Research Article: 2024 Vol: 28 Issue: 3S

Exploring the Nexus between Investor Classifications and Drivers of Sustainable Investments: A Systematic Review

Kumar Manaswi, Delhi Technological University

Archana Singh, Delhi Technological University

Vikas Gupta, Delhi Technological University

Citation Information: Manaswi, K., Singh, A., & Gupta, V. (2024). Exploring the nexus between investor classifications and drivers of sustainable investments: a systematic review. Academy of Marketing Studies Journal, 28(S3), 1-16.

Abstract

The purpose of the present study is, firstly, to systematically review research papers on Sustainable Investments (SI); secondly, to identify and classify investors engaged in SI; thirdly, to map out linkages between investor classifications and drivers of SI; and lastly, to provide future research directions in the domain. To undertake the present study, the PRISMA protocol was used to choose 81 publications that were published between 2015 and 2023 from the Web of Science database. These publications were then analysed using VOSviewer software. A thematic analysis was conducted to assess various themes in the field of sustainable investments. Further, a mapping exercise was conducted by the authors to assess the linkages between types of investors and ESG drivers. This exercise can help identify opportunities for collaboration among investors, policymakers, corporations, and NGOs to achieve common sustainability goals. The study revealed that the number of published research papers on Sustainable investments has exponentially grown in the last eight years. A total of three clusters emerged from the analysis that was conducted on the selected set of research papers. The study identified a total of seven drivers and eight types of investors for sustainable investments. Policymakers can draw inferences from this study and investigate the different barriers, ways to get around them, and opportunities that come with successfully implementing sustainability practices. Future researchers and scholars can conduct a comparative study of developed and developing economies regarding the integration of sustainability practices like environment, social, and governance (ESG) in investor decisions in order to get a comprehensive outlook.

Keywords

Sustainable Investments, Environment, Social, and Governance (ESG), VOS viewer, Thematic Mapping.

Introduction

Recent years have witnessed a remarkable surge in Environmental, Social, and Governance Investments (SI) (Collinson, 2020). This upsurge can be attributed to the growing interest of investors in environmental, social, and governance (ESG) considerations and the rising preference for investments that yield financial returns while positively impacting society and the environment (Stobierski, 2021; Ren et al., 2021; Adam & Shauki, 2014). Investors are increasingly incorporating ESG factors into their investment decisions, recognising the crucial role of companies and investors in promoting sustainable development (Uzsoki, 2020). The different stakeholders in society are increasingly becoming conscious of issues such as climate change, pollution, resource depletion, diversity, human rights, and social justice, leading them to seek out companies that align with their values to mitigate the risks associated with these challenges. Investors are more likely to fund companies that have an emphasis on ESG concerns while also searching for long-term financial gains under the revised scenario (Iqbal et al., 2021).

When it comes to making investments related to ESG, it is crucial to recognise that investors have a diverse set of reasons and goals for making these kinds of investments. While the maximisation of one's earnings and the accumulation of money may be the key motivating factors for some investors, a strong sense of social and environmental responsibility may be the primary motivating factor for other investors. Such investors place great importance on the impact, their investments can have on society and the planet. The motivations behind these investment choices are as diverse as the investors themselves (Waldner, 2022). For instance, some are propelled by a deep sense of responsibility towards future generations. Other may view Sustainable investments as a means to align their financial portfolios with their ethical values (Li et al., 2021; Pástor et al., 2020). To gain a comprehensive understanding of this evolving landscape, further research is needed, including comparative studies across different cultural and economic contexts, which can provide more insightful results (Garg et al., 2022).

In the present study, the authors aim to scrutinise the linkages between investor profiles and Sustainable investments drivers. By analysing existing literature, this study seeks to provide insights into the factors that motivate different types of investors to participate in Sustainable investments besides financial returns (Beisenbina et al., 2022; Serafeim, 2020; Manaswi et al., 2023). The findings of this study would assist investors and investment managers in better understanding the preferences and motivations of various investor profiles and in developing better strategies for Sustainable investments. The research questions of the study aim to

(1) Systematically review research papers on SI;

(2) Identify and classify the types of investors in SI;

(3) Outline the connections between the investor classifications and drivers for SI; and

(4) Provide recommendations for future research in the field of SI.

Section 2 of the paper deals with the methodology used for paper selection and analysis. In Section 3, the results of the systematic analysis have been presented. In Section 4, investor classifications in ESG are identified and discussed. Section 5 deals with the mapping exercise based on investor classification in SI and drivers of SI. The summary and conclusion of the study are given in Section 6. The implications and future research directions related to the present study have been presented in sections 7 and 8, respectively.

Methodology

In this study, the authors adopted a three-step methodology encompassing PRISMA guidelines and network analysis for systematically reviewing the research articles, followed by a mapping exercise to present an integrated framework based on Investor classifications and Drivers of SI.

Database

Web of Science (WoS) database was used for analysis. The selection of WoS database was based on its reputation for containing a robust collection of high-quality academic publications. Compared to other databases such as Scopus and Google Scholar, WoS is renowned for its comprehensive coverage of scholarly literature across several disciplines.

