Research Article: 2022 Vol: 26 Issue: 5

Critical Assessment of Green Financing Initiatives In Emerging Market: A Review of India Green Bond Issuances

Sumit Kumar, Indian Institute of Management Kozhikode

Citation Information: Kumar, S. (2022). Critical Assessment of green financing Initiatives In Emerging Market: A Review of India’s Green Bond Issuances. Academy of Marketing Studies Journal, 26(5), 1-14.

Abstract

In today’s business scenario, sustainability is an emerging trend and a very important business objective driving green business innovation. To provide sustainability to environmental issues, the corporates are moving their focus towards greening the business process. So is true for the financial industry where the function of financial management has turned to environment-friendly activities which include green finance. Green finance is a new innovative financial pattern adopted by financial firms that integrates environmental protection and economic profits. In this study, the focus is to analyze various green finance initiatives adopted by Indian Financial firms, their opportunities, and challenges. The study also highlights the developments and green finance future in India.

Keywords

Green Bonds, Green Finance Initiatives, Climate Change, Sustainable Investments, Sustainable Transformations.

Introduction

During the past few years, the sustainable transformations for a sustainable developed economy have been gaining importance at various discussion forums including national as well as global, helping governments, international and national institutions, organizations in joint initiatives for environmental protection. The transformation of an economy into a sustainable global economy needs financial investments that provide environmental benefits CBI (2018a). On one hand, the business organizations are realizing the importance of green & ecological changes, the business entities, on the other hand, are being forced to issue tailored-made financial instruments that made the concept of green bonds prominent in emerging economies Dubash & Rajan (2001).

Over the past decade, green bonds are the most remarkable ingenious in the domain of green finance initiatives which is giving ways to stabilize the current environmental picture. Green bonds share the same characteristics as general bonds, the only difference is the proceeds use. The proceeds of the green bonds will be utilized to finance the green projects.

The investment in green projects is environmentally friendly which is in turn termed Socially Responsible Investing. With the growing importance of Socially Responsible Investing, there has been a rise in sustainable investments and thus the demand for green finance is rising. Globally, Green bonds are regulated by International Capital Market Association (ICMA). Like any other debt instrument, green bonds are fixed-income instruments, but their proceeds are used only for projects which contribute to the benefit of the environment.

Meaning and Definition

The green bond is described as a debt instrument that is issued by the government, any institution, or a corporation for raising capital that will be used to finance eco-friendly projects. Like any other debt instrument, green bonds are fixed-income instruments, but their proceeds are used only for projects which contribute to the benefit of the environment.

Typically, green bonds are used to finance large-scale capital-intensive projects which are contributing to the development and protection of the environment. These projects might relate to renewable energy, energy efficiency, renewable power. It also includes climate bonds, which are issued to finance projects related to climate change solutions Table 1.

| Table 1 Green Bond Types | ||

| Green Bond Types | Attribute | Recourse of Debt |

| Proceed Use Bond | Funds collected from these bonds are used only for financing the environmentally friendly projects | Recourse lies with the issuer |

| Revenue Bond | Funds collected from these bonds are used for refinancing the environmentally friendly projects | Recourse lies with the issuer |

| Project Bond | Funds collected from these bonds are used only for financing the specific environmentally friendly projects | Securitization |

| Securitization Bond | Funds from proceeds are pooled together to be used only for financing the environmentally friendly projects | Recourse lies with the group of projects |

| Covered Bond | Funds collected from these bonds are used only for financing the specific environmentally friendly projects which are pooled together in the group | Recourse lies either with the issuer or with the group which is affiliated for the issue |

| Loan | Funds from proceeds are used only for financing the green projects mortgaged on assets | Recourse lies with the issuer |

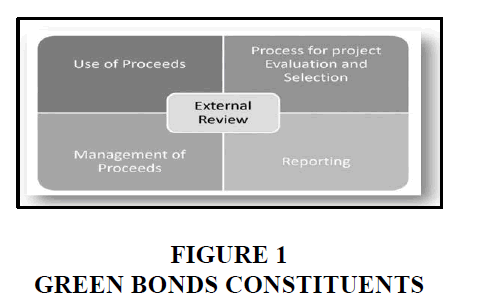

Constituents of Green Bond

The Indian green bond market is regulated by SEBI which has formulated the guidelines based upon the principles of green bond. The guidelines issued by the regulatory authority Chowdhury et al. (2013) provide assurance to the investors that the issuers of the green bonds are working with transparency and providing time to time all the required and full information as mandated for the issuance of such bonds. Green bonds have the following components Dipika (2015) Figure 1.

The first component is the use of Proceeds. This signifies how the funds from the issuance of green bond fund will be utilized and also identifies the projects for the utilization Forbes (2017).

The second component is the project evaluation and selection process. In this process the project is judged from the viewpoint of the environmentally friendly objectives of the project and its impact on the society.

Next is the management of proceeds. In this process, the fund of the project are provided to the reserve set off for the specific project so that the utilization of the funds can be traced. If the funds remain unutilized or are not fully utilized, the issue of such funds should Charles & Philip (2020) be put on temporary use of unutilized funds.

