Research Article: 2024 Vol: 28 Issue: 1

Exploring Antecedents for user Acceptance of Cryptocurrencies through the Lens of the Indian Forex Market

Debashish Sakunia, Indian Institute of Technology Delhi

Biswajita Parida, Indian Institute of Technology Delhi

Citation Information: Sakunia, D., & Parida, B. (2024). Exploring antecedents for user acceptance of cryptocurrencies through the lens of the indian forex market. Academy of Marketing Studies Journal, 28(1), 1-10.

Abstract

This study investigates the factors that influence user acceptance of forex and extends it to cryptocurrency trading. Despite the differences in underlying technologies, both forex and cryptocurrency trading involve buying and selling assets with high volatility and the potential for both profits and losses. Traders in both markets use technical analysis, leverage, and trading platforms to inform their decisions. While cryptocurrencies have unique properties such as decentralization and security, they remain unregulated in many countries including India, where the government has expressed concerns about their potential impact on financial stability and the risk of money laundering. Similarly, forex trading faces risks related to cash flow uncertainty and money laundering. Understanding the factors that influence user acceptance of these trading platforms can inform policymakers and businesses in developing effective regulations and strategies to mitigate risks and promote responsible trading practices. The study identified four key themes that influence acceptance: social influence, convenience, compatibility, and learning and training. Social influence mainly comes from friends and family, while convenience is related to the industry people are in or their friends are in. Learning and training activities can increase compatibility. These findings suggest strategies for increasing the acceptance of upcoming cryptocurrency markets in India. These strategies include targeting influential individuals for social influence, making it more convenient to use, ensuring compatibility with existing financial systems, and providing education and training. By implementing these strategies, cryptocurrency markets can increase their acceptance in India.

Introduction

Forex trading and cryptocurrency trading are similar in many ways despite using different underlying technologies. Both involve buying and selling assets in the hopes of generating profits (Cialdea & Pasqualini, 2020; Foley, Karlsen, & Putni?š, 2019). Both forex and cryptocurrency markets are highly volatile. meaning that prices can fluctuate rapidly and dramatically, which can lead to high profits, but also high losses (Cialdea & Pasqualini, 2020; Foley et al., 2019; Chuen et al., 2017; Zhou, B., 1996). Additionally, both forex and cryptocurrency markets are global, allowing traders to access them from anywhere in the world and trade 24 hours a day (Sulaimon & Oludare, 2021). Traders in both markets use technical analysis to inform their trading decisions by analyzing charts, indicators, and other data to identify patterns and predict future price movements (Cialdea & Pasqualini, 2020). Both forex and cryptocurrency traders can use leverage to increase the size of their trades, which can lead to larger profits, but also larger losses (Liu, Li, & Cui, 2021). Both types of traders use trading platforms to access the markets and execute trades, which offer a variety of tools and features to help traders analyze the markets and make informed decisions (Sulaimon & Oludare, 2021).

The cryptocurrency market is a decentralized digital exchange system, operating on a peer-to-peer basis (Mukhopadhyay, 2016), while the forex market is an over-the-counter (OTC) market that is also decentralized (Motilal Oswal (n.d.)). Both markets operate without geographical limitations (Zhou, B., 1996) or business hour restrictions (Becker, 2023; Zhou, B., 1996), and are highly volatile (chuen et al., 2017; Zhou, B., 1996).

One might argue that Forex trading is done in real money, while cryptocurrencies are merely digital tokens with no intrinsic value. However, researchers such as Kim and Chiu (2018) suggest that cryptocurrencies, like Bitcoin, may actually have some advantages over traditional assets such as gold and fiat currencies like the USD. These advantages are attributed to the unique properties of cryptocurrencies, such as decentralization and security. While there is a debate about whether cryptocurrencies could ultimately replace fiat currencies, Narayanan et al. (2016) provide a comprehensive overview of Bitcoin and cryptocurrency technologies in their book "Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction." This book outlines the benefits and potential drawbacks of cryptocurrencies, which can help inform the ongoing debate around their role in the global financial system. There is a possibility of cryptocurrencies being used as the means of exchange of the future and as researchers, we ought to study the phenomenon.

