Research Article: 2025 Vol: 29 Issue: 5

Corporate Governance Practices and the Quality of Financial Reporting in Indian Companies

Sanjay Pareek, Indian Institute of Management, Sirmaur, Himachal Pradesh

Vivek Soni, Faculty of Management Studies, University of Delhi

Sana Maidullah, Indian Institute of Management, Sirmaur, Himachal Pradesh

Citation Information: Pareek, S., Soni, V., & Maidullah, S. (2025). Corporate governance practices and the quality of financial reporting in indian companies. Academy of Marketing Studies Journal, 29(5), 1-14.

Abstract

Corporate governance comprises the frameworks, principles, and procedures by which corporations are managed and regulated, safeguarding the interests of all stakeholders. For financial reporting to be accurate, transparent, and accountable, strong governance procedures are essential. This study examines the effects of governance factors on the accuracy and transparency of financial reports using an empirical analysis. These factors include board independence, audit committee efficacy, transparency, and CEO duality. To evaluate the suggested hypotheses, data was gathered from publicly traded Indian businesses and we used statistical and econometric techniques including structural equation modeling (SEM) and confirmatory factor analysis (CFA) to arrive at our results. The study sheds light on the important governance elements that raise the quality of financial reporting. Robust governance frameworks enhance transparency and foster investor confidence, both of which are crucial for the sustained development of financial markets. The findings indicate that firms with strong governance processes are more adept at fulfilling stakeholder expectations and reducing risks linked to financial misreporting. The study's findings are relevant to policymakers, who might utilize these insights to enhance policies that bolster governance norms.

Keywords

Indian Companies, Corporate Governance, Financial Reporting, Board Independence, Audit Committee, Transparency.

Introduction

Corporate governance has become an essential factor globally in maintaining the integrity, accountability, and transparency of corporate management, and it is even more important for a swiftly evolving economy such as India. The quality of financial reporting, which mirrors a company's actual financial condition, is significantly impacted by the robustness and efficacy of its governance practices (Vashisht, 2021). Corporate governance comprises the frameworks, principles, and procedures by which corporations are managed and regulated, safeguarding the interests of all stakeholders. India's intricate corporate environment, comprising family-owned enterprises, international firms, and public sector organizations, necessitates a strong governance framework to guarantee that financial reporting is transparent, accurate, and timely.

In recent years, regulatory authorities including the Securities and Exchange Board of India (SEBI) have implemented rigorous corporate governance reforms to improve financial disclosures and mitigate financial misreporting. These reforms emphasize critical governance elements, including board independence, the function of audit committees, CEO duality, and corporate transparency. The quality of financial reporting is crucial not only for investors and regulators but also for the overall economy, as it fosters confidence in financial markets and underpins sustainable economic growth.

In the realm of Indian corporations, where governance standards may differ markedly, comprehending the direct influence of corporate governance policies on the quality of financial reporting is essential. Effective governance serves as a protection against financial fraud, misstatements, and inefficiencies, promoting a culture of accountability (Afework, et.al., 2020). As enterprises expand, the correlation between robust governance processes and superior financial reporting becomes increasingly vital for sustaining investor confidence and fostering long-term corporate prosperity. This study seeks to examine and evaluate the link, elucidating how governance structures might enhance the entire financial reporting framework in Indian corporations.

Corporate Governance Practices

Corporate governance procedures denote the framework of rules, concepts, and processes that regulate the direction and control of enterprises. These practices aim to guarantee that organizations function transparently, accountably, and equitably, aligning the interests of management with those of shareholders and other stakeholders. Corporate governance standards include various components, such as the board of directors' makeup, the function of independent directors, audit committee duties, executive remuneration, and the delineation of authority between the CEO and the board chairman (Narayanaswamy et al. 2012)

An successful corporate governance framework fosters ethical decision-making, facilitates robust managerial scrutiny, and guarantees compliance with legal and regulatory obligations. Board independence is a crucial element of corporate governance, as independent directors offer impartial supervision and diminish the potential for conflicts of interest. The audit committee is crucial in supervising financial reporting, guaranteeing the accuracy of financial accounts, and assuring the effectiveness of internal controls. This fosters transparency and trust in the company's financial statements. A significant element of corporate governance is CEO duality, wherein the CEO concurrently holds the position of chairman of the board. This arrangement may facilitate efficient decision-making but also poses governance problems by centralizing power in one individual, thereby complicating scrutiny (Beyer, et al. 2010). Effective corporate governance prioritizes openness, mandating that corporations provide timely, accurate, and comprehensive information to shareholders and the public, thereby facilitating informed decision-making.

In India, corporate governance procedures have markedly advanced over the last twenty years, propelled by regulatory reforms made by entities like the Securities and Exchange Board of India (SEBI). The reforms seek to fortify governance norms and synchronize them with international best practices, guaranteeing corporate accountability, safeguarding shareholder rights, and improving the overall accuracy of financial reporting.

