Research Article: 2020 Vol: 21 Issue: 3

Democracy, Governance and Economic Growth: Time Series Evidence From Pakistan

Asif Razaq, School of Management and Economics Dalian University of Technology, China

Rabia Nazir, The Islamia University of Bahawalpur, Pakistan

Fareeha Adil, Sustainable Development Policy Institute, Islamabad, Pakistan

Misbah Akhtar, The Islamia University of Bahawalpur, Pakistan

Abstract

Debate on the nature and direction of linkages between democracy, governance, and economic growth is evolving. This paper attempts to determine the relationship between governance quality, the strength of democracy, and economic growth in Pakistan using timeseries data from 1984 to 2017. The paper also tests and confirms the causality running from democracy and governance to economic growth through the Granger causality test. No relationship was observed between governance and growth in our data. We propose a very little variation in the governance indicators of Pakistan over the studied period for this insignificant impact of governance measure on economic growth. However, democracy has a positive and significant impact on the GDP and its growth.

Keywords

Governance, Democracy, Economic Growth, Causality

Introduction

Democracy is the most celebrated form of government having its roots in ancient Greek philosophy dating back to over 500BC1. The concept and significance of democracy have evolved and are universally acknowledged as a vital ingredient in the ideal welfare of any society. Identifying democracy as the only acceptable form of government by the UN’s ‘Universal Declaration or Human Rights (1948)’ and the ‘International Covenant on Civil and Political Rights (1966)’ bear evidence to its esteem2. In the words of Anna Garlin Spencer3:

“The essence of democracy is its assurance that every human being should so respect himself and should be so respected in his personality that he should have an opportunity equal to that of every other human being to show what he was meant to become."

Democracy is supposed to establish freedom in the society in terms of human rights, thought, opinion, association, and expression, as well as the free judiciary, transparency, efficiency, accountability, and thus equity in the country4. This perception presumes democracy as a part and parcel of apt governance supported by the United Nations that regards Governance as the outcome of ‘good democracy’. Any economy, however, may survive under either democracy or dictatorship but not under anarchy. Anarchies are unstable and, therefore, either the anarchy collapses or the system itself. Governance is, therefore, an indispensable element for countries to survive.

According to Kaufman et al. (1999) governance exemplifies the authoritative customs and institutions of a country whereas the World Bank’s PRSP5 The handbook defines governance as the method of exercising power through economic, political, and social institutions of a country.

Good governance is believed to efficiently and effectively endorse equity, unity, peace, involvement, perspicuity, liability, and law abidance in the host country. Theoretically, this implies strong ties between a democratic government and good governance. Empirical testing nevertheless may or may not validate this conjecture. Rivera-Batiz (2002) found governance quality to be significantly superior in democratic states affecting growth via efficient and powerful democratic institutions. Commander et al. (1997) find good governance as an outcome of the duration and extent of political freedom along with many other determinants. Although the case studies of Taiwan, Singapore, and South Korea present a contradictory picture, yet simple analysis shows a reverse causal relation for these countries where good governments lead these countries to shift towards democracy.

Recently, researchers are focusing to explore the impact of democracy and governance on economic growth. Several studies have inspected two-way causal relationships between governance and growth and came up with different findings depending upon the sample, period, and especially the methodology adopted. The features of both strong democracy and good governance seem to be significant determinants of economic growth; however, there are different contradictory schools of thought in this regard.

Many researchers, through empirical findings, suggest a positive impact of good governance, possibly via strong democracy, on economic development. Olson et al. (1998) held the difference in the quality of governments to be responsible for the difference in the pace of growth between countries, with a positive impact of improved governance. Jong-A-Pin and Haan (2007) found the accelerations of economic growth preceded by economic reforms that are likely to occur at the start of almost every new political regime. However, the negative impact of political instability and high vulnerability to regime-switching can in effect outweigh the positive impacts of democracy, if any.

On the other hand, regarding the link between democracy and development, there is a greater dispute. Rodrik (1997) & Barro (1999) argued that there exists no meaningful relationship between democracy and economic growth. Many followers argue that controlling for other variables; democracy and development seem unrelated in both ways.

Some authors like Friedman advocate an inverse relationship between democracy and economic development. Friedman (1962) does favor the increased economic freedom as an outcome of democracy but argues that some redistributive or intrusive activities of democratic governments may in practice retard economic growth.