Cryptocurrency has emerged as a new investment asset that has gained significant attention due to its potential to disrupt the tech industry and provide high returns (Moodalagiri, 2022). In India, Bitcoin was the first form of cryptocurrency to appear in 2009, and it has since grown in popularity, with an estimated 15 to 20 million cryptocurrency investors in India holding around 41 thousand crore rupees ($5.37 billion) (Moodalagiri, 2022). India is a leading player in the cryptocurrency market, with over 60% of states adopting crypto technology and more than 15 million retail investors. However, the lack of established regulations for cryptocurrency trading in India and the government's unpredictable approach to regulation make it a risky investment for traders, entrepreneurs, and institutional investors (Moodalagiri, 2022).

The foreign exchange market is becoming a worldwide trading platform that operates 24/7 and offers high earning potential while being regulated by strict laws. India is the third most attractive destination for foreign direct investment, according to UNCTAD's World Investment Prospects Survey 2012-14. However, prior to the 1991 liberalization, privatization, and globalization reforms, the Indian government had reservations about forex trading and frequently changed regulations, which is similar to the current situation with cryptocurrency. The government has not released structured regulations for the cryptocurrency trading and has concerns in regards to advertisements for these markets. As a result, most advertising channels have prohibited the promotion of cryptocurrencies.

The Indian government has expressed concerns about cryptocurrencies and their potential impact on macroeconomic and financial stability, with the finance minister warning that cryptocurrencies are not issued by the central bank or government, and their value is based solely on speculation (Mint, 2022). The government fears that unregulated cryptocurrency markets could become avenues for money laundering, fraud, and terror financing (Krishnan, 2021). Additionally, the government is concerned that the widespread adoption of cryptocurrencies could lead to the dollarization of a part of the Indian economy, which could go against the country's sovereign interests (Parliamentary standing committee on Cryptocurrency).

The forex market also faces risks such as uncertainty of cash flow caused by inflows to emerging market economies (EMEs) in search of better yields, followed by sudden stops and reversals (Prakash, 1993). The government is concerned about maintaining the external competitiveness of exports and the stability of the Indian Rupee, fearing dollarization of the economy (Prakash, 1993). Additionally, the forex market is at risk of money laundering, especially through corrupt practices like mirror trading with offshore banking (Stahlie & Ridder, 2020). The fact that forex trade is heavily invoiced in dollars raises questions about the main premise of the Monetary and Financial Partnership (MFP), suggesting the need for an alternative paradigm (Gopinath, 2017).

Recently, the Indian government banned 34 mobile applications, including forex trading apps, due to concerns over data privacy and national security (Press Information Bureau, 2021). The government stated that these apps were engaging in activities that were "prejudicial to the sovereignty and integrity of India" (Press Information Bureau, 2021). The move demonstrates the Indian government's commitment to maintaining strict control over forex trading activities within the country and ensuring the safety of its citizens. A similar incident happened when the Indian government has recently brought cryptocurrencies under the purview of the Prevention of Money Laundering Act (PMLA), putting them in line with the regulations governing the forex market (The Economic Times, 2020). This move reflects the government's concerns about the potential misuse of digital currencies for illicit activities, including money laundering and terrorism financing. The forex market, much like the cryptocurrency market, is subject to stringent anti-money laundering laws to prevent these activities (Reserve Bank of India, 2020).

Examining the Forex Markets can shed light on crucial variables that impact user acceptance, a multifaceted process influenced by a range of factors. Financial institutions should take these factors into account while creating and marketing new financial instruments, ensuring their successful uptake and utilization.

By comprehending the factors that shape user acceptance, financial institutions can devise instruments that cater to users' preferences and needs, ultimately boosting user satisfaction and loyalty. Since the Indian Cryptocurrency market shares similar circumstances (such as government regulations, user awareness, etc.) to the Indian Forex Markets, this investigation can identify user-centric variables that could strengthen the adoption of cryptocurrency as an established financial investment instrument.

