Review Article: 2023 Vol: 27 Issue: 5

Financial Management Behavior of Women: Role of need for Cognitive Closure and Financial Self-Efficacy

Kalaa Chenji, The ICFAI Foundation for Higher Education

Sode Raghavendra, The ICFAI Foundation for Higher Education

Mustakhusen Mujawar, The ICFAI Foundation for Higher Education

Citation Information: Chenji, K., Raghavendra, S., & Mujawar, M. (2023). Exploring the protective role of mindfulness: how practicing mindfulness can mitigate the impact of organizational intolerance on consumer discontent. Academy of Marketing Studies Journal, 27(5), 1-11.

Abstract

The aim of the present study is to explore the financial management behavior of Gen Y and Z women in the present business arena. Financial self-efficacy mediates the relationship between financial literacy and financial management behavior. Need for cognitive closure moderates the relationship between financial self-efficacy and financial management behavior. A total of 574 financially active Gen Y and Z women participated in the study. The purpose of the study is to understand if financial literacy and financial self-efficacy drive well-informed and responsible financial behavior. Possession of financial knowledge, skills, an evaluative judgment with high levels of financial confidence enable women make financial decisions that improve their integration into the formal financial system and improved wellbeing. The results contribute towards the limited empirical and theoretical evidence regarding the mediating role of financial self-efficacy and moderating role of need for cognitive closure in explaining financial behaviour of women.

Keywords

Financial Management Behavior, Need for Cognitive Closure, Financial Self-Efficacy, Financial Literacy.

Introduction

The financial decisions taken by individuals influence the economic growth and development of an economy. Financial management behaviour has become an essential topic in the present business arena. The global financial market and ever-changing objectives have enhanced an individual's financial responsibility. The availability of many financial products and diversified markets makes it essential for individuals to gather knowledge and understand the financial environment for responsible decision-making. Some people are more efficient in their economic behaviour than others. Financial management is a complex set of behaviours influencing people's capabilities, skills and opportunities to perform such duties. In developing countries and the world, it is found that the level of financial literacy among individuals is a matter of grave concern for securing economic well-being. Factors such as returns, risk, regulatory framework and market need rational analysis. Among others, one such prominent factor that impacts financial literacy is 'gender'. Research and empirical evidence document the prevalence of gender differences in several countries over several dimensions.

It is observed that women perform worse than men in the context of financial knowledge, literacy and level of self-confidence in the field of financial intelligence. In India, despite the focus on women's position in society, education, health, and economic status, the women's level could be more balanced. In this connection, an important area of concern has been "personal financial planning". Though women have been considered prudent money managers on the household front, critical financial decisions are still in the hands of their spouses/fathers/sons. In other words, the expertise in managing their homes cannot be extended to their financial front. The reasons are a need for more literacy and self-efficacy among women. A survey conducted by NCFE reveals that financial literacy among women in India is low and needs particular focus (Dwivedi, 2015) (Kumar, 2013). Hence, the present paper aims to understand women's financial management behaviour by identifying their levels of financial literacy, financial self-efficacy and need for cognitive behaviour in India.

Financial literacy is "the perception of being able to sustain current and anticipated desired living standards and financial freedom" (Brüggen, 2017). Financial literacy is "the ability to use knowledge and skills to manage financial resources effectively for a lifetime of financial well-being." Research suggests that communities with better financial literacy live prosperous and happy lives. Goncalves et al. (2021) highlight the wider gender gap in financial literacy among men and women. Financial literacy is critical for women to promote economic empowerment.

