Review Article: 2023 Vol: 27 Issue: 2

ICT and Women Empowerment in Digital India: A Global Perspective

Manoj PK, Cochin University of Science and Technology (CUSAT)

Sruthy Krishna, Cochin University of Science and Technology (CUSAT)

Jayson Jacob, Cochin University of Science and Technology (CUSAT)

Reni Sebastian, Cochin University of Science and Technology (CUSAT)

Lakshmi, Cochin University of Science and Technology (CUSAT)

Citation Information: Manoj, PK., Krishna, S., Jacob, J., Sebastian, R., & Lakshmi. (2023). ICT and women empowerment in digital india: a global perspective. Academy of Marketing Studies Journal, 27(2), 1-10.

Abstract

Given the vast advances in ICT and the immense potential of ICT to effect radical changes in business processes, this paper points out that ICT-integrated enterprises, especially those based on modern practices like Artificial Intelligence (AI) can be used for women empowerment and rural development in India. As ICT-based tools are devices are growingly becoming cheap as well as more and more popular among the masses, women’s initiatives adopting such modern technologies can command a competitive edge and attract more customers.

Keywords

Micro Enterprises, ICT, Social Media, eWOM, eCRM, AI, Competitiveness.

Introduction

There has been added thrust on digitization and ICT adoption in India over the last few years. The flagship project of the Govt. of India (GOI) viz. Digital India has added another dimension to the growth momentum for ICT-based initiatives in India. As the positive policy stance of the GOI continues, at the State level too, States like Kerala have accorded added thrust on ICT adoption. Kerala, for instance, has embarked on a mission to transform Kerala into a Knowledge Economy. Considering the diverse issues that women encounter, such as depression, lack of representation in the decision making process in the family as well as society, poor status in the family and society, lack of ownership of assets, dependence on male family members etc., their empowerment is a national priority across the nations, and India is no exception. Accordingly, Governmental plans and programs, of both the Govt. of India (GOI) as well as the State Governments, like the Govt. of Kerala (GOK), accord high priority to women in various projects.

Most Governmental policies and programs, however, approach the issue of women empowerment from the economic perspectiveonly, on the logic that women’seconomic self-reliance empowers them, disregarding other aspects, like, mental peace, health, literacy, education, etc. Also, ICT’s role in women empowerment concerted efforts for using ICT and advanced technologies like artificial intelligence (AI) for financial inclusion, rural development etc. need special attention.

Significance of the Study

Women were equally significant as men, if we look intothe history of human development. Actually, women’s status, their employment conditions and work accomplished by them in anysociety is an index of the overall growth of the nation concerned. Without women’sparticipationin the economic activities of a nation, its socio-economic and political advancement will be affected adversely seriously. Even though women constitute about a half of the humanity and theycontribute nearly two-thirds of world’s work hours, theyearn one-third only of the total earnings and they own less than one-tenth only of the world’s resources. Owing to their poor entitlements, women suffer from diverse kinds of deprivations in the familial, social, economic,cultural and political fronts, particularly in the developing nations including India.Effective use of ICT and other modern technologies, like, artificial intelligence (AI), machine learning (ML), could be explored so as to get women rid of their diverse kinds of deprivations and issues like depression, by taking advantage of the Digital Indiapolicy of the GOI and Knowledge Economy. The need for ICT-based interventions, including AI, for faster women empowerment and rural development, and hence rapid equitable economic growth in India are sought to be studied here.

Objectives and Methodology of the Study

This paper seeks to explore the need for adoption of ICT and advanced technologies including artificial intelligence (AI), machine learning (ML), etc. for the purpose of women empowerment, rural development, etc. and hence equitable and sustained national economic development. This study is of descriptive-analytical in nature and is exploratory too. The data used were secondary data from authentic sources, and common statistical tools were used in this study.

