Review Article: 2023 Vol: 27 Issue: 3

Customer Experience of Banking Self-Service Technologies in India′s An Empirical Study

Thirupathi Chellapalli, National Forensic Sciences University, Delhi

Citation Information: Chellapalli, T. (2023).Customer Experience Of Banking Self-Service Technologies In India – An Empirical Study. Academy of Marketing Studies Journal, 27(3), 1-20.

Abstract

Purpose: This study investigates the factors that influence overall customer experience in the acceptance of self-service technologies (SSTs) i.e. ATM in the retail banking sector. Methodology: Cross-sectional survey and purposive sampling techniques were used to collect data of 437 customers from four major cities of India i.e. Hyderabad, Delhi, Mumbai, and Kolkata. The data was analysed and interpreted by using Factor Analysis and Structural Equation Modelling (SEM). Major findings: The findings lend support to hypothesis that all the considerable factors i.e. Convenience, Services cape, Technology Interface, Transactional Security, Transactional Reliability, Speed were found supportive and significant, except social environment contribution to overall customer experience in the usage of ATM banking. Implications of the research: The study provides insights for bank managers to address the key factors contributing to the delivery of superior experience in the current competitive scenario.

Keywords

ATM banking, Customer Experience, Self-service Technologies etc.

Introduction

The innovations in the information and technologies haveresulted in the growth of services sector and made it one of the primary drivers of India’s economic growth (Erumban & Das, 2016). IT tools are progressively penetrating organisations, and organisations are proactively utilising IT tools to fulfil goals and improve customer experience (Tewari, 2022).Service organizations realized that offering quality services is no longer adequate for establishing a long-lasting competitive advantage (Arunachalam, 2005).In today’s rapidly changing economic and competitive environment, survival is no longer confined to low costs and innovative products/services. To compete, the organizations need to recognize the personality traits of each customer. As customer preferences could be differentiated based on their attitudes, values, preferences, beliefs, personalities, backgrounds, experience etc (Chen, 2007: Deliza et al., 2003). Therefore, each customer gains experiences through his/her lens. In the phase of post modernity, these experiences of the customers contribute in the growth and survival of an organization. To compete effectively, the business organizations have entered an era of “customer experience” which originates with the direct or indirect an ongoing engagement between a customer and an entity and appeals to the sensory, cognitive, behavioural, create value (Berry et al., 2002) and relational levels of the customer (Lijander et al., 1995).

The banking sector in India includes monetary mediators that serve as economic mobilisation units.They act as a bridge for much-needed cash to be channelled from excess spending areas to shortage spending portions of the economy by organizations and families (Roy, 2018). A efficient and advanced banking systemfacilitates therapid economic growth of a nation’s economy. Mobile banking (m-banking) has developed as an innovative technical innovation in the highly protected and regulated world of banking, financial services, and insurance (BFSI) (Srivastava & Fernandes, 2022). To enhance depositors’ convenience, there is need to acquaint with self-service technology intervention that eventually impacts positive performance and sustainable growth of the banking sector(Kaushik & Rahman, 2015: Odawa, 2016:Prashara & Mishra, 2020). Post-liberalization has brought swept in the economic landscape and boom many sectors such as Insurance, Banking, Energy, Airline, Information Technology, etc. As a revolutionary impact of Information Technology in banking sector experienced tremendous growth, as due to paradigm shift from tradition banking to Technology based banking (Barras 1990). Technology empowers customers to perform exchanges without going to bank’s office. The Self-Service Technologies (SSTs) facilitate access to keep money exchanges by utilization of innovative technology as medium (Shamdasani et al., 2008). SSTs make banking accessible for the customers thereby providing convenience and comfort (Meuter et al., 2000: Bitner et al., 2002). According to Devlin (2010) the banking business is among pioneers in the adoption of automation services. Banks have executed the SSTs of several kinds which are availed to clients autonomously to address their issues without having them to interact specifically with any bank representatives (Meuter et al., 2000).

Self-service is a process of producing the service to customers without service person or employee’s physical presence. According to Bitner et al., (2000) and Blut et al., (2016), the conventional “high-touch and low-tech” personal interactions supplemented by the “high-tech and low-touch” technology interfaces result in self-service. Man to man interaction is increasingly being replaced by man to machine interaction in technology-based self-services (Meuter, Bitner& Brown, 2000). The banking sector has been witnessing a new intervention known as technology-based self-services which include online banking, ATM banking and mobile banking, etc.

Despite significant and expanding body of literature has not investigated customer experience in the area of marketing, service marketing and retailing as a construct. Majority of the researcher have focused on customer satisfaction, customer loyalty, behavioural intention and service quality (Parasuraman, et al., 1988; Verhoef et al., 2007: Sun, L. S, 2002). But, the importance of experimental aspect in consumption was introduced by, Holbrook and Hirschmann (1982).Experience is a phenomenon that develops through time. It is the result of engaging in a series of events in a social setting. Lewis and Chambers (2000) have explored how Consumer experience is the total result to the customer from the combination of environment, goods and services. Lemon et al., (2016) suggest that an overall customer experience refers to the uniform portrayal and perfect execution of your brand's message across all distribution channels and the relationship you want your consumers to have with it.

Research Gap

Most of the previous studies in the context of SSTs have focused on:

1. Adoption Of SSTs: Studies done by Dabholkar and Bagozzi (2002), Curran, Meuter, and Surprenant (2003), Montoya-Weiss, Voss, and Grewal (2003), Meuter et al. (2005), and Falk et al. (2007) etc. focussed onthe adoption of the self-service technologies.

2. Attitude Towards SSTs: Certain studies have been carried out focusing on customer attitude towards SSTs. Examples include studies by Simon & Usunier 2007; Dabholkar & Bagozzi 2002; Bobbit & Dabholkar 2001; Dabholkar 1996, etc.