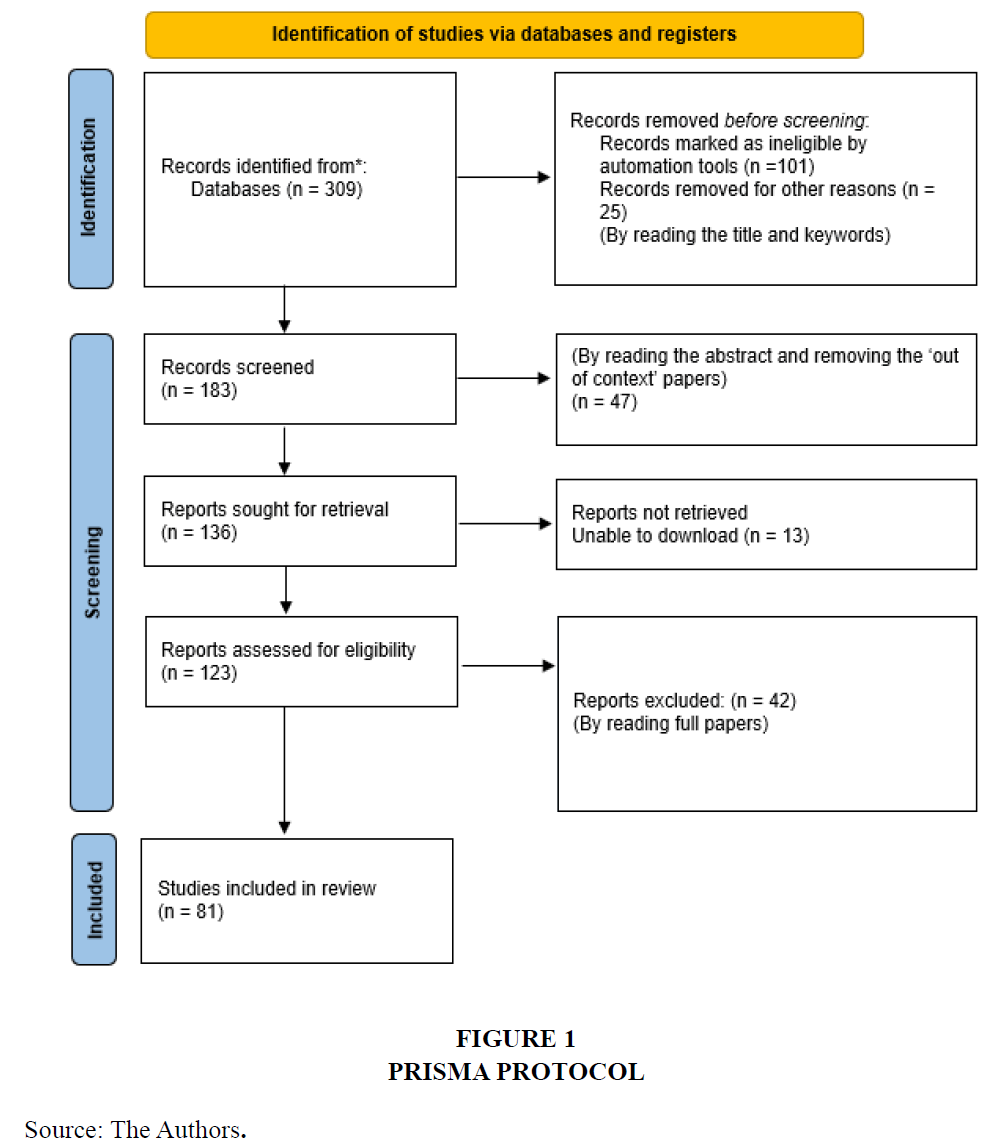

Paper Selection Using PRISMA

In this study, a comprehensive search strategy was developed by authors, incorporating specific keywords related to Sustainable investments. Search query was constructed using the following keyword search strategy: "socially responsible invest*" or "drivers of ESG" or "Motivations for ESG" or "ESG invest*" or "Sustainable Invest*" OR "SRI" OR "Impact invest*" OR "green invest*" (Topic) and "Investor" OR "Investor classification" OR "Shareholder" OR "Shareholder classification" (Topic) and Business or Business Finance or Economics or Management or Ethics or Environmental Studies or Environmental Sciences or Green Sustainable Science Technology or Law or Operations Research Management Science or International Relations (Web of Science Categories) and English (Languages)

The search encompassed research papers published between 2015 and 2023, allowing for the inclusion of recent and relevant publications in the analysis.

The authors a multidisciplinary approach by drawing on literature from a wide variety of fields, such as management, business, business finance, and business economics. This allowed the authors to examine the topic from a variety of perspectives. Only papers written in English were included in the study because the researchers wanted to make their findings as clear as possible and cut down on the likelihood of finding discrepancies. The final set consisted of a total of 81 different research publications. Figure 1 offers a full overview of the procedures performed in the process of selecting papers to include and exclude from this analysis. It also outlines the particular criteria that were utilised for the inclusion and removal of certain studies in this investigation.

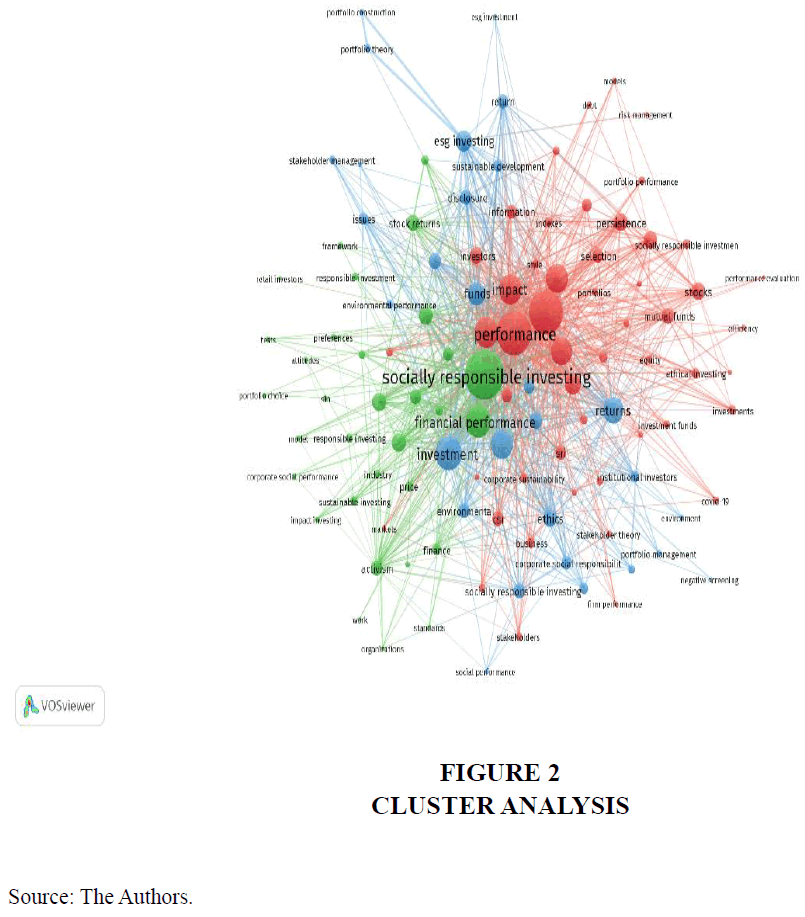

Network Analysis based on Keyword Co-occurrence using VosViewer

Using the VOSviewer software, a network analysis that was based on the co-occurrence of keywords was carried out. VOSviewer is software that may be utilised for both visualising and analysing scientific writing. The authors were able to identify patterns and links between the keywords contained within the chosen research publications using this technique. Following this analysis, a total of five clusters were identified (Figure 2).