In addition to gender differences in financial literacy, there is financial literacy gap among people in different regions (Lusardi A. a., 2011). There needs to be more financial literacy between developed and less developed countries. According to the World Bank's report (2016), women's financial inclusion is remarkably low worldwide compared to men's. Global Financial Literacy Excellence Centre for the G20 countries reports that the highest financial literacy for the United Kingdom is 72 per cent for women, and the lowest financial literacy rate at 29 per cent. The borrowing rate of women from financial institutions is found to be quiet for women in Asian countries compared to Canada, where the borrowing rate is found to be the highest (Hasler, 2017). Financial literacy allows women to gain self-efficacy and control over their financial position. A better financial situation results in better social standing for women. Women pursue happiness through economic behaviour, but certain behaviours can be problematic during life changes or periods of instability. For example, young women in their late teens and early 20s face considerable differences, such as leaving home and entering college, requiring them to make decisions in many areas, including finance (Greenberg & Hershfield, 2019). Amid global economic uncertainty due to COVID-19, many women have financial independence from their parents and are making financial decisions in a challenging economic environment (Price, 2020). However, most research on consumer financial behaviour (Greenberg, 2019) has been focused on adults (Deenanath et al., 2019). Existing research has focused on various economic decisions, such as investors' lack of financial knowledge, low savings, burden of credit cards and other payments.

Financial management is a complex set of behaviours and decisions that can change as a function of the importance and difficulty of implementing the behaviour, as well as of people's capabilities, skills, and opportunities to perform such behaviours (Topa G, Financial Management Behavior Among Young Adults: The Role of Need for Cognitive Closure in a Three-Wave Moderated Mediation Mode, 2018). Bad financial behaviour influences individuals in the short term and society in the long run. Past research in economic behaviour has identified numerous financial well-being gaps, outcomes, and antecedents. Better knowledge of financial concepts and products is inevitable in prudent financial decision-making, empowerment, and well-being (Philippas, 2020).

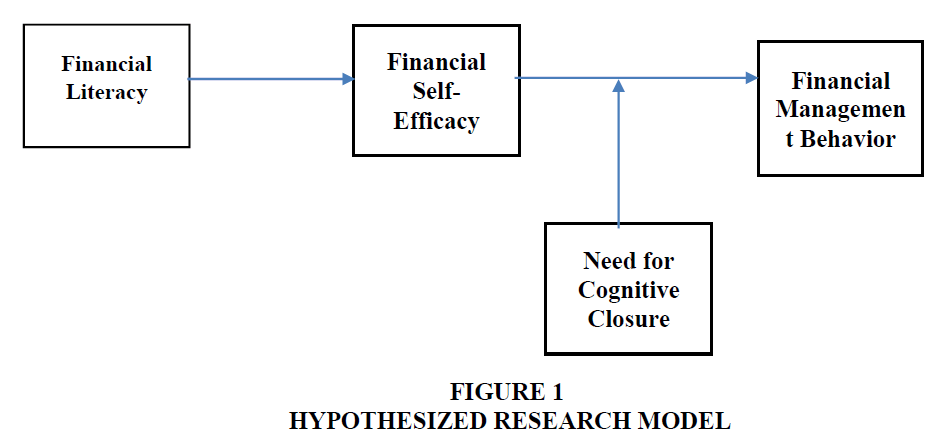

The current study aims to identify the financial management behaviour of young women and their access to economic resources and opportunities. Financial self-efficacy mediates the relationship between financial literacy and financial management behaviour of gen Y women. The need for cognitive closure moderates the relationship between financial self-efficacy and financial management behaviour.

Theoretical Background

The study uses the theoretical background from the social cognitive theory (SCT) proposed by Bandura (1986), explaining the triadic interrelation between the individual, attitudinal and ecological aspects. Social cognitive theory is said to identify the capability of an individual to employ embattled behaviour built on internal and external constraints and interrelationships (Martin, 2014). The present study aims to test the triadic interrelationship between (i) factors that provide financial literacy to (ii) millennial women (individual factors) to (iii) determine financial management behaviour. Past literature indicates the employment of SCT to test the relationship between financial literature and financial well-being (Thomas, 2021).

Review of Literature

Financial Management behaviour

According to the consumer financial protection bureau (2015), Financial Management behaviour is the procurement, distribution and use of financial resources towards a goal. Empirical research on financial management reveals improvement in financial satisfaction and economic condition of people in the long run. Implementing financial management behaviour is complex and requires frugal and careful spending. However, financial management behaviour is a valuable protection against risky financial practices.

