Research Article: 2023 Vol: 27 Issue: 5

ICT for Promotion of Retail Banking in Digital India: A Study with a Focus on Housing Finance

Jacob Joju, Cochin University of Science and Technology, Kerala

Sankar Ganesh K, Sharda University, Uzbekistan

Ranjith K, LEAD College of Management, Dhoni, Palakkad, Kerala

Manoj P K, Cochin University of Science and Technology, Kerala

Prajith K, KSHM Arts and Science College, Palakkad, Kerala

Citation Information: Joju, J., Sankar Ganesh., Rajith, K., Manoj, P.K., & Prajith, K. (2023). ICT for Promotion of Retail Banking in Digital India: A Study with a Focus on Housing Finance. Academy of Marketing Studies Journal, 27(5),1- 18.

Abstract

Considering the general sluggishness in the growth of bank credit and the prospects of retail credit, especially housing finance, to propel credit growth in an economy like India where the credit to GDP ratio and mortgage to GDP ratio are very poor, this paper suggests aggressive promotion of housing finance and other retail banking products for the faster economic growth. The linkage effects of housing and its ability to trigger growth in many other allied sectors are noted. Due to its huge potential, ICT adoption gives another dimension to the effective promotion of retail banking. The need to ensure sustainability in the growth process by using environment-friendly materials, processes and methods as well as by the adoption of green banking, ICT and such other methods is specifically noted in this paper.

Keywords

Retail credit, Housing finance, Mortgage to GDP ratio, Linkage effects, ICT, AI.

Introduction

The banking sector in India in general and the housing finance segment in particular could tide over the COVID-19 slump. Still, the bank credit to GDP in India and the mortgage to GDP ratio are very low. So, there is enough scope for broadening bank credit in India, especially retail banking with a focus on housing finance, so that Indian economy can catch up very fast with the pre-COVID levels. The vast linkage effects of retail banking products like housing finance gives tremendous scope for faster growth in the economy, as many other allied sectors pick up growth momentum as a result of investment in the housing sector. The national goal of ‘Housing for All’and that too with a focus on ‘Affordable Housing’ gives another solid reason for the promotion of retail banking in India, especially the housing finance. The positive growth momentum in the housing sector because of the implementation of the Real Estate Regulatory Authority (RERA) Act needs to be further reinforced through suitable policy measures. Policy focus on ICT usage in this era of Digital India gives another dimension to the need for promotion of retail banking in India because of the immense potential of ICT to enhance quality and reduce operational costs.

Significance of the Study

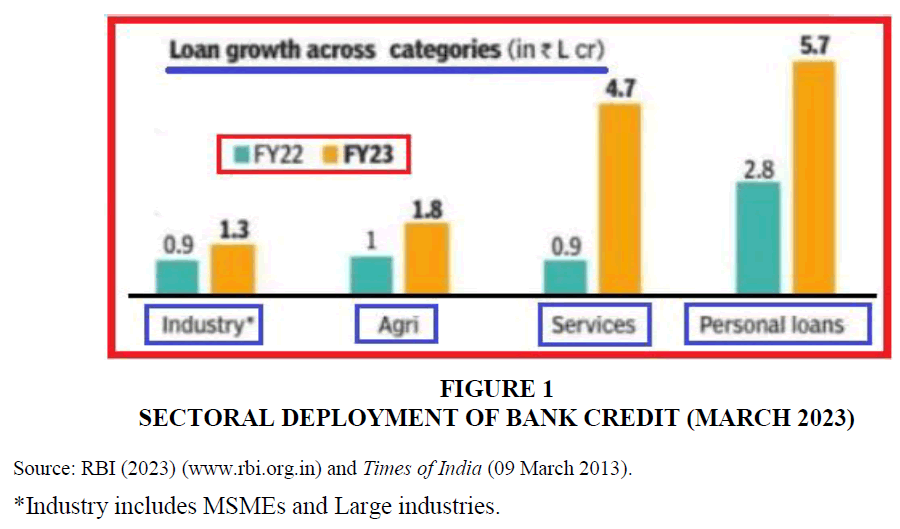

It is noted that retail banking (personal loans) is a sector that could withstand the slump in bank credit growth due to COVID-19, as of March 2023(data till Jan. 2023-end.) (Table 1) (Figures 1 & 2).

| Table 1 Sectoral Deployment of Bank Credit (March 2023) | |||||

| Particulars | 29 Jan 2021 | 26 Mar 2021 | 28 Jan 2022 | 25 Mar 2022 | 27 Jan 2023 |

| 1. Agriculture and Allied Activities | 1296998 | 1329618 | 1431992 | 1461719 | 1638079 |

| 2. Industry (Micro and Small, Medium and Large) | 2855099 | 2934689 | 3024185 | 3156067 | 3288720 |

| 2.1. Micro and Small | 407471 | 433192 | 502516 | 532792 | 578976 |

| 2.2. Medium | 130584 | 138599 | 199075 | 213996 | 235162 |

| 2.3. Large | 2317044 | 2362897 | 2322594 | 2409279 | 2474582 |

| 3. Services | 2709173 | 2770713 | 2862868 | 3011975 | 3477752 |

| 3.1. Transport Operators | 141198 | 142994 | 147641 | 155352 | 166550 |

| 3.2. Computer Software | 17966 | 19816 | 20516 | 20899 | 21071 |

| 3.3. Tourism, Hotels and Restaurants | 57601 | 59525 | 63571 | 64378 | 64909 |

| 3.4. Shipping | 7866 | 8066 | 7210 | 8436 | 7259 |

| 3.5. Aviation | 28190 | 27519 | 24212 | 23979 | 27824 |

| 3.6. Professional Services | 109418 | 108430 | 108561 | 116742 | 127711 |

| 3.7. Trade | 601065 | 628249 | 665677 | 696301 | 777832 |

| 3.7.1. Wholesale Trade (other than food procurement) | 296410 | 328461 | 340021 | 351213 | 381139 |

| 3.7.2. Retail Trade | 304655 | 299788 | 325656 | 345088 | 396692 |

| 3.8. Commercial Real Estate | 287743 | 289474 | 291336 | 291168 | 313440 |

| 3.9. Non-Banking Financial Companies (NBFCs) of which, | 895191 | 948568 | 983457 | 1022399 | 1287906 |

| 3.9.1. Housing Finance Companies (HFCs) | 266927 | 284469 | 271849 | 282048 | 309755 |

| 3.9.2. Public Financial Institutions (PFIs) | 72036 | 82184 | 132626 | 137084 | 181803 |

| 3.10. Other Services2 | 562937 | 538072 | 550688 | 612320 | 683251 |

| 4. Personal Loans | 2913384 | 3009013 | 3287408 | 3386982 | 3958874 |

| 4.1. Consumer Durables | 16767 | 17265 | 25707 | 27628 | 36910 |

| 4.2. Housing (Including Priority Sector Housing) | 1450154 | 1492302 | 1636091 | 1684424 | 1888144 |

| 4.3. Advances against Fixed Deposits | 70821 | 77928 | 84263 | 83379 | 109749 |

| 4.4. Advances to Individuals against share, bonds, etc. | 4948 | 5400 | 6149 | 6261 | 6858 |

| 4.5. Credit Card Outstanding | 131056 | 131704 | 144162 | 148416 | 186783 |

| 4.6. Education | 79681 | 78131 | 82302 | 82723 | 95226 |

| 4.7. Vehicle Loans | 361295 | 368412 | 395803 | 402689 | 496662 |

| 4.8. Loans against gold jewellery | 67563 | 75049 | 74779 | 73960 | 85928 |

| 4.9. Other Personal Loans | 731101 | 762821 | 838150 | 877503 | 1052614 |

Figure 1 Sectoral Deployment of Bank Credit (March 2023)

Source: RBI (2023) (www.rbi.org.in) and Times of India (09 March 2013).