Mapping Exercise

The primary goal of this mapping was to identify the relationships between the different types of investors and drivers that influence SI in the context of this study. The purpose of this mapping effort is to provide a comprehensive understanding of the interrelationships between the various types of investors and the many forces that influence SI.

Cluster Analysis

The authors have made an effort to recognise emerging themes in the field of SI in this section of the study. The procedure of identification is based on a combination of keywords combined. According to Aggarwal & Manaswi (2022), the findings of cluster analysis can lead to a variety of alternative conclusions as well as a deeper comprehension of the topic at hand.

Cluster 1-Red: Sustainable Investments and Investment Performance

Recent studies on Sustainable investments have yielded valuable insights into their performance and impact. Notably, ESG funds have demonstrated the potential to outperform their conventional counterparts, frequently delivering financial returns comparable to or exceeding traditional funds (Yadav et al., 2015; Saci et al., 2022; Jain et al., 2019; US SIF, n.d.). The Morningstar US Sustainability Index experienced a modest decline of 18.9% during the year 2022. Surprisingly, this decline was slightly lower than the 19.5% experienced by the renowned Morningstar US Large-Mid Cap Index. Further, the widely recognised S&P 500 witnessed a decline of 19.4% in parallel (US SIF, n.d.; Norton, 2023; Cohen et al., 2021). Morgan Stanley, in a comprehensive analysis of 3,000 US mutual funds and exchange-traded funds (ETFs), published a report that underscored the significance of ESG considerations in investment portfolios during a period marked by heightened market volatility and an economic downturn (Folqué et al., 2021; Hassani & Bahini, 2022; Morgan Stanley, 2021). The study revealed that portfolios neglecting ESG factors underperformed in comparison to those incorporating them, encompassing both equity and bond investments. Remarkably, sustainable equity funds demonstrated a noteworthy median total return in 2020, outperforming their non-ESG counterparts by an impressive margin of 4.3 percentage points. Similarly, sustainable taxable bond funds exhibited a median total return that surpassed competing funds by 0.9% during the same period. These positive trends of superior performance extended further back to 2019, with both sustainable equity funds and sustainable taxable bond funds outshining their traditional peer funds. Further, compelling findings from Morgan Stanley’s study highlight the enduring advantages and financial rewards associated with integrating ESG considerations into investment strategies. Cunha et al. (2019) conducted a study suggesting that the effectiveness of Sustainable investments varies based on the geographical location of the investment. It has also been observed that green portfolios tend to outperform the market during financial crises, indicating a growing awareness of the significance of sustainability among investors. Notably, developing economies like India are showing a heightened interest in corporations’ green initiatives, which can stimulate demand for their shares (Kaur and Chaudhary, 2022). Jain et al., (2019) affirm that businesses that prioritise eco-friendly practices and invest in green initiatives tend to generate substantial returns, creating better financial value and attracting proactive stakeholders concerned with environmental conservation. However, it is worth noting that several studies suggest no significant difference in performance between sustainable and traditional investments (Daugaard & Ding, 2022). Therefore, it is crucial to consider various factors such as risk tolerance, investment objectives, and personal values alongside the investment performance of Sustainable investments when making investment decisions (Talan & Sharma, 2019).

Some studies have found a positive relationship between Sustainable investments and investment performance, while others have found no significant difference (Jain et al., 2019). The investment performance of Sustainable investments should not, however, be the sole factor that investors consider when making investment decisions. Other factors, including risk tolerance, investment goals, and personal values, should also be considered (Talan & Sharma, 2019).

Cluster 2-Blue: Drivers of Sustainable Investments

According to Rücker (2021), there are three crucial factors that drive Sustainable investments. Firstly, companies that prioritise ESG practices tend to achieve greater economic prosperity and generate more risk-adjusted returns in financial markets. Secondly, advances in technology and social media have brought about increased awareness regarding environmental conservation, action against climate change, and the need to exercise social responsibility. This shift in values has influenced investment decisions, with investors desiring to put their money into companies that align with their beliefs and values (Cooper & Weber, 2020). Thirdly, regulatory measures are emerging as key drivers of Sustainable investments, with businesses coming under increasing pressure to become more environmentally conscious and responsible (Sun et al., 2022). This trend is set to persist as the world strives to achieve collective political goals such as the Paris Agreement or the Sustainable Development Goals outlined by the United Nations. For instance, the European Union’s efforts in sustainable finance and classification serve as a case in point (Lopes et al., 2022; Chiu et al., 2022; Uzsoki, 2020). Investors exhibit varying degrees of motivation driven by both higher risk-adjusted returns and values, considering different age groups. To illustrate, a notable 42% of investors aged 25–34 anticipate superior risk-adjusted returns from investments based on ESG, compared to a mere 16% of investors aged 55–64. Furthermore, across all age brackets, a significant 47% of investors express a desire to engage in Sustainable investments, either to manifest their personal values or to support companies actively contributing to positive societal and environmental impacts (Boffo & Patalano, 2020). This indicates that both financial considerations and ethical convictions play influential roles in shaping investor attitudes towards ESG investing across different age cohorts (Boffo & Patalano, 2020; Neufeld, 2021; Sorensen et al., 2021). Chatzitheodorou et al. (2019) identified seven types of motivation for investors engaged in socially responsible investing. Their analysis of motivations was based on the triple bottom line. The identified motivations were environmentally profit-seeking, environmentally conscious, socially profit-seeking, socially conscious, socio-environmentally profit-seeking, and value-based investing. This highlights the growing relevance of investment drivers and their significance for investor classification.