Literature Survey

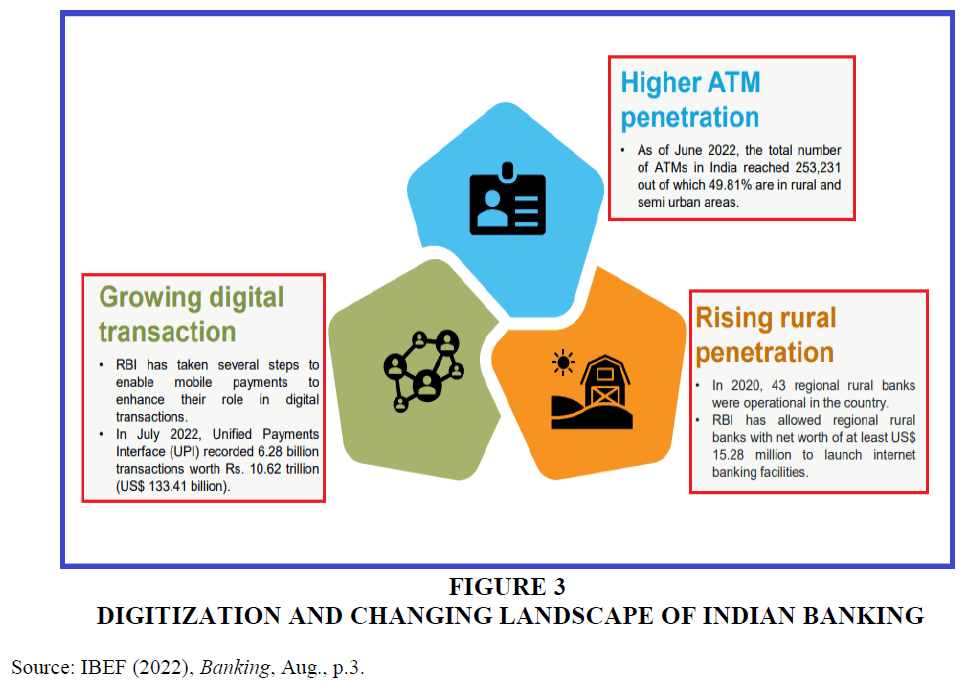

While Gerda, (1988) has sought to find the origins of the creation of patriarchy resulting in sidelining the women to the margins, Sen, (1993) seeks to point out that women empowerment involves “adjusting relations of power” that restricts their choices and freedom, and it “horribly impact prosperity and thriving". More recently with the onslaught of ICT in every walks of life, India Brand Equity Federation (IBEF, 2022) in its report on Indian banking has noted the fast digitization process is going on India along with growing ATM penetration and rural penetration - all these leadto radical changes in Indian banking landscape.

The vast scope of ICT for financial inclusion has been noted by Pickens, (2009) as he has observed a common ICT tool viz. mobile phone could ensure banking services to the unbanked masses. A study by Manoj (2010), ‘Environment-friendly tourism for sustainable economic development in India’, in International Journal of Commerce and Business Managaement has noted the need for promotion of eco-friendly tourism for India’s sustained economic growth. A study by Nasar & Manoj (2015), ‘Purchase Decision for Apartments: A Closer Look into the Major Influencing Factors’ in IMPACT International Journal of Research in Applied, Natural and Social Sciences, has pointed out that price, quality, and location as the major influencing factors. A study by Manoj (2016), ‘Determinants of sustainability of rural tourism: a study of tourists at Kumbalangi in Kerala, India’, in International Journal of Advance Research in Computer Science and Management Studies, has noted that better infrastructure, like, internet and ICT-based tools as one of the key needs for the sustainability of Kerala tourism. A study by Neeraja & Manoj (2014), ‘Relevance of E-Banking Services in Rural Area – An Empirical Investigation’ in Journal of Management and Science, has noted based on theirfield study the needfor E-Banking in rural Kerala to hasten rural development and women empowerment, and recommended for expansion of E-banking. A paper by Joju et al. (2017), ‘Electronic CRM & ICT-based banking services: An empirical study of the attitude of customers in Kerala, India’ in International Journal of Economic Research has pointed out the favorable influence of E-CRM on banking performance. A study by Jacob et al. (2009), ‘Banking Technology and Service Quality: Evidence from Private Sector Banks in Kerala’ in International Journal of Recent Technology and Engineering (IJRTE) has pointed out the positive effect of the adoption of ICT-based banking on service quality in banks. A study by Manoj, (2015), ‘Socio-Economic Impact of Housing Microfinance: Findings of a Field based Study in Kerala, India’ in International Research Journal of Finance and Economics, as pointed out the positive impact of housing micro finance on the poor. Another study by Manoj, (2015), “Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’ in Kerala, India” in International Research Journal of Finance and Economics, the deterrents to HMF are discussed with remedial strategies. A study by Rajesh & Manoj (2015) ‘Women Employee Work-life and Challenges to Industrial Relations: Evidence from North Kerala’ in IPASJ International Journal of Management has noted the vital need for work-life balance for healthy industrial relations.

