Research Article: 2023 Vol: 27 Issue: 5

Does Culture Influence Consumer′s Perception towards usage of Digital Banking Platforms (DBP)? A Comparative Study

Pushpender Kumar, Institute of Management Studies, Ghaziabad

Vaishali Agarwal, Institute of Management Studies, Ghaziabady

Subhash Kizhakanveatil Bhaskaran, Goa University

Parul Yadav, Institute of Management Studies, Ghaziabad

Rhea Coelho, Goa University

Indrawati, Telkom University

Sonali P. Banerjee, Amity Business School, Amity University, Noida

Citation Information: Kumar, P., Agarwal, V., Bhaskaran, S.K., Yadav, P., Coelho, R., Indrawati, & Banerjee, P.S (2023). Does culture influence consumer’s perception towards usage of digital banking platforms (dbp)? a comparative study. Academy of Marketing Studies Journal, 27(4), 1-20.

Abstract

Purpose: This paper is aimed at comparing the cultural effect on user’s perception towards digital banking while living in two differently developed countries, namely, India and the United Kingdom. This paper has examined the influence of trust and perceived risk on consumer’s intention to use DBP.

Design/Methodology/Approach: The authors have made use of an online survey to collect primary data. An online questionnaire was created and circulated among the three consumer segments under study, namely, British, Indian and the Bi-cultural segment. The number of responses received included 96 responses from Indian consumers, 85 responses from Indian’s living in UK and 75 responses from British consumers.

Findings: The findings of the research revealed that no matter where people live, if they trust the system, they will use it. Moreover, banks should consider adopting latest technology like cryptography to manage information and financial services with an objective to reduce users perception of risk. The samples in this study belong to a society which shows a trait of collectivism as well as femininity. All three samples are tolerant towards uncertainty and they belong to a Traditional Normative Society, that is, Short Term Oriented.

Practical Implications: This research highlights the fact that the banks should market the innovation to its customers based on its utility and help them in adopting the latest techniques to reduce risk in the mind of the consumer irrespective of the cultural background of the user.

Keywords

Digital Banking, Hofstede’s Cultural Dimensions, UTAUT, India, United Kingdom.

Introduction

The nature of banking and financial services has seen a huge change in the recent years with the advancement in the field of information and communication technology (ICT). Digital banking minimizes financial operating costs and offers consumers more convenience and easier accessibility. Despite these benefits, such technology adoption rate varies noticeably between countries. The different rates of acceptance may be due differential cultural dimensions and also level of awareness.

Over the years, it globally observed that the technological tools undergo advancements to ensure effective delivery of financial services to consumers (Hassan & Wood, 2019), which resulted in transforming traditional offline banking in to digital banking with 24x7 services. Digital banking can be defined in simple terms as digitization / moving online of the banking activities that were previously only accessible to customers only when they are physically present at the bank premises. Digital Banking Platforms (DBP) is the medium of conducting the normal banking activities of the customer by using computers, mobile phones and ATM services.

The basic objective behind this study is to compare the effect of culture on the user’s perception towards digital banking while living in two differently developed countries, namely, United Kingdom, one of the developed nation, and India, one of the developing nation. The researches have stated that cultural orientation of an individual has significant influence on his behavior and attitude towards innovation. The cultural orientation of an individual is derived from the cultural influence of his/ her country of origin (Muk & Chung, 2015).

Multiple studies conducted by Rogers (1995); Minkov & Hofstede (2011); & Martinsons & Davison, 2007 have stated that, ‘it is the different aspects of an individual’s national culture that usually affects consumer decision making process in terms of shaping his/her perceptions and preferences towards products, services and innovations’. The new technology adoption behaviors of individuals differ across countries on account of their distinct cultures (Hasssan & Wood, 2019). The empirical studies to investigate the cultural influence on adoption of digital banking services are limited in number, thus the need to explore this dimension further is highlighted in the prior researches (Mohammadi, 2015; Mortimer et al. 2015).

Though the advantages of digital banking are imperative, yet the adoption of digital banking services is limited among the consumers across different countries (Lin, 2011; Zhou, 2012; Akutran and Tezcan, 2012; Malaquias & Hwang, 2019; Alalwan et al. 2016). The research to explore the reasons for low adoption rates in developing nations and to recommend the solutions for improving same is of relevance to the researchers (Lee & Chung, 2009; Hassan & Wood, 2019).

Present study is basically trying to analyze the reasons for slow diffusion of digital banking services around the globe by taking into consideration customers' suspicion about the safety of banking transactions in electronic mode and due to absence of trust in DBP along with limited acceptance of or chaos involved in new innovations under various cultural dimensions.

It was also attempted to check whether the individual behaviors regarding the adoption of digital banking technology differs across individuals having distinct cultural background as they come represent different nations, hence the aim was to examine the impact of cultural differences on consumers’ intention to adopt and use innovations in current era led by information and technology (Hassan & Wood 2019).

This study is conducted with the help of survey research. It focuses on the differences in perception towards digital banking and its utilization among the consumers of two different countries i.e. India, an emerging economy and United Kingdom, an advanced economy. The Indian and British consumers represent two distinct cultures. This study further explores the perception of Indians shifted to United Kingdom and now living there resulting in Bi-cultural Indians. The influence of change in the cultural surrounding of an individual due to movement from his/ her native (primary) culture to a host (secondary) culture on his/ her perceptions is examined.

Theoretical Framework and Research Model

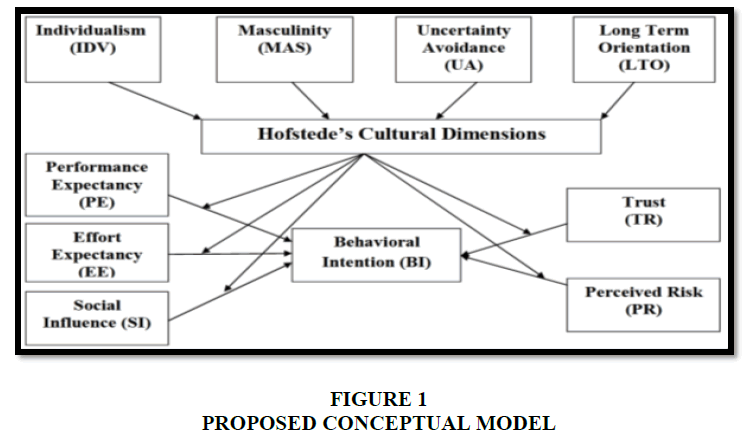

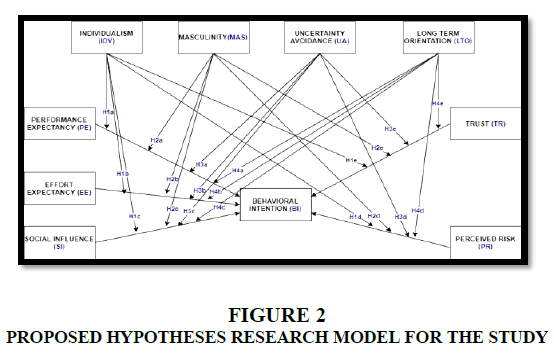

In this study four of Hofstede’s (2001) cultural dimensions from the 6-D model are utilized to check their effect on three constructs from the Unified Theory of Acceptance and Use of Technology Model (UTAUT) (Venkatesh et al. 2003). The cultural dimensions used in this study are Individualism (IDV), Masculinity (MAS), Uncertainty Avoidance (UA) and Long Term Orientation (LTO). The constructs of UTAUT are Performance Expectancy (PE), Effort Expectancy (EE) and Social Influence (SI) was incorporated into this model with an addition of two more constructs, namely, Perceived Risk (PR) and Trust (TR). The proposed model used in the study is given in Figure 1, and all the 10 constructs are explained below.

