Research Article: 2022 Vol: 26 Issue: 2

Drivers of Sustainability and Financial Performance In Indian Automobile Sector: An Interpretive Structural Modelling based Approach

Mohit Saxena, Indian Institute of Foreign Trade (IIFT), New Delhi

Nitin Seth, Indian Institute of Foreign Trade (IIFT), New Delhi

Citation Information: Saxena, M., & Seth, N. (2022). Drivers of sustainability and financial performance in indian automobile sector: an interpretive structural modelling-based approach. Academy of Marketing Studies Journal, 26(2), 1-13.

Abstract

Managing sustainability implementation in the automotive environment and financial performance (FP) has always been an area of Interest for professionals & researchers. Accomplishing Sustainability Implementation in the automotive context is very difficult and seeks to consider the attention of suppliers, top management, dealers, government, regulators, and stakeholders. It is prudent that the Sustainability Implementation & FP is regularly assessed, supervised, and improved for gaining competitiveness & status for creating a point of differentiation. This paper tries to establish interrelationships among Sustainability Implementation & FP criteria by using an interpretive structural modelling-based approach for the Indian automotive industry. Three sustainable measures (09 sub-factors) and 03 financial performance factors have been evaluated. The insights gained through the present work have several practical implications for academia and practicing managers of the Indian automobile industry.

Keywords

Sustainability Implementation, Financial Performance, Automobile Sector, Interpretive Structural Modelling (ISM).

Introduction

There is a rapid increase in customer demand, shorter product life cycle and intense competition the sustainability and financial performance are the focus areas in Indian auto sector. The major reason for selecting the automobile sector is that India was the fourth largest auto market superseding Germany, with approximately 3.99 million units sold in the commercial and passenger vehicles segment. Indian automotive industry (including component manufacturing) is expected to reach Rs. 16.16-18.18 trillion (US$ 251.4-282.8 billion) by 2026 (Indian Brand Equity Foundation, 2020). The automotive industry has been under considerable pressure from governments and society to pursue a more sustainable model of growth. However, because of the growing sales of SUVs after 2015, carbon emissions started to rise. Rising environmental concerns have meant increased pressure from a variety of stakeholder groups like public – interest groups, investors, regulators, etc. (The Automotive Industry in the era of Sustainability, 2019). Sustainability is a significant conceptual framework collating economic, environmental, and social dimensions (Dempsey, et al., 2009) and the three pillars (TBL) are very much prevalent within the sustainability literature.

Financial performance reflects how the firm is accomplishing its financial/accounting objectives. The performance indicators will include standard indicators of performance for a business unit. From the literature review, it is determined that the common financial performance indicators are ROE, ROA, net profit, ROI, market share, productivity ratio, Free cash flow, Growth in sales, total cycle time, Gross Margin, Financial liquidity, and inventory turns. In this light, the paper aims to:

Determine the drivers of sustainability implementation and financial performance in the Indian automotive environment using the ISM approach.

Review of Literature

Automobile Sector in India: An Overview

Significant progress has been observed in the Indian automobile industry since its dawn. It has transitioned from just five players in 1982, to a more than 44 local and international manufacturers competing in the marketplace (Indian Brand Equity Foundation, 2020). A literature review is done to identify the drivers of sustainability and financial performance in the context of Indian automotive sector.

Sustainability Implementation (SI)

To establish sustainable supply chain practices, sustainable suppliers are a prerequisite. (Carter and Easton, 2011) And while selecting the supplier, it’s essential to have sustainability as one of the key criteria in addition to competitiveness, quality, and delivery, etc. Sourcing functions/organizations are more concerned with sustainability nowadays, to avoid any non-compliance in the process which may impact the business and its reputation (Koplin, et al. 2007). As per (Reuter, et al. 2010) sustainability is the tripartite pursuit of economic, ecological, and social performance, which (Elkington, 1998) called the “triple bottom line” of an organization. Thus, the term sustainability is a combination of social, environmental, and economic dimensions. These dimensions are widely used and accepted for sustainability implementation. The Global Reporting Initiative (GRI) is also based on these three pillars.

