Review Article: 2024 Vol: 28 Issue: 3

Creating Greener Pathways- Achieving Net Zero in the Oil and Gas Industry

Anand Acharya, TERI School of Advanced Studies, New Delhi

Shruti Sharma Rana, TERI School of Advanced Studies, New Delhi

Citation Information: Acharya., & Sharma Rana, S. (2024). Creating greener pathways- achieving net zero in the oil and gas industry. Academy of Marketing Studies Journal, 28(3), 1-17.

Abstract

As the climate crisis deepens, the term Net-Zero has gained significant traction in recent times as it calls for action from major economies and organizations around the world. As a result, over the past few months, Global, Indian companies are announcing their plan of action to become net-zero emission companies by 2050, or sooner. For achieving this they are making a significant shift in their strategy as to how they operate and what they produce. There is a need to decarbonize the carbon intensive sector companies to limit the temperature rise and reach the Net Zero target of the India. This paper depicts that the improvement in targets and their implementation is required in the following areas: having executive board-level leadership on sustainability and climate, setting up long-term, science-based targets, and engaging in sustainable finance. Although almost all the companies are considering alternatives like afforestation, renewable energy, and energy transition they also need to consider solutions like green bonds, carbon credits, battery energy storage, and carbon capture utilization and storage (CCUS). This paper aims to analyze and compare their Net Zero journey and suggests some improvements.

Keywords

Net Zero, Renewable Energy, Target, Emissions, Oil and Gas, Energy Transition.

Introduction

The transition to a sustainable, low-carbon future is imperative to combat climate change. Given that the energy sector is a major contributor to global greenhouse gas (GHG) emissions, exploring greener alternatives in the oil and gas industry is of utmost importance. This research seeks to examine the strategies adopted by prominent oil and gas companies to reduce GHG emissions and progress toward a Net Zero future by assessing their sustainable pathways. It also delves into their present and future financial investments in clean and green energy solutions, highlighting the challenges and actions necessary to cut emissions.

The world's finite carbon budget is akin to a household's monthly expenditure budget. Just as exceeding the monthly budget impacts future spending capacity, high GHG emissions are raising global temperatures at an alarming rate, resulting in extreme weather events such as floods, droughts, heatwaves, and cyclones. The severity of these events is escalating, causing irreparable harm to the ecosystem. The Inter-Governmental Panel on Climate Change (IPCC) AR6 Synthesis Report for 2023 notes that global surface temperatures have risen, with observed warming primarily attributed to human-induced factors. Limiting global temperature increase requires managing cumulative net CO2 emissions and substantial reductions in other GHGs. In light of these concerns, this paper aims to provide eco-friendly pathways for achieving Net Zero in India's oil and gas industry and offers recommendations for refining their strategies Annual Report ONGC (2023).

Literature Review

Net Zero

Net Zero carbon entails reducing carbon emissions to the minimum level possible and utilizing offsets as a last resort to compensate for remaining essential emissions. It differs from "carbon neutral," which aims to prevent an increase in carbon emissions and achieve reductions through offsets. The 2015 United Nations Framework Convention on Climate Change (UNFCCC) Paris Agreement called for ambitious efforts to combat climate change, limit global warming to below 2°C, and ideally, well below this threshold.

Corporate Net Zero Targets

Corporate net-zero targets play a crucial role in signaling a commitment to transitioning to a business model aligned with a net-zero economy. The Science-Based Targets initiative's Corporate Net-Zero Standard provides guidance for setting science-based net-zero targets consistent with limiting global temperature rise to 1.5°C. Many companies have embraced these targets, emphasizing the need to align strategies and investments with climate science.

Pathway towards Net-Zero Emissions in Oil Refineries

The escalating demand for energy and mobility services has led to increased greenhouse gas emissions. Achieving carbon-neutral refinery operations necessitates measures such as post-combustion carbon capture and storage (CCS) with a high CO2 capture rate, fuel substitution, and emission offsets. These strategies must be implemented cost-effectively to enhance energy affordability and accessibility.

Green Pathways Solutions

Achieving Net Zero emissions involves several pathways, including energy efficiency improvements, the use of green hydrogen, electrification, and bioenergy. These pathways offer cost-effective and sustainable approaches to reducing emissions and transitioning to cleaner energy sources.

Research Methodology

This study employs a comparative analytical approach to assess GHG emissions from leading oil and gas companies during the financial years 2017-2022. It focuses on Scope 1 and Scope 2 emissions, measuring direct and indirect emissions from company activities. The paper also examines companies' future clean energy strategies and their potential for emissions reduction based on investment plans. The study is based on a thorough review of the literature, official reports, sustainability reports, and company websites.

By systematically reviewing various industries, the study identified the top eight large Indian oil and gas companies as the focus of analysis.

The methodology proposed for the present research is discussed under the following.

Study Locale

The Locale of the study is India. Oil and Gas companies of India have been selected for the study.

Sampling

The sample is taken from Oil and Gas Companies listed on stock exchange.

Sample Size

Oil and Gas companies were shortlisted because they were disclosing GHG emissions data and mitigation efforts from last 5 years

Sample selection Method

Oil and Gas Companies: As per Nifty Oil and Gas Index, a list of all oil and gas companies have been prepared out of all the companies top eight companies have been selected for the study through purposive sampling method.

Data Collection

Methods of data collection: The data for the present study was collected by the researcher by studying official documents from company’s website. As part of review Sustainability Reports (SR), Annual Reports (AR), Business Responsibility and Sustainability Reports (BRSR), among other official publications were studied. It also includes information disclosed in public through news, articles, or online.

Analysis and Interpretation

Data collection will be subjected to qualitative analysis. The data will be graphically represented wherever required using any software.

Limitations of the study

Due to shortage of time, the researcher was not able to meet in physical mode with the stakeholder.

