Research Article: 2020 Vol: 24 Issue: 1

Impact of Services Quality in E-Banking: Evidence from Indian Public Banks

Jitender Kumar, Sharda University

Monisha, CPJ College of Higher Studies

Ashish Gupta, Indian Institute of Foreign Trade

Md. Chand Rashid, Galgotias University

Hari Shankar Shyam, Sharda University

Abstract

The purpose of this research is to know the important attributes of E-banking services of Public sector banks which impact the customer’s perception through modified SERVQUAL dimensions. Five dimensions Tangibility, Assurance, Empathy, Responsiveness and Reliability were taken into considerations. Data has been gathered from 252 respondents by convenience and snowball sampling method from two nationalized public sector banks using online surveys and field survey within bank premises. Factor analysis, weighted average score, mean score, regression analysis were used to extract the factors and to know the level of satisfaction. 43 items were taken in the questionnaire, which were categorized into five dimensions by using the SERVQUAL model. Key findings of this empirical study includes that the factors having higher factor loading are better satisfiers. All five dimensions i.e. Tangibility, Empathy, Assurance, Reliability, Responsiveness are positively related to the Customer satisfaction. Only two public sector banks of Delhi NCR were considered, further research can be carried out by incorporating private banks. Confining the focus to DELHI NCR may limit generalization of findings to a broader population. There are many studies on the service quality of banks. However, few attempted to find out for the managers to know which dimension of modified SERVQUAL has maximum weightage.

Keywords

SERVQUAL, E-banking, Tangibility, Understanding, Security, Courtesy, Access, Responsiveness, Reliability, Credibility, Competence, Communication, Corporate Image.

Introduction

The growth of the Indian banking sector after the liberalization and deregulated environment has brought extensive transformation in the banking industry. The remarkable development of technology and the wide spread use of information technology has brought this paradigm change. For the banking sector, the technological advancements have appeared to be a strategic source for attaining greater level of competence, organized operations, increased efficiency and productivity. From the customer point of view, it is the apprehension of ‘Anytime, Anyway and Anywhere’ banking vision. As a result banks have been encouraged to exploit the advanced technology to satisfy the ever increasing demands of the bank customers.

E-banking is the process through which a customer can interacts digitally with a bank by means of computers without the need of a human contact (Jayewardene, 2004). At the underlying stage, e-banking was used to provide data about banking services. However, now-a-days customers uses online banking not only for information but also for transactions, and experiences the wide range of banking services it brings to the table like account request, Download bank statement, ordering chequebook, payments of bills, transfer of funds, fixed deposit management, stock investment and insurance term payment (Tan & Teo, 2000).

The purpose of this research is to know the important attributes of E-banking services of Public sector banks which impact the customer perception through modified SERVQUAL dimensions. First, this study investigates the influence of the dimensions of customer perception. This study will consider five dimensions Tangibility, Empathy, Assurance, Responsiveness, Reliability to measure the customer satisfaction and to know which dimension is most important for in e-banking of Public sector banks. This study has both academic and practical implications. This study makes a significant contribution to the literature relating to customer perception, Satisfaction on E banking Services provided by public sector banks. The study will show us which dimension is important for the customer in E Banking services. This study offers several recommendations to banks about which specific Service quality dimensions they need to improve to make customers satisfied to e-banking services.

The primary objective of the study is ‘To know the relationship of SERVQUAL dimensions on customers’ satisfaction on E-services in pubic banks in Delhi NCR’. SERVQUAL is a predominant topic on which many studies have been conducted. Other objectives are is to explore the attributes of an ideal electronic banking service system and to know the ranking of important attributes of electronic banking.

Literature Review

E-banking Services, Service Quality Dimensions, Service Quality in e-banking, SERVQUAL and five Dimensions

E-banking offers customers more extensive options, control, Convenience and helps in reducing costs. Customers can approach their financial data and can act whenever and anyplace. They have better control of overseeing account and family budgets, arranging their money related records. Cost saving funds originates from evading excursions to the banks and diminished transaction cost. Particularly for old and sick individuals e-banking services improve their life by discharging valuable time, diminishing the paper works in an organization and avoiding bank trips and time in queues. For customers who live in outskirts or in little towns without banks, e-banking services may be important. From the banks viewpoint e-banking effectiveness increases and operational expense decreases (Kurnia & Liu, 2008).

