Research Article: 2021 Vol: 25 Issue: 1

Customer Experiences and a Conceptual Model Proposed for Retail Banking Experiences in Bank Settings of Mauritius

Sharmila Pudaruth, University of Mauritius

Abstract

Further to the wide discussion in the literature towards the significance of customer experience and its contribution in the banking landscape, this paper aims to explore customer experience by providing a broad, holistic and integrative approach to understand customer experience management in banking contexts. From the constructive literature review, an integrative conceptual model has been developed based upon existing set of constructs, which were already established in the marketing, customer experience and services management literature. This paper will contribute to the contemporary body of empirical and conceptual knowledge by providing updates to the existing work of other researchers and scholars and thus, adding new contributions in the body of literature in the field of customer experience management for context specific experience driven organizations such as retail banks. Hence, the research on customer experiences will give a new impetus to the findings of previous studies on customer experience management whereby an integrative framework of customer experience management for enhancing service excellence will be proposed for the banking landscape of Mauritius. Yet, it is important to note that the overwhelming body of literature on customer experience has not been able to posit a holistic picture of customer experience management for banking contexts in developing economies.

Keywords

Customer Experience Management, Service Excellence, Bank Settings, Conceptual Model, Mauritius.

Paper Type

Research paper.

Introduction

The concept of customer experience has received intense and great interest among academics during the previous decades with voluminous studies in several fields (Pine & Gilmore, 1998; Gentille et al., 2007; Kim et al., 2011). It is well articulated in the extant literature that customer experience is a critical measure for organizational performance and it is considered as the next battleground for companies and in turn, it would be very difficult for companies to survive without delivering compelling customer experiences (Pine & Gilmore, 1998; Berry et al., 2002; Gentille et al., 2007; Meyer & Schwager, 2007). In their study, Maklan & Klaus (2011) have argued that there is an accelerating interest in the arena of customer experience since contemporary customers are more willing to seek memorable, robust, compelling and engaging experiences as highlighted by Gilmore & Pine (2002), hence, urging research in the discipline of customer experience. Although there is a profusion of literature on the concept of customer experience management, the concept is still under researched for the banking landscape.

The application of customer experience management is still in its infancy for context specific sectors such as banks and this study will attempt to fulfill the knowledge gap as there are disparate studies in leisure, hospitality and recreation contexts on customer experience management. Furthermore, the existing literature has speculated that brand experience can influence customers’ long-term memories to brands (Schmitt, 2003; Kotler, 2005). Yet, there still exists a gap in the extant literature on how brand experience can contribute towards compelling customer experiences for the banking sector. In a recent study conducted by Garg et al. (2014), it has been posited that employees were the ones who directly influenced customer experiences. It has also been depicted that research on the role of servicescape to create customer experiences is still underdeveloped (Cronin, 2003; Walter et al., 2010; Fernades & Neves, 2014). Prior studies on trust have revolved around exploring the influence of trust on relationship marketing, internet banking, mobile banking (Suh et al., 2003; Suh & Han, 2003; Lin, 2011), commitment (Morgan & Hunt, 1994) and overall trust (Bigley and Pearce, 1998; Mayer et al., 1995, Sirdeshmukh et al., 2002). Moreover, it has been highlighted that the presence of other customers have started to gain exceptional importance for service providers in the experience-oriented service industry (Grove & Fisk, 1997; Albrecht, 2016; Ponsignon et al., 2015; Brocato et al., 2012).

The growing body of literature also suggested that customers are considered as active value creators during customer decision-making processes. Yet, the paucity of empirical and conceptual research on the impact of customer value co-creation behavior upon customer experience advocates for further research opportunities. This is where the study attempts to make additional contributions since there is no study that has simultaneously modeled all the above constructs into one single integrative theoretical model and assessed the impact of these constructs on customer experience management for banks. Therefore, the lack of an integrative model to assess customer experience management for banking contexts in Mauritius will pave the way forward to develop and test a more robust and integrative model of customer experience management. Furthermore, there is no conceptual study that has investigated the link among customer experience management and service excellence so far in banking contexts. This gap and omission in the customer experience literature also presses an urge for further research on these important concepts pertaining to customer experience management and service excellence. However, previous research is still unable to convincingly explain the contribution of customer experience management towards service excellence for banking customers.

Objectives of the Study

Therefore, the aim of this paper is to develop an integrative model of customer experience management for enhancing service excellence in the retail banking sector of Mauritius. The research will also accomplish the following specific objectives:

1. To develop an integrative model of understanding customer experience management in the banking landscape of Mauritius.