Lipset (1959) suggested that sustained growth leads to the path of democracy. Some scholars propose a reverse relationship between the two i.e. although development leads to democracy, yet democracy may also lead to inefficiency and lowers the pace of economic development. This school holds that nearly all of the developed countries and emerging economies such as the US, Japan, UK, Germany, China, Russia, and Singapore, etc. took-off and achieved accelerative growth under authoritative or non-democratic regimes. Przeworski and Limongi (1997) go further in stating dictatorships to be required for economic development

Pakistan, since its independence in 1947, has remained extremely vulnerable to coups and has seen four declared martial laws and several unsuccessful attempts of coups since 1958. Moreover, even under the elected governments, often the quality of governance remained poor. Data from various sources bears evidence to this statement. However, this evidence owes to the poor quality of democracy; rather than democracy itself; since election or referendum is the only prerequisite for democracy. Nevertheless, the picture is not as bleak as it seems. Pakistan has seen high rates of economic growth, sound democracy with good quality governance, a significantly improved standard of living, and has been on the path of development, albeit slowly. This study attempts to identify the mutual impact of democracy and governance on the GDP growth in Pakistan.

Governor State Bank of Pakistan, Yaseen Anwar (2012)6, acknowledging the importance of governance, emphasized the need of intensifying and implementing good governance practices to impart momentum to economic growth. This study examines that weather governance and democracy are directly related to the real per capita output and its growth or not. We also test the causal relationship between good governance/democracy and faster economic growth.

The rest of the paper is structured as follows: section two covers relevant literature in this field. The methodology is explained in section three, the data description is given in section four, and the results are explained in section five. Finally, section six concludes the study.

Literature Review

Helliwell (1992) analyzed the impact of democracy on economic growth using the Solow growth model. The findings suggest that higher growth leads toward democracy but democracy, in turn, harms growth. However, democracy indirectly affects growth through education as democratic societies spend more on education which results in higher income and growth.

Saint-Paul and Verdier (1993) present a model of endogenous growth where voting, education, growth, and income distribution evolve endogenously and redistribution, determined by a political equilibrium, is in the form of public education and concluded that democratic societies having high inequalities may well be good for growth, provided they imply more support for public education. While Milanovic and Ying (2001) investigated the impact of democracy on income inequality and observed that democracy not only reduces inequality directly but also indirectly through the political system.

Rivera-Batiz (2002) examined the long-run effects of democracy on growth by influencing the quality of governance. The results suggest a strong positive impact of the quality of governance on the strength of democratic institutions, directly, as well as indirectly via increased total factor productivity. On the other hand, Bhagwati (2002) examined the unfavorable relationship between democracy and development and concluded that there prevails no tradeoff between democracy and development and democracy is significant for development. Kaufmann and Kraay (2002) identified a strong positive causal effect from the government to growth per capita income but a week negative effect from per capita income to governance.

Lundström (2002) examined the impact of democracy on the different category of economic freedom in developing countries and identified a positive impact of democracy on two categories of economic freedom that are Government Operations and Regulations and Restraints on International Exchange while no impact on Money and Inflation and Takings and Discriminatory Taxation.

Decarolis (2003) examined the effect of democracy on growth and inequality using Instrumental Variables and found out that democracy doesn’t have any significant effect on fiscal policy however it reduces income inequality and political conflicts. Gerry and Mickiewicz (2006) suggested that in short-run political reforms increase income inequality but in the long run, it has opposite effects as stable democracies decrease inequality. Similarly, there is a positive relationship between fiscal capacity and income equality. As democratic countries raise more revenue and decrease inequality through redistribution of income.

Amir-ud-Din et al (2008) analyzed the relationship between economic growth, income inequality, and democracy in Pakistan using Instrumental Variables and RALS (rth-order autoregressive least squares) estimation techniques. The results showed no significant impact of democracy on the fiscal policy and only weakly significant impact on income inequality. They identify regime vulnerability to be the root cause of this outcome. Haq and Zia (2009) analyzed the link between governance and pro-poor growth in Pakistan and found a significant and positive relationship. They suggested a need to formulate and effectively implement governance policies to improve governance dimensions in Pakistan.

Mutascu (2009) analyzed the relationships between political regime durability, economic development, and form of government and found significant economic development in Romania under democracy rather than a dictatorship. Asian and Veiga (2010) determined the impact of political instability on economic growth. The results showed that political instability widely reduces economic growth and so is very harmful to the economy.

