Research Article: 2018 Vol: 22 Issue: 4

Examining Financial Risk Tolerance via Mental Accounting and the Behavioral Life-cycle Hypothesis

William C Martin, Eastern Washington University

Arezoo Davari, Eastern Washington University

Keywords

Investing, Retirement Planning, Risk Tolerance, Mental Accounting.

Introduction

With employers steadily moving away from defined benefit plans, such as pensions, and toward defined contributions plans, such as 401(k) programs (Kozup, Howlett and Pagano, 2008), consumers are now largely responsible for making the investment decisions that will have a direct impact on whether they meet their financial goals, such as retirement (Lauricella, 2004; Lusardi, 2012). Unfortunately, these decisions can be difficult and many consumers are often ill-equipped to make proper investment choices (Kozup, Howlett and Pagano, 2008). One of the most imperative aspects of consumers’ investment choices is having an appropriate degree of financial risk tolerance, the level of uncertainty that one is willing to bear for the purpose of achieving adequate returns on investments (Droms, 1987). Having an appropriate tolerance for risk when it comes to investment decisions is necessary as higher levels of risk are often needed to achieve the returns on capital requisite for long-term financial goals (Droms, 1987). However, many consumers are unwilling to take on the financial risk generally recommended by financial planners in order to meet these goals (Larson, Eastman & Bock, 2016). It has been estimated that half of American adults will have insufficient funds with which to sustain their retirement (Warshawsky & Ameriks, 2000); this can largely be explained by low savings rates and inadequate financial risk tolerance (Hallahan, Faff & McKenzie, 2004). Understanding the factors underlying financial risk tolerance, then, is vital for consumers, marketers, policymakers, financial planners and the investment industry as a whole (Hallahan, Faff & McKenzie, 2004).

Extant literature has identified several factors which impact financial risk tolerance, including age, gender, marital status, personality traits, education, income, financial stability and financial knowledge (Carducci & Wong, 1998; Hallahan, Faff & McKenzie, 2009; Fan & Xiao, 2006; Gilliam, Chatterjee & Zhu, 2010; Grable, 2000; Grable, Lytton & O'Neill, 2004; Hallahan, Faff & McKenzie, 2004; Irandoust, 2017). However, the behavioral life-cycle hypothesis (Shefrin & Thaler, 1988), which builds on the theory of mental accounting (Thaler, 1985), suggests that consumers’ current (i.e. readily accessible) assets, which include assets such as checking and savings account balances, may also be an important antecedent to financial risk tolerance (Kitces, 2017). The behavioral life-cycle hypothesis’s basic premise is that individuals’ financial needs are mentally segregated by consumers into three separate accounts or ‘buckets’: current income, current assets and future income and the assets needed to support that income.

It has been subsequently suggested that these three types of accounts are hierarchically structured in such a way that the need for current income and current assets must be at least minimally fulfilled before the need for future income, including assets used to derive that income, becomes active (Kitces, 2017). If current income and current assets can be improved in the view of consumers, then they will perceive a need for future income and the assets needed to generate it, potentially leading to a higher tolerance for financial risk. As such, the research question examined herein is to what extent financial risk tolerance is explained by the theory of mental accounting and the behavioral life-cycle hypothesis.

The remainder of this manuscript is laid out as follows. Pertinent literature is first reviewed and used to develop the hypotheses, followed by a review of the methods used in their testing. Results are discussed and the implications of the findings for theory and practice are provided. Lastly, limitations of this research and directions for future research are assessed.

Literature Review and Hypotheses

Financial risk tolerance is defined as “the maximum amount of uncertainty that someone is willing to accept when making a financial decision” (Grable, 2000). Several demographic (e.g. age, gender, income, education) and non-demographic factors (e.g. financial stability, financial knowledge, self-esteem, personality type, sensation seeking) have been identified as antecedents of financial risk tolerance (Fan & Xiao, 2006; Hallahan, Faff & McKenzie, 2004; Kannadhasan, Aramvalarthan, Mitra & Goyal, 2016). In addition, factors causing individuals’ risk aversion (Cohn, Lewellen, Lease & Schlarbaum, 1975; Coles & Li, 2017; Grable, 2000) and its relationship with financial risk tolerance (Faff, Mulino & Chai, 2008) have also been discussed in the literature to further understanding of individuals’ risk taking behavior. Of particular importance to the study at hand, a strong negative relationship has been found between wealth and relative risk aversion, suggesting that individuals invest in risky assets when they have higher levels of wealth (Cohn, Lewellen, Lease & Schlarbaum, 1975). Since greater levels of risk are usually associated with higher returns over long periods of time (Droms, 1987), a higher level of financial risk tolerance among consumers is associated with greater wealth (Hallahan, Faff & McKenzie, 2004; Yao, Hanna and Lindamood, 2004; Fan & Xiao, 2006). For instance, consumers with higher levels of financial risk tolerance tend to have higher balances in defined contribution retirement plans (Jacobs-Lawson & Hershey, 2005; Yuh & DeVaney, 1996). Consequently, it has been suggested that consumers may not realize the need for future income unless their current income and current assets are both viewed as acceptable (Kitces, 2017). Thus, due to mental accounting, which is discussed below, current income and current assets may be key antecedents of financial risk tolerance.

