Research Article: 2019 Vol: 20 Issue: 4

Hot Money Inflow Monetary System and Inclusive Growth in Nigeria

Ogunrinola Ifeoluwa, Covenant University

Edo Samson, University of Benin

Bowale Ebenezer, Covenant University

Abstract

This study examines the interactive effect of hot money inflows and the monetary system on inclusive growth in Nigeria. The structural vector autoregressive (SVAR) technique is employed to examine this interactive effect. Findings from the study reveal that inclusive growth is positively and significantly impacted by hot money inflows passing through the monetary system. The study therefore, recommends that policies aimed at attracting more inflows of short term capital such as interest rate policies, exchange rate deregulation policies, lower inflation targeting policies, targeting higher GDP growth rates, and the development of stock market structure are to be uncompromisingly pursued.

Keywords

Foreign Portfolio Investment; Hot money Inflows; Inclusive Growth; Monetary System; SVAR

JEL Classification

E42; E52; F20

Introduction

The quest for the attainment of increases in the levels of inclusive growth patterns rather than the conventional dimension of growth targets have been at the centre of topical debates among academicians, policy makers, international agencies and government bodies in recent times. Essentially, conventional or real gross domestic product (RGDP) growth-led debates are now being less talked about, while debates in favour of inclusive growth have been on the rise. Growth is said to be inclusive when it creates economic opportunities along with ensuring equal access to them, and it also refers to the “pace” and “pattern” of growth inter-relatedly. It is about raising the pace for growth and enlarging the size of the economy, while levelling the ground for investments and improving productive investment opportunities (World Bank, 2009; Alfredo, 2010). However, the desire to attain such enviable levels of an inclusively led growth pattern may be impossible without a stable macro economy which rides on the wheels of a stable and well capitalized financial or monetary system.

For economies to enjoy stable growth episodes devoid of major macroeconomic imbalances or shocks, efforts by the monetary authorities who control the monetary system to maintain monetary stability become very necessary. This requires that the purchasing power of money-in the conduct of monetary policy by the monetary agents-be maintained and that money continues to perform its main functions through time. This translates into low and stable interest rates, which is an important factor for stimulating investment and capital accumulation and facilitating savings decisions and portfolio allocation, the stability of the exchange rate which can be defined in nominal or real terms, and the stability in the growth of money supply.

The Nigerian financial/money market has over the years, been found to be susceptible to instability because of the nature of uses of fund on short term basis to meet the philosophy of liquidity and profitability. Also, the continuous flow of short term funds through the banks in form of portfolio investment or “hot money” has contributed to this instability so experienced (Ajakaiye & Tella, 2014). Various studies have shown preferences for international capital inflow of long term nature in form of foreign direct investment (FDI) other than hot money in form of portfolio investments (FPI) (see for example Ashford, 2011; Obiechina & Ukeje, 2013). This is because portfolio investors can panic and withdraw their investments from economies without sound fundamentals. Hence, inflow of hot money according to diverse literature is considered dangerous to financial stability and growth since it can be withdrawn at short notice, given the slightest incidence of shocks.

Some studies have shown for Nigeria that increased flow of longer term capital such as FDIs have not helped transform the economy as expected. For instance, Danja (2012) reveals that despite heavy FDI inflow, the Nigerian economy has not enjoyed any benefit which should accompany such flows. These may be due to the repatriation of profits, incidences of high contract fees, high interest payments on foreign loans, choice of trade policy being practiced, and other unfavourable economic conditions. The works of Edozien (1968): Akinlo (2004): Oyejide (2005); Ayanwale (2007); for Nigeria and Dolan & Tomlin (1980); Saltz (1992); Greenaway & Sapsford (1994); Behzad & Reza (1995); Chakraborty & Basu (2002) for other countries attests to Danja’s (2012) view. Furthermore, a barrier which prevents FDIs from enhancing social progress also abound. In Nigeria for instance, there is a prevalence of a disproportionate directional focus of FDIs to certain industries while other sectors suffer wont of capital. Also, there is the illusion of rapid growth exceeding the pace of social progress-a vital component of growth inclusiveness-which leaves an impression of a healthy economy, where in fact, poverty looms (Alfredo, 2010).

