Research Article: 2019 Vol: 23 Issue: 3

Drivers of Marketing Channel Performance: Evidence from Iran

Mohammad Abbaszadeh, University of Tehran

Mohammad Haghighi, University of Tehran

Mohammad Rahim Esfidani, University of Tehran

Abstract

This study sought to elicit and explore useful emerging themes for understanding key drivers of marketing channel performance in the Iranian Fast-Moving Consumer Goods (FMCG) market. In-depth interviews were conducted with fifteen senior marketing executives of the Golrang Industrial Group (GIG) to identify the key drivers of FMCG marketing channel performance. Interview data were analyzed using thematic analysis. The findings revealed that the long-term integrated policy of GIG, Explicit information system, inter-channel coordination, up-to-date market knowledge, human resource development, integrated marketing strategy, organizational relations management, economics of relationships, and personal relationship management are key emerging drivers of marketing channel performance. The identified themes in this study provide valuable insights into the key drivers of marketing channel performance for use and development by researchers and industrial stakeholders. This research fills a gap in the literature on marketing channel performance drivers in developing countries. This issue was approached by extracting marketing channel performance drivers directly from the opinions of marketing managers.

Keywords

Inter-organizational Relations, Channel Performance, Thematic Analysis, Retailing.

Introduction

Marketing channels are groups of interdependent organizations or middlemen that are fundamental routes for delivering propositions to end users (Watson et al., 2015). Marketing channels are an essential constituent of value chains due to the fact that significant amounts of economic outputs flow through them (Krafft et al., 2015). Thus, academics and managers have important and challenging decisions vis-à-vis identifying, choosing, and managing different combinations of marketing channels. Indeed, the importance of marketing channels in comparable to areas like pricing and products.

Using multichannel marketing is nothing new, firms have done it for decades (Brown et al., 2014). In recent years, the number of channel alternatives has increased rapidly and manufacturers are increasingly using multiple complex channels to distribute their goods. Technological innovations, changing customer expectations, and the emergence of new forms of business have been contributing factors to this trend (Eyuboglu et al., 2017). Designing and managing these multiple channels pursuant of desirable performance outcomes represents a key challenge for marketing managers (Chen & Chiang, 2011; Chung et al., 2012).

Interfirm exchanges in marketing channels have long been an interesting topic for both academics and practitioners (Wang & Zhang, 2017). Effective governance of interfirm exchanges is key to channel performance and competitive advantage (Heide, 1994) because most firms need to harness the capabilities and resources of other organizations to effectively compete (Trada & Goyal, 2017). Various theoretical perspectives on governance have been developed or adopted to explain interfirm transactions and relationships for reviews see (Cao & Lumineau, 2015; Palmatier et al., 2007). Marketers and researchers focus on the drivers of marketing channel performance so as to develop successful strategies by understanding the antecedents of marketing channel performance. Thus, herein we seek to uncover key drivers of multichannel marketing performance to add to the extant body of knowledge in this domain.

While multichannel marketing performance research has advanced significantly in recent years, it offers limited insights and tools to understand and analyze the multiple complex channels associated with contemporary business environments. There seems to be a gap in the literature in terms of a salient theoretical framework to guide multichannel decision making. A new approach is required to address channel performance enhancement. This research uses interviews with senior marketing executives to identify multichannel marketing performance drivers. Analyzing and exploring these interview data in terms of emergent themes can be used as a guiding framework for academics and practitioners who are interested in understanding and optimizing multichannel marketing performance. Specifically, we explore drivers of marketing channel performance pursuant of enhancing performance for a case-study of the Iranian FMCG market.

Literature Review

Different theoretical views have been used to understand marketing channel performance. Economic theories focus on efficiency and optimization whereas behavioral science theories explain inconsistent behavior of the rational agent assumed by economists.

Resource based view (RBV)

Based on social exchange theory, the RBV perceives interfirm relationships as a strategic response to uncertainty and dependence (Pfeffer & Salancik, 1978). Few organizations are self-sufficient and a lack of self-sufficiency creates dependence on the parties from whom the focal resources are obtained. The RBV argues that firms develop and leverage scarce resources because they have the organizational capability to use these resources to gain sustainable competitive advantages (Wernerfelt, 1984).

The availability, acquisition, and utilization of these resources depends on the firm’s strategies for interacting with other channel members. As a result, firms will seek to reduce uncertainty and manage dependence by purposely structuring their exchange relationships through establishing formal or semiformal links with other firms (Heide, 1994). The RBV can accommodate diverse channel activity, including the addition of a new channel, acquisitions of valuable information, peerless technologies, and enhancement of organizational capabilities (Watson et al., 2015). Further, a variety of links have been suggested in the extant literature, including contracting, joint ventures, and complete mergers (Heide, 1994). The establishment of an interfirm link is viewed in the literature as an approach to dealing with the problems of uncertainty and dependence by deliberately increasing the extent of coordination with the relevant set of exchange partners or creating "negotiated environments" (Cyert & March, 1963). The RBV argues that a firm’s intangible assets can help improve its performance and it can be used as a theoretical framework to explain how buyer-supplier relationships can improve performance.