Many dimensions and items of previous service quality models are established to acquire the nature of interpersonal service encounters (Cox & Dale, 2001). Several authors (Meuter et al., 2000; Parasuraman & Grewal, 2000; Santos, 2003; van Riel et al., 2001) propose to dispose quality scales that depend on explicit service experience attributes and rather recommend using general arrangements of services as a framework for establishing new quality models for web based services. Following this recommendation, we draw on existing methodologies, which utilize worldwide meanings of service quality. A portion of the recommendations set forward in these investigations are outlined. Kano's (1984) strategy for estimating customer-defined quality and recommends three key quality demands applicable to quality assessment: Basic, Performance and enthusiasm demands (Kano, 1984). The two-dimensional technical/functional quality methodology by Gronroos (1990) and Gronroos (2001) propose an e-service idea comprising of facilitating services, supporting services and core services. Since usually hard to differentiate among facilitating and supporting services, van Riel et al. (2001) used the term supplementary services in a more general approach to denote services that are not part of but rather firmly associated with core services. As a third category of services offered through an online site, van Riel et al. (2001) present integral services that are neither facilitating nor supporting the core service. Though supplementary services increase the value of the core service and are used to separate it from similar competing offerings, complementary services can possibly enhance completely. Likewise, Zeithaml (2002) differentiate between recovery and core services.

Jayawardhena (2004) changes the SERVQUAL scale to the context of internet and builds up a battery of 21 items to evaluate service quality in e-banking. Exploratory (EFA) and confirmatory factor analysis (CFA), 21 items are consolidated to five quality dimensions: web site interface, Access, attention, trust, credibility and attention. Despite the fact that 59 percent of the variance in service quality can be clarified by the model, affective customer responses to the service procedure are not considered. This must be seen basic as a few authors underline the significance of hedonic parts of the electronic service consumption represented by the degree of fun and satisfaction given by the portal (Dabholkar, 1995; Dabholkar et al., 1996; van Riel et al., 2001; Zeithaml et al., 1996).

SERVQUAL dimensions differ from industry to industry and from country to country. previous research studies has directed on analyzing the SERVQUAL scale and its dimensions from the perspectives of the customers’ by analyzing two customers’ samples (Arasli et al., 2005; Ladhari et al., 2011). There have been very few comparative research studies that examine the SERVQUAL dimensions and items from employees and customers’ perspectives alike. In the literature, service quality SERVQUAL has been the one of the most debated and discussed model and measurement (Seth et al., 2005; Ladhari, 2008; Martinez & Martinez, 2010; Sangeetha & Mahalingam, 2011; Dahiyat et al., 2011; Brun et al., 2014). Parasuraman et al., (1985) explained ten Dimensions of SERVQUAL MODEL Table 1.

| Table 1 Determinants of Service Quality |

| 1. RELIABILITY: consistency of performance and dependability, accuracy in billing, keeping records correctly, performing the service right at the designated time. |

| 2. RESPONSIVENESS: willingness or readiness of employees to provide service, timeliness of service such as mailing a transaction slip immediately, calling the customer back quickly, giving prompt service. |

| 3. COMPETENCE: possession of the required skills and knowledge to perform the service, knowledge and skill of the contact and support personnel, research capability of the organization. |

| 4. ACCESS: approachability and ease of contact, the service is easily accessible by telephone, waiting time to receive service is not extensive, convenient hours of operation, convenient location of service facility. |

| 5. COURTESY: politeness, respect, consideration, friendliness of contact personnel, consideration for the consumer's property, clean and neat appearance of public contact personnel. |

| 6. COMMUNICATION: keeping customers informed in language they can understand and listening to them, explaining the service itself and its cost, assuring the consumer that a problem will be handled. |

| 7. CREDIBILITY: trustworthiness, believability, honesty, company reputation, having the customer's best interests at heart, personal characteristics of the contact personnel. |

| 8. SECURITY: freedom from danger, risk, or doubt, physical safety, financial security, confidentiality. |

| 9. UNDERSTANDING/KNOWING THE CUSTOMER: understanding customer needs, learning the customer's specific requirements, providing individualized attention, recognizing the regular customer. |

| 10. TANGIBLES: physical evidence and representations of the service, other customers in service facility. |

