Review Article: 2023 Vol: 27 Issue: 5

Customer Centricity: A Strategic Necessity or Challenge for the Banks?

Srijanani Devarakonda, Vignana Jyothi Institute of Management

Viswanadham N, Unitech, Taraka campus, Papua new gunia, Lae

Vijaya T, Osmania University

Citation Information: Devarakonda, S., Viswanadham, N., & Vijaya, T. (2023). Customer centricity: a strategic necessity or challenge for the banks?. Academy of Marketing Studies Journal, 27(5), 1-8.

Abstract

Customer needs change rapidly. To meet these requirements, banks must make the customer experience the starting point for process design. The present study aims to examine the importance and customer centricity in banks and to investigate the concept of customer-centric strategy and the components that make it up. Banks are always emphasising the importance of replacing the current strategy with one that ensures that the products and services delivered are oriented toward the demands of the consumer. However, the current situation in the sphere of financial services shows the opposite tendencies: banks continue to prioritise products over consumer needs.

Keywords

Customer Centricity; Banks; Strategy; Customer Needs; Customer Experience.

Introduction

Customer needs change rapidly. To meet these requirements, banks must make the customer experience the starting point for process design. The availability of new online services has had an impact on the survival and profitability of organisations (Bapna et al., 2014). Banking is one industry that has had to adjust to meet its clients' expectations by rapidly increasing its online services with new technologies.

With the industry's focus on digital transformation and the proliferation of banking technology, it is more vital than ever for banks to get back to basics. The customer relationship, or customer centricity, is critical for the success of any firm that relies on constant, recurring business. Banking is not immune to the phenomenon.

From client relocation to digital banking ubiquity, the pandemic is giving pressure for dramatic changes in banking. In fact, relationship banking with client centricity as a fundamental capability can propel banking forward. According to McKinsey, a "wait and see" strategy to transformation will not work for banks. Instead, it is a time for bold innovation. Banks that focus on improving customer engagement and empowering their personnel will emerge as leaders."

Relationship banking as a core competency is a strategic foundation that works now and expands into the future.

While most banks cannot currently develop an enterprise-wide strategy for data integration and customer centricity, they can start to set the stage for it. Based on a fundamental principle that is central to customer centricity, this is: If there is one advantage that community banks and credit unions already have over their larger competitors, it is that they have in-depth knowledge of their customers and their communities. The goal is not to "sell more," but rather to "provide more" value to the consumer. The process, i.e., how the service is provided to them and how user interaction with the mobile service works, also adds value for the user through the customer experience (Heinonen, 2004; Dube & Helkkula, 2015). The process, i.e., how the service is provided to them and how user interaction with the mobile service works, also adds value for the user through the customer experience (Heinonen, 2004; Dube & Helkkula, 2015).

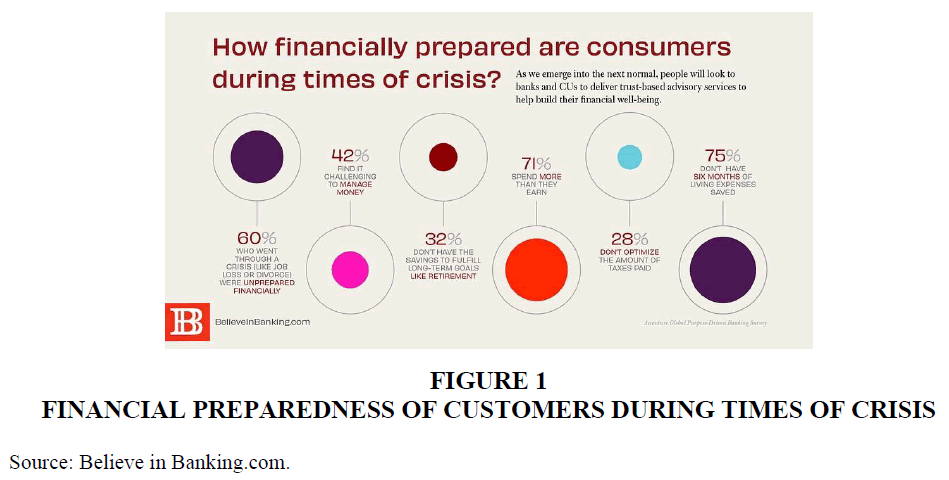

Consumers want to feel important, especially in their primary financial connection, whether through personalization via smart data deployment or individualised attention Figure 1.