Like other perspectives, the RBV is not without its criticisms. One of the main criticisms of the RBV is that it is a self-verifying perspective. Barney (2001) stated that resources that can produce a sustained advantage are recognized by their ability to produce a sustained advantage, and is thus a tautology. Kozlenkova et al. (2015) address many RBV criticisms in their comprehensive review of the RBV as a framework for marketing research. Nevertheless, this perspective provides limited insight into the specific mechanisms that can be used to manage relationships and other strategies discussed in the literature could also serve to accommodate and mitigate uncertainty and dependence, and they are highly different in terms of the requirements they apply to the firm and the benefits they propose (Heide, 1994).

Transaction cost economics (TCE)

With its roots in economics (Williamson, 1975), the transaction cost perspective focuses on two constructs of transaction-specific investments and opportunism from the perspective of the firm as a governance mechanism instead of a production mechanism. Transaction cost economics asserts that transaction-specific investments (RSIs) and opportunism affect exchange partners' relationships and impact on interorganizational performance (Palmatier et al., 2007). TCE suggests that managers are limited by bounded rationality, therefore their decisions may be impeded by a scarcity of information and limited cognitive resources (Simon, 1972), and managers are prone to be misled by opportunists. The general response to these governance problems identified in the original transaction cost framework is complete vertical integration. But theoretical extensions, however, have shown that the governance features of internal organization can also be achieved within the context of interfirm relationships (Heide, 1994).

Empirical studies have supported the transaction cost view that firms should vertically integrate when faced with opportunistic behaviors by other exchange partner (Rindfleisch & Heide, 1997). Therefore, RSIs by an exchange firm concurrently show its intention and produce a need to safeguard investments. Suppliers invest in channel relationships of various forms (e.g., employee training, information technologies, and physical facilities) to increase channel outcomes and reduce transaction costs. Because RSIs represent non-redeployable properties in an exchange relationship, parties' RSIs decrease their motivation to act opportunistically and the possibility of shifting threats, which in turn minimizes the partner’s need to control performance or protect assets. The transaction cost view proposes that performance will increase as the governance structure is better aligned to mitigate relationship uncertainty or environment ambiguity.

The transaction cost perspective is consistent with the resource dependence perspective in terms of using non-market governance as a response to uncertainty and environmental dependence. Nevertheless, the transaction cost perspective is explicitly related to efficiency considerations of managing relationships, while the resource based perspective focuses on the effectiveness or ability to meet the demands of external parties. (Heide, 1994).

Commitment-trust view

Originating from social exchange theory, the commitment trust view argues that the two antecedents of exchange performance are commitment and trust (Morgan & Hunt, 1994). Successful channel members cooperate with each other and leverage their trust and commitment to boost performance. Trust is determined as a channel member’s confidence in other exchange

members´ reliability and integrity (Morgan & Hunt, 1994). Commitment is determined as one channel member’s tendency to maintain a valued relationship (Moorman et al., 1992). Commitment and trust raise performance by reducing relationship destroying behaviors, resulting in partners avoiding short-term interest in favor of long-term advantage, and reducing the hazard of opportunism by motivating the channel members to work in the interests of each other (Anderson & Weitz, 1992). Later research sought to move beyond descriptions of channel relationships and concentrate on a dynamic view. For instance, Palmatier et al. (2013) show that the velocity of relationship commitment has a significant impact on performance.

Dependence view

Dependence has been extensively studied as a vital determinant of interfirm relationship performance (Palmatier, 2007). Most research argues that interdependent channel members exhibit better exchange performance because they typically work coherently to maintain mutually useful relations and dependence increases partners' motivation to maintain the relationship (Watson et al., 2015; Palmatier, 2007). Furthermore, dependence asymmetry negatively affects performance by greater risk of exposure to coercive power and reduced desire for agreement (Kumar et al., 1998). As partners invest time and endeavor to build a relational governance system, they become more dependent on each other since establishing and developing relations with a new partner would involve additional investments. Thus, commitment and trust in a partner increases interdependence (El-Ansar, 1975).