*Industry includes MSMEs and Large industries.

Figure 2 Sectoral Deployment of Bank Credit (FY 2018 and FY2019)

Source: RBI (2019), Report on Trend and Progress of Banking in India, p.56.

The relative share of industry in the loans provided by the banks in India during FY 2023 has slipped to 9.2 percent during the first 10 months of FY 2023 from as high as 17.2 percent during the same period of the last fiscal, FY 2022. Fresh loans to industry in FY 2023 were the least impressive and were lower than those granted to agriculture (viz. Rs.1,76,360) and the same is very much lower than the loans granted to services sector and also personal loans. The service sector accounts for over one-third of the total incremental credit. This situation indicates the growing prominence of retail banking (personal loans) in India in the current post-COVID regime, when the credit off-take, in general, is low. Because, it may be noted that growth in the advances (credit off-take) of banks during the first 10 months of FY 2023, till Jan-end 2023 has been only to the extent of only 12 percent. Accordingly, the total bank advances (credit) has increased only to the extent of Rs 14.5 lakh Crore in FY 2023 to reach the level of Rs 133.4 lakh Crore.

The modest credit growth at 12 percent rate has led to total credit of 14.5 lakh Crore, an amount of Rs 5.7 lakh Crore which is as high as 39.4 percent of the incremental credit this year, was bank loans for personal finance (retail banking). Over a third of incremental credit has gone to the services sector, and the credit growth to this sector has been at the rate of 15.5 percent. Further, it is noted that this vital sector accounts for as high as 26.1 percent of the bank credit as of FY 2023 as against 24.4 percent recorded in FY 2022.It may be pointed out here that personal loans (retail banking) denotes the fastest growing segment in bank credit and housing loans account for nearly half of the same. So, in this post-COVID scenario promoting this segment can ensure faster credit growth and economic growth also given the vast linkage effects of housing.

Objectives and Methodology

This study has set the following as its objectives: (i) To study the relevance of retail banking in the ongoing Post-COVID scenario in India, with a focus on housing finance; (ii) To study the case of housing development in India for the faster economic development of the country and the need for adoption of ICT-based technologies, and other methods for maintaining sustainability; (iii) To suggest strategies for promoting retail banking in India with a focus on housing finance.

The study is descriptive-analytical as well as exploratory in nature and is primarily based on authentic secondary data from Government sources like Govt. of India, Reserve Bank of India, National Housing Bank and also from other reputed sources like McKinsey, JLL etc.

Literature Review

In a research paper by Manoj, P. K. (2003), “Retail Banking: Strategies for Success in the Emerging Scenario” in IBA Bulletin, the vital relevance of promoting retail credit, especially home loans for the faster economic recovery of India, in times of economic slowdown.A paper by P.K. Manoj (2004), ‘Dynamics of Housing Finance in India’ in Bank Quest has noted the vital need for promoting housing development for India’s sustained economic growth.A research article by P.K. Manoj (2007), ‘ICT industry in India: A SWOT analysis’, in Journal of Global Economy has discussed the problems, challenges, strengths and limitations of India’s ICT industry. Another paper by P.K. Manoj (2010), ‘Environment-friendly tourism for sustainable economic development in India’, in International Journal of Commerce and Business Managaement has observed the crucial need for promoting environment-friendly tourism in India for the sustained economic growth of the country. A study by P.K. Manoj (2010), ‘Impact of technology on the efficiency and risk management of old private sector banks in India: Evidence from banks based in Kerala’, in European Journal of Social Sciences has noted the vital need for ICT integration for enhanced performance and better customer service by the banks in Kerala. A paper by P.K. Manoj (2012), ‘Information and communication technology (ICT) for effective implementation of MGNREGA in India: An analysis”, in Digital Economy in India: Security and Privacy has noted the key role that ICT plays while implementing MGNREGA in India.Astudy by Manoj P. K. (2012), “Potential of micro enterprises in women empowerment: A critical study of micro enterprises run by women under the Kudumbashree Programme in Kerala” has noted that micro enterprises of Kudumbashreehave high potential for empowering women.

An empirical study on CRM by William George & Manoj (2013) “Customer Relationship Management in Banks: A Comparative Study of Public and Private Sector Banks in Kerala” has pointed out the superior level of ICT integration and better CRM systems in private banks in Kerala as against their public sector counterparts in the State, and hence the high-tech private banks are quite ahead in customer service and in CRM.A paper by Manoj (2013), ‘Prospects and Challenges of Green Buildings and Green Affordable Homes: A Study with Reference to Ernakulam, Kerala’ in Global Research Analysis, has observed the vital need for promoting eco-friendly housing for the sustained economic development of Kerala.A research paper by Nasar & Manoj (2013), ‘Customer satisfaction on service quality of real estate agencies: An empirical analysis with reference to Kochi Corporation Area of Kerala State in India’ in International Journal of Management, IT and Engineering, has noted the diverse service quality factors relating to real estate agencies at Kochi in Kerala State, India.

A research paper by James & Manoj (2014), ‘Relevance of E-Banking Services in Rural Area – An Empirical Investigation’ in Journal of Management and Science, has observed based on their field study the utmost relevance of E-Banking in rural Kerala to expedite process of rural development and women empowerment, and suggested its expansion. An HMF (housing micro finance) study by Manoj, (2015), “Socio-Economic Impact of Housing Microfinance: Findings of a Field based Study in Kerala, India” in International Research Journal of Finance and Economics, has observed the hugegrowth prospects of HMF in Kerala for empowering the homeless. Astudy by Manoj, (2015) “Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’ in Kerala, India”, has identified the factors that deter the growth of HMF in Kerala to be lack of awareness regarding the terms and conditions of loans, and also their expectation of a ‘writing of’ loans.

A joint study by Vidya Viswanath, & Manoj, (2015), “Socio-Economic Conditions of Migrant Labourers - An Empirical Study in Kerala”, has observed that the socio-economic situation of migrants is very poor, but the earnings of migrants in Kerala quite higher than those of their home States. A field-based study by Nasar & Manoj (2015) “Purchase Decision for Apartments: A Closer Look into the Major Influencing Factors” has observed that price, quality and location are the significant factors influencing the purchase decision of apartments by customers in Kochi, a city in the central part of Kerala.

A research paper by Rajesh & Manoj (2015) ‘Women Employee Work-life and Challenges to Industrial Relations: Evidence from North Kerala’ in IPASJ International Journal of Management has observed the inevitability of WLB (work-life balance) for attaining conducive and healthy industrial relations and accordingly greater industrial productivity as well. An article by Manoj (2016), ‘Determinants of sustainability of rural tourism: a study of tourists at Kumbalangi in Kerala, India’, in International Journal of Advance Research in Computer Science and Management Studies, has observed that enhanced infrastructure (internet, other ICT-based tools etc.) facilities should be provided for the sustainable growth of the tourism sector in Kerala State.

