Research Article: 2024 Vol: 28 Issue: 2

Banking Digitalisation: An Analysis of Literature Using Bibliometric Analysis

Ruchi Singhal, Jagannath International Management School, New Delhi

Sangeeta, Maharaja Agrasen University

Dolly, Jagannath International Management School, New Delhi

Sanam Sharma, Maharaja Agrasen Institute of Management Studies, Delhi

Manika Garg, Senior Research Analyst, New Delhi

Ruchika Bhateja, Government College, Higher Education Haryana

Citation Information: Singhal, R., Sangeeta, Dolly, Sharma, S., Garg, M., & Bhateja, R. (2024). Banking digitalisation: an analysis of literature using bibliometric analysis. Academy of Marketing Studies Journal, 28(2), 1-15.

Abstract

Purpose: This study aims to analyse the literature on banking digitalisation using bibliometric techniques comprehensively. By examining the key themes, trends, and influential works in this field, the study seeks to shed light on the current state of research and identify future directions for scholars and practitioners. Methods: A systematic bibliometric analysis was conducted on a selected corpus of scholarly publications related to banking digitalisation. The data were collected from reputable academic databases and carefully curated to ensure relevance and quality. Various bibliometric indicators, including citation counts, co-citation analysis, and co-authorship analysis, were employed to analyse the literature and identify influential authors, journals, and research themes. Findings: The findings of the bibliometric analysis reveal a significant growth in research output on banking digitalisation over the past decade. The analysis identified several influential authors who have contributed substantially to the field. The most frequently cited works revolve around digital banking channels, customer adoption of digital services, technological innovation, and the impact of digitalisation on banking performance. Moreover, the analysis uncovered emerging themes such as blockchain technology, artificial intelligence, and cybersecurity, which reflect the evolving landscape of banking digitalisation research. Managerial Implication: The managerial implications derived from the bibliometric analysis of banking digitalisation literature provide valuable guidance. Managers should stay updated on emerging technologies, prioritise customer-centric digital experiences, foster a culture of innovation, collaborate with fintech companies, address cybersecurity challenges, invest in employee training, and monitor regulatory developments. By considering these implications, managers can make informed decisions, drive innovation, enhance customer satisfaction, mitigate risks, build strategic partnerships, ensure compliance, and create a competitive advantage in digital banking. Incorporating these managerial implications will enable managers to navigate the complexities of banking digitalisation and successfully drive their organisations' digital transformation strategies. Practical Implication: The bibliometric analysis of banking digitalisation literature offers valuable practical implications. Practitioners can utilise the analysis to make evidence-based decisions, benchmark their strategies against influential works, identify research gaps for collaboration or internal projects, evaluate performance, assess risks and mitigate them, guide technology adoption and implementation, and stay informed about policy and regulatory considerations. This analysis provides a roadmap for practitioners to leverage existing knowledge, access reputable sources, and align their strategies with emerging trends in banking digitalisation. By incorporating these practical implications, practitioners can enhance their decision-making processes and drive successful digital transformation within their organisations. Social implications: The analysis of banking digitalisation literature using bibliometric techniques has important social implications. As banking becomes increasingly digitalised, it impacts various stakeholders in society. Consumers may need help with digital literacy, access to digital banking services, and potential exclusion from the banking system. Addressing these social disparities and ensuring that digitalisation benefits all segments of society is crucial. Privacy and data protection concerns arise as personal information is collected and utilised in digital banking. Policymakers and organisations must prioritise the development of robust regulations and safeguards to protect consumer rights and mitigate potential social risks associated with banking digitalisation. Originality/Value: This study on banking digitalisation contributes to the existing literature by employing bibliometric analysis techniques to provide a comprehensive overview of the field. The analysis identifies influential works, key themes, emerging trends, and influential authors, shedding light on current research in banking digitalisation. The value of this study lies in its ability to guide researchers in identifying research gaps, facilitating collaboration, and suggesting future directions for scholars and practitioners. Additionally, the analysis offers practical insights for managers and policymakers by highlighting the implications of banking digitalisation on decision-making, customer experiences, innovation, cybersecurity, and regulatory considerations.

Keywords

Digital Banking, Technologies, Mobile Banking and Bibliometric Analysis.

Introduction

The advent of digital technologies has brought about significant transformations in various sectors, and the banking industry is no exception. Banking digitalisation, also known as digital banking or online banking, has emerged as a prominent phenomenon, revolutionising the way financial services are delivered and consumed. This transformation encompasses a wide range of digital applications, including internet banking, mobile banking, digital payment systems, blockchain, and artificial intelligence in banking operations. As this field continues to evolve rapidly, it becomes crucial to gain a comprehensive understanding of the existing research landscape and identify emerging trends, key contributors, and research gaps Anagnostopoulos (2018); Aysan et al. (2021); Baabdullah et al. (2019); Chen et al. (2019); Dosso, & Aysan, (2022); Eyal (2017); Grand View Research (2021); Geebren et al. (2021); Folkinshteyn & Lennon, (2016); Firdau et al. (2019).

Digitalisation, also called digital transformation, is integrating digital technologies into various aspects of organisational and societal activities. It encompasses adopting and utilising digital tools, technologies, and platforms to enhance efficiency, productivity, and innovation. The process of converting information, such as data, sound, text, photographs, music, and any other type of data, into "bits" (0s and 1s) and then translating those bits into computer language using microprocessors is referred to as "digitisation." This process is referred to by the term "digitisation." Sometimes, the word digitalisation may be used interchangeably with the phrase digitisation. The digitisation of information has made preserving, replicating, and sharing information simpler (Leong et al. 2017). In a nutshell, utilising the possibilities offered by digital technology has resulted in a change not only to the operational procedures but also how business is conducted across all industries, including banking. This change has been brought about directly due to the change mentioned above Haroune et al. (2014); Hettar et al. (2019).

The role of digitization in Indian banking has been instrumental in transforming the banking sector, enhancing efficiency, expanding access to financial services, and promoting financial inclusion. The adoption of digital technologies has revolutionized traditional banking operations, offering customers convenient and secure banking services while enabling banks to streamline processes and improve service delivery. Some key aspects highlighting the role of digitization in Indian banking:

Digital Payments: One of the significant impacts of digitization in Indian banking is the rise of digital payment systems. Initiatives such as the Unified Payments Interface (UPI) and mobile wallet services have revolutionized the way people transact, making it easier, faster, and more convenient to make payments, transfers, and bill payments. Digital payment platforms have reduced the reliance on cash, enabling smoother transactions and contributing to the government's efforts towards a less-cash economy.

