Research Article: 2024 Vol: 28 Issue: 4S

Exploring Trust in Mobile Payments in Crises Situations

Afef Sahli, University of Manouba

Hajer Ben Lallouna, University of Manouba

Citation Information: Sahli, A., & Lallouna, H.B. (2024). Exploring trust in mobile payments in crises situations. Academy of Marketing Studies Journal, 28(S4), 1-12.

Abstract

The COVID-19 pandemic and geopolitical tensions have had a significant impact on various aspects of our lives, including the way we transact and conduct business. In light of this, the present study aims to investigate the impact of trust on mobile payment adoption in order to facilitate the growth of mobile commerce, both during and after the pandemic. Through a comprehensive literature review and a quantitative analysis based on an online survey of 342 participants, this study has identified several key factors that influence trust in mobile payments, such as hesitancy, self-efficacy, perceived ease of use, speed, and ubiquity. Furthermore, the study found that predisposition to trust and perceived benefits were not significant factors in determining trust in mobile payments. Only perceived competence was found to have a significant effect on the intention to adopt mobile payments. This finding underscores the importance of merchants and service providers demonstrating their competence and reliability in order to build trust with consumers.

Keywords

Trust, Mobile Payment, Adoption, Mobile Commerce, Crises.

Introduction

Mobile payment (m-payment) refers to a wireless financial transaction conducted between two parties using a mobile device capable of securely processing the transaction over a wireless network (Ondrus and Pigneur, 2005). The process is initiated, authorized and confirmed by the customer on their mobile device when purchasing a product or service (Au and Kauffman, 2008).

The mobile payment industry has experienced significant growth globally in recent years, with the transaction value projected to reach USD 4.7 trillion by 2025, according to Statista. In the current global climate, trust in mobile payments has become increasingly crucial, particularly in light of various crises, including the ongoing conflicts in Ukraine and Africa, the COVID-19 pandemic, and other geopolitical tensions. The COVID-19 pandemic has accelerated the adoption of mobile payments as a safer and more convenient alternative to cash transactions. The unprecedented outbreak has had a significant impact on the global economy, hastening the transition to mobile payments. The pandemic has compelled individuals to rely more on mobile devices for transactions due to concerns regarding physical contact and the need for social distancing. According to a survey conducted by McKinsey & Company, 76% of respondents changed their payment preferences during the pandemic, with 60% using contactless payments. The Mobile Payment Index survey indicates that the percentage of consumers using mobile payments increased from 24% in 2019 to 29% in 2020. In the United States, 67% of retailers now accept mobile payments, according to the National Retail Federation. The Asia-Pacific region leads in mobile payment adoption, with China and India being the frontrunners. A report by eMarketer reveals that mobile payments accounted for 81.1% of all proximity mobile payment transactions in China in 2020. In India, mobile payments accounted for 67.3% of all digital transactions in the same year. However, this increased dependence on mobile payment transactions has raised concerns about their security and privacy, particularly in light of the heightened occurrence of cybercrime during the pandemic. Similarly, in the context of ongoing conflicts in Ukraine and Africa, trust in mobile payments may be affected by the instability and uncertainty in the region. Consumers may be reluctant to adopt mobile payments due to concerns about the reliability of mobile networks, the security of their personal and financial information, and the risk of fraud and hacking.

There have been a plethora of payment methods that have emerged in recent years, which include Apple Pay, PayPal, Samsung Pay, Amazon Pay, Google Pay, Venmo, Cash App, Zelle, and Alipay, among others. These digital payment platforms permit users to conveniently and securely carry out transactions via their mobile devices or computers and have gained popularity due to their speed and ease of use. Furthermore, some retailers and businesses have started to accept cryptocurrencies, such as Bitcoin, as a means of payment. Research examining the slow adoption of mobile payments has identified several factors that contribute to the delay. These factors include vulnerability arising from the lack of authentication, insecurity from potential data breaches, risks from hackers gaining access to users' accounts or even entire countries, and the lack of trust among consumers in this new payment method. Therefore, building trust between consumers and mobile payment providers is essential in overcoming the barriers to mobile payment adoption.

Drawing on these insights, our research investigates trust as a crucial factor in promoting the use of mobile payment and subsequently in developing mobile commerce, particularly in crisis contexts. Specifically, our study aims to identify the determinants of trust in mobile payment and its impact on its adoption. To achieve these objectives, a conceptual framework will be introduced, followed by a description of the quantitative study process. Finally, the primary results will be presented, along with their practical implications.

Conceptual Framework

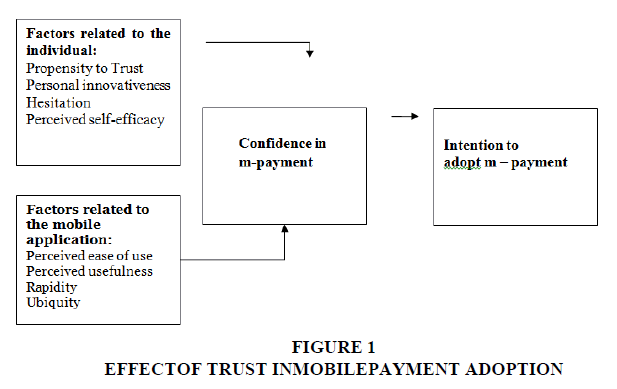

Drawing on related contexts such as e-commerce, m-commerce, and m-banking, this conceptual framework will examine the determinants of trust in mobile payment. Specifically, we will explore factors such as propensity to trust, personal innovativeness, hesitation, self-efficacy, perceived ease of use, perceived usefulness, rapidity, and ubiquity, to identify the drivers of trust in mobile payment. Additionally, we will investigate the link between trust and the intention to adopt mobile payment.