Later on, in Parasuraman et al., (1988) this rule was further identified with 5 dimensions of service quality namely Tangible, Reliability, Responsiveness, Assurance and Empathy and these five dimensions are examined by 44, items, in which 22 items assessed the customer’s general expectations related to service; and the balance 22 items measured the customers perception regarding the service levels offered by organizations within that service category.

In this study the review of literature is related to two main issues. First, the SERVQUAL dimensions, and second, the relationship between the SERVQUAL dimensions and customer satisfaction. Consequently, only selected literature review is presented as it relates to the research objectives. An examination of the content of the final items making up each of SERVQUAL’s five dimensions (three original and two combined dimensions) suggested the following labels and concise definitions for the dimensions in Table 2.

| Table 2 Five Broad Dimensions of Service Quality | |

| Dimensions | Definitions |

| Tangibles | Appearance of physical facilities, equipment, personnel and written materials |

| Reliability | Ability to perform the promised service dependably and accurately |

| Responsiveness | Willingness to help customers and provide prompt service |

| Assurance | Employees’ knowledge and courtesy and their ability to inspire trust and confidence |

| Empathy | Caring, easy access, good /communication, customer understanding and individualized attention given to customers |

Table 3 shows previous research findings regarding the number of dimensions of SERVQUAL which varies from one study to another which included Tangibility, Understanding, Security, Courtesy, Access, Responsiveness, Reliability, Credibility, Competence, and Communication.

| Table 3 Previous Studies and Literature in Servqual Context | |

| Research Author | SERVQUAL Dimensions |

| Parasuraman et al. (1988) | Tangibles, reliability, responsiveness, assurance, and empathy |

| Oberoi & Hales (1990 | Tangibles and intangibles |

| Knutson et al. (1990) | Reliability, assurance, responsiveness, tangibles, and empathy |

| Akan (1995) | Courtesy and competence of the personnel, communications and transaction, tangibles, knowing and understanding the customer, accuracy and speed of service, solutions to problems, and accuracy of hotel reservations |

| Al-Khatib & Gharaibeh (1998) | Physical features and facilities, the staff you contact, responsiveness to customer’s needs, pricing dimensions |

| Mei et al. (1999) | Employees, tangibles, and reliability |

| Al-Tamimi & Al-Amiri | Tangibles, reliability, and empathy |

| Khan (2003) | Tangibles, ecotangibles, reliability, assurance, responsiveness, and empathy |

| Arasli et al. (2005) | Tangibles, reliability, assurance, and empathy |

| Jabnoun & Khalifa (2005) | Personal skills, reliability, values, and image |

| Kang (2006) | Tangibles, reliability, responsiveness, assurance, and empathy |

| Ladhari (2009) | Tangibles, reliability, responsiveness, confidenceandcommunications |

| Kumar et al. (2009) | Tangibility, reliability, competence, and Convenience |

| Chaniotakis & Lymperopoulos (2009) | Tangibles, reliability, responsiveness, assurance, and empathy |

| Ramseook-Munhurrun et al. (2009) | Assurance-empathy, reliability-responsiveness, and tangibles |

| Kumar et al. (2010) | Tangibility, reliability, competence, and Convenience |

| Dahiyat et al. (2011) | Reliability, interaction quality, and tangibles |

| Ladhari et al. (2011) | Tangibles, reliability, responsiveness, assurance, and empathy |

| Shekarchizadeh et al. (2011) | Professionalism, reliability, hospitality, tangibles, and commitment |

| Vaughan & Woodruffe-Burton (2011) | Staff professionalism, reliability, and tangibles |

| Abdullah et al. (2011) | Systemisation, reliable communication, and Responsiveness |

