Review Article: 2023 Vol: 27 Issue: 3

Exploratory Analysis of use of Customer Relationship Management Approach towards Retention of Customers in Automobile Industry

Ankur Kumar Rastogi, Avantika University

Hemlata, Chandigarh University

Ravindra R Kaikini, Sahyadri College of Engineering and Management, Adyar, Managalore

Abhijeet Chavan, Dr. Vishwanath Karad MIT World Peace University

Sukhmeet Kaur, Dr. Vishwanath Karad MIT World Peace University

Geetika Madaan, University Centre for Research and Development,Chandigarh University

Citation Information: Rastogi A.K., Hemlata, R., Kaikini, R.R., Chavan, A., Kaur, S., & Madaan, G. (2023). Exploratory analysis of use of customer relationship management approach towards retention of customers in automobile industry. Academy of Marketing Studies Journal, 27(3), 1-8.

Abstract

Purpose: The main aim of the existing research is to enhance retention of customer by applying customer relationship management approach in automobile industry. Methodology: The existing study in exploratory and primary in nature. The sample size of the study was 356 customers as respondents belong to automobile industry in Delhi/NCR. The responses retrieved from structured questionnaire. Structural Equation Modelling applied to quantitively analyses the results of the current research. The seven prime latent variables selected for the study namely, “Perceived Value of customers (CPV), Image of company (CI), Service Quality (SQ), Barriers switching (SB), Satisfaction among customer (CS), Trust in customers (CT) and Retention of customer (CR).” The conceptual model is also proposed in the study. Findings: The study found that barriers switching had a considerable impact on retention of customer, whereas perceived value of customer, image of company, and service quality all have a notable impact on satisfaction among customer. Customers are more likely to stick around if they trust the credit procedure, but satisfaction of customer has no direct effect on retention of customer. Managerial Implication: These results have important implications for management, such as the need to segment customers and set sales goals in accordance with that segmentation, the importance of providing products with competitive advantages, developing tele sales as informational channels, the significance of supplying credit packages and specific initiatives to promote low-interest rates, and so on. Originality: In this study, we take a look at how likely consumers are to stick with their current auto loan provider when applying for new credit.

Keywords

Customer, Relationship, Retention, Satisfaction, Trust.

Introduction

This research's featured auto loan provider specializes in financing automobiles with four wheels. Customer acquisition has been at the forefront of the company's business process tactics in recent years(Kim, Park, & Jeong, 2004). The credit application pool is indicative of this, with about 80% consisting of new clients and 20% consisting of returning ones(Ranaweera & Prabhu, 2003). Despite aiming to have 30 percent of its portfolio comprised of repeat customers, the company has failed to do so during the past five years(Howshigan & Ragel, 2018).

A satisfied consumer is more likely to make additional purchases after receiving a product or service that lives up to their expectations. Customers that buy from a business repeatedly show that they have faith in that business and its products or services (customer trust). Customers' long-term financial well-being depends on their positive word-of-mouth about the products or services to their friends and family and their reluctance to switch to competitors(Leninkumar, 2017). As the cornerstone of any successful business relationship, customer trust can be described as the belief that a firm will deliver on its commitments. Ranaweera & Prabhu, (2003)agree, arguing that trust between a business and its clientele is a major factor in the latter's decision to stay loyal. In addition to customer happiness and trust, switching barriers also play a role in determining client retention (Robert & Cooper, 2014). One of the most important elements in customer retention in the financial services sector is the high price of switching providers.

Due to the preponderance of studies in the insurance sector, this investigation concentrates on the automotive sector instead. As a result, “a Customer Relationship Marketing (CRM) strategy was implemented, as it places greater emphasis on the connections between trust, commitment, satisfaction, and loyalty(Ashraf, Ilyas, Imtiaz, & Ahmad, 2018). New variables, including service quality, customer perceived value, and switching obstacles, were introduced into the CRM framework to improve its predictive power. This study's original contribution to the advancement of relationship-based marketing models is a conceptual framework that integrates the CRM model with the three variables. Using the customer relationship management paradigm, Samudro et al. (2018) looked at the connections between customers' perceptions of quality and their trust, contentment, commitment, and loyalty.”

Competition in the lending market is high, making this study all the more crucial. In addition, the study's results should help businesses establish the limits of a successful marketing plan, particularly in regards to the utilisation of databases. Findings from this study can be used by businesses to improve client retention rates, therefore reducing the amount spent on acquiring new customers. Adding to the existing body of literature on the topic of client retention is another goal of this study.

