Research Article: 2022 Vol: 26 Issue: 5

Impact of Financial Literacy on Financial Capability Evidence from Urban Working Women in Rajasthan

Monu Bhargava, Manipal University Jaipur

Birajit Mohanty, Manipal University Jaipur

Kavita Tak, S.S. Jain Subodh Girls P.G. College, Jaipur

Aashima, Manipal University Jaipur

Saurabh Sharma, Manipal University Jaipur

Citation Information: Bhargava, M., Mohanty, B., Tak K., Aashima, & Sharma, S. (2022). Impact of financial literacy on financial capability: evidence from urban working women in rajasthan. Academy of Marketing Studies Journal, 26(5), 1-18.

Abstract

Background: Financial knowledge and access to basic financial services enable the women to overcome from financial crisis and positively impact the financial stability of households and may put long-term implications on financial well-being. Purpose: In this particular research work, impact of financial literacy on financial capability of urban working-women is analysed in selected districts of Rajasthan state of India. Procedure: In all 530 urban working women in state and private organization as well as self-employed and women entrepreneurs have shared their opinion regarding the level of finacial literacy from the perspective of Financial knowledge, financial behaviour and finacial attitude on financial capability during primary survey. Multi-stage sampling is used to conduct the survey. Factor analysis, correlation and regression analysis tools were used for data analysis. Findings: This was found that financial behaviour and financial attitude impact financial decision making the most in urban working women however impact of financial literacy upon financial decision-making by urban working women was found significant. Conclusion: The results indicated that There is substantial impact of the financial behaviour on financial capability. Financial knowledge, financial behaviour and financial attitude put 76.6% impact on financial decision making of urban working women with different demographic profiles which is highly significant

Keywords

Financial Capability, Financial Attitude, Financial literacy, Financial Decision, Financial Behaviour.

Introduction

Proper financial decision making is getting vital due to availability of several sophisticated financial products in the market and the growing need to save for retirement and healthy financial life. (Grohmann, 2018) Rising incomes, higher savings, long anticipation combined with declining birth rates and increased social depersonalization have increased the necessity for personal financial decision making. These changes are happening faster in urban areas than the rural areas with greater complexities. To deal these challenges adequately and use the financial products judiciously, individuals must be financially literate.(Campbell, 2014) Recent advancements, such as increased financial product possibilities, increased individual responsibility for financial decisions, new technology and rapid information expansion have fundamentally transformed the necessity for everyone to be functionally literate and financially capable (Teravainen-goff, 2019). Financial capability may be described as having skills, knowledge, attitudes & behaviour necessary to form well-versed judgments and make decisions about employment & fund-management effectively (Pathak et al., 2011). The premise capability of finance similarly entails acquiring proper financial instruments (e.g., financial services and products) & therefore ability to practice real-world options regarding finance (Financial Capability Index A Toolkit for Use What Is Financial Capability ?) An important indicator of ones capability to make economic choices is their degree of financial literacy (Lusardi, 2019).

Financial literacy encompasses not solely the understanding & knowledge of concepts regarding monetary, risks and ideas, but in addition abilities, confidence and motivation for using that understanding and knowledge to select financial products effectively, improve economic participation and improve individuals’ financial well-being. (OECD, 2013) Governments are pushing to broaden financial inclusion and knowledge by boosting access of bank accounts and other monetary services but if individuals do not possess the necessary financial abilities and skills, these chances can be result in high obligation, contract defaults, or indebtedness. This can be extremely true for women, poor people, and furthermore the less educated.(Financial literacy around the world et al., 2015)

In most of the countries, women work hard more than men. Women represent 52% of jobs in the world and men 48%. Even though women carry more than half the burden but they are still underprivileged in both paid and unpaid work. Globally in 2015, 72% of men were employed in paid work as compared to just 47% of women. Participation of within labour-market and employment rates are strongly influenced by economic, societal and ethnic issues and the distribution of home care work. The picture is reversed for unpaid work, which is predominantly domestic in nature and includes a wide range of caregiving responsibilities, out of the 41% of unpaid work, women perform 31% as compared to men that performs only 10% -more than three times. (Human Development Report, 2015, UNDP) The global wage gap by gender is 23% - that is, women earn only 77% of what men earn (World Employment Social Outlook, 2018) and Progress and Policy Action Women at Work in G20 Countries : Women at Work in G20 Countries :, n.d., 2019). Women Participation is 41% of the real personnel throughout the globe, however they're underrepresented in most of the financial activities (Hunt & Samman, 2016). Today, women are at par with men in most of the fields however once it involves monetary decision-making, they're still obsessed with the male members of their family (Arora, 2016). Only 47% women own a bank account globally as compare to 55% men (Gender Development Report, 2013) , however in India, 43% females had a bank account in comparison with 63% of men In India (Ghosh & Vinod, 2017). Women hardly used the monetary service via mobile. Across nineteen LAC countries, 79% females “never” used the internet services for financial activities as compared to 72.5% men Global Employment Trends, 2011. Women do better in every day’s management of household cash, but women sometimes underperform in a variety of critical areas such as financial product selection, financial planning and remaining aware. These areas are essential not only just for creation of wealth in longer terms, but also for improvement of financial positions and strengthening self-employment abilities (Brown, 2015). Financial knowledge is the significant element to measure literacy of finance but in terms of knowledge regarding finance women lack behind compared with man and they are not found considerably involved in literate themselves regarding finance, therefore it has been discovered that “financial behaviour” and “financial attitude” have a stronger relationship with women's “financial literacy” rather than financial knowledge. (Rai et al., 2019) Degree of financial ignorance among working females gives off an impression of being especially severe. (Scheresberg et al., 2014) When it comes to investing decisions, women in India are quite risk adverse, have a cautious mindset for investment, having relatively low levels of expertise on finance, lack of assurance, and rely solely upon assistance from others. Even after making their personal investments, Women in India remain dependent on their spouses' recommendations (Sharma, 2021).

