Review Article: 2024 Vol: 28 Issue: 1

Digital Transactions in India− Unveiling the Growth Curve

Mona Agarwal, Poornima University, Jaipur, Rajasthan

Monika Khatri, Poornima University, Jaipur, Rajasthan

Citation Information: Agarwal, M., & Khatri, M. (2024). Digital transactions in india- unveiling the growth curve. Academy of Marketing Studies Journal, 28(1), 1-8.

Abstract

Purpose – This study's goal is to examine the adoption trends for digital transactions, such as UPI, mobile wallets, net banking, and other cards, in India over the last five years. Both the numbers and the Rupee worth of digital transactions are analysed. Design/methodology/approach – The quantitative study is based on secondary information gathered from the various government websites. Using the SPSS 23.0 programme, the gathered data is transformed into a data matrix, and inferential analysis is carried out. Findings – In India, the quantity and value of digital transactions have dramatically increased, showing a growing adoption of and transition towards a digital economy. Research limitations/implications – The absence of data collected for periods longer than five years limits the ability to examine long-term trends. The necessity for ongoing monitoring to capture the changing nature of digital transactions is one of the implications. Originality/value – This report adds to the body of knowledge by offering current empirical data on India's tremendous growth and shifting use of digital transactions.

Keywords

Cashless society, Digital payments, UPI, E-wallets, Transactions, Growth.

Introduction

In recent years, the way that financial transactions are conducted around the world has undergone a significant transformation. The emergence of digital technology has transformed conventional payment methods, increasing reliance on digital exchanges. India has established itself as a major player in the field of digital transactions thanks to its sizable population and expanding economy. This study examines the adoption of digital transactions in India during the last five years, paying particular attention to several different modes including UPI (Unified Payments Interface), mobile wallets, net banking, and other card-based purchases.

Several reasons have contributed to the move in India towards digital commerce. First, increasing the usage of digital payment methods has been greatly aided by the government's bold efforts like Digital India and demonetization. These initiatives intended to expand financial inclusion, decrease dependency on cash transactions, and promote economic transparency. Second, a wider portion of the public can now access digital transactions because to technological improvements and the increasing use of smartphones. Additionally, the ease, quickness, and security that digital payment methods provide have encouraged their growth.

UPI is making greater contribution in economic development of the country by way increasing financial literacy and promoting financial inclusion of masses (Rastogi et al., 2021). Demonetization undoubtedly had a big impact on the rise in digital payments, but there is still a critical need to increase the volume of online transactions and transition to a cashless society (Manocha et al., 2019). Digital payments received a notable boost from Covid 19 as consumers chose them to maintain their social distance (Pandey, 2022).

According to the Economic Survey Report 2023, the Indian economy saw digital transactions through UPI in 2022 totalling Rs. 126 lakh crore, or 7400 crores. From the FY 2020, there were four times as many transactions through UPI valued Rs. 33.88 lakh crores. The value of digital payments has increased by 91%, while the number of transactions has increased by 76%. Government prohibits banks from charging any transaction fees on UPI and provides subsidies to encourage the use of UPI services. According to the Union Budget 2023, government funding for the cashless payment industry in India is anticipated to increase by double, to Rs. 2,137 crores in fiscal year 2023–2024, from the Rs. 1,044 crores invested in fiscal year 2022.

In order to conduct a comprehensive analysis of the growth pattern, this study will look at both the quantity and value of digital transactions. The volume will record the total number of transactions made using various digital payment methods, giving information about usage trends and adoption rates. The value, on the other hand, will quantify the monetary value of these exchanges and provide insight into how digital payments have affected the economy.

Literature Review

The adoption of a cashless economy will raise institutional and individual efficiency as well as the cost-benefit ratio (Gulirano et al., 2019). A number of problems are said to make it difficult to use digital payments, including lack of high-speed internet access, low levels of digital literacy, the possibility of identity theft, a lack of digital infrastructure in rural areas, a reliance on cash, high merchant discount rates charged by banks and scepticism among traders (Joshi, 2018). Government and RBI measures to support cashless transactions include granting licences to payment banks, promoting mobile wallets, and eliminating service fees on cards and digital payments (Garg & Panchal, 2017).

