Review Article: 2024 Vol: 28 Issue: 2S

Drivers of Customer′s Loyalty in Unorganized Retail: Insights from India

Pankaj Chamola, Jaipuria Institute of Management Jaipur, Jaipur

Anurag Dugar, Goa Institute of Management, Goa

Citation Information: Chamola, P., & Dugar, A. (2024). Drivers of customers’ loyalty in unorganized retail: insights from india. Academy of Marketing Studies Journal, 28(S2), 1-17.

Abstract

Loyalty in retail is a well-studied phenomenon but it has been studied from the perspective of organized retail where resource-and-data heavy strategies are used to cultivate customer loyalty. It is not established why customers are loyal to unorganized retail where the retailer is neither schooled in marketing, aware and exposed to modern technology, nor have they got the resources to formulate and execute resource-heavy loyalty building strategies. This study attempts to find an answer to this question. A two-step empirical approach has been deployed, wherein a qualitative thematic analysis has been undertaken to identify broad groupings of drivers of loyalty for unorganized retailers and then a customer survey has been conducted to confirm and classify factors identified in step one, as determinant of customers’ attitudinal and behavioral loyalty. In total, seven overarching drivers of customer loyalty have emerged from the analysis. Convenience and assortment were found to be the most powerful drivers of behavioral loyalty, whereas retailer’s indigeneity, socialization, extraordinary help, and unbiased recommendations were found to be the drivers of attitudinal loyalty. General behavior of the retailer contributed to the formation of both types of loyalty. The article also discusses the implications of the findings for practitioners and scope for future research.

Keywords

Unorganized Retail, Loyalty, Attitudinal Loyalty, Behavioral Loyalty.

Introduction

Marketing academics and practitioners alike have long advocated that customer loyalty is imperative to survive and thrive in hyper-competition, increasing commoditization, shrinking Product Life Cycles, and decreasing switching costs for customers (Maggioni, 2016; Reichheld & Sasser, 1990). Retail industry, like all others, also holds this well-nursed ambition of cultivating customer loyalty.

To achieve that, organized retailers deploy a lot of resources, adopt cutting-edge technology, and use scientific decision-making to identify store locations, design stores, select merchandize, design and execute promotions, improve shopping processes, frame customer friendly policies etc. On the other hand, the unorganized retailers, typically characterized by lack of monetary, human, and technological resources, are neither oriented, nor equipped to design and execute sophisticated loyalty building strategies. Despite that, this feeble entity is not only surviving but is also giving a tough fight to the sophisticated, technology-driven, resourceful organized retail (Ramakrishnan, 2010). Despite the lure of organized retail, the customers of unorganized retail have remained loyal to these stores. But why?

This study attempts to explores what drives customers’ loyalty for unorganized retail and that perspective makes this study distinct from others (Dawes, 2022; Kanakaratne et. al., 2020; Grosso, 2018; Maggioni, 2016; Clottey, Collier & Stodnick, 2008). Previous research has already highlighted the dissimilarities between the two retail formats, in terms of – context, quiddity as well as haecceity, which lead to both types of retail having different modus operandi, target segments, and resources at their disposal (Dugar & Chamola, 2021; Kanakaratne et. al., 2020; Paparoidamis et. al., 2017). So, the overall context of these two retail formats differs significantly and since loyalty is a context specific phenomenon, it is safe to assume that the drivers of loyalty would be different as well. Therefore, the idea is worth exploring and establishes the contribution of this study, which is, - furthering the extant literature on customer loyalty in retail, and by unearthing the drivers of loyalty in unorganized retail, it benefits the practitioners in transmogrifying their loyalty building strategies.

A two-step empirical approach has been used in this study. First, a qualitative thematic analysis has been used to identify and group the factors that make a customer loyal to the unorganized retailer, and second, a customer survey has been undertaken to corroborate the identified drivers into drivers of attitudinal and behavioral loyalty respectively.

The rest of the paper is organized as follows. An overview of the literature on loyalty is presented after this introduction. Following that, the methodology has been elaborated. The fourth section discusses the analysis and results. Finally, the discussion on findings and implications for managers is given.

Literature Review

Customer Loyalty - Customer loyalty is a well-explored area and is widely recognized as a positive construct instrumental in improving performance of the brand and the organization (Watson et. al., 2015; Dick & Basu, 1994). Customer loyalty is often expressed and studied in terms of attitudinal and behavioral loyalty. The definitions provided by Jacoby & Chestnut (1978) capture the behavioral aspect of customer loyalty, while Smith and Swinyard (1983) express its attitudinal aspect, and Ehrenberg et. al. (1990), Dick and Basu (1994), and Chaudhuri and Holbrook (2001) maintain that it is a combination of these two aspects.

The proponents of attitudinal loyalty state that factors like customers’ commitment, preferences and purchase intentions indicate their attitudinal loyalty. They also claim that attitudinal loyalty drives customers’ behavioral loyalty (Dick & Basu 1994; Thomson et al., 2005). Worthington et. al. (2010) further splits attitudinal loyalty into three components, namely - affective, cognitive, and habitual, which are also referred to as heart, head, and hand loyalty (Dapena-Baron et. al., 2020). For this study, attitudinal loyalty is considered as customers’ commitment, liking and / or preference to buy from the same retail store.

Contrary to the proponents of attitudinal loyalty, patrons of behavioral loyalty (Jacoby & Chestnut, 1978; Dick & Basu, 1994) have opined that certain ‘behaviors’ or ‘actions’ of customers reflect their loyalty, like - ‘repeat buying’ (Ehrenberg et al., 1990; Ehrenberg, 2000), ‘higher frequency of buying’ (Romaniuk & Nenycz-Thiel, 2013), and ‘share of wallet’ (Williams et al., 2020). Verhoef (2003) clarifies that it is not that behaviorally loyal customers will buy only one brand, they actually act in favor of that brand more times in comparison to other brands. For this study also, a customer who buys more from a particular store has been considered as behaviorally loyal to that store.

A third and equally well-accepted stance on customer loyalty is that it is a composite of attitudinal and behavioral loyalty (Bandyopadhyay & Martell, 2007; Ehrenberg et. al. 1990; Chaudhuri & Holbrook, 2001; Jacoby & Chestnut, 1978; Ranganathan et al., 2013). Cognition captures customers’ knowledge and understanding of the brand, affect captures their emotional interpretation and perception of the brand (Huitt and Cain, 2005) and the behavioral aspect captures their actions that display loyalty towards the brand. This makes sense because a combination of - cognitive, affective, and behavioral elements - encapsulate loyalty in a holistic manner.