Propensity to Trust and Trust in Mobile Payment

The concept of trust has received extensive attention across various disciplines such as sociology, psychology, and administration (McKnight et al., 2004; Guibert, 2009). Trust is defined as an expectation, belief, or behavior and is highly relevant in assessing the risks associated with opportunistic behavior by companies and the inherent risks of using the Internet, such as security breaches and unauthorized access to customer databases.

Propensity to trust is a critical factor in the adoption and success of new technologies, particularly in the realm of mobile payment, where it has been identified as a key predictor of trust. Propensity to trust refers to an individual's general inclination to trust others in different contexts (McKnight et al., 1998). In the context of mobile payments, it is important to consider whether an individual has a predisposition to trust digital systems, such as mobile payment platforms.

Several studies have shown a positive and direct relationship between trust propensity and trust formation in online transactions (Gefen, 2000; Teo and Liu, 2007; Agag and El Masry, 2016).

In the context of mobile commerce, trust propensity has been found to exert a significant influence on consumer trust in m-commerce and m-banking (Alqatan et al., 2012; Guangming and Yuzhong, 2011; Kim et al., 2010), which is critical for establishing and sustaining customer relationships in the online context (Gefen et al., 2003; Touzani et al., 2014).

Recent studies have found that people who are more inclined to trust others are more likely to have confidence in and use mobile payment services (Rahman & Rahman, 2021; Turel et al., 2019). Specifically, research has shown that individuals with a higher propensity to trust are more likely to trust and use mobile payment platforms frequently (Wang et al., 2021; Kim and Park, 2020). For example, Wang et al. (2021) reported a significant association between propensity to trust and trust in mobile payment among Chinese consumers. Likewise, Kim and Park (2020) found that people with a higher propensity to trust were more likely to perceive mobile payment as secure and trustworthy in the context of South Korea. In the context of the COVID-19 pandemic and other crises, the importance of trust in mobile payments has increased due to the shift towards contactless and online payment methods.Thus, it is essential for mobile payment providers to comprehend the role of propensity to trust in building consumer trust in their platforms.

Therefore, we propose the following hypothesis, H1: Propensity to trust has a positive influence on trust in mobile payments.

Personal Innovation and Trust in Mobile Payments

Personal innovativeness is the measure of an individual's willingness and ability to adopt new technologies. In recent years, various studies have explored the association between personal innovativeness and trust in mobile payment systems. For instance, Alalwan et al. (2018) discovered that personal innovativeness significantly contributes to building trust in mobile payment systems. Similarly, Huang et al. (2020) demonstrated that personal innovativeness positively influences users' trust in mobile payments during the COVID-19 pandemic. Additionally, Liébana-Cabanillas et al. (2020) found that personal innovativeness is linked to greater trust in mobile payment adoption. Moreover, Rashid et al. (2020) revealed that personal innovativeness is a critical factor affecting trust in contactless payment methods, which have become increasingly popular due to the pandemic. Collectively, these studies suggest that personal innovativeness may be a crucial determinant in cultivating trust in mobile payment technologies. Therefore, we propose the following hypothesis: H2: Personal innovativeness positively affects trust in mobile payments.

Hesitation and Trust in Mobile Payment

Although hesitation has been a topic relatively overlooked in existing literature, it has recently emerged as a significant factor in the context of mobile payment.

Lu and Ng (2007) define hesitation as a state of indecision during the transaction process, which could potentially impact consumer behavior. It is a personality trait that is not necessarily associated with preventing a purchase but rather a form of indecision that can influence the decision-making process (Danguir and Chandon, 2006; Danguir, 2018). Hesitation, therefore, can be a significant barrier to the adoption of mobile payment, as it is characterized by a reluctance to use a new payment method due to concerns over security, privacy, and convenience (Wang and Liao, 2014; Yang et al., 2019). Research has also revealed a negative relationship between hesitation and trust in mobile payment, suggesting that consumers who are more hesitant to adopt mobile payment are less likely to trust the technology (Suki and Suki, 2016; Huang et al., 2020).

Recent studies have shown that hesitation has a significant impact on consumer behavior and trust in mobile payment. For instance, Sahli and Ben Lallouna Hafsia (2019) found hesitation to be a significant variable affecting consumer behavior in mobile payment. Additionally, Sahli (2020) discovered that hesitation had a positive impact on trust in mobile payment.

Overall, understanding the complex interplay between hesitation and trust is critical for marketers to successfully promote and encourage the adoption of mobile payment among consumers. Therefore, we propose H3: Hesitation has a positive influence on trust in mobile payment.

Self-efficacy and Trust in Mobile Payments

Compeau et al. (1999) define self-efficacy as an individual's belief in their ability to perform a specific behavior. A body of literature, including works by Davis (1989), Compeau and Higgins (1999), and Reid (2008), has identified a close relationship between self-efficacy, knowledge and experience on the internet, and trust. Al-Somali et al. (2009) have reported that self-efficacy has a significant positive impact on trust.

Recent studies have further examined the relationship between self-efficacy and trust in mobile payments. One study found that higher levels of self-efficacy were positively associated with trust in mobile payment security, which, in turn, led to greater intention to use mobile payments (Wang et al., 2021). Another study investigating the impact of self-efficacy on trust in mobile payments during the COVID-19 pandemic found that higher levels of self-efficacy were associated with greater trust in mobile payment security (Zhang et al., 2021). A third study found that trust mediated the relationship between self-efficacy and intention to use mobile payments, indicating that individuals with higher self-efficacy were more likely to trust the system, which, in turn, increased their likelihood of using it (Chen et al., 2021).