The financial management behaviour of an individual is related to a person's financial responsibilities and ability to manage finances. According to Dew & Xio (2011), a person's financial management behaviour could be observed from how he manages consumption, cash-flow management, savings and investment, credit management, etc. (Dew, 2011).

Further, research proves the disparity in financial management behaviour amongst men and women and younger and older people. It is observed that youngsters engage in fewer financial activities like planning, budgeting, saving and others (Jorgensen, 2010). Because of the above facts, examining the antecedents of young women's financial management behaviour is fascinating.

Financial Literacy

Financial literacy is "a combination of awareness, knowledge, skill, attitude and behaviour necessary to make sound financial decisions and ultimately achieve individual financial well-being" (Shobha, 2015).

De Bassa Scheresberg (2013) expressed that higher financial literacy provided higher confidence in financial decision-making and aimed at better monetary outcomes. Previous research pointed out severe concerns over low financial literacy worldwide, India not being an exception. Differences in financial literacy are found based on gender, age, income, qualification and others (Atkinson, 2012). Though financial literacy among men is more than that of women, Financial literacy amongst working women is considerably higher (Lusardi & 2017). As women contribute to 50 per cent of the population in India, the need for financial literacy among women becomes essential for rational decision-making.

According to OECD (2013), "financial literacy is a blend of skill, behaviour, awareness, attitude and knowledge of the individual required to make a sound financial decision to achieve financial well-being. Anthes (2004) defined financial literacy as the ability to know, analyze, manage and inform about the financial conditions that affect the material well-being of an individual. Atkinson and Messy (2012) recommended three dimensions to judge financial literacy as justified and widely used in the literature. Three critical determinants of financial literacy are financial knowledge, financial behaviour and financial attitude.

Financial Self-efficacy

Financial self-efficacy is the level of confidence an individual has in his ability to access, and use financial products or services, undertake a financial decision, and deal with a complex financial situation (Akudugu, 2015)(Amatucci, 2011). In general, behaviour psychology explains the concept of self-efficacy as an individual's sense of self-agency, borne out in a belief that they can cope with life's challenges and may accomplish their task. Self-efficacy may be achieved through various aspects of personal behaviour, such as how well a person preservers in the phase of adversity and his optimistic and pessimistic attitude about the future (Bandura, 2006). Self-efficacy applied to the context of personal financial management; self-assured individuals are more likely to overcome life's challenges confidently. Such an attitude may result in more favorable personal financial outcomes. Hence, the study included the self-efficacy construct to examine and explain its influence on financial management behaviour.

A literature study found evidence of self-efficacy being used as a mediator and proved to predict behaviour and behavioural change (Zimmerman, 1992)(Zhao, 2005). Over the years, several studies have supported Bandura's findings that self-efficacy mediates the relationship between many variables and performance attributes in specific domains.

Hence, it is observed that self-efficacy is a vigorous quality an individual may acquire and possess and may be modified by specific behaviour, events and environment in which they interact. Self-efficacy is said to have played a crucial role in cognitive thinking to attain preferred action driven by willpower and the skills an individual endowed (Nimra Noor, 2020). Based on the above literature review, the following hypothesis may be proposed:

H1: Financial self-efficacy will mediate the relationship between financial literacy and financial management behaviour

Need for Cognitive Closure

Need for cognitive closure (NCC) is used as a dispositional construct, currently preserved as a latent variable established with the help of different aspects, namely, decisiveness, yearning for certainty, preference for order and structure, discomfort with ambiguity and close-mindedness. The need for cognitive closure is considered to be an individual-difference measure.

Empirical studies in the past have been found to have focused on personality, psychological bias, self-control problems and procrastination to influence earning and saving. In contrast, other research has called attention to the influence of individual differences in information processing and complex decision-making (Topa G, 2018) (Rahimi, 2016).

The need for cognitive closure refers to the individual necessity of arriving at a clear and definitive opinion or answer to a problem, particularly any opinion or answer, rather than experiencing confusion, ambiguity or inconsistency (Webster, 1994). Studies reveal remarkable differences between people with high and low NCC. High and low NCC influence the amount of information processed, factors on which the decisions are taken, and self-efficacy on the decision taken. People with low NCC are open to information, available to complex information that may be difficult to process. They are more concerned about the accuracy of information rather than the speed at which it is processed. On the contrary, people with high NCC focus on information processed quickly, reject more complex and incomplete information, and update investments as per the changes in market situations (Livi, 2015).

