Research Article: 2024 Vol: 28 Issue: 3S

Electronic Customer Relationship Management Practices and Customer Experience in Banking Sector: A Bibliometric Analysis and Systematic Literature Review

Lalitha P S, CMR University

Kiran Kumar Paidipati, Indian Institute of Management Sirmaur

Citation Information: Lalitha, P.S., & Paidipati, K.K. (2024). “Electronic customer relationship management in banking sector: a bibliometric analysis and systematic literature review”. Academy of Marketing Studies Journal, 28(S3), 1-21.

Abstract

The Electronic Customer Relationship Management (ECRM) has progressed and become a crucial business application, gradually making its impact felt over the years. It has become an essential requirement for effective business operations. In recent years, ECRM has evolved into a more customer-oriented application, focusing on fostering strong customer relationships. This study purposes to analyze the electronic customer relationships to customer experience in banking sector. The analysis includes the field of research, sources, affiliations, authors, and citations. To conduct this analysis, science mapping techniques and performance analysis were utilized with the help of Vos-Viewer Bibliometric software. A total of 327 publications indexed in the DIMENSIONS database between 2000 and 2023 August were extracted for this analysis. The bibliometric analysis revealed that the year 2001 had the highest number of citations in the publication, with 438 indexed in the Dimensions database. In contrast, 2001 had a significant rise of total number of citations with 574 citations only 5 indexed publications. The author Winer, Russell S. had the highest number of citations in article publications. The study helps in developing structured literature review among CRM and ECRM concepts in the banking sector.

Keywords

Electronic Customer Relationship Management, Customer Experience, Banking Sector Systematic Literature Review, Bibliometric Analysis.

Introduction

Organizations globally are adopting CRM systems, with overall usage increasing from 56% to 74% in 2020. ECRM, a revolutionary technology, is gaining popularity as businesses explore its benefits. It is a potent strategic sales tool for growing businesses. Understanding its components is crucial for modern organizations. ECRM integrates web channels into CRM strategy to drive consistency and unify sales, marketing, and customer service activities. It provides a seamless experience for customers and encourages loyalty because customers are a company's greatest asset. ECRM “involves acquiring, building, and maintaining customer relationships through e-business operations”. “Marketing activities, tools, and techniques transacted over the internet using technologies such as web sites, e-mail, data capture, ware housing and mining” defined as ECRM by Lee -Kelley (2003). ECRM has been considered as “a part of online marketing, which is similar to traditional CRM tools but is implementing use of electronic channels with electronic businesses to form ECRM strategy for the organization” (Gartner, 2013).

ECRM “is a complex process involving hardware, software, processes, and management practices to improve customer service and maintenance. It is a powerful and effective application of information systems” (Usman et al., 2012).

ECRM software combines e-commerce, customer communication, and business applications. Web-based applications are a natural progression of traditional CRM software. ECRM technology helps businesses gain an edge and outperform rivals. It unifies customer information and improves team collaboration. Benefits of ECRM includes holistic customer records, seamless integration, enhanced service management, advanced reports, customer loyalty, and retention. ECRM is an integrated sales, marketing, and service strategy that manages customer-related activities through the internet. It empowers organizations to gain a competitive advantage and become more responsive to customer needs.

Electronic touch points are provided as service for interacting with customers (Garg et al., 2014). Kranzbuhler et al., (2018) identified the customer experience scope has expanded from short-term to long-term. As well as memorable and positive experiences is needed to sustain financial performance was provided by the banks. Schmitt (1999) stated Customer experience is based on “sensory, cognitive, emotional, relational, and behavioral values”. Klaus & Maklan, 2013). ECRM provides customer experiences in a 360-degree view (Mulyono & Situmorang, (2018). Seamless transactions save time and effort, while providing smooth platforms delight customers (Chahal & Dutta, 2014). Happy customers lead to increased satisfaction Sharma et al., (2016). Unique experiences improve customer satisfaction, leading to improved business performances. Customer experience is crucial for survival in a competitive environment. Loyalty is enhanced by positive experiences with service providers (Leva & Ziliani, 2018).

ECRM systems are needed in digital world to meet customer demand, but not yet widely used in India. Research shows significance in developed countries (Mangunyi et al., 2018). Customer satisfaction is increased when customers have a memorable and positive experience (Raina et al., 2019). Other literatures related to the customer satisfaction, customer loyalty and customer experience towards CRM and ECRM practices were mentioned in the following appendix as detailed systematic literature review. (Kamath et al., 2019; Mulyono & Situmorang, 2018) establishes a positive relationship between customer experience and satisfaction. Saini & Singh, 2020; Syahputra & Muwatiningsih, 2019) literature confirms the positive association among customer experience and loyalty (Cajestan, 2018; Srivastava & Kaur, 2016; Saini & Singh, 2020). Further in-depth analysis of literature review and details were listed below in appendix.

Methodology

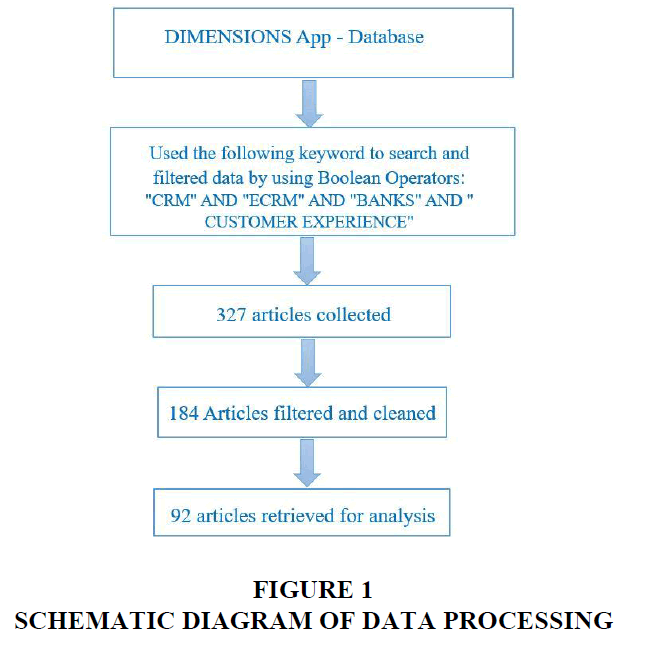

Many different sources of databases are obtainable to accomplish the literature review like ‘PubMed’, ‘ProQuest’, ‘Web of Science’, ‘Scopus’, ‘Dimensions’. For easy access and export the data files, the study chooses Dimensions app database for data collection, no need of any institutional access, it could be easier for young researcher, academicians, experts and students. The data includes different types of researches like articles, reviewed journals, edited books, books, monographs, book chapters, conference proceedings and others etc. The data collection and gathering process as follows mentioned in (Figure 1).

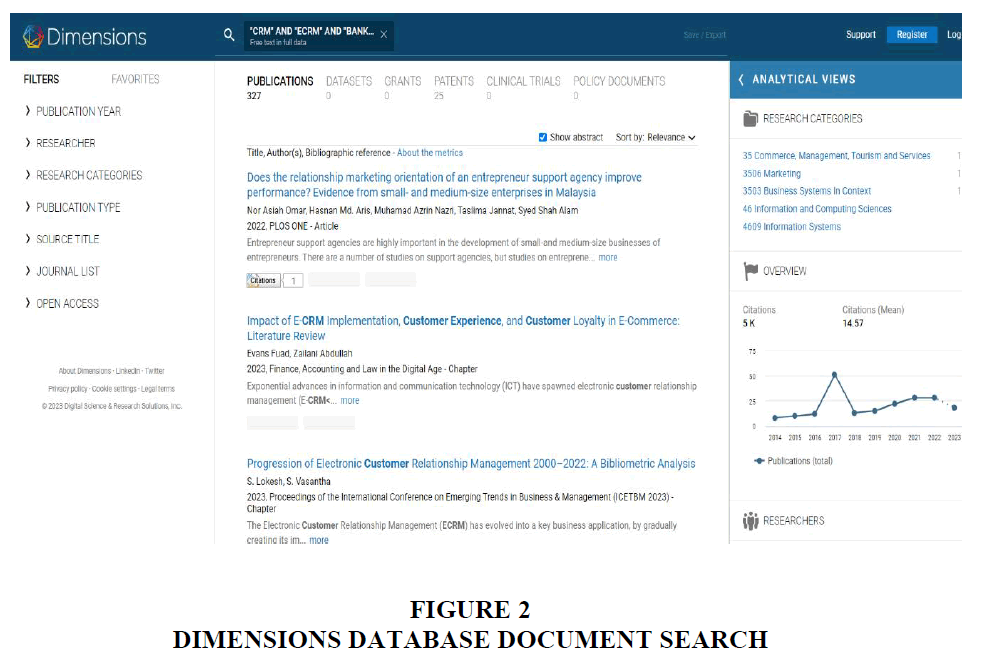

Out of 372 files, the suitable data matched was 92, confined with exact domains was more than 50 which represented in below figure 2 with the keyword search. The search focused on title, abstract and keywords in database DIMENSION app database to retrieve numerous assemblages of articles from 2000 to 2023.Exported on Aug 19, 2023. For better search using Boolean Operators called “AND”, “OR”. For association the Boolean operator used was “AND” and for Connection of the keyword the operator used was “OR”. Criteria: "CRM" AND "ECRM" AND "BANKS" AND " CUSTOMER EXPERIENCE" in search bar. The (Figure 2) represents the documents search webpage of dimensions database app for the current research study.