The purpose of this research is, thus, to determine how switching obstacles affect customer retention and how customer satisfaction affects retention both directly and indirectly through such variables as perceived value of customer, image of company, and service quality.

Review of Literature

To increase customer satisfaction and loyalty from existing customers, insurance service providers should prioritise enhancing both the quality of their services and the public's perception of them (Nguyen et al. 2018). “As Hardjanti & Amalia (2014) found, customers' perceptions of value have a favourable impact on their overall happiness with their internet service providers. According to Mbango, (2019), the two are connected in some way. Both Samudro et al. (2020); Susanti et al. (2020) revealed that perceived value has a greater impact on customer satisfaction in the chemical business.

Corporate image positively affects client happiness, according to research by Setiawan & Sayuti (2017) on a tour and travel company. Ashraf et al. (2018) did a similar case study on a firm that provides services, hotels, hospitals, education, and banks, and found that corporate image significantly affected customers' happiness with the company.

A number of studies have shown that the quality of service provided has a substantial impact on clients' overall levels of satisfaction. One case study by Ashraf et al. (2018) examined the impact of service quality on customer satisfaction across five service industries in Pakistan, including hotels, hospitals, educational institutions, and financial institutions.

The review of above-mentioned studies indicated that there is rarely any study that indicated the use of customer relationship management approach for retention of customers in automobile industry.

Research Methodology

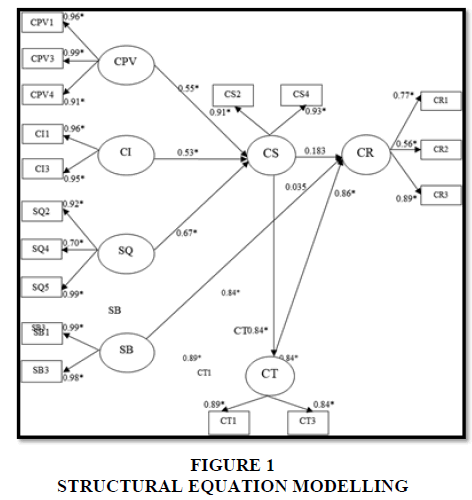

The existing study in exploratory and primary in nature. The sample size of the study was 356 customers as respondents belong to automobile industry in Delhi/NCR. The responses retrieved from structured questionnaire. Structural Equation Modelling applied to quantitively analyses the results of the current research. The study aimed at enhancing retention of customer using customer relationship management approach. The seven prime latent variables selected for the study namely, “Perceived Value of customers (CPV), Image of company (CI), Service Quality (SQ), Barriers switching (SB), Satisfaction among customer (CS), Trust in customers (CT) and Retention of customer (CR).” The proposed conceptual model is as follows:

Results and Discussion

The results of the model compatibility test reveal how well the primary data (obtained from the field study) fits inside the framework of the constructed model. There are three theoretical facets to model fit measurement: the absolute fit index, the incremental fit index, and the parsimony fit index. Results of the model-fitting analysis are shown in Table 1.

| Table 1 Overall Model Fit |

|||

|---|---|---|---|

| Parameters | Acceptable threshold limit | Estimated outcome | Decision |

| 1.Root Mean Square Error of Approximation (RMSEA) | ≤0.05 | 0.04 | “Fit” |

| 2. Parsimony Ratio (PRATIO) | >0.5 | 0.90 | “Fit” |

| 3. Normed Fit Index (NFI) | >0.9 | 0.91 | “Fit” |

| 4. PNFI | >0.5 | 0.56 | “Fit” |

| 5. PCFI | >0.9 | 0.92 | “Fit” |

To account for the chi-squared distribution in large samples, an index called RMSEA (Root Mean Square Error of Approximation) might be utilised. Model acceptance requires an RMSEA value of 0.05 or less. The results of the calculations show that the RMSEA value is 0.04; this places the model in the acceptably close to the true value and the fit group.

Coefficients in the structural equations were subjected to a compatibility test, with the significance threshold for the test determined beforehand. In conclusion, Figure 1 displays the outcomes of the measurement model evaluation.