Akram et al. (2011) explored the impact of poor governance and inequality on poverty in Pakistan and discover a significant positive relationship between poor governance and income inequality and poverty. The study proposes that poverty can be alleviated through improving governance quality and reducing inequality. Adem and Elveren (2012) suggested a positive relationship to exist between income inequality and a share of military expenditures while strong democracy leads to less inequality and military expenditure.

Qureshi and Ahmed (2012) tested for the endogeneity between democracy and per capita growth for the cross country analysis. The results suggest the prevalence of non-linear quadratic relationship between democracy and growth.

Methodology

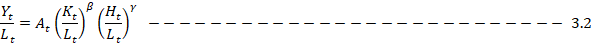

To relate governance and democracy to economic growth, a simple Cobb-Douglas production function is taken as follows:

Here the economy’s aggregate output level (Yt) depends upon total factor productivity (At), the labor force (Lt), physical capital stock (Kt), and the level of human capital (Ht).

Dividing both sides by Lt and assuming constant returns,

i.e. the output per capita (GDP) depends upon capital stock per capita (CST) and human capital per capita (ht). Linearizing the model;

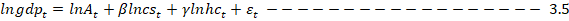

Transforming into the econometric model:

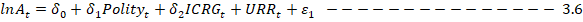

Recent literature suggests that democracy and governance affect the economy via changes in its total factor productivity (TFP). Good governance is presumed to improve the TFP while two opposing schools of thought exist for the effect of democracy on TFP. Solow (1957)7 suggests residual from equation (3.5) be a proxy of TFP (Solow Residual) since it is considered as an unobservable variable. TFP is also expected to vary along with urbanization. Considering a linear impact, TFP can be determined as:

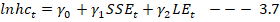

Where, the variable Polity is used for democracy, ICRG for governance, and URR for urbanization. Following Qureshi and Ahmed (2012), human capital is proxied by the gross secondary school enrollment (SSE - for education) and life expectancy (LE - for health); again linearly,

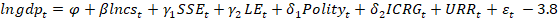

The final GDP level form equation takes the form as:

Where,

= Real per capita output,

= Real per capita output,

= Real per capita capital stock,

= Real per capita capital stock,

= Secondary school enrollment, gross, (%)

= Secondary school enrollment, gross, (%)

= Life Expectancy at Birth, (years)

= Life Expectancy at Birth, (years)

= Measure of democratic strength,

= Measure of democratic strength,

= Measure of governance quality,

= Measure of governance quality,

= Rate of urbanization,

= Rate of urbanization,

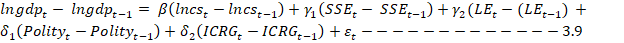

To find the impact of certain variables on the growth rate of output per capita, the differential equation of 3.8 is generated as:

which can simply be written as:

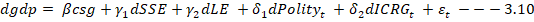

We have allowed flexibility in the model to obtain robust results. We have estimated various models using gLE (growth rate of LE) or lnLE in place of dLE, gICRG (growth of ICRG) as against dICRG to determine the governance on economic growth. Lag of lngdp are time trend are also tested for the sake of comparative analysis. VAR is also applied to test the causality between governance, democracy, and growth.

Data and Estimation Technique

This paper uses two major equations, 3.8 and 3.10, to measure the impact of governance and democracy on output and economic growth. 1st equation is a level form GDP equation while the 2nd is in the first difference form. The former uses a natural log of real per capita GDP as the dependent variable and natural log of real per capita capital stock, secondary school enrollment, and rate of urbanization, life expectancy, democracy, and governance as the independent variables. The later equation uses the growth rate of real per capita GDP as explained variable and growth rate of capital stock with differentials of the rest as explanatory variables.

Vector Auto-Regressive technique for the possible causality between governance and growth is tested using the corresponding variables. Data used in this analysis covers the period 1984 to 2017.

