Research Article: 2018 Vol: 19 Issue: 1

Do Defined Benefit Pensions Create Monopsony Power Evidence From The Academic Labour Market

Scott Wallace, University of Wisconsin-Stevens Point

Abstract

Introduction

Labour economists have demonstrated a renewed interest in monopsony over the last two decades (Ashenfelter et al., 2010). Developments in empirical industrial organization and the job search literature have inspired theoretical and empirical extensions that explore the sources of monopsony power (Boal and Ransom, 1997). Of particular interest here is the role of “moving costs” in allowing firms to engage in the post-hire exploitation of workers. “Moving costs” are the pecuniary or psychic costs that workers incur when changing employment from one firm to another (Boal and Ransom, 1997). “Moving costs” become a source of monopsony power for employers over employees once they are hired because employees would require a large increase in salary to switch employers (Black and Lowenstein, 1991). Ransom (1993) applied the idea of “moving costs” in analysing the academic labour market. He argued that incumbent professors face high moving costs and that these moving costs accounted for the unusual finding of a negative correlation between real wages and seniority. The market for newly hired faculty, however, remains competitive because all new hires must pay moving costs.

This paper applies the concept of “moving costs” in analysing varying degrees of monopsony power between universities within the academic labour market. We argue that the composition of professors’ total compensation packages affect the level of “moving costs” and therefore the degree of monopsony power universities possess over incumbent professors. More specifically, compensation packages with defined benefit (DB) pension benefits increase the moving costs for faculty leading to monopsonistic exploitation of incumbent faculty. Recently, Costrell & Podgursky (2010) have demonstrated that state retirement pension systems impose mobility costs on K-12 teachers in Missouri. We hypothesize that these mobility costs largely account for a negative relationship between the presence of DB pension plans and the total level of compensation for university professors. We will be using data from AAUP to test this hypothesis.

The rest of the paper will proceed as follows. First, we look at the economics literature covering moving costs as a source of monopsony power, empirical studies on salaries and seniority in the academic labour market and salary differentials between private and public universities. Then we discuss how the presence of a DB pension as part of a professor’s compensation package increases “moving costs” for incumbent professors thereby increasing the monopsony power of those institutions. Next, we describe the econometric model employed to test the hypothesis of a negative relationship between DB pensions and the total level of compensation for university professors. Last, we discuss the results of our analysis and the scope for future research.

Literature Review

Moving Costs and Monopsony Power

Black & Lowenstein (1991) introduce a model of a “labour market where workers find it costly to change employers; these costs that may reflect such factors as locational preferences, relocation expenditures, search costs and psychic costs stemming from the stress of changing jobs. Because a worker finds it costly to switch employers in the future, the initial acceptance of employment creates a specific asset that may allow the employer to act opportunistically” (Black & Lowenstein, 1991). In their model, employers are unable to make credible commitments regarding future compensation and given the high moving costs of employees, can renegotiate existing workers’ wages below their marginal revenue product (MRP). In other words, employers engage in monopsonistic exploitation. Anticipating ex-post opportunism, the wages of new hires, according to this model, will be front-loaded. Such opportunism also causes low-mobility cost workers to switch to new employers while employers engage in wage discrimination among remaining employees based on observed differences in moving costs. The profitability of such monopsonistic behavior requires that turnover costs be relatively unimportant to the firm (Black & Lowenstein, 1991).

The moving cost model is a classic example of firm differentiation as a source of monopsony power. “Firms between whom the worker is indifferent at the time of hire become ‘differentiated’ once the employee moves to a particular job location” (Boal & Ransom, 1997). The relevance of the moving cost model, however, depends upon the particular characteristics that define firm-employee relationships. “[T]his model seems unlikely to apply to unskilled workers whose alternative employers are in close proximity and whose wages can be roughly specified in advance at low-cost. It also seems unlikely to apply to managers or other skilled workers with substantial specific training and therefore high turnover costs to firms. It seems most likely to apply to professionals with general skills whose alternative employers are geographically dispersed and whose wages cannot be specified far in advance-such as college professors” (Boal & Ransom, 1997).

Our focus is on the implications of the moving cost model on professors’ total compensation. When examining monopsonistic exploitation, total compensation (the sum of monetary salaries and non-wage benefits) is truly the appropriate measure to use as it incorporates both components of pay. Looking only at salaries can be misleading. Decreases in salary potentially can be offset by increases in non-wage benefits leaving total compensation of the individual unaffected. While people often think only of monetary salaries when examining monopsonistic exploitation, a reduction in benefits related to monopsony power is a possible method of exploitation as well. Although there is not a well-developed body of literature examining the effects of monopsony power on benefits, there is a literature examining the effects on salaries. The next section looks at the empirical literature that tests the relationship between seniority and faculty salaries.

Salaries and Seniority in the Academic Labour Market

The general nature of human capital, large average distances between universities and the individualized nature of pay are factors that contribute to monopsonistic tendencies within the academic labour market (Ransom, 1993). In his empirical study, Ransom (1993) found that these factors accounted for a negative correlation between seniority and faculty salaries. “After controlling for total teaching experience, educational level and other productivity-related characteristics Ransom finds maximum ‘seniority penalties’ of about 5 to 15 percent in three national surveys of faculty and for faculty at the University of Arizona”(Boal & Ransom, 1997). This result is highly unusual in that it contradicts life-cycle theories of pay structure and many empirical analyses that show a positive correlation between wages and seniority (Ransom, 1993). The results, however, are consistent with the model of moving costs. As seniority increases, moving costs for faculty likely increase, granting greater monopsony power to employers resulting in a greater degree of monopsonistic exploitation as a result.

A number of other studies looking at salaries and seniority in the academic labour market followed Ransom’s analysis. Unlike Ransom (1993), Hallock (1995) found that the returns on seniority for the first fifteen years of seniority were positive in his survey of UMASS faculty salaries. Hallock, however, noted that, unlike the University of Arizona, UMASS faculty were unionized and received “cost of living” raises as stipulated in their collective bargaining agreement (Hallock, 1995). Hoffman’s earlier study at UMASS-Amherst before the establishment of collective bargaining demonstrated a negative return to seniority (Hoffman, 1997). Brown & Woodbury (1998) also found a negative relationship between salaries and seniority at Michigan State University which doesn’t have collective bargaining. These results confirm Barbezat (1989) which showed that faculty unionization increased the return to seniority. The correlation between collective bargaining agreements and a positive return on seniority is consistent with faculty unionization acting as a countervailing force to the monopsony power of universities.

