Review Article: 2023 Vol: 27 Issue: 4

Digitalization Effect of Financial Inclusion in Banking

Animesh Shekhar, Manipal University Jaipur

Birajit Mohanty, Manipal University Jaipur

Sankersan Sarkar, T.A.Pai Management Institute, Manipal University Jaipur

Citation Information: Shekhar, A., Mohanty, B., Sarkar, S. (2023). Digitalization effect of financial inclusion in banking. Academy of Marketing Studies Journal, 27(4), 1-10.

Abstract

Thousands of adults worldwide have little access to the financial markets that they need to maintain even moderate financial well-being. Many families and small companies have little to no access to structured financial institutions in emerging markets. Except in advanced economies, financial institutions have only limited access to a menu of cost-effective goods to meet their financial needs. The advantages for financial services consumers, digital funding suppliers, states, and the economy are diverse in digital finance and financial inclusion, while there are still many challenges that will help to improve digital financing for private, commercial, and government users if tackled. It allows individuals to save on potential stability, allows for a high degree of bank deposit, a safe deposit base, and the prospect of savings building, investing, and accessing credit. One day there will be an inclusive increase that focuses on financial inclusion. Taking modern financial technologies together, this is done. Several banks landed in the latest banking scenario known as "Digital Finance," with new banking technology. There is a global financial transformation led by smartphones, access to new data, technological developments, and changing perceptions of customers of financial services. We are witnessing the emergence of Financial Technologies (Fintech) players, who are committed to promoting greater financial inclusion.

Keywords

Digital Finance, Financial Inclusion, Financial Services, Fintech Information, and Communication Technology, Social Inclusion, Health Inclusion, Sustainable Growth.

Introduction

Inadequate access by a large proportion of the world’s population to financial services is a challenge. The nature of the challenges, however, differs considerably among developed and developing countries and even among different demographic groups in the same country and area (Tay et al. 2022).

“Universal access to financial services is within reach—thanks to new technologies, transformative business models, and ambitious reforms... As early as 2020, such instruments as e-money accounts, along with debit cards and low-cost regular bank accounts, can significantly increase financial access for those who are now excluded.”

-By “Jim Yong Kim (President, World Bank Group)”

President Kim’s hope is expressed by G-20 leaders and representatives from over fifty countries who are committed both internationally and domestically to the Financial Inclusion Programme, the worldwide monetary sector “standard-setting bodies” (SSBs). Almost every main industry, including the financial services sector, is expanding with new technology and business models. An increasing number of digital partners and other entrants are joining traditional retail banks. Digital banks, for example, are companies that adopt emerging technology to provide more competitive financial services. The gains for financial sector consumers, the digital finance provider, policymakers, and the economy are numeric and financial inclusion. To counteract poor standards in emerging and developing economies, the G20 and the World Bank are working to improve financial inclusion in developed countries since 2010 (Hannig & Jansen, 2010). Today’s importance to poverty reduction and economic development in digital finance and financial inclusion is attracted by policymakers and scholars, mostly by the persistent number and problems that can make digital finance work easier for people, companies, policymakers, and the economy when tackled. Digital access technology enables a larger variety of financial services like online banking, mobile banking, etc. The technology has been used to extend online banking, smart banking, electronic wallet, mobile wallet, and credit and debit cards. It provides the consumer with many advantages, such as simplicity, ease of financing, etc. In contrast, the threat of cyber-attacks serves as a red warning for economic growth (Kanungo & Gupta, 2021). The Digital India Movement and the widespread penetration of telecom in rural areas have prompted serious efforts to bring widespread formal banking channels and innovative financial technology together to create an ecosystem that is both viable and vibrant. This has been made possible as a result of the widespread penetration of telecom in rural areas. Unbanked and economically disadvantaged groups of the Indian population will have greater access to formal financial products as a result of this ecosystem’s efforts. TCS initiated this course of action for some of our partner banks at an extremely early stage by providing them with services such as free checking accounts, and the issuance of smart cards that included balance information, and biometric information for individuals who registered their cards. During the early stages of FI, there was no active network connectivity available. Before biometrics, agents would travel to each beneficiary’s location and authenticate with their biometrics before delivering the services they had withdrawn from the bank. Then they return to the bank to complete the reconciliation of their accounts. According to the BC Model, around 150,000 villages out of India’s total population of 650,000 have been allocated for service (Kulkarni & Ghosh, 2021).

