Review Article: 2022 Vol: 26 Issue: 4

Customer Empowerment as Mediator between Customer Relationship Marketing and Satisfaction Level In Banking Sector

Deboshree Chatterjee, Koneru Lakshmaiah Education Foundation

Savanam Chandra Sekhar, Koneru Lakshmaiah Education Foundation

Kishore Babu M, Koneru Lakshmaiah Education Foundation

Citation Information: Chatterjee, D., Chandhra Shekhar, S., & Kishore Babu, M. (2022) Customer empowerment as mediator between customer relationship marketing and satisfaction level in banking sector. Academy of Marketing Studies Journal, 26(4), 1-9.

Abstract

Relationship marketing is a philosophy that is adopted by all progressive business organizations in recent times. The banking sector is standing in a dynamic market where competition and customer demand are ever-evolving. So, customer acquisition has become a costly affair, and customer retention has proven to be more fruitful. Studies suggested that inflated customer satisfaction results in customer loyalty and retention of customers in long run. Therefore, it is important to explore the correlation between an innovative relationship marketing approach and customer satisfaction. The present generation of scholars, academicians, and professionals provided sufficient evidence to prove that a relationship-oriented marketing approach aids in empowering the customers which later enhances their satisfaction. Satisfied customers show greater loyalty toward firms. This study tries to ascertain the role of customer empowerment in mediation which links the approach of relationship marketing with the satisfaction level of customers significantly. Data was collected from 800 customers from the various public sector and private sector banks. Factor analysis and reliability tests were done with the help of SPSS 25 software. Finally, with the help of the structural equation model, the correlation of customer relationship marketing with satisfaction was determined in the presence of empowerment as a mediator.

Keywords

Banking sector, Dimensions of Relationship Marketing, Customer Empowerment, Satisfaction of Customers, and Mediation.

Introduction

In modern days, superiority shifted from business people to their customers. Now, the customers dictate very clearly what they demand from the organization. If the business does not deliver the desired products and services, the customers don’t hesitate to switch to the competitors. The business is expected to produce complete and relevant particulars to their clients so that they can make well-informed decisions independently. This concept is called customer empowerment, becoming more popular, especially in the service sector industry. (Len, 2006) States that the concept of customer empowerment initially gained importance in the United States in the 1960s and later got recognized by all other countries. This study claims that when customers enjoy their purchase experience and if they are presented with sufficient and relevant information, they develop a feeling of satisfaction and willingness to stay connected with the organization. Customers who feel supported by the business and aligned with their actual needs can trust their business for taking any type of decision and they will be connected with their business for the long term. When any company makes efforts to empower their customers, they build a rapport with them which further leads to customer satisfaction and customer retention. Customer empowerment generates additional value to the sales transaction as it helps the customers achieve their purchase goals and adds delight to their experience. Many studies support the concept that customer empowerment is an active measure to decrease customer churn and increase retention rate. The banks act as an intermediary between demand and supply of capital and so, banks are treated as the foundation of growth and development of any economy. At present, the world is globalized. After the 1990s, due to globalization, the level of competition has increased in the banking sector also. So, customer acquisition has become a costly affair. Customer loyalty and retention have become the most significant challenge for all banks. Here, the relationship marketing approach helps in understanding the actual needs of customers to serve them effectively. Finally, this leads to customer satisfaction and retention. In a developing country like India, empowering the citizens through banking services is essential. People should feel confident in taking their own financial decisions and planning their stable financial lives. This is customer empowerment in the banking sector. The feeling of empowerment enhances the satisfaction level of customers that develops the likelihood to repurchase and stay connected with their banks.

Review of Literature

A shift from transactional marketing to relationship marketing in Indian banks (Chirica, 2013) clearly explains in her study that since the 1990s, there is a transformation in the marketing approach in the Indian banking sector. The center of attention of banks got shifted to understanding the specific needs and expectations of customers and satisfying them accordingly due to the ever-increasing demand of customers and ever-evolving market conditions. (Rupali, 2015) Believe that the present generation of customers of banks are more knowledgeable and sophisticated and so they started demanding customized products. Developing and maintaining a loyal customer base is very important for banks through a transition in their marketing approach. (Sucharitha, 2017) State, it is the history when banks served as just holders and creators of money to their customers. At the present age, the banks have become the administrators of the national economy. Banking trends are undergoing many changes and a as consequence, a new culture of banking is expected to be established where long-haul relations can be developed. (Agrawal, 2017) Views banking as primarily a customer-oriented industry in the service sector where “put the customers first” is the most desired strategy. Therefore, identifying the specific customer needs by deepening customer relationships and satisfying them in the best possible manner will be profitable for banks. (Sarabu, 2017) Identifies three important phases in the Indian banking sector. The initial phase was from 1786- to 1969, the second phase was from 1969-to 1991 and the final phase is from 1991 onwards. As the competition in the bank market has increased dramatically in the last phase of 1991 onwards, the need for transformation to the relationship marketing approach was strongly felt by the entire banking sector.