In light of the above, the paper will address the following research questions:

1 What are the different dimensions of customer experiences for the banking landscape?

2 What is the association between customer experience dimensions and service excellence in banks?

Literature Review and Proposed Conceptual Framework

The notion of experience has entered the field of consumption and marketing through the pioneering article of Holbrook & Hirchman’s (1982). Many business entreprises have adopted customer experience in order to achieve sustainable competitive advantage (Shaw & Ivens, 2005) and as posited by Pine & Gilmore (1998), researchers have affirmed customer experience as the forthcoming competitive battleground for companies. Yet, many studies have asserted that there is lack of research on customer experiences (Hill et al., 2002; Roth & Menor, 2003; Stuart & Tax, 2004; Patrício et al., 2008; Verhoef et al., 2009; Teixeira et al., 2012). Unfortunately, no academic research has developed an integrative model to facilitate the application of customer experience management and techniques in Mauritius. This gap in academic knowledge is substantial, as policy makers and banking executives have no proper guideline to evaluate, measure and assess the experience of customers from a holistic perspective. In fact, there has been a tendency to make various assumptions on customer experience and associating customer experience management to mere customer satisfaction and equally, the contribution of customer experience management for enhancing service excellence has received less attention in the field of marketing.

Moreover, Winer (2001) further stresses the importance of CEM, proposing that the frequency of customer interactions is high in retail banking business, thus, it is crucial to adopt experience management strategies in the banking landscape. Several researchers have also posited the growing importance of managing customer experiences for service organisations (Schmitt, 1999; Badgett et al., 2007; Gentile et al., 2007; Ismael et al., 2011; Garg et al., 2014). In a similar vein, it has been stressed in several studies that business executives who are accountable for customer experience should demarcate a bank as an experience seller compared to the bank being perceived as a provider of contents and environments, enabling the preferred customer experiences to emerge. In this respect, instead of adopting sophisticated technological push solutions and market-driven innovative strategies, banking institutions that emphasise on customer experience are more probable to gain positive and constructive market responses (Schmitt, 1999; Caru & Cova, 2007; Gentile et al., 2007).

Despite the plethora of studies on customer experience management and service excellence in the marketing literature (Garg et al., 2014, Gentille et al., 2007, Pine & Gilmore, 1998), there is no single study that has explored the contribution of customer experience management on service excellence. It has been highlighted that customer experience concept has been fragmented because of diverse views on customer experience (Holbrook, 2006). In a similar vein, previous research is still unable to convincingly posit a holistic picture of the customer experience concept (Gentille et al., 2007 Grace & Cass, 2004; Verhoef et al., 2009; Palmer, 2010; Ismail et al., 2011). Moroever, the services marketing and customer experience literature to date has not clearly identified a theoretical framework of the constructs contributing towards customer experience (Gentille et al., 2007 Grace & Cass, 2004; Verhoef et al., 2009; Palmer, 2010; Ismail et al., 2011). In a prior doctoral study, Ismail (2010) has investigated the impact of customer experiences for improving brand loyalty in services contexts in the hotel sector of Egypt through mixed method approaches comprising of netnography and SEM. His research has provided a research model that has been proved to be a useful theoretical model for predicting customer experience for the tourism sector. Another interesting piece of research has been conducted by Garg et al. (2014) who have reported on the importance of customer experience management for improving customer satisfaction in the banking contexts of India. Klaus & Maklan (2012) have deepened their research work to understand customer experiences in mortgage societies of developed economies. Yet, this present research serves as one of the pioneer studies that will address the banking experiences of customers in emerging economies such as Mauritius. However, among its constructs, brand experience, employee behavior and servicescape have been widely recognized as contributing towards customer experience. Yet, there is limited study demonstrating the impact of trust, presence of other customers and customer value co creation behavior towards customer experience management in the banking landscape as the present body of literature highly warrant specific context specific studies to assess the impact of these antecedents on marketing outcomes of companies.

Numerous studies have depicted that brand experience can influence the long-term customer memories connected with brands, that, in turn, can offer strategic benefits in the market place in order to compete with the rivals firms in terms of differentiated products and services (Sivarajah, 2014; Chattopadhyay & Laborie, 2005; Schmitt, 2003; Shaw & Ivens, 2002; Smith & Wheeler, 2002; Kotler, 2005). However, it has been found that there is limited study that has explored the impact of brand experience dimensions towards experiences of customers in banking contexts. It has been argued that there is an academic urge to expand upon the domain of brand experience (Brakus et al. 2009), which warrants a review to ensure that brand experience studies move in the right direction. Although the investigation in the arena of brand experience research was commendable and has gained attention among researchers as highlighted by Brakus et al. (2009), the direction in which brand experience research is now moving is still confusing and a comprehensive study demonstrating an insightful understanding of brand experience towards customer experience management concept is almost inexistent in the present academic literature.

H1: Brand experience has a positive effect on customer experience in banks.

The overwhelming body of literature has argued that banking personnel exert a crucial role to deliver high quality services and create satisfied customers in the fierce banking environment (Yavas et al., 2003; LeBlanc & Nguyen, 1988; Lewis & Gabrielsen, 1998). In their studies, Grewal et al. (2009) & Klaus & Maklan, (2012) have stated that the creation of superior customer experience is viewed as imperative to attain customer satisfaction and loyalty. A key concern for banks is to ensure that employees possess the right competencies and expertise to deal with customers. Similarly, existing literature based upon retailing, hospitality, banking services context have highlighted the high degree of contact among service providers and customers, which in turn, influences customer experiences (Aarikka-Stenroos & Jaakkola, 2012; Grönroos, 2008; Meyer & Schwager, 2007; Verhoef et al., 2009). Hence, the importance of employee behavior to create superb customer experiences has galvanized scholarly attention whereby employees have a crucial role to exert in the experience settings of retail banks. It is important to gauge how employee behaviou can enable to foster enduring experiences with banking customers.