3. Users Choice Of SSTs: Studies by Black et al. 2002; Howcroft et al. 2002, etc. have focused on user choice of SSTs.

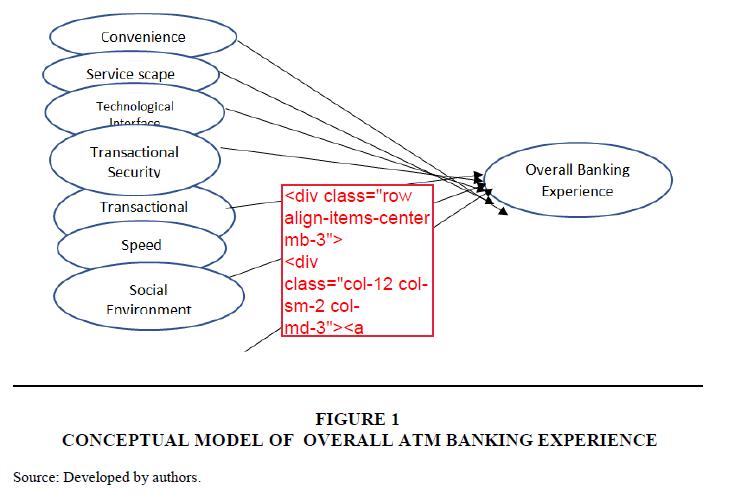

Though a number of studies were carried out focussing on several prospective issues and application of customer experience, still some potential issues like factors affecting customer experience, and role of demographics in experience outcome remain unaddressed. Therefore, these gaps highlight the abundant scope of research in the field of customer experience in the usage of SST’s particulary ATM banking in the retail banking sector Figure 1.

Literature Review

According to Schmitt (1999) the customer experience is a constant stream of imaginations, sentiments, and enjoyment. As opined by Carbone and Haeckel, (1994) the experience is a takeaway impression form by peoples’ experience with products, services, and businesses – an attitude that occurs when people combine sensorial data. Almost 20 years back Haeckel et al., (2003) explained total experiences means the emotions that consumers obtain left from their interactions with a company's goods, services, and environment stimuli, as well as the consumer's overall experience. It is a combination of an organization's physical performance, senses aroused, and emotions elicited, all of which are intuitively compared against consumer expectations across all points of contact (Shaw, 2005: Mascarenhas et al., 2006). It is a key component in creating a positive consumer experience. The reason for this is because consumers want to be at ease at every point of interaction with the company Rowly (1994, 1999), Constantinides (2004), Arnold et al. (2005), Knutson et al. (2007), Mahfouz et al. (2008), Jain and Bagdare (2009).

It is the physical environment that all employees and customers of a company share. The three aspects of the physical environment influence client responses. These are artefacts and symbols, environmental circumstances and space, as well as function and signals. It is the rapidity of any organization, which it shows in delivering the responses against the requirements of the customers Sarel and Marmorstein (1999), Grove and Fisk (1997), Berry et al. (2002), Flanagan et al. (2005), Jain and Bagdare (2009)(Table 1).

| Table 1 Summary Of The Articles Reviewed For Research Gaps Identification |

|||||||

|---|---|---|---|---|---|---|---|

| S. No. | Author of the Study | Year of the Study | Area of application, Statistical methods used and Sampling |

Focus on the Study | Dimensions of the Study | Factors Identified in the Study |

Conseq since/s of the Study |

| 1 | Rowley D.B. | 1994 | Library, case studies | Identified the factors that influence the customer experience. | - | Quality service Technology, Value-AddingLife Style, Choice, Age, Convenience, Discounting, Speed | Customer Satisfaction |

| 2 | J.E. Otto & J.R.B. Riche | 1997 | Tourism/Vancouver, factor analysis, random sampling sample size-399 | Measuring customer satisfaction with service experience in the tourism industry. | Stimulation Comfort Novelty Interactive Safety Hedonic | Human Interaction, Service Delivery, Servicescape | Customer Satisfaction |

| 3 | Johnson C. & MathewsB.P. | 1997 | Fast food restaurant, t-test, random sampling sample size-389 | Measure the expectations of customers to evaluate quality dimensions of service. | - | Specific to Person. | Customer Satisfaction |

| 4 | S.J. Grove & Fisk R.P. | 1997 | Tourism, “Critical incident analysis,” 486 | Identify positive and negative effects of the presence of other customers on the serviceexperience. | - | Demographic Variables, Service, Social Interaction, Waiting Lines, Presence of Others. | Customer Satisfaction |

| 5 | Sarel D. & Marmorstein H. | 1999 | Bank, Ancova, Sample size 170 | Analyze reaction to consumer service delay. | - | Employee Apology, Perceived Employee Behavior, Prior Waiting Experience. | Customer Satisfaction |

| 6 | Rowley J. | 1999 | Museum, two case studies | Identified the factors which influence customer experience | - | Discounting, Quality Technology Service, Value-AddingLifestyle, Choice, Age, Convenience, Speed. | Customer Satisfaction |

| 7 | M. M. Tseng Quinghai M. & C.J. Su | 1999 | General study, Conceptual | Identified improvement in service operations which mapping service experiences of customers. | - | Service Process, Service Personnel, Other customers, Physical Environment. | Customer Satisfaction |

| 8 | McIntosh A. J. | 1999 | Heritage, Structured Interviews & Case Studies, sample size-1200 | Identified value attained through the visitor’s experience dimensions. | Cognitive, Reflective, Affective | Environment, Presence of Other Visitors. | Quick &Sustainable Benefits, Insightfulness |

| 9 | Johnson W. | 1999 | General, two case studies | Identified service design techniques to know the quality of service processes from customers’ point of view. | - | Speed, Employee Behavior, Service Process | Customer Satisfaction |

| 10 | B. Schmitt | 1999 | General, conceptual | Aim to provide a new approach to marketing-Experiential Marketing. | Relate, Act, Think, Feel, Sense | - | New Opportunities |

| 11 | T.P. Novak, D. L. Hoffman & Y.F. Young | 2000 | Online, Survey-Structured modeling, sample size 147 | Measuring Customer Experience. | - | Focused Attention, Time Distortion, Telepresence, Interactivity, Involvement, Control, Challenge, Arousal, Skill | Explorative Behavior and Positive effect |

| 12 | R.K. Fulbright, C.J. Skudlar, P. Gore & B. E. Wexler | 2001 | Pain/conceptual study | Proposed a model which identify whether pain experience includes sensory and affective components. | Cognitive, Sensory Affective | - | Balance pain |

| 13 | W. Sun | 2002 | Online Shopping/conceptual ethnographic content analysis | To identify experiential dimensions of online shopping. | Consumer Affective Responses, Flow Experiences | - | Customer Loyalty, Sensory Stimulation, Social gains |

| 14 | Grass & O’ Cass | 2004 | Bank/ mall intercept, in-depth interviews/CFA, SEM/ Sample size-254 | To identify the impact of service experience on satisfaction aroused feelings and brand attitude. | - | Employee Service, Core Service, |

