Research Article: 2023 Vol: 27 Issue: 1

E-Wallet Adoption among Indian Consumers: An Empirical Study

Girish Santosh Bagale, NMIMS University

Rajshree Srivastava, ASM’s IMCOST, University of Mumbai

Citation Information: Santosh Bagale, G., & Srivastava, R. (2023). E-Wallet adoption among indian consumers: An empirical study. Academy of Marketing Studies Journal, 27(1), 1-18

Abstract

Adoption of e-wallets is influenced and affected by several factors which are related to consumers understanding about its awareness, compatibility, security, usefulness, etc. A sample of 387 respondents using e-wallets belonging to Maharashtra and other states of India was validated through random sampling survey method. The results indicate Perceived Ease of use, Awareness, Compatibility, Perceived security; Perceived usefulness and Triability in this order have influenced the intent of users to adopt e-wallets. Attitude and Innovativeness are the obstacles that have an insignificant impact on the adoption of e-wallets. Factors such as Perceived Ease of use, Awareness, Compatibility, Perceived security have larger significance. To understand the benefits which accrue to the marketers and to the customers through E-Wallets is dependent upon the speed with which they adopt the new technology. The resultant model can be used to derive insightful understanding about the intent of consumers towards the adoption of e-wallets platform.

Keywords

E-wallets, TAM, Awareness, Compatibility, Perceived Usefulness, Perceived Ease of Use, Adoption, DOI.

Introduction

Digitalization is reshaping the Indian customer market. Gone are the days when customers have to go to the product or visit the stores for shopping of goods, now the products are reaching the customer doorsteps .With the growing technological revolution and drastic changes taking place every nano second, customers have also become smarter and advanced. Earlier customers have to match themselves or their needs with the products or services sold in the market , now the advancements in technology is matching the product with the requirements and preferences of the customers just the vice-versa Aydin & Burnaz (2016).

Looking back to the history, payment system in India has witnessed a lot of transformation starting from the barter system exchanging the goods against the goods and then the evolution of coins, moving to the notes and paper currency, then the evolution of plastic cards, leading to online payments or digital payments through E-Wallets and further leading to adoption of bit coins in the coming years (Burn-Callander, 2014).

Later, in 1983, the idea of digital cash got propounded firstly by (Rampton, 2016), marking the presence of the digital payments era. These innovations later witnessed the first online purchase and payment. Digital revolution has replaced the physical money with plastic money and then to electronic money for the purpose of using it for the routine transactions of making bill payment, online money transfers or etc (Shethna, 2015).

Digital wallets, Electronic payments, mobile commerce, and mobile banking are all terms used to describe virtual payment systems and services. Among all the alternatives of online payments, An e-wallet is a prepaid account in which a user can deposit money, and its fundamental components are software (which saves personal information and provides security and encryption) and information (record of user details) (Sharma, 2017). In the years to come it has been estimated by Forrester that digital wallets will boom, in light of the fact that keen traders and advertisers will start utilizing them as platforms to draw in shoppers all through the whole customer life cycle, not simply the buy stage. The individuals who plan for this vision today will approach a ground-breaking switch they can pull to direct people to organization sites and to the physical store tomorrow (Source : Article by Forrester). There are as of now around 20 E- wallets payment gateways in INDIA and some which are being authorized by RBI.

Mobile technology has progressed a long way in India, from being a sign of lavishness to a benefit of service available to all. India has become one of the leading mobile marketplace, leaving everyone behind in the race.(Report - The case for Mobile Payments in India page no 15). Corresponding to the IAMAI (2019) report, as of quarter 2019, India has 451 million active internet users who are 5 years and above. Of the total online traffic, 385 million comprise of 12+ years old and 66 million comprise of the 5-11 age group of the kids or children using internet services on the devices of their parents or other family members.

With more than 1 in 3 individuals, 12 yrs and above accessing internet in the country, diffusion in urban market is twice in comparison to that of the rural market. Rural India – the largest population segment comprises of a substantial portion that lacks the facilities of internet access. Hence it calls for the new opportunities and scope for development which will supplement to boost the general use of the internet by the public over the subsequent several years.

Overall the top 8 metros have a 63% diffusion of internet usage and less significant urban towns have comparatively smaller penetration followed by rural – indicating access of internet dripping down as we move ahead to other locations and areas being lesser developed or still fighting for basic necessities in different cities.

Though internet penetration is still getting to grips across India, when entering metros with Mumbai considered having the largest population of internet users closely followed by other metro cities, the circumstances are quite perfect and favorable.

This scale of penetration of internet is on the other level leading to development and more adoption of new applications and moving more towards the cashless economy. There is lot of competition among organizations that supply mobile based payment services (Baidya, 2016), since individuals now trust and use online shopping combined with online payment services.

India has a significant 39 percent mobile wallet market penetration.

According to the reports of Reserve Bank of India, there were 60 e-wallet companies in 2017 compared to just one in 2006. Investors are particularly cautious of the market's level of competition and fragmentation (Bhakta & Srinivasan, 2018). Smaller companies have been exiting the market or being swallowed by larger companies (Nupur, 2018) (for example, Flipkart acquired PhonePe, and Amazon chooses FreeCharge).

This means that, despite the growing popularity of m-payments, e-wallet service providers are working hard to attract and retain customers. Because convincing users to abandon traditional payment methods in favour of m-payments is difficult, it is necessary to investigate the predictors that may influence customers' intent to adopt e-wallets. Therefore, this study recognizes the need to identify influencing factors that contribute to or detract from Indian consumers' behavioral intent to use e-wallets.

Prior to introduction and innovations in digital payments and its adoption by customers, plastic money and internet transactions and its usage and perceptions of customers about it have got ample exposure in the market and in the academic literature over the last 10 years.

This topic is of utmost importance and requires a lot of investigation and study in the field of academics as per the growing trends of the market and the customer’s perception about the usage of digital wallets and its services Soodan & Rana (2020).

There has been not much deep research on this topic analyzing the different segments of the customers and their behavioral intent to use E- Wallets in the market, as it has gained much relevance in the market after the demonetization in India.

To the best of my knowledge not much publication or research work by academicians as a part of empirical analysis has been found with respect to study of different segments of the customers in the market regarding the usage and adoption of E- Wallets considering the Innovation Adoption Model and Technology Acceptance Model hasn’t been worked out in depth yet.

