Review Article: 2023 Vol: 27 Issue: 5

Impact of Financial Literacy on Behavioural Biases and Investment Decision

Madhavi Ishwar Dhole, SIES College of Management Studies Nerul Navi Mumbai

Rashmi Soni, Somaiya Vidhyavihar University, Mumbai

Manoj Bagesar, SIES College of Management Studies Navi Mumbai

Citation Information: Dhole, M.I, Soni, R & Bagesar, M. (2023). Impact of financial literacy on behavioural biases and investment decision. Academy of Marketing Studies Journal, 27(5), 1-21.

Abstract

Purpose: of the study is to examine the impact of Behavioural finance factors (Overconfidence, risk aversion, herding, disposition etc) on investment decisions amongst gender. Authors further examine the moderation effect of financial literacy in the relationship between behaviour biases and investment decisions amongst gender. Design/Methodology/Approach: The study considered a cross sectional research design. For this Research Work data has been collected through structed questionnaire from 200 individual investors from different cities. Pearson’s Correlation and Cronbach’s Alpha test have been taken to analyse the validity and reliability. For testing hypothesis hierarchical regression analysis has been used in the research work Findings: The results of this study indicate that all income levels experienced capital appreciation and satisfactory income The study found that the level of financial literacy among professionals is satisfactory, indicating high financial literacy irrespective of their professions Research Limitations and Implications: individual investors are prepared to make new investment for better financial returns, but they should be cautious while making an investment. An investment plan is not universal which can satisfy everybody’d investment purposes therefore to meet the requirements of individual investors the portfolio should be made depending upon their gender, age, income, education, risk tolerance etc Originality: Present study aims to explore whether various behavioural finance factors affect investment decision making. Author would like to examine whether these associations are moderated by financial literacy. In this respect financial literacy might also show a substantial part in the predication of investments and play a crucial role in investment decision making

Keywords

Traditional Finance, Financial Literacy, Behaviour Finance, Investment Decision, Behavioural Biases

Introduction

The global financial crisis emphasized the importance of financial literacy and competence because the lack of consumer knowledge played a role in the genesis of the crisis. Financial literacy represents the level of aptitude in understanding personal finance. It often refers to awareness and knowledge of key financial concepts required for managing personal finances and is generally used as a narrower term than financial capability. (World Bank, 2014)

Financial literacy programs are fast becoming an essential component in financial policy reform worldwide. Importance of financial literacy has expanded widely, with the rising complication of financial products and the growing significance of financial choice, made by households. During recent years, the introduction of innovative financial products and instruments has pushed individual investors to participate actively in financial markets.

Financial literacy is a fundamental element of financial decision-making, exerting significant influence on the behaviour of individual investors, while making budgetary, house financing, stock investing and retirement planning decisions.(Rasool & Ullah, 2020).

Financial literacy has mostly been defined from a consumer’s behaviour point of view and contains personal finance constructs, financial habits/behaviour, borrowing, investment, and financial protection. (Jambunathan, 2018).Impact of Financial literacy is documented by many European studies. Many studies have been conducted in the United States and other developed countries to assess the level of financial literacy among people.(Mochammad Rizaldy Insan Baihaqqy & Sugiyanto, 2020s) describes impact of financial literacy on generation gaps like generation X and generation Y. Educational attainment and cognitive ability are important determinant of financial literacy. (Annamaria Lusardi, sept 2009)

(Statman, 2003)The Royal Swedish academy of Science Awarded the 2002 Noble Price in Economics to Daniel Kahneman for having integrated insights of psychological research into Economics especially human judgement and decision making under uncertainty. Prospect theory provides major psychological understandings for the behavioural approaches to investment selection and decision making.

Traditional Finance Theories

(Prasad, 2017)The traditional financial theories were well constructed to make calculated financial decisions.(Veni & Kandregula, 2020) Standard finance theories and efficient market hypothesis was studied earlier but they explore modern behavioural finance theories from traditional framework of finance (Singh et al., 2021) aims on a complete review of the evolution of Efficient Market Hypothesis and Behavioural Finance. They attempt to understand the evolution of a novel discipline Behavioural Finance and how the traditional finance theories (EMH) unsuccessful in understanding the market anomalies and the human behaviour involved in investment decision making process. The EMH model became a famous financial model explaining the stock market behaviour in 1970’s i.e. first decade of its beginning and was widely respected as the best model by the investment community in large.

Behavioural finance is a relatively new school of thought that deals with the influence of psychology on the behaviour of financial practitioners and its subsequent impact on stock markets. Behavioural finance shows a different model of human behaviour and is constructed of different components-prospect theory, cognitive errors, problems of self-control, and the pain of regret. These components assist to get sense of the world of finance-including investor preferences, the design of modem financial products, and financial regulations-by making sense of normal investor.

Growing body of Literature suggests that financial literacy is now worldwide documented as a significant component of economic and financial stability. Financial development needs are tried to be satisfied by different investments avenues. (Mohd Adil, 2022) Financial Development needs that funds are utilized rationally consequently extreme value is achieved.

Financial Literacy helps in managing financial resources efficiently. As the existing literature is puzzling the current study aims to explore behavioural finance factors can affect investment decision amongst the investors from the selected population. The present study helps to know how financial literacy affects the behaviour while taking investment decision. The current study might be critical importance to improve understanding of investment patters amongst the selected population for study in an increasingly worldwide and extremely competitive economy.

Aimed at the aforesaid purpose the study has been conducted in different cities individual investors. The present study offers a corresponding way of providing theories of behavioural finance and hypothesis and offers powerful reasoning.

Review of Literature

Behavioural Finance is financial theory which has risen from 1980. It studies three main issues that is standard finance theories, Market anomalies and behaviour finance. (Tversky, 1979) (Kahneman & Tversky, 2018) describes a review of expected utility theory as a descriptive model of decision making under risk and develop alternative model as prospect theory.

Behavioural finance is the study of the impact of psychology on the behaviour of financial experts and the consequent effect on markets” It is basically the field of finance that inspects how the behaviour of representatives in the market is influenced by various psychological factors which affects the decision-making process that said representatives undertake which in turn affects investment return (Hind Lebdaoui, 2021) Behavioural Finance factors matter for the use of financial services (Mwakyusa, 2017) The most stimulating task for investors is to make logical investment decisions. Normally, investors indulge in behavioural biases in uncertain situations. Several cognitive factors affect investors during decision making for investment and lead towards herding the acts of others (Sabir et al., 2019) Behavioural factors that require people to decision-making experiments can promote investment decision-making on a range of critical decisions (Iram et al., 2021).

(Shabgou & Mousavi, 2016)Behavioural finance theories, which are centred on the psychology, attempt to understand how emotions and cognitive errors influence individual investors’ behaviours. (Mochammad Rizaldy Insan Baihaqqy & Sugiyanto, 2020a) Financial literacy and Investment experience is needed in the capital market in making investment decisions. Social and demographic conditions in the generation group will have an impact on financial literacy and financial behaviour in deciding an investment decision. Markowitz (1952) argues that individuals act rationally in their financial decisions. In contrast, Kahneman and Tversky (1979) claim that the psychological characteristics of people significantly affect financial decisions. (Õzen & Ersoy 2019) The different behavioural finance theories and concepts that effect an individual’s perception of risk for different types of financial services and investment products are heuristics, overconfidence, prospect theory, loss aversion, representativeness, framing, anchoring, familiarity bias, perceived control, expert knowledge, affect (feelings), and worry (RICCIARDI, 2008).