Satisfaction Aroused feelings, Brand attitude. |

| 15 | Constantinides | 2004 | Web/ conceptual study | To identify and classify the web experience elements. | - | Aesthetics, Trust, Marketing mix Interactivity, Usability, |

Customers Online Buying Behavior. |

| 16 | Knutson & Beck | 2004 | General/ conceptual study | To develop a model to incorporate the components of experience construct. | - | Extrinsic-Intrinsic, Functional, Emotional, Absorption-Immersion, Real-Virtual, Active,Passive, Mass-produced, Novelty, Customized Interaction. | Satisfaction, Loyalty. |

| 17 | Arnold, Reynold, Ponder &Lueg | 2005 | Retail/ critical incident analysis with open structured interviews/sample size-113 | To identify the customer delight in a retail shopping context. | - | Other customers, Salesperson, Customer timing or mood Atmosphere, product, |

Patronage, Complaints, Convenience, Voice, WOM. |

| 18 | Rahman | 2006 | Banks/questionnaire survey, sample size-100 customers & 21 employees | To identify the customers’ ratings regarding automated telling machines (ATMs) and employees. | Cognitive, Physical Emotional | Speed, Availability of Facilities, Environment, Employees, Working condition of equipment. |

Loyalty, Profitability. |

| 19 | Oh, Fiore & Jeoung | 2007 | Bread & Breakfast Industry/self-administered questionnaire through survey/ sample size-95 operators & 419 guests | To develop the scale to test the model of experience economy concept. | Escapist Entertainment, Esthetic Educational | - | Customer Satisfaction, Arousal, memories Overall quality. |

| 20 | Gentile, Spiller, &Noci. | 2007 | General/structured questionnaire through survey/sample size-200 | To provide a model which will be helpful for the managers to understand the complex experiences of the customers regarding their products? | Relational, Sensorial, Cognitive, Emotional, Pragmatic, Life style. | - | Loyalty, Value |

| 21 | Verhoef et al., | 2009 | Retail/ conceptual study | Creation of the customer experience, a conceptual model has been proposed along with the determinants and moderators that influence the customer experience. | Cognitive, Physical, Affective, Social | Social Environment, Service Interface, Price Atmosphere, Channels Experience, Assortment, | - |

| 22 | Jain & Bagdare | 2009 | Retail/India Survey, convenience sampling, factor analysis, sample size-218 |

To identify the determinants of customer experience in the new format retail stores. | Physical Cognitive, Social, Behavioral, Emotional | Customer Service, Physical Environment, Value Added Service, Customer Delight, Convenience, Merchandise, Amenities, Audio Visual. | |

| 23 | Brakus, Schmitt & Zarantonello | 2009 | Retail/ conceptual | To identify the contribution of seven articles on retail customer experience. | - | Economic, Promotion, Price, Political, Supply chain, Location, Merchandise | Customer Satisfaction |

| 24 | Hosany & Gilbert | 2009 | Holiday/ Destination/ questionnaire Survey, EFA, CFA, Sample size-200, Purposive sampling | To identify significant dimensions of tourism emotionalexperiences. | Love, Joy, Positive Surprise | - | Customer Satisfaction, |

| 25 | Zarantonello& Schmitt | 2010 | Brand/questionnaire survey/sample size-10 cities | To develop a typology of consumers with different experiential profiles and examine differences related to the attitudes intention relationship. | Senior Behavioral Intellectual Affective | - | Brand Attitude Purchase Intentions |

| 26 | Kim et al., | 2011 | General/web-based survey/sample size-506 | To develop a customer index to authenticate the dimensionality aspect of the experience constructs. | - | Convenience, Environment, Benefit, Accessibility, Incentive, Utility | Customer Satisfaction |

| 27 | Garg et al., | 2012 | Bank/ survey method | To identify and rank the critical success factors of customer experience in banks. | Affective Sensory Behavioral, Cognitive, Relational. | - | - |

| 28 | Bagdare, S & Jain R. | 2013 | Retail/ survey method/ sample size- | Developed retail customer experience scale. | - | - | - |

| 29 | Garg et al., | 2014 | Bank/survey method & SEM/sample size-612 | To measure customer experience in banks: scale development and validation. | Affective, Sensory, Behavioural, Cognitive, Relational | Service Process, Core Service, Speed, Value Addition, Convenience, Service, Employees, Presence of Other Customers, Customer Interaction. | Customer Satisfaction |

| 30 | Chahal, H & Dutta, K | 2015 | Banking | Developed a scale consisting of three dimensions. | Sense, Feel, Relate | - | - |

| 31 | Khan, Imran, Rahman, Zillur Fatma, Mobin | 2016 | Brand experience/empirical study | Customer engagement and experience in online context. | - | - | Brand Engagement. |

| 32 | Ladhari, Riadh, Souiden, Nizar Dufour | 2017 | Retail experience/empirical study | Investigating the effects of customers’ perceptions of service quality and services cape on their emotional reactions, and their perceptions of product quality and subsequent behavioral intentions. | - | - | Behavioral Intention |

Research Questions

1. What are the factors, effecting customer experience while using SST (ATM banking)?

2. How these identified factors influence the SST (ATM banking) experience of the retail bank customers?

Research Objectives

Main Objective: To identify the factors that affect overall customer experience in the usage of self service technology (ATM) in retail banking sector.

Sub Objective: To measure the effect of the identified factors on overall customer experience.

Sub Objective: To rank the critical success factors in creating superior overall customer experience.