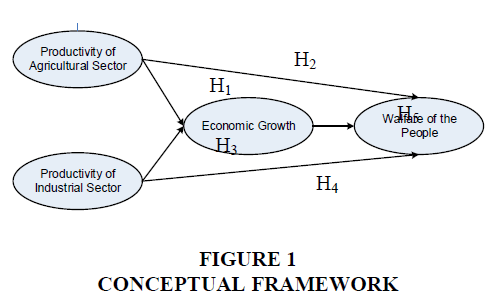

Further, destabilising effects of hot money or portfolio investments as studied by various researchers have been deemed incomplete and overly simplistic (see Gunning, 1999), as capital flows of short-term nature as between countries cannot, by themselves, cause a financial crisis.. Growing body of literature now suggests that banks play a crucial role in contributing to the destabilizing effects of hot money inflows, creating market bubbles, financial crisis and collapse of economic welfare (Gavin & Hausman, 1995; Adomaviciute & Seskas, 2012). In the light of Gunning (1999), Gavin & Hausman (1995) and Adomaviciute & Seskas (2012) submission, this study therefore, examines the joint impact of hot money flows and the monetary system on inclusive growth in Nigeria. The uniqueness of this study hinges on the framework-a transmission mechanism-through which hot money flows transmit to inclusive growth for Nigeria, and, the use of a computed composite index to measure inclusive growth.

The remainder of this work progresses as follows: section two briefly addresses empirical literatures relevant to the study under research. The third section discusses the theoretical framework and research method. Section four discusses data estimation and interpretation of results while the fifth section provides policy recommendation and then, concludes.

Brief Review of Literature

Hot money, Monetary System and Inclusive Growth in Nigeria

Hot money1 inflow, also known as short term capital or FPIs usually flow from capital rich, developed countries that have lower GDP growth rate and lower interest rates to capital scarce, less developed countries whose GDP growth rate and interest rate are comparatively higher. They include investments in an assortment or range of securities, or other types of investment vehicles, to spread the risk of possible loss due to poor performance of one or a few of such securities or investments. These investments are seen as source of domestic capital which is used to strengthen the financial adequacy of the receiving economy thus, improving their credit worthiness. Short term capital flows possess the capacity to increase welfare by enabling countries to smooth out their consumption patterns over time and achieve a higher level of consumption. These flows can also help developed countries achieve a better international diversification of their portfolios. However, large and sudden inflows of capital with a short term investment horizon could result in negative macroeconomic effects, including rapid monetary expansion, inflationary pressures, and real exchange rate appreciation and widening current account deficits.

However, this is not to say that hot money flows are totally unbeneficial. As stated earlier, foreign portfolio investment increases the liquidity of domestic capital markets, and can help develop market efficiency as well. As markets become more liquid, as they become deeper and broader, a wider range of investments can be financed. New enterprises, for example, have a greater chance of receiving start-up financing. Savers have more opportunity to invest with the assurance that they will be able to manage their portfolio, or sell their financial securities quickly if they need access to their savings. In this way, liquid markets can also make longer-term investment more attractive.

The monetary system in any economy refers to any formal structure adapted by a government that issues a currency which is accepted as the medium of exchange by its citizens and by other governments (Francois, 2002). Most monetary systems are managed by a central bank which is given the authority to print money and control its supply in the economy. Modern monetary systems, which consist of a set of institutions by which a government makes money available in a country consists of mints, commercial banks and central banks. Indeed, central banks are regarded as the apex monetary authority in any country, saddled with the main responsibility of conducting monetary policy in quest for the attainment of set macroeconomic goals. In Nigeria for instance, the central bank of Nigeria (CBN) acts as the sole monetary authority whose core mandate is to promote monetary and price stability and to evolve an efficient and reliable financial system through the application of appropriate monetary policy instruments and systematic surveillance (Ibeabuchi, 2007). In this sense, the effectiveness of any central bank in executing its functions hinges crucially on its ability to promote monetary and price stability. From the foregoing, a condition for sustainable growth can be thought of as one in which economic agents are confident of the stability of the monetary system.

Inclusive growth is economic growth that creates opportunity for all segments of the population and distributes the dividends of increased prosperity, both in monetary and non-monetary terms, fairly across society. It also refers to the “pace” and “pattern” of growth inter-relatedly, and so, is about raising the pace for growth and enlarging the size of the economy, while levelling the ground for investments and improving productive investment opportunities (World Bank, 2009; Alfredo, 2010). Growth that does not account for equality, poverty reduction, social and economic security, reduced vulnerability and improvement in the general well-being of individuals in a country cannot be termed as inclusive. The channels through which inclusive growth outcomes are realized are observable in the quest to create economic opportunities (which helps to lower poverty), efforts to ensure equal access to created opportunities, i.e. jobs, education, finance, information, property rights, and so on (which helps to reduce inequalities) and efforts towards the preservation of social cohesion (which helps to improve the quality of life of individuals and countries as a whole). It is, therefore, clear that income inequality reduction schemes alone (which is a major characteristic of the conventional or real GDP growth objective) are incapable of reducing poverty and ensure greater equality. Therefore, efforts that encourage productivity, decent employment and financial liberty for every inhabitant of a country are necessary, alongside other complementary policies, to ensure the achievement of inclusive growth.