A research paper by Manoj (2016) “Bank Marketing in India in the ICT Era: Strategies for Effective Promotion of Bank Products” has observed the crucial role that ICT could play in enhancing the competitiveness of bank products and services and also in the effective marketing of such products and services in this ICT regime.A study by Joju et al. (2015), “E-CRM: A Perspective of Urban & Rural Banks in Kerala” has made a comparison of ICT (E-CRM) experiences of rural and urban customers, and has observed that both types liked E-CRM owing to its convenience and such other benefits, and suggested different sets of marketing strategies for the two types.

A research paper by Joju, et al. (2017), ‘Electronic CRM & ICT-based banking services: An empirical study of the attitude of customers in Kerala, India’ in International Journal of Economic Research has noted the positive impact of E-CRM on the performance of banks.A study by Manoj, (2018), ‘CRM in old private sector banks and new generation private sector banks in Kerala: A comparison’ has pointed out the superior level CRM systems in private banks primarily due to the better ICT integration by them as opposed to their public sector (Govt.) counterparts; ultimately resulting in higher business, better customer service, and lower cost for private banks. A joint study by Joju & Manoj (2019), “Banking Technology and Service Quality: Evidence from Private Sector Banks in Kerala” in International Journal of Recent Technology and Engineering has noted the positive influence of ICT adoption by banks on service quality.A paper by Manoj, (2019), ‘Dynamics of human resource management in banks in the ICT era: A study with a focus on Kerala based old private sector banks’ has pointed out the changing HRM practices in the banking sector and the relevance of a ‘human touch’ even in this era of vast ICT adoption and automation in the banking sector.

A paper by Manoj, (2019) ‘Social banking in India in the reforms era and the case of financial inclusion: Relevance of ICT-based policy options’ has noted utmost need for social banking even in this reforms era, and the relevance of ICT for inclusive and equitable growth. JLL and La-Salle (2022) in the 12 Ed. (2022) of Global Real Estate Transparency Index portrays a poor picture regarding India’s low real estate transparency as against the situation in other peer nations such as China, US etc. and has also noted the top status in respect of China. A paper by Lakshmi & Manoj, (2017) “Service quality in rural banking in North Kerala: A comparative study of Kannur district co-operative bank and Kerala Gramin bank” in International Journal of Applied Business and Economic Research has noted that service quality for rural banking in Kerala Gramin Bank is higher than that in respect of Kannur District Co-operative Bank owing to higher ICT adoption and customer service. India Brand Equity Federation (IBEF, 2022) in its Banking report has noted the rapid digitization process in India, like, growing ATM penetration, rural penetration–all these resulting in drastic changes in the banking landscape in the country.

In view of the foregoing discussion, it is noted that ICT has got a crucial role in improving the quality and competitiveness of banking services, empowering the poor especially the women, rural development and hence bringing about faster and equitable economic development. The case of retail banking deserves special mention, as it is the segment which is growing fast and the one which is capable of tiding over the slump in the credit off-take. In this post-COVID era, as the banking sector strives hard to catch up with pre-COVID era, retail banking (especially home loans segment) needs to be encouraged further for faster credit growth and economic recovery. ICT adoption gives another push to this endeavor, given its immense potential. As papers on retail banking in this ICT era are scarce, this paper seeks to bridge this research gap by focusing on the need for promotion of retail banking with a focus on home loans.

Retail Banking in India: For Faster Recovery in the Post-COVID Scenario

Retail banking segment has grown by 16.9 percent in FY 2023 (first 10 months). The share of this segment has gone up to 29.8 percent of the total non-food credit of the banks in India, as against 28.6 percent as of comparable period of last fiscal, FY 2022 (first 10 months). Of the total retail credit (29.8 percent) as above, nearly half (14.2 percent, to be precise) is home loans.Within Retail Banking group, the fastest-growing type is loans against shares and other securities and this sub-group has grown by 31 percent. Next comes, the Credit cards type of retail credit which has grown by 25.9 percent to Rs 1.9 lakh Crore in FY 2023 (first 10 months).

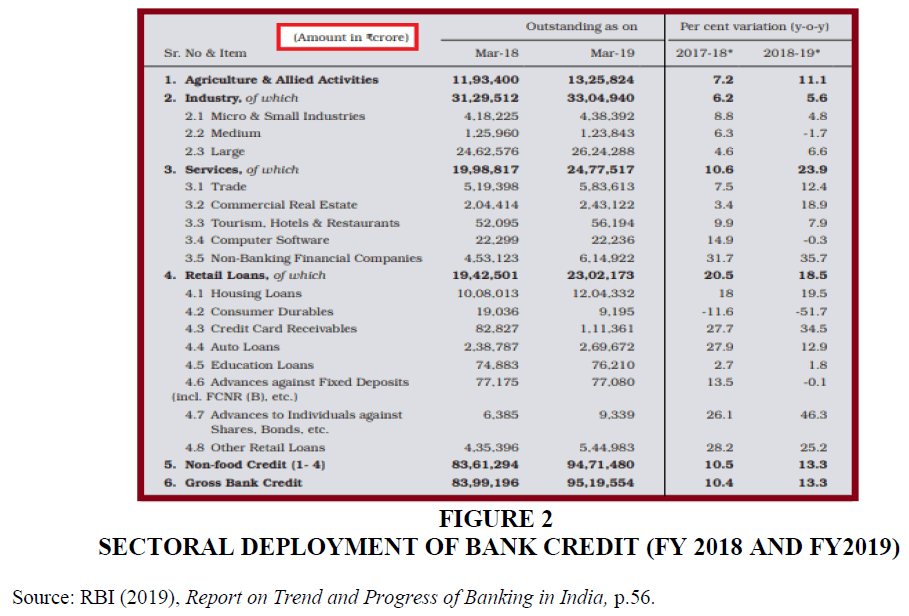

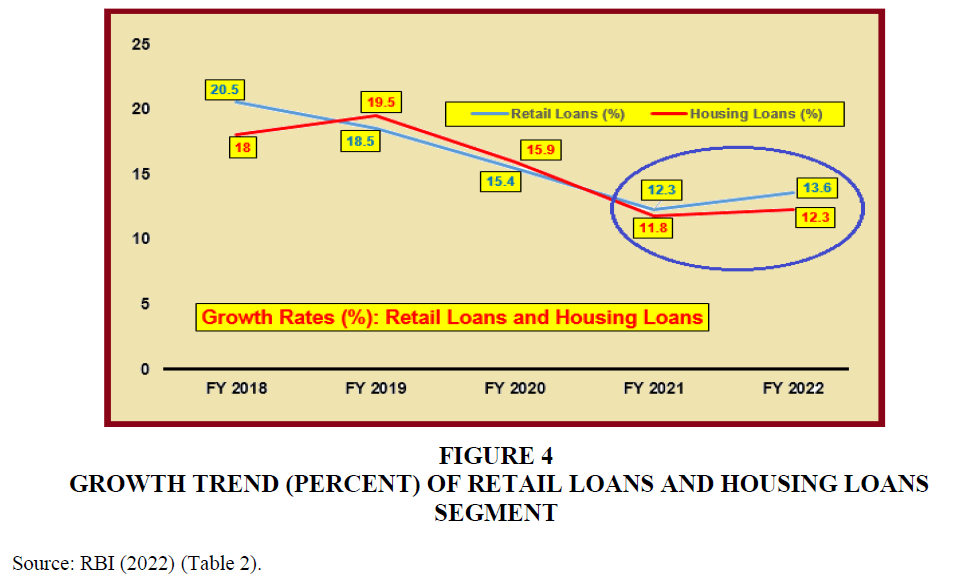

From Table 2, it may be noted that there has been a gradual fall in the Y-on-Y (Year-on-Year) growth rate (percentage) in Retail Loans right from FY 2018 till FY 2021, that is four years in a row, and thereafter (FY 2022) there is a reversal of trend.