Unorganized Retail - Unorganized retail is a prevalent and dominant form of retail in most emerging economies and plays a major strategic role in emerging economies in terms of employment generation (Ramakrishnan, 2010). They are also the backbone of distribution for most companies operating in such economies, especially the FMCG and consumer durables, who sell a major, chuck of their products through these retailers. Hence, it is important for marketers of these companies to understand the operations and concerns of unorganized retail, to address them, to empower them so that they can increase their sales and develop a formidable competitive advantage in the market by winning over these retailers.

It is difficult to define unorganized retail because it could vary from market to market. However, the following characteristics make unorganized retail different from organized retail:

1. Size of store – In terms of the size of the store, unorganized retail stores are significantly smaller than organized retail stores. Often the size of an unorganized retail store is around 10 square meters or less. Although store size is not the defining criteria in itself because it may vary, but in presence of other conditions (given below) along with small size of the store, can help in classifying a store as unorganized or organized retail store.

2. Proprietorship and manpower – unorganized retail stores are often owned and managed by a single person, the retailer himself. At times, this retailer is assisted by family members or some helper, but essentially it is a one-man-show.

3. Lack of technology – these retail stores use little or no technology. Most of the decisions about merchandize, customers, vendors etc. are taken on heuristics and mental models of the retailer. Accounting is done manually, CRM systems are non-existent (Dugar and Chamola, 2021).

4. Lack of resources – Unorganized retail stores and retailers lack resources in terms of education, money, and / or professional assistance. In fact, the lack of these resources is one of the primary reasons that the owners start this business.

5. Small catchment area – Unorganized retail stores are small and do not carry a very large assortment. Essentially, they are meant to cater to a smaller catchment area which is most likely a neighborhood spread across a kilometer or two.

6. Modus Operandi – since the size of the store is so small, and because the retailer (with negligible assistance), cannot keep an eye on everything, while doing everything himself/herself, these stores are designed in a way that customers cannot enter the store or reach the products. They must stand outside the store or on the other side of a counter and ask for what they want. Then the retailer brings that product and hands it over to the customers. This system works as a barrier between the customers and the products, and does not allow them to explore, touch, and feel the products. The customers must rely on the retailer to understand and give them what they are looking for.

7. Personal relations – unlike organized retail, where conversations between retailer and customer is either absent or is negligible, in unorganized retail, the aforementioned modus operandi makes it mandatory for customers and retailer to have a conversation. This conversation gradually turns into familiarity and over a period they often form a bond.

Methodology

This study is an attempt to explore what drives customers’ loyalty for unorganized retailers and towards that purpose, the customers of unorganized grocery retailers have been chosen as the subject. The rationale behind the choice of grocery retailers is the omnipresence of these retailers in every nook and corner of the market which means that there is a very high probability that almost everyone has an experience of these retail stores. So, it was safe to believe that when asked about these retailers, most customer respondents would be able to visualize and recall their experiences and answer the questions with certainty.

This study has been conducted in two phases, whose details are provided below:

Phase 1

The first phase of the study aimed at identifying the drivers of customers loyalty towards unorganized retail. To achieve that, a qualitative thematic analysis has been employed in an emergent research design. To ensure reliability of findings, a six-step methodological approach involving back and forward reflective movement between steps (Braun and Clarke, 2006) has been followed.

Sampling and Participants for Phase 1

To understand the drivers of loyalty in customers of unorganized retailers, a natural first step was to identify the stores whose customers will be studied. To identify those retailers, purposive sampling strategy has been used and those retailers were selected which meet the following criteria:

1) The store must qualify as unorganized retail store on basis of the parameters given above,

2) Since development of loyalty is a long-term phenomenon, only those stores were considered for the study which have been in operation for at least four years or more,

3) Only those retailers have been included which have other similar stores selling similar products within the vicinity (both organized and unorganized retail stores), so that occurrences of spurious loyalty can be ruled out.

The retailers who meet all three conditions were briefed about the study were informed that they will be required to share the contact details of their most loyal customers. Those retailers who agreed constituted the final sample. Contact details of 108 customers in total was received from the participating retailers. These customers were then approached for the purpose of data collection. 81 customers refused to participate, and the remaining 27 customers constituted the final sample for phase 1 of the study.

Interview Process and Data Analysis

These customers were interviewed at their residences on a mutually agreed day and time. The interviews were based on a tentative semi-structured protocol that provided some flexibility and freedom to explore the construct. The interviews were conducted in Hindi because it is the native language of the region so that the respondents could express themselves freely and properly. The interviews were audio-recorded, and later, transcribed verbatim and printed. These transcripts were translated into English by bi-lingual experts. Each author went through the transcripts separately and identified the themes from the responses and highlighted the specific quotes which indicated the themes. Then the themes identified by each author were put together and each author presented his understanding and logic behind the identified themes. After brainstorming on each of the identified themes, the ones on which there was a consensus were finalized.

The interviews revolved around capturing respondents’ thoughts about the central research question - ‘why do you prefer buying from XYZ retail store?’ (Where XYZ is store’s name). Although, the interviews were based on a predesigned protocol, the participants were encouraged to express themselves freely, even if what they said was going beyond the protocol. Each respondent was assigned a code which started with letter P (for ‘participant’) and was followed by the interview number. The gender and age of the participants were also recorded, along with the place (city) of interview. The audio and transcription files were named with this information to make them identifiable. Hence, the file names would look like – “P22 F 29 Homemaker” which meant that the file is of interview no. 22 who was a 29-year-old female and that she is a homemaker.

Results

After deliberation over each interview transcript, the authors arrived at a consensus that there are seven overarching themes that make customers loyal to stores (Table 1).

| Table 1 Themes |

| Unbiased Recommendations |

| Socialization |

| Extraordinary Help |

| Retailer’s Indigeneity |

| General Behavior (Common) |

| Convenience |

| Assortment |

The Themes

1. Convenience – Most respondents highlighted convenience that they get from shopping at these retail stores as the major reason behind their preference for these stores. Amongst other things, convenience translated into four major benefits for the customers – a) ease of buying and returning of products, b) saving of time, effort and cost due to proximity, no parking issues etc., c) instant credit, such as when the customers were not carrying money or had insufficient money but could still take the products, and d) long store timings, that is from early morning to late night. From the conversation it was apparent that the respondents were stating these points with reference to their experience and knowledge of organized retail stores.

Some of the comments from the respondents who cited convenience as their reason to prefer a particular store are:

“I always prefer to buy grocery from this retailer because it is so close to my house. You cannot travel 5 – 10 kilometers to buy grocery and then why get tired driving all the way. Finding the parking slot and then walking to the store is another headache. I don’t like standing in payment queues at all!” – (P4, Male, 63, Retired Serviceman)

“My office has very long hours. There is literally no timing …but this store is always open! I can go there early morning or late at night! In fact, since the retailer’s shop is inside his house, I feel I can buy things anytime... literally anytime (giggles)!” - (P9, Female, 29, Homemaker).

