Review Article: 2023 Vol: 27 Issue: 6S

Factors Enabling the Shift from Unorganized to Organized Retail Sector through Mobile Payments

Shivani Shukla, Panipat Institute of Engineering & Technology, Panipat

Omesh Chadha, Panipat Institute of Engineering & Technology, Panipat

Citation Information: Shukla, S., & Chadha, O. (2023). Toxic traits: unpacking the relationship between personality and workplace bullying and its repercussion. Academy of Marketing Studies Journal, 27(S6), 1-11.

Abstract

In the 21st century, smart phones and the internet have become an integral part of life. It is noteworthy that the future is full of technology- driven payment systems; therefore, the mobile payment system is the next big thing in this arena. This study highlights the factors influencing the consumers to accept or adopt the mobile payments system. This study attempts to study elements having a role in shifting consumers from unorganized to organized retail sector through the Mobile Payment System (MPS). A questionnaire was prepared using Google forms to collect data, and it was shared using WhatsApp and e-mail with the target respondents. In this study, 103responses were analyzed and collected before India’s first lockdown. The confirmatory factor analysis was used, and various factors were identified. It is found that trust, privacy and security issues are still restricting the user to adopt the online mode of payment; hence TAM model stands valid. This study attempts to examine the influence of MPS on unorganized retailing.

Keywords

Mobile Payments, Behavioral Shift, Technological Advancement, Unorganized Retailing.

Introduction

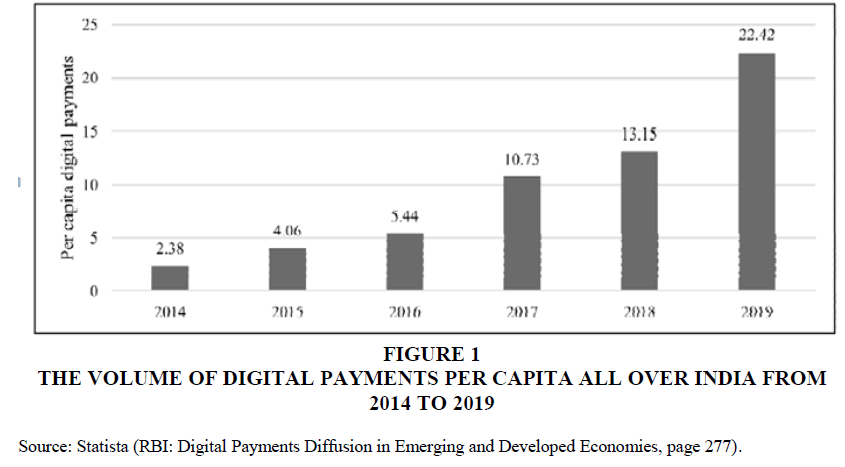

India is young, energetic, and has the second-largest population globally. The technology outreach in each part of the community is significantly less. ‘Power to Empower’ means to make sure the services are accessible to people by electronic means, adding Internet connectivity and enhanced online infrastructure. The government aims to be digitally vested in technology. The Digital India campaign has contributed to this technological advancement immensely. The developing countries have emerged as one of the leading markets in mobile payments. The mobile payment system is one of the critical factors for the growth of online retail markets. The main goal of mobile payments is to make speedy transactions, thereby encouraging people not to use cash. The new technology is expected to help users with well-suited payment solutions in current scenarios. As per the Statista Report conducted by Redseer, for 2020, Mobile payments market value across India was estimated to be 25 trillion Indian Rupees, wherein 2015 it was only 0.08 trillion Indian Rupees. This is estimated to increase to 234 trillion Indian Rupees by 2025 with remarkable growth, and non-cash transactions are expected to increase by 20% by 2023, according to the latest report by KPMG. PRICE (People Research on India’s Consumer Economy & Citizen Environment) with NPCI, researched ‘Tracking Digital Payments Awareness, Adoption and Use Behaviour of Households’. As per the report, Indian digital payment acceptance is currently widespread. One-third of all families use it in some form or another. It is encouraging to see that over a quarter of households in the bottom 40 per cent of the income bracket utilize it, indicating that it is no longer only for the wealthy or well- educated. Fifteen per cent of households want to utilize digital payments in the lower- and middle- income brackets. Mobile payments will play a significant role in the coming years. Even if we did not encounter Covid-19, this technology would have increased immensely. According to the survey in 2018 of Regalix, mobile wallets or e-wallet use is widespread in India; 80 per cent of consumers (taken as a whole) use it once a week and 33 per cent use it regularly. It is such that Covid-19 has given a massive boost to it. Figure 1 states the digital transaction per capita all over India from 2014 to 2019.