Financial Inclusion: Digitization has played a crucial role in advancing financial inclusion in India. Through digital banking services, individuals in remote and underserved areas can access banking services without the need for physical branches. Mobile banking and internet banking have provided avenues for people to open bank accounts, avail credit facilities, and perform financial transactions, thereby bridging the gap between the unbanked and the formal banking system.

Customer Convenience: Digitization has brought significant convenience for customers in accessing banking services. With mobile banking applications and internet banking platforms, customers can perform various transactions such as fund transfers, bill payments, account management, and loan applications from the comfort of their homes or offices. This 24/7 availability of services has transformed the customer experience and enhanced customer satisfaction.

Cost Reduction and Efficiency: Digitization has enabled banks to streamline their operations, automate processes, and reduce costs. With the adoption of digital platforms, banks can handle a higher volume of transactions with fewer resources, leading to operational efficiency and cost savings. Automated processes, such as online account opening and digital document verification, have significantly reduced paperwork and processing time.

Data Analytics and Personalization: Digitization has enabled banks to collect and analyze vast amounts of customer data, providing valuable insights for personalized banking experiences. By leveraging data analytics, banks can offer customized products and services tailored to individual customer needs. This data-driven approach has also helped banks in risk management, fraud detection, and enhancing overall customer engagement.

Enhanced Security: While digital banking brings convenience, ensuring the security of customer transactions and data is of paramount importance. Banks have invested in robust security measures, including two-factor authentication, encryption technologies, biometric authentication, and real-time fraud monitoring systems. These measures instill confidence in customers and promote trust in digital banking channels.

Fostering Innovation: Digitization has created a platform for innovation in the banking sector. Banks are increasingly collaborating with fintech start-ups and technology providers to develop innovative solutions such as digital lending, robo-advisory services, and blockchain-based applications. These innovations are aimed at improving operational efficiency, expanding service offerings, and enhancing the overall banking experience Nobanee & Ellili, (2022).

In conclusion, digitization has played a transformative role in Indian banking, bringing convenience, accessibility, and efficiency to customers while driving financial inclusion. It has revolutionized payment systems, enhanced operational efficiency, facilitated personalized services, and fostered innovation. As technology continues to advance, the banking sector in India is poised to leverage digitization further, paving the way for a more inclusive and digitally empowered economy.

Methodology

This study uses bibliometric analysis to evaluate the most recent developments in the academic literature on banking digitalisation, such as mobile banking and electronic wallets. Indicators of bibliometrics are used to report the findings of this study. Bibliometrics studies formal knowledge fields by applying mathematical and statistical methodologies Nayak (2018); (Palinggi & Allolinggi, (2019). In order to contribute to the information provided by earlier bibliometric analyses, this research uses the Scopus database to analyse the intellectual structure of mobile banking. In this bibliometric study, 1,348 source papers were investigated using a keyword search, and their publication counts and citations were counted. According to Martin and Daim, (2008); Marsal-Llacuna, (2018); Magdalena & Suhatman, (2020). The two most fundamental forms of bibliometric measurement are the citation and publication counts. The mobile banking literature generated between 1984 and 2021 was written in these languages. Material that has been archived in Scopus and has the terms "mobile payment" or "e-wallet" in the title Santiago Carbo-Valverde (2017); Kitsios et al. (2021); Jiang et al. (2020); Jain et al. (2020).

Data and Source

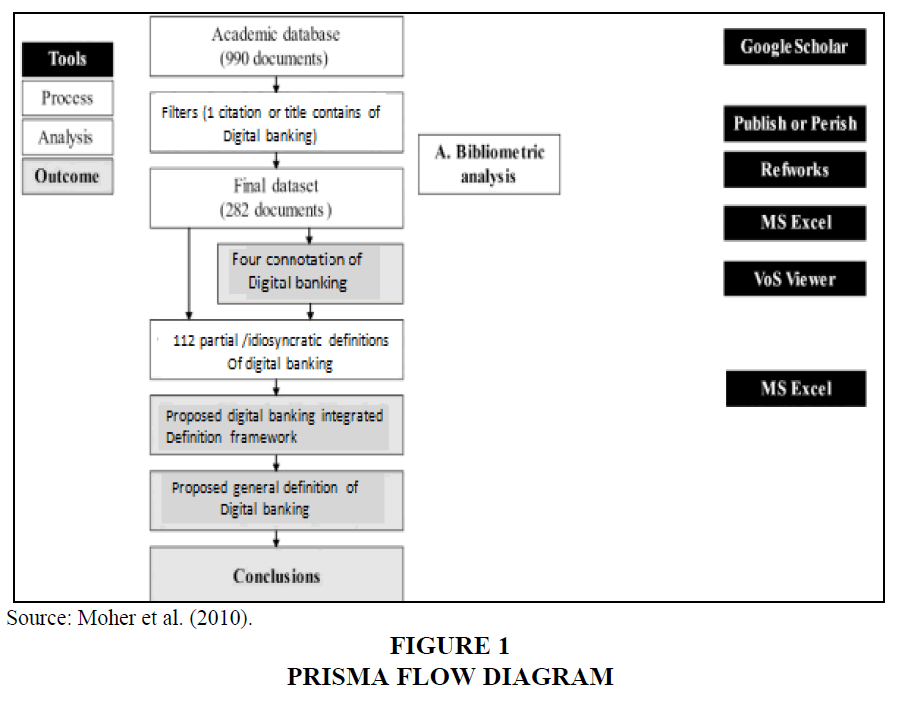

The database Scopus was mined for bibliometric information. The most valuable aspect of Scopus is its straightforward and user-friendly bibliometric measures Seibel & Khadka, (2002). (Sweileh et al., 2018). Scopus, one of the most comprehensive academic databases, provides the 1348 titles that this study uses to compile its data. The terms "mobile payment," "electronic wallet," and "mobile wallet" were discussed extensively throughout this assessment. The authors utilised standards known as Preferred Reporting Items for Systematic Reviews and Meta-Analyses during their search for relevant publications (Figure 1). (Moher et al. 2010); Mathang et al. (2010). There was a search for combinations involving TITLE-ABS-KEY ("mobile banking" OR "m-payment" OR "electronic wallet" OR "e-wallet" OR "mobile wallet" OR "e-wallet"). The search engine Scopus located 1,348 documents on the 10th of October, 2021 (Figure 1). One thousand three hundred forty-eight documents are unfiltered. The evaluation of all 1,348 papers was carried out with the assistance of Harzing Publish or Perish and Microsoft Excel.