NCC has been described as urgency to achieve knowledge (seizing) and retaining the knowledge permanently (freezing). People with high NCC will result in less efficient financial management behaviour as they need closure and permanently retain information. This pattern of information processing is found in choices of consumer purchasing, attitudes about technological products and decisions to manage business supply chains. At the same time, people with low NCC are more efficient and consistent in their financial behaviour. They are open to information and believe in elaboration, integration and revision (Dolinski, 2016).

Hypothesis 2: Need for cognitive closure will moderate the relationship between financial literacy and financial management behaviour through financial self-efficacy. The mediating relationships will be stronger for low levels of need for cognitive closure than for high levels of cognitive closure.

Financial Management Behavior of Women: Role of Need for Cognitive Closure and Financial Self-efficacy

The hypothesized model is displayed in figure 1, where financial self-efficacy mediates the relationship between financial literacy and financial management behaviour. The need for cognitive closure moderates the relationship between financial behaviours and financial self-efficacy.

Method

Participants and Procedure

Data were collected from the respondents in two phases. A questionnaire was administered to 767 women in the age group of 19 to 42 years. Millennial and post-millennial women participated in the study. Millennials included women born between 1981 and 1996, while post-millennials or Gen Z were born between 1997 and 2012. Women from both cohorts were included in the study. A 7-week gap was maintained between phases to separate the variables to avoid standard method variance (Podsakoff, 2003). The participants orally consented, and the participation was voluntary.

Seven hundred sixty-seven questionnaires were mailed in the first phase, of which 661 (86 per cent response rate) responses were returned. The first phase included questions on demographic factors and measured financial literacy and self-efficacy. The second phase included questions about cognitive closure and financial management behaviour. Five hundred seventy-nine responses (88 per cent of 661approx.) were received from the second phase. The average respondent was 24 years old, and more than 50 per cent of the respondents were above 23 years old. Sixty-eight per cent of the respondents held a college degree and above. Seventy-three per cent of the women were millennials, the rest of them were from Z Generation, and 79 per cent of the respondents were working. More than 40 per cent of the women who participated in the study were married.

Measures

The financial Literacy scale included three constructs, namely financial knowledge, financial behaviour and financial attitude, developed by Shockey (2002) and OECD (2013). Financial attitude included questions related to risk attitude, financial planning, the stress in handling finances, satisfaction, etc. Financial behaviour included savings behaviour, bill and loan repayment behaviour, responsible investment behaviour and financial planning behaviour. In contrast, financial knowledge included questions about savings and investments, borrowings, insurance, risk and return.

The Financial Self-Efficacy scale developed by Lown JM (2011) is used in the study, and items such as "it is hard to stick to a spending plan when unexpected expenses arise" and "I lack confidence in my ability to manage my finances" are included.

Need for cognitive closure used the NFCS short version developed by Roets A and Van Hiel (2011) was used for measuring the need for cognitive closure and included items such as "I do not like situations that are uncertain" and "I dislike questions which could be answered in many different ways."

Financial management behaviour was assessed with the Financial Practices Scale (Loibl et al., 2006), consisting of seven items that measure the probability of the participants' adopting positive financial management behaviours. Examples of some items are "Pay your bills on time every month"; "Start saving for emergencies"; "Develop a written plan for expenses"; "Have more organized records of payments."

