Research Article: 2021 Vol: 22 Issue: 6

Cross Study on Tax Gap and Infrastructure: Lessons from Nigeria

Shonal Rath, University of Delhi

Citation Information: Rath, S. (2021). Cross study on tax gap and infrastructure: lessons from Nigeria. Journal of Economics and Economic Education Research, 22(6), 1-13.

Abstract

Every country wishes to have state-of-the-art infrastructure that will ensure that its inhabitants live a meaningful and pleasant existence; such amenities include power, education, enough protection of lives and property, a good transportation system, and access to a good health-care system. A country's degree of infrastructure development will decide whether it is classified as developed or developing. Taxation has been identified as the most secure method of funding infrastructure development. Because of the tax deficit, the government has been unable to raise the necessary funds to fund capital projects. This study was required by a lack of data on the estimated Companies Income Tax Gap (CITG) and Customs and Excise Duty Tax Gap (CEDTG). Ex post facto research was used in this study. The study's population was companies that paid income tax, customs duty, and excise duty in Nigeria over a 38-year period (1981–2018).

Keywords

Taxation, Companies Income Tax (CITG), Customs and Excise Duty Tax Gap (CEDTG), ARDL

Introduction

A country's degree of infrastructure development will decide whether it is classified as developed or developing. Inability to produce sufficient finances can have an impact on the amount of infrastructure services offered by a state's government (Adeosun, 2017). As a result, despite a lack of appropriate funding, governments continue to attempt to provide basic infrastructure. According to Adegbie and Daniel Adebayo (2017); Akintoye et al. (2015); Raczkowski, (2015), any country's infrastructure development is based on tax income, and a deficit in infrastructure can result in a country being constantly referred to as "developing." Governments today, according to Chauvet and Ferry (2016), will have to constantly generate funds to furnish and update current infrastructure if they wish to stay relevant in the future. For decades, many African developing countries have battled with infrastructure issues.

Metcalfe and Valeri (2019) calculated Africa's infrastructure gap, which they described as the difference between the expenditure required to develop and deliver infrastructure and the resources available to do so. By 2040, the deficit is expected to reach US$ 1.59 trillion. The lack of vision, political stability, and funding to not just develop new projects are the difficulties that most African countries confront. Metcalfe and Valeri (2019) stated that the government will have to raise borrowing or revenue to close this deficit. They argue, however, that expanding the tax base will bring much-needed income.

Nigeria is currently suffering from a severe infrastructural deficit, ranking 132 out of 138 countries with the least infrastructure (WEF), and if current trends continue, Nigeria will be ranked 136 out of 138 by 2040, as the country with the least access to basic amenities and ease of doing business. Nigeria has struggled to establish rules and legislation to enhance the country's infrastructure landscape throughout the years. The First Native Development Plan, which ran from 1962 to 1968 and aimed to discourage importation while also exploring national economic potential on a cost-benefit basis, is one of them. This era saw the construction of the Kanji Dam and the Ughelli Thermal Plants. The Second National Development Plan, which ran from 1970 to 1974, was aimed at industrialising the economy with oil's newfound profits. However, due to a lack of technology and political will, as well as a military coup, agriculture, transportation, mining, and quarrying suffered, and the country did not progress much during this period (Chete et al., 2014). The Third National Development Plan ran from 1975 to 1980. This plan was announced during the height of the oil boom, with a budget of 42 billion Naira for industrial development and the public sector, propelling Nigeria into the industrial age. The first worldwide economic crisis occurred during the Fourth National Development Plan (1981-1985). Nigeria's foreign exchange profits plummeted as the country's economy became increasingly reliant on revenue from oil and oil-related industries. This resulted in significant unemployment and a trade imbalance. Those industries that rely on imported raw materials have been severely harmed. Oil revenues continued to decrease, and the government faced significant economic difficulties (Adeoti, 2010); Adger (2003). The goal of the 1986 Structural Adjustment Programme (SAP) was to reduce the country's overdependence on oil income while also stimulating indigenous businesses and private investment. A National Science and Technology Policy were also created in 1986 to stimulate the growth of science and technology in Nigeria in 1989.