Sustainability practices differ according to business process complexities, organization structure, company size, level of business maturity, strategic planning, and stakeholder interests (mostly of the shareholders). “Firms that execute and implement sustainability, control their inclusion by delivering sustainability reports. Sustainability reports have increasingly expanded, with the most recognized report being the Global Reporting Initiative (GRI), utilized and acknowledged across the globe. There are no legal commitments in sustainability, so every firm utilizes its reporting model” Cioca, et al. (2019).

Financial Performance (FP)

In manufacturing industries, the economic dimension of sustainability is about is impacting the economic prosperity of the country & stakeholders (Butnariua & Avasilcai, 2015). All economic relations, including financial accounting related to standard indicators and intangible assets (that usually do not appear in financial reports) are covered in the economic dimension (Butnariua & Avasilcai, 2015) . “Moreover, there is no single indicators framework that focuses on all three sustainability dimensions equally” (Winroth, et al., 2016).

A firm’s business objectives cannot be solely meeting the shareholders' wishes but also to take care of supply chain partners and society at large.

“Firms that consider external stakeholders’ interests in the ethical decision may gain extraordinary returns if those decisions align with internal stakeholder interests” (Donaldson & Preston, 1995); (Freeman, et al. 2004). Various firms have started considering sustainable supply chains as an integral part of their process because sustainability implementation will be an effective catalyst for financial performance Carter & Rogers, (2008). A framework of sustainable supply chain management: moving toward new theory.

Methodology

The literature review resulted in the identification of 33 dimensions of sustainability implementation and 07 dimensions of financial performance.

Delphi technique was used which resulted in the finalization of 09 dimensions of sustainability implementation and 03 for financial performance specific to the automobile sector Table 1. These were subsequently used to develop the ISM model. The methodology specially focuses on the development of a structural model among effective sustainability and financial performance dimensions for the automobile sector using the ISM approach.

| Table 1 Sustainability and Financial Performance Dimensions For Automobile Sector: Results of Delphi Rounds | |||

| Dim.no. | Dimension | Description | Author (Year) |

| 1 | Energy | An organization can consume energy in various forms, such as fuel, electricity, heating, cooling, or steam. Energy can be self-generated or purchased from external sources and it can come from renewable sources (such as wind, hydro or solar) or from non-renewable sources (such as coal, petroleum or natural gas). | Rocio Ruiz- Benitez et al. (2019); Sibel Yildiz Cankaya et al. (2019); Rohit et al. (2018); Sara Perotti et al. (2012); Kenneth W. Green Jr et al. ( 2012) |

| 2 | Emission | Emissions into air, which are the discharge of substances from a source into the atmosphere. Types of emissions include greenhouse gas (GHG), ozone-depleting substances (ODS), and nitrogen oxides (NOX) and sulfur oxides (SOX), among other significant air emissions | Rocio Ruiz- Benitez et al. (2019); Sibel Yildiz Cankaya et al. (2019); Singh et al. (2018);Sara Perotti et al. (2012); Kenneth W. Green Jr et al. ( 2012) |

| 3 | Materials | The inputs used to manufacture and package an organization’s products and services can be non-renewable materials, such as minerals, metals, oil, gas, or coal; or renewable materials, such as wood or water. Both renewable and non-renewable materials can be composed of virgin or recycled input materials. | Helene Laurell et al. (2019); Rocio Ruiz- Benitez et al. (2019); Sibel Yildiz Cankaya et al. (2019); Singh et al., (2018); Sara Perotti et al. (2012); Kenneth W. Green Jr et al. ( 2012) |

| 4 | Child Labor | Abolishing child labor is a key principle and objective of major human rights instruments and legislation and is the subject of national legislation in almost all countries. Child labor is work that ‘deprives children of their childhood, their potential and their dignity, and that is harmful to their physical or mental development including by interfering with their education. Specifically, it means types of work that are not permitted for children below the relevant minimum age. | Joe Miemczyk et al. (2019); G4 Standard: GRI Standard |

| 5 | Occupational Health & Safety | Healthy and safe work conditions are recognized as a human right and addressed in authoritative intergovernmental instruments, including those of the International Labour Organization (ILO), the Organisation for Economic Co-operation and Development (OECD), and the World Health Organization (WHO). | Rocio Ruiz- Benitez et al. (2019); Sibel Yildiz Cankaya et al. (2019); Singh et al. (2018); Sara Peroti et al. (2012) |

