Research Article: 2023 Vol: 27 Issue: 1

Dynamics of Demographic Factors, Digital Usage and Choice of Crowdfunding In India

Seeboli Ghosh Kundu, IFHE University

Girish G P, IFHE University

Aruna B, IFHE University

Sharon K Jose, IFHE University

Citation Information: Ghosh Kundu, S., Girish, G.P., Aruna, B., & Sharon, K. (2023). Dynamics of demographic factors, digital usage and choice of crowd funding in India. Academy of Marketing Studies Journal, 27(1), 1-11.

Abstract

Startup revolution in India has been propelled by dawn of technology ensuring speediness, effectiveness, simplicity and diverse fundraising options available for entrepreneurs. Possibly India could create a sustainable environment for startups to flourish in years to come going by the initiatives taken by Government of India to promote and nurture the startup environment. Entrepreneurs today have started reconnoitering different newfangled fundraising options like crowdfunding. Conversely, India being a very diverse and a young country has ensued in Indian entrepreneurs being unalike and their picks being diverse from raising funds perspective. Over time crowdfunding has become an important platform for fundraising in India. In this study we empirically explored the dynamics of demographic factors, digital usage and the choice of crowdfunding as a viable option for raising pre-seed capital in India. The results of the study suggest that entrepreneurs’ based on demographic factors such as age, gender and educational background are significantly distinct in their understanding of using social media platforms for business.

Keywords

Demographic Factors, Digital Usage, Crowd funding, India, Entrepreneurship.

Introduction

The foremost sustainable development goal of the United Nations 2030 is to “End poverty in all its forms everywhere”. The social consequence of the United Nations first goal is to implement nationally suitable social protection systems to achieve substantial coverage of the poor and the vulnerable segment. This is possible only if Government, Policy Makers, Industry, Private Sector, Small and Medium Enterprises and all Entrepreneurs of the country work together and contribute towards achieving this goal. Startup revolution in India has been propelled by dawn of technology ensuring speediness, effectiveness, simplicity and diverse fundraising options available for entrepreneurs Akrong & Kotu (2022). Possibly India could create a sustainable environment for startups to flourish in years to come going by the initiatives taken by Government of India to promote and nurture the startup environment Agarwal (2018).

The Covid-19 crisis in India has put the society at sensitive risk of unemployment and produced colossal turbulence in sustainable entrepreneurship. Entrepreneurs today have started reconnoitring different new-fangled fundraising options like crowd funding. Contrariwise, India being a very diverse and a young country has ensued in Indian entrepreneurs being unalike and their picks being diverse from raising funds perspective. Over time crowd funding has become an important platform for fundraising in India. Considering this background crowd funding could be an effective medium to unravel the delinquent faced by Indian entrepreneurs during and post pandemic in terms of raising capital for their business sustainability.

In this study we empirically explore the dynamics of demographic factors, digital usage and the choice of crowdfunding as a viable option for raising pre-seed capital in India. Crowdfunding is a reasonably novel area of research and most of the studies are infrequent in nature. Though a few studies in literature try to explore the dynamics of demographics and social media associations from crowd funding milieu there is barely any study exploring Indian entrepreneurial cluster apprehending predilections towards different crowdfunding platforms and social media usage. The rest of the paper is organized as follows. In Section 2 we review literature pertaining to social media marketing and crowd-funding and highlight the gaps identified in literature. In Section 3 we explicate the main objective of this study, Research Methodology and Hypothesis formulated for our study and in Section 4 we present our empirical findings and conclude our study in Section 5.

Literature Survey

Chaudhuri et al. (2022) revealed the role of entrepreneur's age, gender, and education having a direct impact on espousal of digital technology in business by considering 431 startup entrepreneurs from small and medium enterprises (SMEs) of India. Baber (2019) recognized factors underlying attitude formation towards Crowdfunding in India under the broad categories of: a) Consumer Traits and Demographics b) Experience of Technology c) Traditional Financial Market Experience and d) Influence of Reference Group. The study also pointed out that gender inequality exists in crowdfunding initiatives and found that in most cases, male entrepreneurs are more active viz.a.viz. women counterparts.

