Review Article: 2023 Vol: 27 Issue: 1

Funding Issues and Challenges of Conventional Energy Market In the Esg Conscious World

Sumit Kumar, Indian Institute of Management Kozhikode

Citation Information: Kumar, S. (2023). Funding issues and challenges of conventional energy market in the esg conscious world. Academy of Marketing Studies Journal, 27(1), 1-10.

Abstract

Energy plays an important role in our life. Traditionally investing in energy was considered a great investment from a return perspective. With an increased awareness of ESG (Environment, Social and Governance) and Climate risk among investors, there is evidence of investment not being channeled to the conventional energy sector for the past few years. This has caused a major decline in investment in this sector. In the current research, we wanted to give evidence of how the investment has shrunk into this sector and issues arising because of it. The conventional energy sector needed more funds to re-invent themselves transition from operating at higher ESG risk level to Lower ESG. This lower ESG risk transition requires adequate funding and funding has become a challenge due to the ESG concerns of the conventional energy sector. This paper examines how the traditional energy sector has stuck into a funding spiral and it is challenging to come out of the situation.

Keywords

ESG, Sustainability, Carbon Footprint, Fossil Fuel, UNSDG, Sin Sector.

Introduction

Energy is extremely important in our life. Investing in energy has traditionally been regarded as a sound financial decision. There is evidence that investment has shifted away from the traditional energy industry in recent years as investors get a better understanding of ESG (Environmental, Social, and Governance) and climate risk. As a result, there has been a major reduction in investment in this sector. The traditional energy business requires more capital to re-invent itself and go from a higher ESG risk level to a lower ESG risk level Kumar et al. (2021). This reduced ESG risk transfer necessitates sufficient funding, which has proven problematic due to traditional energy's ESG issues. Commissioner Peirce (SEC Commissioner) popularized the term ESG Shame when she equated ESG Shaming to the new "Scarlet Letters." Energy companies are embarrassments in terms of environmental, social, and governance (ESG). Traditional investors such as hedge funds, institutional asset managers, and other fund managers have historically had a strong return on investment from these energy businesses, but because they carry a significant ESG risk, they have been primarily placed in the Sin Stock category. This has moved investors away from the business, especially when it comes to raising capital to upgrade goods and operations. For this industry, this has produced a vicious spiral. They have no money to enhance their ESG score, particularly in terms of reducing air pollution, and because they are unable to address their emission concerns due to a lack of cash, no investors are willing to invest in them, and they do not receive funding Aaltonen (2013). Because the energy demand forecast indicates that, even though we are rapidly catching up with alternate sources of energy that have much better ESG points, the conventional energy source will still be the primary source of energy for us in the next 12-15 years, it is critical to keep this industry safe and secure with lower emission issues.

Sin Stock

Sin stock or for that matter any Sin investments are those investments that do not incorporate positive social norms including but not limited to Environment, Social and Governance norms, and other related areas. Sin stocks, defined as shares of public firms active in the alcohol, gambling, and cigarette industries, have been proven to yield significant positive anomalous returns in several studies. Despite this, many investors omit sin stocks from their portfolios in order to avoid being associated with these firms' activities. Individual conduct is significantly influenced by social norms (Kubler, 2001). If the investment activities are done using these social norms as screening factors for the investment, then Sin Stocks would generally be “Screened Out” for investment.

Review of Relevant Literature

There has been a considerable increase in the number of securities, regulators, and trading exchanges throughout the world that have recognized the relevance of ESG (Environmental, Social, and Governance) issues in investing decisions during the previous few decades. Empirical research suggests that including ESG factors into an investment portfolio can result in a more stable return, less volatility stock performance, and overall, a significantly better risk-adjusted return. In 1987, the World Commission on Environment and Development established the term "sustainable development." It was described as progress that did not jeopardize future generations' ability to fulfill their own needs.