Quality of Financial Reporting

The quality of financial reporting pertains to the correctness, reliability, transparency, and timeliness of the financial information provided by a corporation. Accurate financial reporting guarantees that financial statements faithfully represent the company's actual financial status, performance, and cash flows, thereby allowing stakeholders—such as investors, regulators, creditors, and analysts—to make educated decisions (Aifuwa., et.al., 2019). Effective financial reporting is crucial for establishing investor trust, augmenting a company's legitimacy, and preserving the integrity of financial markets.

Numerous factors influence the quality of financial reporting, including as compliance with accounting rules, the strength of internal controls, and the efficacy of the audit process. Financial reports prepared in accordance with accepted accounting standards, such as Indian Accounting Standards (Ind AS) or International Financial Reporting Standards (IFRS), offer a dependable and comparable foundation for evaluating a company's financial condition. Moreover, robust internal controls mitigate the likelihood of errors, fraud, or manipulation in financial statements, whilst independent audits offer external validation of the financial reports' integrity (Porter., et.al., 2023).

Timeliness constitutes a vital element of the quality of financial reporting. Timely reports enable stakeholders to swiftly react to new information, hence minimizing the possibility of outdated data influencing decisions (Babalola., et.al., 2025). Transparency, achieved via comprehensive and voluntary disclosure, improves the quality of financial reporting by guaranteeing that all significant information, including potential risks and uncertainties, is accessible to the public.

In India, the caliber of financial reporting has markedly improved over the years, primarily due to legal measures designed to enhance corporate governance and financial disclosures. The Securities and Exchange Board of India (SEBI), in conjunction with other regulatory authorities, has implemented rigorous criteria to guarantee that corporations uphold elevated reporting standards, essential for safeguarding shareholder interests and fostering market stability. Ultimately, superior financial reporting fosters enhanced investor confidence, decreases capital costs, and promotes a more effective allocation of resources within the economy (Yasser., et.al., 2015).

Review of Literature

Literature Related to Board Independence and Financial Reporting Quality

Aifuwa and Emcentele (2019) examine how financial reporting assets affect board quality. This study examines variables such as board size, independence, gender diversity, and financial knowledge. Using data from companies located in Nigeria, the author determines how board independence and financial knowledge positively affects the quality of financial reporting. Conversely, excessively large boards can interfere with effective control. The paper emphasizes the role of good governance in ensuring transparency. Their findings support reforms to strengthen board structures in corporate governance. Alzoubi (2014) investigates the impact of board characteristics on financial reporting quality in Jordanian firms. The study focuses on board independence, size, and CEO duality. Results show that greater board independence enhances financial reporting quality, while CEO duality negatively affects it. Board size shows no significant influence. The findings highlight the importance of strong governance mechanisms. The study supports policies promoting independent oversight in corporate boards. Porter and Sherwood (2023) examine how increasing board independence affects financial reporting quality. Using empirical data, they find that higher board independence leads to improved accuracy and transparency in financial reports. The study shows that independent directors improve supervision and reduce revenue management. It also shows that the timing and degree of change is important in board configuration. This result supports the independence of the board to ensure a better government. This study complements the evidence that combines the structure of the board structure with the quality of the report.

Literature Related to Audit Committee Effectiveness and Financial Transparency

Hasan, Aly, and Hussainey (2022) conduct a comparative study on the relationship between corporate management and the quality of financial reporting in different countries. Analyze governance factors such as board independence, examination committees and owner structure. This study found that strong governance mechanisms significantly improve the quality of financial reporting. However, the impact will vary depending on the country's regulatory environment. The research highlights the need for context-specific governance reform. It highlights how institutional differences shape governance effectiveness. Babalola et al. (2025) present a conceptual analysis of how audit committees influence financial reporting quality. The study emphasizes the role of audit committee independence, expertise, and frequency of meetings in enhancing transparency. It argues that well-structured audit committees strengthen oversight and reduce financial misstatements. The paper highlights the link between governance structures and reporting integrity. It calls for regulatory support to reinforce audit committee effectiveness. Overall, the study underscores audit committees as vital to transparent financial reporting. Ghafran (2013) explores the role of audit committees in enhancing financial reporting quality in his doctoral dissertation. The study focuses on factors such as audit committee independence, expertise, and diligence. Findings suggest that effective audit committees significantly improve the credibility and accuracy of financial reports. The research also discusses the importance of regulatory frameworks in shaping committee performance. It highlights the need for continuous improvement in audit committee practices. The dissertation contributes valuable insights into corporate governance and financial transparency. Al-Shaer, Malik, and Zaman (2022) examine the dual role of audit committees in promoting transparency and managing stakeholder impressions. The study finds that while audit committees enhance financial reporting quality, they may also engage in impression management to protect corporate image. Their actions are influenced by external pressures and board dynamics. This paper illustrates the tension between actual transparency and strategic disclosure. A greater investigation of exam board practices is needed. Overall, it shows complexity in the company's governance behavior.