In this study, we would focus on 80% of the effects coming from 20% of the causes as suggested in The Pareto principle (Juran, 1992). Focusing on the 20% of the variables that contribute to 80% of the outcomes can provide the most significant value. Several studies have highlighted the importance of Pareto analysis in research. For example, Li et al. (2018) used Pareto analysis to identify the critical factors that affect the adoption of mobile payment services. The study found that the security of mobile payments, the convenience of mobile payments, and the perceived usefulness of mobile payments were the most critical factors that influenced the adoption of mobile payment services. Similarly, Yusuf and Ayuba (2019) used Pareto analysis to identify the factors that influence the adoption of e-learning systems. The study found that the perceived usefulness of e-learning systems, the ease of use of e-learning systems, and the compatibility of e-learning systems with existing technologies were the most critical factors that influenced the adoption of e-learning systems.

Furthermore, by focusing on the 20% of the variables that contribute to 80% of the outcomes, we can optimize the use of research resources and provide the most significant value.

Implication of the Research

The research on factors influencing user acceptance of forex and cryptocurrency trading has significant implications for product managers and marketers in making more informed decisions. Understanding these factors can help guide the development and marketing strategies of forex and cryptocurrency trading platforms, leading to improved user acceptance and adoption.

Firstly, by identifying the factors that positively influence user acceptance, product managers and marketers can prioritize the development of features and functionalities that address these factors. For example, if trust and security emerge as key factors, efforts can be directed towards implementing robust security measures, transparent data handling practices, and building trust through user-friendly interfaces. This focus on addressing user concerns can enhance the overall user experience and attract more users to the platforms.

Secondly, the research findings can assist in tailoring marketing and communication strategies to effectively promote forex and cryptocurrency trading platforms. By understanding the factors that influence user acceptance, marketers can develop targeted messaging that highlights the platform's strengths in relation to these factors. For instance, if convenience and performance expectancy are important to users, marketing campaigns can emphasize the ease of use, time efficiency, and potential gains in job performance that can be achieved through the platform. Such tailored marketing messages can resonate better with the target audience and increase the likelihood of user adoption.

Furthermore, the research can guide resource allocation and investment decisions. By identifying the most influential factors, product managers and marketers can allocate resources and investments accordingly. For instance, if social influence and learning/training are found to be significant, efforts can be directed towards building strong user communities, engaging influencers, and developing comprehensive training programs. By investing in areas that have the greatest impact on user acceptance, organizations can optimize resource allocation and increase the chances of success in the competitive forex and cryptocurrency trading market.

Lastly, the research can contribute to the long-term sustainability of forex and cryptocurrency trading platforms. By understanding the factors that influence user acceptance, product managers and marketers can proactively address potential barriers or challenges that may hinder adoption. This knowledge can inform continuous improvement initiatives and drive innovation in areas that are critical for user acceptance, such as user interface design, data security, customer support, and transparency. By consistently meeting user expectations and adapting to their evolving needs, organizations can foster user loyalty, build a positive reputation, and establish a strong market position in the long run.

The research on factors influencing user acceptance of forex and cryptocurrency trading holds valuable implications for product managers and marketers. It can guide decision-making related to product development, marketing strategies, resource allocation, and long-term sustainability. By considering these implications, organizations can enhance user acceptance, drive adoption, and gain a competitive edge in the dynamic and rapidly growing market of forex and cryptocurrency trading.