Numerous studies has been carried out to understand the user behavior and various factors that influences technology adoption, resulted in development of various theories over more than four decades, specifically, Roger’s (1960) Diffusion of Innovation Theory (DOI), Fishbein and Ajzen’s (1975) Theory of Reasoned Action (TRA), Bandurra’s (1986)Social Cognitive Theory (SCT), Davis’s (1989) Technology Adoption Model (TAM), Ajzen’s (1991) Theory of Planned Behaviour (TPB) by Icek, Model of Personal Computer Utilization (MPCU) by Thompson and Higgins in 1991, Motivation Model (MM) by Davis, Bagozzi & Warshaw in 1992 and Venkatesh & Davis’s (2000) Extended Technology Adoption Model (TAM2) (Castanha et al., 2021).

The existence of several theories, with their respective merits and demerits result in confusion among the researchers. This confusion results in compulsion for a researcher to use a model or theory from widely available variety of models to suit the characteristics of their study. Venkataes et al (2003) developed a comprehensive model i.e. the unified theory of acceptance and use of technology (UTAUT) to clear the confusion of multiple theories. This model was developed by systematically reviewing and consolidating multiple constructs as suggested in earlier models between1960-2000 (Castanha et al., 2021).

Performance Expectancy (PE)

PE basically tries to assess to what extent the use of a technology helps an individual in improving the job performance level (Venkatesh et al, 2003). Alalwan et al. (2016); Davis et al. (1989); and Venkatesh et al. (2003), have opined that ‘customers seem to be more motivated to use and accept new technology if they perceive that this technology is more advantageous and useful in their daily life’. The research has found that customers use computing technology to conduct banking activities when they believe that it is beneficial (Baptista& Oliveira, 2015). The users will utilize IS/IT systems once they observe their benefits (Dwivedi et al. 2019; Rana et al. 2017). The research studies of Dodds et al. (1991) and Venkatesh et al. (2012) have stated that the customers perform a rational comparison between the functional benefits and the monetary cost paid towards using a technology.

Effort Expectancy (EE)

The effort expectancy (EE) is determined in terms of the ease of using a system (Venkatesh et al., 2003). The computer literacy of few users is more than others towards a new technology (Sharma et al, 2020). Thus, Koenig-Lewis, Palmer, & Moll (2010) and Sharma et al (2020) in their research opined, it is expected that the more literate users will be quick in adopting new technology and would face less problems. The users perform the rational comparison between the amount of efforts required in successful application of a new technology against the advantages and benefits offered by it in terms of its utility (Davis, 1989).

Social Influence (SI)

Individuals get easily influenced by others in the society or social networks (e.g., friends, family, peers and seniors/superiors) to adopt Behavioral Intention (BI) (López-Nicolás et al. 2008). The SI dimension is the extent to which a person perceives that other individuals expect them to use the new system (Venkatesh et al., 2003). Alalwan, Dwivedi et al. (2015 & 2016), stated that the role of other customers is critical in influencing the awareness and usage intentions toward IT/IS.

Perceived Risk (PR)

PR is conceptualized as the extent of uncertainty experienced by the individuals which may result in negative consequences during the use of a product or service (Bauer & Cox, 1967). According to the study of Hoffman et al. (1999), customers find even the simple transactions risky and exhibit reluctance in performing them online (Jarvenpaa et al. 1999; Pavlou, 2001). This resulted in considering perceived risk as the main barrier for customers’ adoption of electronic services, namely if it is financial transactions (Sharma et al, 2020). Risks related to online and electronic banking consists of transaction security related risks, risks on account of banking frauds, and the risk of breach of privacy of personal and financial information. The research has stated that the consumers who perceive high risks in online and electron banking transactions are more averse toward new innovations.

Trust (TR)

TR is the “subjective probability with which customers believe that a particular transaction occurs in a manner consistent with their confident expectations”. (Koksal, 2016). The higher trust factor on online banking will result in better rate of adoption by the customers (Lin, 2011). With respect to doing banking transactions digitally the role of trust is of great importance. Trust led to reduction of fear and concerns of users regarding their personal data privacy and security. Trust could also help in providing confidence to the customers with respect to the security of their mobile banking transactions. Study of mobile payment in Indonesia also revealed that there was a positive and significant influence of Trust on Continuance Intention of customer in adopting mobile payment (Permana & Indrawati, 2020) and e-payment (Putri, 2018). Multiple researchers have identified trust as a key driver influencing customers’ intention to adopt and utilize technology innovations by multiple researches (Gu et al., 2009).

The Hofstede’s Cultural Dimensions Theory was developed by a Dutch management researcher by the name of Geert Hofstede in the year 1980. The framework is used to differentiate between different national cultures, the dimensions of culture, and assess their influence on a business setting. The six dimensions were Power Distance Index, Collectivism vs. Individualism, Uncertainty Avoidance Index, and Femininity vs. Masculinity, Short-Term vs. Long-Term Orientation and Restraint vs. Indulgence.

Individualism (IDV)

IDV reflects the point to which people prefer to take care of only themselves and their families (Sharma et al, 2020). The individuals belonging to highly individualistic cultures are considered more innovative and they take decisions on their own (Park et al. 2015). Sun & Zhang, (2006), stated that PE has more impact on BI for individualistic cultures than collective cultures. Further, impact of PE will be stronger on BI in case of the technology providing benefits to the user (Im, Hong, & Kang, 2011). Hung & Chou, 2014; Zhang et al. (2018), observed the relationship between PE and BI for internet banking, hence the following hypotheses are proposed:

H1a: Individualism has a significant effect on the PE→BI relationship.

H1b: Individualism has a significant effect on the EE→BI relationship.

H1c: Individualism has a significant effect on the SI→BI relationship.

H1d: Individualism has a significant effect on the PR→BI relationship.

H1e: Individualism has a significant effect on the TR→BI relationship.

Masculinity (MAS)

The dimension Masculinity (MAS) as an inclination for more materialistic rewards such as achievement, valor, boldness, and success; whereas femininity, represents an inclination towards more soft aspects such as cooperation, modesty, and quality of life. A masculine society will be driven by competition, accomplishment and success. Individuals want to be best in their field of interest. Though the proposed study includes respondents from both genders, the hypotheses proposed to ascertain the effect of masculinity are as follows:

H2a: Masculinity has a significant effect on the PE→BI relationship.

H2b: Masculinity has a significant effect on the EE→BI relationship.

H2c: Masculinity has a significant effect on the SI→BI relationship.

H2d: Masculinity has a significant effect on the PR→BI relationship.

H2e: Masculinity has a significant effect on the TR→BI relationship.