ESG integration is defined by Eurosif (2014) as "the explicit incorporation of ESG risks and opportunities into traditional financial analysis and investment choices by asset managers based on a systematic methodology and relevant research source." We've witnessed a trend in recent years of firms being measured and evaluated based on their Environmental E, Social S, and Governance G characteristics. The Paris Climate Agreement and the Sustainable Development Goals (SDGs) adopted by the United Nations in 2015 functioned as drivers for increasing the adoption and monitoring of sustainable corporate practices. Companies are increasingly considering ESG policies and issues as part of their business or risk management, as opposed to their general corporate social responsibility (CSR) efforts, thanks to initiatives like the United Nations Principles for Responsible Investment (UN PRI), which was launched in 2007. (UN PRI, 2018). World Bank (2018) defines the ESG Investing activities as, Environmental, social, and governance problems that are factored into the analysis, selection, and management of assets in ESG investing. The following are some of the most important aspects to think about:

E: climate change, carbon emissions, pollution, resource efficiency, biodiversity.

S: human rights, labor standards, health & safety, diversity policies, community relations,

development of human capital (health & education);

G: corporate governance, corruption, rule of law, institutional strength, transparency.

Impact of ESG Management in Investment Decisions

Institutional investors value environmental and governance aspects more than social factors, according to the findings of this study. Investors' investment decisions are influenced more by factors such as shareholder rights, pollution and waste, greenhouse gas emissions, and risk and opportunity management Park & Jang (2021). ESG provides investors with significant and possibly valuable information that affects both potential profits and risk Bender et al. (2018). Sustainability measures may increase company value and promote sustainability Freeman (2010), provide distinction and cost savings Porter et al. (2019), boost the level of employee engagement Agarwal et al. (2012), and improve employee productivity and customer retention Park (2020). Kim & Park (2017). One of the research projects Eccles et al. (2014) found that corporations that voluntarily adopted sustainability policies by 1993—dubbed high sustainability companies—exhibited distinct organizational processes by 2009 when compared to a matched sample of companies that adopted almost none of these policies, dubbed low sustainability companies. Another related research (Nagy, Kassam, and Lee, 2016) examines two global strategies with relatively significant tracking errors built using ESG data—a tilt strategy and a momentum strategy—and show that both model portfolios beat the MSCI World Index over the last eight years while also improving the portfolios' ESG profile. These back-tested model portfolios show how institutional investors that are willing to accept some active risk while also trying to enhance their portfolios' ESG profile on a regular basis may include such methods into their investing procedures. There are studies (Duren et al.,2017) that suggest that ESG data is used by fund managers for risk management and red flagging. One such study (Mervelskemper and Streit,2017) of the direction and extent to which financial market investors target an organization's ESG performance concluded that it is significant. Institutional asset managers do take into consideration the importance of ESG reporting and its value creation for the investment portfolio Landau et al. (2020). A similar study but for the Hedge Fund Managers Amel-Zadeh & Serafeim (2018) highlights the applicability of ESG data into portfolio construction and optimization. A related work Henisz & McGlinch (2019) supported the idea that having a strong ESG offer allows for greater value development. Outstanding growth, cost-cutting, regulatory and legal Intervention, capacity expansion, and investment and asset rationalization are all examples of this. The most important KPIs and reporting structures that investors pay attention to while managing their portfolio investments Sridharan (2018). There is an established relationship between Corporate Financial Planning and ESG criteria Friede et al. (2015). The association between corporate financial performance and ESG in the commercial banking industry has been discovered through experimental investigation Kotsantonis & Bufalari (2019). In a review of ESG practices in the Middle East and North African (MENA) region, it was concluded that ESG Index supports the hypothesis that a better ESG score can positively impact financial performance (Hawkamah, 2014). In a study of the impact of ESG disclosures on the market value of Egyptian firms Aboud & Diab (2018) It was concluded that companies listed on the ESG index reflected higher firm value relative to the unlisted companies. Furthermore, the results indicate a positive relationship between the quality of ESG and firm value. In the case of Korean firms Yoon et al. (2018) it was found the ESG factor inclusion in the investment decision has a positive impact on the firm market value.