Results

Descriptive statistics and correlations for the study variables are shown in Table 1. AMOS 18 is used to conduct confirmatory factor analysis to calculate the observed differences between the variables in the study. The incremental fit index (IIFI, Bollen, 1989), normed fit index (NFI, Bentler and Bonett, 1980), comparative fit index (CFI, Bentler, 1990) and RMSEA (Root mean square error of approximation, Browne & Cudeck, 1993) were assessed to check the fitness of the models. Numerous models were compared, from the one-factor model to the hypothesized six-factor model. As a result, a strong degree of fit was found in the six-factor model (X2 (714)=1198.89, NFI=.87, IFI=.94, CFI=.93, RMSEA=.05) compared to the other models, therefore, suggesting the observed differences in the study variables.

| Table 1 Mean, Standard Deviations, Zero-Order Correlations | ||||||||||

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| 1 Age | 23.90 | 6.89 | 1 | |||||||

| 2. Income | 2.90 | 0.63 | -0.23** | 1 | ||||||

| 3. Education | 2.85 | 0.68 | -0.09 | 0.11 | 1 | |||||

| 4. Experience | 6.89 | 7.00 | -0.15* | 0.69** | -0.07 | 1 | ||||

| 5. Financial Literacy (FL) | 1.56 | 0.88 | -0.06 | 0.13 | 0.03 | 0.11 | 1 | |||

| 6. Financial Self-efficacy (FSE) | 3.33 | 0.86 | 0.11 | -0.15* | 0.08 | -0.09 | -0.04 | 1 | ||

| 7. Need for cognitive closure (NCC) | 4.85 | 1.17 | -0.18* | -0.12 | 0.32** | -0.29** | 0.22** | 0.11 | 1 | |

| 8. Financial Management Behavior (FMB) | 5.26 | 0.84 | -0.40** | -0.06 | 0.25** | 0.33** | 0.21** | -0.16** | -0.43** | 1 |

Regression analysis was conducted to study the hypotheses. Age, education, income, and experience were controlled for regression analysis. While conducting mediation analysis, Preacher and Hayes (2004) recommendations, including the steps by Baron and Kenny (1986), were considered. Bootstrapping tests of the estimated indirect effect, which do not generalize that the indirect effects are typically distributed, were conducted (Bentler, 1980) (Baron, 1986) (Browne, 1993). The study hypothesized (Hypothesis 1) that financial self-efficacy mediates the relationship between financial literacy and financial management behaviour. Financial literacy indicated an indirect effect on financial management behaviour (-.08), and bootstrapped results with 95% CI around the indirect effect was more than zero for financial management behaviour (-.14, -.01), hence supporting the first hypothesis (Table 2).

| Table 2 Regression for Simple Mediation | ||||

| B | SE | t | p | |

| Direct and total effects | -.26 | .05 | -4.28 | .000 |

| FMB regressed on FL | .17 | .08 | 2.49 | .015 |

| FSE regressed on FL | -.37 | .07 | -6.26 | .000 |

| FMB regressed on FSE, controlling FL | -.19 | .06 | -3.55 | .000 |

| FMB regressed on FL, controlling FSE | M | SE | LL 95% CI | UL 95% CI |

| Bootstrap results for indirect effect Effect on financial management behavior |

-0.08 | 0.03 | -0.14 | -0.01 |

The second hypothesis predicted a strongly mediated relationship when the need for cognitive closure is low, explaining that the conditional indirect effect of financial literacy on financial management behaviour through financial self-efficacy will be more substantial. In order to test the moderated mediation, regression analysis was conducted, which estimated the conditional indirect effect of the need for cognitive closure. Preacher et.al (2007) recommended that the high and low levels of the moderator were operationalized at one standard deviation above and below the mean.

The conditional indirect effect of financial literacy on financial management behaviour was significant when the need for cognitive closure was low (financial literacy = -.076, p<.05) and not significant when the need for cognitive closure was high (financial literacy = -.018: ns) as indicated in Table 3. Therefore, the second hypothesis is supported (Preacher, 2004) (Preacher, 2008).

| Table 3 Results of Moderated Mediation for Financial Literacy Through Need for Cognitive Closure for Financial Management Behavior | |||||

| Financial Literacy | |||||

| Level | conditional indirect effect | SE | z | p | |

| Need for cognitive closure on financial | Low | -.076 | .043 | -1.72 | .047 |

| Management behavior | High | -.018 | .016 | -1.02 | .298 |

Discussion

The present study examines the mediating effects of financial self-efficacy on the association between financial literacy and financial management behaviour and the moderating effect of the need for cognitive closure for the mediated relationship. The study aims to understand if financial literacy influences the financial management behaviour of millennial and post-millennial women. Firstly, the study's findings reveal the importance of a long research tradition linking financial literacy with improving financial management behaviour. In addition, the present paper reveals that effective management of funds should not be the only consequence of knowledge and self-confidence but rather the outcome of the joint influence of cognitive aspects and social influences that affect individuals. The impact of financial literacy on financial behaviour is described as investment advice provided through social communication and from financial expert advice.

