Research Article: 2024 Vol: 28 Issue: 3S

Driving Growth in India's Fintech Sector: A Market Exploration

Varun Sharma, Indian Institute of Information Technology Lucknow

Neelu, Indian Institute of Information Technology Lucknow

Payoj Raj Singh, Vivek PG College, Jaipur

Citation Information: Sharma, V., Neelu, Singh, P.R. (2024). Driving growth in India’s fintech sector: a market exploration. Academy of Marketing Studies Journal, 28(S3), 1-15.

Abstract

Despite the fact that the question of how information technology and financial services interact is not new, a new acronym has emerged: fintech. After adopting FinTech in 2015, India's financial industry skyrocketed. It's the hottest topic in the financial world right now, and the newest development of Fintech, spearheaded by startups, presents problems for regulators and market players alike, most notably in striking a balance between the advantages of innovation and the hazards of new methods. As a result of fintech, banking as we know it has evolved. The term "FinTech" refers to the many recent technical advancements in the financial industry. The financial services industry is being revolutionised by fintech. Many people have spoken about it during the previous few decades (Thakor, A. V, 2019) Fintech, the widespread use and growth of IT in the financial sector, has recently risen to prominence in both the business world and the academic and research communities. The Indian financial technology industry is rapidly becoming one of the world's biggest and most influential. Indian FinTech businesses are on the right track, as shown by the country having one of the largest and most valuable digital payment ecosystems, rapid expansion of consumer and SME digital credit access, and skyrocketing involvement of retail investors in the stock market. Financial technology (FinTech) has the potential to radically alter the financial system, allowing for more efficient financial institutions to provide more customers with a wider range of goods at lower costs to them. To ensure that authorities and society can keep up with the underlying technical and entrepreneurial flux, FinTech's fast and revolutionary developments must be monitored and analysed. This article provides an exploration of the Indian fintech scene.

Keywords

FinTech Ecosystem, Financial Technology, Services, Digital Payments, Entrepreneurial Flux, etc.

Introduction

Since the Global Financial Crisis (GFC) of 2008, financial technology businesses, sometimes known as "FinTechs," have had a profound impact on the banking and financial industry. FinTechs have helped optimise costs, improve customer service, and broaden access to banking and finance in a number of ways, acting as both disruptive innovators and enabling intermediaries. Banking's key tasks of settling payments, completing maturity transformation, sharing risk, and allocating capital have been unbundled in large part because of the work of financial technology companies (Carney, 2019). FinTech is at the forefront of the innovative disruption brought about by the information and communications technology (ICT) revolution, sometimes called the fifth 'Technological Revolution' (Hendrikse et al., 2018). Since its inception, FinTech companies have expanded their operations to include not just crypto assets but also payments, insurance, equities, bonds, P2P lending, robo-advisors, regulatory technology, and support technologies Karakas, & Stamegna (2019).

Besides major banks, medium-sized banks like specialised banks, small finance banks, regional rural banks, and cooperative banks, India may soon have a fourth kind of financial institution: FinTech and digital players (Das, 2020). When this market share is fully realised, it has the potential to radically disrupt the current financial system, providing consumers with more affordable options while also allowing banks to become more efficient as a result of reduced overhead. India is now the world's third biggest FinTech ecosystem and the fastest-growing FinTech market (Mankotia, 2020). Today, we can conduct a wide range of financial transactions, including wire transfers, bill payments, online shopping, stock market trading, insurance policy purchases, and personal loan applications, all from the convenience of our own smartphones, and without ever having to interact with a bank employee in person. The potential digital payments industry in India is around $1 trillion (PIB, 2018). In 2019-2020, it processed a total of 3,435,000,000 digital payments.

FinTech's innovative, quick, and revolutionary developments to financial services need constant monitoring and evaluation so that regulators and society can keep up with the underlying technology and entrepreneurial flux. The regulatory community must be innovative, adaptable, and technologically aware in its approach. It's easier said than done, but they'll have to broaden their scope from entities to activities while also learning to evaluate the safety and efficacy of algorithms (Lagarde, 2017). This article aims to give a concise assessment of FinTechs, including their development, characteristics, and driving forces in order to facilitate conversation and understanding that may be relevant for policy and regulatory reasons. Sobering worries about the state of digital hygiene, data usage, and privacy arise from our analysis of the future of FinTechs.

Previous Studies

Mohanasundaram et al (2021) thought on the 5G Swell and Its Potential Impact on India's FinTech Industry. A new FinTech biological system is anticipated to emerge in India as a result of their research showing that 5G, the fifth-generation mobile network, has upended the whole FinTech perspective. 5G technology has the potential to dramatically alter the banking and financial sector in India. The authors of this study have taken a unique focus on FinTech to examine how 5G would affect the future of banking technology.

Shree et al (2021) figured out how things like customers' level of confidence in digital payment systems and their exposure to online fraud affect their target customers' propensity to make purchases on such platforms. Although a variety of factors, including gender, salary, and age, determine whether or not a given individual will choose to make use of these installment entries. Individuals' critical thinking skills and their willingness to put faith in FinTech's revolutionary advances also play critical roles. Their findings provide light on the rising importance of cash transactions in the economy as a whole. The results of this study have been presented in five categories: prior literature, information and system test summaries, experimental findings, conclusions, and recommendations.

Rajeswari and Vijai (2021) researching India's revolutionary financial technology industry, or FinTech. Their research report dissects the FinTech adoption rate, the FinTech news network, the Indian FinTech sector structure, and the FinTech trends in India, concluding that FinTech has displaced traditional financial institutions and is in the process of reshaping the global financial landscape. The test included a summary of the FinTech industry and the government's push to assist the sector. FinTech provides customers with more timely financial services and products. It is crucial for the Indian economy and the global economy that the FinTech industry continues to develop.

Shashidhar K.J (2020) Exploring Regulatory Sandboxes: Unlocking India's Attempt to Regulate Fintech Disruption. According to his research, technological developments are causing turbulence in the traditional financial sector, and the RBI's administrative sandbox approach is an effort to be more coordinated and absorb some of this disruption. His study evaluates the success and failure of his relatively new administrative system and apparatus by analysing the current state of administrative sandboxes in India. In addition, his report sheds light on the gap the company identifies as crucial and lays out projections for the future. When these factors are considered, it provides commentary on why controllers need other, more traditional tools of enabling growth.

