Research Article: 2018 Vol: 22 Issue: 3

Customer Satisfaction, Service Quality, Consumer Demographics and Word of Mouth Communication Perspectives Evidence From The Retail Banking in United Arab Emirates

Vimi Jham, Institute of Management Technology

Abstract

This study considers variables of customer satisfaction, quality of services and consumer demographics as essential antecedents for Word of Mouth communications in the banking sector. A mixed method research with systematic probability sampling was used in this study to draw the list of respondents. The study considered three antecedents to service quality, which are satisfaction with traditional facilities, internal marketing and multichannel banking. The relationship between the constructs was established with (PLS) path modeling. The outcome of the results show that satisfaction with service quality is dependent on satisfaction with various banking services creating positive word of mouth communication and consumer demographics play no role in this process. Therefore, the findings of this research support the above observations that banks should consider the quality of service they provide to the customers as an opportunity to acquire new customers. It also re enforces the fact that the employee’s needs to be trained on regular basis to result in customer satisfaction.

Keywords

Customer Satisfaction, Service Quality, Word of Mouth Communication, Partial Least Squares, United Arab Emirates.

Introduction

Today with all the services globally, quality of service remains an important organizational differentiator creating a competitive place in the market. This applies to the financial services marketing with respect to banks where the marketplace is competitive with products that cannot be differentiated easily (Stafford, 1996). High quality of service to customers helps the organizations to differentiate themselves in competitive markets (Karatepe et al., 2005). Excellent service paves the way towards a satisfied and loyal customer who is willing to recommend (Danaher, 1997). Services are context oriented, and since different industries offer different services, separate service quality models may be required to understand the banking sector (Hossain et al., 2015). Another research using social identity theory suggests that satisfaction with good quality of service brings in a customer-oriented culture (Lindsey et al., 2016).

Customer’s lifetime association with banks is an outcome of getting high quality services from the banks (Lassar et al., 2000). As services are intangible quality of service, which satisfies the consumers’ needs becomes the differentiating factor (George and Kumar, 2014). In the current study, the different variables of service quality, customer satisfaction and word of mouth communications are discuss as core elements for understanding the current context of UAE (United Arab Emirates) banking. In order to generate a broader theory, a model based on the satisfaction and service qualities of the bank taken as essential antecedents for Word of Mouth communications.

According to Crosby and Stevens (1987), dimensions of satisfaction in a service industry are satisfaction with employee interactions, core services, and the organization. Therefore, to satisfy a customer the banks need to differentiate their products and services (Levesque and Gordon, 1996). To have a satisfied customer is a multifaceted work and there are multiple moderators and mediators are required for this purpose (Kumar, 2016). New measurement tools like GRID Scale been used to understand the service mixed satisfaction of customers with Bank services (Audrezet et al., 2016). Researchers have proposed that customer satisfaction plays an intervening role between service quality and customer loyalty (Rajeswari et al., 2017)

Research on Service quality and its consequences has received extensive academic findings for over three decades. When the service quality need of customer is met, it results in customer satisfaction and loyalty Haque et al. (2012). Another study suggested that quality of service finally decides the satisfaction of the customer and his length of association with the organization (Ismail et al., 2016).

It has established that a high quality of service provides benefits, which include enhanced customer satisfaction and positive word-of-mouth communication (Ilyas et al., 2013). Research by Syed Muhammad Fazal-e-Hasan et al. (2017) suggests that thankfulness by the customer and his brand affinity improve positive word of mouth communications. This research focuses on the effect of satisfaction of the customer with service quality. It is therefore crucial that bank managers and other service providers understand how customers evaluate satisfaction with bank service and link it to the quality of service. It has found that familiarity with the language leads to word of mouth communications that are beneficial to the organization (Lassar et al., 2017).

Literature Review

Research in customer satisfaction literature has conducted in retail environments (Oliver, 1981). The few studies that look at the financial services industry are mainly concerned with retail banking (Caruana, 2002). Improved service quality leads to customer satisfaction which results in word of mouth communication (Berry and Parasuraman, 1991).

Practitioners and market researchers (Dabholkar et al., 1995) have done theoretical and practical research in the area of customer satisfaction. Therefore, in strategy formulations customer satisfaction and customer retention play an important role.

Positive disconfirmation with service of the bank leads to the continuity of the relationship and positive communication by the customer whereas the negative one results in the discontinuity of the relationship and negative recommendations (Jamal and Naser, 2002; Levesque and Gordon, 1996).

According to Taylor and Baker (1994), the antecedents of customer satisfaction are the variables underlying satisfaction, which are global rather than specific to a brand. Demographic factors affect the general mindset of individuals, with each unique combination of demographic characteristics differentially shaping an individual’s perspectives. Such perspectives influence expectations, perceptions, and behavior. In a study on factors influencing bank selection of Islamic banking products in South Africa, Saini et al. (2011) found that many variables of Service Quality determine the selection of banking institution, and that these determinants vary between people with different demographic characteristics (Naser et al., 1999).

Demographic subgroups of gender and age have significantly different expectations for many unique dimensions of banking service, indicating that demographic characteristics shape service standards (Stafford, 1996). Demographic differences in perceptions of banking service, satisfaction, and customer loyalty are evident across age groups and education levels (Caruana, 2002). According to findings from a study on service quality and demographics of customers of private sector banks in Chennai, India, by Balaji and Babbu (2012), customers differ in dimensions of service quality perceptions across income, occupation, education level, age, gender, and marital status.

Lal et al. (2014) found that Indian banking customers overall service quality perceptions are the same across all demographic subgroups for age, gender, marital status, income, education, and occupation. However, when investigating the individual dimensions of functional service quality, demographic differences are present for age, marital status, income, and education. There are demographic differences in banking customers’ satisfaction with various aspects of Jordanian Islamic banks across age group, gender, and occupation, but no differences exist in satisfaction across nationality or religion (Naser et al., 1999). Research does not suggest any impact of gender in a retail banking service. Hence, the effect of gender on customer satisfaction and loyalty remains an area of research where gap exists. In a recent research in the area of banking, it was found that functional quality had higher impact on customer satisfaction when compared to technical quality. Thus, customer satisfaction was found to have impact on customer loyalty (Kasiri et al., 2017). Service quality is a measured and assessed on the basis of service delivery which matches the expectations of the customers (Lewis and Booms, 1983) and customer service quality and value creation affect customer satisfaction (Roy et al., 2011).