Fast forward to the present day, where there is far greater internet connectivity even in the most distant places, and the smart card has been replaced by real-time authentication. It is possible to perform Aadhaar-based verification, beneficiary enrollment, and transactions in real-time while out in the field. Last-mile channels such as mini ATMs, Point of Sale devices, tablets, Kiosks, and mobile phones are being used to offer services. The beneficiary account for an FI transaction based on UPI must be created under the “PMJDY” scheme and connected to the customer’s mobile phone for the transaction to be valid. Banks have begun to process UPI-based transactions using newly created bank accounts (Rasheed et al., 2019). According to government estimates, India’s urban population in 2019 is slightly more than 470 million people (34.77 percent ). At least 65 percent of people live in semi-urban/rural areas where internet services are less accessible than in the cities. In today’s world, there is a pressing need for more equitable growth. The adoption of digital technology presents significant opportunities for governments and market leaders to increase digital penetration, the ease of use of digital goods, contextualized and individualized offerings to people, expanded availability, price reductions, improvements in security, and the creation of trust in digital services. Long-term success requires collaboration between governments, companies, and those who do not have bank accounts.

Digital financial integration requires digital savings strategies to target already financially vulnerable and underserved markets that provide a variety of formal financial services tailored to consumer and provider needs at an economical rate. Technologies have expanded to include online banking, electronic banking, electronic wallets, and mobile wallets. Provides various benefits for the user, such as convenience, easy financial transfers, etc. Yet, the red flag coinciding with the evolution of the economy is the threat of cyber attacks. It seems like some bad attitudes, such as protection, low network coverage, a lack of commercial will, high transaction rates, a lack of technology for users, etc., are preventing many from implementing the new system, as people become familiar with the cashless payments. Furthermore, the wider population (Kulkarni & Ghosh, 2021), reflects an emergent void in affordability, accessibility, and use, which has not been adequately penetrated by digital financing and financial inclusion. “Digital financial integration, financial data inclusion, and digital finance” are areas where the disparity is fairly common, particularly among FinTech providers, and attracts greater interest.

The Basis for Digital Finance

Digital finance covers Internet banking, mobile banking, card credit, and debits. Financial inclusion is considered in the study as a convenience, adjustment, availability, safety, user-friendly, low service, exact time, online monthly statement, fast decision-making on financial matters, easy interbank account facility, Internet connectivity, and usability. Digital financing, according to (Gomber et al., 2017), covers the magnitude, through FinTech firms and creative financial services providers, of the latest financial products, financial software, and new ways of consumer contact and interaction. It is generally accepted that the term "digital finance" refers to any products, services, technologies, and/or infrastructure that make it possible for individuals and businesses to conduct transactions, make deposits, and obtain loan facilities without having to physically visit a bank branch. This is because digital finance eliminates the need for individuals and businesses to travel to a bank branch to complete these activities. Even though no one definition of digital finance is widely accepted, it is generally accepted that all of these features are included in digital finance. The Internet has established itself as a widely recognized financial distribution channel in Europe, with both traditional banks and new companies recognizing the advantages it has over earlier distribution channels. This recognition has led to the growth of the Internet as a channel for the distribution of financial products and services. This is the situation due to the extensive awareness that the Internet has achieved as a conduit for the delivery of financial products (Barbesino et al., 2005).

In terms of digital finance, there are certain advantages. In the developing world, for example, digital finance would help to increase financial inclusion and the extension of financial services to nonfinancial industries, given that nearly half of the population currently has access to mobile telecommunications services (about 50 percent) (Bank, 2014). Individuals, as well as small, medium, and large businesses, will have easier access to a wider variety of financial products and services, as well as lending facilities, thanks to the efforts of digital finance, which is working to improve the overall expense ratio to boost the Gross Domestic Product (GDP) of digitally regulated economies. With the help of digital finance, consumers, as well as the economy in which they live and their own families, may benefit from increased financial stability and intermediation. (Manyika et al., 2016) for more information. The growth in aggregate spending also helps governments via the development of the platform, which allows for larger tax collections as a consequence of the increase in the volume of financial transactions. By completing digital finance, financial and monetary institution regulators will be able to dramatically restrict the circulation of bad (or fraudulent) money, counterfeit currency, and other illegal financial instruments. Other advantages of digital consumer finance include increased client access, faster funding, and the ability to make payments in seconds rather than minutes or hours (Demir et al., 2022).