| Table 2 Housing Investments- Multipliers | ||

| Multiplier | Type I | Type II |

| Employment Multiplier | 1.15 | 1.73 |

| Income Multiplier | 1.54 | 2.84 |

| Output Multiplier | 2.33 | 5.11 |

| Employment Co-efficient | 2.69 | 4.05 |

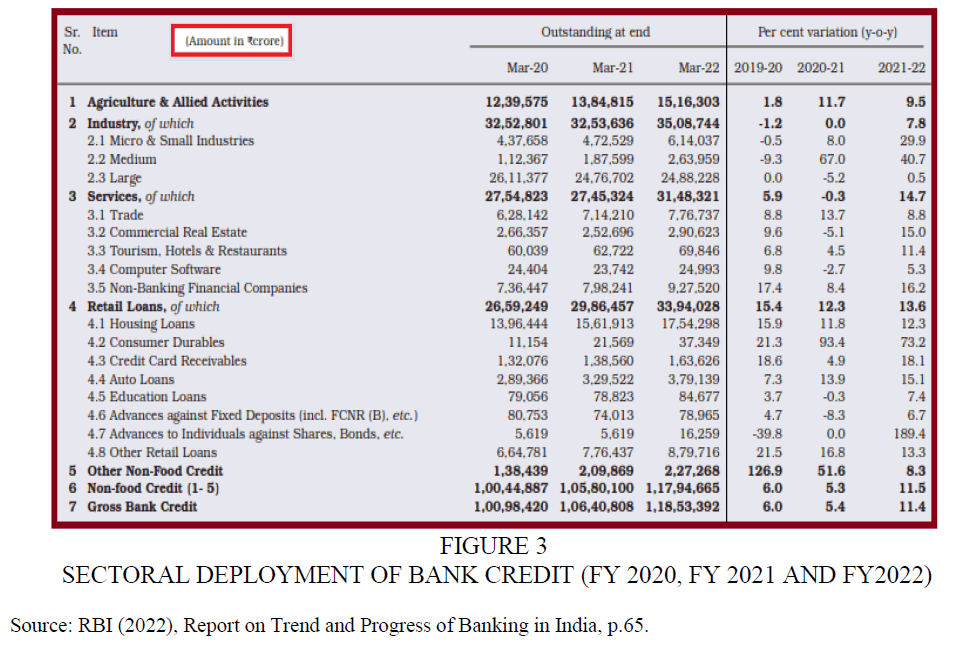

In respect of Housing Loans in particular, similar to the general trend in respect of Retail Loans, there has been a generally declining growth rate Y-on-Y till FY 2021 (except FY 2019), and a reversal of this trend is noted in FY 2022. This trend reversal needs to be sustained for ensuring faster credit growth and hence economic growth (Table 2; Figure 3).

Figure 3 Sectoral Deployment of Bank Credit (FY 2020, FY 2021 and FY2022)

Source: RBI (2022), Report on Trend and Progress of Banking in India, p.65.

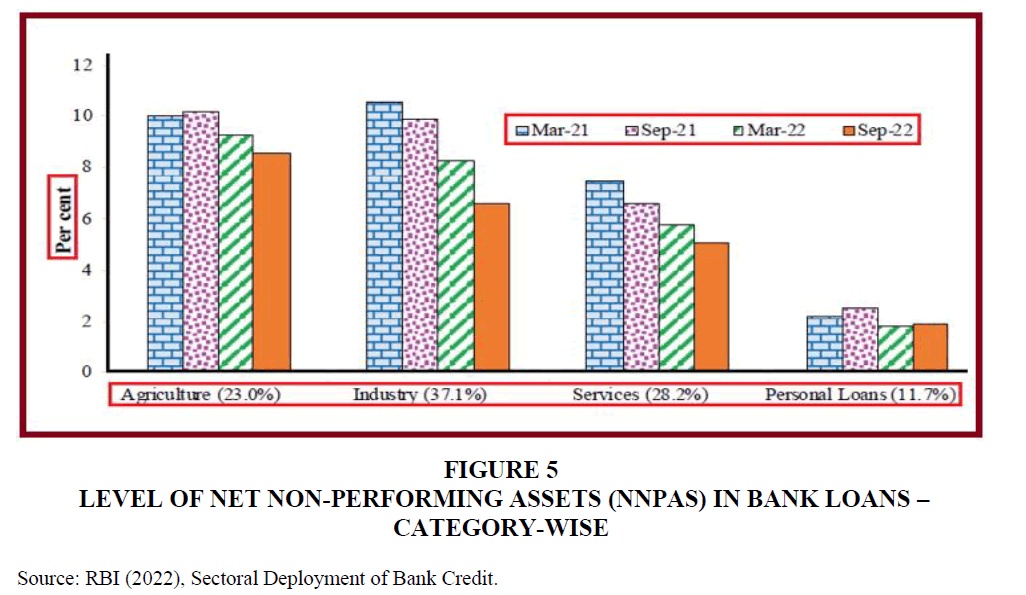

One of the most significant positive features of Retail Banking (Personal Loans) segment is that this segment has the lowest level of NPAs (Non-Performing Assets) or in other words the highest quality in terms of repayment track-record. Thus, these loans are least risky (Figure 4).

Figure 4 Growth Trend (Percent) of Retail Loans and Housing Loans Segment

Source: RBI (2022) (Table 2).

Given the superior asset quality of Retail Loans (Personal Loans) in general and Housing Loans in particular (Figure 5) in terms of their lowest default (NPA) levels, and also the trend reversal indicating the growth in Retail Loans (and also Housing Loans, in particular) as against a generally declining trend of these loans witnessed earlier (Figure 5), it is meaningful to delve more into the more recent developments till FY 2023. As already noted earlier, there are clear indications of positive growth in Retail Loans in general and Housing Loans in particular even after FY 2022 till FY 2023 so far (till the 10 months ended 31 Jan. 2023) (Table 1). Now, let us make a closer look intocase of housing and residential real estate sector.

Figure 5 Level of Net Non-Performing Assets (NNPAS) in Bank Loans – Category-Wise

Source: RBI (2022), Sectoral Deployment of Bank Credit.

Housing and Residential Real Estate Sector in India: Need for Further Investments