The breakdown of the overall number of publications into their respective categories of ten different kinds of articles is presented in Table 1, which can be seen here. Most of the profiles were either presented as conference papers or published as articles, with the former accounting for 92.28 per cent of the total profiles. As seen in Table 1, book series, individual books, and specialised trade journals comprised the remainder of the sources, while journals accounted for 49.33% of the papers. On the other hand, conference proceedings comprised 36.87% of the total number of materials. In addition, the data sets that were collected were analysed so that we could determine the language that was used in the articles that were made public. According to the information presented in Table 1, English is used most frequently for writing about mobile banking and electronic wallets, which accounts for 97.78% of the total usage. It is important to point out that most publications were written in languages other than English. This is something that should be noted. Among these languages are German (4), Spanish (4), French (1), Turkish (2), and Chinese (18). Portuguese is also included in this list (1).

| Table 1 Document Types and Languages | ||||||||

| Document Source | T.P. | % | ||||||

| Document Type | Source Type | Language | ||||||

| Article | Journal | English | 636 | 665 | 1321 | 47.18% | 49.3% | 97.78% |

| Conference Paper | Conference Proceeding | Chinese | 608 | 497 | 18 | 45.10% | 36.87% | 1.33% |

| Book Chapter | Book Series | German | 59 | 123 | 4 | 4.38% | 9.12% | 0.30% |

| Review | Book | Spanish | 20 | 54 | 4 | 1.48% | 4.01% | 0.30% |

| Note | Trade Journal | Turkish | 11 | 9 | 2 | 0.82% | 0.67% | 0.15% |

| Book | - | French | 5 | 1 | 0.37% | 0.07% | ||

| Short Survey | - | Portuguese | 5 | 1 | 0.37% | 0.07% | ||

| Editorial | - | 2 | 0.15% | |||||

| Letter | - | 1 | 0.07% | |||||

| Retracted | - | 1 | 0.07% | |||||

| Total | 1348 | 100.00% | ||||||

Results and Discussion

Key themes and trends: In the literature on banking digitalization, several key themes and trends have emerged. These themes and trends reflect the major areas of focus and research within the field. Some of the key themes and trends include:

Technological Advancements: The rapid advancement of digital technologies, such as artificial intelligence, blockchain, cloud computing, and data analytics, has been a central theme in the literature. Researchers have explored the potential of these technologies to transform various aspects of banking, including customer experiences, operational efficiency, risk management, and fraud detection.

Customer-Centric Approach: There is a strong emphasis on the customer in the literature on banking digitalization. Researchers have examined ways to enhance customer experiences through personalized banking services, omnichannel interactions, mobile banking applications, and chatbots. The focus is on meeting customer expectations, providing seamless digital experiences, and improving engagement and satisfaction.

Cybersecurity and Data Privacy: With the increasing digitization of banking services, cybersecurity and data privacy have become critical concerns. The literature highlights the challenges and risks associated with protecting customer data, preventing cyber attacks, ensuring regulatory compliance, and building robust security frameworks in the digital banking environment.

Fintech Innovations: The rise of fintech companies and their impact on the banking industry is a prominent theme in the literature. Researchers have explored the disruptive potential of fintech innovations, such as peer-to-peer lending, digital payments, robo-advisors, and crowdfunding. The focus is on understanding the implications of fintech on traditional banking models, competition, collaboration, and regulatory frameworks.

Regulatory and Policy Considerations: The literature on banking digitalization also addresses the regulatory and policy implications of digital transformation. Researchers have examined the evolving regulatory landscape, compliance challenges, consumer protection, data governance, and ethical considerations in the context of banking digitalization. The aim is to provide insights into the regulatory frameworks needed to foster innovation while ensuring a safe and fair banking environment.

Organizational Transformation: The literature explores the organizational changes required for successful banking digitalization. It covers topics such as leadership and change management, talent acquisition and retention, organizational culture, agile methodologies, and digital skills development. Researchers investigate how banks can adapt their structures, processes, and strategies to embrace digital transformation and remain competitive These themes and trends represent the major areas of interest and research within the field of banking digitalization. By understanding and addressing these key themes, researchers and practitioners can stay informed about the latest developments and make informed decisions in their pursuit of successful digital transformation in the banking industry.

Further, the following aspects were taken into consideration when analysing the scholarly work that was unearthed as a result of the search: research productivity; document and source type; the language of documents; subject area; distribution of publications by country; most active institutions; authorship analysis; keyword analysis; and citation metric analysis.

Analyse the Subject Area

The papers are presented in Table 2 in a format arranged according to the many subject areas they discuss. Because of this, it is clear that the category known as "computer sciences" was responsible for a total of 848 articles, which is a proportion that is equal to a proportion that is identical to 62.91% of all publications. Next on the list is "business, management, and accounting," which accounts for 29.67%; then comes "engineering," which accounts for 26.93%; then comes "social sciences," which accounts for 13.87%, then comes "decision sciences," which accounts for 10.39%, and finally comes "economics, econometrics, and finance," which accounts for 10.16%. When they were rated in the top 10 of the table, the subject categories "mathematics," "physics and astronomy," "environmental science," and "energy" each had fewer than 10% of the total publications in the fields to which they belonged when it came to the total number of publications.

| Table 2 The Top Ten Subject Areas and the Countries with the Most Contributions | |||||

| Subject Area | Country | T.P. | % | ||

| Computer Science | China | 848 | 304 | 62.91% | 22.55% |

| Business, Management and Accounting |

India | 400 | 163 | 29.67% | 12.09% |

| Engineering | United States | 363 | 121 | 26.93% | 8.98% |

| Social Sciences | Indonesia | 187 | 92 | 13.87% | 6.82% |

| Decision Sciences | South Korea | 140 | 75 | 10.39% | 5.56% |

| Economics, Econometrics and Finance |

Malaysia | 137 | 69 | 10.16% | 5.12% |

| Mathematics | Taiwan | 130 | 61 | 9.64% | 4.53% |

| Physics and Astronomy | United Kingdom | 36 | 57 | 2.67% | 4.23% |

| Environmental Science | Germany | 35 | 54 | 2.60% | 4.01% |

| Energy | Australia | 30 | 40 | 2.23% | 2.97% |

The year in which the book was published.