These recent studies underscore the continued importance of self-efficacy and trust in the adoption and use of mobile payment systems. Individuals with higher levels of self-efficacy are more likely to trust the security and reliability of mobile payments, increasing the likelihood of adoption and use. Moreover, trust can mediate the relationship between self-efficacy and intention to use mobile payments, emphasizing the need for mobile payment systems that foster both selfefficacy and trust. Therefore, we propose hypothesis H4: Self-efficacy has a positive influence on trust in mobile payment.

Perceived Ease of use and Trust in Mobile Payments

The concept of perceived ease of use refers to an individual's belief that using a particular system requires minimal effort (Davis, 1989). This factor is particularly important in the context of new technologies, especially in the case of payment systems. Agag and El Masry's (2016) study indicates that ease of use is a crucial determinant of consumer acceptance of new payment technologies, and other research supports a positive and significant relationship between perceived ease of use and consumer trust (Gefen et al., 2003; Sahli, 2020).

Recent academic research has examined the interplay between perceived ease of use and trust in mobile payments, particularly in light of the COVID-19 pandemic. Chen et al. (2021) found that perceived ease of use was positively linked with trust in mobile payment security during the pandemic. Nguyen and Nguyen's (2021) study explored the connection between perceived ease of use, trust, and behavioral intention to use mobile payment systems during the pandemic. The results demonstrated that both perceived ease of use and trust positively influenced the behavioral intention to use mobile payments. Moreover, trust was found to mediate the relationship between perceived ease of use and behavioral intention to use mobile payments.

Based on these findings, we propose the following hypothesis, H5: Perceived ease of use has a positive impact on trust in mobile payment.

Perceived Usefulness and Trust in Mobile Payments

Perceived utility, a concept derived from the Technology Acceptance Model (TAM), refers to the extent to which an individual believes that using a specific system will enhance their performance (Davis, 1989). In the context of mobile payments, perceived usefulness pertains to the benefits that users perceive to be associated with using the technology, such as time-saving, convenience, and access to payment at any time.

Chen et al. (2021) discovered that perceived usefulness had a significant positive influence on trust in mobile payment, highlighting the importance of the perceived benefits of using the technology in establishing trust. Similarly, Nguyen and Nguyen (2021) found that perceived usefulness was a significant predictor of trust in mobile payment, indicating that convenience and utility play a crucial role in promoting trust during the COVID-19 pandemic.

These findings suggest that perceived usefulness is a critical factor in building trust in mobile payment systems, particularly during a time when the convenience and safety of digital transactions have become increasingly important. Based on this, we propose the following hypothesis: H6 - Perceived usefulness has a positive impact on trust in mobile payments.

Rapidity and Trust in Mobile Payment

The concept of rapidity in the context of mobile payments refers to the speed at which transactions occur, from the initiation of a purchase to the validation phase. As noted by Zhou (2013), transaction speed is a critical indicator of system quality. In mobile payments, rapidity is essential for building trust, as it reflects the efficiency and reliability of the technology (Sahli, 2020). The COVID-19 pandemic has heightened the importance of transaction speed as customers seek fast and secure payment options that minimize physical interaction (Sahli et al., 2020). Recent research has confirmed the positive impact of rapidity on trust in mobile payments. For example, Rahman and Rahman's (2021) study found that transaction speed significantly influences user trust and recommended that mobile payment providers prioritize improving transaction speed to enhance users' trust. Thus, we propose the hypothesis H 7: Rapidity has a positive influence on trust in mobile payment.

Ubiquity and Trust in Mobile Payment

Ubiquity in mobile payments refers to the ability of users to access payment services anytime and anywhere, facilitated by mobile devices and networks. This feature allows users to make payments without being restricted by geographical or time constraints, making it a significant advantage over traditional and online payment methods.

However, to provide ubiquitous services, service providers must commit ongoing efforts and resources, making ubiquity an essential trust signal. Lee's (2005) research supports this notion, finding that ubiquitous connection positively impacts mobile trust.

Recent research by Liu et al. (2021) confirms its positive impact on consumer trust. The study suggests that mobile payment services available anytime, anywhere, and on any device can increase users' confidence in the system and their willingness to use it.

Given the current context of COVID-19, where the demand for contactless payments has increased, the importance of ubiquitous mobile payment systems has become even more evident.

Therefore, we propose the following hypothesis: H 9: Ubiquity has a positive influence on trust in mobile payment.

Trust and Intention to Adopt Mobile Payment

Mobile payments offer a promising way to combine mobility and payment, but their adoption and use are not uniform across countries. Although mobile payments have been gaining popularity globally, their adoption and use are not uniform across countries. In Germany, cash remains the preferred payment method, and consumers and merchants have been hesitant to switch to mobile payments. Italy shares a similar situation, with many Italians being skeptical of mobile payments due to concerns about security and privacy. In Brazil, a large unbanked population and concerns about the security and reliability of mobile payments have hindered their adoption. Despite having a well-developed financial system, mobile payments have not taken off in South Africa, partly due to the dominance of traditional banking methods and affordability concerns for consumers. Tunisia, on the other hand, has a large cash-based economy, and mobile payments have not yet gained widespread adoption due to concerns about security and fraud.

This relationship between trust and adoption intention is also supported in the mobile payment context. Several studies have indicated that trust is a necessary element in the adoption of mobile payments (Zhou, 2011; Yan and Yang, 2015; Shuhaiber, 2016), especially in developing countries (Chandra et al., 2010; Alqatan et al., 2012; Xin et al., 2013). It is critical to better understand and directly address trust-related issues by mobile commerce technology and service providers (Siau et al., 2003) to promote online customer retention and interpret the Internet market (Isaac and Volle, 2008).