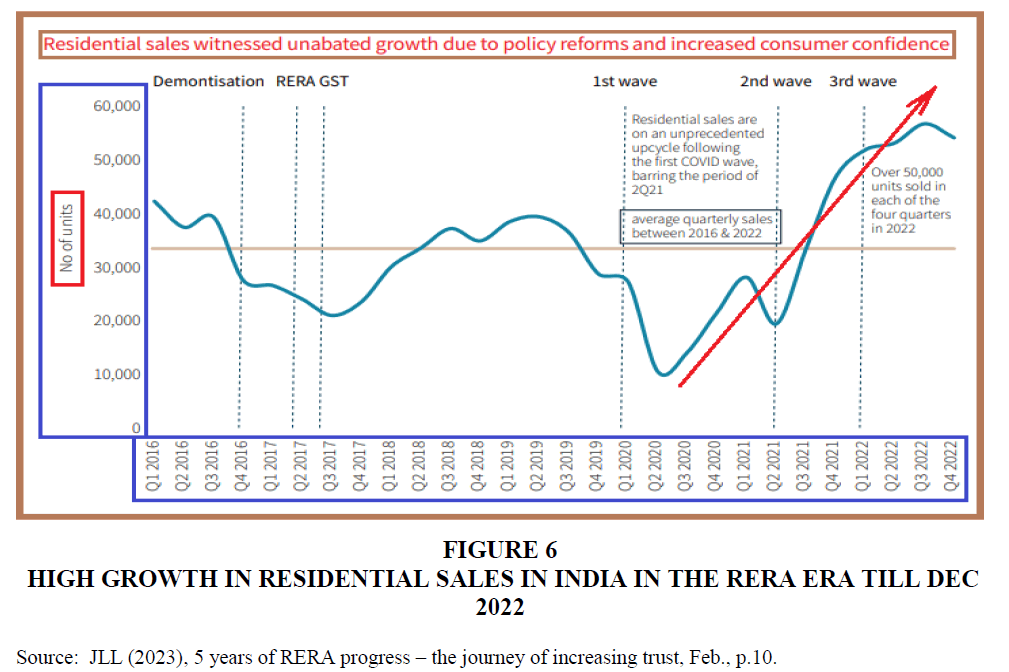

The growing trend in housing development in India in terms of the sales in housing units can be since FY 2021 till date (JLL, 2023). The policy support of the Government, and the conducive legal and regulatory environment created by the Government by way of the enactment of RERA (Real Estate Regulatory Authority) Act would have supported the growth momentum in housing development. As RERA has since been implemented in most of the States and Union Territories (UTs) in India, customer confidence has grown rapidly in the recent past, and the real estate court cases havedrastically fallen also. These positive changes due to RERA could greatly enhance the transparency in real estate deals, leading to rise in the sales of houses (Figure 5).

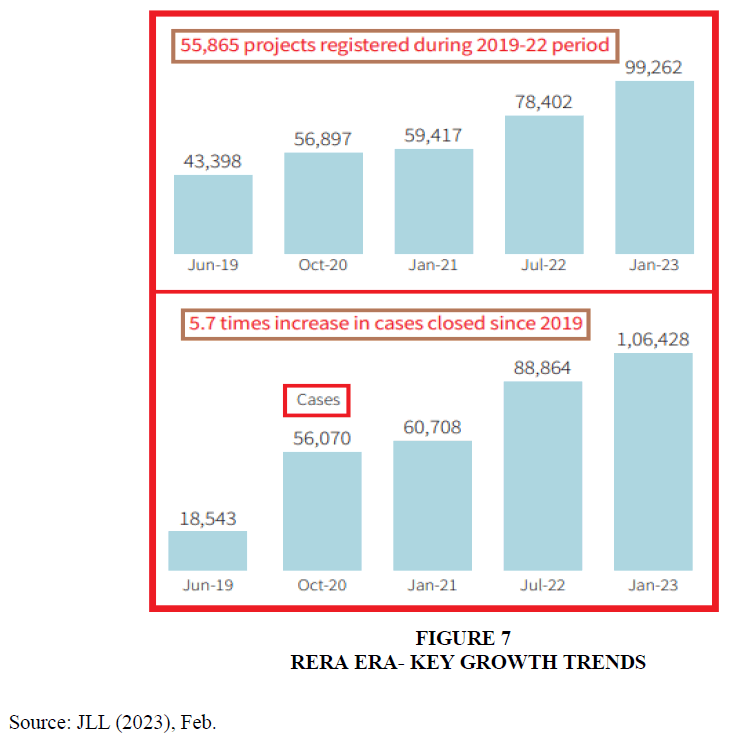

The enactment of RERA has been a landmark in the history of housing development in India. Fast adoption of RERAin India by the States and UTs created a favorable environment for housing development in the country. The consistent rise in the sales of housing units, fast growth in the RERA-registered housing projects (nearing almost 1 lakh, as of Jan.-end 2023) and dramatic fall (5.7 times) in the number of court cases relating to housing deals, etc. indicate the acceptance of RERA in India. It may be noted that these positive developments have taken place in a situation of economic slump in the aftermath of COVID-19 pandemic and other shocks such as Demonetisation (Demo), hasty implementation of GST, etc. (JLL, 2023) (Figure 6).

Figure 6 High Growth in Residential Sales in India in the Rera ERA Till Dec 2022

Source: JLL (2023), 5 years of RERA progress – the journey of increasing trust, Feb., p.10.

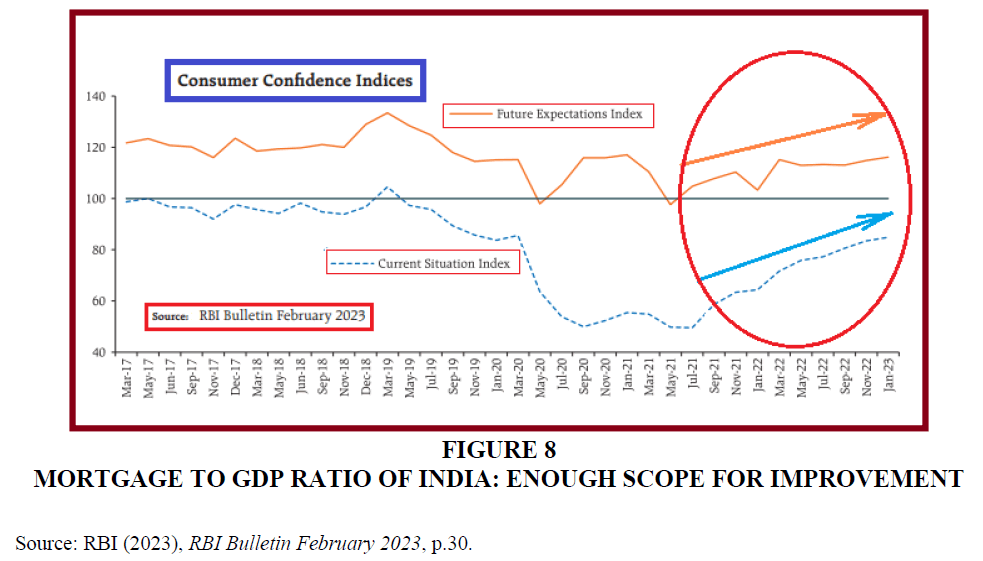

It may be stated that the growth momentum in the housing finance and housing development sectors in India needs to be sustained to ensure faster credit growth and hence economic growth in India. This needs leveraging the positive factors: (i) least mortgage to GDP ratio in India, suggesting bright prospects for housing loans; (ii) governmental policies conducive to housing (e.g. RERA, REITs), ICT usage (e.g. Digital India);(iii) growing GDP, customer confidence, transparency etc. Both the consumer confidences indices of RBI are growing, and this also suggest good prospects for investments in housing (Figures 7,8).

Figure 8 Mortgage to GDP Ratio of India: Enough Scope for Improvement

Source: RBI (2023), RBI Bulletin February 2023, p.30.