“We have been buying grocery from this store for two generations now! When we shifted to this locality, there were only 7 houses here. The retailer also moved here at that time only. He knows what is consumed at our house and even how much! For example, he knows which quality of rice I buy and in what quantity. You know what, at times, he would suggest me that a product might be getting over at my place! Can you imagine?! Moreover, he never asks for the money (looks surprised!) … we settle the bills monthly! Now that he has also started accepting payments through apps, it has made things easier” - (P6, Male, 48, Banker).

Assurance of return from retailer’s side to return the purchased products anytime, also emerged as a big contributor to the convenience factor. One respondent quoted:

“The retailer always says that I can return the products anytime if I do not like them and I have done that many times. In fact, I have returned the products whose pack I opened … he just took them back! I wonder how he manages this! So, when he is fine when I return things, obviously, exchanging things is even better. It is beneficial for him only.” - (P10, Female, 29, Housewife).

Many participants cites that the short-term instant credit provided by the retailer is very important reason behind their preference. Credit is given as a gesture of showing trust and no formalities are required. This appealed to customers who are not well to do, or do not have regular incomes. Some comments from the respondents are:

“I have a large family to support. Due to COVID-19, the company is not doing well. In any case, my salary is not much and now it is often delayed as well, but I need to run my house. So, a little help from this retailer is a very big thing for me! Not only me, but he also allows anyone from my family to take products and we settle the bills later. Although, my kids sometimes misuse it by buying chocolates and ice-cream (humorous laughter). Had this retailer not been there, my life would have become very difficult.” - (P1, Male, 37 years, Service).

“Sometimes me and my friends just reach this retailer while having a walk after dinner and have cold-drink or ice-cream at his store, but usually we do not carry our wallets at that time, but that is never a problem at this store! Probably because we know each other since my childhood, he knows that his money is safe, but I like that he trusts me with the money!” - (P31, Male, 44 years, Businessman)

“I run a small business and you know in business you do not have regular income. Some days are too good, and some are bad. So, I buy grocery of entire month in one go and often pay the retailer in two installments. The retailer has never objected. Can the big retail stores allow that!” - (P66, Male, 29, Businessman).

2. Assortment: Many participants mentioned that they prefer a particular store because of the assortment of products, brands and variants carried by the store. It seems that customers develop a perception about the store that what they want is available at that store, then they keep visiting that store, and the feeling gets reinforced. As one participant noted -

“I always buy from this shop because I have never returned from his store without getting what I wanted. Everything that I need is always available there, the products are handed over quickly, and the billing is always correct. In fact, I have been buying from him since last 7-8 years and I never felt like going at any another store.” - (P38, Female, 53, Service)

3. Unbiased recommendations - Many participants highlighted that candid and unbiased suggestions about different products / brands is the reason that they like to shop at that store. Since the grocery retailer and his family also consume the products from his store, he shares his experience with the customers. This adds value for customers who are not sure or are not aware of the options. One of the participants mentioned -

“I have lived my entire life in a tribal area in the North-East. We have recently shifted to this city and hence, I am not aware of many things which are available here. So, I started buying things on the recommendation of this retailer. I realized that he gives fair recommendations. He often says – “I am using the same product at my home”, and because of this I trust him and depend on his advice.” - (P32, Male, 54, Service)

4. Socialization - shopping at these stores offers a good platform to satisfy the basic human need for socialization. This happens in two ways –

a. Interaction between the retailer and the customers – As mentioned in the characteristics of unorganized retail stores, the setting at these stores is such that the customers and retailers must interact with each other. Gradually, they start having small talk. Virtually, no shopping trip to these stores is complete without some discussion on topics like – well-being of elders, whereabout of children, their studies, and careers, local politics, weather, and sports etc. This happens primarily because being from the same locality, retailers and customers share beliefs, values, interests, and behaviors. As one participant shares -

“He knows everyone in our family, and I know his! In fact, my kids and his kids go to the same school. Whenever I go to his store, we often talk about what’s going on in the school and how are the kids doing! I think we share the same problems as far as kids are concerned (laughs)!” - (P56, Male, 41, Service)

b. The second social interaction happens between customers and other customers – As mentioned in the characteristics above, the retailer gets customers from a small catchment area and often these people know each other. So, when they meet each other at the store, they interact. In fact, friends in the neighborhood often go to the store together at a common time as this gives them a good opportunity to talk and spend some time together. In that sense, the trip to the store is often the highpoint for these people. They look forward to it, they plan for it, and they enjoy it! One participant said -

“I like going to this store because it allows me to spend some time with my close friend. Me and the lady next door go to the store together. Everyday there is some requirement at the homes, and we coordinate to go together and buy things. We know when other ladies also come there, so it is nice that we can meet each other!”- (P4, Female, 27, Homemaker)

5. Extraordinary help: One noticeable thing that emerged during the interaction was that many respondents cited a situation or two where the retailer has helped them in some extraordinary way and that leaves a mark on the customers and makes them extremely loyal. Such cases were usually from the lockdowns which happened during COVID-19 when almost everything was difficult to get. Here are the comments from some of the respondents:

“During COVID-19 there was a short supply of most things and even online was closed, but the retailer opened his store for the people of this colony. He offered as much help as he could! This was remarkable!” - (P14, Female, 30, Homemaker)

“Even if the shop is closed and if you call him, he gets things from inside. Not only that, but I have also seen him open large packets and give small quantities to poor people as much as they want! He is very helpful.” - (P90, Female, 33, Homemaker).

“You know … even if you ask a particular brand or a product that he does not keep, or deals in, he arranges it for you. He will note it down, find the holeseller, call him, and try to get it delivered at his store – or - when he goes to the wholesale market, he would get that for us! The best part is, he gives it to us at the MRP* and doesn’t charge extra.” - (P41, Male, 40, Service).

* - Maximum Retail Price mentioned on the pack

6. Retailer’s Indigeneity: In India, being from the same community is a powerful binding force and it brings and keeps people together. Many participants preferred a particular retail store because the retailer belongs to their community and they believed that it is their moral responsibility to patronize people from their community and that’s why they shop at certain stores. As one participant said—

“I like to shop at this store because the owner is from my village. Our great grandfathers lived there. So, I must support him. If we do not support people from our village then who will? Moreover, he is doing his work properly. So, he is my first choice for buying any grocery items.” - (P5, Male, 71, Retired)

Another respondent pointed that -

Even if something is out of stock at his store, and if I do not need that thing urgently, I wait rather than going to another store. I know that he will arrange it for me. We help each other... that’s the least that we can do! - (P25, Female, 63, Homemaker)

7. General behavior: The retailer’s conduct or behavior with customers affected his relationship with the customers, and that also emerged as a prominent theme driving customers’ loyalty. This included things like – greeting, way of talking, paying attention to customers, and their needs. It appears that this has a sound logic behind it. The offerings at grocery retail stores are quite similar so retailer’s conduct and behavior works as a major differentiator and customers become loyal for that. Once respondent said:

“I shop at this store because the retailer is so nice to me. Even if there are a lot of customers, he always listens and talks properly. I have never seen him angry, even when my kids would run around in his store, touch everything and nag me to buy things!” - (P8, Female, 30, Service)

Phase 2

While phase 1 of the study aimed at identifying the major drivers of customers’ loyalty, phase 2 of the study has been dedicated to confirming whether these drivers lead to the formation of attitudinal or behavioral loyalty or both. Towards this purpose, a quantitative study has been designed wherein the loyal customers of selected unorganized retail stores were surveyed using a structured questionnaire.