The Basis for Digital Financial Inclusion

Digital financial inclusion is a broad spectrum that highlights the digital access of underserved companies to traditional financial and banking services. Except in the most remote corners of the world, the transition of digital financial services enables digital financial integration. Digital financial inclusion is described by CGAP as "digital access for the excluded and underserved to and use of formal financial services" (CGPA, 2015) (Arner et al., 2020). Whether it is government subsidies or foreign account transfers, digital financial inclusion paves the way for the smooth incorporation of benefits. Digital financial inclusion has three main elements:

• Digital transaction platforms: Digital transaction platforms have the highest level of privacy and protection to store and process user data in electronic form.

• Retail agents: Retail agents are those who access funds to send and receive funds, which turns the fund electronically deposited in hard cash.

• Platform Electronics products: Electronic devices such as cell phones, tablet PCs, or laptops that can wirelessly access information without problems.

Inclusion in the digital financial system has a few desirable side effects. The integration of digital financial systems enables financial institutions to cut costs by decreasing the need for human labor, doing away with paper reports, and consolidating a smaller number of banking businesses (IFC, 2017). Because a large number of depositors can transfer banks in a matter of minutes using DIF, financial institutions are under increased pressure to deliver high-end services or face the risk of losing depositors competing for financial institutions in the same period. The term "financial technology," more commonly abbreviated as "FinTech," is synonymous with "digital financial services." This age of information technology makes our digital life easier, which in turn benefits the growing number of FinTech companies. Any kind of payment is now available online, therefore you may choose to either pay your bills or run a taxi (Rauniyar et al., 2021). To boost overall efficiency, financial digital platforms, often known as the FinTech industry, are altering both our way of life and the economy. Some benefits are as follows:

• Everywhere accessible

• Quite simple and powerful

• No more waiting in queues for the transfer of funds saves a lot of time and money.

• All transactions are updated in real-time

• Facilitates reliability and flexibility in the decision-making process

• All digital channels are fully integrated

• Pleasant to the environment

• Increased customer base with technology support Reaches digital marketing omnichannel

These are the benefits of digital financial services that both businesses and customers socially benefit from. The development of computer technology changes traditional banking and financial systems dynamics (Pandey et al., 2022).

The Basics for Financial Inclusion

Financial integration is a sustainable supply of financial and affordable resources that make the formal economy vulnerable (Nations, 2016). The use by poor people of formal financial services can also be defined as financial inclusion (Beck & Brown, 2011; Bruhn & Love, 2014). Financial inclusion, according to Investopedia, refers to activities that make financial goods and services available and cheap to all individuals and businesses, regardless of their net worth or the scale of their business operations. To achieve financial integration, efforts must be made to remove and use these resources to alleviate the obstacles that prevent people from being active participants in the financial system. It is often referred to as integrated finance. Inclusion of finances leads to an increase in (mostly poor) people accessing formal financial services primarily using official bank accounts which contributes to poverty reduction and development. More financial inclusion will help to reduce poverty and economic growth by investing in education, saving, and start-up enterprises, which are financially excluded previously (Beck et al., 2007).

Financial inclusion benefits:

• Rural crowds are able, using fingerprint verification, to have access to bank receipts, cash payments, balance inquiries, and account statements. The customer receives an online receipt to ensure trust in fulfillment.

• Cash economy reduction, as the banking environment gets more capital

• It instills the habit of saving and thus increases and stimulates the growth of capital in the country.

• Instead of physical cash payments for a subsidy, direct cash transfers to beneficiary bank accounts would be possible. This also guarantees that the funds eventually hit the expected beneficiaries rather than being sifted.

• It is expected that access to adequate and accessible financing through formal banking networks is expected to encourage people to be more entrepreneurial, boosting rural productivity and prosperity.

Therefore, the next revolution of growth and development can be initiated by financial inclusion. In the 21st century, India has channeled its transactions to lubricate the economy to promote financial inclusion and economic citizenship. The path for India to economic growth is based on how the financial infrastructure is activated to provide 65% of India’s unbanked population (Conservative World Bank 2012 estimate).