Dwivedi (2020) research financial technology, or FinTech, an all-encompassing technological foundation for India's financial sector. The author of this article has explored FinTech inside the Indian Financial Ecosystem (IFES), focusing on the social, economic, Technical, and regulatory dynamics that have made FinTech an integral part of India's financial framework. The term "Financial Inclusion" was also a focal point of the author's work. The role that financial regulators and policymakers like those in India play in shaping the future of the country's burgeoning economy. Furthermore, the impact of two of FinTech's newest and most exciting technology subfields—Blockchain and AI—on the IFES is briefly discussed.

Priya and Anusha (2019) thought about Fintech's Problems and India's Potential Solutions. The essay begins by discussing the opportunities and challenges that financial innovations provide in the Indian corporate environment, before turning its attention to the fundamental types of financial innovations and their capabilities. In all areas of fiscal management, India is a hotbed for the development of innovative balancing Techs. The rapid ascent of India's balancing experts indicates the country's immense leadership potential. Approximately half of India's roughly 1,500 active FinTech startups have launched in the last two years. The best tech enterprises should be well equipped both practically and monetarily. It seems to reason that a sector dedicated to installment payments would be more conducive to the growth of innovative enterprises, and this assumption holds true across a range of financial sectors.

Kandpal and Mehrotra (2019) examined the impact of FinTech and digital financial services on India's effort to provide access to financial services for all citizens. Credit-only transactions are becoming more common as the market becomes more international and the financial sector develops. The credit-only system isn't only a need in the modern economy; it's a demand. By making adjustments to the financial display, the government, RBI, and banking institutions have made it clear that they want to ensure a steady growth of the economy through a robust BFSI. Large technological corporations are using improved methods, aided by the government, to reach out to the rural populace and educate them on the many monetary goods, ensuring that their hard-earned money is properly provided. In most cases, customers' comfort and familiarity with the established norms of the banking system would make them resistant to change. Until customers are satisfied with safety and security measures, new innovations will not bear fruit. Even while it's cheaper and easier than traditional methods, it still needs the right conditions to win over customers' trust.

Vijai (2019) predicted that his paper's primary emphasis would be on the prospects for and obstacles to the development of the FinTech industry in India. FinTech allows for safer and quicker online financial transactions. His study demonstrates how FinTech is reshaping the Indian financial services sector. The government of India actively supports the financial technology sector and innovative policies. The Indian economy benefits from FinTech because it is safer, quicker, more user-friendly, and cheaper than traditional methods of providing financial services.

Badruddin (2017) contemplated Methodology for Analyzing Fintech's Impact on Expanding Access to Financial Services She presented the idea of an exploratory paper, which is conceptual and relies on the supplementary material gleaned from other assets like diaries, books, websites, etc. The development of FinTech, she said, has not only lowered costs but also increased the amount of work put in and the number of new customers attracted by the Microfinance model. Her conclusion was that the future of FinTech is clear at this point in time. Although there are issues that are being ignored by this sector.

Guild (2017) Researched Financial Technology (FinTech), the state of the industry now, and its potential future. Also looked at the impact of technical progress and development on FinTech. Online money transfer platforms in countries like India and Kenya are instances of FinTech developments. The main focus of his study is on the role that regulatory frameworks play in facilitating the introduction of FinTech to the financial systems of emerging countries like India and China, where it has benefited millions of people. He concluded that FinTech may undergo a revolutionary change if technology were to be applied to it, making it more democratic, decentralized, and accessible to more people. In his last remarks, he warned that the policy aim of increased access to finance may not be achieved if the market is shaped by force via legislative and regulatory intervention.

Yoon et al (2016) used ad hoc research techniques, including multiple linear regression analysis, to examine user habits while consulting for fintech firms. Using this strategy, we were able to examine the independent effect of each independent variable on the dependent variables, which was a significant benefit. According to their research, the results for the dependent variables varied by country since consumers from different nations had diverse cultural backgrounds and social norms. Consequently, organizations seeking to enter the global market need to develop specific plans for entering each target market and expanding their customer base inside each target area.

Leading Countries for Fintech Adoption

Among the world's emerging FinTech markets, India is one of the most promising. With only China ahead of it, India has the greatest adoption rate of any country in the world for financial technologies. With a 2019 value of $65 billion, digital payments are projected to expand at a CAGR of 20% through 2023 (https://www.investindia.gov.in) Table 1.

| Table 1 Leading Countries for Fintech Adoption | ||||

| Countries | Banking and payments | Financial management | Financing | Insurance |