Pricing ESG Risk in Energy Sector

Oil and gas contributed for 2.55 percent of S&P Global's total investments in February 2021, while coal and consumable fuels accounted for 0.36 percent. Despite the tiny percentages, the investments are significant, totaling close to $255 billion and $36 billion in the energy industry, respectively. The United Nations Environment Program (UNEP) has produced a useful assessment of significant academic and broker papers on responsible investing and performance (2007). Half of the 20 academic research cited found that ESG elements had a positive impact on portfolio performance, three had a negative impact, and the rest were neutral. Three of the ten investment broker reports examined were favorable, while the others were indifferent. A similar study Clark et al. (2015) also came to the same conclusion. Commodity derivatives are the most common means for institutional investors to gain exposure to commodities Till (2009). Commodity futures are one of the most frequent ways to gain exposure to commodity prices or to place a market bet on them. In an investigation (IPIECA,2002) the activities and investment efforts undertaken by firms in Brazil and South Africa’s oil and gas company were in the pursuit of sustainability. In a comprehensive study (Voisin and Lamotte, 2006) on the impact of carbon on the oil and gas industry, the findings revealed a positive return on investment, but they also cautioned that the impact might take time and that the study window should be substantially larger (2 years in that research). One more research Meade et al. (2006) found a similar result. It is important to arrive at an ESG framework especially for the Energy sector. In the oil and gas sector, a standard for ESG management has been proposed Forrest et al. (2006). A critical examination of the regulation to encourage ESG integration in the oil and gas sector in both upstream and downstream processes, as well as a comparison of different options. UBS study (Potter,2007) has also been released to look at ESG concerns in the oil and gas sector, particularly among "Deep Well" producers.

Market Evidence of Sin Stock

ESG concerns in Conventional Energy Sector

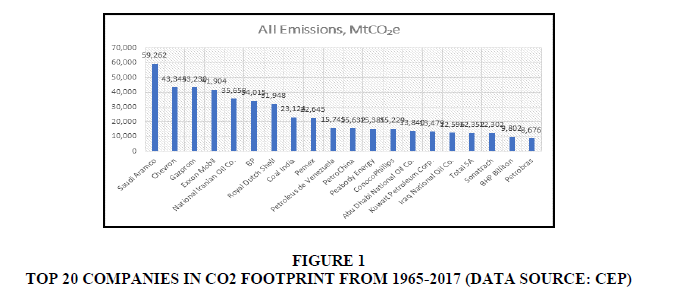

Highest Carbon footprint: Carbon footprint refers to the total amount of carbon dioxide and other greenhouse gases (GHGs) emitted during a certain time period Allen & Pentland (2011). Unfortunately, the top 20 corporations with the biggest carbon footprint contributions are all from the energy industry. Pic1.1 shows the total carbon footprint of the top 20 firms since 1965, including all 20 companies in the energy sector Figure 1.

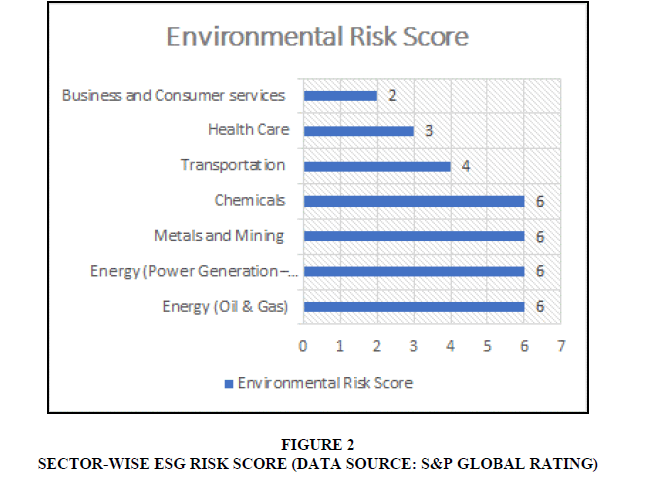

Pollution and GHG ( Green House Gas) emission is one of the perennial problems in the conventional and fossil fuels-based energy sector. GHG EPA (2016) emissions and resulting health hazards are direct blame that CES (Conventional Energy Sector) must face. S&P has come up with a rating methodology to provide environmental risk scores to the various industry within S&P 500 (S&P, 2021). According to this report, the highest ESG risk is associated with Energy Sector (Oil & Gas) along with Power generation. Figure 1.2 depicts the comparative Environment Risk Score Figure 2.