H2: Employee behaviour has a significant impact on customer experience during service consumption in banks.

Of particular interest in the study is to explore the impact of servicescape on customer experiences. Prior studies on services cape have been limited to customer satisfaction aspects and services cape has been neglected in several business contexts for many years. Indeed, the pioneer works of Booms & Bitner (1981) and Bitner (1992) have posited that the responses of the customers are affected by the three key dimensions of servicescape comprising of artifact and symbols, ambient elements, space, function and related signs. However, it has also been found that research on servicescape and its impact for creating and managing customers experiences is still lacking and the linkage between servicescape and customer experience has not been well documented in the existing literature (Cronin, 2003; Harris & Ezeh, 2008; Esbjerg et al., 2012; Goi & Kalidas, 2015; Walter et al., 2010; Fernades & Neves, 2014). Several studies have highlighted servicescapes as stimuli to provide cues in order to create, influence and enable customer experiences (Pine & Gilmore, 1998; Sandsstrom et al., 2008) and in turn, earlier studies have found that servicescape impacts significantly on the future purchasing and consumption behavior (Berry et al., 2006; Carbone & Haekel, 1994; Pareigis et al., 2012).

H3: Servicescape has a significant effect on customer experience during service consumption in banks.

In their study, Kim et al. (2009) have outlined trust as a complex multifaceted construct which is fundamental to build and maintain service relationships as depicted in several existing research works (Garbarino and Johnson, 1999; Singh and Sirdeshmukh, 2000; Gounaris, 2005; Greenwood and Buren 2010). As proposed by Ennew and Sekhon (2007), consumer trust in an organization may be cognitive, affective and consumer trust is also related to individual characteristics, which means that consumers may have different dispositions to trust. Prior research works have also affirmed that a positive relationship exists between trust and commitment as stated by Morgan and Hunt (1994) and despite numerous research studies have already recognized the impact of the dimensions of trust towards the overall trust (Bigley and Pearce, 1998; Mayer et al., 1995; Sirdeshmukh et al., 2002), there is limited understanding on the impact of trust dimensions on customer experiences with only a few studies positing a relationship between trust and customer experience by Kim et al. (2011) and Constantinides et al. (2010) where the researchers have already made an initial attempt to study the impact of trust on customer experience both in offline and online settings.

H4: Trust impacts significantly on customer experience during service consumption in banks.

Numerous studies have highlighted that the presence of other customers can also influence customer experiences in several sectors such as retailing, fitness and banking (Verhoef et al., 2009; Brocato et al., 2012; Garg et al., 2014). The existing literature has shown that customers are not only influenced by physical surroundings, but they are influenced by their social surroundings that is, other customers who are simultaneously present in the service environment (Grove & Fisk, 1997; Harris et al., 2010, 2011) and they affect the customer’s service experience (Brocato et al., 2012). For these reasons, it is imperative to explore how the presence of other customers can influence customer experiences in bank settings since social impact theory suggested that the simple presence of a group of persons or any individual person can influence people in different settings (Latané, 1981).

H5: Presence of Other Customers impacts significantly on customer experience during service consumption in banks.

Several studies have highlighted that customers are regarded as active value creators rather than passive responders during customer decision-making processes (Vargo & Lusch, 2004; Xie et al., 2008; Yi et al., 2011). Indeed, customer value co-creation behavior in terms of customer participation behavior and citizenship behavior has asserted customers as active responders (Bove et al., 2008; Groth, 2005; Yi & Gong, 2008 & Yi et al., 2011). Although many research works have considered the active role of customers as value creators, research on customer value co-creation behaviour as another important construct for managing customer experiences has been virtually silent in the existing body of literature. Hence, there is a pressing need to address the knowledge gap exploring the impact of customer value co-creation behavior on overall experiences among banking customers.

H6: Customer value co-creation behavior impacts significantly on customer experience during service consumption in banks.

Johnston (2004, 2007) have challenged the notion that organisations should depend uniquely upon the delivery of unanticipated, amazing experiences and service excellence has also become a critical success factor for business organisations. Several authors have depicted that service excellence in terms of providing excellent service quality through effective management systems, exceeding previous expectations of customers results in customer delight, thereby leading to superior customer loyalty (Dobni, 2002; Edvardsson & Enquist, 2011; Khan & Matlay, 2009; Turnois, 2004; Dubrovski, 2001). An imperative element for achieving customer delight and customer patronage behavior, mostly for competitive services where the customer-service provider interface is very high, encompasses the delivery of memorable, unique, personalised customer experiences and customer’s commitment with brands (Stuart & Tax, 2004; Berry & Carbone, 2007).

H7: Customer experience impacts significantly on service excellence in banks.