Using a national survey, Barbezat & Donihue (1998) found that the effect of seniority on salary is positive for untenured faculty but negative for tenured faculty. “Upon stratifying by academic rank, the estimated coefficient is negative for full professors and associate professors but positive for ranks of assistants, instructors and lecturers” (Barbezat & Donihue, 1998). Their results indicate that the institution of tenure, by increasing faculty mobility costs, is an important source of monopsony power for universities (Barbezat and Donihue, 1998). In a related study, Barbezat & Hughes (2001) analysed the effect of job mobility on salaries in the academic labour market. The authors began by referencing human capital theory which suggests a positive relationship between worker mobility and salary. Workers move to new jobs “when the present value of expected earnings in the new job exceed the discounted returns to the present job plus the cost of moving” (Barbezat & Hughes, 2001). Their empirical findings, however, were not consistent with human capital theory. The evidence shows that faculty members do not change jobs frequently with the average number of academic jobs equalling 2.17. Further, the authors were unable to find any statistically significant relationship between mobility and salary except when the number of jobs exceeds four which was associated with lower pay. The absence of a significant effect of mobility from the sample may be due to the offsetting effects of voluntary and involuntary separations on salary. High mobility may be a sign of involuntary separations and therefore results in lower salaries (Barbezat & Hughes, 2001). Taken together, both studies suggest that tenure is an important source of monopsony power for universities and should be controlled for in empirical analyses. The results also suggest that anything that disproportionately limits mobility for more senior faculty, such as DB pensions, should have similar effects on salaries as tenure.

Moore, Newman, & Turnbull (1998) criticized Ransom (1993) for the productivity measures he employed in his study. “Whereas Ransom (1993) introduced total publications in his study to control for productivity, his data were not sufficiently detailed to adjust for the quality of each individual’s publications” (Moore, Newman & Turnbull, 1998). Using more comprehensive productivity measures to capture publication and teaching quality for economics faculty from nine Ph.D. granting institutions, the authors found that the negative relationship between seniority and earnings tended to fade away (Moore, Newman & Turnbull, 1998).

Bratsberg, Ragan & Warren (2003), however, countered that all empirical studies looking at seniority and salary have ignored the importance of “job match” and therefore their results have been biased in a positive direction. These authors stress the differences between academic institutions with regard to expectations of faculty for teaching, scholarship, service and other factors and the importance of post-hire work experience in determining the quality of job match. “When the fit between faculty and institution turns out to be poor, one or both parties have an incentive to terminate the relationship. Good matches are more likely to survive. Stated differently, high seniority is likely to be associated with a good fit” (Bratsberg, Ragan & Warren, 2003). The omission of job match from these empirical models poses problems for interpreting their results. “Because the quality of the job match is unobserved by the researcher and because match quality is positively correlated with wages and seniority (good job matches survive), cross-sectional estimates are upwardly biased” (Bratsberg, Ragan & Warren, 2003). Using a sample of non-union universities, the authors ultimately find a negative correlation between seniority and faculty and that the biases from not correctly accounting for research performance and match quality are offsetting (Bratsberg, Ragan & Warren, 2003).

Together the results for salaries suggest that moving costs may be leading to monopsonistic exploitation for more senior faculty members. We next turn to observed gaps in private and public compensation to highlight another possible source of exploitation, namely defined benefit pensions.

Salaries in Private and Public Universities

In her comparison of public and private universities, Zoghi (2003) found that faculty salaries at public universities grew more slowly than at private universities over a twenty five year period with the average gap between private university pay and public university pay at twelve percent in 2001 (Zoghi, 2003). A Chronicle of Higher Education report shows that this gap has increased from 18% in 2004 to 24% in 2013 (Dunn, 2013). Zoghi’s results also show that the lower wage growth of public university professors had not been compensated for by increases in the level of non-pecuniary benefits. Zoghi referenced the decline in state support of public universities in response to increasing financial pressures as the main cause of the slower growth in pay (Zoghi, 2003). The author then goes on to speculate on the implications of the divergence in salaries between public and private university professors.

If academic labour markets are competitive, however, a difference in wages between public and private institutions should reduce the supply of faculty to the lower-paying sector and result in an excess supply of faculty to the higher-paying sector. Assuming heterogeneity in the quality of faculty members, one likely outcome would be that private universities could attract higher quality professors with their wages, while the lower quality professors would accept positions at public universities. Thus the wage gap has important ramifications for the quality of public higher education (Zoghi, 2003).

In a competitive labour market, one would expect that differences between salaries of public and private universities to narrow over time yet the evidence shows just the opposite. While there certainly has been raiding of high quality public university faculty by private institutions, no empirical study to our knowledge has demonstrated a negative effect on the overall quality of public universities.

An explanation consistent with the hypothesis of this paper is that academic labour markets are not competitive and that incumbent faculty members at public institutions face higher moving costs than those at private institutions. Along with the typical moving costs experienced by all faculty members at private or public universities, public university faculty are more likely to have a DB pension as part of the benefits component of their total compensation. Because DB pensions are not as portable across employers as Defined Contribution (DC) pensions, the prevalence of DB pension plans at public universities may be an important factor in contributing to these higher moving costs. Greater moving costs may then lead to greater monopsonistic exploitation in public universities and to the divergence in salaries between private and public institutions. The increasing rate of divergence in recent years may be due to the decline in DB pensions at private universities. While DB pensions are becoming less frequent in all universities, they are now virtually unheard of in private universities. This shift may have exacerbated the difference in moving costs across the university types and thus the level of salaries. The next section looks in more detail at DB pensions and mobility costs.

Moving Costs And Defined Benefit Pensions

Defined benefit pension plans are annuities whose benefits are based on pre-determined rules. “In a defined benefit pension plan, the employer promises the employee an annual payment that begins when the employee retires where the annual payment depends on the employer’s age, tenure and late career salary” (Novy-Marx & Rauh, 2009). Under defined contribution plans, employers annually contribute a predetermined amount, usually based on a fixed percentage of the employee’s salary, to the employee’s retirement account. Employers additionally (often) match employee contributions to the account, up to a certain limit. If the employment relationship ends, the retirement account leaves with the employee (Podgursky & Ehlert, 2007).

We argue that the presence of a defined benefit pension as part of a professor’s compensation package will negatively impact her total level of compensation. The non-linear growth of benefits associated with DB pensions raises moving costs by increasing the opportunity costs of exit (Ransom & Sims, 2010). Additionally, these opportunity costs increase as the duration of the employment relationship lengthens thus enhancing the monopsony power of the academic institution. This story is consistent with empirical studies that show a negative correlation between seniority and salaries for associate and full professors (Barbezat & Donihue, 1998).