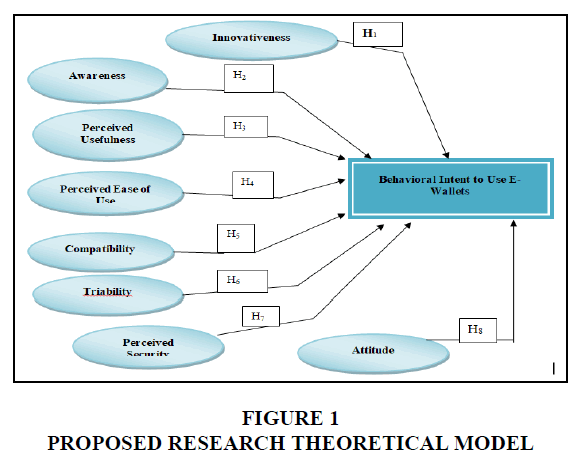

This fact created the need for addressing the research gaps mentioned above thus, this study seeks to refine and validate an empirical model that describes the factors that affect the Indian consumers' intent to use or adopt e-wallets, by integrating and utilizing prominent theories like TAM (Technology acceptance model, Nikola Maranguni?, etal, 2015) & DOI (Diffusion of Innovation theory, (Rogers, 2003).

Literature Review And Theoretical Framework

The relationship between e-wallets and its adoption by consumers have been evaluated using various theoretical models.

The existing research reflects the links between consumer adoption and e-wallets and has validated the models TAM (Davis etal,.1989) DOI (Rogers,2003). According to Vaggelis Saprikis, etal, (2018) many popular studies have identified TAM, UTA & DOI as the behavioral intention theories behind the user’s intent to use mobile technology for online shopping and payments via e-wallets. The theoretical fundamentals of the TAM have been used to make an important contribution to the research on the adoption of mobile wallets (David Campbell etal, .2017).

Researchers have utilized several extensions of these frameworks to better understand the motivations for adopting IT Yang et al. (2015). For instance, according to a study conducted by Faqih & Jaradat (2015) utilizing the TAM3 framework for investigating the adoption of mobile commerce technology. The findings reveal that perceived ease of use and perceived usefulness are major deterrents to users' willingness to accept mobile commerce. A significant contribution to the research on mobile wallet adoption has used the frameworks Like DOI and UTAUT2 and deduced that the factors like Perceived security, compatibility, innovativeness plays a vital role in influencing the behavioural intent of users to use e-wallets (Olievera et al., 2016). Sadi & Noordin (2011) investigated the factors that affect the adoption of m-commerce in Malaysia based on traditional models such as technology acceptance model (TAM), theory of reason action (TRA), diffusion innovation theory (DOI) and theory of planned behaviour (TPB) and derived the factors like Perceived ease of use, perceived usefulness, personal innovativeness, trust, Attitude, cost and self efficacy plays the significant role in adoption of mobile commerce. Researchers in their studies based on technology acceptance model in order to assess the intent to use mobile commerce by examining the impact of various other variables on it, have derived factors like Perceived ease of use, perceived usefulness, awareness and perceived trust as the significant element determining the intention to use mobile commerce (Shah et at.,2014) Table 1 and 2.

| Table 1 Summary Of Researchers Approach & Their Purposes On E-Wallets |

|||

|---|---|---|---|

| Researchers | Topic of study | Purpose | Approach |

| Junadi & Sfenrianto | A Model of Factors Influencing Consumer’s Intention To Use E-Payment System in Indonesia |

To` determine the significance factors that influence acceptance of e-payment technology | Unified theory of acceptance, use of technology (UTAUT) with culture and perceived security |

| Satadruti Chakraborty & Mitra (2018) | A Study On Consumers’ Adoption Intention For Digital Wallets In India | To find out whether customer demographics influence adoption intention for e-wallets in India and to identify the parameters that are most important in predicting consumers’ adoption intention. | Perceived usefulness, perceived ease of use, perceived self-efficacy, personal innovativeness & individual playfulness, perceived compatibility, attractiveness of alternatives, perceived value, perceived risk and adoption intention |

| Avinash Rana | Modeling Customers’ Intention to Use E-Wallet in a Developing Nation: Extending UTAUT2 With Security, Privacy and Savings | ||

| Table 2 Construct Definition In Tam Model & Doi Theory (Constructs In Bold Are Additions To The Original Tam Model And Signify Inherent Utilities) |

|||

|---|---|---|---|

| S.No | Factor | TAM & DOI Definition | Affects |

| 1 | Perceived Usefulness (PU) | The degree at which a person assumes that a specific system will increase the performance of his or her job in an organizational context. (Davis,1989) | BI |

| 2 | Perceived Ease of Use (PEOU) | The degree to which the person believes that the use of a specific method will be effort-free (Davis, 1989). | BI |

| 3 | Compatibility | It is an extent to which a technological modernization is alleged as being constant with the current ethics, precedent skills and wants of potential adopters (Rogers, 2003). | BI |

| 4 | Trialability | The degree at which developments in the technical relationship can be attempted in a limited manner (Rogers, 2003). | BI |

| 5 | Perceived Security (PS) | This ensures that the degree at which the consumer considers the use of a certain mobile payment process would be safe and stable. (Salvendy, 2005). | BI |

| 6 | Awareness | It is referred to as individual consumers something interest and curiosity (Endsley, 2000). | BI |

| 7 | Innovativeness | The extent to which the theory or concept or idea, or product or service is perceived to be new and unique. | BI |

| 8 | Attitude | Consumer’s attitude refers to the thoughts and opinions of the customers. | BI |

Core and Augmented Model

To understand the relevance of above mentioned constructs of TAM model and DOI theory to the current study, it is necessary to discuss these in detail.

Perceived Usefulness

This construct analyses the perception of respondents regarding the usefulness about the E- Wallets. It measures whether respondents prefer the idea of E-Wallets for the purchase decision making, or do they prefer the idea of buying products through E-Wallets. The perceived usefulness is considered to be fundamental predecessor towards the usage of a particular technology (Davis, 1989). Several studies over the years have also demonstrated the significance of this construct in the study of technology acceptance (Chen & Adams, 2005).