Tuo et al. (2019) explored reward-based crowdfunding and how configurational models are used to understand delivery performance. Gupta et al. (2022) used buckley fuzzy-AHP technique to emphasize on crowdfunding benefits. Kenworthy et al. (2020) investigated the role played by gender, race and age disparities in medical crowdfunding i.e. donation-based crowdfunding in USA and found that black women in distinct are under-represented by using online platforms for individuals to plea to social networks requesting donations for medical needs. Cinta (2020) focused on reward-based crowdfunding wherein funders receive a reward for supporting a crowdfunding project by considering 335 reward-based crowdfunding projects in Spain and highlighted the statistical significance of variables such as gender, location, experience and human capital.

Susana Bernardino et. al. (2022) investigated whether gender affects the characteristics of the project, motivation, satisfaction of the campaign and the use of social media by collecting data using survey from entrepreneurs using the Portuguese crowd-funding platform PPL for financing. They found that cultural projects show a gender association and highlight that crowd-funding can contribute to decrease gender gap in entrepreneurship. Kami?ski et al. (2021) investigated patients who had used donation-based crowdfunding and found that factors such as younger age of the patient in the campaign, lower financial goals, exposure on Facebook, aim, disease and emotional expression in the photographs and video in the campaign were the key success factors in donation-based medical crowdfunding.

Abhishek (2020) examined 322 small and medium-sized firms using partial least squares modelling convoluting in crowdfunding campaign and witnessed the strategic use of social media and the integrative part of orientation in a firm's crowdfunding campaign accomplishment. Meghana & Cariappa (2020) focused on awareness of crowdfunding platforms in Bengaluru City, India. Manoj (2018) reconnoitered the development of crowdfunding by attributing to motorized advances in the field of data and innovations in the Web and emphasized the necessity for government backing in order to spread the extent and magnitude of crowdfunding in India. Yashar (2021) examined how digital word-of-mouth via social media has developed as a prevalent promotional platform for crowdfunding campaigns owing to low cost by utilizing panel data on several unique funding campaigns from gofundme.com and investigated them using econometric techniques and found that psychological motivation is utmost important for both donations based and reward based campaigns and further highlighted that the role of social media in accomplishment of a campaign changes over time and is most advantageous in the first 10 days of the campaign's unveiling.

Baber (2019) found gender inequality in crowdfunding as one of the utmost imperative factor which needs contemplation in Indian context. Vijaya and Mathur (2022) investigated why donation-based crowdfunding is so prevalent in India and what motivates fund providers to participate in donation-based crowdfunding Bulock (2018). Aspects such as funders' predisposition to follow the herd, sentiments, spiritual beliefs, data privacy, lack of pecuniary burden and infinitesimal return assured in other forms of crowdfunding play a definite role. The study submits that fund providers are enthused to upkeep donation-based crowdfunding projects based on personal interest in the cause, project inimitability and abilities, collective views and dogmas, pro-social reasons and also influence of personal networks. Kromidha et. al., (2021) investigated awareness on digital microfinance crowdfunding for women entrepreneurship and expansion by using empirical data of Rang De - India's first digital social entrepreneurship platform for crowdfunding and loaning. The study suggests that environmental factors play a key role irrespective of technological and social similarities and also provided insights on gender equality and the digital divide in banking.

Leonardus et. al., (2019) visualized a model that reigned in the significance of digital transformation in diverse business scenarios. Snehal (2019) study explored the in which Indian Financial firms use social media platforms for financial awareness, cost reduction and customer satisfaction. Girish and Seeboli (2019) identified that awareness of different options of crowd-funding for raising pre-seed capital is strongly correlated with the effective convention of social media platforms by the organizations. The results of the study gave a viewpoint for all entrepreneurs, fundraisers and start-up companies on how digital visibility through social media marketing can disentangle the problem of crowdfunding.