Literature Related to CEO Duality and Financial Reporting Quality

Yasser and Mamun (2015) investigate how CEO duality influences earnings management in Eastern firms. The study finds that when the CEO also serves as board chair, it increases the likelihood of earnings manipulation. CEO duality weakens board oversight, reducing financial reporting quality. The research emphasizes the risks of concentrated power in leadership roles. It suggests separating the CEO and chair positions to enhance governance. The findings support reforms promoting accountability in corporate structures. Alves (2023) analyzes the effects of CEO duality and board independence on earnings quality. This study shows that CEO duality has a negative impact on revenue quality by reducing supervision and increasing management discretion. In contrast, higher independence of the board is improved through stronger oversight. The interaction between these factors shows that independent boards can partly offset the risks of CEO duality. The research highlights the importance of balanced governance structures. It supports policies promoting board independence to safeguard financial reporting integrity. Nuanpradit (2024) explores how CEO duality and financial reporting quality affect investment efficiency in Thailand’s targeted S-curve industries. The study finds that CEO duality often leads to lower investment efficiency due to weaker oversight. However, high financial reporting quality can mitigate this negative effect. The research highlights the importance of transparent reporting in enhancing investment decisions. It emphasizes balancing leadership roles with strong governance mechanisms. The study provides insights for improving performance in innovation-driven sectors.

Literature Related to Transparency and Financial Reporting Quality

Barth and Schipper (2008) discuss the concept of financial reporting transparency and its importance to investors and markets. They define transparency as the clarity, completeness and accuracy of financial information. This paper shows how transparent reporting can reduce information asymmetry and improve market efficiency. It also examines factors that influence transparency, such as accounting standards and corporate governance. The authors emphasize the need for policies promoting high-quality disclosures. Their work provides a foundational understanding of transparency’s role in financial markets. Rose et al. (2013) examine how director stock ownership and board discussion transparency affect financial reporting quality. The study finds that higher director stock ownership aligns interests, improving reporting quality. Additionally, transparent board discussions enhance monitoring and reduce earnings management. Both factors together strengthen financial oversight and increase report reliability. The research highlights the importance of incentives and openness in governance. It supports policies encouraging director investment and transparency. Salehi, Ammar Ajel, and Zimon (2023) investigate the relationship between corporate governance and financial reporting transparency. Their research shows that strong governance mechanisms such as board independence and effective examination committees significantly improve transparency in financial reporting. It also highlights the role of ownership structure and regulatory frameworks. Research shows that increasing transparency reduces information asymmetry and increases investor confidence. The authors highlight the need for a robust government to ensure accurate and clear reporting. Their results support reforms aimed at strengthening the company's oversight. Harakeh et al. (2023) study how board gender diversity moderates the impact of firm opacity on stock returns. They find that greater gender diversity on boards weakens the negative effect of opacity on stock performance. Various organizations improve transparency and decision-making and improve investor trust. Research illuminates gender diversity as an important factor to reduce information asymmetry. It suggests that companies will benefit from integrated leadership for better market outcomes. This study supports corporate committee guidelines to promote gender diversity.

Literature Related to Corporate Governance and Financial Reporting in Emerging Markets

Rajpurohit and Rijwani (2022) provide a structured literature overview of the quality of corporate management and the quality of financial reporting in emerging countries. They analyze a variety of governance mechanisms, including board structure, examination committees, and ownership patterns. This review shows that strong governance has a positive effect on quality reporting by increasing transparency and reducing revenue manipulation. However, challenges such as regulatory gaps and cultural factors persist in emerging economies. The authors emphasize the need for tailored governance reforms. Their study offers comprehensive insights to improve financial reporting standards in these markets. Singh and Newberry (2008) examine the challenges and impacts of adopting International Financial Reporting Standards (IFRS) in developing countries within the context of corporate governance. They highlight how weak governance structures can hinder effective IFRS implementation. This study discusses topics such as lack of expert knowledge, regulation of supervision, and cultural differences. It highlights the need to strengthen governance mechanisms to ensure the benefits of IFRS. The authors argue that improving governance supports transparency and comparability in financial reporting. Their work is a manufacturer to lead political decisions and improve the quality of financial reporting in emerging countries.

Literature Related to Governance Reforms and Financial Reporting in India

Goel (2018) analyzes the impact of corporate governance on India's financial performance and focuses on government reform and social reporting. This study emphasizes that strong governance practices lead to better financial outcomes and increased transparency. It also emphasizes the growing importance of reporting social responsibility along with financial information. Research shows that reforms have increased accountability for Indian companies. Goel highlights the need for continuous improvement in its governance framework. The paper contributes to understanding governance as a driver of sustainable performance. Sanan and Yadav (2011) examine the impact of corporate governance reforms on financial disclosures in Indian companies. The study finds that governance reforms have improved the quality and transparency of financial reporting. Enhanced board independence and stronger audit committees are linked to better disclosure practices. The research highlights regulatory changes as key drivers of improved governance. It also points to ongoing challenges in enforcement and compliance. The study underscores the positive role of reforms in fostering corporate accountability.