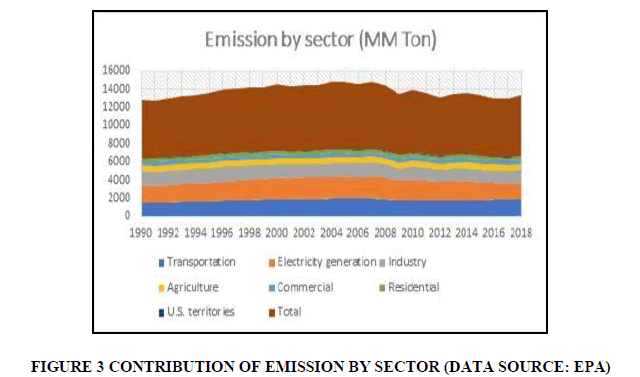

While there are other sectors who has a bad reputation from an ESG risk perspective, for example, the transportation sector, some segments of the agriculture sector, Commercial real estate, in some cases pharma and medical sector, the whole blockchain, and Cryptocurrency mining but with CES (Conventional Energy Sector) the ESG issues are more visible. One can easily see a refinery IEA (2019) excreting hazardous Inderst & Stewart (2018) gases and other harmful excretions Kübler (2001). Visuals stay in a human memory more than published data somewhere in a news website (Brady et al., 2008) and this orients our interpretation in a particular direction. As shown in figure 1.3, even though the contribution of the energy sector to the total emission is higher than other sectors but other sectors are also not insignificant players in harmful emissions Figure 3.

As one can see above there are other sectors that are also to be blamed for the environmental concerns and the conventional energy sector (CES) shouldn’t be singled out, but unfortunately, that is the case with this sector. The ESG concerns of the Oil and gas sector have harmed this sector in multiple ways. Adverse perceptions of the general public especially investors have kept the investment flow away from this sector.

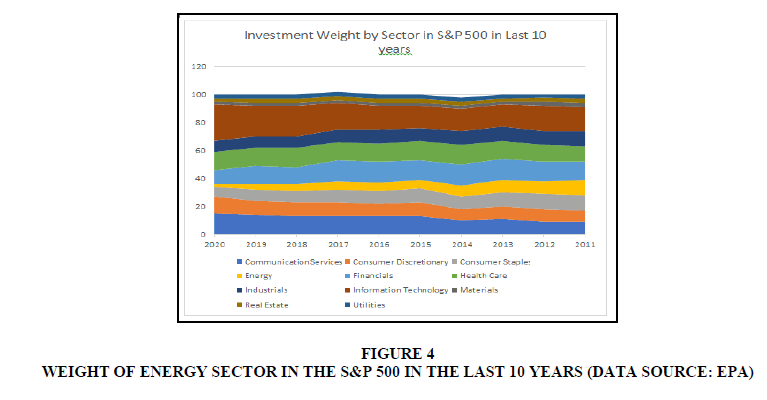

Shrinking Investment due to the ESG concerns in the Conventional Energy Sector (CES) Issues with Shrinking Investment: In recent years, investments in this area have been reduced due to environmental concerns and increased awareness. This industry is struggling to stay afloat, but it lacks the financial means to support research and development on emissions reduction. Figure 1.4 depicts how the statistical weight of CES (Conventional Energy Sector) has shrunk in the last 10 years Figure 4.

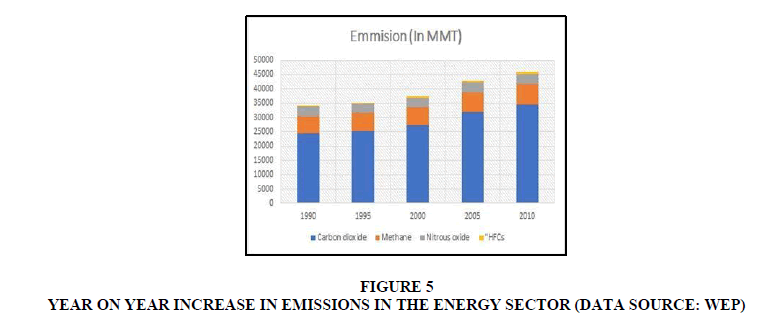

One of the reasons might be the growing emission difficulties, and fund managers do not want to be associated with investing in sectors that involve ESG risk, even if they wish to achieve higher profits Owens & Sykes (2005). It is true that pollution issues have worsened in recent years Van Duuren et al. (2016). As indicated in Figure 1.5, emissions Mously et al. (2009) from conventional energy sources have grown, although the growth is not significant, and it may require further R&D expenditure in this sector Figure 5.