Figure 1: The Volume Of Digital Payments Per Capita All Over India From 2014 To 2019.

Source: Statista (RBI: Digital Payments Diffusion in Emerging and Developed Economies, page 277).

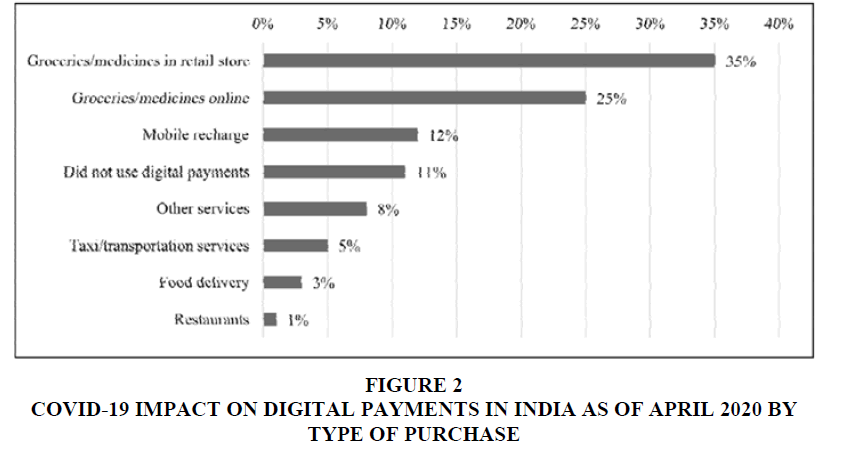

As per the NPCI-PRICE Report on Digital payments adoption in India (2020), we find a significant potential in the adoption of digital payments as far as op, middle and bottom-income groups are concerned. The top income and middle-income groups comprising 40 and 20 per cent of people respectively are much more dominating in digital payment adoption. They also have the massive potential of conversion if given a chance compared to the bottom income group. However, smartphone ownership is no longer a barrier to digital payment adoption. Usage of Unique Payment Interface (UPI) across India in 2019 was 7%, 12%, 26% and 59% by Paytm, BHIM, PhonePe, and Google Pay, respectively. As far as the Covid-19 impact is concerned, we see a sudden shift in India’s digital payments app usage. A report by KPMG published in April 2020 states that almost 50 per cent of people started using UPI or online wallets during Covid-19. UPI is undoubtedly the king of digital payments with the evident consumer benefit of rapid payment; however, simplicity of use might be enhanced. UPI is also becoming one of the popular methods of payment. Top and middle-income group people prefer UPI over specialized bank applications for mobile payments (NPCI-PRICE Report, 2020). The Indian retail sector has grown to be one of the fastest-paced and most evolving markets. The Retail sector is classified as organized and unorganized. The unorganized retail sector includes traditional types of minimal cost retailing, such as general stores, paan/beedi shops, Kirana shops, convenience stores, shops on footpaths. Unorganized trade contributes around 93 percent to the overall business, highlighting the scope for more penetration of unorganized retailing in India. Retailers have gained from less transaction time and improved customer trustworthiness while consumers enjoy the handiness and speed in the transaction. Covid-19 has changed the picture altogether; its impact on digital payments has been immense. Also, retail categories have seen much deeper e-commerce penetration — from 25 per cent for footwear and apparel to upwards of 50 per cent for mobile phones and books, with more than 500 million smartphone consumers and the determination of the government to encourage cashless transactions. India will have 549 million e-commerce users by 2020 as per IMF data; indeed, mobile payment systems will play a significant role. A study by Shrestha (2018) discusses retailing in India, and she concludes that the online retail business has exponential growth in India. Her study mentions that a secure mobile payment system might encourage customers to transact online. It will be interesting to address factors affecting their behaviour to use online retailing. Figure 2 shows the results of a survey conducted by local circles.