In view of the above analysis, it is noted that ICT may be noted to be crucial for any sector, especially for women empowerment and rural development. It enhances the competitiveness of any business and helps women and other deprived segments to be abreast of developments, and hence get rid of deprivations, issues like dependence and depression. As ICT is vital in women empowerment, rural development etc., this study closely looks into latest developments, like AI.

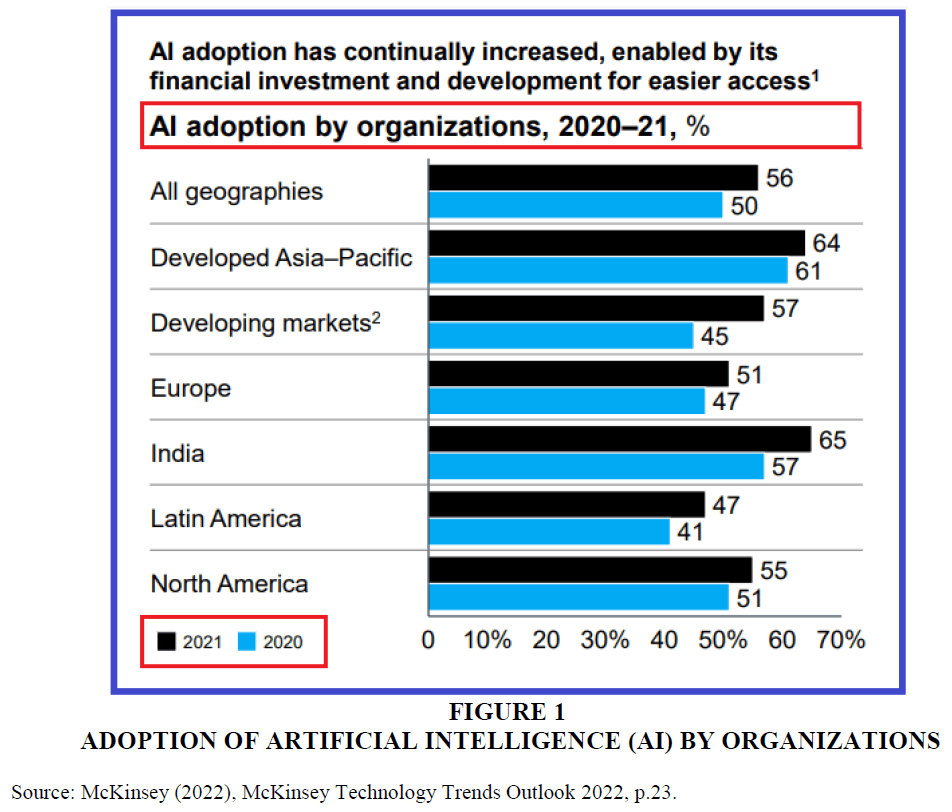

ICT Adoption for Business Continuity and Business Excellence

The good old and traditional belief that ‘men are for thy field while women are for thy home’ is no longer valid in this ICT era when women too are in the forefront of business and industry, and in this ICT era in India where Digital India is the new normal, business and industry are fast adopting ICT for their competitiveness. This must hold good especially in a State like Kerala as it strives mold itself into a typical Knowledge Economy in India, and the world as a whole. In this context, it may be noted that in respect of adoption of the most modern technologies like AI (artificial intelligence), India is ahead of any other nation or geographical region as of 2021, as per the latest report of McKinsey (2022). With the advent of ICT in general and its latest versions like AI in particular, which are being fast adopted by organizations in India than anywhere else in the world, the relevance of such most modern technologies in empowering women, whether in service or in own business, need not be overemphasized. From Figure 1 which depicts the global status regarding AI adoption by organizations across the world, India has been second (57 percent) only to Developed Asia-Pacific (61 percent) in 2020 and is 2021 India has been the topmost AI adopter with 65 percent – the highest in the world. This shows the empowerment potential of women by ICT adoption, including AI, and ensure greater quality and operational efficiency, given the vast potential of modern ICT tools, including AI. (Figure 1).

Figure 1 Adoption of Artificial Intelligence (AI) by Organizations

Source: McKinsey (2022), McKinsey Technology Trends Outlook 2022, p.23.