Though money is fungible, consumers tend to place financial assets into different accounts, each of which is mentally assigned to a different purpose or function, a process known as mental accounting (Thaler, 1985 & 1999). The most common mental accounts used by consumers are current income, current assets and future income, the latter of which include assets used to produce future income (Shefrin & Thaler, 1988). These accounts appear to exist in a hierarchy whereby current income is the most basal to consumers, followed by current assets and lastly future income (Kitces, 2017). This notion is supported by research which has shown that current assets, such as funds in checking and savings accounts, are positively associated with subjective well-being, even after controlling for the value of consumers’ investments (Ruberton, Gladstone & Lyubomirsky, 2016). This means that a consumer with significant current assets appears likely to be more satisfied with their financial status than another consumer with greater wealth but lower current assets, everything else held equal.

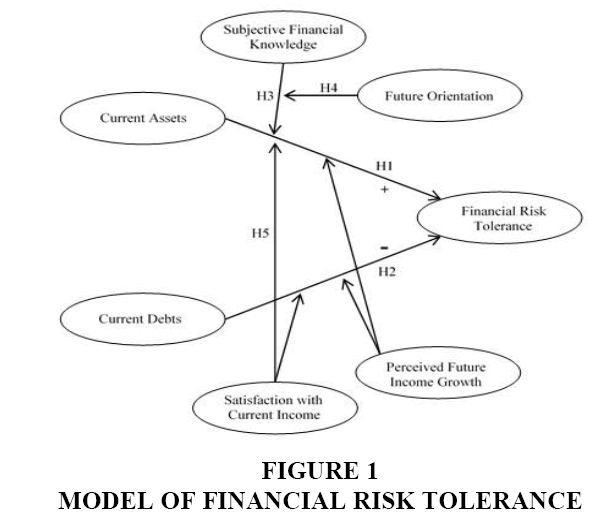

This supposition may also help explain why Millennials seem to be far more conservative with their investment choices than what is generally believed appropriate by financial planners (Larson, Eastman and Bock, 2016). This group of consumers appears to have fewer current assets available to them than other age groups (Kirkham, 2015). As such, this deficiency of current assets may be leading them to select overly conservative investments in an effort to build up their assets before moving into more volatile, but higher expected return, asset classes. Taken together, it appears likely that consumers’ perceptions of the adequacy of their current assets, herein referred to as perceived current assets, are positively associated with the level of risk they are willing to take on in their finances. This, along with all the other hypotheses made herein, is illustrated in Figure 1.

H1: Perceived current assets are positively associated with financial risk tolerance.

In many respects, current debts can logically be viewed as largely counter to current assets; the former represents a future obligation to pay, whereas the latter represents property that can be used to pay future expenses. Contrary to perceived current assets that may enhance consumers’ financial satisfaction by providing them with a sense of economic security, perceived current debts may give rise to economic concerns for the future (Drentea, 2000; Hansen, Slagsvold & Moum, 2008). Consumers’ debts represent an expense that reduces their net worth as well as current disposable income. As such, consumers’ debts may result in them feeling less financially secure and, thus, showing lower levels of willingness to take on financial risks. When consumers are carrying multiple debts, paying off debts and determining which debts to repay first seem to be of a higher priority to consumers than making new financial investments (Amar, Ariely, Ayal, Cryder & Rick, 2011). Thus, consumers’ perceived current debts seem apt to be negatively related to their financial risk tolerance.

H2: Perceived current debts are negatively associated with financial risk tolerance.

Financial knowledge can have a significant impact on consumers’ investment decisions (Hershey & Walsh, 2000). As consumers’ financial knowledge improves, so does their confidence in making financial decisions and, in turn, the quality of those decisions (Parker, Bruin, Yoong & Willis, 2012). This knowledge, like all forms of knowledge, can take one of two primary forms: objective knowledge and subjective knowledge (Carlson, Vincent, Hardesty & Bearden, 2008). Objective financial knowledge refers to a consumers’ actual familiarity with financial concepts, whereas subjective financial knowledge refers to a consumer’s self-determined level of familiarity with financial concepts (Xiao, Ahn, Serido & Shim, 2014). Compared to objective financial knowledge, subjective financial knowledge is more predictive of consumers’ financial behaviors (Xiao, Ahn, Serido & Shim, 2014). Higher levels of familiarity with a topic generally lead to less perceived risk (Fischoff, Lichtenstein, Slovic, Derby & Keeney, 1981). Indeed, as subjective financial knowledge increases, consumers take on greater risk regarding their investment choices (Larson, Eastman & Bock, 2016). When consumers have significant current assets, a strong understanding of financial concepts is more likely to lead to greater financial risk tolerance.