Review Of Literature

TAM (Technology Acceptance Model) is one of the most significantly used models for analyzing individual intentions to accept technology (Shin, 2010). Davis (1989) created the TAM in 1989 to illustrate the behaviour of computers. An attempt was made to use psychological variables to understand the computer’s information system and adoption process. TAM 2 (revised version) discussed the fundamental forces’ such as original judgments of perceived usefulness (PU), explaining up to 60 per cent of the variance in this critical driver of usage intention. TAM 2 strengthens TAM by demonstrating that the subjective standard directly affects use expectations over and beyond perceived user-friendliness and perceived utility for mandatory (but not intentional) programs. Researchers have signified the validity of the TAM across an extensive collection of IT (Information technology). Recently, researchers have been growing to reinforce the TAM with many other motivating variables. TAM may explain mobile payments adoption entirely and may have some limitations for various reasons. With the addition of categories such as perceived happiness and risk, TAM will become technology-specific research, providing insight into consumer perceptions while contemplating the purchase of smartphones (Wani et al., 2015). Above all, the social context in which technology is adopted, it is observed that TAM ignores this aspect; for example, the TAM does not consider the social weight of new technology acceptance. Second, the TAM claims that there are no roadblocks to discourage a person from using a specific program whether he or she wished to. Third, TAM tends to imagine a single technology for users only.

Behavioural belief explains an individual’s negative or positive evaluation while performing the behaviour. In contrast, the normative view reveals an individual’s sense of societal forces to consider creativity or not. Those two forms of factors on behavioural intention may differ from person to person. The original TAM studied the linking role of perceived user-friendliness and perceived utility and their relationship between the probability of information systems adoption and external variables. A significant number of experiments in both human and corporate settings have confirmed other related research in development adoption, particularly IDT (Innovation Diffusion Theory) given by Rogers (1983), which incorporates five noteworthy innovation characteristics: reliability, competitive advantage, observability, difficulty and trialability. However, Tornatzky and Klein (1982) published a meta-analysis finding that only relative advantage, reliability, and uncertainty among these attributes were associated continuously with utilization decisions or adoption. Campbell and Singh (2017) conducted a study of factors that could influence the usefulness of mobile wallets. They also concluded that perceived ease of use is an essential aspect of overall perceived utility, but it is not enough to make mobile payments helpful.

Additionally, these traditional models frequently overlook the effect of personal innovativeness on acceptance/adoption, which is a significant factor for elucidating individual consumer adoption behaviour, mainly in particular settings. The study (Thakur and Shrivastava, 2014) considered literate customers with active bank accounts. As a result, the findings might not be immediately applicable to different consumers who can use mobile payment systems. Telecom-centric, bank-centric, independent service providers and collaborative business models are now used in mobile payments. However, each form of business model has advantages and limitations. It is noteworthy that offering a compelling value proposition to all stakeholders is critical in developing a long-term mobile payment business strategy.

Bezhovski (2016) studied the growth and prospects of the mobile payment system. He has mentioned that various factors are affecting the usage of the mobile payments system. Convenience, cost and privacy were the most significant factors among them. Waris et al. (2006) conducted a study for the Netherland region where they have laid out the reasons for the success of mobile wallets in the Netherland, such as cost of the transaction, banking sector role and customers response though there were some privacy issues. Sinha et al. (2019) also concluded that the role of privacy concerns is enormous as far as acceptance of technological innovation is concerned. The top three issues preventing Mobile payment technology uptake are data privacy, safe transactions, and trust. The determinants are present in all three categories of street vendors studied, namely milk sellers, vegetable vendors, and roadside service repair businesses (Chopra, 2017). De Kerviler et al. (2016) highlighted utilitarian, hedonic, and social gains as significant drivers and financial and privacy threats from the standpoint of perceived value. In Finland, consumer adoption of mobile wallets is still in its early phases of the Innovation-Decision Process. It also demonstrates that customers in Finland have a favourable opinion of mobile payments (Doan, 2014).