| U.K. | 41% | 37% | 34% | 24% |

| South Africa | 47% | 43% | 34% | 26% |

| Mexico | 49% | 36% | 31% | 23% |

| U.S. | 52% | 49% | 41% | 31% |

| China | 92% | 91% | 89% | 62% |

| Total | 56% | 51% | 46% | 33% |

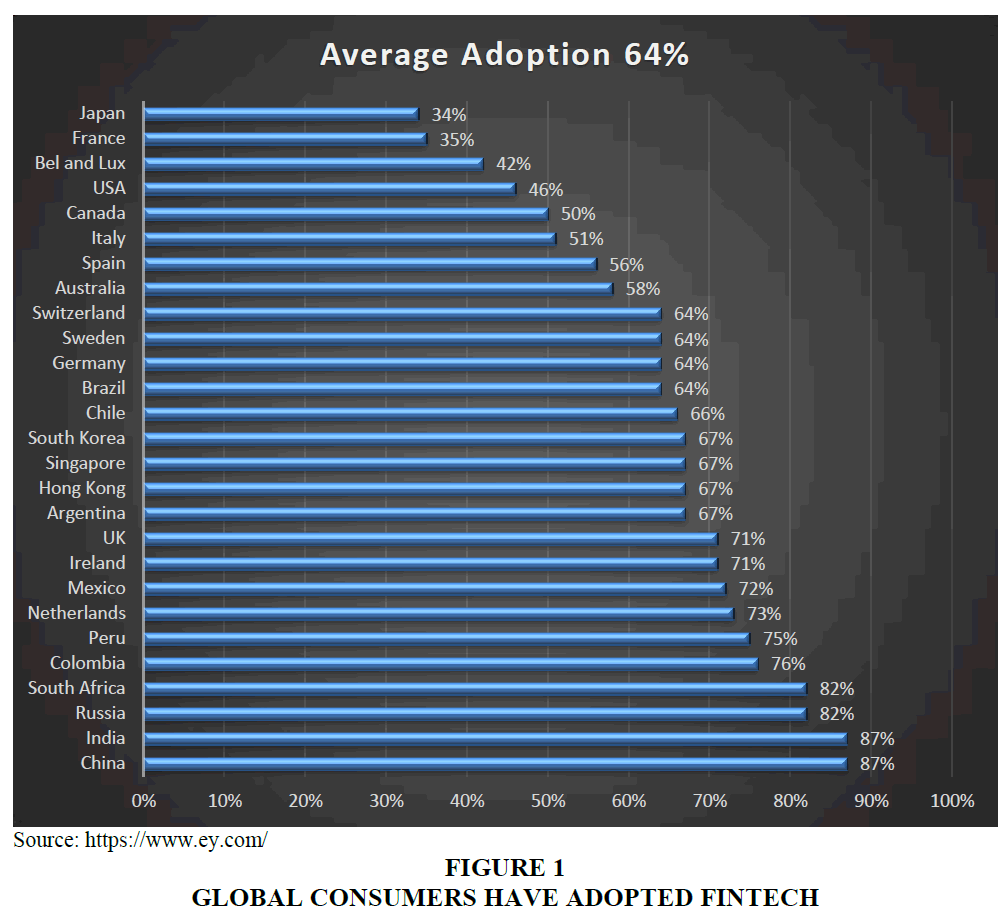

Across all markets assessed, 64% of consumers are using some form of FinTech (Figures 1-7). This number reflects a continuous upward trend over the past five years when compared to adoption rates in 2015 and 2017 across prior polls. Adoption rates increased by about 100% per two years in the six areas examined within this time span, from 16% in 2015 to 31% in 2017 to 60% in 2019 (Hatch, 2019).

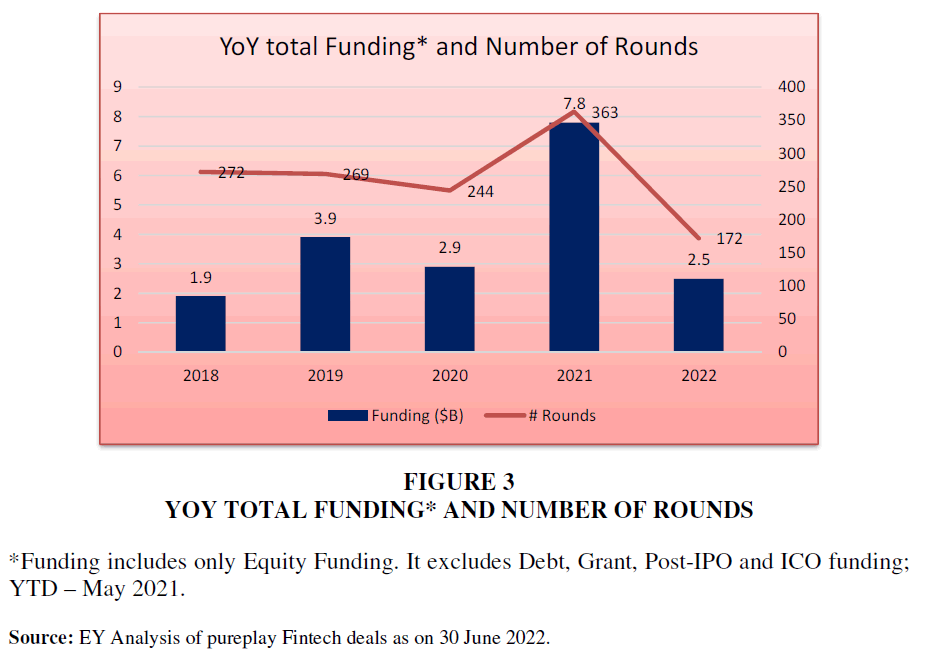

Figure 3 YOY Total Funding* and Number of Rounds

*Funding includes only Equity Funding. It excludes Debt, Grant, Post-IPO and ICO funding; YTD – May 2021.

Source: EY Analysis of pureplay Fintech deals as on 30 June 2022.