Review of Literature and Hypotheses Development

Financial Knowledge & Skills and Financial Capability

Knowledge incorporates understanding the aims of saving and the application of the best approach to achieve them.(Hinz et al., 2013) Financial knowledge includes four characteristics: first, Financial management – being capable of creating budget for household expenses & tracking down spending and incomes; second, financial expenses and incomes planning –determining the expected needs for the future while budgeting; third, selection of appropriate products of banking– to monitor, analyse & choose the most suitable products as per the need and circumstances and forth, database of product providers to provide information about the services to consumers. (Mihal?ová et al., 2014) "Skills" the ability to make a saving arrangement. Financial knowledge and abilities includes numeracy skills as they relate to the ability to perform calculations, a comprehension of inflation, and an understanding of risk diversification.(Lusardi, 2019) The knowledge can be acquired through education and experiences about personal finance concepts and products.(Sun et al., 2022) Knowledge is required to manage personal finances in a methodical and successful manner. Financial literacy and financial education are linked to financial knowledge.(Yogasnumurti et al., 2021) The knowledge of financial concepts and the ability to apply numeracy skills in financial contexts will enable individuals to explore financial issues more confidently that may affect their financial well-being.(OECD, 2020) People with better financial knowledge and comprehension, as well as financial management abilities, are more likely to make sound financial decisions. Financial literacy is linked to sound financial decisions.(Sherraden, 2013) Women have less financial knowledge than males and are less confident in their financial abilities.(Hung et al., 2012)

H1: There is a significant relationship between financial knowledge and financial capability

Financial Behaviour & Financial Capability

Financial behaviour is one of the most important aspects of financial literacy.(Atkinson & Messy, 2012) It includes of planning for short-term and long-term expenditures, quick and regular payment of bills, making of budgets, regular savings.(Banerjee et al., 2021) It is the positive behaviour that enhances the financial capability of the individual. An active saver who plans his financials also exhibits financially responsible behaviour. (Bhushan & Medury, 2014) Financial competence is defined not only by a high level of financial knowledge or a good attitude, but also by positive and impulsive behaviour to face the problems and the ability to make precise financial judgments.(Shephard & Bailey, n.d., 2017) Individuals who engage in positive financial behaviour, such as proper budgeting and financial stability, improve their financial literacy, whereas those who engage in poor financial behaviour, such as relying heavily on credit and loans, deteriorate their financial well-being. (Rai et al., 2019) Therefore, it can be said financial capability influence with positive financial behaviour.

H2: There is a significant relationship between financial behaviour and financial capability.

Financial Attitude & Financial Capability

An individual's attitude can be defined as a belief or mindset about how they manage their finances. (Arifin, 2018) Financial attitude includes assertiveness toward saving money, spending money and planning money. (OECD, 2020) Financial decision-making is influenced by attitudes, as financial attitudes are strongly linked to financial management behaviour.(Yap et al., 2018) An individual's financial capability is influenced by their attitude, which is defined as their confidence in making sound financial judgments.(Shim et al., 2013) Financial capability improves when attitudes improve. A person's financial attitude impact and aid in acting and behaving towards money both in terms of managing, budgeting, and making decisions. (Yogasnumurti et al., 2021) People with a positive attitude towards finance and money can affect their behaviour to achieve financial literacy and enhance financial knowledge. But negative attitude will weaken their financial decision-making power.(Rai et al., 2019)

H3: There is a significant relationship between financial attitude and financial capability

Financial Literacy & Financial Capability

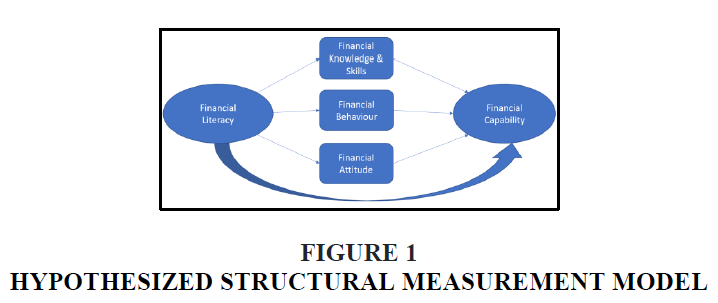

The terms financial capability & financial literacy are considered alternately. Financial Capability is that the term normally used in the UK and Canada, then, at that point Financial Literacy is regularly used in Australia and furthermore in the U.S. (Pokrikyan, 2016) But it's also important to differentiate between the terms financial capability and financial literacy. However, meanings of financial literacy have frequently centred on knowledge, skills and ability. Interestingly, Financial Capability in general more extensive and take in consideration attitudes and behaviour together with literacy. (Teravainen-goff, 2019) Capability of finance can be revealed through a specific degree of “financial literacy” and implementation of advantageous “financial behaviour.” So, it can be said that “financial literacy” and “financial behaviour” are firmly connected with financial capacity. (Xiao et al., 2015) It is being observed across the countries, individuals seem to be good at short-term financial management but their behaviour is a problem which includes lack of active and long term savings, reliability on credit, difficulties in choosing appropriate financial product as per requirements and planning etc. due to limited financial skills. (World Bank, 2013) (OECD, 2013) "attitude" eagerness to save from squandering, & "behaviour" specific action of placing savings into reserve funds. In financial capability, the key concern is with behavioural outcomes. (Hinz et al., 2013) “Financial literacy” has positive impact upon “financial status” & “financial behaviour” and enables any financial-literate individual to be capable enough in savings, minimizing expenditures and creating budgets. (Robb & Woodyard, 2011) Higher educated individual exhibit positive behaviour, attitude and advance level of knowledge which illustrates existence of a positive association amongst financial literacy and education. OECD, 2013 Individuals do not always act reasonably, if all things remain constant, feelings, heuristics and different predispositions are related with financial decision making that reflect the financial behaviour (Baker et al., 2019) Figure 1.

H4: There is a significant relationship between financial literacy on financial capability.

Research Objectives

1. To study the socio-demographic profile of Urban Working Women in the selected cities of Rajasthan

2. To investigate the level of finacial literacy from the perspective of Financial knowledge, financial behaviour and finacial attitude of selected urban working women.

3. To examine the effect finacial literacy on financial capability of selected urban working women.

Research Methodology

Analytical Framework

Sampling technique and research design In multistage stratified purposive sampling was used to select the sample for the study. A primary survey was done in five districts of Rajasthan i.e. Jaipur, Ajmer, Kota, Jodhpur and Udaipur with the help of a 5-point Likert scale structured questionnaire based on OECD & NCFE financial literacy survey tool. The study design id descriptive in nature.

Sample Size The questionnaire was sent to 600 respondents, out of which responses were received from 542 respondents thus the response rate was more than 90%. However 530 responses were found to be complete in all respects and hence suitable for the data analysis. Therefore the sample size of the study is 530.

Analytical Tools Used in the Study

Both descriptive and inferential statistics were used to analyse the data. Descriptive statistics such as mean, standard deviation were used to analyse the data. Further, inferential statistics like correlation an regression analysis were used to examine the impact of financial literacy on financial capability of working urban women.