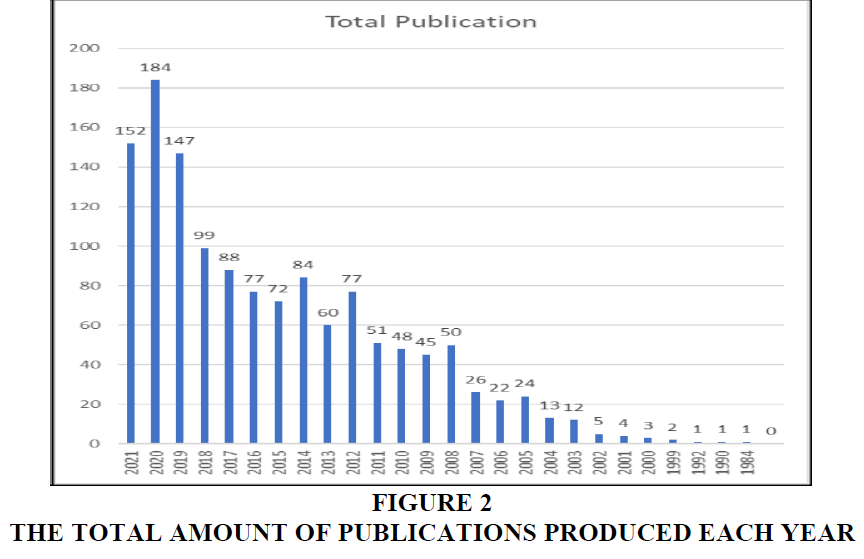

The publishing order of the works in dispute is detailed in Figure 2, which may be seen here. The vast majority of the articles (184 in total) were produced in the year 2020, while the years 2021 and 2019 were responsible for the publication of 152 and 147 citations, respectively. Since 1984, there has been a consistent trend towards an increase in the overall number of publications. This trend is expected to continue in the foreseeable future.

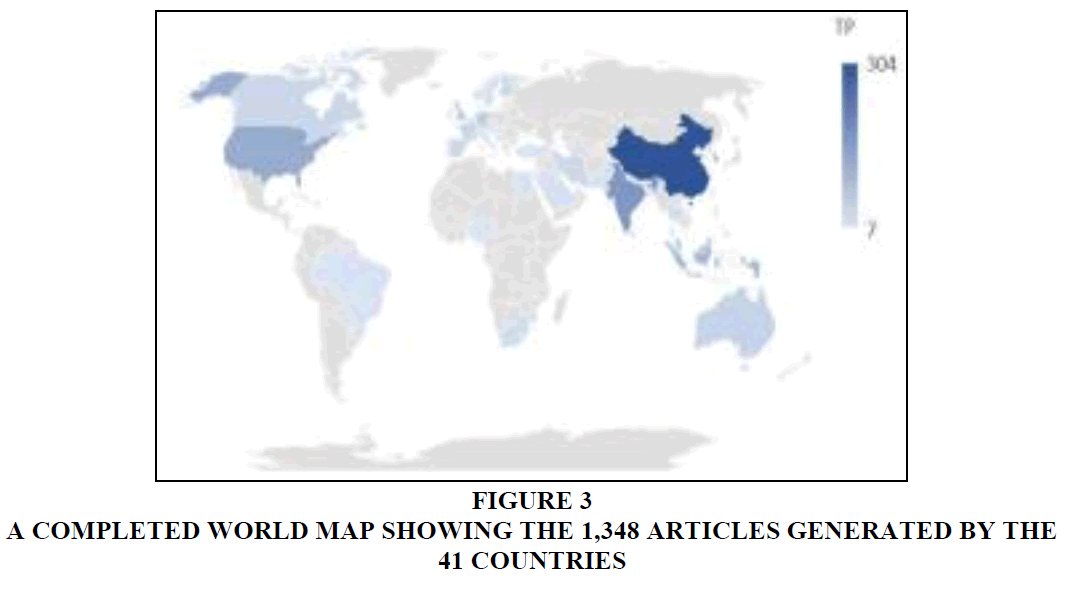

As can be seen in Table 2, the articles that were given serious consideration for inclusion came from a total of 10 different nations. These ten nations accounted for 76.75% (1036/1348) of the total contribution. The proportion of people from China who participated in the study was about 22.55% (304/1,348) of the total number of people who participated in the research. Second place was taken by India (163 out of 1348, for a percentage of 12.09%), while third place was taken by the United States of America (121 out of 1348, for a percentage of 8.98%). Figure 3 presents a complete world map that labels publications according to the nation from where they originated.

Since 1984, the information shown in Table 3 offers specifics on contributors' roles in publishing works whose titles include research on mobile banking and electronic wallets. This information has been compiled from various sources. The authors who provided the most significant contributions to the research were Liébana-Cabanillas, (19), Ondrus (15), Gong, X. (12), and Zhang These authors are listed in the order of their year of publication (12). Each of the following writers has contributed to a combined total of at least six different papers during their careers.

| Table 3 The Most Prolific Authors and Significant Institutions | |||||

| Author Name | Institution | TP | % | ||

| Liébana-Cabanillas, F. | Bina Nusantara University | 19 | 32 | 1.41% | 2.37% |

| Ondrus, J. | Beijing University of Posts and Telecommunications | 15 | 31 | 1.11% | 2.30% |

| Gong, X. | Universidad de Granada | 12 | 23 | 0.89% | 1.71% |

| Zhang, K.Z.K. | Universitas Indonesia | 12 | 17 | 0.89% | 1.26% |

| Lee, M.K.O. | City University of Hong Kong | 11 | 13 | 0.82% | 0.96% |

| Muñoz-Leiva, F. | Copenhagen Business School | 11 | 12 | 0.82% | 0.89% |

| Pousttchi, K. | Delft University of Technology | 11 | 11 | 0.82% | 0.82% |

| Sánchez-Fernández, J. | Xi'an Jiaotong University | 9 | 11 | 0.67% | 0.82% |

| Ahamad, S.S. | Huazhong University of Science and Technology | 8 | 10 | 0.59% | 0.74% |

| Sastry, V.N. | UniversitiTunku Abdul Rahman | 8 | 10 | 0.59% | 0.74% |

| Dahlberg, T. | Aalto University | 7 | 10 | 0.52% | 0.74% |

| Dwivedi, Y.K. | The University of Electronic Science and Technology of China | 7 | 9 | 0.52% | 0.67% |

| Ooi, K.B. | Hong Kong Polytechnic University | 7 | 9 | 0.52% | 0.67% |

| Pal, A. | ESSEC Business School | 7 | 9 | 0.52% | 0.67% |

| Pigneur, Y. | University of Science and Technology of China | 7 | 9 | 0.52% | 0.67% |

| Chawla, D. | South China University of Technology | 6 | 9 | 0.45% | 0.67% |

| Joshi, H. | UCSI University | 6 | 9 | 0.45% | 0.67% |

| Rabara, S.A. | Facultad de Ciencias Económicas y Empresariales | 6 | 9 | 0.45% | 0.67% |