Cluster 3-Green: Investment Opportunities based on Socially Responsible Investing

Socially responsible investing (SRI) provides investment opportunities that align financial goals with ethical values. Key opportunities include investing in renewable energy, sustainable agriculture, socially responsible companies, sustainable infrastructure, and social impact projects (Lehmann et al., 2022). These investments contribute to addressing climate change, promoting responsible farming, supporting social justice, enhancing urban development, and empowering underserved communities (Talan & Sharma, 2019; Erragraguy & Revelli, 2015). By capitalising on these opportunities, investors can generate financial returns while making a positive impact on society and the environment, contributing to a more sustainable and inclusive future. Socially responsible investments (SRI) have garnered considerable attention, particularly regarding their impact on financial performance. However, the absence of reliable instruments like ESG ratings has led to confusion surrounding the true representation of social responsibility (Chen, 2019; Boffo & Patalano, 2020). While veteran investors have been at the forefront of Sustainable investments, individual participation has been relatively low over the past three decades (Meunier & Ohadi, 2022). Extensive comparisons between Sustainable investments and traditional investments have sought to identify various determinants and intentions of investing through behavioural models (Avram, 2022). However, there is a dearth of studies investigating the linkages between investor classifications and drivers of Sustainable investments. For instance, Thanki et al. (2022) conducted a cross-sectional analysis of 449 individual investors and found that collectivism, ESG awareness, environmental concerns, and financial performance had significant positive effects on attitudes towards SI, subsequently influencing ESG investment intentions. Additionally, research by Morgan Stanley revealed that sustainable mutual funds outperformed traditional mutual funds in the US over a ten-year period, while MSCI’s study demonstrated that corporations with high ESG scores exhibited better risk-adjusted returns compared to their competitors. SRI has the potential to guide investors in aligning their investments with their values and beliefs while providing valuable insights into investor classifications (Shahrour, 2022; Tseng et al., 2019). To further expand the understanding of Sustainable investments and their ever-evolving drivers, more in depth studies are warranted in order to provide a more comprehensive outlook (Peterdy, 2023).

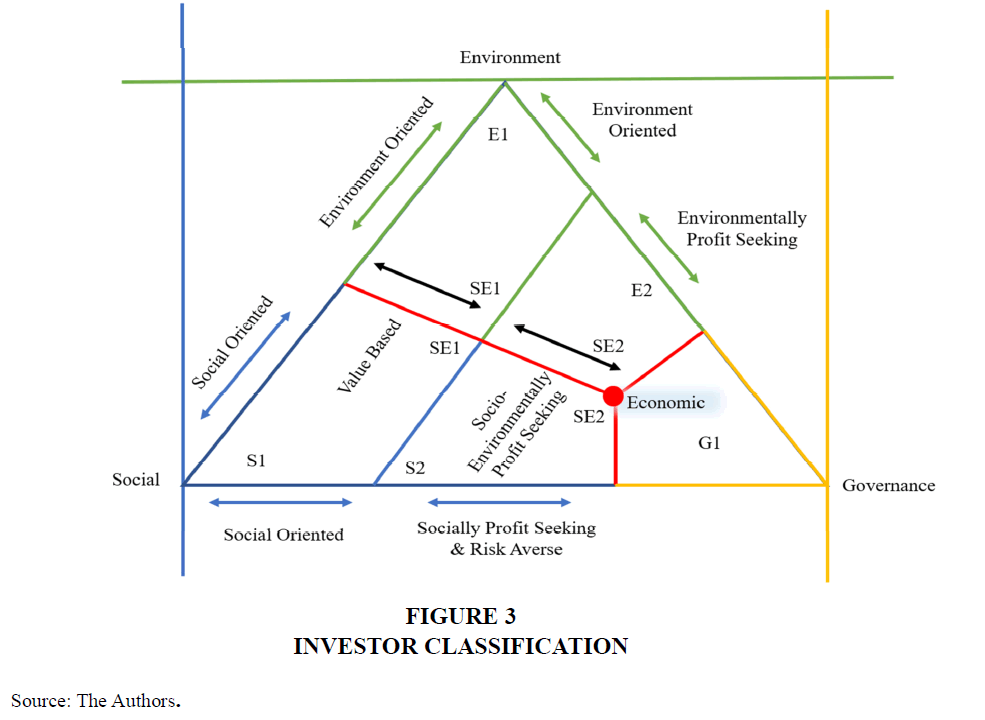

Investor Classifications

In this section, the authors identified and categorised investors who engage in sustainable businesses to learn more about what drives and motivates them. This analysis is a continuation of the three different clusters that were discussed above. Each cluster presents a distinct perspective on Sustainable investments. In Cluster 1, the authors looked at studies on how well Sustainable investments did. This helped in understanding the risks as well as potential returns that come with these types of investments. In Cluster 2, the authors have attempted to provide insights into the motivations and preferences of investors as well as the larger social and economic contexts that shape ESG investment decisions. In Cluster 3, assisted in the assessment and identification of socially conscious investors, as SRI mainly focuses on those investors. Overall, these three clusters contribute to a comprehensive analysis of investor classifications, offering insights into investment opportunities, driving forces, and performance outcomes in the context of Sustainable investments. To better comprehend the motivations behind Sustainable investments, it is essential to address two key questions: (a) which categories of investors are the most active in Sustainable investments? and (b) what are the motivations for such investments? In Figure 3 the authors present a comprehensive synopsis of the different classifications of investors. In the figure, a total of four dimensions are presented: environment (top), social (left), corporate governance (right), and the economic dimension at the core which depicts traditional investments that prioritise financial gain over ESG considerations.