The adoption of mobile payment systems can address economic and social challenges in India. The issue today is whether mobile payments will eventually replace cash and credit cards as universal payment technology. Au and Kauffman (2008) mentioned that irrespective of the region, Europe, North America or Asia, the young people will be the ambassadors as they transform into the next generation of a workforce with increased buying power. Citizens with a higher monthly income, younger, more educated, and who travel more and live in the capital city and overseas are more acclimated to mobile payments (Keramati et al., 2010). In the Iranian context, customers’ adoption of mobile payments is influenced by behavioural and technological variables (Keramati et al., 2012). Early adopters place a premium on the simplicity of use, relying on their own mobile payments’ expertise, but late adopters praise the utility of mobile payments, particularly reachability and comfort of use (Kim et al., 2010). High levels of stress have a detrimental impact on users’ perceptions of m-wallet services (Singh et al.2020). Slade et al. (2015) described mobile payment adoption is becoming trustworthy, and using mobile payment leads the risk into a unitary dimension. A study conducted by Renjan and Anju (2019) regarding smartphone users’ perception of mobile payments systems suggested studying the various factors affecting the usage of the mobile payment system.

Jain (2020) analyzed the retail industry using SWOT Analysis, where strengths, weaknesses, opportunities and threats are discussed. She concluded; it is right to say that online retailing has disrupted the unorganized traditional Indian retail market. Kiran does well in location, but not so well in cleanliness, deals, quality, or friendly, trustworthy sales associates. However, the opposite is true (Goswami and Mishra, 2009). Online retailing is growing with an increase in technology and other advancements. Retailers are interested in linking e-wallet apps with coupon features and loyalty. As loyalty and coupon apps are progressively more linked with social networking sites, security threats are high because they access location and purchases data. Sivanesan and Green (2019) studied organized retail stores that adversely affected the unorganized retail sector in its nearby areas in terms of their business and profit. It is observed that organized stores give more offers than unorganized retail stores. Although there is a compelling rationale for mobile payment, it has been shown that retailers are not as aware of the possible pitfalls (Taylor, 2016).

It is significant to note that mobile payments transactions occur in primarily underdeveloped ecosystems. In many cases, immature standards, weak infrastructures, mobile phones with only basic features, network congestion, overloading, and outages have slowed down the flow of mobile payments services. Location, friendly, trustworthy salespeople, home shopping, cleanliness, deals, and quality were favourably connected to customer patronage of grocery shops, but travel convenience was found to be adversely related. We should not overlook that despite the expansion in emerging markets of the mobile payment system. They are expected to be victims of mobile malware because of the underdeveloped antivirus industry. These products are not as reasonable/affordable, regardless of whether several mobile innovations are invented in these markets. Payment models that depend on modern technology are not suitable for the emerging world. However, to enhance the service providers, the mobile payments ecosystem, including mobile operators and banks, must collaborate with main value chain partners, such as app developers, solution vendors, merchants, retailers, device vendors, and the handset and consumer associations. The flow of mobile payments hinges on actions taken to improve consumers’ responsiveness, awareness, and compliance to embrace/accept such services.

Objectives of the Study

The objectives for the study are:

• To study the factors enabling the shift from the unorganized to the organized retail sector.

• To analyze the factors influencing the adoption of mobile payment services.

• To check the validity of the TAM model.

Research Methodology

Construct Measurement

In the initial stage of the current study, existing literature on technology adoption technology advancement was reviewed. Therefore, based on our review, we prepared our survey instrument. This process helped us in knowing the gap in research, originality and collecting the attributes/variables for the study. A structured questionnaire was prepared, which consisted of attributes connected to technology adoption, advancement, and behavioural shift. A Likert scale with five points was used. The questions in our survey instrument were created by translating construct definitions into a questionnaire format or modifying existing instruments (e.g., knowledge of mobile payments). Constructs such as Perceived Usefulness (PU), Perceived Ease of Use (PEU), and Behavioural Intention (BI) were used and questions regarding the same were prepared with the help of (Campbell and Singh, (2017) (Davis, 1989), (Karaarslan and Şükrü, 2015) & (Venkatesh et al., 2003) studies.