Findings

According to the research, for instance, the sum of total Scope 1 GHG emissions of the top five O&G Companies from 2017 to 2022 was 210.16 MMTCO2e, highlighting the significant emissions connected with this industry. This paper investigates the creative ways these firms have taken to decrease emissions and move to a more sustainable energy mix through their green pathway. It reveals their financial investment intentions for clean and green energy technology, highlighting their commitment to decarbonization. These initiatives include technology advances, operational improvements, and more renewable energy integration.

Review of Net Zero initiatives by the Oil and Gas Companies

As part of their attempts to minimize greenhouse gas emissions, Indian O&G companies are strongly shifting to green hydrogen generation. Green hydrogen is created by the electrolysis process, which uses renewable energy sources such as solar or wind power to split water into hydrogen and oxygen without emitting any carbon dioxide.

Indian O&G companies are investing in renewable energy infrastructure, constructing hydrogen production facilities, and seeking partnerships with technology suppliers and research institutes to facilitate the use of green hydrogen. These efforts seek to increase the production and deployment of green hydrogen, stimulate innovation, and build a strong hydrogen ecosystem in the country Figures 1-6.

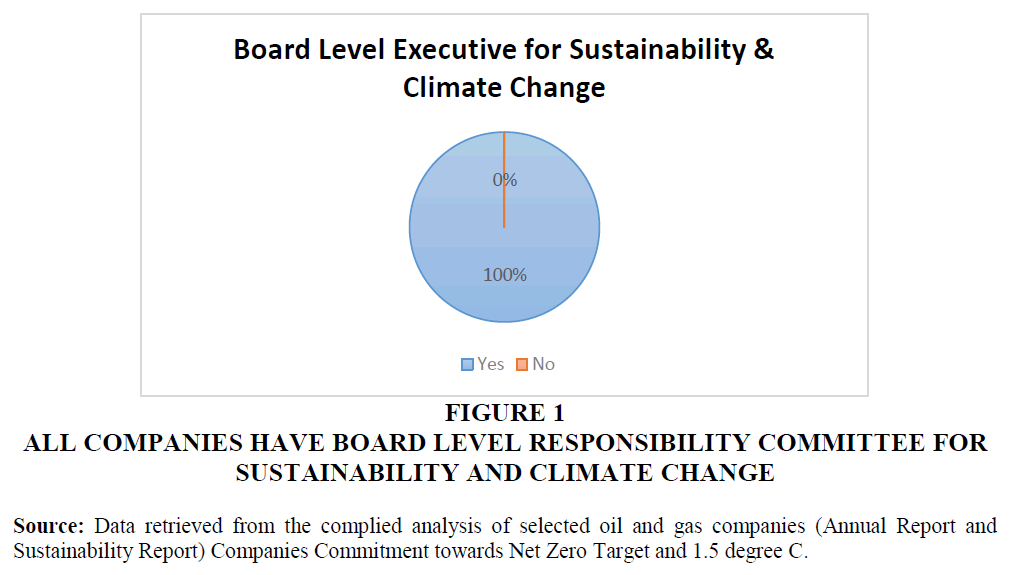

Figure 1 All Companies have Board Level Responsibility Committee for Sustainability and Climate Change

Source: Data retrieved from the complied analysis of selected oil and gas companies (Annual Report and Sustainability Report) Companies Commitment towards Net Zero Target and 1.5 degree C.

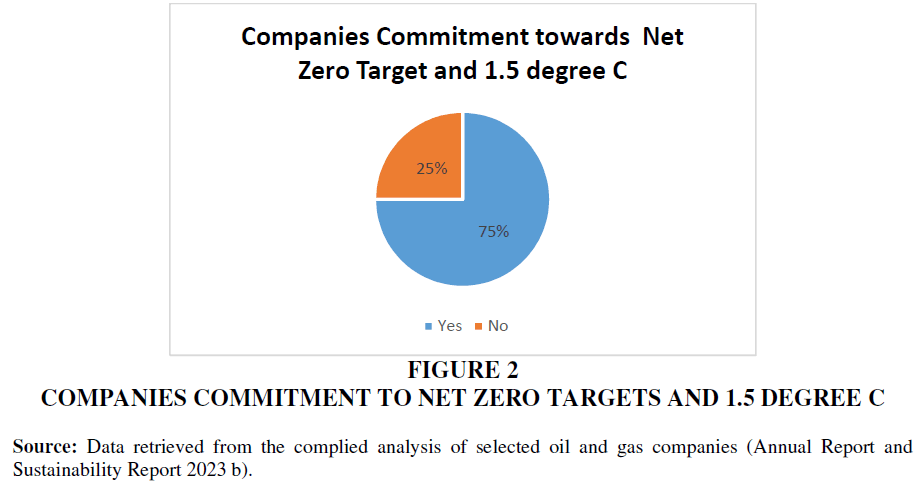

Figure 2 Companies Commitment to Net Zero Targets and 1.5 Degree C

Source: Data retrieved from the complied analysis of selected oil and gas companies (Annual Report and Sustainability Report 2023 b).