Research Methodology and Hypothesis

Sample

The sample frame for the present study encompassed Indian entrepreneurs having rudimentary cognizance of the usage and feasibility of different types of crowd funding. The databank of around 1250 respondents was primed. The foundations of database involved the Directory of Confederation of Indian Industry (CII), Indian Industry Association (IIA) and Electronic Industries Association of India (ELCINA). Primary data was collected by means of both online and offline approaches such as telephonic calls, e-mails, one-on-one interactions and events/conferences (i.e. in Plastasia, Rideasia, Aahar conferences at New Delhi where the survey questions were administered to the entrepreneurs/ directors/ top management executives of various companies partaking). A total of 425 entrepreneurs partook in the survey with a 34% of conversion rate from the databank. The authors confirm that informed consent was obtained from all participants for our research.

Questionnaire

The questions in the survey encompassed capturing demographic details, business segment, their firm’s need for funds, level of profit and revenue generated, social media usage through pandemic period in addition to their penchant to different crowd funding routes. The questions posed in the questionnaire was a concoction of continuous and categorical variables Chalmers et al. (2021).

Methodology Followed

The principal objective was to realize the predilections of entrepreneurs regarding their crowd funding choices for raising the pre-seed capital and to reconnoiter how social media is abetting them for the same. The exploration is carried out in 3 steps.

? Step 1: Entrepreneurs are segmented into homogenous clusters. As the sample included entrepreneurs who were of different gender, educational qualification and ages, cluster analysis envisaged will bring out entrepreneur segmentation.

? Step 2: Post segmentation, we dig deeper into unraveling firms as well as entrepreneurs’ social media usage, their preferred social media platforms, the amount of revenue they have generated till date etc.

? Step 3: A mean comparison test i.e. ANOVA test in our study is employed to apprehend if there is any significant difference in their preference of crowd funding choice (donation based, equity based and reward-based) by each of these clusters.

The cluster analysis is an exploratory technique to understand a pattern that ascends in the data and is ordinarily used to group a set of sample units which are similar with respect to chosen variables. Cluster analysis has been ominously used in the studies on entrepreneurship. Cluster analysis can be carried out in multiple levels i.e. be it firm or individual level (Crum et al., 2020). Gibcus et al. (2009) employed cluster analysis to create five-group taxonomy of entrepreneurial decision makers. McMahon (2001) formulated a classification of small and medium sized firms with the variables such as firm age, size and growth. In our present study we employ cluster analysis at the individual level of entrepreneurs bearing in mind their demographic aspects Jaslin Joseph (2019).

Empirical Findings

Stage 1: Cluster Analysis

The study employed two-step cluster analysis method which has the advantage of allowing both categorical and continuous data in the clustering model. Categorical data of demography is a critical part of this study and as literature advocates two-step cluster analysis is appropriate specially when the data is huge (Tkaczynski et al., 2010). First step focuses on identifying pre-clusters and these pre-clusters are treated as singular cases for engaging hierarchical clustering in the second step. Once clusters were identified, chi-square tests conducted for categorical variables and student t-tests for continuous variables examined the importance of individual variables in the cluster (Norusis, 2011). The final clusters thus formed are homogenous within the cluster and heterogeneous between the clusters for the chosen variables of the study Borrero-Domínguez et al. (2020).

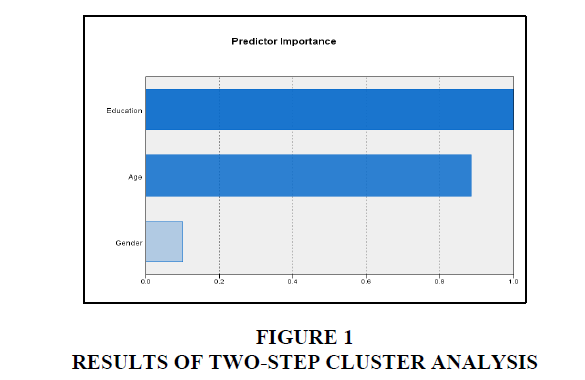

The two-step cluster analysis provided us with a three cluster solution based on 425 respondents. The cluster analysis is run based on three demographics: gender, age and educational qualification. We found educational qualification and age as significant variables that categorizes entrepreneurs. Figure 1 presents the results of two-step cluster analysis. Owing to lower number of women entrepreneurs, they were not found to be Significant Behl & Dutta (2019).