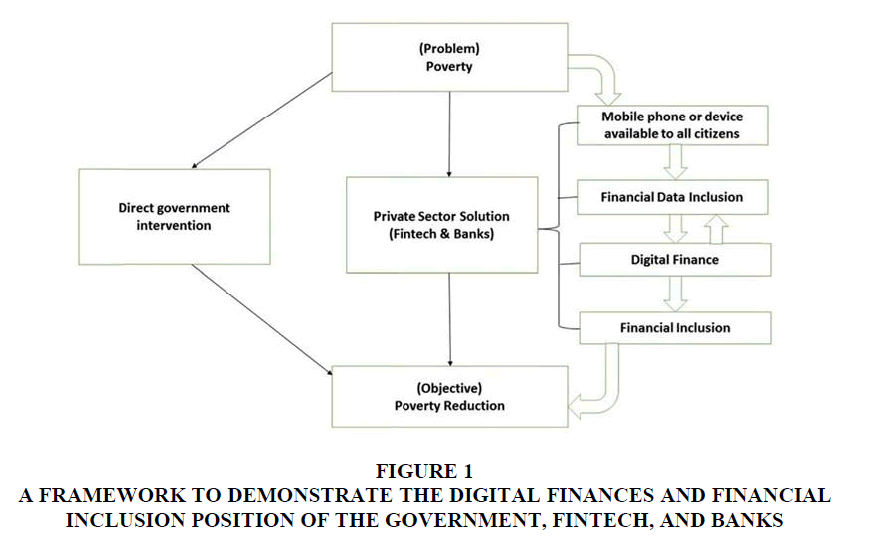

The Basis for Fintech

Fintech is a portmanteau for any company using technology to enhance or automate financial services and processes. "Finance" "technology" The concept is an industry that serves customers and companies both broadly and rapidly growing. Financial technology (Fintech) is a term that refers to the definition of new technologies that are used to enhance and automate the supply and usage of financial products and services. Fintech supports businesses, business owners, and customer management using special applications and algorithms, which are increasingly used on computers and smartphones. Fintech is a mixture of the term “financial technology”. Some self-identified fintech providers claim that the technology they use significantly reduces the barriers between seeking a financial service and providing a financial service, which raises questions about whether the technology used by these individuals or businesses can be considered fintech technology (Kralj, 2020). Fintech businesses play a significant role in the development of the digital financial industry. Depending on their business model, fintech businesses compete with or complement the functions of their clients in the financial services sector. In the real world, Fintech firms charge higher fees to finance companies, even though the cost of acquiring banks’ financial services is significantly lower; however, customers switch from banks to nonbanking providers after being denied loans from controlled banks for an extended period. Finally, fintech businesses are varied, and the extent to which they are diverse is largely determined by the technologies that are available online and offline. A variety of Fintech firms offer services such as rapid cash checks, payment loans, and other similar products and services. Finally, the operations of Fintech providers have an impact on the integration and stability of the financial system (Hoang et al., 2022)(Figure 1).

Figure 1: A Framework To Demonstrate The Digital Finances And Financial Inclusion Position Of The Government, Fintech, And Banks.

Advantages of Fintech:

• It protects you from liability that is not covered by conventional insurance.

• You have the right to decide.

• You can provide financial and emotional support and guidance to your peers.

• Any remained funds will be returned to members after your coverage is complete.

• Member awareness is transformed into community knowledge and reduces the change in adverse events.