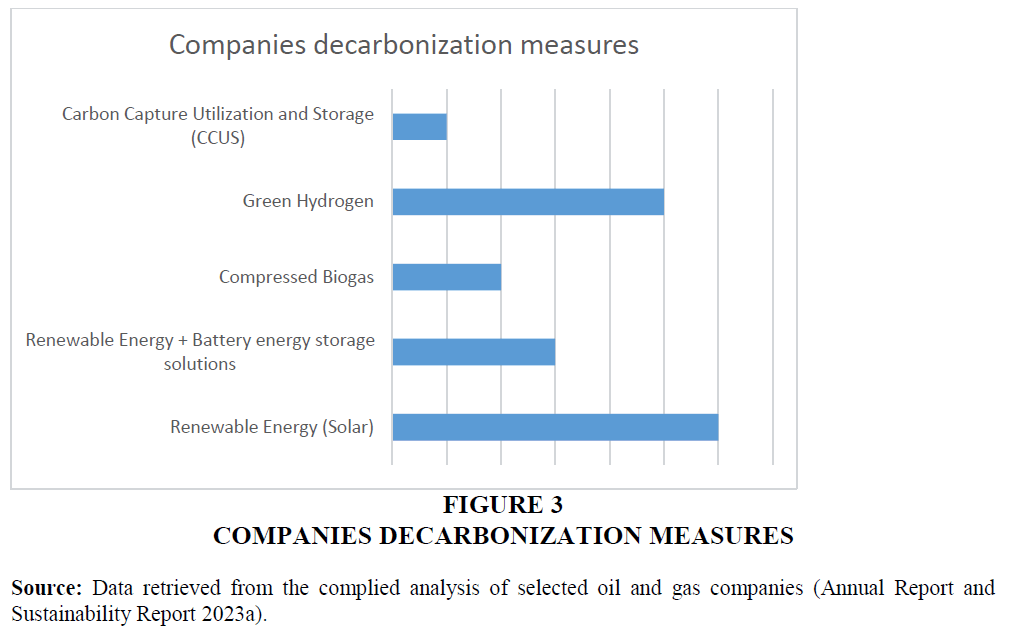

Figure 3 Companies Decarbonization Measures

Source: Data retrieved from the complied analysis of selected oil and gas companies (Annual Report and Sustainability Report 2023a).

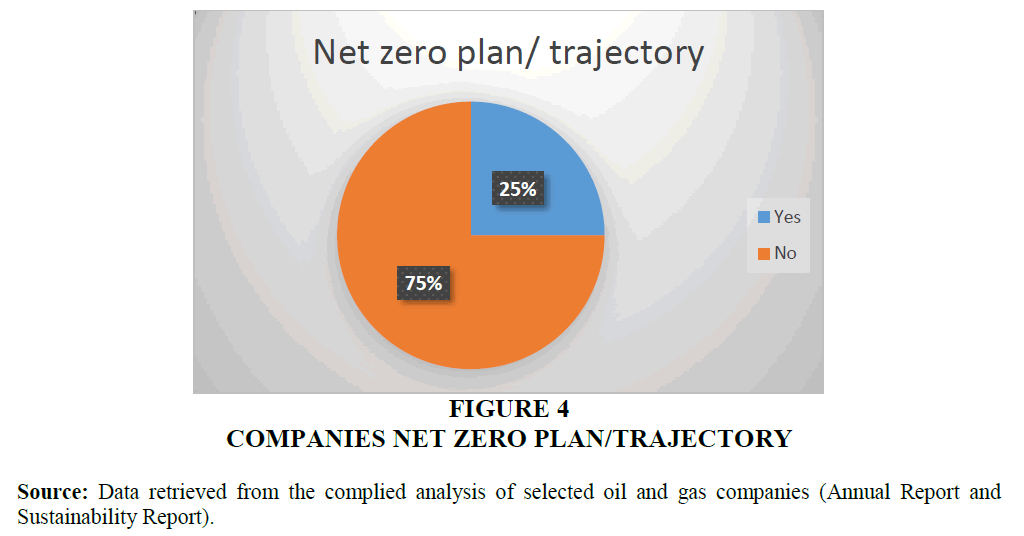

Figure 4 Companies Net Zero Plan/Trajectory

Source: Data retrieved from the complied analysis of selected oil and gas companies (Annual Report and Sustainability Report).

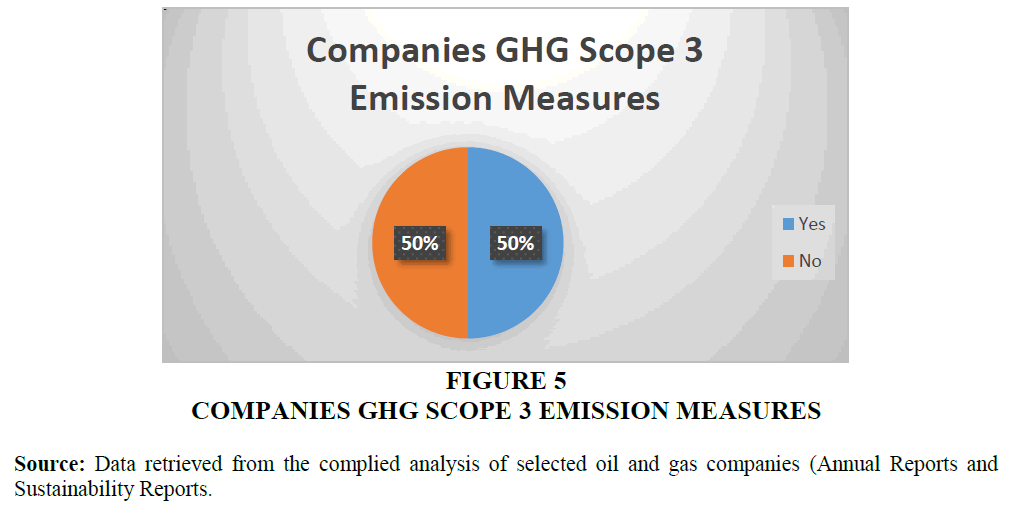

Figure 5 Companies GHG Scope 3 Emission Measures

Source: Data retrieved from the complied analysis of selected oil and gas companies (Annual Reports and Sustainability Reports.