The annual benefit from a DB pension is calculated using the following formula:

Annual Benefit = Years of Service x Final Average Salary x Benefit Factor

The “final average salary” is an average of the worker’s highest several years of salary with the benefit factor being a fixed percentage (Podgursky and Ehlert, 2007).

For example, take an individual with 30 years of service with a final average salary of $50,000 and receives a “benefit factor” of 2.0%. Then the annual benefit would be:

Annual Benefit = 30 x 50,000 x 0.02=30,000

Since both “years of service” and “final average salary” increase with work experience, benefits will “increase very slowly when the employee is new and very quickly when the worker nears retirement” (Novy-Marx & Rauh, 2007). The back-loaded nature of these benefits means that the cost of exit will be relatively low for those professors with limited work experience. Because annual benefits increase more than proportionally with age, the opportunity cost of quitting increases with the level of seniority. Even though the individual typically does not lose the benefits they have already accrued in the pension, leaving early means they miss out on the disproportionately larger benefits earned later in their career. Vesting requirements which force workers to work at the institution for a number of years before being fully guaranteed the pension also reduce the mobility costs for new professors who have not yet qualified for benefits.

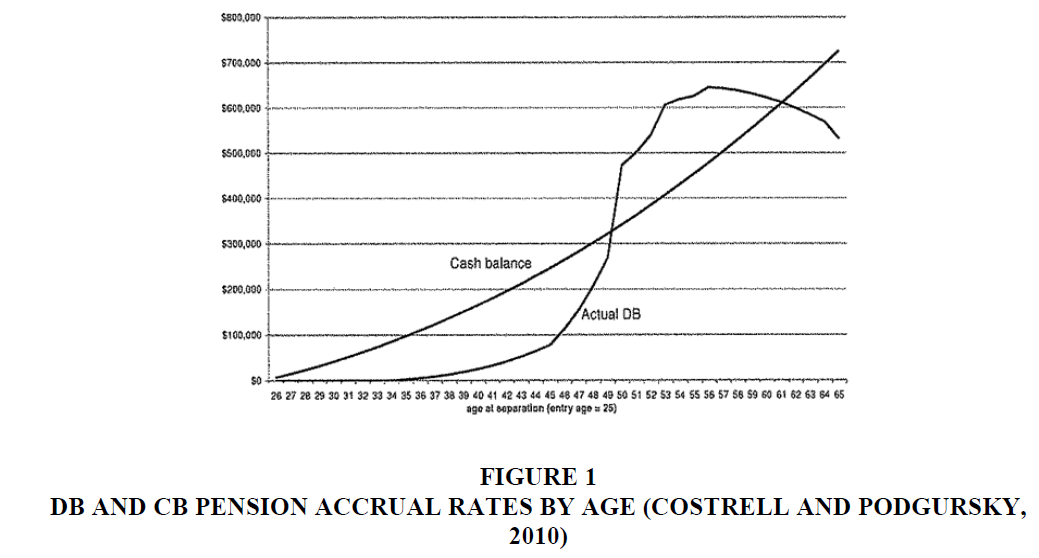

Costrell & Podgursky (2010) illustrate these mobility costs of traditional defined benefit pensions by comparing the accrual of benefits under traditional DB pensions with cash balance (CB) plans. “CB systems calculate employee retirement accounts, based on contributions of employees and employers, with a guaranteed rate of return (usually comparable to the risk-free discount rate recommended by finance economists). Thus pension wealth, both gross and net of employee contributions, is a fixed percentage of cumulative earnings, independent of age of separation” (Costrell & Podgursky, 2010). Figure 1 shows the accrual of benefits under both the Missouri DB plans and a hypothetical, fiscally equivalent CB plan (Costrell & Podgursky, 2010, Figure 1). As the figure shows, net pension wealth increases more smoothly under the CB plan than under the DB plan. Employees under DB pensions who leave employment during the early and middle years of their career accrue little pension wealth compared to CB plans. These employees thus bear significant opportunity costs associated with early exit.

The relevant comparison here is not between traditional DB pensions and CB plans but between DB pensions and DC plans. In the absence of risk, however, the accrual of benefits of a DC plan would resemble that of CB plans. Of course, risk is a very important consideration. In addition to the non-linear benefit accrual, a professor leaving a university with a DB pension for one with a DC plan will now bear the risk of uncertain investment returns and the longevity risks associated with outliving investment income during retirement. This risk shifting may also lead to greater moving costs for senior faculty as there is less time to take advantage of investment earnings as individuals near retirement ages.

Aaup Data And The Econometric Model

The primary data we use to investigate the effects of DB pensions on total compensation is the 2012-2013 American Association of University Professors (AAUP) Faculty Compensation Survey. The AAUP survey provides self-reported information on average faculty salaries and total compensation by rank for over 1,000 institutions across the United States. Because the theoretical basis of the analysis relates to the voluntary limitation of mobility due to moving costs, our study applies more to faculty who are employed on a more permanent basis and who have a greater amount of control over the continuation of their employment.

Thus, we limit our analysis to assistant, associate and full professors. Moving costs should be less of a restriction to mobility for instructors and adjuncts since the decision to stay or move is often made by the institution. The salary data provided is for regular duties and excludes pay for overloads, summer or other sources. The benefit data reported represents the institution’s contribution on behalf of the employee. We separate the information for each institution into one observation per rank, giving us three observations for each institution.

Outside of the compensation information, the survey also provides information about the location, type of institution (Doctoral, Masters, Baccalaureate) and curricular programs offered (Business, Law, Dentistry, Nursing, Engineering). We include this information so that we can control for baseline differences in compensation due to the type of and focus of the institution. Finally, the data contains information related to the gender compensation of each rank which allows us to control for possible differences in compensation due to gender. While the aggregated nature of the AAUP data does limit us regarding the individual specific characteristics that we can include in the analysis, it also reduces the need to have controls for individual productivity and allows us to look for institution wide influences such as having a DB pension.

We supplement the AAUP data with a few outside sources. First, in order to control for differences between public and private universities we classify each institution as public or private using UnivSource.com, a website providing extensive information on institutions across the United States. This allows us to control for baseline differences due to funding sources and other issues related to university type. Second, we include data from US News & World Report’s National University Rankings. Outside of which degrees are offered and whether a university is public or private, there also may be an effect for simply being an elite institution. Elite institutions may be “elite” because they have attracted and retained the best faculty. These faculty will likely command higher total compensation as a result. Alternatively, elite institutions may be able to offer their services at higher prices which then allow them to compensate faculty at higher rates. To capture the effect we classify institutions as being in the top 10, top 11-25 and top 26-50 institutions in the US News & World Report rankings.