As a result the following hypothesis can be presented for this study:

H1: There is a positive relationship between Perceived usefulness and behavioral intent of users to use e-wallets.

Perceived Ease of Use

This construct measures whether it is easy for the respondents to use E- wallets on phone or not, it measures the respondents view whether it is easy to use E- Wallets or not. An individual's belief that using a particular system is simple or easy is referred to as perceived ease of use (Davis, 1989). One of the most concerning factors influencing consumer acceptance of a technology is how simple the technology appears to be to use. It is regarded as one of the dimensions with the greatest impact on the acceptance of new technologies (Davis, Bagozzi, & Warshaw, 1992; Moore & Benbasat, 1991). In the context of e-wallets, this factor is revealed as one of the most essential elements affecting the behavioral intent of users to adopt the new technology (Dahlberg & Mallat, 2002; Liébana-Cabanillas et al., 2014; Ovum, 2012).

As a result, we propose the following hypothesis:

H2: There is significant positive relationship between perceived ease of use and behavioural intent of users to use e-wallets.

Compatibility

This construct measures whether the app is user-friendly and the analysis of this measure provides the input that whether the respondents are compatible to use the app and the E- wallets is compatible to use existing technology. Compatibility is a key component of technology adoption models, and inconsistency of an individual's interest with the innovation is widely recognized as a barrier to adoption (Rogers, 2003). As proposed in related theories and studies on technology adoption it has revealed positive effects of compatibility on users behavioral intent to use e-wallets. (Karahanna, Agarwal, & Angst, 2006; Schierz et al., 2010) Zaichkowsky (1985).

Therefore keeping in view its significance, the accompanying hypothesis for the study is:

H3: There is positive relationship between Compatibility and behavioral intent of users to use e-wallets.

Trialability

The degree at which developments in the technical relationship can be attempted in a limited manner (Rogers, 2003).This construct measures that whether the respondents find it easy to use E-wallets and use frequently after trying it. This element aims to determine whether users are satisfied after using the E-wallets app for the first time and are eager to use it again as an option of payment. Before making it a practice to follow, the degree to which the innovation can be tested or experimented or attempted is referred to as trialability. Based on the above discussion hypothesis can be proposed as follows:

H4: There is significant relationship between Trialability and behavioral intent of the users to use the e- wallets.

Additional Factors

Four more factors were added to the study combining the other constructs of DOI theory and TAM model. In addition, the variables were assessed for significance in order to determine their relevance in the Indian context.

Perceived Security (PS)

This construct measures that whether the respondents care about the security factor. To analyse whether respondents are using E- wallets because it is perceived not very secured. This construct is considered in the questionnaire to find out the trust factor for E- wallets amongst the respondents. Consumer perceptions of the likelihood of becoming a victim of crime while using a technology are referred to as perceived security (Rader, May, & Goodrum, 2007).People while doing financial transactions online give more preference to the security of services. It refers to the users' perceptions of the security risks associated with the usage of e-wallets. Yang et al. (2015), Pedersen, Lee etal, 2015). Hence it can be hypothesized as follows:

H5: There is positive and significant relationship between Perceived Security and behavioral intent of the users to use e-wallets.

Awareness

The next factor being suggested for the augmented model is awareness of the Indian consumers with respect to the e-wallets and its influence on the technology acceptance. This construct measures the awareness level of the respondents with respect to E-wallets, this tries to analyse are the enough information available with respondents so that they can use E- wallets. This variable tries to analyse whether respondents are aware that E- wallets can be used as a method of payment. Rogers and Shoemaker (1971) established that consumer go through several stages in knowledge confirmation before they finally adopt a product of service. Guiltinand & Donnelly (1983) emphasized on the importance of awareness before adoption of any innovative products. Shah, Fatimee, and Sajjad (2014) in their study has considered awareness as one of the explanatory variables for measuring the intention of users to use e-wallets. Therefore we can propose the following hypothesis:

H6: There is positive relationship between awareness and behavioral intent to use e-wallets.

Innovativeness

H7: There is positive relationship between innovativeness and behavioural intent to use e-wallets.

Attitude

Consumers attitude refers to the thoughts and opinions of the customers. Amoroso and Watanabe (2011) conducted a study and identified key constructs for mobile payment adoption from a consumer perspective and revealed that Attitude has strong influence on behavioural intent to use e-wallets. The tendency and feelings of an individual toward an object, an idea, or behaviour are referred to as their attitude (Küçük, 2011).However this factor is not included in the TAM model, therefore by including it into the theoretical model the study intends to see how well the resulting framework predicts the future. Hence the following hypothesis can be proposed on the basis of discussions:

H8: There is significant and positive relationship between attitude and behavioral intent of the users to use e-wallets.

Methodology

This study contemplates on the influencing factors specified in DOI theory and TAM model along with four other additional variables: Perceived Security, Awareness, Innovativeness and Attitude on behavioral intent of users to use e-wallets for online transactions and payments. To identify the intent of the users, the study includes survey method of data collection the same being considered by researchers in their previous studies. To gather responses to the study, simple random sampling technique was applied. Questionnaire comprising of both open ended and close ended questions were circulated in through google forms to the potentials respondents randomly. A structured questionnaire has been considered which consists of close ended, open ended questions and different scales have been considered in the questionnaire to get the responses of the customers in a more accurate manner. The questionnaire has been designed by using multiple-item with 5 Likert Scales. Preparation and designing of the questionnaire includes developing framing questions on the basis of different segments or characteristics of consumers in the market.

First part of the questionnaire deals with the demographic information such as Age, Gender, Education, Occupation, Family income, Total Income, etc was gathered. Part two assessed the respondent's general knowledge of e-wallets and their use, degree of accessibility, and ease of access to e-wallets for various purposes. Parts three included questions that assessed PEOU, PU, perceived protection and risk of privacy, confidence , social impact, attitude and purpose to use e-wallets on the basis of TAM (Technology Acceptance Model) & Diffusion of Innovation Theory by Rogers Figure 1.

Area of Study

The data was collected from different states like Maharashtra, Uttar Pradesh, Punjab and other distinct parts of India and the cities adjoining these states reflecting Indian consumers and their intent to use e-wallets. Hence majority of the respondents ranges within the age group of 25-40 years, majorly comprising of students, corporate professionals, academicians etc. who are more prone towards usage or adoption of e-wallets for online transactions.