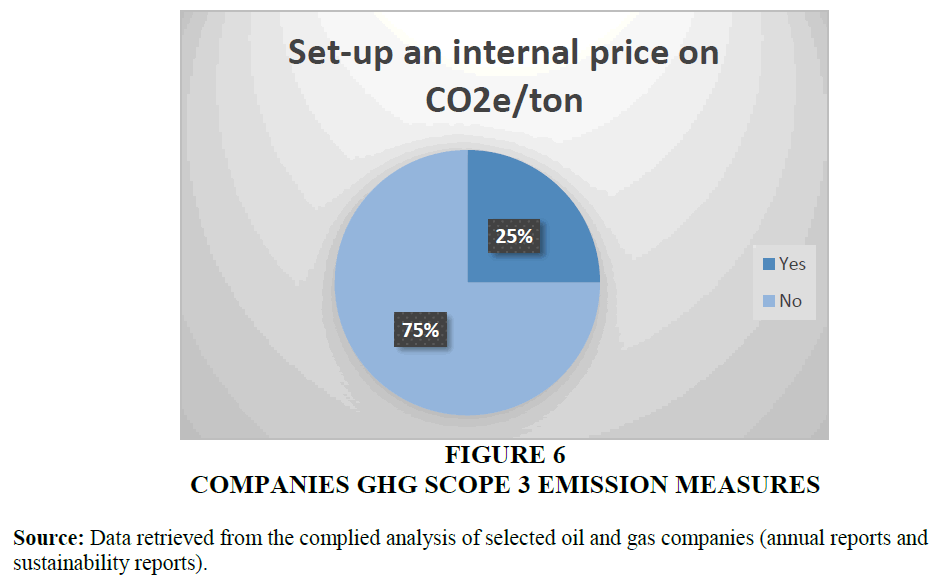

Figure 6 Companies GHG Scope 3 Emission Measures

Source: Data retrieved from the complied analysis of selected oil and gas companies (annual reports and sustainability reports).

The shift of Indian Oil and Gas Companies to green hydrogen not only helps to reduce greenhouse gas emissions, but it also improves energy security, offers employment opportunities, and positions the country as a pioneer in clean energy technology. It exhibits a proactive approach to sustainable development and highlights Indian Oil and Gas commitment to spearheading the transition to a greener and more sustainable future.

Indian Oil Corporation Limited

Indian Oil currently emits approximately 21.5 million metric tonnes of carbon dioxide equivalent (MMTCO2e). When combined with CPCL's emissions, the total reaches around 24 MMTCO2e. These reported figures specifically account for emissions resulting from operational activities, with the greenhouse gases (GHGs) considered being primarily CO2 (98.5%), CH4 (0.5%), and N2O (1%).

Breaking down these emissions further, approximately 96% fall under Scope-1 emissions, while the remaining 4% are attributed to Scope-2 emissions. In terms of emission sources, about 97% of these emissions are linked to refineries and petrochemical operations, while pipeline operations contribute around 2%, and marketing operations make up the remaining 1%. Indian Oil's energy consumption for the year 2023 stands at 297 trillion BTU Tables 1-5.

| Table 1 IOCL GHG Emissions (In MMTCO2e) | ||

| IOCL GHG Emissions (IN MMTCO2e) | Scope 1 | Scope 2 |

| 2017-2018 | 18.76 | 0.09 |

| 2018-2019 | 18.69 | 0.05 |

| 2019-2020 | 18.95 | 0.59 |

| 2020-2021 | 20.21 | 0.7 |

| 2021-2022 | 20.39 | 1.15 |

| 2022-2023 | 20.21 | 0.63 |

| Table 2 Net Zero Efforts | |

| Net Zero Efforts | FY 2023 |

| Investment in renewable energy and greening efforts | 582.80 Crore |

| Installed capacity of renewable energy | 238.70 MW (167.6 MW of wind | 71.10 MW of solar PV) |

| Saplings planted | 6.60 Lakh |

| Green hydrogen production capacity under development | 20 Tonne per day |

| Energy Savings | 2,55,379 SRFT/yr, equivalent |

| Table 3 ONGC GHG Emissions (In MMTCO2e) | ||

| ONGC GHG Emissions (IN MMTCO2e) | Scope 1 | Scope 2 |

| 2017-2018 | 10.23 | 0.38 |

| 2018-2019 | 9.76 | 0.39 |

| 2019-2020 | 10.25 | 0.46 |

| 2020-2021 | 9.66 | 0.50 |

| 2021-2022 | 8.92 | 0.26 |

| 2022-2023 | 8.54 | 0.35 |

| Table 4 Net Zero Efforts | |

| Net Zero Efforts | FY 2023 |

| Energy Consumed form renewable sources | 350,733 GJ |

| Investment in renewable energy and greening efforts | INR 260.90 Million |

| Installed capacity of renewable energy | 189.52 MW (Solar: 36.52 MW and Wind: 153 MW) |

| Saplings planted | 49,320 |

| Energy Savings | 9506 SRFT/annum |

| Table 5 HPCL GHG Emissions (In MMTCO2e) | ||

| HPCL GHG Emissions (IN MMTCO2e) | Scope 1 | Scope 2 |

| 2017-2018 | 3.41 | 0.46 |

| 2018-2019 | 3.44 | 0.48 |

| 2019-2020 | 3.637 | 0.461 |

| 2020-2021 | 3.836 | 0.469 |

| 2021-2022 | 3.323 | 0.432 |

| 2022-2023 | 4.304 | 0.776 |

Indian Oil has made a commitment to achieving net-zero operational emissions by the year 2046, with a substantial investment plan totaling $30 billion. This commitment includes specific targets, such as establishing a portfolio of 5.5 GW of renewable energy capacity and producing 0.7 million metric tonnes (MMT) of biofuels by 2025. Looking ahead, they aim to reach 31 GW of renewable energy capacity, produce 4 MMT of biofuels, including biogas, by 2030, and ultimately target 200 GW of renewable energy capacity, along with producing 7 MMT of biofuels and 9 MMT of biogas by 2050. These decarbonization plans encompass both Scope-1 and Scope-2 emissions and are estimated to require a budget of over INR 2.4 Lakh Crore.

Indian Oil Corporation (IOC) is taking significant steps to expand its renewable energy capacity and achieve net-zero emissions by 2046. They have entered into a partnership with NTPC Green Energy Limited to establish a joint venture that will provide 650 MW of continuous green energy for upcoming refinery projects.

IOCL Future Green Hydrogen Initiatives

As part of their ambitious Rs 2 lakh crore green transition strategy, IOC plans to deploy green hydrogen plants at all of their refineries. Green hydrogen is expected to make up 50% of their total hydrogen production within the next 5-10 years, ultimately reaching 100% by 2040 Sustainibility Report (2022); Sustainibility Report (2023a); Sustainibility Report (2023b).