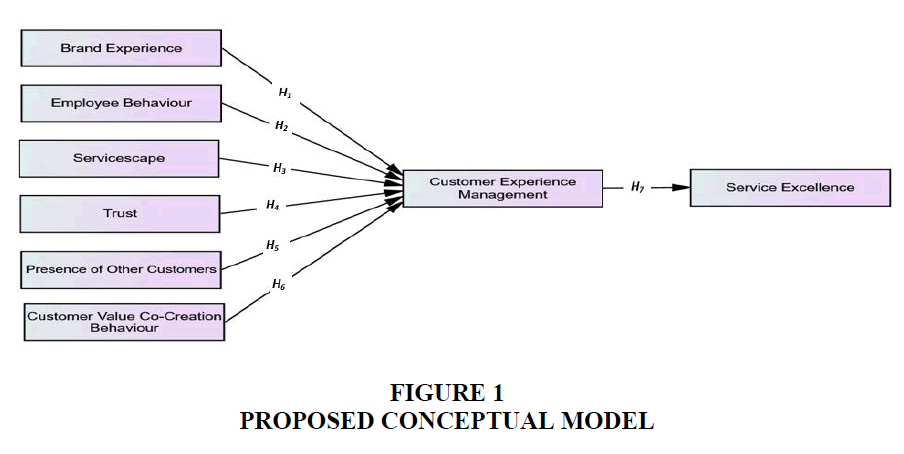

The following research model has been developed and adapted from the present literature as illustrated in Figure 1 below. The proposed conceptual model denotes that the customer experience constructs such as brand experience, employee behaviour, servicescape, trust, presence of other customers, and customer value co-creation behaviour will have an influence on brand loyalty and service excellence. The conceptual model has emerged from the seven research hypotheses that the study is aiming to answer and the above seven hypotheses will be tested empirically in future research works.

Methodology and Proposed Conceptual Model

Secondary data set has been adopted to provide the main data set for the research, compared with literature in several contexts and also the secondary data has enabled to posit critical and argumentative highlights of the main literature in customer experience management and service excellence. Similarly, the use of the secondary data has enabled to highlight the present research gaps of the study and develop the integrative model of customer experience management. Academic Journals were considered as important since these journals have posited information specific on customer experience management phenomenon and service excellence, whilst the textbooks have been very useful in exploring the related theories for this study and guiding for the research methodology and design that have been adopted in this paper.

The main journals used for this present research are listed Journal of Business Research, Journal of Service Management, European Management Journal, International Journal of Bank Marketing, Journal of Business and Management, The Journal of Consumer Marketing, International Journal of Service Industry Management, Journal of Modelling in Management, International Journal of Marketing Research, Journal of Services Marketing, Journal of Brand Management, Journal of Retailing, Journal of Marketing, European Journal of Marketing and Journal of Financial Services Marketing.

Discussion

The main implications of this research can be summarized into several broad categories: theoretical development and understanding of customer experience management, practical contribution towards customer experience management for banking contexts, accelerating adoption of digital platforms in post COVID19 and future experiential strategies for business segments.

The arena of customer experience management and the accelerating interest on customer experience management is of great significance for companies. The significance of this study is portrayed both by theoretical and empirical reasons. From a theoretical perspective, this study will add a new way to understand customer experience management in the existing stream of literature highlighting the different context specific independent dimensions of customer experiences for bank settings.

The present study will also emphasise on the use of Exploratory Factor Analysis (EFA) for scale refinement and purification and Covariance Based - Structural Equation Modelling (CB-SEM) to provide an assessment of causal relationships among customer experience management and service excellence for the forthcoming phases of the study. EFA will be used for purification of the scales items that will be included in the survey instrument in the second phase of the study. CB-SEM will be used in the third phase of the study to examine the contribution of customer experience management on service excellence in banking contexts and thereby, develop the hierarchical model of customer experience management.

The theoretical findings of this study will contribute to the contemporary body of empirical and conceptual knowledge by providing updates to the existing work of other researchers and scholars and thus, adding new contributions. Specifically, this study extends the research undertaken by Maklan and Klaus (2011), Ismail (2010) and Garg et al. (2014) which has assessed the phenomenon of customer experience. Klaus and Maklan (2011) have discussed the importance of customer experience quality in an interesting way by adopting four orientations. Pine and Gilmore (2002) made a helpful initiative to understand customer experience in theme parks. However, their work was limited to suggesting some types of experience realms without developing any type of conceptual or measurement models. Similarly, the article of Garg et al. (2014) was a good introduction to understand customer experience. Garg et al. (2014) have discussed the importance of customer experience in an interesting way by synthesizing the existing literature in a precise and concise manner. Again in their article, they have made an excellent attempt to test a model on customer experience. Nevertheless, the work of Garg et al. (2014) was limited only to customer experience phenomenon and the link among customer experience and service excellence has not been explored.

This study has been undertaken as from 2014 and it has been found that the banking sector has faced many challenges in the 21st Century. All the changes have urged the banks to review their present customer centric strategies and to focus on compelling and memorable experiences for their customers. This study will be of benefit to banking managers since it will enable them to highlight the significant dimensions of customer experience that customer value. The banks will be able to orchestrate those dimensions that would lead to superior customer experiences for banking customers.