Recent studies have shown that trust positively influences the intention to adopt mobile payment during times of crisis (Zhang et al., 2020; Kim and Kim, 2020). Moreover, trust has been found to mediate the relationship between perceived risk and the intention to adopt mobile payment in the context of crises (Chen et al., 2020).

A study by Hussain et al. (2021) found that perceived security, privacy, and trust in mobile payment systems were significant determinants of users' intention to adopt mobile payment during the pandemic. Similarly, Liébana-Cabanillas et al. (2021) found that trust played a significant role in shaping consumers' intention to use mobile payment, particularly in the context of COVID-19.

These findings highlight the importance of trust in shaping consumers' intentions to adopt mobile payment during the pandemic. Hence, we propose the following hypothesis, H9: Trust in mobile payment has a positive influence on the intention to adopt mobile payment

All of these hypotheses are depicted in the diagram below Figure 1.

Research Methodology

This section aims to provide a comprehensive overview of the research context, measurement instruments, sampling techniques, and data collection method. Specifically, we will begin by outlining the research context, followed by a discussion of the measurement tools adopted to conduct the study. Additionally, we will discuss the sampling techniques employed and describe the data collection method utilized in this research.

The Context of the Survey

The research is situated in the context of mobile applications which are closely related to the deployment of internet and telecommunication technologies. Previous studies such as those conducted by Chemingui and Ben Lallouna (2013) and Ltifi and Najjar (2015) have utilized the mobile application "Mobiflouss" offered by the Tunisian mobile network operator "Ooredoo" to investigate mobile banking and mobile payment. In our study, we utilized the mobile application "MobiCash" provided by the Tunisian mobile network operator "Ooredoo". To access the Mobicash service, one needs an "Ooredoo" sim card number and either a traditional bank card or a prepaid Mobicash bank card.

Measuring Instruments

To facilitate our investigation, we employed validated measurement instruments for the constructs of interest, which were previously established in related research. In the context of our research on mobile payment, we adapted these scales to the current study, as indicated in Table 1. To measure the constructs, we utilized a 5-point Likert semantic scale ranging from "strongly agree" to "strongly disagree". According to Touzani and Bakini (2007), this scale was the most appropriate for the Tunisian context.

| Table 1 Sample Composition of the Quantitative Study | |||

| Criterion | Category | workforce | Percentage |

| Type | Male | 217 | 63.5 |

| Woman | 125 | 36.5 | |

| Total | 342 | 100 | |

| Age | 20-25 years | 42 | 12.3 |

| 26-35 years old | 120 | 35.1 | |

| 36-45 years old | 97 | 28.4 | |

| 45-55 years old | 43 | 12.6 | |

| Over 55 years old | 40 | 11.7 | |

| Total | 342 | 100% | |

| School level | Secondary | 16 | 4.7 |

| Bachelor’s | 141 | 41.2 | |

| Masters/Engineer | 146 | 42.7 | |

| PhD | 39 | 11.4 | |

| Total | 342 | 100% | |

| Socio-professional category | Student | 21 | 6.1 |

| Employee | 33 | 9.6 | |

| Teacher | 134 | 39.2 | |

| Supervisor | 138 | 40.4 | |

| Retired | 8 | 2.3 | |

| Unemployed | 8 | 2.3 | |

| Total | 342 | 100% | |

| Income | Less than 500dt | 11 | 3.2 |

| 500 - 1000dt | 132 | 38.6 | |

| 1000 - 1500dt | 156 | 45.6 | |

| More than 1500dt | 43 | 12.6 | |

| Total | 342 | 100% | |

Sampling and Data Collection

In the final data collection phase, an online survey was employed, featuring an image of "Ooredoo" highlighting their mobile payment service. In this study, we aimed to include a diverse range of respondents with various characteristics that may impact the relationships between the concepts under investigation. However, we also ensured that our sample was representative by considering socio-demographic criteria such as age, gender, level of education, and monthly income. It is worth noting that the number of respondents under the age of 20 was limited, as this group may not necessarily have a bank account.

Our study comprised a total of 342 participants, of which 63.5% were male and 36.5% were female. The largest age group among the respondents was 26-35 years old, accounting for 35% of the sample. Additionally, nearly 96% of the participants had received a university education. The socio-demographic characteristics of the participants are presented in Table 1.

Data analysis and discussion

The data analysis process comprised of two main stages, namely, exploratory factor analysis (PCA) and confirmatory factor analysis.

Exploratory Factor Analysis

In this stage of the data analysis, we utilized the IBM SPSS Statistics.20 software to purify the measurement scales. This involved retaining certain items and discarding others. The outcomes obtained indicate that the Cronbach's alpha is acceptable, being greater than 0.7. Additionally, the Kaiser-Meyer-Olkin (KMO) measure is good, exceeding 0.5, while Bartlett's test is significant, exceeding 0.000. Moreover, the explained variance is also good. The complete findings are displayed in Table 2.