Relational view

Rooted in social psychology, the relational exchange view relies on a series of joint contracting norms and the fact that transactions exist in the relationships that surround them (Kaufmann & Dant, 1992). The relational view argues that the strength of relational norms in an exchange influences the level of cooperative behavior and relationship performance (Cannon et al., 2000). Relational exchange, in contrast of discrete exchange, accounts explicitly for the historical and social context in which transactions take place and views enforcement of obligations as following from the mutuality of interest that exists between a set of parties (Heide, 1994). The relational exchange view has had an important impact on channels research and offers novel directions for future studies in this domain. Now, we have a better knowledge of the antecedents and consequences of strong interfirm relationships (Morgan & Hunt 1994; Frazier, 1999).

But it appears that the relational exchange view as applied to distribution channels has been used beyond its natural boundaries and there are many channel contexts where channel

partnerships can be successful, representing a main source of competitive advantage for firms (Frazier, 1999). However, there are many contexts in which trying to build and maintain strong channel partnerships makes little sense because of high costs of relationship building activities which would outweigh their benefits (Jackson, 1985). Market exchanges, discrete exchanges,

repeated transactions, and, in some cases, hierarchical exchanges would be better types of exchange in interfirm channel contexts.

Methodology

This study was conducted to elicit and explore the key drivers of marketing channel performance in Iranian FMCG companies. Investigation into this relatively neglected area requires direct access to the phenomenon (Miles et al., 2013). A case study approach is a suitable research methodology as it attempts to understand phenomena through participants’ perspectives (Yin, 2013). The rationale for case selection was in accordance with the theoretical sampling recommended by (Yin, 2013; Miles et al., 2013). The selected case should fit our theoretical considerations assuming significant differences in ownership, scope of business, and intensity of distribution. Therefore, the candidate should be a private and highly successful company with a high level of distribution intensity. According to these criteria, the Golrang Industrial Group (GIG) was selected as the case study.

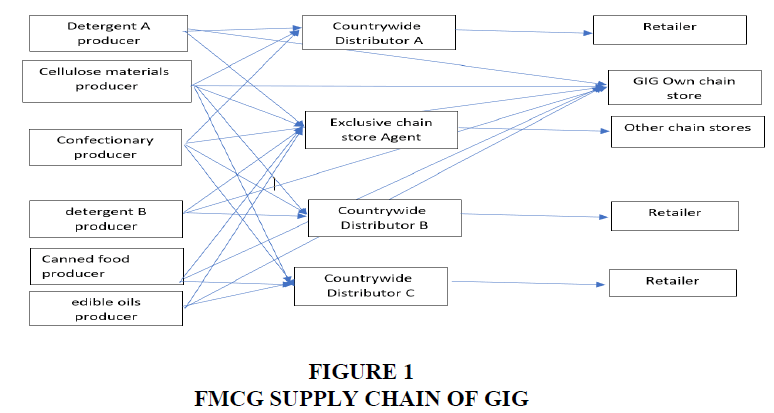

In 2007, the founder and owner of Pakshoo company and many other companies established the Golrang Industrial Group. Since then, GIG has become a leading manufacturer of detergent, cosmetics, and hygiene products. It has the biggest nationwide distribution network amongst its comparators with three distribution companies and the biggest discount chains in the country. In the Figure 1 shows GIG has experienced rapid growth by expanding its production lines to other industrial fields, and now is one of the most successful private conglomerates in the FMCG industry.

This study used a qualitative methodology to investigate key drivers of marketing channel performance. Among previous qualitative studies into marketing theory building are (Frazier & Antia, 1995; Workman et al. 1998; Valos et al., 2010). This qualitative method uses a small sample of marketing managers as knowledgeable sources about inter-organizational performance to understand a range of viewpoints required for developing study propositions instead of generalizable discoveries (Warwick & Liniger, 1975). Data are collected using in-depth interviews which represent a reliable qualitative data collection method for obtaining detailed information. Interviews enhance the chance of extracting rich information (Mason, 2002) compared to, for example, self-administered surveys.

In this study, 15 senior marketing managers from 10 FMCG companies of GIG were interviewed. Each interview lasted between 65 minutes and 121 minutes. A set of broad questions was prepared to allow marketing managers to offer their experiences and knowledge, and present the factors they believed had a role in enhancing or impeding inter-organizational performance. The questions allowed marketing managers to present issues which had not been recognized in the literature. Data from the in-depth interviews were transcribed to facilitate interpretation. Data saturation was reached on the fifteenth interview, and thus the data collection process was terminated (Silverman, 2000).

The transcripts were investigated using thematic analysis, a well-known method for extracting the in-depth opinions of interviewees as a precursor to revealing themes based on people’s responses, that allow us to have a better understanding of a process (Aronson, 1994). Thematic analysis gives meaning to fragments of ideas, which may be meaningless (Leininger, 1985) or even overlooked by alternative approaches. This qualitative method is very useful for structuring and describing data in detail. Thematic analysis is especially helpful for drawing information from real cases and experiences, and elaborating social contexts associated with the interpretation of these experiences (Braun & Clarke, 2006). Although some scholars maintain that qualitative findings based on a small sample size are not generalizable, extracting detailed insights from participants is an advantage of this method (Braun & Clarke, 2006) and can serve many functions such as the generation of propositions suitable for a quantitative study.