Literature Related to Voluntary Disclosure and Earnings Management

The connection between earnings management and voluntary disclosure is examined by Kasznik (1999). According to the study, companies that manage their earnings more actively typically make more voluntary disclosures. This implies that strategic use of voluntary disclosure to conceal earnings manipulation is possible. However, reducing knowledge asymmetry with investors is another goal of certain disclosures. The research highlights the dual role of voluntary disclosure in financial reporting. It emphasizes the need to critically assess disclosures in evaluating earnings quality. Consoni, Colauto, and Lima (2017) explore the relationship between voluntary disclosure and earnings management in the Brazilian capital market. According to their research, businesses with better profits management typically make more voluntary disclosures in an effort to sway investor opinions. This implies that voluntary disclosure may be used as an impression management strategy. Transparent disclosures, however, also aid in lessening knowledge asymmetry. The study emphasizes the intricate relationship between earnings quality and disclosure methods. To improve the credibility of disclosures, it advocates for more stringent regulatory monitoring.

Literature Related to Corporate Governance in the Indian Context

In their analysis of corporate governance procedures in India, (Narayanaswamy, et.al.,2012) draw attention to particular difficulties and changes in the law. In the Indian setting, the study addresses shareholder rights, audit committees, and board composition. It highlights the changing regulatory environment that aims to increase accountability and transparency. The writers point out enforcement flaws and cultural factors that compromise the efficacy of governance. The research underscores the need for stronger governance mechanisms tailored to India’s business environment. Overall, it provides a comprehensive overview of corporate governance issues in India.

Literature Related to Regulatory Environment and Financial Reporting

A thorough analysis of current research on the financial reporting environment is given by Beyer et al. (2010). They look at things like market incentives, company governance, and regulatory changes that affect the quality of financial reporting. The study emphasizes how these factors work together to influence earnings management and disclosure procedures. The impact of global convergence and technology on reporting standards is also covered. The authors stress the continuous difficulties in guaranteeing comparability and transparency. Their review offers valuable insights for researchers and policymakers in accounting.

Literature Related to Financial Reporting and Market Performance

Alfraih (2018) investigates the relationship between intellectual capital reporting and a firm's market and financial performance. According to the report, businesses that reveal more intellectual capital typically have improved financial results and market valuations. Transparency about intangible assets, which are essential for value generation, is improved via intellectual capital reporting. The study emphasizes how non-financial data is becoming more and more significant to investors. It implies that competitive advantage can be enhanced through efficient intellectual capital disclosure. The integration of intellectual capital into corporate reporting frameworks is supported by the article. Martínez-Ferrero (2014) examines how financial reporting quality affects corporate performance internationally. The study finds that higher reporting quality leads to better firm performance by improving transparency and reducing information asymmetry. Businesses with trustworthy financial reports have lower capital expenses and draw in more investors. The study emphasizes how precise disclosure improves market valuation and operational effectiveness. It highlights how crucial it is that strict accounting standards be adopted worldwide. In order to increase company success internationally, the study advocates improving the quality of reporting.

Objectives of the Study

1. To evaluate the impact of board independence on the quality of financial reporting.

2. To analyze how the effectiveness of audit committees influences financial transparency.

3. To examine the role of CEO duality in financial reporting quality.

Hypothesis of the Study

H1: Board independence has a significant positive impact on the quality of financial reporting.

H2: The effectiveness of audit committees has a significant positive effect on financial transparency.

H3: CEO duality negatively affects the quality of financial reporting.

H4: Increased transparency positively influences the quality of financial reporting.

Research Methodology

This study follows an empirical research approach utilizing both primary and secondary data sources to examine the relationship between corporate governance practices and the quality of financial reporting in Indian companies Tables 1-6.

| Table 1 Research Design | |

| Aspect | Details |

| Research Approach | Empirical study with primary and secondary data |

| Data Collection | Structured questionnaire (primary data) and annual reports and disclosures (secondary data). |

| Respondents for the Study | Auditors, corporate governance specialists, finance professionals |

| Sample Size | 250 respondents from companies listed on the National Stock Exchange (NSE) and Bombay Stock Exchange |

| Sampling Technique | Sampling at random |

| Sample Breakdown | Large-cap (35%), mid-cap (40%), and small-cap (25%). |

| Data Sources | -Primary data: Questionnaire - Secondary data: Annual reports, governance disclosures |

| Major Focus Areas | -Board independence -Audit committee effectiveness -CEO duality - Transparency |

| Key Analysis Techniques | -Exploratory FactorAnalysis(EFA) -Confirmatory Factor Analysis(CFA) -Structural EquationModeling(SEM) - Regression Analysis |

| Software Used | SPSS for factor analysis and regression, AMOS |

| Table 2 Data Analysis Techniques Used for the Study | |||

| Technique | Purpose | Procedure | Outcome |

| Exploratory Factor Analysis (EFA) | Determine the latent variables (factors) affecting financial reporting and corporate governance. | Principal component analysis with Varimax rotation was used to extract factors. | Transparency, CEO duality, audit committee efficacy, and board independence were found to be the four most important components. |

| Confirmatory Factor Analysis (CFA) | Verify the factor structure found in the EFA. | To test the model fit and the connections between the latent variables, CFA was carried out using AMOS software. | The significant factor loadings validated the connections between financial reporting quality and governance methods. |