To boost local production and develop indigenous businesses, a Trade and Financial Liberation strategy was created. In the same year, the National Economic Reconstruction Fund (NERFUND) was formed to assist local industry in attracting international investment. Time this succeeded for a while, it eventually resulted in an influx of foreign commodities into the economy that were cheaper than the local ones which further killed the local industries.

The economic harm had already been felt by the end of the 1990s, prompting a revision of the Science and Technology strategy to encourage local industries and participation. The Nigeria Vision 20:2020 and the National Economic Empowerment Development Strategy (NEEDS) were both established in 2007 to focus on improving the country's ageing infrastructure.

The current Economy Recovery and Growth Plan (ERGP) are also designed to improve the country's terrible infrastructure while simultaneously promoting economic growth and development (World Bank, 2012). The purpose of taxes is to give cash to the government for fundamental services and infrastructure, as well as to address economic disparities across social classes Bebbington (1999).

Similarly, there is a gap between the degree of infrastructure that the government is supposed to provide and the infrastructure that is actually delivered. The difference between the potential money that might be collected lawfully and the actual revenue collected is known as the tax gap (Khwaja & Iyer, 2014). Taxes are one of the most secure means of funding infrastructure deficits or gaps in the global economy (Gasper & Wise, 2016); Berkhout and Leach (2003).

Adequate tax revenue allows the government to fund and implement domestic economic and infrastructure development plans without having to borrow (Brownlee et al., 2013). As a result, it is critical for developed, emerging, and underdeveloped countries to ensure proper and adequate collection as well as measurement. The low amount of taxes collected and the projected level of infrastructure in a nation were shown to be linked (Raczkowski & Bogdan, 2018; Danquah & Osei Assibey, 2016). According to Usman (2018), the Personal Income Tax Gap in Kaduna is 13.85 percent, accounting for 9.68 percent of the possible tax revenue. The research, however, did not give an estimate of the tax gap in Nigeria for corporate income tax and indirect taxes. According to Warren (2018); Anderson (2003). the importance of tax gap measurement cannot be overstated because administrators can only eliminate existing gaps if they understand what defines a gap and how it is a gap. The study used the MIMC theoretical framework, which was used to quantify the tax gap in Nigeria between corporate income tax and customs and excise duty. It is also critical that Nigeria as a country calculates its tax deficit in order to identify areas where cash may be generated rather than borrowing from foreign creditors.

Several nations, both developed and developing, have detailed data on the tax gap and its impact on infrastructure development. In Nigeria, however, this information is insufficient. Nigeria's massive infrastructure deficit cannot be overlooked, and numerous studies have found that the tax gap has contributed to the deficit. This research has become necessary as a result of this. Using the MIMC model, this study will attempt to quantify the Nigerian tax gap pertaining to corporate income tax and customs and excise tax, as well as the impact on infrastructure development.

Literature Review

The Literature is divided into four sections:

Infrastructural Development

Infrastructure refers to the physical systems that support a nation's structure and guarantee that it can satisfy its demands for growth and development. They're generally simple and assumed to be present. Transportation, communication, clean water supply, efficient waste management, and enough electricity supply are among them. Infrastructure requires a significant financial investment, as well as starting costs and ongoing upkeep, which can be pricey Babatunde, 2018; Ashley and Carney (1999). Infrastructure supply is mostly the responsibility of the government. Traditionally, tax income has been used to support this. Infrastructural development is directly connected to the expansion of economic activities that span a large geographical area, such as a metro system.

Because of the enormity of these demands, public funding, oversight, and regulation are typically necessary to satisfy them. As a result, economic activity will increase, and natural monopolies will emerge. Infrastructure is classified as soft, hard, or critical. The institutions that make up the system, such as regulatory bodies and government systems, are referred to as soft infrastructure. The bedrock of hard infrastructure is soft infrastructure.

Government. Soft infrastructure includes administrative tasks as well as national research and development efforts. The actual, tangible structure or systems are referred to as hard infrastructure. They are the physical structures that support the economy, such as highways, hospitals, and telecommunications systems (Asaolu et al., 2018).

Government Capital Expenditure on Economic Services (LGCEES)

Government Capital Expenditure on Economic Services is described by Babatunde (2018) as spending on education, transportation, communication, health infrastructure, agriculture, and any agricultural-related infrastructure. Economic services are capital expenditures made by the government in order to support economic activity inside the country and provide growth possibilities. Economic services have the impact of boosting money in the economy while also creating job opportunities (Adegbie & Daniel-Adebayo, 2017).