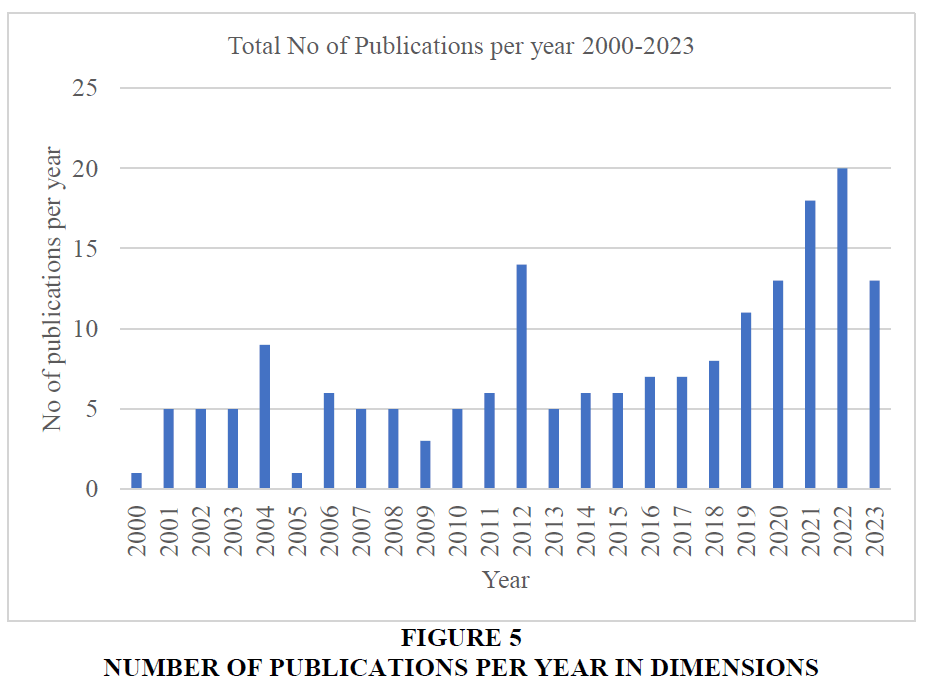

The number of publications in the ECRM and Bank filed retrieved from 2000-2023 August as per figure2. According to the data base of Dimensions the highest number of 20 publications per year in the field of ECRM were in 2022.And there is drop in terms of publications in 2005 again repeated in 2012 the decline to 5 per year. As the target topic ECRM the primary keyword to search in the data collection. And the secondary term is CRM and the third keyword is customer experience, finally the industry focusing on Banks.

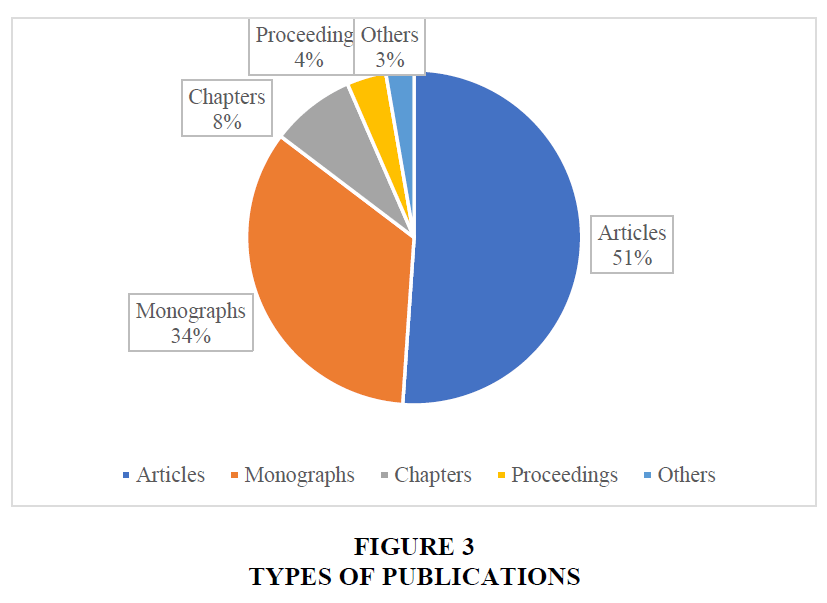

The (Figure 3) depicts the percentage of the type of publications found from the year mentioned from 2000 to 2030 August 19. In the entire files downloaded, the majority of the publications 51% is articles, and 34% monographs, followed by chapters, conference proceedings and others.

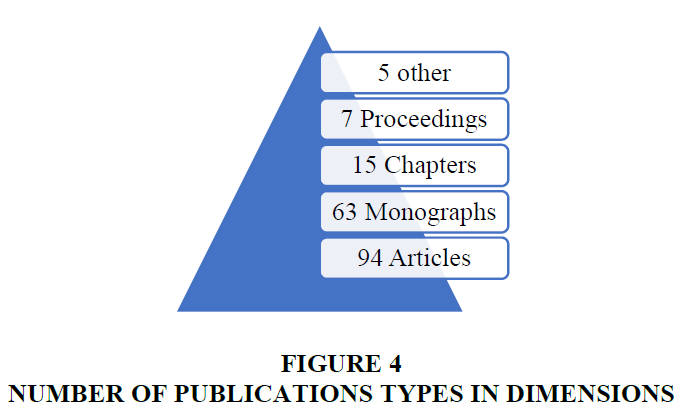

(Figure 4) signifies the various number of publication types collected from Dimensions database includes, Articles, conference proceedings, book chapters, monographs and other scripts. It helps the researcher to find the type of article used for their research analysis. A total of 327 files retrieved form dimensions database in which the essential and important information related with the research topic like ECRM, CRM, Customer Experience and Banks confined to 187 documents that represented in the triangle (Figure 4).

The study discusses the continuation of types of publications in dimensions database and the literature review. Initially starts with the demonstration of list of publications, years, citations.

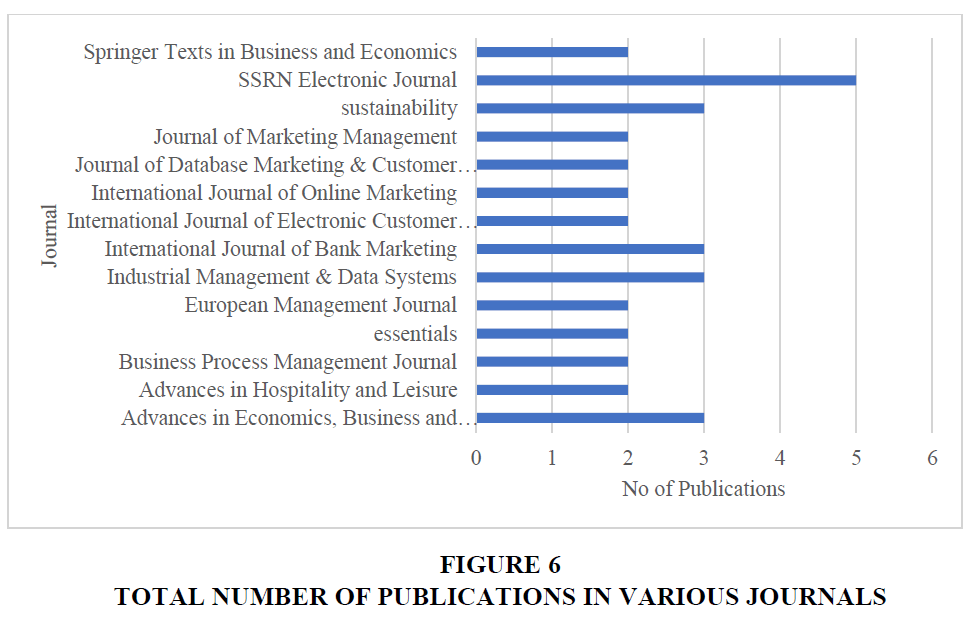

The list of various journals published 2 or more than 2 publications during the period. A list of 40-50 above various journals is extracted. SSRN has the highest no of publications on ECRM reposited in the dimensions database illustrated in Table 1.