| Structural Equation Modeling (SEM) | Create and evaluate a thorough model that explains the connection between financial reporting and governance procedures. | The latent variables found in CFA were used in SEM. Chi-Square, GFI, AGFI, and RMSEA were among the model fit indices that were computed. | The SEM model explained the relationships between the variables and was an excellent fit, according to the model fit indices. |

| Regression Analysis | Calculate how each governance component affects the caliber of financial reporting. | The impact of CEO duality, board independence, audit committee efficacy, and transparency on financial reporting results was assessed using multiple regression analysis. | The results of the regression analysis demonstrated a strong positive correlation between the quality of financial reporting, board independence, audit committee efficacy, and transparency. The detrimental impact of CEO duality was less pronounced but still noteworthy. |

| Table 3 Summary of Results - Exploratory Factor Analysis & Coding for Confirmatory Factor Analysis | |||

| Corporate Governance Practice | Variables | Factor Loadings | Code |

| Board Independence (BI) | Proportion of non-executive directors | 0.912 | BI1 |

| • | Independent directors’ ability to question decisions | 0.863 | BI2 |

| • | Gender diversity on the board | 0.835 | BI3 |

| • | Experience and qualifications of board members | 0.854 | BI4 |

| Audit Committee Effectiveness (ACE) | Number of independent audit committee members | 0.834 | ACE1 |

| • | Frequency of audit committee meetings | 0.789 | ACE2 |

| • | Audit committee financial expertise | 0.821 | ACE3 |

| • | Internal audit independence | 0.802 | ACE4 |

| CEO Duality (CD) | CEO acting as board chairman | 0.853 | CD1 |

| • | Separation of CEO and board chairman roles | 0.806 | CD2 |

| • | CEO’s influence on the board | 0.832 | CD3 |

| • | CEO's role in financial disclosure decisions | 0.776 | CD4 |

| Transparency (TP) | Disclosure of financial information | 0.901 | TP1 |

| • | Timeliness of report submission | 0.859 | TP2 |

| • | Compliance with regulatory frameworks | 0.872 | TP3 |

| • | Voluntary disclosures beyond regulatory requirements | 0.842 | TP4 |

| Table 4 Structural Equation Modeling (SEM) : Regression Weights | ||||

| Variable | Estimate | S.E. | C.R. | P |

| BI1 | 1.000 | • | • | • |

| BI2 | 0.863 | 0.072 | 12.032 | *** |

| ACE1 | 1.000 | • | • | • |

| ACE2 | 0.834 | 0.070 | 11.907 | *** |

| CD1 | 1.000 | • | • | • |

| CD2 | 0.806 | 0.066 | 12.181 | *** |

| TP1 | 1.000 | • | • | • |

| TP2 | 0.859 | 0.071 | 12.091 | *** |

| Table 5 Model Fit Indices | ||

| Fit Indices | Suggested Value | Model Value |

| Chi-Square | <5.00 | 2.873 |

| GFI | >0.80 | 0.918 |

| AGFI | >0.80 | 0.871 |

| CFI | >0.90 | 0.889 |

| RMR | <0.08 | 0.064 |

| RMSEA | <0.09 | 0.056 |

| Table 6 Testing of Hypothesis | ||

| Research Hypothesis | Support Status | Result |

| H1: Board independence has a significant positive impact on the quality of financial reporting. | Supported by factor loadings (0.835 to 0.912), which show that board independence and reporting quality are strongly positively correlated. | Accepted (Fail to reject) |

| H2: The effectiveness of audit committees has a significant positive effect on financial transparency. | Factor loadings (0.789 to 0.834) support the idea that the efficacy of audit committees has a major impact on financial transparency. | Accepted (Fail to reject) |

| H3: CEO duality negatively affects the quality of financial reporting. | Given that the influence of CEO duality is smaller than that of other factors, factor loadings (0.776 to 0.853) somewhat support this. | Partially Accepted |

| H4: Increased transparency positively influences the quality of financial reporting. | Factor loadings (0.842 to 0.901) support the idea that transparency greatly improves the caliber of financial reporting. | Accepted (Fail to reject) |