Objectives of the study

The present study examines the following research objectives:

1. To examine the customer services challenges and challenges in the wake of nationalisation.

2. To examine the importance of customer centricity and how it is a strategic requirement of banks.

Literature Review

Understanding how customers experience value in new banking services has become increasingly important (Medberg & Heinonen, 2014). Even though new types of financial services are continually being developed, clients are dissatisfied and believe they are not receiving enough value from these services (Lähteenmäki and Nätti, 2013). The customer is frequently viewed as the goal of banks' marketing activities, and banking services are designed without a thorough grasp of the corresponding consumer needs (Lähteenmäki and Nätti, 2013). Caselli (2005) felt that having stressed that banks have focused on the quality of the services provided rather than on customer needs. However, existing value research in the context of m-banking appears to focus only on how the customer perceives value from the service provider's activities and offerings (Medberg & Heinonen, 2014), whereas value in the broader context of the customer's lifeworld and life outside the realms of the service interaction has received only limited attention (Helkkula et al., 2012). The term "customer experience" refers to the consumer's cognitive, affective, emotional, social, and physical responses to the service provider (Verhoef et al., 2009).

Brief Background of last 50 years Banking

Banking landscape has undergone many a change since first nationalisation of Banks on 19th July 1969. Before nationalisation of Banks, 8212 bank branches were functioning all over India. As on 31.3.2021 number of commercial bank branches in India stood at 122976. Out of which, number of rural bank branches stood at 36,383. Before nationalisation of Banks in 1969, Bank branches were located Metropolitan, Urban and Semi Urban areas. Number of Bank branches in rural areas was only few branches. Even their customers were belonging to relatively well to do sections of the society. The main purpose of nationalisation of Banks was to facilitate banking services to larger masses across India.

In order to facilitate faster opening of bank branches in rural and unbanked areas, each district in India was allotted to a particular bank. Such a Bank which is entrusted with looking after the banking needs of that district is called Lead Bank of the district. This Lead Bank is entrusted with the responsibility of formulating plan for expansion of bank branches in the district and also credit expansion in the district. Lead Bank must prepare a credit plan for that district every year in consultation with district administration. The district credit plan is approved in the District Consultative Committee. This District Consultative Committee is headed by District Collector, all banks in the district, officials of district administration, MLAs and MPs of the district are members of the District Consultative Committee. The District Credit Plans are integrated into a state level credit plan. In the State Level Credit Plan These arrangements are continuing today in spite of so many changes in banking system in India during last 50 years.

Initial Challenges in the Wake of Nationalisation of Banks

Nationalisation of Banks changed the character of Banking from Class Banking to Mass Banking. This change forced Banks to evolve new policies to meet the larger flow of customers into bank branches. The carpet area and infrastructure of the Bank branches has been improved. To encourage opening of more and more bank branches in rural areas, RBI permitted opening of one branch in urban and metropolitan areas for 3 branches opened in unbanked rural areas. These policies led to rapid expansion of bank branches in rural areas, which in turn led to more recruitment of clerks and bank officers. This massive recruitment in Banks in 70s and 80s enabled youth to get jobs in Banks by clearing a competitive examination and an interview. Opening of large number of rural branches led to more demand for credit from farmers and other credit needy sections of the society. In response RBI and Government of India mandated that all Banks must lend minimum 40 percent of adjusted net bank credit to priority sectors as determined by RBI.

Customer Service Challenges

With more and more customers approaching banks every day, Banks began to feel the heat of servicing the customers in the limited space and time available to banks. To improve customer service in Banks RBI appointed following committees from time to time.

1. Talwar Committee headed by the then Chairman of SBI Shri RK Talwar in 1975.

2. Goiporia Committee headed by Shri M.N. Goiporia then Chairman of SBI in 1990.

3. Tarapore Committee on Procedures and Performance Audit on Public services headed by Shri S .S. Tarapore former Deputy Governor of RBI.