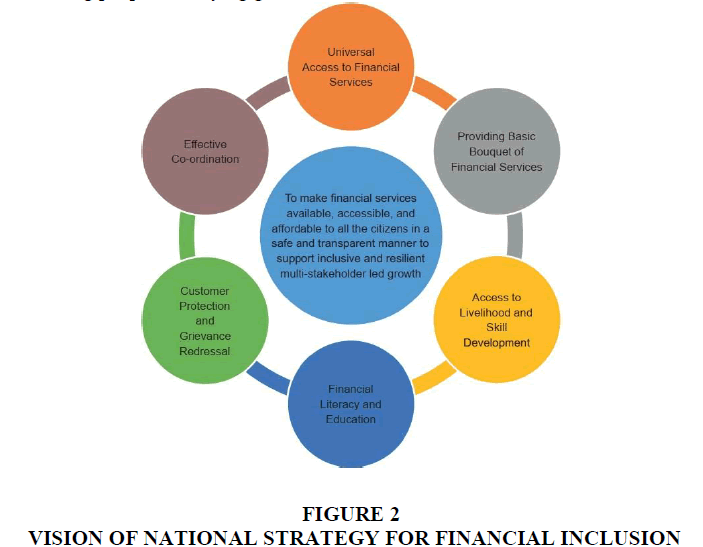

National Financial Inclusion Strategy

It presents the overarching goal of India’s financial inclusion initiatives as well as its primary aims for the years 2019-2024, to facilitate the growth and continuation of the process of national financial inclusion using a comprehensive convergence of action including all of the players in the financial sector. The program aims to expand and deepen financial inclusion, as well as to promote financial literacy and consumer protection among the general population. Under the auspices of the Financial Inclusion Advisory Committee, the “Reserve Bank of India” (RBI) developed the “National Strategy for Financial Inclusion” for India 2019-2024. This strategy is informed by inputs and recommendations from the Government of India, as well as other Financial Sector Regulators such as the “Securities and Exchange Board of India” (SEBI), the “Insurance Regulatory and Development Authority of India” (IRDAI), and the “Pension Fund Regulatory and Development Authority of India” (PFRDAI). This document incorporates a variety of outcomes from extensive consultations with a diverse range of stakeholders and market participants (Ozili, 2021), including the “National Bank for Agriculture and Rural Development” (NABARD), the National Payments Corporation of India (NPCI), commercial banks, and corporate business correspondents. The report contains a study of the present situation and limitations on financial inclusion in India, as well as certain financial inclusion targets, a strategy for achieving the goals, and a system for tracking progress.

Sustainability Through Comprehensive Inclusion

The World Bank’s focus is on overcoming long-term development impediments, expanding the focus on those who have been excluded from economic and social possibilities, and boosting investment in inclusive growth. The department formerly known as Social Development has been renamed Social Sustainability and Inclusion to reflect this shift in emphasis.

The term “social sustainability” refers to societies that are both diverse and stable, in which individuals are given a voice and governments take action. Increasing the possibilities for everyone today and in the future is also a component of “social sustainability”. It is necessary for the elimination of poverty, shared prosperity, and economic and environmental sustainability. The work of Social Sustainability and Inclusion is centered on assisting people of varying genders, races, faiths, nationalities, ages, sexual orientations, and disabilities in overcoming barriers that prevent them from fully participating in society and assisting them in shaping their futures (Kumaraguruparan et al., 2022). These barriers can be broken down into eight categories: gender, race, religion, nationality, age, and sexual orientation. It accomplishes this via engagement with governments, communities, civil society, businesses, and other stakeholders to build resilient and peaceful communities, citizen empowerment, and more inclusive societies (Meiling et al., 2021)(Figure 2).

Advantages and Disadvantages of Digital Finance

Advantages:

• Its expansion into non-financial sectors of financial services.

• Convenient and safe banking services for the poor.

• Increasing overall spending on the GDP of digital economies.

• Reduce bad/fake cash circulation.

• Increased regulation of personal finance for customers.

• Quick decision-making on financial matters.

• Ability within seconds to make and receive payments in seconds.

• Digital financing providers generate revenue.

Disadvantages

1. Digital funding is not available for people who have not accessed mobile or digital devices.

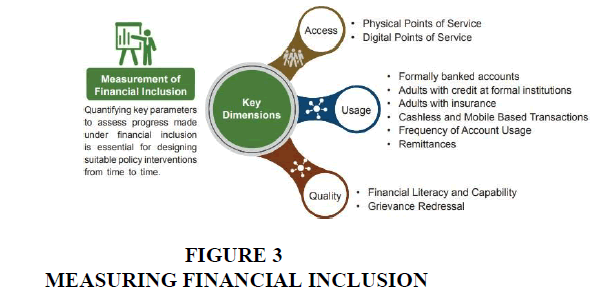

2. Internet accessibility, which excludes those who do not have internet connectivity, is unnecessarily dependent(Figure 3).

• If people are unwilling to accept voluntary exclusion, digital funding in a country (whether voluntary or coerced) can result in voluntary exclusion.