A flow pattern does exist, between hot money flows, monetary system and inclusive growth of any nation as will be seen in the sections that follow. This work shall predicate on specific measures of each macro-component here mentioned: foreign portfolio investment (FPI) as main proxy for hot money flows, growth of broad money supply as main proxy for monetary system and a composite index for inclusive growth in Nigeria

Theoretical Framework and Methodology

A baseline theoretical framework

The neoclassical theory of capital flows and the Keynesian theory of monetary policy together form the main theoretical framework for this paper. The standard neoclassical theory predicts that capital should flow from rich to poor countries. Under the usual assumptions of countries producing the same goods with the same constant returns to scale production technology using capital and labour as factors of production, differences in income per capita reflect differences in capital per capita. This means that the direction of capital flows is determined by the rate of return on capital for the countries concerned. Hence, higher rate of returns will attract more capital inflow and vice versa. Increased inflow of capital is therefore, expected to augment domestic savings which will be used to finance investment projects which should benefit the entire economy. An inclusive level of growth is therefore, expected to be realized thereafter.

Also, the Keynesian theory of monetary policy explains that with a monetary contraction or tight monetary policy, interest rates rises and this leads to capital inflow since domestic interest rates are higher than foreign interest rates and causing an appreciation of the local currency. The appreciated currency makes local goods less competitive in the world market, leading to a fall in net exports. The overall net effect of a fall in the net exports is projected by a decrease in aggregate demand, overall welfare level and (inclusive) growth, ceteris paribus. This explanation is however, discounted from the consideration of the uncovered interest rate parity (UIP) relation, whose existence makes it theoretically possible for investments to be interest inelastic. Hence, given that the UIP theory does not hold (in this case), then, investors can leverage on risk-free profits that accrue to currency or foreign exchange arbitrage. Thus, the channel of monetary transmission plays an important role in how monetary policy affects the economy as is relevant in other prominent research such as those of Bryant et al., (1993); Taylor (1993).

Methodology

To determine the effect of hot money (or FPI) inflows on inclusive growth in Nigeria through monetary channel, the Structural Vector Autoregressive (SVAR) method is adopted. The suitability of this method for this paper stems from its attractiveness for estimating this kind of model to help demonstrate how a dynamic simultaneous equation model is identified with the help of a simple multivariate model consisting of an output variable (i.e. inclusive growth), a capital flow variable, and other variables depicting the Keynesian monetary channel of monetary policy. The model is set to establish the effect of capital flows on monetary stability and inclusive growth in Nigeria through the Keynesian monetary channel.

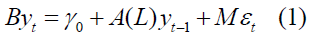

Specifying an SVAR model requires the estimation of a system of simultaneous equations which can be expressed in a general vector form as

Where yt is a vector of endogenous variables, γ0 is the constant term, yt-1 is a vector of their lagged values, εt is a vector of random error of the disturbance terms for every variable which captures any exogenous factors in the model, B is the square matrix of dimensions n x n, where n is a number of variables, and contains the structural parameters of the contemporaneous endogenous variables, A(L) is a matrix polynomial in the lag operator L of lag length p, and M is the square n x n matrix, which contains the contemporaneous response of the variables to the innovations or disturbances. Equation (1) is a structural VAR model, given the assumption that it is to be determined by some underlying economic theory.

Model Specification

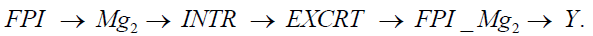

The model structure for this paper follows the Keynesian monetary transmission mechanism because of its relevance to the objective herein considered. However, modelling the Keynesian monetary transmission mechanism will require some slight modification of the original Keynesian structure as explained in the theoretical framework. Since the model to be estimated is expected to reflect the interaction between hot money flows and inclusive growth (output) through the Keynesian channel, hot money (or FPI) flow is fitted into the channel structure and we model the pass through to output accordingly. Hence, it is expected that increased FPI flows will increase international reserves, bank reserves and expand domestic credit in the domestic economy. The immediate effect of this is the increase in money supply. This increase causes a reduction in the real rate of interest, causing investment to increase as more money is freed up for investors to acquire capital and intermediate goods for production. Cost of credit also falls and so more loans are available for investment spending. Also, the reduction in real interest rate leads to a depreciation of the domestic currency, causing net exports to rise. The overall effect of this is an increase in income, employment, aggregate demand and eventually, output.