Finally and most importantly, we classify the type of pension offered for each institution using information from the National Association of State Retirement Administrators (NASRA) and from web searches of institution websites. The NASRA had recently conducted a survey of their members asking which retirement benefits were available to higher education staff (Brainard, 2011). This information was extremely useful in filling in the majority of pension types for public institutions, but manual web searches of human resources pages were necessary to fill in gaps and to verify the NASRA information. From the information we classify the type of pension as DC only, DB only or a DB/DC choice. The third option where faculty are allowed to choose is typically an irrevocable choice and is generally either a newer option to faculty or is an option only open to faculty but not others who work at the institution. The method of classifying pensions and the aggregated nature of the university data means we are not able to observe the choices individual faculty make in these institutions. We, therefore, split the DB/DC choice group into its own category to try and control for differences.

We use the combined data to estimate the following model:

Ln(Compensation) = f(Pension, Rank, Institution Type, % Male, Programs, State, Institution).

Outside of the basic controls discussed previously, the multiple observations for each institution allow us to control for possible influences due to the institution itself using random effects estimation. Although we are not particularly interested in the effect of individual institutions specifically, systematic differences in compensation within an institution may influence the results if not controlled. We also correct standard errors for clustering by institution.

After applying the sample selection criteria and eliminating observations with missing variables, we arrive at a final sample of 2,981 observations. Variable definitions, means and standard deviations are presented in Table 1. Combining all ranks the average compensation in the sample is roughly $99,000, with average salary accounting for about 77% of the total. Breaking total compensation, salaries and benefits down by rank we observe the expected distribution with compensation increasing by rank. Examining the pension distribution, the vast majority of institutions, 68.5%, offer only a DC pension. This number accounts for the decline of DB pensions within public universities, but primarily is due to the fact that virtually no private institutions still offer DB pensions. The next largest portion, 24.8%, is employee choice of a DB/DC plan. Some of these institutions have offered choices for a number of years, but others are institutions which used to solely offer DB pensions but created a DC pension and a choice for faculty relatively recently. Only a small portion of the sample, 6.7%, offers only a DB pension. This number clearly reflects the trend toward DC pensions in the labour market. However, it is important to note that this number likely underestimates the number of people with DB pensions given that some of the people offered the DB/DC choice decided to opt for the DB pension.

| Table 1: Variable Definitions, Means And Standard Deviations | |||

| Variable | Definition | Mean | Std. Dev. |

|---|---|---|---|

| Compensation ($1k) | Salary plus institutional contributions to benefits | 99.371 | 29.561 |

| -Professors | 121.170 | 33.691 | |

| -Associate Professors | 95.091 | 20.087 | |

| -Assistant Professors | 81.796 | 16.737 | |

| Salary ($1k) | Contracted regular salary | 76.689 | 23.220 |

| -Professors | 94.507 | 26.602 | |

| -Associate Professors | 72.804 | 14.998 | |

| -Assistant Professors | 62.708 | 12.511 | |

| Benefits ($1k) | Institutional contributions to benefits | 22.683 | 7.752 |

| -Professors | 26.663 | 8.718 | |

| -Associate Professors | 22.287 | 6.516 | |

| -Assistant Professors | 19.087 | 5.739 | |

| PENSION | |||

| DC only | Only a Defined Contribution style pension | 0.685 | 0.465 |

| DB only | Only a Defined Benefit style pension | 0.067 | 0.251 |

| DB/DC choice | Choice of DB or DC pension | 0.248 | 0.432 |

| RANK | |||

| Professor | Rank of Full Professor | 0.334 | 0.472 |

| Assoc. Professor | Rank of Associate Professor | 0.333 | 0.472 |

| Assist. Professor | Rank of Assistant Professor | 0.333 | 0.471 |

| INSTITUTION TYPE | |||

| Public | Public University | 0.415 | 0.493 |

| Doctoral | Significant level of doctoral level education | 0.219 | 0.414 |

| Masters | Diverse post-baccalaureate masters programs | 0.382 | 0.486 |

| Baccalaureate | Primarily undergraduate baccalaureate education | 0.399 | 0.490 |

| Top 10 rank | Top 10 rank by US News and World Report | 0.011 | 0.105 |

| Top 11 to 25 rank | Top 11-25 rank by US News and World Report | 0.015 | 0.122 |

| Top 26 to 50 rank | Top 26-50 rank by US News and World Report | 0.023 | 0.150 |

| Percent male in rank | Percent of faculty in rank that is male | 56.926 | 14.564 |

| -Professors | 67.481 | 13.280 | |

| -Associate Professors | 55.223 | 12.057 | |

| -Assistant Professors | 48.257 | 11.558 | |

| PROGRAMS | |||

| Business | Institution offers program in Business | 0.437 | 0.496 |

| Law | Institution offers program in Law | 0.142 | 0.349 |

| Dentistry | Institution offers program in Dentistry | 0.040 | 0.197 |

| Nursing | Institution offers program in Nursing | 0.306 | 0.461 |

| Engineering | Institution offers program in Engineering | 0.198 | 0.399 |

The distribution of observations by rank is split virtually in thirds due to the fact that we have observations for each of the ranks for almost all of the institutions. In terms of institution type, 41.5% of the sample is public universities, with the two most common types being primarily masters and baccalaureate granting institutions. Roughly 5% of our sample falls into one of the three elite university categories. The sample is disproportionately male accounting for 57% of faculty across all ranks. Interestingly, the percentage of faculty that are male increases with rank, from only 48% of assistant professors to over 67% of full professors.

The numbers by rank may represent women dropping out of the labour force before reaching full professor, but it also may simply represent the fact that more men than women became professors a number of years ago and therefore have had enough time to reach full professor. Of the highlighted programs within universities sampled, business programs are the most common, with dentistry being the least common. The next section estimates our baseline model to test for the impacts of DB pensions.