Existing Literature on user Acceptance in Financial Markets

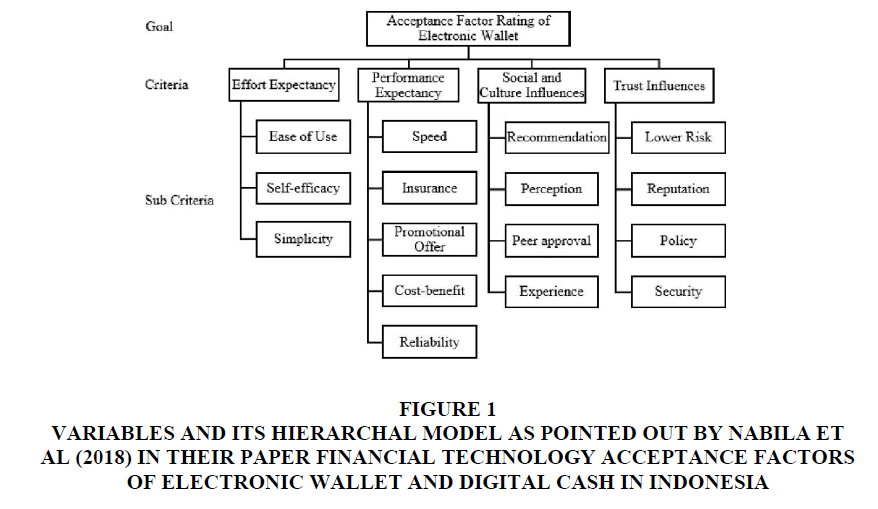

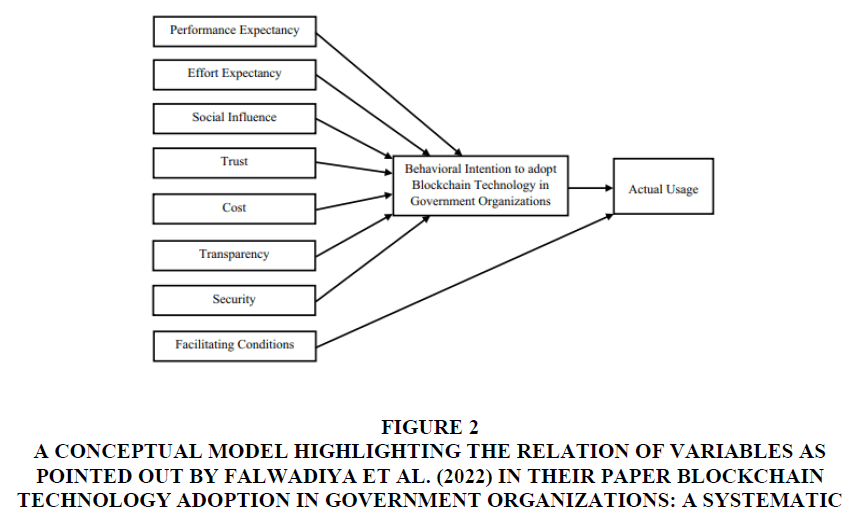

The success of financial instruments heavily relies on user acceptance, which is influenced by several factors identified in the existing literature. There have been several studies in an attempt to understand user acceptance in Financial Markets. Three SLRs studies by Falwadiya et al. (2022), Nabila et al. (2018) and Artha et al. (2020) beautifully capture most of these variables and also paint a model highlighting a potential relation Figure 1 and 2.

Figure 1: Variables And Its Hierarchal Model As Pointed Out By Nabila Et Al (2018) In Their Paper Financial Technology Acceptance Factors Of Electronic Wallet And Digital Cash In Indonesia.

Figure 2: A Conceptual Model Highlighting The Relation Of Variables As Pointed Out By Falwadiya Et Al. (2022) In Their Paper Blockchain Technology Adoption In Government Organizations: A Systematic .

Literature Review

Of the variables highlighted in the above studies and many others, the factors that have emerged often in the literature and therefore significant in user acceptance of financial instruments have been defined below:

Effort expectancy refers to the degree of ease associated with using a system. Easier use of the system leads to a higher intention to adopt technology (Venkatesh et al., 2003; Khazaei, 2020).