| Singh, N. | The Royal Institute of Technology KTH | 6 | 8 | 0.45% | 0.59% |

| Tan, G.W.H. | Universiti Utara Malaysia | 6 | 8 | 0.45% | 0.59% |

| Tripathy, A.K. | Zhejiang University | 6 | 8 | 0.45% | 0.59% |

Table 3, which organises the data in a tabular style, includes entries for the organisations with the most sway in publishing articles on mobile banking and electronic wallets. The Bina Nusantara University in Indonesia and the Beijing University of Posts and Telecommunications in China were acknowledged as the educational institutions responsible for producing the greatest number of academic research works (located in China). These two educational facilities had 32 and 31 students enrolled in their programmes, respectively. The remainder of the contributed institutions are led by the Universidad de Granada, Universitas Indonesia, City University of Hong Kong, Copenhagen Management School, and the Delft University of Technology; however, each of these institutions' departments have contributed fewer than 23 publications.

A comprehensive study on keywords and analysis of Citation Metrics

Table 4 presented the citation metrics for the works retrieved going back 37 years' worth of history as of the 10th of December, 2021. The citation metric for the data received from the Scopus database was computed using the tool included in Harzing's Publish or Perish. The data in question came from the Scopus database. The purpose of this was to determine whether or not the data should be included in the research. Therefore, this was done. The summary provides information on the total number of citations and the number of citations for each year, each work, and each author. Also included is information on the overall number of citations. Moreover, information on the overall number of citations is included in the report as well.

| Table 4 The Top 20 Most-Used Keywords and Citations | ||||

| Keywords | T.P. | % | Citations | |

| Metrics | Data | |||

| Mobile Payment | 700 | 51.93% | Papers | 1348 |

| Global System for Mobile Communications | 581 | 43.10% | Number of Citations | 18247 |

| Electronic Money | 474 | 35.16% | Years | 37 |

| Mobile Telecommunication Systems | 145 | 10.76% | Citations per Year | 493.16 |

| Mobile Payments | 143 | 10.61% | Citations per Paper | 13.54 |

| Electronic Commerce | 141 | 10.46% | Citations per Author | 8230.31 |

| Mobile banking System | 131 | 9.72% | Papers per Author | 590.76 |

| Mobile Commerce | 127 | 9.42% | Authors per Paper |

2.83 |

| Mobile Devices | 103 | 7.64% | h-index | 61 |

| Authentication | 85 | 6.31% | g-index | 109 |

| Near Field Communication | 85 | 6.31% | ||

| Security | 76 | 5.64% | ||

| Cryptography | 65 | 4.82% | ||

| Information Systems | 62 | 4.60% | ||

| Surveys | 62 | 4.60% | ||

| Trust | 60 | 4.45% | ||

| Technology Acceptance Model | 59 | 4.38% | ||

| Commerce | 56 | 4.15% | ||

| NFC | 55 | 4.08% | ||

| Technology Adoption | 54 | 4.01% | ||

There were a total of 1348 articles published on the subject of mobile banking and e-wallet technologies. These papers were mentioned in 18247 instances, with an annual average of 493.16 citations. In addition, a total of 1,348 articles were written and published on the subject of mobile banking and electronic wallet technologies. The total number of times an item was mentioned was 13.54, and the aggregate h-index and g-index totals for all publications were 61 and 109, respectively. A piece of writing was cited 13.54 times on average within the academic community.

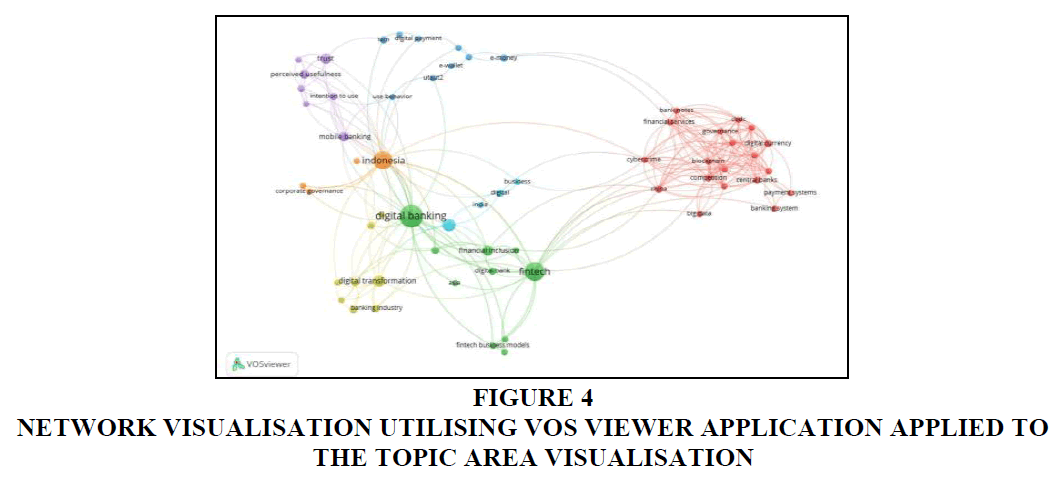

As seen in Figure 4, we analysed the list of the top 15 keywords published between 1984 and 2021 to show the most important terms utilised in developing mobile banking and electronic wallets. This can be seen by comparing the keywords list to those published between 1984 and 2021. The phrases that were utilised during the process of building mobile banking and electronic wallets were uncovered by this investigation. Mobile payment, worldwide system for mobile communications, and electronic money were the three fundamental keywords employed throughout the entire research conducted for this particular study's literature review. The purpose of the research that was done for this study was to produce a review of the previous research that had been done.