Environmental Domain

Existing literature suggests two fundamental categories of investors in this domain. The first group consists of environmentally conscious investors who prioritise environmental protection and preservation over financial gain (Haigh & Guthrie, 2008; Hassel et al., 2005). They base their investment decisions on the environmental impact of the companies they choose to invest in. On the other hand, the second group comprises investors primarily driven by financial returns but who also consider the environmental impact of their investments. They aim to avoid environmental risks while pursuing profits (Bergek et al., 2013; Bernow et al., 2017). To illustrate this distinction, Figure 3 depicts environmentally conscious investors in area E1 and environmentally profit-seeking and risk-averse investors in area E2. By analysing these different investor categories, researchers gain valuable insights into the preferences and priorities of investors within the environmental domain (Reboredo & Otero, 2021).

Social Domain

The social domain encompasses investors who are driven by social motivations and seek to invest in initiatives that promote the common good and improve community living standards. Extensive literature exploration revealed two distinct types of investors within the social realm, each with different incentives and levels of emphasis on sustainability. The first group, represented as “S1” in Figure 3, consists of socially conscious investors who conscientiously refrain from investing in industries considered “dirty,” such as tobacco, alcohol, gambling, or armaments, due to their ethical principles. These investors willingly forgo potentially lucrative opportunities, prioritising their principles over financial gains. The second category comprises investors primarily motivated by profit maximisation or risk mitigation with minimal concern for social issues (Jain et al., 2019). They engage in social investment to explore untapped profit potential or safeguard their investments from potential negative societal repercussions. Referred to as “socially profit-seeking and risk-averse investors,” this group is symbolised as area S2 in Figure 3. According to Collinson (2020), ethical investments sometimes attract conventional investors who are expecting better returns than conventional investments.

Socio-Environmental Domain

The socio-environmental domain of investment is witnessing remarkable growth as more investors seek to align their financial goals with their personal values and make a positive impact on the world (Garg et al., 2022; Thompson, 2022). Within this domain, two distinct categories of investors emerge after a thorough analysis of the literature. The first category consists of investors who primarily consider a company’s socio-environmental performance and its societal impact when making investment decisions. They favour businesses that operate sustainably and responsibly (SE1 in Figure 3). The second category includes socio-environmentally profit-seeking and risk-averse investors who believe that investing in companies committed to social and environmental responsibility can generate higher long-term returns (SE2 in Figure 3). These investors recognise the growing significance of socio-environmental considerations and their potential to drive financial success.

Governance Domain

The governance domain focuses on investing in companies that demonstrate a firm commitment to ethical business conduct and effective governance procedures (G1 in Figure 3). Investors in this domain are driven by diverse and intricate motivations, which encompass factors such as transparency, social accountability, risk mitigation, and overall financial success (Shank et al., 2013). By prioritising strong governance practices, investors aim to benefit from increased transparency, enhanced accountability, and reduced risk. This domain plays a vital role in aligning investment decisions with ethical and responsible business practices.

Mapping Investor Classifications and Drivers of Sustainable Investments

The proposed mapping exercise aims to consolidate the fragmented literature on Sustainable investments and enhance scholars' and academicians’ understanding of this field, particularly in the absence of a standard definition. By mapping the relationships between investor classifications and drivers of Sustainable investments, several objectives can be achieved. Firstly, this mapping would bring clarity to investors' interest in ESG by highlighting the most influential drivers and distinguishing them from less critical factors. Secondly, a better comprehension of these linkages would stimulate greater investor participation in Sustainable investments, directing capital towards socially and environmentally responsible projects. Thirdly, policymakers can develop targeted policies to promote Sustainable investments when equipped with a comprehensive understanding of these interconnections, thereby fostering long-term investments. Lastly, the construction of a diagram illustrating the connections between different investor types and driving factors would help in identifying areas that require further investigation, prompting academics and industry professionals to disseminate relevant data to the investment community Table 1.

| Table 1 Mapping Investor Classifications with Drivers of SI | ||||||

| Investor Types | ESG Focus | Investor Motivation | Potential Investors | Drivers of SI | Mapping Drivers | |

Value Based  |

Profit Seeking & Risk Averse  |

|||||

| Climate-conscious investors | Environment  |

|

NPOs, Green MFs | Climate change awareness, Environmental stewardship, Sustainable future | E1 | |

| Environmentally Profit Seeking & Risk Averse | Environment  |

|

Conventional Investors, institutional investors, NGOs, NPOs, charities | Financial returns, Environmental preservation, Risk management, Resource efficiency, Sustainable business models | E2 | |

| Ethical Investors | Social, Governance  |

|

Social Investors, Charities, Foundations | Values alignment, Ethical considerations, social impact, Responsible investing, Alignment with values and beliefs | S1, G1 | |

| Socially Profit Seeking and Risk Averse | Social  |

|

Conventional Investors | Financial gains, social impact, Risk management, Responsible business practices, Sustainable growth | S2 | |

| Socially Responsible Investors | Socio-Environment  |

|

Institutional investors, pension funds, charities | Environmental preservation, social responsibility, Ethical governance, Impactful investing, Sustainable development | SE2 | |

| Socio-Environmentally Profit Seeking & Risk Averse | Socio-Environment  |

|

Individual investors, institutional investors, NGOs, NPOs, charities | Sustainable development, social progress, Environmental responsibility, Balanced risk exposure | SE1 | |

| Governance focused | Governance  |

|

Institutional investors, pension funds, sovereign wealth funds | Corporate transparency, Strong governance practices, Shareholder rights, Board accountability, Board diversity | G1 | |

| ESG Investors | Environment Social Governance  |

|

|

Institutional investors, pension funds, sovereign wealth funds, charities | Environmental awareness, social responsibility, Governance considerations, Long-term value creation | SE1, SE2 |

The table maps eight different types of sustainable investors and their investment drivers. The first column lists the investor types, namely: climate-conscious investors, environmentally profit-seeking and risk-averse investors, ethical investors, socially profit-seeking and risk-averse investors, socially responsible investors, socio-environmentally profit-seeking and risk-averse investors, governance-focused investors, and ESG investors. The second column focuses on ESG criteria, including environmental, social, governance, and socio-environmental factors, respectively. The third and fourth columns show investor motivations, i.e., value-based and profit-seeking investors, respectively. The fifth column highlights potential investors, including institutional investors, high net-worth individuals, retail investors, pension funds, NPOs, and charities and NGOs. The sixth column shows potential drivers for those investors, and the last column maps these characteristics with investor classifications identified in Section 4 (Figure 3).