Behavioural finance aims on the theories and concepts that impact the risk judgment and final decision-making process of investors, which contains factors known as cognitive bias or mental mistakes (errors) Rational financial and investment decision making has been the foundation of traditional (standard) finance since the 1960s. The standard finance literature develops the notion of rationality in which individuals make logical and coherent financial and investment choices.

Economic Approach to Investor Behaviour and Behavioural Biases

Theory of planned behaviour and past behavioural biases as a factor in investment decision making are studied (Raut et al., 2018) (Tversky & Kahneman, 1974a) studied different situations like representativeness, heuristics are highly economical and usually effective, but they lead to systematic and predicable errors. Risk is an important parameter in all types of investment decisions due to its variable nature. Risk depends upon several factors like unpredictable return, lack of knowledge of financial instruments, chance of incurring losses, dependency on other for advice (Sindhu & Kumar, 2014).

Behavioural Finance Factors

Zhuo et al., (2021) establishes parameter of behavioural finance simulation model to investors group .Behaviour finance argues that some financial phenomena can be studied through model.(Barberis & Thaler, 2003).Behavioural finance model of investor group has been studies and simulation model is tested on said investor group for returns on investment.(Zhuo et al., 2021) Global Crisis in 2008 was big wave of volatility worldwide. Investor sentiment is a key element in market movement. All behavioural finance factors like overconfidence, herding, representativeness, anchoring, mental accounting, hindsight, loss aversion, gamblers fallacy etc are studied through demographic variables (Katariya & Joshi, 2017).

(Tversky & Kahneman, 1974) studied three heuristics which are employed in making judgement under uncertainty. Better understanding of these heuristics and biases improve judgements and decisions in situations of uncertainty (Khan et al., 2020) stated effect of heuristic and representativeness biases on investment decision through structured questionnaire from 374 responses listed on Pakistan stock exchange.IT proved through that both biases have positive impact on investment decision.(Hamidon & Kehelwalatenna, 2020) Behavioural finance factors, stockbroker recommendations as a contextual factor and investor investors existing knowledge as a demographic factor are studied with structured questionnaire and responses from 221 individual investors in Colombo Sri Lanka. Due to different behavioural finance factors investors do tend to take irrational investment decisions. Behavioural Finance involves human psychology aspect in the study One among the many Herding is one of the important biases in investment decision making. They studied impact of demographic and psychological factors on decision making. (Devadas M & Vijaykumar T 2019) (ul Abdin et al., 2022) examines behavioural finance biases which specifically study overconfidence. All cognitive biases have positive relations with investment decision according to them. Overconfident investors prefer high risk with time and expect high returns so they able to take risk in the investment decision. Mental accounting considers the cost and benefits of loss avoidance decisions made by investors to protect them from the losses. A new model has been developed using cognitive psychology and microeconomics for consumer behaviour and decision making.

Investment Decision

Barberis et al., (1998) presented prudent model of investor sentiment. Model is based on psychological evidence and produces underreactions and over reactions for a wide range of parameter value.(Grinblatt & Keloharju, 2001) evidenced that investors are reluctant to realize loss. Personality and possession of information affect the decision making of investors (Fiksenbaum et al., 2017).(Armansyah, 2021) investment decision is strategy carried out by the investors to invest one or more investment avenues as per his awareness and knowledge. Psychology of investors is important aspect in the Investment decision making. Association and impact between psychological factors and investment decision are studied through structured questionnaire. Study was conducted in Nigerian capital market (Evbayiro-Osagie & Chijuka, 2021).

Methodology and Data Set

Objectives- This study attempted to analyse following key objectives.

➢ To find the investment trends among the different professions.

➢ To analyse the reasons for investment among the various income level groups.

➢ To check the views of respondents on the safety of their investment preference according to various professions.

➢ To investigate the behavioural finance factors affects the investment decisions among the various income group.

Research Questions: Underlaying are the research questions explored from the present research article.

➢ What are the various investment approaches among professionals.

➢ What are major factors affecting on the investments

➢ How psychological treats affecting to invest money among the various income groups.

Hypotheses: Study requirement to seeks the answers about investment behaviours through the following hypotheses.

➢ Null Hypothesis (H0)- There is no significant difference between the investment objectives among the respondents.

➢ Alternate Hypothesis (H1)- There is definite significant difference between the investment objectives among the respondents.

➢ Null Hypothesis (N0)- The experience doesn’t significantly association contributory factors for investment

➢ Alternate Hypothesis (N1)- The experience has significantly association contributory factors for investment.

Research Design: A cross Sectional research design has been considered in the study which aims at collective quantifiable exploration in examining the effect of moderation of financial literacy in the association between behavioural biases and investment decisions of the investors.(Lin, 2011) Studied rational decision making under behavioural biases. Psychological cognation of decision making of investors and antecedents of behavioural biases are studied through questionnaire collected from 430 voluntary individual investors in Taiwan. (Mushinada & Veluri, 2019) observed that personal characteristics of investors like gender, age, occupation, annual income, trading experience have impact on behavioural biases. A survey-based technique has been used for data collection.

Data Collection tool: For the collection of quantitative research data, a structured and pilot-tested self-reported interview schedule was utilized. A total of 19 questions covering socioeconomic, demographic, investment, psychological factors behind investment, and investment motto were posed to 200 respondents for collecting data through google form during September to October 2022.

Reliability and Validity of Data Collection Tool: It is possible to describe a measurement's consistency as its reliability. Internal consistency is used to measure the reliability of a construct. Based on the Cronbach Alpha test, the interview schedule was found to be reliable with a score of 0.805 was considered 'Good'. As a result of the pilot test, 56 samples were evaluated for Cronbach Alpha. According to the coefficient of correlation test value, all questions have validity levels greater than the observed value i.e. p=0.310 to 0.654 α=0.00 df=199) > predicted value = 0.211. As a result of using a data collection tool, the validity of questions in this study was also established.

Sampling: Non-probabilistic Quota sampling was best suited to collect the data due to unknown population to carry such kind of generalised subject of vast interest.

Statistical analysis- For the present study SPSS (Version-22.6) software was used to get numerous tests like cross tabulations, Cronbach alpha, correlation regression, Friedman test and Kruskal Wallis nonparametric tests during testing the hypotheses.

Limitations of study- The study was based on an online survey conducted in several cities throughout India. Since the results are based on quota sampling, they are subject to change over time on different age groups, income levels and locations within cities Table 1.