Data Collection

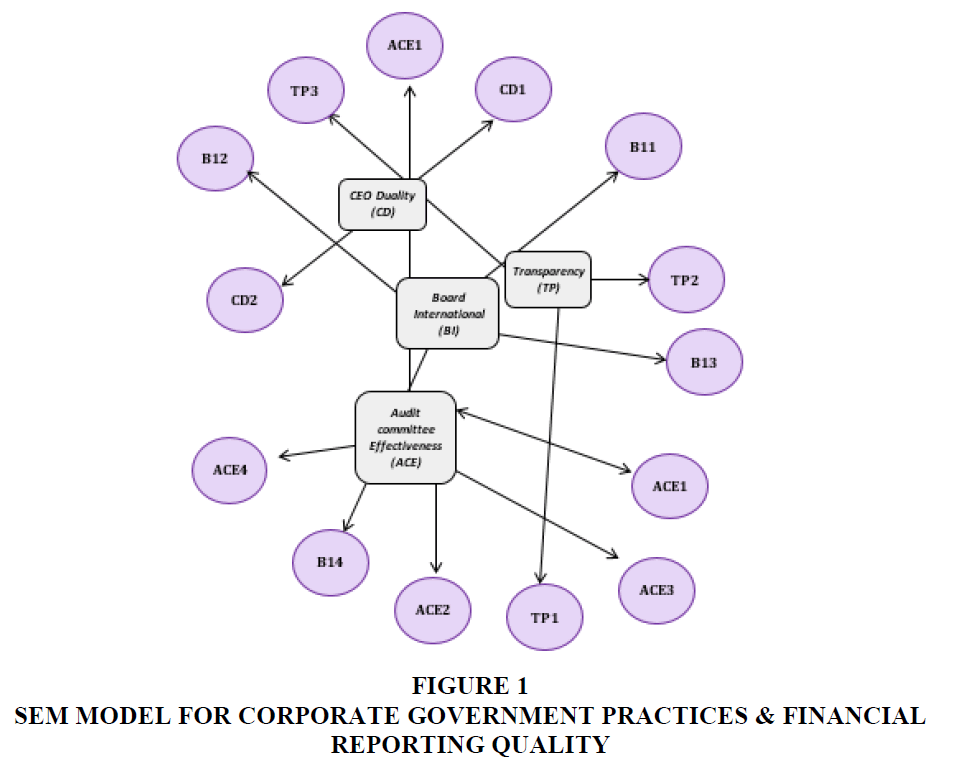

Primary and secondary sources were implemented during the data collection phase of this research. A structured questionnaire was administered to professionals in the field of corporate governance, including finance professionals, auditors, and corporate governance experts, in order to obtain primary data. The respondents were chosen from publicly listed companies on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). The questionnaire was developed to collect information on critical components of corporate governance, with a particular emphasis on the efficacy of the audit committee, board independence, CEO duality, and transparency. Secondary data were obtained from the annual reports and governance disclosures of the selected companies, in addition to primary data. These reports contained valuable information, such as financial statements, corporate governance reports, audit committee reports, and disclosures regarding transparency and voluntary reporting practices. A comprehensive analysis of corporate governance practices and their impact on the integrity of financial reporting was facilitated by the combination of primary and secondary data Figure 1.

Interpretation & Analysis

Strong correlations between the detected variables and their corresponding governance components are shown by the factor loadings in the table. The variables chosen for each corporate governance practice are well-represented and pertinent in the analysis, as evidenced by the fact that all factor loadings are above 0.75. The large loadings confirm that these governance factors have a major impact on raising the standard of financial reporting. The table displays the findings of exploratory factor analysis (EFA), which codes for use in confirmatory factor analysis (CFA) after identifying important variables linked to different corporate governance approaches and their related factor loadings. The four corporate governance practices of Board Independence (BI), Audit Committee Effectiveness (ACE), CEO Duality (CD), and Transparency (TP) form the framework for the table's interpretation.

Board Independence (BI)

1. Proportion of non-executive directors (BI1). With the greatest factor loading of 0.912, (BI1) shows a substantial correlation between the notion of board independence and a sizable percentage of non-executive directors. This implies that non-executive directors are essential to preserving an impartial board capable of efficiently overseeing management's activities.

2. Independent directors’ ability to question decisions (BI2). The factor loading of (BI2) is 0.863, indicating a high correlation with board independence. This highlights how crucial it is for directors to be able to question management choices impartially and independently.

3. Gender diversity on the board (BI3). With a factor loading of 0.835, (BI3) emphasizes how important gender diversity is for encouraging independent thought and a range of viewpoints on the board.

4. Experience and qualifications of board members (BI4). With a factor loading of 0.854, (BI4) shows that board members' experience and qualifications are crucial for efficient governance and supervision, which improves decision-making.

Audit Committee Effectiveness (ACE)

• Number of independent audit committee members (ACE1). With a factor loading of 0.834, (ACE1) emphasizes how important it is for audit committee members to be independent in order to ensure efficient supervision of financial reporting procedures.

• Frequency of audit committee meetings (ACE2). With a factor loading of 0.789, (ACE2) indicates that frequent meetings are a crucial component of an audit committee's efficacy. Better oversight of the financial reporting process is made possible by more regular meetings.

• Audit committee financial expertise (ACE3). With a factor loading of 0.821, (ACE3) emphasizes how crucial it is to have members with financial knowledge in order for the audit committee to be able to offer significant monitoring.

• Internal audit independence (ACE4). With a factor loading of 0.802, (ACE4) highlights how important it is to keep an independent internal audit function in place to guarantee the accuracy of financial statements.

CEO Duality (CD)

• CEO acting as board chairman (CD1). With a high factor loading of 0.853, CD1 shows a strong correlation between this governance approach and CEO duality, in which the CEO also acts as the board chair. This can indicate possible dangers related to the concentration of power.

• Separation of CEO and board chairman roles (CD2). With a factor loading of 0.806, (CD2) highlights how crucial it is to keep these two responsibilities distinct in order to maintain balanced governance and avoid conflicts of interest.