Variable Construction and Data Sources

The two most commonly used indicators for democracy are the annual data series Polity IV and Freedom in the World (FIW) Index. Polity IV uses values with range (-10, +10) to represent the status of government in all independent countries, having a minimum population of 0.5million, for a time ranging from 1800-2012. Evaluating electoral system, participation rate, openness, and competitiveness in a country it assigns (-10, -6) score to autocracies, (-5,5) to transition or anocracies and (6,10) to democracies. Polity IV data is taken from Political Instability Task Force8. FIW, alternatively, assesses political rights (PR) and civil liberties (CL) to determine the state of freedom; democracy in a country. Evaluating 195 countries, it classifies them into three categories i.e. Free, Partly Free, and Not Free, using a range of (1,7) for each indicator, since 1972. Employing Gastil’s transformation, PR and CL scores are often summed up (range: 2, 14) and via simple algebra9 converted in a score ranging from 0 (strongly democratic) to 1(strongly autocratic). FIW is taken from Freedom House10 and transformed according to Gastil. Data for both the indices are collected and analyzed. PR in FIW is strongly correlated with Polity IV while CL is related more with the governance indicators. Since governance data is also used in the analysis, to avoid the chances of multi-collinearity, Polity data seems more appropriate for estimating equation 3.8 and 3.10. However, FIW’s Gastil data is also used in many places for comparative analysis.

To measure governance we have used the International Country Risk Guide (ICRG) Researcher’s dataset.

ICRG uses 3 dimensions (political, economic, and financial) to assess risk factor in a country, using 22 indicators, for the principal purpose of guiding the investors and to analyze potential business risks in each country. However, its Researcher’s dataset (commonly called table3B) uses political risk as a proxy to measure the quality of governance. This set involves 12 weighted components i.e. Government Stability, Socioeconomic Conditions, Investment Profile, Internal Conflict, and External Conflict – each given a weight of 12 points; Corruption, Military in Politics, Religion in Politics, Law and Order, Ethnic Tensions and Democratic Accountability – each weighted by 6 points; and Bureaucracy Quality – 4 points. The scores can simply be summed up to range between 0 (worst governance) to 100 (best governance).

To get a better insight into the real living standards, real GDP per capita is used in this study. To get in real terms, GDP is divided by GDP deflator. As per convention, the real GDP is then divided by the total population of the country for each year (instead of the labor force) to get the per capita real GDP. Data for GDP, GDP deflator, and population are obtained from World Development Indicators (WDI).

Capital Stock is undoubtedly the major determinant of output. Gross Fixed Capital Formation is used as a proxy of Capital Stock which, after being converted to real form, is also divided by the total population to get real per Capita Capital Stock. Data are taken from WDI.

Gross Secondary School Enrollment measures the secondary school enrollment out of the total population belonging to that age group. The data are taken from WDI. Some data values are missing in the dataset which is estimated with the help of data from the Handbook of Statistics on Pakistan Economy.

The rate of urbanization is used as a control variable in this paper. This variable is constructed using the ratio of the urban population out of the total population. The rate of urbanization is proxied by taking the 1st difference of natural log of urban to total population i.e. the growth in urban population; since population growth rates are considered roughly homogeneous. Life Expectancy at birth is also used as a proxy of human capital in the study. Data for this variable are also taken from WDI.

Estimation Procedure and Diagnostics

Each variable is tested for unit root before starting the analysis. Orders of integration are determined for each variable. To assess the causal relation between governance, democracy, and growth, the causality test is applied. Lag lengths are selected based on the Akaike information criterion (AIC), and Hannan and Quinn information criterion (HQIC. Based on lags selection, VAR model is estimated to evaluate the Granger causality. For estimating the equations 3.8 and 3.10, Ordinary Least Square (OLS) method is used. Since Durbin Watson (DW) has limitations such as an inconclusive zone, Bruesch Godfrey statistic is also used to test for autocorrelation, along with DW. To alleviate any possibility of autocorrelation, Prais-Winsten Regression is used. Jarque-Bera test is used to ensure the normality of the residuals in both cases.

Results

Various graphical, statistical, and econometric procedures are adopted during the course of this study.

The results obtained are as under: Initially, graphs showing trends in governance and democracy in Pakistan are presented. 1997 (a democratic year) is entitled as the best year based on Governance whiles the 1990 (again a democratic year) is considered to be the worst year as per the quality of governance. Extremely surprising is the fact that 1990, deemed one of the best years as per democracy, comes out to be the worst year in terms of governance. But the opposite of this does not hold as the best year of governance is yet a year of democracy.