IOC has set a goal to have a green hydrogen production capacity of 70 KTA (kilotons per annum) at the Panipat refinery by 2030. Additionally, at their Research and Development center in Faridabad, IOC already operates a PEM Electrolyser (Polymer Electrolyte Membrane Electrolysis) with a capacity of 30 Nm3/hr and has established the country's first high-pressure hydrogen storage facility, operating at 550 bar.

ONGC

ONGC (Oil and Natural Gas Corporation) has outlined an ambitious plan to invest INR 1 trillion in green initiatives by 2030 with the goal of reducing their carbon footprint. This investment is part of a broader strategy aimed at achieving net-zero emissions (Scope-1 and Scope-2) by 2038, with a total investment of INR 2 lakh crore. ONGC's plans include expanding their Renewable Energy portfolio to 10 GW by 2030 and establishing a green ammonia production capacity of 1 million tonnes per annum. As an example, the installation of a 5 MW solar plant in Hazira is estimated to reduce emissions by 4861 tCO2e per year NASA (2023).

For the fiscal year 2022, ONGC's total Scope-3 emissions, which encompass emissions from sources not directly owned or controlled by the organization, amounted to 24.3 million metric tons of CO2 equivalent (MTCO2eq). Scope-3 emissions represent approximately 73% of ONGC's total emissions, with the processing of sold products being the major contributor to these emissions. ONGC is actively developing an internal hydrogen roadmap and is exploring opportunities in renewable energy. The company is also giving priority to Carbon Capture, Utilization, and Storage (CCUS) as a key strategy for decarbonization Berghout (2019); Brandz (2023).

In collaboration efforts, ONGC Tripura Power Company Limited (OTPC) has signed a Memorandum of Understanding (MoU) with Assam Power Distribution Company Limited (APDCL) to establish a Battery Energy Storage System Project with a capacity of up to 250 MW. This project will involve an investment of INR 20,000 million in Assam and will be carried out through a Joint Venture Company. Additionally, ONGC has entered into a partnership with Equinor ASA in April 2022 to collaborate in various areas, including upstream exploration and production, midstream, downstream activities, and clean energy options, with a focus on Carbon Capture and Utilization (CCUS).

ONGC Future Green Hydrogen Initiatives

ONGC and Greenko Zero C have entered into a strategic partnership to collaborate on the production of Green Ammonia and its related derivatives in India. The two companies intend to establish a joint venture aimed at constructing a substantial 1.3 GW Green Hydrogen plant, with the capacity to produce 1 million metric tons per annum (MMTPA) of Green Ammonia. Additionally, they have plans to develop approximately 6 GW of solar and wind energy generation capacity Business Responsibility & Sustainability Report. (2022); Business Responsibility & Sustainability Report (2023) ONGC.

To ensure a continuous supply of renewable energy (RE) to the Green Ammonia plant, the partnership will utilize Greenko's pumped hydro storage infrastructure and Energy Storage Cloud. This infrastructure will be employed to deliver uninterrupted RE power to the Green Ammonia facility. Moreover, ONGC will contribute its expertise in commodities marketing to the collaboration Camilo Mora et al. (2017).

In summary, ONGC and Greenko Zero C are joining forces to establish a joint venture focused on producing Green Ammonia and derivatives. This initiative includes the construction of a substantial Green Hydrogen plant, significant renewable energy capacity, and the utilization of energy storage solutions to support Green Ammonia production.

HPCL

HPCL (Hindustan Petroleum Corporation Limited) is a prominent player in the Indian oil and gas industry. As a government-owned entity, HPCL operates throughout the entire hydrocarbon value chain, encompassing activities such as petroleum exploration, refining, marketing, and distribution Duttagupta et al. (2021).

HPCL has outlined a well-defined plan to achieve Net Zero in Scope 1 and 2 emissions by the year 2040. This plan involves various strategies, including optimizing energy usage in operations, incorporating renewable energy sources in refineries, transitioning to green hydrogen to fulfill hydrogen needs, reducing flare gas emissions, and offsetting emissions through Carbon Capture and Utilization (CCU).

During the fiscal year 2022-23, HPCL has successfully installed 30.34 megawatts-peak (MWp) of captive solar power capacity at various locations, thereby increasing its total solar power capacity to 84.35 MWp by March 31, 2023.

In alignment with the National Green Hydrogen Mission, HPCL is in the process of constructing a Green Hydrogen plant with a capacity of 370 tons per annum (TPA) at the Visakh Refinery, aimed at fulfilling a part of the refining process's hydrogen requirements. Furthermore, HPCL has continued its commitment to transitioning towards a low-carbon economy by installing solar panels at 1,763 retail outlets during the year, resulting in a total of 6,411 outlets equipped with solar power.

The company has made substantial capital investments in energy conservation equipment, with INR 5.5 Crore allocated for the Mumbai refinery and INR 26.4 Crore for the Visakh refinery during the financial year 2022-23.

A crucial technology employed by HPCL for achieving its green objectives is Hydrogen Pressure Swing Adsorption (H2 PSA). This process involves passing hydrogen gas through an adsorbent material, which selectively captures contaminants like carbon dioxide and water. The H2 PSA method effectively eliminates impurities through a cycle of high-pressure adsorption and low-pressure desorption, resulting in the production of high-purity hydrogen gas. This technology is known for its cost-effectiveness and adaptability, making it valuable in various sectors such as hydrogen fueling stations, chemical processes, and metal refining. H2 PSA plays a pivotal role in advancing hydrogen-based technologies and promoting a more sustainable and environmentally friendly energy landscape.