• Infringements of data protection in digital financial systems are popular and can decrease clients’ confidence.

• When they happen, systemic threats for black-swan services all over the globe can be fatal.

• Many regulatory and policy frameworks do not allow for complete digital finance.

• Digital fee-based financial services would benefit middle- and high-performance people to the detriment of the poor and poor people who cannot support the associated costs.

Current Issues and Insights

• There is a significant divide between those who are tech-savvy and those who are not; some individuals in downtown regions and the bulk of people in rural areas struggle to explain and use technology skillfully, while others in urban areas and the bulk of people in rural areas struggle.

• Due to a general absence of trust among rural inhabitants and a lack of financial literacy and understanding of financial cybercrime, rural populations have lower levels of digital penetration.

• Exposure and exploitation of technical systems and artifacts is a risk. BC or BF agents cannot properly control it due to a lack of suitable security measures. On the ground, there has been a significant number of scams. In 2017, 22% of BC agents were victims of fraud, a significant increase from the 2% of agents who were victimized in 2015. The Last Mile and the BC Agent network’s business model must be reexamined from a privacy, security, and safety perspective.

• Due to a lack of strict adherence to the regulations of personally identifiable information (PII), a significant amount of collected data is freely accessible to a wide range of stakeholders. KYC data and cellphone numbers are readily available in any location.

1. Some BC agents in clay use dishonest methods to obtain biometric data, which they later use to copy the data for fraudulent purposes.

2. Another example is when they hand out a paper receipt instead of a computerized one at the end of each transaction.

• Customers are unable to get SMS alerts for account transfers due to a shortage of mobile devices (still lack access to basic feature phones or smartphones, moreover 310 million people) or financial institutions that do not send messages for low-value cost. As a result, there has been an increase in reliance on local agents.

• Rural regions are still plagued by small-time lenders that charge exorbitant interest rates, making it difficult for people to get loans. Government programs still haven’t reached rural areas to their full potential, necessitating a greater effort to do so. The market does not yet provide digital lending or online loans from respectable financial institutions.

Methodology For Deployment

The information for this research study was gathered from a variety of official sources, including the websites of the “Reserve Bank of India” and the “Niti Aayog”, as well as the Direct Benefit Transfer and the Prime Minister’s “Jan Dhan Yojana”, including information released by the Government of India and the Ministry of Finance, as well as other official sources. Data points and statistics indicate the beneficial result of Financial Inclusion in India to date, and they assist us in identifying the gaps that must be fixed to accelerate growth and guarantee long-term viability in the future. Extensive secondary research from previously published journal articles and the opinions of expert committees were taken into consideration to provide a clearer explanation of Digital Financial Inclusion initiatives and the particulars of best practices that are being put into practice in a variety of regions all over the world. Using this knowledge, we have identified the main issues that hinder us from achieving our vision of a more inclusive society and made qualified recommendations on how to address these issues.

Conclusion

To perform more financial transactions on their bank accounts, digital finance can improve the health of people and companies that have formal bank accounts and assets. As a result, the anticipated benefits of digital funding will be fully realized only if the costs of providing digital financial services are kept to the absolute lowest level possible or are nonexistent. The advantages that digital financing offers for low and variable earnings dividends are even more attractive to them than the higher costs paid for obtaining services from traditionally regulated banks by Fintech’s providers for the financial inclusion of emerging and advanced economies. This article addressed some of the challenges to financial integration and stability, despite the advantages of digital finance.

It is necessary to minimize the high degree of injustice in India, as well as the digital divide between urban and rural areas, and as a consequence of these efforts, people must be educated in both financial and social terms. To build a sustainable and inclusive society, financial, social, and health inclusion must be linked into a cohesive ecosystem that can work in concert with one another. India’s digital payment and rural infrastructure must be developed to guarantee that there will be no disruptions and that customers will continue to have access to telecom network services. To ensure that services are properly provided to customers, having access to a line of credit is required, and this access must be complemented by an appropriate last-mile infrastructure.

References

Arner, D. W., Buckley, R. P., Zetzsche, D. A. & Veidt, R. Sustainability, fintech and financial inclusion. Eur. Bus. Organ. Law Rev. 21, 7–35 (2020).