Relationship Marketing Dimensions in the Indian Banking sector

(Kumar, 2017) Discuss significant factors say tangibility, reliability, responsiveness, empathy, and assurance that can help in reducing customer churn. The study emphasized service delivery on time, sincere efforts of bankers in problem-solving, and their trustworthiness which causes customer satisfaction and further customer loyalty. (Abdullah Mohammad Al- Hersh, 2014) Explored unique dimensions of relationship marketing like commitment and trustworthiness, effective communication, empathy in employee response, social bonding with customers, and fulfilling promises on Htime which significantly affects the level of customer satisfaction. (Singh, 2013) Explains that knowledge of employees and their responsiveness, prompt service delivery, convenient business hours, personalization, reliability, etc. assist in enhancing customer satisfaction and consequently their retention. (Joan, 2016) determined quality service, communication, and trust as the important three dimensions for achieving customer satisfaction (Sivesan, 2012) Introduces dimensions of customer relationship marketing like trust and commitment, personalized communication, and conflict handling and their impact on customer loyalty.

Customer Empowerment and Customer Satisfaction in the Indian banking sector

(Aldaihani, 2018) Have witnessed that customer empowerment is a significant element in developing strong relationships with customers. They have verified information access by customers and co-creation in product or service design as two important dimensions of customer empowerment. They claimed that relationship marketing dimensions have a significant influence on empowering the customers which lead to increased customer retention. (Amolak 2014) This is the age of customers in the banking sector. At this age, customers seek their banking partners to be more customer-centric, provide easier financial services, which are seamless and relevant to people’s lives. They want to gain more perceived control over their financial situation as well. This indicates that they want to be empowered. (Castillo, 2018) Has validated the pragmatic impact of customer empowerment on customer satisfaction in retail banking. (Vaslow, 2018) Clearly shows that customer satisfaction has left as the only true competitive advantage left in the banking sector. Satisfied customers are always willing to enhance the relationship by doing more business and they recommend others also to become the customer of the organization. (Kumar, 2016) Explains the transition from traditional banking to modern banking. Due to immense competition enhanced level of customer satisfaction has become an essential factor for the banks to survive effectively. The study creates a link between innovative marketing approaches and the satisfaction level of customers. (Leninkumar, 2017) Tries to prove that if the customers develop trust towards their banks they will turn to be loyal ones. Satisfaction among customers is responsible to enhance the feeling of trust and loyalty which further increases profitability.

Research Problem

It is evident from various studies that several research works have been carried out to study the correlation between customer relationship marketing and customer loyalty in banks. However, there arises a need to measure the effectiveness of correlation between relationship dimensions and satisfaction of the customers as loyalty can be assured by inflated satisfaction only. There is a research gap in this area and a need is felt to determine the mediating role of customer empowerment between relationship marketing and customer satisfaction. Further, the study aims to fill the existing literature gap.

Objectives of The Study

The objectives of this research are:

1. To explore the unique dimensions of customer relationship marketing in the Indian banking sector.

2. To demonstrate the role of Customer Empowerment as a Mediator between Customer Relationship marketing and Satisfaction level.

