Research Article: 2020 Vol: 24 Issue: 4

Gb Multiplex: Demand Forecasting Pricing for A Movie Ticket & Strategy for Revenues Maximization Using Market Research

Abstract

The case discusses the application of market research technique for pricing a product and service at very first time (Movie ticket pricing in a multiplex in tier-2 city in emerging market), along with demand forecasting, revenue maximization and understanding break-even analysis. Further, how a survey is designed, the instrument is validated, data is collected and analyzed and how the survey is implemented, is discussed in details in the case. The case also discusses that how price elasticity is used to forecast the demand and understand consumer behavior in an emerging market. Further, the subtle relationship between pricing and its possible impact on the sale of auxiliary products and how the demographics of the target audience influence decision making of consumers in emerging economies are discussed.

Keywords

Market Research, Survey, Demand Forecast, Break-Even Analysis, Price Sensitivity, Consumer Behavior.

Introduction

Ronit was glancing at the survey results when memories of the first launch, in Mumbai, flashed before his eyes. The planning exercise, the mixed feelings of apprehension and excitement, the nervousness and the courage it had taken to go through with the execution of the plan, were all back in an instant. The GB Group owned a chain of multiplexes across India, and operated in X-class cities like Delhi, Bengaluru, Mumbai, and metropolitans which included Gurugram, Jaipur, Kochi, Hyderabad. Ronit Sharma, the Chairman of the GB Group, saw an opportunity to expand the business to Y-class and Z-class cities and to exploit demand for multiplexes. GB group was about to launch a four-screen multiplex in Kota, (Rajasthan state of India). Kota is considered as the education hub of the country. The city boasts of a number of private educational institutes (popularly known as coaching institute in local language), which provide educational services to the students for engineering and/or medical school entrance examinations. Kota is popularly labeled as the “city of students”. The newly constructed multiplex had a capacity of 400 seats for a particular show of 3 hours duration movie, split across two screens with 120 seats each (120+120=240 seats), and two smaller screens with 80 seats each (80+80 =160 seats). (refer Figure 1 for details).

The management had realized that single screens cinema houses were frequented more by student’s population and not by family, Management realized the quick need for quality family entertainment cinema house in the city. “Our aim is to replicate the city multiplex experience at a lower cost,” Ronit noted. With lower viewership, single screen theatres were dying out in Y-class and Z-class cities, while multiplexes were tapping into these markets with affordable prices of their tickets, food and beverage offerings. According to industry experts, there were a little over 10,000 screens across the country then, against a couple of thousands that existed a few years ago. The GB Group, thus, decided to invest ? 3 billion to set up over 80 multiplexes in Y and Z class cities, which were new to Ronit, who had a rich experience in selling entertainment value proposition in only X-class and metropolitan cities.

The City of Kota

Kota is located in the southeast region of the Indian state of Rajasthan, located around 250 kilometers (155 mi) south of the state capital, Jaipur, and is situated on the banks of Chambal River. With a population of over 1 million, it is the third most populous city of Rajasthan state after Jaipur and Jodhpur, and is the 46th most populous city of India. It is primarily known for its education service sector for engineering and medical entrance exam preparations. Traditionally, the city is also a trade center for cotton, millet, wheat, coriander and oilseeds, cotton and oilseed milling, textile weaving, distilling, dairying, and manufacturing of metal handcrafts. The city of Kota is also popular for stone-polishing, ingenious to the region, and the stone being a namesake, Kota stone, which is mainly used for flooring and walls of residential and business buildings. For past two decades, the city of Kota has emerged as a popular destination for competitive entrance exams preparation.

The education sector of Kota had become a major contributor to the city's economy. Annually, over 150,000 students from all over the country flock every year towards the city for preparation of various exams such as IIT-JEE, NEET-UG and AIIMS-PMT, etc. Many hostels and PGs (paying guest accommodations) for students are available near the vicinity of coaching centers, where students live for two to three years. The annual turnover of the Kota coaching industry is ? 15 billion.