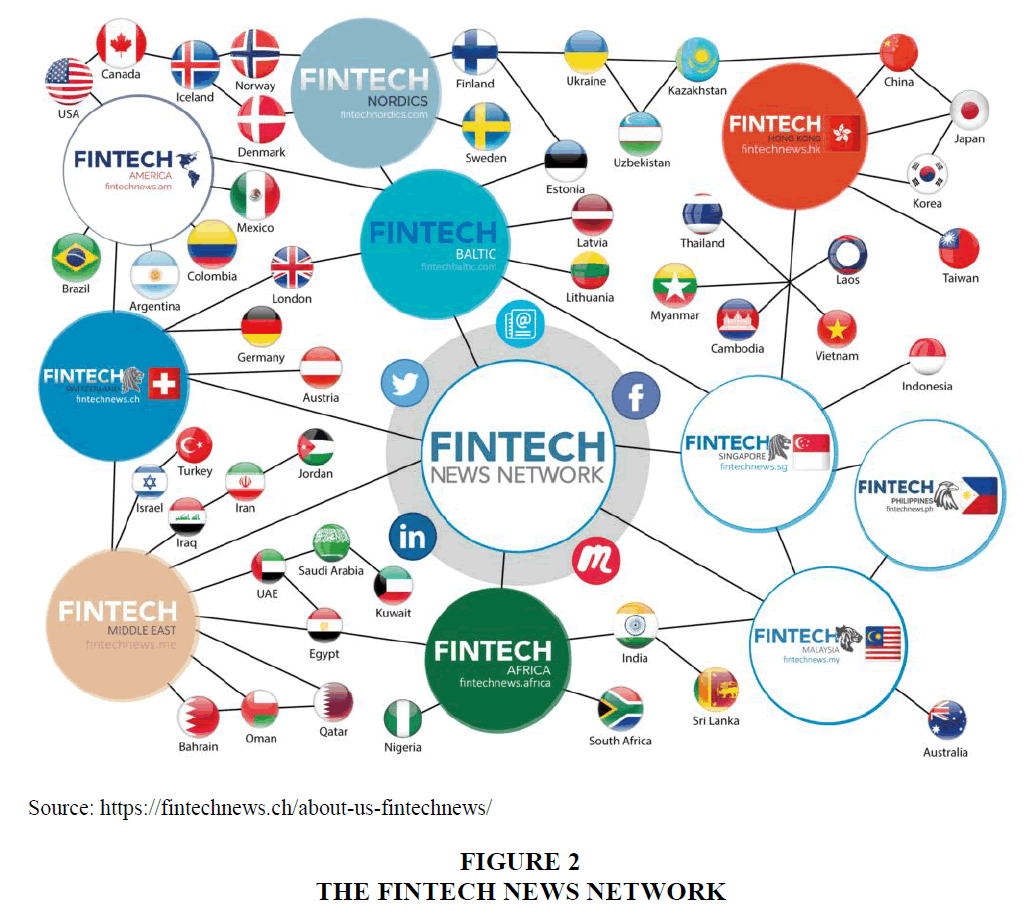

The Fintech News Network was established in 2015, and its staff works tirelessly to provide its readers with content related to the rapidly growing field of fintech. This includes news and information about upcoming events and webinars, insightful commentary from leading figures in the digital finance industry, in-depth examinations of specific fintech applications, and more. (https://fintechnews.ch/about-us-fintechnews/)

Fintech In 2022

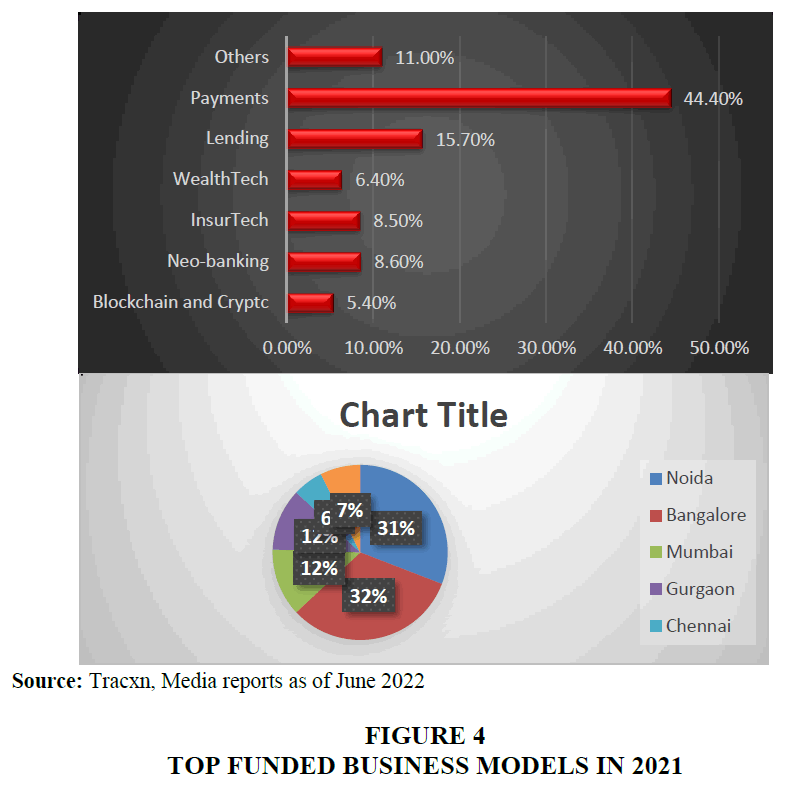

Embedded finance, PayTech, increasing online shopping, InsurTech, and Wealthtech are five of the most significant new developments in the field of financial technology. Every facet of financial services is being impacted by embedded solutions, from payments to investments to loans. E-commerce transactions, both small and big, have benefited greatly from the advent of digital payment processing, which has opened up new consumer bases and international marketplaces. FinTech companies (including Visa, Klarna, and PayPal) are making significant contributions to expanding the global banking system, from mobile money to services like BNPL, cross-border transactions, mobile wallets, and payment orchestration. By developing risk-free underwriting, instant purchase, activation, and claims processing, InsurTech and IT entrepreneurs are helping to guarantee that the vast majority of people have access to insurance. Equity and alternative investments are becoming more accessible to regular investors because to advancements in wealth technology. Super Applications and similar solutions and services have emerged as a consequence of the trend away from single-function apps. Lyft is one example of a business that provides transportation, but others include online shopping, food delivery services (like DoorDash), banking, entertainment, and more. In 2022, fintech businesses are expected to further increase their use of AI and machine learning in areas ranging from conventional banks' deployment of 'robo-advisors' to sophisticated algorithms' assessments of a credit applicant's risk. India's financial technology industry has expanded rapidly in recent years, making it one of the world's most dynamic and dynamic marketplaces for this sector. Ahead of the rest of the Asia-Pacific (APAC) region, India led in FinTech investments in 2020, and it continued to pull ahead the following year, raising $7.8 billion.