H3: As subjective financial knowledge increases, the positive relationship between perceived current assets and financial risk tolerance strengthens.

A future-oriented person places greater importance on future consequences of their actions as opposed to those which are more immediate (Aspinwall, 2005). Though some argue that consumers with a strong future orientation are apt to engage in financial planning for their future (Croy, Gerrans & Speelman, 2010; Jacobs-Lawson, Hershey & Neukam, 2004), others have shown that this is not always the case (Howlett, Kees & Kemp, 2008). Consumers appear to require at least a modest awareness of financial concepts before they perceive a need for planning for future financial needs. A stronger future orientation, when combined with at least a modest awareness of financial concepts, leads to greater participation in retirement plans, though future orientation has no impact on this participation when financial knowledge is low (Howlett, Kees & Kemp, 2008). We hypothesize that since current assets are likely a precursor to taking on risk for future income needs; a three-way interaction is likely to occur in a way that for consumers who are future oriented and possess strong subjective financial knowledge, there is a stronger relationship between their perceived current assets and their tolerance of financial risk.

H4: As future orientation and subjective financial knowledge both increase, the positive relationship between perceived current assets and financial risk tolerance strengthens.

If the mental accounts used by consumers are indeed hierarchical, then current income needs must be met before current assets and, in turn, future income needs can become active. As such, if consumers’ current income is not adequate to meet their spending requirements, they are unlikely to take on the financial risks generally required in order to meet their need for future income. Satisfaction with income is one of the major factors leading to overall financial wellbeing and, consequently, financial satisfaction (Diener, Sandvik, Seidlitz & Diener, 1993; Frijters, Haisken-DeNew & Shields, 2004; Headey & Wooden, 2004; Kahneman & Deaton, 2010). Consumers who are more satisfied with their current income due to an increase in their current income believe themselves to be in a better financial status (i.e. have improved financial capability) and are more prone to make riskier investment decisions (Xiao, Ahn, Serido & Shim, 2014). The positive psychological influence of satisfaction with current income may also reduce consumers’ concerns regarding their current debts, putting them in an overall positive attitude toward financial risk taking. Therefore, we hypothesize that as consumers become more satisfied with their current income, the positive relationship between their perceived current assets and financial risk tolerance will grow stronger. Comparably, we also hypothesize that as current income satisfaction increases, the negative relationship between perceived current debts and financial risk tolerance will wane.

H5: As satisfaction with current income increases, the positive relationship between perceived current assets and financial risk tolerance strengthens.

H6: As satisfaction with current income increases, the negative relationship between perceived current debts and financial risk tolerance weakens.

When consumers believe that their income is likely to grow in the future, they are apt to sense a reduction in the consequences of financial risks as they believe they will have greater resources in the future with which to address the potentially negative consequences of those risks. Hence, consumers will be more likely to take on financial risks in the present if they believe their future income growth to be strong. In other words, being optimistic about future financial status as a result of possible higher future income can give consumers more peace of mind in the present, putting them in a more positive attitude about their perceived current assets. This optimism will likely lead to a propensity to accept higher financial risks in the present (Puri & Robinson, 2007). As such, we hypothesize that as consumers’ perceived future income growth increases, the positive relationship between their current assets and willingness to accept financial risks will strengthen. Similarly, when consumers expect future income growth, they feel less stressful about their current debts (Puri & Robinson, 2007), which ultimately may direct them to accept higher levels of risk in their financial decisions. Such consumers seem apt to feel more confident about their capability to repay their debts in the future because of higher levels of future income and, therefore, be more prone to have higher risk tolerance in their present financial investments. Thus, we hypothesize that the negative relationship between perceived current debts and financial risk tolerance will be attenuated when consumers believe that their income will rise significantly in the future.

H7: As perceived future income growth increases, the positive relationship between perceived current assets and financial risk tolerance strengthens.

H8: As perceived future income growth increases, the negative relationship between perceived current debts and financial risk tolerance weakens.

Methodology

Survey data were collected via the student referral method. Students in various marketing courses at a university in the Pacific Northwest were offered course credit for participation in the survey. These students were also allowed to refer up to four other individuals, at least two of whom were required to be over the age of 40, to participate in the survey. This resulted in the collection of usable data from 243 respondents. Fifty-one percent of the respondents were female, and respondents’ mean age was 35 years. Annual personal income was reported as follows: 37% in the “Under $20,000” category, 19% in the “$20,001-$40,000” category, 15% in the “$40,001-$60,000” category, 9% in the “$60,001-$80,000” category, 9% in the “$80,001-$100,000” category, 5% in the “$100,001-$120,000” category and 7.9% in the “More than $120,000” category.