Cinema as Industry in India

India is the largest producer as well as consumer of movies in the world. In a year, more than 2,000 movies are being produced in more than 20 languages. The citizens are fond of watching movies and the movie stars. In spite of high demand of movies, the availability of screens to release these movies are very less. In India, one screen per 96,300 residents is available. It is the world’s most under-screened territory. In contrast, The U.S. has one screen per 7,800 residents and China has one screen per 45000 residents. With such shortages of movie theaters and screens, many Indian movie fans are simply unable to watch these movies in the theater.

Further, India’s movie theaters are sub-par in infrastructure quality and operations. More than 10,000 of the country’s 13,000 screens are single-screen cinemas, operates are extremely poor economies of scale. On the other hand, modern multiplexes operate at lesser costs because of economies of scale and these multiplexes are able to fetch higher prices, as they attract a different segment of population. Further, the cost of production of these movies are higher. Since most of the movie producers are from different regional culture, they produce movies in 20 different languages. Unlike west, where most of the movies are produced in single language (i.e. North America, China), the average cost of movie production in India is significantly higher. The other reason of being high price of the movie tickets in Indian is, high tax policy of the government. In India, movies are under double tax policy (Entertainment tax and Service tax). Double tax policy has made movie production business in India is extremely unattractive and risky. In addition, piracy is also rampant in the country. Indian film industry loses around ? 180 billion (US$3.34 billion) and some than 60,000 jobs every year because of piracy.

Multiplex Industry in India

The cinema exhibition industry, which has witnessed significant consolidation in recent years, would have over 3,000 multiplex screens by 2020, said a ratings agency, ICRA (Information and Credit Rating Agency). Players like PVR, Inox, Carnival Cinemas, and Cinepolis, which account for more than 70 per cent of the total screen count, have changed the market dynamics. Since it is expected that the number of multiplex screens would cross 3,000 by 2020, and most upcoming malls are being constructed in Y-class and Z-class cities, a majority of new screen additions would happen in these places. The industry would also be helped by factors as increase in disposable income and changing consumer preferences for an enhanced movie-watching experience. Moreover, increasing number of malls with multiplexes has also contributed to the shift from single screen theaters to multiplexes. Multiplex screens in India have grown at a CAGR of 13.5 per cent during 2009 to 2019; while the film exhibition industry continues to be dominated by single screen theaters, which are almost three times the number of multiplex screens. Despite healthy growth, the screen penetration remains significantly low at six screens per million of population as compared to developed countries such as the USA, which is estimated to have over 125 screens per million of population with over 40,000 screens at the end of FY2019.

The GB Multiplex: Exploring the Economy for Sustenance

The new GB multiplex had 4 screens with the capacity to run 24 shows daily, and the number of movies run would depend on their popularity and the audience interest in watching those movies. The eateries within the multiplexes had already been allocated as vendors showed tremendous interest in a multiplex facility, knowing that they could also charge more in the multiplex as compared to other outlets. The eateries had been allocated on an annual contract of ? 20 million. Parking was also another money-making avenue, depending on the multiplex occupancy. Multiplexes had a parking space for 100 cars and 150 motor bikes. Considering a 50% occupancy, the revenue from parking were estimated at ? 2 million per month.

Using Existing Research

In order to succeed, GB multiplex needed to find out the target customer base and their probable footfall. Ronit also looked at available research data for Indian audience, more specifically for Y-class cities. The social aspect of watching a movie in India is more important that the movie exhibition itself, and it appears as exaggerated when compared to the West. Public places such as cinema theatres are centers for enjoyment in group and experience family outing, in contrast to many Western societies, where it is now an acceptable practice to watch a movie, or even eat at a restaurant by oneself. However, movie experiences in India often involve families, friends and co-workers. In addition to couples as movie-goers, groups may be composed of four to eight people, or even ten individuals or more. Families going together include all age groups such as infants, toddlers, young adults, and the elderly people are also part of the group. In India, watching movies in theatre is a group activity, rather than an individual activity in the West.

As far as revenue is concerned, ticket income is the largest contributor to the multiplexes and is a function of the total number of seats, average number of daily shows, average ticket price, and average occupancy levels. Ticket revenue contribution varies between 70 to 77% of the total revenue, half of which is earned over the weekends when the occupancy levels are generally higher. Food & Beverage revenue, includes sale of items such as popcorns, cold drinks and confectionary items, and contributes to 20 to 22% of the total revenue. This revenue is generally directly proportional to the average number of patrons. Advertising revenue, both on-screen and off-screen, is a relatively small source of income; and is generally around 3 to 5% of the total revenue.