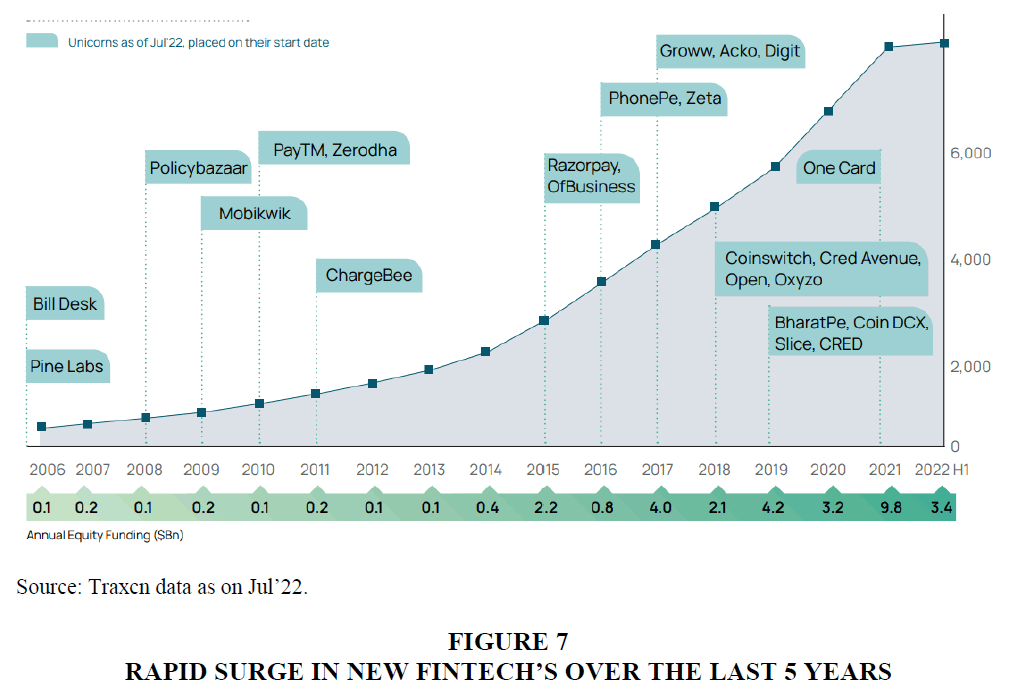

In 2021, the largest increase in investment for Asian and Pacific FinTech startups came from Southeast Asia. In 2021, FinTech firms in Southeast Asia raised $4.70 billion over 217 agreements, up from $1.13 billion across 118 deals the year before. Using this data as a lens, we can see that the private capital obtained by FinTech in the Asia-Pacific region more than quadrupled from $5.87 billion in 2020 to $15.69 billion in 2021. Despite the fact that this expansion followed a year of rather slow fundraising activity, 2020, the 2021 number still marked a 74% increase over 2019's pre-pandemic levels. Similarly, the amount of deals followed a similar pattern. A rise of 81% in 2020 and 49% in 2019 led to a total of 754 agreements closed by Asia Pacific FinTech businesses last year5. Tracxn data suggests that as of July 2022, India has more than 7,300 active FinTech firms; this figure does not include companies that have been bought or have since died. Some of these companies have just recently been established and are still in the prototype phase of developing their first goods. About $30.2 billion will have been invested in FinTech by June 2022, with 35% of that sum coming in the last sixteen months. The total amount invested in FinTech in 2021 skyrocketed to $7.8 billion. FinTech financing dropped by 26.7% in early 2020, to $2.9 billion.

There was a precipitous drop in equity FinTech financing in the first half of 2022. Excluding debt, Grant, Post-IPO and ICO financing, and corporate minority/majority rounds, total FinTech capital raised as of 30 June 2022 was $2.47 billion. Investor confidence in the future exit possibilities of big FinTech businesses may have been dented by a number of issues, including macroeconomic and geopolitical events such as the Ukraine crisis, a rise in inflation, and lacklustre financial and public market performance.

In June 2022, India was home to over a hundred unicorns, the pinnacle of business success, and about one-fourth of these successful firms were in the FinTech sector. However, there is a lot of space for improvement when compared to the worldwide pool of FinTech unicorns, to which India contributes just around 7%. The scale of the market suggests more offerings.

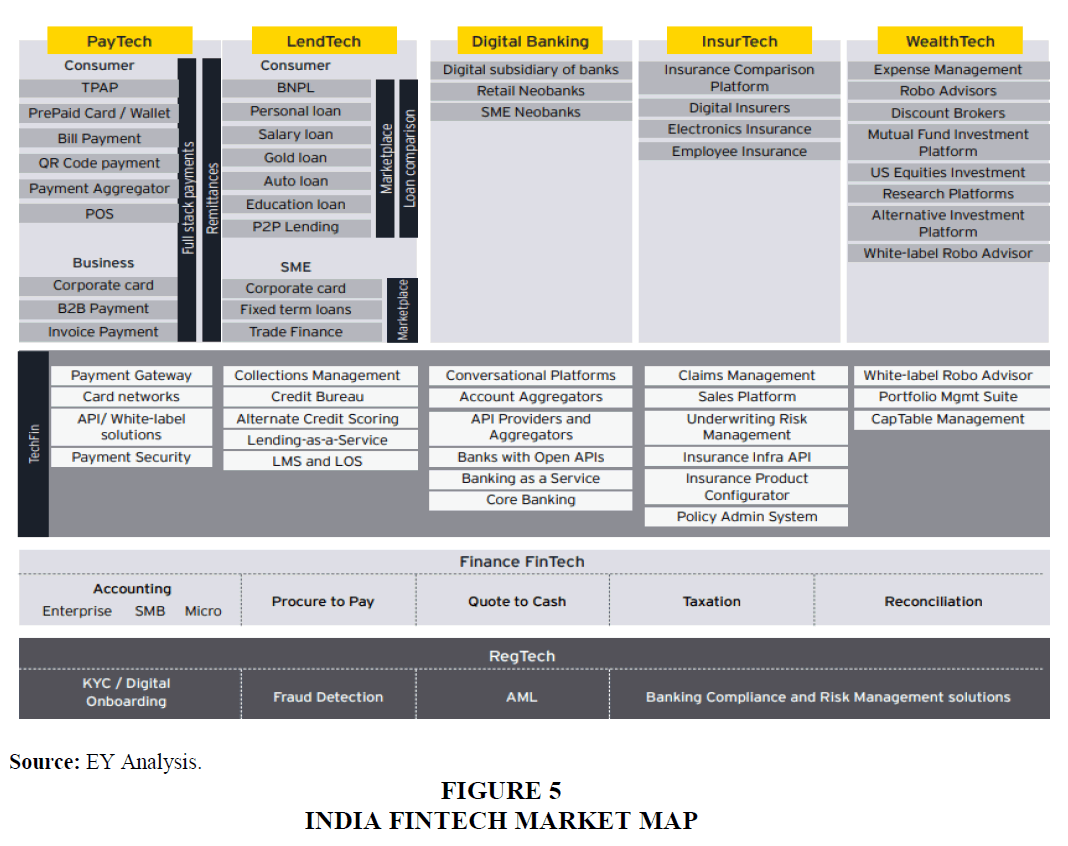

This paper provides a thorough examination of significant subsets of the FinTech industry with the goal of identifying growth, potential, and difficulties. Indicative of India's expansive and varied FinTech environment is the following:

Dark Side of Fintech

Some might even see fintech as a moral force. Startups in the financial technology sector have developed innovative solutions to pressing challenges, such as payment applications that make it easy and cheap for distant country labourers to receive remittances from faraway cities. Crowdfunded lending to SMEs, for instance, covers a funding vacuum and increases cash flows (Tok, Tan, and Chansriniyom., 2020), therefore these payments and FinTech lending services are perceived to make up for a shortcoming in the conventional supply of financial services. Researchers and authorities are becoming aware of the "dark side of Fintech" and the pressing need to address it as digital financial services grow more pervasive and popular.