Delivering quality service means conforming to customer expectations on a consistent basis. According to Parasuraman et al. (1985) the literature provides conceptual development of service quality as the result of the comparison between delivered and expected service performance. Under the framework of the disconfirmation, the paradigm models of perceived service quality by Oliver (1980), the Nordic by Gronroos (1982) and the American by Parasuraman et al. (1985) dominate the literature. These models distinguish between “technical” and “functional” quality, reflecting the service outcomes and processes. Customers form perceptions of these dimensions based on corporate image. The “gaps analysis model” defines service quality across five dimensions given by Parasuraman et al. (1985) as reliability, responsiveness, assurance, empathy, and tangibles. A by-product of the “gaps analysis model” is SERVQUAL a 22-item generic scale for measuring service quality as suggested by Parasuraman et al., 1988.

Banks have to differentiate themselves based on services they provide. A recent research using GAPs model for service quality gave empirical evidence, which proved that banks have to enhance service quality in order to bring in customer satisfaction (Tan, 2017). The need of the hour for banks today is to have a bank specific widely known instrument to evaluate service quality (Bahia and Nantel, 2000). This study considers functional quality (equivalent to what is offered) as primary quality, because it is directly associated with the service provided. Similar variables of service quality that affect satisfaction have studied in the health industry (Chen and Tan, 2017).

Word-of-Mouth communication (WOM) impacts the consumer’s buying behavior. Research proves that, one dissatisfied customer tells nine other people about the experiences that resulted in the dissatisfaction. Satisfied customers, on the other hand, relate their story to an average of five other people (Knauer, 1992). This is particularly more important in the service sector. Relying on WOM to reduce the dissonance about the service is common among consumers. Much of the research pertaining to WOM in the marketplace has focused on negative, rather than positive, communication. Richins (1983) found that the tendency to engage in negative WOM was positively related to the level of dissatisfaction and negatively related to the consumer’s perception of the retailer’s responsiveness to complaints. Evidence indicates that reliability, tangibility, responsiveness has significant effect on WOM (Ren, 2016). A positive link between satisfaction and loyalty has established in a research on airlines service industry by (Christian et al., 2011) (Table 1).

| Table 1 Comparative Analysis of Findings from Other Studies |

|

| Study Variable | Reference |

| Service quality is a measured and assessed on the basis of service delivery, which matches the expectations of the customers. | Lewis and Booms, 1983. |

| Perceived service quality research. | Oliver (1980), the Nordic by Gronroos (1982) and the American by Parasuraman et al. (1985). |

| Service quality leads to customer satisfaction which results in WOM. | Berry and Parasuraman, 1991. |

| Satisfied customers relate their story to an average of five other people. | Knauer, 1992. |

| Antecedents of customer satisfaction. | Taylor and Baker, 1994. |

| Customer Satisfaction and Retention. | Dabholkar et al. 1995. |

| Demographic characteristics shape service standards. | Stafford, 1996. |

| Service Quality determines the selection of banking institution, and that these determinants vary between people with different demographic characteristics. | Naser et al., 1999. |

| There are demographic differences in banking customers’ satisfaction with various aspects of Jordanian Islamic banks across age group, gender, and occupation, but no differences exist in satisfaction across nationality or religion. | Naser et al., 1999. |

| Positive disconfirmation with service of the bank leads to the continuity of the relationship and positive communication by the customer. | Naser, 2002; Levesque & Gordon, 1996. |

| Customer service quality and value creation affect customer satisfaction. | Roy et al., 2011. |

| Banking customers overall service quality perceptions are the same across all demographic subgroups for age, gender, marital status, income, education, and occupation. | Lal et al., 2014. |

| Enhancement in service quality in order to bring in customer satisfaction. | Tan, 2017. |

| Evidence indicates that reliability, tangibility, responsiveness has significant effect on WOM. | Ren, 2016. |

| Customer satisfaction was found to have impact on customer loyalty. | Kasiri et al., 2017. |

Limited research has suggested on impact of Consumer demographics on Word of mouth communication in a retail banking service. However, many studies exist on customer satisfaction and service quality but the study of customer satisfaction as an antecedent to service quality is a researched area today. Hence, this research is trying to fill the gap in the literature by linking customer satisfaction based on functional variables with quality of service, demographics and WOM.

Objective of the Study

Cronin and Taylor (1992) pointed out that good service quality results in a satisfied customer and vice versa. Limited research is published taking satisfaction of the customer as an antecedent to quality of service and this research gap is covered by this study. Although a number of studies have published where, service quality has taken as an antecedent to customer satisfaction.

The link between service quality and customer’s behavioral intentions, combined with the limited published research in this area, the purpose of this study is to understand the relationship between customer satisfaction, quality of service, consumer demographics and their effect on word of mouth communication.

The research in this paper establishes empirical tests with the key variables and their relationships as proposed in the existing literature. Quantitative and qualitative data were collected from Five UAE banks and the research objectives addressed in the paper are to understand the drivers of Customer Satisfaction, and their relative impact on service quality and consumer demographics. The study also makes an attempt to understand the drivers of Service Quality and Consumer demographics, and assess their impact on WOM communications with respect to the banking sector.

Theory Development

Measuring service quality in different ways and techniques has researched by several scholars. The continuously changing environment requires an ongoing assessment of quality factors. In order to generate a broader theory, a model based on the relationship between satisfaction with the various services provided by the bank, quality of services, consumer demographics and word of mouth communications were proposed in this research. Customer satisfaction, quality of service and consumer demographics were identified as antecedents for WOM.

This theoretical approach means that customers assess the quality of services from their experience and if this is positive, they refer the bank to others. Several researchers have found positive relationship between service quality and customer satisfaction, which leads to referrals. Thus, relationships among these variables have established by several research studies (Kuo et al., 2009).