Theoretical background and Hypotheses Development

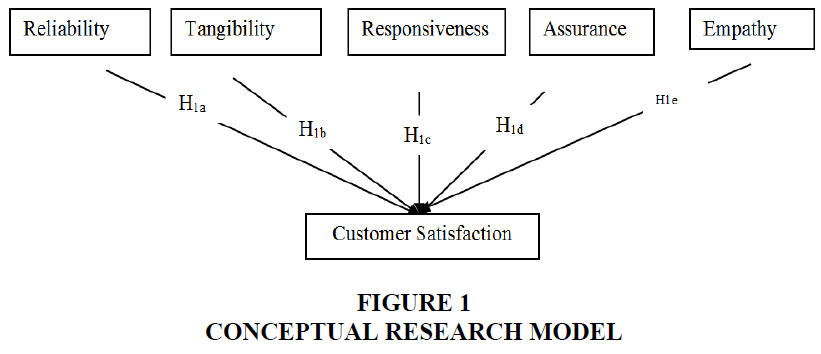

Assurance and Empathy includes original seven items i.e. communication, Credibility, Security, Competence, Courtesy, Understanding/Knowing Customers, and Access Parasuraman et al., (1988) in Figure 1.

Hypothesis of Study

H1: There is a significant impact of Service Quality attributes on customer’s satisfaction in electronic banking.

H1a: Reliability is significantly related to Customer Satisfaction.

It includes uniformity of the bank performance, dependability of the customers on the bank, providing accurate bills to the customers, proper record keeping by the banks, providing the required service at the right time. In the questionnaire reliability aspect includes three statements to check the level of satisfaction customers derives from this dimension.

H1b: Tangibles is significantly related to Customer Satisfaction.

It includes the physical evidence and portrayal of the provided service. Installing new machines, changing in the electronic infrastructure of the banks in terms of web portals, providing 24*7 facilities etc. are included in tangibility. This dimension includes six statements in the research instrument which are use of advance or modern computer servers by the banks to provide services to their clients, using modern equipments to serve the customers, debit and credit card facility provided by the banks, 24 hours service facility, lowering the number of bank visits and thus reducing the number of queues and providing more physical facilities to the customers.

H1c: Responsiveness is significantly related to Customer Satisfaction.

Responsiveness includes motivation or inclination of bank employees to provide the service to the customers, suitability of service like providing transaction slip right away, call back facility to the customers, providing instant service. It has got four statements under consideration.

H1d: Assurance is significantly related to Customer Satisfaction.

Assurance is about the employees’ skills and capabilities, and regardless of whether these capabilities and skills gain the trust and customer’s confidence. Assurance likewise includes the competence, courtesy, communication, general attitude that provide services to the customers efficiently and effectively. Assurance in SERVQUAL dresses the ability of the organisation, the courtesy stretched out to its customers, and the operational security. Competence has a place with the knowledge and skills of the organisation in playing out its service. Their knowledge and the manner in which they collaborate with the customers rouses trust in the organisation (Gao & Wei, 2004). In this study Assurance has 18 items related to security, courtesy, communication, competence, credibility.

H1e: Empathy is significantly related to Customer Satisfaction.

Empathy shows how the organization takes care of its customers and gives individual attention, how customers feels esteemed valued and special. It incorporates access, and understanding the requirements of client. It is worried about providing individual attention and care to the customer. Through empathy organisation comprehends the issues of customers and results to support them, with individual attention. Organisation having Empathy didn't lose contact with their very own customers and also comprehend the requirements of their customer and make their services available to them. Parasuraman et al. (1985) characterized empathy as the caring and individual attention the firm gives its customers. Empathy includes nine items having questions related access and understanding of the customers

Methodology and Data Analysis

Data Collection and Procedure

The population of the study was limited to the customers using e-banking services of SBI, PNB banks in Delhi NCR region only. For the collection of data only two public and two private sector banks were taken into consideration. By keeping this in vision sample of 252 customers has been taken, so that it may be a true representation of the whole universe. Therefore, the customers of aforesaid banks using e-services were taken randomly to comprise the sample.