Research Hypotheses of SST (ATM-Banking):

H1: The Convenience of theATM bankingas perceived by the customer has a significanteffect on overallATM banking experience.

H2: The Servicescape of the ATM banking as perceived by the customer has a significanteffect on overall ATM banking experience.

H3: The Technological Interface of the ATM banking as perceived by the customer has a significanteffect on overall ATM banking experience.

H4: The Transactional Security of the ATM banking as perceived by the customer has a significanteffect on overall ATM banking experience.

H5: The Speed of the ATM banking as perceived by the customer has a significant effect onoverallATM banking experience.

H6: The Transactional Reliability of the ATM banking as perceived by the customer has a significanteffect on overall ATM banking experience.

H7: The Social Environment of the ATM bankingas perceived by the customer has a significanteffect on overall ATM bankingexperience.

The eight aspects explored are Convenience, Servicescape, Technological interface, Transactional Security, Transactional Reliability, Speed, Social environment, and overall customer experience.The research objectives have been arrived at based on the research gaps and research questions.To identify the factors that affect overall ATM banking experience in the retail banking sector.To measure the effect of the identified factors on overall customer experience.

3. Research Methodology:

The study is based on cross-sectional survey and techniques of purposive sampling were utilised to collect data of 437 customers from four major cities of India i.e. Hyderabad, Delhi, Mumbai, and Kolkata. The data were analysed and interpreted by using Factor Analysis and Structural Equation Modelling (SEM).

4. Results and Discussion:

In represents the city wise sample distribution of ATM-banking users in four select cities in India. The Distribution results indicate that approximately 25% of samples are drawn from each of the cities. Hyderabad 111 (25.4%), Delhi 109 (24.9%), Mumbai 107 (24.4%) and Kolkata 110 (25.1%).

Interpretation: Table 2 represents the city wise sample distribution of ATM-banking users in four select cities in India. The Distribution results indicate that approximately 25% of samples are drawn from each of the cities. Hyderabad 111 (25.4%), Delhi 109 (24.9%), Mumbai 107 (24.4%) and Kolkata 110 (25.1%).

| Table 2 Atm Banking Users City-Wise Sample Distribution |

||

|---|---|---|

| City | Frequency | Percent |

| Hyderabad | 111 | 25.4 |

| Delhi | 109 | 24.9 |

| Mumbai | 107 | 24.4 |

| Kolkata | 110 | 25.1 |

| Total | 437 | 100 |

Interpretation: Table 3 represents age wise sample distribution of ATM users in four select cities in India. A majority of the respondents (47.95%) belong to the age group 26 years to 33 years followed by 21.9% of respondents belonging to the age group under 25 years and 18% belonging to the age group 34-41 years. Rest of the respondents were spread across age groups 42-50 years, 51-60 years and above 60 years.

| Table 3 Atm Banking Users Age-Wise Sample Distribution |

||

|---|---|---|

| Age | Frequency | Percent |

| Under 25 | 96 | 21.9 |

| 26-33 | 209 | 47.9 |

| 34-41 | 79 | 18.0 |

| 42-50 | 32 | 7.3 |

| 51-60 | 17 | 3.0 |

| Above 60 | 4 | 0.9 |

| Total | 437 | 100 |

Interpretation: Table 4 represents the gender wise sample distribution of ATM users in four select cities in India. The distribution indicates 219 male (50.2%) and 218 female (49.8%) respondents.

| Table 4 Atm Banking Users Education-Wise Sample Distribution |

||

|---|---|---|

| Education | Frequency | Percent |

| High School & Below | 8 | 1.8 |

| Intermediate | 32 | 7.3 |

| Bachelor degree | 102 | 23.3 |

| Master degree | 264 | 60.2 |

| M.Phil./Ph.D. | 31 | 7.4 |

| Total | 437 | 100 |

Interpretation: Table 5 represents education wise sample distribution of ATM users in four select cities in India. A majority of the respondents (60.2%) belong to the master degree holders followed by 23.3% of respondents belonging to the bachelor degree holders and 7.4% belonging to the M.Phil./Ph.D. Rest of the respondents were spread across (7.3%) Intermediate, (1.8%) high school & below.

| Table 5 Atm Banking Users Marital Status-Wise Sample Distribution |

||

|---|---|---|

| Marital Status | Frequency | Percent |

| Married | 197 | 45.3 |

| Unmarried | 240 | 54.7 |

| Total | 437 | 100 |

Interpretation: Table 6 represents the Marital Status-wise sample distribution of ATM users in four select cities in India. The distribution indicates 197 married (45.3%) and 240 Unmarried (54.7%) respondents.

| Table 6 Atm Banking Users Monthly Income-Wise Sample Distribution |

||

|---|---|---|

| Income | Frequency | Percent |

| Upto 15000 | 15 | 3.4 |

| 15001-25000 | 32 | 7.3 |

| 25001-35000 | 98 | 22.3 |

| 35001-45000 | 138 | 31.5 |

| >45000 | 154 | 35.3 |

| Total | 437 | 100 |

Interpretation: Table 7 represents monthly Income-wise sample distribution of ATM users in four select cities in India. A majority of the respondents (35.3%) belong to the income group of Rs.>45,000 group followed by 31.5% of the respondents belonging to the income group of Rs. 35,001-Rs. 45,000followed by 22.3% of the respondents belonging to the income group of Rs.25,001-Rs.35000. Rest of the respondents were spread across income groups of (7.3%) Rs. 15,001-25,000 (3.4%) up to Rs. 15,000.

| Table 7 Atm Banking Users Occupation-Wise Sample Distribution |

||

|---|---|---|

| Income | Frequency | Percent |

| Self employed | 16 | 3.7 |

| Students | 70 | 16.2 |

| Pvt. Emp. | 238 | 54.3 |

| Govt .Emp. | 113 | 25.8 |

| Total | 437 | 100 |

Interpretation: Table 8 represents occupation wise sample distribution of ATM users in four select cities in India. A majority of the respondents (54.3%) belong to the private employees followed by (25.8%) of the respondents belonging to the government employees and (16.3%) belonging to the students. Rest of the respondents (3.7%) belonging to self-employed.