Performance expectancy is the belief that using the system will help improve job performance. Constructs related to performance expectancy include extrinsic motivation, outcome expectation, perceived usefulness, relative advantage, and job fit. Performance expectancy positively influences technology adoption (Venkatesh et al., 2003; Queiroz and Fosso Wamba, 2019; Gil-Cordero et al., 2020; Alazab et al., 2021; Tran and Nguyen, 2020).

Facilitating conditions refer to the extent to which an individual believes the organization has adequate resources to support system use. Insufficient technical resources negatively impact adoption, while a good fit between technology and infrastructure increases the likelihood of adoption (Falwadiya et al., 2022; Francisco and Swanson, 2018; Barnes and Xiao, 2019).

Social influence is the extent to which a person is affected or influenced by other people's beliefs in society when deciding to use a particular information system. Social influence significantly leads to technology adoption (Falwadiya et al., 2022; Queiroz et al., 2020; Nuryyev et al., 2020; Tran and Nguyen, 2020).

Cost is seen in two ways: the price of technology (cost of investment) and cost reduction. Adoption occurs when the perceived benefits or cost reduction of a technology exceed its price (Falwadiya et al., 2022; Venkatesh et al., 2012).

Transparency, which involves reducing information asymmetry, increasing data availability, and enabling easy verification of transactions, is a key factor in technology adoption (Falwadiya et al., 2022; Hoxha and Sadiku, 2019; Tran and Nguyen, 2020; Kamble et al., 2020

Trust refers to the belief of one party in another and includes constructs such as system trust, situational decision to trust, dispositional trust, trusting beliefs, trusting intention, and trusting behavior. Trust between parties and in the network positively influences technology adoption (Falwadiya et al., 2022).

Security is the subjective probability that customers believe their data will not be stored, viewed, or manipulated during transit. Security, including data reliability, high-security encryption, data accuracy, and data inalterability, positively influences behavioral intentions to use technology (Falwadiya et al., 2022).

Incentives such as gifts, rewards, and premiums, can positively influence user acceptance of technology (Barr, 2023).

Learning and training initiatives, such as classroom or online teaching, help users become comfortable with using technology. Users are more likely to accept technology if they receive proper training and support (Venkatesh et al., 2008).

Convenience of use is defined by dimensions such as time, place, acquisition, use, and execution. Perceived convenience is an antecedent factor to user acceptance (Bansah et al., 2022; Brown, 1989).

Control refers to the arrangement and display of information and instructions on a computer or phone screen. Perceived control, composed of behavioral, cognitive, and decisional controls, has a positive effect on user acceptance (Abraham et al., 2019).

Study Methodology

Several research methods could have been considered to investigate the factors influencing user acceptance of forex and cryptocurrency trading. These methods include survey questionnaires, observational studies, experimental studies, focus groups, and document analysis. Surveys could have provided quantitative data from a large sample, while observational studies could have captured users' actual behaviors. Experimental studies could have allowed for causal relationships, and focus groups could have facilitated interactive discussions. Document analysis could have offered insights from various texts. However, in the context of studying user acceptance, interviews were found to be the most appropriate method. Interviews provided direct engagement with participants, allowing for open-ended questioning and exploration of individual perspectives. It offered the opportunity to capture rich qualitative data and delve into the nuanced factors influencing user acceptance. Interviews also ensure privacy and confidentiality, enabling participants to share their experiences openly.

Therefore, interviews were chosen as the research method for gaining comprehensive insights into the factors influencing user acceptance of forex and cryptocurrency trading. A purposive sampling strategy was followed to select participants who met the inclusion criteria of having experience in investing in the Indian Financial Markets. The sample size was determined based on the principle of data saturation, and data collection continued until no new information was obtained from additional participants.

The interviews were conducted face-to-face, over the telephone or online, using a semi-structured interview guide based on the participant's preference. The interview guide consisted of open-ended questions that explored the investors' perceptions, attitudes, and behaviours towards financial investments, including cryptocurrencies. A total of 9 interviews were taken with 2 investors who have been active in the financial markets for over 30 years, 4 investors who been active in financial market for 15-20 years and the remaining, who have been active between 5-10 years.