As suggested by Zaichowsky (1985), by analysing the constructs, the validity of the questionnaire is required to be tested. Moreover, the designed structured questionnaire was sent to 30 respondents for pilot testing to refine the items listed in the questionnaire before its final circulation for collection of data. Subsequently, Cronbach's alpha has been used to check the precision and validity of the questionnaire so as to know if any shortcomings or discrepancy in the questions for the purpose of achieving the desired outcomes as per the objectives framed.

Following that, the sample size was calculated using the recommendation of Cochran (1963:75), Krejcie & Morgan (1970). Keeping in mind the study's acceptable sample size (384), a total of 387 responses were received.

Data Analysis

For the analysis of factors, Factor analysis as a statistical tool have been used to summarize the thirty two items into smaller set of variables and also to explore the new and most significant variables influencing the adoption or behavioral intent to use E- wallets among the Indian consumers. The appropriateness of factor analysis can be carried out by assessing Sampling Adequacy through Kaiser-Meyer-Olkin Measure of Sampling Adequacy (KMO). The resulting value of Bartlett's sphericity test is considered to be important only when (p<0.001, p=0.000). Statistically, it has been proposed and shown by the researchers that if the Bartlett sphericity test is found to be important, even if the Kaiser-Meyer - Olkin calculation is found to be greater than 0.6, then the factorability is often assumed to occur between the variables ( J. C. Coakes and C. Ong.) The Kaiser-Meyer-Olkin (KMO) test of sample adequacy and the Bartlett test of sphericity were applied to the data, and the KMO measure was 0.970, while the Bartlett test of sphericity was significant at p=.000. As a result, the data was determined to be suitable for factor analysis Table 3 and 4.

| Table 3 Adopted Constructs |

|||

|---|---|---|---|

| S.No | Construct | Measurement | |

| 1 | Attitude | Amoroso and Watanabe, 2011 | A.I like the idea of using my cell phone for making payments through E-wallets at a point of sale terminal or scanner. |

| B. I would like to use E-Wallets in the near future | |||

| C.I intend to use E- wallet to manage my payment transactions in the future | |||

| 2 | Perceived Usefulness | Adapted from Davis et al., 1989 | A. I can easily complete the payment of transactions through E-Wallets |

| B. Using E- wallet improves my purchase decision making | |||

| C. I believe E- wallet is useful for buying products. | |||

| 3 | Perceived Ease of use | Adapted from Davis, 1989 | A. It is easy to use E-Wallets on phone for purchasing products |

| B. It is easy to understand how to use E-wallets | |||

| C.E-wallets can easily be used at anytime for payments | |||

| 4 | Compatibility | Adapted from Rogers, 2003 | A. Hard to use E-Wallets on mobile phone for purchasing things |

| B.I am compatible in using E-wallets | |||

| C.E-Wallets is compatible with our existing technology | |||

| 5 | Triability | Adapted from Rogers, 2003 | A. It is easy to use E- wallet more frequently after trying them out. |

| B. A trial would convince me that using E- wallet is better than using credit/debit cards. | |||

| C. It is better to experiment with E- wallet before adopting it. | |||

| 6 | Perceived Security | Adapted from Salvendy, 2005 | A. I believe E-wallets are not a secure system to save my credit cards and personal information. |

| B.I do not trust E- wallet service providers. | |||

| C. There is a security risk in using E- Wallet. | |||

| 7 | Awareness | Adapted from Endsley, 2000 | A.I have enough information to decide to use E-wallet for purchasing products. |

| B.I already know what E- Wallets are and how they work. | |||

| C.I am aware of the E- wallet as a payment method. | |||

| 8 | Innovativeness | Adapted from Midgley & Dowling, 1978 | A.E-wallets are new platform for making payments digitally |

| B.E- wallets have innovative features | |||

| C.I would like to use innovative methods of making payments when shopping | |||

The table 4 above indicates the demographic profile of the total number of respondents for the study. For the purpose of analyzing the contributing factors of respondents towards the behavioral intent to use E- wallets Principal Component Method of Exploratory Factor Analysis (EFA) using Varimax Rotation is applied using IBM SPSS 21.0 as a tool for analyzing data. Table 2 above shows the rotated factor matrix for the Likert scales Wahab et al. (2018). Thus, as proposed by the literature researchers, variables with a loading factor of more than 0.50 were chosen and considered in this analysis because loadings equal to 0.45 are considered to be normal, whereas objects with a loading factor of 0.32 are not considered to be fine. (Tabachnick and Fidell) Yan & Yang (2015).

| Table 4 Demographic Profile Of Respondents |

||

|---|---|---|

| N=387 | Percentage | |

| Gender | ||

| Male | 217 | 56.1 |

| Female | 170 | 43.9 |

| Educational qualification | ||

| 10 | 1 | .3 |

| 10+2 | 29 | 7.5 |

| Graduation Degree | 138 | 35.7 |

| Master Degree | 193 | 49.9 |

| Ph.d | 26 | 6.7 |

| Profession | ||

| Govt Employee | 21 | 5.4 |

| Private Employee | 166 | 42.9 |

| Business | 27 | 7.0 |

| Self Employee | 34 | 8.8 |

| others (Please Specify)...student............... | 139 | 35.9 |

Factor-1 known as Perceived Ease of Use ( PEOU) consists of eight items with factor loading varying from 0.59 to 0.86 after the Varimax Rotation Process with Kaiser Normalization is performed, the items in the PEOU factor are variables with numbers listed in (refer Table 2 below)-Variable no-3, 2, 1, 9, 7, 8, 6, and Variable- 4 Usman et al. (2014).

Factor 2 Awareness consists of six items with factor loads varying from 0.50 to 0.68. Items included in this factor Awareness are Variables listed with no’s as variable - 19, 20, 21, 22, 23, and Variable- 24 (refer Table 2).

Factor 3 Compatibility consists of 3 items with factor loadings varying from .619 to .657. Items included in this factor Compatibility are Variable-11, Variable- 13, and Variable- 12 (refer Table 2). Factor 4 comprises of Perceived Security which includes 3 items with factor loadings ranging from values .711 to .889. Items included the factor Perceived Security are Variable-18, Variable-17 and Variable-16 (refer Table 2)

Factor 5 Perceived Usefulness comprises of 2 items having factor loadings ranging from .646 to .695. Items included in this factor Perceived Usefulness are Variable-10 and Variable-5 (refer-Table 2).