| Table 2 Result of the Principal Component Analysis | ||||

| Constructs/ Dimensions | KMO | Bartlett test Meaning | Explained Variance %. | Cronbach’s |

| Propensity to trust | 0.719 | 503.937; p=0.000 | 78.824 | 0.864 |

| Personal innovativeness | 0.727 | 729,004; p=0.000 | 84.414 | 0.905 |

| Hesitation | 0.663 | 1881.701; p=0.000 | 27.577 | 0.891 |

| Hesitation G dimension | 22.426 | 0.794 | ||

| Indecision dimension | ||||

| Doubt dimension | 21.709 | 0.869 | ||

| Perceived self-efficacy | 0.625 | 326.642; p=0.000 | 68.270 | 0.768 |

| Perceived ease of use | 0.877 | 2564.946; p=0.000 | 90.617 | 0.974 |

| Perceived usefulness | 0.864 | 1827.213; p=0.000 | 91,004 | 0.967 |

| Rapidity | 0.693 | 488.962; p=0.000 | 77.101 | 0.846 |

| Ubiquity | 0.693 | 502.982; p=0.000 | 77.490 | 0.849 |

| Trust in payment | 0.762 | 1988.877; p=0.000 | ||

| Benevolence dimension | 39.107 | 0.910 | ||

| Integrity dimension | 25.631 | 0.918 | ||

| Competence dimension | 18.025 | 0.839 | ||

| Intent to adopt MP | 0.639 | 340.107; p=0.000 | 70.372 | 0.778 |

Confirmatory Factor Analysis and Model Fitting

In order to analyze the proposed hypotheses, we utilized the structural equation method (SEM) with Smart PLS.3 (Partial Last Square) software to estimate our structural model. The findings demonstrate that the construct reliability is satisfactory. The convergent reliability is measured using the average variance extracted (AVE) method (Bennaceur and Chafik, 2019), with the recommended threshold being 0.5 (Table 3).

| Table 3 Hypothesis Testing | |||||

| Assumptions | Relations | Β | T | P | Results |

| H1 H1.1 H1.2 H1.3 | Predisposition to trust – > Mobile trust Propensity->Benevolence Predisposition->Integrity Predisposition – >Competence | -0,005 0,114 -0,024 |

0,066 1,456 0,268 |

0,947 0,146 0,789 |

Rejected Rejected Rejected Rejected |

| H2 H2.1 H2.2 H2.3 | Personal innovativeness-> Mobile trust Innovativeness-> Benevolence Innovativeness->Integrity Innovativeness – >Competence | -0,008 -0,067 -0,089 |

0,094 0,856 0,965 |

0,925 0,393 0,335 |

Rejected Rejected Rejected Rejected |

| H3 H3.1 H3.2 H3.3 H3.4 H3.5 H3.6 H3.7 H3.8 H3.9 | Hesitation – > Mobile trust

Hesitation G – >Benevolence Hesitation. G – >Integrity Hesitation. G – >Competence Indecision-> Benevolence Indecision – >Integrity Indecision ->Competence Doubt-> Benevolence Doubt->Integrity Doubt – >Competence |

0,082 -0,044 -0,049 0,105 0,049 0,090 0,018 0,034 0,037 |

1,722 0,621 0,637 1,746 1,642 1,225 0,241 1,981 1,995 |

0,022 0,535 0,525 0,079 0,052 0,221 0,810 0,004 0,001 |

Partially confirmed Confirmed Rejected Rejected Confirmed Confirmed Rejected Rejected Confirmed Confirmed |

| H4 H4.1 H4.2 H4.3 | Perceived self-efficacy-> Mobile trust

Self-efficacy – > Benevolence Self-efficacy – >Integrity Self-efficacy – >Competence |

-0,075 0,048 0,164 |

1,001 0,598 2,005 |

0,317 0,550 0,046 |

Partially confirmed Rejected Rejected Confirmed |

| H5 H5.1 H5.2 H5.3 | Perceived ease of use-> Mobile trust FUP – > Benevolence FUP – >Integrity FUP – >Competence | 0,019 -0,041 0,147 |

0,359 0,695 2,558 |

0,719 0,487 0,011 |

Partially confirmed Rejected Rejected Confirmed |

| H6 H6.1 H6.2 H6.3 | Perceived usefulness-> Mobile trust Perceived usefulness-> Benevolence Perceived usefulness – >Integrity Perceived usefulness ->Competence | -0,017 0,043 -0,023 |

0,317 0,826 0,335 |

0,751 0,409 0,738 |

Rejected Rejected Rejected Rejected |

| H7 H7.1 H7.2 H7.3 | Rapidity – > Mobile trust Rapidity -> Benevolence Rapidity – >Integrity Rapidity ->Competence | 0,129 -0,138 -0,014 |

3,816 0,890 0,083 |

0,001 0,414 0,934 |

Partially confirmed Confirmed Rejected Rejected |

| H8 H8.1 H8.2 H8.3 | Ubiquity-> Mobile trust Ubiquity – >Benevolence Ubiquity – >Integrity Ubiquity ->Competence |

0,400 0,383 0,071 |

2,820 2,342 0,432 |

0,005 0,020 0,666 |

Partially validated Confirmed Confirmed Rejected |

| H9 H9.1 H9.2 H9.3 | Confidence – > Intent to adopt. Benevolence – >Intention Integrity-> Intent to adopt. Competence – > Intention | 0,039 -0,026 0,705 |

0,954 0,640 27,834 |

0,341 0,522 0,000 |

Partially validated Rejected Rejected Confirmed |

Additionally, the discriminant validity was assessed using three techniques, including the Fornell-Larcker (1981) test when √AVE> R, the Cross-loading technique (Chin, 1998) when Cross-loadings<Loadings, and the correlation ratio HTMT (Heterotrait-Monotrait matrix) when HTMT<0.90. The primary objective of discriminant validity is to ensure that each latent variable is strongly related to its indicators, as opposed to other latent variables in the model. As a result of the reliability and validity of the selected measurement scales, the quality of our measurement model is deemed satisfactory (Tritah and Daoud, 2021).