Descriptive Statistics

Correlations between various variables regarding democracy & governance are estimated in order to be able to have a better insight of the relationship. Correlations between the components of governance & indicators of democracy are as under in Table 1.

| Table 1 Correlations B/W Democracy & Components of Governance | ||||||

| Variable | Govt. Stab. | Socio | Inv. Prof. | Intcon | Extcon | Corrupt |

| Gastil | -0.605 | -0.252 | -0.021 | 0.012 | -0.054 | 0.367 |

| Polity | -0.606 | -0.627 | 0.104 | 0.263 | 0.283 | 0.483 |

| Variable | Miltrypol | Relpol | Laworder | Ethnic | Democr. | Bureauq. |

| Gastil | 0.137 | 0.273 | -0.323 | -0.367 | 0.465 | 0.321 |

| Polity | 0.253 | 0.358 | -0.131 | -0.227 | 0.663 | 0.274 |

Correlations between aggregate measure of governance & democracy are presented in Table 2. Poor quality of governance is exhibited in the low score of composite governance indicators with a mean of 45 and S.D. of ± 7.5

| Table 2 Correlations B/W Democracy & Governance | |||

| Variable | ICRG | Gstil | Polity |

| ICRG | 1.000 | - | |

| Gstil | -0.229 | 1.000 | |

| Polity | -0.012 | 0.792 | 1.000 |

Score of democracy, based on Polity IV, ranges between -7 to +8. For the case of Pakistan, year 1984 deemed to be worst on the basis of democratic indicators while 1988-1996 (having stable regimes with no martial law) are considered best years of democracy according to polity data and 1993-1995 acc. to FIW Gastil data11. On the other hand, 1997 (a democratic year) is entitled as the best year on the basis of Governance while the 1990 (again a democratic year) is considered to be the worst year as per the quality of governance. Extremely surprising is the fact that 1990, deemed one of the best years as per democracy, comes out to be the worst year in terms of governance. But the opposite of this does not hold as the best year of governance is yet a year of democracy. Underneath, data for democracy & governance12 are presented for two specific years 1984 (worst in democracy) and 1994 (one of the best in democracy via both indicators):

Unit Root Tests

All the variables were tested for stationarity and their orders of integration were noted, before making estimations. All the variables of equation 3.8, except LE, are found to have a unit root at the level and are stationary at 1st difference; i.e. integrated of order one I(1). On the other hand, all the variables of equation 3.10 except for dLE are found to be stationary a level; i.e. I(0). Due to non-stationarity of dLE, lnLE is used in equation 3.1013 in Table 3.

| Table 3 ADF Unit Root Test | |||||

| Variables | T-Stat (Level) |

T-Stat (1st d/f) |

1% Critical Value | 5% Critical Value | 10% Critical Value |

| le | -5.532 | - | -3.736 | -2.944 | -2.628 |

| lngdp | -1.075 | -5.261 | -3.736 | -2.944 | -2.628 |

| lncs | -0.069 | -4.252 | -3.736 | -2.944 | -2.628 |

| urr | -2.733 | -5.612 | -3.736 | -2.944 | -2.628 |

| sse | -1.241 | -4.861 | -3.736 | -2.944 | -2.628 |

| polity | -1.871 | -6.215 | -3.736 | -2.944 | -2.628 |

| icrg | -1.568 | -4.984 | -3.736 | -2.944 | -2.628 |

The next following hypothesis was tested using causality tests.

Hypothesis 1: H0: Governance Granger Cause Growth

H1: Presence of Causality

Hypothesis 2: H0: Democracy Granger Cause Growth

H1: Granger causality does not exist

The results, with high p-value, lead to the acceptance of H0 i.e. two-way causality is not observed to exist between governance and growth in this particular study for Pakistan. The lag length was selected to be 1 based on AIC, SBIC, and HQIC for applying VAR. The results represent that democracy is not caused by GDP growth, but GDP growth is caused by Democracy. This relation holds, however, in the short run only where the 1st lag of democracy is observed to, significantly, positively affect GDP growth rate in Table 4.

| Table 4 Granger Causality Wald Tests | |||

| Equation | Excluded | Chi2 | Prob>Chi2 |

| ICRG | Polity | 12.608 | 0.013 |

| ICRG | All | 12.608 | 0.013 |

| Polity | ICRG | 19.14 | 0.001 |

| Polity | All | 19.14 | 0.001 |

Next, we present our results for equation 3.8 is particularly according to the model specifications, yet other models are also estimated with little variation in the original equation. Few better fit models were identified, out of which the best one was selected (based upon several tests) in Table 5.

