Review Article: 2023 Vol: 27 Issue: 5S

Blockchain Based Emerging Technologies: NFTs and Crypto Currencies

Priyanka Budania, Manipal University Jaipur, Jaipur

Gaurav Lodha, Manipal University Jaipur, Jaipur

Garvita, Manipal University Jaipur, Jaipur

Citation Information: Budania, P., Lodha, G., & Garvita. (2023). Blockchain based emerging technologies: nfts and crypto currencies. Academy of Marketing Studies Journal, 27(S5), 1-11.

Abstract

The non-fungible token (NFT) is a single unit of data recorded on a digital leader that is not exchangeable (blockchain). NFTs can be used as unique articles (analogous to a certificate of authenticity) to represent readily reproduced objects such as pictures, videos, audio, and others, and can utilize blockchain technology to provide verifiable, public evidence of ownership. The original file may be shared and copied like other files and is not limited to the NFT owner. The absence of interchangeability differentiates NFTs from blockchain cryptocurrencies, for instance, bitcoin. The primary goal of this paper is to explain that NFTs are useful in tokenizing digital goods, preventing fraud, and improving secondary market transaction control, to provide widespread awareness about the advantages of Non Fungible Tokens, and to describe the link between NFTs and Cryptocurrencies. The methodological approach of this paper is the literature review and secoundary data is used. In this work, we present some key elements involved in the link between Non-Fungible tokens and blockchain technology.

Keywords

Non-fungible tokens, Blockchain Technology, tokenizing, Cryptocurrencies.

Introduction

Security issues have always been one of the main concerns for cryptocurrencies in past years. To survive, changes regarding security are required in the mechanism of cryptocurrencies for smooth flow of trading because in trading cryptocurrencies only persons who are trading have the authority to see and maintain the transaction no central authority is involved in it. However recent advancements and development in the structure of technology have introduced effective ways for cryptocurrencies. Blockchain is a very modern and advanced technology on which these cryptocurrencies are working and managing a decentralized and secured record of transactions basically, it is a digital ledger technology that is shared among the nodes of the computer system. It stores information in digital format. The block chain’s distinguishing characteristic is that it preserves and manages data record securely and reliability, also fostering confidence without the use of a trusted third participant. A blockchain is a database that changes from that of a regular data structure. The blockchain divides data into many blocks, each of which contains a collection of information. Blocks have defined powerful capacities, and when they are filled, they are closed and joined to the previous block, forming the blockchain, a data chain record. All further data contributed after that newly updated block is built into a new block, which is then added to the chain after it has been filled. Recently Non-fungible tokens (NFTs), which are defined as a medium that allows for the ownership and exchange of digital assets in any form, have gotten a lot of interest in recent years.

Non-fungible tokens are a unit that stores data in blockchain technology that can be sold or traded it is associated with the form of digital files likewise photos, videos, and audios, and each token of these data units can be individually identified, it is different from the blockchain of cryptocurrencies. All subsequent sales of an NFT produced on a blockchain are monitored and documented. Because each token's metadata contains information about ownership and any other rules and conditions that apply to that token, such tracking is possible. So its metadata cannot be reproduced or recreated, each token is non-fungible. To put it another way, one NFT cannot be substituted for another NFT or any other asset. NFTs are usually bought and sold with the sort of cryptocurrency or digitally tokenized (generally referred to as tokens) that is utilized or accepted on that blockchain. Earlier, NFTs were almost entirely generated and acquired with ether tokens on the Ethereum network Kugler (2021).

The purpose of this paper is to explain the uses of NFTs in digital assets including photos, art pieces, digital currencies. In this paper, we explore the challenges, opportunities, and risks involved with it concluding with recommendations for the usage of NFTs in digital assets Matney (2021).

The Emergence of Non-Fungible Tokens (NFTs)

Non-Fungible Tokens (NFTs) are supposed to be a cryptographically signed copies of analog and digital assets that can be registered on the blockchain and, have technologically enabled proprietorship and exchange of digital assets. Non-fungible tokens made digital assets trading possible it also makes the ownership of digital assets possible. When a person or buyer buys the non-fungible token the transaction is recorded in the database through blockchain technology, so no one can do mala fide activity (carried out in bad faith), or no one can change the ownership of that particular token. NFTs are the tokens that can be purchased, sold, repurchased, traded, and transferred through blockchain identical to any type of cryptocurrency.