Further, the study findings suggest that individuals' financial self-efficacy greatly influences their financial behaviour (Rachel Mindra, 2017). The bootstrapping method tested financial self-efficacy as a mediator between financial literacy and financial management behaviour. Before testing for mediation effects, the Baron and Kenny (1986) criteria for establishing the existence of the mediation effects. It is observed that financial self-efficacy is a mediating variable between financial literacy and financial management behaviour. High levels of financial literacy and financial self-efficacy among investors provide higher levels of empowerment and evaluative judgment in financial management behaviour, especially in decision-making regarding credit, savings, insurance and remittances. Financial self-efficacy is said to stimulate the level of confidence an investor has in making decisions regarding investments and integration in the formal financial system.

Next, following the growing literature on the importance of personality traits influencing investment behaviour beyond the effect of external factors and financial knowledge, the present study reveals the need for cognitive closure in the role of a moderator in the association between financial literacy and financial management behaviour, financial self-efficacy being the mediator. On the other hand, results reveal that seizing harms investment behaviour, suggesting that those who take quick financial decisions tend to have low financial behaviour. Contrary to our expectations, women with a high need for cognitive closure improve their financial behaviour, accept financial advice from experts quickly and implement them consistently and repeatedly improving financial behaviour.

The current study provides a new perspective for enhancing women's financial behaviour and thus contributes to increasing the efficacy of early interventions to develop prudent financial management behaviour (Gariepy, 2017).

Past research proves that financial advice helps improve financial literacy (Collins, 2012). Therefore, social, educational and political infrastructure must provide opportunities for women to improve their financial competencies. Intervention strategies for coherence between expert advice, knowledge and financial management behaviour must be provided to women in early adolescence to practice the specific behaviour of savings and investment in their early adulthood. In addition, the initial calculation of people's inclinations of seizing and freezing could help identify their tendencies and future bias in handling financial information. Based on these recommendations, policymakers, educators, and parents may plan training programs expressly aimed at overcoming these biases.

Implications

Financial literacy combines awareness, knowledge and skill to make well-informed decisions. It is the process to inculcate awareness about financial products, financial knowledge sources and confidence in discussing financial issues to plan for better decision-making and individual financial well-being (Shobha, 2015). However, the level of financial literacy among women in India has been questionable as it needs to be documented. This paper attempts to study the level of financial management behaviour of women owing to several cultural, social, financial, physical and psychological barriers that create hindrances to acquiring financial literacy. In order to boost financial literacy, policymakers have implemented several interventions and initiatives (Garima Baluj, 2016).

The current study presents a new perspective to improve the financial management behaviour of women and focuses on self-efficacy and the need for cognitive closure of women to develop prudent financial behaviour. It is observed that the combination of expert advice accompanied by a high level of financial literacy provides better benefits for investment decision-making. Building a solid educational, political and social system is essential to create opportunities for young women to enhance their financial competencies. Intervention strategies must be diverted toward increasing the association between financial knowledge, expert advice and financial management behaviour to intensify the habit of saving and investing from adolescence.

The study contributes to the theory of financial self-efficacy regarding the mediation effects between financial literacy, the need for cognitive closure and financial management behaviour. The study reveals that financial self-efficacy is a measure of self-confidence that women require and provides the ability to take prudent investment decisions, and is proven to be a true mediator between financial literacy and financial management behaviour.