Uncertainty Avoidance (UA)

It has referred to UA as the extent to which an individual feels uncomfortable with ambiguity and uncertainty. Al Kailani& Kumar (2011) & Cyr (2013) found that higher the degree of UA more will be the preference towards security and vice versa. While using internet banking, the individuals with high UA are more concerned about the risks such as privacy, hacking and fraud (; Lim, Yeow, & Yuen, 2010; Khan et al. 2017; and Sampaio et al. 2017). The concerns people have about unknown situations in high UA cultures can also be alleviated by listening to others’ comments and usage experience (Hwang & Lee, 2012). People from high UA cultures often value safety more than people with low UA. To mitigate unknown situations, individuals from high uncertainty avoidance cultures would concentrate more on the attributes of products such as the ease of use and usefulness. To see how UA affects and differs in multi-culture society, the proposed hypotheses are:

H3a: Uncertainty Avoidance has a significant effect on the PE→BI relationship.

H3b: Uncertainty Avoidance has a significant effect on the EE→BI relationship.

H3c: Uncertainty Avoidance has a significant effect on the SI→BI relationship.

H3d: Uncertainty Avoidance has a significant effect on the PR→BI relationship.

H3e: Uncertainty Avoidance has a significant effect on the TR→BI relationship.

Long Term Orientation (LTO)

LTO is related to the extent to which people are encouraged by determination to prepare for the future; in contrast, people with short-term orientation often show reverence for the norms while being doubtful of societal change (Hofstede & Minkov, 2010; Zhang et al 2018). Those cultures having more LTO, people tend to concentrate more on the future rewards. Wang & Bansal (2012) proposed that LTO has a positive impact on financial performance, as it facilitates long-term investments which can achieve greater benefits. Here also the following hypotheses are proposed for testing the impact of LTO in different cultures:

H4a: Long Term Orientation has a significant effect on the PE→BI relationship.

H4b: Long Term Orientation has a significant effect on the EE→BI relationship.

H4c: Long Term Orientation has a significant effect on the SI→BI relationship.

H4d: Long Term Orientation has a significant effect on the PR→BI relationship.

H4e: Long Term Orientation has a significant effect on the TR→BI relationship.

Methodology

Data Collection Process

Data was collected using convenience sampling. The sampling unit for this study are the bank customers of age 18 and above and holding a bank account. The data was collected from different consumer segments considered in this study with the help of an online survey during December 2022 to February 2021. The first set of sample were customers living in India and having a bank account in an Indian bank; the second sample comprises of the British customers living in United Kingdom and holding a bank account in a British bank; and third set of sample was of the Indians staying in UK and having a bank account with Indian bank. The total number of questionnaires submitted online was 150 each for the three different groups. The response rate of the three different samples were, namely, 64% for Indian customers (96 out of 150), 57% for British customers (85 out of 150), and 50% for Indians who currently live in UK.

Questionnaire Development

All the items used in this present study were adopted and adjusted from previously published literature. Multiple items for measuring Performance Expectancy (PE), Effort Expectancy (EE), Social Influence (SI), Facilitating Conditions (FC) and Behavioural Intention (BI) were adopted from Venkatesh et al, 2003. Items for measuring the Hofstede’s Cultural Dimensions, namely, Individualism (IDV), Masculinity (MAS), Uncertainty Avoidance (UA) and Long Term Orientation (LTO), were adopted from Ameen et al. 2019, Srite and Karahanna, 2006. The construct of Perceived Trust (TR) were taken from Malaquias & Hwang, 2016 while items from Hassan & Wood 2019 were taken and modified to measure Perceived Risk (PR). The scales from the previous studies are adapted to suit the objectives of this study and based on them authors have developed the investigated variables of this research.

The questionnaire consisted of two parts: the questions related to demographic profile and prior digital banking experience of the respondents’ were given in the part I. The second part comprised of the latent constructs of the study including Performance Expectancy (PE), Effort Expectancy (EE), Social Influence (SI), Facilitating Conditions (FC) and Behavioural Intention (BI) and Hofstede’s four cultural Dimensions, namely, Individualism (IDV), Masculinity (MAS), Uncertainty Avoidance (UA) and Long Term Orientation (LTO). The research questions were framed in English. Most items were measured using five-point Likert’s scale, ranging from strongly disagree (1) to strongly agree (5). Behavioral Intention (BI) was measured by asking respondents about their intentions and plans to use the technology during the next 3 months.

Data Analysis

The data collected was tabulated and analyzed using statistical software packages: Statistical Product and Service Solutions (IBM SPSS version 26.0) and Smart PLS 3.To find the reliability and internal consistency of the data,Cronbach’s alpha (α) was calculated for each sample independently. Convergent validity was analyzed by calculating Composite Reliability and Average Variance Extracted for each sample. Discriminant validity was found by HTMT method. Sample Adequacy was calculated using Kaiser-Meyer-Olkin and Bartlett’s test for Sphericity. Further Exploratory Factor Analysis was performed on the data. Finally the model was subjected to path analysis using Structural Equation Modeling for hypothesis testing. The data analysis pertaining to the study is presented in the following sections, namely, descriptive statistics of the sample to know who the customers are, and validity of the proposed model and hypothesis is tested using path analysis and SEM, which provided answers to what influences customers towards DBS.

Descriptive Statistics

The descriptive statistics showed in Table 1 reveals that that the percentage of Indian female respondents (51%) and British female respondents (52%) is slightly on a higher side. However, it can be seen that 67.1% of the respondents are male in case of the bicultural sample.

| Table 1 Sample Demographic Profile/ Participants Profile Overview |

|||||||

|---|---|---|---|---|---|---|---|

| Indians | UK | Indians in UK | |||||

| (n1=96) | (n2=75) | (n3=85) | |||||

| Measure | Items | N | % | N | % | N | % |

| Gender | Male | 47 | 49 | 36 | 48 | 57 | 67.1 |

| Female | 49 | 51 | 39 | 52 | 28 | 32.9 | |

| Age | 18-30 | 74 | 77.1 | 50 | 66.7 | 42 | 49.4 |

| 31-40 | 19 | 19.8 | 23 | 30.7 | 42 | 49.4 | |

| 41-50 | 2 | 2.1 | 1 | 1.3 | 1 | 1.2 | |

| 51 and above | 1 | 1 | 1 | 1.3 | 0 | 0 | |

| Educational Qualification | Up to HSSC | 3 | 3.1 | 2 | 2.6 | 1 | 1.2 |

| Graduate | 43 | 44.8 | 38 | 50.7 | 52 | 61.2 | |

| Post Graduate | 36 | 37.5 | 17 | 22.7 | 21 | 24.7 | |

| Professional | 14 | 14.6 | 18 | 24 | 11 | 12.9 | |

| Marital Status | Married | 31 | 32.3 | 36 | 48 | 60 | 70.6 |

| Unmarried | 65 | 67.7 | 39 | 52 | 25 | 29.4 | |

| Income | Below 1500 US$ | 33 | 34.4 | 16 | 21.3 | 7 | 8.2 |

| Between 1500 -7000 US$ | 45 | 46.9 | 39 | 52 | 58 | 68.2 | |

| Above 7000 US$ | 18 | 18.8 | 20 | 26.7 | 20 | 23.5 | |

| Occupation | Student | 24 | 25 | 14 | 18.7 | 5 | 5.9 |

| Entrepreneur | 9 | 9.4 | 8 | 10.7 | 13 | 15.3 | |

| Government Employee | 17 | 17.7 | 9 | 12 | 15 | 17.6 | |

| Private Employee | 42 | 43.8 | 43 | 57.3 | 51 | 60 | |

| Unemployed | 4 | 4.2 | 1 | 1.3 | 1 | 1.2 | |

| Location | Rural | 34 | 35.4 | 13 | 17.3 | 13 | 15.3 |

| Urban | 35 | 36.5 | 46 | 61.3 | 56 | 65.9 | |

| Semi-Urban | 27 | 28.1 | 16 | 21.3 | 16 | 18.8 | |

| Account Type | Savings | 34 | 35.4 | 58 | 77.3 | 59 | 69.4 |

| Current | 35 | 36.5 | 15 | 20 | 22 | 25.9 | |

| Fixed Deposit | 27 | 28.1 | 2 | 2.7 | 4 | 4.7 | |

| Prior use of Digital Banking Platforms | Yes | 91 | 94.8 | 70 | 93.3 | 81 | 95.3 |