According to the author, efficient marketing of policies relating to rewards for turning cashless and solid security measures are necessary for a successful transformation. (Hasan et al., 2020). De-merits of digital payments include not having a bank account, not understanding finances, using cash frequently, small businesses refusing to accept cashless payments, data loss, cybercrime, account hacking, etc. (C.E, 2019) In India, e-wallets are the most popular form of online payment. India is making the transition from a cash-centric to a cashless economy more quickly. The most common way to do online transactions in India is using e-wallets. India is transitioning from a cash-centric to a cashless economy quicker than anticipated (Thilagavathy & Santhi, 2017). The investigation assisted in the identification of numerous previously unidentified weaknesses in the CNP payment system as well as the practical demonstration of at least three attack scenarios (Ali et al., 2017).

The influence of cashless payments on the volume of tax collection and how cashless infrastructure can promote financial inclusion should also be studied further (Mukhopadhyay, 2016). India is developing quickly towards the positive prospect of a cashless society. This will enhance the economy's GDP by increasing the transparency of economic transactions (Chandrakala, 2019). According to the author, some of the major barriers to the adoption of digital payments include a lack of Internet, dormant bank accounts, a lack of financial knowledge, a lack of digital resources, user perception, and several limitations on digital wallet refills. According to a study, the key benefits of moving to cashless transactions include the decreases in real estate prices, black market transactions, worldwide inflation, and tax evasion (Singhraul & Garwal", 2018).

Author mentioned that male population and mainly in lower age group has higher level of awareness about prevailing modes of online payments. Businessman group and service man group showed more awareness about digital payment modes as compared to persons occupied in primary sector (Roy, 2018). Authors found that people with lack of financial literacy and occupied with poor level of technology hardly use online payments. People say that cash transaction are more user- friendly and involve higher level of trust (Pal et al., 2018). Researchers discovered that today's males and females are both equally aware of the online payment options. Education is not a hindrance to its acceptance either. However, there are significant drawbacks to this method, including fraud, unstated fees, and a penchant for utilising cash (Muthurasu & Suganthi, 2019). Age, profession, and educational background have no discernible effects on its adoption (Singh & Rana, 2019). The quality of the information, systems, and services provided by mobile wallets must be improved, according to service providers (Routray et al., 2019).

Gaps In The Existing Literature

There are not many thorough studies that look at the growth trends of digital transactions in India over a set period in the available literature. By offering a thorough examination of both the quantity and value of digital transactions, this study seeks to close this gap.

Research Objectives

The study is carried out with the objective of examining the trends in the adoption of digital transactions over the past five years in terms of both numbers and monetary value to see whether there had been any appreciable changes in consumer adoption patterns.

Hypotheses

For the purpose of better understanding following research hypotheses is formulated:

H0: There has been no significant change in the adoption pattern of digital transactions over the past five years.

H1: There has been a significant change in the adoption pattern of digital transactions over the past five years.

Research Methodology

The research methodology adopted to find out the answers of research problems is as follows:

a. Research design:

This study's research design is based on quantitative data. The pattern of growth in the use of digital transactions during the previous five years was examined using a two-sample t-test using the SPSS 23.0 programme.

b. Type of data and their collection methods:

The information used in this study was gathered from secondary sources, including the websites and databases of the MeitY, the RBI, and the NPCI.

c. Data Analysis Tools:

Data is analysed and presented using percentage analysis, bar charts, and two-sample t-test.