4. Damodaran Committee on customer service headed by Shri Damodaran former chairman SEB.I

5. On 23rd May 2022 RBI has set up a 6-member committee headed by former Deputy Governor of RBI Shri B. P. Kanungo to evaluate the efficacy and quality of customer service in Banks, Non-Bank Finance Companies and other entities regulated by RBI.

While the committee headed by Shri B.P. Kanungo was a new one, the remaining 4 committees made many useful recommendations which were implemented by banks and RBI. Many efforts were made by Banks, RBI and Government to improve customer experience.

During early 1980s, Nomination facility was introduced to eliminate hassles in settlement of claims of deceased customers. Nomination facility enabled family members to easily receive the proceeds of money outstanding in the credit of a customer of a bank who breathed his last by recording his or her nomination even at the time of opening an account.

During mid 1980s all Banks were mandated to declare 15th of every month (if 15th of a month happens to be a public holiday next working day of the month) is declared as a customer meeting day. Right from a branch manager to general Manager of a Bank were designated as officials to receive the customers at 3 p.m. on 15th of every month and listen to their grievances and suggestions. Apart from this direction, all employees, and officers of banks during their interactions with senior officials and also in trainings are being told to render best customer service.

However, India being heterogeneous, and the employees background being varied apart from their educational background and capacity levels, the response and adherence to customer service standards is varied. In order to solve customers’ problems customer complaint cells were established at all banks Regional Offices, Zonal Offices or Divisional Offices and also at Head offices. In addition, RBI also formulated Ombudsman scheme to resolve customer complaints.

The adoption of information technology brought new set of challenges for Banks. Before the advent of Information Technology, the process of customer service is known to all staff members across all banks at all levels. However, with the introduction of CORE Banking solutions across all major Banks, what computer does is not known to most of the employees. Even where it is known, where the fault lay, in many cases branch managers are not having enough knowledge of computer process to rectify the mistake. Thus, the branch managers are forced to refer the customer complaints to regional offices/ Zonal Offices /Divisional offices / local head offices and finally to Head offices for rectification. With more and more regulation the computer process to correct inadvertent mistakes or design mistakes is taking more time. So, to reduce the time to resolve customer complaints RBI has to set uniform timelines and direct banks to sensitise staff at all levels to resolve customer complaints in general and computer related complaints in particular within specified timelines.

Since opening of first Automated Teller Machine (ATM) in 1988 at Mumbai, large number of ATMS and Cash Deposit Machines (CDMs) were installed across the country. But their functioning leaves much to be desired. RBI directed that customer will be eligible for five free transactions, every month from their own bank ATMs. They are also eligible free transactions (inclusive of financial and non-financial transactions) from other bank ATMS, viz., three transactions in metro centres and five transactions in non-metro centres. Beyond the free transactions the ceiling / cap on customer charges has been increased to Rs.21/- per transaction effective from 1st January 2022. Due to various reasons, some banks are unable to maintain enough cash in their ATMs and forcing customers to use other Bank ATMs especially in rural and semi urban centres. Commercial Banks themselves should check their ATM functioning and ensure continuous functioning of ATMs. RBI should permit closure unviable ATMs by banks so that banks can optimise costs on maintenance of ATMs and minimise complaints on lack of cash in ATMs.

RBI issued circular on KYC and AML guidelines on 21st February 2005. Thereafter many amendments were brought in, and this circular is being updated from time to time. Today many banks are outsourcing KYC verification process to cut costs. Such outsourcing of KYC can result in some frauds and such other risks. KYC of a customer is the basis for opening of an account by the Bank. Opening of an account is a contract under Indian Contract Act 1872. Any laxity on the part of outsourced agency may cost the Bank as well as customer a lot of money. To avoid unnecessary ambiguity with KYC circulars running into several pages, RBI must issue clear a two- or three-pages circular along with a standard format for opening Savings Bank Accounts by all Banks. Such a standard circular would eliminate lot of ambiguity while opening accounts for Bank officials and customers.

Today due to explosion of Information, Communication Technologies (ICT), while sitting in the comfort of home / office / even travelling funds can be transferred and received. These facilities are welcome from customer point of view and are contributing cutting of costs by the Banks. But in the process of creating these user-friendly features, a lot of autonomy for changing passwords and other such features is given to customers which sometimes are enabling clever fraudsters to perpetrate frauds. Banks are warning customers repeatedly not to reveal passwords and other such information. Customers must remember that ETERNAL VIGILANCE IS PRICE OF LIBERTY and keep passwords and question those fraudsters who try to trick them.

