Case Reports: 2020 Vol: 24 Issue: 4

Cento-Tel Data Products for the us Market: Pricing Strategy and Demand Forecasting for New Products

Vikas Gupta, Director, Sunled Energy, Lucknow

Dr. Prem Prakash Dewani, Associate Professor, Indian Institute of Management, Lucknow

Abstract

The case discusses that how a leading player in the international mobility market (Cento-Tel from India) is trying to tackle the problem of growing uneasiness among the customers on increasing bills due to high data usage charges. How firm use multiple pricing strategies i.e., cost-based pricing, competition-based pricing and value-based pricing to address the price sensitivity of the target population. Further, for managers, the case focus on how the overall profitability of the firm considering each type of pricing levels, contribution margins and price sensitivity is being analyzed. The case also discusses that how a new product is being priced in the international market and how its demand is forecasted.

Keywords

Pricing, Demand Forecasting, New Product.

Introduction

Cento-Tel is one of the leading players in the international mobility market. It provides SIM cards of international operators to the Indian customers travelling abroad – for short or longer durations (from one-day trips to annual subscriptions). Like other players in this industry, Cento-Tel has tie-ups with the local telecom operators across the world and have bought postpaid connections from them with bulk deals on minutes, messages and data to be used through these connections. These postpaid SIM cards are provided to Indian customers travelling abroad for the duration of their international travel. As per Indian regulatory guidelines, these connections cannot be used within India, not even as a roaming connection. Further, like any other mobile connection to be issued to a customer in the country, the regulatory authorities mandate fulfillment of the required KYC (Know-Your-Customer) norms. So, customers, purchasing these international connections, are required to fill up a detailed Customer Acquisition Form (CAF) and provide the required KYC documents as attachments.

Besides, as these are provided as postpaid connections to the customers and the payment for the usage done is collected post-usage, initially either a security amount is collected from the customers or they are required to submit the details of their credit card for pre-authentication, to be charged when the bills are generated. For many years, the major part of the usage by customers was for calls (incoming and outgoing) - the data usage formed a smaller portion of the usage and therefore, of the bills generated.

However, in April 2019, an interesting trend was observed - the share of the data usage was noticed to be increasing sharply. This increase in data usage by the customers was felt to be the ripple effect of higher data usage in the domestic telecom market. While this increasing data usage was leading to higher revenues, it was also giving rise to several cases of customer complaints, as bills often shot up sharply due to increased data usage. This was primarily due to two reasons. One, many customers did not used to subscribe to data packs, but inadvertently use the data and so, were charged basis pay-per-use rates, which were exorbitantly high. Secondly, often customers used to subscribe to lower data packs (avoiding higher data packs costing more), but ended up using more and then being charged basis pay-per-use rates. Nitya Nand, vice-president, Revenue Assurance, was given the responsibility of coordinating with the concerned stakeholders in the Sales, Marketing, Product and Finance teams to review and redesign the data products, starting with the products for US market, which formed almost one-third of the company’s revenues.