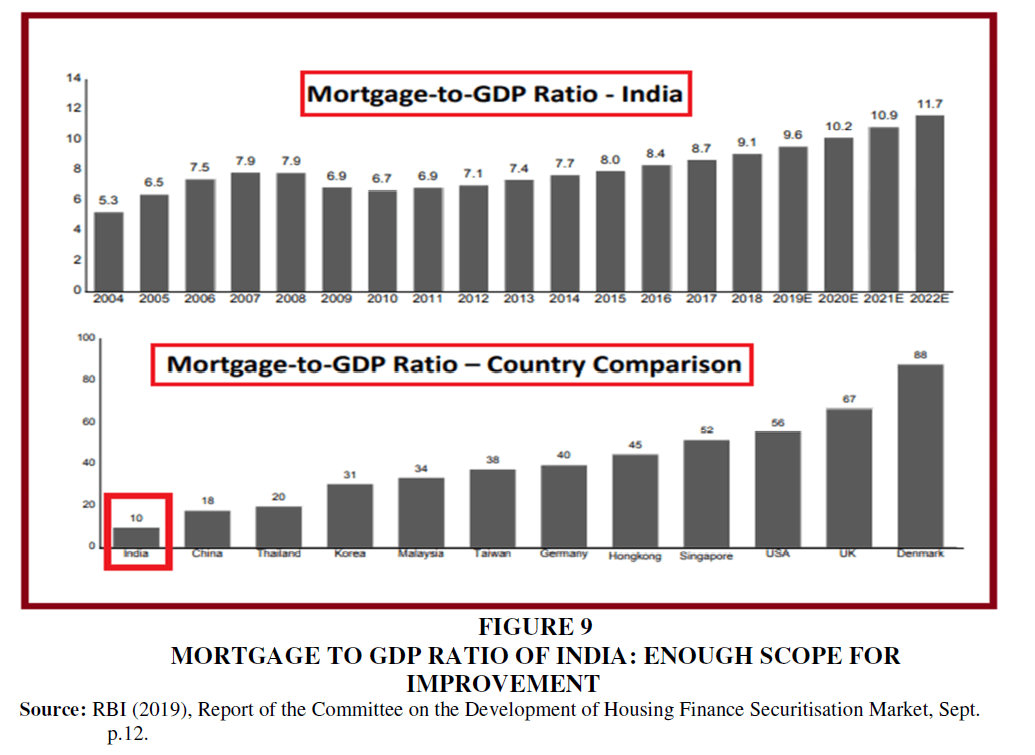

The Mortgage to GDP ratio in India (about 10 percent) is one of the leastvis-à-vis other nations of the world gives good scope for further housing investments in India (Figures 9).

Figure 9 Mortgage to GDP Ratio of India: Enough Scope for Improvement

Source: RBI (2019), Report of the Committee on the Development of Housing Finance Securitisation Market, Sept. p.12.

Given the conducive macroeconomic conditions (like, a growing economy with a high GDP growth rate), favorable governmental policies (RERA, REITs etc.), very poor mortgage to GDP ratio which suggests more growth prospects for housing loans, growing nature of consumer confidence etc. suggest more housing investments. Probably, the vital reason that justifies more investments in housing by promotion of housing finance is the linkage effects of housing, both Type I and Type II linkages, that create multiplier effects on nearly 350 other sectors (Table 2).

Sector on GDP and Employment in Indian Economy

In short, the current scenario in India may be noted to be quite conducive for further investments. However, it is equally important to ensure sustainability of such investments. This is because of the adverse effects of housing construction and allied activities on the environment which needs to be controlled and due regard be given to ensure ‘Green Houses’ that cause the least harm to the environment are promoted. While granting housing finance, the vast potential of ICT and allied technologies like Artificial Intelligence (AI), Blockchain etc. be used so that greater customer service and competitiveness can be ensured at lower cost. The fact that ICT use can reduce the harm to the environment (eg. saving trees for producing paper) especially if ICT is used for marketing or promotional purpose. Besides the use of ICT and allied technologies like AI and Block chain, it is vital to use construction methods and technologies that save energy, mitigate the harmful environmental effects etc. These aspects are dealt in the next session.

Sustainable Housing Finance and Development: Use of ICT and Other Technologies

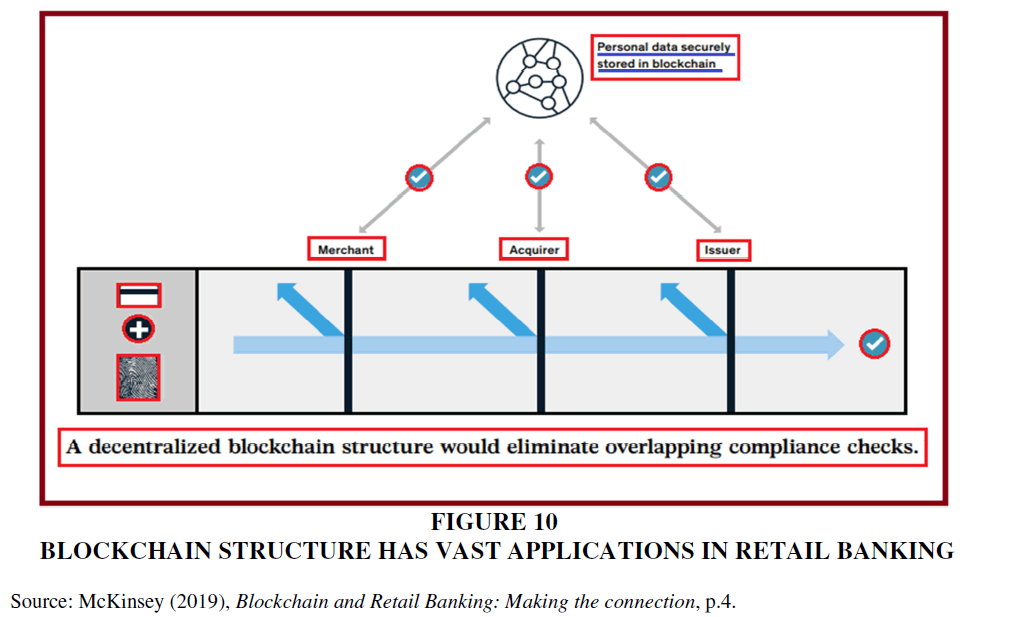

In this era of Digital India, the relevance of ICT integration need not be over stated. But, over and above this, use of ICT and allied technologies (eg. AI and Blockchain) can greatly improve the delivery of retail banking services, like, housing loans. Blockchain technology can be used in Retail Banking by leveraging its three main features: data handling, disintermediation, and trust.

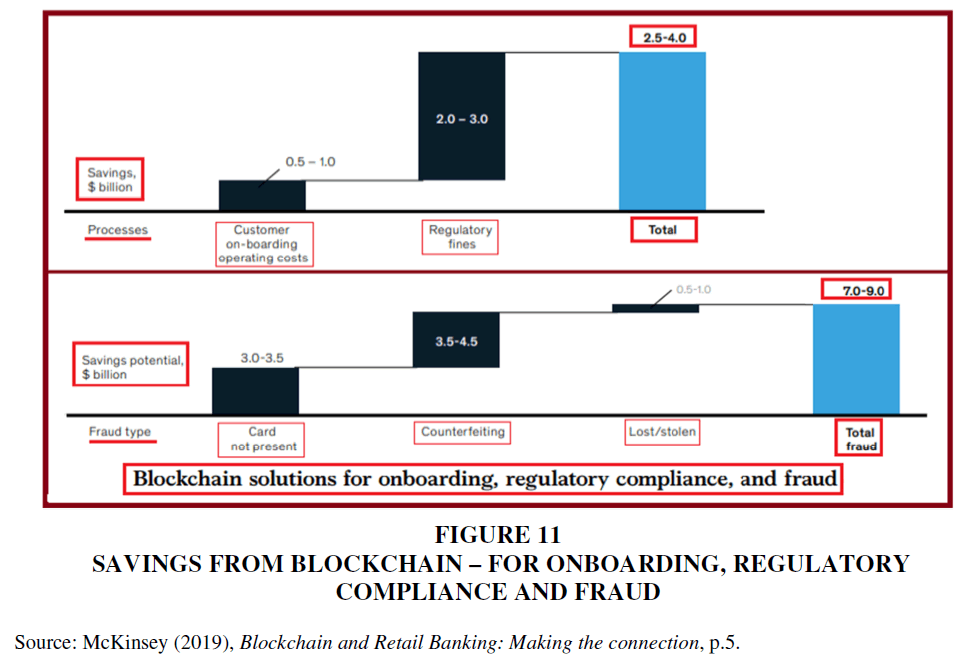

The three vital Blockchain features (viz. data handling, disintermediation, and trust) can be effectively used in retail banking settings for the purpose of (i) Remittances, (ii) KYC / ID fraud prevention, and (iii) Risk scoring. A decentralized Blockchain structure can eliminate the overlapping compliance checks (McKinsey, 2019) (Figure 10, 11).