Factor 6 Triability comprises of 2 items bearing factor loadings values from .513 to .586. Items included in this factor Triability are Variable-15 & Variable-14 (refer-Table 2).

The Exploratory Factor Analysis through PCA outcomes at the rotated component matrix illustrates that all the components are valid; as they have been properly loaded on identified factors therefore it is evident that factors and their scales are valid and can be tested further Riffai et al. (2012).

Reliability & Validity

Researchers in their literature have very well stated that the PLS SEM uses composite durability rather than Cronbach’s alpha to evaluate the internal accuracy of the calculation model. Earlier Cronbach's alpha was used as a metric for determining the reliability of internal consistency Zwick & Velicer (1986).

Thus later it was not found very much suitable and reliable for PLS SEM because of its sensitivity to the number of items in the scale. (Werts, Linn, & Joreskog,1974).

The composite reliability for the constructs such as PEOU, Awareness and Behavioural Intention to use E-Wallets are shown to be 0.9734, 0.9657, and 0.9615 therefore, suggesting strong standards of durability of internal accuracy (Nunnally & Bernstein, 1994). Previous literature indicates that a threshold level of 0.60 or higher is needed to demonstrate a sufficient composite reliability in exploratory study. Bagozzi & Yi (1988).Thus the values of composite reliability indicate that high levels of internal consistency reliability is observed in all the reflective latent variables Junadiª (2015).

The internal consistency of the latent variables is calculated by the composite reliability and the Cronbach’s Alpha of the structures;. Both the composite reliability ( CR) and the alpha values of Cronbach’s can surpass the minimum threshold of 0.70 in order to achieve acceptable reliability. (Nunnally,1978). The values derived exceed these thresholds by substantial margins. Therefore, it can be interpreted that the constructs demonstrate sufficient reliability and validity. Except for perceived usefulness which has Cronbach’s Alpha value as 0.403 which is nearing to .050 or as the composite reliability of the variable is 0.71 it means it is adequately reliable. Convergent validity explains the variances in the indicators of the model. The AVE data in the model indicates the level of convergent validity (Fornell and Larcker, 1981). Researchers have suggested an AVE threshold level of 0.5 or higher as proof of confirmed convergent validity. Average Variance Extracted (AVE) is evaluated for each construct to validate convergent validity. The AVE for the latent variable Awareness is 0.8245, Behavioral Intention to use E-wallets is 0.8927, Compatibility is 0.8747, Perceived Ease of Use is 0.8207, Perceived Security is 0.7396, Perceived Usefulness is 0.5800, Triability is 0.84777 respectively, has been found to be above the required minimum level of 0.50.(Table-2). Hence, as the calculations of all reflective latent variables can be said to have a high degree of converging validity. It can be found and interpreted that the AVE values of all latent variables are more than the appropriate threshold of 0.5, thus showing that there is certainly a convergence of validity Oliveira et al. (2016) Table 5.

| Table 5 Cr, Ave And Factor Loading |

||||||

|---|---|---|---|---|---|---|

| S.No | Variable | Factors | Scores | AVE | CR | |

| I | PEOU | 0.820742 | 0.973402 | |||

| Variable- 3 | PEOU1 | I intend to use E- wallets to manage my transactions. | 0.862 | |||

| Variable ? 2 | PEOU2 | I would like to use E- wallets in near future. | 0.842 | |||

| Variable ? 1 | PEOU3 | I Like the idea of using cell phones for making payments through E- Wallets. | 0.788 | |||

| Variable ? 4 | PEOU4 | I can easily complete the payment of transactions through E-Wallets. | 0.785 | |||

| Variable-9 | PEOU5 | E-wallets can easily be used at anytime for payments. | 0.743 | |||

| Variable -7- | PEOU6 | It is easy to use E-Wallets on phone for purchasing products. | 0.729 | |||

| Variable-8- | PEOU7 | It is easy to understand how to use E-wallets. | 0.679 | |||

| Variable-6 | PEOU8 | I believe E- wallet is useful for buying products. | 0.592 | |||

| II | Awareness | 0.824582 | 0.965721 | |||

| Variable-22- | AW1 | E-wallets are new platform for making payments digitally. | 0.679 | |||

| Variable- 23 | AW2 | E- wallets have innovative features. | 0.643 | |||

| Variable-21 | AW3 | I am aware of the E- wallet as a payment method. | 634(2) | |||

| Variable- 20 | AW4 | I already know what E- Wallets are and how they work. | 0.618(2) | |||

| Variable-24 | AW5 | I would like to use innovative methods of making payments when shopping. | 0.599 | |||

| Variable- 19 | AW6 | I have enough information to decide to use E-wallet for purchasing products. | 0.500 | |||

| III | Compatibility | 0.874726 | 0.954436 | |||

| Variable-11 | CP1 | I am compatible in using E-wallets. | 0.657 | |||

| Variable- 13 | CP | It is easy to use E- wallet more frequently after trying them out. | 0.644 | |||

| Variable-12 | CP3 | E-Wallets is compatible with our existing technology. | 0.619 | |||

| IV | Perceived Security | 0.739689 | 0.894855 | |||

| Variable- 18- | PS1 | There is a security risk in using E- Wallet. | 0.889 | |||

| Variable- 17 | PS2 | I do not trust E- wallet service providers. | 0.813 | |||

| Variable-16 | PS3 | I believe E-wallets are not a secure system to save my credit cards and personal information. |

0.711 | |||

| V | Perceived Usefulness | 0.580055 | 0.709048 | |||

| Variable- 5 | PU1 | Using E- wallet improves my purchase decision making. | 0.695 | |||

| Variable- 10 | PU2 | Hard to use E-Wallets on mobile phone for purchasing things. | 0.646 | |||

| VI | Triability | 0.847775 | 0.917617 | |||

| Variable- 15 | TR1 | It is better to experiment with E- wallet before adopting it. | 0.586 | |||

| Variable14 | TR2 | A trial would convince me that using E- wallet is better than using credit/debit cards. | 0.513 | |||