The data collected from the interviews were analyzed using a thematic analysis approach, which involved identifying patterns and themes in the data. The analysis was conducted manually, and the identified themes were cross-checked by a second analyst to ensure inter-rater reliability.

To ensure the trustworthiness and credibility of the study findings, various strategies were employed, including member checking, peer debriefing, and thick descriptions of the data analysis process.

Findings from the Study

Several Variables from the above literature review occurred in sporadic fashion. However, the study used pareto analysis which revealed that social influence, convenience, compatibility, and learning and training are important factors influencing the acceptance of forex markets. The influence of friends and family is a significant source of social influence, while convenience is linked to the industry people are in or their social network. Further, learning and training activities increase compatibility. These findings provide insight for the development of strategies aimed at increasing the acceptance of financial products and services in India.

Inference for Cryptocurrency Market

Cryptocurrency markets are gaining increasing popularity around the world, and India is no exception. However, there are several factors that influence the acceptance of cryptocurrency in India. The study identified four key themes that influence acceptance: social influence, convenience, compatibility, and learning and training.

Social influence was found to be a crucial factor that influences acceptance of cryptocurrency in India. Friends and family were identified as key sources of social influence. It is important for cryptocurrency companies to target influential individuals who can sway the opinion of their friends and family towards cryptocurrency. Such individuals can act as brand ambassadors and help to increase the visibility and credibility of cryptocurrency markets in India.

Convenience is another important factor that influences acceptance. The convenience of using cryptocurrency is related to the industry that people are in, or their friends are in. If people find it easy to use cryptocurrency for their daily transactions, they are more likely to accept it. Therefore, cryptocurrency companies need to ensure that their platforms are user-friendly and accessible to everyone. Making it easy to use and access will help to increase the adoption of cryptocurrency in India.

Compatibility with existing financial systems is also a crucial factor that influences acceptance. It is important for cryptocurrency companies to ensure that their platforms are compatible with existing financial systems in India. This will help to ease the transition for people who are used to traditional financial systems. Additionally, cryptocurrency companies need to provide incentives for people to switch to their platforms. This can include lower transaction fees, faster transaction times, and other benefits that can help to attract new users.

Finally, learning and training activities were identified as an important factor that influences acceptance. Cryptocurrency companies need to provide education and training to people to help them understand the benefits and risks of using cryptocurrency. By providing education and training, cryptocurrency companies can increase the comfort level of people with the concept of cryptocurrency. This, in turn, can help to increase the adoption of cryptocurrency in India.

In conclusion, the acceptance of cryptocurrency in India can be increased by targeting influential individuals for social influence, making it more convenient to use, ensuring compatibility with existing financial systems, and providing education and training. These strategies can help cryptocurrency companies to improve their chances of being accepted in the Indian market. However, it is important for cryptocurrency companies to understand the unique cultural, social, and economic factors that influence acceptance in India and tailor their strategies accordingly. By doing so, cryptocurrency companies can succeed in the Indian market and help to drive the adoption of cryptocurrency in India.

References

Artha, B., & Jufri, A. (2020). Fintech: A Literature Review. Jurnal Proaksi p-ISSN, 2089, 127X.

Becker, S. (2023). Does Cryptocurrency Have Trading Hours?

Chuen, D.L.K., Guo, L., & Wang, Y. (2017). Cryptocurrency: A new investment opportunity?.The journal of alternative investments, 20(3), 16-40.

Cialdea, E., & Pasqualini, L. (2020). The similarities and differences between forex trading and cryptocurrency trading. International Journal of Academic Research in Accounting, Finance and Management Sciences, 10(3), 48-53.

Falwadiya, H., & Dhingra, S. (2022). Blockchain technology adoption in government organizations: A systematic literature review. Journal of Global Operations and Strategic Sourcing.