In addition, to identify youngsters' tendencies of seizing and freezing efforts and to understand their propensities of potential bias in the processing of financial information, the process of acquiring financial knowledge and skill must start at an early age to strengthen women's contribution to the financial sector (Gerlach, 2017). The study results reveal that the decision-making ability of an investor depends on the need for cognitive closure in addition to other factors such as knowledge and self-efficacy. Executive functions such as cognitive behaviour, impulse control, and attention regulation can be linked to NCC and performance in financial management behaviour. The present study invites new criteria for enhancing financial management behaviour amongst women and contributes to responsible financial management behaviour development.

Limitations and Future Directions

First, the study is explicitly limited to women in the age group between 19 – 40 years of age and cannot be generalized to all consumers and investors. The study's findings are subject to the data collected from the respondents during the research and may not be generalized for the larger population. It is observed that there are several other methods to predict the consequences of variables such as financial literacy and financial self-esteem. It is recommended that future researchers may use several sources of collecting information on financial literacy to identify the financial literacy of women. Longitudinal research methods may yield better results for future studies.

References

Akudugu, M. (2015). The determinants of financial inclusion in Western Africa : Insights from Ghana. Research. Journal of Finance and Accounting , 4(8), 1-9.

Amatucci, F. M. (2011). Financial self-efficacy among women entrepreneurs. International Journal of Gender and Entrepreneurship , 3(1), 23–37 .

Indexed at, Google Scholar, Cross Ref

Atkinson, A. &. (2012). Measuring financial literacy: . Results of the OECD/International Network on Financial Education (INFE) pilot study.

Indexed at, Google Scholar, Cross Ref

Baron, R. M. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, , 51, 1173–1182.

Indexed at, Google Scholar, Cross Ref

Bentler, P. M. (1980). Significance tests and goodness of fit in the analysis of covariance structures. Psychological Bulletin, , 88, 588–606.

Indexed at, Google Scholar, Cross Ref

Birkenmaier, J. a. (2019). Does consumer financial management behavior relate to their financial access? Journal of Consumer Policy , Vol. 42 No. 3, pp. 333-348.

Indexed at, Google Scholar, Cross Ref

Browne, M. W. (1993). Alternative ways of assessing model fit. In K. A. Bollen & J. S. Long (Eds.) , Testing structural equation models. Newbury Park: CA: Sage.

Brüggen, E. C. (2017). Financial well-being: a conceptualization and research agenda. J. Bus. Res , 79, 228–237. doi: 10.1016/j.jbusres.2017.03.013.

Indexed at, Google Scholar, Cross Ref

Collins, J. M. (2012). Financial advice: a substitute for financial literacy? . Financial service review , Vol. 21, No. 4, 307-322.

Indexed at, Google Scholar, Cross Ref

Dew, J. &. (2011). A deeper review of the literature resulted in eight more studies that used financial management behavior scales. Journal of Financial Counseling and Planning , 22, (1), p.43.

Dolinski, D. D.-T. (2016). Need for closure moderates the break in the message effect. Frontiers in Psychology , Volume 7, 7: 1879.

Indexed at, Google Scholar, Cross Ref

Gariepy, G. E.-L. (2017). Early-lifefamily income and subjective well-being in adolescents. . Plos one collection , 12:e0179380.

Indexed at, Google Scholar, Cross Ref

Garima Baluj, 2. (2016). Financial Literacy Among Women in India: A Review. Pacific Business Review International , Vol. 9 (4), 82-88.

Gerlach, P. (. (2017). The games economists play: why economics students behave more selfishly than other students. PLoS One , 12(9): e0183814.

Indexed at, Google Scholar, Cross Ref

Hasler, A. a. (2017). The Gender Gap in Financial Literacy: A Global Perspective. Washington DC: Global Financial Literacy Excellence Center,: Global Financial Literacy Excellence Center, , The George Washington University School of Business.

Jorgensen, B. L. (2010). Financial literacy of young adults: the importance of parental socialization. Family Relations , 59, (4) 465–478 .

Indexed at, Google Scholar, Cross Ref

Kim, K. a. (2018). Financial knowledge and household saving: evidence from the survey of consumer finances. Family and Consumer Sciences Research , Journal, Vol. 47 No. 1 pp 5-24.

Indexed at, Google Scholar, Cross Ref

Livi, S. K. (2015). Epistemic motivation and perpetuation of group culture: Effects of need for cognitive closure on trans-generational norm transmission . Organizational behavior and human decision processes , Vol.129, pages 105-112.