Measurement Structural Model

To get a structural model fit exploratory factor analysis results are summarized and the theoretical model (Figure 1) has been validated. We have got r square value as 0.79 or 79% which indicates our model is robust and having high predictive value as the threshold value should be more than 0.60 Figure 2 and Table 6.

| Table 6 Hypothesis Testing Result |

|||||

|---|---|---|---|---|---|

| Hypothesis | Relationship | Path Coefficient | Standard Deviation (STDEV) | T Statistics | Validation |

| H5 | Awareness -> Behavioural Intention to use E-Wallets | 0.461 | 0.032 | 2.397** | Supported |

| H6 | Compatibility -> Behavioural Intention to use E-Wallets | 0.242 | 0.026 | 1.516 | Rejected |

| H7 | Perceived Ease of Use -> Behavioural Intention to use E-Wallets | 1.127 | 0.038 | 29.409*** | Supported |

| H8 | Perceived Security -> Behavioural Intention to use E-Wallets | 0.296 | 0.011 | 1.709 | Rejected |

| H9 | Perceived Usefulness -> Behavioural Intention to use E-Wallets | 0.518 | 0.018 | 2.101* | Supported |

| H10 | Triability -> Behavioural Intention to use E-Wallets | 0.58101 | 0.025 | 2.319* | Supported |

To get a structural model fit exploratory factor analysis results are summarized and the theoretical model (Figure 1) has been validated. We have got r square value as 0.79 or 79% which indicates our model is robust and having high predictive value as the threshold value should be more than 0.60 Figure 2 and Table 6.

In the table presented above, presents the path coefficient of the structural model using SmartPLS 2.0. It is used to assess the significant value for all the path coefficients for the purpose of evaluating the hypothesis of research. It can be interpreted from the figure and the table presented above that the latent variables like Awareness, PEOU, PU and Triability with t statistics value as 2.397, 29.409, 2.101, 2.319, greater than 1.96, respectively are significant with 0.00 as their p Value validating the decision of rejection of the Null hypothesis and supporting the alternate hypothesis. The similar interpretation is repeated for the next row until the end of column to observe the significant value. Based on the results of analysis, there exists 4 variables having significant values and two constructs that is Compatibility and Perceived security with t statistics value as 1.516 and 1.709 rejects the alternate hypothesis and accepts the Null hypothesis signifying no relation with the behavioural intent to use E-wallets.

The findings from the analysis reveal that Perceived Security and compatibility when associated with the consumers’ behavioural intention to use E-Wallets do not resemble a significant relationship together. The structural model constructed favours the effect of other influences on the user's behavioural decision to use and adopt the E-wallets, emphasizing on the role of awareness, Triability, PEOU & PU, thereby leading to increase in the usage of E-wallets among Indian consumers.

Lastly it can be interpreted from the analysis that research work undertaken has provided the desired results required to prove the established objectives through the various statistical tests at various stages.

Analysis involves the extensive study about the variables or factors influencing the behavioral intent of the users to adopt E-Wallets amongst consumers in India.

Discussions

From the analysis it has been observed that, data was collected from the 387 respondents as per the calculation of the sample size during the data collection stage. There were no missing data or value hence responses of all the 387 respondents in the sample size were finally taken for analysis. All the information collected through the close ended questions was validated on the smart pls software except the open ended questions where respondents have given their brief opinion for different questions. As the data was validated and does not have any missing data or values so it was decided to proceed with the existing data for analysis. From the analysis of the Descriptive statistics it reveals that not less than 51% of collected responses comprised of the population within the age group of 15-25 years old, which resembles that this segment of respondents have a close relationship with the intent to use or adopt the e-wallets. Likewise, if the responses of the people lying within the age of 26-35 years are combined, then collectively segment of individuals lying in both of these two age groups comprise of not less than 78% of the composed sample. Thus, majority of the sample in the study comprise of the young enthusiasts or millennials from the intended cluster. Furthermore, the geographical division of the feedback portrays the intent of the sample population on adoption of new technology, expecting a wave in the adoption of E-Wallets amongst the consumers across the country.

Almost 56% of respondents are males versus 44% of females. This specifies a skew toward opinions of men’s about the adoption of E-wallets. In future with another sample there can be rise in the sample population of women’s respondents for representing the vice- versa of present results. Almost 45 % of respondents are pursuing their master’s studies and belong to the age group of 18-25 who are not earning as well. Additionally, study reveals that approx. 53% of people from the sample size belong to the category of working class, with professional occupation as business, Private employee or are working in government department or part-time along with their education. Therefore, more than 51% of sample constitutes respondents, who are the best to yield desired outcomes or results for the analysis

From the analysis and Interpretation, the results show that about 99.5% of the respondents or we can say that majorly all the respondents of the sample has used the smart phones or are users of smart phone (consequently, .5% have never used it). Only 2 respondents out of the total respondents have not used smart phones it may be due to any reason or may be the age factor sometimes creates disinterest in using or accepting the new technologies. With the data of respondents making online payment using smart phone it can be easily predicted that the sample size of the study comprises of two behaviors of people firstly those who have just heard but not used the e-wallets for making online payments through smart phones secondly those, who have tried using it and have formed their opinions and ideas about it. Behavioral intent of the user is reflected through the likert scale items in the questionnaire.

Model of behavioral intent to use E-wallets construct is represented by the items of scale, as the questionnaire comprised of 24 items of scale which was categorized under 8 constructs in the questionnaire which has to be responded in 5 Likert scale namely with options varying from Strongly Disagree denoted as the code 1, Disagree denoted with the code 2, Neutral defined as the code 3, Agree denoted as the code 4, Strongly Agree signifying the highest points as 5. The analysis of items of the scale has been done using SPSS Software (IBM SPSS Statistics 21) with the help of Factor analysis tool by finding out the strongest variable contributing towards the behavioral intent to use E-wallets.

Model of behavioral intent to use E-wallets construct is represented by the items of scale, as the questionnaire comprised of 24 items of scale which was categorized under 8 constructs in the questionnaire which has to be responded in 5 Likert scale namely with options varying from Strongly Disagree denoted as the code 1, Disagree denoted with the code 2, Neutral defined as the code 3, Agree denoted as the code 4, Strongly Agree signifying the highest points as 5. The analysis of items of the scale has been done using SPSS Software (IBM SPSS Statistics 21) with the help of Factor analysis tool by finding out the strongest variable contributing towards the behavioral intent to use E-wallets.