Indexed at, Google Scholar, Cross Ref

Foley, S., Karlsen, J., & Putni?š, T.J. (2019). Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies? Review of Financial Studies, 32(5), 1798-1853.

Gopinath, G. (2017). Dollar Dominance in Trade: Facts and Implications. EximBankIndia.com.

Gopinath, G., Boz, E., Casas, C., Díez, F.J., Gourinchas, P.-O., & Plagborg-Møller, M. (2016). Dominant Currency Paradigm.

Juran, J.M. (1992). Juran on quality by design: The new steps for planning quality into goods and services. Free Press.

Kim, J., & Chiu, I. (2018). Is Bitcoin better than Gold and USD? Journal of Risk and Financial Management, 11(4), 66.

Krishnan, M. (2021). Why is India cracking down on cryptocurrency?

Li, X., Deng, R.H., Li, Y., & Lu, R. (2018). A multi-criteria evaluation framework for mobile payment methods. Decision Support Systems, 109, 88-96.

Liu, J., Li, W., & Cui, Y. (2021). Cryptocurrency investment behavior and trading strategy. Journal of Risk and Financial Management, 14(1), 21.

Mint (2022). Https://www.Livemint.Com/news/india/cryptocurrency-rbi-seeks-ban-but-india-needs-global-support-to-regulate-it-says-fm-nirmala-sitharaman-11658129082511.Html.

Moodalagiri, S. (2022). The evolution of cryptocurrencies in India and what the future looks like. The Times of India.

Motilal Oswal (n.d.). Similarities and Differences Between Crypto and Forex Online Trading. Motilal Oswal PhyGital.

Mukhopadhyay, U., Skjellum, A., Hambolu, O., Oakley, J., Yu, L., & Brooks, R. (2016). A brief survey of cryptocurrency systems. In 2016 14th annual conference on privacy, security and trust (PST) (pp. 745-752). IEEE.

Nabila, M., Purwandari, B., Nazief, B. A., Chalid, D. A., Wibowo, S. S., & Solichah, I. (2018). Financial technology acceptance factors of electronic wallet and digital cash in Indonesia. In 2018 International Conference on Information Technology Systems and Innovation (ICITSI) (pp. 284-289). IEEE.

Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction. Princeton University Press.

Prakash, A. (n.d.). Major Episodes of Volatility in the Indian Foreign Exchange Market in the Last Two Decades (1993-2013): Central Bank’s Response.

Press Information Bureau. (2021). Press Release: 34 more Mobile Apps banned under the information technology act, 2000.

Reserve Bank of India. (2020). Frequently asked questions on forex facilities for residents (individuals).

Stahlie, D., & Ridder, S. D. (2020). Mirror trading, an opportunity for criminals?

Sulaimon, M.A., & Oludare, O.T. (2021). Comparative analysis of cryptocurrency trading and foreign exchange trading. Journal of Management and Marketing Review, 6(2), 62-74.

The Economic Times. (2020). IAMAI's Blockchain and Crypto Council announces new training program. The Economic Times.

Venkatesh, V., & Bala, H. (2008). Technology acceptance model 3 and a research agenda on interventions. Decision Sciences, 39(2), 273-315.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Morris, M.G., Davis, G.B., & Davis, F.D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 425-478.

Venkatesh, V., Thong, J. Y., & Xu, X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157-178.

Yusuf, M.O., & Ayuba, A.A. (2019). Determinants of e-learning adoption in Nigeria: An empirical analysis. International Journal of Emerging Technologies in Learning, 14(16), 76-89.

Zhou, B. (1996). High-frequency data and volatility in foreign-exchange rates. Journal of Business & Economic Statistics, 14(1), 45-52.

Received: 20-Jun-2023, Manuscript No. AMSJ-23-13714; Editor assigned: 21-Jun-2023, PreQC No. AMSJ-23-13714(PQ); Reviewed: 26-Sep-2023, QC No. AMSJ-23-13714; Revised: 03-Oct-2023, Manuscript No. AMSJ-23-13714(R); Published: 16-Nov-2023