Results and Discussion

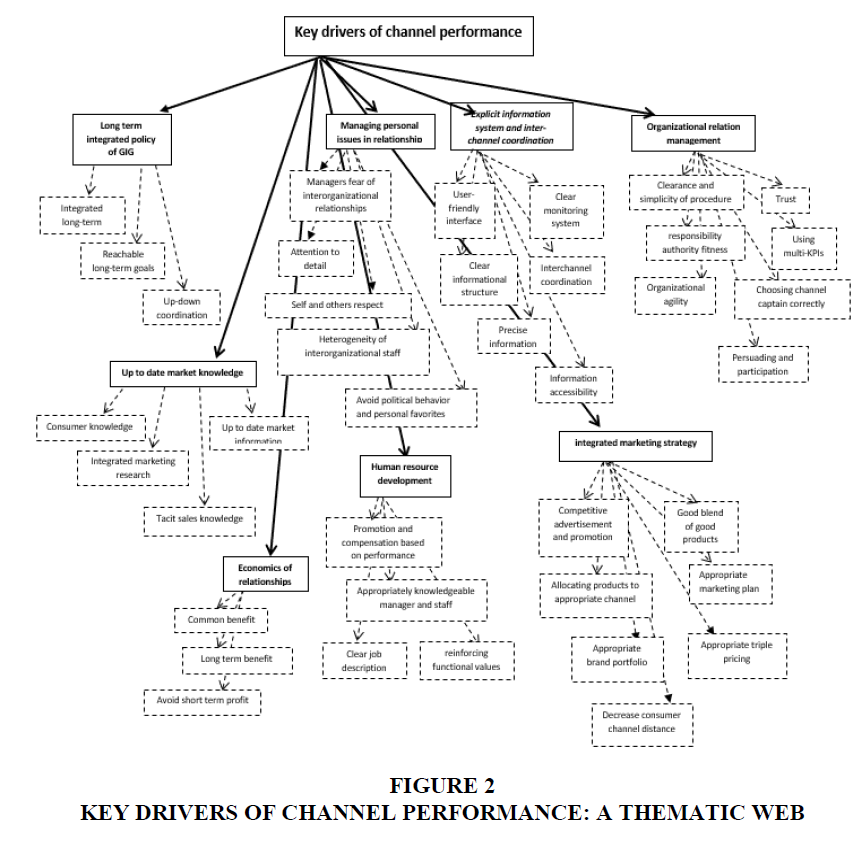

A holistic organization-wide understanding of marketing channel performance drivers is required to shed light on performance drivers in the Iranian FMCG industry. The qualitative data were analyzed to categorize the drivers of marketing channel performance. The responses were manually coded and classified and eight dominant themes emerged vis-à-vis the key drivers of inter-organizational relations performance Figure 2. This study discusses the eight themes and presents implications for a marketing channel performance framework.

Theme 1

Long term integrated policy of GIG. Having a long-term policy to facilitate managerial decision making in different situations can enhance performance. GIG has adopted a strategic business units (SBUs)-centered policy to compete efficiently in the market. Some of these SBUs compete with each other to get on more store shelves, capture more market share, and produce similar products. In the past, there was low competition in Iran's FMCG market and some companies like GIG produced similar products with different brands and supplied different market segments, which made competition very difficult for newcomers. Nowadays, entering the domestic market in Iran and successfully competing with international companies operating therein requires a greater extent of coordination. Setting long-term policies and goals, along with useful instructions, can help managers to avoid conflicts with other SBUs within GIG, keep them motivated, and concentrate them on their duties by avoiding inter-brand competition and cannibalization.

Interviewee 1 (producer company):

"I placed the parent organization's attitude at the top of the list. In production and distribution companies, the parent company's attitude is very important. When a parent company pays more attention to distribution companies, they don't see themselves in need of cooperation, rather they expect the other party to surrender, and they don't cooperate. Unfortunately, a similar situation can be seen at Golrang Industrial Group regarding production and distribution, maybe not at the highest layers, but in layers with the most relevance and effect".

Theme 2

Explicit information system and inter-channel coordination. This theme focuses on the necessity of an explicit information system. Marketing managers’ emphasis on an explicit information system can help them to control distributors, have a better monitoring system, and use more complicated strategies. In some cases, the lack of an explicit information system may allow for opportunistic activities.