Muthu (2010) have proposed that any service should provide good quality and include the core service, employee commitment, updated technology, perceived tangibles and congenial environment concerns. Lenka et al. (2009) suggested use of employee interaction, technology and tangible aspect of service quality. It has extensively researched that employees plays a key role in delivering services. Kaura (2013) recommended the use of people, process and physical evidence as dimensions of service quality. There are two ways of measuring customer satisfaction, one that deals with customer’s feedback about the product or service and other which measures satisfaction on a single item rating scale, (Olsen and Johnson, 2003).

Brown et al. (1996) and Lemmink and Mattsson (1998) found that customer satisfaction increased with good employee behavior. A study conducted by Kaura and Datta (2012) found that positive impact on customer satisfaction was because of the employees. Research by Caruana and Calleya (1998) have found that employees who are not committed tend to harm the organization, which results in poor performance due to bad service offerings. A recent study by Gremler (2013) suggested that customer perceptions of employee emotional competence positively influence customer satisfaction and loyalty. Satisfaction with online banking is related with satisfaction with physical banking (Rios, 2015). The studies conducted previously by researchers suggest that tangibility of services, technology, various touch points of banks interactions, reliability, employee qualities and skills increase customer satisfaction (Bitner et al., 2000). Therefore, it can be prove that Customer Satisfaction with traditional facilities leads to satisfaction with service quality, Customer Satisfaction with Multichannel banking leads to satisfaction with service quality and Customer Satisfaction with Internal Marketing leads to satisfaction with service quality.

The first study of consumer demographics was conducted by Zeithaml (1985) analyzing the effects of gender, age, and income. In retail banking evidence has found with demographic differences in perceptual image of bank service quality, satisfaction, and levels of loyalty across age groups and education levels (Caruana, 2002). Although these authors find significant demographic differences, they determine that perceptions of bank service quality are not different across gender or marital status. Private banking customers in Germany differ across employment status and size of liquid assets in terms of variables of service quality constructs, value with service, satisfaction with services, and loyalty (Seiler et al., 2013). In addition, these authors have found that German private banking customer’s service quality perceptions are not different across gender or age.

Using SERVPERF, Havinal et al. (2013) found that customers of the commercial banks state that no significant differences in these perceptions arise across age or gender. Lal et al. (2014) found that Indian banking customers overall service quality perceptions are the same across all demographic subgroups for age, gender, marital status, income, education and occupation. There are demographic differences in banking customers’ satisfaction with various aspects of Jordanian Islamic banks across age group, gender, and occupation, but no differences exist in satisfaction across nationality or religion (Naser et al., 1999). However, the authors state that these demographic differences are only marginally significant and very small. There are no demographic differences in the likelihood of patronizing Islamic banks across levels of education, income, or gender. While some demographic differences are present, Bizri, M (2014) finds that only religion is a significant predictor of the likelihood of patronizing Islamic banks. Therefore, it can be proved that Consumer demographics impacts the customer satisfaction with traditional facilities, Consumer demographics impacts the customer satisfaction with multi-channel banking, Consumer demographics impacts the customer satisfaction with internal marketing and Consumer demographics impacts the WOM Communications.

The main link between the long-term relationship between suppliers and buyers is customer satisfaction (Westbrook and Oliver, 1991). The customer gets motivated if satisfied by the service provider and this leads to recommending the provider to other customers (Trif, 2013). The retail banking industry is one service industry where there is a tremendous potential to leverage WOM to reach out to people. With globalization and increase technology, orientation service quality pressures of performing have increased in the banking professionals. Zeithaml et al. (1996) developed a conceptual model understanding the positive or negative effect of overall service quality on WOM communications A recent study suggested that attitude of employees was the most important service quality attribute which resulted in positive WOM (Choudhury, 2014). Therefore, it can be prove that Satisfaction with service quality leads to positive WOM Communications.

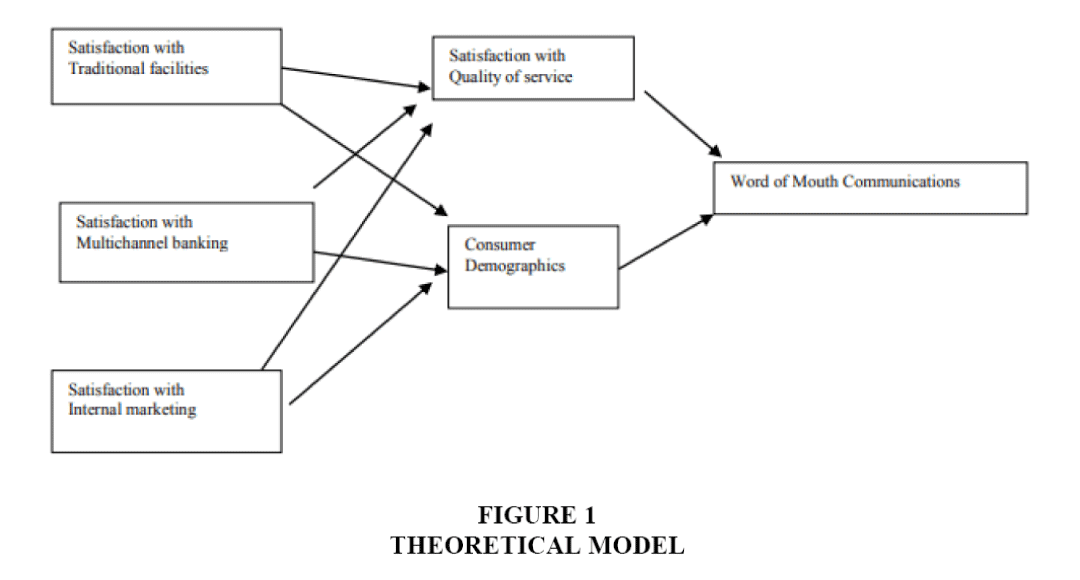

This study considered three antecedents to service quality, which are satisfaction with traditional facilities, internal marketing and multichannel banking (Table 2). Satisfaction with quality of service leads to increase in positive word of mouth communications. The theoretical model below in Figure 1 explains the research perspective.