A thorough examination of the many definitions noted above reveals that economic services refer to government expenditure on tangible and physical assets. These are assets that all residents, regardless of geography, may see, feel, and utilise. While Adegibe and Daniel Adebayo (2017) defined what economic services are, in clarifying the definition of the term, Babatunde (2018) used many instances of expenditure on economic activities.

Tax Gap

The difference between the actual or projected tax due in a given tax year and the amount of voluntary tax paid is known as the tax gap. The tax that tax payers want to pay may differ from the amount that is statutorily calculated or estimated. The difference is used to close the tax deficit. However, in recent years, industrialised countries have used the MIMC macro methodology to calculate the tax gap uses macroeconomic indicators to calculate the tax gap and gives additional precision to the results (Schneider et al., 2015).

Countries in the Far East, such as Nepal, India, Bangladesh, Pakistan, and Sri Lanka, have invested in calculating their tax deficit, as have other advanced countries. This will allow them to compare their situation to that of their more sophisticated peers and take remedial action to increase government income generated through tax ways. Estimating the tax gap is a global issue that is quickly gaining traction in governments across the world. Kenya, Zambia, and Zimbabwe are among the African countries that have sought to calculate their tax gap by concentrating on tax avoidance and evasion Despite the fact that they employ less sophisticated tactics than their developed counterparts, the ultimate result or goal remains the same: decreasing revenue loss during collection in order to provide social amenities for their people and nation. South Africa conducted a study of tax payers in 2018 to discover the causes behind poor tax collection.

Finally, the tax gap was identified as a result of complicated tax rules and inadequate tax payer education and enlightenment (Bouet & Roy, 2014). In Zambia, the constitution places a higher emphasis on auditors and accountants reporting instances of tax evasion As the tax gap widens, it is becoming increasingly obvious that professionals prioritise their own interests over the country's (Nalishebo & Aliwampa, 2014). Nigeria, like its African counterparts, fails to correctly assess its tax deficit, owing to a lack of data and a lack of willingness to establish real tax losses.

Nigeria has one of the lowest tax collections in the world, with a stated GDP to tax ratio of 6%. A large underground sector, high levels of tax evasion and avoidance, as well as widespread corruption, have resulted in a large revenue gap and decades of infrastructural development shortfalls in the country (Ariyo & Bekoe, 2014).

Companies Income Tax (CIT)

CIT refers to taxes paid by registered businesses, and it is generally calculated on the basis of a flat rate on profits. CIT is a tax levied on the profits and other operations of businesses that are registered Collier & Venables, 2016; Adegbite, 2015; Appadurai, 1996. CIT proceeds contribute considerably to government income, assisting in the achievement of macroeconomic goals such as fiscal consolidation (Gale & Samwick, 2014; Adegbie & Fakile, 2011). However, according to Usman (2018), CIT and other taxes in Nigeria are not at their ideal levels since many businesses underreport income and take use of tax loopholes to pay the bare minimum of taxes. These activities contribute to Nigeria's poor GDP-to-tax revenue ratio. Customs and Excise Duty: Customs and Excise Duty are taxes that are collected on products that are imported and exported.

This type of tax can be used to promote or discourage a certain type of activity inside a country (Asaolu et al., 2018). They are imposed by a country's customs officials to collect money for the government while also protecting domestic and indigenous businesses against more modern and sophisticated international competitors. Customs duty is calculated according to the value of the products in terms of weight, percentage, and other factors outlined in the constitution. Customs duties, often known as import charges, are the earliest type of contemporary taxation. Export duties are however charged on goods leaving the country for foreign lands.

In order to support local industries, it is common practise to have export tariffs that are lower than import levies. Custom duties are generally in the form of percentages of the import value or a set part of a given amount or weight, according to Ibadin and Oladipupo (2015) and Fasoranti (2013). On the other hand, excise duty is imposed on products produced within a country but intended for export. The excise charge is therefore used by the government to encourage the export of locally manufactured goods or to improve a country's fiscal economy. Because of the tax revenue head's goal, it is predicted that excise duties would be lower than custom duties (Babatunde, 2018).