Conceptualization

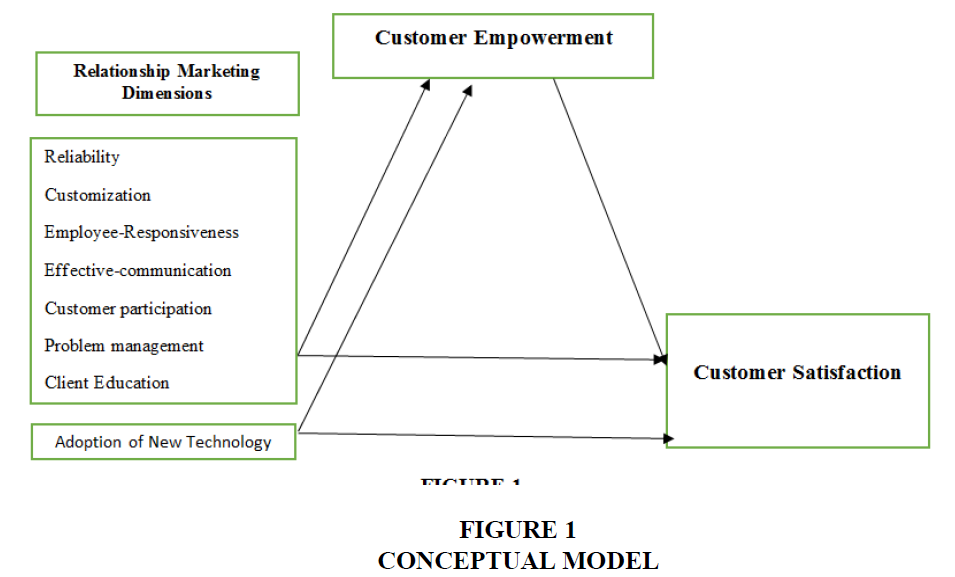

The study explored significant relationship marketing dimensions after an extensive literature review. Further, a conceptual model was constructed to fill the existing research gap. This model introduces unique dimensions of relationship marketing and their correlation with the dependent variable customer satisfaction through empowering the customers. The conceptual model which is hypothetical is represented in Figure 1.

The above figure represents the hypothetical conceptual model which is developed based on an extensive literature review. In this model, dimensions of customer relationship marketing are independent factors. The significant dimensions of relationship marketing are explored as Reliability, Customization, Employee-Responsiveness, Effective-communication, Customer participation, Problem management, Client Education and adoption of new technology. Customer satisfaction is the dependent variable that is determined by the implementation of the relationship marketing approach by an organization. Customer empowerment is the significant mediator linking customer relationship marketing with customer satisfaction.

Hypotheses of The Study

The following Hypothesis is formulated for the study.

H0: Customer relationship marketing does not significantly impact the satisfaction level of customers through the mediating role of customer empowerment.

Research Methodology

To achieve the above-stated objective, recent available published secondary data was first used. The information was collected from various national and international research journals on the banking sector, marketing, and relationship marketing. Various textbooks and websites were also referred to. For primary data collection, a well-structured questionnaire was designed and distributed among bank customers on a random basis. Sometimes, questions were asked in person also in the case of uneducated customers or old age people. The customers were taken into consideration from SBI, Punjab national bank, Union Bank of India, Canara Bank, ICICI Bank, HDFC Bank, Axis Bank, and IDBI bank. Primary data was collected from 800 customers.

Analysis and Interpretation of Collected Data

Descriptive statistics were applied to analyze that all the variables involved in the research study positively depicted their presence and all the relationship marketing dimensions are accepted. Further, the Factor analysis and Reliability tests are carried out to check the internal consistency among the components and to determine the goodness of data by using SPSS 25 Software. Confirmatory factor analysis was executed to measure the fitness of the conceptual model. Further, to check the overall fitness of the model the Structural equation model was used. Finally, SEM helped to determine the relationships between the independent variables and dependent variables in the presence of the mediator.

Descriptive Statistics

Descriptive statistics are used to analyze the existence of all the variables involved in the research study and the outcome is portrayed in Table 1.

| Table 1 Descriptive Statistics | |||||

|

|

N | Minimum | Maximum | Mean | Std. Deviation |

| Relationship Marketing Dimensions | 800 | 0.94 | 4.70 | 3.2543 | 0.71642 |

| Adoption of New Technology | 800 | 0.91 | 4.54 | 3.4750 | 0.66657 |

| Customer Empowerment | 800 | 0.93 | 4.63 | 3.4026 | 0.66851 |

|

Customer Satisfaction |

800 | 0.69 | 3.45 | 2.6290 | 0.54424 |

In the questionnaire, the Likert scale is used to measure the perception of the customers where point 1 represents strongly disagree and point 5 represents strongly agree. The table of descriptive statistics shows the mean values of all the variables. The mean value of customer relationship marketing is 3.2543, new technology adoption is 3.4750, and customer empowerment is 3.4026 respectively. It represents that the customers have a positive perception of all these factors under study. However, the mean value of customer satisfaction is 2.6290 which represents that customers of banks have low satisfaction levels. Further, it is understood from the analysis of descriptive statistics that all the variables involved in the research study positively depicted their presence.