Interviewee 2 (distribution company):

"The flow of information must be accessible, that is, everyone should have access to all levels of information. There should be no confidential information. The production and distribution companies must share their data with each other in a complete and clear manner. A healthy flow of information can be very helpful. I must place all my market flow and market information at the production company's disposal very honestly, and the production company must be transparent and share its conditions with me".

Without an explicit information system, marketing managers are limited to sales data for performance measurement, which may impair long-term performance. Performance measurement using key performance indicators (KPIs) is essential for long-term growth by allowing managers to use more comprehensive strategies according to their information system. In addition, free access to information and user-friendly software are important matters to many managers.

Interviewee 6 (producer company):

"In Henkel Company, the bonuses are based on specific KPIs. Their indicators are very detailed. I must update my indicators as well".

Theme 3

Up to date market knowledge. Up-to-date market knowledge is a key performance driver. Nowadays, rapid market changes render old information useless which, in turn, necessitates a comprehensive market research system. Some small-sized companies do not have a comprehensive market research system and thus do not have access to up-to-date market knowledge for optimizing decision making. These companies suffer from poor tacit knowledge in sales. In some cases, producers and distributors argue that they are more knowledgeable about market decisions and may seek to frustrate processes if their offer is rejected.

Interviewee 3 (distribution company):

"I expect our production company to be more active in marketing. Without market research, it is like driving at night with the lights off. Our production company does not have coherent and consistent marketing research. The report that they have provided me covers February to July. The information is now irrelevant".

Theme 4

Human resource development. Many human resource development issues inhibit marketing managers from reaching their goals. Many marketing managers complain about insufficient marketing knowledge and emphasize the need to enhance the marketing knowledge of mid-level managers. Most mid-level managers have been promoted based on seniority and sometimes do not have up-to-date management and marketing knowledge. In addition to managers, the employees may suffer from insufficient knowledge about marketing skills, general relationship skills, human resource development, and in other respects. Moreover, recruitment of more skilled staff, promotion based on performance, modification of compensation systems, and motivation are regarded as performance-enhancing factors. Another important factor is the perceived injustice in the compensation system. For example, unlike in manufacturing companies, distribution companies award bonuses on a sales commission basis, which can increase employees' income.

Interviewee 1 (producer company):

"If the distribution company's manager asked me about leadership, I'd say you are not charismatic at all, you lack management insight, and you do not care about the personnel. Leadership is defined by personality and audacity. Because a distribution company's job has a lot to do with people management; people management to achieve financial goals. People management is not an easy task".

Theme 5

Integrated marketing strategy. The lack of marketing plan and strategy gives a cause for complaint in almost all distribution companies. Distribution companies expect producer companies to have a comprehensive marketing plan, especially when manufacturing new products. Without having a proper marketing plan, distribution companies may waste a lot of time and money on making marketing decisions, which may distract their attention away from channel activities. In some cases, the lack of a proper marketing plan can cause new products to fail to compete effectively in the market.

Interviewee 5 (distribution company):

"One of the shortcomings that burden distribution companies is the lack of a marketing plan. The ideas behind new products are mostly not well-thought-out. From the beginning it must be planned, say a concentrated bleach should compete with Domestos. If this is the case, the pricing needs to be very accurate. How should it be introduced to the market? Let's say I want to distribute a commodity at a close price range to Domestos. Since the sales are low, I cannot afford a TV teaser for 5,000 to 10,000 boxes. So I need another market strategy. All these factors must be taken into account. The timing must be planned. We are doing executive work at the distribution company. The goods arrive in the company, they say, the concentrated bleach is here. The marketing agents are provided with the catalog. Now the situation is better. So the product must have a plan, that is, how can a typical distributor sell this product?"

Core products are often central to high performance. Products that satisfy the needs of consumers with less distribution difficulties have a greater chance of success. Due to its multiple brands, GIG is sometimes faced with inter-brand competition. Therefore, brand management is essential to avoid inter-brand competition and ensure that focus is placed on competing with other companies. In this regard, having a good brand portfolio is the key to higher performance. GIG has a lot of products, and thus it is very important to correctly weight their differential impacts on performance. Unfortunately, due to the lack of weighting systems, companies often target at profit maximization.

Interviewee 9 (distribution company):

"Do we need, say, 50 brands for a product? There is a product called bleach and cleaner. Another one is a detergent. In our group, we have 7 or 8 brands for this item. Is such a variety of brands necessary? These are the challenges we face. When no one accepts the responsibility for one or two brands, no distribution channels volunteer to sell them and they are forced onto one of the channels".

Consumer pricing should follow legal procedures established by the respective governmental agencies. Manufacturing companies distribute their products to discount chains, convenience stores, chain stores, and wholesalers by some distributor companies. Small retailers sell products at consumer price. Therefore, pricing by the manufacturing company should be done carefully to avoid losing a distribution channel. In some cases, inappropriate pricing may cause losing a channel, especially when prices in discount chains are much lower than in convenience stores. Under such conditions, the convenience stores, which account for nearly 70% of market share of GIG products, may switch to its competitors. Moreover, GIG should avoid price inconsistency that has a deleterious impact on brand image which, in turn, leads to losing wholesale market.