| Table 5 Results for the Impact of Polity and Governance on GDP and GDP Growth | ||||

| Model 1 | Model 2 | Model 3 | Model 4 | |

| Variables | Dependent LGDP | Dependent LGDP | Growth of GDP as Dependent | Prais-Winsten AR(1) Regression |

| Polity | 0.0047*** (0.0017) |

0.0019 (0.002) |

0.0033 (0.002) |

|

| Lagged Polity | 0.0049*** (0.0017) |

|||

| ICRG | -0.0023 (0.0017) |

-0.002 (0.0018) |

-0.003 (0.0018) |

|

| Life Expectancy | -0.1104*** (0.0162) |

-0.848*** (0.0152) |

0.701*** (0.005) |

-0.138*** (0.0227) |

| Capital Stock | 0.433*** (0.0462) |

0.489*** (0.0419) |

0.400*** (0.061) |

0.379*** (0.62) |

| Urbanization | 107.85*** (30.99) |

121.87*** (131.33) |

44.34 (26.94) |

67.68*** (26.16) |

| School Enrollment | 0.0012 (0.005) |

-0.0052*** (0.004) |

0.009* (0.004) |

0.007 (0.005) |

| Constant | 7.979*** (1.041) |

6.33*** (0.934) |

-3.29*** (0.98) |

9.89*** (1.409) |

| F | 397.14*** | 445.66*** | 10.15*** | 247.04*** |

| R2 | 0.99 | 0.99 | 0.75 | 0.98 |

| Adj R2 | 0.98 | 0.98 | 0.67 | 0.98 |

| DW | 1.24 | 1.91 | 1.24 | |

| BG-LM | 4.53*** | 2.118 | ||

| Observations | 34 | 34 | 34 | 34 |

The results suggest that as real per capita capital stock increases by 1%, the GDP of Pakistan is likely to increase by around 0.38%. Further, as life expectancy increases by 1 year, the real GDP per capita is likely to reduce by 0.14%.

Note: Model 1 and 2 use GDP per-capita as dependent variable with polity and lag of polity in both models separately. Model 3 is estimated by taking first difference of GDP as dependent variable and all other variables are also taken at first difference. Model 4 is estimated using Prais-Winston AR (1) regression for robustness. *, ** and *** denote significance at 10%, 5% and 1% level of significance.

This is because as life expectancies increase, the population increases as well which exerts downward pressure on all per capita variables. Moreover, as urbanization in the country increases by 1%, GDP is expected to grow by 67% via its total factor productivity impacts and also via the likelihood of human capital development since cities are equipped with better facilities.

Democracy, which appears to be a significant determinant of GDP in the OLS estimation, is rendered insignificant when corrected for autocorrelation. Governance, on the other hand, remained an insignificant factor affecting GDP in all the models estimated and received a negative sign in all. Since insignificant, the negative relation needs not to be justified

Since equation 3.8 uses GDP in the level form, wherein reality GDP is quite strongly affected by its lagged value, there is a possibility of auto-correlation. Although in the stated models, auto-correlation was not found to be much significant based on the Bruesch Godfrey LM test, yet, a need was felt to estimate the models using Prais – Winsten Regression(appendix A), to tackle with even little auto-correlation. Since multicollinearity makes the estimates erratic, to get trustworthy results, correlations among explanatory variables are tested beforehand.

Life Expectancy (LE) has a high correlation with Secondary School Enrollment (SSE) since both variables measure the quality of human capital in the country. Better health itself is a determinant of increased school enrollments. LE is observed to have a strong negative correlation with the stock of real physical capital per capita because as life spans increase, the population of a country increases, even if the birth rates are on a slow decline (due to hidden momentum of the population). Nevertheless, with six independent variables, that is to say among 15 pair-wise correlations, two strong correlations are not expected to create many problems in the analysis.

Estimating equation 3.8, Results for Durbin Watson statistic as well as Bruesch Godfrey Hypothesis Testing validate the presence of Autocorrelation in the model. Since the inclusion of the 1st lag of GDP in the model solves the problem of autocorrelation, the model is expected to bear a 1st order autocorrelation. To cope up with this problem, Prais – Winsten regression model is estimated which via iteration, identifies the value of rho (coefficient of AR(1)), transforms the variables back into the original form, and presents the results thus solving for the problem of autocorrelation. Along with the regression equation, the normality of residuals was also tested using the Jarque-Bera Normality test. Results for Jarque-Bera authenticate the normality of residuals.

The above model, after multiple checks, is found better than the rest of the models analyzed. However, as the lag impact of democracy on GDP, as suggested by the VAR model, another model is estimated which is as follows: Here autocorrelation is not very likely and the results show a positive impact of previous year’s democratic strength on the current year’s real per capita GDP.