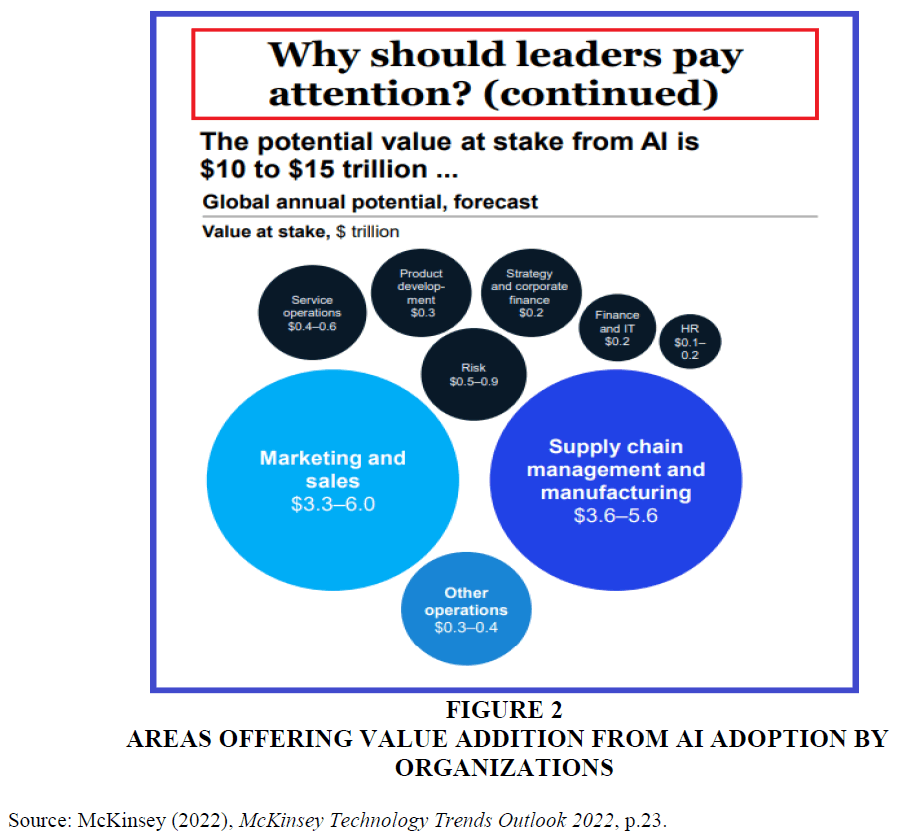

Regarding the areas wherein AI adoption offers maximum benefits, the same report of McKinsey throws some meaningful insights. Thus, sectors like Marketing and Sales (USD 3.3 to 6 Trillion) and Supply Chain Management and Manufacturing (USD 3.6 to 5.6 Trillion). Other sectors (like, risk, HR, service operations etc.) have relatively very low significance only. It may be noted that learning from the global experiences in this regard, AI adoption or adoption of such other ICT tools could offer maximum relative benefits in Marketing and Sales function as well as SCM and Manufacturing sectors. Naturally, deliberate efforts towards ICT integration, including ICT adoption in these functions seems to be very meaningful in the current context. The case of ICT-integration by enterprises run by or proposed to be run by women should consider this vital aspect in their future endeavors, so as to reap maximum benefits from such technological advances in the form of enhanced competitiveness, better customer service, lower operational costs or higher operational efficiency, and so on. Figure 2 is self-explanatory.

Figure 2 Areas Offering Value Addition from AI Adoption by Organizations

Source: McKinsey (2022), McKinsey Technology Trends Outlook 2022, p.23.

Many an empirical study at the global level, like, the one by Pickens (2009) done in Philippines hasnoted the positive role played by a very popular ICT device (viz. mobile phone) in ensuring the formal sector banking services to the unbanked masses, the rural poor, including women. In India, a Kerala-based study by Neeraja & Manoj (2014) has noted the positive influence of E-banking on the rural populace especially the rural women, andthus this study has recommended for the expansion of E-banking services in rural areas. Digital lending forecast for India suggests the vast growth prospects of digital lending in India. Also, now the policy of the Govt. of India (GOI) is formolding a Digital India, andthere is focused attention on ICT adoption in every sector, including the banking sector. It is noted that the digitization process in Indian banking has been growing every year. This has led to (1) fast growth in digital deals (6.28 Billion deals worth Rs.10.62 Trillion, as of July 2022), (2) higher ATM penetration (253231 as of June 2022), and (3) growing rural penetration (43 RRBs in India in 2020 and RBI has allowed RRBs with net worth of USD 15.28 million to launch internet banking facilities (Figure 3).

Figure 3 Digitization and Changing Landscape of Indian Banking

Source: IBEF (2022), Banking, Aug., p.3.