Test of Reliability

The alpha value of Cronbach alpha test was used to check the reliability of the instrument used in the study . The Cronbach alpha value for Financial Knowledge, Financial Behaviour, Financial Attitude and Financial Capapbility was found to be 0.952, 0.957, 0.849 and 0.967 respectively which is higher than than the alpha=0.7 benchmark, proving the instrument valid and reliable and having internal consistency, the details are presented in the Table 1.

| Table 1 Test of Reliability: Cronbach’s Alpha | ||||

| Financial Knowledge | Financial Behaviour | Financial Attitude | Financial Capability | |

| Value of Alpha (α) | 0.952 | 0.957 | 0.849 | 0.967 |

Author Declaration

All of the participants signed a written informed consent form. The Social Science Ethical Committee approved the research protocol. The research was carried out in conformity with the declaration.

Results and Discussion

Socio-Demographic distribution

The Table 2 shows the Socio-Demographic features and frequencies of working women who had responded in the reseach. After studying the data it can be revealed that majority of respondents belong to age group of 30-39 years (38.1%) which shows that majority of the respondents are young and of middle age group. Highest numbers of respondents are Higher education (62.1%) and most of them are married (63.4%). Most of the respondents are Pvt. Employees (41.9%). Most of the participants earn less than Rs. 20,000 insurance and only 39.8% owned health insurance policies. More than half of the women live in joint family(53.2%) but having family members 3-5 only(41.1%). monthly (45.3%) and highest percentage of the family income is more than Rs. 80,000 (34%). 92.6% working women are owned the bank accounts but only 43.8% women have life insurance policies and only 39.8% women have health insurance policies Table 3.

| Table 2 Socio-Demographic Distribution | ||

| Demographic Variables | Frequency | Percentage |

| Age Range | ||

| 18-19 | 40 | 7.5 |

| 20-29 | 156 | 29.4 |

| 30-39 | 202 | 38.1 |

| 40-49 | 98 | 18.5 |

| 50-59 | 28 | 5.3 |

| 60 and Above | 6 | 1.1 |

| Total | 530 | 100.0 |

| Occupation | ||

| Salaried – Private Job | 227 | 42.8 |

| Salaried –Govt. Job | 207 | 39.1 |

| Business | 45 | 8.5 |

| Self-Employed Professional | 51 | 9.7 |

| Total | 530 | 100 |

| Educational Level | ||

| Illiterate | 24 | 4.5 |

| Elementary School | 52 | 9.8 |

| High School | 57 | 10.8 |

| Technical Education | 68 | 12.8 |

| Higher Education | 329 | 62.1 |

| Total | 530 | 100 |

| Marital Status | ||

| Single | 166 | 31.3 |

| Married | 336 | 63.4 |

| Widowed/ Separated | 28 | 5.3 |

| Total | 530 | 100 |

| Number of Family Members | ||

| Less than Three | 52 | 9.8 |

| Between 3-5 | 218 | 41.1 |

| Between 5-7 | 193 | 36.4 |

| More Than 7 | 67 | 12.6 |

| Total | 530 | 100 |

| Individual Monthly Income | ||

| Less than INR 20 K | 260 | 49.1 |

| INR 21 K-40K | 160 | 30.2 |

| INR 40 K-80 K | 85 | 16.0 |

| More Than INR 80 K | 25 | 4.7 |

| Total | 530 | 100 |

| Family Monthly Income | ||

| Less Than INR 20K | 39 | 7.4 |

| INR 20 K-40K | 164 | 30.9 |

| INR 40K -80K | 147 | 27.7 |

| More Than INR 80K | 180 | 34.0 |

| Total | 530 | 100 |

| Owned Bank Account | ||

| Yes | 491 | 92.6 |

| No | 39 | 7.4 |

| Total | 530 | 100 |

| Owned Life Insurance | ||

| Yes | 232 | 43.8 |

| No | 298 | 56.2 |

| Total | 530 | 100 |

| Owned Health Insurance | ||

| Yes | 211 | 39.8 |

| No | 319 | 60.2 |

| Total | 530 | 100 |

| Household Structure | ||

| Entirely alone | 24 | 4.5 |

| Nuclear | 205 | 38.7 |

| Joint Family | 282 | 53.2 |

| Relatives | 19 | 3.6 |

| Total | 530 | 100 |

| Table 3 Descriptive Analysis of Financial Knowledge | ||||

| Variables | N | Mean | Std. Deviation | Percentage |

| Application of principles of Addition, Subtraction, Multiplication and Division in Monetary operation. (FK1) | 530 | 3.82 | 1.014 | 76.4% |

| Ability to handle money transaction with banks (FK2) | 530 | 3.66 | 1.082 | 73.2% |

| Knowledge to calculate simple and compound interest (FK3) | 530 | 3.51 | 1.038 | 70.2% |

| Understanding the effect of Inflation in estimating value of money. (FK5) | 530 | 3.19 | 1.129 | 63.8% |

| Understanding the principles and application of Simple and compound interest. (FK6) | 530 | 3.52 | .999 | 70.4% |

| Understanding of the relationship between Risk and associated return. (FK7) | 530 | 3.17 | 1.107 | 63.4% |

| Understanding of the role of Diversification in mitigating risk in financial investment. (FK8) | 530 | 3.08 | 1.103 | 61.6% |

| Ability to distinguish between need and want to set financial goal. (FK9) | 530 | 3.38 | 1.090 | 67.6% |

| Understand the importance of Bank A/C ownership and its uses.( FK10) | 530 | 3.50 | 1.065 | 70.0% |

| Ability to use online e-Payment portals and wallet. (FK11) | 530 | 3.82 | 0.998 | 76.4% |

| Understanding the process and eligibility for an access of loans from banks. (FK12) | 530 | 3.34 | 1.029 | 66.8% |

| Good understanding of financial products and appropriately able to invest in them.( FK13) | 530 | 3.06 | 1.142 | 61.2% |

Status of financial Knowledge, Finacial Attitude, Financial Behaviour Score Among Sample Working Women