| Table 1 List of Journals and their Publications | |

| Journal | Total Publications |

| Advances in Economics, Business and Management Research | 3 |

| Advances in Hospitality and Leisure | 2 |

| Business Process Management Journal | 2 |

| essentials | 2 |

| European Management Journal | 2 |

| Industrial Management & Data Systems | 3 |

| International Journal of Bank Marketing | 3 |

| International Journal of Electronic Customer Relationship Management | 2 |

| International Journal of Online Marketing | 2 |

| Journal of Database Marketing & Customer Strategy Management | 2 |

| Journal of Marketing Management | 2 |

| sustainability | 3 |

| SSRN Electronic Journal | 5 |

| Springer Texts in Business and Economics | 2 |

The above (Figure 5) represents the publications year wise from 2000-2023 August. The ECRM, CRM, Customer Experience (CE) and Banks research gradually rise from the year 2013 to 2022 like no of publications from 5 to 20 per year. And the least 1 article published in the year 2000 and repeats in 2005. And the 2012 year it was a number of 14 for various reasons.

The (Figure 6) illustrates the journal wise publications, the highest contribution is by SSRN and second by Sustainability, International Journal of Bank Management, Industrial Management & Data systems and Advances in Economics and business management.

The (Table 2) mentions various relevant articles published in Journals include Advances in Economics, Business and Management Research (3), Advances in Hospitality and Leisure (2), Business Process Management Journal (2), Essentials (2), European Management Journal (2), Industrial Management & Data Systems (3), International Journal of Bank Marketing (3), International Journal of Electronic Customer Relationship Management (2), International Journal of Online Marketing (2), Journal of Database Marketing & Customer Strategy Management (2), Journal of Marketing Management (2) , Sustainability (3), SSRN Electronic Journal (5), Springer Texts in Business and Economics (2).

| Table 2 Articles Published in Various Journals from 2000 - 2023 August | ||||||||||||||||||

| Journal | 2000 | 2001 | 2002 | 2003 | 2006 | 2007 | 2008 | 2011 | 2012 | 2013 | 2014 | 2015 | 2018 | 2019 | 2021 | 2022 | 2023 | Total |

| Advances in Economics, Business and Management Research | 1 | 2 | 3 | |||||||||||||||

| Advances in Hospitality and Leisure | 1 | 1 | 2 | |||||||||||||||

| Business Process Management Journal | 1 | 1 | 2 | |||||||||||||||

| essentials | 1 | 1 | 2 | |||||||||||||||

| European Management Journal | 1 | 1 | 2 | |||||||||||||||

| Industrial Management & Data Systems | 1 | 1 | 2 | |||||||||||||||

| International Journal of Bank Marketing | 1 | 1 | 1 | 3 | ||||||||||||||

| International Journal of Electronic Customer Relationship Management | 1 | 1 | 1 | 3 | ||||||||||||||

| International Journal of Online Marketing | 1 | 1 | 2 | |||||||||||||||

| Journal of Database Marketing & Customer Strategy Management | 1 | 1 | 2 | |||||||||||||||

| Journal of Marketing Management | 1 | 1 | 2 | |||||||||||||||

| Advances in Economics, Business and Management Research | 1 | 1 | 2 | |||||||||||||||

| Sustainability | 1 | 1 | 1 | 3 | ||||||||||||||

| SSRN Electronic Journal | 1 | 1 | 1 | 2 | 5 | |||||||||||||

| Springer Texts in Business and Economics | 1 | 1 | 2 | |||||||||||||||

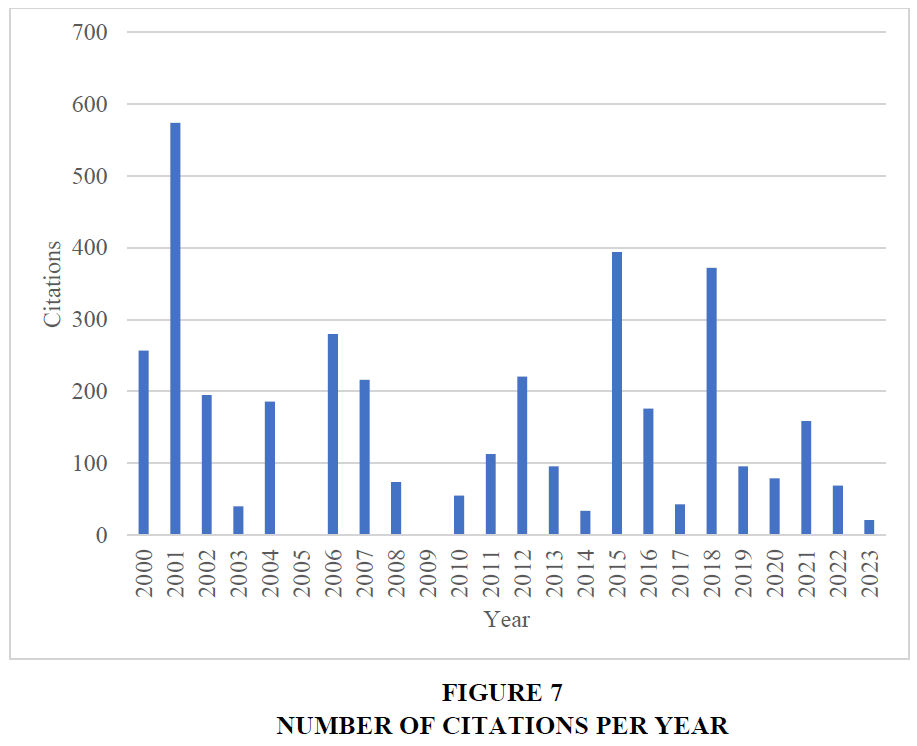

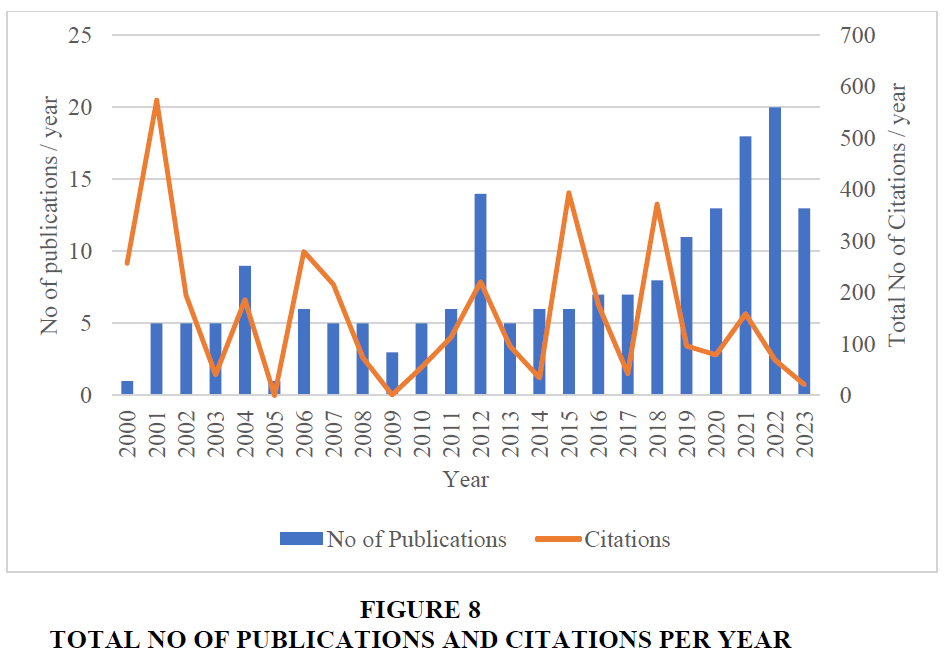

The (Figure 7) depicts the citations as per year for ECRM, CRM and Banks were 574 in the year 2001 followed by 2015 (392 citations) and 2018 (372 citations).