| 6 | Labour& Management Relations | This covers an organization’s consultative practices with employees and their representatives, including its approach to communicating significant operational changes. An organization’s consultation practices are expected to be aligned with relevant international norms and standards. | Sibel Yildiz Cankaya et al. (2019); Singh et al. (2018); G4 Standard: GRI Standard |

| 7 | Market Presence | Its contribution to economic development in the local areas or communities where it operates. For example, this can include the organization’s approaches to remuneration or local hiring. | Fatima et al. (2019); Carlo Ferro et al. (2019); Sibel Yildiz Cankaya et al. (2019); G4 Standard: GRI Standard |

| 8 | Procurement Practice | This covers an organization’s support for local suppliers, or those owned by women or members of vulnerable groups. It also covers how the organization’s procurement practices (such as the lead times it gives to suppliers, or the purchasing prices it negotiates) cause or contribute to negative impacts in the supply chain. | Rocio Ruiz- Benitez et al. (2019); Sibel Yildiz Cankaya et al. (2019); Singh et al. (2018); sara perotti et al. (2012) G4 Standard: GRI Standard |

| 9 | Anti-Corruption | In this Standard, corruption is understood to include practices such as bribery, facilitation payments, fraud, extortion, collusion, and money laundering; the offer or receipt of gifts, loans, fees, rewards, or other advantages as an inducement to do something that is dishonest, illegal, or represents a breach of trust. It can also include practices such as embezzlement, trading in influence, abuse of function, illicit enrichment, concealment, and obstructing justice. | G4 Standard: GRI Standard |

| 10 | Sales Growth | Firms that have greater push to increase sales will generate future profits; this causes the desire to invest increases markedly. The increase of corporate investment activity will have a positive impact on firm performance. Can be calculated by (Sales for the current period- sales for the previous period) *100/sales for the previous period | Nufazil et al. (2019); Najul et al. (2018); Aradhana et al. (2017); Anthonny et al. ( 2013); Wai et al. (2011) |

| 11 | Return on Asset | ROA gives a quick indication of whether the business is continuing to earn an increasing profit on each dollar of investment. ROA= Net Income/ Total assets | Simona Fiandrino et al. (2019); Nufazil et al. (2019); Najul et al. (2018); Aradhana et al. (2017); Walker et al. (2016); Jin Su et al. (2012) |

| 12 | Return on equity | ROE shows the firm’s ability to turn equity investments into profits. To put it another way, it measures the profits made for each dollar from shareholders’ equity. ROE= Net Income/ Average Shareholder's Equity | Simona et al. (2019) Martin et al. (2011); Peter et al. ( 2007) |

The three-round Delphi approach was applied to determine sustainability elements and financial performance in the Indian automobile sector. This study comprised of a team of subject matter experts including senior level professionals from related domain and academicians.

The Delphi study was conducted online through video conferencing (Skype), with automotive specialists. 32 members were first given the list of sustainability elements which they were mentioned to fill. Subsequently, the detailed interview conducted with all 32 members to seek their opinion. Whenever more than half of the group members suggested to remove any measure/ sub- measure, the same was taken into consideration and changes were made accordingly. If experts recommend moving, reclassify or details around the elements/ sub- elements then the list was to be revised accordingly.

Developing an SSIM and Reachability Matrix

Based on the contextual relationship for each of the variables, questions on the existence of a relation between any two dimensions (i and j) and the related direction is done (Thakkar, et al. 2005); (Kumar & Raj, 2014). Four codes are employed to indicate the direction of association between the dimensions (i and j). (Barve, et al. 2008). These are:

“V dimension I will help to achieve dimension j

A dimension j will be achieved by dimension i

X dimension i and j will help to achieve each other

O dimensions i and j are unrelated.”