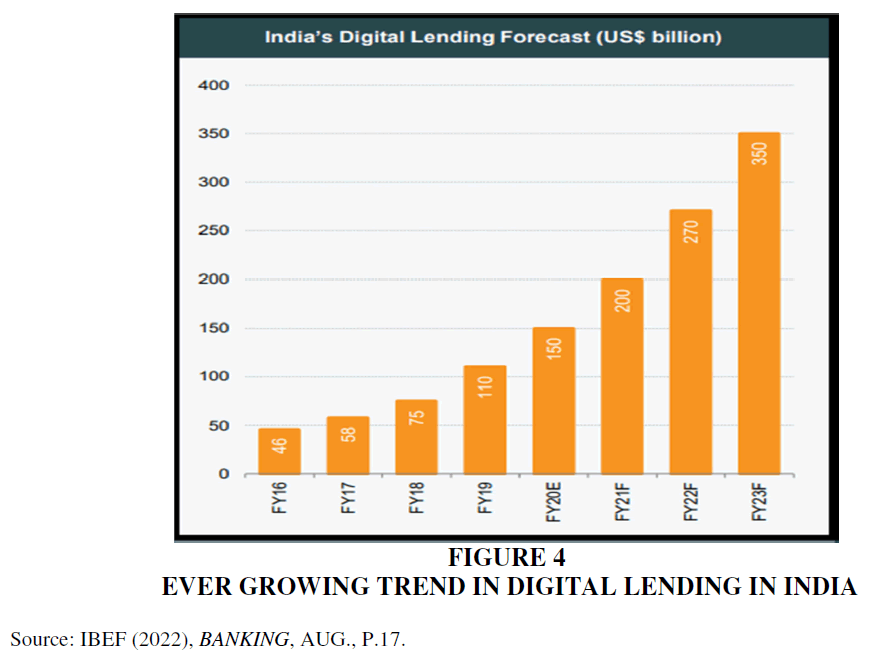

The fast growing digital footprint in Indian banking is clear from the huge amount of USD 270 Billion as of FY 2022 which is projected to be USD 350 Billion as of FY 2023 Figure 4.

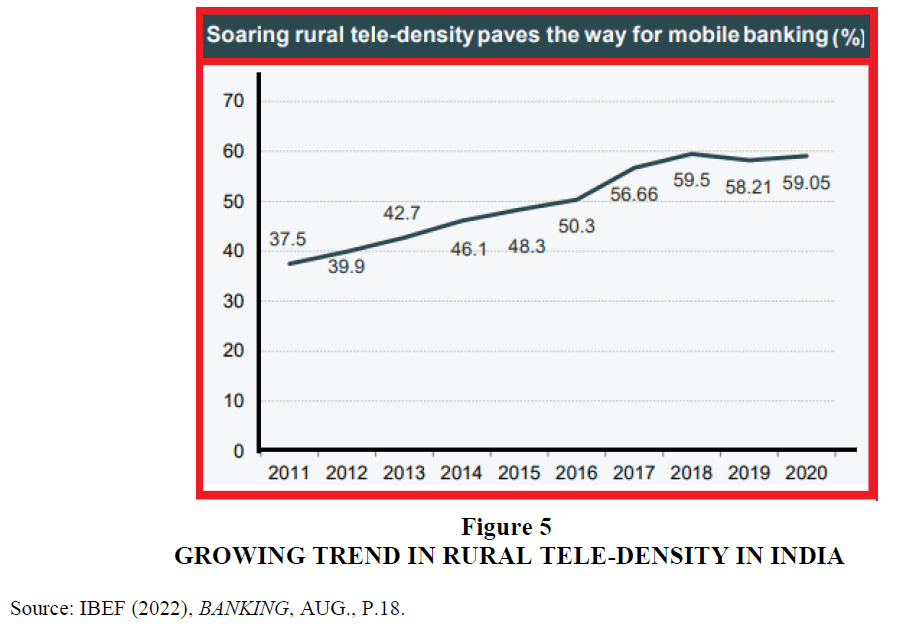

Another notable feature of Indian banking is the growing rural tele-density which in turn further augments the growing footprint of RRBs and their growing interest in internet banking. This situation will definitely pave way to faster ICT penetration (like, E-Banking, ATM, Internet banking etc.) in rural areas of India, thus accelerating the financial inclusion process in India. However, mobile banking appears to be the most significant beneficiary from the growing rural tele-density in India which has been steadily rising over the years Figure 5.