The Questionnaire

The questionnaire comprised of two parts. The first part captured the demographic information of the respondents, whereas the second part had questions to capture attitudinal and behavioral loyalty as well as questions to capture the intensity of identified themes / drivers generated in phase 1. The questions for attitudinal loyalty were adapted from the work of Price et.al. (1999); and for behavioral loyalty the questions were adapted from the work of Bobalca et. al. (2012). To assess the intensity of drivers identified in phase 1, the questions were developed based on the qualitative insights drawn in phase 1 of the study. Responses to questions in the second part of the questionnaire were captured on a five-point Likert scale and were averaged to arrive at the overall score of the respective constructs. The items used in the questionnaire are given in Table 2.

| Table 2 Questionnaire Items and CFA Results | |||||

| Constructs | Items | SL | CR | AVE | Alpha |

| Behavioral Loyalty (BL) | I recommend this retailer to others | 0.741 | 0.836 | 0.631 | 0.807 |

| I say positive things about this retailer | 0.814 | ||||

| I consider this retailer my first choice when I want to buy grocery products | 0.825 | ||||

| Attitudinal Loyalty (AL) | I feel a commitment to continuing my relationship with this retailer | 0.79 | 0.917 | 0.736 | 0.904 |

| I like this store more than other stores that sell similar products | 0.933 | ||||

| I feel like I am going to buy from this store in future also | 0.818 | ||||

| I am alright in postponing my purchases so that I can buy from this store | 0.883 | ||||

| Convenience (CONV) | Purchasing and returning products at this store is more convenient than other stores | 0.907 | 0.937 | 0.788 | 0.923 |

| It is costly and difficult to go and shop at other stores | 0.917 | ||||

| Shopping at this store takes least amount of my time | 0.876 | ||||

| It is easy to get credit from this retailer | 0.85 | ||||

| Unbiased Recommendations (URC) | The retailer gives honest opinion about products | 0.905 | 0.901 | 0.752 | 0.924 |

| The retailer’s recommendations match my requirements | 0.846 | ||||

| I trust retailer’s recommendations because they are based on his experience of using the product | 0.85 | ||||

| General Behavior (GB) | The retailer gives personal attention to me whenever I go to shop | 0.903 | 0.904 | 0.759 | 0.941 |

| The retailer is very responsive to my needs | 0.908 | ||||

| The retailer talks nicely and has good etiquette | 0.799 | ||||

| Socialization (SOCI) | I enjoy interacting with the retailer and other customers while shopping at this store | 0.903 | 0.955 | 0.841 | 0.956 |

| I miss the experience of interacting with my friends when I don’t go to the store | 0.909 | ||||

| It is fun to go and shop with my friends | 0.92 | ||||

| It is always nice to meet people while shopping at the store | 0.936 | ||||

| Extraordinary Help (SOL) | The retailer genuinely tries to satisfy my requirements | 0.868 | 0.931 | 0.817 | 0.922 |

| The retailer gets the products even if he didn't have them | 0.915 | ||||

| The retailer is ready to help me in every situation | 0.928 | ||||

| Retailer's Indigeneity (IND) | The retailer belongs to my community | 0.929 | 0.924 | 0.802 | 0.921 |

| The retailer belongs to my locality / neighborhood | 0.873 | ||||

| The retailer communicates in the local language | 0.884 | ||||

| Assortment (ASQ) | The store has all the products that I need | 0.831 | 0.872 | 0.694 | 0.883 |

| The store keeps good quality products and charges fair price | 0.883 | ||||

| The retailer keeps the products safely and takes care of them | 0.782 | ||||

Sample and Data Collection

Nine Ph.D. students have assisted the authors in data collection. Fifty-eight grocery retail stores (excluding those used in the first phase) from the cosmopolitan mini-metro city of Jaipur (state capital of Rajasthan, India) were selected on same parameters used in phase 1. The authors met the retailers at these stores and explained the purpose of the study. They were told that whenever the loyal customers would come to the store, after their shopping is over, the retailer will have to direct the customers to the students, who would be present at their store to conduct the survey. Only seventeen stores agreed to these conditions.

The stores would typically operate for 15 hours in a day. Three students were assigned to a store in a way that each student would man the store for roughly 5 hours and then the next student would replace him/her. In this way, three stores were covered parallelly. At every store, the students would survey 20 loyal customers and then they would move to another store.

The respondents were filtered for the study at two levels. First, the retailer would indicate to the students that the customer is loyal, and second, the students would ask the customer if they have been shopping from the store for at least three years. The final set of respondents were those customers who met both these conditions.

Analysis

The two-step approach recommended by Hair et. al, (2014) has been used for data analysis. First, the measurement model has been run to assess the measurement quality, followed by the structural model (path analysis) to confirm the drivers of loyalty.

Common Method Bias

To rule out the occurrence of Common Method Bias (CMB), Harman’s Single-factor Test has been used and the results clearly indicate that the variance explained by the first factor is only about 26.23%, and hence, CMB is unlikely to affect the analysis (Hair et. al., 2014).