Data Collection Procedure

For recording data, online surveys are convenient and accurate, and they help prevent responders from missing items (Chang and Wu, 2012). The questionnaire was prepared after reviewing the literature and administered to the selected respondents. The survey was conducted for over ten days, and the responses were collected through online questionnaires using Google forms. The data was collected from one hundred five respondents, but two had not been filled, so these two questionnaires were rejected due to invalid or missing responses. Finally, one hundred three responses were eventually utilized for the analysis. The questions were asked, keeping in mind the following attributes: secure transaction, ease of use, data privacy, shifts from unorganized to organized, and trust.

Data Analysis and Interpretation

The collected data was presented and analyzed in this section through the distributed questionnaires. In addition, the influence of each attribute on others was studied, and confirmatory factor analysis was used. The population analysis of the samples was based on descriptive statistics. Data had been analyzed using SPSS version 26. Given the nature of the Mobile Payment System, the sample consists of the users who were young and pursuing higher education, also able to afford a smartphone. Thus, this sample represented the people who use mobile e-wallets; as per the study of Brown (2002), Cronbach’s alpha was used to examine the reliability and validity through the construct measurement’s internal consistency.

Demographic Details of Participants

The respondents’ demographics such as Gender, Marital Status, Age, Qualification, Employment status and Purchase Preference. For the study, one hundred and three responses were used. The respondents’ demographic profile is expressed. With respect to gender, females are more in number than males (64.1 per cent) and (34 per cent), respectively. As far as age is concerned, the respondents were mostly aged between 18-25 years (71.8%) and 26-32 years (23.3%); therefore, 95.1% of responses are covered within 18-32 years aged participants. The majority have at least a bachelor’s degree or equivalent (about 52.4%, including the postgraduates) when it comes to education. In terms of occupation, students account for 58.3% of the respondents, while employed people account for 35.9% of the respondents. Most respondents preferred offline purchases from local Kirana stores, 68.9%, and respondents preferred online purchasing was 24.3% only.

Respondents were asked to answer a list of 11 statements to evaluate their usage and behaviour pattern. These eleven statements were examined to minimize correlation and reveal compact and meaningful dimensions through Factor Analysis. Initially, a reliability check was done on these questions (statements) to refine the scale and eliminate unnecessary statements shows the statistics named as Cronbach alpha and corrected-item-to-total correlation in column 5 and column 4, respectively. On the other hand, column 2 and column 3 shows the scale mean and variance if that statement (question) is deleted from the scale.

Descriptive Analysis

Analysis of Statements

Using Cronbach’s alpha test, the models were checked for reliability. Nunnally (1978) proposed that the score of each build would be greater than 0.6 to be viewed as reliable. As, Cronbach’s alpha (reliability) ranges from 0.601 to 0.690. Because the overall reliability of Measurement is above 0.6, the instrument was shown to have adequate internal consistency, and therefore, all variables are reliable. Few statements had Cronbach alpha as less than 0.6; therefore, those have not been considered further as they do not fulfil the minimum criteria proposed by Nunnally (1978).

Factor analysis with varimax rotation was used. Kaiser-Meyer-Olkin (KMO) and Barlett’s Test of Sphericity (Dziuban, 1974) was done to examine the appropriateness of the collected data displays the sampling adequacy scale Kaiser-Meyer-Olkin, which was 0.655. Therefore, it was deemed acceptable to implement the factor analysis 0.00 to 0.49 is considered unacceptable, 0.50 to 0.59 is horrible, 0.60 to 0.69 is poor, 0.70 to 0.79 is considered medium, 0.80 to 0.89 is considered meritorious, and 0.90 to 1.00 is fantastic (Cerny and Kaiser, 1977). Barlett’s Test of Sphericity at 205.698 is highly significant at five per cent of the significance level. According to Bartlett’s test of sphericity, the correlations between items were suitably significant for Principal component Analysis, 2 (55) = 205.698. These values confirm the statistical significance of the sample to run factor analysis.