Measures

Financial risk tolerance was measured using the five-item Likert-type scale created by Jacobs-Lawson and Hershey (2005) and was anchored by “Strongly Disagree” (1) and “Strongly Agree” (7). Future orientation was measured using the five-item Likert-type scale created by Stratham and colleagues (1994) and was anchored by “Strongly Disagree” (1) and “Strongly Agree” (7). Subjective financial knowledge was measured with the five-item semantic differential scale developed by Xiao and colleagues (2014) and was numerically anchored by “1” and “7.” Satisfaction with current income was measured with five Likert-type items loosely based on items used by Castilla (2012) and was anchored by “1” and “7”: “I am satisfied with my current pay,” “My income is enough to live well on,” “I am being paid what I deserve based on my performance,” “My income is enough to pay for my expenses” and “Compared to others doing the same type of work, my income is fair”.

Perceived current assets was measured using four original semantic differential response items to the question “How do you feel about your checking and savings account balances”; the items were numerically anchored by “1” and “7” and included “Very uneasy/At ease,” “Very uncomfortable/Very comfortable,” “Very stressed/Not at all stressed,” “Very tense/Very calm,” and “Very worried/Not at all worried.” Perceived current debts was measured using five original Likert-type questions, numerically anchored by “1” and “7” and included “I have too much debt right now,” “My current level of debt worries me”, “I am concerned about my current debts”, “When I think about my current debts, I feel anxious”, and “My current debts might cause me trouble in the future”. Perceived future income growth was measured using four original Likert-type items anchored by “Strongly Disagree” (1) and “Strongly Agree” (7); items included “I believe my income will grow significantly in the next five years,” “In the coming years, I will have a much higher income than I do now,” “In the near future, my income will be considerably more than what it is now”, and “Between now and the year 2022, my income will grow greatly.”

Results

An exploratory factor analysis of the seven construct measures was conducted using principal axis factoring, and the factors were then subjected to Promax rotation as they were assumed to be correlated. This indicated that two of the items measuring financial risk tolerance had significant but low factor loadings on this construct. These two items were removed, and a new factor analysis was conducted. In this analysis, seven factors had an eigenvalue greater than one and cumulatively explained 79.03% of the variance in the data. All items loaded significantly (>0.50) on their respective factors with no significant cross-loadings present. All seven measures were then subjected to a confirmatory factor analysis using maximum likelihood estimation of the covariance matrix. The construct correlation matrix, along with descriptive statistics for each summated measure, is shown in Table 1. Fit of the measurement model is satisfactory (χ2=869.61, df=443, p<0.001; χ2/df=1.96; RMSEA=0.061; CFI=0.94; NNFI=0.93), and all the items load significantly on their respective constructs. Average variance extracted is greater than 0.50 for all the measures, and each measure’s average variance extracted is greater than its squared correlation coefficient with the other measures. Composite reliability is greater than 0.75 for all measures. In sum, the measures demonstrate unidimensionality as well as convergent and discriminant validity (Fornell & Larcker, 1981; Hair, Black, Babin, Anderson & Tatham, 2006).

| Table 1 Construct Correlation Matrix With Descriptive Statistics |

|||||||

| Risk Tolerance | Self-Perceived Financial Knowledge | Income Satisfaction | Income Growth | Current Assets | Debts | Future Orientation | |

| Self-Perceived Financial Knowledge | 0.29 | ||||||

| Income Satisfaction | 0.19 | 0.29 | |||||

| Income Growth | 0.28 | 0.14 | -0.15 | ||||

| Current Assets | 0.24 | 0.35 | 0.66 | -0.04 | |||

| Debts | 0.03 | -0.07 | -0.22 | 0.12 | -0.39 | ||

| Future Orientation | 0.23 | 0.23 | 0.16 | 0.35 | 0.18 | -0.02 | |

| Mean | 3.87 | 4.27 | 4.01 | 4.89 | 4.26 | 3.30 | 4.86 |

| Standard Deviation | 1.45 | 1.29 | 1.53 | 1.80 | 1.64 | 1.90 | 1.22 |

The hypotheses were examined using multiple regression analysis. There was no evidence of significant multicollinearity being present between the independent variables in any regression model (VIF<5). Hierarchical multiple regression was used to investigate the hypothesized moderating variables. Statistics for each of the three regression blocks investigated are provided in Table 2. In the first block, age, gender (male=0, female=1) and income (0=Less than or equal to $40,000 annual income, 56%; 1=More than $40,000 annual income, 44%) were included as control variables. The resulting regression model was significant (F [3,232] =4.270, p=0.006, adjusted R2=0.040). Gender is not a significant predictor of financial risk tolerance (β= -0.008, p=0.900), but there is a negative relationship between age and financial risk tolerance (β= -0.231, p=0.001) and a positive relationship between the latter and having an annual income greater than $40,000 (β=0.280, p=0.005).