Figure 4 Network Visualisation Utilising VOS Viewer Application Applied to the Topic Area Visualisation

VOS Viewer

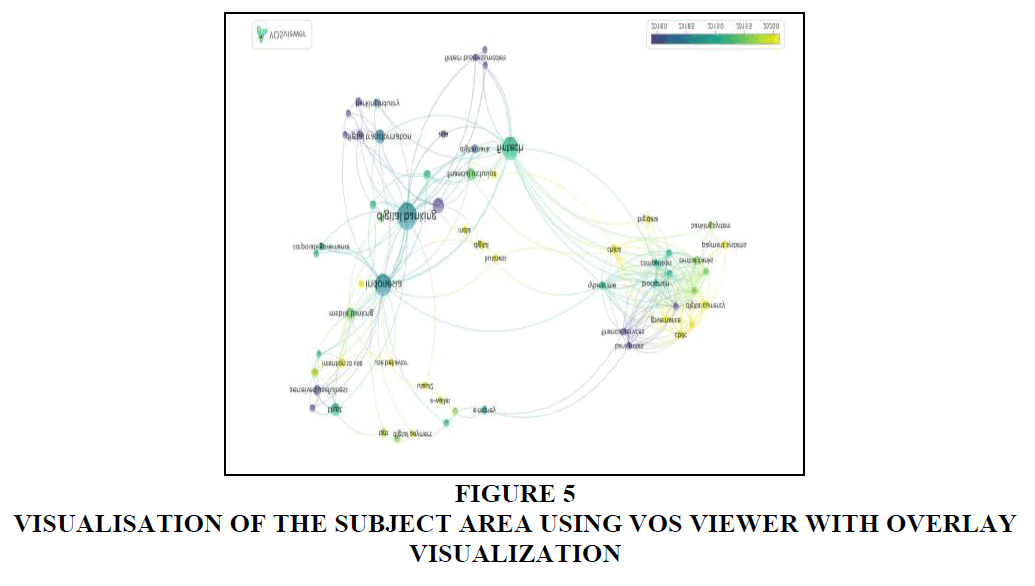

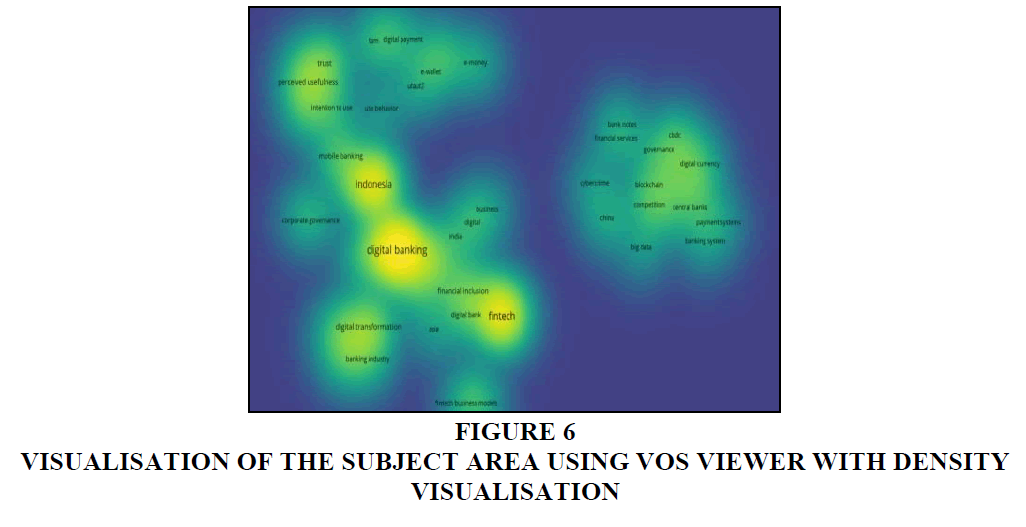

The VOS viewer can display bibliometric mappings in three different visualisations: network visualisation, overlay visualisation, and density visualisation (Figure 4). The spheres of various colours represent the various keywords. The findings of the extraction of titles are as follows: seven documents in the year 2021, two documents in the year 2020, four documents in the year 2019, and three documents in the year 2018.

Figure 4 illustrates the clusters that can be found in each of the topic areas that were researched. There are connections to be made between the term "digital banking" (located in the green region) and "fintech," "cybercrime," "blockchain," "e-money," "trust," and "India." Figure 5 depicts the progression of the trend from one year to the next in this study. This illustration demonstrates how digital banking is moving in the direction of e-wallets, digital currencies, and large amounts of data, as well as the countries of India and China.

Figure 6, meantime, illustrates the breadth of the investigation by demonstrating that the more concentrated the colour seems, the greater the amount of research. It is clear from Figure 4-6 that "digital banking" is one of the most common search terms. It has been determined through mapping done with Vosviewer that the nations of China, India, the United States, and Indonesia are the ones that use digital banking.

Conclusion

The bibliometric analysis of banking digitalisation literature provided valuable insights into the current state of research in this field. We identified key themes, trends, influential works, and prominent authors by examining a selected corpus of scholarly publications. The analysis revealed several significant findings.

Firstly, the analysis highlighted the emergence of key themes in banking digitalisation, such as blockchain technology, artificial intelligence, cybersecurity, and customer experience. These themes signify the growing importance of technological advancements and the need for robust security measures in the digital banking landscape. Understanding these themes allows practitioners to focus on areas with the highest potential for innovation and improvement.

Secondly, the analysis identified influential works and authors in banking digitalisation. This information is invaluable for researchers and practitioners seeking to access reputable sources of knowledge and identify thought leaders in the field. Engaging with influential works and collaborating with prominent authors can foster the exchange of ideas, facilitate further research, and drive practical advancements in banking digitalisation.

Thirdly, the analysis revealed research gaps and opportunities for collaboration. By identifying areas with limited research attention, practitioners and researchers can address these gaps through collaborative efforts. Collaboration between academia and industry can lead to practical insights, innovative solutions, and a deeper understanding of the challenges and opportunities in banking digitalisation.

Lastly, the analysis provided practical implications for practitioners. The findings offer guidance for evidence-based decision-making, knowledge dissemination, benchmarking, risk assessment, technology adoption, and policy considerations. Incorporating these practical implications into organisational strategies can enable practitioners to navigate the complexities of banking digitalisation more effectively and drive successful digital transformation initiatives.

In conclusion, the bibliometric analysis of banking digitalisation literature has shed light on the current research in this field. The analysis has revealed key themes, influential works, and prominent authors, providing valuable insights for researchers and practitioners. The findings contribute to the existing knowledge base and enhance our understanding of banking digitalisation. The practical implications derived from the analysis can guide decision-making, promote collaboration, and drive successful digital transformation within organisations. Future research should explore emerging trends and advancements in banking digitalisation and further investigate the practical implications identified in this analysis. By leveraging the insights gained from the analysis, organisations can effectively navigate the dynamic landscape of banking digitalisation and harness its potential for transformative change.