Depending on the contextual relationships, the SSIM is developed for the 12 dimensions as depicted in Table 2.

| Table 2 Ssim for The Automobile Sector | |||||||||||||

| Variable Number | |||||||||||||

| Dim.no. | Dimension | 12 | 11 | 10 | 9 | 8 | 7 | 6 | 5 | 4 | 3 | 2 | 1 |

| 1 | Energy | V | V | O | O | O | O | O | V | O | A | V | X |

| 2 | Emmision | O | O | O | O | A | O | V | X | O | A | X | |

| 3 | Materials | V | V | V | O | X | V | O | V | O | X | ||

| 4 | Child Labour | A | A | O | X | A | A | V | V | X | |||

| 5 | Occupational Health & Safety | V | V | O | O | A | O | V | X | ||||

| 6 | Labour & Management Relations | V | V | X | V | A | V | X | |||||

| 7 | Market Presence | V | V | V | O | V | X | ||||||

| 8 | Procurement Practice | V | V | V | A | X | |||||||

| 9 | Anti Corruption | V | V | V | X | ||||||||

| 10 | Sales Growth | V | V | X | |||||||||

| 11 | Return on Asset | X | X | ||||||||||

| 12 | Return on equity | X | |||||||||||

The SSIM is converted into an initial reachability matrix by replacing the symbols ‘V’, ‘A’, ‘X’ and ‘O’ by binary digits 1 and 0 as per the following principles (Barve, et al. 2008) (Garg, et al., 2011) : “

• if the (i, j) value in the SSIM is ‘V’, it makes the (i, j) value of the reachability matrix 1 while (j, i) value turns into 0

• if the (i, j) value in the SSIM is ‘A’, it makes the (i, j) value of the reachability matrix 0 while (j, i) value turns out to be 1

• if the (i, j) value in the SSIM is ‘X’, it makes the (i, j) value of the reachability matrix 1 while (j, i) value also becomes 1

• if the (i, j) value in the SSIM is ‘O’, it makes the (i, j) value of the reachability matrix 0 while (j, i) value to be converted into 0.”

Therefore, the initial reachability matrix for the 12 sustainability and financial performance drivers for the automobile sector is introduced using the previously mentioned rules as depicted in Table 3. The final reachability matrix which is obtained by incorporating the transitivities as stated in the ISM method. Additionally, it entails the driving power (DP) and dependence of each of the dimensions. The DP of a specific dimension is the overall number of dimensions (with itself) which it may help out to achieve while the dependence is the entire dimensions that may assist to attain it (Singh & Kant, 2008).

|

Table 3 Reachability Matrix of Sustainability and Financial Performance Drivers For Automobile

|

||||||||||||||

| Final Reachability Matrix

|

Variable Number

|

|||||||||||||

| Dim.no.

|

Dimension

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

9

|

10

|

11

|

12

|

Total

|

| 1

|

Energy

|

1

|

1

|

0

|

0

|

1

|

0

|

0

|

0

|

0

|

0

|

1

|

1

|

5

|

| 2

|

Emmision

|

0

|

1

|

0

|

0

|

1

|

1

|

0

|

0

|

0

|

0

|

*1

|

*1

|

5

|

| 3

|

Anti Corruption

|

1

|

1

|

1

|

*1

|

1

|

*1

|

1

|

1

|

0

|

1

|

1

|

1

|

11

|

| 4

|

Procurement Practice

|

0

|

0

|

0

|

1

|

1

|

1

|

0

|

0

|

1

|

0

|

*1

|

*1

|

6

|

| 5

|

Occupational Health & Safety

|

0

|

0

|

0

|

0

|

1

|

1

|

*1

|

0

|

0

|

0

|

1

|

1

|

5

|

| 6

|

Labour & Management Relations

|

0

|

0

|

0

|

0

|

0

|

1

|

1

|

0

|

1

|

1

|

1

|

1

|

6

|

| 7

|

Market Presence

|

0

|

0

|

0

|

1

|

0

|

0

|

1

|

1

|

*1

|

1

|

1

|

1

|

7

|

| 8

|

Child Labour

|

0

|

1

|

0

|

1

|

1

|

1

|

0

|

1

|

0

|

1

|

1

|

1

|

8

|

| 9

|

Materials

|

0

|

*1

|

0

|

*1

|

*1

|

0

|

*1

|

1

|

1

|

1

|

1

|

1

|

9

|

| 10

|

Sales Growth

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

1

|

1

|

1

|

3

|

| 11

|

Return on Asset

|

0

|

0

|

0

|

1

|

0

|

0

|

0

|

0

|

0

|

0

|

1

|

1

|

3

|

| 12

|

Return on equity

|

0

|

0

|

0

|

1

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

1

|

2

|

| Total

|

2

|

5

|

1

|

7

|

7

|

6

|

5

|

4

|

4

|

6

|

11

|

12

|

70/70

|

|

“Once the initial reachability matrix is transformed from SSIM for the automobile sector, the reachability set and antecedent set for every dimension are established. The reachability set for a given dimension comprises of the dimension itself and the other dimensions which it may facilitate to attain while the antecedent set consists of the dimension itself and the other dimensions which may aid in achieving it.” (Barve, et al. 2008) (Talib, et al. 2011)

Consequently, the intersection of these sets is identified for all the dimensions. The dimension for which the reachability and the intersection sets are identical is allocated as the top-level dimension in the ISM ladder as it would not help out any other dimension over its level.