Interviewee 9 (distribution company):

"We are distributing edible oil with a well-known brand. Many people in this country know and use this brand, which has produced many leading and innovative products. The company had raised its brand awareness as a health product. We were easily selling the product until now. Now, the marketing agents visit shops only to get thrown out by shopkeepers who ask are we not entitled to 10% discount. Kourosh Stores are selling their products below your prices. This goes to show there is something wrong with the parent company's policy".

Effective advertisement that targets such markets should also be considered. After supplying convenience stores, promotions, discounts, and brand image are key factors in increasing purchase intention and motivating the selection of a brand. Distributors of products with lower market share may try to persuade convenience stores by offering special discounts. It is always a challenging consideration. Producers generally consider this extra discount as a cost and believe it negatively impacts on brand image in the long term, while distributors believe that discounts should be based on market competition. Nevertheless, effective advertisement and promotion are regarded as performance drivers.

Interviewee 3 (distribution company):

"Therefore, I expect the production company to provide a promotional plan on the sales process, the brand's competitive power, and similar information”.

Selecting the right channels is very important. Some manufacturers try to sell products through all distributors, which may harm GIG’s interests in the long run. Another important factor is choosing the right channel in case of product shortage. Due to abrupt changes which characterize the contemporary business environment in Iran, many companies may suffer from a lower production rate. Therefore, manufacturers try to sell more products through a direct marketing channel, such as their chain stores, instead of passing the product through several intermediaries (indirect channel) before it gets to the consumer’s hands. However, it seems that both the distributor companies and GIG are suffering from a lack of a comprehensive distribution framework in case of shortage.

Interviewee 9 (distribution company):

"We have no models in critical times to ask the managers how to allocate the goods to distribution units, so it is up to the individuals, based on no specific policies or models to help with the decision".

Interviewee 9 (distribution company):

"Is it really necessary to distribute every product via all channels? We have many distribution channels right now. We have almost all kinds of distribution channels, but is it really necessary to distribute all the products through all the distribution channels? What we do here is mostly playing it by ear, that is, first, we do something and then see if it's good or bad".

Theme 6

Managing organizational relationships. Honesty and trust were two organizational relationship performance drivers mentioned by interviewees. At a macro level, financial transparency builds up trust among managers by showing what they really do. On the other hand, at a micro level, when two marketing representatives negotiate with each other, they try to gain more for their companies. Sometimes, these negotiations lead to the prisoner's dilemma and the lack of clear information may harm both companies. Moreover, opaque procedures, the lack of sufficient authority, and unclear job descriptions for relationship liaison can hinder the performance of channels.

Interviewee 4 (distribution company):

"Someone comes and honestly says: our sales are at the break-even point, and I cannot afford to give you more discounts. Another one tries to be cunning and opportunistic, pretending in their organization that: I spoke with them and convinced them to pay more attention to this product. What happens then? We are working within one system and conglomerate, nothing remains hidden".

In case of substantive conflict, the use of coercive power by the channel captain can damage organizational relationships and cause frustration in other parties. Some marketing managers emphasized the necessity of a way to resolve disputes (arbitration) and make appropriate decisions based on mutual interests.

Heterogeneity of production and distribution sectors may create barriers to relationships. Most distribution companies promote their managers based on seniority. Contrary to the majority of managers in the production sector who are university educated, the majority of managers in distribution sectors start their careers as a marketing agent and are less likely to have pursued an academic education. Sales commission is a key policy in the distribution sector to earn compensation. Marketing managers in manufacturing companies may perceive compensation unfair as compared to their peers in distribution companies which, in turn, may hinder their performance.

Theme 7

Economics of relationships. Producer-distributor relationships should be based on mutual long-term benefits. In GIG, the mutual long-term benefits of both sectors have been guaranteed by making them common shareholders. However, the marketing managers in the production sector view payable margin and promotion to distributors as a cost and thus try to cut them as much as possible. On the other hand, distributors need these compensation policies to cover their costs and compete effectively. GIG has established distribution and production companies as separate entities to make them more efficient. Sometimes the board of directors ignores mutual long-term interests of both parties, which is essential for high performance, by putting too much pressure on profitability.

Interviewee 8 (producer company):

"People are not working in the spirit of common interests. If I provide them with accurate information, they will use it against me. Ignoring the fact that undermining me ultimately undermines them".