| Table 1 Crosstabulation Profession with Annual Investment Among the Respondents | |||||

| Profession | Less than Rs.25000 | Rs.25000-Rs50000 | Rs.50000-Rs100000 | Rs.1 lakh and above | Total |

| Unemployed | 0 0.00% 0.00% |

6 30.00% 3.00% |

5 25.00% 2.50% |

9 45.00% 4.50% |

20 100.00% 10.00% |

| Banking employee | 3 9.10% 1.50% |

8 24.20% 4.00% |

10 30.30% 5.00% |

12 36.40% 6.00% |

33 100.00% 16.50% |

| Education Field | 6 14.30% 3.00% |

6 14.30% 3.00% |

11 26.20% 5.50% |

19 45.20% 9.50% |

42 100.00% 21.00% |

| Government | 2 7.40% 1.00% |

3 11.10% 1.50% |

6 22.20% 3.00% |

16 59.30% 8.00% |

27 100.00% 13.50% |

| Doctor | 4 28.60% 2.00% |

2 14.30% 1.00% |

1 7.10% 0.50% |

7 50.00% 3.50% |

14 100.00% 7.00% |

| Lawyer | 1 4.30% 0.50% |

4 17.40% 2.00% |

6 26.10% 3.00% |

12 52.20% 6.00% |

23 100.00% 11.50% |

| Engineer | 2 6.90% 1.00% |

2 6.90% 5.50% |

10 34.50% 5.00% |

15 51.70% 7.50% |

29 100.00% 14.50% |

| Entrepreneur | 2 16.70% 1.00% |

1 8.30% 0.50% |

5 41.70% 2.50% |

4 33.30% 2.00% |

12 100.00% 6.00% |

| Total | 20 10.00% 10.00% |

32 16.00% 16.00% |

54 27.00% 27.00% |

94 47.00% 47.00% |

200 100.00% 100.00% |

Results and Discussion

In the above table, it is evident that the number of respondents from education fields was higher than the number of respondents from other professions (N=33, 16.5%). Out of all investment categories, 45.2% (N=19) were made by educational professionals investing more than Rs.100,000. In a study by John Nofsinger (2017), it was demonstrated that the investment undertaken by teachers and professors was motivated by the prospect of a secure future and the possibility of accumulating significant savings. Entrepreneurs, however, are the professions with the lowest amount of investment. It is likely that this is due to their priorities in terms of cash flow (N=12, 6%) for further expansion. In the category of unemployed respondents, 10% were investments (N=20). Those respondents may come from elite families where their wealth is channelled into investing. Doctors are among the lowest paid professions (N=14, 7%), whereas investments among government employees were 13.5% (N=27), lawyers were 11.5% (N=23), and engineers were 14.5% (29). After inspecting the investing potential of the various professionals, factors of financial literacy and financial planning were observed. Additionally, the study found that the level of financial literacy among professionals is satisfactory, indicating high financial literacy irrespective of their professions might be helping to raise cognisance about their investment.

According to Table 2, those with a monthly income over Rs.51,000 are likely to make more investments than those with a lower income. This is due to capital appreciation and a satisfactory level of income. Accordingly, the investment priorities of respondents who have income levels below Rs.20,000 were Very Important (N=2,1%) and Important (N=4,2%). Those with monthly incomes between Rs.21,000 and Rs.50,000 are reported to consider investments very important (N=36, 18%), whereas a similar trend was observed for those with income levels between Rs.51000 and Rs.70000. Respondents who have a monthly income more than Rs.71000 were approached in an effort to increase capital appreciation of their investment increase the capital satisfactory income. The availability of numerous investment options with digital technologies has facilitated the creation of avenues for investors of all categories (Jorgenson, D. W., & Fraumeni, B. M., 2020). Investing was aimed at increasing wealth by providing steady income along with capital appreciation (Govindasamy et al, 2020). The results of this study indicate that all income levels experienced capital appreciation and satisfactory income.

| Table 2 Cross Tabulation of Monthly Income with Capital Appreciation and Satisfactory Income of Respondents | ||||||

| Monthly income | Very important | Important | Moderately Important | Less Important | Not Important | Total |

| >Rs.20,000 | 2 33.30% 1.00% |

4 66.70% 2.00% |

0 0.00% 0.00% |

0 0.00% 0.00% |

0 0.00% 0.00% |

6 100.00% 3.00% |

| Rs. 21,000-Rs. 50,000 | 22 37.30% 11.00% |

36 61.00% 18.00% |

1 1.70% 0.50% |

0 0.00% 0.00% |

0 0.00% 0.00% |

59 100.00% 29.50% |

| Rs. 51,000-Rs. 70,000 | 36 48.60% 18.00% |

37 50.00% 18.50% |

1 1.40% 0.50% |

0 0.00% 0.00% |

0 0.00% 0.00% |

74 100.00% 37.00% |

| More than Rs.71,000 | 27 44.30% 13.50% |

32 52.50% 16.00% |

2 3.30% 1.00% |

0 0.00% 0.00% |

0 0.00% 0.00% |

61 100.00% 30.50% |

| Total | 87 43.50% 43.50% |

109 54.50% 54.50% |

4 2.00% 2.00% |

0 0.00% 0.00% |

0 0.00% 0.00% |

200 100.00% 100.00% |

There are many investors who are interested in growth investing as the returns that can be obtained by purchasing are impressive option for them (Rosenbaum & Pearl, 2013). The above Table 3 shows how monthly income relates to investment strategies that aim at generating high growth output in a secure environment. A majority of respondents (46.5%, N=93) and a majority (50.5%, N=101) of the income groups considered it to be Very Important (46.5%, N=93). A mere 3% (N=6) of respondents reported it to be merely significant. Therefore, it was obvious that the goal for any income class was to increase their wealth.

| Table 3 Cross Tabulation of Monthly Income with Investment Objectives i.e. ‘Basically Growth Oriented but Intends to play it somewhat safe’ | ||||||

| Monthly income | Very important | Important | Moderately Important | Less Important | Not Important | Total |

| >Rs.20,000 | 3 50.0% 1.5% |

3 50.0% 1.5% |

0 0.0% 0.0% |

0 0.00% 0.00% |

0 0.00% 0.00% |

6 100.00% 3.00% |

| Rs. 21,000-Rs. 50,000 | 26 44.1% 13.0% |

31 52.5% 15.5% |

2 3.4% 1.0% |

0 0.00% 0.00% |

0 0.00% 0.00% |

59 100.00% 29.50% |

| Rs. 51,000-Rs. 70,000 | 34 45.9% 17.0% |

38 51.4% 19.0% |

2 2.7% 1.0% |

0 0.00% 0.00% |

0 0.00% 0.00% |

74 100.00% 37.00% |

| More than Rs.71,000 | 30 49.2% 15.0% |

29 47.5% 14.5% |

2 3.3% 1.0% |

0 0.00% 0.00% |

0 0.00% 0.00% |

61 100.00% 30.50% |

| Total | 93 46.5% 46.5% |

101 50.5% 50.5% |

6 3.0% 3.0% |

0 0.00% 0.00% |

0 0.00% 0.00% |

200 100.00% 100.00% |

In Table 4, income groups are shown with the investment objective of 'maximize growth as income is not critical'. An interesting observation of the above table is that there is mixed opinion among respondents of all income groups regarding the importance of income from investments. While they believed that increased wealth through investments would be more important than increasing their income, they felt that the monthly income of Rs.51000-Rs.70,000 was less important (9.5%, N=7) and not important (6.8%, N=5) to them. There were 8.2% (N=5) who believed it was not important when their monthly income exceeded Rs.71,000, and 3.3% (N=2) who believed it was less important when it came to building wealth as opposed than just improving their income. There was a clear tendency for those with high family incomes to invest their money for maximum profits. This was in order to maximize their sources of income without compromising their investments Table 5.