BPCL

Bharat Petroleum Corporation Limited (BPCL), a prominent government-owned oil and gas company in India, has a strong presence in the downstream sector of the petroleum industry Tables 6-10.

| Table 6 Net Zero Efforts | |

| Net Zero Efforts | FY 2022 |

| Energy Consumed form non-renewable sources | 55,576,179 GJ |

| Energy Consumed form renewable sources | 105,616 GJ |

| Installed capacity of renewable energy | 155 MWp |

| Saplings planted | more than 7,800 |

| Energy Savings | 85,042 SRFT/year |

| Table 7 BPCL GHG Emissions (In MMTCO2e) | ||

| BPCL GHG Emissions (IN MMTCO2e) | Scope 1 | Scope 2 |

| 2017-2018 | 5.129 | 0.273 |

| 2018-2019 | 5.024 | 0.366 |

| 2019-2020 | 6.568 | 0.481 |

| 2020-2021 | 5.569 | 0.423 |

| 2021-2022 | 6.682 | 0.524 |

| 2022-2023 | 10.13 | 0.79 |

| Table 8 Net Zero Efforts | |

| Net Zero Efforts | FY 2022 |

| Energy Consumed from renewable sources | 33201.248 MWh |

| Investment in renewable energy and greening efforts | INR 4.28 Crore |

| Installed capacity of renewable energy | 46.44 MW |

| Saplings planted | 4000 |

| Energy Savings | 520.37 GJ |

| Table 9 GAIL GHG Emissions (In MMTCO2e) | ||

| GAIL GHG Emissions (IN MMTCO2e) | Scope 1 | Scope 2 |

| 2017-2018 | 2.928776 | 0.733843 |

| 2018-2019 | 3.424266 | 0.396616 |

| 2019-2020 | 3.95993 | 0.387358 |

| 2020-2021 | 3.281058 | 0.419125 |

| 2021-2022 | 4.133249 | 0.434135 |

| 2022-2023 | 3.656175 | 0.31938 |

| Table 10 NET Zero Efforts | |

| Net Zero Efforts | FY 2022-23 |

| Energy Consumed from renewable sources | 1,16,872 GJ |

| Investment in renewable energy and greening efforts | 685.27 Crores |

| Installed capacity of renewable energy | 132 MW |

| Saplings planted | 150000 |

| Energy Savings | 3,88,952 kWh |

Currently, BPCL is actively involved in several solar projects situated across Kerala, Maharashtra, and Madhya Pradesh. These projects are at various stages of development and have a combined capacity of 45.5 megawatts (MW), involving an investment of INR 245 crore. Additionally, BPCL is in the process of implementing two wind power projects in Maharashtra and Madhya Pradesh with a total capacity of 100 MW, representing an investment of INR 978 crore.

In line with its commitment to sustainability, BPCL has set ambitious targets to achieve Net Zero in Scope 1 and Scope 2 emissions by 2040. The company is diligently working on a comprehensive roadmap to turn this vision into a practical reality.

BPCL's Bina Refinery is in the process of installing a 20 MW green hydrogen electrolysis plant. EIL has been selected as the Project Consultant, and a tender has been floated for the construction of this 20 MW Green H2 plant. The selection of the LEPC (Lump Sum Turnkey) contractor will be made at a later stage.

To promote the use of Hydrogen Compressed Natural Gas (HCNG), BPCL has initiated an Expression of Interest (EoI) to identify potential partners interested in setting up a 5 MW electrolyser for the production of green hydrogen, which will be blended into natural gas networks. The response evaluation for this initiative has been completed, and decisions regarding the project's feasibility, blending process, and location are currently in progress.

GAIL

GAIL has seen an increase in GHG emissions over time, just like many other PSUs present in the energy industry. The primary activities of GAIL, which include the extraction, processing, and distribution of natural gas, are responsible for this increase in GHG emissions. Despite being a less dirty fossil fuel than coal or oil, natural gas still emits greenhouse gases (GHGs), primarily through the combustion of carbon dioxide (CO2). It is essential for GAIL to implement sustainable and low-carbon solutions in order to address the growing concern about climate change and the requirement to reduce GHG emissions.

Combining Compressed Biogas (CBG) and green hydrogen can indeed be a potential strategy for shaping the future energy mix, and GAIL can play a significant role in this regard. The integration of CBG and green hydrogen offers a dual benefit of decarbonizing the energy sector while promoting sustainable waste management practices.

GAIL (India) Limited is building proton exchange membrane (PEM) electrolysers in accordance with the National Hydrogen Mission. The project would be based on renewable energy and would be installed at GAIL's Vijaipur Complex in Madhya Pradesh's Guna District.

The project is planned to produce about 4.3 metric tonnes of hydrogen per day with a purity of about 99.999 volume percent (roughly 10 MW capacity). It will be put into operation by November 2023. The project was given to a vendor who has a domestic value addition of more than 50% in keeping with the mission of Atmanirbhar Bharat.

OIL

Oil India Limited (OIL) a PSU is an upstream oil and gas company, we are in the business of exploration, production and transportation of crude oil & natural gas Tables 11-15.