Further, after demonetisation, there has been a rise in the use of digital banking, and customers' comprehension of financial services has also increased. However, the banking sector has to be aware that most people still need to prepare to accept and use the services due to various causes, including economic hardship, illiteracy, ignorance, and a lack of willingness. Ignorance is the result of a lack of education. According to the results of this poll, educated account holders choose digital banking since it helps them save time and is simpler to use. However, illiterate people cannot access the Internet or smartphones because of their lack of education and financial stability. Educating impoverished individuals about the benefits of using digital banking services and providing them with orientation programmes can help improve the situation. Because it is possible that India will transition to a plastic economy and that paper money may go extinct, digital banking may become essential. As a result of the government's efforts to eradicate shadow economies, society's economy may continue to be demonised. These occurrences cannot take place in a single day. At some point in the future, everyone will utilise digital banking Nielsen Syndicated Studies (2018); Nayak (2018); Nasir, et al. (2020).

Everyone will soon use digital banking since cell phones are now so widely available, even to people who are illiterate and live below the poverty line. Thus, everyone in our society needs to educate themselves on digital banking services and use them for the sake of our economy and our people. These things are only possible with education and a younger generation proficient in technological skills. Beginning in 2019, there has been a marked increase in e-wallet releases. The increasing use of electronic wallets could explain this publication trend. The COVID-19 outbreak has an additional effect on how individuals use technology. The movement control order drives more people to use electronic wallets while making online transactions.

Managerial Implications

Stay updated on emerging technologies: The analysis revealed emerging themes like blockchain technology, artificial intelligence, and cybersecurity in banking digitalisation. Managers should actively monitor these technologies and assess their potential impact on the banking industry. Understanding these emerging trends can help organisations stay ahead and make informed decisions regarding their digital transformation strategies.

1. Prioritise customer-centric digital experiences: The literature analysis highlighted the importance of digital banking channels and customer adoption of digital services. Managers should focus on creating seamless and user-friendly digital experiences to enhance customer satisfaction and retention. Investing in user-centric design, personalised offerings, and robust security measures can significantly improve the digital banking experience and attract more customers.

2. Foster a culture of innovation: Technological innovation is a recurring theme in the literature on banking digitalisation. Organisations should foster a culture of innovation that encourages employees to explore and experiment with new technologies. By promoting a mindset of continuous improvement and providing resources for research and development, managers can drive innovation within their organisations and create a competitive advantage in the digital banking landscape.

3. Collaborate with fintech companies: The analysis revealed the increasing importance of collaboration between traditional banks and fintech companies. Managers should actively seek partnerships with fintech firms to leverage their expertise and innovative solutions. Collaborations can facilitate the adoption of cutting-edge technologies, enable rapid experimentation, and enhance the delivery of digital services. Building strong alliances with fintech companies can help banks remain agile and competitive in the digital era.

4. Address cybersecurity challenges: With the growing reliance on digital technologies, cybersecurity has become a critical concern in banking digitalisation. Managers should prioritise cybersecurity measures to protect customer data, prevent fraud, and ensure the integrity of digital transactions. Implementing robust cybersecurity frameworks, conducting regular audits, and investing in advanced security technologies can help mitigate the risks associated with digitalisation and maintain customer trust.

5. Invest in employee training and upskilling: The rapid pace of digital transformation requires employees to possess the necessary skills and knowledge to navigate the changing landscape. Managers should invest in training programs and upskilling initiatives to equip their workforce with the digital competencies needed to adapt to new technologies and processes. Organisations can enhance their internal capabilities by investing in employee development and embracing banking digitalisation.

6. Monitor regulatory developments: As the banking industry undergoes a digital transformation, regulatory frameworks and policies evolve accordingly. Managers should closely monitor regulatory developments and ensure compliance with relevant laws and regulations. Staying informed about regulatory changes can help organisations avoid potential legal pitfalls and proactively adapt their strategies to align with the regulatory landscape.

Overall, the managerial implications derived from the bibliometric analysis highlight the importance of embracing digitalisation, prioritising customer-centric approaches, fostering innovation, collaborating with fintech companies, addressing cybersecurity concerns, investing in employee training, and staying abreast of regulatory developments. By considering these implications, managers can navigate the complexities of banking digitalisation and position their organisations for success in the digital era.

Practical Implications

Evidence-based decision-making: The bibliometric analysis provides a comprehensive overview of the literature on banking digitalisation. Practitioners can use this analysis as a valuable resource to inform decision-making. By studying the influential works, key themes, and emerging trends identified in the analysis, practitioners can gain insights into best practices, potential risks, and strategic opportunities related to banking digitalisation.

1. Knowledge dissemination and sharing: The analysis highlights the most influential authors and journals in banking digitalisation. Practitioners can leverage this information to identify thought leaders and reputable sources of knowledge for further exploration. Engaging with influential authors' work and accessing relevant journals can help practitioners stay informed about the latest research, trends, and innovations in banking digitalisation.

2. Identifying research gaps and collaboration opportunities: The bibliometric analysis reveals current research in banking digitalisation. Practitioners can identify research gaps or areas that require further investigation. By recognising these gaps, organisations can explore opportunities for collaboration with academic researchers or initiate internal research projects to address the identified knowledge gaps. Collaboration between practitioners and researchers can lead to mutual learning, practical insights, and the development of innovative solutions.

3. Benchmarking and performance evaluation: The analysis provides insights into the most cited works and influential authors in banking digitalisation. Practitioners can benchmark their organisation's initiatives and performance against the findings of the analysis. Comparing their progress to industry-leading research can help organisations assess their digitalisation strategies, identify improvement areas, and set success benchmarks. Additionally, practitioners can use the analysis to evaluate the impact and relevance of their research contributions to banking digitalisation.

4. Risk assessment and mitigation: The analysis identifies emerging themes like blockchain technology, artificial intelligence, and cyber security. Practitioners can use this information to conduct risk assessments and identify potential threats to these emerging technologies. Understanding the risks and challenges enables organisations to develop appropriate risk mitigation strategies, allocate resources effectively, and establish robust security measures to protect against cyber threats.

5. Technology adoption and implementation: The analysis sheds light on the key themes and trends in banking digitalisation research. Practitioners can use this knowledge to make informed decisions about adopting and implementing digital technologies in their organisations. By understanding the prevalent technologies and their implications, practitioners can strategically invest in technologies that align with their organisational goals, improve operational efficiency, and enhance customer experiences.

6. Policy and regulatory considerations: The analysis provides insights into the regulatory landscape and evolving banking digitalisation policies. Practitioners can stay informed about regulatory developments and ensure compliance with relevant laws and regulations. By understanding the regulatory environment, organisations can proactively adapt their strategies, policies, and operational practices to meet compliance requirements while leveraging digitalisation opportunities.

References

Anagnostopoulos, I. (2018). Fintech and regtech: Impact on regulators and banks. Journal of Economics and Business, 100, 7-25.