Figure 10 Blockchain Structure has Vast Applications in Retail Banking

Source: McKinsey (2019), Blockchain and Retail Banking: Making the connection, p.4.

Figure 11 Savings from Blockchain – for Onboarding, Regulatory Compliance and Fraud

Source: McKinsey (2019), Blockchain and Retail Banking: Making the connection, p.5.

By way of Blockchain solutions, retail banking services (like, housing finance) can be delivered with significant savings in customer onboarding operations and regulatory compliance, as well as fraud-prevention (Figure 10). Besides the use of ICT and allied technologies (like, Blockchain, as discussed above) modern construction methods and technologies that ensure environment-friendly (“Green Houses” that ensure lesser harm to the environment) construction that can also ensure energy savings and cost savings. An example is Circular Technologies for construction that ensure (i) Energy savings, (ii) Lower CO2 (Carbon Dioxide) emissions, and (ii) Lower consumption of Materials and Minerals (through recycling) (Figure 11).

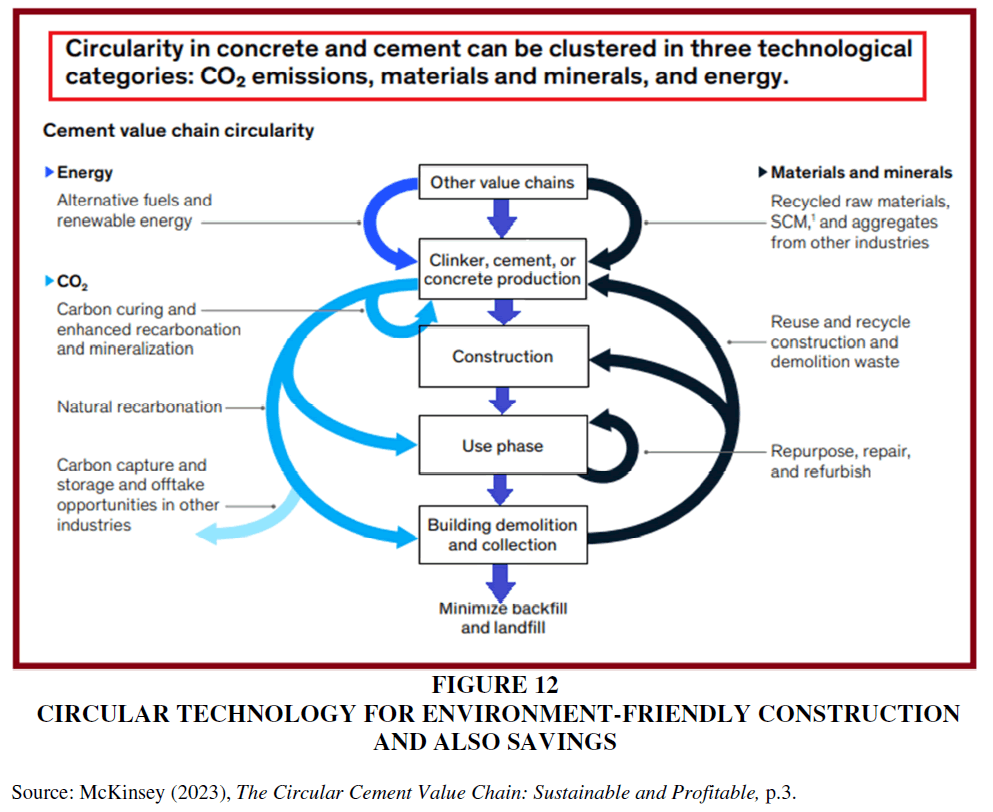

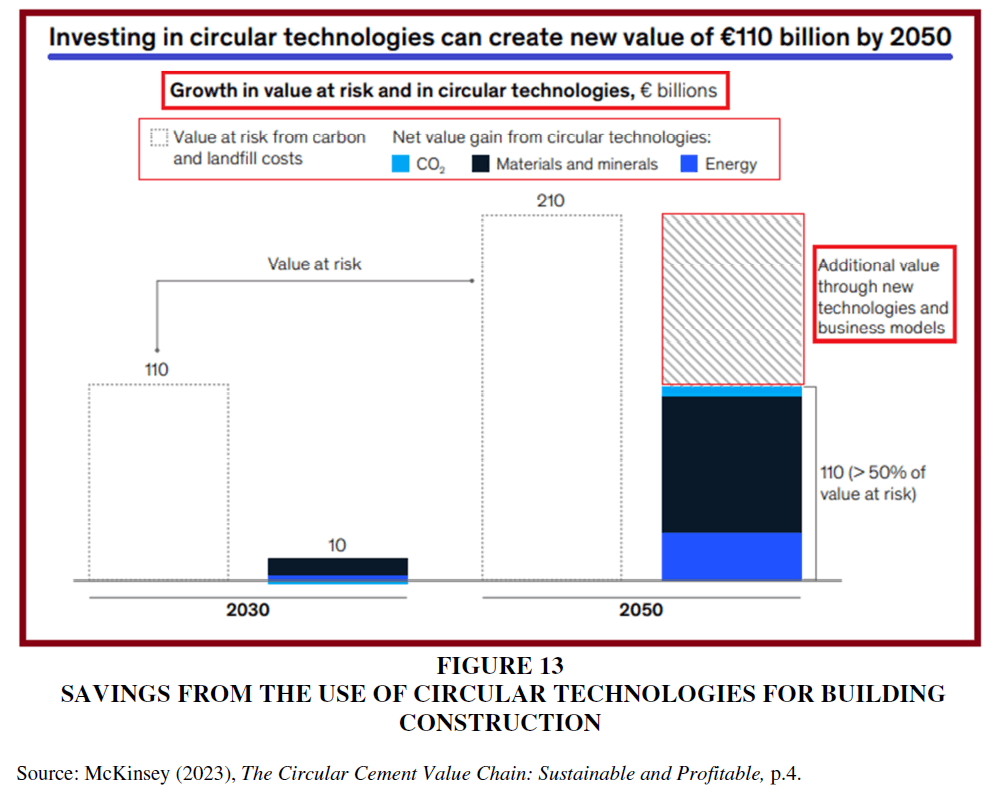

Adoption of modern technologies, like, Circular Technology (Figure 12) is an imperative for the sustainability of construction sector worldwide, given the negative environmental effects of construction like CO2 emissions as well as high levels of consumption of energy, materials and minerals. Use of these resources be optimized, or they must be re-used or re-cycled. Regarding energy use, renewable energy be used. So, significant cost savings can be attained (Figure 13).