| Table 2 Multiple Regression Results |

||||||

| Block | Independent Variables | Dependent Variable | ∆F | Adjusted R2 | β | p-value |

| 1 | Financial Risk Tolerance | 4.270 | 0.040 | 0.006 | ||

| Gender | -0.008 | 0.900 | ||||

| Age | -0.231 | 0.001 | ||||

| Annual Income | 0.280 | 0.005 | ||||

| 2 | Financial Risk Tolerance | 6.250 | 0.082 | 0.002 | ||

| Gender | -0.031 | 0.622 | ||||

| Age | -0.229 | 0.005 | ||||

| Annual Income | 0.188 | 0.027 | ||||

| Current Assets | 0.260 | <0.001 | ||||

| Current Debts | 0.086 | 0.210 | ||||

| 3 | Financial Risk Tolerance | 4.614 | 0.217 | 0.004 | ||

| Gender | 0.026 | 0.677 | ||||

| Age | -0.037 | 0.671 | ||||

| Annual Income | 0.118 | 0.148 | ||||

| Current Assets | 0.119 | 0.171 | ||||

| Current Debts | 0.040 | 0.549 | ||||

| Subjective Financial Knowledge | 0.115 | 0.087 | ||||

| Satisfaction with Current Income | 0.007 | 0.928 | ||||

| Future Income Growth | 0.198 | 0.012 | ||||

| Future Orientation | 0.043 | 0.557 | ||||

| Subjective Financial Knowledge* Current Assets | 0.183 | 0.006 | ||||

| Subjective Financial Knowledge* Current Assets*Future Orientation | 0.142 | 0.050 | ||||

| Satisfaction with Current Income*Current Assets | -0.118 | 0.129 | ||||

| Satisfaction with Current Income*Current Debts | -0.061 | 0.396 | ||||

| Future Income Growth*Current Assets | 0.104 | 0.168 | ||||

| Future Income Growth*Current Debts | -0.201 | 0.002 | ||||

In the second block, both perceived current assets and perceived current debts, which were first standardized, were included as predictors and financial risk tolerance was the dependent variable. The resulting regression model was significant (ΔF [5,230] =6.250, p=0.002, adjusted R2=0.082). This indicated that perceived current assets are significantly and positively related to financial risk tolerance (β=0.260, p<0.001), though there is no relationship between perceived current debts and financial risk tolerance (β=0.086, p=0.210). Therefore, the data support H1 but not H2.

To avoid potential multicollinearity issues, the hypothesized moderating variables were also standardized and interaction terms were created. In the third and final block, the interaction terms were added to the model; these explained a significant proportion of the variance in financial risk tolerance (ΔF [16,219] =4.614, p<0.001, adjusted R2=0.217). Subjective financial knowledge significantly moderates the relationship between perceived current assets and financial risk tolerance such that this relationship is stronger when subjective financial knowledge is high (β=0.183, p=0.006). Thus, the data support H3. Further, there is a moderately significant, positive three-way interaction between future orientation, subjective financial knowledge and perceived current assets (β=0.142, p=0.050), in support of H4. In addition to these significant, hypothesized interaction effects, subjective financial knowledge has a moderately significant main effect on financial risk tolerance (β=0.115, p=0.087), though there is no main effect of future orientation (β=0.043, p=0.557).

Satisfaction with current income has no significant interaction with perceived current assets (β=-0.118, p=0.129) nor current debts (β=-0.061, p=0.396). Hence, the data support neither H5 nor H6. There is also no main effect of satisfaction with current income (β=0.007, p=0.928).

No significant interaction exists between perceived future income growth and perceived current assets (β=0.104, p=0.168), providing no support for H7. However, there is a significant negative interaction between perceived future income growth and perceived current debts (β=-0.201, p=0.002). As perceived future income growth increases, the negative relationship between perceived current debts and financial risk tolerance is abated. Thus, the data support H8. Further, there is also a main effect of perceived future income growth on financial risk tolerance (β=0.198, p=0.012).

Discussion and Implications

In this study, we seek to examine the explanatory ability of the theory of mental accounting and the behavioral life-cycle hypothesis with regard to consumers’ financial risk tolerance. In general, we find that financial risk tolerance operates in line with these theoretical frameworks. Consumers’ perception of their current assets, including checking and savings account balances, is positively associated with their financial risk tolerance. Presumably, having more current assets helps consumers to psychologically mitigate some of the risks associated with more volatile investments. This suggests that financial risk tolerance might be improved if consumers simply increased the balances in their checking and/or savings accounts.

This positive relationship between perceived current assets and financial risk tolerance is strengthened by subjective financial knowledge. As consumers’ perceived current assets increase, financial risk tolerance improves for those consumers who have more financial knowledge. In addition, this moderating effect is itself further strengthened as consumers become more future oriented. This is in accord with research which argues that future orientation only impacts financial risk tolerance when consumers possess at least a modest amount of financial knowledge (Howlett, Kees & Kemp, 2008).