The second equation, 3.10, being in growth form, is estimated fairly using simple OLS. This equation is also tested with many minor variations and the best one is presented here. Many models were estimated in this regard since the specified model is not a good fit with lots of insignificant coefficients. The following model, on various grounds, seems a better choice:

The results suggest that a 1% increase in physical capital stock per capita growth, GDP growth rate accelerate by 0.4%. 1% increase in secondary school enrollment over a year causes GDP to increase by 0.01%. 1% increase in life expectancy over a year leads to a 0.7% increase in GDP per capita (this time via human capital effect). The rest of the variables remain inconsequential in determining the GDP growth rate.

Conclusion

In the long run, good governance is caused by strong democracies, and strong democracies in turn improve the quality of governance. No relationship, whatsoever, is observed between the composite index of governance and economic growth for the case of Pakistan whereas the previous year’s democratic strength is identified to have a positive influence on the current year’s economic output as well as economic growth. The reason for such a dilemma is that the political regime in Pakistan has always remained prone to military coups, which conceals any positive impact of democracy on economic growth as well as on the quality of governance. The seemingly insignificant impact of governance on economic growth owes to the fact that throughout there 28 years, the governance indicators in Pakistan have remained repulsively low with a low average of 45 points out of 100.

End Notes

1. http://en.wikipedia.org/wiki/Democracy#History

2. http://www.un.org/en/globalissues/democracy/index.shtml

3. http://www.brainyquote.com/quotes/authors/a/anna_garlin_spencer.html

4. http://www.un.org/en/globalissues/democracy/human_rights.shtml

5. Poverty Reduction Strategy Papers

6. http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/business/09-Nov-2012/good-governance-can-bolster-economic-growth-sbp-chief

7. http://en.wikipedia.org/wiki/Solow_residual

8. http://www.systemicpeace.org/ (Political Instability Task Force)

10. http://www.freedomhouse.org/

11.These results are for data ranging from 1984-2017

12.Note that a higher value represents better state of affairs.

13.Reason for using lnLE in 3.10 instead of LE, both integrated of order zero I(0), is to keep the variance low since all other variables are in growth or difference form.

References

- Abbas, Q. & Foreman-Peck, J. (2008) “Human Capital and Economic Growth: Pakistan 1960-2003”, The Lahore Journal of Economics, Vol. 13, No.1, pp. 1-27.

- Ahmad, E. (2010) “Improving Governance in Pakistan: Changing Perspectives on Decentralisation”, The Pakistan Development Review, Vol.49, No. 4 Part I, pp. 283–310.

- Ahmad, N. (2005) “Governance, Globalisation, and Human Development in Pakistan”, The Pakistan Development Review, Vol. 44, No. 4 Part II, pp. 585–594.

- Akram, Z. et al. (2011) “Impact of Poor Governance and Income Inequality of Poverty in Pakistan”, Far East Journal of Psychology and Business, Vol. 4 No. 3.

- Albornoz, F. & Dutta, J. (2007) “Political Regimes and Economic Growth in Latin America”.

- Amir-ud-Din, R. et al. (2008) “Democracy, Inequality and Economic Development: The Case of Pakistan”, MPRA Paper No. 26935.

- Anwar, T. (2006) “Trends in Absolute Poverty and Governance in Pakistan: 1998-99 and 2004-05”, The Pakistan Development Review, Vol. 45, No. 4 Part II, pp. 777–793.

- Asien A. & Veiga J.F. (2010) “How does Political Instability Affect Economic Growth”, NIPE WP Vol. 5.

- Barro, Robert J. (1999) “Rule of Law, Democracy, and Economic Performance”, in 2000 Index of Economic Freedom, New York: Heritage Foundation.

- Bednarik, R. & Filipova, L. (2009) “The Role of Religion and Political Regime for Human Capital and Economic Development”, MPRA Paper No. 14556.

- Bhagwati, N.J. (2002) “Democracy and Development: Cruel Dilemma or Symbiotic Relationship?”, Review of Development Economics, Vol. 6, No.2, pp. 151–162.

- Cogneau, D. (2012) “The Political Dimension Of Inequality During Economic Development”, Région Et Développement, Vol. 35.

- Commander, S. et al. (1997) “The Causes of Government and the Consequences for Growth and Well-Being ”, Policy Research Working Paper No. 1785.

- Decarolis, F. (2003) “Economic Effects of Democracy. An Empirical Analysis”.