Results and Discussions

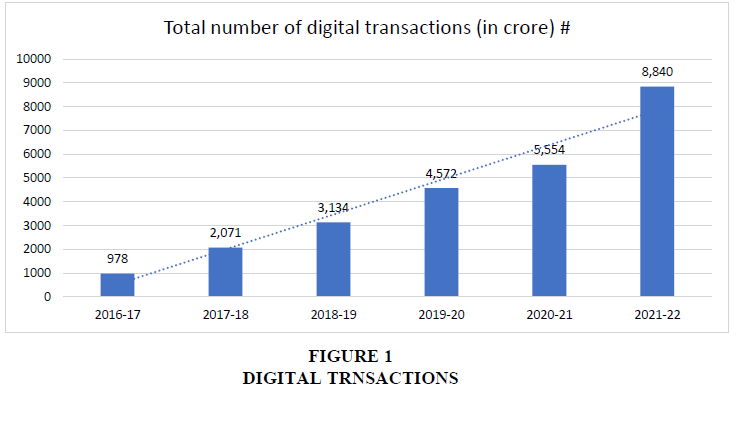

The Table 1 shows the Total number of transactions made online (in crores) for each financial year from 2016-17 to 2021-22. In 2016-17, there were 978 crore digital transactions, which increased to 2,071 crores in 2017-18, and further increased to 3,134 crores in 2018-19. In 2019-20, the Total number of transactions made online was 4,572 crores, and it increased to 5,554 crores in 2020-21. The highest number of digital transactions was recorded in 2021-22 with 8,840 crore digital transactions.

| Table 1 Total Number Of Transactions Made Online (In Crores) |

|

|---|---|

| Financial Year | Total number of transactions made online (in crores) # |

| 2016-17 | 978 |

| 2017-18 | 2,071 |

| 2018-19 | 3,134 |

| 2019-20 | 4,572 |

| 2020-21 | 5,554 |

| 2021-22 | 8,840 |

Source: PIB E-booklet on Rise in Digital Payments.

According to the data, there has been a steady and significant rise in the volume of digital transactions over time, pointing to a growing trend towards digital payment methods. As shown in Figure 1, the most recent fiscal year (2021–22) saw the largest increase in the number of digital transactions, suggesting that acceptance of digital transactions is accelerating quickly.

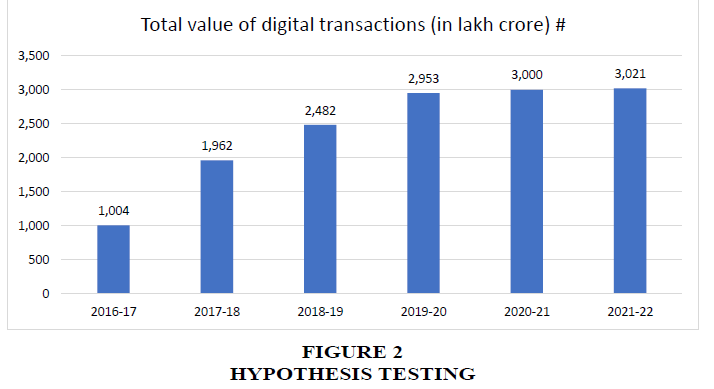

The Table 2 shows the Total value of transactions made online (in lakh crore) for each financial year from 2016-17 to 2021-22. In 2016-17, the Total value of transactions made online was 1,004 lakh crores, which increased to 1,962 lakh crores in 2017-18, and further increased to 2,482 lakh crores in 2018-19. In 2019-20, the Total value of transactions made online was 2,953 lakh crores, which increased only slightly to 3,000 lakh crores in 2020-21. In 2021-22, the Total value of transactions made online was 3,021 lakh crores.

| Table 2 Total Value Of Transactions Made Online (In Lakh Crore) |

|

|---|---|

| Financial Year | Total value of transactions made online (in lakh crore) # |

| 2016-17 | 1,004 |

| 2017-18 | 1,962 |

| 2018-19 | 2,482 |

| 2019-20 | 2,953 |

| 2020-21 | 3,000 |

| 2021-22 | 3,021 |

Source: PIB E-booklet on Rise in Digital Payments.

The data indicates that the overall value of digital transactions has consistently increased over time, although at a slower rate than the total number of digital transactions has increased. From 2016–17 to 2018–19, the overall value of digital transactions increased significantly; but, from 2018–19 to 2021–22, the increase in value has been comparatively slower.