Hypothesis Testing and Discussion

In our study, we utilized the PLS approach as described by Hair et al. (2014) to examine the significance of direct structural links. The results revealed a mixed response with regards to the relationship between propensity to trust and trust, as some respondents supported it while others rejected it. One possible explanation for this inconsistency is that the respondents were already familiar with Ooredoo as they were subscribers, and hence, were not fully aware of their own propensity to trust. This explanation is consistent with the findings of McKnight and Chervany (2001), who suggest that the propensity to trust may become insignificant with more experience with a particular company. The findings indicate that there is no significant relationship between personal innovativeness and mobile trust, as measured by its three dimensions: benevolence, integrity, and competence. This contrasts with previous studies by Zhou (2012), Chitungo and Munongo (2013), Mohammadi (2015), and Malaquias (2016), which have suggested that individuals who are open to new technologies and exhibit a willingness to take risks are more likely to trust mobile banking services. The lack of a relationship in this study could be attributed to the Tunisian consumer being relatively non-innovative and resistant to change, thereby exhibiting a lower propensity for risk-taking and heightened concerns over the safety of technological innovations.

In our study, we found that hesitation has a significant positive effect on mobile trust. Hesitators may delay their purchases and take longer to gather information about the product, or they may struggle to make a decision. Nevertheless, this characteristic does not necessarily prevent the purchase from occurring (Danguir and Chandon, 2006; Danguir, 2018).

In our study, H4.3 was partially validated, indicating that the relationship between perceived self-efficacy and mobile trust is significant with respect to the integrity dimension. Self-efficacy is a recently introduced concept that refers to an individual's ability to proficiently use a computer to complete a task. It is frequently linked to an individual's knowledge, experience, and familiarity with the internet. Individuals who are experienced or familiar with the internet are more likely to utilize online services than those who have not previously used it. Internet familiarity is often used interchangeably with experience and knowledge. In our study, we found that perceived usability is positively related to mobile trust, with the link between perceived usability and competence being validated at the 5% threshold. This finding is consistent with prior research studies (Chandra et al., 2010; Chaix, 2014; Yan and Yang, 2015). One of the possible reasons for this consistency is that most of the respondents in our study referred to the usability of the mobile application and its ease of download. Users tend to trust applications that are simple and easy to use. Additionally, users seek easy and accessible information to use the mpayment service. Furthermore, our sample consisted of an affluent and educated generation that is comfortable and proficient in using smartphones, which may also explain this relationship.

The study findings indicate that perceived usefulness does not have a significant influence on mobile trust across its three dimensions (benevolence, integrity, competence). This deviation from the literature (Chandra et al., 2010; Chaix, 2014; Agag and El Masry, 2016) suggests that the Tunisian users in this study do not consider perceived usefulness as a crucial determinant of trust.

The limited use of mobile payment in Tunisia, primarily for small purchases and bill payments, may contribute to this perspective. However, the study reveals that the factor of rapidity significantly impacts trust in m-payment, particularly with benevolence at a 1% threshold. These results are consistent with prior research (Miranda, 2011; Zhou, 2013; Yan and Yang, 2015). The participants noted that the mobility of their smartphones, wireless network availability, and quick transactions at any time and location increase their trust in this service.

The relationship between trust and ubiquity has been investigated in previous studies, such as that conducted by Yan and Yang (2015). They found that ubiquity functions as a signal of trust, as users may lower their evaluations of service providers' capacity and integrity if they cannot access reliable and ubiquitous services. Additionally, respondents in our study emphasized the positive impact of ubiquitous connectivity on mobile trust. As a result, mobile payment has an advantage over traditional and online payment systems due to its ubiquity, as noted by Zhou (2011). This new way of life has thus strengthened the notion of mobile phone ubiquity.

To summarize, the relationship between mobile trust and intention to adopt is significant, as previously established in the literature (Chandra et al., 2010; Xin et al., 2013). The lack of consumer trust poses a challenge to the adoption of new technologies, including m-payment. As m-payment is still a relatively new innovation, consumers may have uncertainties about its technology and operational environment (Chandra et al., 2010). Thus, trust plays a crucial role in the intention to adopt mobile payment. Previous studies on e-commerce and m-commerce have consistently shown that trust has a positive relationship with the intention to adopt a technology (Chandra et al., 2003). This logic can be extended to the mobile payment context, where Xin et al. (2013) found that the consumer's level of trust in mobile payment has a positive effect on their intention to adopt the service.

Based on the findings of our analysis, we recommend that managers consider customer experience when designing mobile phone interfaces to enhance accessibility and efficiency for different generations of customers, such as Generation X and Generation Y. Additionally, telecommunication operators should invest in mobile technologies to improve transaction speed, including the download of mobile applications and mobile payment, while ensuring network continuity and availability.

Conclusion/Recommendations

Over the past few decades, the expansion of digital commerce has been remarkable. Today, mobile phones are one of the most impressive technological innovations, widely used in our daily lives. This device has brought about significant changes in human habits, especially in the form of mobile payment or m-payment. However, despite its potential benefits, the adoption of this new service is hindered by various obstacles, including the lack of trust among users. To address this issue, we aimed to identify the main determinants of mobile trust and their impact on adoption intention. A quantitative survey of 342 respondents revealed that hesitancy, perceived self-efficacy, perceived ease of use, rapidity, and ubiquity play a crucial role in building trust in mobile payment. Furthermore, our findings suggest that mobile trust has a positive influence on the intention to adopt mobile payment.