The lack of published empirical and conceptual research in the discipline of customer experience management for a developing economy such as Mauritius is limited. Voluminous studies on customer experience management, service excellence and customer satisfaction have been centered for developed and developing economies such as UK in banking and mortgage contexts, Indian banking contexts and hotel contexts of Egypt (Maklan & Klaus, 2011, Al-Eisawi, 2013; Garg et al., 2014; Ismail et al., 2010) and not for a developing country such as Mauritius. In this respect, the research on customer experience management to enhance service excellence in banking contexts for a developing country such as Mauritius is crucial because Mauritius is an emerging economy.

The proposed integrative model will be designed to serve as a practical tool to assess customer experience in banking landscape and can be extended to other sectors within the financial services sector. The model could be useful to marketing departments, customer relationship areas, quality and assurance areas and senior banking managers to assess, measure and monitor the experiences of customers. The model could also be a useful tool for banking managers and executives to analyse the opportunities to provide better customer experiences in banking contexts.

It is also important to note that there are accelerating changes in the banking landscape of emerging economies in terms of technological advancement and the adoption of digital platforms to serve customers in the current pandemic era. It has been found that banks are being equipped by self-service technologies around the globe and customers are also using digital platforms such as internet banking and mobile banking to communicate with their banking institutions. However, despite the proliferation of digital platforms and accelerating advancement of electronic and mobile banking services, it has been found that banks has to operate in their conventional approaches during the pandemic situations. Despite the alarming situation of COVID-19, customers were visiting the banks for their banking requirements as banking services represent one of high involvement services for banking customers. In this respect, COVID-19 also provides a firm glimpse that banking institutions have to cater for exceptional banking experiences in any circumstances. Experiences with banks have been highly valued during pre-covid and covid situations and even during post-covid, banking experiences serve as a differentiating attribute for banks. There are several challenges for banks to nurture the experiences of customers in the banking contexts of Mauritius as despite the acceleration of digital platforms and electronic services together with the challenges of post COVID-19, customers are visiting the bank branches across the nine districts of Mauritius for their banking requirements and services.

In particular, this paper addresses the banking experiences of customers from the perspective of retail banking customers. The present study is focusing mainly on customer experiences in the retailing contexts. In this respect, scholars and practitioners could further enlarge the scope of the present study and investigate experiences of customers for business to business segments. For instance, banking service providers can also uncover the experiential requirements of small and medium enterprises that are facing numerous challenges in post COVID-19 such as economic recession and liquidity. The banking sector of Mauritius should gather fresh insights on small and medium entities and extend their corporate social responsibility roles to support the small and medium enterprises for agricultural micro-financing, thereby, providing rigorous agro-environmental secondary education to better internalize the local services of small and medium entreprises to strengthen the national trading of local products and also capture the nearby markets in order to cope with the current economic recession and liquidity. In the light of the above, it can be further affirmed that banking institutions have to unveil the experiential requirements of small and medium entreprises by collecting qualitative insights. Hence, these experiential driven strategies of banking institutions towards small and medium entreprises are further aligned with the strategies of high-level policy makers and the governmental in general to enhance the competitiveness of small and medim enterprises in todays’ uncetain post COVID19 era.

Conclusions and Future Research Directions

This paper has made a preliminary exploration to develop an integrative framework to assess the contribution of customer experience management for enhancing service excellence in bank settings of Mauritius. This research will have implications for the banking sector since it is anticipated that services providers are interested in customer experience management as the next battleground for organizations to improve service excellence. A conceptual model to explore the contribution of customer experience management to enhance service excellence has originated from specific constructs that are conceptually rooted in several disciplines. Further research with a positivist research paradigm, using a deductive will be applied along with a mono-survey strategy which is purely quantitative in nature for further scale refinement of the survey instrument during the first phase of the ongoing research with a sample of banking customers. EFA will be used for the purification process of the respective constructs.

Covariance Based Structural Equation Modeling (CB-SEM) will be used to test the refined integrative conceptual model with another sample of banking customers. As highlighted by Bryne (2001) and Kline (2005), CB-SEM is best suited for confirmatory modeling where it is adopted to evaluate substantive theory with empirical data through a hypothesized model (Chou and Bentler, 1995). SEM is a technique that enables a set of relationships between independent variables and dependent variables. According to Hair et al. (2012), CB-SEM provides the most suitable and most effective calculation method for a sequence of distinct multiple regression equations assessed concurrently and it is established by two mechanisms, namely the testing of a measurement model and the testing of a structural model, whereby overall model fit is estimated in both cases to confirm the appropriateness of a theoretical model compared to the estimated model (Tabachnick and Fidell, 2007). This study is one of the visionary studies that will enable to posit greater predictive power of an integrative model of customer experience management with the exogenous and endogenous constructs o for the competitive banking arena of Mauritius. This paper also provides a new turnaround to explore the experiential strategies that can be geared towards small and medium entreprises through qualitative insights, prior to proposing, testing and validating a conceptual model for enhancing the experiences of customers in the business segments of banking landscape in Mauritius for different categories of business customers, that will enable to have a more comprehensive and coherent picture of the experiential strategies of banking institutions that are striving to be positioned as a provider of memorable banking experiences rather than a mere provider of banking services for the upcoming experiential banking frontiers of 2020-2030 for emerging economies such as Mauritius, Rodrigues and Seychelles.