All variables in this study have been shown to be reliable and valid by the reliability and validity analysis results displayed in Table 2 as reliability test estimated “value is greater than the acceptable threshold limit of 0.60 and in case of validity test estimated value is greater than the acceptable threshold limit of 0.70. Therefore, internal consistency among the variables is present in the existing study.”

| Table 2 Validity And Reliability Analysis Of Variables |

||

|---|---|---|

| Variables | Reliability | Validity |

| Perceived Value of customers (CPV) | 0.95 | 0.87 |

| Image of company (CI) | 0.97 | 0.89 |

| Service Quality (SQ) | 0.89 | 0.92 |

| Barrier switching (SB) | 0.88 | 0.88 |

| Satisfaction among customer (CS) | 0.82 | 0.93 |

| Trust in customers (CT) | 0.93 | 0.71 |

| Retention of customer (CR) | 0.87 | 0.79 |

Perceived value of customers: Table 3 displays the results of indicator contributions to the studied variables. The "perceived value of customer" latent variable is comprised of three sub-indicators. With an estimated value of 0.89, the "to be sure" (CPV2) indicator clearly had a considerably larger contribution to the perceived value of customer variable than the CPV1 and CPV3 indicators. This indicates that the company's credit process is satisfactory in the eyes of its customers.

| Table 3 Sub Latent Variables Description To Latent Variables |

||||

|---|---|---|---|---|

| Laten variables | Sub latent variables | Codes | Estimation of results | P-value |

| Perceived Value of customers (CPV) | 1. Bonus advantages | CPV1 | 0.84 | 0.00* |

| 2. To be sure | CPV2 | 0.89 | 0.00* | |

| 3. Expansion of the company's worth | CPV3 | 0.82 | 0.00* | |

| Image (of company CI) | 4. Branding strategies for corporations | CI1 | 0.91 | 0.00* |

| 5. Communicate with the client | CI2 | 0.89 | 0.0* | |

| Service Quality (SQ) | 6. Demands are minimally onerous | SQ1 | 0.83 | 0.00* |

| 7. Proof of conformity | SQ2 | 0.81 | 0.00* | |

| 8. Service acceleration through focused care | SQ3 | 0.88 | 0.00* | |

| Barrier (switching SB) | 9. Difficult and annoying client | SB1 | 0.89 | 0.00* |

| 10. Participation is required | SB2 | 0.86 | 0.00* | |

| Satisfaction among customers (CS) | 11. Transaction completed with satisfaction. | CS2 | 0.84 | 0.00* |

| 1 12. Happy with the service provided by the firm | CS4 | 0.93 | 0.00* | |

| Trust in customers (CT) | 13. Relationships of trust have been established. | CT1 | 0.98 | 0.00* |

| 14. Assurances exist | CT3 | 0.95 | 0.00* | |

| Retention of customers (CR) | 15. Intent on Recycling | CR1 | 0.98 | 0.00* |

| 16. Give your opinion | CR2 | 0.53 | 0.00* | |

| 17. The needs of the business must be met | CR3 | 0.99 | 0.00* | |

Image of the company

This research uses two indicators to measure the corporate image variable. The estimated Branding strategies for corporation’s indicator (CI1) was 0.91, indicating that it contributed more to the corporate image variable than the CI2 indicator. How often a firm advertises its product and services in print or on social media, making them easily memorable to consumers, is a good indicator of the company's reputation.

Service Quality

The service quality variable in this analysis is measured in three ways. The estimated value of the SQ3 indication, Service Acceleration through Focused Care, was 0.88, showing that its contribution to service quality significantly outweighs that of SQ1 and SQ2 indicators. Many clients today value quick turnaround times more than personalized care, but they still value both. In order to fully satisfy client expectations, service providers must take into account accuracy in providing services in addition to meeting the wants and aspirations of the consumer.

Barrier Switching

Indicators of switching barriers include two factors. Customers who are difficult and bothersome to work with (SB1) were projected to contribute 0.89 more to the switching barriers variable than customers who are easy to work with (SB2). Customers often worry that changing their credit to a new company will make it more difficult to apply for credit or learn about the company's products and services.

Satisfaction among Customers

There are two measures that can be used to gauge customer happiness. According to the estimated value of 0.93 for CS1, the indicator "Happy with the service given by the firm" contributes more to overall customer satisfaction than CS2. Not only one component of performance, but the company's overall performance becomes a measure of customer satisfaction. This provides circumstantial evidence that consumer discontent with a single facet of service is predictive of a greater level of dissatisfaction with the company's performance as a whole.

Trust in Customer

There are two measures of trust from clients. With an estimated value of 0.98, the indicator of "Relationships of trust have been built" (CT1) contributed more to customers' trust than the CT2 indication. One must have complete faith in the business in order to apply for credit through it. For businesses to successfully cultivate lasting relationships with their clientele, they must consistently meet or exceed their customers' expectations.