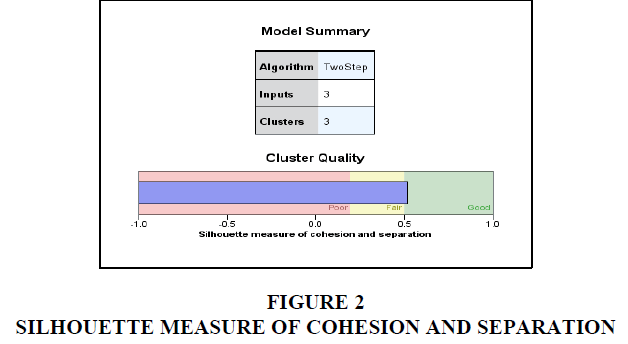

The elucidation comes with a silhouette measure of cohesion and separation of 0.5 which meets the expectations as per the methodology suggested by Norusis (2011). Ideally, the obtained value must be above 0.0, suggesting validity of the within and between the cluster distances Ashta (2018). The ratio of the sizes of largest and smallest cluster is maintained under the value of 2 to ensure equitable distribution of sample units among the clusters. Figure 2 presents silhouette measure of cohesion and separation Figure 1 and 2.

The three clusters are named as follows:

? Cluster 1 has 133 entrepreneurs and almost all of them are highly educated. We label this cluster as qualified businessmen.

? Cluster 2 is the largest cluster and has 177 entrepreneurs. The peculiarity of this cluster is the age diversity in the age range [entrepreneurs who are in their 20s and even 60s in this group]. But most of them have a basic graduation as their educational qualification. We label this cluster as assorted entrepreneurs. The cluster has a fair amount of women entrepreneurs as well.

? Cluster 3 has 118 entrepreneurs and they are characterized by homogenous set of entrepreneurs with respect to their age, gender and education [entrepreneurs who are in their 30s, who are males (no female entrepreneur at all) and graduates]. We label them as late bloomers considering the average number of years since their firm is operational.

Stage 2: Demographic Cluster of Entrepreneurs and Characteristics

It is believed that most of the people from developed and developing countries are involved in tertiary sector (Rosenberg, 2020). Table 1 provides Demographic cluster of Entrepreneurs and Characteristics. We find majority of entrepreneurs are in tertiary sector of the economy involved in selling the goods produced by secondary sector and providing commercial services to the public. Sub-sectors in this Shah & Shah (2017) industry comprise retail and wholesale sales, transportation and distribution, restaurants, clerical services, media, tourism, insurance, banking, health care and law. Apart from the late bloomers, other two clusters have started their firms 10 years past and thus their professed success with respect to revenue is less significant than the other two clusters Denza (2021).

| Table 1 Demographic Cluster Of Entrepreneurs And Characteristics |

|||

|---|---|---|---|

| Cluster number | 1 | 2 | 3 |

| Number of samples | 133 | 174 | 118 |

| Cluster label | Qualified business men | Assorted entrepreneurs | Late bloomers |

| Primary sector | 6 | 6 | 5 |

| Secondary sector | 6 | 7 | 6 |

| Tertiary sector | 106 | 125 | 96 |

| Quaternary sector | 14 | 33 | 9 |

| Quinary sector | 1 | 3 | 2 |

| Average number of cofounders | 2 | 3 | 2 |

| Time since operational | 13 | 16 | 9 |

| Average profit | 3 | 3 | 3 |

| Perceived revenue | 7 | 7 | 6 |

| Donation based crowdfunding | 2 | 3 | 2 |

| Reward based crowd funding | 3 | 3 | 2 |

| Equity based crowd funding | 3 | 3 | 3 |

| Social media usage | Moderate (frequency of agreement) | High | Low |

| Use of social media for raising capital | High agreement (Average score) | High agreement | Moderate agreement |