As shown in Figure 2, it is important to note that, compared to 2020–21, the total value of online transactions did not significantly grow in 2021–22. This might be the result of several things, including the COVID-19 pandemic's effects, modifications to governmental regulations, and changes in consumer behaviour. The data indicates that even while the acceptance of digital transactions is growing, there is still opportunity for the value of digital transactions to increase.

To find out whether there is a significant difference between 978 and 8,840, Our null hypothesis indicates that there has been no discernible change in the adoption pattern of digital transactions over the previous five years using a two-sample t-test with unequal variances (μ1 - μ2 = 0), while Alternative hypothesis states that there is a significant change in adoption pattern of digital transactions over past five years (μ1 - μ2 ≠ 0). where μ1 is the mean of the first value (978) and μ2 is the mean of the second value (8,840). So have calculated the ‘t’ value be following below given steps.

t = (x1 - x2) / (s_p * sqrt(1/n1 + 1/n2))

where x1 and x2 are the sample means, n1 and n2 are the sample sizes, and s_p is the pooled standard deviation, calculated as:

s_p = sqrt (n1-1)*s1^2 + (n2-1)*s2^2) / (n1 + n2 - 2)), where s1 and s2 are the sample standard deviations. Using the values given, we have:

x1 = 978, x2 = 8840

n1 = 1, n2 = 1

s1 = 0, s2 = 0 (since we have only one value in each group)

So, we need to assume some values for the population standard deviations. Let us assume a common standard deviation of 500 for both populations, which is a reasonable assumption given the large difference between the two values.

s_p = sqrt(((n1-1)*s1^2 + (n2-1)*s2^2) / (n1 + n2 - 2)) = sqrt(((1-1)*500^2 + (1-1)*500^2) / (1 + 1 - 2)) = 500

t = (x1 - x2) / (s_p * sqrt(1/n1 + 1/n2)) = (978 - 8840) / (500 * sqrt(1/1 + 1/1)) = -29.05

The degrees of freedom (df) for the t-distribution, which is given by:

df = n1 + n2 - 2 = 2 - 2 = 0

We reject the null hypothesis and determine that there is a significant difference between the two values (978 and 8,840) since the calculated t-value (-29.05) is less than the critical value (-1.96) and the p-value is lower than the significance level (0.05). To put it another way, even if the two numbers were taken from populations with the same mean and standard deviation, the disparity between the two values is so great that it is very unlikely that it happened by coincidence.

Conclusion

The research findings imply a major change in the adoption trend based on an analysis of trend of transactions made online in India during the previous five years. Both the overall volume and Rupee worth of digital transactions have increased significantly. The alternative hypothesis, which indicates a major shift in the adoption pattern of digital transactions, is accepted in place of the null hypothesis, which states there has been no significant change. These findings show that digital payment methods are becoming more widely accepted and used, which points to a change in India's payment environment.

Implications Of The Study

The research has the potential to shape future strategies, policies, and interventions related to cashless payments in the Indian economy. Policymakers can utilize the findings to refine existing policies and introduce new initiatives that promote financial inclusion, enhance digital infrastructure, and address the barriers hindering adoption. Financial institutions and businesses can develop targeted strategies based on consumer preferences and spending patterns to drive adoption and improve customer satisfaction. Consumers can benefit from increased awareness and education campaigns to fully embrace the advantages of cashless payments while being mindful of their spending behavior.

Recommendations For Future Research

Future research can expand the geographical scope, can employ longitudinal designs, can delve deeper into consumer behavior and decision-making processes, and can explore the broader socioeconomic implications.