From the above explanation, the transmission mechanism is modelled to follow the order:

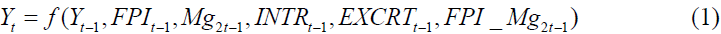

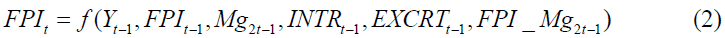

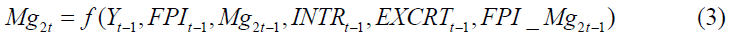

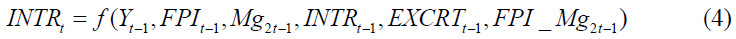

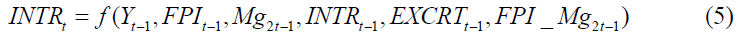

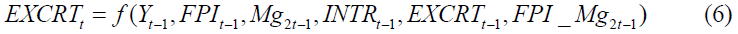

Notice that net export is replaced with the interaction variable, FPI _Mg2 since this study is concerned with the effect of this interaction on inclusive growth (output). In the model formation that follows (equation 2-7), inclusive growth (output or Y) is the dependent variable and will thus, appear on the right hand side of the first equation. Other variables on the left hand side of the equation follows transmission order, starting with FPI. It is also essential to note that since the system is an autoregressive type model, the dependent variable Yt would also depend on its own lag (Yt-1) as well as the lag of other variables in the system. This is the modified Keynesian monetary channel for this study. Hence, the functional relationship between hot money flow and inclusive growth, passing through the (modified) Keynesian monetary channel is thus:

Where Y represents Output (inclusive growth), measured in units; FPI represents Foreign Portfolio Investment (that is, hot money flows), measured in billion US dollars; Mg2 represents growth rate of broad money supply (monetary system), measured in percentage; INTR represents Real Interest Rate, measured in percentage; EXCRT represents Real exchange rate, measured in US dollar per Naira; and FPI _Mg2 represent the interaction between foreign portfolio investment (hot money flow). However, estimating the structural model requires that the reduced form VAR model be estimated first. Thereafter, the SVAR model can be used to identify shocks, innovations or “surprises” and trace out these shocks by employing impulse-response functions (IRF) and/or forecast error variance decomposition (FEVD) through imposing restrictions on the A and/or B matrices.

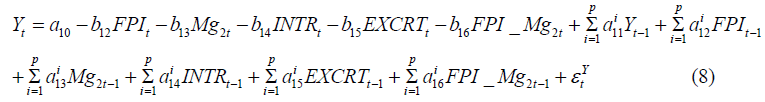

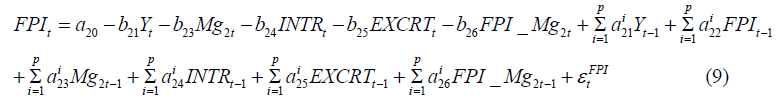

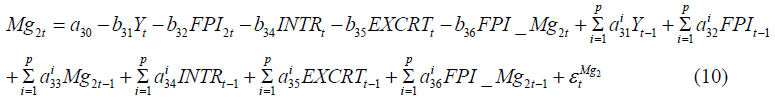

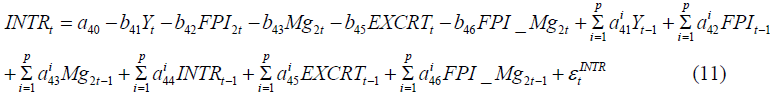

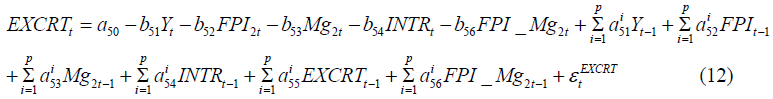

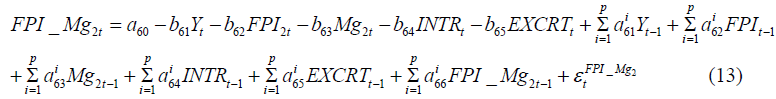

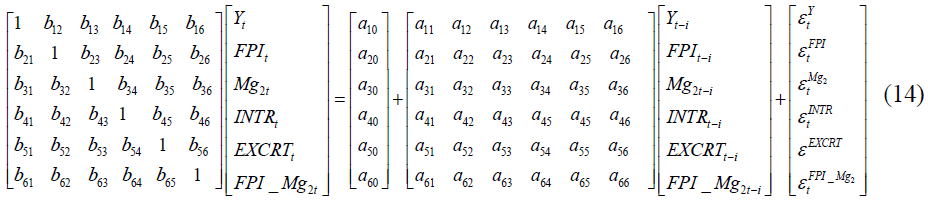

The structural model of this study can therefore be described by the following dynamic system of simultaneous equations with each variable taken as endogenous:

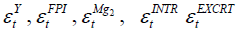

The exogenous error terms  , and

, and  are independent and are

interpreted as structural innovations. The model is such that realisations of each structural

innovation are known to capture unexpected changes to its respective dependent variables, which

are uncorrelated with other unexpected changes or shocks (εt). In the system of simultaneous

equations (i.e. equations 8-13), the endogeneity of Yt, FPIt, Mg2t, INTRt, EXCRTt, and FPI_Mg2t,

are determined by the values of the coefficients of b. The simultaneous equation model above

can thus be re-written in matrix form as:

are independent and are

interpreted as structural innovations. The model is such that realisations of each structural

innovation are known to capture unexpected changes to its respective dependent variables, which

are uncorrelated with other unexpected changes or shocks (εt). In the system of simultaneous

equations (i.e. equations 8-13), the endogeneity of Yt, FPIt, Mg2t, INTRt, EXCRTt, and FPI_Mg2t,

are determined by the values of the coefficients of b. The simultaneous equation model above

can thus be re-written in matrix form as:

Where i = 1, 2, …. , ρ.

However, the reduced form of the VAR model that is to be estimated does not have the instantaneous endogenous variables and the error terms et are linear combinations of the orthogonalized shocks (εt), such that each individual error term is serially uncorrelated with a zero mean and a constant variance. Also, the corresponding A and B matrices of the SVAR are presented in Appendix Table 1.

Data Estimation and Interpretation

Presentation of results

In this section, annual data of selected variables between 1980 and 2015 are used to estimate the structural VAR model of this paper. All the data are sourced from the World Development Indicators (WDI) for the various years. In what follows, is the test for stationarity, since time series data are believed to be inherently non-stationary (Gujarati, 2004). It is the result which follows that now sets the stage for the estimation of the SVAR.

Choice of Maximum Lag Length

Choosing an optimal lag length in a VAR process is a very important aspect in the estimation procedure. According to the Akaike, Hanan-Quinn and the SB information criteria, the optimal lag length for this estimation process is set to four (see, Appendix Table 2). This was computed and thereafter, obtained by default using the Eviews 10 software.

Estimation of the Reduced Form Var Model

Parameter identification problem which is particular to SVARs usually result to inconsistent parameter estimates in the ordinary least squares estimation of the structural VAR model. This problem can be overcome by first estimating the reduced form of the VAR model. The variables included in the VAR system are hereby estimated to observe the effects of foreign portfolio investment on inclusive growth in Nigeria through the monetary system (or monetary channels). The outcome of the estimation of the reduced form VAR is explained below.

The result of the reduced form VAR estimation reveal that that predictive power of inclusive growth on itself is significant only at the second lag. For foreign portfolio investment, FPI and exchange rate, EXCRT, their respective relative power of predictability on inclusive growth, IG, is insignificant at all critical levels and at both lags. The predictive influence of broad money supply growth on inclusive growth is observed to be statistically significant at lag 2, although with small coefficient value of approximately 0.02. The real interest rate is observed to hold an important influence over inclusive growth at the estimated lag one, while its expected direction of influence is observed to follow apriori expectations.

For the interaction variable (FPI_Mg2), it is observed that the predictive influence on inclusive growth is statistically significant only at the 10 percent level of significance at lag 1. The expected apriori is also observed, indicating that inclusive growth in Nigeria is positively and statistically influenced by the interaction between the monetary system and capital inflow. Overall findings from the reduced form VAR estimation show that the inflow of short term foreign portfolio investment through the monetary system has significant and positive influence on inclusive growth in Nigeria.

Test for Stability of the VAR Model

Before estimating the SVAR model, the VAR model is subjected to a stability test. This is set to ensure that the model satisfies the basic stability conditions. The LM stability test shows that all the eigenvalues of the model lie inside the unit circle and this establishes that the VAR satisfies the stability condition (see, Appendix Table 3).

The Lagrange Multiplier (LM) Test

The Lagrange Multiplier (LM) test is conducted to see that the disturbances are not autocorrelated in the post analysis of the VAR and SVAR models (Johansen, 1995). One of the assumptions upon which inference and post analysis after VAR and SVAR are predicted is that the errors are not autocorrelated. The obtained LM statistics for residual autocorrelation show that there is no autocorrelation at the tested lag orders. Therefore, the null hypothesis of no autocorrelation is accepted while the estimation of the SVAR model follows.