Measurement Model

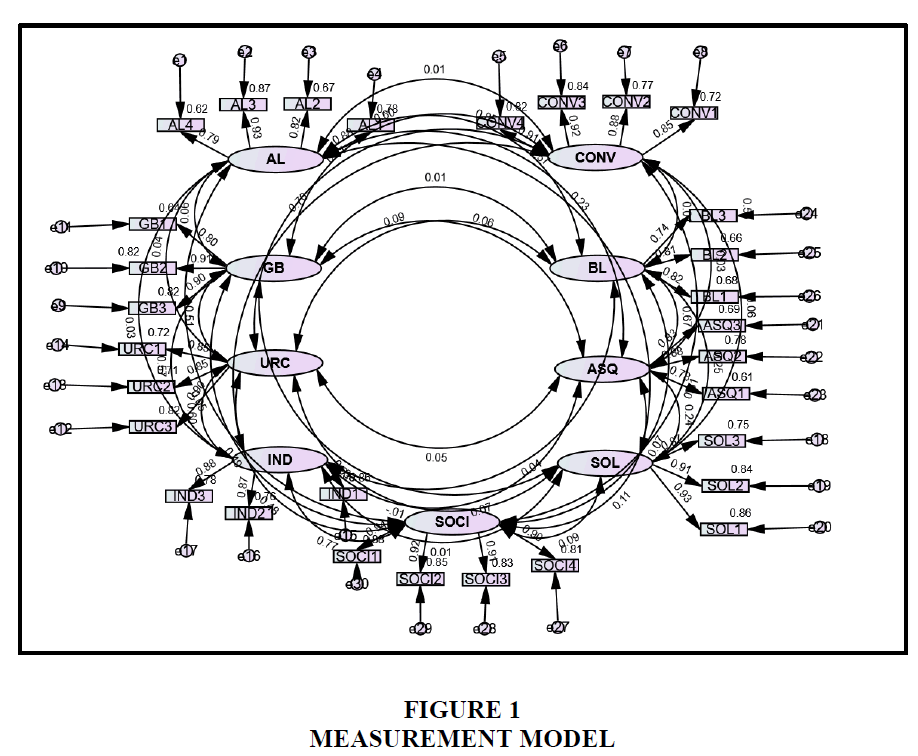

Once the preliminary data analysis revealed that there were no issues pertaining to normality, outliers, and multi-collinearity, the measurement model was specified and run in AMOS 26 to check the measurement quality. The overall model-fit diagnostics (chi square/df = 2.095, GFI = .858, CFI = .951, TLI = .943, RMSEA = .059, RMR = .047), attest satisfactory fitness (Hair et. al., 2014). Next, the validity and reliability of study constructs were assessed. The factor loading of each item, and the reliability score of each construct, were more than 0.70, and the AVE is also higher than 0.50 (Table 2). This indicates sufficient convergent validity (Hair et. al, 2014). Moreover, the square root of AVE is also higher than the inter-construct correlations (Table 3) which establishes the discriminant validity of the constructs (Hair et. al, 2014) Figure 1.

| Table 3 Discriminant Validity Assessment | |||||||||

| Construct | CONV | AL | GB | URC | IND | SOCI | SOL | ASQ | BL |

| CONV | 0.888 | ||||||||

| AL | 0.012 | 0.858 | |||||||

| GB | 0.598 | 0.055 | 0.871 | ||||||

| URC | 0.613 | 0.036 | 0.505 | 0.867 | |||||

| IND | 0.705 | 0.028 | 0.572 | 0.601 | 0.896 | ||||

| SOCI | 0.610 | 0.048 | 0.490 | 0.484 | 0.772 | 0.917 | |||

| SOL | 0.057 | 0.226 | -0.026 | -0.007 | 0.012 | 0.094 | 0.904 | ||

| ASQ | 0.031 | 0.573 | 0.059 | 0.050 | 0.072 | 0.110 | 0.239 | 0.833 | |

| BL | 0.007 | 0.246 | 0.006 | 0.089 | 0.038 | 0.072 | 0.247 | 0.667 | 0.794 |

Structural Model

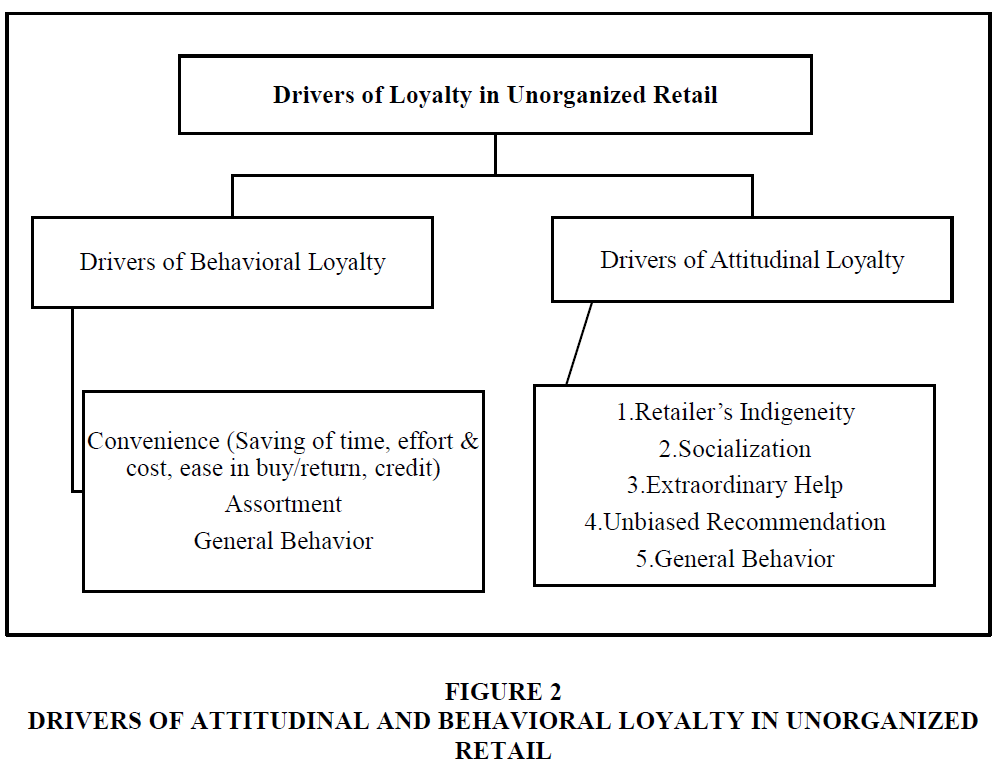

To confirm the drivers of attitudinal and behavioral loyalty, path analysis has been used. Two models were run wherein one model all identified drivers were allowed to explain attitudinal loyalty, and in the second model all identified drivers were allowed to explain behavioral loyalty. Results indicate good model fitness in both models as recommended by Hair et. al. (2014). Distinct drivers emerged for each type of loyalty, except the ‘General Behavior’ (of the retailer) which was found to be driving both types of loyalty (Figure 2).