Results

The results from our baseline model are presented in the first column of Table 2. The coefficient on the DB only pension variable is negative and strongly significant, showing that faculty members with DB pensions receive 8.4% lower total compensation. We also see a significant 5.8% reduction in total compensation for those with a DB/DC choice. This result may reflect the fact that some faculty chose the DB pension or that the installation of a DC choice was a more recent development with many of the faculty included in the average never actually having a choice other than a DB pension. The results suggest that DB pensions do reduce total compensation relative to faculty who receive only a DC pension. These initial findings match the predictions of our model.

| Table 2: Random Effects Regression Coefficients For Compensation, Salary And Benefits | ||||

| Baseline Model | Interaction Model | |||

|---|---|---|---|---|

| Variable | ln(Compensation) | ln(Salary) | ln(Benefits) | ln(Compensation) |

| ln(Salary) | - | - | 0.786*** | - |

| ln(Benefits) | - | 0.265*** | - | - |

| PENSION | ||||

| DB only | -0.084*** | -0.076*** | 0.018 | -0.057** |

| DB/DC choice | -0.058*** | -0.022 | -0.061 | -0.050** |

| PENSION*RANK | ||||

| DB only*Associate Professor | - | - | - | -0.042*** |

| DB only*Full Professor | - | - | - | -0.039*** |

| DB/DC*Assoc. Professor | - | - | - | -0.019*** |

| DB/DC*Full Professor | - | - | - | -0.004 |

| RANK | ||||

| Associate Professor | 0.142*** | 0.104*** | 0.035*** | 0.150*** |

| Professor | 0.358*** | 0.299*** | 0.004 | 0.363*** |

| INSTITUTION TYPE | ||||

| Public | 0.098*** | 0.015 | 0.143*** | 0.098*** |

| Masters | 0.046*** | 0.043*** | -0.010 | 0.046*** |

| Doctoral | 0.193*** | 0.170*** | -0.012 | 0.193*** |

| Top 10 rank | 0.254*** | 0.230*** | -0.053 | 0.255*** |

| Top 11 to 25 rank | 0.204*** | 0.156*** | 0.024 | 0.205*** |

| Top 26 to 50 rank | 0.084*** | 0.057** | 0.023 | 0.084*** |

| Percent male in rank | 0.001*** | 0.0004*** | 0.001** | 0.001*** |

| PROGRAMS | ||||

| Business | 0.008 | 0.006 | 0.003 | 0.008 |

| Law | 0.116*** | 0.089*** | 0.016 | 0.116*** |

| Dentistry | -0.015 | -0.020 | 0.015 | -0.015 |

| Nursing | -0.034*** | -0.021** | -0.022 | -0.035*** |

| Engineering | 0.045*** | 0.021** | 0.046** | 0.046*** |

| Note: All models include state indicators and correct standard errors for clustering by institution. N=2,981. Statistically significant at the *** 1%, ** 5% and 10% level | ||||

The other coefficients generally match expectations, suggesting that our sample is similar to others. Associate professors make 14.2% more than assistant professors while full professors, on average, make 35.8% more than assistant professors. Relative to Baccalaureate granting institutions, Masters and Doctoral institutions make 4.6% and 19.3% more respectively. Interestingly, in our sample total compensation is 9.8% higher in public institutions. How total compensation is distributed is unclear. There also appears to be an effect of elite status with all the ranking indicators being statistically significant and positive. Universities with a top 10 ranking pay 25.4% more on average than those that are not highly ranked, while those with a top 11-25 and top 26-50 ranking increase compensation by 20.4% and 8.4% respectively. Faculty from institutions which offer law degrees and engineering degrees make 11.6% and 4.5% more respectively than institutions that do not, while faculty from institutions with nursing programs actually make 3.4% less. These results may reflect higher salaries in law and engineering which pull up the overall average compensation or it may reflect the fact that institutions who branch into these fields simply have greater resources overall and compensate their faculty more generously across the board. A rather interesting result is that each percentage point increase in the percentage male within the rank increases total compensation by 0.1%. While small in magnitude, the result is strongly statistically significant. This finding may reflect the fact that men are paid more than women for the same job due to discrimination, but it may also reflect that men chose to enter higher paying fields of study.

As a first step, the results suggest that having a DB pension does significantly reduce overall compensation. The total compensation figures used in the baseline regression does not provide any information about whether this is due to lower salaries or lower benefits. The next two columns of Table 2 present models attempting to break down precisely how compensation is affected by pension type. The model in the second column regresses ln(Salary) on the pension and control variables, as well as the ln(benefits). The model in the third column does the opposite, regressing ln(benefits) controlling for ln(salary). Including the control for ln(benefits) in the salary model [or ln(salary) in the benefits model)] is important for isolating how total compensation changes since salaries and benefits may offset each other. Without the benefits control one could observe a significantly lower salary for faculty with DB pensions, but this may not have actually led to lower compensation overall if institutions that offer DB pensions also offer greater benefits to offset the lower salaries. The simple model could make it appear that DB pensions led to less compensation when in reality it simply altered the composition of compensation.

Turning to the salary and benefits results, we conclude that it is lower salaries and not benefits that are driving the lower total compensation results. After controlling for the level of benefits at the institution, faculty with DB pensions receive 7.6% lower salaries on average. We do not observe any effect of DB pensions on benefits after controlling for salaries. This result further supports the idea that institutions are using the monopsony power created by DB pensions to reduce monetary pay for faculty. Given that the value of benefits may be harder to manipulate, the effect on salaries is probably as expected. Examining the control variable results for the salary and benefits models we can also conclude that most of the variation in total compensation is due to variations in salaries and not benefits. The coefficients in the salary equation display a high level of significance and essentially match those from the total compensation model. On the other hand, benefits are not affected by many factors overall. The only real exception is for public institutions which do not have statistically different salaries, but do have significantly more generous benefits than private institutions. The results also suggest that there is a positive relationship between the level of salaries and benefits. The salary and benefit controls are both significant and positive in their respective equations, showing that those institutions that are more generous with salaries also tend to be more generous with benefits. This result has been found before (Zoghi, 2003) and suggests that salaries and benefits do not necessarily offset each other within total compensation.

Although the baseline results in Table 2 match our expectations related to monopsonistic exploitation and do suggest that DB pensions lead to lower total compensation, there is an alternative explanation for the findings. Because DB pensions include guaranteed payments to the employee upon retirement until death, DB pensions are inherently less risky for the employee than DC pensions. With DC pensions the only guarantee is what is contributed into the plan. The employee must bear the investment risk related to whether their contributions will accrue enough value to provide for their retirement. The employee also experiences longevity risk related to possibly outliving the amount of accumulated assets. Neither of these risks is relevant for DB pension holders. Given the reduction in risk associated with DB pensions, it is possible that individuals who choose to work and stay at universities with DB pensions are simply more risk averse and are willing to trade some compensation for less risk. Under this interpretation DB pensions would lead to lower total compensation, but it would not be due to monopsonistic exploitation of employees, but rather to a negative compensating wage differential.