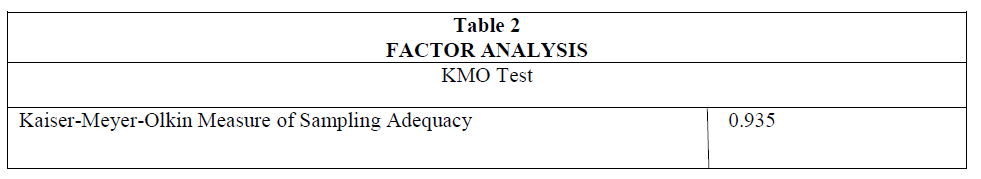

Factor Analysis

To test the suitability of data, KMO Test and Bartlett’s Test are used. The result of factor analysis is illustrated in Table 2.

The recommended KMO value is 0.70 (Kaiser and Rice, 1974). In the above table of factor analysis, the calculated KMO value is 0.935. Thus, the data is regarded to be suitable for analysis Table 3.

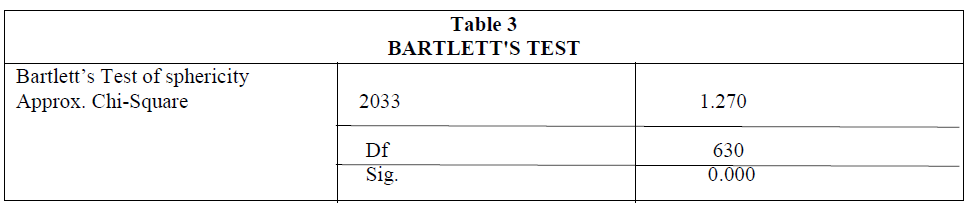

Further, Bartlett’s Test of sphericity values signifies the acceptability of data for further analysis.

Reliability Test

36 variables of the research questionnaire are tested with Cronbach’s alpha to assess the reliability of the data and to determine the internal consistency among the variables. The derived value of Cronbach’s alpha test is represented in Table 4.

| Table 4 Reliability Test

|

|

| Measure

|

Cronbach’s Alpha Value

|

|

Overall Reliability of four factors i.e. Relationship Marketing, Adoption of new technology, Customer Empowerment, and Customer Satisfaction |

0.947

|

The suggested Cronbach’s alpha reliability coefficient value is 0.70 (Nunnally, 1978). In the above table, the overall reliability value of all four factors is 0.947 which is exceeding the suggested value. Hence, it can be methodically interpreted that the data is magnificently reliable for further analysis.

Confirmatory Factor Analysis

The relationship that exists between the observed variables in the research is explained by Confirmation Factor Analysis. CFA is generally used to confirm the hypothetical model, developed based on a literature review. Here, SPSS 22.0 is used to obtain the parameter values which are discussed in Table 5.

| Table 5 Model Fit Parameter Values | |

| Name of the Parameter | Value |

| GFI value | 0.908 |

| CFI value | 0.948 |

| RMSEA value | 0.065 |

In this study, the CFI value is 0.948 which is greater than 0.9, RMSEA value is 0.065 which is again less than 0.08. Hence, the hypothetical model is considered to be statistically fit and accepted.