As with all research, it is essential to acknowledge the limitations of this study, which can be addressed and enhanced in future research. Firstly, we did not account for demographic factors such as age, gender, income, socio-professional status, and educational level, which may affect mobile trust. Secondly, we did not examine the mediating role of trust in the relationship between the factors and the adoption intention of mobile payment. Finally, we suggest that researchers should consider the geographical location (urban, rural) as a new research avenue, given that urban areas typically have a more advanced mobile technology infrastructure.

References

Agag, G., and El-Masry, A. A. (2016). Understanding consumer intention to participate in the online travel community and effects on consumer intention to purchase travel online and WOM: The integration of innovation diffusion theory and TAM with trust. Computers in human behavior, 60, 97-111.

Alalwan, A. A., Baabdullah, A. M., Rana, N. P., Tamilmani, K., & Dwivedi, Y. K. (2018). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 38(1), 80-92.

Indexed at, Google Scholar, Cross Ref

Alqatan, S., Singh, D., and Ahmad, K. (2012). Study on success factors to enhance customer trust for mobile commerce in small and medium-sized tourism enterprises (SMTEs) – A conceptual model. Journal of Theoretical & Applied Information Technology, 46(2).

Al-Somali, S.A., Gholami, R., and Clegg, B. (2009).An investigation into the acceptance of online banking in Saudi Arabia. Technovation, 29, 130-141.

Au, Y. A., and Kauffman, R. J. (2008). The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. Electronic Commerce Research and Applications, 7(2), 141-164.

Bennaceur, A., and Chafik, K. (2019). Les fondements de l’usage des équations structurelles dans les recherches en sciences de gestion : Cas de l’approche PLS. Revue du contrôle, de la comptabilité et de l’audit, 3(2).

Chaix, L. (2014). Le paiement mobile : perspectives économiques, modèles d'affaires et enjeux concurrentiels. Université Nice Sophia Antipolis.

Chandra, S., Srivastava, S.C., and Theng, Y.L. (2010). Evaluating the role of trust in consumer adoption of mobile payment systems: An empirical analysis. CAIS, 27(29), 27.

Indexed at, Google Scholar, Cross Ref

Chemingui, H. and Ben Lallouna, H. (2013). Resistance, motivations, trust and intention to use mobile financial services. International Journal of Bank Marketing.

Chin, W. W. (1998). The partial least squares approach to structural equation modelling. Modern methods for business research, 295(2), 295-336.

Chen, J., Li, H., Zhang, Z., & Song, X. (2021). Self-efficacy, trust, and intention to use mobile payment: A moderated mediation analysis. Frontiers in Psychology, 12, 710996.

Chen, X., Zhang, X., & Zhang, Y. (2020). Understanding the influence of perceived risk on mobile payment usage during the COVID-19 pandemic. Journal of Retailing and Consumer Services, 59, 102357.

Chitungo, S. K., and Munongo, S. (2013). Extending the technology acceptance model to mobile banking adoption in rural Zimbabwe. Journal of Business Administration and Education, 3(1).

Compeau, D. R., & Higgins, C. A. (1999). Application of social cognitive theory to training for computer skills. Information Systems Research, 10(2), 167-185.

Compeau, D., Higgins, C. A., and Huff, S. (1999). Social cognitive theory and individual reactions to computing technology: A longitudinal study. MIS quarterly, 145-158.

Danguir-Zine, S. (2018). Degré d’hésitation entre marques : substituabilité et trait de personnalité de l’acheteur ? Revue Tunisienned’Economie et de Gestion, RTEG. Danguir-Zine, S., and Chandon, J-L. (2006). Ensemble d’hésitation et degré d’hésitation- Application à l’achat des chaussures. Revue Tunisienne d’Economie et de Gestion, RTEG25,1-24.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology.MIS quarterly, 319-340.

Fornell, C., and Larcker, D. F. (1981).Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 39- 50.

Gefen, D., Karahanna, E., and Straub, D. W. (2003). Inexperience and experience with online stores: The importance of TAM and trust. IEEE Transactions on engineering management, 50(3), 307-321.

Indexed at, Google Scholar, Cross Ref

Guibert, N. (1999). La confiance en marketing : fondements et applications. Recherche et Applications en Marketing (French Edition), 14(1), 1-19.

Hair J. F., Sarstedt, M., Hopkins, L., and G. Kuppelwieser, V. (2014). Partial least squares structural equation modelling (PLS-SEM) An emerging tool in business research. European Business Review, 26(2), 106-121.

Indexed at, Google Scholar, Cross Ref

Huang, L., Li, X., & Zhang, X. (2020). The impact of COVID-19 pandemic on mobile payment usage: Evidence from China. Journal of Retailing and Consumer Services, 59, 102357.

Hwang, Y., and Kim, D. J. (2007). Customer self-service systems: The effects of perceived Web quality with service contents on enjoyment, anxiety, and e-trust. Decision support systems, 43(3), 746-760.

Indexed at, Google Scholar, Cross Ref

Isaac, H., et Volle, P. (2008). E-commerce: de la stratégie à la mise en oeuvre opérationnelle. Pearson Education France.

Kim, C., Mirusmonov, M., and Lee, I. (2010).An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior, 26(3), 310-322.

Kim, H. W., & Kim, M. (2020). The effects of trust and risk on users’ continuous intention to use mobile payment services: Focusing on the moderating role of gender. Sustainability, 12(20), 8547.

Lee, T. (2005).The impact of perceptions of interactivity on customer trust and transaction intentions in mobile commerce.Journal of Electronic Commerce Research, 6(3), 165.