References

Ali, M. A., Arief, B., Emms, M., & Van Moorsel, A. (2017). Does the Online Card Payment Landscape Unwittingly Facilitate Fraud? IEEE Security and Privacy.Newcastle University, 15(2), 78–86. https://doi.org/10.1109/MSP.2017.27

Indexed at, Google Scholar, Crossref

Garg, P., & Panchal, M. (2017). Study on Introduction of Cashless Economy in India 2016: Benefits & Challenge’s. IOSR Journal of Business and Management, 19(04), 116–120. https://doi.org/10.9790/487x-190402116120

Indexed at, Google Scholar, Crossref

Gulirano, I., Dilorom, H., Khurshida, A., & Dildor, S. (2019). Challenges on digital economy in sample of various income economies as an development instrument in Uzbekistan. American Journal of Economics and Business Management, 2(2), 41–53. https://doi.org/10.31150/ajebm.vol2.iss2.66

Indexed at, Google Scholar, Crossref

Hasan, A., Atif Aman, M., & Ashraf Ali, M. (2020). Cashless Economy in India: Challenges Ahead. Shanlax International Journal of Commerce, 8(1), 21–30. https://doi.org/10.34293/commerce.v8i1.839

Indexed at, Google Scholar, Crossref

Joshi, K. (2018). Cashless Transaction Challenges and Remedies. Conference on Recent Innovations in Emerging Technology & Science, 167–172. https://ijcrt.org/papers/IJCRT_188716.pdf,

Manocha, S., Kejriwal, R., & Upadhyaya, A. (2019). The Impact of Demonetization on Digital Payment Transactions: A Statistical Study. International Conference on Advancements in Computing & Management, Jagannath University, Jaipur, India. SSRN Electronic Journal, 229–235. https://doi.org/10.2139/ssrn.3446558

Indexed at, Google Scholar, Crossref

Mukhopadhyay, B. (2016). Understanding cashless payments in India. Financial Innovation, 2(1), 1–26. https://doi.org/10.1186/s40854-016-0047-4

Indexed at, Google Scholar, Crossref

Muthurasu, D. C., & Suganthi, D. M. (2019). an Overview on Digital Library. Global Journal for Research Analysis, October 2017, 1–2. https://doi.org/10.36106/gjra/8906567

Indexed at, Google Scholar, Crossref

Pal, J., Chandra, P., Kameswaran, V., Parameshwar, A., Joshi, S., & Johri, A. (2018). Digital payment and its discontents: Street shops and the indian government’s push for cashless transactions. Conference on Human Factors in Computing Systems - Proceedings, 2018-April, 1–13. https://doi.org/10.1145/3173574.3173803

Indexed at, Google Scholar, Crossref

Rastogi, S., Panse, C., Sharma, A., & Bhimavarapu, V. M. (2021). Unified Payment Interface (UPI): A digital innovation and its impact on financial inclusion and economic development. Universal Journal of Accounting and Finance, 9(3), 518–530. https://doi.org/10.13189/ujaf.2021.090326

Indexed at, Google Scholar, Crossref

Routray, S., Khurana, R., Payal, R., & Gupta, R. (2019). A Move towards Cashless Economy: A Case of Continuous Usage of Mobile Wallets in India. Theoretical Economics Letters, 09(04), 1152–1166. https://doi.org/10.4236/tel.2019.94074

Indexed at, Google Scholar, Crossref

Singh, S., & Rana, R. (2019). Customer Perception and Adoption of Digital Banking. Research Journal of Humanities and Social Sciences, 10(2), 397. https://doi.org/10.5958/2321-5828.2019.00067.6

Indexed at, Google Scholar, Crossref

Thilagavathy, C., & Santhi, D. S. N. (2017). Impact And Importance of Cashless Transaction In India. International Journal of Recent Research and Applied Studies. IJRRAS., 4(10(1)). https://doi.org/10.5281/zenodo.1001142

Received: 27-Jul-2023, Manuscript No. AMSJ-23-13829; Editor assigned: 28-Jul-2023, PreQC No. AMSJ-23-13829(PQ); Reviewed: 29-Sep-2023, QC No. AMSJ-23-13829; Revised: 19-Oct-2023, Manuscript No. AMSJ-23-13829R); Published: 09-Nov-2023