| No | 5 | 5.2 | 5 | 6.7 | 4 | 4.7 | |

| Frequency of Use | Never | 5 | 5.2 | 5 | 6.7 | 4 | 4.7 |

| Quarterly | 16 | 16.6 | 9 | 12 | 5 | 5.9 | |

| Monthly | 29 | 30.2 | 23 | 30.7 | 21 | 24.7 | |

| Weekly | 32 | 33.3 | 24 | 32 | 36 | 42.4 | |

| Daily | 14 | 14.6 | 14 | 18.7 | 19 | 22.4 | |

| Period of stay in UK | Less than one year | 11 | 12.9 | ||||

| One year to three years | 11 | 12.9 | |||||

| Four (4) years to Ten (10) years | 38 | 44.7 | |||||

| More than Eleven (11) years | 25 | 29.4 | |||||

Source: Authors Compilation

A majority of the respondents across the three different samples belong to the age group of 18-30 years and 31-40 years. Most of the respondents from the three samples were well educated with the largest percentage of the respondents being a graduate (44.8%-India, 50.7%-UK, 61.2%-Bicultural) followed by being a post graduate and having a professional degree. A higher percentage of the respondents in India and UK were unmarried (67.7% and 52.0% respectively) while a majority of the bicultural respondents were married (70.6%).

In all the three samples a higher percentage of respondents earned an income between 1500-7000 US$ (46.9%-India, 52.0%-UK, 68.2%-Bicultural). In the case of occupation, 43.8%-India, 57.3%-UK, and 60.0%-Bicultural are private employees followed by, being a Government employee for the Bicultural sample (17.6%) and being a student (25.0%-India and 18.7%-UK) respectively. In all the three samples a high percentage of the users of DBP are located in an urban society. All three samples used savings and current banking accounts more than the fixed deposits.

With respect to the respondent’s earlier experience of conducting banking transactions using DBP, a large percentage of respondents from all three samples have used some or the other form of digital banking before (94.8%-India, 93.3%- UK, 95.3%-Bicultural). It is also seen that most of the respondents from all three samples have used DBP weekly (33.3%-India, 32.0%-UK, 24.7%-Bicultural) followed by monthly (30.2%-India, 30.7%-UK, 24.7% - Bicultural) and daily (14.6%-India, 18.7%-UK, 22.4%-Bicultural) respectively.

One peculiar characteristic feature of the third sample, namely, Indians living in UK, 44.7% have been in the UK for 4-10 years’ time and 29.4% for more than 11 years. These two accounts for almost 74.1% of all respondents in this third group. This is an indication that this third group has readily accepted and transition into a bi-cultural status (Indian and British).

Testing of Validity

Convergent Validity

Convergent validity evaluates the level of correlation between measures of the same concept (Albayrak et al. 2011). Items which fall under a particular construct should have a noticeably high amount of common variance (Hair et al., 2010). Convergent validity can be assessed by looking at average variance extracted (AVE) values. AVE is the mean variance extracted for a construct, and it is a pointer of adequate convergence if its value is more than 0.5 (Fornell & Larcker, 1981; Hair et al., 2010). In the case of the Indian and the UK sample the AVE was greater than our threshold value of 0.5 for all the items supporting convergent validity. However, for the bicultural sample, uncertainty avoidance has a value of 0.496 which is still very close to 0.5 and hence can be considered acceptable in the present study based on the recommendation by Ryu et al. (2010).

The composite reliability (CR) of a construct gives the internal consistency of several indicators for every construct, designed from the squared sum of factor loadings along with the sum of error term of variance for every construct (Hair et al., 2010). The recommended threshold value has to be greater than 0.6 for sufficient composite reliability (Bagozzi and Yi, 1988). The CR for each construct is displayed in Table 2 for each sample. CR sufficiently exceeded the recommended threshold value supporting internal consistency in all the three samples.

As recommended by Hair et al. (2010) and Nunnally & Bernstein (1994), level of Cronbach’s Alpha and composite reliability values should be above 0.70. The Cronbach’s alpha (α) for each sample is also displayed in Table 2 along with CR and AVE, in the present study all nine constructs have value above 0.7, indicating that all constructs used are reliable.

| Table 2 Calculated Value Of Cronbach’s Alpha, Composite Reliability (Cr) And Average Variance Extracted (Ave) For The Samples Under Study |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Constructs | India | UK | Indians living in UK | ||||||

| α | CR | AVE | Α | CR | AVE | α | CR | AVE | |

| Performance Expectancy | 0.885 | 0.921 | 0.744 | 0.821 | 0.88 | 0.647 | 0.793 | 0.863 | 0.614 |

| Effort Expectancy | 0.889 | 0.923 | 0.750 | 0.801 | 0.87 | 0.627 | 0.825 | 0.884 | 0.656 |

| Social Influence | 0.891 | 0.925 | 0.755 | 0.861 | 0.906 | 0.709 | 0.937 | 0.955 | 0.841 |

| Perceived Risk | 0.953 | 0.970 | 0.914 | 0.963 | 0.974 | 0.927 | 0.983 | 0.989 | 0.967 |

| Trust | 0.938 | 0.960 | 0.890 | 0.887 | 0.930 | 0.815 | 0.917 | 0.948 | 0.858 |

| Individualism | 0.847 | 0.907 | 0.766 | 0.902 | 0.937 | 0.831 | 0.901 | 0.935 | 0.828 |

| Masculinity | 0.727 | 0.839 | 0.644 | 0.728 | 0.848 | 0.651 | 0.737 | 0.803 | 0.579 |

| Uncertainty Avoidance | 0.789 | 0.869 | 0.690 | 0.753 | 0.854 | 0.664 | 0.786 | 0.744 | 0.496 |

| Long Term Orientation | 0.701 | 0.870 | 0.770 | 0.737 | 0.882 | 0.790 | 0.749 | 0.888 | 0.799 |

Source: Authors compilation

Discriminant Validity

Discriminant validity can be defined as the extent by which a specific construct is different from other constructs (Hair et al., 2010). Heterotrait-Monotrait Ratio (HTMT) method is used to examine Discriminant Validity. Henseler et al. (2015) suggested that the threshold value should be less than 0.90, the annexure 1 reflects that all the values are less than the threshold limit of 0.90, thus the discriminant validity of our model is supported.