Figure 12 Circular Technology for Environment-Friendly Construction and Also Savings

Source: McKinsey (2023), The Circular Cement Value Chain: Sustainable and Profitable, p.3.

Figure 13 Savings from the use of Circular Technologies for Building Construction

Source: McKinsey (2023), The Circular Cement Value Chain: Sustainable and Profitable, p.4.

Suggestions and Concluding Remarks

In view of the foregoing, it may be suggested that (i) Retail Banking be promoted in India with a focus on Housing Loans, considering the vast linkage (multiplier) effects of housing investments in many allied sectors; (ii) ICT and allied technologies (like, AI and Blockchain) be used in the delivery of Retail Banking products, including Housing Finance in view of the high potential for cost savings along with higher customer service and competitiveness, and (iii) all housing construction activities be made ‘Green’ through the use of modern green technologies and green standards for building construction be adopted, (iv) ESG norms and other environment friendly norms and standards be adopted to ensure long-term sustainability of the housing construction sector, along with aligning these with relevant SDGs. (v) effective use of social media and other ICT-based modes for the marketing of retail banking products, including housing finance, since such channels are more environment-friendly and cost-effective than the traditional channels. Given the conducive macroeconomic environment and Government’s policy support, let us hope that India’s retail credit segment will grow faster, leading to faster growth of the whole economy.

References

James, N., & Manoj, P. K. (2014). Relevance of E-Banking Services in Rural Area–An Empirical Investigation. Journal of Management and Science, 5, 1-14.

Joju, J., & Manoj, P. K. (2019). Banking Technology and Service Quality: Evidence from Private Sector Banks in Kerala. International Journal of Recent Technology and Engineering, 8(4), 12098-12103.

Indexed at, Google Scholar, Cross Ref

Joju, J., Vasantha, S., & Manoj, P. K. (2015). E-CRM: A perspective of Urban and Rural Banks in Kerala. International Journal of Recent Advances in Multidisciplinary Research, 2(09), 0786-0791.

Joju, J., Vasantha, S., & Manoj, P. K. (2017). Electronic CRM & ICT-based banking services: An empirical study of the attitude of customers in Kerala, India. International Journal of Economic Research, 14(9), 413-423.

KK, N., & PK, M. PURCHASE DECISION FOR APARTMENTS: A CLOSER LOOK INTO THE MAJOR INFLUENCING FACTORS.

Lakshmi, L., & Manoj, P. K. (2017). Service quality in rural banking in north Kerala: A comparative study of Kannur district co-operative bank and Kerala Gramin bank. International Journal of Applied Business and Economic Research, 15(18), 209-220.

Manoj P.K. (2016). Bank Marketing in India in the ICT Era: Strategies for Effective Promotion of Bank Products. International Journal of Advance Research in Computer Science and Management Studies. 4(3). 113-112.

Manoj, P. K. (2003). Retail Banking: Strategies for Success in the Emerging Scenario. IBA Bulletin, 25(11), 18-21.

Manoj, P. K. (2004). Dynamics of Housing Finance in India. Bank Quest, 75(3), 19-25.

Manoj, P. K. (2007). ICT industry in India: a swot analysis. Journal of Global Economy, 3(4), 263-278.

Indexed at, Google Scholar, Cross Ref

Manoj, P. K. (2009). Emerging Technologies and Financing Models for Affordable Housing in India. Directorate of Public Relations and Publications, Cochin University of Science and Technology (CUSAT), Kochi, Kerala, April.

Manoj, P. K. (2010). Determinants of Successful Financial Performance of Housing Finance Companies in India and Strategies for Competitiveness: a Multivariate Discriminant Analysis. Middle Eastern Finance and Economics, 7, 199-210.

Manoj, P. K. (2010). Environment-friendly tourism for sustainable economic development in India. International Journal of Commerce and Business Managaement, 2(2), 139-147.

Manoj, P. K. (2010). Impact of technology on the efficiency and risk management of old private sector banks in India: Evidence from banks based in Kerala. European Journal of Social Sciences, 14(2), 278-289.

Manoj, P. K. (2011). Determinants of Profitability of Housing Finance Companies in India and Strategies for Competitiveness: a Multiple Partial Correlation Approach. International Journal of Business Intelligence and Management, 3(2), 121-137.

Manoj, P. K. (2012). Information and communication technology (ict) for effective implementation of mgnrega in india: An analysis. Digital Economy of India–Security and Privacy, Serials Publications, New Delhi, 145-150.

Manoj, P. K. (2012). Potential of micro enterprises in women empowerment: A critical study of micro enterprises run by women under the Kudumbashree Programme in Kerala. International Journal of Business Policy and Economics, 5(2), 1-16.

Manoj, P. K. (2013). Research paper economics prospects and challenges of green buildings and green affordable homes-concept: a study with reference to Ernakulam, Kerala. Economics, 2(12), 45-49.

Manoj, P. K. (2015). Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’in Kerala, India. International Research Journal of Finance and Economics, 138, 44-53.

Manoj, P. K. (2016). Determinants of sustainability of rural tourism: a study of tourists at Kumbalangi in Kerala, India. International Journal, 4(4).

Manoj, P. K. (2017). Construction costs in affordable housing in Kerala: relative significance of the various elements of costs of affordable housing projects. International Journal of Civil Engineering and Technology, 8(9), 1176-1186.

Manoj, P. K. (2017). Cost management in the construction of affordable housing units in Kerala: A case study of the relevance of earned value analysis (EVA) approach. International Journal of Civil Engineering and Technology (IJCIET), 8(10), 111-129.

Manoj, P. K. (2019). Dynamics of human resource management in banks in the ICT era: A study with a focus on Kerala based old private sector banks. Journal of Advanced Research in Dynamical and Control Systems, 11(7), 1667-1680.

Manoj, P. K. (2019). Social banking in India in the reforms era and the case of financial inclusion: Relevance of ICT-based policy options. Journal of Advanced Research in Dynamical and Control Systems, 11(7), 1654-1666.

Manoj, P. K., & Viswanath, V. (2015). Socio-economic conditions of migrant labourers—An empirical study in Kerala. Indian Journal of Applied Research, 5(11), 88-93.

Manoj, P.K. (2015). Socio-Economic Impact of Housing Microfinance: Findings of a Field based Study in Kerala, India. International Research Journal of Finance and Economics, 137, 32-43.

Nasar, K. K., & Manoj, P. K. (2013). Customer satisfaction on service quality of real estate agencies: An empirical analysis with reference to Kochi Corporation Area of Kerala State in India. International Journal of Managment, IT and Engineering, 3(6), 213-227.

Pickens, M. (2009). Window on the unbanked: Mobile money in the Philippines.

Rajesh, S., & Manoj, P. K. (2014). Politicization of Trade Unions and Challenges to Industrial Relations in India: A Study with a Focus on Northern Kerala. International Journal of Business and Administration Research Review, 1(2), 45-54.

Rajesh, S., & PK, D. (2015). Women Employees work life and challenges to Industrial Relations: Evidence from North Kerala. IPASJ International journal of Managment (IIJM), 3, 5, 6.

Received: 20-Mar-2023, Manuscript No. AMSJ-23-13358; Editor assigned: 21-Mar-2023, PreQC No. AMSJ-23-13358(PQ); Reviewed: 24- Apr-2023, QC No. AMSJ-23-13358; Revised: 24-Jun-2023, Manuscript No. AMSJ-23-13358(R); Published: 14-Jul-2023