Estimation of the Contemporaneous (Short Run) Variables of the Model

Inclusive growth (IG) is here considered as the main dependent variable and is being determined by a set of endogenous factors such as foreign portfolio investment (or hot money) inflows, broad money supply which is proxy for the monetary system, real interest rate, exchange rate and the interaction between foreign portfolio investment inflow and the monetary system. The interaction variable (FPI_Mg2), which is the main look-out variable in this analysis is observed to contemporaneously cause changes in the level of inclusive growth throughout the sample period. This contemporaneous effect is positive and statistically significant. In the same vein, the response of FPI, INTR, and EXCRT to changes in FPI_Mg2 are statistically significant and positive except Mg2. The implication of this result as shown in Table 1 is that inclusive growth in Nigeria is sensitive, positively to inflow of foreign portfolio investment passing through the monetary system. Hence, a stable monetary system, given the inflow of hot money is capable of inducing inclusively led growth outcomes in Nigeria as the study result suggests. To this end, this study posits that the interactive effect of hot money inflows and the monetary system on inclusive growth is significant in Nigeria.

The Estimated Effects of Hot money Inflows and Monetary System Interaction on Inclusive Growth in Nigeria

The interactive effect of hot money inflows and the monetary system on inclusive growth in Nigeria is estimated in this section. The impulse-response analysis describes how innovations, shocks or changes in one variable affect another variable after a given period of time. Sims’ (1980) Cholesky decomposition is one method to identify the impulse-response functions in a VAR model. Hence, the Cholesky decomposition identification method corresponds to structural VAR. However, the aim of the structural VAR is to apply economic theory (rather than Cholesky decomposition) to better obtain the structural innovations from the residuals, eit (Enders, 1995). The IRFs are generated from the recursively Orthogonalised SVAR estimated residuals and they show the path of output (or inclusive growth) when there are innovations or changes in other variables.

The impulse response function graphs (see, Appendix Figure 1) illustrate the response of the respective endogenous variables in the model to a one standard deviation impulse over a ten year period. An IG response to a one standard deviation impulse to FPI is observed to have no transitory effect in the first year. This means that in the first period, IG does not respond to FPI impulses, and this stresses the truth in the theoretical (Keynesian) explanation that a transmission mechanism does exist in the effect of capital inflows to output. Immediately beyond the first year, IG responses to FPI is seen to follow a positive but sluggish response, and then later offset by a lowering of IG up to the fifth year. The negative response of inclusive growth to FPI impulses may be explained by the negative effects of capital flow reversals on growth as experienced during the Asian crisis of the late 90’s and in Latin America.

A one standard deviation positive innovation to the monetary system, proxied by the growth of broad money supply does not show any effect on inclusive growth in Nigeria in the first two years. However, a sluggish rise-fall response is observed between year two and year four. This innovation persists although, weakly for some time and then explodes northwards beyond year nine. This implies that money supply increases are capable of increasing the level of growth in an economy over time if properly utilized in the relevant sectors.

Changes in the interaction variable, FPI_Mg2 (which represents hot money flows passing through the monetary system) observes no immediate effect on inclusive growth, as with other variables except for inclusive growth itself. Also, the response of IG given innovations to FPI_Mg2 is sluggish but mostly positive throughout the time horizon. At the tenth year, the innovation dissipates. This slow response of inclusive growth (or output) in Nigeria to the interaction variable (hot money inflows and the monetary system) is consistent with theoretical expectations in that monetary policy variables affect domestic variables with a lag as emphasized by the transmission mechanism of monetary policy (Gottschalk, 2001). This means that inclusive growth (or output) does not, and hence, is not expected to react contemporaneously to innovations in the interaction variable (i.e. FPI_Mg2).

Analyzing the structural impulse response function of the SVAR model for the Nigerian economy, it can be concluded that the interactive effect of hot money inflows and the monetary system has positive and significant effects on inclusive growth. This result corroborates with the result obtained from the estimated coefficients of the contemporaneous (short run) endogenous variables of the SVAR model. Further, it can be noted from the response of inclusive growth to the impulses on the respective endogenous variables that, hot money inflows transmit to inclusive growth through a transmission mechanism as explained in the theoretical framework of this study.