• CEO’s influence on the board (CD3). When duality exists, the CEO has a substantial impact on the board, which could jeopardize the board's independence, as shown by (CD3), which has a factor loading of 0.832.

• CEO's role in financial disclosure decisions (CD4). The CEO's participation in financial disclosures is a crucial element that may affect the caliber of financial reporting, according to (CD4)'s factor loading of 0.776.

Transparency (TP)

• Disclosure of financial information (TP1). One important component in the transparency construct is the transparent disclosure of financial information, as indicated by (TP1), which has a very high factor loading of 0.901. Ensuring the accuracy of financial reports and preserving investor confidence depend on this.

• Timeliness of report submission (TP2). With a factor loading of 0.859, (TP2) demonstrates the strong correlation between overall openness and the timely submission of financial reports. Uncertainty and mistrust might result from delayed reports.

• Compliance with regulatory frameworks (TP3). With a factor loading of 0.872, (TP3) highlights how crucial it is to follow legal obligations for transparency. Financial misreporting and legal problems may arise from noncompliance.

• Voluntary disclosures beyond regulatory requirements (TP4). With a factor loading of 0.842, (TP4) shows that businesses that disclose more information than is required are seen as more transparent, which raises the standard of financial reporting.

The Structural Equation Modeling (SEM) table's regression weights demonstrate how strongly the governance characteristics and financial reporting quality are related. With a large critical ratio (C.R.) of 12.032, the variable BI2 (board independence) has a high estimate of 0.863, suggesting a considerable positive impact on financial reporting. Similarly, with an estimate of 0.834 and a C.R. of 11.907, ACE2 (audit committee effectiveness) demonstrates a substantial positive connection. A large influence is also shown by CD2 (CEO duality), which has an estimate of 0.806. Lastly, with an estimate of 0.859, TP2 (transparency) demonstrates a strong influence on the quality of financial reporting. These correlations are all statistically significant (P < 0.001), suggesting that governance factors have a major impact on higher-quality financial reporting.

The SEM model fits the data well, according to the model fit indices shown in the table. The model is well-fitting since the Chi-Square value of 2.873 is less than the recommended value of 5.00. Acceptable model adequacy is demonstrated by the GFI (Goodness of Fit Index) of 0.918 and the AGFI (Adjusted Goodness of Fit Index) of 0.871, both of which are above the suggested cutoff of 0.80. At 0.889, the Comparative Fit Index (CFI) is marginally below the optimal value of 0.90, but it is still near enough to suggest a fair fit. The model appears to accurately reflect the relationships in the data, as seen by the RMR (Root Mean Square Residual) of 0.064 and RMSEA (Root Mean Square Error of Approximation) of 0.056, both of which are well within the acceptable range.

Findings of the Study

• Board independence significantly enhances the quality of financial reporting, hence validating H1. Organizations with autonomous boards are more inclined to generate clear and precise financial statements.

• The efficacy of audit committees markedly enhances financial openness, corroborating H2. Independent and financially astute audit committees are essential for guaranteeing superior reporting quality.

• CEO duality exhibits a notable correlation with financial reporting quality; nevertheless, its influence is comparatively less than that of board independence and audit committee efficacy, thereby partially corroborating H3. Dividing the responsibilities of CEO and board chairman may improve reporting quality; nonetheless, it is not the most significant element.

• Transparency exerts the most significant impact on the quality of financial reporting, evidenced by high factor loadings and robust model fit, hence validating H4. Prompt, precise, and regulatory-compliant disclosures are essential components of high-quality financial reports.

Conclusion

This study's findings emphasize the critical importance of corporate governance in bolstering the credibility and reliability of financial reporting in Indian corporations. Robust governance frameworks enhance transparency and foster investor confidence, both of which are crucial for the sustained development of financial markets. The findings indicate that firms with strong governance processes are more adept at fulfilling stakeholder expectations and reducing risks linked to financial misreporting. The study's findings are relevant to policymakers, who might utilize these insights to enhance policies that bolster governance norms. Furthermore, the research offers a significant framework for organizations seeking to enhance their governance systems, resulting in improved financial performance and increased market trust. Future study may investigate the influence of evolving governance changes, especially in other emerging countries, on the quality of financial reporting and corporate responsibility.

References

Aifuwa, H.O., & Embele, K. (2019). Board characteristics and financial reporting. Journal of Accounting and Financial Management, 5(1), 30-44.

Alzoubi, E.S.S. (2014). Board characteristics and financial reporting quality: Evidence from Jordan. Corporate Ownership and Control Volume 11, Issue 3, 2014, Pages 8-29.

Afework, Y., Chekole, A., & Saxena, N. (2020). The Effect of Supply Chain Management Practices on Organizational Performance with the Mediating Role of Inventory Management: The Case of Ethiopian Pharmaceutical Supply Agency. Kaav International Journal of Economics, Commerce & Business Management, 7(1), 21-26.

Al-Shaer, H., Malik, M. F., & Zaman, M. (2022). What do audit committees do? Transparency and impression management. Journal of Management and Governance, 26(4), 1443-1468.