Descriptive research design has been adopted to make this study. This study aims for reviewing service quality measure suggested in the existing literature on service quality, newly applying it to E banking services, and then finding out the influence of service quality in E banking on customer satisfaction. Therefore, research model for empirical analysis was established as Figure 1 based on the result of precedent research. As research model, based on the results of previous studies; Lee & Lin (2005), Lee et al. (2006), Jeon (2006) suggested the dimension of E-banking quality to find out its influences on customer satisfaction.

H1: There is a significant positive impact of electronic banking attributes on customer’s satisfaction.

H1a: Reliability is significantly related to Customer Satisfaction.

H1b: Tangibles is significantly related to Customer Satisfaction.

H1c: Responsiveness is significantly related to Customer Satisfaction.

H1d: Assurance is significantly related to Customer Satisfaction.

H1e: Empathy is significantly related to Customer Satisfaction.

Method of Research

Data was collected with both primary as well as secondary sources. In this study, the questionnaire survey was targeted against the customers aged from 20s to 60s who had experience of E-banking. Total 252 responses of the customers of aforesaid banks using e-services were taken randomly to comprise the sample. Convenience Sampling and Snowball sampling techniques were used to carry out the research. In this study, survey was conducted in banking premises of Delhi NCR (INDIA) and as well as was conducted online and survey was targeted to the persons who uses online banking services.

A structured questionnaire has been designed by following SERVQUAL model. Data have been collected from primary and secondary sources. SPSS-23 Software was chosen for data analysis. After data entry into the SPSS software, descriptive statistics of the questionnaire have been generated using SPSS. Afterwards, reliability testing has been carried out by using Cronbach’s Alpha.

Collection of Primary Data

E-baking customers of two Public sector banks namely SBI, PNB from Delhi and National Capital Region served as the primary source of information. Mailed structured questionnaires were used for collecting the data. The questions in the questionnaire were designed by keeping in view of the objectives of the research. In order to make sample accurately representative, customers belonging to various demographic groups like gender profile, age profile, education profile, income profile and marital status profile were considered in Table 4.

| Table 4 Bank Wise Distribution of Respondents | |

| Bank Name | Frequency |

| SBI | 110 |

| PNB | 142 |

Demographic Profile of the Respondents

Among 300 forms delivered to respondents, only 252 responses were collected. This is analyzed by “SPSS 23.0-version software”. Among the respondents, 47% are male and 53% of them are female. Most of the respondent's age is below 25 and their percentage is 61 and 36% of respondents age are between 26 and 60 years. 81% of the respondents are earning between 20000 and 40000 per month and 65% are unmarried and does have bank account in public sector banks. 43% of the respondents have been associated for more than 5 years with their banks in Table 5.

| Table 5 Respondents’ Profile | |||

| Basis | Categories | Frequency | Percentage |

| Gender | Male Female |

118 134 |

46.8 53.7 |

| Age Group | < 25 26-40 41-60 >60 |

154 75 18 5 |

61.1 29.7 7.1 1.9 |

| Occupation | Govt Private Agri Business Other |

24 115 2 53 58 |

9.5 45.6 0.79 21.0 23.0 |

| Banks | SBI PNB |

110 142 |

44 56 |

| Duration of using service | <1 Year 1-3 Years 3-5 Years >5 Years |

12 65 66 109 |

4.76 25.79 26.19 43.25 |

| Education | Up to 12 Graduate Post Graduate Any Others |

11 91 127 23 |

4.3 36.1 50.3 9.1 |

| Marital status | Married Unmarried |

87 165 |

35 65 |

| Income (in 000 P.M.) | 20-30 31-40 41-50 > 51 |

144 61 22 25 |

57.1 24.2 8.7 9.9 |

To examine the perception of service quality of e-banking from customers’ viewpoint, a modified SERVQUAL type questionnaire pertinent to the banking industry was constructed. Total 43 items were incorporated under five dimensions (i.e. Tangibility, Responsiveness, Reliability, Assurance, Empathy) to measure the quality of e-banking services. The respondents were required to assess their level of satisfaction on 43 statements. All the 43 statements were measured on the five-point Likert scale from strongly agree (1) to strongly disagree (5). In addition to service quality, the questions concerning internet banking, mobile banking, online payments and overall customer satisfaction were also incorporated in the questionnaire.