International Mobility Market in India

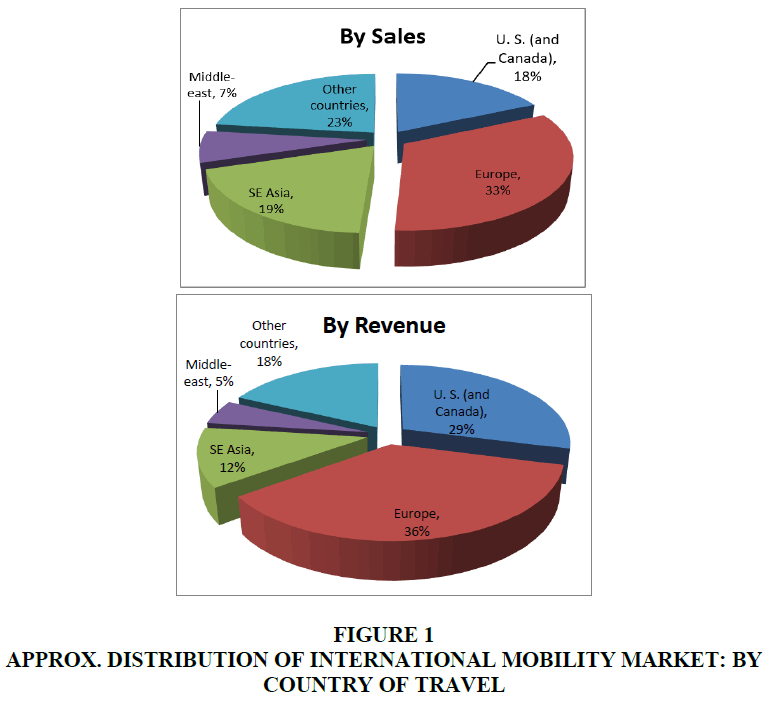

The international mobility market took off in India around early nineties in sync with the domestic mobility market. As the customers, who started using the mobile services in the country, realized the convenience of connectivity, they also felt the need to be able to use mobile services on their travel abroad. Initially, they were using their local (Indian) mobile connections on roaming, but the costs were prohibitive. Very quickly, some entrepreneurs including Rama Nand Verma, the promoter of Cento-Tel, saw an opportunity to bring the international mobility product offerings to Indian market. In around two decades of the emergence of the industry, it grew exponentially with a few thousand connections in a year initially to around a million connections in 2019, with U.S. being the single largest market - contributing roughly 18% of the connections, with even higher revenue share of around 29% Figure 1.

Cento-Tel had a 28% share of this market (in FY 2018-19), and was targeting to grow it to 33% in the expanding market by end of FY 2019-20. This would mean an annual growth target of 44% as the market was expanding by around 20% annually Table 1. This ambitious growth target was set by the company as Average Revenue Per User (ARPU) and Rate Per Minute (RPM), were dropping continuously for last few years, and so growth in EBITDA was not possible from growing just in sync with the market.

| Table 1 Summary of AOP (FY 19-20) – CENTO-TEL | ||

| For Cento-Tel | Financial Yr. | Financials |

| Total Connections sold | FY 18-19 | 278,434 |

| Current Market share** | FY 18-19 | 28% |

| Target Market Share | FY 19-20 | 33% |

| Target Sales Projections## | FY 19-20 | 400,000 |

| Sales growth target | FY 19-20 | 44% |

## - Expected Market size (international mobility) – 1,200,000 connections (FY 92-20)

The customers’ concerns over high data charges and their impact on sales, was seen as a major challenge to this sales growth targeted, and hence, the top management was highly worried for the last few months, particularly as the company was preparing itself for upcoming May-June months - the peak season for international travel, both for leisure and work related travel.

Dissonance Among Customers for Higher Data Charges

Till around a year back (i.e. 2017-18), data usage on international mobility connections was low, in line with low data usage among domestic telecom users. Due to this low penetration and therefore low contribution, the data usage tariffs were kept high - both for pay-per-use data charges and data packs – to maintain adequate profitability from these products.

However recently, Cento-Tel has witnessed sharp increase in data usage on their connections – probably as domino effect of increasing data usage in the domestic telecom market. International travelers, normally belonging to the high-end segments, were early adopters of data usage and preferred to do the same when they travelled abroad. But as the data usage tariffs were high, this led to sharp increase in their bills reducing the overall attractiveness of these connections.

As Aviral Tyagi, Director (Sales), highlighted, many of the loyal customers who used to take Cento-Tel connections every time they travelled abroad without fail, have started questioning the high data charges. Similar sentiments were shared by Rama Nand, Customer Care head, who shared several instances of customers calling up the contact center after receiving their bills and asking for details of the data usage made by them.

As Rama Nand pointed out: There is growing uneasiness among the customers on increasing bills due to high data usage charges. There have been several cases of repeat customers who escalated the billing issues to me. Many of these customers have taken data pack, but of lower denomination due to high data pack charges. However, their data usage was higher, and they were charged pay-per-use data usage beyond the pack size. Now, they would want to be upgraded to the higher data pack.

With this exercise to review and revise the data usage charges, Cento-Tel aimed to target a larger penetration and usage of data services and hence, more than compensate for the any reduction implemented on the data usage tariffs.