From preference for crowd funding viewpoint, we found qualified businessmen prefer more of reward and equity based crowd funding while late bloomers dominantly prefer equity based crowd funding Ralcheva & Roosenboom (2020). Since the cluster has multifarious set of entrepreneurs, we can see they have equally preferred all the crowd funding options for raising the pre-seed capital. Notable dissimilarity among the clusters of entrepreneurs is apropos their social media usage. Qualified business men were judicious users of social media and late bloomers do not depend on social media while assorted entrepreneurs appeared to be of substantial users of social media which can be attributed to the age group involved a lot of youngsters and male-female population. We found late bloomers do not have confidence that social media can be an actual podium for raising the pre-seed capital whereas qualified business men and assorted entrepreneurs vow for the practicability of social media platform for the same Table 1.

Stage 3: Testing of Our Hypotheses

The descriptive data exhibited that there are dissimilarities with respect to social media usage and the choice of crowd funding to Shneor & Flåten (2020) raise the pre-seed capital Papadopoulos et al. (2020). In order to statistically test this, hypotheses testing was carried out. ANOVA results convey thought-provoking insights on the same Fraiberg (2021).

Ho: There is no significant difference in the social media usage among entrepreneurs from different clusters.

The social media usage is measured in terms of present utilization, years of experience in using social media and belief in social media as a viable platform for raising pre-seed capital in the form of crowd funding Panetta (2020). Table 2 presents the Hypothesis Testing Results – Social media usage. The results show that not all Snyder et al. (2021) entrepreneurs have profound experience in using social media for their business. Nonetheless, practically all of them use social media at present-day for their business regardless of the cluster they belong. Everyone is influenced with the prospective of social media platforms in raising pre-seed capital such as crowd funding. Significant dissimilarity in the social media usage can only be seen in the experience factor which echoes the variances in the temperament of people to the use of social media. Today social media marketing and digital discernibility is deliberated as a critical component for growth of a business firm and the consequences are a factual mirror of the existing reality Table 2 and 3.

| Table 2 Hypothesis Testing Results – Social Media Usage |

|||

|---|---|---|---|

| Hypotheses | Variables | F-value | Sig. |

| 1 | Present Utilization | 0.179 | 0.836 |

| 2 | Experience in using social media | 7.165** | 0.001 |

| 3 | Belief in social media as a viable platform for raising the pre-seed capital | 0.895 | 0.409 |

All the three clusters are significantly different in their experience in using social media platforms for business. Post hoc checks aid to ascertain which are the clusters with dissimilar scores. We have confidence that educated folks were pioneers in consuming social media for their business and the post hoc test validates it Lim & Busenitz (2020). Thus the null hypothesis is rejected. The mean scores of qualified businessmen viz.a.viz. their experience in using social media is significantly different from assorted entrepreneurs and late bloomers. Entrepreneurs with higher education qualification have more familiarity in using social media as a platform for their business compared to other clusters.

H1: There is no significant difference among various clusters of entrepreneurs regarding their predilection for several crowd funding options.

Partakers were probed to specify their predilections regarding three different crowd funding options and given a choice, which one they would go for. The results illustrate that entrepreneurs are at variance regarding their preference for donation-based crowd funding paralleled to reward based and equity-based crowd funding Lenart-Gansiniec (2021). In crux, all the entrepreneurs are alike regarding their predilection for reward based and equity-based Wu & Yuan (2022) crowd funding Kukk & Laidroo (2020). Table 3 presents Hypothesis Testing Results – Preference for various crowdfunding options. Donation-based funding is lopsidedly preferred by the entrepreneurs. Post hoc tests signposts that the Roe & Smith (2021) assorted entrepreneurs wish donation-based crowd funding paralleled to the other two clusters. Assorted entrepreneurs have a combination of all population, male and female from all age groups. Thus null hypothesis is rejected Table 4 and 5.