Banking regulation act defines Banking as accepting Deposits for lending. This is the core focus area for all Banks. Nowadays, apart from core activity, Bank staff is saddled with duties selling insurance products and mutual fund products to improve profitability. This emphasis on selling and incentivising insurance and third-party products is relegating primary function of servicing the deposit and loan customers to back seat. The Millennials and Generation Z are not focussing on core banking skills. RBI must caution the Banks to focus once again on core banking activities of deposit mobilisation, lending, and customer service.

This facility to purchase a mobile SIM easily can be misused and money from Banks can be looted easily. Some regulation is necessary in this regard. Registration of SIM sellers and proper recording and preservation of SIM sales duly following standard procedures can avoid number of frauds in future Figure 2.

Banking clients all over the world are becoming increasingly uneasy. They are frustrated by contract conditions they do not comprehend, astounded by hidden expenses, and irritated by slow complaint response. McKinsey report estimates that in the banking sector, 75 to 80 percent of transactional operations (e.g., general accounting processes, payments processing) and up to 40 percent of strategic activities can be automated.

In the past decade the strong forces reshaping the banking industry are: i) The interest rates that decreased continuously; ii) More and more regulation – a higher cost for the banks; iii) Innovation and disruption from the fintech industry.

Banks must develop hyper-personalized products and services that comprehend not just what the customer wants and needs today, but also what they may demand in the future. Large technology businesses such as Facebook, Google, Apple, and Amazon have successfully entered the financial services market, changing the game for traditional players. Their business models are based on customization, with a focus on user experience and the customer journey in order to retain existing customers and gain market share from established businesses.

These software companies understand how to use customer data to create the most personalised experience possible, as well as to advise – and even predict – the customer journey, thereby setting the bar for consumer expectations. Banks must follow the suit and strategically examine and understand the requirements of the customers and especially the new tech savvy generation and make the services more tech savvy and more customer centric.

The Changing Needs of Customers

Many banks continue to think in terms of products rather than client journeys. Despite their desire for digital channels, digital customers prefer to resort to traditional banks for the heavy lifting - mortgage applications, financial guidance. All of this is still going on in the branch. Personalization and adaptability are crucial. With the epidemic, we accelerated technology and our thinking by 6-8 months. If you are not digital-first now, you will most likely be extinct in the coming years. The revolution took place rapidly. The sector will be a fascinating area to work.

With the pandemic, we shifted technology and thought forward by 10-15 years in 6-8 months. Prior to Covid-19, we saw a lot of banks and institutions all around the world digitising - digitization, not digital transformation. Banking is changing, and clients will not accept a traditional product. They will not want firms to push their products and services on them; instead, they will want to be pulled. Banks have no choice but to become more customers centric.

Companies in other industries have had great success by focusing on the clients/ customers. By beginning their journey on the customer-centric transformation, banks can, not only improve customer happiness but also achieve sustained growth and improve profitability. Customer-centricity is more than simply asking customers what they want and then delivering on it, while that is an important component. Customer-centricity necessitates banks rethinking what they know about their customers to better understand who they are, what interests them, what they value, and what motivates them.

It is about developing a relationship with consumers that is more meaningful than the transactional one that banks have traditionally had with them - a relationship that looks more like a partnership and is responsive to the customer's demands.

Banks must win and reward customer loyalty with exciting incentives. A travel rewards programme, such as the one mentioned above, that allows consumers to earn credit card miles with every transaction is just one method to express gratitude to your customers. The following are some examples of customer loyalty reward programmes in action: Citibank’s Thank You rewards program, Bank of America’s (BoA) Preferred Rewards and Wells Fargo’s Go Far awards.

Banks, like most businesses, face an urgent need to reinvent themselves and seize new growth opportunities. Acquiring new customers is one of the biggest challenges for most bankers surveyed by PwC. However, banks also recognize the need to deepen customer relationships and focus on customer profitability. Improving the customer experience is therefore a top investment priority for banks around the world. Many banks nowadays build connections with their customers that are merely "transactional," with no deeper understanding of their daily needs. Loyalty programmes can be used to integrate a user-centric feature into the heart of a business.