Of the various costs incurred by multiplexes, a major chunk is the entertainment tax and payments to distributors, which accounts for about 18 to 20% of the total revenue. Operational cost on account of property is 15-20% of the turnover. Other costs include cost of Food & Beverage (F&B), employees, marketing, and utilities like electricity, water, security, maintenance, IT, and telecom etc., but such overheads are lower per screen since most of it is distributed across multiple screens Table 1. Either way, multiplexes enjoy better bargaining power with producers, distributors and F&B suppliers. Distributor cost is the cost incurred to acquire the film content and is normally paid as a percentage of the net balance of total box office collections after paying all the taxes (notional or actual). It accounts for about 35% of the total ticket revenue. F&B cost is the cost of various food and beverages items and equipment, which is about 6 to 7% of the total cost. Salaries and wages of staff form the remaining cost.

| Table 1: Estimated Annual Operating Expenses, Gb Multiplex Kota | |

| Expenses | ? |

|---|---|

| Movie Exhibition | 37,800,000 |

| Property | 22,050,000 |

| Food & Beverages | 9,450,000 |

| Salaries & Wages | 17,850,000 |

| Maintenances & Repairs | 5,250,000 |

| Others | 12,600,000 |

| Total Expenses | 105,000,000 |

Ronit also had access to data of research done on the multiplex market in India and trends in Y-class cities (Table 2), conducted by Movitone Consulting, a research firm specializing in movie industry research. The data showed that Rajasthan was among the states with the least number of multiplex screens available. The population between the age group of 15-34 years is the most frequent movie-going segment of the country and growth in this segment would propel growth in the multiplex. As Kota has a large population of students in the age group of 18 to 22 years old, if the multiplex is opened, customers would not be hard to find. Kota is a city predominantly inhabited by middle class families and hence watching the trends of middle-class families with higher earned incomes and greater disposable incomes could be one of the key success factors in driving footfall growth in the multiplex.

| Table 2: Selected Findings From Movitone Survey | |||

| A. Total Percent of Patrons by Age [Age?] | |||

| Movie | Fairs | Others | |

| Students | 90 | 4 | 6 |

| Single Adults | 77 | 8 | 15 |

| Families | 67 | 25 | 8 |

| Elderly | 48 | 7 | 45 |

| B. Income Composition of Audience (figures in ?) | |||

| Movie | Fairs | Others | |

| 1,00,000 and over | 70% | 8% | 22% |

| 75,000 to 99,999 | 77% | 11% | 12% |

| 50,000 to 74,999 | 82% | 9% | 9% |

| 25,000 to 49,999 | 87% | 11% | 2% |

| Up to 24,999 | 92% | 7% | 1% |

| C. Educational Composition of Audience | |||

| Movie | Fairs | Others | |

| Master’s Degree | 60% | 17% | 23% |

| Bachelor’s Degree | 79% | 10% | 11% |

| College | 86% | 13% | 1% |

| High School | 91% | 9% | - |

Y-class cities having multiple single-screen theatres, has been the norm for a long time, and owing to operations under fragmented ownership, unclear control, and scarcity of funds for maintenance and upgradation, they resulted in lower occupancy rates and lower ticket prices. This provided an opportunity for multiplexes, which meant higher occupancy rates and thereby and opportunity for exhibitors to charge higher ticket prices.

To design ticket offers, Ronit had to understand in detail the behavior of consumers of Kota and figure out what an average citizen might be willing to pay for such an experience. Ronit planned to analyze the data available from Movitone, which examined the audience characteristics. Ronit felt that he also needed a detailed, methodological, and rigorous study of the industry to build the GB Multiplex pricing strategy. He decided to move forward and conduct a primary market research survey. He thought that making a decision without any tangible data backing, could prove to be a risky affair.