Theoretical Consideration Multiple Indicators Multiple Causes Theory

This study is based on Frey and Weck Hanneman's Multiple Indicators Multiple Causes Theory, which was proposed in 1984. The observed and indicator variables are used in this theory of calculating the tax gap. The observed variable aids in identifying the causes of the shadow economy, such as government expenditure levels (taxation), Infrastructure, GDP per capita, government consumption, cost of security supplied, unemployment rate, and corruption index are all factors to consider. However, the indicator (latent) variable indicates the shadow economy, which contributes to the tax gap. To estimate, parameters such as the amount of cash circulating in the economy, the rate of growth per GDP, and the number of jobs outside the official system are measured. The variable that is hidden (Nchor & Adamec, 2015). The main premise of this theory is that the indicator and the observed variables have a latent connection. The observed variables are computed using Structural Equation Modelling.

Empirical View of Method

Using secondary data from the Central Bank of Nigeria, Asaolu et al. 2018) investigated the link between tax revenue and economic development in Nigeria from 1994 to 2015. Taxation is the cornerstone of every contemporary society, according to the research, and proper utilisation of tax income may help the economy expand, but underestimating the tax deficit can lead to tax evasion and avoidance.

According to the findings, CIT has a negative association with economic growth, but Customs and Excise Duty has a favourable relationship. CIT has a detrimental impact on the Nigerian economy in terms of growth and income, according to Adegbie and Daniel-Adebayo (2017). The analysis emphasised the need of keeping CIT and perhaps lowering it in order to

mimic future economic activity that will close the gap. Adegbie and Fakile (2011) investigated the relationship between corporate income tax and economic growth in Nigeria and found that there is a strong link between corporate income tax and economic development in Nigeria. Yousuf and Jakaria (2013) offered empirical evidence that CIT had a strong relationship with revenue creation and development, and that tax revenue from Companies I and II had a significant relationship with revenue generation and development.

It had a strong correlation with CED revenue in Bangladesh between 1980 and 2011. According to the findings, an increase in CIT may be used as a predictor of projected income from other taxes. In Nigeria, Asaolu et al. (2018) looked at the current link between tax revenue heads and economic development. The investigation included the years 1994 to 2015, using secondary data sourced from the Central Bank. Customs and Excise Duty had a positive significant association with economic development, but Companies Income Tax had a negative significant relationship. Using the same characteristics, Ibadin and Oladipipo (2016) concurred that Customs and Excise Duty had a favourable and substantial impact on Nigerian economic development from 1981 to 2014Inyiama and Ubesie (2016); Joseph et al. (2016) studied customs duties and their contribution to tax income in the Nigerian economy, as well as other indirect taxes. For the period 1994 to 2014, the results experimentally indicated that Customs and Excise Duty and Value Added Tax had a substantial influence on the total tax collected in Nigeria.

According to Akintoye et al., Nigeria's economic progress has been hampered by a lack of enough power. Overall, the study found that declines in capital spending on economic activities had the most detrimental impact on development, and that massive increase in capital expenditure on economic services was required. The findings of Darma (2014); Fasoranti (2016) corroborate Akintoye et al. stance (2015). In his study on the influence of capital spending on economic growth in Nigeria from 1980 to 2010, Darma (2014) found that capital investment on administration, social and community services and transfers boosted Nigeria's economic growth.

This indicates that increasing any of the aforementioned factors will boost economic growth. Poor usage and abuse of cash, according to the report, led to the country's infrastructure deterioration. According to the research, the government should guarantee that corrupt leaders are dealt with in order to deter corruption. In Nigeria, this is a big problem.

Maintaining a stable currency rate has been a key issue for governments, and exchange rate management measures can contribute to foreign exchange accumulation. According to a research by Anyanw et al. (2017), the exchange rate has a substantial impact on the actual economy. According to Nse and Anietie (2018).

In 2016 and 2017, inflation reached as high as 9.2 percent and 18.3 percent, respectively. As a result of such a high amount, residents' standard of life will deteriorate as their buying power declines. Economic development and activity will be discouraged, and price stability would be impossible to achieve.