The highest citations of paper among the search in the database for respective years were illustrated in (Table 3). The journal and paper with high citations was in 2015 in springer texts in business and economics with 246 citations with paper electronic commerce 2018, A managerial and social networks perspectives. And Journal of Marketing Management also with equal citations in 2006 titled as customer relationship management.

| Table 3 Highest Citation Paper in Various Journals and Year | |||

| Title of the paper | Year | Journal | Citations |

| Electronic Commerce 2018, A Managerial and Social Networks Perspective | 2015 | Springer Texts in Business and Economics | 246 |

| Electronic Commerce, A Managerial and Social Networks Perspective | 2018 | Springer Texts in Business and Economics | 188 |

| Customer Relationship Management (CRM) in financial services | 2000 | European Management Journal | 257 |

| A Framework for Customer Relationship Management | 2001 | California Management Review | 188 |

| Customer Relationship Management: from Strategy to Implementation | 2006 | Journal of Marketing Management | 246 |

(Table 4) illustrates the year wise total number of publications and citations. highest citations of paper among the search in the database for respective years. The highest number of publications in 2012 with 14 number and with highest citations in 2015 as 394.

| Table 4 Year Wise Publications and Citations | ||

| Year | No of Publications | Citations |

| 2000 | 1 | 257 |

| 2001 | 5 | 574 |

| 2002 | 5 | 195 |

| 2003 | 5 | 40 |

| 2004 | 9 | 186 |

| 2005 | 1 | 0 |

| 2006 | 6 | 280 |

| 2007 | 5 | 216 |

| 2008 | 5 | 74 |

| 2009 | 3 | 1 |

| 2010 | 5 | 55 |

| 2011 | 6 | 113 |

| 2012 | 14 | 221 |

| 2013 | 5 | 96 |

| 2014 | 6 | 34 |

| 2015 | 6 | 394 |

| 2016 | 7 | 176 |

| 2017 | 7 | 43 |

| 2018 | 8 | 372 |

| 2019 | 11 | 96 |

| 2020 | 13 | 79 |

| 2021 | 18 | 159 |

| 2022 | 20 | 69 |

| 2023 | 13 | 21 |

The (Figure 7) represents the total number publications per year was in 2012, followed by 2012 and 2021. The highest number of citations was in 2001 followed by 2015 and 2018.

Co-authorship cluster

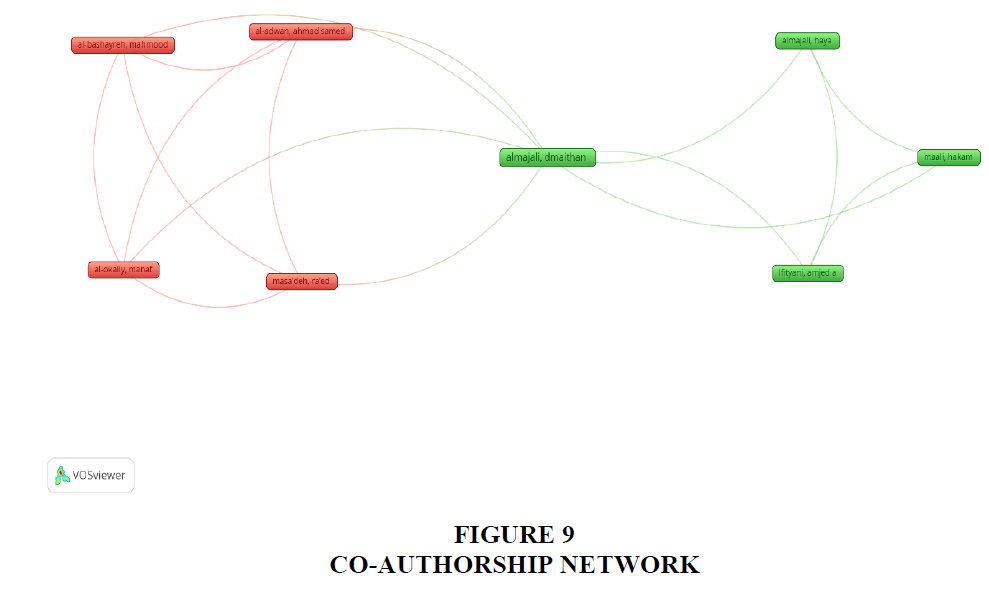

The above (Figure 8) represents cooperation among various researchers towards ECRM and customer experiences in two cluster colours. Red is one cluster and green is the second one. For advancing any field of research cooperation among the researchers is very significant.

Density Visualization for Co-authorship

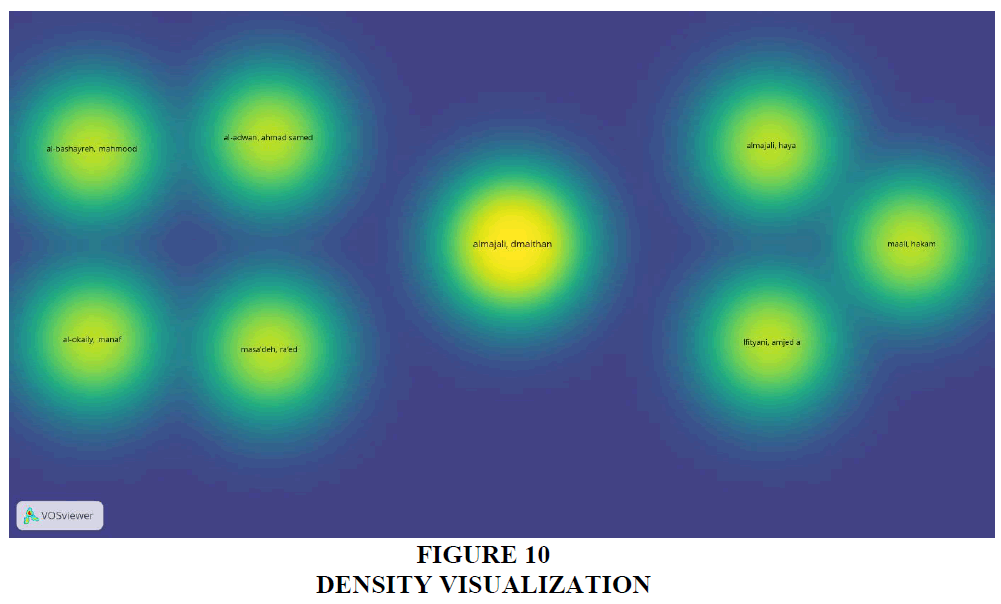

In (Figure 9) represents the co-authorship density visualization for ECRM and customer experiences using dimensions app database. The larger bubbles imply the majority of collaborations with the co-author. almajali, dmaithan did most of the collaborative works among the other authors.

Keyword Analysis

The below (Figures 10 & 11) represents the word cloud of keyword occurrence for the majority number of articles collected. The keywords like customer, bank customer satisfaction, banking industry, loyalty is the majority of the keywords occurred from 368 articles.

Findings

The majority of publications downloaded from a dimensions database were articles and monographs, followed by chapters and conference proceedings. A total of 327 files related to research topics were retrieved, with 184 related to ECRM, CRM, Customer Experience, and Banks. SSRN had the highest number of publications reposited in the dimensions database.

The number of publications in ECRM, CRM, Customer Experience, CE, and Banks research increased from 2013 to 2022, with no publications from 5 to 20 per year. SSRN had the highest contribution, followed by Sustainability, International Journal of Bank Management, Industrial Management & Data systems, and Advances in Economics and business management. The table 1 lists 40-50 journals with 2 or more than 2 publications, with SSRN having the highest no of publications.

Kaur (2016) informed that e-trust and e-satisfaction and e-loyalty had as a positive influence on ECRM in the Indian banking sector. Al-Shoura and Oumar (2017) found a positive relationship between E-CRR and customer loyalty in Zain and Kenya commercial banks, respectively. Marketing strategies should be reviewed and enhanced to achieve e-customers' loyalty. Regression analysis supports positive relationship Oumar et al., (2017) ECRM features were found to have a positive relationship with customer loyalty in Kenya's banking sector Mangunyi et al (2018). Customer experience and satisfaction also played a role in increasing loyalty. Mulyono and Situmorang (2018)

The success factors of ECRM positively impact customer satisfaction, retention, trust, and business performance of Jordanian commercial banks. Al-Dmour et al., (2019); Customer satisfaction and trust positively affect retention and trust. E-banking satisfaction does not have a mediating effect on the association between E-CRR dimensions and e-loyalty dimension. Positive relationship found in Egypt's commercial banks of Egypt. No mediation effect found for E-Banking satisfaction Rashwan et al., (2019). Sokmen and Bas (2019) investigate the impact of ECRM on relationship quality and customer loyalty in different industries. In Turkey, there is a positive association among perceived rewards and privileged transactions,

Tariq et al., (2019) while in Pakistan, service quality and loyalty are more effective than trust, technology acceptance and employee satisfaction. In Pakistan, only loyalty and service quality were positively associated with effectiveness. Trust was insignificant in Turkey. Upadhyaya (2020) investigated the relationship between ECRM, service quality, trust, satisfaction, and e-loyalty in different industries. Sasono et al., (2021) Positive relationships were found for service quality and trust, and negative relationships for satisfaction and trust.