Some firms have done a lot of research and development to try to manage the threat of emission risk, but they require funding and the continued attention of institutional investors who have shied away from this industry because of ESG concerns. In this industry, we primarily want an investing strategy that incorporates ESG into investments in a proportionate manner. In an ideal world, we'd identify an investment parameter/efficiency parameter in this sector that, when targeted, integrates a substantial ESG element into the investment by its link to one or more ESG parameters. The most significant ESG pillar for the Energy industry is E (Environment), and within E (Environment), CO2 and GHG emissions have caused a big concern and kept investors away from this sector. So, while investing in energy firms, the goal is to maximize profit while keeping the portfolio companies' total emission grade as high as possible, so we need to figure out which economic performance indicator is directly and positively related to the ESG criteria.

We Cannot Ignore the CES (Conventional Energy Sector)

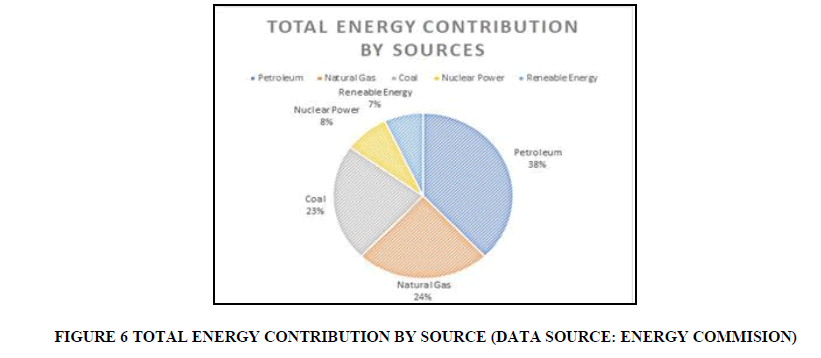

Demand Forecast: While emission concerns are a rising worry within the research community in this field, the truth remains that traditional energy sources such as fossil fuels, oil, and gas continue to contribute a significant amount of energy, as shown in Figure 6.

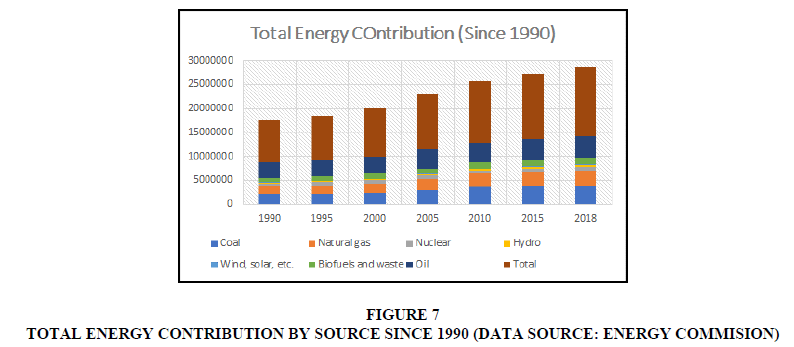

Historically speaking CES (Conventional Energy Sector) has been the primary contributor to the total energy demand. Proportionally this sector is the major provider of the total energy requirement globally. Figure 1.7 shows the significant contribution of CES (Conventional energy Sector) to satisfy the global requirement huge energy requirement Figure 7.