The top-level element is removed from the listing of the remaining dimensions upon being known. Return on equity (dimension 12) is found at level I in the case of automobiles. Hence, it would be positioned at the top. It’s Iteration I for level partitions and this will be repeated till the levels of each dimension are located. The recognised levels assist in constructing the diagraph and the final model of ISM for the sustainability and financial performance in consideration. Table 4 elucidates the consolidated result of all the iterations for sustainability and financial performance effectiveness dimensions for the automobile sector to develop the ISM hierarchy.

| Table 4 Partitioning of Levels For The Automobile Sector | ||||

| Dim.no. | Reachability set | Antecedent Set | Intersection | Level |

| 1 | 1,2,5,11,12 | 1,3 | 1 | Level 4 |

| 2 | 2,5,6,11,12 | 1,2,3,8,9, | 2 | Level 4 |

| 3 | 1,2,3,4,5,6,7,8,10,11,12 | 3 | 3 | Level 4 |

| 4 | 4,5,6,9,11,12 | 3,4,7,8,9,11,12 | 4,9,11,12 | Level 6 |

| 5 | 5,6,7,11,12 | 1,2,3,4,5,8,9 | 5 | Level 4 |

| 6 | 6,7,9,10,11,12 | 2,3,4,5,6,8 | 6 | Level 4 |

| 7 | 4,7,8,9,10,11,12 | 3,5,6,7,9 | 7,9 | Level 7 |

| 8 | 2,4,5,6,8,10,11,12 | 3,7,8,9 | 8 | Level 4 |

| 9 | 2,4,5,7,8,9,10,11,12 | 4,6,7,9 | 4,7,9 | Level 5 |

| 10 | 10,11,12 | 3,6,7,8,9,10 | 10 | Level 3 |

| 11 | 4,11,12 | 1,2,3,4,5,6,7,8,9,10,11 | 4,11 | Level 2 |

| 12 | 4,12 | 1,2,3,4,5,6,7,8,9,10,11,12 | 4,12 | Level 1 |

Sectioning of reachability matrix through multiple iterations has led to the identification of the level of sustainability and firm performance effectiveness in the ISM hierarchy. “The structural model is to be formulated utilizing these level sections while ignoring the transitivities as stated in ISM.” (Thakkar, et al. 2005).

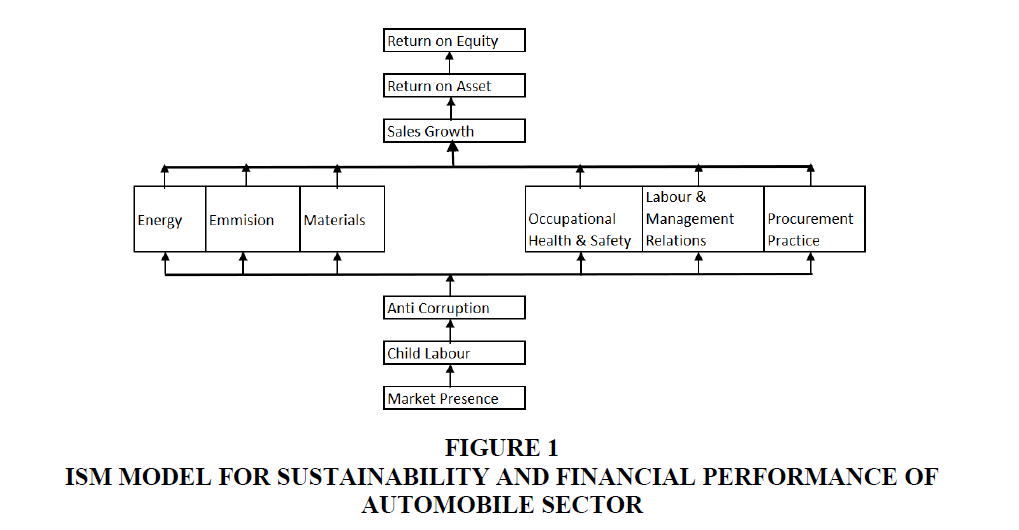

Figure 1 demonstrates the ISM model for the automobile sector which defines the interrelationships among various sustainability and financial performance dimensions.