Contrary to our expectations, satisfaction with current income has no effect on the relationship between perceived current assets and financial risk tolerance. As there is a positive link between income and financial risk tolerance (Hallahan, Faff & McKenzie, 2004), it may be that the effect of satisfaction with income cited in prior research is buffered by the positive impact of current assets on the risk consumers are willing to accept in their finances. When consumers’ belief in the growth of their future income is low, a negative relationship emerges between perceived current debts and financial risk tolerance. Conversely, when consumers believe that their income will grow significantly in the foreseeable future, the negative relationship between their perceived current debts and financial risk tolerance weakens. Thus, consumers’ willingness to take on financial risks, such as allocating a greater proportion of their assets toward volatile investments like stocks, is less impacted by their views on their debt when they believe their future income will grow significantly. Considering that Millennials are likely to experience comparatively greater increases in their future income than most other age cohorts, this group seems less likely to have their financial risk tolerance negatively impacted by their perceptions of debt than others.

This research has three important theoretical implications. Firstly, this is the first study to provide empirical evidence that more basal financial needs such as the need for current assets may require at least minimal fulfilment before the higher-level need for future income is activated. Until the need for future income is activated, consumers seem apt to be more conservative in their investment choices, even for investment goals like retirement that may be decades away from fulfilment. Secondly, our findings provide additional evidence of the power of subjective financial knowledge in impacting consumers’ financial decisions. Higher levels of consumers’ self-determined financial literacy lead to higher levels of financial risk tolerance when combined with increasing current assets as well as a future oriented mind-set. Thirdly, our findings reinforce those of prior research in demonstrating that a future orientation alone is insufficient to enhance consumers’ financial risk tolerance; subjective financial knowledge is needed to an extent as well (Howlett, Kees & Kemp, 2008). Unless consumers understand their need for some degree of volatility in their investments, being future oriented alone is unlikely to impact their ability to accept substantial risk.

In addition, there are four particularly noteworthy implications from this research for employers, marketers, the investment industry and policymakers. First, this research shows that when consumers perceive that their current assets, including checking and savings account balances, are acceptable, they are more apt to take on financial risk in their investments, which is viewed as generally positive by financial planners. Perhaps employers should encourage employees to first build accessible monetary savings outside of their defined contribution plan before they decide on which type of investments to make in said plan. As consumers usually make asset allocation decisions in their defined contribution plans when they initially join an employer, it might be particularly prudent to encourage Millennials, who typically have a relatively low level of current assets, to revisit their asset allocation after they have amassed some funds in their checking and/or savings accounts.

Second, the positive effect of current assets on financial risk tolerance is enhanced when consumers believe themselves to be knowledgeable of financial topics, which also has a direct effect on financial risk tolerance. Providers of retirement plans should seek to educate their participants of investment topics, such as the concepts of risk-to-return, different types of investment vehicles and the impact of savings rate. Employers should both encourage this education among investment providers and seek to instruct employees on financial topics themselves as well (Eccles, Ward, Goldsmith & Arsal, 2013), partly due to financial satisfaction helping to reduce employees’ stress and improve their productivity (Consumer Financial Protection Bureau, 2014). Policymakers should seek to find and implement means of improving consumers’ financial knowledge as well.

Third, financial service providers and consumers can both benefit from the former designing financial training programs specifically targeted at consumers with a future orientation. Such consumers can be readily identified by measuring future orientation through the use of investor questionnaires, which are common in the financial services industry. These consumers, who may be more receptive to financial education than others, will benefit more from being taught financial concepts in terms of their risk tolerance levels than would other consumers.

Fourth and finally, financial organizations should be aware of the positive psychological influence of future income growth on consumers’ perceptions of their current financial capabilities, which result in higher financial risk tolerance. Consumers who have higher levels of perceived current debts but are optimistic about their future income growth can be successfully targeted by financial service providers, since perceived future income growth weakens the negative psychological influence of current debts on consumers’ tolerance of financial risks. Millennials would be a group that appears to fit this description aptly.

Limitation and Future Research

While the relationships suggested by the theory of mental accounting are causal, the cross-sectional data analyzed in this study do not allow for conclusive testing of cause-and-effect relationships. Future research should seek to examine whether there is a causal relationship between perceived current debts and financial risk tolerance, for instance.

In this study, data were collected from a wide array of consumers, but considering that college students were the source of the respondent referrals, it is likely that the respondents have a higher level of educational attainment than the general population. These results may differ among those with lower educational attainment levels and should be investigated in additional research on the topic.