| Table 3 Two Step Cluster Details |

|||

|---|---|---|---|

| Two step cluster details | N | Subset for alpha=0.05 | |

| 1 | 2 | ||

| Assorted entrepreneurs | 173 | 2.32 | |

| Late bloomers | 117 | 2.45 | |

| Qualified businessmen | 133 | 2.71 | |

| Sig. | 0.438 | 1.000 | |

| Table 4 Hypothesis Testing Results – Preference For Various Crowdfunding Options |

|||

|---|---|---|---|

| Hypotheses | Variable-crowd funding options | F value | Sig. |

| 1 | Donation-based crowd funding | 4.821** | 0.009 |

| 2 | Reward-based crowd funding | 1.071 | 0.344 |

| 3 | Equity- based crowd funding | 0.500 | 0.607 |

| Table 5 Two Step Cluster Details |

|||

|---|---|---|---|

| Two step cluster details | N | Subset for alpha=0.05 | |

| 1 | 2 | ||

| Late bloomers | 118 | 2.33 | |

| Qualified businessmen | 133 | 2.35 | |

| Assorted entrepreneurs | 174 | 2.72 | |

| Sig. | 0.994 | 1.000 | |

H2: There is no significant relationship between trust in social media as a feasible platform for raising the pre-

seed capital and their predilections for various crowd funding, social media convention and familiarity in

expending social media for business progression.

To establish the association between social media usage and the entrepreneurial preference of crowd funding options, multiple regression analysis is engaged. Belief of entrepreneurs concerning the viability of social media as a helpful platform for raising pre-seed capital through crowd funding is the dependent variable Vealey & Gerding (2016). The predictors used are predilections for various crowd funding options, the extent of present utilization of social media for business and the experience in using social media as a platform for business growth. We assume that donation-based crowd funding necessitates a platform for a better outreach and henceforth, persons who prefer donation-based crowdfunding will have more confidence in social media as a viable platform for raising pre-seed capital Khurana (2021).

Table 4 presents the Multiple Regression Results – Model Summary, Anova and Coefficients. The adjusted R square pronounces that the model elucidates 16.3% of variance in the model which is not adequate with respect to the impending in elucidation of the dependent variable completely. Nevertheless, the ANOVA table shows the model is fit with a F value of 17.225 which is statistically Significant. The results indicate that there is a significant relationship between the predictors and the dependent variable. The beta coefficients of present utilization of social media (≥5.163**) and experience in using social media (≥ 3.808**) and donation-based crowd funding (≥ 1.947*) are found to be significant in predicting the trust i.e. belief of the entrepreneurs considering social media as a workable platform for raising pre-seed capital through crowd funding. Those who have faith in social media can be seen as a viable platform are associated with more usage of social media and more experiences in the usage of social media and preference for donation-based crowd funding Table 6-8.

| Table 6 Model Summary |

||||

|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.415a | 0.173 | 0.163 | 0.858 |

Table 7 Anova |

||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| Regression | 63.456 | 5 | 12.691 | 17.225 | 0.000b | |

| Residual | 304.292 | 413 | 0.737 | |||

| Total | 367.747 | 418 | ||||

| Table 8 Coefficients |

||||||

|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| (Constant) | 2.041 | 0.169 | 12.101 | 0.000 | ||

| Donation based crowd funding | 0.094 | 0.048 | 0.127 | 1.947 | 0.052 | |

| Reward based crowd funding | 0.001 | 0.066 | 0.002 | 0.019 | 0.985 | |

| Equity based crowd funding | 0.054 | 0.052 | 0.085 | 1.031 | 0.303 | |

| Present utilization of social media | 0.176 | 0.034 | 0.240 | 5.163 | 0.000 | |

| Experience in using social media? | 0.183 | 0.048 | 0.180 | 3.808 | 0.000 | |

Dependent Variable: Online platforms are trustworthy enough to raise crowd funding?

The standardized beta values help us to understand which are significant predictors of the model

Conclusion

With a stable inclination of today’s youth embracing start-ups and entrepreneurship in developing economies like India, crowdfunding is anticipated to grow ominously in near future aiding startups to raise capital and conduit the gap amongst demand and supply. Crowdfunding has a colossal consequence from contribution to incipient economy in terms of prosperity and job formation. Most of studies in literature have been deliberated from a developed economy’s perspective while exploring crowdfunding and entrepreneurial finance. In Indian Context Crowdfunding studies are quite few and sporadic. To the best of our knowledge there is no study steered from the perspective of how crowdfunding can resolve the problem of raising capital especially post pandemic. Though there are few works of crowdfunding that parleys about the demographic and sectorial association and the linkage between crowd funding and social media, none of the studies have explored from the track of creating entrepreneurial cluster and identifying the association which is novel.