Methodology

For this study, an ex-post facto research design was used. Usman (2018); Danquah and Assibey (2016); Raczkowski (2016) are examples of previous research (2015). This research looked at the impact of corporate income tax and customs and excise duty on infrastructure development in Nigeria during a 38-year period, from 1981 to 2018. For all variables, Nigeria is the target population. Because the Federal Government administers the income tax and customs and excise duty revenue heads, data was readily evaluated and confirmed. Economic services were used as a proxy for infrastructure development, and they were the dependent variables, whereas Companies Income Tax and Customs and Excise Duty were the independent variables. The underground economy was utilised to calculate the tax gap, and the variables used for the underground economy were actual balances of the money supply, interest rates, and value added tax. The data from the Federal Inland Revenue Service (FIRS) and the Statistical Bulletin of the Central Bank of Nigeria (CBN) was evaluated and approved as genuine and trustworthy by the office of the Auditor-General of Nigeria.

The time series nature of the data utilised in this study helps fulfil the stated aims. As a result, the research was put to three different types of tests. First, descriptive statistics were used to determine the data's descriptive properties. To understand the behaviour, statistics such as the mean, maximum, and lowest values, standard deviation, and the Jarque-Bera test were computed.

Unit root tests were also used to look at the time series characteristics of the variables in the research. The Augmented Dickey-Fuller (ADF) and Phillip-Peron (PP) will be utilised to accomplish this. Second, Pesaran and Pesaran (2001) utilised the Auto Regressive Distributed Lag (ARDL) technique to investigate the long-run and short-run co-integrating dynamics of the tax gap on infrastructure.

The diagnostic tests, on the other hand, were designed to see if the estimated models were genuine. To this end, five diagnostic tests were performed:

1. Serial Correlation LM Test to determine if the successive error terms are correlated;

2. Breusch-Pagan/Harvey test for homoscedasticity residuals

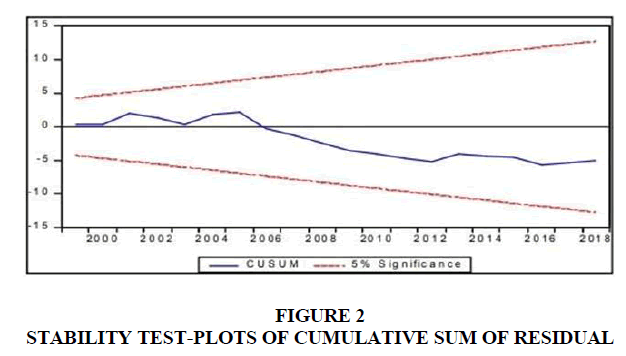

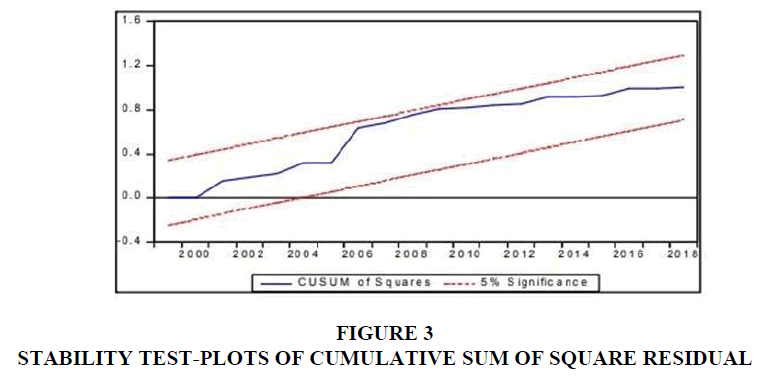

3. The model's stability was further tested using the cumulative sum of residuals (CUSUM) and the cumulative of squared residuals. To make the estimating process easier, E-View version 10 was utilised.