The purpose of the mapping exercise that is presented in the table is significant to the overall study because it illustrates the linkages that exist between the different types of sustainable investors and the investment motivations that are associated with them. For instance, environmental concerns drive climate-conscious investors to prioritise environmental factors in their investment decisions (Cunha et al., 2019). These investors may prioritise the reduction of carbon emissions or the promotion of renewable energy projects. On the other hand, investors who are concerned about the environment but are also interested in making a profit place a primary emphasis on financial returns while also taking environmental considerations into account (Boffo & Patalano 2020). Through this exercise, scholars would gain a better understanding of how various categories of investors match certain ESG criteria and motives. The fact that this activity is able to shed light on the various viewpoints and priorities of sustainable investors is the primary reason why it is relevant. The table offers valuable insights into the complex environment of Sustainable investments by mapping the different categories of investors to specific ESG criteria, motivations, potential investors, and drivers. In Table 1, ethical investors emphasise the significance of social and governance elements alongside their investing decisions. Additionally, they take values and ethical considerations into account while selecting portfolios. According to Garg et al. (2022), Collinson (2020), and Derwall et al., (2011), these investors may include social investors, non-profit organisations (NPOs), charities, or non-government organisations (NGOs). This demonstrates their commitment to having a positive impact on society. Chatzitheodorou et al., (2019) also conducted a similar study wherein they only looked at SRIs and identified additional investor classifications, giving readers a comprehensive understanding of the ESG investment landscape. Finally, COVID-19's influence on environmentally responsible spending is not to be discounted. Many investors have been forced to revise their investment strategies because of the economic slowdown caused by the pandemic. Additionally, it has emphasised the significance of making Sustainable investments in resilience-building and tackling global crises.

Conclusion

Sustainable investments (SI) are increasingly gaining attention for their ability to blend financial viability with social responsibility, making them a powerful force that fosters positive returns and fuels long-term economic growth. A meticulous systematic review by the author’s unveiled three emerging themes in the field of SI: 'Sustainable investments and investment performance,' 'drivers of Sustainable investments,' and 'investment opportunities based on socially responsible investments (SRI)' (as shown in Figure 2). These themes provide invaluable insights into the emerging frontiers of SI. After the thematic analysis, the authors then identified and classified investors engaged in ESG based on their different drivers and motivations. This comprehensive investigation yielded a total of seven distinctive classifications, as demonstrated in Figure 3. The authors in this study also conducted a mapping exercise, examining the intricate linkages between investor classifications and the driving forces behind Sustainable investments (Table 1). This exercise provides a profound framework, enabling researchers and practitioners alike to navigate the diverse landscape of sustainable investors, drawing out similarities and highlighting their unique differentiating factors. Socially responsible investors consider both environmental and social factors when making investment decisions, attracting retail investors and pension funds seeking to align their investments with their values and societal impact goals. Further, the exercise highlights the alignment between investor characteristics and the identified investor classifications from Section 4 and Figure 3 of the study. This correlation further validates and strengthens the understanding of investor behaviour in the context of Sustainable investments. For instance, governance-focused investors prioritise good governance practices in the companies they invest in, primarily attracting pension funds that emphasise responsible corporate practices and transparency. By mapping the investor types, ESG criteria, motivations, potential investors, and drivers, researchers can identify patterns, trends, and interconnections within the ESG landscape. This knowledge not only enhances our understanding of sustainable investing but also informs policymakers, practitioners, and stakeholders about the potential avenues for promoting and advancing sustainable practices. Therefore, as the understanding of Sustainable investments continues to evolve, policymakers can leverage this knowledge to develop policies that foster long-term investments and support sustainable practices.

Implications

The present study has important implications for asset managers, enabling them to better engage with the businesses in which they have invested. By integrating human rights and environmental concerns into business strategies and corporate governance, ethical and sustainable business practices can be promoted. Additionally, fund managers and investors can benefit from this study by gaining a deeper understanding of which activities are sustainable and which are not, empowering them to make more informed investment decisions.

Exploring investor classification within Sustainable investments holds significant potential for shaping the trajectory of sustainable finance and driving investments towards responsible and sustainable practices. The present study comprehensively identified and categorised investors based on their preferences, motivations, and engagement with Sustainable investments. Such understanding would lay the groundwork for informed strategies and initiatives that foster positive environmental and social impacts within the financial landscape.

Further, policymakers can leverage the findings of this study to design targeted initiatives and regulations that encourage greater investment in sustainable practices. For instance, tax incentives or subsidies can be provided to make certain types of Sustainable investments more attractive to investors. Policymakers can also focus on improving transparency and standardisation of ESG products, facilitating investor understanding and comparison of different options. In addition, the analysis of investor classification assists policymakers in evaluating the impact of Sustainable investments on various stakeholders, such as businesses, communities, and the environment Table 2.

| Table 2 Future Research Directions | |

| Clusters | Particulars |

| Cluster 1 ‘Red’: Sustainable investments and Investment Performance | The landscape of Sustainable investments is ever changing due to financial innovations like impact investing, green bonds, ETFs, among others. Future studies assessing the impact of these new financial products on ESG investment performance and their potential to drive positive social and environmental outcomes can be insightful (Quatrosi, 2022). Sustainable investments can provide benefits beyond social and environmental dimensions i.e., portfolio diversification. Future studies focusing on potential benefits of integrating Sustainable investments into portfolio management, particularly in terms of risk reduction and long-term performance can yield interesting results. |

| Cluster 2 ‘Green’: Drivers of Sustainable investments | Assessing Sustainable investments through a multicultural lens, researchers can gain deeper insights into how economic and cultural factors shape investors’ overall behaviour and attitudes. Such a comparative analysis can shed light on the nuances and variations in ESG investment practices worldwide, enhancing our understanding of the complex interplay between culture, economics, and sustainable finance (Garg et al., 2022). Advances in technology are enabling new ways of investing in sustainability, such as impact investing and blockchain-based platforms. Future research could examine how technology is changing the landscape of sustainable investing and how it is influencing investor behaviour (Li et al., 2022). |

| Cluster 3 ‘Blue’: Investment Opportunities based on Socially Responsible Investments | Sustainable business practices are becoming the norm, and investors are increasingly looking for possibilities based on ESG factors. The impact of the indicated sustainability metrics on investment outcomes needs more investigation (Koenigsmarck & Geissdoerfer, 2023). Since the UN introduced ESG in 2004, academic research has favoured it over CSR. Studies have mostly focused on developed nations when it comes to the impact analysis of SIs. Further research on developing nations can be insightful to get a comparative and comprehensive outlook. |

References

Adam, A. A., & Shauki, E. R. (2014). Socially responsible investment in Malaysia: behavioral framework in evaluating investors’ decision making process. Journal of Cleaner Production, 80, 11.