Leveraging the ICT Advantage for Women Empowerment and Rural Development

Given the unprecedented level of ICT adoption across the world including in India, including most modern technologies like AI (wherein India is a world leader, as of 2021; Figure 1), nations like India should leverage on such developments by focusing more on women empowerment, rural development etc. This is because equitable and sustained development in a country like India is possible only through bringing the rural people, the women, the physically challenged etc. into the main stream of the economy by providing opportunities for starting their own economic activities. The SHG-Bank Linkage Programme (SHG-BLP) of the NABARD, the apex regulatory body under the GOI, is a classic example in this regard. SHG-BLP focuses on women empowerment, about 90 percent or more of the SHGs being “All Women” SHGs. Table 1.

| Table 1 Growth in Digitization of Shgs (Eshakti Programme) of NABARD | ||||||

| Particulars | FY 2019-‘20 | FY 2020-‘21 | FY 2021-‘22 | |||

| SHGs Nos-Lakh |

Amount (Cr) |

SHGs Nos-Lakh |

Amount (Cr) |

SHGs Nos-Lakh |

Amount (Cr) |

|

| SHG Savings with Banks (FY 2020 to FY 2022) | ||||||

| Total SHGs (No) | 102.43 (02.29%) |

26152.05 (12.12%) |

112.23 (09.57%) |

37477.61 (43.31%) |

118.93 (05.97%) |

47240.48 (26.05%) |

| All women SHGs | 88.32 (03.53%) |

23320.55 (13.91%) |

97.25 (10.11%) |

32686.08 (40.16%) |

104.05 (06.99%) |

42104.77 (28.81%) |

| Women (Percent) | 86.22% | 89.17% | 86.65% | 87.21% | 87.45% | 89.13% |

| Loans Disbursed to SHGs (FY 2020 to FY 2022) | ||||||

| Total SHGs (No) | 31.46 (16.60%) |

77659.35 (33.17%) |

28.27 (-08.23%) |

58070.68 (-25.22%) |

33.98 (17.71%) |

99729.22 (71.74%) |

| All women SHGs | 28.84 (21.95%) |

73297.56 (37.64%) |

25.9 (-10.19%) |

54423.13 (-25.75%) |

31.50 (21.63%) |

93817.21 (72.38%) |

| Women (Percent) | 91.67% | 94.38% | 89.71% | 93.72% | 92.70% | 94.07% |

| Loans Outstanding against SHGs (FY 2020 to FY 2022) | ||||||

| Total SHGs (No) | 56.77 (11.82%) |

108075.07 (24.08%) |

57.80 (01.81%) |

103289.71 (-04.43%) |

67.40 (16.61%) |

151051.30 (46.24%) |

| All women SHGs | 51.12 (14.59%) |

100620.71 (27.00%) |

53.11 (03.89%) |

96596.6 (-04.00%) |

62.65 (17.96%) |

142288.61 (47.30%) |

| Women (Percent) | 90.05% | 93.10% | 91.89% | 93.52% | 92.95% | 94.20% |

(Figures in brackets indicate percentage growth over the preceding year).