Implication of Findings

The overall result from the analysis of this study indicate that approaching the interactive effect of hot money inflows (or FPIs) and the monetary system on inclusive growth in Nigeria using the Structural Vector Autoregressive (SVAR) method is beneficial to government agencies who rely on the study outcome to chart a course for the achievement of inclusive growth objectives for the country. The result which showed that the interactive effect of hot money flows and the monetary system on inclusive growth in Nigeria over the study period is positive and statistically significant highlights a clear point of note for government: the Nigerian financial or monetary sector is able facilitate growth that permeates through all sectors that encompasses human livelihood by exploring the advantages of hot money or FPI inflows. This supports scholarly arguments in favour of financial/monetary sector led growth campaigns since it is believed that the financial sector is able to trigger growth in the long run and fuel institutional reforms by ensuring that funds are increasingly available for cross country investment and risk diversification. Hence, the research result of this study highlights the benefits that come with such policies as interest rate management, exchange rate deregulation, higher GDP growth rate targeting, and development of a solid stock market structure which altogether help attract inflow of FPIs to facilitate inclusive growth.

Conclusion

In this study, a controlled experiment is carried out using the SVAR estimation technique to examine the impact of hot money inflows and the monetary system on inclusive growth in Nigeria between 1980 and 2015. The need for this study target follows some identified gaps in literature, which mainly hinged around examining the transmission mechanism through which hot money (i.e. FPI) transmits to inclusive growth in Nigeria. The SVAR estimation result show that the interactive effect of hot money inflows and the monetary system has positive and significant effects on inclusive growth. This indicates that the objective of meaningful inclusive growth is realizable given the inflow of foreign short term capital passing through the monetary system in Nigeria. It therefore follows that financial sector can facilitate growth to complement the real sector, since studies have shown over the years that the contributive effect of increased FDI inflows for instance, have not been felt in Nigeria. Hence, monetary and financial policies aimed at attracting more inflows of FPI such as interest rate policies, exchange rate deregulation policies (which leads to higher returns), lower inflation targeting policies, targeting higher GDP growth rates, and the development of stock market structure should be pursued.

Appendix Figure

Structural and Orthogonalised Impulse Response Function (IRF) showing the response of respective variables to a 1 standard deviation shock of another variable over a 10 year time horizon. Responses to shocks are shown by the blue line segments which hover about the horizontal time path. Positive shocks are shown by line segment above the horizontal time line and negative shocks are below the time line.

Appendix Tables List

| Table 1 A & B Matrices of the SVAR Model | |||||

| Model: Ae = Bu where E[uu']=I | |||||

| Restriction Type: short-run pattern matrix | |||||

| A = | |||||

| 1 | 0 | 0 | 0 | 0 | 0 |

| C(1) | 1 | 0 | 0 | 0 | 0 |

| C(2) | C(6) | 1 | 0 | 0 | 0 |

| C(3) | C(7) | C(10) | 1 | 0 | 0 |

| C(4) | C(8) | C(11) | C(13) | 1 | 0 |

| C(5) | C(9) | C(12) | C(14) | C(15) | 1 |

| B = | |||||

| C(16) | 0 | 0 | 0 | 0 | 0 |

| 0 | C(17) | 0 | 0 | 0 | 0 |

| 0 | 0 | C(18) | 0 | 0 | 0 |

| 0 | 0 | 0 | C(19) | 0 | 0 |

| 0 | 0 | 0 | 0 | C(20) | 0 |

| 0 | 0 | 0 | 0 | 0 | C(21) |

| Table 2 Maximum Lag Order Selection Criterion | ||||||||

| Sample: 1985 - 2015 | Number of obs=31 | |||||||

| lag | LL | LR | df | p | FPE | AIC | HQIC | SBIC |

| 0 | -1958.95 | 4.60E+47 | 126.771 | 126.861 | 127.048 | |||

| 1 | -1921.65 | 74.598 | 36 | 0.0000 | 4.40E+47 | 126.687 | 127.32 | 128.63 |

| 2 | -1875.47 | 92.365 | 36 | 0.0000 | 3.00E+47 | 126.03 | 127.206 | 129.638 |

| 3 | -1814.53 | 121.87 | 36 | 0.0000 | 1.50E+47 | 124.421 | 126.14 | 129.695 |

| 4 | -1688.38 | 252.3* | 36 | 0.0000 | 5.4e+45* | 118.605* | 120.867* | 125544* |

| Table 3 Var Stability Test | |

| Eigenvalue | Modulus |

| 0.2227387+0.7945295 i | 0.82516 |

| 0.2227387-0.7945295 i | 0.82516 |

| 0.8082214 | 0.808221 |

| 0.381655+0.5496641 i | 0.6691712 |

| 0.381655-0.5496641 i | 0.6699172 |

| -0.3142106+0.5482693 i | 0.631924 |

| -0.3142106-0.5482693 i | 0.631924 |

| -0.00292598+0.574386 i | 0.574393 |

| -0.00292598-0.574386 i | 0.574393 |

| -0.5581613+0.95103013 i | 0.56621 |

| -0.5581613-0.95103013 i | 0.56621 |

| -0.1199683 | 0.119968 |

End Notes

1Hot money is used interchangeably with short term capital or foreign portfolio investment (FPI).