Indexed at, Google Scholar, Cross Ref

Aggarwal, P., & Manaswi, K. (2022). Role of Circular Economy, Industry 4.0 and Supply Chain Management for Tribal Economy: A Systematic Review. Journal of the Anthropological Survey of India, 12.

Indexed at, Google Scholar, Cross Ref

Avram, C. B. (2022). Bibliometric analysis of sustainable business performance: where are we going? A science map of the field. Economic Research-Ekonomska Istra?ivanja, 25.

Beisenbina, M., Fabregat-Aibar, L., Barberà-Mariné, M., & Sorrosal-Forradellas, M. (2022). The burgeoning field of sustainable investment: Past, present and future. Sustainable Development, 9.

Indexed at, Google Scholar, Cross Ref

Bergek, A., Mignon, I., & Sundberg, G. (2013). Who invests in renewable electricity production? Empirical evidence and suggestions for further research. Energy Policy, 56, 13.

Bernow, S. , Klempner, B., & Magnin, C. (2017). From “why” to “why not”: Sustainable investing as the new normal. McKinsey & Company.

Boffo, R., & Patalano, R. (2020). ESG Investing: Practices, Progress and Challenges - OECD. In oecd.org (p. 31).

Chatzitheodorou, K., Skouloudis, A., Evangelinos, K., & Nikolaou, I. (2019). Exploring socially responsible investment perspectives: A literature mapping and an investor classification. Sustainable Production and Consumption, 19, 9.

Indexed at, Google Scholar, Cross Ref

Chen, J. (2019). Socially Responsible Investment (SRI). Investopedia.

Chiu, I. H-Y., Lin, L., & Rouch, D. (2022). Law and Regulation for Sustainable Finance. European Business Organization Law Review, 23(1), 5.

Cohen, D., Nelson, S., & Rosenman, E. (2021). Reparative accumulation? Financial risk and investment across socio-environmental crises. Environment and Planning E: Nature and Space, 11.

Collinson, P. (2020). Ethical investments are outperforming traditional funds. The Guardian.

Cooper, L. A., & Weber, J. (2020). Does Benefit Corporation Status Matter to Investors? An Exploratory Study of Investor Perceptions and Decisions. Business & Society, 10.

Cunha, F. A. F. de S., Oliveira, E. M., Orsato, R. J., Klotzle, M. C., Cyrino Oliveira, F. L., & Caiado, R. G. G. (2019). Can sustainable investments outperform traditional benchmarks? Evidence from global stock markets. Business Strategy and the Environment, 29(2), 15.

Daugaard, D., & Ding, A. (2022). Global Drivers for ESG Performance: The Body of Knowledge. Sustainability, 14(4), 5.

Indexed at, Google Scholar, Cross Ref

Derwall, J., Koedijk, K., & Ter Horst, J. (2011). A tale of values-driven and profit-seeking social investors. Journal of Banking & Finance, 35(8), 6.

Indexed at, Google Scholar, Cross Ref

Erragraguy, E., & Revelli, C. (2015). Should Islamic investors consider SRI criteria in their investment strategies? Finance Research Letters, 14, 2.

Indexed at, Google Scholar, Cross Ref

Folqué, M., Escrig-Olmedo, E., & Corzo Santamaría, T. (2021). Sustainable development and financial system: Integrating ESG risks through sustainable investment strategies in a climate change context. Sustainable Development, 29(5), 5.

Indexed at, Google Scholar, Cross Ref

Garg, A., Goel, P., Sharma, A., & Rana, N. P. (2022). As you sow, so shall you reap: Assessing drivers of socially responsible investment attitude and intention. Technological Forecasting and Social Change, 184, 9.

Indexed at, Google Scholar, Cross Ref

Haigh, M., & Guthrie, J. (2008). Management practices in Australasian ethical investment products: a Role for regulation? Business Strategy and the Environment, 2.

Hassani, B. K., & Bahini, Y. (2022). Relationships between ESG Disclosure and Economic Growth: A Critical Review. Journal of Risk and Financial Management, 15(11), 5.

Hassel, L., Nilsson, H., & Nyquist, S. (2005). The value relevance of environmental performance. European Accounting Review, 14(1), 14.

Indexed at, Google Scholar, Cross Ref

Iqbal, N., Naeem, M. A., & Suleman, M. T. (2021). Quantifying the asymmetric spillovers in sustainable investments. Journal of International Financial Markets, Institutions and Money, 12.

Indexed at, Google Scholar, Cross Ref

Jain, M., Sharma, G. D., & Srivastava, M. (2019). Can Sustainable Investment Yield Better Financial Returns: A Comparative Study of ESG Indices and MSCI Indices. Risks, 7(1), 3.

Indexed at, Google Scholar, Cross Ref

Kaur, J., & Chaudhary, R. (2022). Relationship between macroeconomic variables and sustainable stock market index: an empirical analysis. Journal of Sustainable Finance & Investment, 12.

Koenigsmarck, M., & Geissdoerfer, M. (2023). Shifting the Focus to Measurement: A Review of Socially Responsible Investing and Sustainability Indicators. Sustainability, 15(2), 5.