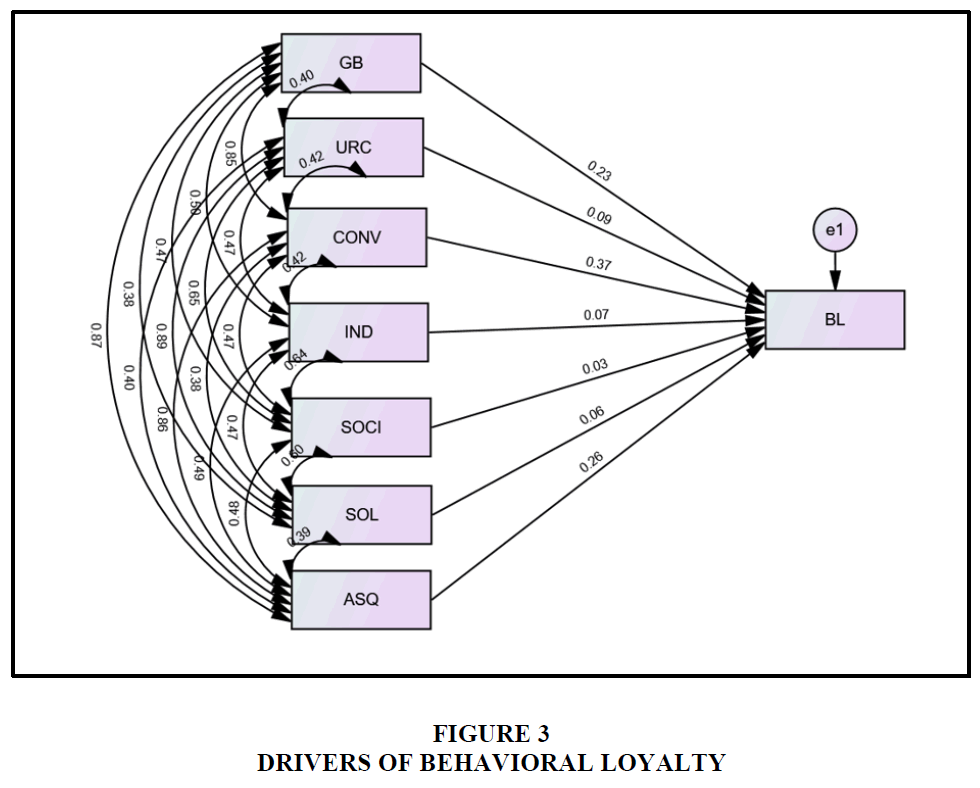

Results indicate that ‘Convenience’ and ‘Assortment’ (p < 0.05) drive customers’ behavioral loyalty, and the transactional nature of these elements explain the same (Figure 3). The benefits of these elements are direct, immediate, and instantly measurable for the customers, like - savings of money, time or effort, availability of desired products, brands, and variants. It can be concluded that when customers repeatedly reap these rewards or get these benefits, they get into a habit of buying from the stores, and they become behaviorally loyal to the store (Johnson et. al., 2006). As expected, out of these two, Convenience has emerged as a more powerful driver of behavioral loyalty.

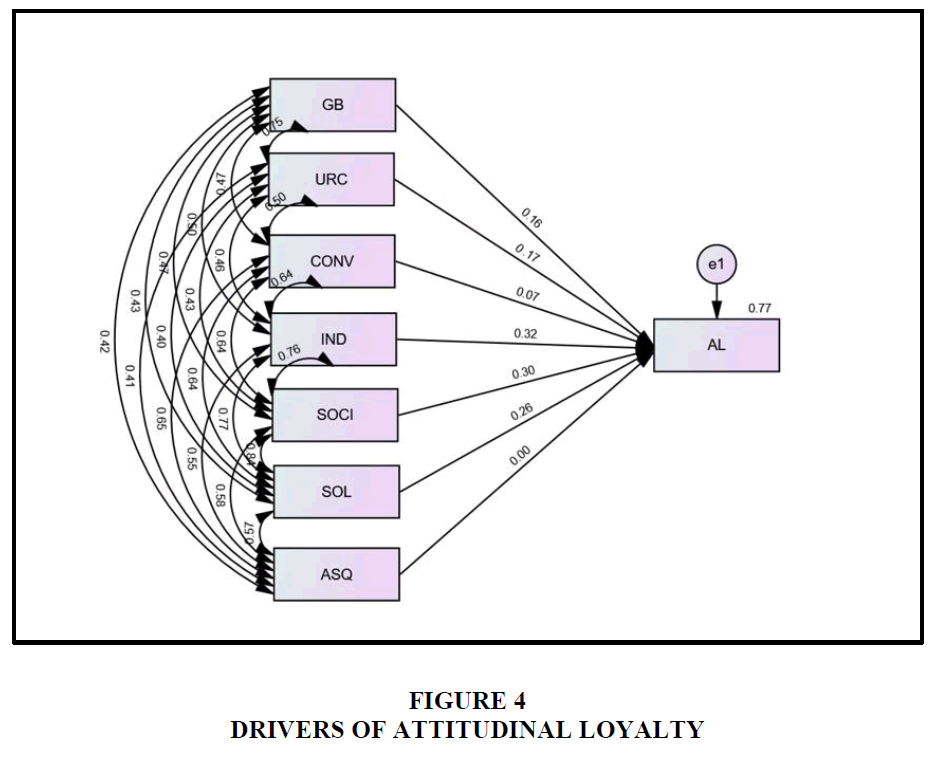

‘General Behavior’ (of the retailer) has been found to be driving both attitudinal as well as behavioral loyalty (Figures 3 and 4). Although its power in driving both types of loyalty has been the least amongst all other drivers. Even the authors had a disagreement over this finding. Two of the three authors felt that the benefits of General Behavior of the retailer are instant and observable, it makes sense that it is emerging as a driver of Behavioral Loyalty. However, one of the authors believed that the benefits of General Behavior of the retailer are not measurable and objective, therefore, General Behavior makes more sense as a driver of customers’ attitudinal loyalty.

Results clearly indicate that ‘Retailer’s Indigeneity’, ‘Socialization’, and ‘Extraordinary Help’ and ‘Unbiased Recommendations’ drive customers’ attitudinal loyalty (p<0.05) (Figure 4). Out of these ‘Retailer’s Indigeneity’ emerged as the most influential driver (highest beta, Tables 4 & 5). This might be because of the culture of the land. In India, for a large section of society, belonging to community, caste or religion is an extremely powerful binder of people. Out of the four drivers of attitudinal loyalty, ‘Unbiased Recommendation’ was found to be the least influential driver. This might be because the study was conducted in an urban area where customers are more aware, and hence, are more independent in choosing what they want and therefore they might not be relying on retailer’s recommendation as much.