Finally reporting, which is the process where the issuer should disclose all the relevant information needed regarding the project such as fund allocation and utilization, project progress, use of unutilized funds and information which might be needed by the investors? Therefore, full disclosure of the information should be provided through the annual reports.

One more component which is included in the above four components is External Review. The process of external review involves detailed evaluation done by the auditor who is external to the organization. The external auditor verifies all the working, documents related to the project and issues a certificate to the issuer regarding the issue Agarwal & Singh (2018).

Global Green Bond Market

During the past few years, the green bond market has grown significantly all over the globe, and predictions are also made for its rise in the coming few years CBI (2018b). There are many factors that have contributed to the growth of green bond issuance in India as well as all over the globe. The concern for environment protection, creating and maintaining ecological balance, demand for eco-friendly products by the society are the parameters that gave rise to the green bonds Ministry of Corporate Affairs (2011).

There are lots of issuers involved in the issuance of green bonds across the globe. These include both the private and public sector enterprises. Within these enterprises, there are financial, non- financial corporates who are involved in the green bond market as primary issuers.

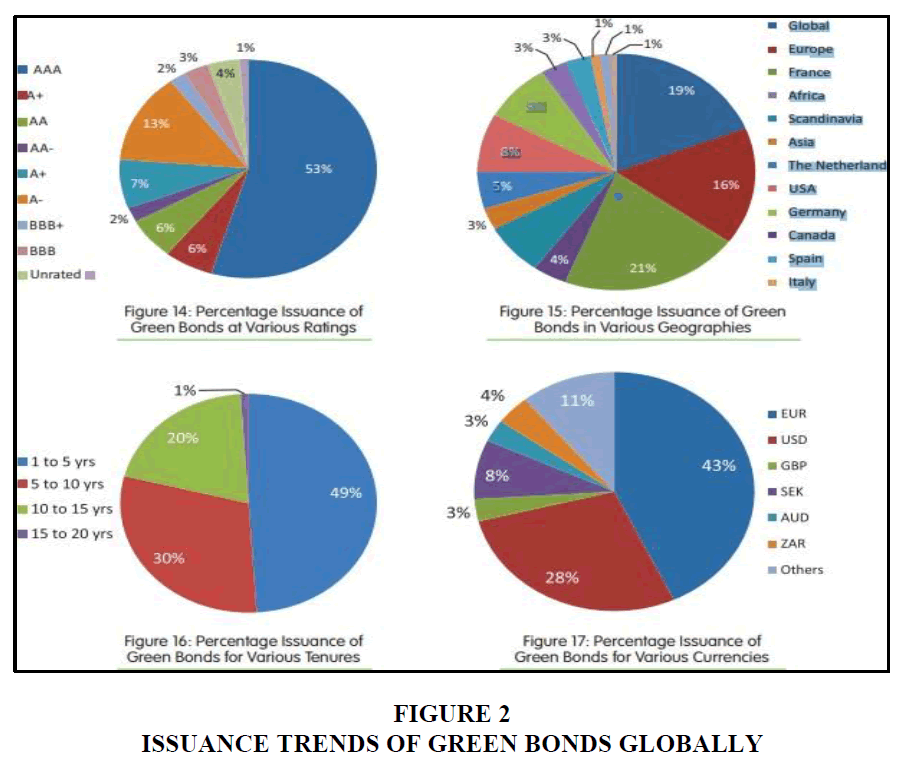

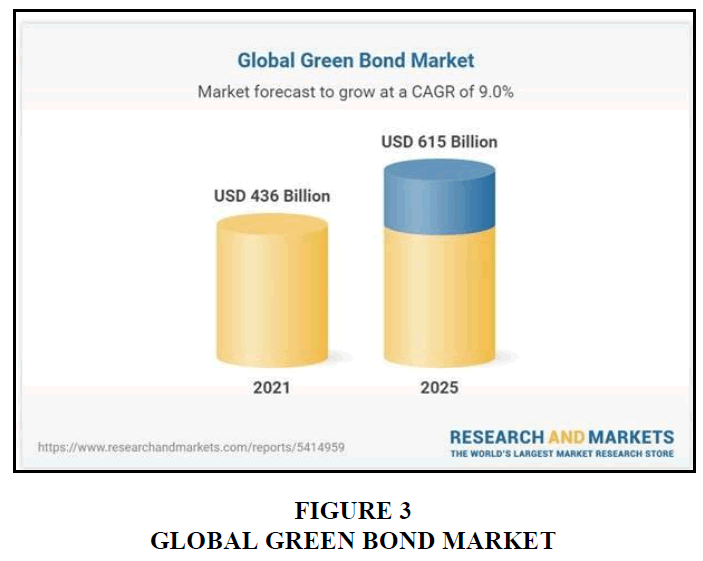

As the green bond market is expanding and there has been an increase in the investor base, there is a need to create a benchmark for the performance measurements. Market indices are the metrics based upon the statistics, keeping track of the investments and securities. Four indices for the green bonds are available. These indices differ in their methodologies and consider different factors for the green bond to be included in the index Figure 2 & 3. The indices are:

1. Bank of America Merrill Lynch Green Bond Index

2. Barclays MSCI Green Bond Index

3. S&P Green Bond Index and Green Project Bond Index

4. Selective Green Bond Index

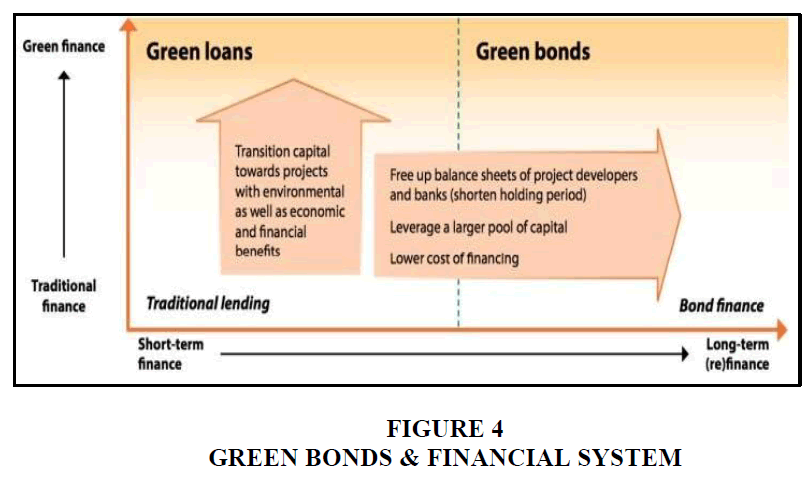

Green finance is helping economies of various countries to transform their financial system thereby diversifying the risks. With the help of green bonds, the issuers are able to raise large pool

of capital at low cost which in turn provide “economies of scale”. Also, it provides reputational benefits as marketing of green products highlights the green credentials & green investment support of the issuer Figure 4.

Issuance of Green Bonds for Green Energy Financing in India

The government of India is playing major role for mobilizing funds in order to finance the green projects. Issuance of green bonds by India is going to set new benchmark by the year end 2022. More and more issuers are joining the race of green bond issues which requires environment conscious investors.

In this regard, the efforts are made to form a pool of funds from the proceeds of projects specific in the area of renewable energy. The Indian Renewable Energy Development Agency (IREDA) which is owned by Indian Government is putting up their efforts to provide loans to the banks at the concessional rate which might provide further loans to the corporate enterprises engaged in energy projects Kumar et al. (2019).

The IREDA took help from the international organizations to collect funds in order to provide financial support to the developers of renewable energy projects at a low-interest rate. The international agencies include World Bank (2019).

The IREDA took an innovative move by introducing a unique financial instrument called as ‘green masala bonds’. The Green masala bonds are issued for financing the green projects Christophers (2018).

India’s Status in Green Bond Market

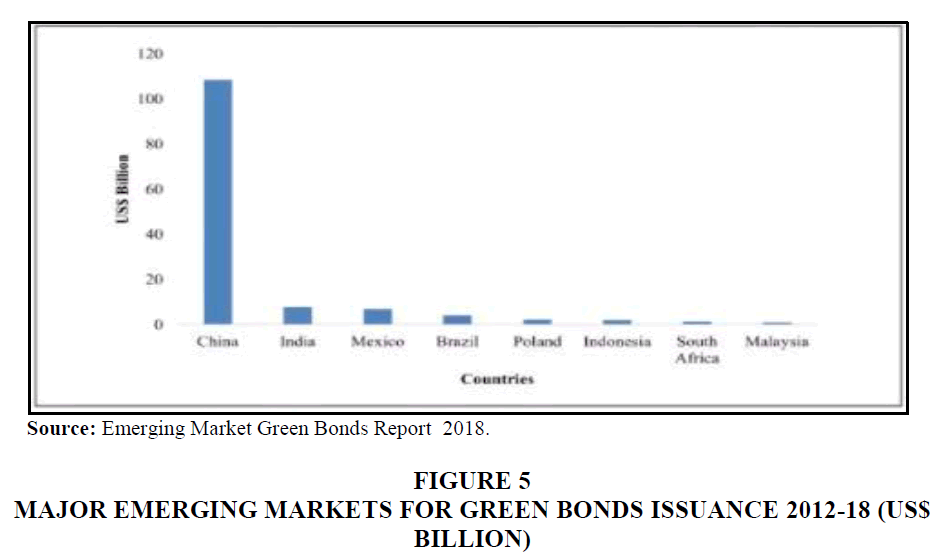

India has been ranked second for issuing green bonds across the globe as per the economic Survey 2019-20 for doing transaction worth $10.3 billion during first half of the year 2019 Figure 5.