| Table 2 Explanation of Constructs |

|

| Construct | Definitions |

| Satisfaction with Traditional Marketing (TF). | The degree to which the consumer is satisfied with the tangibles and intangible aspect of service provided. It reassures the customer of quality services when he physically visits the bank. |

| Satisfaction with Multichannel banking (MCB). | The degree to which the consumer is satisfied with services provided by various touch points of the banks like ATM, mobile, internet, banking etc. |

| Satisfaction with Internal marketing (IM). | The degree to which the consumer is satisfied with employees’ behavior and customer service encounter. |

| Quality of banking service (Quality). | The quality of service as perceived by the customer on dimensions related to traditional facilities, multichannel banking and internal marketing. |

| Consumer demographics (CD). | Variables like education and occupation of the consumer. |

| Word Of Mouth Communication (Refer Bank). | Reference given by the customer about the bank on having a positive experience through word of mouth. |

Data and Methodology

The research process started with the literature review. The research done in the area of customer satisfaction, service quality and word of mouth communication in the banking industry were analyzed. The demographics variables and their importance in the study was ascertained. A research mixed method design of research was used where qualitative and quantitative methods of research were applied. The depth interviews were conducted with customers to explore the views of the respondents with respect to customer satisfaction and service quality. The pilot test of the questionnaire was completed. The sampling was done and data collected for the exploratory study. Relationships were developed for testing. The theoretical saturation in qualitative research was achieved when the outcomes of the depth interview were enough to answer the various questions of research. In quantitative research, the analysis of the data indicated the saturation point.

The questionnaire was designed from the results of the depth interview and the literature review (Johnston, 1995). Sixteen variables of satisfaction with the banks in UAE were considered for the study. These banks chosen were customer centric in approach and had a strong retail presence.

The data collected remained confidential. Data from 1000 customers were collected out of which 478 contacts were rejected because they were incomplete. The final questionnaire was given to 522 customers of these banks in the month of September 2016. Out of which 494 questionnaires were complete and the rest rejected. The sampling procedure used was Systematic sampling to draw the sample from the population.

Questions related to experience while account opening were asked followed by respondent’s satisfaction with respect to services provided, transaction variables, on semantic differential scale ranging from extremely good to extremely bad (7point scale, where 1- extremely good, 7- extremely bad). This was followed by collection of demographic information of the customer, which included variables like gender, marital status, monthly family income, age, education and occupation. The UAE banks open current accounts for salary and the bank provides a saving account to its customers if they desire interest, which is just 0.25 %. Hence, most of the accounts are current accounts.

The sample size consisted of 70% males and 30% females. The major category of respondents in the sample were married which was 51% and 49% were unmarried. 29% respondents had monthly income of AED 20000- AED 30000, 27% between AED 10000-AED 20000 20% had income of less than AED 10000, and 24% had income between AED 30000-AED 40000. 3.1% of the respondents were having associated with the bank for less than one year. 10.5% were between one and three years, 17.8% were between three and five years and 68.6% were having transaction relationship with the bank for more than five years. 53% of the respondents were graduates, 39% were postgraduates and the 8% had not completed their graduation. 74% of the respondents were working in organizations such as government or private and 26% were having business of their own. The average age of the respondents was between 22 and 60 years.

Data Analysis

Partial Least Square path-modeling algorithm does not require a normally distributed data (Fornell, 1994). Therefore, Smart PLS.2.0 was found ideal for allowing estimation of measurement and structural model at the same time.

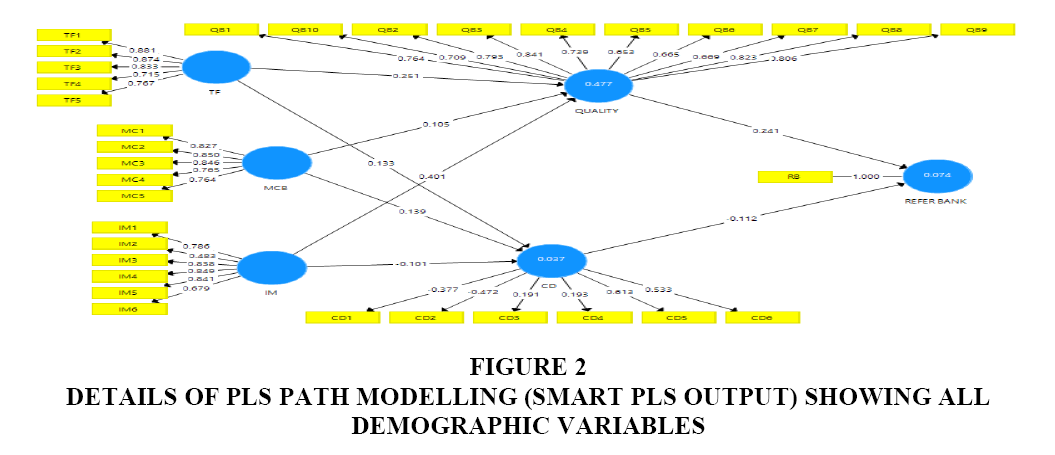

The bootstrapping process identified the significant indicators that measure the latent constructs using 494 sub samples. The procedure resulted in removal of two formative indicators related to internal marketing, multichannel banking and four reflective indicators pertaining to consumer demographics. The indicators for consumer demographics (Table 3) used in this study were gender (CD 1), marital status (CD 2), income (CD 3), age (CD 4), education (CD 5) and occupation (CD 6). The outer loadings for all the indicators except education qualifications and occupation were very insignificant, hence others indicators were removed. The outer loadings for demographic variables can be seen in Figure 2. This also proves that in UAE, the occupation is skill based and educational qualifications are important. The marital status does not hold importance as the accounts are opened for the people who have jobs and are salaried. The “t” values greater than 1.96 was found significant at 0.05 levels. The running of the PLS algorithm was conducted which resulted in estimation of the model. The estimated model is presented in Figure 3 along with significant statistics. The assessment of the outer model was done before evaluating the structural model. The criteria for assessing reflective constructs and formative constructs was established. Table 4 below explains the assessment criteria for the reflective constructs. Table 5 shows the value given to the constructs.