| Table 11 OIL GHG Emissions (In MMTCO2e) | ||

| OIL GHG Emissions (IN MMTCO2e) | Scope 1 | Scope 2 |

| 2017-2018 | 0 | 0 |

| 2018-2019 | 1.49 | 0.12 |

| 2019-2020 | 1.53 | 0.13 |

| 2020-2021 | 1.5 | 0.137 |

| 2021-2022 | 1.36 | 0.145 |

| 2022-2023 | ** | ** |

| Table 12 Net Zero Efforts | |

| Net Zero Efforts | FY 2022-23 |

| Energy Consumed form renewable sources | 6.73 Million GJ |

| Investment in renewable energy and greening efforts | 75,000 crore |

| Saplings planted | 2.4 crore |

| Energy Savings | 2.53 million GJ |

| Table 13 RIL GHG Emissions (In MMTCO2e) | ||

| RIL GHG Emissions (IN MMTCO2e) | Scope 1 | Scope 2 |

| 2017-2018 | 0.31 | 0.82 |

| 2018-2019 | 0.29 | 1.14 |

| 2019-2020 | 0.47 | 1.45 |

| 2020-2021 | 0.44 | 1.25 |

| 2021-2022 | 0.372 | 0.867 |

| 2022-2023 | 0.37 | 0.85 |

| Table 14 Net Zero Efforts | |

| Net Zero Efforts | FY 2022-23 |

| Energy Consumed form renewable sources | 6.73 Million GJ |

| Investment in renewable energy and greening efforts | 75,000 crore |

| Saplings planted | 2.4 crore |

| Energy Savings | 2.53 million GJ |

| Table 15 Vedanta GHG Emissions (In MMTCO2e) | ||

| Vedanta GHG Emissions (IN MMTCO2e) | Scope 1 | Scope 2 |

| 2017-2018 | 0.517 | 1.4 |

| 2018-2019 | 0.55 | 3.5 |

| 2019-2020 | 0.61 | 2 |

| 2020-2021 | 0.589 | 1.3 |

| 2021-2022 | 0.595 | 3.3 |

| 2022-2023 | 0.571 | 8.6 |

Renewable Energy

As of March 31, 2022, the cumulative installed capacity for renewable energy amounts to 188.1 megawatts (MW). This includes 174.1 MW generated from wind energy projects and 14.0 MW from solar energy projects. Furthermore, there are additional solar plants with a capacity of 0.906 MW designed for internal consumption.

RIL

Reliance’s goal is to reduce its operational GHG footprint as part of its long-term emission reduction strategy, in addition to enhancing resource efficiency and energy conservation. As a part of Reliance’s long-term emission reduction strategy, the Company is committed to reducing its Scope 1 or direct emissions and Scope 2 or indirect emissions from energy purchases. RIL announced Net Carbon Zero by 2035 target.

In 2021, Reliance made a substantial investment of ₹75,000 crore in expanding its New Energy business. Reliance is committed to fulfilling its growing energy requirements while prioritizing environmentally friendly sources. The company saw a remarkable 352% year-on-year increase in its total consumption of renewable energy. The Hazira manufacturing unit played a significant role in renewable energy generation, contributing 1,360,181 gigajoules (GJ) during the fiscal year 2021-22. To reduce reliance on natural resources, Reliance also adopted the practice of co-firing biomass alongside coal at its Dahej and Hazira manufacturing units. In total, RIL's energy consumption reached 518.86 million GJ.

Vedanta

In the fiscal year 2022, the cumulative Scope 1 and Scope 2 emissions resulting from our operations amounted to 62.83 million metric tonnes of CO2 equivalent, representing a modest increase of 4.2% compared to the previous year. Starting from the preceding reporting year (FY2021), we have also begun tracking our Scope 3 emissions. Vedanta has reported a reduction in greenhouse gas (GHG) intensity of approximately 5% in FY22 as compared to FY21, specifically for the metals and mining sectors, which aligns with our short-term target.

Sustainability is deeply ingrained in their operational approach. They have taken a significant step by substituting fossil-fueled heavy vehicles with advanced lithium-ion forklifts. At a substantial scale, they will be introducing 23 lithium-ion battery-powered electric forklifts at their Aluminum Smelter in Jharsuguda. This transition not only results in a reduction of approximately 690 tonnes of CO2 equivalent in greenhouse gas emissions but also extends work cycles, thereby enhancing productivity. Additionally, these electric forklifts are practically maintenance-free Tables 16-23.

| Table 16 Net Zero Efforts | |

| Net Zero Efforts | FY 2022-23 |

| Saplings planted | 55,000 |

| Energy Savings | ~10,000 GJ |

| Table 17 Total GHG Emissions (Scope 1+ Scope 2) | |

| Scope 1 + Scope 2 Emission (IN MMTCO2e) | 2022-2023 |

| IOCL | 20.84 |

| HPCL | 5.08 |

| ONGC | 8.89 |

| GAIL | 3.975555 |

| BPCL | 10.92 |

| OIL | 1.22 |

| Reliance | 9.171 |

| Vedanta | 20.84 |

| Table 18 Board Level Executive for Sustainability & Climate Change Department | ||

| Companies | Yes | No |

| IOCL | Yes | - |

| HPCL | Yes | - |

| ONGC | Yes | - |

| GAIL | Yes | - |

| BPCL | Yes | - |

| OIL | Yes | - |

| Reliance | Yes | - |

| Vedanta | Yes | - |

| Table 19 Companies Commitment Towards Net Zero Target and 1.5 Degree C | ||

| Companies | Yes | No |

| IOCL | Yes | - |

| HPCL | Yes | - |

| ONGC | - | No |

| GAIL | - | No |

| BPCL | Yes | - |

| OIL | Yes | - |

| Reliance | Yes | - |

| Vedanta | Yes | - |

| Table 20 Companies Decarbonization Measures | |

| Decarbonization Measures | Responses |

| Renewable Energy (Solar) | 6 |

| Renewable Energy + Battery energy storage solutions | 3 |

| Compressed Biogas | 2 |

| Green Hydrogen | 5 |

| Carbon Capture Utilization and Storage (CCUS) | 1 |

| Table 21 Net Zero Plan/ Trajectory | ||

| Companies | Yes | No |

| IOCL | - | No |

| HPCL | - | No |

| ONGC | - | No |

| GAIL | - | no |

| BPCL | - | No |

| OIL | Yes | - |

| Reliance | - | No |

| Vedanta | Yes | - |

| Table 22 Companies GHG Scope 3 Emission Measures | ||

| Companies | Yes | No |

| IOCL | Yes | - |

| HPCL | - | no |

| ONGC | - | no |

| GAIL | Yes | - |

| BPCL | Yes | - |

| OIL | - | No |

| Reliance | - | No |

| Vedanta | Yes | - |

| Table 23 Set-Up an Internal Price on Co2e/Ton | ||

| Companies | Yes | No |

| IOCL | - | No |

| HPCL | - | No |

| ONGC | - | No |

| GAIL | Yes | - |

| BPCL | - | No |

| OIL | - | No |

| Reliance | - | No |

| Vedanta | Yes | - |

By 2023, Vedanta's energy consumption is anticipated to reach 559 million gigajoules (GJ).

Internal Carbon Price: Out of 8 companies only one company (Vedanta) is having internal carbon price in their organization which is US$15/tCO2e.