Future research should examine whether assets such as cash balances held in tax-advantaged accounts, such as 401(k) plans, individual retirement arrangements and health savings accounts, have a similar impact on consumers as cash balances held in checking and savings accounts. While it is generally more difficult for individuals to access funds held in tax-advantaged accounts, the psychological assurance of knowing that one has a safe reserve of funds somewhere may have a similar effect to holding funds in more readily accessible accounts.

References

-

p id='Reference_Titile_Link' value='1'>Amar, M., Ariely, D., Ayal, S., Cryder, C.E. & Rick, S.I. (2011). Winning the battle but losing the war: The psychology of debt management. Journal of Marketing Research, 48, S38-S50.

- Aspinwall, L.G. (2005). The psychology of future-oriented thinking: From achievement to proactive coping, adaptation and aging. Motivation and Emotion, 29(4), 203-235.

- Carducci, B.J. & Wong, A.S. (1998). Type A and risk taking in everyday money matters. Journal of Business and Psychology, 12(3), 355-359.

- Carlson, J.P., Vincent, L.H., Hardesty, D.M. & Bearden, W.O. (2008). Objective and subjective knowledge relationships: A quantitative analysis of consumer research findings. Journal of Consumer Research, 35(5), 864-876.

- Castilla, C. (2012). Subjective well-being and reference-dependence: Insights from Mexico. Journal of Economic Inequality, 10(2), 1-20.

- Census. (2013). Wealth, asset ownership & debt of households detailed tables. Retrieved from: https://www.census.gov/data/tables/2013/demo/wealth/wealth-asset-ownership.html

- Cohn, R.A., Lewellen, W.G., Lease, R.C. & Schlarbaum, G.G. (1975). Individual investor risk aversion and investment portfolio composition. The Journal of Finance, 30(2), 605-620.

- Coles, J.L. & Li, Z.F. (2017). Managerial attributes incentives and performance. Working Paper, University of Utah.

- Consumer Financial Protection Bureau. (2014). Financial wellness at work: A review of promising practices and policies. Retrieved from http://files.consumerfinance.gov/f/201408_cfpb_report_financial-wellness-at-work.pdf

- Croy, G., Gerrans, P. & Speelman, C. (2010). The role and relevance of domain knowledge, perceptions of planning importance and risk tolerance in predicting savings intentions. Journal of Economic Psychology, 31(6), 860-871.

- Diener, E., Sandvik, E., Seidlitz, L. & Diener, M. (1993). The relationship between income and subjective well-being: Relative or absolute? Social indicators research, 28(3), 195-223.

- Drentea, P. (2000). Age, debt and anxiety. Journal of Health and Social Behaviour, 437-450.

- Droms, W.G. (1987). Investment asset allocation for PFP clients. Journal of Accountancy, 163(4), 114-118.

- Eccles, D.W., Ward, P., Goldsmith, E. & Arsal, G. (2013). The relationship between retirement wealth and householders' lifetime personal financial and investing behaviours. Journal of Consumer Affairs, 47(3), 432-464.

- Faff, R., Hallahan, T. & McKenzie, M. (2009). Nonlinear linkages between financial risk tolerance and demographic characteristics. Applied Economics Letters, 16(13), 1329-1332.

- Faff, R., Mulino, D. & Chai, D. (2008). On the linkage between financial risk tolerance and risk aversion. Journal of Financial Research, 31(1), 1-23.

- Fan, J.X. & Xiao, J.J. (2006). Cross-cultural differences in risk tolerance: A comparison between Chinese and Americans. Journal of Personal Finance, 5(3), 54-75.

- Fischhoff, B., Lichtenstein, S., Slovic, P., Derby, S.C. & Keeney, R.L. (1981). Acceptable risk. Cambridge: Cambridge University Press.

- Fornell, C. & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 39-50.

- Frijters, P., Haisken-DeNew, J. & Shields, M. (2004). Money does matter! Evidence from increasing real incomes and life satisfaction in East Germany following reunification. American Economic Review, 94, 730-740.

- Gilliam, J., Chatterjee, S. & Zhu, D. (2010). Determinants of risk tolerance in the baby boomer cohort. Journal of Business & Economics Research, 8(5), 79-87.

- Grable, J., Lytton, R. & O'Neill, B. (2004). Projection bias and financial risk tolerance. The Journal of Behavioral Finance, 5(3), 142-147.

- Grable, J.E. (2000). Financial risk tolerance and additional factors that affect risk taking in everyday money matters. Journal of Business and Psychology, 14(4), 625-630.

- Hair, J.F., Black, W.C. Babin, B.J. Anderson, R.E. & Tatham, R.L. (2006). Multivariate data analysis. NJ: Pearson Prentice Hall Upper Saddle River.

- Hallahan, T.A., Faff, R.W. & McKenzie, M.D. (2004). An empirical investigation of personal financial risk tolerance. Financial Services Review, 13(1), 57-78.