Acknowledgement

I wish to acknowledge the support of my PhD supervisors, Associate Prof Thanika Devi Juwaheer and Associate Prof Robin Nunkoo for all their guidance during my PhD journey.

References

- Aarikka-Stenroos, L., & Jaakkola, E., (2012). Value co-creation in knowledge intensive business services: A dyadic perspective on the joint problem-solving process. Industrial Marketing Management, 41(1), 15-26.

- Albrecht, K. (2016). Understanding the Effects of the Presence of Others in the Service Environment – A Literature Review. Journal of Business Market Management, 9(1), 541-563.

- Al-Eisawi, D.D. (2013). Modelling service excellence: the case of the UK banking sector. Unpublished PhD Thesis. Coventry: Coventry University.

- Badgett, M., Moyce, M.S., & Kleinberger, H. (2007). Turning shoppers into advocates. IBM Institute for Business Value.

- Barsky, J., & Nash, L. (2002). Evoking emotion: Affective keys to hotel loyalty. Cornell Hotel and Restaurant Administration Quarterly, 43, 39.

- Berry, L.L., & Carbone, L.P. (2007). Build loyalty through experience management, Quality Progress, 40(9), 26-32.

- Berry, L.L., Carbone, L.P., & Haeckel, S.H. (2002). Managing the total customer experience. MIT Sloan Management Review, 43(3), 85-89.

- Berry, L.L., Wall, E.A., & Carbone, L.P. (2006). Service clues and customer assessment of the service experience: lessons from marketing. Academy of Management Perspectives, 20(2), 43-57.

- Bigley, G.A., & Pearce, J.L. (1998). Straining for shared meaning in organizational science: Problems of trust and distrust. Academy of Management Review, 23, 405-421.

- Bitner, M.J. (1992). Servicescapes: The impact of physical surroundings on customers and employees. The Journal of Marketing, 57-71.

- BOOMS, B.H., & BITNER, M.J. (1981). Marketing strategies and organization structures for service firms. In: Donnelly, J.H., George, W.R. (Eds.), Marketing of Services. American Marketing Association, Chicago, IL, 47-51.

- BOVE, L.L., PERVAN, S.J., BEATTY, S.E., & SHIU, E. (2008). Service worker role in encouraging customer organizational citizenship behaviours. Journal of Business Research, 62, 698-705.

- BRAKUS, J.J., SCHMITT, B.H., & ZARANTONELLO, L. (2009). Brand experience: What is it? How is it measured? Does it affect loyalty? Journal of Marketing, 73(5), 52-68.

- BROCATO, E.D., VOORHEES, C.M., & BAKER, J. (2012). Understanding the Influence of Cues from Other Customers in the Service Experience: A Scale Development and Validation. Journal of Retailing, 88(3), 384-398.

- CARBONE, L.P., & HAECKEL, S.H. (1994). Engineering customer experience. Marketing Management, 3, 8-19.

- CARU, A., & COVA, B. (2007). Consuming experience. Oxon: Routledge

- CHATTOPADHYAY, A., & LABORIE, J.L. (2005). Managing Brand Experience: the Market Contact Audit, Journal of Advertising Research, 45(1), 9-16.

- Constantinides, E., Lorenzo-Romero, C., & Gómez, M.A. (2010). Effects of web experience on consumer choice: A multicultural approach. Internet Research, 20(2), 188-209.

- CRONIN, J.J. (2003). Looking back to see forward in services marketing: some ideas to consider, Managing Service Quality, 13(5), 332-7.

- DOBNI, B. (2002). A model for implementing service excellence in the financial services industry. Journal of Financial Services Marketing, 7, 42-53.

- DUBROVSKI, D. (2001). The role of customer satisfaction in achieving business excellence, Total Quality Management, 12(7-8), 920-925.

- EDVARDSSON, B., & ENQUIST, B. (2011). The service excellence and innovation model: Lessons from IKEA and other service frontiers. Management and Business Excellence, 22(5), 535-551.

- ENNEW, C., & SEKHON H. (2007). Measuring Trust in Financial Services: The Trust Index, Consumer Policy Review, 17(2), 62-68.

- ESBJERG, L., JENSEN, B.B., BECH-LARSEN, T., DUTRA DE BARCELLOS, M., BOZTUG, Y., & GRUNERT, K.G. (2012). An integrative conceptual framework for analyzing customer satisfaction with shopping trip experiences in grocery retailing, Journal of Retailing and Consumer Services, 19(4), 445-456.

- FERNANDES, T., & NEVES, S. (2014). The role of servicescape as a driver of customer value in experience-centric service organizations: the Dragon Football Stadium case. Journal of Strategic Marketing, 22(6), 548-560.

- GARBARINO, E., & JOHNSON, M.S. (1999). The different roles of satisfaction, trust, and commitment in customer relationships, Journal of Marketing, 63(2), 70-87.

- GARG, R., RAHMAN, Z., & QURESHI, M.N. (2014). Measuring customer experience in banks: scale development and validation, Journal of Modelling in Management, 9(1), 87-117.

- Gentile, C., Spiller, N., & Noci, G. (2007). How to sustain the customer experience: An overview of experience components that co-create value with the customer. European Management Journal, 25(5), 395-410.