The result of reliability and validity analysis the findings were deemed suitable for further investigation. Variables with loading larger than 0.3 are crucial for (Hair et al., 1998); similarly, loading greater than 0.4 is more critical, while loadings of 0.5 or above are highly significant. This study includes items having a load of 0.3 or above. Factor analysis with three phases was carried out. Four factors could initially be discovered, and factor loadings would generate Varimax rotation. To obtain relevant factors, the most common decision-making strategy is to find essential factors with an Eigenvalue of more than one (Albadvi et al., 2007). A total of three factors were identified, with Eigenvalues greater than 1.0. Factor 1 seemed to measure a dimension of ‘Perceived Usefulness’, how valuable and productive the mobile payment system has been. Factor 2 tapped into aspects of a person’s ‘Trust and Privacy’. Factor 3 revealed a ‘Behavioural Shift’ in users shifting towards online payments. Following the data analysis, reliability and validity are analyzed in this article shows Cronbach’s reliability results and factor analysis for validity.

Factors Involved

Three statements have been loaded perceived usefulness factor, and the statement that MPS (Mobile Payment System, other MPS will be used) would increase my productivity in online transactions has the most significant loading as 0.842 followed by the statement that MPS allows making payments faster has the factor loading as 0.772 and the third statement that MPS fits well with the way I like to engage in online transactions has factor loading as 0.699.

Factor 2: Trust and Privacy (T&P)

After the Perceived Usefulness, the most significant factor has been Trust and Privacy. Three statements, i.e., MPS put my privacy at risk (0.819), MPS in online purchasing has a potential risk of fraud/ cheating (0.812), Mobile Banking is easy to use (0.501) have been loaded on Trust and Privacys.

Factor 3: Behavioural Shift (BS)

It is the third dominant factor. Two statements have been loaded on Behavioural Shift. These statements are MPS has helped me reduce my offline transactions (0.863), Mobile wallets, Banking, and UPI have led to a change in purchase Patterns (0.732).

Findings

This study explains the significance of various essential factors kept in mind by the respondents while using the mobile payment system. All statements have been analyzed using confirmatory factor analysis, and three factors (Perceived Usefulness, Trust and Privacy and Behavioural Shift) have been identified. Mobile payment systems provide convenience in organizing payments and keeping a record of them. It is the faster way to make payments. This study suggests that perceived usefulness is the critical factor influencing the adoption of the mobile payments system. However, another view: despite its benefits, few users still find it risky as there are privacy concerns. A statement such as “MPS has helped me reduce my offline transactions” has the most considerable factor loading, i.e., 0.863. It has been observed that since online retailing is relatively easy, it has influenced the purchase pattern of respondents. They are more inclined towards organized retailing as compared to unorganized retailing.

Conclusion

This study found that usefulness, trust, and privacy play a key role in technology adoption, as mentioned in the TAM model. It was found (with the highest factor loading) that the mobile payment system has influenced the users to adopt online mode and shift from the offline mode; therefore, there is a behavioural shift. Users are more inclined towards the online payment system. After the initiative of Pradhan Mantri Jan Dhan Yojana, immense growth in the number of savings bank accounts was found. This has eventually led to a growth in the mobile payments system. This study could help the interested stakeholders to analyze the impact of the shift towards mobile payments in unorganized sectors, especially in rural or remote areas. Stakeholders must give attention to the industry’s requirements as far as mobile payment is concerned. Financial inclusion should be given importance.

This study also reveals that there is no doubt they provide convenience to the user, but there is a lot to be examined. It was observed that several people were hesitant to adopt technology developments and innovations due to security concerns, despite the demand for quick and trouble-free transactions. Better security mechanisms are required when various data sources are combined into one domain.