Model of behavioral intent to use E-wallets construct is represented by the items of scale, as the questionnaire comprised of 24 items of scale which was categorized under 8 constructs in the questionnaire which has to be responded in 5 Likert scale namely with options varying from Strongly Disagree denoted as the code 1, Disagree denoted with the code 2, Neutral defined as the code 3, Agree denoted as the code 4, Strongly Agree signifying the highest points as 5. The analysis of items of the scale has been done using SPSS Software (IBM SPSS Statistics 21) with the help of Factor analysis tool by finding out the strongest variable contributing towards the behavioral intent to use E-wallets.

Once the research model is constructed further the Internal Consistency Reliability of the model is analyzed through the values derived from the composite reliability f which reflects that as the values are more than 0.60, therefore there exist high levels of internal consistency reliability between the latent variables Bagozzi & Yi (1988); Hair et al. (2011), Wong (2013). Even the Cronbach’s’ alpha value of the constructs predicts that there is significant level of reliability among the variables in the model constructed.

Further to show the converging validity of the variables, the values of AVE for all the constructs are defined (Fornell and Larcker, 1981). As the Average Variance Extracted values derived from all the structures were greater than the limit of 0.50 Bagozzi & Yi (1988), thereby illustrating the verified convergence stability of the variables.

Later as the part of the analysis the values of outer Loadings were analyzed to find the variance of all the indicators or the constructs.

For the purpose of finding out the relation or significant variable and to prove the hypothesis of the research, further analysis of the data is done which involves the Bootstrapping Algorithm, for the purpose of testing the significance of the structural path of the model Wong (2013). Total of 387 samples were bootstrapped to analyze the relationship of the independent variables with the dependent variable ie, behavioral intent to use E-Wallets. As the Bootstrapping process is run the t value and the p value of the variables are identified to find out that whether the relationship is significant or not. Therefore after the bootstrapping model is derived we can arrive at the conclusion that which variable is highly significant and which is less significant Wong (2016).

For the purpose of evaluating the hypothesis of the research Path coefficient values of all the variables are observed and the results show that four variables out of the total 6 variables are found to be significant and the two variables are found to be insignificant. Thus it can be concluded that the results show that there are four factors like – PEOU, Awareness, PU and Triability occupy a very significant role in shaping the behavioral intent of users to adopt E-Wallets amongst Indian consumers.

Implications of Study

One of the main reasons responsible for achieving success in technological development is user acceptance (Ravangard Et Al., 2017). From the practical viewpoint, the statistical findings support the critical role of the following factors: Awareness, perceived ease of use, perceived usefulness and trialability. As a result, aspects related to these factors must be given preference by the service providers to encourage and influence the behavioral intent of Indian customers to adopt e-wallets .It has been observed that the majority of scholarly studies have used empirical research methods to achieve their research goals (Mavilinda, H. F. 2018). On the same note, this study aims to highlight unexplored variables relating to adoption of e-wallets with reference to Indian consumers by incorporating new variables into the well-validated TAM model. The findings indicated and suggest that consumers have high expectations from e-wallets. This finding is in line with previous research findings (Grant & Edgar, 2012, Venkatesh et al., 2003) and demonstrates that prospective e-wallet users confident that e-wallets are more performing than the other payment methods. As a result, service providers should concentrate on features that make e-wallets more convenient and at the same time should try to convince and attract more potential users towards e-wallets. Researchers have made in depth study of consumer behaviour not only in terms of acceptance or adoption of new technologies but other factors considered influential on consumers and their intent (Junadi et al., 2015). Besides the service providers should concentrate upon making the experience of e-wallet users more user friendly, thus saving the time and efforts of consumers Laukkanen et al. (2009). As Indian consumers are very much price sensitive, e-wallet companies should focus upon leveraging it by offering discounts and cashback, so as to reward their potential customers and to retain them for longer Madan &Yadav (2016). According to Lai (2016), the security of a payment system increases customer trust and confidence, which leads to the intent of users to adopt a technology. As a result, e-wallet companies should focus on educating customers on how to protect their e-wallet transactions by enhancing the security and privacy features of the e-wallets.

Conclusion

This research work has focused to provide an in-depth and comprehensive plethora of knowledge about the E-Wallets, its awareness, usage and its adoption by Indian consumers and the perception of the consumers about the E-wallets.

By examining the various literature work of the researchers from academic sources and the corporates, various information’s and knowledge related to E-wallets have been considered and studied that could help in understanding the dimensions related to factors affecting the usage or adoption of E-Wallets amongst consumers in India.

Emergence of advanced mobile phones and other technological gadgets and broad use of internet had brought about an amazing change in our life. It has made our lives increasingly easier and each data and procedures is by all accounts on our tongue. With the rising expediency and ease of shopping and making payments online through E-Wallets apps is making the buyers feeling bit relaxed. This research work intends to ascertain or explore the factors influencing the behavioural intent to use E-Wallets among Indian consumers. Through the analysis it is quite clear to derive the fact that respondents are keenly interested towards the adoption and usage of few popular E- wallets service providers for making payments like Paytm, Amazon Pay, and Google Pay etc. while shopping or for other online bill payments.

Emergence of advanced mobile phones and other technological gadgets and broad use of internet had brought about an amazing change in our life. It has made our lives increasingly easier and each data and procedures is by all accounts on our tongue. With the rising expediency and ease of shopping and making payments online through E-Wallets apps is making the buyers feeling bit relaxed. This research work intends to ascertain or explore the factors influencing the behavioural intent to use E-Wallets among Indian consumers. Through the analysis it is quite clear to derive the fact that respondents are keenly interested towards the adoption and usage of few popular E- wallets service providers for making payments like Paytm, Amazon Pay, and Google Pay etc. while shopping or for other online bill payments.

