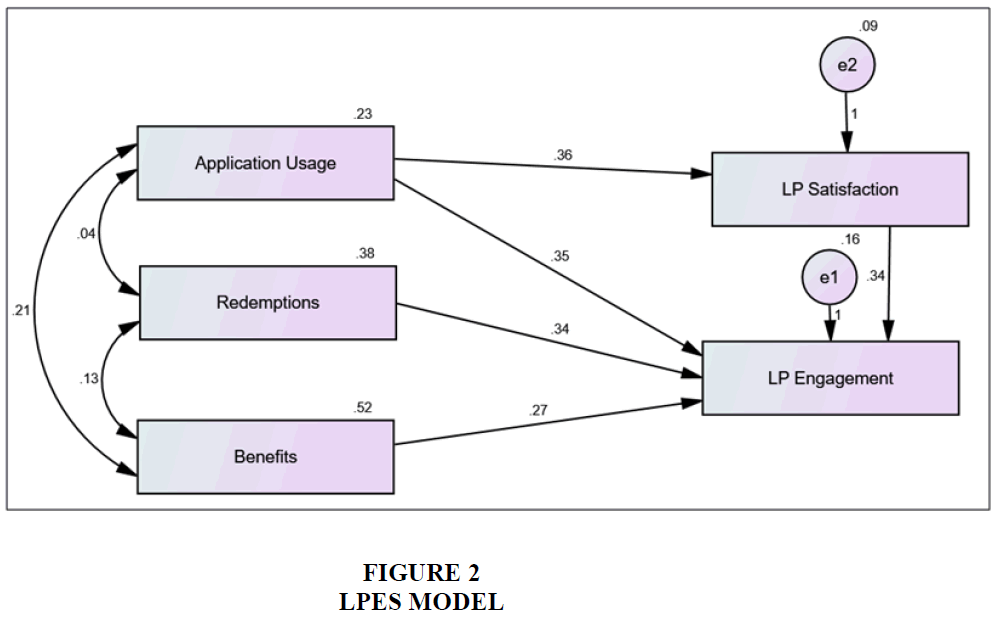

Loyalty Program Engagement and Satisfaction Model Using Structural Equation Modelling

Members' views on the use of applications, point banking, point redemption, and benefits were taken into account when constructing the LPES Model for the LP members. To measure the dependant variables, these independent variables were used (LP Engagement and LP satisfaction). Endogenous variables that are observed serve as dependant variables, while exogenous variables that are observed serve as independent variables in a model.

The structural relationship between LP Engagement, LP Satisfaction, and other independent variables like application usage, redemptions, and benefits is shown in Figure 2 above.

CMIN/DF, RMSEA, GFI, AGFI, NFI, and CFI are specified in Tables 3 & 4 above and are used to evaluate the LPES model's adequacy. The likelihood of obtaining the chi-square statistic is 0.840, which is greater than 0.05. This finding provides statistical support for the validity of the stated model's relationship assumptions. The LPES model provides a superior match to the data since its Minimum Discrepancy Function divided by Degrees of Freedom (CMIN/DF) is just 0.420, which is less than 5. Root Mean Square Error of Approximation (RMSEA) less than 0.08 is an excellent indicator of model fitness. With this model, we get values of 0.996 for the Goodness of Fit Index (GFI), 0.966 for the Adjusted Goodness of Fit Index (AGFI), 0.994 for the Normed Fit Index (NFI), and 1.000 for the Comparative Fit Index (CFI). All estimated fit index values for the provided model are more than 0.9, which is indicative of the reliability of the model, because each goodness of fit index has a cutoff point of 0.9.

| Table 3 Professional Profile of the LP Members | |||

| Professional Profile | Category | Frequency | Percentage |

| Influencer for joining in LP | Company representatives | 70 | 93.3 |

| Dealer | 4 | 5.3 | |

| Friends or co-workers | 1 | 1.3 | |

| Frequency of banking the points | At the time of Purchasing | 4 | 5.3 |

| Daily | 17 | 22.7 | |

| Monthly Once | 11 | 14.7 | |

| Never | 4 | 5.3 | |

| Occasionally | 4 | 5.3 | |

| Weakly Once | 35 | 46.7 | |

| Redemption of points when | <Rs.2000 | 12 | 16.0 |

| >4000 | 1 | 1.3 | |

| Rs.2000-3000 | 3 | 4.0 | |

| When I need something | 59 | 78.7 | |

| Aware about bonus points | Company representatives | 50 | 66.7 |

| FCC application | 25 | 33.3 | |

| Assistance to redeem the points | Company representatives | 71 | 94.7 |

| Dealer | 1 | 1.3 | |

| Myself | 3 | 4.0 | |

| Types of rewards preferred by the members of LP | Adding amount directly into bank account | 3 | 4.0 |