| Table 4 Cross Tabulation of Monthly Income with Investment Objective- ‘Maximise Growth as Income is not Critical’ | ||||||

| Monthly income | Very important | Important | Moderately Important | Less Important | Not Important | Total |

| >Rs.20,000 | 2 33.3% 1.0% |

2 33.3% 1.0% |

0 0.0% 0.0% |

0 .0% .0% |

2 33.3% 1.0% |

6 100.00% 3.00% |

| Rs. 21,000-Rs. 50,000 | 7 11.9% 3.5% |

31 52.5% 15.5% |

12 20.3% 6.0% |

4 6.8% 2.0% |

5 8.5% 2.5% |

59 100.00% 29.50% |

| Rs. 51,000-Rs. 70,000 | 18 24.3% 9.0% |

31 41.9% 15.5% |

13 17.6% 6.5% |

7 9.5% 3.5% |

5 6.8% 2.5% |

74 100.00% 37.00% |

| More than Rs.71,000 | 12 19.7% 6.0% |

24 39.3% 12.0% |

18 29.5% 9.0% |

2 3.3% 1.0% |

5 8.2% 2.5% |

61 100.00% 30.50% |

| Total | 39 19.5% 19.5% |

88 44.0% 44.0% |

43 21.5% 21.5% |

13 6.5% 6.5% |

17 8.5% 8.5% |

200 100.00% 100.00% |

| Table 5 Cross Tabulation of Profession with Views on Safety of Investment in Banks | |||||

| Profession | Highly Safe | Reasonable Safe | Don't know | Don't know | Total |

| Unemployed | 4 20.00% 2.00% |

10 50.00% 5.00% |

2 10.00% 1.00% |

4 20.00% 2.00% |

20 100.00% 10.00% |

| Banking employee | 10 30.30% 5.00% |

11 33.30% 5.50% |

0 0.00% 0.00% |

12 36.40% 6.00% |

33 100.00% 16.50% |

| Education Field | 13 31.00% 6.50% |

11 26.20% 5.50% |

1 2.40% 0.50% |

17 40.50% 8.50% |

42 100.00% 21.00% |

| Government | 11 40.70% 5.50% |

9 33.30% 4.50% |

1 3.70% 0.50% |

6 22.20% 3.00% |

27 100.00% 13.50% |

| Doctor | 7 50.00% 3.50% |

2 14.30% 1.00% |

3 21.40% 1.50% |

2 14.30% 1.00% |

14 100.00% 7.00% |

| Lawyer | 9 39.10% 4.50% |

6 26.10% 3.00% |

2 8.70% 1.00% |

6 26.10% 3.00% |

23 100.00% 11.50% |

| Engineer | 10 34.50% 5.00% |

9 31.00% 4.50% |

3 10.30% 1.50% |

7 24.10% 3.50% |

29 100.00% 14.50% |

| Entrepreneur | 0 0.00% 0.00% |

4 33.30% 2.00% |

1 8.30% 0.50% |

7 58.30% 3.50% |

12 100.00% 6.00% |

| Total | 64 32.00% 32.00% |

62 31.00% 31.00% |

13 6.50% 6.50% |

61 30.50% 30.50% |

200 100.00% 100.00% |

In general, a bank is defined as a financial institution that accepts deposits from the public for lending or investing purposes. These deposits are repayable on demand or otherwise able to be withdrawn by check, draft, or order. It is the responsibility of commercial banks to perform a variety of functions in developed as well as developing countries (Yarashevich et al., 2021). The above table gives information about views of respondents working in the different profession about safety of investment in banks. Among them 39.4% N=13 respondents working in the banks are felt ‘Undecided’ about investment in Banks are safe where as 4 .4% N=14 believed its ‘Highly Safe’. This kind of dilemma among the banking professionals about investment in Banks was due to the recent frauds happened in some banks in India (Hung 2019). The professionalise from the education filed were puzzled to choose banks are safe for investments. It is observed among them 16.7% N=7 believed its ‘Highly Safe’ 40.5% N=17 said ‘Reasonable safe’ while 4 .9% N=18 were ‘Undecided’ about it. This kind of trend was found among the Doctors, Lawyers, Engineers, Government servants as well as Entrepreneurs. Therefore, it is intended to put forth that making decision of investments in the banks was seriously considered in all the professions. The decision making before investment in banks was judged well and its was clearly indicated by the responses of ‘Undecided’ higher in all i.e. 45.2% (N=90) Table 6.

| Table 6 Cross Tabulation of Profession with Views on Safety in Mutual Funds | |||||

| Profession | Highly Safe | Reasonable Safe | Least Safe | Undecided | Total |

| Unemployed | 2 10.0% 1.0% |

8 40.0% 4.0% |

1 5.0% 0.5% |

9 45.0% 4.5% |

20 100.00% 10.00% |

| Banking employee | 5 15.2% 2.5% |

14 42.4% 7.0% |

1 3.0% 0.5% |

13 39.4% 6.5% |

33 100.00% 16.50% |

| Education Field | 7 16.7% 3.5% |

17 40.5% 8.5% |

0 0.0% 0.0% |

18 42.9% 9.0% |

42 100.00% 21.00% |

| Government | 4 14.8% 2.0% |

11 40.7% 5.5% |

1 3.7% 0.5% |

11 40.7% 5.5% |

27 100.00% 13.50% |

| Doctor | 3 21.4% 1.5% |

3 21.4% 1.5% |

0 0.0% 0.0% |

8 57.1% 4.0% |

14 100.00% 7.00% |

| Lawyer | 1 4.5% 0.5% |

11 50.0% 5.5% |

0 0.0% 0.0% |

10 45.5% 5.0% |

23 100.00% 11.50% |

| Engineer | 2 6.9% 1.0% |

14 48.3% 7.0% |

0 0.0% 0.0% |

13 44.8% 6.5% |

29 100.00% 14.50% |

| Entrepreneur | 3 25.0% 1.5% |

1 8.3% 0.5% |

1 8.1% 0.5% |

8 48.6% 4.0% |

12 100.0% 6.0% |

| Total | 27 13.6% 13.6% |

79 39.7% 39.7% |

4 2.00% 2.00% |

90 45.2% 45.2% |

200 100.00% 100.00% |

Since mutual funds do not require the investor to select which securities to purchase, investing in mutual funds is a more cost-effective method of investing in the capital markets. Mutual funds can be described essentially as a monetary instrument used by a group of investors to invest their money in accordance with a predetermined plan. It is the responsibility of the fund chiefs of mutual funds to appropriate pooled capital for explicit investment purposes (Boguth, & Simutin, 2018). The mutual fund investment is considered under the category of high-risk investment. It is observed that 45.2% (N=90) respondents were still obsessed where marked ‘Undecided’ to make their investments in the Mutual funds. Generally, among the professions i.e. Doctor (57.1%, N=8), Entrepreneur (48.6%, N=8), Unemployed (45%, N=9) and Engineer (44.8%, N=13) unsure to make their investments in the mutual funds. There are professions like Banking professions (59.6%, N=19), Education field (57.2%, N=24), Government (55.5%, N=15), Lawyer (55.5%, N=15) and Engineer (55.1%, N=16) were prospective for making their investment in the mutual funds.