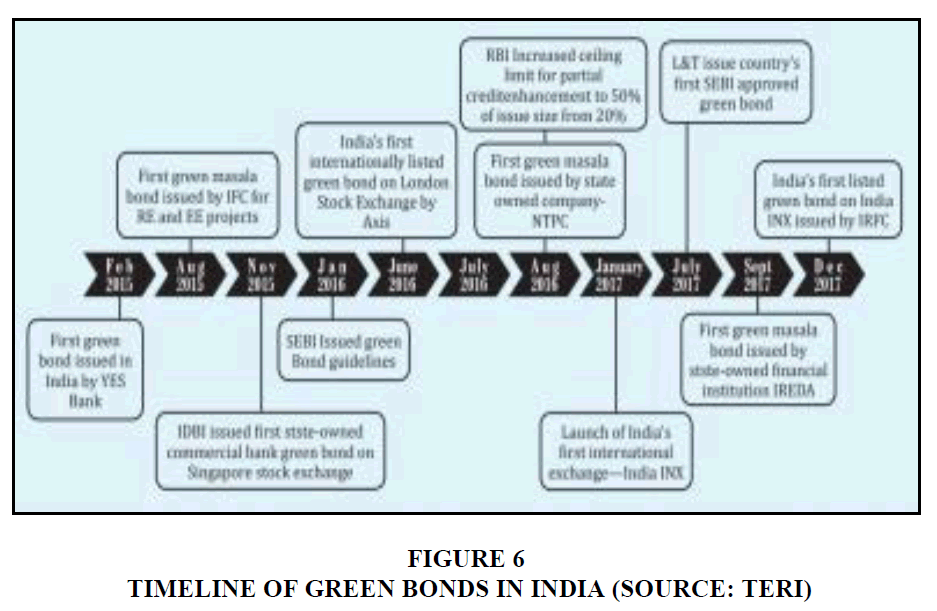

Among emerging markets for green bonds, India bagged the second position, the first largest being China till the year 2021. Even though the innovations in the area of green project financing were started early in the year 2015, the bond market in India fails to expand assets wise and has been focusing majorly energy based projects Harikumar & Susha (2017) Figure 6.

Currency Trends

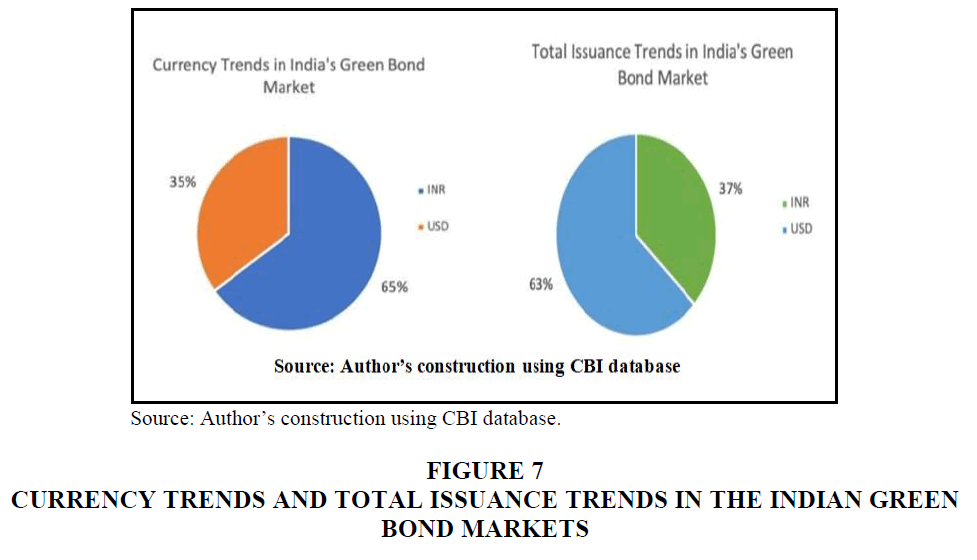

India’s green bond market majorly consist of US dollar denominated bonds as 65% of total capital raised accounted for the US green bonds and India’s Rupee denominated bonds consist of only 37% of the total capital. The total amount of funds raised by the issue of green bonds in the Indian bond market was $7.8 billion in the year 2015-2017 Figure 7.

Green Bond Issuance in India

As a means of finance, green bonds have attracted lot of issuers like which includes private and public sector banks, public sector undertakings. These enterprises are raising funds for environmentally friendly and sustainable development projects Ministry of Finance (2018).

Several organizations including private and public companies, banks and governments have issued green bonds to remain in the competition for sustainable development. In order to protect the interest of the investors and to provide them confidence for investing in green bonds, Climate Bonds Initiative has issued several guidelines. Also, it has issued standards and certification schemes in order to promote investments in climate bonds and green bonds RBI (2019).