| Table 3 Consumer Demographics Data |

|

| Consumer Demographics | Variable name |

| CD 1 | Gender |

| CD 2 | Marital Status |

| CD 3 | Income |

| CD 4 | Age |

| CD 5 | Education |

| CD 6 | Occupation |

| Table 4 Criteria for Assessing Reflective Constructs |

|

| Criterion | Condition |

| Composite Reliability. | More than 0.7 (Nunnally and Bernstein, 1994). |

| Indicator Reliability. | Standardized outer loading should be more than 0.5 (Hulland). |

| Average variance extracted. |

More than 0.5. |

| Fornell Larcker Criterion. |

In order to ensure discriminant validity, the AVE of each latent variable should be higher than the squared correlations with all other latent variables. |

| Cross loadings. | An indicator should not have higher correlation with another latent variable than with its respective latent variables. |

| Table 5 Reflective Constructs Validation |

|||

| Reflective constructs | Loadings | Composite reliability | Discriminant validity Fornell Larcker, AVE |

| CD | 0.830 | 0.70 | 0.53 |

| Quality of service | 0.805 | 0.92 | 0.57 |

From the results of Smart PLS 2.0 output, the composite reliability of all reflective constructs was more than 0.7 for both consumer demographics and quality of service, which meant good levels of internal consistency. The convergent validity (AVE) value for all the reflective constructs was above 0.5. The discriminant validity as established by Fornell-Larcker by Fornell (1981) criterion was met, all indicators loaded highest on their associated constructs. The assessment showed that the indicator reliability for all the indicators had loading of above 0.7. Thus, the adequate quality for all reflective constructs used in the study was established.

The PLS evaluation of the structural model is based on prediction oriented measures that are non-parametric (Chin, 1998). The predictive capabilities of the model included R2 and the cross-validated redundancy measure Q2 (Hair et al., 2012). The R2 values of the two constructs-Quality of service, consumer demographics and the outcome construct word of mouth communication (refer bank) were acceptable. The Q2 values were larger than 0, which proved the support for the endogenous constructs predictive relevance. The predictive validity of the model was established through cross-validated communality and redundancy (Table 6).

| TABLE 6 R Square and Q Square to Assess the Quality of Structural Model |

||

| R2 | Q2 | |

| Quality of service | 0.495 | 0.267 |

| CD (Consumer Demographics) | 0.030 | 0.001 |

| Refer Bank | 0.073 | 0.061 |

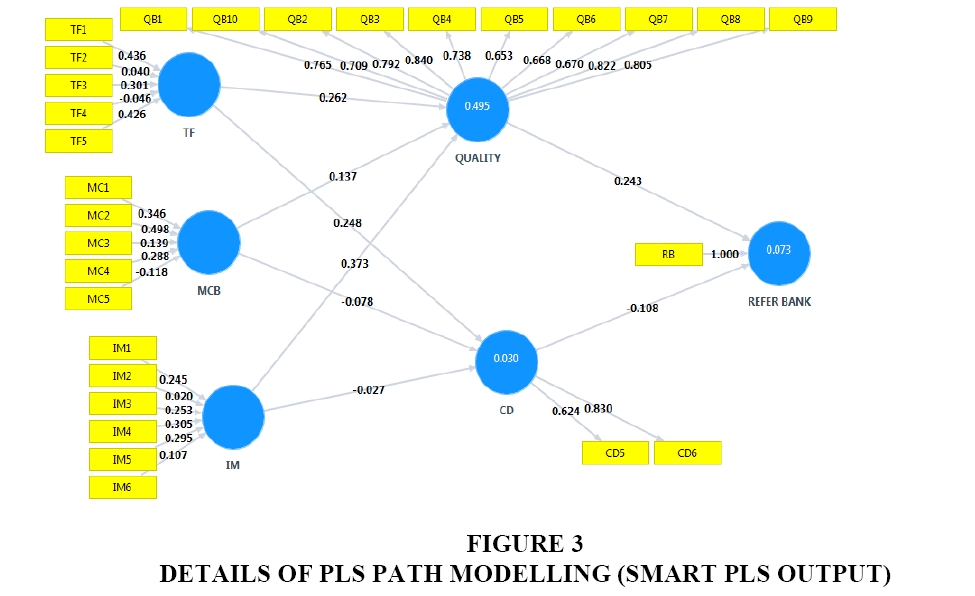

The structural model and relationships in Partial Least Squares were tested by computing path coefficients (β). The squared multiple correlations (R2) for each dependent construct in the model determines the model’s fit. As can be seen in Figure 3, the R2 value of the Quality was 0.495, indicating that 49.5% of the variance in the quality of services is explained. The R2 value of consumer demographics was 0.030 indicating that 3% of the variance is explained by consumer demographics. Also the R2 value for WOM (refer bank) was 0.073 indicating 7.3% of variance being explained by this variable. Details of the relationship testing can be seen in Table 7.

| Table 7 Results of Relationships Testing |

||||

| No. | Relationships | Standard regression coefficient | T value | Result |

| 1. | TF leads quality | 0.262 | 3.135** | Accepted |

| 2. | MCB leads to quality | 0.137 | 1.96** | Accepted |

| 3. | IM leads to quality | 0.373 | 5.512** | Accepted |

| 4. | CD impacts TF | 0.248 | 1.96** | Accepted |

| 5. | CD impacts MCB | 0.078 | 0.729 | rejected |

| 6. | CD impacts IM | 0.027 | 0.220 | rejected |

| 7. | CD impacts WOM | 0.108 | 1.846 | rejected |

| 8. | Quality impacts WOM | 0.243 | 4.372** | Accepted |

**t values more than 1.96 are treated as significant at 5% level; path coefficient greater than 0.1.

The above table shows R2 values which measures a construct’s percent variation that is explained by the model and the model’s predictive capabilities the cross validated redundancy and communality measure Q2. Q2 values for reflective constructs quality of service and consumer demographics, which is more than zero, provides support for the endogenous constructs predictive relevance.