Lehmann, C., Cruz-Jesus, F., Oliveira, T., & Damásio, B. (2022). Leveraging the circular economy: Investment and innovation as drivers. Journal of Cleaner Production, 360, 1.

Li, S., Yu, Y., Jahanger, A., Usman, M., & Ning, Y. (2022). The Impact of Green Investment, Technological Innovation, and Globalization on CO2 Emissions: Evidence From MINT Countries. Frontiers in Environmental Science, 10, 5.

Indexed at, Google Scholar, Cross Ref

Li, T.-T., Wang, K., Sueyoshi, T., & Wang, D. D. (2021). ESG: Research Progress and Future Prospects. Sustainability, 13(21), 6.

Indexed at, Google Scholar, Cross Ref

Lopes, J. M., Gomes, S., Pacheco, R., Monteiro, E., & Santos, C. (2022). Drivers of Sustainable Innovation Strategies for Increased Competition among Companies. Sustainability, 14(9), 7.

Indexed at, Google Scholar, Cross Ref

Manaswi, K., Singh, A., & Gupta, V. (2023). Building a Better Future with Sustainable Investments: Insights from Recent Research. Indian Journal of Human Development.

Indexed at, Google Scholar, Cross Ref

Meunier, L., & Ohadi, S. (2022). Misconceptions about socially responsible investments. Journal of Cleaner Production, 373, 4.

Indexed at, Google Scholar, Cross Ref

Morgan Stanley. (2021). Sustainable Funds Beat Peers in 2020. Morgan Stanley.

Neufeld, D. (2021, March 18). ESG Investing: The Top 5 Drivers. Advisor Channel.

Norton, L. (2023). ESG Investing Keeps Pace With Conventional Investing in 2022. Morningstar, Inc.

Pástor, L., Stambaugh, R. F., & Taylor, L. A. (2020). Sustainable Investing in Equilibrium. Journal of Financial Economics, 142(2), 5.

Indexed at, Google Scholar, Cross Ref

Peterdy, K. (2023). Sustainable Investing. Corporate Finance Institute.

Quatrosi, M. (2022). Financial Innovations for Sustainable Finance: An Exploratory Research. SSRN Electronic Journal, 7.

Reboredo, J. C., & Otero, L. A. (2021). Are investors aware of climate-related transition risks? Evidence from mutual fund flows. Ecological Economics, 189, 3.

Ren, S., Hao, Y., & Wu, H. (2021). How Does Green Investment Affect Environmental Pollution? Evidence from China. Environmental and Resource Economics, 81(1), 12.

Indexed at, Google Scholar, Cross Ref

Rücker, N., & Jordan, N. (2021). Three main drivers of responsible investing. Julius Baer.

Saci, F., Jasimuddin, S. M., & Hasan, M. (2022). Performance of Socially Responsible Investment Funds in China: A Comparison with Traditional Funds. Sustainability, 14(3), 7.

Indexed at, Google Scholar, Cross Ref

Serafeim, G. (2020, September 1). Social-Impact Efforts That Create Real Value. Harvard Business Review.

Shahrour, M. H. (2022). Measuring the financial and social performance of French mutual funds: A data envelopment analysis approach. Business Ethics, the Environment & Responsibility, 31(2), 20.

Indexed at, Google Scholar, Cross Ref

Shank, T., Paul Hill, R., & Stang, J. (2013). Do investors benefit from good corporate governance? Corporate Governance: The International Journal of Business in Society, 13(4), 11.

Sorensen, E., Chen, M., & Mussalli, G. (2021). The Quantitative Approach for Sustainable Investing. The Journal of Portfolio Management, 47(8), 5.

Indexed at, Google Scholar, Cross Ref

Stobierski, T. (2021, May 25). What Is Sustainable Investing? Business Insights - Blog.

Sun, Y., Guan, W., Razzaq, A., Shahzad, M., & Binh An, N. (2022). Transition towards ecological sustainability through fiscal decentralization, renewable energy and green investment in OECD countries. Renewable Energy, 190, 6.

Indexed at, Google Scholar, Cross Ref

Talan, G., & Sharma, G. (2019). Doing Well by Doing Good: A Systematic Review and Research Agenda for Sustainable Investment. Sustainability, 11(2), 2.

Indexed at, Google Scholar, Cross Ref

Thanki, H., Shah, S., Rathod, H. S., Oza, A. D., & Burduhos-Nergis, D. D. (2022). I Am Ready to Invest in Socially Responsible Investments (SRI) Options Only If the Returns Are Not Compromised: Individual Investors’ Intentions toward SRI. Sustainability, 14(18), 9.

Indexed at, Google Scholar, Cross Ref

Thompson, B. S. (2022). Impact investing in biodiversity conservation with bonds: An analysis of financial and environmental risk. Business Strategy and the Environment, 5.

Indexed at, Google Scholar, Cross Ref

Tseng, M.-L., Tan, P., Jeng, S.-Y., Lin, C.-W., Negash, Y., & Darsono, S. (2019). Sustainable Investment: Interrelated among Corporate Governance, Economic Performance and Market Risks Using Investor Preference Approach. Sustainability, 11(7), 7.

Indexed at, Google Scholar, Cross Ref

US SIF. (n.d.). The Forum for Sustainable and Responsible Investment. Www.ussif.org.

Uzsoki, D. (2020). Sustainable Investing: Shaping the future of finance. International Institute for Sustainable Development.

Waldner, L. (2022). Council Post: Innovation Is Key To Enabling Holistic Sustainable Investing. Forbes.

Yadav, P. L., Han, S. H., & Rho, J. J. (2015). Impact of Environmental Performance on Firm Value for Sustainable Investment: Evidence from Large US Firms. Business Strategy and the Environment, 25(6), 11.

Indexed at, Google Scholar, Cross Ref

Received: 29-Sep-2023, Manuscript No. AMSJ-23-14053; Editor assigned: 02-Oct-2023, PreQC No. AMSJ-23-14053(PQ); Reviewed: 27-Oct-2023, QC No. AMSJ-23-14053; Revised: 02-Jan-2024, Manuscript No. AMSJ-23-14053(R); Published: 02-Feb-2024