MICMAC Analysis

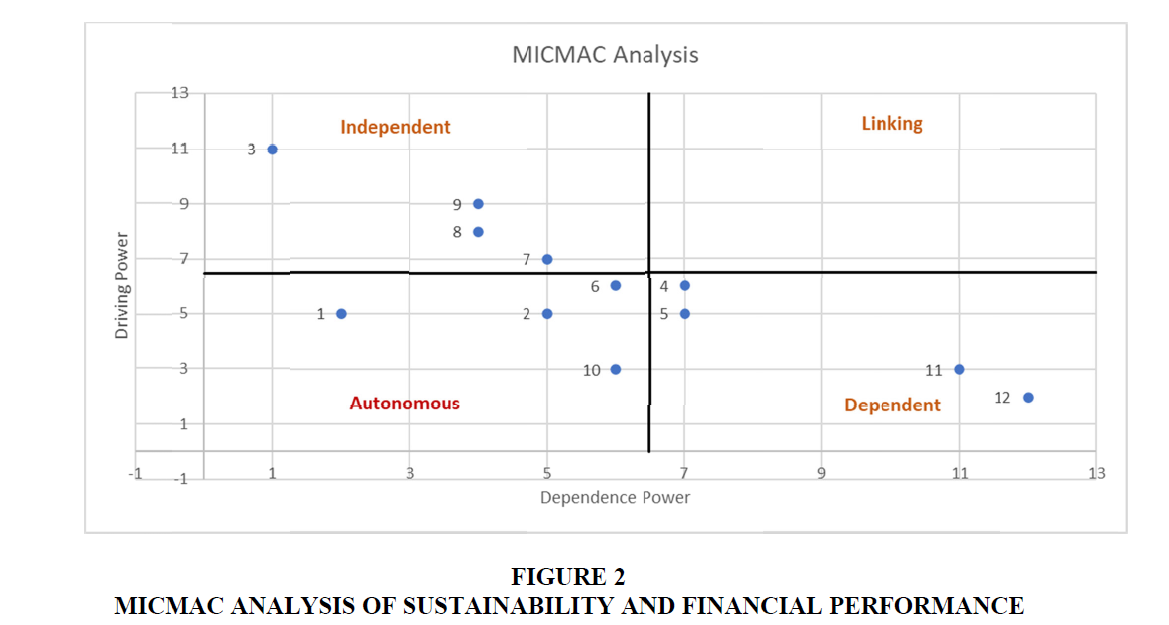

MICMAC analysis was implemented to analyze the driving power (DP) and dependence (d) of sustainability and financial performance for the automobile sector. According to (Barve, et al. 2008) drivers of sustainability and financial performance were categorized into four sets viz. autonomous measures (weak DP, weak d), dependent measures (weak DP, strong d), linkage measures (strong DP, strong d) and independent measures (strong DP, weak d) as illustrated in Figure 2. The DP and dependence (d) value for each of the 12 sustainability and firm performance measures are depicted in Table 5. It is evident from Figure 2 that none of the 12 measures for the automobile sector are linkage measures. These are unstable as any change occurring to them will affect other measures also (Barve, et al. 2008). Further, only four measures viz. Energy (D1), Emission (D2), Labour & Management Relations (D6), and Sales Growth (D10) are autonomous measures that are regarded as disconnected measures with relatively few links (Barve, et al. 2008). Measures such as Materials (D3), Market Presence (D7), Procurement Practice (D8) and Anti-Corruption (D9) are independent measures with strong driving power and weak dependence while Child Labour (D4), Occupational Health & Safety (D5), Return on Asset (D11) and Return on equity (D12) falls into the set of dependent measures with strong dependence and weak driving power as depicted in Figure 2.