Issuer Trend

Green bonds in India were invested across 5 sectors. Different sectors have different patterns of investments which are based on issuer type, number of issuers, number of green bonds issued. The table highlights the issuer trend of sector-wise issuance of green bonds based on the above pattern Network (2018) Table 2.

| Table 2 Green Bond Sector Wise Classification | |||

| SECTOR NAME | NO. OF GREEN BONDS ISSUED IN THIS SECTOR | ISSUER TYPE | NO. OF DIFFERENT ISSUERS IN THIS SECTOR |

| Adaptation | 1 | 1 | 1 |

| Energy | 25 | 7 | 15 |

| Buildings | 2 | 2 | 2 |

| Transport | 4 | 4 | 4 |

| Waste | 0 | 0 | 0 |

| Water | 2 | 2 | 2 |

| Land Use | 0 | 0 | 0 |

| Industry | 0 | 0 | 0 |

Municipal Green Bond Initiatives

India is undergoing rapid urbanization, with an increasing number of populations transitioning to urban populations. As per the report given by United Nations (UN), urban regions are contributing more than 60% to India’s Gross Domestic Product (GDP). Therefore, as India rapidly urbanizes, meeting the financial needs of urban areas has acquired greater urgency Sushma (2021).

The Bangalore Municipal Corporation was the first municipal corporation to issue bonds worth INR 125 crore (USD 21 million) with a state guarantee in 1997. In January 1998, Ahmedabad Municipal Corporation issued bonds worth INR 100 crore (USD 17 million) without a government guarantee. The Government of India issued guidelines for the Pooled Finance Development Fund (PFDF) Scheme for small ULBs in November 2006 to raise money from the bond market; however even issuance under the scheme has remained very low CBI (2020). In aggregate, only INR 13.53 billion (USD 226 million) bonds under tax-free, taxable, and pooled bonds schemes have been issued Ansari et al. (2013).

Advantages for Issuing and Investing in Municipal Green Bonds

Even though the India’s municipal bond market is in infant stage, there are several advantages for issuing and investing in municipal green bonds. These includes: -

1. Municipal Green bonds expand the quantum of funds to be invested in green projects.

2. These bonds have broadened the investor base due to their nature of investments in green and climate bonds.

3. Municipal green bonds are a source of capital for the long term at a low cost.

4. Such green bonds increase liquidity by enabling refinancing of unused funds.

5. Green bonds attract strategies such as forex hedging.

6. Backed by standards and certification schemes.

7. Helpful in climate-friendly investments.

Municipal green bonds have the potential of financing large investments for green and climate- friendly urban development projects compared to the staggering investments that urban local bodies currently make based on operating incomes. The funds raised by municipal bonds in India so far have been significantly small, and there is substantial scope for scaling it up by promoting the concept of municipal green bonds to meet their green development targets. The low level of municipal involvement in the bond market is often attributed to bottlenecks such as lack of Credit worthiness, non-bankability of projects, lack of project management and, insufficient, human resources among, others Goel (2016).

Although green bonds have a strong potential as an innovative financing mechanism for Municipal Corporations in financing green infrastructure projects, some common barriers have stifled their growth. Political will, if suitably complemented with a regulatory push, can encourage the issuance of green municipal bonds in India. Structural and administrative changes are also required to be heralded to ensure that sufficient incentives to push municipalities to capital markets are in place Volz (2018).

Municipal Green Bonds Issuance in India

In India, Ghaziabad Municipal Corporation Uttar Pradesh (UP) has issued first ever municipal green bonds becoming the first corporation to enter into the green bond issuer segment. The Corporation has raised Rs 150 crore by issuing municipal green bonds in BSE on April 8, 2021. The union government funded the corporation by providing an incentive of 19.5 crores. AK Capital Services Ltd and HDFC Bank Ltd were the merchant bankers to the bond issue Filkova et al. (2018).

Purpose

The proceeds of municipal green bonds will be used to benefit industries in Ghaziabad by constructing sewage treatment plant. This Municipal bond was issued as green bonds as the purpose comes underwater management i.e., recycling. The corporation has entered into an understanding with Sahibabad Industries Association to achieve various goals and objectives relating to the water supply Cowan (2017).

Green Bond Framework of Various Indian Co’s

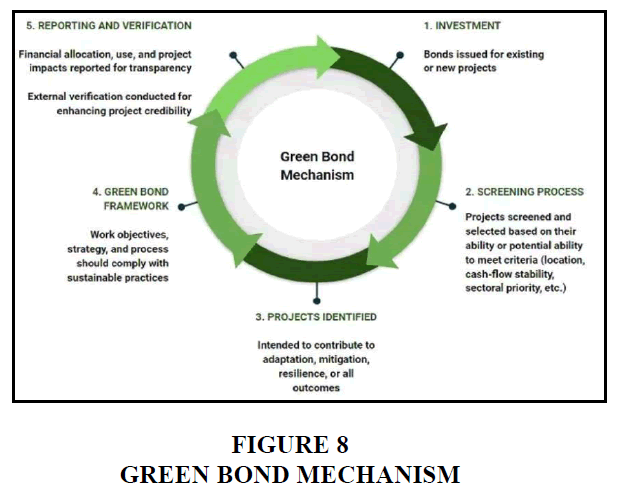

The framework for green bonds can be categorized into five elements which are presented diagrammatically below Figure 8.