Existing Data Products, Their Pricing and Their Penetration

Cento-Tel had two categories of data products. The first category was ‘pay-per-use’ mode, in which case the customers paid at a flat rate for each MB/GB of data used. The second category was set of data packs, which were available in different data usage amount, such as 100 MB, 250 MB, 500 MB, 1 GB, and so on.

In case of U.S. connections, the data packs were available in four sub-categories basis the handset used – Black Personal, Black Enterprise, iPhone and other Smartphones. For U.S. connections, Pay-per-use charges for data usage was $5.00/MB, whereas the charges for data packs was $75 for Black Enterprise users, $65 for iPhone users, and $60 for Black Personal and other Smartphones customers. The Overage charges for all data packs were uniformly fixed at $20 per GB of data usage. The table 2 below depicts the various offerings:

| Table 2 Various Offerings | |||

| Data Pack Type | Monthly Rental | Inclusive Usage | Overage |

| Black Personal | USD 60 | 2 GB | $ 20/GB |

| Black Enterprise | USD 75 | 2 GB | $ 20/GB |

| iPhone | USD 65 | 2 GB | $ 20/GB |

| Other Smart phones | USD 60 | 2 GB | $ 20/GB |

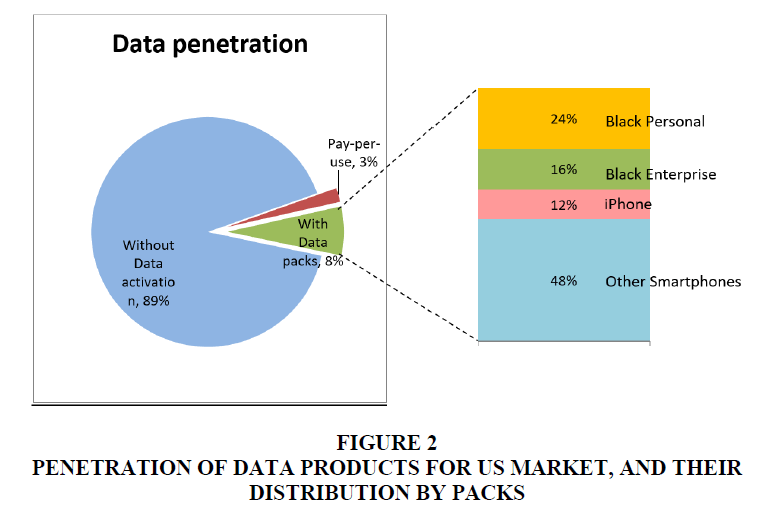

Currently, the penetration of the data usage among the Cento-Tel’s customers travelling to U.S. was around 11%. Of these customers, around 3% used the data services under pay-per-use mode, while the balance 8% subscribed to data packs, with ‘Other Smartphone’ data pack being most popular Figure 2.