The Table 8 signifies the reliability statistics of ATM banking experience. The Cronbach’s alpha value is .803.

| Table 8 Atm-Banking Experience Reliability Statistics |

||

|---|---|---|

| SST | Reliability Statistics | Cronbach’s Alpha |

| 1 | ATM-Banking Experience | .803 |

Exploratory Factor Analysis (EFA) on ATM Banking Experience

Exploratory factor analysis is used to empirically group the items into the various variables. Despite the fact that few of the components and items are theoretically defined in the literature, the need for EFA is felt as the measure for a specific reason is developed. Principal component analysis and Varimax with Kaiser Normalization Rotation are being used in the EFA Table 9.

| Table 9 Atm-Banking Experience Kmo And Bartlett's Test |

||

|---|---|---|

| Kaiser-Meyer- Olkin Measure of Sampling Adequacy | 0.775 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 8952.805 |

| df | 703 | |

| Sig. | 0.000 | |

Source: calculated by authors.

The KMO Bartlett’s test performed on the data has resulted in a sample adequacy of 0.775, which is more than the required threshold (0.7) value. The threshold for factor loading is kept at 0.1 since the number of respondents is above 400 (Hair et al., 2006). The total variance explained is 61.096 percent. The KMO measure of sampling adequacy value of 0.775 indicates that the sample size is adequate. The Bartlett’s test of Sphericity has a significance of .000 with a chi-square of 8952.805 at 703 degrees of freedom indicating that the factor analysis can be conducted on this data furnished in Table 10.

| Table 10 Reliability And Validity Assessment Of The Survey |

|||||

|---|---|---|---|---|---|

| Description of Variable | Item total | Factor Loading | Eigen Value | Cumulative Variance Explained | Cronbach’s Alpha |

| Convenience (CON) | 4.80 | 12.65 | 0.90 | ||

| CON1 | 0.787 | 0.878 | |||

| CON2 | 0.836 | 0.856 | |||

| CON3 | 0.858 | 0.840 | |||

| CON4 | 0.734 | 0.797 | |||

| CON5 | 0.724 | 0.795 | |||

| CON6 | 0.669 | 0.737 | |||

| Service scape (SS) | 4.25 | 21.49 | 0.89 | ||

| SS1 | 0.709 | 0.891 | |||

| SS2 | 0.791 | 0.876 | |||

| SS3 | 0.735 | 0.809 | |||

| SS4 | 0.632 | 0.767 | |||

| SS5 | 0.709 | 0.765 | |||

| SS6 | 0.599 | 0.749 | |||

| Technological Interface (TI) | 3.71 | 30.49 | 0.87 | ||

| TI1 | 0.734 | 0.878 | |||

| TI2 | 0.787 | 0.828 | |||

| TI3 | 0.836 | 0.815 | |||

| TI4 | 0.858 | 0.806 | |||

| TI5 | 0.721 | 0.783 | |||

| Transactional Security (TS) | 3.29 | 39.31 | 0.88 | ||

| TS1 | 0.767 | 0.864 | |||

| TS2 | 0.761 | 0.808 | |||

| TS3 | 0.721 | 0.794 | |||

| TS4 | 0.808 | 0.793 | |||

| TS5 | 0.762 | 0.776 | |||

| Transactional Reliability (TR) | 2.84 | 48.12 | 0.87 | ||

| TR1 | 0.895 | 0.865 | |||

| TR2 | 0.846 | 0.813 | |||

| TR3 | 0.893 | 0.802 | |||

| TR4 | 0.739 | 0.785 | |||

| TR5 | 0.751 | 0.758 | |||

| Speed (SP) | 2.08 | 55.04 | 0.82 | ||

| SP1 | 0.768 | 0.850 | |||

| SP2 | 0.701 | 0.797 | |||

| SP3 | 0.669 | 0.785 | |||

| SP4 | 0.711 | 0.762 | |||

| Social Environment (SE) | 1.83 | 61.85 | 0.80 | ||

| SE1 | 0.782 | 0.848 | |||

| SE2 | 0.703 | 0.793 | |||

| SE3 | 0.714 | 0.750 | |||

| SE4 | 0.721 | 0.750 | |||

Source: calculated by authors.

Reliability and Validity Assessment:

Reliability and validity were tested and the results are presented in the Table 10. According to Nunnally (1978), the minimum threshold of 0.7 is required for all constructs. In the present study, it is exceeding this figure in all the cases, the minimum threshold of 0.5 for the item-to-total correlation coefficient is also met. Thus, the reliability of the questionnaire was accepted. Convergent validity of the questionnaire was met as the extracted factors should be at least over 1, factor loadings should be 0.5, and the variance explained values should be above 0.5. To meet the discriminant validity of the questionnaire, correlation between any two constructs should not be more than the Cronbach’s alpha. This criterion was also satisfied.

Confirmatory Factor Analysis (CFA) on ATM Banking Experience

Confirmatory factor analysis was carried out using analysis of moment structures (AMOS) 20.0 version for the data related to ATM banking. The confirmatory factor analysis helps to verify the measurement model and test the validity of constructs. The discriminant and convergent validity are tested using the measurement model. The nomological validity is tested using the structural model explaining the relationships between different variables. The face validity was tested through expert opinions and has been done both at the time of instrument development as well as finalization of the scale Table 11.

| Table 11 Atm Banking Experience Model Fit Statistics For Measurement Model |

||||

|---|---|---|---|---|

| Measure | Actual value | Threshold | Interpreted as | Source |

| Cmin/df | 2.233 | <3.0 | (Hair et al., 2006) | |

| Comparative Fit Index | 0.928 | >0.95 | Good | Byrne (1994) Schumacher & Lomax (2004) |

| Goodness of Fit Index | 0.941 | >0.9 | Good | Byrne (1994) Schumacher & Lomax (2004) |

| Adjusted Goodness of Fit Index | 0.912 | >0.80 | Good | Byrne (1994)Schumacher & Lomax (2004) |

| Incremental Fit Index | 0.908 | >0.9 | Good | Byrne (1994) Schumacher & Lomax (2004) |

| Root Mean Square Residual | 0.903 | >0.09 | Good | Byrne (1994) Schumacher & Lomax (2004) |

| Root Mean Square Error of Approximation | 0.048 | <0.05 | Good | Byrne (1994) Schumacher & Lomax (2004) |

| Pclose | 0.765 | >0.05 | Good | Byrne (1994) Schumacher & Lomax (2004) |

Source: calculated by authors.