Before the emergence of non-fungible tokens ownership of art pieces, collectibles, pictures, and, works of art can be claimed in many ways. When mechanical reproduction was discovered, "artists and collectors had to come to terms with the fact that they could produce an unlimited number of identical prints of any photograph." Whereas painters and sculptors could always create antique physical artifacts, photographers "had to come to terms with the fact that they could produce an unlimited number of identical prints of any photograph." As a result, signed editions were established to attain legitimacy, insufficiency, and so collectability. Similarly, NFTs develop and execute the notion of signed editions in the digital arena as a response to the Internet's "artificial abundance." More importantly, they do so in a manner that is widely accepted. NFTs are designed to minimize the fraud that happens with digital assets.

Working of NFTs through Blockchain Technology

“The First Non-Fungible token was created by Kevin McCoy and Anil Dash on May 3rd, 2014 named Quantum” (Cascone & Sarah, 2021). Quantum is a pixelated octagon with various forms that pulse in a fascinating pattern. McCoy's wife Jennifer created a short clip for the film. “During a live presentation at the New Museum for the Seven on Seven conferences in New York City, McCoy registered the video on the Namecoin network and sold it to Dash for $4. "Monetized visuals," as McCoy and Dash described the technology” (Dash, 2021) Chohan (2021).

“Three months after the Ethereum blockchain was created, the first NFT project, Etheria, was presented and showcased at DEVCON 1 in London, Ethereum's inaugural developer conference. Until March 13, 2021, when revived interest in NFTs ignited a purchasing frenzy, the majority of Etheria's 457 purchasable and tradable hexagonal tiles went unsold for more than five years. All tiles from the current and previous versions, each hardcoded at 1 ETH ($0.43 at the time of launch), were sold for a total of $1.4 million in less than 24 hours.” (Matney, 2021); Trautman (2021).

“Following the introduction of many NFT initiatives that year, the ERC-721 standard, initially suggested in 2017 via the Ethereum GitHub, acquired currency. The standard was launched at the same time as numerous NFT initiatives, including Curio Cards, CryptoPunks (a project to trade unique cartoon characters put on the Ethereum blockchain by the American company Larva Labs), and rare Pepe trading cards”. (Entriken, Shirley, Evans, & Sachs, 2018).

Platforms developed on the upper edge of the Bitcoin blockchain have seen a great amount of research and testing. It marked the start of Ethereum's hegemony over NFTs. The Counterparty system, for example, allows for the production of digital assets. Later onwards, Magic of Genesis followed in Following in Counterparty's methods, their platform pioneered the issuing of game assets. Finally, the meme era began in 2016 with the Counterparty platform's introduction of Rare Pepes NFTs. It should be emphasized, however, it was never the concept of using valuable block space to store tokens that indicated picture ownership. That marked the start of the transition for NFTs to the Ethereum Blockchain.

Process to buy NFTs

Create an account on the platforms

Firstly, all we need to create NFT, through the internet anybody can create this token, all he/she need to fill in the details and upload the digital file online. NFTs are now generating the most attention in the art industry, where they are used as blockchain-backed evidence of ownership of a costly original work of art. Ethereum is the most popular platform on which NFTs are traded.

In order to get ownership of the token Ethereum is being configured as a proxy integration, that executes the logic to utilize and mint. The signed transactions is being sent to the Ethereum blockchain by forwarding the request to a managed blockchain endpoint. Depending on the traffic on the network on which it is working it can required many minutes to be approved.

In order to avoid any possible timeout of task polls the blockchain, check for the number of necessary authorizations. The transaction is said to be completed only when the required number of authorizations is done. Once the transaction completes email is sent to the NFTs creator.

Second step is begun with creating a wallets there are plenty of active wallets are available in market one of them are METAMASK, Trust Wallets, etc. For buying NFTs, we need to transfer the cryptocurrency to non-custodial wallet. Now we can select NFTs on marketplace, there are wide range of NFTs are available in marketplace the best known marketplace is Opensea. Then browse the marketplace for NFTs to buy.

Literature Review

Valeonti, Foteini, et.al (2021) This paper examines recent affairs in respect to Non-Fungible Tokens and the historical heritage sector in this paper, noting obstacles while emphasizing revenue-generating prospects, to assist galleries and museums in addressing their ever-increasing financial issues. Finding states that some have viewed the introduction of NFTs as a "lifeline" for museums that have been forced to rely on layoffs to stay afloat financially Fairfield (2021).