Green bonds are also called balance sheet financing. Therefore, the proceeds from the issuance of these bonds are not combined with the general revenues of the organization nor they are used for the general organizational expenditures. With such characteristics, green bonds has some obligations for the issuers i.e. the issuers should clarify the intentions for the bond proceeds before issuance of such bonds. They should also disclose their organizational structure, mode of project selections, financial controls. In this process time to time, proper reporting has to be done by the issuer regarding the issuance, use of proceeds, and use of unutilized funds to the investors Reddy (2018).

This is important from the viewpoint of the investors as investments in green bonds involves high degree of risk and requires high degree of trust. Organizational governance and control provide integrity and credibility among the present and potential investors in investment market for bonds Ministry of Statistics and Program Implementation (2021).

Green Bonds stream in India

In the year 2015, the first green bond was issued in India. Even though green bonds issued in India are small in size, they represent the selective issue of green bonds.

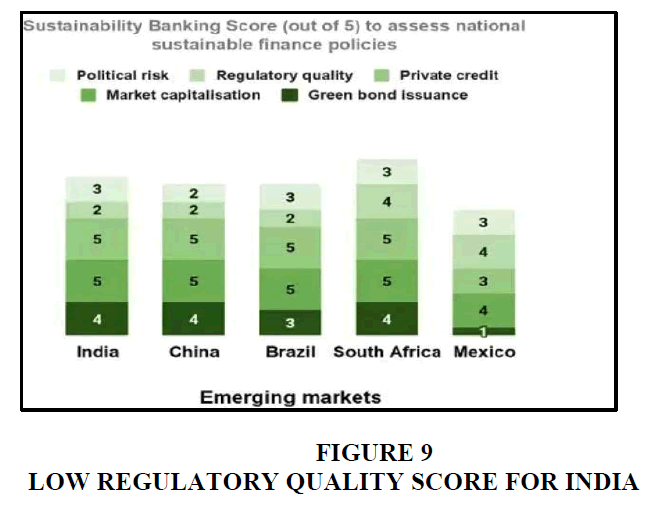

In year 2019, India’s bond market became second largest emerging market, and the net worth transaction was $10.3 billion Figure 9.

The green bonds issued in India are subjected to risks which are project-centric risks. These risks includes poor financial health of the companies, failure to follow the given guidelines, risk of asset quality, payment failures etc Jha & Bakhshi (2019).

India’s overall sovereign rating for investment-grade bonds has been affected due to these risks and reaches a low BBB. Also, in the absence of proper regulations, the funds collected from the green bond issues are used for the non-green projects which is giving rise to the risk called reputational risk CBI (2018a).

Profiles of Green Bond Issuers in India

Yes Bank The bank has issued first infrastructure bond with a maturity of 10 years. The fund from the proceeds of these bonds is going to be utilized for energy related projects Keerthi (2013).

AXIS Bank The first green bond within its $5 billion Medium Term Note (MTN) program. The bond is listed internationally on London Stock Exchange. The bond is also certified as green bond by the Climate Bonds Standards Board. The bank is expected to use the proceeds towards green energy, transportation, and infrastructure projects Otek Ntsama et al. (2021).

Hero Future Energies Hero Future Energies is an Indian developer of wind energy that came out with INR 3 billion (US$44mn) climate bonds certified green bond for wind projects.

IDBI Bank The first state-owned commercial bank in India to raise Reg S green bonds to refinance clean energy projects in the area of solar power, wind energy as also to finance sustainable transport. This is a part of the US$ 5 billion Medium-Term Note (MTN) listed on the Singapore Exchange.

GREENKO the first-ever high-yield green bond. Greenko is a Hyderabad-based clean energy company backed by GIC, Singapore’s Sovereign Wealth Fund. The proceeds from the issuance of such bonds will be used to pay off debts and for meeting transactional and operative expenses. Greenko’s parent is Greenko Energy Holdings, based in Singapore, and will be listed on its stock exchange.

EXIM Bank Exim Bank of India, established in 1982, is the premier export financing institution in India. One of the first dollar-denominated offerings from India, the bond was raised through a 5-year Reg S green bond to deploy to fund projects in Bangladesh and Sri Lanka.

CLP Wind Farms It is the first corporate to issue green bonds. The funds from the proceeds are used for capital-related expenditure and projects related to wind management

IREDA It is the enterprise of the Government of India that comes under the Ministry of New and Renewable Energy (MNRE). IREDA provides financial assistance to the corporates engaged in projects related to energy efficiency and energy conservation Shen (2020).

Major Underwriters The major underwriters include Bank of America, Merrill Lynch, JP Morgan, Credit Agricole, HSBC, Standard Chartered, Deutsche Bank, UBS, and Investec were lead managers in most of the issues. Bonds of issuers are rated by Standard and Poor and Moody.

Independent Review Providers CICERO, Sustainalytics, Vigeo, Eiris, Oekom, EY, CECEP Consulting, KPMG, Syntao Green Finance, DNV GL are the leading providers of independent reviews, with CICERO accounting for a large number of reviews carried out Singh (2019).