Customer loyalty is linked to favorable and memorable experiences with service providers (Pine & Gilmore, 1998). Loyalty creates some emotional positive values for customers, (Chahal & Dutta, 2014). It leads to increased loyalty and willingness to endorse and buy back products/services (Mulyono & Situmorang, 2018). Customer satisfaction is more important for customer loyalty than customer experience (Cajestan, 2018). In customer experience rationale and affective clue create commitment towards service providers, improving loyalty (Brun et al., 2017; Kamath et al., 2019). Collaboration among researchers in ECRM and customer experiences is significant for advancing research and preventing duplication of effort. SSRN has the highest number of publications in the dimensions database. Further detailed literature record is displayed in Appendix (Appendix Table 1).

| Appendix Table 1 List of Records in the Literature Review | |||||||

| Appendix: Systematic Literature Review from 2000 to 2023 August | |||||||

| S. No | Authors | Title | Year | Document Type | Source Title | Cited by | Findings |

| Abdul-Muhmin, Alhassan G | CRM technology use and implementation benefits in an emerging market | 2012 | Article | Journal of Database Marketing & Customer Strategy Management | 8 | Examines CRM system awareness, adoption, and usage in Saudi Arabia, with a focus on analytical CRM. It finds a high adoption rate, especially among large organizations, dispelling the notion that service firms are more likely to adopt CRM. Key benefits include enhanced customer insight and employee productivity, consistent across organization size and industry. | |

| Alam, Mirza Mohammad Didarul; Karim, Rashed Al; Habiba, Wardha | The relationship between CRM and customer loyalty: the moderating role of customer trust | 2021 | Article | International Journal of Bank Marketing | 18 | Customer trust only moderates the relationship between customer knowledge and customer loyalty, while the other CRM components and customer loyalty are not moderated by trust. | |

| Alawiye-Adams, Adewale Adegoke; Afolabi, Babatunde | An Empirical Investigation into the Effects of Customer Relationship Management on Bank Performance in Nigeria | 2014 | Preprint | SSRN Electronic Journal | 0 | Customer Relationship Management (CRM) and bank performances link was investigated financial services industry. CRM involves managing individual customer information and touch points to maximize loyalty found that CRM has a positive impact on bank performances. Banks should be trained on CRM practices and given frequent seminars to update knowledge. Customer relationship management is used as a business strategy to increase performance through customer satisfaction. |

|

| Al-Bashayreh, Mahmood; Almajali, Dmaithan; Al-Okaily, Manaf; Masa’deh, Ra’ed; Al-Adwan, Ahmad Samed | Evaluating Electronic Customer Relationship Management System Success: The Mediating Role of Customer Satisfaction | 2022 | Article | Sustainability | 5 | Evaluated the relationship between variables in eCRM success, including customer pressure, trust, technological readiness, privacy, COVID-19, service quality, and customer satisfaction. Results showed positive effects on success. | |

| Al-Dmour, Hani H.; Algharabat, Raed Salah; Khawaja, Rawan; Al-Dmour, Rand H. | Investigating the impact of ECRM success factors on business performance | 2019 | Article | Asia Pacific Journal of Marketing and Logistics | 35 | Customer retention, trust, satisfaction positively influenced by ECRM success factors, positively impacting business financial performance. | |

| Almajali, Dmaithan; lfityani, Amjed A; Maali, Hakam; Almajali, Haya | Critical success factors for assessing the effectiveness of ECRM systems in online shopping: the mediating role of user satisfaction | 2022 | Article | Uncertain Supply Chain Management | 2 | A study examined the effectiveness of ECRM systems of those customers are regular of Carrefour in Jordan. Data was obtained through questionnaires and analyzed using SEM. Results showed positive impacts of system quality, security, training, and access to information on user satisfaction. | |

| Banerjee, Shubhomoy; Ratnakaram, Sunitha; Lohan, Amanish | Customer relationship maintenance and loyalty intentions after a brand transgression: a moderated mediation approach | 2021 | Article | Journal of Strategic Marketing | 1 | A study examines relationship marketing orientation and customer attributions and the role of a brand transgression in customer loyalty towards a bank. A study in India found that customers have stronger intentions of continuing their relationship with a bank after a brand transgression. | |

| Cvijiovia, Jelena; Kosti -Stankovia, Milica; Reljia Marija | Customer relationship management in banking industry: Modern approach | 2017 | Article | Industrija | 7 | A fundamental tool for achieving long-term and mutually beneficial relations with the banking services and products users and better business results is customer relationship management. | |

| Das, Subhasish; Mishra, Manit; Mohanty, Prasanta Kumar | Investigating the moderated mediation effect on customer relationship management and customer acquisition | 2019 | Article | International Journal of Electronic Customer Relationship Management | 1 | Employee job satisfaction moderates the relationship between CRM and CA through job satisfaction, providing information on how CRM can be practiced in the real world. | |

| Dash, Guruprasad; Nayak, Bhagirathi | An empirical study for customer relationship management in banking sector using machine learning techniques | 2022 | Article | International Journal of Computer Applications in Technology | 1 | Indian banks' CRM aims to develop and retain customers, with low deposit and innovation capacity in rural areas. A study using Machine Learning techniques aims to investigate the technological progress faced by commercial banks. | |

| Farhan, Marwa Salah; Abed, Amira Hassan; Ellatif, Mahmoud Abd | A systematic review for the determination and classification of the CRM critical success factors supporting with their metrics | 2018 | Article | Future Computing and Informatics Journal | 20 | Implementing CRM is complex, with 70% of projects failing. Researchers focus on critical success factors (CSFs) to enhance success. The paper reviews previous studies, identifies CSFs, and proposes metrics to measure them. | |

| Farmania, Aini; Elsyah, Riska Dwinda; Tuori, Michael Aaron | Transformation of CRM Activities into eCRM: The Generating e-Loyalty and Open Innovation | 2021 | Article | Journal of Open Innovation: Technology, Market, and Complexity | 13 | A study in Indonesia identified ten factors that contribute to e-Customer Relationship Management (e-CRM) value on e-loyalty. | |

| Fjermestad, Jerry; Robertson Jr, Nicholas C | Electronic Customer Relationship Management | 2015 | Monograph | 1 | The book provides a comprehensive survey of information systems research on ECRM, with a collaborative approach and emphasis on integration with other systems. It is organized into four parts, covering marketing, supply chain management, implementation, performance enhancement, and business-to-consumer commerce. | ||

| Fuad, Evans; Abdullah, Zailani | Impact of ECRM Implementation, Customer Experience, and Customer Loyalty in E-Commerce: Literature Review | 2023 | Chapter | Contributions to Management Science | 0 | ECRM improves customer connections, service, and retention. A study found a positive link between ECRM, customer experience, and customer loyalty in e-commerce, but more research is needed. | |

| Grabner-Kraeuter, S.; Moedritscher, G.; Waiguny, M.; Mussnig, W. | Performance Monitoring of CRM Initiatives | 2007 | Proceeding | 2016 49th Hawaii International Conference on System Sciences (HICSS) | 15 | The article discusses the lack of guidance on assessing the profitability of CRM projects and the need for a comprehensive measurement system for ongoing performance monitoring. The authors propose an integrated approach to determine and measure CRM effectiveness and efficiency based on well-known methods for measuring business performance. | |

| Gummesson, Evert | Total Relationship Marketing | 2011 | Monograph | 67 | The third edition of Total Relationship Marketing is a classic text on relationship marketing and CRM. It presents a powerful in-depth analysis of relational approaches to marketing. The book integrates the ongoing evolution in marketing through service-dominant logic, lean consumption and the customer's value chain. It addresses both the high tech, information technology aspects of marketing and the high touch, human aspects. | ||