This paper gives the overview, evaluation, opportunities, and challenges of Non-Fungible Tokens and explains the basic characteristics of Non-Fungible Token. The results show that the first popular example of NFT is Crypto Kitties, which caused the blockage of the Ethereum network in December 2017 and led to the development of the NFT market.

This research adds to the body of knowledge about the criteria that attract investors to the Non-Fungible Token marketplace. This is the first research to look at how much attention non-fungible tokens get. We begin by generating vector autoregressive (VAR) models with endogenous variable to investigate the relationship between cryptocurrency returns and NTF attentiveness. The findings show that the excitement around cryptocurrencies may be to blame for the Non-Fungible Token's rise in popularity.

Wang et al. (2021) This is the first systematic study of the current Non-Fungible Token of the ecosystem, this paper starts with the overview of NFTs, technical components, Protocols, and properties, this report delivers timely analysis and summary of existing proposed solutions.

Usage of NFTs

Non-fungible tokens are used basically for the security of digital assets like artworks, pictures, music collections. It has been used as a means of exchange of digital tokens and secured by blockchain technology.

Digital Artwork

Mostly the uses of NFTs are seen in digital artworks, the technology allows for a completely new approach to market paintings. The Non-Fungible Tokens are a digital certificate of ownership that may be added to any digital asset – a jpeg picture file, a movie, or a song – and are virtually always bought and sold using bitcoin. Anyone can watch and download the file associated with a Non Fungible Token for free and save it on their phone or computer using a simple Google search, but only the owner has the right to sell or trade it on the digital platform. Each Non Fungible Token has a unique identity, and all the transactions are recorded and placed on the blockchain platform, a form of the database created in 2008 to track and record cryptocurrency transactions securely.

Cryptopunks is one of the most famous NFTs

Use in Gaming

“NFTs may be used to reflect in-game assets like digital landholdings, which some critics consider as being managed "by the user" rather than the game creator since they allow assets to be exchanged on third-party markets without the game developer's approval non-fungible tokens” (Alexander, 2021) use in games as representations as characters, and other consumables tradeable items. In the game-fi world, Non-Fungible Token games have grown popular as a method to make money. You may sell your Non-Fungible Tokens in-game to other collectors and gamers, or use play-to-earn models to gain tokens. Make sure you move your gaming Non-Fungible Tokens to a wallet that accepts them. When sending the NFT to an NFT marketplace or another user, keep an eye out for typical frauds. Finally, check the rules of every NFT game you play carefully to discover whether there is any risk of losing. Ubisoft Quartz, "a Non-Fungible Token venture that allows users to acquire artificially scarce digital things using bitcoin," was launched in December 2021 by Ubisoft. NFTs have the potential to become the next step in the development of in-game micro-transactions. This concept has evolved from treasure boxes to battle passes.

Louis: The Game is the best Example of an NFT game, in this game players have to complete the challenges to find hidden NFTs in game.

Use in audio clips & music

Non-Fungible Tokens are proposed to provide more involvement to the music business with the prospect for higher profit for bands, at a period when composers have faced constraints on-stage performances and contact with fans. Such a new digital platform may also benefit creators, whether they are well-known or just getting started on their path to fame. Listeners' preferred destination is currently online music streaming services, with frictionless and easy-to-use apps like Spotify and Apple Music accounting for a substantial portion of the worldwide market share. Despite the increased ease with which individuals can hear music, Citigroup research found that artists only earn 12% of the catch share by the total music business. Non-Fungible Tokens make all the difference in this case. NFTs, which include a unique digital identification number, is a game-changer for creatives wishing to increase their online presence since they assure that actual content ownership stays with the artist despite digital copying. This allows fans and community members to connect directly with the artists' music while also paying royalties to those who created the material when the NFT collectible is traded. As a bigger share of revenue goes to content creators, they are driven to generate higher-quality works as well, raising overall music quality and democratizing the music business. Elon Musk did a tweet and said he would create a techno song about NFT and he is going to sell this song as NFT and the highest bid was over on $1.1 million.

Protection from Money Laundering

Money laundering is a possibility with NFTs, as it is with other blockchain assets and artistic works sales. Compliance with current anti-money laundering regulations may put regulatory pressure on auction networks for NFT sales. The US Treasury found "some indications of money laundering danger in the great art market," such as through "the developing digital art industry, such as the usage of non-fungible tokens," according to research released in February 2022. (NFTs). The study looked at how Non-Fungible Tokens exchanges are more convenient way to launder money through art since they bypass the logistics and insurance issues that come with dealing with actual art.