Theme 8

Managing personal issues in relationships. Good personal relationships can enhance performance. Breakfast meetings and playing games can improve personal relationships and facilitate personal interactions. Moreover, particular qualities, like attention to detail, respect for self and others, attention to sectoral heterogeneities, and avoidance of individualistic behaviors, can remove barriers to relationship performance.

Interviewee 1 (producer company):

"In improving our relationship, something interesting happened between us and the distribution company. We organized an event for the distribution staff in our department. They participated and our relation became closer, and we saw how much gamification and group activities beyond sales can bring people to a closer understanding".

The findings of this study are a first step towards the development of a new framework for enhancing multichannel marketing performance in the Iranian FMCG market. This paper provides managers and scholars with insights into real challenges facing marketing managers, aiming to improve channel performance in the Iranian FMCG market. Accordingly, GIG has designed different businesses as SBUs with common ownership while their independence and expected profitability are not undermined. In this context, it seems that GIG prefers supply chain ownership to the extent that maximum efficiency is achieved. The owner’s channel designs and management decisions should be consistent with the two dominant theoretical views in this domain, namely transaction cost theory and the resource-based perspective; a single theoretical view cannot address all channel performance drivers. Table 1 delineates which theoretical views explain the eight themes which emerged in this research.

| Table 1 Theoretical Basis of the Eight Emergent Themes | |||||

| Resource based view (RBV) | Transaction cost economics (TCE) | Commitment-trust view | Dependence view | Relational view | |

| Long term integrated policy of GIG | NO | NO | YES | YES | YES |

| Clear information system and inter-channel coordination | YES | YES | NO | NO | YES |

| Up to date market knowledge | YES | NO | NO | NO | NO |

| Human resource development | YES | NO | YES | NO | YES |

| Integrated marketing strategy | NO | NO | YES | NO | YES |

| Managing organizational relationships | YES | NO | YES | YES | YES |

| Economics of relationships | YES | YES | NO | YES | NO |

| Managing personal issues in relationships | NO | NO | YES | YES | YES |

Conclusion and Future Research

The present study extracted themes concerning inter-organizational performance drivers based on data collected from 15 in-depth interviews with marketing managers. Whilst data saturation appeared to be reached at the fifteenth interview, hence justifying the termination of the data collection phase, this study is not without its limitations. Since this is an exploratory research study with a focus on in-depth interviews (i.e., preferencing data depth rather than data breadth) this may affect the generalizability of the results. As such, there is ample scope for future research in this domain which could, for example, focus on a large-sample quantitative study of marketing channel performance pursuant of identifying findings which are amenable to generalization. Despite the importance of these preliminary findings regarding the enhancement of inter-organizational performance frameworks, development of a more robust model is required before wide application by marketers, particularly in contexts which are not cognate to the case-study used in this research. Whether and the extent to which the themes extracted in this research are exhaustive, representative, or case-specific could be explored in future studies in different industry and country contexts. Related to this, understanding commonalities and differences in themes between developing versus developed economies and traditional versus nascent industries also represents fruitful terrain for future research.

References

- Anderson, E. & Weitz, B. (1992). The use of pledges to build and sustain commitment in distribution channels. Journal of Marketing Research, 29(1), 18-34.

- Aronson, J. (1994). A pragmatic view of thematic analysis. Qualitative Report, 2, 1-3.

- Barney, J. (2001). Is the resource-based “view” a useful perspective for strategic management research? Yes. Academy of Management Review, 26(1), 41-56.

- Braun, V. & Clarke, V. (2006). Using thematic analysis in psychology. Qualitative Research in Psychology, 3, 77-101.

- Brown, J.R. & Dant, R.P. (2014). The role of e-commerce in multi-channel marketing strategy. in Martínez-López F. (Ed.), Handbook of Strategic e-Business Management, Progress in IS, Springer-Verlag Berlin Heidelberg, 467-487.

- Cannon, J.P., Achrol, R.S., & Gundlach, G.T. (2000). Contracts, norms, and plural form governance. Journal of the Academy of Marketing Science, 28(2), 180-194.

- Cao, Z. & Lumineau, F. (2015). Revisiting the interplay between contractual and relational governance: A qualitative and meta-analytic investigation. Journal of Operations Management, 33, 15-42.

- Chen, W.H. & Chiang, A.H. (2011). Network agility as a trigger for enhancing firm performance: A case study of a high-tech firm implementing the mixed channel strategy. Industrial Marketing Management, 40, 643-651.

- Chung, C. Chatterjee, S.C. & Sengupta, S. (2012). Manufacturers' reliance on channel intermediaries: Value drivers in the presence of a direct web channel. Industrial Marketing Management, 41, 40-53.

- Cyert, R.M. & March, J.G. (1963). A Behavioral Theory of the Firm, Prentice-Hall, Inc., Englewood Cliffs, NJ.