Data Analysis

Reliability Analysis

In this study, in order to measure reliability, Cronbach’s a coefficient-internal consistency analysis was used. The reason of adopting Cronbach’s a coefficient was to enhance variable reliability by sorting out the items affecting reliability and then ruling out those variables when several items were used to measure the same concept. Normally, it proves to be sufficient when Cronbach’s a coefficient appears at least 0.6, and therefore reliability coefficient on each variable was suggested in Table 6 to show reliability for each item.

| Table 6 Exploratory Factor Analysis | |||

| Dimensions | Items | Factor Analysis | Cronbach Alpha |

| TANGIBILITY | Tan_Banks use advanced Computer/IT to serve clients. | 0.708 | 0.849 |

| Tan_E-banking provides modern looking equipment. | 0.642 | ||

| Tan_Physical representation of service through credit or debit card is easy. | 0.754 | ||

| Tan_E-banking provides 24 hours, 365 days a year service to customers. | 0.760 | ||

| Tan_It helps in reducing the no. of queues in the bank branches. | 0.824 | ||

| Tan_E-banking provides more physical facilities to the customers. | 0.782 | ||

| EMPATHY | Emp_Access E-Banking services are easy to use. | 0.5 | 0.891 |

| Emp_Access E-Banking service is accessible via Internet banking, mobile banking, EFT, ECS, ATM. | 0.690 | ||

| Emp_Access Online purchase of goods and services including online payment is easier. | 0.713 | ||

| Emp_Access It provides convenient location of service facility(location of ATM, POS terminals) | 0.661 | ||

| Emp_Access It reduces the waiting time to receive the service. | 0.528 | ||

| Emp_Understanding It provides individualized attention to the customers. | 0.545 | ||

| Emp_Understanding It provides necessary information to the customers. | 0.56 | ||

| Emp_Understanding Website of the bank is designed according to the need of the customer | 0.57 | ||

| Emp_Understanding E-banking answers the specific requirement of the customer. | 0.636 | ||

| ASSURANCE | Assu_Security E-banking ensures physical safety of the transaction. | 0.708 | 0.942 |

| Assu_Security Password facility provides confidentiality to transaction. | 0.642 | ||

| Assu_Security It also increases the financial security. | 0.754 | ||

| Assu_Security Privacy can be easily maintained. | 0.760 | ||

| Assu_Courtesy It assures the customer that problem will be handled. | 0.824 | ||

| Assu_Communication It explains the cost of service being used. | 0.782 | ||

| Assu_Communication It explains the trade-off between service and cost. | 0.52 | ||

| Assu_Communication E-banking provides up to date information. | 0.642 | ||

| Assu_Communication E-banking provides effective medium of promotion of various schemes. | 0.57 | ||

| Assu_Communication It also provides sophisticated information for well-educated customers. | 0.555 | ||

| Assu_Competence It is trusted by young generation. | 0.616 | ||

| Assu_Competence Transfer of fund is easier through E-banking. | 0.685 | ||

| Assu_Competence E-Banking provides more punctuality, transparency, accountability. | 0.547 | ||

| Assu_Competence Transfer of funds is faster as compared to manual banking system | 0.722 | ||

| Assu_Credibility E-banking increases the reputation of the banks. | 0.540 | ||

| Assu_Credibility It increases the believability, honesty and trustworthiness of the customers in banks. | 0.57 | ||

| Assu_Credibility It ensures the ability to fulfill the requirement. | 0.870 | ||

| Assu_Credibility It provides unlimited network to the banks to approach customers. | 0.5 | ||

| RELIABILITY | Rel_It provides accuracy in billing. | 0.707 | 0.818 |

| Rel_It helps in keeping records correctly. | 0.811 | ||

| Rel_It performs the service at designated time. | 0.602 | ||

| RESPONSIVENESS | Res_Availability of service is faster in e- banking as compared to manual banking. | 0.775 | 0.860 |

| Res_E-banking is very necessary for the development of new economy of India. | 0.823 | ||