The link between NFTs and cryptocurrencies

• When Non-Fungible Tokens are exchanged or traded through cryptocurrencies, they have many well-defined attributes that are significant and crucial to keep in presence while trying to recognize and understand them. Cryptocurrency are designed to be used as currencies first and foremost, even if they have certain asset-like features. Non-Fungible Tokens, contrary, are made to be used simply as assets. The phrase "non-fungible" in the Non-Fungible Token term is a good indicator performer of this dissimilitude (Dirk G, Kihoog, & Adrian D, 2018). One of the axioms of cryptocurrency and money, is fungibility, or interchangeability (one bitcoin is similar to another bitcoin, and one dollar is similar to another). The non-fungibility of NFTs is one of the significant asset qualities.

• Having said that, everybody who follows the Non-Fungible Token marketplace is aware of the significantly imbricate between cryptocurrencies and NFT market participators. That is partly due to the fact that buying a Non-Fungibility Token entails the usage of cryptocurrencies, which presents a degree of difficulty for individuals. With this in mind, we investigated if there are any cross or diversified effects between cryptocurrency and Non-Fungible Token pricing in our research. “We expect cryptocurrencies to have an impact on NFT pricing because larger markets tend to spill over into smaller related markets, and cryptocurrencies are a much larger connected market than NFTs. NFT pricing may have an impact on cryptocurrency markets, as NFTs and their popularity provide a strong commercial case for blockchain technology” (Bhattarai, Chatterjee, & YongPark, 2020).

• Both Non-Fungible Tokens and Cryptocurrencies are traded through the same platform called Blockchain this is the most important link between Non-Fungible Tokens and cryptocurrencies. Blockchain is an online platform that is highly secured and it is very difficult to illegal activity on blockchain because it records every single transaction in the ledger and makes a separate block for it.

Purpose

Purpose of this research paper is to Explain the usage of NFTs and its working through Blockchain Technology. Usage of cryptocurrency for buying NFTs and to analyse how the NFTs Market share are increasing by using cryptocurrencies, and in which areas NFTs are useful like gaming, Audio & video clips, etc Table 1.

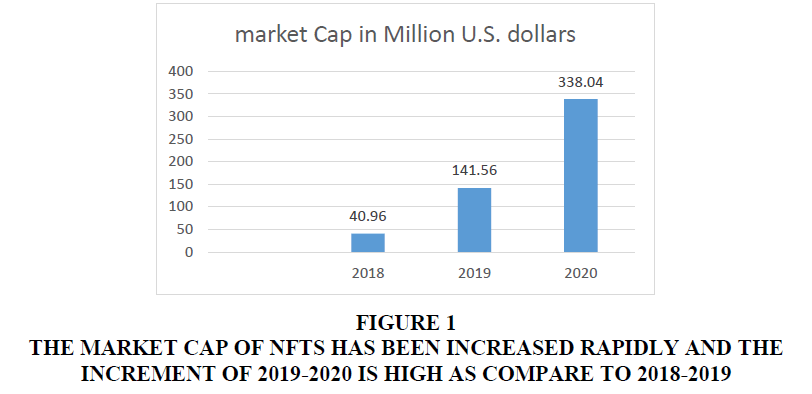

| Table 1 Market Capitalization Of Nfts From 2018-2020 Globally |

|

|---|---|

| Year | market Cap in Million U.S. dollars |

| 2018 | 40.96 |

| 2019 | 141.56 |

| 2020 | 338.04 |

Objectives of the Paper

•To study the concept of Non-Fungible Tokens (NFTs)

• To understand the working of Non-Fungible Tokens (NFTs)

• To explain the Link Between NFTs and Cryptocurrencies

Research Methodology

This research paper is based on Secondary Data. It is information that has previously been gathered from primary sources and made accessible to scholars for their own study. It is a sort of information that has previously been gathered. The sources I have used in this include books, journals, newspapers, websites http://nonfungible.com/market-tracker etc.

• For analysing, the impact of NFTs I have took the data of year 2021 and 2022.

•Variables are number of sales, unique buyers, Active market Wallets.

In Figure 1 the Market Cap of NFTs has been increased rapidly and the increment of 2019-2020 is high as compare to 2018-2019 Table 2.