As far as future scope is concerned, more studies are needed to determine how this technology has opened new areas of vulnerability and risk and how best to give them the security to ensure customer uptake and acceptability. This study would also assist parties engaged in designing and executing a mobile payment system (Dennehy and Sammon, 2015). The management consequences are well established when implementing these mobile systems and, for that matter, any new/modern technology.

Limitations

There have been certain inconsistencies in the findings of the paper. The findings reveal only restricted consumer experiences with the mobile payment system. A lot can be discussed, such as social context and the impact of a consumer’s behaviour. Mobile payments are not a conventional phenomenon. These conditions direct the way to restricted generalizability, it is tough to generalize the findings of this study. It may not be possible to generalize it to other cellular contexts as well considering the sample size taken for this study. It is essential to mention that perceived security is subjective and mobile users may have different security concerns, which is altogether a different study area. Second, the study’s sample size was small and could be increased in future studies, primarily made up of users who had an accessible internet connection and, as a result, a dependable second-best replacement, which may have influenced their views on mobile payments. Third, this is a pre-Covid-19 study, and now we have entered into a completely different realm; therefore, the impact of Covid-19 waves can be studied in future studies.

References

Albadvi, A., Keramati, A. & Razmi, J. (2007). Assessing the impact of information technology on firm performance considering the role of intervening variables: organizational infrastructures and business processes reengineering. International Journal of Production Research, 45:12, 2697-2734.

Indexed at, Google Scholar, Cross Ref

Au, Y. A., & Kauffman, R. J. (2008). The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. ElectronicCommerceResearchandApplications, 7(2), 141-164.

Indexed at, Google Scholar, Cross Ref

Bezhovski, Z. (2016). The Future of the Mobile Payment as Electronic Payment System. European Journal of Business and Management, 8 (8), 127-132.

Brown, J. D. (2002). The Cronbach alpha reliability estimate. JALT Testing & Evaluation SIG Newsletter, 6(1), 17- 19.

Campbell, D., & Singh, C. B. (2017). A Study of Customer Innovativeness for the Mobile Wallet Acceptance in Rajasthan. Pacific Business Review International, 10(6), 7-15.

Cerny, B. A., & Kaiser, H. F. (1977). A study of a measure of sampling adequacy for factor-analytic correlation matrices. Multivariate behavioural research, 12(1), 43-47.

Indexed at, Google Scholar, Cross Ref

Chang, M. L., & Wu, W. Y. (2012). Revisiting perceived risk in the context of online shopping: An alternative perspective of decision making styles. Psychology & Marketing, 29(5), 378-400.

Indexed at, Google Scholar, Cross Ref

Chopra K. (2017). Attitude of unorganized retailers towards mobile payments. International Journal of Research in IT and Management, 7(3), 95-100.http://dx.doi.org/10.1007/978-981-13-1610-4_18.

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology.

De Kerviler, G., Demoulin, N. T., & Zidda, P. (2016). Adoption of in-store mobile payment: Are perceived risk and convenience the only drivers? Journal of Retailing and Consumer Services, 31, 334-344.

Indexed at, Google Scholar, Cross Ref

Dennehy, D., & Sammon, D. (2015). Trends in mobile payments research: A literature review. Journal of Innovation Management, 3(1), 49-61.

Indexed at, Google Scholar, Cross Ref

Doan, N. (2014). Consumer adoption in mobile wallet: a study of consumers in Finland, Turku University of Applied Science Thesis.

Dziuban, C.D., & Shirkey, E.C. (1974). When is a correlation matrix appropriate for factor analysis? Some decision rules. Psychological Bulletin, 81(6), 358–361.

Indexed at, Google Scholar, Cross Ref

Goswami, P. & Mishra, M.S. (2009), “Would Indian consumers move from Kirana stores to organized retailers when shopping for groceries?”, Asia Pacific Journal of Marketing and Logistics, Vol. 21 No. 1, pp. 127-143.

Indexed at, Google Scholar, Cross Ref

Jain, S. (2020). Perspective of online retailing in India. Journal of Management Research and Analysis, 5(2), 213-216.