Discussion on Constructs and Measurement

The reflective indicators are the latent variables, which store information (Martell, 1987). The definitions of different reflective and formative constructs used in this study are shown in Table 1. The formative indicators are the antecedents, which define and are reasons for the cause of latent variable the indicators are highly correlated in reflective measurement models as case in formative models.

In this study, to measure satisfaction with traditional facilities, five formative indicators pertaining to satisfaction namely demand draft, money transfer, fixed deposits, locker facility, ATM service were used. The construct of satisfaction with multichannel banking were measured using five formative indicators related to satisfaction with tele banking, internet banking, debit card, credit card and stock trading online. The construct of satisfaction with internal marketing had indicators pertaining to five different aspects of services provided by the bank such as service scape, parking space, query handling, information dissemination, and attitude of the staff.

The purpose of this study was to analyze causal relationships between formative and reflective constructs mentioned above. The best tool for understanding the relationships was identified as variance-based PLS (Partial Least Squares) (Fornell, 1982).

Findings and Conclusions

Contribution to Theory

The positive perception associated with traditional facilities, which include face to face interactions with the customers, multichannel banking including various touch points by which the customer interacts with the bank and internal marketing which includes the behavior of the employee with the customers leads to positive impact and satisfaction of the customer. Consumer demographics consisting of education and occupation variables is important when satisfaction with traditional facilities is assessed as here the attribute of employee proficiency becomes important. While analyzing satisfaction with internal marketing and multichannel banking consumer demographics does not play an important role. Satisfaction with quality of service leads to a positive impact and communication by the customer, which paves the way for increasing referrals for the bank.

The key point in this research is the analysis of satisfaction of the customer as an antecedent to quality of service, which covers the gap in the existing literature and is in nascent stages of research. The research contributes to understanding the relationship between customer satisfaction and service quality and its impact along with consumer demographics on word of mouth communication through exploration of antecedents and consequences.

Previously research has conducted on understanding the negative and positive effects of word of mouth communications with service quality as an antecedent. Having said that, very limited research has been conducted on understanding the role of demographics on word of mouth communication in the banking industry. The model proposed in this research expresses the direct influence of consumer demographics on word of mouth communication and pioneers in understanding this relationship. Research in the area of customer satisfaction and service quality has done by various researchers, but the model in this research adds value to the literature by initiating the effect of communication with customer satisfaction as the key input to the process.

However, the generalizations in the literature talks about impact of service quality on customer satisfaction. This research has tried to create a new paradigm, which talks about the impact of customer satisfaction with various services of the bank and links it forward with service quality and consumer demographics. The effect of consumer demographics is then assessed on word of mouth communication.

Contribution to Practice

The importance of each item in determining the associated latent variable is based on the weight and loadings of the indicators. Thus, the variable in traditional facilities which provided the most satisfaction to the customer was demand draft facility (β=0.436) followed by ATM services (β=0.426). The critical indicators of satisfaction with multichannel banking were, credit card facility (β=0.498) followed by debit card (β=0.346). The most satisfaction with internal marketing was found with information dissemination by the bank employees to the customers (β=0.305) followed by query handing (β=0.295) by the bank employees. Thus, committed employees emerged as a critical indicator that would decide the satisfaction of the customer with the bank. Withdrawal of money from the bank (β=0.840) and the number of working days (β=0.822) of the bank came out as critical factors to decide the service quality provided by the bank.

Satisfaction with Internal marketing (β=0.373) was found to have strong effect on Service quality provided by the bank when compared with Traditional facilities (β=0.262) and Multichannel banking (β=0.137). Satisfaction with Internal marketing (β=0.027) and Multichannel banking (β=0.078) was found to have negative association with consumer demographics as compared with Traditional facilities (β=0.248). The study established strong connect between service quality (β=0.243) and word of mouth communication (reference of the bank by the customer). There was a negative relationship established between consumer demographics (β=0.108) and WOM communication.

The satisfaction with quality of service of bank and then reference of the bank by customers can be considered as a support to the fact that when quality of service provided by the bank satisfies a customer he spreads positive word of mouth communication. Whereas consumer demographics play no role in making a customer spread a positive word on its own. Therefore, there has been a negative association between the two. The findings of this research support the above observations that banks should consider the quality of service they provide to the customers as an opportunity to acquire new customers.

Satisfaction with quality of service provided by the bank reveals that satisfaction with various services which results in customer satisfaction. As the mean score of withdrawal of money (0.839) from bank plays an important role as people do not like to waste their time standing in the ques. If the process is smooth and does not take time the customer stays satisfied. The mean score of working days of the bank (0.821) was high as the customers who have holiday on weekend gets an opportunity to visit the bank and get their work done. Thus, the employee’s needs to be trained on regular basis to keep the customers satisfied (Table 8).

| Table 8 Satisfaction with Quality of Service |

|

| Quality of Service Variable | Mean Score |

| Passbook update. | 0.763 |

| Value added service. | 0.708 |

| Cheque facility. | 0.791 |

| Withdrawal of money. | 0.839 |

| Loan Sanction. | 0.738 |

| Processing fee. | 0.651 |

| Acceptability. | 0.667 |

| Time taken to complete Paper work. | 0.669 |

| Working days of the bank. | 0.821 |

| Working Hours. | 0.804 |

Limitations and Future Research

The limitations of the study include limited geographic area covered, which is the Middle East market, Dubai. Even though the study introduced that quality of service is linked to various services provided by the bank and consumer demographics have no role in getting references for the bank. A psychographic profile study of the consumer can be done to understand the linkage for the same. In addition, a service quality and satisfaction structure with universal applicability and acceptance can be considered as potential area of research.

References

- Audrezet, A., Alice, A., Svein, O.O., & Ana, A.T. (2016). The grid scale: A new tool for measuring service mixed satisfaction. Journal of Services Marketing, 30(1), 29-47.

- Bahia, K., & Nantel, J. (2000). A reliable and valid measurement scale for the perceived service quality of banks. International Journal of Bank Marketing, 18(2), 84-91.