| Hamid; Ghasemi, Shirin; Ghasemkhani, Ahmad; Ramezantabar, Reza | Improving the performance of customer relationship management regarding trust factors by a unique mathematical programming approach | 2023 | Article | International Journal of Services and Operations Management | 0 | CRM is crucial for businesses as customers are crucial for economic development. Trust factors like moral behavior, commitment, brand, usability, privacy, security, and competence play a significant role in success, with usability having the most effect. | |

| Hota, Sweta Leena | Customers Perception on ECRM Technology: A Comparative Study | 2022 | Article | ECS Transactions | 0 | Customer Relationship Management (CRM) is crucial for banks to achieve customer satisfaction and revenue generation in need-based banking. This study analysed if ECRM techniques used by banks have been successful in bringing about customer satisfaction, which reflects loyalty and success in implementing CRM strategies. | |

| Karim, Rashed Al; Alam, Mirza Mohammad Didarul; Balushi, Maha Khamis Al | The nexus between CRM and competitive advantage: the mediating role of customer loyalty | 2023 | Article | Nankai Business Review International | 1 | A study on customer loyalty in Bangladesh’s banks sector shows that customer orientation and technology capability positively impact competitive advantage. This can help bank managers communicate with new and old customers about new CRM initiatives. | |

| Krishna, Gutha Jaya; Ravi, Vadlamani | Evolutionary computing applied to customer relationship management: A survey | 2016 | Article | Engineering Applications of Artificial Intelligence | 41 | Data mining techniques can be used as a substitute for evolutionary techniques in CRM to improve customer experience and satisfaction. | |

| Lamrhari, Soumaya; Ghazi, Hamid El; Oubrich, Mourad; Faker, Abdellatif El | A social CRM analytic framework for improving customer retention, acquisition, and conversion | 2022 | Article | Technological Forecasting and Social Change | 14 | A proposed social CRM analytic framework can help companies leverage insights from social media data for cost-effective marketing strategies. | |

| Liu, Yishu; Chen, Zhong | A new model to evaluate the success of electronic customer relationship management systems in industrial marketing: the mediating role of customer feedback management | 2022 | Article | Total Quality Management & Business Excellence | 3 | ECRM success depends on consumer-driven innovation, buyer behaviors, product lifecycle management, and customer feedback management. Organizations can gain competitive advantages by identifying these aspects and implementing appropriate strategies. | |

| Lokesh, S.; Vasantha, S. | Progression of Electronic Customer Relationship Management 2022: A Bibliometric Analysis | 2023 | Chapter | Advances in Economics, Business and Management Research | 0 | The Electronic Customer Relationship Management (ECRM) has evolved into a key business application. A study aims to analyzed the relevance of ECRM in various fields. The study extracts 1,687 publications between 2000 and 2022 that are indexed in the SCOPUS database. The research shows the progress and impact all over the world and is not restricted to any specific industry. | |

| Marolt, Marjeta; Pucihar, Andreja; Zimmermann, Hans-Dieter | Social CRM Adoption and its Impact on Performance Outcomes: a Literature Review | 2015 | Article | Organizacija | 27 | The paper reviews scholarly literature on social CRM adoption and its impact on performance outcomes. The findings suggest further adjustment/extension of models. | |

| Marshellina, Marshellina; Prabowo, Hartiwi | The Effect of ECRM Implementation and E-Service Quality on Corporate Image and Customer Satisfaction and Its Impact on Customer Loyalty | 2013 | Article | Binus Business Review | 3 | The study examines the impact of e-CRM and quality of service on customer satisfaction and loyalty at PT XL. The study used questionnaires and Pearson correlation and path analysis to collect data from approximately three million respondents in West Jakarta. Based on the results, the study suggests that more companies should improve their communication with customers and provide better training for employees. | |

| Mumuni, Alhassan G.; O’Reilly, Kelley | Examining the Impact of Customer Relationship Management on Deconstructed Measures of Firm Performance | 2014 | Article | Journal of Relationship Marketing | 5 | Aggregated measures of CRM performance may not accurately reflect the true impact of activities. Examining the impact of 6 activities on individual firm performance indicators provides better diagnostic value for managers. Results provide direction for marketing and customer managers in prioritizing CRM activities and suggest examining individual performance dimensions. | |

| Noviana, Graha | An Analysis of the Implementation of Electronic Customer Relationship Management (E-CRM) Towards Customer Loyalty | 2021 | Proceeding | Advances in Economics, Business and Management Research | 4 | Internet technology enables companies to capture new customers and customize communications, products, services, and prices. Customer relationship management (CRM) is crucial for e-commerce competitiveness. Customer loyalty is the most important component in a business, and ECRM plays a role in its success. | |

| Nurjannah, Nurjannah; Erwina, Erwina; Basalamah, Jafar; Syahnur, Muh. Haerdiansyah | The Impact of E-CRM and Customer Experience on E-Commerce Consumer Loyalty Through Satisfaction in Indonesia | 2022 | Article | Mix Jurnal Ilmiah Manajemen | 6 | The study examines how ECRM and customer experience affect customer loyalty. Customer experience did not affect customer satisfaction or loyalty, but satisfaction was found to be an important factor. Internet use is increasing in Indonesia, and new terms like IoT, AI, startups, and Big Data are emerging. The findings should aid in digital marketing and consumer behavior to improve customer experience. An online questionnaire was randomly distributed to 85 e-commerce users during the pandemic and analyzed using PLS 3 SEM application. | |

| Oumar, Timothy K.; MangUnyi, Eric E.; Govender, Krishna K.; Rajkaran, Sookdhev | Exploring the e-CRM a e-customer- e-loyalty nexus: a Kenyan commercial bank case study | 2017 | Article | Management & Marketing Challenges for the Knowledge Society | 17 | The paper reviews scholarly literature on social CRM adoption and its impact on performance outcomes. The findings suggest further adjustment/extension of models. | |

| Pani, Ashis K.; Venugopal, Pingali | Implementing e-CRM using Intelligent Agents on the Internet | 2008 | Proceeding | 3 | The internet has shifted focus from transactions to relationships. Companies that invest in customer relationship management become winners in the digital economy. Intelligent agents are an emerging technology, but their use in e-CRM is unclear. This paper provides an overview, presents ways to enhance customer attainment and retention, and proposes an integrated model. | ||

| Payne, Adrian | Handbook of CRM, Achieving Excellence in Customer Management | 2012 | Monograph | 43 | The Handbook of CRM covers key concepts for managing customer relationships to increase shareholder value, focusing on successful concepts rather than systems. It includes explanations, cases, templates, and audit advice for assessing CRM needs. | ||

| Payne, Adrian; Frow, Pennie | Customer Relationship Management: from Strategy to Implementation | 2006 | Article | Journal of Marketing Management | 188 | The article discusses the importance of adopting a cross-functional approach to CRM strategy formulation and implementation. It proposes a model that addresses both and identifies four critical components of a successful CRM program. The model structure is used to identify a research agenda. | |

| Rosyid, Rosyid Nurrohman; Astuti, Endang Siti; Yulianto, Edy | The Effect of E-CRM Implementation and E-Service Quality on Corporate Image and Customer Satisfaction and Its Impact on Customer Loyalty | 2023 | Article | Profit | 0 | e-CRM and e-service quality have little impact on customer loyalty and company image, according to a study using random sampling and PLS SEM. The Slovin formula was used to evaluate strategies for maintaining customer satisfaction and loyalty. | |

| Shastri, Siddharth; Sharma, Ridhima; Sethi, Vaishali | An empirical study on influence of e-CRM towards customer loyalty in banking sector | 2020 | Article | International Journal of Public Sector Performance Management | 5 | Axis Bank needs to focus on retaining existing customers to succeed in the competitive Indian banking sector. A study examined the relationship between e-commerce promotional initiatives and customer loyalty. Respondents had positive views on e-DM, relational interaction, privileged conduct, and observed incentive. | |

| Vella, Joseph; Caruana, Albert; Pitt, Leyland F. | The effect of behavioural activation and inhibition on CRM adoption | 2012 | Article | International Journal of Bank Marketing | 5 | Behavioural activation and inhibition systems affect user intention to adopt CRM, with varying degrees of willingness attributed to individual personality traits. | |

| Venkatesh, Umashankar | E-CRM, Issues of Semantics, Domain and Implementation | 2001 | Preprint | SSRN Electronic Journal | 0 | The paper discusses e-CRM as a concept and tool, tracing its evolution from Relationship Marketing. It identifies major components and implementation imperatives. The paper emphasizes the need to prepare the ground well for successful implementation. | |

| Winer, Russell S. | A Framework for Customer Relationship Management | 2001 | Article | California Management Review | 438 | The paper discusses e-CRM as a concept and tool, tracing its evolution from Relationship Marketing. It identifies major components and implementation imperatives. The paper emphasizes the need to prepare the ground well for successful implementation. | |

Conclusion

India's banking system is well-regulated and growing, with a focus on digital banking and personalized customer service. Banks need to adopt the latest technologies to improve customer engagement and loyalty. Banks are using AI technologies like voice recognition and predictive analytics to compete with new financial technology. To maintain a competitive edge, banks must continuously improve their service quality on ECRM reposited in database.