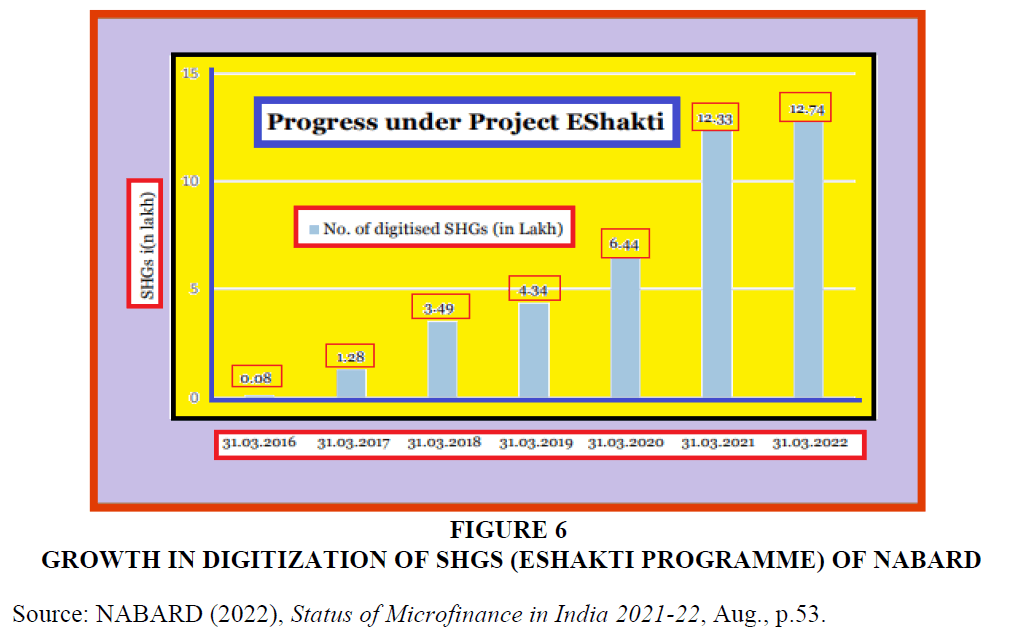

In March 2015, NABARD embarked on a policy of digitization of the SHGs through its Eshaktiproject. As at the end of FY 2022, financial and non-financial relating to 12.74 lakhs SHGs in India have been digitized. Steady growth in the digitization process of SHGs over the years under the EShakti project can be observed in Figure 6. Thus, the EShakti project seeks to further reinforce the SHG-BLP through ICT means; because digitization of SHGs is preferred by the banks and other lending institutions, while extending credit to SHGs. (Figure 6).

Figure 6 Growth in Digitization of SHGS (Eshakti Programme) of NABARD

Source: NABARD (2022), Status of Microfinance in India 2021-22, Aug., p.53.

In fact, NABARD has promoted MEDP (Micro-enterprise Development Program), LEDP (Livelihood Enterprise Development program) and such other programs for the purpose of developing and nurturing the employable skills in rural people India, especially women.

These programmes accelerate the financial inclusion process in the country. As of FY 2022 end, cumulatively, MEDP programme could cover4.66 lakh SHG members while LEDP could cover 1.06 lakhs SHG members. In fact, advances in ICT, including AI and other modern technologies, have become imperatives for the successful conduct of any business or industry. Naturally, these technologies need to be promoted deliberately for women empowerment and rural development.

Artificial Intelligence (AI) can help women in different ways, whether in employment or in entrepreneurship. AI can enable women to retrain, upskill and equip themselves and keep themselves abreast of the times. AI, thus, seeks to bridge the gender bias, as whatever the men can perform can be done equally well by the women too in today’s ICT era. Similarly, Machine Learning (ML) algorithms can be used by women entrepreneurs for marketing their products in this era when social media is being used by entrepreneurs as well as customers. The likes and dislikes of customers are growingly being shared in the social media and eWOM (electronic Word of Mouth) has become a powerful marketing tool today. AI, ML and other ICT tools are giving women a chance to redefine and reimagine their roles, professions and livelihoods.

Suggestions and Concluding Remarks

In view of the foregoing, it may be suggested that (i) all initiatives for women empowerment, rural development, gender mainstreaming etc. should primarily focus of effective use of ICT by the target population, (ii) deliberate and systematic efforts towards enhancing financial literacy, those for training them in the use of modern ICT-based tools be promoted by the Governments at the Union and State levels, either directly or through agencies like Kudumbashree(under Govt. of Kerala) as well as formal sector banks and financial institutions, (iii) promotion of the use of ICT and modern technologies like AI, ML by the entrepreneurs for better competitiveness and these modern tools be particularly encouraged in Marketing and Sales, SCM and Manufacturing, going by the global trend in this regard; (iv) Effective use of CRM (especially eCRM which is the new normal today) and diverse kinds of E-Banking, including Mobile banking by the banks and financial institutions, (v) special thrust on ICT-enabled services in rural areas to leverage from the fast growing tele-density in rural areas and also huge middle income rural customers; because ‘rural-focus’, of late, is a business model too rather than a statutory compulsion as in the case of priority sector lending (PSL) norms enforced by the Government, (vi) encouraging the effective use of social media by the women entrepreneurs, including, ICT-based (online) delivery channels, eWOM, etc. for marketing and after-sales service; because these more eco-friendly as well as cost-effective than the traditional modes, and furthermore these ICT-based modes are preferred by the modern discerning customers.