| Table 5 Driving Power and Dependence For The Automobile Sector | ||||||||||||||

| Drving & Dependence Power | Variable Number | |||||||||||||

| Dim.no. | Dimension | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | Driving Power |

| 1 | Energy | 1 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 5 |

| 2 | Emmision | 0 | 1 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | *1 | *1 | 5 |

| 3 | Anti-Corruption | 1 | 1 | 1 | *1 | 1 | *1 | 1 | 1 | 0 | 1 | 1 | 1 | 11 |

| 4 | Procurement Practice | 0 | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 1 | 0 | *1 | *1 | 6 |

| 5 | Occupational Health & Safety | 0 | 0 | 0 | 0 | 1 | 1 | *1 | 0 | 0 | 0 | 1 | 1 | 5 |

| 6 | Labour & Management Relations | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 6 |

| 7 | Market Presence | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | *1 | 1 | 1 | 1 | 7 |

| 8 | Child Labour | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 1 | 0 | 1 | 1 | 1 | 8 |

| 9 | Materials | 0 | *1 | 0 | *1 | *1 | 0 | *1 | 1 | 1 | 1 | 1 | 1 | 9 |

| 10 | Sales Growth | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 3 |

| 11 | Return on Asset | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 3 |

| 12 | Return on equity | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 |

| Dependece Power | 2 | 5 | 1 | 7 | 7 | 6 | 5 | 4 | 4 | 6 | 11 | 12 | 70/70 | |

Results and Discussion

The resulted interpretive structural model Figure 1 elucidates the dimensional hierarchy through which sustainability implementation and better financial performance can be attained. Evidently, market presence has emerged as a significant dimension, with strong DP and low dependence (d) for automobiles and consequently, forms the base of the structural model. Market presence instigates child labor which successively instigates anti-corruption and is positioned accordingly in the ISM model. It appears logical because the Indian automobile sector's sustainability and financial performance are largely depending on these factors.

There are few factors at the next level which predominantly essential for sustainability practices like- Energy, Emission, Materials, Occupational Health & Safety, Labor & Management Relations, Procurement Practice.

In subsequent levels, all factors are affecting the financial performance of an organization like- Sales growth, Return on Asset, Return on Equity.

This study has multiple implications for academicians and research scholars as well as for practicing managers involved in sustainability implementation and financial performance management for automobile firms operating in India as explained in the following:

Implications for Academia

The study provides several noteworthy implications for academicians and research scholars exploring the domains of sustainability and financial performance. The present study has explored the subject in the backdrop of the automobile sector only. Similar research can be conducted for other sectors and geographies.

Implications for Practitioners in the Automobile Sector

The present study has numerous notable implications for sustainability implementation practitioners also involved in enhancing the financial performance of the automobile sector in India. The study resulted in the recognition of 09 sustainability and 03 financial performance dimensions. It proposes practicing managers to focus sustainability practices implementation and financial performance enhancement around these 12 specific dimensions only. ISM illustrates the hierarchy through which effectiveness can be achieved for sustainability and financial impact in the automobile sector. Professionals should concentrate on vital hierarchical aspects while planning and executing sustainability and buildup financial performance. The derived hierarchical model may be used as a strategic tool by the organizations involved in formulating effective sustainability practices and financial performance improvement strategies to create a responsible organization.

Conclusion

The prevailing business scenario in the Indian automobile sector is extremely complex and achieving competitive advantage (Mohapatra & Srivastava, 2012) is at the top priority for existing automobile players. An attempt has been made through the present study to identify drivers of sustainability practices and financial performance for the automobile in the Indian context with subsequent establishment of a hierarchal model using the ISM methodology. Researchers (Sharma, et al. 1995); (Puri, et al. 2010); (Thakkar, et al., 2005) frequently employed various modelling techniques in the context of diverse studies but this is rarely observed in the sustainability domain. Implementation of the Delphi technique reduced and refined varied measures to finalize 12 dimensions from an initial list of 40 dimensions for the automobile sector while ISM led to the establishment of interrelationships/linkages among these specific sustainability and financial performance drivers of the automobile in Indian scenario. MICMAC analysis categorized the recognised 12 drivers into four sets which helped to understand their relative importance. It is expected that present scholarly work will offer valuable insights to SCM practitioners and a novel direction for further exploration of the subject. The scope of the present work is limited to identify sustainability and financial dimensions for automobiles. This study is likely to provide support and direction to the researchers to explore the field of other product/service categories as well.