Indexed at, Google Scholar, Cross Ref

Alves, S. (2023). CEO duality, earnings quality and board independence. Journal of Financial Reporting and Accounting, 21(2), 217-231.

Indexed at, Google Scholar, Cross Ref

Alfraih, M. M. (2018). Intellectual capital reporting and its relation to market and financial performance. International Journal of Ethics and Systems, 34(3), 266-281.

Indexed at, Google Scholar, Cross Ref

Beyer, A., Cohen, D. A., Lys, T. Z., & Walther, B. R. (2010). The financial reporting environment: Review of the recent literature. Journal of accounting and economics, 50(2-3), 296-343.

Indexed at, Google Scholar, Cross Ref

Barth, M. E., & Schipper, K. (2008). Financial reporting transparency. Journal of Accounting, Auditing & Finance, 23(2), 173-190.

Babalola, F. I., Kokogho, E., Odio, P. E., Adeyanju, M. O., & Sikhakhane-Nwokediegwu, Z. (2025). Audit Committees and Financial Reporting Quality: A Conceptual Analysis of Governance Structures and Their Impact on Transparency. International Journal of Management and Research, 4(1), 89-100.

Consoni, S., Colauto, R. D., & Lima, G. A. S. F. D. (2017). Voluntary disclosure and earnings management: evidence from the Brazilian capital market. Revista Contabilidade & Finanças, 28(74), 249-263.

Indexed at, Google Scholar, Cross Ref

Goel, P. (2018). Implications of corporate governance on financial performance: An analytical review of governance and social reporting reforms in India. Asian Journal of Sustainability and Social Responsibility, 3(1), 4.

Indexed at, Google Scholar, Cross Ref

Ghafran, C. (2013). Audit committees and financial reporting quality (Doctoral dissertation, University of Sheffield).

Hasan, A., Aly, D., & Hussainey, K. (2022). Corporate governance and financial reporting quality: a comparative study. Corporate Governance: The International Journal of Business in Society, 22(6), 1308–1326.

Indexed at, Google Scholar, Cross Ref

Harakeh, M., Leventis, S., El Masri, T., & Tsileponis, N. (2023). The moderating role of board gender diversity on the relationship between firm opacity and stock returns. The British Accounting Review, 55(4), 101145.

Indexed at, Google Scholar, Cross Ref

Kasznik, R. (1999). On the association between voluntary disclosure and earnings management. Journal of accounting research, 37(1), 57-81.

Porter, C., & Sherwood, M. (2023). The effect of increases in board independence on financial reporting quality. Accounting Research Journal, 36(2/3), 109-128.

Indexed at, Google Scholar, Cross Ref

Martínez-Ferrero, J. (2014). Consequences of financial reporting quality on corporate performance: Evidence at the international level. Estudios de economía, 41(1), 49-88.

Nuanpradit, S. (2024). Investment efficiency of targeted S-curve industries: the roles of CEO duality and financial reporting quality. Journal of Asia Business Studies, 18(3), 565-592.

Indexed at, Google Scholar, Cross Ref

Narayanaswamy, R., Raghunandan, K., & Rama, D. V. (2012). Corporate governance in the Indian context. Accounting Horizons, 26(3), 583-599.

Rose, J. M., Mazza, C. R., Norman, C. S., & Rose, A. M. (2013). The influence of director stock ownership and board discussion transparency on financial reporting quality. Accounting, Organizations and Society, 38(5), 397-405.

Indexed at, Google Scholar, Cross Ref

Rajpurohit, P. D., & Rijwani, P. R. (2022). Corporate governance and quality of financial reporting in emerging markets: a structured literature review. Indian journal of corporate governance, 15(1), 89-134.

Indexed at, Google Scholar, Cross Ref

Salehi, M., Ammar Ajel, R., & Zimon, G. (2023). The relationship between corporate governance and financial reporting transparency. Journal of Financial Reporting and Accounting, 21(5), 1049-1072.

Singh, R. D., & Newberry, S. (2008). Corporate governance and international financial reporting standard (IFRS): The case of developing countries. In Corporate governance in less developed and emerging economies (pp. 483-518). Emerald Group Publishing Limited.

Sanan, N., & Yadav, S. (2011). Corporate governance reforms and financial disclosures: a case of Indian companies. IUP Journal of Corporate Governance, 10(2), 62.

Yasser, Q. R., & Mamun, A. A. (2015). The impact of CEO duality attributes on earnings management in the East. Corporate Governance, 15(5), 706-718.

Indexed at, Google Scholar, Cross Ref

Vashisht, R. (2021). Influence of Corporate Governance on Organizational Performance in Indian Banks- An Empirical Study. Kaav International Journal of Economics, Commerce & Business Management, 8(1), 40-45.

Received: 28-May-2025, Manuscript No. AMSJ-25-15968; Editor assigned: 29-May-2025, PreQC No. AMSJ-25-15968(PQ); Reviewed: 10-Jun-2025, QC No. AMSJ-25-15968; Revised: 26-Jun-2025, Manuscript No. AMSJ-25-15968(R); Published: 16-Jul-2025