Liébana-Cabanillas, F., Sánchez-Fernández, J., & Muñoz-Leiva, F. (2020). Mobile payment systems adoption: A quantitative analysis in the context of COVID-19. Journal of Retailing and Consumer Services, 57, 102245.

Liu, F., Zheng, Z., Wei, J., & Zeng, Z. (2021). Mobile payment service quality, trust, and users' continuous intention to use in China: A moderated mediation model. Electronic Commerce Research, 21(1), 1-25.

Ltifi, M., & Najjar, F. (2015). The consequences of electronic word of mouth in the banking sector. The Management and Organization Review , 7 (2), 116-124.

Lu, A., and Ng, W. (2007). Mining hesitation information by vague association rules. In International Conference on Conceptual Modeling (pp. 39- 55).Springer, Berlin, Heidelberg.

McKnight, D. H., Choudhury, V., & Kacmar, C. (1998). Developing and validating trust measures for e-commerce: an integrative typology. Information Systems Research, 9(7), 1-24.

McKnight, D. H., Kacmar, C. J., & Choudhury, V. (2004).Shifting Factors and the Ineffectiveness of Third Party Assurance Seals: A two‐stage model of initial trust in a web business. Electronic Markets, 14(3), 252-266.

Miranda, S. (Ed.). (2011). Systèmesd'informationmobiquitaires. Lavoisier.

Mohammadi, H. (2015).A study of mobile banking loyalty in Iran. Computers in Human Behavior, 44, 35-47.

Nguyen, T. T., & Nguyen, H. T. (2021). The impacts of perceived ease of use and trust on the intention to use mobile payment during the COVID-19 pandemic: An empirical study in Vietnam. International Journal of Environmental Research and Public Health, 18(7), 3657.

Ondrus, J., and Pigneur, Y. (2005). A disruption analysis in the mobile payment market. In System Sciences, 2005.HICSS’05.Proceedings of the 38th Annual Hawaii InternationalConference on (pp. 84c-84c).IEEE.

Rahman, M.M., & Rahman, M.H. (2021). Examining User Acceptance and Continuance Intention towards Mobile Payment Services: A Study in Bangladesh. Journal of Electronic Commerce Research, 22(1), 21-38.

Rahman, M.S., & Rahman, M.E. (2021). Factors Affecting the Acceptance of Mobile Payment in Bangladesh: An Empirical Study. Journal of Open Innovation: Technology, Market, and Complexity, 7(4), 121.

Sahli, A. (2020). La confiance dans le paiement mobile : influence des réseaux sociaux. Thèse de Doctorat en Marketing, Ecole Supérieure de Commerce de Tunis. Sahli, A., and Ben Lallouna, H. (2019). L’analyse de la confiance avec Sphinx - Une application au paiement mobile. 18 ème International Marketing Trends Conference Venice Italy.

Sahli, N., Zulqarnain, M., & Ghani, U. (2020). Factors Affecting the Adoption of Mobile Payment Services in Pakistan. International Journal of Innovation, Creativity and Change, 11(7), 170-186.

Shuhaiber, A. (2016). Factors Influencing Consumer Trust in Mobile Payments in the UnitedArab Emirates. (Doctoral dissertation, Victoria University of Wellington). Telematics and Informatics, 52, 101423.

Touzani, M., & Driss, F.B. (2007). Perceived security and attendance at points of sale: proposal for a measurement scale and impact study

Touzani, M., Skandrani, H., and Ben Jennet I. (2014). Représentations et déterminants de la confiance dans le système d’échange virtuel : une étude exploratoire en Tunisie. AnnualMarketing Division Conference of the Administrative Sciences, 34, Canada.

Tritah, S., and Daoud, M. (2021). Les fondements conceptuels et théoriques de la méthode des équations structurelles PLS. Journal international de comptabilité, de finance, d'audit, de gestion et d’économie, 2(1), 378-395.

Turel, O., Serenko, A., & Bontis, N. (2019). User acceptance of hedonic digital artifacts: A theory of consumption values perspective. Information & Management, 56(1), 103- 114.

Wang, S., Wu, J., & Wu, J. (2021). Understanding the effects of self-efficacy and perceived risk on intention to use mobile payment: The moderating role of trust. Journal of Retailing and Consumer Services, 59, 102443.

Xin, H., Techatassanasoontorn, A.A., & Tan, F.B. (2013).Exploring the influence of trust on mobile payment adoption.

Yan, H., and Yang, Z. (2015).Examining mobile payment user adoption from the perspective of trust. International Journal of u-and e-Service, Science and Technology, 8(1), 117-130.

Zhang, J., Hu, H., & Fan, J. (2021). Self-efficacy and trust in mobile payment security during COVID-19: A moderated mediation model. Frontiers in Psychology, 12, 667328.

Zhang, Y., Li, X., Xu, X., & Wu, D. (2020). Effects of perceived security, perceived privacy, and trust on mobile payment adoption: Evidence from China.

Zhou, T. (2013). An empirical examination of continuance intention of mobile payment services. Decision support systems, 54(2), 1085-1091.

Zhou, T. (2012).Examining mobile banking user adoption from the perspectives of trust and flow experience.Information Technology and Management, 13(1), Zhou, T. (2011).Examining the critical success factors of mobile website adoption. Online Information Review, 35(4), 636-652.

Indexed at, Google Scholar, Cross Ref

Received: 12-Dec-2023, Manuscript No. AMSJ-23-14254; Editor assigned: 13-Dec-2023, PreQC No. AMSJ-23-14254(PQ); Reviewed: 29-Dec-2023, QC No. AMSJ-23-14254; Revised: 20-Mar-2024, Manuscript No. AMSJ-23-14254(R); Published: 30-Apr-2024