Karaarslan, M. H., & M. Şükrü A. (2015). Consumer Innovativeness: A Market Segmentation. International Journal of Business and Social Science, 6(8), 227–237.

Keramati, A., Taeb, R., & Larijani, A. M. (2010). The adoption of mobile payment: A descriptive study on Iranian customers. International Journal of Electronic Customer Relationship Management, 4(3), 264-279.

Indexed at, Google Scholar, Cross Ref

Keramati, A., Taeb, R., Larijani, A. M., & Mojir, N. (2012). A combinative model of behavioural and technical factors affecting ‘Mobile’-payment services adoption: an empirical study. The Service Industries Journal, 32(9), 1489-1504.

Indexed at, Google Scholar, Cross Ref

Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior, 26(3), 310-322.

Indexed at, Google Scholar, Cross Ref

Nunnally, J.C. (1978). Psychometric Theory. New York: McGraw-Hill.

Renjan, R & Anju K. (2019). Perception of Smartphone users Towards Mobile Payment System an Empirical Study. International Journal of Recent Technology and Engineering , 8(1), 424-434.

Rogers, E.M. (1983). Diffusion of innovations, New York: The Free Press.

Indexed at, Google Scholar, Cross Ref

Shin, D. H. (2010). Modeling the interaction of users and mobile payment system: Conceptual framework. International Journal of Human-Computer Interaction, 26(10), 917-940.

Indexed at, Google Scholar, Cross Ref

Shrestha, S. (2018). Foreign Direct Investment in Retail Sector: The Case of India.

Singh, N., Sinha, N., & Liébana-Cabanillas, F. J. (2020). Determining factors in the adoption and recommendation of mobile wallet services in India: Analysis of the effect of innovativeness, stress to use and social influence. International Journal of Information Management, 50, 191-205.

Indexed at, Google Scholar, Cross Ref

Sinha, M., Majra, H., Hutchins, J., & Saxena, R. (2019). Mobile payments in India: the privacy factor. International Journal of Bank Marketing, 37(1), 192-209.

Indexed at, Google Scholar, Cross Ref

Sivanesan, R. & Green, G. (2019). Impact of Organized Retail on Unorganized Retail Sector. Asian Journal of Managerial Science, 8(1), 28-34. http://dx.doi.org/10.51983/ajms-2019.8.1.1451.

Indexed at, Google Scholar, Cross Ref

Slade, E., Williams, M., Dwivedi, Y., & Piercy, N. (2015). Exploring consumer adoption of proximity mobile payments. Journal of Strategic Marketing, 23(3), 209-223.

Indexed at, Google Scholar, Cross Ref

Taylor, E. (2016). Mobile payment technologies in retail: a review of potential benefits and risks. International Journal of Retail & Distribution Management, 44(2), 159-177.

Indexed at, Google Scholar, Cross Ref

Thakur, R., & Srivastava, M. (2014). Adoption readiness, personal innovativeness, perceived risk, and usage intention across customer groups for mobile payment services in India. Internet Research, 24(3), 369-392.

Indexed at, Google Scholar, Cross Ref

Tornatzky, L. G., & Klein, K. J. (1982). Innovation characteristics and innovation adoption-implementation: A meta-analysis of findings. IEEE Transactions on engineering management, (1), 28-45.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly, 27(3), 425–478.

Wani, T. A., & Ali, S. W. (2015). Review & Scope in the Study of Adoption of Smartphones in India. Journal of General Management Research, 3(2), 101-118.

Waris, F. S., Mubarik, F. M., & Pau, L. F. (2006). Mobile Payments in the Netherlands: Adoption Bottlenecks and Opportunities, or… Throw out Your Wallets. ERIM report series reference no. ERS-2006-012-LIS.

Received: 06-Apr-2023, Manuscript No. AMSJ-23-13443; Editor assigned: 07-Apr-2023, PreQC No. AMSJ-23-13443(PQ); Reviewed: 07-Jun-2023, QC No. AMSJ-23-13443; Revised: 19-Jul-2023, Manuscript No. AMSJ-23-13443(R); Published: 05-Aug-2023