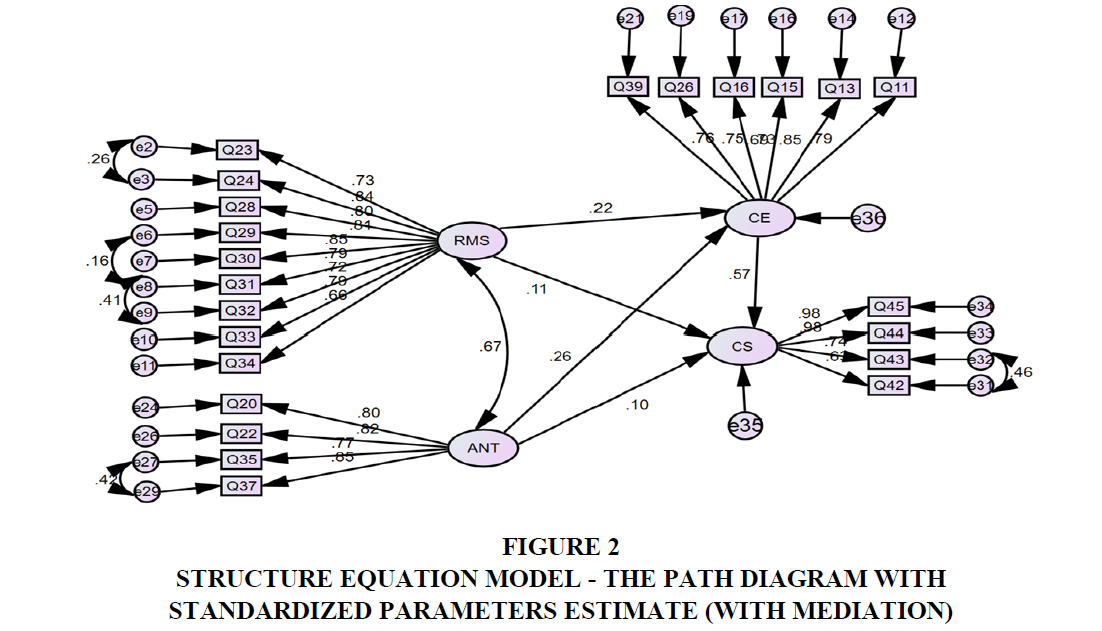

Structural Equation Model

To estimate the relationship of dependent variables with independent variables in the presence of the mediator, the structural equation model was used. Further, it is used to accept or reject the hypothesis. The path diagram with standardized parameters estimate (with mediation) is represented in Figure 2.

Figure 2 Structure Equation Model - The Path Diagram With Standardized Parameters Estimate (With Mediation)

In the above figure, the RMS is relationship marketing and ANT is the adoption of new technology that are independent variables. CE is customer empowerment that is the mediator. CS is customer satisfaction which is the dependent variable. The independent variable's direct, indirect, and total effect is measured on customer satisfaction. The regression weight estimates found from the above SEM model are summarized in Table 6.

| Table 6 Direct, Indirect and Total Effects of Hypothesized Mediation Model | ||||

| Hypothetical Relations | Total Effect | Direct Effect | Indirect Effect | |

| RMS à CS | Estimation | 0.230 | 0.106 | 0.124 |

| Sig Value | 0.008 | 0.098 | 0.016 | |

| ANTàCS | Estimation | 0.252 | 0.103 | 0.149 |

| Sig Value | 0.011 | 0.095 | 0.006 | |

| RMS à CE | Estimation | 0.217 | 0.217 | 0.000 |

| Sig Value | 0.013 | 0.013 | ---- | |

| ONCE | Estimation | 0.262 | 0.262 | 0.000 |

| Sig Value | 0.006 | 0.006 | ---- | |

| CE àCS | Estimation | 0.571 | 0.571 | 0.000 |

| Sig Value | 0.015 | 0.015 | ---- | |

The above table represents that in the presence of the mediation variable customer empowerment the direct effect of the independent variable became insignificant and the indirect effect is still significant on the dependent variable. Here it can be interpreted that customer empowerment is significantly mediating between customer relationship marketing and customer satisfaction.

Hypothesis Testing

Based on the structural equation model using SPSS Amos 22, it is found that Chi-square (CMIN) value is 945.918, the Degree of freedom (DF) value is 219, and the probability level is about 0.000. CMIN/DF is 4.319 which is less than the suggested value of 5 (Wheaton et al, 1977). The following parameter values are found in the study to test the fitness of the model and are represented in Table 7.

| Table 7 Model Fit Parameter Values | |

| Parameters | Value |

| GFI values | 0.908 |

| CFI values | 0.948 |

| RMSEA values | 0.065 |

In the above table, the CFI value is 0.948 which is greater than 0.9, and the RMSEA value is 0.065 which is less than 0.08. Hence, the model is suggested to be fit and accepted (Bentler and Bonett 1980) and (Jöreskog, and Sörbom 1974). Further, the findings of SEM suggest rejecting the null hypothesis. So, it can be interpreted that customer empowerment significantly mediates between relationship marketing with the adoption of new technology and customer satisfaction.

Findings

The findings of the study reveal that

1. Reliability, Customization, Employee-Responsiveness, Effective-communication, Customer participation, Problem management, Client Education and adoption of new technology are the significant relationship marketing dimensions.