Structural Equation Modeling (SEM)

Many constructs in psychology, such as intelligence, achievement motivation, and mental health status, cannot be measured directly. Such constructs are termed latent variables, or factors, and the data analytic technique designed to study the relationships among such variables is called structural equation modeling (Savalei & Bentler, 2010). SEM tests models and assist the researcher to confirm the factor structure of newly developed or existing psychological instruments and to examine the plausibility of complex, theoretical counseling models (Crockett 2012). The interest of SEM lies in the ability of the researcher to quantify and test the hypotheses. In the present study, SEM was used to generate a working model and to test the proposed hypotheses. SmartPLS 3 was used to analyze and to generate the path diagrams for testing the hypotheses.

Based on the model, the effect of the four cultural constructs; namely, Individualism (IDV), Masculinity (MAS), Uncertainty Avoidance (UAV) and Long Term Orientation (LTO); on the relationship of users Behavioral Intention (BI) with Performance Expectancy (PE), Effort Expectancy (EE), Social Influence (SI), Perceived Risk (PR) and Trust (TR) respectively is examined using SEM. The test results of the hypotheses formulated are presented in the following sub sections along with the path analysis of the model under study for each sample independently Figure 2.

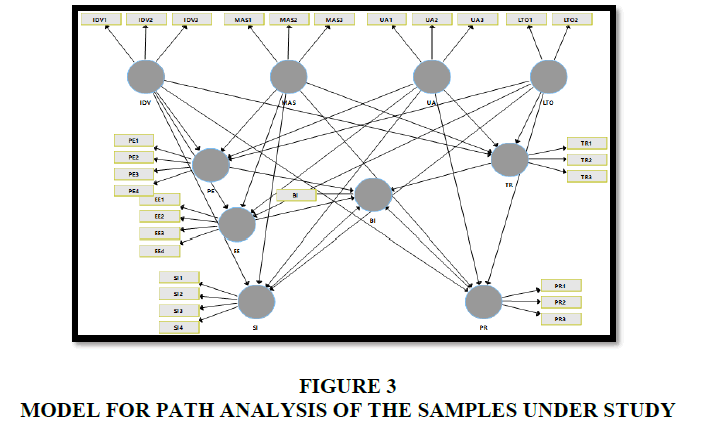

Path Analysis of the Model under Study

In Structural Equation Modeling, path analysis is used to illustrate the directed dependencies between a set of variables. Figure 3 shows the model diagram for path analysis.

The outer loadings are displayed in Table 3. As per Hair et al. (2010), the standardized factor loading should be more than 0.50, the table 3 depicts that loading for all the items across all the three samples is greater than 0.50 thus, adequate convergent validity is reflected.

Results of Hypotheses Testing

The reliability and validity of the proposed measurement model is affirmed from the data. After this the structural model for all three samples separately. The results of hypotheses testing for each sample after conducting Bootstrapping of the data in SmartPLS 3 are displayed in Table 4.

| Table 4 Summary Results Of Hypotheses Testing (Indirect Effects, Pls Bootstrapping) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Hypothesis | India | UK | Bicultural | ||||||

| t-value | p-value | Result | t-value | p-value | Result | t-value | p-value | Result | |

| Individualism | |||||||||

| H1a: Individualism has a significant effect on the PE-BI relationship | 1.11 | 0.27 | NS | 0.61 | 0.55 | NS | 0.44 | 0.66 | NS |

| H1b: Individualism has a significant effect on the EE-BI relationship | 1.29 | 0.20 | NS | 0.14 | 0.89 | NS | 0.09 | 0.93 | NS |

| H1c: Individualism has a significant effect on the SI-BI relationship | 0.49 | 0.63 | NS | 0.30 | 0.76 | NS | 2.82 | 0.01* | S |

| H1d: Individualism has a significant effect on the PR-BI relationship | 0.12 | 0.91 | NS | 0.75 | 0.45 | NS | 0.43 | 0.67 | NS |

| H1e: Individualism has a significant effect on the TR-BI relationship | 0.88 | 0.38 | NS | 1.01 | 0.31 | NS | 0.25 | 0.80 | NS |

| Masculinity | |||||||||

| H2a: Masculinity has a significant effect on the PE-BI relationship | 0.94 | 0.35 | NS | 0.17 | 0.87 | NS | 0.36 | 0.72 | NS |

| H2b: Masculinity has a significant effect on the EE-BI relationship | 1.11 | 0.27 | NS | 0.00 | 1.00 | NS | 0.05 | 0.96 | NS |

| H2c: Masculinity has a significant effect on the SI-BI relationship | 0.32 | 0.75 | NS | 1.01 | 0.31 | NS | 1.45 | 0.15 | NS |

| H2d: Masculinity has a significant effect on the PR-BI relationship | 0.23 | 0.82 | NS | 0.35 | 0.72 | NS | 0.46 | 0.65 | NS |

| H2e: Masculinity has a significant effect on the TR-BI relationship | 1.44 | 0.15 | NS | 0.91 | 0.36 | NS | 0.63 | 0.53 | NS |

| Uncertainty Avoidance | |||||||||

| H3a: Uncertainty Avoidance has a significant effect on the PE-BI relationship | 1.02 | 0.31 | NS | 0.32 | 0.75 | NS | 0.63 | 0.53 | NS |

| H3b: Uncertainty Avoidance has a significant effect on the EE-BI relationship | 0.22 | 0.83 | NS | 0.15 | 0.88 | NS | 0.10 | 0.92 | NS |

| H3c: Uncertainty Avoidance has a significant effect on the SI-BI relationship | 0.39 | 0.69 | NS | 0.51 | 0.61 | NS | 1.94 | 0.05 | NS |

| H3d: Uncertainty Avoidance has a significant effect on the PR-BI relationship | 0.85 | 0.39 | NS | 0.66 | 0.51 | NS | 0.49 | 0.62 | NS |

| H3e: Uncertainty Avoidance has a significant effect on the TR-BI relationship | 0.87 | 0.38 | NS | 0.91 | 0.36 | NS | 0.52 | 0.60 | NS |

| Long Term Orientation | |||||||||

| H4a: Long Term Orientation has a significant effect on the PE-BI relationship | 1.09 | 0.27 | NS | 0.56 | 0.58 | NS | 0.41 | 0.68 | NS |

| H4b: Long Term Orientation has a significant effect on the EE-BI relationship | 1.39 | 0.17 | NS | 0.20 | 0.84 | NS | 0.09 | 0.93 | NS |

| H4c: Long Term Orientation has a significant effect on the SI-BI relationship | 0.03 | 0.98 | NS | 1.14 | 0.25 | NS | 0.27 | 0.79 | NS |

| H4d: Long Term Orientation has a significant effect on the PR-BI relationship | 0.33 | 0.74 | NS | 0.49 | 0.63 | NS | 0.50 | 0.62 | NS |

| H4e: Long Term Orientation has a significant effect on the TR-BI relationship | 1.28 | 0.20 | NS | 1.21 | 0.23 | NS | 0.71 | 0.48 | NS |

significant at 0.05

PLS-SEM relies on a nonparametric bootstrap process (Efron & Tibshirani, 1986; Davison & Hinkley, 1997) to test the magnitude of estimated path coefficients in PLS-SEM.