Indexed at, Google Scholar, Cross Ref

Aysan, A.F.; Demirta, H.B.; Saraç, M. The ascent of bitcoin: Bibliometric analysis of bitcoin research. J. Risk Finance. Manag. 2021, 14, 427.

Indexed at, Google Scholar, Cross Ref

Baabdullah, A. M., Alalwan, A. A., Rana, N. P., Patil, P., &Dwivedi, Y. K. (2019). An integrated model for m-banking adoption in Saudi Arabia. International Journal of Bank Marketing, 37(2), 452–478.

Indexed at, Google Scholar, Cross Ref

Chen, M.A.; Wu, Q.; Yang, B. How valuable is FinTech innovation? Rev. Financ. Stud. 2019, 32, 2062–2106.

Dosso, M., & Aysan, A. F. (2022). The technological impact in finance: a bibliometric study of fintech research. In Eurasian Business and Economics Perspectives: Proceedings of the 35th Eurasia Business and Economics Society Conference (pp. 193-209). Cham: Springer International Publishing.

Eyal, I. (2017). Blockchain technology: Transforming libertarian cryptocurrency dreams to finance and banking realities. Computer, 50(9), 38–49.

Firdaus, A., Ab Razak, M. F., Feizollah, A., Hashem, I. A. T., Hazim, M., & Anuar, N. B. (2019). The rise of "blockchain": Bibliometric analysis of blockchain study. *Scientometrics, 120, 1289–1331.

Indexed at, Google Scholar, Cross Ref

Folkinshteyn, D., & Lennon, M. (2016). Braving Bitcoin: A technology acceptance model (TAM) analysis. Journal of Information Technology and Applied Research, 18, 220–249.

Geebren, A., Jabbar, A., & Luo, M. (2021). Examining the role of consumer satisfaction within mobile ecosystems: Evidence from mobile banking services. *Computers in Human Behavior, 114 106584.

Grand View Research. (2021). Mobile Payment Market Size, Share & Trends Analysis Report By Technology, By Payment Type (B2B, B2C, B2G), By Location, By End Use, By Region, And Segment Forecasts, 2021 - 2028.

Haroune, L., Salaun, M., & Menard, A. (2014). Photocatalytic degradation of carbamazepine and three derivatives using TiO2 and ZnO: Effect of pH, ionic strength, and natural organic matter. Science of The Total Environment, 475*, 16–22.

Indexed at, Google Scholar, Cross Ref

Hettar, R., Samiti's, H. A., Jigalur, K., & Sheshgiri, S. (2019). Digital banking from an Indian perspective. Journal of Economics and Finance.

Jain, V., Sharma, P., Kumar, A., & Kansal, A. (2020). Digital Banking: A case study of India. Solid State Technology, 63(6), 3-5.

Jiang, S., Li, X., & Wang, S. (2020). Exploring evolution trends in cryptocurrency study: From underlying technology to economic applications. *Finance Research Letters, 38*, 101532.

Indexed at, Google Scholar, Cross Ref

Kitsios, F., Giatsidis, I., & Kamariotou, M. (2021). Digital transformation and strategy in the banking sector: Evaluating the acceptance rate of e-services. Journal of Open Innovation: Technology, Market, and Complexity, 7(3), 204.

Indexed at, Google Scholar, Cross Ref

Lakshmi, N. M., & Kavitha, M. (2020). A study on customer satisfaction on digital banking. Xi'an University of Architecture & Technology, 727.

Leong, C., Tan, B., Xiao, X., Tan, F., & Sun, Y. (2017). Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. *International Journal of Information Management, 37, 92–97.

Indexed at, Google Scholar, Cross Ref

Magdalena, S., & Suhatman, R. (2020). The effect of government expenditures, domestic investment, and foreign investment on the economic growth of the primary sector in Central Kalimantan. Budapest International Research and Critics Institute-Journal (BIRCI-Journal)*, 3(3), 1692-1703.

Marsal-Llacuna, M. L. (2018). Future living framework: Is blockchain the next enabling network? Technological Forecasting and Social Change, 128, 226–234.

Indexed at, Google Scholar, Cross Ref

Martin, H., & Daim, T. (2008). Technology road mapping through intelligence analysis: The case of nanotechnology. International Journal of Society Systems Science, 1(1), 49–66.

Mathangi R., Latasri O. T., & Isaiah Onsarigo Miencha (2017). Improving service quality through digital banking - Issues and challenges. International Journal of Recent Scientific Research.

Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G. (2010). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. International Journal of Surgery, 8(5), 336–341.

Indexed at, Google Scholar, Cross Ref

Nasir, A., Shaukat, K., Khan, K. I., Hameed, I. A., Alam, T. M., & Luo, S. (2020). What is Core and What Future Holds for Blockchain Technologies and Cryptocurrencies: A Bibliometric Analysis. IEEE Access, 9, 989–1004.

Nayak, R. (2018). A conceptual study on digitalization of banking - Issues and challenges in rural India. International Journal of Management, IT, and Engineering.

Nielsen Syndicated Studies. (2018). Malaysia's Payment Landscape 2018.

Indexed at, Google Scholar, Cross Ref

Nobanee, H., & Ellili, N. O. D. (2022). Non-fungible tokens (NFTs): A bibliometric and systematic review, current streams, developments, and directions for future research. International Review of Economics & Finance, in press.

Indexed at, Google Scholar, Cross Ref

Palinggi, S., & Allolinggi, L. R. (2019). Analisa Deskriptif Industri Fintech di Indonesia: Regulasi dan Keamanan Jaringan dalam Perspektif Teknologi Digital. jurnal ekobis, 6(2), 177-192.

Indexed at, Google Scholar, Cross Ref

Santiago Carbo-Valverde (2017). The impact on digitalization on banking and financial stability. Journal of Financial Management, Markets and Institutions.

Seibel, H. D., & Khadka, S. (2002). SHG Banking: A financial technology for poor microentrepreneurs. Savings and Development, 26(2), 133–150.

Sweileh, W. M., Wickramage, K., Pottie, K., Hui, C., Roberts, B., Sawalha, A. F., & Zyoud, S. H. (2018). Bibliometric analysis of global migration health research in the peer-reviewed literature (2000–2016). BMC Public Health, 18(1), 1–18.

Indexed at, Google Scholar, Cross Ref

Received: 19-Sep-2023, Manuscript No. AMSJ-23-14022; Editor assigned: 20-Sep-2023, PreQC No. AMSJ-23-14022(PQ); Reviewed: 30-Oct-2023, QC No. AMSJ-23-14022; Revised: 29-Dec-2023, Manuscript No. AMSJ-23-14022(R); Published: 17-Jan-2024