Results and Discussion

The rationale behind analyzing the top companies is that they shall be capable of reaching the Net Zero path and act as an inspiration for other companies. The sustainability report, annual report, official content of these companies was analyzed. The maturity of their plan of action for achieving net zero emissions were based on dimension of Sustainability, Strategy, Maturity Model, Corporate Net Zero Standard.

In total, we found that 100% of all the companies considered for this research paper have executive board-level leadership on sustainability and 75% of the companies have committed to a year by which their emissions should be zero out of which only 25% targets are SBTi approved. We also found that 75% of the companies have set up Internal Carbon Price. Our findings indicate that while most of the Top 8 companies have announced their scope 1 and scope 2 targets, and 50% agree on measuring scope 3 emissions none of them have set any clear objective for their scope 3 emissions. Corporates are disclosing action measures around decarbonization. Around 85% companies have decarbonization measures. Renewable Energy. (RE) plays a key role in current decarbonization followed by Energy Efficiency initiatives Around 80% of the companies involve renewable energy and 55% Energy Efficiency (EE) in their practices. Only about 35% of the disclosed about their engagement in any of the green/sustainable finance. Around 55% of the companies are taking other initiatives or projects under decarbonization (Compressed Bio Gas, Battery energy storage solutions, Green Hydrogen, Carbon Capture Utilization and Storage). The widespread adoption of net zero targets might provide the impression that the Paris Agreement's objectives are being met faster but unsurprisingly net zero is actually still in its early stages. Further work needs to be done for proper setting up and implementation of net zero.

Conclusion and Contribution

Governance, proper planning before taking action, are a set of factors relate to industry fragmentation and a difficulty in sharing best practices even when they exist. Most of the companies focus on product innovation rather than process or manufacturing innovation (strategic managerial role, energy management systems, and improved processing techniques). Almost all the companies are considering alternatives like afforestation, renewable energy, and energy transition. They also need to consider integrated approach involving more solutions like green bonds, carbon credits, battery energy storage, and carbon capture utilization and storage . Companies are concerned about climate and are taking action towards it but they also require to reach higher maturity level for effective implementation which is in line with science based requirements. It can be observed that although around 100% of the top 8 companies have set their Net Zero targets, 75% of the companies have set Net Zero plan/trajectory rest 25% still lack planning. Thus it shows gap between commitment and proper implementation. This study analyse the roadmap towards net-zero for major companies in India and suggests some improvements. More the targets taken in relatively early target year, more the rank of the company will be in terms of maturity. This will be helping in setting of long-term planning by focusing of major areas to accelerate the science based process to reach Net Zero. Further studies are needed to be conducted to make solutions more practical and viable.

This research study provides a complete review of the long-term potential paths to Net Zero in the oil and gas sector. It illustrates the urgent need for a transition to greener practices by analyzing the GHG emissions management practices of prominent O&G companies over the last five years. The study delves into the strategies, financial investment plans, challenges, and actions needed to cut emissions and transition to a clean energy mix. Finally, this research contributes to the underlying subject of "Building Back Greener Pathways" by showing how the O&G sector can play an important part in the global effort to overcome climate change and create a sustainable future

In conclusion, this research project has provided valuable insights into the future development of solutions for Net Zero Technological governance, Standards, etc through an in-depth analysis of the latest technologies, market trends, and policy frameworks, have identified opportunities and challenges for green hydrogen deployment in the Indian Oil and Gas Companies.

The GHG accounting analysis has quantified the greenhouse gas emissions and energy consumption associated with the Indian Oil and Gas Companies existing operations. However focus on Scope 3 Emissions of these companies is yet to be developed. These findings will serve as an important foundation for detailing their Net Zero pathway and aligning with global science based requirements as per Paris Agreement.

References

Annual Report 2022-23 - en - ongcindia.com. (2023). ONGC.

Annual Report. (2023a). Bharat Petroleum Corporation Limited.

Annual Report. (2023b). Hindustan Petroleum.

Berghout, N., Meerman, H., van den Broek, M., & Faaij, A. (2019). Assessing deployment pathways for greenhouse gas emissions reductions in an industrial plant – A case study for a complex oil refinery. Applied Energy, 236, 354–378.

Indexed at, Google Scholar, Cross Ref

Brandz, K. (2023). Indian Oil Corporation Limited | Integrated Annual Report 2022-23. Indian Oil Corporation.

Business Responsibility & Sustainability Report. (2022). Indian Oil Corporation.

Business Responsibility & Sustainability Report. (2023). ONGC.

Camilo Mora, Bénédicte Dousset, Iain R. Caldwell, Farrah E. Powell, Rollan C. Geronimo, Coral R. Bielecki, Chelsie W. W. Counsell, Bonnie S. Dietrich, Emily T. Johnston, Leo V. Louis, Matthew P. Lucas, Marie M. McKenzie, Alessandra G. Shea, Han Tseng, Thomas W. Giambelluca, Lisa R. Leon, Ed Hawkins & Clay Trauernicht (2017). Global risk of deadly heat. Nature climate change, 7(7), 501-506.

Duttagupta, A., Islam, M., Hosseinabad, E. R., & Zaman, M. A. U. (2021). Corporate social responsibility and sustainability: a perspective from the oil and gas industry. Journal of Nature, Science & Technology, 2, 22-29.

NASA. (2023). Carbon Dioxide | Vital Signs – Climate Change: Vital Signs of the Planet. NASA Climate Change. Retrieved September 20, 2023, from https://climate.nasa.gov/vital-signs/carbon-dioxide/

Sustainability Report. (2023). GAIL (India) Limited.

Sustainability Report. (2023a). Oil India Limited.

Sustainability Report. (2023b). Vedanta Limited.

Sustainibility Report. (2022). Bharat Petroleum Corporation Limited.

Received: 03-Nov-2023, Manuscript No. AMSJ-23-14148; Editor assigned: 06-Nov-2023, PreQC No. AMSJ-23-14148(PQ); Reviewed: 29-Dec-2023, QC No. AMSJ-23-14148; Revised: 29-Feb-2024, Manuscript No. AMSJ-23-14148(R); Published: 09-Mar-2024