Since we do not have individual observations of individual risk aversion which is difficult to measure anyway, it is hard to say which explanation of the findings is correct. In an attempt to isolate the cause of the DB effect we estimate a model interacting our pension variables with faculty rank. As mentioned previously, DB pensions likely create moving costs for all employees, but it is also very likely that the moving costs and mobility restrictions increase with seniority due to the non-linear accrual of benefits and to vesting clauses. If moving costs do increase with seniority, the monopsony power of employers would increase with seniority, which should lead to greater monopsonistic exploitation for senior faculty members. The interaction model should be able to pick up this effect which would be displayed by significant coefficients for the pension/rank interactions with possibly larger effects for higher ranks. At the same time, as an inherent attitude of an individual, risk aversion should be less likely to change with seniority. Therefore, if the DB effect is simply an exchange of compensation for risk, we should not expect to see significant interaction coefficients.

Of course, this interpretation of our specification is problematic if risk aversion does actually increase with age. Although not perfectly correlated, rank and age are obviously positively related to some extent which could complicate our analysis. The literature on how risk aversion (or risk tolerance) changes with age (Yao et al., 2011) is hardly uniform in its findings. Some studies show that risk aversion does increase with age (Morin and Suarez, 1983; Sahm, 2012; Yao et al., 2011) while others studies find that risk aversion actually decreases with age (Bertaut, 1998; Grable, 2000; Guiso et al., 1996; Ida & Goto, 2009). At least one study finds that risk aversion is essentially constant during working ages (Bucciol & Miniaci, 2011) while other analyses find that risk aversion follows a non-linear trend, decreasing over traditional working ages and increasing as workers approach their 60s (Halek & Eisenhauer, 2001; Riley & Chow, 1992). The lack of consensus in the literature suggests that an explanation other than risk aversion is responsible for the relationship between rank and total compensation. While risk aversion may increase with age eventually, the literature suggests that for the working ages that we observe, risk aversion does not increase and may decline. Any effects we would observe with rank would happen in the range of ages before risk aversion starts increasing. Estimated coefficients for the interaction model are presented in the last column of Table 2. In addition, in Table 3 we present easier to interpret results for the DB pension variables. The interaction terms can at times cause confusion about the relevant effects for various groups, so we break the effects down by rank, showing the relevant B coefficients for each group as well as the combined estimated effects.

| Table 3: Interaction Model Effects By Pension Type And Rank | |||||

| TABLE 3 EQUATION: B0 + B1(DB) + B2(DB*Rank) + B3(Rank) + B4(X) | |||||

| B Coeff. | B effect of DB relative to DC | Est. effect of DB relative to DC | B extra effect of DB relative to Asst. w/DB | Est. extra effect of DB rel. to Asst. w/ DB | |

|---|---|---|---|---|---|

| Assistant Professor | |||||

| w/DB | B0 + B1 | B1 | -0.057** | - | - |

| w/ DC | B0 | ||||

| Associate Professor | |||||

| w/DB | B0 + B1 + B2 + B3 | B1 + B2 | -0.099*** | B2 | -0.042*** |

| w/DC | B0 + B3 | ||||

| Full Prof | |||||

| w/DB | B0 + B1 + B2 + B3 | B1 + B2 | -0.096*** | B2 | -0.039*** |

| w/DC | B0 + B3 | ||||

| Note: Statistically significant at the *** 1%, ** 5% and 10% level | |||||

A first finding shows that the coefficients for the control variables are closely similar to the baseline indicator model as could be expected. Turning to the pension estimates, we find that for assistant professors, a DB pension reduces compensation by 5.7% relative to their counterparts with only DC pensions. This result is shown by the DB only pension indicator by itself in the last column of Table 2 and also in the top panel of Table 3. This result follows the baseline results from the indicator model. More importantly, we see significant, negative coefficients for both of the DB only interactions as our moving cost model predicts. These results, shown also in the last column of Table 3, suggest that relative to assistant professors, associate professors with DB pensions see an additional decrease in compensation of 4.2%, while full professors’ compensation falls an additional 3.9%. The interaction coefficients are highly significant, although the magnitude of the effect does not increase between associate and full professors. This may be due to the fact that promotion to full professor is by no means assured for associates. There may be many associate professors with greater seniority and pension benefits accrual than some full professors, arguably leading to greater moving costs despite the lower rank.

| Table 4: Interaction Model Effects By Pension Type And Rank | |||||

| B0+B1(DB)+B2(Rank)+B3(Type)+B4(DB*Rank)+B5(DB*Type)+B6(DB*Rank*Type)+B7(X) | |||||

| B Coeff. | B effect of DB relative to DC | Estimated DB Effect | B extra effect of DB relative to Asst. w/DB | Estimated DB Effect | |

|---|---|---|---|---|---|

| Bachelors | |||||

| Assistant | |||||

| w/DB | B0 + B1 | B1 | 0.032 | - | - |

| w/DC | B0 | ||||

| Associate | |||||

| w/DB | B0 + B1 + B2 + B4 | B1 + B4 | 0.021 | B4 | -0.011 |

| w/DC | B0 + B2 | ||||

| FULL | |||||

| w/DB | B0 + B1 + B2 + B4 | B1 + B4 | -0.031 | B4 | -0.063* |

| w/DC | B0 + B2 | ||||

| Masters | |||||

| Assistant | |||||

| w/DB | B0 + B1 + B3 + B5 | B1 + B5 | -0.059** | - | - |

| w/DC | B0 + B3 | ||||

| Associate | |||||

| w/DB | B0 + B1 + B2 + B3 + B4 + B5 + B6 | B1 + B4 + B5 + B6 | -0.118*** | B4 + B6 | -0.059*** |

| w/DC | B0 + B2 + B3 | ||||

| FULL | |||||

| w/DB | B0 + B1 + B2 + B3 + B4 + B5 + B6 | B1 + B4 + B5 + B6 | -0.159*** | B4 + B6 | -0.100*** |

| w/DC | B0 + B2 + B3 | ||||

| Doctoral | |||||

| Assistant | |||||

| w/DB | B0 + B1 + B3 + B5 | B1 + B5 | -0.083** | - | - |

| w/DC | B0 + B3 | ||||

| Associate | |||||

| w/DB | B0 + B1 + B2 + B3 + B4 + B5 + B6 | B1 + B4 + B5 + B6 | -0.101*** | B4 + B6 | -0.018 |

| w/DC | B0 + B2 + B3 | ||||

| FULL | |||||

| w/DB | B0 + B1 + B2 + B3 + B4 + B5 + B6 | B1 + B4 + B5 + B6 | 0.016 | B4 + B6 | 0.099*** |

| w/DC | B0 + B2 + B3 | ||||

| Note: Statistically significant at the *** 1%, ** 5% and 10% level | |||||

Overall, the estimated results presented in Table 3 suggest that compensation for an associate professor with a DB pension is 9.9% less on average than that for an associate professor with a DC pension, a difference that is highly statistically significant. Similarly, the difference for a full professor with a DB pension is 9.6% lower, which is also highly significant. The results suggest that there is not only a significant effect of DB pensions for assistant professors, but also a significant negative effect for higher ranks. This finding lends support to the moving cost and exploitation interpretation of the results over the risk aversion interpretation.