Model fit statistics of the measurement model for ATM banking experience construct will provide us with an empirical validation of the variables and the items falling under these constructs. Table 5 provides the model fit statistics for the measurement model. According to Thai Hoang, et al. (2006) the ratio between goodness of fit and degree of freedom should not be more than 3 and RMR and RMSEA values should be 0.5 or more. As specified by Bagozzi and Yi (1988), GFI, AGFI, NFI, and CFI values should be more than 0.9.

The present study analyses the results using Structural Equation Modelling using AMOS 20 version. The measures of model fit and confirmatory factor analysis (CFA), as illustrated in table 5 show that the recommended values and the CFA values are calculated using AMOS. The complete results are presented in the Table 12.

| Table 12 Confirmatory Factor Analysis (Cfa) Of Atm-Banking Experience |

||||||

|---|---|---|---|---|---|---|

| Factors | Item | loadings | Factors | Item | loadings | |

| TI | TI1 | 0.893 | TS | TS1 | 0.838 | |

| TI2 | 0.717 | TS2 | 0.849 | |||

| TI3 | 0.747 | TS3 | 0.785 | |||

| TI6 | 0.865 | TS4 | 0.766 | |||

| CON | CON1 | 0.870 | SP | SP1 | 0.880 | |

| CON2 | 0.771 | SP2 | 0.790 | |||

| CON4 | 0.762 | SP4 | 0.790 | |||

| CON5 | 0.790 | SP5 | 0.807 | |||

| TR | TR1 | 0.875 | SS | SS1 | 0.828 | |

| TR2 | 0.751 | SS2 | 0.710 | |||

| TR3 | 0.769 | SS4 | 0.729 | |||

| TR5 | 0.812 | |||||

| SE | SE1 | 0.830 | ||||

| SE2 | 0.663 | |||||

| SE4 | 0.680 | |||||

Source: calculated by authors.

TI=Technological Interface, TS=Transactional Security, CON=Convenience, SP=Speed, TR=Transactional Reliability, SS=Servicescape, SE=Social Environment.

From the Table 12 it can be analyse that for factor 1 (Technological Interface -TI) loadings are ranging from 0.717 to 0.893, for factor 2 (Transactional Security -TS) loadings are ranging from 0.766 to 0.838, for factor3 (Convenience-CON) loadings are ranging from 0.762 to 0.870, for factor 4 (Speed-SP) loadings are ranging from 0.790 to 0.880, for factor 5 (Transactional Reliability -TR) loadings are ranging from 0.751 to 0.875, for factor6,(Services cape-SS) loadings are ranging from 0.710 to 0.819, and finally for factor 7, (Social Environment -SE) loadings are ranging from 0.663 to 0.830.

Confirmatory Factor Analysis Model Fit Indices are as Follows

Chi-square (χ2) =779.391; Degrees of Freedom = 349; CMIN/DF = 2.233; CFI = 0.928; GFI = 0.941; TLI = 0. 916; IFI = 0.908; NFI = 0.901; RMR = 0.903; RFI = 0.860; RMSEA = 0.048; Pclose =0.765. As model fit indices are satisfying the threshold values, the model indicates good fit.

ATM Banking Experience (CR, AVE, and Alpha Value:

From the Table 13 it can be observed that, Composite Reliability (CR), Cranach’s Alpha values are above 0.7 and Average Variance Extracted (AVE) is >0.5. Hence, the measurement criteria of overall ATM banking experience scale have been satisfied Table 13.

| Table 13 Atm-Banking Experience Cr, Ave, And Alpha Value |

|||

|---|---|---|---|

| Factors | CR value | AVE | Alpha value |

| Technological Interface (TI) | 0.88 | 0.65 | 0.87 |

| Transactional Security (TS) | 0.88 | 0.65 | 0.88 |

| Convenience(CON) | 0.88 | 0.64 | 0.90 |

| Speed(SP) | 0.89 | 0.69 | 0.82 |

| Transactional Reliability (TR) | 0.88 | 0.64 | 0.87 |

| Servicescape (SS) | 0.80 | 0.57 | 0.89 |

| Social Environment (SE) | 0.77 | 0.53 | 0.72 |

Source: calculated by authors.

ATM Banking Experience Convergent Validity, Discriminant Validity & Correlation Matrix

The convergent and the discriminant validity of the variables is examined and the correlation among the variables is computed. A useful excel macro developed by James Gaskin available on Statwikiis used for this purpose (Gaskin, 2016). Table 8 provides the validity and reliability of the constructs Table 14.

| Table 14 Atm Banking Experience Convergent, Discriminant Validity And Correlation Matrix |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Factors | AVE | MSV | ASV | TI | TS | CON | SP | TR | SS | SE |

| TI | 0.65 | 0.04 | 0.02 | 0.81 | ||||||

| TS | 0.65 | 0.09 | 0.03 | 0.101 | 0.81 | |||||

| CON | 0.64 | 0.09 | 0.04 | 0.165 | 0.265 | 0.80 | ||||

| SP | 0.69 | 0.06 | 0.02 | 0.103 | 0.149 | 0.226 | 0.82 | |||

| TR | 0.64 | 0.09 | 0.03 | 0.154 | 0.254 | 0.141 | .104 | 0.80 | ||

| SS | 0.57 | 0.12 | 0.03 | 0.168 | 0.019 | 0.005 | .074 | 0.067 | 0.76 | |

| SE | 0.53 | 0.12 | 0.03 | 0.074 | -.0041 | -0.037 | -.026 | 0.123 | 0.284 | 0.73 |

Note:Average Variance Extracted (AVE), Maximum Shared Variance (MSV), Average Shared Variance (ASV), Technological Interface (TI), Transactional Security (TS), Convenience (CON), Speed (SP), Transactional Reliability (TR), Servicescape (SS), Social Environment (SE). *Bold values indicate square root of AVE Source: calculated by authors.