Green Bond Impact on Climate from India’s Perspective

Due to tremendous change in climatic conditions across the world, proactive approach is required for the bond issues that have repercussions on the industry as a whole. The climate changes leads to significant threats to human and animals life. Therefore, mitigation and adaptation measures require urgent financing to save the loss of human and economic capital. This is possible only when the corporate, public, and private enterprises, the government promote funds to the green sector Keerthi (2013).

India has made aggressive steps towards sustainable development goals by aiming at a low- carbon economy and targets like these require a huge amount of funds. In order to provide funding to the environmentally friendly projects, the green bonds issue came into the picture, which is recognized as innovative funding methods International Monetary Fund (2018).

Environmental sustainability has emerged as an important policy imperative in developed and emerging markets. The steps towards developing a sustainable financial sector began with a Reserve Bank of India circular issued in December 2007 outlined the scope of banks role towards corporate social responsibility and sustainable development. It also defines sustainable development as “the process of maintenance of the quality of environmental and social systems in the pursuit of economic development”.

Future of Green Bonds in India

India’s economy is growing at a very rapid pace with 7%-8% rise every year. In this race the financial needs are also growing to match the growing economy. In order to fulfill the goal of sustainable development, Indian economy is promoting sustainable financial models. This model includes market instruments such as climate bonds and green bonds. The major challenge to make green bonds and climate bonds workable in Indian financial market is to make investors view the sustainable development objectives lies with the issuance of these instruments. Also, the Government of India should provide a steady stream of investible green projects CBI (2018c).

Green and climate bonds is an important key for India to achieve sustainable development goals. As India is rebuilding, introducing new and innovative financial instruments are crucial as the proceeds from the issuance of these instruments serve as a reserve for projects which are having environmental benefits.

According to World Economic Forum’s Energy Transition Index 2020, India ranked 74th making consistent and measurable progress in the area of sustainable development Joshi (2013).

Challenges

Inspite of so many advantages from the issuance of green bonds, there are certain drawbacks of this market in India. Green finance and green products are at a very young stage. The issuers are still gaining education regarding the issuance of green bonds and the use of their proceeds Sarangi (2018).

The size of the market is very small, and therefore small bond sizes create problems of liquidity. Lack of standards and legal enforcement leads to the creation of reputational risk & complexities for green integrity Jain (2020).

The performance of green bonds depends on the bond market of the country thereby affecting its demand. India has a sovereign credit rating of BBB, which means a low rating for any country. Therefore, to attract international investors, green bonds require credit enhancement Gupta & Alok (2012).

The poor and uncertain regulatory mechanisms are also impacting the investments in the renewable energy sector which in turn impacts demand for green bonds Roy (2016).

India’s bond market is in infant stage even after it is second largest market after China. In order to attract investors including domestic as well as international, the focus should be on the following principal areas:

1. The Reserve Bank of India and Securities and Exchange Board of India should play an important role in decreasing the cost of green bond issuance in order to attract the developers of the project.

2. The Indian government should formulate policies and principles for certification of climate change projects.

3. The policy framework should provide incentives to the bond issuer for labelling their projects as green bonds.

4. The green bonds issued by the government and semi-government institutions will attract more international investors to invest in India’ green bond market.

India offers great scope for the development of green bonds. Its economy is in a fast mode; its financial sector is adaptive and transformative; its global linkages are spreading fast, and its role in global policymaking is expanding. Though the current level of its greenhouse emissions is far less as compared to the developed markets or even to the big emerging markets like China, its commitment to low-carbon growth and various programs that it unveiled in the recent period show its determination to pursue low-carbon intensity growth. India’s banking system is quite big and the country has vibrant securities markets, which should augur well for faster growth of the green bonds market.

Its well-developed regulatory structure and seamless integration with global regulatory templates and standards can enable a smooth transition to successfully harness the potential of emerging market segments. Though the corporate bond market remained a challenge in India for quite some time, greater thrust and focus are now beginning to create a strong corporate debt market both in terms of the size of issuance and the level of trading activity. Notwithstanding this constraint, the growing integration of India’s financial markets with the outside world put India in a distinct position to play a major role in the growth of the green bonds market.

Conclusion

Going forward, in the pursuit of creating and nurturing new market segments and product innovations, efforts to improve domestic institutional investor base, rating systems relevant for new products, building bench market yield curve, creating more risk-hedging instruments with deeper liquidity pools, generating awareness, education, skills and expertise, developing guidelines for issuance of green bonds in local markets, stepping the scope and pace of listing of green bonds, opening local green bonds market to international investors along with other mainstream bond markets, developing local investors, including institutional and retail investors for green bonds, developing examinations and certifications for professionals involved in green bonds, information media, journals and publications devoted to green bonds markets, research studies and specialized courses on green bond markets, etc. will assume importance and significance in creating a strong and vibrant green bonds market in India.

References

Agarwal, S., & Singh, T. (2018). Unlocking the green bond potential in India.

Ansari, S., Wijen, F., & Gray, B. (2013). Constructing a climate change logic: An institutional perspective on the “tragedy of the commons”. Organization Science, 24(4), 1014-1040.

CBI. (2018a). Green Bond Market Summar.

CBI. (2018b). Bonds and Climate Change. State of the Market 2018.