We also investigate whether there are different effects across Bachelors, Masters and Doctoral granting institutions. The logic here is that there are likely different labour markets for faculty for each type of institution. First, bachelors and masters granting institutions are simply more plentiful than doctoral in situations and therefore may offer faculty a more competitive labour market less subject to exploitation. While moving costs will continue to be associated with DB pensions, a greater number of alternatives may bid up compensation to alleviate the effect. Second, while possible for faculty with doctorates to move across institution types, it is likely that relatively few do once they secure their first position. Therefore, each of these university types likely represents a separate, relevant labour market. Finally and perhaps most importantly, the prevalence of these different university types differs across private and public institutions and thus the likelihood of having DB pensions will differ accordingly. For instance, bachelors granting institutions make up almost 40% of all universities, but only 14.5% of public universities. This means that only 1.8% of bachelors granting institutions have DB pensions compared to 10.8% and 8.8% of masters and doctoral granting institutions, respectively. Therefore, there may not be a prevalent, recognizable effect on compensation in bachelors granting institutions, while faculty at other institutions may be more susceptible to DB effects.

To check for differential effects across both rank and university type we estimate a model including pension/rank interactions, pension/degree type interactions and a final interaction for pension/rank/type. The equation for this model is presented at the top of Table 4. To aide with interpretation of the interaction effects, in Table 4 we also present the relevant B coefficients for each group as well as the combined estimated effects. We do not present the estimates for the control variables as they are virtually identical to the baseline and interaction models in Table 2.

First, the panel shows there are essentially no significant negative effects of DB pensions for bachelors granting institutions for any rank relative to their DC counterparts. There is also no negative effect for associates relative to assistants. The only negative effect found that is marginally significant (p value=0.098) is for full professors relative to assistants. Even with this effect, full professors are no worse off than their DC counterparts. As discussed earlier, these results may be due to the greater number of bachelors granting institutions, which provide faculty with more options when looking to move. The number of alternatives can even be higher than observed in our sample as bachelors institution faculty may also look to associates granting institutions, community colleges and technical schools as alternatives, all of which we excluded from our sample. The low prevalence of DB pensions for this group also may mean that in order to attract and retain quality faculty, administrators are not able to take advantage of the moving costs created by the DB pension. Whatever the reason, faculty members in baccalaureate institutions simply do not experience the same negative effects as seen overall.

On the other hand, we find that there are strong negative effects of DB pensions within masters granting institutions as shown in the middle panel. Relative to assistant professors we find additional negative effects of 5.9% for associates and 10.0% for full professors. The increasing effect with rank shows a significant difference as well, just as our moving cost model would predict. We find significant reductions in compensation for every rank relative to their counterparts with DC pensions. The differences are sizable as well, ranging from 5.9% less for assistants to 15.9% less for full professors. While it is not exactly clear why we find effects in masters granting institutions and not bachelors, it could likely be related to fewer alternatives for faculty and a greater prevalence of DB coverage.

The results for doctoral granting institutions presented in the bottom panel fall somewhere between those for bachelors and masters institutions. As in masters institutions assistant professors experience a significant reduction in compensation, 8.3%, relative to their DC counterparts. Associate professors experience a 10.1% reduction relative to DC associates, although this effect is not significantly different than the negative effect for assistants. This suggests that lower ranks at doctoral institutions may experience some exploitation as with their masters’ counterparts. Interestingly, we do not find a significant negative effect for full professors relative to their DC counterparts. Relative to assistant professors, full professors get an extra positive effect of 9.9% which brings compensation back in line with DC professors. This pattern of results is quite different than what we found in the other two types of institutions, but may have to do with the types of people who become full professors at doctoral institutions. While limited alternatives in the labour market may lead to reduced compensation for DB pension holders at lower ranks, those who become full professors are likely to be stars in their fields. The star status of full professors at doctoral institutions likely grants them the bargaining power to force administrators to grant higher salaries in order to retain them at the university. Even if these professors move, they will likely continue to command higher salaries at their destination university as well, even if the institution offers a DB pension.

Our extended model results using the pension/rank interactions suggest that there is a reduction in compensation due to DB pensions and that the reduction is particularly felt by associate and full professors, particularly at masters granting institutions. Again, risk aversion may be an alternative explanation for these results. Given the variation in DB coverage in different university types, it is possible that the negative effects found in masters and doctoral granting institutions are due to risk averse faculty flocking to those institutions precisely because they offer DB pensions and therefore are willing to accept reduced compensation. Although possible, this explanation seems less likely than the labour market explanation of the findings. If this was the case we would still expect to find negative effects in the bachelors granting institutions that offer DB pensions, even though they are less prevalent. This interpretation also ignores the two sided nature of employment. Even if risk averse faculty are more likely to apply to DB institutions there is no guarantee that they would have the qualifications for open positions and therefore would be hired by these employers. As many recently minted PhDs have found the academic labour market can be very competitive. While faculty may prefer certain jobs based on pension type given their attitudes towards risk, most likely do not have enough offers to reject a tenure track position based on the retirement plan they offer. Although sample selection may be part of our findings, labour market realities suggest that risk aversion cannot explain the full extent of our results.

Concluding Remarks

Our study investigates whether DB pensions as a source of moving costs lead to monopsonistic exploitation and thus lower total compensation for university faculty. Using data on total compensation and institution type from the AAUP, supplemented by pension information for each institution, we find that our predictions are born out. The presence of a DB pension leads to an overall 8.4% reduction in total compensation for faculty relative to having a DC pension. We also find that there are different effects by rank. The presence of DB pensions significantly reduces compensation by an extra 4.2% for associate and an extra 3.9% for full professors relative to assistants with a DB. As moving costs for DB pensions will tend to increase with seniority, the greater effects for higher ranks suggest that the effects are caused by moving costs rather than a reduction in compensation due to risk aversion. Overall, our results show that assistant professors with DB pensions make 5.7% less, associate professors make 9.9% less and full professors make 9.6% less than their counterparts with DC pensions.