The perusal of Table 8 revealed the validity and reliability measures are calculated using the Stats Tools package of excel macro developed by Gaskin (available on Stat Wiki site maintained by the support of Doctor of Management Program at Case Western Reserve University and by Brigham Young University).

1. From Table 8, it can be observedthat MSV & ASV are less than AVE. This indicates that discriminant and convergent validity requirements are met.

2. Square of AVE is greater than correlation loadings of other constructs.

3. Therefore, the ‘Overall ATM Banking Experience’ scale has satisfied the criteria of convergent and discriminant validity.

As shown in the Table 15 value of CMIN/DF = 2.317; CFI = 0.918; GFI = 0.910; AGFI = 0.916; TLI = 0.910; IFI = 0.919; NFI = 0.904; RFI = 0.930; RMR = 0.0914; RMSEA = 0.045; Pclose = 0.756.As structural model fit indices are satisfying the threshold values, the model indicates good fit Table 15.

| Table 15 Model Fit Indices Of Structural Model |

|||

|---|---|---|---|

| Measure | Actual value | Threshold | Interpreted as |

| Cmin/df | 2.317 | <3.0 | |

| Comparative Fit Index | 0.918 | >0.95 | Good |

| Goodness of Fit Index | 0.910 | >0.9 | Good |

| Adjusted Goodness of Fit Index | 0.916 | >0.80 | Good |

| Incremental Fit Index | 0. 919 | >0.9 | Good |

| Root Mean Square Residual | 0.0914 | >0.09 | Good |

| Root Mean Square Error of Approximation | 0.045 | <0.05 | Good |

| Pclose | 0.756 | >0.05 | Good |

ATM Banking Experience Hypotheses Testing Results

The significance of relationships can be obtained from the AMOS output which provides the estimates as well as a significant value or p-value. Table 10 provides the regression weights as well as the significance levels, which are used to test the hypotheses regarding the relationship among variables provides the research hypotheses and the decision taken about the relationships Table 16.

| Table 16 Regression Weights And Relationship Between Construct |

|||

|---|---|---|---|

| Relation | Estimate | R2 | P -value |

| TI→ATM | 0.351 | 0.123 | *** |

| TS→ATM | 0.490 | 0.240 | *** |

| CON→ATM | 0.542 | 0.294 | *** |

| SP→ATM | 0.376 | 0.142 | *** |

| TR→ATM | 0.402 | 0.162 | *** |

| SS→ATM | 0.172 | 0.029 | 0.034 |

| SE→ATM | 0.104 | 0.011 | 0.178 |

Source: calculated by authors.

***Indicates p-value less than 0.001.

The perusal of indicated that convenience of the ATMs as perceived by the customers is statistically significant and has an effect on overall ATM banking experience with standardized coefficient value 0.542. The convenience of the ATM banking as perceived by the customer goes up one-unit standard deviation as overall ATM-banking experience goes up by 0.542.The results indicate thatservice compatibility of the ATMs as perceived by the customer is the statistically significant effect on overall ATM banking experience with standardized coefficient value 0.172. The services cape compatibility of the ATM banking as perceived by the customer goes up one-unit standard deviation as overall ATM-banking experience goes up by 0.172.

The results indicated that ease of usage of a technological interface of the ATMs as perceived by the customer is the statistically significant effect on overall ATM banking experience with standardized coefficient value 0.351. Ease of use of the technological interface of the ATM banking as perceived by the customer goes up one-unit standard deviation as overall ATM banking experience goes up by 0.351.The transactional security of the ATMs as perceived by the customer is the statistically significant effect on overall ATM

banking experience with standardized coefficient value 0.490. The transactional security of the ATM banking as perceived by the customer goes up one-unit standard deviation as overall ATM banking experience goes up by 0.490.The transactional reliability of the ATMs as perceived by the customer is the statistically significant effect on overall ATM banking experience with standardized coefficient value 0.402. The transactional reliability of the ATM banking as perceived by the customer goes up one-unit standard deviation as overall ATM banking experience goes up by 0.402.The transaction speed of the ATMs as perceived by the customer is the statistically significant effect on overall ATM banking experience with standardized coefficient value 0.376. The transaction speed of the ATM banking as perceived by the customer goes up one-unit standard deviation as overall ATM banking experience goes up by 0.376.The social environment in the ATMs as perceived by the customer is statistically insignificant.

Theoretical Contribution

The study has identified and validated the factors influencing the overall customer experience with respects to banking SSTs (i.e. ATM banking experience).

Implications of the Study for Banking Industry

The study provides insights for bank managers to address the key factors contributing to the delivery of superior customer experience in the current competitive scenario. This study highlights the importance of customer experience in the context of banking SSTs which might be very helpful for the managers at the time of resource allocation.

Conclusion

The findings lend support to hypothesis that all the considerable factors i.e. Convenience, Servicescape, Technology Interface, Transactional Security, Transactional Reliability, Speed were found supportive and significant, except social environment contribution to overall customer experience in the usage of ATM banking. Social environment is not influenced by other social actors (peers, friends, family, and successful and high-status person). Social environment construct not significant effect on ATM banking experience. Positive customer experiences have the potential to take part in an imperative role in the creation of competitive advantage to the firms.

In turn, it would create sustainable growth of the organization. It likewise brings about the type of fulfilled and faithful clients who could generate positive word of mouth in addition to developed retention and diminished complaints. The factors identified in the study contribute to the successful design of SSTs in banking and help in the delivery of superior customer experience, which in turn could lead to advantage for the banking firms.

Suggestions for Further Research

The sample of the study was from four select cities, i.e., Hyderabad, Mumbai, Delhi, and Kolkata. Therefore, the future studies can focus on semi-urban and rural areas, to draw key inferences in the Indian context. A similar study may be conducted on a longitudinal basis, to verify the consistency of the results in the country of retail banking SSTs. Future studies may consider the comparison of experiential quality among private, public and foreign banking SSTs. This study is carried on retail banking self-service technologies in India. The retailing and travel industries are also introducing self-service technologies for competitive advantage. Therefore, it is recommended that further study is undertaken to study the experiential quality of the retail and travel industry self-service technologies (SSTs).