| Direct Cash | 8 | 10.7 | |

| Direct Gift | 29 | 38.7 | |

| Rewards through points banking | 35 | 46.7 | |

| Table 4 Fitness of Loyalty Program Engagement Model | ||||||||

| Chi-Square | Probability Level |

DF | CMIN/DF | RMSEA | GFI | AGFI | NFI | CFI |

| 0.840 | 0.657 | 2 | 0.420 | 0.000 | 0.996 | 0.966 | 0.994 | 1.000 |

Loyalty Program Engagement and Satisfaction Model Path and Hypothesis Testing

Regression or path coefficients between the constructs serve as a representation of the relationships between the theoretical components. The causal relationship included in the model is shown in Tables 4 & 5.

| Table 5 LPES Model Variable Casual Relationship | ||||||

| Dependent and Independent variables | Estimate | S.E. | C.R. | P | ||

| LP Satisfaction | <--- | Application Usage | 0.356 | 0.074 | 4.802 | 0.001 |

| LP Engagement | <--- | Benefits | 0.269 | 0.087 | 3.099 | 0.002 |

| LP Engagement | <--- | Redemption | 0.336 | 0.080 | 4.206 | 0.001 |

| LP Engagement | <--- | Application Usage | 0.348 | 0.137 | 2.549 | 0.011 |

| LP Engagement | <--- | LPS | 0.341 | 0.154 | 2.215 | 0.027 |

Casual characteristics are related to LP engagement and satisfaction, as indicated by the single-headed arrow. The above data reveals that a one-unit increase in application usage leads to a 0.35-unit increase in LP satisfaction. The correlation between application usage and LP satisfaction is statistically significant (p = 0.001). The p value indicating a significant association between benefits and LP engagement is 0.002. An increase of one unit in loyalty program benefits results in a 0.26 unit increase in LP engagement. The correlation between redemption and LP engagement is statistically significant (p = 0.001). An increase of one unit in redemption results in a 0.33 unit increase in LP engagement. One unit is added to other casual variables like application usage and LPS whereas just 0.34 units are added to LP engagement.

Effects of LPES Model Variables

In Table 6, we summarize the direct, indirect, and total effects of independent variables on LP engagement and LP satisfaction using standard measures. The percentage of LP satisfaction that may be attributed to the variable of application usage is 23.8%. That is to say, estimating LP satisfaction from separate factors carries an approximate 76.2 percent margin of error. The degree to which LP members are engaged may be predicted with 58.7 percent accuracy using independent factors including rewards, redemption, application usage, and LP satisfaction. That is to say, the reliability of utilizing an independent variable to predict LP engagement varies by around 41.3%.

| Table 6 Effects of LPES Model Variables | |||||

| Dependent Variable | Independent Variable | Total Effects | Direct Effects | Indirect Effects | R2 |

| LP Satisfaction | Application Usage | 0.356 | 0.356 | 0.000 | 0.238 |

| LP Engagement | Benefits | 0.269 | 0.269 | 0.000 | 0.587 |

| Redemption | 0.336 | 0.336 | 0.000 | ||

| Application Usage | 0.470 | 0.348 | 0.121 | ||

| LP Satisfaction | 0.341 | 0.341 | 0.000 | ||

Conclusion and Managerial Implication

Based on this model, we can see that loyalty program engagement is affected by factors such as application use, redemption, benefits, and LP satisfaction. Only via regular use of the app can members feel more positive emotions toward the loyalty programs. As a result, businesses need to make their LP Applications simple to use. If the LP app's UI isn't intuitive enough, members won't find it useful, and the program's reputation will suffer. A high rate of redemption indicates that members are engaged with the loyalty program. When consumers are satisfied with a loyalty program, they tend to stick with it for a longer amount of time. The findings of this research will help the company ensure these metrics remain as Loyalty program indicators. As a result, it is crucial that businesses pay close attention to the LP members' redemption patterns while designing the UI of the LP application. The corporation also has to learn what kind of LP rewards are most attractive with its members. Customers are likely to remain committed to a company in the long run if they enjoy the benefits of a loyalty program.