Designing the Survey

Ronit was clear that his primary research objectives were to predict how many people would come to watch the movies in the multiplex, and how much to charge them. He knew that he needed to identify the multiplex audience in terms of demographics and their social behavior, and he wondered what else he may need to know. First, Ronit conducted telephone interviews with other counterparts who were multiplex owners in other Y-class cities in the northern and western parts of India, where majority of the moviegoer’s viewed movies in Hindi, the official and most spoken language in India. Most of these multiplex owners emphasized the need to price the seats at par with other available means of entertainment, like fairs, circus, and other programs. They also emphasized on having a different pricing strategy for weekends as compared to weekdays. Some also pointed out the growing popularity of Hollywood movies in the young adults and suggested this factor to be considered while pricing the tickets. But none of them was able to explain that how to include local factors into a price building activity.

Few of the multiplex owners also highlighted how they differentiate prices for afternoon vis-à-vis evening and night shows, pricing for evening and night shows being higher than the matinee show. But they were not able to point out exactly how they had arrived at the price currently being charged at their multiplex. Ronit then realized the issues, particularly those involving differential pricing. Though he had past experience in dealing with such issues in metro cities, the sensitivity of Y-class citizens to price was becoming difficult to estimate. In addition, he was also thinking of food & beverage revenues which have a 55% contribution margin. From past data, he knew that there is 70% chance of a person visiting the multiplex and buying some food and beverage item. He needed to get clarity on the price differential and price elasticity of tickets for the target demographic in these cities through this survey.