In this study we empirically explored the dynamics of demographic factors, digital usage and the choice of crowdfunding as a viable option for raising pre-seed capital in India. The results of the study suggest that entrepreneurs’ based on demographic factors such as age, gender and educational background are significantly distinct in their understanding of using social media platforms for business. The results of the study will help in hewing a novel viewpoint for all entrepreneurs, fundraisers, practitioners, policy makers, researchers and start-up companies in India and open varied boulevards including crowd-sourcing as a source of finance to protect their startups from the colossal financial affliction of the pandemic. The study helps in formulating augmented strategy and roadmap in aiding the startups to endure the tumbling exit rate which is one of the biggest complications during the pandemic. The current study only included entrepreneurs from Delhi and NCR region. Further studies can be conducted setting a larger sample frame and considering entrepreneurs from different regions.

Funding / Acknowledgement

The authors are extremely thankful and grateful for receiving seed money funding for this research project from ICFAI Foundation for Higher Education (a Deemed to-be-University under Sec 3 of UGC Act 1956) India [Award No: IFHE/RC/2021/October/124].

References

Agarwal, H., 2018. A Study on Crowdfunding. International Journal of Engineering Technology Science and Research.

Akrong, R., & Kotu, B.H. (2022). Economic analysis of youth participation in agripreneurship in Benin.Heliyon,8(1), e08738.

Indexed at, Google Scholar Cross Ref

Ashta, D. (2018). A critical comparative analysis of the emerging and maturing regulatory frameworks: Crowdfunding in India, USA, UK.Journal of Innovation Economics Management,26(2), 113-136.

Baber, H. (2019). Factors underlying attitude formation towards crowdfunding in India.International Journal of Financial Research.

Behl, A., & Dutta, P. (2019). Social and financial aid for disaster relief operations using CSR and crowdfunding: Moderating effect of information quality.Benchmarking: An International Journal.

Indexed at, Google Scholar Cross Ref

Borrero-Domínguez, C., Cordón-Lagares, E., & Hernández-Garrido, R. (2020). Analysis of success factors in crowdfunding projects based on rewards: A way to obtain financing for socially committed projects.Heliyon,6(4), e03744.

Indexed at, Google Scholar Cross Ref

Bulock, C. (2018). Crowdfunding for open access.Serials Review,44(2), 138-141.

Indexed at, Google Scholar Cross Ref

Chalmers, D., Matthews, R., & Hyslop, A. (2021). Blockchain as an external enabler of new venture ideas: Digital entrepreneurs and the disintermediation of the global music industry.Journal of Business Research,125, 577-591.

Indexed at, Google Scholar, Cross Ref

Chaudhuri, S.C., Vrontis, D. & Thrassoud, A., 2022. SME entrepreneurship and digitalization – the potentialities and moderating role of demographic factors. Technological Forecasting and Social Change, Issue Volume 179, June 2022, 121648.

Indexed at, Google Scholar, Cross Ref

Denza, A. (2021). Equity crowdfunding: overview, Italian regulatory framework and selected case studies.

Fraiberg, S. (2021). Introduction to special issue on innovation and entrepreneurship communication in the context of globalization.Journal of Business and Technical Communication,35(2), 175-184.

Indexed at, Google Scholar, Cross Ref

Gupta, S., Raj, S., Gupta, S., & Sharma, A. (2022). Prioritising crowdfunding benefits: a fuzzy-AHP approach.Quality & Quantity, 1-25.

Jaslin Joseph, N.A.D.V., 2019. Awareness towards Crowdfunding among Young, Budding and Prospective Entrepreneurs in Bangalore. IJRAR- International Journal of Research and Analytical Reviews .