- GILMORE, J., & PINE, B. (2002). Differentiating hospitality operations via experiences: why selling services is not enough. Cornell Hotel and Restaurant Administration Quarterly, 43(3), 87-96.

- Goi, M.T., & Kalidas, V. (2015). Effect of Servicescape on Emotion, Mood, and Experience among HEI students. World Review of Business Research, 6(1), 81-91.

- GOUNARIS, S. (2005). Measuring service quality in b2b services: an evaluation of the SERVQUAL scales vis-à-vis the INDSERV scale. Journal of Services Marketing, 19(6), 421-435.

- GRACE, D., & O'CASS, A. (2004). Examining service experiences and post-consumption evaluations. Journal of Services Marketing, 18(6), 450-461.

- GREENWOOD, M., & BUREN, H. (2010). Trust and stakeholder theory: Trustworthiness in the organization-stakeholder relationship, Journal of Business Ethics, 95, 425- 438.

- GREWAL, D., LEVY, M., & KUMAR, V. (2009). Customer experience management in retailing: An organizing framework. Journal of Retailing, 85(1), 1-14.

- GRÖNROOS, C. (2008). Service logic revisited: who creates value? And who co-creates? European Business Review, 20(4), 298-314.

- GROTH, M. (2005). Customers as good soldiers: Examining citizenship behaviours in internet service deliveries. Journal of Management, 31, 7-27.

- GROVE, S.J., & FISK, P.R. (1997). The Impact of Other Customers on Service Experiences: A Critical Incident Examination of Getting Along. Journal of Retailing, 73(1), 63-85.

- HARRIS, L.C., & EZEH, C. (2008). Servicescape and loyalty intentions: an empirical investigation. European Journal of Marketing, 42(3-4), 390-422.

- HARRIS, R., ELLIOTT, D., & BARON, S. (2011). A Theatrical Perspective on Service Performance Evaluation: The Customer-Critic Approach, Journal of Marketing Management, 27(5-6), 477-502.

- Hill, A.V., Collier, D.A., Froehle, C.M., Goodale, J.C., Metters, R.D., & Verma, R. (2002). Research opportunities in service process design. Journal of Operations Management, 20, 189‐202.

- HOLBROOK, M., & HIRSCHMAN, E. (1982). The experiential aspects of consumption: Fantasies, feelings, and fun. Journal of Consumer Research, 9, 132-140.

- HOLBROOK, M. (2006). The Consumption Experience – Something New, Something Old, Something Borrowed, Something Sold: Part 1, Journal of Macromarketing, 26(2), 259-266.

- ISMAIL, A.R. (2010). Investigating British customers’ experience to maximise brand loyalty within context of tourism in Egypt: Netnography and structural modelling approach, Published Ph.D Thesis, Brunel University, London.

- ISMAIL, A.R., MELEWAR, T.C., LIM, L., & WOODSIDE, A. (2011). Customer Experiences with Brands: Literature Review and Research Directions. The Marketing Review, 11(3), 205-225.

- Johnston, R. (2004). Towards a Better Understanding of Service Excellence. Managing Service Quality, 14(2-3), 14.

- JOHNSTON, R. (2007). The Internal Barriers to Improving External Service, in: Ford, R.C. et al. (Eds.), Managing Magical Service, The Rosen College of Hospitality, Florida: USA, 179-188.

- KEAVENEY, S.M. (1995). Customer switching behaviour in service industries: An exploratory study. Journal of Marketing, 59(2), 71-82.

- KHAN, H., & MATLAY, H. (2009). Implementing service excellence in higher education. Education and Training, 51(8-9), 769-780.

- KIM D. J., FERRIN D.L., & RAO, H.R. (2009). Trust and satisfaction, the two wheels for successful e-commerce transactions: a longitudinal exploration. Information System Research, 20(2), 237-257.

- KIM, S., KNUTSON, B., & BECK, J. (2011). Development and testing of the Consumer Experience Index (CEI), Managing Service Quality, 21(2), 112-132.

- KLAUS, P., & MAKLAN, S. (2012). EXQ: a multiple-scale for assessing service experience. Journal of Service Management, 23(1).

- KOTLER, P. (2005). The role played by the broadening of marketing movement in the history of marketing thought. Journal of Public Policy and Marketing, 24(1), 114-116.

- LATANE, B. (1981). The Psychology of Social Impact. American Psychologist, 36, 343-356.

- LEWIS, B.R., & GABRIELSEN, G.O.S. (1998). Intra-organizational aspects of service quality management: the employees’ perspective, The Service Industries Journal, 18(2), 64-89.

- LIN, H.F. (2011). An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. International Journal of Information Management, 31(3), 252-260.

- MAKLAN, S., & KLAUS, P. (2011). Customer experience: are we measuring the right things? International Journal of Marketing Research, 53(6), 771-792.

- MAYER, R.C., DAVIS, J.H., & SCHOORMAN, F.D. (1995a). An integrative model of organizational trust. Academy. Management Review, 20(3), 709-734.

- MEYER, C., & SCHWAGER A. (2007). Understanding Customer Experience. Harvard Business Review, 85(2), 117-26.