Limitations and Scope for Future Research

The current study examines the existing literary works of the similar field by conducting an empirical analysis of variables that evaluates the behavioral intent of the users to use e-wallets within certain constraints. First, as the study is confined by geographical limits, generalizing conclusions of the study should be approached with caution. Second the goal of the study was limited to evaluating the behavioral intent of the users rather than their actual behavior, as much of the research is needed to study the relationship behavior and intention. The third limitation poses that it is essential to conduct the study on a larger sample size to make the inferences from the model more consistent and valid. Furthermore, in order to overcome constraints conducting the study with larger sample size would lead to higher belongingness of the conclusions and findings for a larger number of samples. Moreover, the new population of the sample should belong to more diversified categories in terms of characteristics of respondents, including occupation, age, gender, etc. The topic of e-wallets have not been a new one but a trending one after demonetization and moreover due to pandemic or effect of covid-19 compelling people to go for digital payments so as to make lesser point of contacts. For instance, there are many predictors influencing the adoption of e-wallets in the literature, but just a few of them were examined in this study, other factors affecting adoption of e-wallets can be included in the future research models. As this research work focuses mainly on the consumers segments, studies similar to this can be conducted and preceded taking into consideration the other stakeholders of the society and their requirements or challenges faced by them.

References

Aydin, G., & Burnaz, S. (2016). Adoption of mobile payment systems: a study on mobile wallets.Journal of Business Economics and Finance,5(1), 73-92.

Bagozzi, R.P., & Yi,Y. (1988). On the evaluation of structural equation models.Journal of the academy of marketing science,16(1), 74-94.

Chakraborty, S., & Mitra, D. (2018). A study on consumers adoption intention for digital wallets in India.International Journal on Customer Relations,6(1), 38.

Coakes, S.J., Steed, L.G., & Ong, C. (2009).SPSS version 16.0 for Windows: Analysis without anguish. John Wiley & Sons Australia.

Faqih, K.M., & Jaradat, M.I.R.M. (2015). Assessing the moderating effect of gender differences and individualism-collectivism at individual-level on the adoption of mobile commerce technology: TAM3 perspective.Journal of Retailing and Consumer Services,22, 37-52.

Indexed at, Google Scholar, Cross Ref

Gitau, L., & Nzuki, D. (2014). Analysis of determinants of m-commerce adoption by online consumers.International Journal of Business, Humanities and Technology,4(3), 88-94.

Guiltinand, J.P., & Donnelly, J.H. (1983). The use of product portfolio analysis in bank marketing planning.Management issues for financial institutions, 50.

Hair Jr, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R. L. (2011). Multivariate Data Analysis. New Jersey: PrenticeHall.

Junadia, S. (2015). A model of factors influencing consumer’s intention to use e-payment system in Indonesia.Procedia Computer Science,59, 214-220.

Indexed at, Google Scholar, Cross Ref

Krejcie, R.V., & Morgan, D.W. (1970). Determining sample size for research activities.Educational and psychological measurement,30(3), 607-610.

Lai, P.C. (2016). Design and Security impact on consumers' intention to use single platform E-payment.Interdisciplinary Information Sciences,22(1), 111-122.

Indexed at, Google Scholar, Cross Ref

Laukkanen, T., Sinkkonen, S., & Laukkanen, P. (2009). Communication strategies to overcome functional and psychological resistance to Internet banking.International journal of information management,29(2), 111-118.

Indexed at, Google Scholar, Cross Ref

Madan, K., & Yadav, R. (2016). Behavioural intention to adopt mobile wallet: a developing country perspective.Journal of Indian Business Research.

Indexed at, Google Scholar, Cross Ref

Oliveira, T., Thomas, M., Baptista, G., & Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology.Computers in human behavior,61, 404-414.

Indexed at, Google Scholar, Cross Ref

Riffai, M.M.M.A., Grant, K., & Edgar, D. (2012). Big TAM in Oman: Exploring the promise of on-line banking, its adoption by customers and the challenges of banking in Oman.International journal of information management,32(3), 239-250.

Indexed at, Google Scholar, Cross Ref

Sadi, A.H.M.S., & Noordin, M. F. (2011). Factors influencing the adoption of M-commerce: An exploratory Analysis. InInternational Conference on Industrial Engineering and Operations Management(492-498).

Soodan, V., & Rana, A. (2020). Modeling customers' intention to use e-wallet in a developing nation: Extending UTAUT2 with security, privacy and savings.Journal of Electronic Commerce in Organizations (JECO),18(1), 89-114.

Indexed at, Google Scholar, Cross Ref

Usman, S.M., Fatimee, S., & Sajjad, M. (2014). Mobile commerce adoption: An empirical analysis of the factors affecting consumer intention to use mobile commerce.Journal of Basic and Applied Scientific Research,4, 80-88.

Wahab, Z., Shihab, M.S., Hanafi, A., & Mavilinda, H.F. (2018). The influence of online shopping motivation and product browsing toward impulsive buying of fashion products on a social commerce.Jurnal Manajemen Motivasi,14(1), 32-40.

Wong, K.K.K. (2013). Partial least squares structural equation modeling (PLS-SEM) techniques using SmartPLS.Marketing Bulletin,24(1), 1-32.

Wong, K.K.K. (2016). Mediation analysis, categorical moderation analysis, and higher-order constructs modeling in Partial Least Squares Structural Equation Modeling (PLS-SEM): A B2B Example using SmartPLS.Marketing Bulletin,26(1), 1-22.

Yan, H., & Yang, Z. (2015). Examining mobile payment user adoption from the perspective of trust.International Journal of u-and e-Service, Science and Technology,8(1), 117-130.

Yang, Y., Liu, Y., Li, H., & Yu, B. (2015). Understanding perceived risks in mobile payment acceptance.Industrial Management & Data Systems.

Indexed at, Google Scholar, Cross Ref

Zaichkowsky, J.L. (1985). Measuring the involvement construct.Journal of consumer research,12(3), 341-352.

Indexed at, Google Scholar, Cross Ref

Zwick, W.R., & Velicer, W.F. (1986). Comparison of five rules for determining the number of components to retain.Psychological bulletin,99(3), 432.

Received: 27-Aug-2022, Manuscript No. AMSJ-22-12497; Editor assigned: 29-Aug-2022, PreQC No. AMSJ-22-12497(PQ); Reviewed: 12-Sep-2022, QC No. AMSJ-22-12497; Revised: 28-Sep-2022, Manuscript No. AMSJ-22-12497(R); Published: 03-Nov-2022