ECRM needs improvement to increase customer loyalty. Strategies include gathering big data. Factors influencing loyalty include discounts and loyalty. Banking loyalty is influenced by attitude, confidence, commitment, satisfaction, service quality, trust, switching costs, and bank reputation. Customer satisfaction is the most determining factor in customer satisfaction. Further study is needed to identify dominant factors in increasing customer loyalty and correlate with customer development.

ECRM is driven by computerized technology to increase sales, customer satisfaction, and reduce costs. It offers automated communication channels, complaint handling, post-sale services, customer follow-up, and relationship maintenance. ECRM systems are successful in developing nations due to technological readiness, customer pressure, and customer satisfaction. Businesses face challenges in keeping up with customers' changing preferences and tastes. Integrating online social media with ECRM is a new trend in customer engagement. Organizations should invest in this investment to provide customized products and services, leading to a linear effect of customer experience and brand power. Extending knowledge around trust and privacy concerns with the use of ECRM systems and consumer digital literacy.

References

Abdul-Muhmin, A. G. (2012). CRM technology use and implementation benefits in an emerging market. Journal of Database Marketing & Customer Strategy Management, 19, 82-97.

Indexed at, Google Scholar, Cross Ref

Al Karim, R., Alam, M. M. D., & Al Balushi, M. K. (2023). The nexus between CRM and competitive advantage: The mediating role of customer loyalty. Nankai Business Review International.

Indexed at, Google Scholar, Cross Ref

Alam, M. M. D., Karim, R. A., & Habiba, W. (2021). The relationship between CRM and customer loyalty: The moderating role of customer trust. International Journal of Bank Marketing, 39(7), 1248-1272.

Indexed at, Google Scholar , Cross Ref

Alawiye-Adams, A. A., & Afolabi, B. (2014). An empirical investigation into the effects of customer relationship management on bank performance in Nigeria. Available at SSRN 2492596.

Indexed at, Google Scholar, Cross Ref

Al-Bashayreh, M., Almajali, D., Al-Okaily, M., Masa’deh, R. E., & Samed Al-Adwan, A. (2022). Evaluating Electronic Customer Relationship Management System Success: The Mediating Role of Customer Satisfaction. Sustainability, 14(19), 12310.

Indexed at, Google Scholar, Cross Ref

Al-Dmour, H. H., Algharabat, R. S., Khawaja, R., & Al-Dmour, R. H. (2019). Investigating the impact of ECRM success factors on business performance: Jordanian commercial banks. Asia Pacific Journal of Marketing and Logistics, 31(1), 105–127.

Indexed at, Google Scholar, Cross Ref

Almajali, D., Maali, H., & Almajali, H. (2022). Critical success factors for assessing the effectiveness of E-CRM systems in online shopping: The mediating role of user satisfaction. Uncertain Supply Chain Management, 10(3), 667-678.

Indexed at, Google Scholar, Cross Ref

Al-Shoura, M. S., Al-Kasasbeh, E., & Rabbai, R. A. Q. (2017). Investigating the impact of E-CRM on customer loyalty: A case of B2B (Business to Business Zain’s customers) in Zain Company in Jordan. Humanities and Social Sciences Series, 32(4), 9-40.

Indexed at, Google Scholar, Cross Ref

Banerjee, S., Ratnakaram, S., & Lohan, A. (2023). Customers’ relationship maintenance and loyalty intentions after a brand transgression: a moderated mediation approach. Journal of Strategic Marketing, 31(3), 693-717.

Indexed at, Google Scholar, Cross Ref

Brun, I., Rajaobelina, L., Ricard, L., & Berthiaume, B. (2017). Impact of customer experience on loyalty: A multichannel examination. Service Industries Journal, 37(5-6), 317–340.

Indexed at, Google Scholar, Cross Ref

Chahal, H., & Dutta, K. (2014). Chahal H. & Dutta K. (2015). Measurement and impact of customer experience in banking sector. Decision: Official Journal of Indian Institute of Management Calcutta 42, 57–70.

Indexed at, Google Scholar, Cross Ref

Cvijovic J Kostic-Stankovic M Reljic M. (2017). Customer relationship management in banking industry: modern approach. 45(3).151-165.

Indexed at, Google Scholar, Cross Ref

Das, S., Mishra, M., & Mohanty, P. K. (2019). Investigating the moderated mediation effect on customer relationship management and customer acquisition. International Journal of Electronic Customer Relationship Management, 12(2), 167-190.

Indexed at, Google Scholar, Cross Ref

Dash, G., & Nayak, B. (2022). An empirical study for customer relationship management in banking sector using machine learning techniques. International Journal of Computer Applications in Technology, 68(3), 286-291.

Indexed at, Google Scholar, Cross Ref

Farhan, M. S., Abed, A. H., & Abd Ellatif, M. (2018). A systematic review for the determination and classification of the CRM critical success factors supporting with their metrics. Future Computing and Informatics Journal, 3(2), 398-416.

Indexed at, Google Scholar, Cross Ref

Farmania, A., Elsyah, R. D., & Tuori, M. A. (2021). Transformation of crm activities into e-crm: The generating e-loyalty and open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 109.

Indexed at, Google Scholar, Cross Ref

Fjermestad, J., & Romano, N. C. (2006). Electronic customer relationship management (Vol. 3). ME Sharpe.

Indexed at, Google Scholar, Cross Ref

Fuad, E., & Abdullah, Z. (2023). Impact of E-CRM Implementation, Customer Experience, and Customer Loyalty in E-Commerce: Literature Review. Finance, Accounting and Law in the Digital Age: The Impact of Technology and Innovation in the Financial Services Sector, 389-399.

Indexed at, Google Scholar, Cross Ref

Garg, R., Rahman, Z. and Qureshi, M.N. (2014), “Measuring customer experience in banks: scale development and validation”, Journal of Modelling in Management, Vol. 9 No. 1, pp. 87-117.

Indexed at, Google Scholar, Cross Ref

Grabner-Kraeuter, S., Moedritscher, G., Waiguny, M., & Mussnig, W. (2007, January). Performance monitoring of CRM initiatives. In 2007 40th Annual Hawaii International Conference on System Sciences (HICSS'07) (pp. 150a-150a). IEEE.

Indexed at, Google Scholar, Cross Ref

Gummesson, E. (2011). Total relationship marketing. Routledge.

Hamid, M., Ghasemi, S., Ghasemkhani, A., & Ramezantabar, R. (2023). Improving the performance of customer relationship management regarding trust factors by a unique mathematical programming approach. International Journal of Services and Operations Management, 45(3), 401-425.

Indexed at, Google Scholar, Cross Ref

Hota, S. L. (2022). Customers Perception on E-CRM Technology: A Comparative Study. ECS Transactions, 107(1), 10171.

Indexed at, Google Scholar, Cross Ref

Kamath, P., Pai, Y., & Prabhu, N. (2019). Building customer loyalty in retail banking: A serial-mediation approach. International Journal of Bank Marketing, 38(2), 456–484. http://doi:10.1108/IJBM-01-2019-0034

Indexed at, Google Scholar, Cross Ref

Kaur, B. (2016). Electronic customer relationship management (E-CRM) in the banking industry in India [Doctoral thesis]. Guru Nanak Dev University. Retrieved from http://shodhganga.infibnet.ac.in/handle.net/10603/169250

Klaus, P., & Maklan, S. (2013). Towards a better measure of customer experience. International Journal of Market Research, 55(2), 227–246

Indexed at, Google Scholar, Cross Ref

Kranzbuhler, A. M., Mirella, H. P. K., Robert, E. M., & Marije, T. (2018). The Multilevel Nature of Customer Experience Research: An Integrative Review and Research Agenda. International Journal of Management Reviews, 20(2), 433–456.