Retention of Customer

The estimated value of the third indicator for customer retention, "The demands of the business must be addressed," was 0.98, indicating that it contributed to customer retention more than either of the first two indicators, CR1 and CR2. This demonstrates that prioritising the firm increases the likelihood of sustaining a profitable commercial relationship with the consumer.

Hypothesis Testing

It is possible to conduct hypothesis analysis using the empirical model presented in this study by calculating route coefficients from a structural equation model. In Table 4, “we see that most of the variables have a significant effect”, including "the effect of perceived value of customer on satisfaction among customer," "the effect of image of company on satisfaction among customer," "the effect of service quality on satisfaction among customer," "the effect of switching barriers on retention of customer," "the effect of satisfaction among customer on trust in customer," and "the effect of satisfaction among customer on retention of customer." In any case, customer pleasure has no appreciable bearing on client retention.

| Table 4 Direct Effect Result |

|||||

|---|---|---|---|---|---|

| Path | Beta | C.R. | P-value | Decision | |

| H1 | Perceived Value of customer (CPV) →Satisfaction among customer (CS) |

0.663 | 9.248 | 0.000 | Accepted |

| H2 | Image of company (CI) → Satisfaction among customer (CS) | 0.635 | 9.903 | 0.000 | Accepted |

| H3 | Service Quality (SQ) → Satisfaction among customer (CS) | 0.566 | 8.858 | 0.000 | Accepted |

| H4 | Barrier switching (SB) →Retention of customer (CR) | 0.043 | 2.641 | 0.090 | Accepted |

| H5 | Satisfaction among customer (CS) → Retention of customer (CR) | 0.238 | 0.641 | 0.643 | Rejected |

| H6 | Satisfaction among customer (CS) → Trust in customer (CT) | 0.734 | 4.987 | 0.000 | Accepted |

| H7 | Trust in customer (CT)→ Retention of customer (CR) | 0.716 | 2.123 | 0.089 | Accepted |

The findings of the study's examination of indirect relationships between variables are presented in Table 5. For the purpose of this study, we will refer to these four independent variables as "perceived value of customer and retention of customer," "image of company and retention of customer," "service quality and retention of customer," and "satisfaction among customers and retention of customers," respectively.

| Table 5 Indirect Effect Result |

|||

|---|---|---|---|

| Path | Estimate | P-value | Conclusion |

| Perceived Value of customer (CPV) → Retention of customer (CR) |

0.202 | 0.127 | Rejected |

| Image of company (CI) → Retention of customer (CR) | 0.089 | 0.089 | Accepted |

| Service Quality (SQ)→ Retention of customer (CR) | 0.321 | 0.076 | Accepted |

| Satisfaction among customer (CS) → Retention of customer (CR) | 0.331 | 0.000 | Accepted |

Conclusion

The purpose of this study was to examine the relationships between customer satisfaction and three independent variables: (a) customer-perceived value; (b) company image; and (c) service quality (Samudro et al. 2019).

Value as perceived by the consumer was discovered to have a considerable impact on a company's ability to retain happy customers(Hardjanti & Amalia, 2014). The credit products and services the company provides are generally well received by customers. Further, the corporate image significantly affects consumer happiness, and the organisation is viewed as having positive branding and a solid reputation (Sarwar et al. 2012). Customers are more satisfied when they feel their wants and expectations have been met by the services they have received, which is directly related to service quality. Additionally, switching obstacles have a major impact on client retention rates (Susanti et al. 2020). Customers are aware that switching to a new credit provider would require more time and money. Still, there is no strong correlation between happy customers and increased loyalty. Customers' happiness with the company's products and services is not necessarily indicative of whether or not they will reapply for credit with the same business. Customers who have faith in the company's credit policies and procedures are more likely to apply for new credit through the company's products or services. Managers should organise customers into groups, set sales goals based on those groups, create products with distinct advantages over those of competitors, develop credit packages and special programs to promote enticingly low interest rates, and establish tele sales as channels for disseminating relevant information to customers.”

References

Ashraf, S., Ilyas, R., Imtiaz, M., & Ahmad, S. (2018). Impact of Service Quality, Corporate Image and Perceived Value on Brand Loyalty with Presence and Absence of Customer Satisfaction: A Study of four Service Sectors of Pakistan. International Journal of Academic Research in Business and Social Sciences, 8(2).