It is imperative for investors to consider insurance as a means of earning long-term returns, gaining tax benefits, and protecting themselves against risks. Throughout the course of our lives, we are exposed to constant stress. At the same time, being an individual, he has certain responsibilities to fulfil. Emotional factors have a significant impact on Indian consumers. Nonetheless, their investment behaviour in insurance policies is shaped by rational factors as well (Sharma et al, 2021). Various professional respondents are surveyed regarding their views on the purchase of insurance policies, as shown in Table 7. Among the respondents working in banks, 24.2% (N=8), they don't have to make decisions regarding the purchase of insurance policies, while 30.3% (N=10) noted that making investments in insurance is "highly safe" and 45.5% (N=15) said that it is "reasonably safe." Similarly, 31% (N=13) of respondents from the Education field were unsure whether they would choose insurance policies for investment purposes. It was decided to invest in insurance policies as a long-term investment option, and the above table reflects this choice. Respondents from government, healthcare, law, engineering, and entrepreneurship indicated that insurance policies are yet another alternative investment option, but their views on Undecided indicated concern for array regarding their investment Table 8.

| Table 7 Cross Tabulation of Profession with Views on Safety in Insurance Policies | |||||

| Profession | Highly Safe | Reasonable Safe | Least Safe | Undecided | Total |

| Unemployed | 5 25.0% 2.5% |

10 50.0% 5.0% |

0 0.0% 0.0% |

5 25.0% 2.5% |

20 100.00% 10.00% |

| Banking employee | 10 30.3% 5.0% |

15 45.5% 7.5% |

0 0.0% 0.0% |

8 24.2% 4.0% |

33 100.00% 16.50% |

| Education Field | 13 31.0% 6.5% |

16 38.1% 8.0% |

0 0.0% 0.0% |

13 31.0% 6.5% |

42 100.00% 21.00% |

| Government | 6 22.2% 3.0% |

13 48.1% 6.5% |

1 3.7% 0.5% |

7 25.9% 3.5% |

27 100.00% 13.50% |

| Doctor | 4 28.6% 2.0% |

7 50.0% 3.5% |

0 0.0% 0.0% |

3 21.4% 1.5% |

14 100.00% 7.00% |

| Lawyer | 5 21.7% 2.5% |

11 47.8% 5.5% |

0 0.0% 0.0% |

7 30.4% 3.5% |

23 100.00% 11.50% |

| Engineer | 8 27.6% 4.0% |

11 37.9% 5.5% |

0 0.0% 0.0% |

10 34.5% 5.0% |

29 100.00% 14.50% |

| Entrepreneur | 4 33.3% 2.0% |

2 16.7% 1.0% |

0 0.0% 0.0% |

6 50.0% 3.0% |

12 100.0% 6.0% |

| Total | 55 27.5% 27.5% |

85 42.5% 42.5% |

1 0.5% 0.5% |

59 29.5% 29.5% |

200 100.00% 100.00% |

| Table 8 Cross Tabulation of Profession with Views on Safety of Shares, Debentures, and Bonds | |||||

| Profession | Highly Safe | Reasonable Safe | Least Safe | Undecided | Total |

| Unemployed | 2 10.0% 1.0% |

12 60.0% 6.0% |

0 0.0% 0.0% |

6 30.0% 3.0% |

20 100.00% 10.00% |

| Banking employee | 6 18.2% 3.0% |

20 60.6% 10.0% |

0 0.0% 0.0% |

7 21.2% 3.5% |

33 100.00% 16.50% |

| Education Field | 5 11.9% 2.5% |

15 35.7% 7.5% |

21 50.0% 10.5% |

1 2.4% 0.5% |

42 100.0% 21.0% |

| Government | 3 11.1% 1.5% |

13 48.1% 6.5% |

2 7.4% 1.0% |

9 33.3% 4.5% |

27 100.0% 13.5% |

| Doctor | 3 21.4% 1.5% |

6 42.9% 3.0% |

5 35.7% 2.5% |

0 0.0% 0.0% |

14 100.0% 7.0% |

| Lawyer | 0 0.0% 0.0% |

9 39.1% 4.5% |

1 4.3% 0.5% |

13 56.5% 6.5% |

23 100.0% 11.5% |

| Engineer | 6 20.7% 3.0% |

14 48.3% 7.0% |

8 27.6% 4.0% |

1 3.4% 0.5% |

29 100.0% 14.5% |

| Entrepreneur | 0 0.0% 0.0% |

6 50.0% 3.0% |

0 0.0% 0.0% |

6 50.0% 3.0% |

12 100.0% 6.0% |

| Total | 25 12.5% 12.5% |

95 47.5% 47.5% |

5 2.5% 2.5% |

75 37.5% 37.5% |

200 100.0% 100.0% |

Bonds are safe havens for lenders since they are backed by collateral. Furthermore, credit rating agencies are regularly responsible for reviewing and rating bonds issued by corporations. Due to their lack of collateral, debt instruments are generally associated with higher risks (Singh, & Kaur, 2018). Among the various professions, the opinion of investment in stocks, debentures, and bonds varies. Nearly 50% (N=21) of respondents in the Education field were noted as being least safe when investing in shares, debentures, and bonds. As opposed to this, only 11.9% (N=5) feel that they are highly safe while 35.7% (N=15) feel that they are reasonably safe to place their money in stocks, bonds, and debentures. It was found that respondents from the banking profession were more willing to invest in shares, bonds, and debentures. 60.6% (N=20) of respondents indicated "Reasonably safe" and 18.2% (N=6) indicated "Highly safe". Education and banking professions differed in their approach to investment in shares, debentures, and bonds because banks were riskier. There may be a difference in analytical thinking within the banking profession as compared to the other professions due to the greater amount of time spent studying the market. People in professions such as government, doctors, and engineers tend to be more inclined towards investing in shares, debentures, and bonds that are categorized as 'least safe'. The reason for this may be that they lack current knowledge of their profession. Shares, bonds, and debentures were chosen as 'undecided' by professionals such as lawyers and entrepreneurs. Shares, debentures, and bonds are the safest investments according to 62% (N=120) of respondents Table 9.

| Table 9 Cross Tabulation of Profession with Views on Safety in Gold | |||||

| Profession | Highly Safe | Reasonable Safe | Least Safe | Undecided | Total |

| Unemployed | 4 20.0% 2.0% |

13 65.0% 6.5% |

0 0.0% 0.0% |

3 15.0% 1.5% |

20 100.00% 10.00% |

| Banking employee | 10 30.3% 5.0% |

17 51.5% 8.5% |

0 0.0% 0.0% |

6 18.2% 3.0% |

33 100.00% 16.50% |

| Education Field | 8 19.0% 4.0% |

19 45.2% 9.5% |

1 2.4% 0.5% |

14 33.3% 7.0% |

42 100.0% 21.0% |

| Government | 6 22.2% 3.0% |

11 40.7% 5.5% |

0 0.0% 0.0% |

10 37.0% 5.0% |

27 100.0% 13.5% |

| Doctor | 4 28.6% 2.0% |

6 42.9% 3.0% |

0 0.0% 0.0% |

04 28.6% 2.0% |

14 100.0% 7.0% |

| Lawyer | 4 17.4% 2.0% |

8 34.8% 4.0% |

0 0.0% 0.0% |

11 47.8% 5.5% |

23 100.0% 11.5% |

| Engineer | 9 31.0% 4.5% |

9 31.0% 4.5% |

1 3.4% 0.5% |

10 34.5% 5.0% |

29 100.0% 14.5% |

| Entrepreneur | 2 16.7% 1.0% |

6 50.0% 3.0% |

0 0.0% 0.0% |

4 33.3% 2.0% |

12 100.0% 6.0% |

| Total | 47 23.5% 23.5% |

89 44.5% 44.5% |

2 1.0% 1.0% |

62 31.0% 31.0% |

200 100.0% 100.0% |

There is a possibility that gold, silver, and other metals like platinum and copper will retain their value if not increase in value in the unlikely event that financial markets cease to function. In the future, it is unlikely that physical goods will need to be bartered, however, it may be beneficial to keep a certain percentage of your assets in this form (Yadav & Tiwari, 2012). The Indian people have long been interested in gold as a means of investment. As the stock market performed on an international level, there was a fluctuation in the gold market. Since the advent of globalization, gold has been a more attractive investment for long-term purposes. In a survey 68% (N=136) respondents believed that gold was a safer investment option than stocks, while 31% (N=62) were unsure whether to continue investing. The 'Unemployed' and 'Entrepreneurs' groups were significant contributors to the total number of respondents who were interested in investing in gold. The reason for this could be that they are seeking to maximize their returns from long-term investments in gold. It is true that other professionals have expressed an interest in gold investments, however. Furthermore, all other professions indicated that they were 'Undecided' regarding investing; indicating that they would like to choose from a variety of investment options Table 10.