Descriptive Analysis

The above Table 3 depicts the descriptive statistics of financial knowledge of respondents. A perusal of data presented in Table-3 reveals that financial knowledge with regard to application of principals of arithmatical operations (FK1), use of online E-payment portals & wallets (FK11) and good understanding of financial products(FK 13) is found to be 76.4% and hold first rank. A further probe of data reveals that handling money transactions with banks (FK2) (73.2%), understanding of principles and applications of simple and compound interst (FK6)(70.4%) , Knowledge to calculate simple and compound interest (FK3)(70.2%), Understand the importance of Bank A/C ownership and its uses (FK10)(70.0%), Ability to distinguish between need and want to set financial goal (FK9)(67.6%) holds second, third, forth , fifth and sixth rank. But it is also found that the highest standard deviation (1.142) is in good understanding of financial products and appropriately able to invest in them ( FK13) which shows the highest variability and the least variation (0.998) is in the Ability to use online e-Payment portals and wallet (FK11) which indicates the low variability. It can be concluded that the respondents are able to apply financial concepts but with variations, can use E-payments and having good knowledge of financial products but not able to distinguish between needs and wants and to set financial goal Table 4.

| Table 4 Descriptive Analysis of Financial Behaviour | ||||

| Variables | N | Mean | Std. Deviation | Percentage |

| Affordability to fulfil the basic requirements of households. (FB1) | 530 | 3.26 | 1.063 | 65.2% |

| Habit of budgeting for household income and expenses. (FB2) | 530 | 3.35 | 1.055 | 67.0% |

| Habit of Setting Long Term Goals and strive to achieve them on scheduled time. ( FB3) | 530 | 3.30 | 1.043 | 66.0% |

| Financial planning to meet monthly expenses without any financial stress.( FB4) | 530 | 3.38 | 1.003 | 67.6% |

| Habit of prima Evaluation of financial products before investing. (FB5) | 530 | 3.22 | 1.068 | 64.4% |

| Habit of gathering financial information from authentic sources prior to investment in financial products.( FB6) | 530 | 3.23 | 1.081 | 64.6% |

The above Table 4 depicts the descriptive statistics of financial behaviour of respondents. A perusal of data presented in Table 4 reveals that financial behaviour with regard to financial planning to meet monthly expenses without any financial stress (FB-4) is ranked first with 67.6 per cent. Habit of budgeting for household income and expenses ( FB-2), habit of Setting Long Term Goals and strive to achieve them on scheduled time (FB-3) and affordability to fulfil the basic requirements of households (FB-1) is found 67.0%, 66.0% and 65.2% respectively ranked second , third and fourth. It is found to be interesting that the standard deviation is highest in the habit of gathering financial information from authentic sources (FB6) i.e. 1.081 and the least variation (1.003) is in the financial planning to meet monthly expenses (FB4). It can be concluded that working women are good in financial planning to meet short-term and long-term expenses without stress and having habits of budgeting but they are less likely to evaluate the financial products before investing and gathering information from authentic sources Table 5.

| Table 5 Descriptive Analysis of Financial Attitude | ||||

| Variables | N | Mean | Std. Deviation | Percentage |

| Do worry about the future; life approach for present and future both (FA1) | 530 | 2.81 | 1.032 | 56.2 |

| satisfaction to save money than to spend it for the long term (FA2) | 530 | 2.84 | .997 | 56.8% |

| Money is to save rather than spend (FA03) | 530 | 2.67 | .980 | 53.4% |

| It is important to set financial goals for better future. (FA4) | 530 | 3.48 | 1.022 | 69,7% |

| Saving is a priority of the family.( FA5) | 530 | 2.53 | 1.040 | 50.6% |

| After making a decision to buy products for household, do not worry about spending money. (FA6) | 530 | 2.95 | .901 | 59.0% |

| Budgeting for family is a common practice. (FA7) | 530 | 2.62 | 1.009 | 52.4% |

| The way to manage money will affect the future.(FA8) | 530 | 3.52 | 1.027 | 70.4% |

Descriptive Analysis of Financial Attitude

The above Table 5 depicts the descriptive statistics of financial attitude of respondents. A perusal of data presented in Table-5 reveals that financial attitude with regard to “way to manage money will affect the future” (FA8) is 70.4% and found to be in first rank. “It is important to set financial goals for better future” (FA4), “After making a decision to buy products for household, worry about spending money” (FA6) is found 69.7% and 59.0% and scored second and third rank. It is to interestingly noticed that the highest variation is in “Saving is not a priority of the family” (FA5) which is 1.040 and the least variation (.901) is found in After making a decision to buy products for household, worry about spending money. (FA6). It can be concluded that working women understand the importance of money and setting of financial goal for future but still women are less likely to family saving and family budgeting habits Table 6.

| Table 6 Decsciptive Analysis of Financial Capability | ||||

| Variables | N | Mean | Std. Deviation | Percentage |

| Keep up financial commitments without stretching. (FC1) | 530 | 3.27 | .904 | 65.4% |

| Attitude towards toward saving and investment is highly Positive and optimistic. (FC2) | 530 | 3.38 | .955 | 67.6% |

| Having the provision for contingency and Never ran out for money (FC3) | 530 | 3.20 | .969 | 64% |

| Have faced no financial difficulty in the last five years and even if has raised it was managed appropriately. (FC4) | 530 | 3.05 | 1.001 | 61.0% |

| Always keep an eye on the amount of savings & investments done. (FC5) | 530 | 3.38 | .923 | 67.6 |

| Habit of checking bank statements frequently after each transaction.( FC6) | 530 | 3.32 | .962 | 66.4% |

| Aware about saving a/c balance. ( FC7) | 530 | 3.49 | .957 | 69.8% |

| Always keep Budget to cover heavy expenditures (FC8) | 530 | 3.51 | 1.007 | 70.2% |

| Have sufficient provisions to meet out any future emergency and uncertainty. (FC9) | 530 | 3.25 | .916 | 65.0% |

| Can manage existing liabilities and household’s expenses at least for 12 months’ even if current income drops (FC10) | 530 | 3.09 | 1.268 | 61.8% |

| Have life insurance policy to cover financial requirements in case of loss of life (FC11) | 530 | 3.24 | .989 | 64.8% |

| Life of all family members is insured (FC12) | 530 | 3.22 | 1.018 | 64.4% |

| Have enough health insurance coverage for self and family. (FC13) | 530 | 2.77 | 1.145 | 55.4% |

| Have created enough provisions for retirement planning. (FC14) | 530 | 2.65 | 1.079 | 53% |

| Have created saving funds for difficult time.( FC15) | 530 | 3.22 | .962 | 64.4% |

| Always Sought advises from professional advisors before finalizing any financial products. (FC16) | 530 | 3.14 | .935 | 62.8% |

| Seeking experience personally rather than just rely on product information. (FC17) | 530 | 3.21 | .948 | 64.2% |

| Before finalizing any financial product, compare offers from different service providers.( FC18) | 530 | 3.26 | .944 | 65.2% |

| Compare product features and prices, not just brand. (FC19) | 530 | 3.26 | .979 | 65.2% |

| Always Read the terms and conditions in detail before buying any financial products. (FC20) | 530 | 3.21 | .931 | 64.2% |

| Always keep on Monitoring performance of financial investments (FC21) | 530 | 3.20 | .948 | 64.0% |

| Always keep Checking The performance of financial products on regular time intervals.( FC22) | 530 | 3.20 | .970 | 64.0% |

| Always keep up-to-date in financial matters (FC23) | 530 | 3.25 | .951 | 65.0% |