Indexed at, Google Scholar, Cross Ref

Hardjanti, A., & Amalia, D. (2014). The Influence of Customer Service Quality, Customer Perceived Value, Customer Satisfaction, Customer Trust And Switching Barriers On Customer Retention. Jurnal Ekonomi, 5(1), 1–12.

Howshigan, S., & Ragel, V. R. (2018). The Effectiveness of Switching Barrier on Customer Loyalty Mediated with Customer Satisfaction: Telecommunication Industry, Batticaloa. South Asian Journal of Social Studies and Economics, (June), 1–9.

Indexed at, Google Scholar, Cross Ref

Kim, M. K., Park, M. C., & Jeong, D. H. (2004). The effects of customer satisfaction and switching barrier on customer loyalty in Korean mobile telecommunication services. Telecommunications Policy, 28(2), 145–159.

Indexed at, Google Scholar, Cross Ref

Leninkumar, V. (2017). The Relationship between Customer Satisfaction and Customer Trust on Customer Loyalty. International Journal of Academic Research in Business and Social Sciences, 7(4), 450–465.

Indexed at, Google Scholar, Cross Ref

Mbango, P. (2019). The role of perceived value in promoting customer satisfaction: Antecedents and consequences. Cogent Social Sciences, 5(1).

Indexed at, Google Scholar, Cross Ref

Nguyen, H. T., Nguyen, H., Nguyen, N. D., & Phan, A. C. (2018). Determinants of customer satisfaction and loyalty in Vietnamese life-insurance setting. Sustainability (Switzerland), 10(4), 1–16.

Indexed at, Google Scholar, Cross Ref

Ranaweera, C., & Prabhu, J. (2003). The influence of satisfaction, trust and switching barriers on customer retention in a continuous purchasing setting. International Journal of Service Industry Management, 14(3–4), 374–395.

Indexed at, Google Scholar, Cross Ref

Robert, G., & Cooper. (2014). The effects of customer satisfaction, perceived value, corporate image and service quality on behavioral intentions in gaming establishments. The Eletronic Library, 34(1), 1–5.

Indexed at, Google Scholar, Cross Ref

Samudro, A., Sumarwan, U., Simanjuntak, M., & Yusuf, E. Z. (2019). How Commitment, Satisfaction, and Cost Fluctuations Influence Customer Loyalty. GATR Journal of Management and Marketing Review, 4(2), 115–125.

Indexed at, Google Scholar, Cross Ref

Samudro, A., Sumarwan, U., Simanjuntak, M., & Yusuf, E. Z. (2020). Assessing the effects of perceived quality and perceived value on customer satisfaction. Management Science Letters, 10(5), 1077–1084.

Indexed at, Google Scholar, Cross Ref

Samudro, A., Sumarwan, U., Yusuf, E. Z., & Simanjuntak, M. (2018). Perceived Quality and Relationship Quality as Antecedents and Predictors of Loyalty in the Chemical Industry: A Literature Review. European Scientific Journal, ESJ, 14(28), 173.

Indexed at, Google Scholar, Cross Ref

Sarwar, M. Z., Abbasi, K. S., & Pervaiz, S. (2012). The Effect of Customer Trust on Customer Loyalty and Customer Retention: A Moderating Role of Cause Related Marketing. Global Journal of Management And Business, 12(6), 26–36.

Setiawan, H., & Sayuti, A. J. (2017). Effects of Service Quality, Customer Trust and Corporate Image on Customer Satisfaction and Loyalty: An Assessment of Travel Agencies Customer in South Sumatra Indonesia. IOSR Journal of Business and Management, 19(05), 31–40.

Indexed at, Google Scholar, Cross Ref

Susanti, V., Sumarwan, U., Simanjuntak, M., & Yusuf, E. Z. (2020). Rational Antecedent Framework of Brand Satisfaction in the Industrial Market: Assessing Rational Perceived Quality and Rational Perceived Value Roles. International Review of Management and Marketing, 10(1), 19-26.

Indexed at, Google Scholar, Cross Ref

Received: 03-Jan-2023, Manuscript No. AMSJ-23-13130; Editor assigned: 04-Jan-2023, PreQC No. AMSJ-23-13130(PQ); Reviewed: 30-Jan-2023, QC No. AMSJ-23-13130; Revised: 28-Feb-2023, Manuscript No. AMSJ-23-13130(R); Published: 06-Mar-2023