Indexed at, Google Scholar, Cross Ref

Lusardi, A. &. (2017). Financial capability and financial literacy among working women: New insights.

Lusardi, A. a. (2011). Financial Literacy and Planning Implications for Retirement Wellbeing. (No. w17078). Cambridge: MA: National Bureau of Economic Research.

Indexed at, Google Scholar, Cross Ref

Martin, C. A. (2014). “A dynamical systems model of social cognitive theory,” . in Proceedings of the 2014 American Control Conference, (Portland, OR: IEEE) , 2407–2412. doi: 10.1109/ACC.2014.6859463.

Indexed at, Google Scholar, Cross Ref

Nimra Noor, I. B. (2020). Financial literacy financial self-efficacy and financial account ownership behavior in Pakistan,. Cogent Economics & Finance , 8:1, 1806479, DOI: 10.1080/23322039.2020.1806479.

Indexed at, Google Scholar, Cross Ref

Philippas, N. D. (2020). Financial literacy and financial well-being among generation-Z university students: evidence from Greece. Eur. J. Eur. J. Finance , 26, 360–381.

Indexed at, Google Scholar, Cross Ref

Podsakoff, P. M. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology , Vol. 88(5), 879–903.

Preacher, K. J. (2004). SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behavior Research Methods, Instruments, & Computers , 36, 717–731.

Preacher, K. J. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior Research Method , 40, 879–891.

Rachel Mindra, M. M. (2017). Financial self-efficacy: a mediator in advancing finacial inclusion. Equality, Diversity and Inclusion: An international journal , Vol. 36, No.2 pp 128-140.

Rahimi, S. H. (2016). Attributions of responsibility and blame for procrastination behavior. Frontiers in Psychology , 7:1179. Volume 7 - 2016 |

Indexed at, Google Scholar, Cross Ref

Shobha, T. a. (2015). A Study on the Perception of Women towards Financial Planning in the city of Bengaluru. . Asia Pacific Journal of Research , 1 (XXX), 14-21.

Stavins, J. (2020). “Credit card debt and consumer payment choice: what can we learn from credit bureau data?". Journal of Financial Services Research, , Vol. 58 No. 1, pp. 1-32.

Thomas, A. a. (2021). Social capital theory, social exchange theory social cognitive theory, financial literacy, and the role of knowledge sharing as a moderator in enhancing financial well-being: from bibliometric analysis to a conceptual framework model. Frontiers in Psychology , 12:664638.

Topa G, H.-S. M. (2018). Financial Management Behavior Among Young Adults: The Role of Need for Cognitive Closure in a Three-Wave Moderated Mediation Mode. Frontiers in Psychology , doi: 10.3389/fpsyg.2018.02419.

Indexed at, Google Scholar, Cross Ref

Topa G, H.-S. M. (2018). Financial Management Behavior Among Young Adults: The Role of Need for Cognitive Closure in a Three-Wave Moderated Mediation Model. Frontiers in Psychology , 9:2419 doi: 10.3389/fpsyg.2018.02419.

Webster, D. M. (1994). Individual differences in need for cognitive closure. Journal of personality and social psychology , 67(6), 1049–1062.

Zhao, H. S. (2005). “The mediating role of self-efficacy in the development of entrepreneurial intentions”. Journal of Applied Psychology , Vol. 90 No. 6, pp. 1265-1272.

Zimmerman, B. B.-P. (1992). Self-motivation for academic attainment: the role of self-efficacy beliefs and personal goal setting”. American Educational Research Journal , Vol. 29 No. 3, pp. 663-676.

Indexed at, Google Scholar, Cross Ref

Received: 14-Mar-2023, Manuscript No. AMSJ-23-13335; Editor assigned: 15-Mar-2023, PreQC No. AMSJ-23-13335(PQ); Reviewed: 24-Apr-2023, QC No. AMSJ-23-13335; Revised: 27-May-2023, Manuscript No. AMSJ-23-13335(R); Published: 16-Jul-2023