Model Specification Tax Gap Computation

As a result, this study follows Frey and Hanneman's Multiple Indicators and Multiple Causes (MIMC) methodology (1984). The subterranean economy's regression equation is as follows (Table 1):

| Table 1 Descriptive Statistics | |||||||||

| Variables | Mean | Median | Max | Std. Dev | Skewness | Kurtosis | Jarque-Bera | Prob | Obs |

| LINFDEV | 2.16 | 2.46 | 3.23 | 0.86 | -0.6 | 1.85 | 4.15 | 0.13 | 38 |

| LGCEA | 1.41 | 1.69 | 2.65 | 1.03 | -0.57 | 1.97 | 3.54 | 0.17 | 38 |

| LCITG | 0.44 | 0.3 | 29.86 | 1 | -0.81 | 4.59 | 3.7 | 0.15 | 38 |

| LCEDTG | 0.19 | 2.08 | 11.97 | 7.78 | -0.69 | 2.99 | 2.89 | 0.24 | 38 |

Data Analysis, Results, and Findings Discussion

Descriptive Statistics are used to describe something. The Natural Logarithm of Government Capital Expenditure on Economic Services is used as a proxy for the dependent variable infrastructure development in this section (LGCEES). The tax gap on companies' income tax (LCITG) and customs and excise is the independent variable.

Annual data for thirty-eight years were used and it is from 1981-2018 for Nigeria.

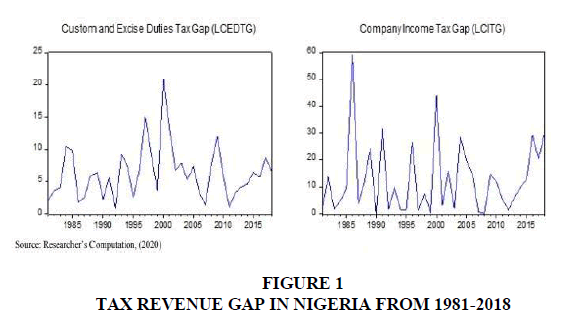

The Natural Logarithm of Infrastructural Development (LINFDEV), or Government Capital Expenditure on Economic Services, is the dependent variable (LGCEES). The logarithms of the Companies Income Tax Gap (LCITG) and the Custom and Excise Duties Gap are the independent variables shown in Figure 1. The estimation process was facilitated using Eviews:

Interpretation

The mean value of infrastructural development, Government Capital Expenditure on Economic Services, Companies Income Tax gap and Custom and Excise Duties:

TAX GAP: 2.16

MEDIAN: 2.46, 1.72, 2.23, 0.44, 0.30, 0.19, 2.08

The Jarque-Bera test reveals that the variables are normally distributed with chi-square statistics of 4.15, 4.75, 3.70, and 2.89, respectively, indicating that infrastructural development follows normal distribution.

Table 2 shows the tax revenue gap estimated using Frey and Hanneman's (1984) Multiple Indicators and Multiple Causes (MIMC) methodology for Companies' Income Tax (LCITG), Custom and Excise Duties (LCEDTG), Value Added Tax (LVATG), and Stamp Duties (LSDTG). From 1981 to 2018, it depicts the CIT and CED tax gap for 38 years.