Figure 1: The Market Cap Of Nfts Has Been Increased Rapidly And The Increment Of 2019-2020 Is High As Compare To 2018-2019.

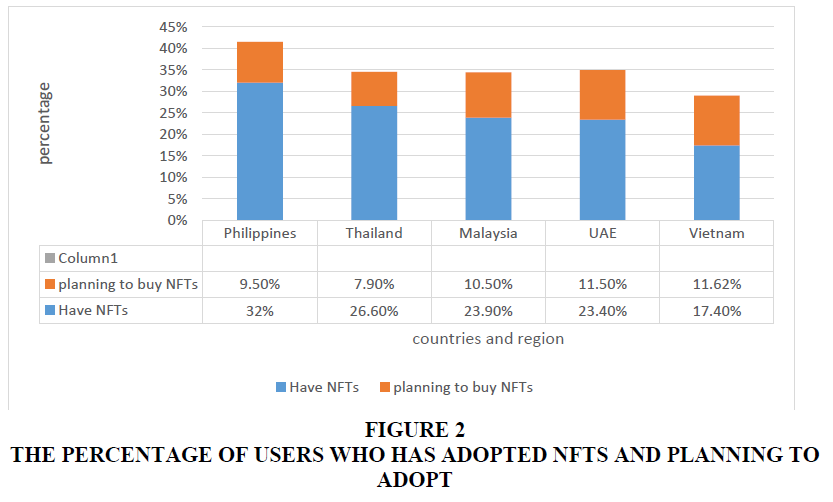

| Table 2 Top 5 Countries Who Used Nfts Most |

||

|---|---|---|

| Countries and Regions | Have NFTs | Planning to buy |

| Philippines | 32% | 9.5% |

| Thailand | 26.6% | 7.9% |

| Malaysia | 23.9% | 10.5% |

| UAE | 23.4% | 11.5% |

| Vietnam | 17.4% | 11.62% |

In Figures 2 & 3 graph shows the top 5 countries who has adopted NFTs and Philippine is at the top in the list with 32% followed by Thailand, Malaysia, UAE and Vietnam. Users in these countries are also having a good percentage of planning to buy NFTs in which Vietnam has the highest percentage of willing to adopt NFTs in future followed by UAE, Malaysia, Philippine and Thailand.

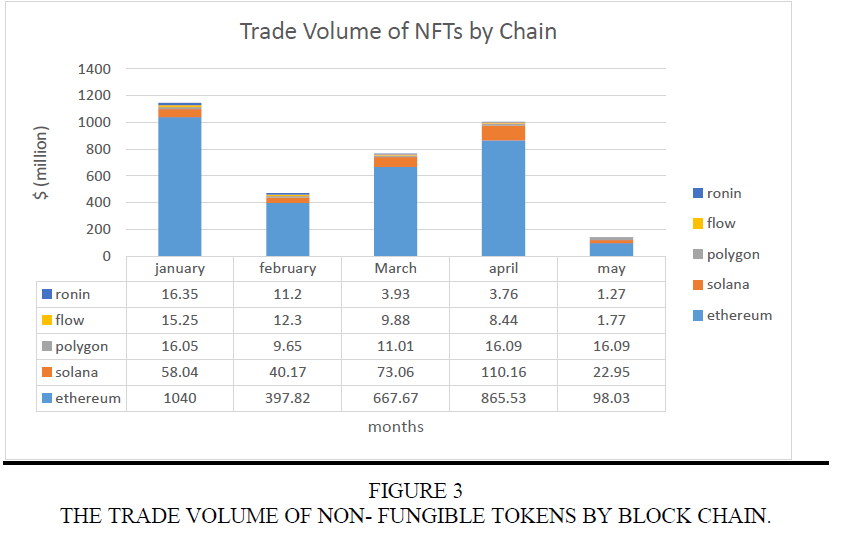

| Table 3 The Weekly Trade Volume Of Nfts By Blockchain For The Year 2022 |

|||||

|---|---|---|---|---|---|

| Months | Ethereum | Solana | Polygon | Flow | Ronin |

| January | 1040.0m | 58.04m | 16.05m | 15.25m | 16.35m |

| February | 397.82m | 40.17m | 9.65m | 12.3m | 11.2m |

| March | 667.67m | 73.06m | 11.01m | 9.88m | 3.93m |

| April | 865.53m | 110.16m | 16.09m | 8.44m | 3.76m |

| May | 98.03m | 22.95m | 16.09m | 1.77m | 1.27m |

Source: https://www.theblockcrypto.com/data/nft-non-fungible-tokens/nft-overview/nft-trade-volume-by-chain