- MORGAN, R., & HUNT, S. (1994). The commitment-trust theory of relationship marketing, Journal of Marketing, 58, 20-38.

- PALMER, A., 2010. Customer experience management: a critical review of an emerging idea. Journal of Services Marketing. 24 (3), 196– 208.

- PAREIGIS, J., ECHEVERRI, P. and EDVARDSSON, B., 2012. Exploring internal mechanisms forming customer servicescape experiences. Journal of Service Management, 23, 677– 695.

- Patrício, L., Fisk, R.P. and Cunha, J., 2008. Designing multi‐interface service experiences: the service experience blueprint. Journal of Service Research, 10, 318‐34.

- PINE, B.J and GILMORE J.H., 1998. Welcome to the Experience Economy, Harvard Business Review, 76 (4), 97-105.

- Pine, B.J., & Gilmore, J.H. (2003). Welcome to the experience economy. Harvard Business Review, 76.

- PONSIGNON, F., PHILIPP, K., & MAULL, R.S. (2015). Experience Co-Creation in Financial Services: An Empirical Exploration. Journal of Service Management, 26(2), 295-320.

- Roth, A.V., & Menor, L.J. (2003). Insights into service operations management: a research agenda. Production and Operations Management, 12, 145‐64.

- RUNDLE-THIELE, S., & MACKAY, M., 2001. Assessing the performance of brand loyalty measures. Journal of Services Marketing, 15(7), 529-546.

- SANDSTROM, S., EDVARDSSON, B., KRISTENSSON, P., & MAGNUSSON, P. (2008). Value in Use through Service Experience. Managing Service Quality, 18(2), 112-126.

- SCHMITT, B.H. (1999). Experiential Marketing. Library of Congress Cataloguing-in-Publication Data, New York.

- SCHMITT, B.H. (2003). Customer experience management. A revolutionary approach to connecting with your customers. New Jersey, John Wiley and Sons, Inc.

- SHAW, C., & IVENS, J. (2002). Building Great Customer Experiences, Palgrave Macmillan, Basingstoke.

- Shaw, C., & Ivens, J. (2005). Building great customer experiences. Palgrave Macmillan, Basingstoke.

- SINGH, J., & SIRDESHMUKH, D. (2000). Agency and trust mechanisms in consumer satisfaction and loyalty judgments. Journal of Academy Marketing Science. 28(1), 150-167.

- SIRDESHMUKH, D., SINGH, J., & SABOL, B. (2002). Consumer trust, value, and loyalty in relational exchanges. Journal of Marketing, 66, 15-37.

- SIVARAJAH, R. (2014). The Impact of Consumer Experience on Brand Loyalty: The Mediating Role of Brand Attitude, International Journal of Management and Social Sciences Research, 3(1), 73-79.

- SMITH, S., & WHEELER, J. (2002). Managing the customer experience: Turning customers into advocates, Prentice Hall, London.

- STUART, I., & TAX, S. (2004). Toward an integrative approach to designing service experiences, Lessons learned from the theatre. Journal of Operations Management, 22, 609-627.

- SUH, B., & HAN, I. (2003). Effect of trust on customer acceptance of internet banking. Electronic Commerce Research and Applications, 1(3), 247-263.

- Teixeira, J., Patrício, L., Nunes, N.J., Nóbrega, L., Fisk, R.P., & Constantine, L. (2012). Customer experience modelling: from customer experience to service design. Journal of Service Management, 23(3), 362-376.

- Turnois, L. (2004). Creating customer value: bridging theory and practice. Journal of Marketing Management. 14(2), 12‐23.

- VARGO, S.L., & LUSCH, R.F. (2004). Evolving to a new dominant logic for marketing. The Journal of Marketing, 68, 1-17.

- VERHOEF, P., LEMON, K., PARASURAMAN, A., ROGGEVEEN, A., SCHLESINGER, L., & TSIROS, M. (2009). Customer Experience: Determinants, Dynamics and Management Strategies. Journal of Retailing, 85(1), 31-41.

- WALTER, U., EDVARDSSON, B., & OSTROM, A. (2010). Drivers of customers’ service experiences: a study in the restaurant industry. Managing Service Quality, 20(30), 236-258.

- WINER, R.S. (2001). A framework for customer relationship management. California Management Review, 43, 89-105.

- XIE, C., BAGOZZI, R.P., & TROYE, S.V. (2008). Trying to prosume: Toward a theory of consumers as co-creators of value. Journal of the Academy of Marketing Science, 36, 109-122.

- YAVAS, U., KARATEPE, O.M., AVCI, T., & TEKINKUS, M. (2003). Antecedents and outcomes of service recovery performance: An empirical study of frontline employees in Turkish banks. International Journal of Bank Marketing, 21(5), 255-265.

- YI, Y., & GONG, T. (2008). If employees “go the extra mile”, do customers reciprocate with similar behaviour? Psychology and Marketing, 25, 961-986.

- YI, Y., NATARAAJAN, R., & GONG, T. (2011). Customer participation and citizenship behavioural influences on employee performance, satisfaction, commitment, and turnover intention. Journal of Business Research, 64, 87-95.