- Hansen, T., B. Slagsvold & Moum, T. (2008). Financial satisfaction in old age: A satisfaction paradox or a result of accumulated wealth? Social Indicators Research, 89(2), 323-347.

- Headey, B. & Wooden, M. (2004). The effects of wealth and income on subjective well‐being and ill‐being. Economic Record, 80(1).

- Hershey, D.A. & Walsh, D.A. (2000). Knowledge versus experience in financial problem solving performance. Current Psychology, 19(4), 261-291.

- Howlett, E., Kees, J. & Kemp, E. (2008). The role of self-regulation, future orientation and financial knowledge in long-term financial decisions. Journal of Consumer Affairs, 42(2), 223-242.

- Irandoust, M. (2017). Factors associated with financial risk tolerance based on proportional odds model: Evidence from Sweden. Journal of Financial Counselling and Planning, 28(1), 155-164.

- Jacobs-Lawson, J.M. & Hershey, D.A. (2005). Influence of future time perspective, financial knowledge and financial risk tolerance on retirement saving behaviours. Financial Services Review, 14(4), 331-344.

- Jacobs-Lawson, J.M., Hershey, D.A. & Neukam, K.A. (2004). Gender differences in factors that influence time spent planning for retirement. Journal of Women & Aging, 16(3-4), 55-69.

- Kahneman, D. & Deaton, A. (2010). High income improves evaluation of life but not emotional well-being. Proceedings of the National Academy of Sciences, 107(38), 16489-16493.

- Kannadhasan, M., Aramvalarthan, S., Mitra, S.K. & Goyal, V. (2016). Relationship between biopsychosocial factors and financial risk tolerance: An empirical study. Vikalpa, 41(2), 117-131.

- Kirkham, E. (2015). 62% of Americans Have Under $1,000 in Savings, Survey Finds. Retrieved from https://www.gobankingrates.com/savings-account/62-percent-americans-under-1000-savings-survey-finds/

- Kitces, M. (2017). Behavioral biases and the hierarchy of retirement needs. Retrieved from https://www.kitces.com/blog/hierarchy-retirement-income-needs-and-mental-accounting/

- Kozup, J., Howlett, E. & Pagano, M. (2008). The effects of summary information on consumer perceptions of mutual fund characteristics. Journal of Consumer Affairs, 42(1), 37-59.

- Larson, L.R., Eastman, J.K. & Bock, D.E. (2016). A multi-method exploration of the relationship between knowledge and risk: The impact on Millennials’ retirement investment decisions. Journal of Marketing Theory and Practice, 24(1), 72-90.

- Lauricella, T. (2004). Money trouble: A lesson for social security: Many mismanage their 401(k) s. Wall Street Journal. Retrieved from https://www.wsj.com/articles/SB110186973081287744

- Lusardi, A. (2012). Financial literacy and financial decision-making in older adults. Generations, 36(2), 25-32.

- Parker, A.M., Bruin, W.B., Yoong, J. & Willis, R. (2012). Inappropriate confidence and retirement planning: Four studies with a national sample. Journal of Behavioral Decision Making, 25(4), 382-389.

- Puri, M. & Robinson, D.T. (2007). Optimism and economic choice. Journal of Financial Economics, 86(1), 71-99.

- Ruberton, P.M., Gladstone, J. & Lyubomirsky, S. (2016). How your bank balance buys happiness: The importance of “cash on hand” to life satisfaction. Emotion, 16(5), 575-580.

- Shefrin, H.M. & Thaler, R.H. (1988). The behavioral life-cycle hypothesis. Economic inquiry, 26(4), 609-643.

- Strathman, A., Gleicher, F., Boninger, D.S. & Edwards, C.S. (1994). The consideration of future consequences: Weighing immediate and distant outcomes of behavior. Journal of Personality and Social Psychology, 66(4), 742-752.

- Thaler, R. (1985). Mental accounting and consumer choice. Marketing Science, 4(3), 199-214.

- Thaler, R.H. (1999). Mental accounting matters. Journal of Behavioral Decision Making, 12(3), 183-206.

- Warshawsky, M.J. & Ameriks, J. (2000). How prepared are Americans for retirement? In O.S. Mitchell, P.B. Hammond & A.M. Rappaport (Eds.), Forecasting retirement needs and retirement wealth (pp. 33-67). Philadelphia, PA: University of Pennsylvania Press.

- Xiao, J.J., Ahn, S.Y., Serido, J. & Shim, S. (2014). Earlier financial literacy and later financial behaviour of college students. International Journal of Consumer Studies, 38(6), 593-601.

- Yao, R., Hanna, S. & Lindamood, S. (2004). Changes in financial risk tolerance, 1983-2001. Financial Services Review, 13(4), 249-266.

- Yuh, Y. & De-Vaney, S.A. (1996). Determinants of couples’ defined contribution retirement funds. Journal of Financial Counselling and Planning, 7, 31-38.