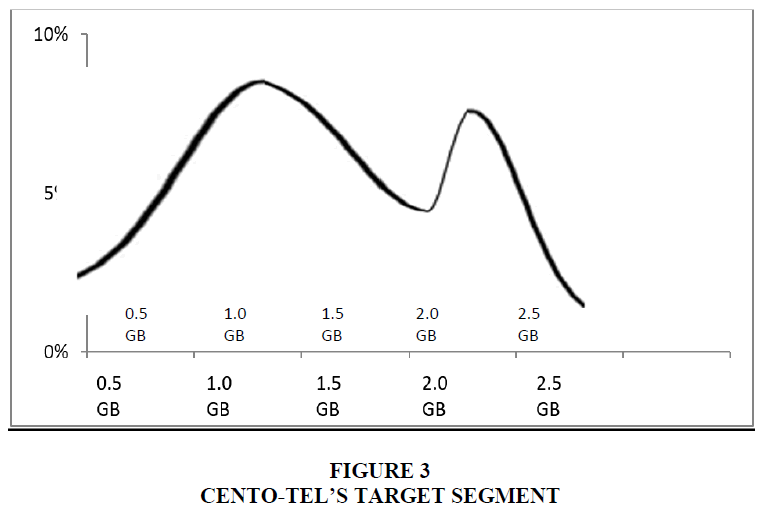

Another key deterrent to increase in data penetration was lack of options in data pack size, as there was only one data pack available of 2 GB. This often led to inefficient use of data packs, because the customers could not predict their usage pattern across the travel duration, and landed with either significantly lower or higher usage (than the data pack limit) – the latter being particularly penalizing, as the customers would then have to pay high overage charges on the excess data used. This led to actual price paid being much higher than originally planned. For example, the benchmark rate for “Black Personal” pack (2 GB @ $60) was $30 per GB. However, for a customer subscribing to this pack, but using only 1.5 GB data, the actual price paid would arrive at $40 per GB – that is 33% higher. Similarly, if the same customer uses more, say 2.2 GB, then too, the cost increases with additional overage charges of $20, leading to the total cost of $80, and so, the actual price paid would be over $36 per GB – over 20% higher.

As customers usually found it difficult to predict and track their data usage regularly, the usage on data packs mostly either fell significantly short or exceeded the data limit Figure 3. As shared earlier, the penetration of data products among the US travelers was only 11%, which was a significant revenue loss for the company, particularly considering the data usage penetration among domestic telecom users.

While the overall mobile internet penetration was around 6% among the domestic telecom users, the mobile internet penetration among the Cento-Tel’s target segment (SEC A & B consumers and international travelers) was expected to be much higher at around 40% - and expected to grow at around 35% annually. Using this information, during the AOP (Annual Operating Plan) meeting in first week of February 2019, the target (for FY 2019-20) for data penetration among the Cento-Tel customers was set at 20%, with target for U.S. and Europe markets set higher at 25% penetration.

It was felt that lack of data penetration among Cento-Tel’s customers was a combination of higher tariffs and (lack of) required sales push, with former (higher tariff) also partly responsible for lack of sales push. So, it was clear that this target would be difficult to achieve with current limited data pack options available & high pricing. So, the management team decided to review the data pack pricing, to motivate higher penetration of data subscriptions.

Pricing Strategy for Revised Data Products

Post discussions with the concerned stakeholders, Nitya Nand considered three pricing models for reviewing the U.S. data products charges -

1. Cost-based model, where the usage charges were basis the network costs, plus variable costs and contribution targeted.

2. Basis competitive rates for equivalent products available in India.

3. Basis competitive rates for equivalent products available in U.S.

While the products available in U.S. market locally were at significantly lower charges (around 20-30% lower), they were typically cumbersome for the users to subscribe to. This was because, given the low frequency of U.S. travel for a traveler, they were mostly not aware of various options available locally (in U.S.) and even if aware, the comfort of having the connection with them before landing in a foreign country was a significant motivator. So, very few U.S. travelers used local (U.S.) mobile connections. Therefore, the third pricing model was excluded after the first round of discussion. The domestic competition (in India) for Cento-Tel products was twofold – one, from the other international mobility players, and second, from the domestic telecom operators’ international roaming services. While the pricing for data products by other international mobility players was very similar (to Cento-Tel) as most of the players followed each other on product pricing, the U.S. data pricing of next major competitor was around 10% lower than that of Cento-Tel

However, the International roaming charges, as charged by domestic telecom operators, were much higher than the international mobility pricing. For example, one of the leading telecom operators charged the data usage only on pay-per-use model at $0.2/MB, which was roughly 7 times the Cento-Tel’s data pack pricing. So, the benchmarking with the international roaming charges by domestic telecom players was not considered for this data products’ review. Exploring the cost-based model, contribution from existing data packs available ranged from 40% - 50%. The cost elements for data products included the data charges by the concerned service provider (operator charges), Sales acquisition costs and Other Operations costs. When a customer subscribes to a data pack, a commiserate data pack is subscribed to with the concerned operator on the respective SIM by the Product team for the travel period of the concerned customer. Hence the operator charges were completely variable costs.