We also find that this negative effect is particularly strong for faculty in masters granting institutions, with lesser effects for lower ranked faculty at doctoral institutions and no effect at bachelors granting institutions. The differentiation of effects across degree types may be due to varying degrees of competition in the labour market for faculty. Those at bachelors’ institutions and full professors at doctoral granting institutions have enough bargaining power to offset the negative DB effect either because of abundant alternative places of employment or through individual star status. Faculty at masters’ institutions and lower ranked doctoral faculty likely do not receive the benefit of either of these two effects, leading to particularly strong negative compensation effects.

While our findings are robust, there are questions still left unanswered. The aggregated nature of our data makes testing the risk aversion hypothesis rather difficult. The significance and sign of the interaction effects and the variation across university type suggests that moving costs are a more likely explanation, but future research, perhaps on an individual level, may be able to shed more light on the topic. We also are not able to observe what choice individual faculty actually made when faced with a choice between a DB and DC pension. On the other hand, the wage setting decisions may be set on an institution wide basis so the policies may not vary on an individual level within universities anyway. More detailed pension information on the individual level could help us refine our estimation.

Our findings are important in general for the literature examining empirical effects of monopsony in labour markets. However, they should be of particular interest for those who study pensions and of course, the faculty who are affected by the findings. The shift to DC pensions in the labour market has shifted risk to workers and has been blamed for reduced financial preparedness for retirement. At the same time, DB pensions increasingly have come under attack, particularly in the public sector for being too generous and unsustainable. Our estimates suggest that while various DB plans may well be financially unsustainable, there is a negative effect on workers that generally goes unnoticed. Workers may be more stable in retirement with DB pensions, but this may have come at a cost of lower monetary earnings while still employed.

References

- Ashenfelter, O.C., Farber, H. & Ransom, M. (2010). Labour Market Monopsony. Journal of Labour Economics, 28(2), 203-210.

- Barbezat, D. (1989). The effect of collective bargaining on salaries in higher education. Industrial and Labour Relations Review, 42(3), 443-455.

- Barbezat, D.A. & Donihue, M.R. (1998). Do Faculty Salaries Rise with Seniority? Economics Letters, 58(2), 239-244.

- Barbezat, D.A. & Hughes, J.W. (2001). The effect of job mobility on academic salaries. Contemporary Economic Policy, 19(4), 409-423.

- Bertaut, C.C. (1998). Stockholding behavior of US households: Evidence from the 1983-1989 survey consumer finances. The Review of Economics and Statistics, 80(2), 263-275.

- Black, D.A. & Lowenstein, M.A. (1991). Self-enforcing labour contracts with costly mobility: The sub-game perfect solution to the chairman’s problem. Research in Labour Economics, 12, 63-83.

- Boal, W. & Ransom, M. (1997). Monopsony in the labour market. Journal of Economic Literature, 35(1), 86-112.

- Boal, W. & Ransom, M. (2010). Monopsony in American labour markets. EH.Net, Retrieved on January 24, 2013 on http://eh.net/encyclopedia/article/boal.monopsony

- Brainard, K. (2011). National association of state retirement administrators’ survey.

- Bratsberg, B., Jr. Ragan, J.F. & Warren, J.T. (2003). Negative returns to seniority: New evidence in academic markets. Industrial and Labour Relations Review, 56(2), 306-323.

- Brown, B.W. & Woodbury, S.A. (1998). Seniority, external labour markets and faculty pay. Quarterly Review of Economics and Finance, 38(4), 771-798.

- Bucciol, A. & Miniaci, R. (2011). Household Portfolios and Risk Taking over Age and Time. Netspar Discussion Paper, 04/2011-037.

- Costrell, R. & Podgursky, M. (2010). Distribution of benefits in teacher retirement systems and their implications for mobility. Education, Finance and Policy, 5(4), 519-557.

- Dunn, S. (2013). Public-private pay gap widens. Chronicle of higher education, (April 8), Retrieved on July 22, 2013 on http://chronicle.com/article/Public-Private-Pay-Gap-Widens/138359/

- Grable, J.E. (2000). Financial risk tolerance and additional factors that affect risk taking in everyday money matters. Journal of Business and Psychology, 14(4), 625-630.

- Guiso, L., Jappelli, T. & Terlizzese, D. (1996). Income Risk, borrowing constraints and portfolio choice. The American Economic Review, 86(1), 158-172.

- Halek, M. & Eisenhauer, J.G. (2001). Demography of Risk Aversion. The Journal of Risk and Insurance, 68(1), 1-24.

- Hallock, K. (1995). Seniority and monopsony in the academic labour market: Comment. American Economic Review, 85(3), 654-657.

- Hoffman, E.P. (1997). Effects of seniority on academic salaries: Comparing Estimates. Proceedings at the Forty-Ninth Annual Meeting of the Industrial Relations Research Association, 347-352.

- Ida, T. & Goto, R. (2009). Simultaneous measurement of time and risk preferences: Stated preference discrete choice modelling analysis depending on smoking behavior. International Economic Review, 50(4), 1169-1182.

- Moore, W.J., Newman, R.J. & Turnbull, G.K. (1998). Do academic salaries decline with seniority? Journal of Labour Economics, 16(2), 352-366.

- Morin, R.A. & Suarez, A.F. (1983). Risk aversion revisited. The Journal of Finance, 38(4), 1120-1216.

- Novy-Marx, R. & Rauh, J.D. (2009). The liabilities and risks of state-sponsored pension plans. Journal of Economic Perspectives, 23(4), 191-210.

- Podgursky, M. & Ehlert, M. (2007). Teacher pensions and retirement behavior: How pension rules affect behaviour, mobility and retirement. National Centre for Analysis of Longitudinal Data in Education Research, Working Paper 5.

- Ransom, M. (1993). Seniority and monopsony in the academic labour market. American Economic Review, 83(1), 221-233.

- Ransom, M. & Sims, D. (2010). Estimating the Firm’s Labour Supply Curve in a ‘New Monopsony’ Framework: School Teachers in Missouri. Journal of Labour Economics, 28(2), 331-355.

- Riley, W.B. & Chow, K.V. (1992). Asset allocation and individual risk aversion. Financial Analysts Journal, 48(6), 32-37.

- Sahm, C.R. (2008). How much does risk tolerance change? Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board 2007-2066. UnivSource. www.univsource.com. Retrieved on September 21, 2013 on http://www.univsource.com US News and World Report. Retrieved on September 15, 2013 on http://colleges.usnews.rankingsandreviews.com/best-colleges/rankings/national-universities

- Yao, R., Sharpe, D.L. & Wang, F. (2011). Decomposing the age effect on risk tolerance. The Journal of Socio-Economics, 40(6), 879-887.

- Zoghi, C. (2003). Why have public university professors done so badly? Economics of Education Review, 22(1), 45-57.