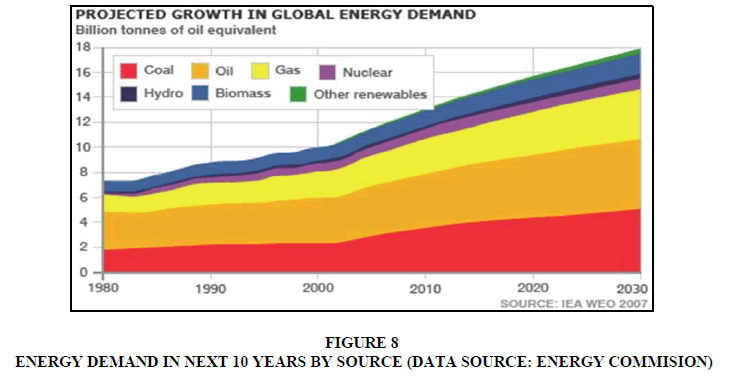

In addition, traditional energy sources are expected to be in high demand over the next 30-40 years. In reality, as illustrated in Figure 1.8, demand for fossil fuels, hydrocarbons, and other traditional energy sources is expected to rise in the next 10-12 years Figure 8.

So as we can we this sector is still a primary provider of the energy required for the long term in future. This sector requires proper attention and investment so that it can revive and stay healthy with better emission and ESG ratings in the next foreseeable future. It is important to make the investment community understand that this sector is really important from a money and investment inflow perspective.

Conclusion

In our life, energy is highly crucial. Historically speaking, investments in energy were considered to be profitable business ventures. There is evidence that investment has been redirected away from the traditional energy industry in recent years as a result of increased investor understanding of ESG (environmental, social, and governance) and climate risk. Because of this, there has been a huge reduction in the amount of money invested in this sector. In the current study, we wanted to demonstrate how investment has decreased in this area as well as the issues that have emerged as a result of this reduction in investment. In order to reinvent itself and go from a higher ESG risk level to a lower ESG risk level, the conventional energy business required a greater amount of cash. This decreased ESG risk transfer requires a sufficient amount of financing, which has been challenging due to the ESG issues associated with traditional energy. This research investigates how the conventional energy industry became trapped in a cycle of funding, as well as how difficult it is to break free of that pattern.

The market data analysis of demand and investment patterns in the CES (Conventional Energy Sector) is very much in accordance with the ESG-based paradigm shifts in the investment that are recorded in the literature research. Because it is already in the ESG risk zone and is seen as a "screened out" sector from an investment point of view, additional capital must be invested if it is to achieve a higher level of performance with regard to the ESG aspects. In order for investors to return to this industry without feeling any ESG shame, a model is required to correlate the ESG factors with the Investment parameter or ratio. It is necessary to conduct research and development in order to determine a set of investment ratios or efficiency ratios, in such a way that if these ratios are used in the process of making investment decisions or in any activity involving the construction of investment portfolios, the ESG factors will be automatically integrated.

References

Aaltonen, A. (2013). Environmental, social and corporate governance practices in the MENA region 2007–2012.

Aboud, A., & Diab, A. (2018). The impact of social, environmental and corporate governance disclosures on firm value: Evidence from Egypt.Journal of Accounting in Emerging Economies.

Agarwal, U.A., Datta, S., Blake?Beard, S., & Bhargava, S. (2012). Linking LMX, innovative work behaviour and turnover intentions: The mediating role of work engagement.Career development international.

Indexed at, Google Scholar, Cross Ref

Allen, S.R., & Pentland, C. (2011). Carbon Footprint of Electricity Generation: POSTnote 383.

Amel-Zadeh, A., & Serafeim, G. (2018). Why and how investors use ESG information: Evidence from a global survey.Financial Analysts Journal,74(3), 87-103.

Bender, J., Bridges, T.A., He, C., Lester, A., & Sun, X. (2018). A blueprint for integrating ESG into equity portfolios.The Journal of Investment Management,16(1).

Meade, D. Morrow, D. Sasrean, S, Viets: (2006) ‘Integrated oil & gas: sector report’, Innovest Strategic Value Advisors,

Clark, G.L., Feiner, A., & Viehs, M. (2015). From the stockholder to the stakeholder: How sustainability can drive financial outperformance.Available at SSRN 2508281.

Indexed at, Google Scholar, Cross Ref

Eccles, R.G., Ioannou, I., & Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance.Management science,60(11), 2835-2857.