References

Agnihotri, R., Rapp, A., & Singh, R. (2017). An Emotion-Based Approach to Understanding Online Impulse Buying Behavior. Journal of Marketing Theory and Practice, 25(2), 154-174.

Angulo-Ruiz, F., Donthu, N., Prior, D., & Rialp, J. (2013). The financial contribution of customer-oriented marketing capability. Journal of the Academy of Marketing Science, 42(4), 380–399.

Indexed at, Google Scholar, Cross Ref

Beatty, S. (1996). Customer-sales associate retail relationships. Journal of Retailing, 72(3), 223–247.

Indexed at, Google Scholar, Cross Ref

Berry, J. (2015). The 2015 colloquy loyalty census. In Colloquy.

Berry, L. L. (1995). Relationship Marketing of Services--Growing Interest, Emerging Perspectives. Journal of the Academy of Marketing Science, 23(4), 236–245.

Indexed at, Google Scholar, Cross Ref

Bluewolf (2013). Bluewolf's annual state of salesforce report. (Retrieved 18/12/2015,2015).

Bolton, R. N., Kannan, P. K., & Bramlett, M. D. (2000). Implications of Loyalty Program Membership and Service Experiences for Customer Retention and Value. Journal of the Academy of Marketing Science, 28(1), 95–108.

Bombaij, N. J. F., & Dekimpe, M. G. (2019). When do loyalty programs work? The moderating role of design, retailer-strategy, and country characteristics. International Journal of Research in Marketing, 37(1), 175–195.

Indexed at, Google Scholar, Cross Ref

Bridson, K., Evans, J., & Hickman, M. (2008). Assessing the relationship between loyalty program attributes, store satisfaction and store loyalty. Journal of Retailing and Consumer Services, 15(5), 364–374.

Indexed at, Google Scholar, Cross Ref

Chen, Y., Mandler, T., & Meyer-Waarden, L. (2021). Three decades of research on loyalty programs: A literature review and future research agenda. Journal of Business Research, 124, 179–197.

De Villiers, R. (2015). Consumer brand enmeshment: Typography and complexity modeling of consumer brand engagement and brand loyalty enactments. Journal of Business Research, 68(9), 1953–1963.

Dorotic, M., Bijmolt, T. H. A., & Verhoef, P. C. (2011). Loyalty Programmes: Current Knowledge and Research Directions*. International Journal of Management Reviews, 14(3), 217–237.

Dorotic, M., Verhoef, P. C., Fok, D., & Bijmolt, T. H. A. (2014). Reward redemption effects in a loyalty program when customers choose how much and when to redeem. International Journal of Research in Marketing, 31(4), 339–355.

Indexed at, Google Scholar, Cross Ref

Dwivedi, A. (2015). A higher-order model of consumer brand engagement and its impact on loyalty intentions. Journal of Retailing and Consumer Services, 24, 100–109.

Evanschitzky, H., Ramaseshan, B., Woisetschläger, D. M., Richelsen, V., Blut, M., & Backhaus, C. (2011). Consequences of customer loyalty to the loyalty program and to the company. Journal of the Academy of Marketing Science, 40(5), 625–638.

Fook, A. C. W., & Dastane, O. (2021). Effectiveness of Loyalty Programs in Customer Retention: A Multiple Mediation Analysis. Jindal Journal of Business Research, 10(1), 7–32. Sagepub.

Indexed at, Google Scholar, Cross Ref

Grewal, D., Levy, M., & Kumar, V. (2009). Customer Experience Management in Retailing: An Organizing Framework. Journal of Retailing, 85(1), 1–14.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Partial Least Squares Structural Equation Modeling: Rigorous Applications, Better Results and Higher Acceptance. Long Range Planning, 46(1-2), 1–12.

Hanna, R., Rohm, A., & Crittenden, V. L. (2011). We’re all connected: The power of the social media ecosystem. Business Horizons, 54(3), 265–273.

Henderson, C. M., Beck, J. T., & Palmatier, R. W. (2011). Review of the theoretical underpinnings of loyalty programs. Journal of Consumer Psychology, 21(3), 256–276.