| Table 4 Impact on Behavioral Loyalty | ||||||

| Drivers | Unstandardized Estimate | Std. Estimate | S.E. | C.R. | P | Result |

| GB | 0.244 | 0.229 | 0.064 | 3.809 | *** | Supported |

| URC | 0.098 | 0.095 | 0.064 | 1.535 | 0.125 | Not Supported |

| CONV | 0.361 | 0.366 | 0.057 | 6.356 | *** | Supported |

| IND | 0.085 | 0.066 | 0.048 | 1.795 | 0.073 | Not Supported |

| SOCI | 0.031 | 0.027 | 0.047 | 0.663 | 0.507 | Not Supported |

| SOL | 0.062 | 0.056 | 0.065 | 0.95 | 0.342 | Not Supported |

| ASQ | 0.263 | 0.264 | 0.062 | 4.216 | *** | Supported |

| Table 5 Impact on Attitudinal Loyalty | ||||||

| Drivers | Unstandardized Estimate | Std. Estimate | S.E. | C.R. | P | Result |

| GB | 0.127 | 0.16 | 0.035 | 3.638 | *** | Supported |

| URC | 0.14 | 0.167 | 0.036 | 3.846 | *** | Supported |

| CONV | 0.061 | 0.07 | 0.037 | 1.625 | 0.104 | Not Supported |

| IND | 0.306 | 0.318 | 0.047 | 6.564 | *** | Supported |

| SOCI | 0.291 | 0.301 | 0.055 | 5.337 | *** | Supported |

| SOL | 0.247 | 0.26 | 0.053 | 4.648 | *** | Supported |

| ASQ | 0.001 | 0.001 | 0.033 | 0.028 | 0.978 | Not Supported |

The presence of ‘general behavior’ as a driver of attitudinal loyalty made sense to one of the authors because according to hum, this trait has the power of developing an affinity, and it helps the retailer in building and maintaining relationships with the customers, which in turn leads to attitudinal loyalty.

Discussion

The results of this study indicate that despite lack of resources, orientation and scientifically drawn-out strategies, unorganized retail has been successful in maintaining customers’ loyalty in spite of customers having a large number of options in terms of organized and online retail (Luceri and Latusi, 2012). In line with previous studies, the findings of this study also prove that there are different drivers of customers’ attitudinal and behavioral loyalty. The drivers of behavioral utility – Convenience and Assortment – are utilitarian and transactional in nature (Sinha & Banerjee, 2004). Out of these two, ‘Convenience’ has emerged as more influential. Clearly, the organized retail can never have that kind of reach as it would be non-feasible to open and run these many stores. In addition, organized retail cannot extend credit in the way that unorganized retailers do (without formalities / papers etc). So, convenience works as a powerful differentiator for unorganized retailers because one, it is difficult to copy and two, it is extremely meaningful for the customer. Similarly, another utilitarian driver of behavioral loyalty is assortment, which indicates that customers tend to prefer these stores because the assortment of merchandize in these stores is highly relevant to their needs. Being in the neighborhood for long periods, the unorganized retailers know the near-by area, the customers, and their consumption patterns so well that they contextualize the assortment according to the specific requirements. In contrast, it might happen that customers feel lost in the long isles of organized retail where the assortment is meant to cater to a large catchment area with diverse customers. Secondly, at organized retail, merchandize decisions are taken centrally with corporate level pan country tie-ups, and that reflects in the high ratio of national and international brands present in these stores.

The study has found that customers’ attitudinal loyalty is driven by – ‘Retailer’s Indigeneity’, the store as a place for ‘Socialization’, offering ‘Extra-ordinary Help’ to the customers, giving ‘Unbiased Recommendations’ about products and brands. Out of these, ‘Retailer’s Indigeneity’ has emerged as the most influential driver. Retailer’s Indigeneity includes retailers’ place of birth, language, and community affiliation. In a diverse country like India, these factors signify ‘oneness’ and ‘belonging’ and often forms the basis of bonding and relationship between retailers and their customers and reduces customers’ perceived risks and increase their trust and comfort level. Customers also feel a sense of duty in supporting the retailer and prefer to buy from them. This is also a powerful differentiator which is difficult to copy for organized retailers and is extremely meaningful for the customers.

The findings of this study show that the unorganized retail store often serves as a place for customer-socialization. Customers in neighborhood know each other, and they frequently bump into each other at the store leading to a small talk. At times, neighbors plan trip to the store and go together. The store plays an important role in customers’ lives by contributing in the creation and maintenance of the social fabric of the neighborhood. Organized retail can never offer that feeling to the customers. Although customers can plan occasional joint trips to these stores also, but that casual, carefree and easy routine and that belonging are too far for them. At unorganized retail stores, the customers can be themselves, that is, speak in their native language, casually talk to each other, and wear normal clothes etc., whereas organized retail stores are still aspirational formal places for most customers where they feel that they are supposed to behave in a certain way, and that they are surrounded and being constantly watched by strangers.

‘Extra-ordinary Help’ from the retailer emerged as the next influence driving customers’ attitudinal loyalty. Being from the same locality and / or community, the interdependence and bonding between customers and the retailer is so high that retailers often do not hesitate to go out of the way to help customers – like, during COVID when the supply chains of various products got disturbed, the retailers used their stocks and contacts to ensure the supplies of essential items for their customers in the neighborhood. Many respondents reported that the retailers have opened their stores at odd times to provide them stuff which they needed etc. Customers notice, remember, and respond to such gestures, and it leads to formation of attitudinal loyalty.

Finally, retailers’ genuine and unbiased recommendations about products have been found to trigger attitudinal loyalty. Often when customers are confused, unaware or unsure about which products / brands to be brought, in what quantity etc., retailer’s recommendations, which are based on knowledge of customers’ preferences and consumption patterns, offer a sense of comfort and certainty for customers. When this gets repeated and reinforced in customers’ minds, it leads to formation of attitudinal loyalty.

Implications

The findings of this study are critical for marketers who sell their products through unorganized retailers as well as through organized retailers. With this knowledge, the marketers can better appreciate the distinguish nature of value proposition in these two types of retail channels, and that targeting unorganized retail would require different types of enablers, like - the credit lines offered, the display allowances, and the PoS (Point of Sales) infrastructure, need to be different. Marketers must invest in making their stores more customer friendly and training these retailers to be a (even more) powerful influencer. Finally, to compete better in a hyper-local market, the marketers must leverage on retailers’ sound knowledge of customers.

By enabling and empowering these retailers and making them better at what they are doing, marketers can help them to attract and retain more customers and enhance their store’s reputation in the area. This will lead to not only in increased sales, but they will also gain the loyalty of these customers, which can be a gamechanger in any emerging market (Dugar & Chamola, 2021).

Limitations and Scope for Future Research

While this study dives into a relatively unexplored area, expand the existing literature, and offers useful insights, it has certain limitations too. First, customer loyalty varies with product category and time, these aspects have not been captured in this study. Next, an important question that needs to be answered is that whether the customers are equally loyal to organized retail stores or not, has not been mapped. It might be possible that customers are equally loyal to both types of retail stores for different benefits and product offerings. Finally, loyalty is also a culture specific phenomenon, and this study explores it in a specific culture. So, to generalize the findings, more and different geographies need to be explored. These are certain interesting areas which future researchers can consider and that would illuminate this important, and yet, ignored aspect of marketing in the retail industry.