The results of the model shown in Table 4 revealed that Individualism (IDV), Masculinity (MAS), Uncertainty Avoidance(UAV) and Long Term Orientation (LTO) does not have a significant effect on the Performance Expectancy (PE), Effort Expectancy (EE), Social Influence (SI), Perceived Risk (PR) and Trust (TR) towards the Behavioral Intention (BI)on the consumer segments in all the three samples except in the case of Individualism (IDV) has a significant positive effect on Social Influence (SI) → Behavioral Intention (BI) relationship in the bicultural sample, i.e., Indians living in U.K.

| Table 3 Standardized Factor Loadings Of Sem For All Constructs |

||||

|---|---|---|---|---|

| Constructs | Items | India | UK | Indians in UK |

| Performance Expectancy |

PE1-DBP is useful to carry out my tasks effectively | 0.872 | 0.738 | 0.791 |

| PE2-DBP would enable me to conduct my tasks more quickly | 0.889 | 0.812 | 0.848 | |

| PE3-DBP will increase my productivity at work and home | 0.879 | 0.849 | 0.83 | |

| PE4-DBP will improve my performance | 0.809 | 0.814 | 0.652 | |

| Effort Expectancy |

EE1-My interaction with DBP should be clear and understandable | 0.855 | 0.783 | 0.804 |

| EE2-It should be easy for me to become skilful at using DBP | 0.848 | 0.808 | 0.770 | |

| EE3-I should find DBP easy to use with time | 0.900 | 0.745 | 0.849 | |

| EE4-learning to operate DBP will be easy for me | 0.861 | 0.829 | 0.814 | |

| Social Influence | SI1-People who influence my behavior think that I should use DBP | 0.879 | 0.891 | 0.908 |

| SI2-People who are important to me think that I should use DBP | 0.890 | 0.852 | 0.941 | |

| SI3-People in my environment who use DBP have more prestige and a higher profile than those who do not | 0.887 | 0.883 | 0.927 | |

| SI4-Using DBP is a status symbol in my environment | 0.818 | 0.733 | 0.891 | |

| Perceived Risk | PR1-DBP could subject my banking account to potential fraud | 0.955 | 0.973 | 0.983 |

| PR2-using DBP could put the privacy of my information at risk | 0.959 | 0.981 | 0.991 | |

| PR3- I feel that conducting my banking activities through Digital banking applications could be a risky choice | 0.954 | 0.935 | 0.976 | |

| Trust | TR1-I believe that DBP is trustworthy | 0.953 | 0.912 | 0.927 |

| TR2-I believe that DBP takes care of user's interest | 0.926 | 0.877 | 0.948 | |

| TR3-I believe that my bank provides secure DBP | 0.951 | 0.918 | 0.903 | |

| Individualism/ Collectivism | IDV1-Being accepted as a member of a group or society is more important than having autonomy and independence | 0.799 | 0.897 | 0.889 |

| IDV2- Group success is more important than individual success | 0.923 | 0.944 | 0.914 | |

| IDV3- Being loyal to a group is more important than individual gain. | 0.899 | 0.893 | 0.927 | |

| Masculinity/ Femininity | MAS1-The reason I prefer DBP is because they are more challenging than traditional banking systems | 0.892 | 0.891 | 0.771 |

| MAS2-The reason I prefer DBP is because DBP gives me an opportunity to learn new skills | 0.906 | 0.770 | 0.834 | |

| MAS3-Men can use DBP better than women. Do you agree? | 0.562 | 0.752 | 0.668 | |

| Uncertainty Avoidance |

UA1- It is important to have instructions spelled out in detail so that people always know what they are expected to do | 0.887 | 0.859 | 0.819 |

| UA2-App developers should avoid making changes to the website features often because of uncertainty in operations and confusion in carrying out a task | 0.870 | 0.711 | 0.664 | |

| UA3-It is better to have a bad situation that you know about, than to have an uncertain situation which might be better | 0.726 | 0.864 | 0.612 | |

| Long Term Orientation |

LTO1-It is easy to adopt to DBP | 0.886 | 0.863 | 0.881 |

| LTO2-DBP are more appropriate as compared to TBP in times of self isolation (Considering current Global Scenario) | 0.869 | 0.914 | 0.906 | |

| Behavioural Intention | BI | 1.000 | 1.000 | 1.000 |

Discussion

The aim of this research was to determine the influence of the culture of a particular country on the consumer perception towards innovations. This study was conducted to compare the adoption and perception towards digital banking platforms among different sets of consumers’ i.e. Indian consumers staying in India, British consumers staying in UK and Indians living in UK. The research was performed with the help of UTAUT model and it was extended using Perceived Risk and Trust and combined with four of Hofstede’s cultural dimensions. The purpose of this research was to interpret the three different segments identified for this study and their behavioral intention toward digital banking platforms.

The two countries in this study have different stages of development; however, it was observed that they did not show much cultural differences. The samples in the study were found to belong to a society that is more feministic and collectivistic. The relationship between the researches constructs designed for this study were observed to be similar among the three samples. However, the influence of Individualism on the SI-BI relationship for the bi-cultural sample was found different. Earlier studies conducted by Zhoua et al (2010); Tan and Lau (2016); Sharma et al. (2017) and Bankole & Bankole (2017), in the cultural context of China, Malaysia, Oman and South Africa have stated that Social Influence (SI) is a positive influence for adoption of technology. However, the studies conducted in Jordan, Lebanon and England, Mozambique, Portugal and Pakistan have not supported the role of Social Influence (SI) in the adoption of technology (Oliveira et al., 2014; Baptista& Oliveira, 2015; Afshan& Sharif, 2016; Alalwan et al., 2017; (Merhi et al., 2019). As DBP will continue to keep growing in the future, Social Influence (SI) will have a significant role in shaping customer’s mind. It appears here that people who travel or who have learnt to live independently show traits of individualism. With respect to Performance Expectancy (PE), Effort Expectancy (EE), Trust (TR) and Perceived Risk (PR), results indicate that for the Indians, the British and the bicultural segment there is no direct impact of culture on these constructs and eventually on the user’s Behavioral Intention (BI) to use DBP. The role of marketing efforts in promoting an innovation’s usefulness to consumers plays a major role irrespective of their nationality or the country they are living in (Hassan & Wood, 2019). Only when the product is well marketed will the user feel free to use it and the Trust (TR) of the user in the product will overcome the fear of risk associated with the DBP services provided.