The "dark side" of Fintech refers to what? It's primarily concerned with the marginalization of many demographics, including women, the elderly, the poor, and people of color. Other examples of the "dark side" that negatively affect marginalized populations include algorithmic prejudice and predatory lending. There is a greater chance of the "evil side" expanding as a result of the epidemic hastened transition to digital financial services. Those lacking the means to receive government assistance in the form of government-to-person (G2P) payments, for instance, are left out of the programme. Americans have a 93% success rate in opening a bank account, yet there is still a 13% gap between the wealthiest and the poorest households. A lack of trust in algorithms, insufficient financial and digital literacy, a lack of access to digital infrastructure like mobile phones, computers, or the internet, and/or the existence of potential biases in these algorithms are all possible causes of financial exclusion.

Women are statistically less likely to create bank accounts, manage household finances, or participate in the stock market than men are (Demirguc-Kunt et al., 2017). (Ke, 2020). Sahay et al. (2020) found that while Fintech has helped decrease gender gaps in financial inclusion in most countries, there is concern that the gap may widen in the post-COVID era. This conclusion was supported by the results of stakeholder interviews, which showed that these individuals were aware that Fintech does not address barriers like cultural or social norms, financial and digital literacy, safety, or the disparity in access to resources, all of which are exacerbated for women.

Concerns about the accuracy and impartiality of data and algorithms used in credit scoring have been highlighted in a number of recent academic publications, highlighting potential discrimination against people of color, those with lower incomes, and women. Credit card default prediction algorithms tend to favor higher income, Caucasian borrowers (Heaven 2021). The inaccuracy of the forecasts is mostly attributable to the background noise in the data. Even if the algorithm was fairer, the problem would still exist. Another analysis of mortgage data reached a similar conclusion, stating that differences in mortgage approvals between minority and majority groups cannot be attributed solely to bias but also to the fact that minority and low-income groups have less data, which in turn leads to less precise predictions. Inequality results from a combination of bias and imprecision, as discussed by (Modi, A.) (n.d.). Furthermore, any algorithm that uses data with any correlation to gender has the risk of being biased against women, regardless of whether or not the algorithm itself is designed to be gender-blind. In a similar vein, they demonstrated that eliminating protected traits like race did not ameliorate the issue of discrimination. Thus, she said, fair lending policies should adopt a more outcome- and welfare-oriented stance.

Fintech Regulation

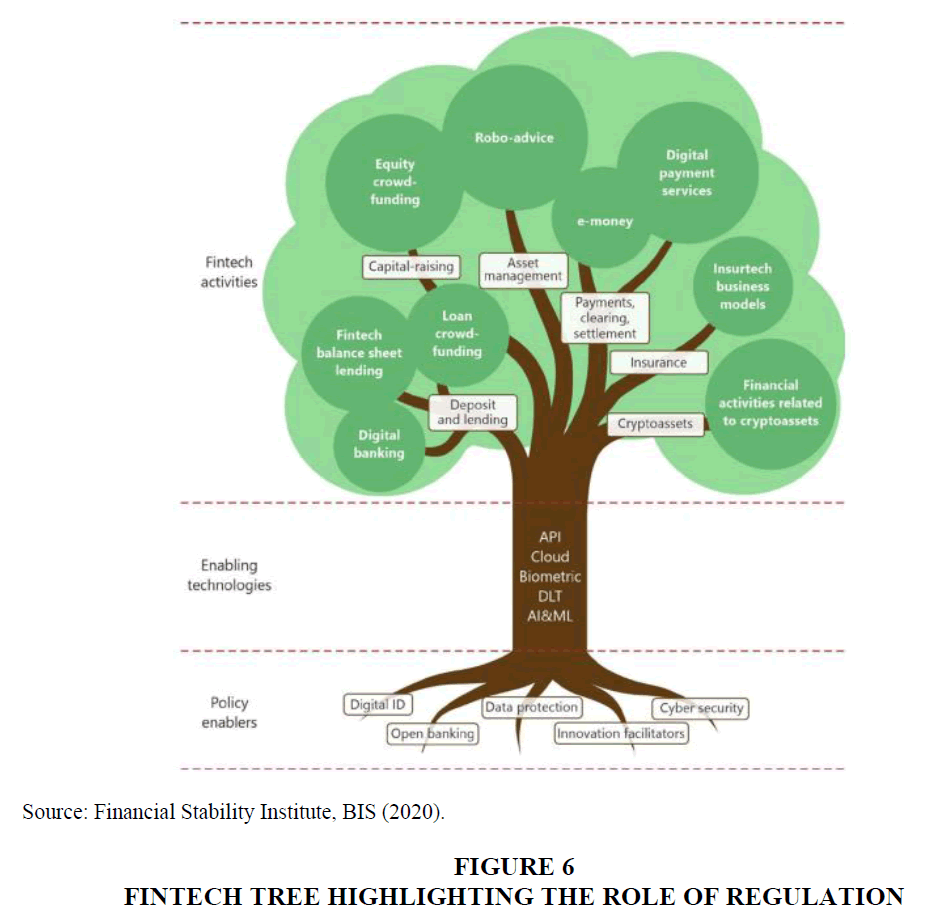

In this way, advances in financial technology may be seen as both helpful and harmful. These developments can have positive outcomes, but they also often amplify dangers that customers already face, such as the possibility of privacy breaches and cybersecurity concerns, and they also leave behind consumers who are digitally illiterate and disconnected. Accordingly, although the need of regulation for the financial system is generally accepted, it takes on an even larger significance for more recent developments like FinTech. The implications of FinTech for financial stability and monetary policy are what really pique the attention of central banks, although this interest goes beyond the sector's immediate relevance. Like a tree's roots that sustain it, the regulatory framework offers a sturdy base upon which FinTech may thrive (Figure 6).