- El-Ansary, A. (1975). Determinants of power-dependence in the distribution channel. Journal of Retailing, 51(2), 59-94.

- Eyuboglu, N., Kabadayi, S., & Buja, A. (2017). Multiple channel complexity: Conceptualization and measurement. Industrial Marketing Management, 65, 194-205.

- Frazier, G.L. (1999). Organizing and managing channels of distribution. Journal of the Academy of Marketing Science, 27(2), 226-240.

- Frazier, G.L. & Antia, K.D. (1995). Exchange relationships and interfirm power in channels of distribution. Journal of the Academy of Marketing Science, 23, 321-326.

- Heide, J.B. (1994). Interorganizational governance in marketing channels. Journal of Marketing, 58(1), 71-85.

- Jackson, B. (1985). Winning and Keeping Industrial Customers. Lexington, MA, Lexington Books.

- Kaufmann, P.J. & Dant, R.P. (1992). The dimensions of commercial exchange. Marketing Letters, 3, 171-185.

- Kozlenkova, I.V., Samaha, S.A., & Palmatier, R.W.J. (2014). Resource-based theory in marketing. Journal of the Academy of Marketing Science, 42(1), 1-21.

- Krafft, M., Goetz, O., Mantrala, M., Sotgiu F., & Tillmanns, S. (2015). The evolution of marketing channel research domains and methodologies: An integrative review and future directions. Journal of Retailing, 91(4), 569-585.

- Kumar, N., Scheer, L.K. & Steenkamp, J.B.E. (1998). Interdependence, punitive capability and the reciprocation of punitive actions in channel relationships. Journal of Marketing Research, 35(2), 225-235.

- Leininger, M.M. (1985). Ethnography and ethnonursing: Models and modes of qualitative data analysis. in Leininger, M.M. (Ed.), Qualitative Research Methods in Nursing, Grune & Stratton, Orlando, FL, 33-72.

- Mason, J. (2002). Qualitative Researching, London, Sage Publications.

- Moorman, C., Zaltman, G. & Deshpandé, R. (1992). Relationships between providers and users of market research: The dynamics of trust within and between organizations. Journal of Marketing Research, 29(3), 314-328.

- Morgan, R. & Hunt, S. (1994). The commitment-trust theory of relationship marketing. Journal of Marketing, 58(3), 20-38.

- Miles, M.B., Huberman, A.M. & Saldaña, J. (2013). Qualitative Data Analysis: A Methods Sourcebook, Thousand Oaks, CA, Sage Publications.

- Palmatier, R.W., Dant, R.P., & Grewal, D. (2007). A comparative longitudinal analysis of theoretical perspectives of interorganizational relationship performance. Journal of Marketing, 71(4), 172-194.

- Palmatier, R.W., Houston, M.B., Dant, R.P. & Grewal, D. (2013). Relationship velocity: Toward a theory of relationship dynamics. Journal of Marketing, 77(1), 13-30.

- Pfeffer, J. & Salancik, G.R. (1978). The External Control of Organizations: A Resource Dependence Perspective. NY, Harper & Row Publications.

- Rindfleisch, A. & Heide, J.B. (1997). Transaction cost analysis: Past, present and future applications. Journal of Marketing, 61(4), 30-54.

- Simon, H.A. (1972). Theories of bounded rationality. Decision and Organization, 1(1), 161-176.

- Silverman, D. (2000). Doing Qualitative Research: A Practical Handbook. London, Sage Publications.

- Trada, S. & Goyal V. (2017). The dual effects of perceived unfairness on opportunism in channel relationships. Industrial Marketing Management, 64, 135-146.

- Valos, M.J., Polonsky, M., Geursen, G., & Zutshi, A. (2010). Marketers' perceptions of the implementation difficulties of multichannel marketing. Journal of Strategic Marketing, 18(5), 417-434.

- Wang, J. & Zhang, C. (2017). The impact of value congruence on marketing channel relationship, Industrial Marketing Management, 62, 118-127.

- Warwick, D.P. & Liniger, C.A. (1975). The Sample Survey: Theory and Practice, NY McGraw-Hill Publications.

- Watson, G.F., Worm, S., Palmatier, R.W., & Ganesan, S. (2015). The evolution of marketing channels: Trends and research directions. Journal of Retailing, 91 (4), 546-568.

- Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171-180.

- Williamson, O.E. (1975), Markets and Hierarchies: Analysis and Antitrust Implications, NY, The Free Press.

- Workman, J.P.J., Homburg, C., & Gruner, K. (1998). Marketing organization: An integrative framework of dimensions and determinants. Journal of Marketing Research, 62, 21-41.

- Yin, R.K. (2013). Case Study Research: Design and Methods, 5th edition. Thousand Oaks, CA, Sage Publications.