Descriptive Analysis of Financial Capability

The above Table 6 shows the descriptive statistics of financial capability of the respondents. A perusal of data presented in Table-6 explains that financial capability with regard to keep budget to cover heavy expenditures (FC8) is highest, which is 70.2% and scored first rank. The followed higher capabilities are aware about saving a/c balance (FC7), keeping an eye on the amount of savings & investments done (FC5), attitude towards toward saving and investment is highly positive and optimistic (FC2) and habit of checking bank statements frequently after each transaction (FC6), i.e. 69.8%, 67.6%, 67.6% and 66.4% which stood on second, third, fourth and fifth rank. It is necessary to be notice the highest standard deviation (1.268) is found to be in ability to manage existing liabilities and household’s expenses at least for 12 months’ even if current income drops (FC10). It can be concluded that that women are having capabilities to plan heavy expenditures and always aware about her saving a/c balances. They are good in money management but not capable in retirement planning and not able to manage the emergency situations.

Factor Analysis

KMO Measures the Sampling Adequacy who determines if the responses given with the sample are adequate or not. Here the KMO value is 0.951 (refer Table-7)which shows that the statements are good for sampling. and Bartlett’s Test, are used to ensure data sampling adequacy for factor analysis. To study the strength of the relationship among variables the Bartleltt’s test of sphericity is used. The Bertleltt’s test is used to quantify the interns' variable correlation that is being examined. The Bartleltt’s test value is significant (refer Table-7) (p value <0.05) which means that the correlation matrix is not an identity matrix. Therefore both KMO and Bartleltt’s tests showed enough adequacies of data to support the factor analysis Table 7.

| Table 7 KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .951 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 14349.604 |

| df | 325 | |

| Sig. | .000 | |

During the identification of significant variables the researcher has taken extraction aigen value of 0.75 as a cut-off point, hence, variables having aigen value of more than 0.75 are considered as significant factors for further analysis in this study Table 8.

| Table 8 Communalities | ||||||||

| Financial Knowledge | Financial Behaviour | Financial Attitude | ||||||

| Variable | Initial Value | Extraction aigen Value | Variable | Initial Value | Extraction aigen Value | Variable | Initial Value | Extraction aigen Value |

| FK1 | 1.000 | 0.760 | FB1 | 1.000 | 0.815 | FA3 | 1.000 | 0.788 |

| FK2 | 1.000 | 0.793 | FB2 | 1.000 | 0.803 | FA4 | 1.000 | 0.774 |

| FK3 | 1.000 | 0.836 | FB4 | 1.000 | 0.795 | FA5 | 1.000 | 0.779 |

| FK5 | 1.000 | 0.780 | FB5 | 1.000 | 0.799 | FA7 | 1.000 | 0.759 |

| FK6 | 1.000 | 0.794 | FB6 | 1.000 | 0.810 | |||

| FK7 | 1.000 | 0.801 | ||||||

| FK8 | 1.000 | 0.817 | ||||||

| FK9 | 1.000 | 0.783 | ||||||

| FK10 | 1.000 | 0.792 | ||||||

| FK12 | 1.000 | 0.774 | ||||||

| FK13 | 1.000 | 0.807 | ||||||

Extraction Method-: Principal Component Analysis

The communalities shows how much of the variance in the variable has been accounted for by the extracted factors. Communalities are the sum of squares of a statements factor loading which explains how much is variable accounts for the factors taken together Table 9.

| Table 9 Total Variance Explained | |||||||||

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 13.830 | 53.193 | 53.193 | 13.830 | 53.193 | 53.193 | 9.342 | 35.931 | 35.931 |

| 2 | 3.649 | 14.034 | 67.226 | 3.649 | 14.034 | 67.226 | 4.485 | 17.250 | 53.182 |

| 3 | 1.492 | 5.739 | 72.965 | 1.492 | 5.739 | 72.965 | 4.120 | 15.848 | 69.029 |

| 4 | 1.075 | 4.134 | 77.099 | 1.075 | 4.134 | 77.099 | 2.098 | 8.069 | 77.099 |

| 5 | .664 | 2.553 | 79.651 | ||||||

| 6 | .537 | 2.067 | 81.718 | ||||||

| 7 | .477 | 1.836 | 83.554 | ||||||

| 8 | .425 | 1.635 | 85.189 | ||||||

| 9 | .394 | 1.516 | 86.705 | ||||||

| 10 | .347 | 1.334 | 88.039 | ||||||

| 11 | .322 | 1.238 | 89.277 | ||||||

| 12 | .294 | 1.130 | 90.407 | ||||||

| 13 | .280 | 1.075 | 91.482 | ||||||

| 14 | .274 | 1.055 | 92.537 | ||||||

| 15 | .272 | 1.045 | 93.582 | ||||||

| 16 | .216 | .829 | 94.412 | ||||||

| 17 | .209 | .804 | 95.216 | ||||||

| 18 | .190 | .729 | 95.945 | ||||||

| 19 | .188 | .722 | 96.667 | ||||||

| 20 | .148 | .571 | 97.239 | ||||||

| 21 | .143 | .552 | 97.790 | ||||||

| 22 | .137 | .528 | 98.318 | ||||||

| 23 | .128 | .491 | 98.809 | ||||||

| 24 | .116 | .446 | 99.255 | ||||||

| 25 | .110 | .423 | 99.678 | ||||||

| 26 | .084 | .322 | 100.000 | ||||||

| Extraction Method: Principal Component Analysis. | |||||||||

Rotated component factor matrix: Basic idea of rotation is to reduce the number of the variables on which the variables under investigation have high loadings. Rotation does not actually change anything but makes the intrepretation of the analysis easier Table 10.