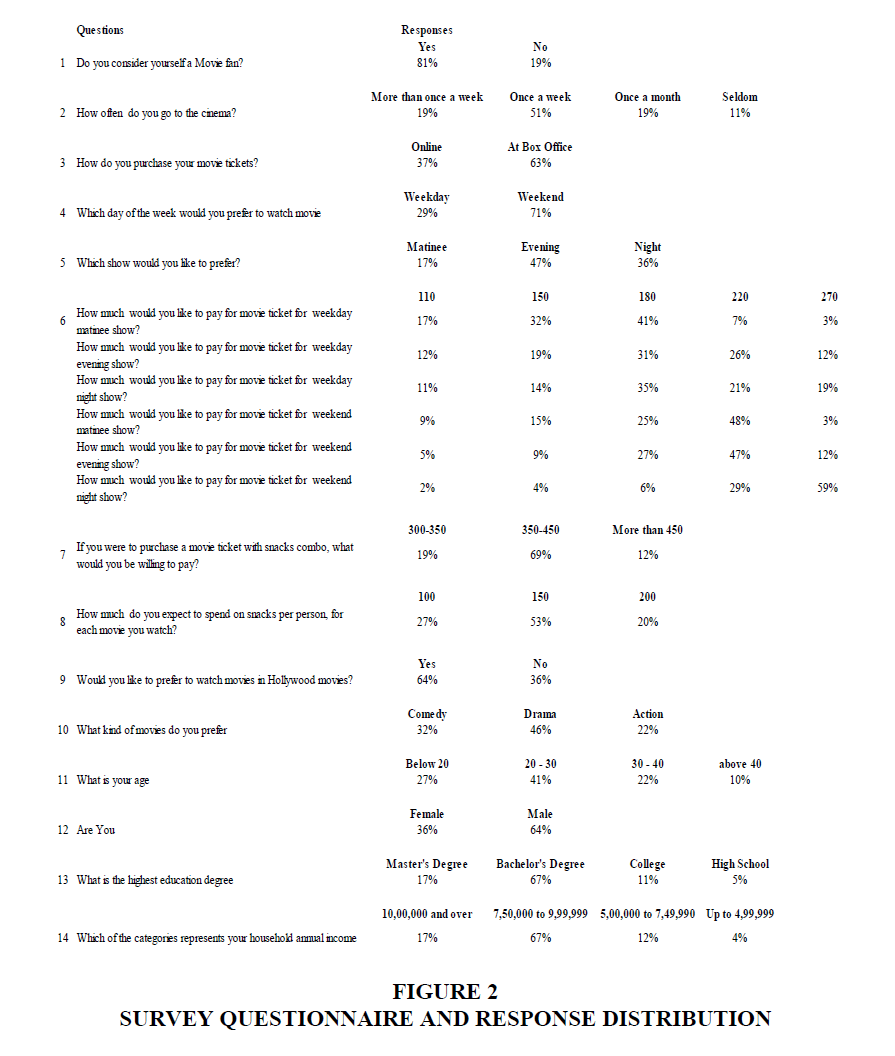

The research questions were hence designed with these three criteria in mind – maximum information yield for management decisions, question clarity for respondents, and ease of data analysis. At first, a mail survey was planned but then the idea was rejected on the account of time required to complete the activity. Ronit then had his team send out 10,000 emails to local residents with a link to the survey questionnaire. Upon completion, the respondent would be eligible for winning a shopping voucher worth ? 25,000. The online survey was pilot tested on friends and GB group staff members to ensure that important criteria of the survey were met. Some feedback acquired via the pilot, was also incorporated into the final survey. These changes reflected the audience acceptance of the fact that evening, night, and weekend shows would be priced higher than others. The online data from the survey was to be tabulated real time as the survey was being conducted. Ronit estimated that it would take about 20 days to get the survey completed and data ready for analysis. He also felt that the total cost of conducting the survey would be ? 65,000, including the prize money, was reasonable for getting the data collected.

Developing the Sample

After identifying the categories of information required – consumer price sensitivity and movie consumption patterns, questions related to those in addition to movie, seat, location preferences, and demographics were added to the final questionnaire. The mailing list for the questionnaire was drawn from the Kota district census report. Another list was also collected from a broker who provided the data from a retail chain, in confidentiality and with a Non-Disclosure Agreement, at the cost of ? 5,000 per name. Within a week, the GB group started getting responses to the questionnaire and the response rate increased as the days passed. Finally, 755 responses were received, which would be considered a decent response rate for an e-survey, via e-mail.

Although there was a variation in the response rates for the list from the census and that from the broker, but subsequent analysis showed no significant variation in the nature of responses from the respondents of the two lists. Ronit also checked, if the sample respondent characteristics were a fair representation of the entire city and he was pleased to know that they were. Although there were a lot of respondents from the age group of 18 to 25 years, but this was expected, as Kota had a lot of students in its population, which was also evident from the list supplied by the two sources.

Analyzing the Results

After the survey results were tabulated (Figure 2 with survey questions shows with percentage response distribution), Ronit constructed a pricing matrix; with rows as price of the ticket and columns with show classifications (refer Table 3). Then he used the survey to calculate the optimal prices and placed them in the chart. His strategy was to work out one year’s cost structure and to then figure out the required number of tickets he would need to sell to break even in the first year itself. Ronit with his experience from the multiplexes in metro cities was clear that he didn’t want to keep the prices too high for them to be a deterrent for the people to come to multiplexes and continue with single screen theatres. At the same time, he also wanted to have a clear differentiation in the service experience provided to the moviegoer. Hence, he could also not price the tickets too low, for people to be able to appreciate the difference and the additional value being provided in their overall experience.

| Table 3: GB Multiplex Pricing Matrix Worksheet | |

| Ticket Type | ? per ticket |

|---|---|

| Weekday – Matinee | 110 |

| Weekday – Evening | 150 |

| Weekday – Night | 180 |

| Weekend – Matinee | 220 |

| Weekend – Evening | 270 |

| Weekend – Night | - |

The single screen theatre tickets were priced at ? 100 for Balcony refers to a middle-class segment of movie theatre in India and ? 80 for Stall refers to a lower-class segment of movie theatre in India categories, which is a seat category differentiator based on the distance from the screen. The closer the seat to the screen, the less enjoyable the movie experience, and hence lower the price ticket, while the balcony gives a wider and better view and hence can charge more. The average occupancy of a theater is between 50 to 60% which often is a factor of the interest, a movie is able to generate. Ronit knew he would have to keep this in mind while deciding the ticket prices for his multiplex.

One Ticket, Please!

Ronit still did not know the comeback to this statement if a customer came and asked for the price of one ticket, and he continuously reminded himself of the aim to maximize revenue and audience number. Footfall would also bring the additional revenue from Food & Beverages (F&B), which captures the next big share after ticket sales, in terms of the revenue generated. Ronit also knew that determining the ticket and F&B revenue would help him analyze whether the break-even was a reasonable objective. He had decided to start with uniform pricing for the screen and not differentiate based on distance from the screen.

As he flipped through the survey results, he was wondering about all the challenges he had faced in his earlier launches in metros and how doing that again would not make him as anxious, as he was in this moment. However, he knew smaller cities were the next phase of multiplex growth and it was time to test out his gut feelings once again.