EPA (2016), Global Green House Gas Emissions.

Eurosif. (2014). European SRI study. Brussels : Eurosif.

Freeman, R.E. (2010).Strategic management: A stakeholder approach. Cambridge university press.

Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies.Journal of sustainable finance & investment,5(4), 210-233.

Indexed at, Google Scholar, Cross Ref

Henisz, W.J., & McGlinch, J. (2019). ESG, material credit events, and credit risk.Journal of Applied Corporate Finance,31(2), 105-117.

Indexed at, Google Scholar, Cross Ref

IEA (2019), World Energy Investment 2019, IEA, Paris.

Inderst, G., & Stewart, F. (2018). Incorporating environmental, social and governance (ESG) factors into fixed income investment.World Bank Group publication, April.

Indexed at, Google Scholar, Cross Ref

Kim, W., & Park, J. (2017). Examining structural relationships between work engagement, organizational procedural justice, knowledge sharing, and innovative work behavior for sustainable organizations.Sustainability,9(2), 205.

Indexed at, Google Scholar, Cross Ref

Kotsantonis, S., & Bufalari, V. (2019). Do sustainable banks outperform? Driving value creation through ESG practices.Report of the Global Alliance for Banking on Values (GABV).

Kübler, D. (2001). On the regulation of social norms.Journal of Law, Economics, and Organization,17(2), 449-476.

Indexed at, Google Scholar, Cross Ref

Kumar, S., Baag, P.K., & SK, V. (2021). Impact of ESG integration on equity performance between developed and developing economy: evidence from S and P 500 and NIFTY 50.Empirical Economics Letters,20(4), 01-16.

Landau, A., Rochell, J., Klein, C., & Zwergel, B. (2020). Integrated reporting of environmental, social, and governance and financial data: Does the market value integrated reports?.Business Strategy and the Environment,29(4), 1750-1763.

Mously, K.A., Campbell, J.A., & Cowie, M. (2009). The International Association of Oil & Gas Producers (OGP) Naturally Occurring Radioactive Material (NORM) Management Guideline. InAsia Pacific Health, Safety, Security and Environment Conference. OnePetro.

Owens, J., & Sykes, R. (2005). The International Petroleum Industry Environmental Conservation Association social responsibility working group and human rights.International Social Science Journal,57, 131-141.

Park, K.O. (2020). How CSV and CSR affect organizational performance: A productive behavior perspective.International Journal of Environmental Research and Public Health,17(7), 2556.

Indexed at, Google Scholar, Cross Ref

Park, S.R., & Jang, J.Y. (2021). The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria.International Journal of Financial Studies,9(3), 48.

Indexed at, Google Scholar, Cross Ref

Porter, M., Serafeim, G., & Kramer, M. (2019). Where ESG fails.Institutional Investor,16(2).

Forrest, A. Ling, M. Lanstone, J. Weghorn: (2006 )‘Enhanced energy ESG framework’, Goldman Sachs,.

Sridharan, V. (2018). Bridging the Disclosure Gap: Investor Perspectives on Environmental, Social & Governance (ESG) Disclosures.Social & Governance (ESG) Disclosures (May 11, 2018).

Indexed at, Google Scholar, Cross Ref

Till, H. (2009). Has there been excessive speculation in the us oil futures markets? what can we (carefully) conclude from new cftc data?.What can we (carefully) conclude from new CFTC data.

Van Duuren, E., Plantinga, A., & Scholtens, B. (2016). ESG integration and the investment management process: Fundamental investing reinvented.Journal of Business Ethics,138(3), 525-533.

Yoon, B., Lee, J.H., & Byun, R. (2018). Does ESG performance enhance firm value? Evidence from Korea.Sustainability,10(10), 3635.

Indexed at, Google Scholar, Cross Ref

Received: 18-Oct-2022, Manuscript No. AMSJ-22-12694; Editor assigned: 19-Oct-2022, PreQC No. AMSJ-22-12694(PQ); Reviewed: 02-Nov-2022, QC No. AMSJ-22-12694; Revised: 09-Nov-2022, Manuscript No. AMSJ-22-12694(R); Published: 10-Nov-2022