| Table 2 Tax Gap in Nigeria from 1981-2018 (in Billions) | ||

| Year | LCITG | LCEDTG |

| 1981 | 1.88 | 2.14 |

| 1982 | 13.79 | 3.61 |

| 1983 | 1.79 | 4.01 |

| 1984 | 4.86 | 10.43 |

| 1985 | 9.49 | 9.79 |

| 1986 | 59.23 | 1.84 |

| 1987 | 3.75 | 2.55 |

| 1988 | 11.52 | 5.74 |

| 1989 | 24.1 | 6.46 |

| 1990 | 0.16 | 2.33 |

| 1991 | 31.57 | 5.63 |

| 1992 | 1.9 | 0.9 |

| 1993 | 9.79 | 9.22 |

| 1994 | 1.46 | 7.36 |

| 1995 | 1.33 | 2.62 |

| 1996 | 26.51 | 6.76 |

| 1997 | 1.46 | 15.04 |

| 1998 | 7.46 | 9.1 |

| 1999 | 0.38 | 3.56 |

| 2000 | 44.28 | 20.98 |

| 2001 | 3.17 | 13.35 |

| 2002 | 15.96 | 6.78 |

| 2003 | 2.01 | 7.79 |

| 2004 | 28.59 | 5.22 |

| 2005 | 19.86 | 7.33 |

| 2006 | 14.7 | 3.29 |

| 2007 | 0.81 | 1.39 |

| 2008 | 0.21 | 7.6 |

| 2009 | 14.73 | 11.97 |

| 2010 | 11.94 | 5.67 |

| 2011 | 5.4 | 1.06 |

| 2012 | 1.51 | 3.34 |

| 2013 | 6.2 | 4.19 |

| 2014 | 9.81 | 4.61 |

| 2015 | 12.62 | 6.49 |

| 2016 | 29.18 | 5.63 |

| 2017 | 20.32 | 8.66 |

| 2018 | 29.86 | 6.67 |

The long-run estimates, short-run estimates, and diagnostic tests for the connection between the tax gap and Government Capital Expenditure on Economic Services are presented in this paper. The logarithm of Government Capital Expenditure on Economic Services (LGCEES) is the dependent variable, while the tax gap on Companies Income Tax (LCITG) and Custom and Excise Duties are the independent variables (LCEDTG) shown in Table 3.

| Table 3 Full Information on the effects of Tax Gap on Government Capital Expenditure on Economic Services | ||||

| Panel A: Long Run Estimates | ||||

| Dependent variable: LGCEES | ||||

| Variable | Coefficient | S.E | t-start | Prob |

| LCITG | 0.1893 | 0.0744 | 2.5464 | 0.0476 |

| LCEDTG | 0.3389 | 0.0987 | 3.4342 | 0.0009 |

| C | 2.7209 | 0.4497 | 6.0508 | 0 |

| Panel B: Short-Run Estimates | ||||

| Variable | Coefficient | S.E | t-start | Prob |

| D(LGCEES(-1)) | -0.1327 | 0.1998 | -0.6643 | 0.5141 |

| D(LCITG) | 0.0044 | 0.0026 | 1.7059 | 0.1035 |

| D(LCITG(-1)) | 0.0055 | 0.0032 | 1.6811 | 0.1083 |

| D(LCITG(-2)) | -0.0054 | 0.0028 | -1.9127 | 0.0702 |

| D(LCITG(-3)) | 0.0027 | 0.0022 | 1.2232 | 0.2355 |

| D(LCEDTG) | 0.0097 | 0.0077 | 1.2654 | 0.2203 |

| D(LCEDTG(-1)) | 0.0068 | 0.0075 | 0.9032 | 0.3772 |

| D(LCEDTG(-2)) | -0.003 | 0.008 | -0.3714 | 0.7143 |

| D(LCEDTG(-3)) | 0.0012 | 0.0086 | 0.1387 | 0.8911 |

| ECM(-1) | -0.1357 | 0.0402 | -3.3789 | 0.003 |

| Panel C: Diagnosis Tests | Statistic | Prob. | ||

| Bound Test | 6.482 | 0 | ||

| Serial Correlation | 0.017 | 0.983 | ||

| Heteroscedasticity | 0.795 | 0.651 | ||

| Normality Test | 0.217 | 0.897 | ||

| Linearity Test | 0.832 | 0.165 | ||

| Adjusted R-Square | 0.687 | |||

| CUSUM | CUSUMSQ | |||

| Stability Test | Stable | Stable | ||

| F-Statistics | 38.411 | 0 | ||

The bound test has critical values of 4.26, 3.50, and 3.13 for 1%, 5%, and 10%, respectively.

There is evidence that the error terms' covariance has a limited variance that is constant. The probability value of F-statistic of 0.017 in the Breusch-Godfrey Serial Correlation LM Test is in favour of the null hypothesis that there is no serial correlation in the residuals up to the given lag order at the 5% significant level.

As a result, the study found that the consecutive error components in the estimated model for the tax gap and Government Capital Expenditure on Economic Services in Nigeria were unrelated. The CUSUM and CUSUMSQ tests also demonstrate that the estimated model is stable, as seen by the plot of the CUSUM and CUSUMSQ statistics, which is depicted by two straight lines and stays within a 5% significant threshold shown in Figures 2 & 3.

Discussion and Findings

For the period 1981 to 2018, the study looked into the potential of a substantial link between the tax gap and infrastructural development in Nigeria. The findings demonstrate that there is a positive and substantial link between companies' income tax gap and government capital spending on economic services, as well as that companies' income tax gap and government capital expenditure on economic services are related. The tax gap is a major determinant of changes in government capital spending. Similarly, there is evidence that the tax gap between Customs and Excise Duties and infrastructural development in Nigeria has a positive significant connection Baumann, (2000).