Hollebeek, L. D., Glynn, M. S., & Brodie, R. J. (2014). Consumer Brand Engagement in social media: Conceptualization, Scale Development and Validation. Journal of Interactive Marketing, 28(2), 149–165.

Indexed at, Google Scholar, Cross Ref

Keh, H., & Lee, Y. (2006). Do reward programs build loyalty for services?The moderating effect of satisfaction on type and timing of rewards. Journal of Retailing, 82(2), 127–136.

Kumar, V., & Pansari, A. (2016). Competitive Advantage through Engagement. Journal of Marketing Research, 53(4), 497–514.

Kumar, V., & Shah, D. (2009). Expanding the Role of Marketing: From Customer Equity to Market Capitalization. Journal of Marketing, 73(6), 119–136.

Indexed at, Google Scholar, Cross Ref

Kumar, V., Aksoy, L., Donkers, B., Venkatesan, R., Wiesel, T., & Tillmanns, S. (2010). Undervalued or Overvalued Customers: Capturing Total Customer Engagement Value. Journal of Service Research, 13(3), 297–310.

Lewis, M. (2004). The Influence of Loyalty Programs and Short-Term Promotions on Customer Retention. Journal of Marketing Research, 41(3), 281–292.

Liu, Y. (2007). The Long-Term Impact of Loyalty Programs on Consumer Purchase Behavior and Loyalty. Journal of Marketing, 71(4), 19–35.

Mägi, A. W. (2003). Share of wallet in retailing: the effects of customer satisfaction, loyalty cards and shopper characteristics. Journal of Retailing, 79(2), 97–106.

Indexed at, Google Scholar, Cross Ref

Meyer-Waarden, L., & Benavent, C. (2008). Grocery retail loyalty program effects: self-selection or purchase behavior change? Journal of the Academy of Marketing Science, 37(3), 345–358.

Mimouni-Chaabane, A., & Volle, P. (2010). Perceived benefits of loyalty programs: Scale development and implications for relational strategies. Journal of Business Research, 63(1), 32–37.

Muniz, A. M., & O’Guinn, T. C. (2001). Brand Community. Journal of Consumer Research, 27(4), 412–432.

Nunes, J. C., & Drèze, X. (2006, April). Your Loyalty Program Is Betraying You. Harvard Business Review.

Palmatier, R. W., Scheer, L. K., Houston, M. B., Evans, K. R., & Gopalakrishna, S. (2007). Use of relationship marketing programs in building customer–salesperson and customer–firm relationships: Differential influences on financial outcomes. International Journal of Research in Marketing, 24(3), 210–223.

Passebois, J., Trinquecoste, J.-F., & Viot, C. (2012). Observatoire de la fidélité et de lafidélisation clientèle. Rapport, 2012.

Raïes, K., Mühlbacher, H., & Gavard-Perret, M.-L. (2015). Consumption community commitment: Newbies’ and longstanding members’ brand engagement and loyalty. Journal of Business Research, 68(12), 2634–2644.

Sharp, B., & Sharp, A. (1997). Loyalty programs and their impact on repeat-purchase loyalty patterns. International Journal of Research in Marketing, 14(5), 473–486.

Shaukat, T., & Auerbach, P. (2011). Loyalty: is it really working for you? | McKinsey. Www.mckinsey.com.

Steinhoff, L., & Palmatier, R. W. (2014). Understanding loyalty program effectiveness: managing target and bystander effects. Journal of the Academy of Marketing Science, 44(1), 88–107.

Tierney, J. (2015). Customer Engagement is Companies’ Top Priority for 2014. Loyalty360.org. Vivek, S. D., Vivek, S. D., Beatty, S. E., Dalela, V., & Morgan, R. M. (2014). A generalized multidimensional scale for measuring customer engagement. Journal of Marketing Theory and Practice, 22(4), 401-420.

Indexed at, Google Scholar, Cross Ref

Received: 16-Nov-2023, Manuscript No. AMSJ-23-14185; Editor assigned: 17-Nov-2023, PreQC No. AMSJ-23-14185(PQ); Reviewed: 29-Dec- 2023, QC No. AMSJ-23-14185; Revised: 29-Mar-2024, Manuscript No. AMSJ-23-14185(R); Published: 03-Apr-2024