References

Arnold, M., Reynolds, K., Ponder, N., & Lueg, J. (2005). Customer delight in a retail context: investigating delightful and terrible shopping experiences.Journal of Business Research,58(8), 1132-1145.

Indexed at, Google Scholar, Cross Ref

Arunachalam, V. (2005). Technology and Economic Growth: Quo Vadis, India?.Vikalpa: The Journal For Decision Makers,30(1), 1-6.

Indexed at, Google Scholar, Cross Ref

Bagozzi, R., & Yi, Y. (1988).On the evaluation of structural equation models.Journal of the Academy Of Marketing Science,16(1), 74-94.

Indexed at, Google Scholar, Cross Ref

Barras, R. (1990). Interactive innovation in financial and business services: the vanguard of the service revolution.Research policy,19(3), 215-237.

Indexed at, Google Scholar, Cross Ref

Bitner, M., Brown, S., & Meuter, M. (2000). Technology Infusion in Service Encounters.Journal of The Academy Of Marketing Science,28(1), 138-149.

Bitner, M., Ostrom, A., &Meuter, M. (2002).Implementing successful self-service technologies.Academy of Management Perspectives,16(4), 96-108.

Indexed at, Google Scholar, Cross Ref

Chen, M. F. (2007). Consumer attitudes and purchase intentions in relation to organic foods in Taiwan: Moderating effects of food-related personality traits. Food Quality and preference, 18(7), 1008-1021.

Constantinides, E. (2004), “Influencing the online consumer’s behavior: the web experience”, Internet Research, 14(2), 111-126.

Erumban, A. A., & Das, D. K. (2016).Information and communication technology and economic growth in India. Telecommunications Policy, 40(5), 412-431.

Flanagan, P., Johnston, R. and Talbot, D. (2005), “Customer confidence: the development of a ‘pre-experience’ concept”, International Journal of Service Industry Management, 16(4), 373-384.

Garg, R., Rahman, Z., & Qureshi, M. (2014). Measuring customer experience in banks: scale development and validation.Journal of Modelling In Management,9(1), 87-117.

Gaskin, J. (2016).Confirmatory factor analysis.Gaskination'sStatWiki. Retrieved November, 15, 2016.

Grove, S.J. and Fisk, R.P. (1997). The impact of other customers on service experiences: a critical incident examination of ‘getting along. Journal of Retailing, 7(1), 63-85.

Jain, R., &Bagdare, S. (2009). Determinants of customer experience in new format retail stores. Journal of Marketing & Communication, 5(2), 34-44.

Kaushik, A., & Rahman, Z. (2015). Innovation adoption across self-service banking technologies in India.International Journal of Bank Marketing,33(2), 96-121.

Indexed at, Google Scholar, Cross Ref

Knutson, B.J., Beck, J.A., Kim, S.H. and Cha, J. (2007), “Identifying the dimensions of the experience construct”, Journal of Hospitality Marketing & Management, 15(3), 31-47.

Lemon, K., &Verhoef, P. (2016). Understanding Customer Experience Throughout the Customer Journey.Journal of Marketing,80(6), 69-96.

Indexed at, Google Scholar, Cross Ref

Mahfouz, A.Y., Philaretou, A.G. and Theocharous, A. (2008), “Virtual social interactions: evolutionary, social psychological and technological perspectives”, Computers in Human Behavior, 2(6), 3014-3026.

Meuter, M., Ostrom, A., Bitner, M., & Roundtree, R. (2003).The influence of technology anxiety on consumer use and experiences with self-service technologies.Journal Of Business Research,56(11), 899-906.

Indexed at, Google Scholar, Cross Ref

Odawa, C.A. (2016). Technology Enabled Banking Self Services And Performance Of Commercial Banks Listed In The Nairobi Securities Exchange (Doctoral dissertation, University of Nairobi).

Prashar, A., &Mishra, B. (2020). Customers Readiness for a Paradigm shift towards Cyberspace: an exploratory Investigation in Indian Retail Banking. International Journal Of Financial Innovation In Banking, 1(1), 1.

Roy, S. (2018). Financial Sector Reforms in India and The Role of RBI. ZENITH International Journal of Business Economics & Management Research, 8(5), 53-63.

Sarel, D., & Marmorstein, H. (1998).Managing the delayed service encounter: the role of employee action and customer prior experience.Journal Of Services Marketing,12(3), 195-208.

Indexed at, Google Scholar, Cross Ref

Shamdasani, P., Mukherjee, A., &Malhotra, N. (2008).Antecedents and consequences of service quality in consumer evaluation of self-service internet technologies.The Service Industries Journal,28(1), 117-138.

Srivastava, M., & Fernandes, S. (2022). An empirical study to measure consumer adoption of mobile banking services. International Journal of Public Sector Performance Management, 9(1-2), 165-189.

Sun, L. (2002). The experiential dimensions of internet shopping: An ethnographic analysis of online store websites.Asian Journal Of Communication,12(2), 79-99.

Indexed at, Google Scholar, Cross Ref

Tewari, S.K. (2022). Information technology: a tool to drive customer experience. Academy of Marketing Studies Journal, 26, 1-14.

Thai Hoang, D., Igel, B., & Laosirihongthong, T. (2006).The impact of total quality management on innovation.International Journal of Quality & Reliability Management,23(9), 1092-1117.

Indexed at, Google Scholar, Cross Ref

Verhoef, P., Lemon, K., Parasuraman, A., Roggeveen, A., Tsiros, M., & Schlesinger, L. (2009). Customer Experience Creation: Determinants, Dynamics and Management Strategies.Journal of Retailing,85(1), 31-41.

Indexed at, Google Scholar, Cross Ref

Received: 15-Dec-2022, Manuscript No. AMSJ-22-13017; Editor assigned: 16-Dec-2022, PreQC No. AMSJ-22-13017(PQ); Reviewed: 17-Jan-2023, QC No. AMSJ-22-13017; Revised: 11-Feb-2023, Manuscript No. AMSJ-22-13017(R); Published: 10-Mar-2023