CBI. (2018c). Green Bond Pricing in the Primary Market H1 (Q1-Q2) 2018. Available online:

CBI. (2020). 2019 Green Bond Market Summary

Charles, G., & Philip, B. (2020). Green Finance: Recent Drifts, Confrontation and Prospect Opportunities for Sustainable Development in India. Mukt Shabd Journal, 9(4), 1854-1865.

Chowdhury, T., Datta, R., & Mohajan, H. (2013). Green finance is essential for economic development and sustainability.

Christophers, B. (2018). Risking value theory in the political economy of finance and nature. Progress in Human Geography, 42(3), 330-349.

Indexed at, Google Scholar, Cross ref

Cowan, G. (2017). Investors Warm to" Green Bonds". The Wall Street Journal, April 9. Available at.

Dipika (2015). Green Banking in India: A Study of Various Strategies Adopted by Banks for Sustainable Development. International Journal of Engineering Research & Technology (IJERT).

Dubash, N. K., & Rajan, S. C. (2001). Power politics: process of power sector reform in India. Economic and Political Weekly, 3367-3390.

Filkova, M., Boulle, B., Frandon-Martinez, C., Giorgi, A., Giuliani, D., Meng, A., & Rado, G. (2018). Bonds and climate change: the state of the market 2018.

Forbes. 2017. Should you invest in ‘green bonds?’ Forbes, June 29.

Goel, P. (2016, March). Green Finance: A Step Towards Sustainable Financial System. Abhinav International Monthly Refereed Journal of Research in Management & Technology. 5(3), 22-31.

Gupta R. Alok. “NCEF – A Fund To Boost Sustainable Growth in India”, Envecologic, July 27, 2012.

Harikumar, P., & Susha, D. (2017, December). Green Bonds: A Sustainable Investment Opportunities. International Journal of Scientific Research. 6(12), 325-328.

International Monetary Fund. (2018). World economic outlook: Challenges to steady growth.

Jain, S. (2020). Financing India’s green transition. ORF Issue Brief, (338).

Jha, B., & Bakhshi, P. (2019). Green finance: Fostering sustainable development in India. Int. J. Recent Technol. Eng, 8, 3798-3801.

Joshi, J., Liberatore, S., & Flensborg, C. (2013). Social investing and structured products: Trends, challenges, and opportunities. The Journal of Structured Finance, 18(4), 222-226.

Indexed at, Google Scholar, Cross ref

Keerthi, B.S. (2013). A Study on Emerging Green Finance in India: Its Challeges and Oppurtunities. International Journal of Management and Social Sciences Research (IJMSSR), 2(2), 49-53.

Kumar, N., Vaze, P., & Kidney, S. (2019). Moving from growth to development: Financing green investment in India. ORF Special Report, (85).

Ministry of Corporate Affairs (MCA). (2011). National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business.

Ministry of Finance (MoF). Government of India. 2018. Economic Survey 2017-18, Sustainable Development, Energy and Climate Change, Chapter 5,

Ministry of Statistics and Programme Implementation (MoSPI) (Government of India).

Network, G.I.I. (2018). Impact investing (Global Impact Investing Network: New York, NY).

Otek Ntsama, U. Y., Yan, C., Nasiri, A., & Mbouombouo Mboungam, A. H. (2021). Green bonds issuance: insights in low-and middle-income countries. International Journal of Corporate Social Responsibility, 6(1), 1-9.

RBI (2019), “Opportunities and Challenges of Green Finance”, Report on Trend and Progress of Banking in India (2018-19), 17-18.

Reddy, A.S. (2018). Green finance-financial support for sustainable development. International Journal of Pure and Applied Mathematics, 118(20), 645-652.

Roy, R. (2016). Financial System for Sustainable Development in India. Journal of Responsible Finance, 1-15.

Sarangi, G. K. (2018). Green energy finance in India: Challenges and solutions (No. 863). ADBI Working Paper.

Shen, C., Zhao, K., & Ge, J. (2020). An overview of the green building performance database. Journal of Engineering, 2020.

Indexed at, Google Scholar, Cross ref

Singh C. 2019. Action on Climate Today. “Assessing India’s mounting climate losses to Financial Institutions”.

Sushma B S (2021). “Green Finance”-An Effective Tool To Sustainability, International Journal of Creative Research Thoughts (IJCRT), ISSN 2320-2882, Vol.9, Issue 1.

Volz, U. (2018). Fostering green finance for sustainable development in Asia. In Routledge handbook of banking and finance in Asia (pp. 488-504). Routledge.

World Bank. 2019. 10 Years of Green Bonds: Creating the Blueprint for Sustainability Across Capital Markets. Washington, DC:WorldBank

Received: 06-Jun-2022, Manuscript No. AMSJ-22-12134; Editor assigned: 08-Jun-2022, PreQC No. AMSJ-22-12134(PQ); Reviewed: 22-Jun-2022, QC No. AMSJ-22-12134; Revised: 28-Jun-2022, Manuscript No. AMSJ-22-12134(R); Published: 04-Jul-2022