| Table 10 Rotated Component Matrix | ||||

| Variable | Components | |||

| 1 | 2 | 3 | 4 | |

| FKI | .816 | |||

| FK2 | .751 | |||

| FK3 | .829 | |||

| FK5 | .774 | |||

| FK6 | .744 | |||

| FK7 | .841 | |||

| FK8 | .859 | |||

| FK9 | .776 | |||

| FK10 | .708 | |||

| FK12 | .765 | |||

| FK13 | .844 | |||

| FB1 | .794 | |||

| FB2 | .747 | |||

| FB4 | .713 | |||

| FB5 | .824 | |||

| FB6 | .832 | |||

| FA3 | .876 | |||

| FA4 | .628 | |||

| FA5 | .874 | |||

| FA8 | .616 | |||

The variables having eigen value more than .75 have been considered as most significant factors affecting the financial capability of respondents and considered as the part of the further study Table 11.

| Table 11 Factor Construction | ||

| Factor Name | Variables | Rotated Factor Loadings |

| Factor 01: Financial Knowledge & Behaviour | Understanding the effect of Inflation in estimating value of money. (FK05) | .774 |

| Understanding of the relationship between Risk and associated return (FK07) | .841 | |

| Understanding of the role of Diversification in mitigating risk in financial investment (FK08) | .859 | |

| Ability to distinguish between need and want to set financial goal (FK09) | .776 | |

| Understanding the process and eligibility for an access of loans from banks. (FK12) | .765 | |

| Good understanding of financial products and appropriately able to invest in them.( FK13) | .844 | |

| Affordability to fulfil the basic requirements of households. (FB1) | .794 | |

| Habit of prima Evaluation of financial products before investing. (FB5) | .824 | |

| Habit of gathering financial information from authentic sources prior to investment in financial products.( FB6) | .832 | |

| Factor 02: Application of Financial Knowledge | Application of principles of Addition, Subtraction, Multiplication and Division in Monetary operation. (FK1) | .816 |

| Ability to handle money transaction with banks (FK02) | .751 | |

| Knowledge to calculate simple and compound interest (FK03) | .829 | |

| Factor 03: Saving Attitude & Financial Planning | Money is to save rather than spend (FA03) | .876 |

| Saving is a priority of the family (FA05) | .874 | |

On the basis of this, three factors named: Financial Knowledge & Behaviour, Application of Financial Knowledge, Saving Attitude & Financial Planning are considered to be the significant factors that affects and improves the financial capability of respondents Table 12.

| Table 12 Correlations | ||||||||||||||||

| FK_1 | FK_2 | FK_3 | FK_5 | FK_7 | FK_8 | FK_9 | FK_12 | FK_13 | FB_1 | FB_5 | FB_6 | FA_3 | FA_5 | FC | ||

| FK_1 | P.C. | 1 | .772** | .685** | .455** | .432** | .360** | .492** | .496** | .379** | .471** | .428** | .441** | .018 | -.100* | .530** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .685 | .021 | .000 | ||

| FK_2 | P.C. | .772** | 1 | .737** | .564** | .542** | .475** | .625** | .621** | .523** | .618** | .564** | .570** | .060 | -.053 | .643** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .165 | .227 | .000 | ||

| FK_3 | P.C. | .685** | .737** | 1 | .594** | .520** | .505** | .532** | .581** | .508** | .560** | .501** | .488** | .129** | .032 | .603** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .003 | .461 | .000 | ||

| FK_5 | P.C. | .455** | .564** | .594** | 1 | .792** | .739** | .689** | .720** | .756** | .702** | .697** | .703** | .265** | .154** | .683** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | ||

| FK_7 | P.C. | .432** | .542** | .520** | .792** | 1 | .848** | .748** | .738** | .775** | .740** | .747** | .739** | .261** | .118** | .707** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .007 | .000 | ||

| FK_8 | P.C. | .360** | .475** | .505** | .739** | .848** | 1 | .734** | .715** | .758** | .709** | .720** | .761** | .279** | .205** | .688** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | ||

| FK_9 | P.C. | .492** | .625** | .532** | .689** | .748** | .734** | 1 | .761** | .702** | .790** | .724** | .742** | .162** | .015 | .768** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .738 | .000 | ||

| FK_12 | P.C. | .496** | .621** | .581** | .720** | .738** | .715** | .761** | 1 | .790** | .736** | .735** | .796** | .209** | .127** | .733** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .003 | .000 | ||

| FK_13 | P.C. | .379** | .523** | .508** | .756** | .775** | .758** | .702** | .790** | 1 | .788** | .757** | .787** | .298** | .202** | .708** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | ||

| FB_1 | P.C. | .471** | .618** | .560** | .702** | .740** | .709** | .790** | .736** | .788** | 1 | .764** | .754** | .199** | .080 | .768** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .065 | .000 | ||

| FB_5 | P.C. | .428** | .564** | .501** | .697** | .747** | .720** | .724** | .735** | .757** | .764** | 1 | .862** | .228** | .146** | .777** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .001 | .000 | ||

| FB_6 | P.C. | .441** | .570** | .488** | .703** | .739** | .761** | .742** | .796** | .787** | .754** | .862** | 1 | .209** | .177** | .773** |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | ||

| FA_3 | P.C. | .018 | .060 | .129** | .265** | .261** | .279** | .162** | .209** | .298** | .199** | .228** | .209** | 1 | .716** | .336** |

| Sig | .685 | .165 | .003 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | ||

| FA_5 | P.C. | -.100* | -.053 | .032 | .154** | .118** | .205** | .015 | .127** | .202** | .080 | .146** | .177** | .716** | 1 | .222** |

| Sig | .021 | .227 | .461 | .000 | .007 | .000 | .738 | .003 | .000 | .065 | .001 | .000 | .000 | .000 | ||

| AVG_FC | P.C. | .530** | .643** | .603** | .683** | .707** | .688** | .768** | .733** | .708** | .768** | .777** | .773** | .336** | .222** | 1 |

| Sig | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | ||

| **. Correlation is significant at the 0.01 level (2-tailed). *. Correlation is significant at the 0.05 level (2-tailed). N=530 |

||||||||||||||||

The Table12 shows the correlation among the financial capapbility and the variables of the extracted factors: Financial Knowledge & Behaviour, Application of Financial Knowledge, Saving Attitude & Financial Planning . The variables: Ability to distinguish between need and want to set financial goal (FK9), Understanding the process and eligibility for an access of loans from banks. (FK12), Affordability to fulfil the basic requirements of households (FB1), Habit of prima Evaluation of financial products before investing. (FB5), Habit of gathering financial information from authentic sources prior to investment in financial products.( FB6) of extracted Factor-1 (Financial Knowledge & Behaviour) are having high, significant and positive correlation with financial capability, whereas the variables Application of principles of Addition, Subtraction, Multiplication and Division in Monetary operation. (FK1), Ability to handle money transaction with banks (FK02), Knowledge to calculate simple and compound interest (FK03) of extracted Factor- 2(Application of Financial Knowledge) and Understanding the effect of Inflation in estimating value of money (FK05), Understanding of the relationship between Risk and associated return (FK07), Understanding of the role of Diversification in mitigating risk in financial investment (FK08), Good understanding of financial products and appropriately able to invest in them.( FK13) of extracted Factor-1(Financial Knowledge & Behaviour) have moderate, significant and positive correlation with financial capapbility of the respondents but the variables Money is to save rather than spend (FA03), Saving is a priority of the family (FA05) of extracted Factor-3 (Saving Attitude & Financial Planning) have low but positive correlation with financial capability of the respondents Table 13.