However, the Sales Acquisition Cost (SAC) was an apportioned cost, as it is a weighted average cost (per acquisition) calculated by dividing the total Sales Acquisition Cost by the number of total acquisitions – across all operators. As regards the Other Operations costs (OOC), around half of it was variable costs, while the remaining operations costs were fixed, and was also calculated as weighted average costs Table 3. With targeted doubling of sales of data products, SAC (per acquisition) will reduce by 50%, while the OOC (per acquisition) will reduce by 25%, due to variable costs involved. While considering the price revision, it was proposed to also explore the potential of the 1 GB data packs to increase the penetration of data usage. The 1 GB data packs would help increase the user base as the customers with expected data usage of much lower than 2 GB would often not take data subscription, many of whom may subscribe now.

| Table 3 Input Pricing Structure (For CENTO-TEL) | |

| Service Provider (operator) charges | |

| Data pack charges | $ 14/ GB |

| Overage charges | $ 10/ GB |

| Sales Acquisition cost (SAC) | $ 5 (weighted average) |

| Other operations costs (OOC) | $ 4 (weighted average) |

Basis the above considerations, three pricing levels were considered –

1. 40% contribution

2. 50% contribution

3. 10% below competitive rates available in India, which was roughly 30% contribution

Taking the “Other Smartphone” as the benchmark category, the following price points was considered for evaluating attractiveness of each of the above pricing levels – $45, $50 and $55 for 2 GB data pack, and $25 and $30 for the 1 GB data pack respectively.

Important Considerations/ Assumptions

Total variable costs would include the Operator charges and variable part of Other Operations costs. Fixed cost allocation/ apportion –

1. At current Sales volume - @ $7/ data connection ($5 SAC + $2 fixed part of OOC)

2. Approx. 100% increase in sales - @ $5.5/ data connection

3. Approx. 150% increase in sales - @ $4.5/ data connection

4. Approx. 200% increase of sales- @$3.5/ data connection

Demand Forecasting

With the above plan, Nitya Nand had long discussions with Rama Nand, Aviral and other key stakeholders, including Naresh Memon, Director (Finance). The main focus of these discussions was to analyze the upward impact of this price drop on the Data products sales. It was unanimously agreed that the sales target for data products for the U.S. market would have to be increased from earlier target of 20% penetration, to compensate for the loss of revenue and profitability due to price drop. For demand forecasting and analyzing financial impact, two factors were considered by Rama Nand and his team. One, the penetration of data products (on domestic telecom connections) among the Cento-Tel customers, and second, the price sensitivity among target segment for the data packs subscription during their US travel. As shared earlier, the penetration of data products on domestic telecom connections for SEC A & B users (and international travelers) was around 40%, and would form the target segment for the data pack subscription during their international travel.

However, the U.S. connections had only single price points for the data packs under each category, and price sensitivity insights cannot be derived. But European markets (which were very similar to US market) had multiple data packs available and at different pricing, given the multiple networks across various countries. Hence, it was decided that the data pack distribution for the European customers would be used to estimate the price sensitivity for data products among the US customers, and hence estimate the potential jump in data pack penetration among U.S. customers with the drop in data pack charges.

It was observed that among the Cento-Tel customers for European countries subscribing to data packs, around 45% customers subscribed to 2 GB packs, with the remaining 55% opting for 1 GB packs. The distribution of data packs for different pricing was as follows Table 4.

| Table 4 Data Packs for Different Pricing | |||

| For 1 GB Data packs | For 2 GB Data packs | ||

| Data pack charges | % share | Data pack charges | % share |

| Greater than €30 | 18% | Greater than €50 | 29% |

| €25-€30 | 14% | €40-€50 | 18% |

| €20-€25 | 24% | €30-€40 | 25% |

| Less than €20 | 44% | Less than €30 | 28% |

Conclusion

Rama Nand and his team’s task now were to put together a cost-benefit analysis using the information and data he had collated in the last few days. While it was decided that two pack sizes would be launched at 1 GB and 2 GB, Rama Nand has to decide on the pricing points to propose for the two data pack sizes, and what target levels he should recommend for the sales team for the data penetration on U.S. connections. His recommendations will depend on his analysis of revenue generation and profitability for the different pricing levels.