- Balaji, M.S., Sanjit, K.R., & Walfried, M.L. (2017). Language divergence in service encounters: Revisiting its influence on word of mouth. Journal of Business Research, 72(3), 210-213.

- Balaji, S.G., & Sureesh, M.B. (2012). Influence of demographic variables on banking service quality: A study of private sector banks in Chennai. Journal of Bank Management, 11(1), 70-96.

- Bitner, M.J., Stephen W.B., & Matthew, L.M. (2000). Technology infusion in service encounters. Journal of the Academy of Marketing Science, 28(1), 138-149.

- Bizri, M.R. (2014). A study of Islamic banks in the non-GCC MENA region: evidence from Lebanon. International Journal of Bank Marketing, 32(2), 130-149.

- Brown, S.P., & Thomas W.L. (1996). A new look at psychological climate and its relationship to job involvement, effort, and performance. Journal of Applied Psychology, 81(4), 358-368.

- Caruana, A., & Peter, C. (1998). The effect of internal marketing on organizational commitment among retail bank managers. International Journal of Bank Marketing, 16(3), 108-116.

- Caruana, A. (2002). Service loyalty: The effects of service quality and the mediating role of customer satisfaction. European Journal of Marketing, 36(8), 811-828.

- Chen, B.K. & Tan, C.L. (2017). Influence of service quality and outcome quality on the member overall satisfaction. Global Business & Management Research, 9(1), 1-14.

- Chin, W.W. (1998). The partial least squares approach to structural equation modeling. Modern Methods for Business Research, 295(2), 295-336.

- Choudhury, K. (2014). Service quality and word of mouth: a study of the banking sector. International Journal of Bank Marketing, 32(7), 612-627.

- Cronin Jr, J.J., & Steven, A.T. (1992). Measuring service quality: a reexamination and extension. The Journal of Marketing, 56(3), 55-68.

- Crosby, L.A., & Nancy, S. (1987). Effects of relationship marketing on satisfaction, retention, and prices in the life insurance industry. Journal of Marketing Research, 24(4), 404-411.

- Dabholkar, P.A (1995). A contingency framework for predicting causality between customer satisfaction and service quality. NA-Advances in Consumer Research, 22(1), 101-108

- Danaher, P.J. (1997). Using conjoint analysis to determine the relative importance of service attributes measured in customer satisfaction surveys. Journal of Retailing, 73(2), 235-260.

- Delcourt, C., Dwayne D.G., Allard, C.R.V., & Marcel, V.B. (2013). Effects of perceived employee emotional competence on customer satisfaction and loyalty: The mediating role of rapport. Journal of Service Management, 24(1), 5-24.

- Dwivedi, Y.K., Kuttimani, T., Michael, D.W, & Banita, L. (2014). Adoption of M-commerce: examining factors affecting intention and behaviour of Indian consumers. International Journal of Indian Culture and Business Management, 8(3), 345-360.

- Fazal, H., Syed, M., Lings, I N., Mortimer, G., Neale, L. (2017). How gratitude influences customer word of mouth intentions and involvement: the mediating role of affective commitment. Journal ofMarketingTheory&Practice, 25(2), 200-211

- Fornell, C., & Fred, L.B (1982). Two structural equation models: Lisrel and Pls applied to consumer exit-voice theory. Journal of Marketing Research 19(4), 440-452.

- Fornell, C. (1994). Partial least squares. Advanced Methods of Marketing Research, 52-78.

- Fornell, C., & Larcker D. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Grönroos, C. (1982). An applied service marketing theory. European Journal of Marketing, 16(7), 30-41.

- Hair, J.F., Marko, S., Christian, M.R., & Jeannette, A.M (2012). An assessment of the use of partial least squares structural equation modeling in marketing research. Journal of the Academy of Marketing Science, 40(3), 414-433.

- Havinal, V., & S. J. (2013). Ranking of public sector banks from customer viewpoint using topsis. ZENITH International Journal of Business Economics & Management Research, 3(7), 49-59.

- Hogan, E.A., & Daniel, A.M (1987). A confirmatory structural equations analysis of the job characteristics model. Organizational Behavior and Human Decision Processes, 39(2), 242-263.

- Hossain, M.A., Yogesh, K.D., & Sarah, B.N. (2015). Developing and validating a hierarchical model of service quality of retail banks. Total Quality Management & Business Excellence, 26(6), 534-549.

- Ilyas, A., Hammad, N., Muhammad, R.M., Uswan, E.M., Saleha, M., & Ali, S. (2013). Assessing the service quality of bank using SERVQUAL model. Interdisciplinary Journal of Contemporary Research in Business, 4(11), 390-400.

- Ismail, A., & Yunan, Y.S.M. (2016). Service quality as a predictor of customer satisfaction and customer loyalty. Scientific Journal of Logistics, 12(4), 269-283.

- Jamal, A., & Kamal, N. (2002). Customer satisfaction and retail banking: An assessment of some of the key antecedents of customer satisfaction in retail banking. International Journal of Bank Marketing, 20(4), 146-160.

- Johnston, R. (1995). The determinants of service quality: satisfiers and dissatisfiers. International Journal of Service Industry Management, 6(5), 53-71.

- Karatepe, O.M., Ugur, Y., & Emin, B. (2005). Measuring service quality of banks: Scale development and validation. Journal of Retailing and Consumer Services, 12(5), 373-383.

- Kasiri, L.A., Kenny, T.G.C., Murali, S., & Samsinar, M.S. (2017). Integration of standardization and customization: Impact on service quality, customer satisfaction, and loyalty. Journal of Retailing and Consumer Services, 35(3), 91-97.

- Kaura, V., Saroj, K.D., & Vishal, V. (2012). Impact of service quality on satisfaction and loyalty: case of two public sector banks. Vilakshan: The XIMB Journal of Management, 9(2), 65-76.

- Kaura, V. (2013). Antecedents of customer satisfaction: a study of Indian public and private sector banks. International Journal of Bank Marketing, 31(3), 167-186.

- Knauer, V. (1992). Increasing customer satisfaction. US Office of Consumer Affairs, Puells, CO.