Their findings demonstrate that CIT had a substantial impact on the economy using ordinary least square regression. Adegite (2015); Arce (2003). Investigated the impact of CIT on the Nigerian economy from 1993 to 2013. The conclusion, based on secondary data, revealed that CIT had a beneficial impact on the Nigerian economy in terms of growth and income Ibadin and Oladipipo (2016); Baulch (1996); Berkes et al. (1998), used the Error Correction Model to assess the influence of Custom and Excise Duty on economic growth in Nigeria. They discovered that between 1981 and 2014, Custom and Excise Duty had a positive and substantial impact on Nigerian economic development. In their study, Nse and Anietie (2018); Almaric (1998); Batterbury (2001). found that inflation has a detrimental impact on economic growth and commercial activity in Nigeria, and the findings of this study support that conclusion. According to Anyanwu et al. (2017); Allison and Ellis (2001). the exchange rate has an impact on the actual economy, which is consistent with the findings of this study.

Conclusion and Recommendations

The major goal of this research was to look at the impact of Nigeria's tax deficit on infrastructure development. The findings of the research conducted to achieve the goal indicated that the tax gap in Nigeria had a strong positive association with capital spending on economic services. Prior empirical research has also found a link between tax revenue and economic growth and development. There is additional evidence in the literature that tax money has no major impact on economic growth and development.

As a result, this research found support in previous studies that established a link between tax income and economic growth and development. As a result, the study's conclusion is that the tax gap has an impact on Nigeria's infrastructure development.

This can be accomplished by enacting policies that expand the tax net by encouraging newly enumerated tax payers to pay voluntarily in the first few years before applying a strict tax computation rule in subsequent years. Punitive measures to deter corruption in the tax administration and collection process must also be implemented.

References

- Adegbie, F.F., & Fakile, A.S. (2011). Companies Income Tax and Nigeria economic development. European Journal of Social Sciences, 22(2), 309-319.

- Adegbite, A. (2015). The Analysis of the Effect of corporate income tax (cit) on revenue profile in nigeria.

- Adger, W.N. (2003). Adaptation to climate change in developing countries. Progressin Development Studies, 3(3): 179-95.

- Allison, E., & Ellis, F. (2001). The livelihoods approach and management of small-scale fisheries. Marine Policy, 25(2), 377-88.

- Almaric, F. (1998). The sustainable livelihoods approach. General report of thesustainable livelihoods project, 1995- 1997, Rome: SID.

- Anderson, S. (2003). Animal genetic resources and sustainable livelihoods. EcologicalEconomics, 45(3), 331-9. Appadurai, A. (1996). Modernity at large: cultural dimensions of globalisation, Minneapolis, MN: University of

- Minnesota Press.

- Arce, A. (2003). Value contestations in development interventions: community development and sustainable livelihoods approaches. Community DevelopmentJournal, 38(3), 199-212.

- Ashley., & Carney, D. (1999). Sustainable livelihoods: lessons from earlyexperience, London: DFID.

- Batterbury, S. (2001). Landscapes of diversity: a local political ecology of livelihood diversification in South- Western Niger. Ecumene, 8(4), 437-64.

- Baulch, R. (1996). Neglected trade-offs in poverty measurement. IDS Bulletin, 27(1), 36-43.

- Baumann, P. (2000). Sustainable livelihoods and political capital: arguments and evidence from decentralisation and natural resource management in India. In ODIworking paper, 136.

- Bebbington, A.S., & Batterbury (2001). Transnational livelihoods and landscapes: political ecologies of globalization. Ecumene, 8(4), 369-464.

- Bebbington, A. (1999). Capitals and capabilities: a framework for analysing peasantviability, rural livelihoods and poverty. World Development, 27(12), 2012-44

- Berkes, F., Folke, C., & Colding, J. (1998). Social and ecological systems: management practices and social mechanisms for building resilience, Cambridge:Cambridge University Press.

- Berkhout, F.M., & Leach I.S. (2003). Negotiating environmental change: new perspectives from social science. Cheltenham Edward Elgar.