References

Bandyopadhyay, S., & Martell, M. (2007). Does attitudinal loyalty influence behavioral loyalty? A theoretical and empirical study. Journal of retailing and consumer services, 14(1), 35-44.

Indexed at, Google Scholar, Cross Ref

Bobalca, C., Gatej, C., & Ciobanu, O. (2012). Developing a scale to measure customer loyalty. Procedia Economics and Finance, 3, 623-628.

Indexed at, Google Scholar, Cross Ref

Braun, V., & Clarke, V. (2006). Using thematic analysis in psychology. Qualitative Research in Psychology, 3(2), 77-101.

Indexed at, Google Scholar, Cross Ref

Chaudhuri, A., Holbrook, M. (2001). The chain of effects from brand trust and brand affect to brand performance: the role of brand loyalty. Journal of Marketing 65 (2), 81–93.

Clottey, T. A., Collier, D. A., & Stodnick, M. (2008). Drivers of customer loyalty in a retail store environment. Journal of Service Science, 1(1), 35-48.

Dapena-Baron, M., Gruen, T.W., & Guo, L. (2020). Heart, head, and hand: a tripartite conceptualization, operationalization, and examination of brand loyalty. Journal of Brand Management, 27(3), 355-375.

Indexed at, Google Scholar, Cross Ref

Dawes, J. (2022). Factors that influence manufacturer and store brand behavioral loyalty. Journal of Retailing and Consumer Services, 68, 103020.

Indexed at, Google Scholar, Cross Ref

Dick, A. S., & Basu, K. (1994). Consumer loyalty: towards an integrated conceptual approach. Journal of the Academy of Marketing Science. 22(2), 99-113.

Dugar, A., & Chamola, P. (2021). Retailers with traits of consumer: Exploring the existence and antecedents of brand loyalty in small unorganized retailers. Journal of Retailing and Consumer Services. 62, 102635.

Indexed at, Google Scholar, Cross Ref

Ehrenberg, A. S. (2000). Repeat buying. Journal of Empirical Generalisations in Marketing Science, 5(2).

Ehrenberg, A.S., Goodhardt, G., Barwise, T. (1990). Double jeopardy revisited. Journal of Marketing. 54 (3), 82–91.

Indexed at, Google Scholar, Cross Ref

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2014). Pearson new international edition. Multivariate data analysis, Seventh Edition. Pearson Education Limited Harlow, Essex.

Huitt, W.G., & Cain S.C., (2005). An overview of the conative domain, In Educational Psychology Interactive, Valdosta State University, Valdosta, GA.

Jacoby, J., Chestnut, R.W., (1978). Brand Loyalty: Measurement and Management. John Wiley and Sons, New York.

Johnson, M. D., Herrmann, A., & Huber, F. (2006). The evolution of loyalty intentions. Journal of Marketing, 70(2), 122-132.

Kanakaratne, M. D. S., Bray, J., & Robson, J. (2020). The influence of national culture and industry structure on grocery retail customer loyalty. Journal of Retailing and Consumer Services, 54, 102013.

Indexed at, Google Scholar, Cross Ref

Luceri, B., Latusi, S. (2012). The importance of consumer characteristics and market structure variables in driving multiple store patronage. Journal of Retailing and Consumer Services. 19 (1), 519–525.

Indexed at, Google Scholar, Cross Ref

Maggioni, I. (2016). What drives customer loyalty in grocery retail? Exploring shoppers’ perceptions through associative networks. Journal of Retailing and Consumer Services. 33, 120–126.

Indexed at, Google Scholar, Cross Ref

Paparoidamis, N. G., Katsikeas, C. S., & Chumpitaz, R. (2019). The role of supplier performance in building customer trust and loyalty: A cross-country examination. Industrial Marketing Management, 78, 183-197.

Indexed at, Google Scholar, Cross Ref

Price, L. L., & Arnould, E. J. (1999). Commercial friendships: Service provider–client relationships in context. Journal of Marketing, 63(4), 38-57.

Indexed at, Google Scholar, Cross Ref

Ramakrishnan, K., (2010). The competitive response of small, independent retailers to organized retail: study in an emerging economy. Journal of Retailing and Consumer Services. 17 (4), 251–258.

Indexed at, Google Scholar, Cross Ref

Ranganathan, S. K., Madupu, V., Sen, S., & Brooks, J. R. (2013). Affective and cognitive antecedents of customer loyalty towards e-mail service providers. Journal of Services Marketing, 27(3), 195-206.

Indexed at, Google Scholar, Cross Ref

Reichheld, F. F., & Sasser, W. E. (1990). Zero defections: quality comes to services. Harvard Business Review, 68(5), 105-111.

Romaniuk, J., & Nenycz-Thiel, M. (2013). Behavioral brand loyalty and consumer brand associations. Journal of Business Research, 66 (1), 67–72.

Sinha, P. K., & Banerjee, A., (2004). Store choice behavior in an evolving market. International Journal of Retail and Distribution Management, 32(10), 482-494.

Smith, R., & Swinyard, W., (1983). Attitude-Behavior consistency: the impact of product trial versus advertising. Journal of Marketing Research. 20 (3), 257–267.

Indexed at, Google Scholar, Cross Ref

Thomson, M., Macinnis, D., & Park, C.W. (2005). The ties that bind: measuring the strength of consumers’ emotional attachments to brands. Journal of Consumer Psychology, 15 (1), 77–91.

Indexed at, Google Scholar, Cross Ref

Verhoef, P.C. (2003). Understanding the effect of customer relationship management efforts on customer retention and customer share development. Journal of Marketing, 67 (4), 30–45.

Watson, G. F., Beck, J. T., Henderson, C. M., & Palmatier, R. W. (2015). Building, measuring, and profiting from customer loyalty. Journal of the Academy of Marketing Science, 43(6), 790–825.

Indexed at, Google Scholar, Cross Ref

Williams, L., Buoye, A., Keiningham, T.L., & Aksoy, L., (2020). The practitioners’ path to customer loyalty: memorable experiences or frictionless experiences? Journal of Retailing and Consumer Services, 57, 102215.

Indexed at, Google Scholar, Cross Ref

Worthington, S., Russell-Bennett, R., & Härtel, C. (2010). A tri-dimensional approach for auditing brand loyalty. Journal of Brand Management, 17(4), 243-253.

Received: 27-Jun-2023, Manuscript No. AMSJ-23-13828; Editor assigned: 28-Jul-2023, PreQC No. AMSJ-23-13828(PQ); Reviewed: 26-Oct-2023, QC No. AMSJ-23-13828; Revised: 02-Nov-2023, Manuscript No. AMSJ-23-13828(R); Published: 09-Dec-2023