References

- Adomaviciute, U. & Seskas, S. (2012), ‘Management of Hot money Flows to China’, Linnaeus University School of Business and Economics.

- Ajakaiye, O. & Tella, S. (2014) ‘Financial Regulation in Low Income Countries: Balancing Inclusive Growth with Financial Stability, The Nigeria Case’, ODI Working Paper No. 409.

- Akinlo, A.E. (2004). Foreign direct investment and growth in Nigeria: An empirical investigation. Journal of Policy Modeling, 26(5), 627-639.

- Alfredo, S. (2010). Growth, poverty and inequality: From Washington consensus to inclusive growth. New York, NY: UN.

- Ashford, C. (2011). Global private capital flows and development finance in Sub-Saharan Africa: Exemplary performers, lessons for others, and strategies for global competitiveness in the twenty-first century. Journal of Sustainable Development, 4(5), 18-31.

- Ayanwale, A.B. (2007) Ayanwale, A.B. (2007). FDI and economic growth: Evidence from Nigeria.

- Behzad, Y., & Reza, G. (1995) Export performance and economic development: an empirical analysis. The American Economist, 39(2), 37-45.

- Bryant, R., Hooper, P., & Mann, C.L. (Eds.). (2010). Evaluating policy regimes: new research in empirical macroeconomics. Brookings Institution Press.

- Chakraborty, C., & Basu, P. (2002). Foreign direct investment and growth in India: A cointegration approach. Applied economics, 34(9), 1061-1073.

- Danja, H. (2012) Foreign direct investment and the Nigerian economy. American Journal of Economics, 2(3), 33-40.

- Dolan, M.B., & Tomlin, B.W. (1980). First World-Third World linkages: external relations and economic development. International Organization, 34(1), 41-63.

- Edozien, E.G. (1968). Linkages, direct foreign investment and Nigeria's economic development. The Nigerian Journal of Economic and Social Studies, 10(2), 191-204.

- Enders, W. (1995) ‘Applied Econometric Time Series’, New York: John Wiley & Sons, Inc., pp: 106-119.

- Francois V.R., (2002). Following the yellow brick road: How the United States adopted the gold standard. Economic Perspectives, 4th Quarter.

- Gavin, M. & Hausman, R. (1995) ‘The Roots of Banking Crises: The Macroeconomic Context.

- Gottschalk, J. (2001). An introduction into the SVAR methodology: identification, interpretation and limitations of SVAR models (No. 1072). Kiel working paper.

- Greenaway, D., & Sapsford, D. (1994). What does liberalisation do for exports and growth? Weltwirtschaftliches Archiv, 130(1), 152-174.

- Gujarati, D.N. & Porter, D.C. (2009), ‘Basic Econometrics’, McGraw-Hill International, 5th Edition, 2009.

- Gunning, J.P. (1999) ‘Hot money Flows, the Domestic Money Supply and Bubbles’. http://www.nomadpress.com/gunning/issues/ipe/asfncris/shtmcpfl.htm.

- Ibeabuchi, S.N. (2007) ‘Overview of Monetary Policy in Nigeria’, CBN Economic and Financial Review 45 (4) 15-37.

- Johansen, S. (1995). Likelihood-Based Inference in Co-integrated Vector Autoregressive Models. Oxford University Press: Oxford.

- Obiechina, M.E., & UzodinmaUkeje, E. (2013). Economic Growth, Capital Flows, Foreign Exchange Rate, Export and Trade Openness in Nigeria1. Management, 2(9), 01-13.

- Oyejide, T.A. (2005). Capital flows and economic transformation: a conceptual framework. In on Proceedings of Central Bank of Nigeria 5th Annual Monetary Policy Conference with the theme “Capital Flows and Economic Transformation in Nigeria.” Held at the CBN Conference Hall, Abuja. November 10th to 11th.

- Saltz, I.S. (1992). The negative correlation between foreign direct investment and economic growth in the third world: Theory and evidence. Rivista internazionale di scienze economiche e commerciali, 39(7), 617-633.

- Sims, C.A. (1980). Comparison of interwar and postwar business cycles: Monetarism reconsidered.

- Taylor, J.B. (1993) ‘Discretion versus Policy in Practice’ Camegie-Rochester Conference Series on Public Policy, 39, 195-214.

- World Bank (2009) ‘What is Inclusive Growth?’ Retrieved From: http://siteresources.worldbank.org/INTDEBTDEPT/Resources/4689801218567884549/WhatIsInclusiveGrowth20081230.pdf.