| Table 10 Cross Tabulation of Profession with Views on Safety in Real Estate | |||||

| Profession | Highly Safe | Reasonable Safe | Least Safe | Undecided | Total |

| Unemployed | 3 15.0% 1.5% |

13 65.0% 6.5% |

0 .0% .0% |

4 20.0% 2.0% |

20 100.00% 10.00% |

| Banking employee | 11 33.3% 5.5% |

14 42.4% 7.0% |

1 3.0% 0.5% |

7 21.2% 3.5% |

33 100.00% 16.50% |

| Education Field | 7 16.7% 3.5% |

22 52.4% 11.0% |

1 2.4% 0.5% |

12 28.6% 6.0% |

42 100.0% 21.0% |

| Government | 9 33.3% 4.5% |

11 40.7% 5.5% |

1 3.7% 0.5% |

6 22.2% 3.0% |

27 100.0% 13.5% |

| Doctor | 5 35.7% 2.5% |

6 42.9% 3.0% |

0 0.0% 0.0% |

3 21.4% 1.5% |

14 100.0% 7.0% |

| Lawyer | 7 30.4% 3.5% |

10 43.5% 5.0% |

2 8.7% 1.0% |

4 17.4% 2.0% |

23 100.0% 11.5% |

| Engineer | 10 34.5% 5.0% |

10 34.5% 5.0% |

0 0.0% 0.0% |

9 31.0% 4.5% |

29 100.0% 14.5% |

| Entrepreneur | 2 16.7% 1.0% |

8 66.7% 4.0% |

0 0.0% 0.0% |

2 16.7% 1.0% |

12 100.0% 6.0% |

| Total | 54 27.0% 27.0% |

94 47.0% 47.0% |

5 2.5% 2.5% |

47 23.5% 23.5% |

200 100.0% 100.0% |

During turbulent times for banks and the stock market, it is understandable that real estate investments can seem appealing. Invest in a rental property, pay down some of your principal, and let your tenants pay off the debt. Investors from all professions were very interested in real estate investments (Baum, 2015). In high-income groups, this phenomenon was frequently observed. Nearly every professional individual in the above table was passionate about real estate investment. Unemployed individuals and entrepreneurs were seen to be more likely to invest in real estate than respondents from other professions. A total of 31%(N=9) respondents from the engineering profession, 28.6%(N=12) respondents from the education profession, and 21.4%(N=3) doctors were marked as 'Undecided' regarding their investment in real estate. There may be a reason for this, as this category was associated with several pitfalls and high risk. Evidence suggests that real estate has rapidly emerged as an option for investment in almost all groups of professions.

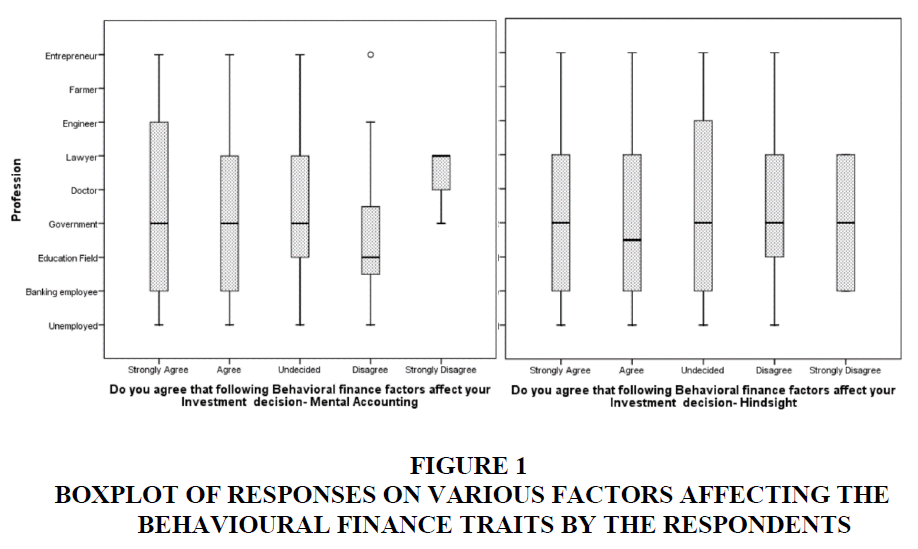

The box plots presented in Figure 1 shows an overview of the profession along with a description of the factors that influence investment decisions. Bank employees, educators, government officials, doctors and lawyers primarily consider representativeness when making investment decisions. The number of respondents condemning Disagree is very low, and there are no respondents who agree strongly with Disagree. A similar trend was also observed in the Herding as a factor affecting investment decisions. Although most respondents are puzzled as reflected in the Undecided count. An overly confident attitude is attributed to a broad range of behavioural traits that influence investment decisions. This box plot indicates that respondents from educational, government, medical, and legal professions are strongly in agreement. Similarly, banking professionals are also in agreement with the box plot. Cognitive conflict is one of the most challenging and vital factors affecting investment decisions. Banking employees, Education, Government employees, doctors, lawyers, and engineers are more suited to this type of behaviour. The largest Fear of Regret was reported by respondents from banks, schools, governments, and doctors. When it comes to investing their money, lawyers and engineers are unafraid of regret. A key constraint to investing is the traditional view that investors lose money due to market fluctuations. People working in the fields of banking, education, government, a lawyer, and a doctor are also found to have extreme views. However, respondents in engineer and farmer positions reject this factor. In this box plot, we demonstrate how Behavioural Finance influences Mental Accounting, an instrumental factor in investment decisions. The study found that bankers, educators, government officials, doctors, lawyers, and engineers were more interested in calculating their investments before finalizing their portfolios. In the above box plot, the last figure depicts the responses of hindsight as one of the factors that affect behavioural finance. Several factors may have contributed to most respondents from all fields declaring their answers undecided. One of the most striking observations was that most professions are cautious when investing. Mental accounting and Cognitive conflict were found to be the most significant factors for making investment decisions among all professions Tables 11,12.