The Bank for International Settlements (BIS) commissioned survey-based research to synthesize the reactions of regulators throughout the globe to fast growing FinTech (Ehrentraud et al., 2020). Despite the prevalence of digital payments and crowdfunding, most of the studied countries lacked a specific legal structure for FinTech loans. Generally speaking, the current insurance requirements were seen to be adequate. However, several countries who responded observed the introduction of crypto-specific permits in addition to the more frequent regulatory reactions of warnings and explanations about crypto-assets. In order to accommodate new forms of technology, most governing bodies revised preexisting regulations to include sector-specific technological considerations. APIs, cloud computing, and biometric identification have all been areas where regulators have been very busy. As more and more FinTech solutions depend on cloud computing, this technology is gaining increasing significance in the broader financial infrastructure. Some future software may eventually be made accessible only through cloud-based services. In these circumstances, central banks may choose to build cloud services in-house or work with several vendors. Some governments have issued regulations on cloud computing; the European Banking Authority, for instance, has released rules for cloud outsourcing, while the US Federal Reserve has conducted on-site inspections of Amazon's cloud facilities (King, 2019). However, regulatory action concerning A.I./ML/DLT has been restricted to risk evaluations and the issue of broad guidelines.

Because of FinTech's rapid rise to prominence, financial authorities must deal with a whole new set of difficulties never before encountered. The new forms that these businesses take make it difficult to classify them for purposes of prudential or risk-based regulation. As the scale of operations expands from the national to the global, so too must the reach of regulation. Furthermore, if conventional banks become less pivotal to the financial system, central banks may need more counterparties to their activities in the money markets to effectively transmit monetary policy (Lagarde, 2017).

Evolution of the Fintech Ecosystem in India

The demonetization of 500- and 1000-rupee notes in 2016 marked the beginning of the true tale of Fintech in India (Ashwini 2020). The economy was mostly conducted in cash until 2016, despite the presence of a small number of fintech firms. A number of new firms joined India's fintech market after demonetization. At first, many consumers were hesitant to switch over to cashless payment and transaction systems (Adithya, 2019). Since physical currency had disappeared from circulation, people felt obligated to resort to digital methods of exchange. But soon after, the public at large began to see the benefits of digital transactions, including their ease, security, and adaptability. Unique Payment Interphase (UPI) is a new payment system that has completely altered the financial landscape in the nation.

The foundation laid over the last decade in India for the development of key enablers is where FinTech has its origins. The current state of the Indian FinTech sector is the consequence of a unique brew of factors, some of which are exclusive to India, such as technology enablers, regulatory interventions, commercial prospects, and other factors. The Reserve Bank, as a payment system regulator, has taken several steps to improve the effectiveness and reliability of payment systems and to make them more available to those who have not previously had access to them. The four pillars of competition, cost, convenience, and confidence are the cornerstones of Reserve Bank's Vision 2021 to realise this (Uniyal 2020).

There are a number of ways in which India's B2B payment environment might be transformed by FinTech enterprises.

1. Soft charges and paper check processing fees may be avoided with the use of a digital payment platform, resulting to financial savings.

2. Commercial and virtual cards: the automated systems may aid in saving time with digital onboarding of customers and suppliers, salary and reimbursement deduction, tax filings and refunds, and much more.

3. Transactions may be verified instantly using blockchain-based payment systems.

4. Feature-rich platforms may be built by businesses, and FinTech firms can help with that by providing specialized options.

5. Payables and receivables should be computerized and streamlined.

In a short amount of time, a digital payment system that was formerly relatively unheard of has become a significant economic force. In the space of less than 5 years, several new fintech services have evolved, including digital lending, online KYC, digital insurance, digital microfinance, buy-now-pay-later, and banks with no physical offices. As of 2021, the Indian financial technology market was worth $50 billion, but projections show that it would more than double to $150 billion by 2025. Today, the nation is home to more than 6,000 fintech startups, each of which offers a different set of financial products and services. India has a far greater rate of acceptance of financial technology than the rest of the world, with an estimated 87% adoption rate. The fact that the resistant-to-change conventional banking sector is being compelled to incorporate digital technology shows the fintech industry's strength. Many established financial institutions are teaming up with new financial technology companies.

Future of Fintech in India

The advent of modern financial technologies like internet banking, automated teller machines, credit cards, extended payment plans, the internet, and many more, has ushered in a new era of revolutionary transformation. Due to the country's antiquated banking infrastructure, India's fintech sector has seen a dramatic transformation in recent years (Singh, 2020). Around $8 billion has been invested in the fintech industry in the nation thus far. India has the third-largest fintech ecosystem in the world because to its high adoption rate of 87%, which is much above the global average of 64. Over the course of the last five years, over 1,400 new businesses have been launched in India (Wilson, 2020).

As a result of the fast digitalization of India's metropolitan centres, a new fintech industry has emerged. India's fintech sector is thriving because to the country's openness to new technologies and its expanding number of specialised enterprises (YS, 2017).

Researches have worked out why India is the future of Fintech by analysing certain static data and using a prominent Indian fintech startup (Paytm) as an example.

1. The value of Fintech transactions is projected to increase from $66 billion in 2019 to $138 billion in 2023.

2. The number of Indian startups with a valuation of over $1 billion (known as "Unicorn Status") is reportedly over 17, with the majority of them being Fintech companies.

Conclusion

According to the Fintech India Expo (https://www.fintechindiaexpo.com), "FinTech is the new financial industry that applies technology and innovation to deliver financial services using new applications, processes, products, or business models offered as complete, end-to-end processes via the Internet." Indian fintech firms benefit greatly from the country's booming young population. The percentage of people who own a smartphone is also expected to rise, from 53% in 2014 to 64% in 2018. Over 80% of transactions in India are conducted in cash, and 40% of the population has no affiliation with any bank, therefore there is a huge untapped market for financial services in the country. With this, Fintech startups may rapidly expand into other markets (https://www.makeinindia.com/). Financial inclusion is crucial to a country's economic development, making fintech a crucial component of the financial sector's future. When it comes to money, the financial services industry is being revolutionized by fintech. Fintech refers to new methods and technologies in the financial sector. With fintech, banking, shopping, transferring money, receiving payments, and saving time are all instantaneous, convenient, and easy to use. The advantages of financial technology extend to both customers and companies. The government of India launched the Unified Payments Interface (UPI), and its companion app, BHIM, has since garnered millions of users in India. In conclusion, this research offered an outline of the Indian Fintech Industry and government actions supporting the sector. The results they've achieved in the present. As a result of advancements in fintech, customers may have their money and banking needs met much more quickly. As a result, progress in the fintech sector is essential for the economies of both India and the rest of the world. Future financial sector technology developments in fintech.