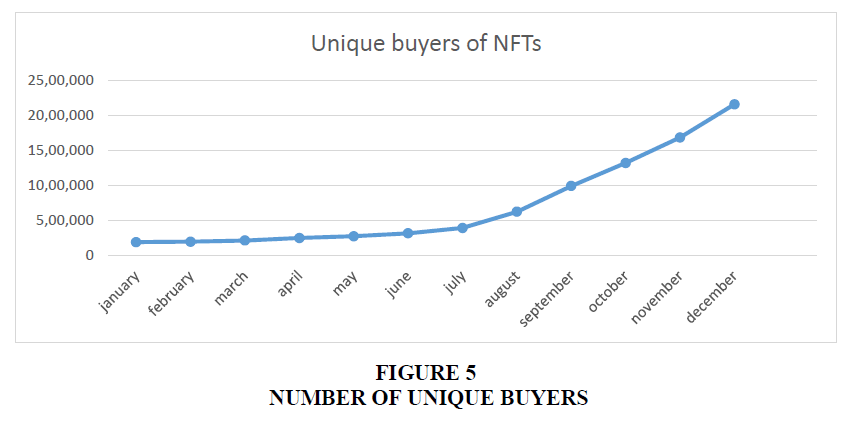

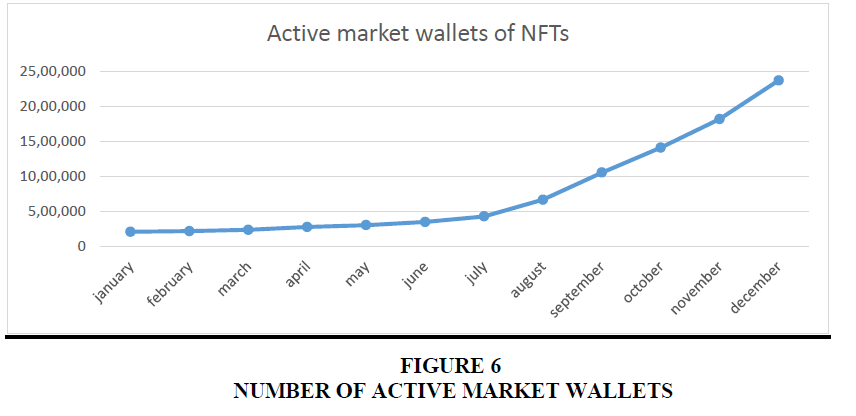

Table 3 Showing the data from January 2021 to December 2021 of Non-Fungible Tokens in the form of-

• Sales of NFTs in USD

• Unique Buyers of NFTs

•Active market wallets of NFTs

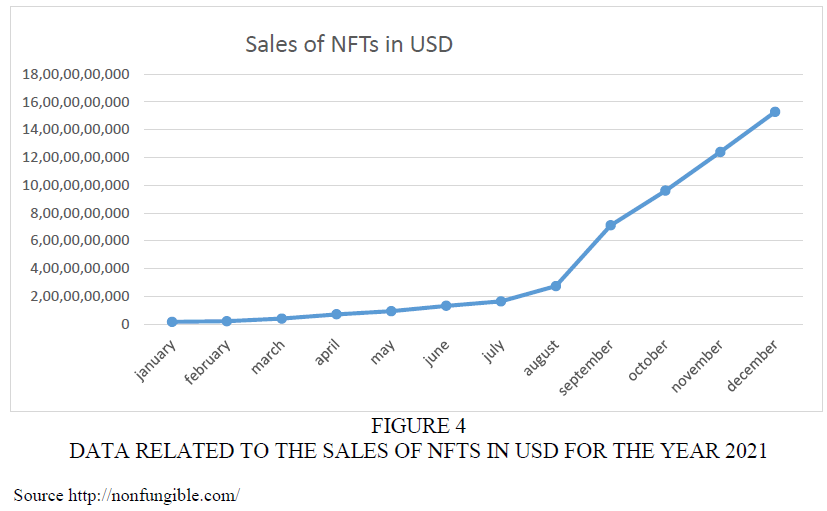

Figure 4 is showing the data related to the sales of NFTs in USD for the year 2021, as we can see that after may NFTs sales starts increasing rapidly as compare to previous months and dynamic movement can be seen in between the month of October to November.