Indexed at, Google Scholar, Cross Ref

Barbesino, P., Camerani, R. & Gaudino, A. Digital finance in europe: Competitive dynamics and online behaviour. J. Financial Serv. Mark. 9, 329–343 (2005).

Indexed at, Google Scholar, Cross Ref

Beck, T. & Brown, M. Use of banking services in emerging markets-household-level evidence. (2011).

Indexed at, Google Scholar, Cross Ref

Beck, T., Demirgüç-Kunt, A. & Levine, R. Finance, inequality and the poor. J. economic growth 12, 27–49 (2007).

Indexed at, Google Scholar, Cross Ref

Bruhn, M. & Love, I. The real impact of improved access to finance: Evidence from mexico. The J. Finance 69, 1347–1376 (2014).

Indexed at, Google Scholar, Cross Ref

Demir, A., Pesqué-Cela, V., Altunbas, Y. & Murinde, V. Fintech, financial inclusion and income inequality: a quantile regression approach. The Eur. J. Finance 28, 86–107 (2022).

Indexed at, Google Scholar, Cross Ref

Gomber, P., Koch, J.-A. & Siering, M. Digital finance and fintech: current research and future research directions. J. Bus. Econ. 87, 537–580 (2017).

Indexed at, Google Scholar, Cross Ref

Hoang, T. G., Nguyen, G. N. T. & Le, D. A. Developments in financial technologies for achieving the sustainable development goals (sdgs): Fintech and sdgs. In Disruptive Technologies and Eco-Innovation for Sustainable Development, 1–19 (IGI Global, 2022).

Indexed at, Google Scholar, Cross Ref

Kanungo, R. P. & Gupta, S. Financial inclusion through the digitalization of services for well-being. Technol. Forecast. Soc. Chang. 167, 120721 (2021).

Indexed at, Google Scholar, Cross Ref

Kulkarni, L. & Ghosh, A. Gender disparity in the digitalization of financial services: challenges and promises for women’s financial inclusion in India. Gender, Technol. Dev. 25, 233–250 (2021).

Indexed at, Google Scholar, Cross Ref

Kumaraguruparan, A., Wijesundara, K. & Weerasinghe, U. A review on prioritizing physical safety and comfort in urban sustainability assessment tools to effectively control accidents in streets of colombo. FARU J. 9 (2022).

Indexed at, Google Scholar, Cross Ref

Manyika, J., Lund, S., Singer, M., White, O. & Berry, C. Digital finance for all: Powering inclusive growth in emerging economies. McKinsey Glob. Inst. 1–15 (2016).

Meiling, L. et al. Boosting sustainability in healthcare sector through fintech: analyzing the moderating role of financial and ict development. INQUIRY: The J. Heal. Care Organ. Provision, Financing 58, 00469580211028174 (2021).

Indexed at, Google Scholar, Cross Ref

Ozili, P. K. Financial inclusion research around the world: A review. In Forum for social economics, vol. 50, 457–479 (Taylor & Francis, 2021).

Indexed at, Google Scholar, Cross Ref

Pandey, A., Kiran, R. & Sharma, R. K. Investigating the impact of financial inclusion drivers, financial literacy and financial initiatives in fostering sustainable growth in north india. Sustainability 14, 11061 (2022).

Indexed at, Google Scholar, Cross Ref

Rasheed, R., Siddiqui, S. H., Mahmood, I. & Khan, S. N. Financial inclusion for SMEs: Role of digital micro-financial services. Rev. Econ. Dev. Stud. 5, 571–580 (2019).

Indexed at, Google Scholar, Cross Ref

Rauniyar, K., Rauniyar, K. & Sah, D. K. Role of fintech and innovations for improvising digital financial inclusion. Int. J. Innov. Sci. Res. Technol 6, 1419–1424 (2021).

Tay, L.-Y., Tai, H.-T. & Tan, G.-S. Digital financial inclusion: A gateway to sustainable development. Heliyon e09766 (2022).

Indexed at, Google Scholar, Cross Ref

Received: 06-Feb-2023, Manuscript No. AMSJ-23-13195; Editor assigned: 07-Feb-2023, PreQC No. AMSJ-23-13195(PQ); Reviewed: 29-Mar-2023, QC No. AMSJ-23-13195; Revised: 21-Apr-2023, Manuscript No. AMSJ-23-13195(R); Published: 15-May-2023