Figure 1 Boxplot of Responses on Various Factors Affecting the Behavioural Finance Traits by the Respondents

| Table 11 Descriptive Statistics | |||||

| N | Mean | Std. Deviation | Minimum | Maximum | |

| Specify your investment objectives- Capital appreciation and satisfactory income | 200 | 1.58 | 0.533 | 1 | 3 |

| Specify your investment objectives- First priority for income and second priority for growth | 200 | 2.06 | 1.148 | 1 | 4 |

| Specify your investment objectives- Balanced preference for income and growth | 200 | 1.56 | 0.554 | 1 | 3 |

| Specify your investment objectives- Basically growth oriented but intends to play it somewhat safe | 200 | 1.84 | 0.871 | 1 | 4 |

| Specify your investment objectives- Maximise growth as income is not critical | 200 | 2.40 | 1.130 | 1 | 5 |

| Table 12 Friedman’s Ranks | |

| Mean Rank | |

| Specify your investment objectives- Capital appreciation and satisfactory income | 2.64 |

| Specify your investment objectives- First priority for income and second priority for growth | 3.12 |

| Specify your investment objectives- Balanced preference for income and growth | 2.52 |

| Specify your investment objectives- Basically growth oriented but intends to play it somewhat safe | 2.97 |

| Specify your investment objectives- Maximise growth as income is not critical | 3.75 |

Hypothesis: 1

From the Table 13 it is observed that objectives of investments i.e. Capital appreciation and satisfactory income possess difference between M=1.58 and SD=0.553 similar trends was observed in First priority for income and second priority for growth (M=2.06 SD=1.148); Balanced preference for income and growth (M=1.56 SD=0.554); Basically growth oriented but intends to play it somewhat safe (M=1.84 SD=0.871) and Maximise growth as income is not critical (M=2.40 SD=1.130). Table 12 it is further revealed that top ranked was ‘Maximise growth as income is not critical’ secondly ranked ‘First priority for income and second priority for growth’ whereas ‘Balanced preference for income and growth’ was least in this order.

| Table 13 Test Statistics Friedman Test | |

| N | 200 |

| Chi-Square | 106.278 |

| Df | 4 |

| Asymp. Sig. | 0.000 |

Friedman Ch-Square statistical test presented in the Table 13 shows that calculated value of Chi-Square value is 06.278 df=4 at significance level p=0.000 is lesser than assumed significance level α=0.05.

Henceforth,

Null Hypothesis (N0)- There is no significant difference between the investment objectives among the respondents is rejected by 0.05 level of significance.

Whereas, Alternate Hypothesis (N1)- There is definite significant difference between the investment objectives among the respondents is retained by 0.05 level of significance.

Hypothesis 2

From the above Table 14 it shows that Kruskal Wallis test value for Representativeness as contributory factor for investment is X2=4.228 of this variable with experience investment at the significance level p =0.376. This was greater than the assumed significance level α =0.05. Later Kruskal Wallis test value for Fear of Regret as contributory factor for investment is X2=4.169 of this variable with experience investment at the significance level p =0.384. This was greater than the assumed significance level α =0.05. Simultaneously for Gamblers myth Kruskal Wallis test value as contributory factor for investment is X2=4.174 of this variable with experience investment at the significance level p =0.383. This was greater than the assumed significance level α =0.05. For Mental Accounting Kruskal Wallis test value as contributory factor for investment is X2=4.151 of this variable with experience investment at the significance level p =0.348. This was greater than the assumed significance level α =0.05. The Hindsight Kruskal Wallis test value as contributory factor for investment is X2=7.451 of this variable with experience investment at the significance level p =0.114. This was greater than the assumed significance level α =0.05.

| Table 14 Kruskal Wallis Test Statisticsa,b | ||||||||

| Do you agree that following Behavioural finance factors affect your investment decision- Representativeness | Do you agree that following Behavioural finance factors affect your investment decision- Herding | Do you agree that following Behavioural finance factors affect your investment decision- Overconfidence | Do you agree that following Behavioural finance factors affect your investment decision- Cognitive conflict | Do you agree that following Behavioural finance factors affect your investment decision- Fear of Regret | Do you agree that following Behavioural finance factors affect your investment decision- Gamblers myth | Do you agree that following Behavioural finance factors affect your investment decision- Mental Accounting | Do you agree that following Behavioural finance factors affect your investment decision- Hindsight | |

| Chi-Square | 4.228 | 11.562 | 12.512 | 9.688 | 4.169 | 4.174 | 4.451 | 7.451 |

| df | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| Asymp. Sig. | 0.376 | 0.021 | 0.014 | 0.046 | 0.384 | 0.383 | 0.348 | 0.114 |

| a. Kruskal Wallis Test | ||||||||

| b. Grouping Variable: What is your experience in the field of investment. | ||||||||

Whereas value for Herding as contributory factor for investment is X2=11.562 of variable with experience investment at the significance level p =0.021. This was less than the assumed significance level α =0.05. Successively value for Overconfidence as contributory factor for investment is X2=12.512 of variable with experience investment at the significance level p =0.014. This was less than the assumed significance level α =0.05. Then value for Cognitive conflict as contributory factor for investment is X2=9.688 of variable with experience investment at the significance level p =0.046. This was less than the assumed significance level α =0.05.

Except Herding, Overconfidence and Cognitive conflict reset of the behavioural factors effect on investment decisions was rejected. Hence,

Null Hypothesis (N0)- The experience doesn’t significantly association contributory factors for investment is retained with 0.05 level of significance only for Representativeness, Fear of Regret, Gambler’s myth and Hindsight. While it been rejected for Herding, Overconfidence and Cognitive conflict.

Whereas Alternate Hypothesis (N1)- The experience has significantly association contributory factors for investment is retained with 0.05 level of significance only for Herding, Overconfidence and Cognitive conflict. While it been rejected for Representativeness, Fear of Regret Gambler’s myth, and Hindsight.

Implications and Future Scope for Study

Based on current study and findings several recommendations for individual investors can be made. Also, these findings are more useful for financial intermediaries and policy makers as it showcases that rise in level of financial literacy of people could have significant effect on their investments. It is also noted that individual investors are prepared to make new investment for better financial returns, but they should be cautious while making an investment.

The limitations of the study are the technique for examining the model assumes that the latent variables possess liner relationship. The study was planned through structured survey questionnaire that was continuously convicted due to general complications. The respondent might feel hesitant in their answers because structured questionnaire was considered for data collection. The study has been conducted only on individual investors from Mumbai, Navi Mumbai, Ahmedabad, Surat, Indore, Delhi, and Pune. Lastly bigger sample size would empower to achieve more generalised outcomes.

Conclusion

In terms of investments, financial literacy is becoming increasingly relevant. In all categories of respondents, there are well-established financial plans. When investing, the respondent is primarily motivated by the desire to increase their capital. In general, the higher one's income level is, the more likely they are to invest in a safer manner. Higher income classes were clearly focused on increasing their wealth through safer means. It has also been found that maximizing sources of income without compromising investments is critical. To conclude, it has been determined that among the various professions, a variety of investment approaches have been developed because of work cultures and modes of income. Some banking professionals appear to be unwilling to place their trust in banking investments. There is a concurrent nature to both banking scams and a loss of interest in banking investments because of this. Additionally, respondents from the education sector were found to be highly selective and subjective when selecting investment strategies. Doctors and engineers, however, are perceived as being dilemmatic when selecting investments. As an alternative to bank-based investment strategies, other instruments such as insurance policies, shares, bonds, and real estate were promising investment opportunities. Among the participants in the study, bankers, educators, government officials, doctors, lawyers, and engineers were more interested in calculating their investments before finalizing their portfolios. One of the factors that affect behavioural finance is hindsight. Several factors may have contributed to many respondents declaring their answers undecided across all fields. The differences in income groups have a significant impact on the investment objectives achieved. There is also no significant association between experience and investment behaviour. In conclusion, investment has been attributed to capital appreciation in a variety of professions due to the attainment of capital appreciation. It is concluded that the level of literacy within each profession has a direct impact on financial investment decisions.

References

Armansyah, R.F. (2021). Over confidence, mental accounting, and loss aversion in investment decision. Journal of Auditing, Finance, and Forensic Accounting, 9(1), 44-53.

Indexed at, Google Scholar, Cross Ref

Baihaqqy, M.R.I. (2020). Investment Decisions Of Investors Based On Generation Groups: A Case Study In Indonesia Stock Exchange. Coopetition: Jurnal Ilmiah Manajemen, 11(3), 189-196.