| Table 13 Coefficientsa | |||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | ||||||||

| B | Std. Error | Beta | Tolerance | VIF | |||||||||

| 1 | (Constant)b | .479 | .081 | 5.942 | .000 | ||||||||

| FK_1 | .049 | .026 | .066 | 1.896 | .059 | .361 | 2.774 | ||||||

| FK_2 | .042 | .028 | .061 | 2.390* | .037 | .265 | 1.770 | ||||||

| FK_3 | .078 | .026 | .107 | 3.048* | .002 | .357 | 2.801 | ||||||

| FK_5 | -.005 | .026 | -.007 | -.185 | .853 | .285 | 2.513 | ||||||

| FK_7 | .012 | .033 | .017 | .352 | .725 | .189 | 1.303 | ||||||

| FK_8 | -.023 | .031 | -.034 | -.748 | .455 | .213 | 1.701 | ||||||

| FK_9 | .168 | .029 | .243 | 5.796* | .000 | .251 | 3.978 | ||||||

| FK_12 | .020 | .031 | .028 | 3.649* | .017 | .241 | 2.149 | ||||||

| FK_13 | -.036 | .030 | .055 | 3.202* | .030 | .215 | 2.653 | ||||||

| FB_1 | .119 | .030 | .168 | 3.920* | .000 | .240 | 4.161 | ||||||

| FB_5 | .146 | .032 | .207 | 4.549* | .000 | .214 | 2.676 | ||||||

| FB_6 | .119 | .035 | .171 | 3.360* | .001 | .171 | 2.841 | ||||||

| FA_3 | .097 | .024 | .126 | 3.968 | .000 | .439 | 2.280 | ||||||

| FA_5 | .053 | .023 | .074 | 2.300* | .022 | .430 | 2.323 | ||||||

| 1. Dependent Variable: Financial Capability 2. Predictors: (Constant), FA_5, FK_9, FK_1, FK_5, FA_3, FK_3, FB_5, FK_8, FK_12, FB_1, FK_2, FK_13, FK_7, FB_6 R Squared=.772, Adjusted R Square=.766, F Value=124.559 at p value 0.000, D-W test=1.905 Significant at 5 percent level. |

|||||||||||||

Table 13 exhibits the regression results analysing the impact of dependent variables named financial knowledge, financial behaviour, and financial attitude on the independent variable named financial capability of respondents. The extracted variables of financial knowledge FK_1, FK_2, FK_3, FK_5, FK_7, FK_8, FK_9, FK_12 and FK_13, the extracted variables of financial behaviour FB_1, FB_5 and FB_6, the extracted variables of financial attitude FA_3 and FA_5 are used to study the impact on financial capability Table 14.

| Table 14 T-Statistic and Hypothesis Testing | ||||

| S.No. | Independent Variable | Dependent Variable | Hypothesis | Information |

| 1 | Financial Knowledge | Financial Capability | H1 | H1 is accepted. |

| 2 | Financial Behaviour | Financial Capability | H2 | H2 is Accepted. |

| 3 | Financial Attitude | Financial Capability | H3 | H3 is Accepted. |

| 4. | Financial Literacy | Financial Capability | H4 | H4 is accepted |

Findings

It was found from analysis that the five items out of nine items of financial knowledge i.e. Ability to handle money transaction with banks (FK02), Knowledge to calculate simple and compound interest (FK03) and Ability to distinguish between need and want to set financial goal (FK09), Understanding the process and eligibility for an access of loans from banks (FK12) and Good understanding of financial products and appropriately able to invest (FK13) affect the financial capability the most but other variables do not impact significantly on financial capability. The significant value of more than 50 percent items of the financial knowledge is less than 0.05, hence H1 is accepted. There is substantial impact of the financial behaviour on financial capability as the Beta value of FB1, FB5 and FB6 is 0.168, 0.207 and 0.171 and also having singnificant value is less than 0.05. Hence H2 is accepted. The significant value of financial attitude (FA3 & FA5) is less than 0.05, Therefore H3 is accepted. As all the variables of financial literacy (knowledge, attitude and behaviour) have significant impact on financial capability therefore it is proved that finacial literacy has significant impact on finacial capability. Therefore H4 is accepted.

The R value is used to explain how to describe the correlation coefficient value and the correlation status between the dependent and independent variables. Depending on the level of measurement of variables, R value is also used to represent the strength and direction of the linear relationship between two variables. The result of the analysis is indicating the variation but statistically significant. It is important to mention that the value of D-W test is 1.905 (less than 2.0) which shows that there is positive autocorrelation between the samples. The ‘F’ Value is 124.559 which is significant at 5% level which reflects that the regression model fits for the data. The correlation between financial knowledge, financial behaviour and financial attitude is high as their R value is 0.772 and the adjusted R-Squared value is .766 which explain that financial knowledge, financial behaviour and financial attitude put 76.6% impact on financial decision making of urban working women which is highly significant and the deviation in financial capability is elucidated by the extracted variables of the financial knowledge, financial behaviour and financial attitude and remaining 23.4% deviation is due to the response variable of the other factors. The negative value of regression coefficient shows the negative relationship between financial capability and FK_5, financial capability and FK_8 and financial capability and FK_13. This indicates that the understanding of financial concepts affects the financial capability of the respondents. Computed Financial Capability score found explaining 23.4% of variance in financial decision making of working women is due to other factors which are not the part of the study.