The observations of this research are slightly unexpected with respect to the explanation provided by Hofstede’s theory. As per the Hofstede’s cultural dimensions, UK score high (89) on individualism hence it can be ascertained that people in the UK take independent decisions without having much dependence on the perceptions of others. On the other hand Indians are representative of collective society with a score of 48, thus people value opinions of others majorly their families and peers. The findings on the other hand say that the UK sample considered in this study as collectivistic. Uncertainty Avoidance (UA) is on the lower end for both the countries according to Hofstede, which matches well with our results as UA has no influence on our predictors in all three samples. Again, as per Hofstede, as above LTO is 51 for India as well as UK and we do not find any influence of LTO on our predictors.Hence we can say that the samples belong to a Traditional NORMATIVE Society, i.e., Short Term Oriented (STO). Developers and marketers of innovations should take into consideration the fact that the factors of usefulness ease of use, trust, social influence and risk perceptions in the mind of the user should be considered while developing the strategies to enhance the use of innovative and new technologies by the consumers Annexure Tables 1 & 2.

| Annexure Table1 Results Of Discriminant Validity Using The Htmt Method |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Construct | BI | EE | IDV | LTO | MAS | PE | PR | SI | TR | UA |

| India | ||||||||||

| BI | ||||||||||

| EE | 0.293 | |||||||||

| IDV | 0.069 | 0.479 | ||||||||

| LTO | 0.335 | 0.865 | 0.274 | |||||||

| MAS | 0.201 | 0.488 | 0.387 | 0.492 | ||||||

| PE | 0.331 | 0.873 | 0.432 | 0.661 | 0.419 | |||||

| PR | 0.185 | 0.131 | 0.058 | 0.07 | 0.131 | 0.13 | ||||

| SI | 0.065 | 0.447 | 0.288 | 0.244 | 0.252 | 0.392 | 0.039 | |||

| TR | 0.134 | 0.824 | 0.385 | 0.755 | 0.665 | 0.688 | 0.118 | 0.419 | ||

| UA | 0.133 | 0.615 | 0.259 | 0.82 | 0.338 | 0.396 | 0.178 | 0.285 | 0.549 | |

| UK | ||||||||||

| BI | ||||||||||

| EE | 0.258 | |||||||||

| IDV | 0.04 | 0.275 | ||||||||

| LTO | 0.15 | 0.947 | 0.342 | |||||||

| MAS | 0.143 | 0.425 | 0.223 | 0.554 | ||||||

| PE | 0.219 | 0.739 | 0.442 | 0.655 | 0.288 | |||||

| PR | 0.174 | 0.186 | 0.074 | 0.046 | 0.109 | 0.175 | ||||

| SI | 0.29 | 0.781 | 0.15 | 0.729 | 0.61 | 0.619 | 0.135 | |||

| TR | 0.323 | 0.91 | 0.332 | 0.954 | 0.597 | 0.568 | 0.076 | 0.773 | ||

| UA | 0.294 | 0.779 | 0.188 | 1.035 | 0.603 | 0.511 | 0.056 | 0.636 | 0.834 | |

| Indians in UK | ||||||||||

| BI | ||||||||||

| EE | 0.152 | |||||||||

| IDV | 0.205 | 0.403 | ||||||||

| LTO | 0.069 | 0.762 | 0.243 | |||||||

| MAS | 0.172 | 0.356 | 0.267 | 0.711 | ||||||

| PE | 0.153 | 0.77 | 0.329 | 0.563 | 0.35 | |||||

| PR | 0.125 | 0.166 | 0.181 | 0.262 | 0.409 | 0.065 | ||||

| SI | 0.348 | 0.791 | 0.579 | 0.442 | 0.207 | 0.667 | 0.062 | |||

| TR | 0.043 | 0.783 | 0.162 | 0.948 | 0.681 | 0.667 | 0.263 | 0.391 | ||

| UA | 0.32 | 0.758 | 0.547 | 0.657 | 0.489 | 0.647 | 0.481 | 0.733 | 0.506 | |

| Annexure Table 2 Digital Banking Platforms |

|

|---|---|

| Constructs | Sources |

| Performance Expectancy DBP is useful to carry out my tasks effectively DBP would enable me to conduct my tasks more quickly DBP will increase my productivity at work |

|

References

Afshan, S., & Sharif, A. (2016). Acceptance of mobile banking framework in Pakistan.Telematics and Informatics,33(2), 370-387.

Indexed at, Google Scholar, Cross Ref

Al Kailani, M., & Kumar, R. (2011). Investigating uncertainty avoidance and perceived risk for impacting Internet buying: A study in three national cultures.international Journal of Business and Management,6(5), 76.

Indexed at, Google Scholar, Cross Ref

Alalwan, A. A., Dwivedi, Y. K., & Rana, N. P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust.International Journal of Information Management,37(3), 99-110.

Indexed at, Google Scholar, Cross Ref

Alalwan, A. A., Dwivedi, Y. K., Rana, N. P., & Williams, M. D. (2016). Consumer adoption of mobile banking in Jordan: Examining the role of usefulness, ease of use, perceived risk and self-efficacy.Journal of Enterprise Information Management,29(1), 118-139.

Indexed at, Google Scholar, Cross Ref

Alalwan, A. A., Dwivedi, Y. K., Rana, N. P., Lal, B., & Williams, M. D. (2015). Consumer adoption of Internet banking in Jordan: Examining the role of hedonic motivation, habit, self-efficacy and trust.Journal of Financial Services Marketing,20, 145-157.

Indexed at, Google Scholar, Cross Ref

Albayrak, T., Caber, M., Moutinho, L., & Herstein, R. (2011). The influence of skepticism on green purchase behavior.International Journal of Business and Social Science,2(13).

Ameen, N., Tarhini, A., Shah, M. H., & Madichie, N. O. (2020). Employees’ behavioural intention to smartphone security: A gender-based, cross-national study.Computers in Human Behavior,104, 106184.

Indexed at, Google Scholar, Cross Ref

Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models.Journal of the academy of marketing science,16, 74-94.

Indexed at, Google Scholar, Cross Ref

Bankole, F. O., & Bankole, O. O. (2017). The effects of cultural dimension on ICT innovation: Empirical analysis of mobile phone services.Telematics and Informatics,34(2), 490-505.

Indexed at, Google Scholar, Cross Ref

Baptista, G., & Oliveira, T. (2015). Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators.Computers in Human Behavior,50, 418-430.

Indexed at, Google Scholar, Cross Ref

Castanha, J., & Pillai, S. K. B. (2020). What influences consumer behavior toward information and communication technology applications: A systematic literature review of UTAUT2 model.ICT Systems and Sustainability: Proceedings of ICT4SD 2020, Volume 1, 317-327.

Indexed at, Google Scholar, Cross Ref

Cox, D. F. (1967). Risk taking and information handling in consumer behavior.

Indexed at, Google Scholar, Cross Ref

Crockett, S. A. (2012). A five-step guide to conducting SEM analysis in counseling research.Counseling Outcome Research and Evaluation,3(1), 30-47.

Indexed at, Google Scholar, Cross Ref

Cronbach, L. J. (1951). Coefficient alpha and the internal structure of tests.psychometrika,16(3), 297-334.

Indexed at, Google Scholar, Cross Ref

Cyr, D. (2013). Website design, trust and culture: An eight country investigation.Electronic Commerce Research and Applications,12(6), 373-385.

Indexed at, Google Scholar, Cross Ref

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology.MIS quarterly, 319-340.

Indexed at, Google Scholar, Cross Ref

Dodds, W. B., Monroe, K. B., & Grewal, D. (1991). Effects of price, brand, and store information on buyers’ product evaluations.Journal of marketing research,28(3), 307-319.

Indexed at, Google Scholar, Cross Ref

Dwivedi, Y. K., Rana, N. P., Jeyaraj, A., Clement, M., & Williams, M. D. (2019). Re-examining the unified theory of acceptance and use of technology (UTAUT): Towards a revised theoretical model.Information Systems Frontiers,21, 719-734.

Indexed at, Google Scholar, Cross Ref

Hassan, H. E., & Wood, V. R. (2020). Does country culture influence consumers' perceptions toward mobile banking? A comparison between Egypt and the United States.Telematics and Informatics,46, 101312.