Barberis, N., & Thaler, R. (2003). A survey of behavioral finance. Handbook of the Economics of Finance, 1, 1053-1128.

Indexed at, Google Scholar, Cross Ref

Baum, A. (2015). Real estate investment: A strategic approach. Routledge.

Indexed at, Google Scholar, Cross Ref

Boguth, O., & Simutin, M. (2018). Leverage constraints and asset prices: Insights from mutual fund risk taking. Journal of Financial Economics, 127(2), 325-341.

Indexed at, Google Scholar, Cross Ref

Evbayiro-Osagie, E.I., & Chijuka, M.I. (2021). Psychological factors and investment decisions in the Nigeria capital market. Oradea Journal of Business and Economics, 6(1), 33-41.

Indexed at, Google Scholar, Cross Ref

Fiksenbaum, L., Marjanovic, Z., & Greenglass, E. Review of Behavioral Finance.

Grima, S., Özen, E., Boz, H., Spiteri, J., & Eleftherios, T. (Eds.). (2019). Contemporary Issues in Behavioral Finance. Emerald Group Publishing.

Indexed at, Google Scholar, Cross Ref

Grinblatt, M., & Keloharju, M. (2001). What makes investors trade?. The journal of Finance, 56(2), 589-616.

Indexed at, Google Scholar, Cross Ref

Hamidon, T.D. (2019). The influence of behavioural finance factors and the moderating effects of contextual and demographic factors on individual investor's investment performance (Doctoral dissertation).

Indexed at, Google Scholar, Cross Ref

HUNG, N.Ð. (2019). TO SECURE CAPITAL FOR THE ECONOMIC GROWTH. Journal of Economic Development, 13-15.

Iram, T., Iqbal, N., Qazi, R., & Saleem, S. (2021). Nexus between Financial Literacy, Investment Decisions and Heuristic Biases of Women Entrepreneurs–A Way forward for Women Empowerment. Pakistan Journal of Social Sciences, 41(1), 221-234.

Kahneman, D., Slovic, S.P., Slovic, P., & Tversky, A. (Eds.). (1982). Judgment under uncertainty: Heuristics and biases. Cambridge university press.

Indexed at, Google Scholar, Cross Ref

Katariya, M., & Joshi, S. (2017). Role of Behavioral Biases and Demographic Variables in the Stock Market: A Cross-Country Study. International Journal of Advanced Research in Engineering and Management, 3(6), 45-52.

Khan, I., Afeef, M., Jan, S., & Ihsan, A. (2021). The impact of heuristic biases on investors’ investment decision in Pakistan stock market: moderating role of long term orientation. Qualitative Research in Financial Markets.

Indexed at, Google Scholar, Cross Ref

Lin, H.W. (2011). Elucidating rational investment decisions and behavioral biases: Evidence from the Taiwanese stock market. African Journal of Business Management, 5(5), 1630.

Indexed at, Google Scholar, Cross Ref

Mushinada, V.N.C., & Veluri, V.S.S. (2019). Elucidating investors rationality and behavioural biases in Indian stock market. Review of Behavioral Finance.

Indexed at, Google Scholar, Cross Ref

Mwakyusa, B.J. (2017). Determinants for the use of financial services in Tanzania: A study of behavioural factors (Doctoral dissertation, University of Central Lancashire).

Nicholas, B., Andrei, S., & Robert, V. (1998). A model of investor sentiment1We are grateful to the NSF for financial support, and to Oliver Blanchard, Alon Brav, John Campbell (a referee), John Cochrane, Edward Glaeser, JB Heaton, Danny Kahneman, David Laibson, Owen Lamont, Drazen Prelec, Jay Ritter (a referee), Ken Singleton, Dick Thaler, an anonymous referee, and the editor, Bill Schwert, for comments. 1. Journal of Financial Economics, 49(3), 307-343.

Pearl, J., & Rosenbaum, J. (2013). Investment banking: valuation, leveraged buyouts, and mergers and acquisitions. John Wiley & Sons.

Rasool, N., & Ullah, S. (2020). Financial literacy and behavioural biases of individual investors: empirical evidence of Pakistan stock exchange. Journal of Economics, Finance and Administrative Science, 25(50), 261-278.

Indexed at, Google Scholar, Cross Ref

Raut, R.K., Das, N., & Kumar, R. (2018). Extending the theory of planned behaviour: Impact of past behavioural biases on the investment decision of Indian investors. Asian Journal of Business and Accounting, 11(1), 265-291.

Indexed at, Google Scholar, Cross Ref

Sabir, S.A., Mohammad, H.B., & Shahar, H.B.K. (2019). The role of overconfidence and past investment experience in herding behaviour with a moderating effect of financial literacy: evidence from Pakistan stock exchange. Asian Economic and Financial Review, 9(4), 480-490.

Indexed at, Google Scholar, Cross Ref

Shabgou, M., & Mousavi, A. (2016). Behavioral finance: behavioral factors influencing investors’ decisions making. Advanced Social Humanities and Management, 3(1), 1-6.

Sharma, Y., Mukherjee, K., & Shrivastav, H. (2021). A Study on Factors Impacting the Investment in Life Insurance Policy. International Journal of Management and Human Science (IJMHS), 5(4), 11-15.

Indexed at, Google Scholar, Cross Ref

Sindhu, K.P., & Kumar, S.R. (2014). Influence of risk perception of investors on investment decisions: An empirical analysis. Journal of finance and bank management, 2(2), 15-25.

Singh, J.E., Babshetti, V., & Shivaprasad, H.N. (2021). Efficient market hypothesis to behavioral finance: A review of rationality to irrationality. Materials Today: Proceedings.

Indexed at, Google Scholar, Cross Ref

Singh, Y., & Kaur, S. (2018). A Study of Investment Pattern & Gender Difference in Investment Behaviour of the Residents-An Empirical Study in and Around Mohali. International Journal of Management Studies, 5(61), 10-18843.

Indexed at, Google Scholar, Cross Ref

Tversky, A., & Kahneman, D. (1986). Judgment under uncertainty: Heuristics and biases.

Indexed at, Google Scholar, Cross Ref

ul Abdin, S.Z., Qureshi, F., Iqbal, J., & Sultana, S. (2022). Overconfidence bias and investment performance: A mediating effect of risk propensity. Borsa Istanbul Review, 22(4), 780-793.

Indexed at, Google Scholar, Cross Ref

Yadav, B., & Tiwari, A. (2012). A study on factors affecting customers investment towards life insurance policies. International Journal of Marketing, Financial Services & Management Research, 1(7), 106-123.

Indexed at, Google Scholar, Cross Ref

Yarashevich Nurillayev, J., Omonovich Tursunov, B., & Sherzod ogli Raimberdiyev, S. (2021, December). Evaluation of The Efficiency of Commercial Banks in Financing Investment Projects. In The 5th International Conference on Future Networks & Distributed Systems (pp. 361-365).

Indexed at, Google Scholar, Cross Ref

Zhuo, J., Li, X., & Yu, C. (2021). Parameter behavioral finance model of investor groups based on statistical approaches. The Quarterly Review of Economics and Finance, 80, 74-79.

Indexed at, Google Scholar, Cross Ref

Received: 01-Apr-2023, Manuscript No. AMSJ-23-13408; Editor assigned: 03-Apr-2023, PreQC No. AMSJ-23-13408(PQ); Reviewed: 17-May-2023, QC No. AMSJ-23-13408; Revised: 20-Jun-2023, Manuscript No. AMSJ-23-13408(R); Published: 13-Jul-2023