Conclusion

In this research the researcher has made an attempt to examine the level of finacial literacy from the perspective of Financial knowledge, financial behaviour and finacial attitude of selected urban working women. From the analysis it is found that financial behaviour and financial attitude and financial knowledge have significant impact on the financial capability of the urban working women. The item-wise analysis of the effect financial knowledge on financial capability revealed that more than 55 percent of the items have significant impact on financial capability. Similarly, the item-wise analysis of effect financial behaviour and financial attitude on financial capability is found most significant.

Only three variables are taken into account in this study when it comes to study the impact of financial literacy on financial capability. Financial awareness financial access and experience are also vital in making financial decisions and forming positive financial behaviour in order to meet financial objectives. These factors could be included in future research.

Funding Statement

The study received no financial support from any of the public, private, or non-profit funding bodies. There are no competing interests declared by the authors.

References

Arifin, A. Z. (2018). Influence factors toward financial satisfaction with financial behavior as intervening variable on Jakarta area workforce.

Arora, A. (2016). Assessment of financial literacy among working Indian women. Business Analyst, 36(2), 219-237.

Atkinson, A., & Messy, F. A. (2012). Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) pilot study.

Indexed at, Google Scholar, Cross ref

Baker, H. K., Kumar, S., Goyal, N., & Gaur, V. (2018). How financial literacy and demographic variables relate to behavioral biases. Managerial Finance.

Indexed at, Google Scholar, Cross ref

Banerjee, A. N., Hasan, I., Kumar, K., & Philip, D. (2021). The Power of a Financially Literate Woman in Intra-Household Financial Decision-Making. Available at SSRN 3246314.

Bhushan, P., & Medury, Y. (2014). An empirical analysis of inter linkages between financial attitudes, financial behaviour and financial knowledge of salaried individuals. Indian Journal of Commerce and Management Studies, 5(3), 58-64.

Brown, E. (2015). OECD Working Papers on Finance , Insurance and Private Pensions No . 14 Empowering Women Through Financial Awareness and Education Angela Hung , Joanne Yoong

Campbell, J. Y. (2014). Household finance. World Development Report 2015: Mind, Society, and Behavior, LXI(4), 112–126.

Ghosh, S., & Vinod, D. (2017). What constrains financial inclusion for women? Evidence from Indian micro data. World Development, 92, 60-81.

Indexed at, Google Scholar, Cross ref

Grohmann, A. (2018). Financial literacy and financial behavior: Evidence from the emerging Asian middle class. Pacific-Basin Finance Journal, 48, 129-143.

Indexed at, Google Scholar, Cross ref

Holzmann, R., Mulaj, F., & Perotti, V. (2013). Financial capability in low-and middle-income countries: measurement and evaluation.

Hung, A., Yoong, J., & Brown, E. (2012). Empowering women through financial awareness and education.

Indexed at, Google Scholar, Cross ref

Hunt, A., & Samman, E. (2016). Women’s economic empowerment. Navigating enablers and constraints, Overseas Development Institute.

Kuhn, S., Milasi, S., & Yoon, S. (2018). World employment social outlook: Trends 2018. Geneva: ILO.

Literacy, O. M. F. (2013). Financial literacy and inclusion: Results of OECD/INFE survey across countries and by gender. Financial Literacy & Education, Russia, jun.

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1-8.

Indexed at, Google Scholar, Cross ref

Mihal?ová, B., Csikósová, A., & Antošová, M. (2014). Financial literacy–the urgent need today. Procedia-Social and Behavioral Sciences, 109, 317-321.

Indexed at , Google Scholar, Cross ref

Pathak, P., Holmes, J., & Zimmerman, J. (2011). Accelerating financial capability among youth: Nudging new thinking. New America Foundation.

Pokrikyan, A. The Impact Of Financial Literacy On The Financial Decisions of Consumers In Low-Income Countries (ARMENIA CASE).

Rai, K., Dua, S., & Yadav, M. (2019). Association of financial attitude, financial behaviour and financial knowledge towards financial literacy: A structural equation modeling approach. FIIB Business Review, 8(1), 51-60.

Indexed at, Google Scholar, Cross ref

Report, W. D. (n.d.). Gender at Work.

Robb, C. A., & Woodyard, A. (2011). Financial knowledge and best practice behavior. Journal of financial counseling and planning, 22(1).

Sharma, D., & Chaturvedi, P. (2021). Factors affecting investment decision of working women of emerging nations: Special reference to Indian metro cities. Journal of Commerce and Accounting Research, 10(1), 58-66.

Shephard, D. D., Contreras, J. M., Meuris, J., te Kaat, A., Bailey, S., Custers, A., & Spencer, N. (2017). THE Psychological Dimensions of Financial Capability.

Sherraden, M. S. (2010). Financial capability: what is it, and how can it be created?

Shim, S., Serido, J., Bosch, L., & Tang, C. (2013). Financial identity?processing styles among young adults: A longitudinal study of socialization factors and consequences for financial capabilities. Journal of Consumer Affairs, 47(1), 128-152.

Indexed at ,Google Scholar, Cross ref

Sun, S., Chen, Y. C., Ansong, D., Huang, J., & Sherraden, M. S. (2022). Household financial capability and economic hardship: An empirical examination of the financial capability framework. Journal of family and economic issues, 1-14.

Indexed at, Google Scholar, Cross ref

Teravainen-Goff, A. (2019). Literacy and Financial Capability: An Evidence Review. National Literacy Trust Research Report. National Literacy Trust.

World Bank. (2013). Why Financial Capability is important and how surveys can help. Financial Capability Survey Around the World,

Xiao, J. J., Chen, C., & Sun, L. (2015). Age differences in consumer financial capability. International Journal of Consumer Studies, 39(4), 387-395.

Indexed at, Google Scholar, Cross ref

Yap, R. J. C., Komalasari, F., & Hadiansah, I. (2018). The effect of financial literacy and attitude on financial management behavior and satisfaction. BISNIS & BIROKRASI: Jurnal Ilmu Administrasi dan Organisasi, 23(3), 4.

Indexed at, Google Scholar, Cross ref

Yogasnumurti, R. R., Sadalia, I., & Irawati, N. (2019). The Effect of Financial, Attitude, and Financial Knowledge on the Personal Finance Management of College Collage Students. In Economics and Business International Conference (pp. 649-657).

Received: 20-May-2022, Manuscript No. AMSJ-22-12047; Editor assigned: 24-May-2022, PreQC No. AMSJ-22-12047(PQ); Reviewed: 14-Jun-2022, QC No. AMSJ-22-12047; Revised: 28-Jun-2022, Manuscript No. AMSJ-22-12047(R); Published:04-Jul-2022