The future of India lies on the country’s ability to mainstream the excluded masses, like the rural poor, including the women, the disabled etc. The immense potential of ICT should be used for mainstreaming the disadvantaged groups as above. Women who are literate, financially empowered (independent), and tech-savvy can very meaningfully run micro enterprises (MEs) and even large-sized business or industrial units. Models like SHG-BLP and also digitization initiatives like EShakti should be further encouraged in India. In States like Kerala in India, the conditions are much more conducive for ICT-based interventions. Kerala’s ICT experience, its KFON project which is being implemented now, vast internet penetration etc. are laudable. In short, issues faced by women and other marginalized groups should be handled by empowering them through ICT and allied technologies including AI, ML etc. Entrepreneurships among the women, the physically challenged etc. need to be encouraged further and that too with maximum ICT-integration, so as to bring about holistic and sustained economic development in India.

References

Gerda Lerner (1988). The Creation of Patriarchy. The Origins of Women's Subordination. Women and History, Vol. 1. Oxford University Press.

IBEF (2022). Banking. India Brand Equity Federation, New Delhi, India. Aug.

Jacob, J., Vasantha, S. & Manoj, P.K. (2017). Financial technology and service quality in banks: Some empirical evidence from the old private sector banks based in Kerala, India. International Journal of Applied Business and Economic Research, 15(16), 447-457.

Jacob, J., Vasantha, S., & Manoj, P.K.. (2017). Future of brick and mortar banking in Kerala: Relevance of branch banking in the digital era. International Journal of Civil Engineering and Technology, 8(8), 780-789.

Joju, J., Vasantha, S., & Manoj, P. K. (2017). Electronic CRM & ICT-based banking services: An empirical study of the attitude of customers in Kerala, India. International Journal of Economic Research, 14(9), 413-423.

Manoj, P.K. (2010). Environment-friendly tourism for sustainable economic development in India. International Journal of Commerce and Business Managaement. 2(2). 139-147.

Manoj, P.K. (2015). Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’ in Kerala, India, International Research Journal of Finance and Economics, 138, 44-53.

Manoj, P.K. (2015). Socio-Economic Impact of Housing Microfinance: Findings of a Field based Study in Kerala, India. International Research Journal of Finance and Economics, 137, 32-43.

Manoj, P.K. (2016). Determinants of sustainability of rural tourism: a study of tourists at Kumbalangi in Kerala, India. International Journal of Advance Research in Computer Science and Management Studies. 4 (4). 17-30.

Manoj, P.K. (2018). CRM in old private sector banks and new generation private sector banks in Kerala: A comparison. Journal of Advanced Research in Dynamical and Control Systems, 10 (2 Special Issue), 846-853.

Manoj, P.K. (2019). Banking Technology and Service Quality: Evidence from Private Sector Banks in Kerala. International Journal of Recent Technology and Engineering, 8(4), 12098-12103.

Indexed at, Google Scholar, Cross Ref

Manoj, P.K. (2019). Dynamics of human resource management in banks in the ICT era: A study with a focus on Kerala based old private sector banks. Journal of Advanced Research in Dynamical and Control Systems. 11(7 Special Issue), 1667-1680.

Manoj, P.K. (2019). Social banking in India in the reforms era and the case of financial inclusion: Relevance of ICT-based policy options. Journal of Advanced Research in Dynamical and Control Systems, 11(7 Special Issue), 1654-1666.

McKinsey (2022). McKinsey Technology Trends Outlook 2022. McKinsey & Company, Aug. (www.mckinsey.com).

NABARD (2022), Status of Microfinance in India 2021-22, Mumbai, India.(www.nabard.org).

Nasar, K.K. & Manoj, P.K. (2015). Purchase Decision for Apartments: A Closer Look into the Major Influencing Factors. IMPACT International Journal of Research in Applied, Natural and Social Sciences. 3(5). 105-112.

Neeraja, J., &Manoj, P.K. (2014). Relevance of E-Banking Services in Rural Area – An Empirical Investigation, Journal of Management and Science, 5, 1-14.

Pickens, M. (2009). Window on the unbanked: Mobile money in the Philippines. Consultative Group to Assist the Poor (CGAP) Brief. Dec. (www.cgap.org).

Rajesh, S., & Manoj, P.K. (2015). Women Employees work life and challenges to Industrial Relations: Evidence from North Kerala. IPASJ International journal of Managment (IIJM), 3, 5, 6.

Received: 29-Oct-2022, Manuscript No. AMSJ-22-12762; Editor assigned: 31-Oct-2022, PreQC No. AMSJ-22-12762(PQ); Reviewed: 20-Nov-2022, QC No. AMSJ-22-12762; Revised: 03-Dec-2023, Manuscript No. AMSJ-22-12762(R); Published: 07-Jan-2023