Kami?ski, M., Borys, A., Nowak, J., & Walkowiak, J. (2021). Crowdfunding campaigns for paediatric patients: A cross-sectional analysis of success determinants.Journal of Mother and Child,25(3), 209-227.

Indexed at, Google Scholar, Cross Ref

Kenworthy, N., Dong, Z., Montgomery, A., Fuller, E., & Berliner, L. (2020). A cross-sectional study of social inequities in medical crowdfunding campaigns in the United States.PLoS One,15(3), e0229760.

Indexed at, Google Scholar, Cross Ref

Khurana, I. (2021). Legitimacy and reciprocal altruism in donation-based crowdfunding: Evidence from India.Journal of Risk and Financial Management,14(5), 194.

Indexed at, Google Scholar, Cross Ref

Kukk, M.L., & Laidroo, L. (2020). Institutional drivers of crowdfunding volumes.Journal of Risk and Financial Management,13(12), 326.

Indexed at, Google Scholar, Cross Ref

Lenart-Gansiniec, R. (2021). Crowdfunding in Public Sector: A Systematic Literature Review.Crowdfunding in the Public Sector, 21-42.

Lim, J.Y.K., & Busenitz, L.W. (2020). Evolving human capital of entrepreneurs in an equity crowdfunding era.Journal of Small Business Management,58(1), 106-129.

Indexed at, Google Scholar, Cross Ref

Meghana, C., & Cariappa, P. (2020). Awareness of Crowdfunding Platforms in Bengaluru City: An Empirical Study.Indian Journal of Research in Capital Markets,7(4), 26-37.

Indexed at, Google Scholar, Cross Ref

Panetta, E. (2020). Crowdfunding as an alternative source of raising capital during the Covid-19 crisis.

Papadopoulos, T., Baltas, K.N., & Balta, M.E. (2020). The use of digital technologies by small and medium enterprises during COVID-19: Implications for theory and practice.International Journal of Information Management,55, 102192.

Indexed at, Google Scholar, Cross Ref

Ralcheva, A., & Roosenboom, P. (2020). Forecasting success in equity crowdfunding.Small Business Economics,55(1), 39-56.

Roe, S.J., & Smith, R.P. (2021). Asking for help: restaurant crowdfunding during COVID-19.Journal of Foodservice Business Research, 1-22.

Indexed at, Google Scholar, Cross Ref

Shah, C., & Shah, P. (2017). Influence of crowdfunding on innovative entrepreneurship eco-systems in India.Journal of Asia Entrepreneurship and Sustainability,13(2), 3-28.

Shneor, R., & Flåten, B.T. (2020). Crowdfunding education: Objectives, content, pedagogy, and assessment. InAdvances in Crowdfunding(pp. 475-497). Palgrave Macmillan, Cham.

Snyder, J., Zenone, M., & Caulfield, T. (2021). Crowdfunding campaigns and COVID-19 misinformation.American Journal of Public Health,111(4), 739-742.

Indexed at, Google Scholar, Cross Ref

Tuo, G., Feng, Y., & Sarpong, S. (2019). A configurational model of reward-based crowdfunding project characteristics and operational approaches to delivery performance.Decision Support Systems,120, 60-71.

Indexed at, Google Scholar, Cross Ref

Vealey, K.P., & Gerding, J.M. (2016). Rhetorical work in crowd-based entrepreneurship: Lessons learned from teaching crowdfunding as an emerging site of professional and technical communication.IEEE Transactions on Professional Communication,59(4), 407-427.

Indexed at, Google Scholar, Cross Ref

Wu, Y.J., & Yuan, C.H. (2022). Crowdfunding Curriculum Design Based on Outcome-Based Education.Frontiers in Psychology,13, 845012-845012.

Received: 27-Aug-2022, Manuscript No. AMSJ-22-12495; Editor assigned: 29-Aug-2022, PreQC No. AMSJ-22-12495(PQ); Reviewed: 12-Sep-2022, QC No. AMSJ-22-12495; Revised: 28-Sep-2022, Manuscript No. AMSJ-22-12495(R); Published: 02-Nov-2022