- Friedman, M. (1962) “Capitalism and Freedom”, University of Chicago Press, United States.

- Gang, G. (1998) “Democracy or Non-democracy – from the perspective of economic development.”

- Gerry. J.C. & Mickiewicz, T. (2006) “Inequality, Fiscal Capacity and the Political Regime: Lessons from the Post-Communist Transition”, William Davidson Institute Working Paper No. 831.

- Gradstein, M. et al. (2001), “Democracy and Income Inequality”, Policy Research Working Paper No. 2561.

- Haq, R. & Zia, U. (2009) “Does Governance Contribute to Pro-poor Growth? Evidence from Pakistan”, PIDE Working Paper, Vol. 52.

- Helliwell., F.J. (1992) “Empiical Linkages between Democracy and Economic Growth”, NBER Working Paper No. 4066.

- Jong-A-Pin, R & Haan, J. de (2007) “Political Regime Change, Economic Reform and Growth Accelerations”, Cesifo Working Paper No. 1905, Category 5: Fiscal Policy, Macroeconomics And Growth.

- Jong-A-Pin, R. & Haan, J. de. (2008) “Growth Accelerations and Regime Changes: A Correction”, Econ Journal Watch, Vol. 5, No. 1, pp 51-58.

- Kaufmann, D. & Kraay, A. (2002) “Growth Without Governance”, Policy Research Working Paper No. 2928.

- Kaufmann, D. et al. (2010), “Growth without Governance”, Policy Research Working Paper No. 5430.

- Lipset, Seymour M. (1959) “Some Social Requisites of Democracy: Economic Development and Political Legitimacy”, American Political Science Review, Vol. 53, No. 1, pp. 69-105.

- Longoni, E. & Gregorini, F. (2009) “Inequality, Political Systems and Public Spending”, Working Paper Series, No.159.

- Lundström, S. (2002) “Decomposed Effects of Democracy on Economic Freedom”, Working Paper in Economics, No 74.

- Minier, J. A. (1998) “Democracy and Growth: Alternative Approaches”, Journal of Economic Growth, Vol. 3, 241–266.

- Mutascu M. (2009), “Political Regime Durability, Development And Governance: The Romania’s Case”, Analele Stiin?ifice Ale Universit??ii, Alexandru Ioan Cuza” Din Iasi Tomul Lvi Stiin?e Economice.

- Nakagawa, H. (2009), “Democracy, Governance and Growth”, Pasific Island Political studies Association.

- Olson, M. (1993) "Dictatorship, Democracy, and Development", American Political Science Review, Vol. 87, No. 3, pp. 567-576.

- Olson, M. et al (2000) "Governance and Growth: A Simple Hypothesis Explaining Cross-Country Differences in Productivity Growth,” Public Choice, Springer, Vol. 102, No. 3 – 4, pp. 341-64.

- Paul-Saint, G. & Verdier, T. (1992), “Education, democracy and growth” Journal of Development Economics, Vol. 42 pp. 399-407.

- Przeworski, A. & Limongi, F. (1993) "Political Regimes and Economic Growth", Journal of Economic Perspectives, Vol. 7, No. 3, pp. 51-69.

- Przeworski, A. & Limongi, F. (1997) "Modernization: Theories and Facts", World Politics, Vol. 49, pp 155-183.

- Qureshi, M. G. & Ahmed, E. (2012) “The Inter-linkages between Democracy and Per Capita GDP Growth: A Cross Country Analysis”, Pakistan Institute Of Development Economics, working papers: No. 85.

- Rivera-Batiz, Francisco L. (2002) “Democracy, Governance and Economic Growth: Theory and Evidence”, Review of Development Economics, Vol. 6, No. 2, pp. 225-247.

- Solow, R.M. (1967) “The Explanation of Productivity Change”, Review of Economic Studies, Vol. 34, No. 2, pp. 249-283.

- Shahbaz M., et al, “Economic Growth and its Determinants in Pakistan”.

- Töngür, Ü. & Elveren, Y.A. (2010) “Military Expenditures, Inequality, and Welfare and Political Regimes: A Dynamic Panel Data Analysis”, ERC Working Papers in Economics, 12/10.

- United Nations (1948) “The Universal Declaration of Human Rights”, retrieved July 11, 2013 from http://www.un.org/en/documents/udhr/

- United Nations (1966) “International Covenant on Civil and Political Rights”, retrieved July 11, 2013 from http://www.hrweb.org/legal/cpr.html