Indexed at, Google Scholar, Cross Ref

Krishna, G. J., & Ravi, V. (2016). Evolutionary computing applied to customer relationship management: A survey. Engineering Applications of Artificial Intelligence, 56, 30-59.

Indexed at, Google Scholar, Cross Ref

Lamrhari, S., El Ghazi, H., Oubrich, M., & El Faker, A. (2022). A social CRM analytic framework for improving customer retention, acquisition, and conversion. Technological Forecasting and Social Change, 174, 121275.

Indexed at, Google Scholar, Cross Ref

Lee-Kelley, L., Gilbert, D. and Mannicom, R. (2003), “How e-CRM can enhance customer loyalty”, Marketing Intelligence and Planning, Vol. 21 No. 4, pp. 239-248.

Indexed at, Google Scholar, Cross Ref

Leva, M., & Ziliani, C., (2018). Expanding the Lens on the Customer Experience-Loyalty Link: The Role of Satisfaction and Shopping Enjoyment. Shopper/Consumer Behaviour and Marketing, 206-210.

Liu, Y., & Chen, Z. (2023). A new model to evaluate the success of electronic customer relationship management systems in industrial marketing: the mediating role of customer feedback management. Total Quality Management & Business Excellence, 34(5-6), 515-537.

Indexed at, Google Scholar, Cross Ref

Lokesh, S., & Vasantha, S. (2023, May). Progression of Electronic Customer Relationship Management 2000–2022: A Bibliometric Analysis. In International Conference on Emerging Trends in Business and Management (ICETBM 2023) (pp. 52-72). Atlantis Press.

Indexed at, Google Scholar, Cross Ref

Mbama, C.I. and Ezepue, P.O. (2018), "Digital banking, customer experience and bank financial performance: UK customers’ perceptions", International Journal of Bank Marketing, Vol. 36 No. 2, pp. 230-255.

Indexed at, Google Scholar, Cross Ref

Mangunyi, E. E., Khabala, O. T., & Govender, K. K. (2018). Bank customer loyalty and satisfaction. The influence of virtual e-CRM. African Journal of Economic and Management Studies, 9(2), 250–265.

Indexed at, Google Scholar, Cross Ref

Marolt, M., Pucihar, A., & Zimmermann, H. D. (2015). Social CRM adoption and its impact on performance outcomes: A literature review. Organizacija, 48(4), 260-271.

Indexed at, Google Scholar, Cross Ref

Mulyono, H. & Situmorang, S.H. (2018). E-CRM and loyalty: a mediation effect of customer experience and satisfaction in online transportation of Indonesia. Academic Journal of Economic Studies, 4(3), 96-105.

Mumuni, A. G., & O’Reilly, K. (2014). Examining the impact of customer relationship management on deconstructed measures of firm performance. Journal of Relationship Marketing, 13(2), 89-107.

Indexed at, Google Scholar, Cross Ref

Noviana, G. (2021, September). An Analysis of the Implementation of Electronic Customer Relationship Management (E-CRM) Towards Customer Loyalty. In 5th Global Conference on Business, Management and Entrepreneurship (GCBME 2020) (pp. 434-438). Atlantis Press.

Nurjannah, N., Erwina, E., Basalamah, J., & Syahnur, M. H. (2022). The impact of E-CRM and customer experience on E-commerce consumer loyalty through satisfaction in Indonesia. MIX: Jurnal Ilmiah Manajemen, 12(1), 56-69.

Indexed at, Google Scholar, Cross Ref

Nurrohman, R., Astuti, E. S., & Yulianto, E. (2023). The Effect of E-CRM Implementation and E-Service Quality on Corporate Image and Customer Satisfaction and Its Impact on Customer Loyalty. Profit: Journal Administration Business, 17(2), 167-179.

Oumar, T. K., Mang’Unyi, E. E., Govender, K. K., & Rajkaran, S. (2017). Exploring the e-CRM–e-customer-e-loyalty nexus: a Kenyan commercial bank case study. Management & Marketing. Challenges for the Knowledge Society, 12(4), 674-696.

Indexed at, Google Scholar, Cross Ref

Pani, A. K., & Venugopal, P. (2008, June). Implementing e-CRM using intelligent agents on the internet. In 2008 International Conference on Service Systems and Service Management (pp. 1-6). IEEE.

Indexed at, Google Scholar, Cross Ref

Payne, A. (2012). Handbook of CRM. Routledge. Indexed at, Google Scholar, Cross Ref

Payne, A., & Frow, P. (2016). Customer relationship management: Strategy and implementation. In The Marketing Book (pp. 439-466). Routledge.

Pine, B. J., & Gilmore, J. H. (1999). The Experience Economy. Harvard Business School Press

Rabbai, R. A. Q., & Al-Shoura, M. (2013). Investigating the impact of e-CRM on customer loyalty: a case of B2B in Zain company in Jordan. Middle East University.

Raina, S., Chahal, H., Klaus, P., & Dutta, K. (2019). Customer Experience and its marketing outcomes in financial services: A multivariate approach: Some Applications. Understanding the Role of Business Analysis, 119-143.

Indexed at, Google Scholar, Cross Ref

Rashwan, H. H., Mansi, A. L., & Hassan, H. E. (2019). The impact of the E- CRM (expected security and convenience of website design) on e-loyalty field study on commercial banks. Journal of Business and Retail Management Research, 14(1), 106–122.

Indexed at, Google Scholar, Cross Ref

Saini, S., & Singh, J. (2020). Managing customer loyalty: An expanded model of customer experience management and customer loyalty. International Journal of Asian Business and Information Management, 11(1), 21–47.

Indexed at, Google Scholar, Cross Ref

Sasono, I., Suroso, & Novitasari, D. (2021). A study on relationship between e-marketing, e-CRM and e-loyalty: Evidence from Indonesia. International Journal of Data and Network Science, 5, 115–120.

Sharma, M., Tiwari, P., & Chaubey, D. S. (2016). Summarizing Factors of Customer Experience and Building a Structural Model Using Total Interpretive Structural Modelling Technology. Global Business Review, 17(3), 730–741.

Indexed at, Google Scholar, Cross Ref

Shastri, S., Sharma, R., & Sethi, V. (2020). An empirical study on influence of e-CRM towards customer loyalty in banking sector. International Journal of Public Sector Performance Management, 6(5), 642-652.

Indexed at, Google Scholar, Cross Ref

Sokmen, A., & Bas, M. (2019). The Influence of Electronic Customer Relationship Management Practices on Relationship Quality and Customer Loyalty: A Research in Airline Industry. Journal of Business Research- Turk, 11(1), 641-652.

Srivastava, M., & Kaul, D. (2016). Exploring the link between customer experience –loyalty-consumer spend. Journal of Retailing and Consumer Services, 31, 277–286.

Indexed at, Google Scholar, Cross Ref

Syahputra, D., & Murwatiningsih. (2019). Building customer engagement through customer experience, customer trust and customer satisfaction in Kaligung Train Customers. Management Analysis Journal, 8(4), 350–359.

Tariq, M., Jamil, A., Ahmad, M. S., & Ramayah, T. (2019). Modeling the effectiveness of electronic customer relationship management (E-CRM) systems: Empirical evidence from Pakistan. Journal of Management and Technology, 19, 77–100.

Indexed at, Google Scholar, Cross Ref

Upadhyaya, M. (2020). Analysis of E-CRM, service quality and brand trust relationship with student satisfaction. Humanities & Social Sciences Reviews, 8(1), 227–232.

Indexed at, Google Scholar, Cross Ref

Usman, M. Z. U., Jalal, A. N., & Musa, M. A. (2012). The impact of Electronic Customer Relationship Management on consumer’s behavior. International Journal of Advances in Engineering and Technology, 3(1), 500–504.

Vella, J., Caruana, A., & Pitt, L. F. (2012). The effect of behavioural activation and inhibition on CRM adoption. International Journal of Bank Marketing, 30(1), 43-59.

Indexed at, Google Scholar, Cross Ref

Venkatesh, U. (2001). E-CRM, Issues of Semantics, Domain and Implementation.

Indexed at, Google Scholar, Cross Ref

Winer, R. S. (2001). A framework for customer relationship management. California management review, 43(4), 89-105.

Received: 13-Oct-2023, Manuscript No. AMSJ-23-14093; Editor assigned: 14-Oct-2023, PreQC No. AMSJ-23-14093(PQ); Reviewed: 27-Oct-2023, QC No. AMSJ-23-14093; Revised: 03-Jan-2024, Manuscript No. AMSJ-23-14093(R); Published: 15-Feb-2024