References

Barve, A., Kanda, A., & Shankar, R. (2008). Making 3PL effective in agile supply chains. International Journal of Logistics Systems and Management, 4(1), 40-69.

Indexed at, Google Scholar, Cross Ref

Butnariua, A., & Avasilcai, S. (2015). The Assessment of The Companies' Sustainable Development. Procedia Economics and Finance, 23, 1233-1238.

Carter, C., & Rogers, D. (2008). A framework of sustainable supply chain management: moving toward new theory. International Journal of Physical Distribution & Logistics Management, 38(5), 360-387.

Indexed at, Google Scholar, Cross Ref

Carter, C.R.; Easton, P.L. (2011). Sustainable supply chain management: evolution and future directions. International Journal of Physical Distribution & Logistics Management, 41(1), 46-62.

Cioca, L.I., Ivascu, L., Turi, A., Artene, A., & Gaman, G. A. (2019). Sustainable Development Model for the Automotive Industry. Sustainability, 11.

Dempsey, N., Bramley, G., Power, S., & Brown, C. (2009). The social dimension of sustainable development: Defining urban social sustainability. Sustainable Development, 19(5), 289-300.

Indexed at, Google Scholar, Cross Ref

Donaldson, T., & Preston, L. (1995). “The stakeholder theory of the corporation: concepts, evidence, and implications”, Academy of Management Review, 20(1), 65-91.

Indexed at, Google Scholar,Cross Ref

Elkington, J. (1998). Cannibals with Forks: The Triple Bottom Line of 21st-Century Business. Stony Creek, CT.: New Society Publishers.

Freeman, R., Wicks, A., & Parmar, B. (2004). Stakeholder theory and the corporate objective revisited”, Organization Science, 15(3), 364-369.

Indexed at, Google Scholar, Cross Ref

Indian Brand Equity Foundation. (2020). Retrieved February 16, 2021, from http//www.ibef.org/industry/india-automobiles.aspx

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar,Cross Ref

Indexed at, Google Scholar,Cross Ref

Indexed at, Google Scholar, Cross Ref

Indexed at, Google Scholar, Cross Ref

Singh, K.R., Modgil, S., & Anand, A. (2018). Identification And Evaluation Of Determinants Of Sustainable Manufacturing : A Case Of Indian Cement Manufacturing. Measuring Business Excellence.

Indexed at, Google Scholar, Cross Ref

Singh, M.D., & Kant, R. (2008). Knowledge management barriers: An interpretive structural modelling approach. International Journal of Management Science and Engineering Management, 3(2), 141-150.

Talib, F., Rahman, Z., & Qureshi, M. (2011). An interpretive structural modelling approach for modelling the practices of total quality management in service sector. International Journal of Modelling in Operations Management, 1(3), 223-250.

Thakkar, J., Deshmukh, S.G., Gupta, A.D., & Shankar, R. (2005). Selection of third-party logistics (3PL): A hybrid approach using interpretive structural modelling (ISM) and analytic network process (ANP). Supply Chain Forum: An International Journal, 6(1), 34–46.

Indexed at, Google Scholar, Cross Ref

The Automotive Industry in the era of Sustainability. (2019) Capgemini. Retrieved February 24, 2021, from https://www.capgemini.com/us-en/research/the-automotive-industry-in-the-era-of-sustainability/

Walker, H., & Jones, N. (2012). Sustainable supply chain management across the UK private sector. Supply Chain Management: An International Journal, 17(1), 15-28.

Indexed at, Google Scholar, Cross Ref

Winroth, M.P., Almström, P., & Andersson, C. (2016). Sustainable production indicators at factory level. Journal of Manufacturing Technology Management, 27, 842-873.

Indexed at, Google Scholar, Cross Ref

Received: 06-Jan-2022, Manuscript No. AMSJ-22-10938; Editor assigned: 08-Jan-2022, PreQC No. AMSJ-22-10938(PQ); Reviewed: 09-Jan-2022, QC No. AMSJ-22-10938; Revised: 14-Jan-2022, Manuscript No. AMSJ-22-10938(R); Published: 28-Jan-2022