Figure 4:Data Related To The Sales Of Nfts In Usd For The Year 2021.

Source: http://nonfungible.com/

According to the Figures 5 & 6 Unique non-fungible tokens buyers hiting high market area NFT growth movement have been turning high after the month of july 2021.

NFTs wallets is a cryptocurrency wallet that supports blockchain. As per the data there is more than 23 lac active wallets in markets in December 2021.

Trading of NFTs through Cryptocurrencies

The most important feature of cryptocurrency's fungibility, or interchangeability, is one of money in general and non-fungibility is the unique factor of non-fungible tokens we can say that this characteristic is the key asset of NFTs. As a means of payment to buy any NFTs, we need to trade in the cryptocurrency. Non-Fungible Token pricing also affects cryptocurrency markets, as Non-Fungible Tokens shows a well-built business usage for the blockchain platform. NFT marketplaces like OpenSea and Raible also accept cryptocurrency as a payment and trading option, most notably Ether (ETH), demonstrating a strong link between the cryptocurrency and NFT markets.

Findings and Conclusion

Non-Fungible tokens can be defined as cryptographically signed copies of digital assets that is registered on the blockchain. This technology made trading of the digital assets possible through online platform. Anybody can buy Non-Fungible Tokens through cryptocurrency. So we can say that there is positive link between NFTs and cryptocurrencies. Almost all Non-Fungible Tokens can brought by using Cryptocurrency, and NFT market may affects the pricing fluctuations of Crypto market but Crypto market have not affected by NFT market Another important link is that both NFTs and cryptocurrencies are traded on the same online platform called Blockchain technology that is why is it highly secure system and protect digital assets from mala fied activities and other cyber threats. This paper contributes to the academic literature on Non-Fungible Tokens that focuses on the factors that explain the process and working of Non-Fungible Tokens market. Furthermore, we extend the understanding of link between leading cryptocurrencies on new blockchain developments with Non-Fungible Tokens. In this research we explore the different uses of NFTs like digital artworks, gaming, audio clips, collectables etc. So we can say that Non-Fungible Tokens have many opportunities and potential applications. Lack of awareness is one of the challenging factors for the Non-Fungible Tokens. Furthermore, research work should be done on the awareness factor. Furtherly we can say that NFTs provides new investment avenues to the investors on the digital platform with the medium of exchange of Cryptocurrencies.

References

Bhattarai, S., Chatterjee, A., & YongPark, W. (2020). Global spillover effects of US uncertainty. Journal of Monetary Economics, 71-89.

Indexed at, Google Scholar, Cross Ref

Cascone, & Sarah. (2021, may 7). "Sotheby's Is Selling the First NFT Ever Minted – and Bidding Starts at $100".

Chohan, U. W. (2021). Non-fungible tokens: Blockchains, scarcity, and value. Critical Blockchain Research Initiative (CBRI) Working Papers.

Indexed at, Google Scholar, Cross Ref

Dash, A. (2021). NFTs weren’t supposed to end like this. The Atlantic.

Dirk G, B., Kihoog, H., & Adrian D, L. (2018). Bitcoin: Medium of exchange or speculative assets? Journal of International Financial Markets, Institutions and Money, 177-189.

Indexed at, Google Scholar, Cross Ref

Fairfield, J. (2021). Tokenized: The law of non-fungible tokens and unique digital property. Indiana Law Journal, Forthcoming.

Kugler, L. (2021). Non-fungible tokens and the future of art. Communications of the ACM, 64(9), 19-20.

Trautman, L. J. (2021). Virtual art and non-fungible tokens. Available at SSRN 3814087.

Indexed at, Google Scholar, Cross Ref

Wang, Q., Li, R., Wang, Q., & Chen, S. (2021). Non-fungible token (NFT): Overview, evaluation, opportunities and challenges. arXiv preprint arXiv:2105.07447.

Received: 20-Feb-2023, Manuscript No. AMSJ-23-13221; Editor assigned: 21-Feb-2023, PreQC No. AMSJ-23-13221(PQ); Reviewed: 21-Apr-2023, QC No. AMSJ-23-13221; Revised: 20-May-2023, Manuscript No. AMSJ-23-13221(R); Published: 04-Jun-2023