2. Customer relationship marketing has a significant impact on the satisfaction level of customers in banks.

3. The modern customers of banks desire to feel the power of independence while taking their financial decisions and planning for their financial lives.

4. Customer empowerment is a significant mediator that links Customer relationship marketing and customer satisfaction in banks.

Discussion and Conclusion

In the present competitive era, customer retention is more significant than customer acquisition in any business. Providing maximum satisfaction to the customers is the key to retaining the existing customers. An effective blend of relationship marketing dimensions says Reliability, Customization, Employee-Responsiveness, Effective-communication, Customer participation, Problem management, Client Education supported with new technology have a noticeable impact on the satisfaction level of customers. In the banking sector, empowered customers achieve financial stability as they can plan their financial lives in a better way. The present study reveals that in the banking sector the feeling of empowerment leads to a feeling of satisfaction. So, it can be concluded that the execution of the relationship marketing approach with technological advancement empowers the customers to a greater extent which further leads to a high level of satisfaction among customers in the Indian banking sector.

References

Abdullah, Mohammad Al- Hersh, A.S. (2014). The Impact of Customer Relationship Marketing on Customer Satisfaction of the Arab Bank Services. International Journal of Academic Research in Business and Social Sciences, 4(5), 67-100.

Agrawal, S. (2017). Impact of customer relationship management on the Indian banking sector. Voice of Research, 6(1), 35-36.

Aldaihani, F.M. (2018). The Mediating Role of Customer Empowerment in the Effect of Relationship Marketing on Customer Retention: an Empirical Demonstration from Islamic Banks in Kuwait. European Journal of Economics, Finance and Administrative Sciences, (99), 42-52.

Castillo, J. (2018). How interactions influence customer empowerment and satisfaction in the retail industry. Journal of Business and Retail Management Research, 12(4), 143-157.

Chirica, C. (2013). Relationship Marketing- Best Practice in the Banking Sector. Amfiteatru Economic, 15(33), 288-300.

Joan Karambu, Muketha, K.T. (2016). Influence of relationship marketing on customer retention in the branches of commercial banks in Meru town, Kenya. International Journal of Advanced Multidisciplinary Research, 3(11), 20-61.

Kumar, M. (2016). Customer Satisfaction Trends in Banking Industry- A Literature Review. International Conference on Banking and Finance. Punjab: Chitkara university.

Kumar, S.M. (2017). Customer Retention: A Study on Indian Banks. International Journal of Research- Granthalay, 5(7), 485- 492.

Len Tiu Wright, A.N. (2006). Enhancing Consumer Empowerment. European Journal of Marketing, 40(9), 925-935,

Lenin, K.V. (2017). The Relationship between Customer Satisfaction and Customer trust on Customer Loyalty. International Journal of Academic Research in Business and Social sciences, 7(4), 450-465.

Rupali Madan, R.A. (2015). Relationship Marketing Strategies in Banking Sector: A Review. International Journal of BRIC Business Research, 4(4), 1-10.

S. Amolak Singh, B.A. (2014). Impact of banking Services on Customer Empowerment, Overall Performance, and Customer Satisfaction: Empirical Evidence. IOSR Journal of Business and Management, 16(1), 17-24.

Sarabu, V.K. (2017). Banking Sector in India- A Review. Banking and Insurance sector in India (pp. 1-8). Warangal: Kakatiya University.

Singh, S. (2013). The impact of service delivery quality on customer satisfaction in indian banks. International Journal of Financial Services Management, 6(1), 60-78.

Sivesan, S. (2012). Impact of relationship marketing on customer loyalty on banking sectors. South Asian Journal of Marketing and Management Research, 2(3), 179-191.

Sucharitha, S.J. (2017). Marketing Strategies in Banking Sector- A Review. Anveshana's International Journal of Research in Regional Studies, Law, Social Sciences, Journalism and Management Practices, 2(4), 80-86.

Vaslow, J. (2018). The Importance of Customer Satisfaction in Banking. Customer Experience Management, Financial Services.

Received: 09-May-2022, Manuscript No. AMSJ-22-11939; Editor assigned: 10-May-2022, PreQC No. AMSJ-22-11939(PQ); Reviewed: 23-May-2022, QC No. AMSJ-22-11939; Revised: 26-May-2022, Manuscript No. AMSJ-22-11939(R); Published: 28-May-2022