| Res_It improves the quality of customer service. | 0.602 | ||

| Res_Response of service through e-banking is very prompt and quick. | 0.870 | ||

| CUSTOMER SATISFACTION | Customer_satisfaction_CS1 | 0.621 | 0.740 |

| Customer_satisfaction_CS2 | 0.870 | ||

| Customer_satisfaction_CS3 | 0.602 | ||

| Value extracted from factor | 75.621 | ||

| Extraction Method: Principal Component Analysis. | |||

| Rotation Method: Varimax with Kaiser Normalization. | |||

| a. Rotation converged in 13 iterations. | |||

| NOTE: Factor scores less than 0.5 have been ignored in the table | |||

Validity Analysis

The result of exploratory factor analysis on service quality (43 items categorized into 6 dimensions), customer satisfaction, in deriving the factors that influences on customer satisfaction of E banking services. As result of factor analysis, Assurance of E banking service quality, tangibility of E banking service quality, responsiveness of E banking service quality, Empathy of E banking service quality, Responsiveness E Banking service quality, Reliability of E-baking service, and customer satisfaction was classified to be the factors.

Analysis was done to curtail the observed variables under each factor. Factor loadings greater than 0.5 with eigenvalue more than 1.0, loaded on seven factors with 75.621 percent of variance. Table illustrates the results of the rotated factor scores of each construct theorized in the research model. The accepted criteria of eigenvalue greater than 1.0, factor loadings greater than 0.5, and a well-explained factor structure were considered in the analysis. The scale’s reliabilities were measured and Cronbach’s α of all constructs ranged between 0.74 and 0.942, indicating good reliability and internal consistency (Nunnally & Bernstein, 1994).

Correlation Analysis

The service quality dimensions which contain “Responsiveness, Tangibles, Assurance, Empathy and Reliability were chosen as independent variables while customer satisfaction was taken as the dependent variable. Sekaran (2005), in any research study having multiple variables, after knowing SD and means of the dependent and independent, the researchers are eager to know how one variable is related to another. Inter correlation analysis shows the direction, nature and importance of the bivariate relationship of the variables applied in the research. This study assesses the relationship that exists between dependent and independent variables. Pearson correlation was run to know the relationship between the dependent and independent variables. There could be a perfect positive correlation between two variables, which is shown as 1.0 (plus1), or it can be shown as perfect negative correlation i.e. -1.0 (Minus 1). Correlation might range between -1.0 and +1.0, the study was conducted to examine if any correlation found between two variables is significant or not (is it occurred by chance or is it there is a probability of its actual existence). Significance of p=0.05 is the generally accepted conventional level in social sciences research. This show that out of 100, 95 times, the researcher can be sure that there is a significant correlation between the variables, and there is only a 5% chance that the relationship does not truly exist. Davis (1997) showed the rules of thumb that need to be used in interpreting the R- value obtained from intercorrelation analysis as shown in Table 7(a) and Table 7(b) below. R value can be interpreted as:

| Table 7(a) R-Value Interpretation | |

| R value | Relationship |

| Above 0.70 | Very strong relationship |

| 0.50-0.69 | Strong relationship |

| 0.30-0.49 | Moderate relationship |

| 0.10-0.29 | Low relationship |

| 0.01-0.09 | Very low relationship |

| Table 7(b) Correlation Matrix of Constructive Concepts | |||||||

| Correlations | CS_2 | Rel_3 | Res_3 | Tan_2 | Emp_2 | ASSU | |

| CS_2 | Pearson Correlation | 1 | 0.853** | 0.917** | 0.754** | 0.846** | 0.875** |

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | 0 | ||

| N | 252 | 252 | 252 | 252 | 252 | 252 | |

| Rel_3 | Pearson Correlation | 0.853** | 1 | 0.953** | 0.714** | 0.858** | 0.849** |

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | 0 | ||

| N | 252 | 252 | 252 | 252 | 252 | 252 | |

| Res_3 | Pearson Correlation | 0.917** | 0.953** | 1 | 0.734** | 0.853** | 0.863** |

| Sig.(2-tailed) | 0 | 0 | 0 | 0 | 0 | ||

| N | 252 | 252 | 252 | 252 | 252 | 252 | |

| Tan_2 | Pearson Correlation | 0.754** | 0.714** | 0.734** | 1 | 0.824** | 0.925** |