References

Adithya, S. (2019). India Is Quite a Different FinTech Market: Great for Consumers and Very Trying for Startups. Retrieved from https://gomedici.com/india-is-a-different-fintech-market-great-forconsumers-and-very-trying-for-startups/

Ashwini. (2020). Top 20 FinTech Startups of India: Fintech Companies in India. Retrieved from https://startuptalky.com/fintech-startups-in-india/

Badruddin, A. (2017). Conceptualization of the effectiveness of Fintech in financial inclusion. International Journal of Engineering Technology Science and Research, 4(7), 960-965.

Carney, M. (2019). Enabling the FinTech Transformation: Revolution, Restoration or Reform?. BIS Central Bankers, Speeches.

Das, K. A. by M., & Tech, at F. (n.d.). Shaktikanta Das: Opportunities and challenges of FinTech. Retrieved 16 October 2022, from https://www.bis.org/review/r190325a.pdf

Deb, J., & Maity, S. (2022). Digital Density Escalates Cost-efficiency of Indian Commercial Banks: Myth or Reality? A Non-parametric DEA Approach. Vision, 09722629221096792.

Indexed at, Google Scholar, Cross Ref

Demirguc-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2018). The Global Findex Database 2017: Measuring financial inclusion and the fintech revolution. World Bank Publications.

Dwivedi, R. K. (2020). FinTech-An inclusive technological framework for the Indian Financial Ecosystem. Journal of Critical Reviews, 7(11), 3797-3805.

Ehrentraud, J., Ocampo, D. G., Garzoni, L., & Piccolo, M. (2020). Policy responses to fintech: a cross country overview.

Guild, J. (2017). Fintech and the Future of Finance. Asian Journal of Public Affairs, 17-20.

Heaven, W. D. (2022). Bias isn’t the only problem with credit scores—And no, AI can’t help. Ethics of Data and Analytics: Concepts and Cases, 300.

Hendrikse, R., Bassens, D., & Van Meeteren, M. (2018). The Appleization of finance: Charting incumbent finance’s embrace of FinTech. Finance and Society, 4(2), 159-80.

Hwa, G. (2019). Eight ways FinTech adoption remains on the rise. Vers, 1, 2019.

Kandpal, V., & Mehrotra, R. (2019). Financial inclusion: The role of fintech and digital financial services in India. Indian Journal of Economics & Business, 19(1), 85-93.

Karakas, C., & Stamegna, C. (2019). Fintech (financial technology) and the European Union: State of play and outlook.

Ke, D. (2021). Who wears the pants? Gender identity norms and intrahousehold financial decision‐making. The Journal of Finance, 76(3), 1389-1425.

Lagarde, C. (2018). Central banking and fintech: A brave new world. Innovations: technology, governance, globalization, 12(1-2), 4-8.

Indexed at, Google Scholar, Cross Ref

Mohanasundaram, T., Sathyanarayana, S., & Rizwana, M. (2021). Disruptions on India’s FinTech landscape: The 5G wave. In ITM Web of Conferences (Vol. 37, p. 01008). EDP Sciences.

Indexed at, Google Scholar, Cross Ref

PIB, (2018), “Digital Payments Set to Become a Trillion Dollar Market in Next Five Years: NITI Aayog”, July 31. https://pib.gov.in/PressReleseDetail.aspx?PRID=1540879

Priya, P. K., & Anusha, K. (2019). Fintech issues and challenges in India. International Journal of Recent Technology and Engineering, 8(3), 904-908.

Rajeswari, P., & Vijai, C. (2021). Fintech industry in India: the revolutionized finance sector. Eur. J. Mol. Clin. Med, 8(11), 4300-4306.

Shashidhar, K. J. (2020). Regulatory Sandboxes: Decoding India’s attempt to Regulate Fintech Disruption. ORF Research Brief, Delhi.

Shree, S., Pratap, B., Saroy, R., & Dhal, S. (2021). Digital payments and consumer experience in India: a survey based empirical study. Journal of Banking and Financial Technology, 5, 1-20.

Indexed at, Google Scholar, Cross Ref

Singh, S. (2020). Indian Fintech Ecosystem: Four Eras of Growth and Contraction. Retrieved from https://thedigitalfifth.com/indian-Fintech-ecosystem-four-eras-of-growth-andcontraction/

Thakor, A. V. (2020). Fintech and banking: What do we know?. Journal of Financial Intermediation, 41, 100833.

Indexed at, Google Scholar, Cross Ref

Tok, Y. W., & Heng, D. (2022). Fintech: Financial inclusion or exclusion?. International Monetary Fund.

Tok, Y. W., Tan, S. L., & Chansriniyom, T. (2021). Do Innovations in Lending Help SMEs?. ADB-IGF Special Working Paper Series “Fintech to Enable Development, Investment, Financial Inclusion, and Sustainability.

Uniyal (2020). 10 Most Successful Fintech Startups & Companies in India as of 2020.

Vijai, C. (2019). FinTech in India–opportunities and challenges. SAARJ Journal on Banking & Insurance Research (SJBIR) Vol, 8.

Vijai, C., Joyce, D., & Elayaraja, M. (2020). Fintech In India. International Journal of Future Generation Communication and Networking, 13(3), 4143-4150.

Wilson, R. (2020). 20 Most Promising Indian Fintech Startups As Per CB Insights 2020 List.

Yoon, B., Kim, J., You, Y., & Kim, S. (2016). A study on user behaviors for consulting of FinTech companies. Indian Journal of Science and Technology, 9(26), 1-6.

Zaccaria, L., & Guiso, L. (2020). From patriarchy to partnership: Gender equality and household finance. Available at SSRN 3652376.

Zala, M. D. A., Chavda, D. R., UPADHYAY, P. M., Parghi, V. K., & Chavda, D. R. Flexibility on the Student-Dr. Rekhaben H. Kachadiya 40-44.

Received: 17-Aug-2023, Manuscript No. AMSJ-23-13913; Editor assigned: 18-Aug-2023, PreQC No. AMSJ-23-13913(PQ); Reviewed: 27-Jan-2023, QC No. AMSJ-23-13913; Revised: 13-Feb-2024, Manuscript No. AMSJ-23-13913(R); Published: 28-Feb-2024