To be truly customer-centric, you need to know your customers well. Create her 360-degree view of each customer including needs, key life events, product portfolio, sphere of influence, complaints filed and satisfaction. The better we understand our customers, the better we can anticipate and meet their needs. Customer centricity also means making the customer experience as seamless as possible, from onboarding to service and beyond. Giving the team all the customer information, they need to seamlessly serve your customers. Open Banking is an opportunity for banks to put their customers first, offering them more choice, convenience and a personalized experience Addis & Holbrook, (2001).

Customer centricity entails putting the customer at the centre of the organisation and ensuring that all decisions and operations are driven by customer outcomes. Being customer-centric entails delivering very intuitive and clear interaction, solving problems, and efficiency. It is critical to break the centralised model and move choices closer to where the customers live. To prosper and develop, banks must explore ways to be more client-centric, provide increased transparency, deliver customised digital capabilities, and maximise their assets to demonstrate their value throughout the customer experience Zeithaml, (1988).

Conclusion

Vision and Direction- A Future Course of Action

A clear vision is the beginning point for every change toward a customer-centric firm. It gives strategic guidance and shapes the bank's image to third parties. Talent will be key to the success of this type of transition, as well as a new business strategy. A recent McKinsey report says, “A ‘wait and see’ approach to transformation will not work for banks. Instead, it is a moment for radical creativity. Banks that reimagine how they engage their customers and empower their employees will emerge as leaders”. The future belongs to those banks who embrace data (large and little) to understand habits and communicate with clients.

References

Addis, M., & Holbrook, M. B. (2001). On the conceptual link between mass customisation and experiential consumption: an explosion of subjectivity. Journal of Consumer Behaviour: An International Research Review, 1(1), 50-66.

Indexed at, Google Scholar, Cross Ref

Caselli, F. (2005). Accounting for cross-country income differences. Handbook of economic growth, 1, 679-741.

Indexed at, Google Scholar, Cross Ref

Chemingui, H. (2013). Resistance, motivations, trust and intention to use mobile financial services. International Journal of Bank Marketing.

Indexed at, Google Scholar, Cross Ref

Dube, A., & Helkkula, A. (2015). Service experiences beyond the direct use: indirect customer use experiences of smartphone apps. Journal of Service Management, 26(2), 224-248.

Indexed at, Google Scholar, Cross Ref

Heinonen, K. (2004). Reconceptualizing customer perceived value: the value of time and place. Managing Service Quality: an international journal, 14(2/3), 205-215.

Indexed at, Google Scholar, Cross Ref

Helkkula, A., Kelleher, C., & Pihlström, M. (2012). Characterizing value as an experience: implications for service researchers and managers. Journal of service research, 15(1), 59-75.

Komulainen, H., & Saraniemi, S. (2019). Customer centricity in mobile banking: a customer experience perspective. International Journal of Bank Marketing.

Indexed at, Google Scholar, Cross Ref

Lähteenmäki, I., & Nätti, S. (2013). Obstacles to upgrading customer value?in?use in retail banking. International Journal of Bank Marketing, 31(5), 334-347.

Indexed at, Google Scholar, Cross Ref

Medberg, G., & Heinonen, K. (2014). Invisible value formation: a netnography in retail banking. International Journal of Bank Marketing.

Indexed at, Google Scholar, Cross Ref

Verhoef, P. C., Lemon, K. N., Parasuraman, A., Roggeveen, A., Tsiros, M., & Schlesinger, L. A. (2009). Customer experience creation: Determinants, dynamics and management strategies. Journal of retailing, 85(1), 31-41.

Indexed at, Google Scholar, Cross Ref

Zeithaml, V. A. (1988). Consumer perceptions of price, quality, and value: a means-end model and synthesis of evidence. Journal of marketing, 52(3), 2-22.

Indexed at, Google Scholar, Cross Ref

Received: 23-Mar-2023, Manuscript No. AMSJ-23-13371; Editor assigned: 24-Mar-2023, PreQC No. AMSJ-23-13371(PQ); Reviewed: 24-Apr-2023, QC No. AMSJ-23-13371; Revised: 27-May-2023, Manuscript No. AMSJ-23-13371(R); Published:18-Jul-2023