Indexed at, Google Scholar, Cross Ref

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling.Journal of the academy of marketing science,43, 115-135.

Indexed at, Google Scholar, Cross Ref

Hofstede, G. (2001).Culture's consequences: Comparing values, behaviors, institutions and organizations across nations. sage.

Indexed at, Google Scholar, Cross Ref

Hwang, Y., & Lee, K. C. (2012). Investigating the moderating role of uncertainty avoidance cultural values on multidimensional online trust.Information & management,49(3-4), 171-176.

Indexed at, Google Scholar, Cross Ref

Jarvenpaa, S. L., Tractinsky, N., & Saarinen, L. (1999). Consumer trust in an Internet store: A cross-cultural validation.Journal of Computer-Mediated Communication,5(2), JCMC526.

Indexed at, Google Scholar, Cross Ref

Khan, I. U., Hameed, Z., & Khan, S. U. (2017). Understanding online banking adoption in a developing country: UTAUT2 with cultural moderators.Journal of Global Information Management (JGIM),25(1), 43-65.

Indexed at, Google Scholar, Cross Ref

Lee, K. C., & Chung, N. (2009). Understanding factors affecting trust in and satisfaction with mobile banking in Korea: A modified DeLone and McLean’s model perspective.Interacting with computers,21(5-6), 385-392.

Indexed at, Google Scholar, Cross Ref

López-Nicolás, C., Molina-Castillo, F. J., & Bouwman, H. (2008). An assessment of advanced mobile services acceptance: Contributions from TAM and diffusion theory models.Information & management,45(6), 359-364.

Indexed at, Google Scholar, Cross Ref

Malaquias, R. F., & Hwang, Y. (2019). Mobile banking use: A comparative study with Brazilian and US participants.International Journal of Information Management,44, 132-140.

Indexed at, Google Scholar, Cross Ref

Malaquias, R. F., & Hwang, Y. (2016). An empirical study on trust in mobile banking: A developing country perspective.Computers in human behavior,54, 453-461.

Indexed at, Google Scholar, Cross Ref

Martinsons, M. G., & Davison, R. M. (2007). Strategic decision making and support systems: Comparing American, Japanese and Chinese management.Decision support systems,43(1), 284-300.

Indexed at, Google Scholar, Cross Ref

Merhi, M., Hone, K., & Tarhini, A. (2019). A cross-cultural study of the intention to use mobile banking between Lebanese and British consumers: Extending UTAUT2 with security, privacy and trust.Technology in Society,59, 101151.

Indexed at, Google Scholar, Cross Ref

Minkov, M., & Hofstede, G. (2011). The evolution of Hofstede's doctrine.Cross cultural management: An international journal,18(1), 10-20.

Indexed at, Google Scholar, Cross Ref

Mohammadi, H. (2015). A study of mobile banking usage in Iran.International Journal of Bank Marketing.

Indexed at, Google Scholar, Cross Ref

Mortimer, G., Neale, L., Hasan, S. F. E., & Dunphy, B. (2015). Investigating the factors influencing the adoption of m-banking: a cross cultural study.International Journal of Bank Marketing,33(4), 545-570.

Indexed at, Google Scholar, Cross Ref

Muk, A., & Chung, C. (2015). Applying the technology acceptance model in a two-country study of SMS advertising.Journal of Business Research,68(1), 1-6.

Indexed at, Google Scholar, Cross Ref

Oliveira, T., Faria, M., Thomas, M. A., & Popovic, A. (2014). Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM.International journal of information management,34(5), 689-703.

Indexed at, Google Scholar, Cross Ref

Park, C., Jun, J., & Lee, T. (2015). Consumer characteristics and the use of social networking sites: A comparison between Korea and the US.International Marketing Review.

Permana, H. (2020). Addition of lifestyle compatibility and trust in modified UTAUT2 model to analyze continuance intention of customers in using mobile payment. InManaging Learning Organization in Industry 4.0(pp. 1-7). Routledge.

Indexed at, Google Scholar, Cross Ref

Putri, D. A. (2018, May). Analyzing factors influencing continuance intention of e-payment adoption using modified UTAUT 2 model. In2018 6th International Conference on Information and Communication Technology (ICoICT)(pp. 167-173). IEEE

Indexed at, Google Scholar, Cross Ref

Rana, N. P., Dwivedi, Y. K., Lal, B., Williams, M. D., & Clement, M. (2017). Citizens’ adoption of an electronic government system: towards a unified view.Information systems frontiers,19, 549-568.

Indexed at, Google Scholar, Cross Ref

Ryu, K., Han, H., & Jang, S. (2010). Relationships among hedonic and utilitarian values, satisfaction and behavioral intentions in the fast-casual restaurant industry.International journal of contemporary hospitality management,22(3), 416-432.

Indexed at, Google Scholar, Cross Ref

Sampaio, C. H., Ladeira, W. J., & Santini, F. D. O. (2017). Apps for mobile banking and customer satisfaction: a cross-cultural study.International Journal of Bank Marketing,35(7), 1133-1153.

Indexed at, Google Scholar, Cross Ref

Savalei, V., & Bentler, P. M. (2010). Structural equation modeling Corsini Encyclopedia of Psychology.Los Angeles: University of California.

Sharma, R., Singh, G., & Sharma, S. (2020). Modelling internet banking adoption in Fiji: A developing country perspective.International Journal of Information Management,53, 102116.

Indexed at, Google Scholar, Cross Ref

Sharma, S. K., Govindaluri, S. M., Al-Muharrami, S., & Tarhini, A. (2017). A multi-analytical model for mobile banking adoption: a developing country perspective.Review of International Business and Strategy,27(1), 133-148.

Indexed at, Google Scholar, Cross Ref

Sun, H., & Zhang, P. (2006). The role of moderating factors in user technology acceptance.International journal of human-computer studies,64(2), 53-78.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view.MIS quarterly, 425-478.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Thong, J. Y., & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology.MIS quarterly, 157-178.

Indexed at, Google Scholar, Cross Ref

Wang, T., & Bansal, P. (2012). Social responsibility in new ventures: profiting from a long-term orientation.Strategic Management Journal,33(10), 1135-1153.

Indexed at, Google Scholar, Cross Ref

Zhang, Y., Weng, Q., & Zhu, N. (2018). The relationships between electronic banking adoption and its antecedents: A meta-analytic study of the role of national culture.International Journal of Information Management,40, 76-87.

Indexed at, Google Scholar, Cross Ref

Zhou, T. (2012). Understanding users’ initial trust in mobile banking: An elaboration likelihood perspective.Computers in human behavior,28(4), 1518-1525.

Indexed at, Google Scholar, Cross Ref

Zhou, T., Lu, Y., & Wang, B. (2010). Integrating TTF and UTAUT to explain mobile banking user adoption.Computers in human behavior,26(4), 760-767.

Indexed at, Google Scholar, Cross Ref

Received: 02-Mar-2023, Manuscript No. AMSJ-23-13288; Editor assigned: 03-Mar-2023, PreQC No. AMSJ-23-13288(PQ); Reviewed: 08-Apr-2023, QC No. AMSJ-23-13288; Revised: 25-Apr-2023, Manuscript No. AMSJ-23-13288(R); Published: 24-May-2023