- Krishnamurthy, R., Arun, K.S., & Prabhakaran, S. (2010). Influence of service quality on customer satisfaction: Application of SERVQUAL model. International Journal of Business and Management, 5(4), 117-120.

- Kumar, V. (2016). Introduction: is customer satisfaction (IR) relevant as a metric?” Journal of Marketing, 80(5), 108-109.

- Kuo, Y., Chi, M.W., & Wei, J.D. (2009). The relationships among service quality, perceived value, customer satisfaction, and post-purchase intention in mobile value-added services. Computers in Human Behavior, 25(4), 887-896.

- Lassar, W.M., Chris, M., & Robert, D.W (2000). Service quality perspectives and satisfaction in private banking. Journal of Services Marketing, 14(3), 244-271.

- Lemmink, J., & Jan, M. (2002). Employee behavior, feelings of warmth and customer perception in service encounters. International Journal of Retail & Distribution Management, 30(1), 18-33.

- Lenka, U., Damodar, S., & Pratap, K.J M. (2009). Service quality, customer satisfaction, and customer loyalty in Indian commercial banks. The Journal of Entrepreneurship, 18(1), 47-64.

- Levesque, T., & Gordon, H.G.M. (1996). Determinants of customer satisfaction in retail banking. International Journal of Bank Marketing, 14(7), 12-20

- Lewis, R.C., & Bernard, H.B. (1983). The marketing aspects of service quality. Emerging Perspectives on Services Marketing, 65(4), 99-107.

- Lindsey, H., Kristina, K., Baker, T.L., Andrews, M.C.H., Tammy, G., & Rapp, A.A. (2016). The importance of product/service quality for frontline marketing employee outcomes: The moderating effect of leader- member exchange (LMX). JournalofMarketingTheory&Practice, 24(1), 23-41.

- Naser, K, Ahmad. J., & Khalid, A.K. (1999). Islamic banking: a study of customer satisfaction and preferences in Jordan. International Journal of Bank Marketing, 17(3), 135-151.

- Oliver, R.L. (1980). A cognitive model of the antecedents and consequences of satisfaction decisions. Journal of Marketing Research, 17(4), 460-469.

- Oliver, R.L. (1981). Measurement and evaluation of satisfaction processes in retail settings. Journal of Retailing, 57(1), 25-48

- Olsen, L.L., & Michael, D.J. (2003). Service equity, satisfaction, and loyalty: from transaction-specific to cumulative evaluations. Journal of Service Research, 5(3), 184-195.

- Parasuraman, A., Valarie, A.Z., & Leonard, L.B. (1985). A conceptual model of service quality and its implications for future research. The Journal of Marketing, 49(4), 41-50.

- Parasuraman, A., Leonard, L.B, & Valarie, A.Z. (1991). Refinement and reassessment of the SERVQUAL scale. Journal of retailing, 67(4), 420-450.

- Parasuraman, A., Valarie, A.Z., & Leonard, L.B. (1988). Servqual: A multiple-item scale for measuring consumer. Journal of Retailing, 64(1), 12-40.

- Rahman, M.S., Abdul, H.K., & Mahmudul, H. (2012). A conceptual study on the relationship between service quality towards customer satisfaction: Servqual and gronroos's service quality model perspective. Asian Social Science, 8(13), 201-209.

- Rajib, R., Amit, K.B., & Partha, P.S. (2011). A comparative study of customer satisfaction between two Indian retail brands. Global Business Review, 12(2), 331-342.

- Ren, Y., & Desmond, L. (2016). An investigation into the link between service quality dimensionality and positive word of mouth intention in Mainland China. Journal of Marketing Communications, 22(5), 513-523.

- Richins, M.L. (1983). Negative word-of-mouth by dissatisfied consumers: A pilot study. The Journal of Marketing, 47(1), 68-78.

- Ringle, C.M., Sarstedt, M., & Zimmermann, L. (2011). Customer satisfaction with commercial airlines: The role of perceived safety and purpose of travel. JournalofMarketingTheory&Practice, 19(4), 459-472.

- Riquelme, H.E., Khalid, A.M., & Rosa, E.R. (2015). Internet banking customer satisfaction and online service attributes. The Journal of Internet Banking and Commerce, 14(2), 47-60.

- Rose, P.S., & Sylvia. C.H. (2005). Bank management & financial services, McGraw-Hill.

- Rajeswari, S., Yarlagadda, S., & Thiyagarajan, S. (2017). Relationship among service quality, customer satisfaction and customer loyalty: with special reference to wire line telecom sector (dsl service). Global Business Review, 18(4), 1041-1058.

- Royne, S.M. (1996). Demographic discriminators of service quality in the banking industry. Journal of Services Marketing, 10(4), 6-22.

- Saini, Y., Geoff, B., & Loonat, A. (2011). Consumer awareness and usage of Islamic banking products in South Africa. South African Journal of Economic and Management Sciences, 14(3), 298-313.

- Seiler, V., Markus, R., & Tim, K. (2013). The influence of socio-demographic variables on customer satisfaction and loyalty in the private banking industry. International Journal of Bank Marketing, 31(4), 235-258.

- Tan, L.H., Syaiful, R.H., & Boon, C.C. (2017). Exploring manager’s perspective of service quality strategies in Malaysian Banking Industry. Journal of Strategic Marketing, 25(1), 31-48.

- Taylor, S.A., & Thomas, L.B. (1994). An assessment of the relationship between service quality and customer satisfaction in the formation of consumers' purchase intentions. Journal of Retailing, 70(2), 163-178.

- Trif, S.M. (2013). The influence of overall satisfaction and trust on customer loyalty. Management & Marketing, 8(1), 109-128.

- Westbrook, R.A., & Richard, L.O. (1991). The dimensionality of consumption emotion patterns and consumer satisfaction. Journal of Consumer Research, 18(1), 84-91.

- Zeithaml, V.A. (1985). The new demographics and market fragmentation. The Journal of Marketing, 49(3), 64-75.

- Zeithaml, V.A., Berry, L.L., & Ananthanarayanan, P. (1996). The behavioral consequences of service quality. The Journal of Marketing, 60(4), 31-46.