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | 0 | ||

| N | 252 | 252 | 252 | 252 | 252 | 252 | |

| Emp_2 | Pearson Correlation | 0.846** | 0.858** | 0.853** | 0.824** | 1 | 0.905** |

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | 0 | ||

| N | 252 | 252 | 252 | 252 | 252 | 252 | |

| ASSURANCE | Pearson Correlation | 0.875** | 0.849** | 0.863** | 0.925** | 0.905** | 1 |

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | 0 | ||

| N | 252 | 252 | 252 | 252 | 252 | 252 | |

Correlation Table

It is carried out to find the relationship between constructs. “The correlation coefficients span on a range of -1 to +1 where -1 represents perfect negative correlation and +1 representing perfect positive correlation”. By analyzing the results of the correlation table, most dimensions of service quality have strong relationship with customer satisfaction. Tangibility which had values of 0.754, the Empathy dimension was correlated with a value of R=0.846, similarly Responsiveness has value of 0.917, Reliability has a value of 0.853, Assurance has .875 with dependent variable customer satisfaction amongst the five SQ dimensions, which shows all five dimensions has very strong relationship with the dependent variable. By analyzing the correlation matrix, it shows service quality dimensions have very strong relationship with customer satisfaction Therefore, according to the correlation analysis done on the SQ dimensions on the dependent variable “Customer Satisfaction”, the highest correlation was found with Responsiveness and the lowest correlation was found with Tangibility (Kumar et al., 2018).

The result from correlation indicates that all the 5 dimensions of service quality have very strong relationship with customer satisfaction. This indicates a good sign to run linear regression.

Regression Analysis

It was performed to predict the impact of “service quality dimensions on customer satisfaction” in the Banking industry of India (Delhi NCR). The dependent variable selected for this study is the CS. As demonstrated in the above model, summary table which foretells the customer satisfaction, dependent variable is CS while REL, RES, ASS, EMP and TAN are used as independent variables.

It shows “R value of 0.940, R square value as 0.884 and Adjusted R square value of 0.882”. This suggest 88.2% of variance of CS can be used to forecast the independent variables, RES (Responsiveness), TAN (Tangibles), (ASS) Assurance, (EMP) Empathy and (REL) Reliability used in the study. Though, it is stated that a good fit will be able to forecast a variation of dependent variable which is not less than 60%, nevertheless due to the fact that results of this regression fall below the minimum rate, this model is a perfect one. The “Durbin Watson result (2.135) shows that there is no auto correlation between respondents chosen for this study”.

R Square Table

Beta Coefficient for Customer Satisfaction TABLE

Multicollinearity is regarded as the extent of correlation that exists among the independent variables. As such, for the independent variables used in this study, multicollinearity was examined for Tolerance test and Variance Inflation Factor. The reference ranging for both the tests posited by Hair et al propose that tolerance test should give a value above 0.10 and VIF (Variance Inflation Factor) should not go beyond 10, in order for multicollinearity to be in acceptable range. Hence, the model can be equated as follows:

CS = β1 REL + β2 RES + β3 ASS+ β4 EMP + β5 TAN + C The beta coefficient results of REL (-0.391, p=0.000), RES = (0.909, p=0.000), EMP (0.144, p=0.019), Assurance (0.556, p=0.000), Tangibility (-0.183, 007) show a significant and positive relationship on customer satisfaction.

In addition, the constant should also be deducted from the original equation since it is also significant. Hence the empirical model is shown as below: CS= -0.002 - 0.183 TAN + 0.909 RES + 0.144 EMP- 0.391 REL+ 0.556 ASSU (1)

So according to this model of Table 8, a change of 1 unit in REL, RES, EMP ASSU and TAN while other items kept constant will change CS by 1.03 UNIT.

| Table 8 (Beta Coefficient for CS) | ||||||||

| Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | -0.002 | 0.066 | -0.026 | 0.979 | |||

| Rel_3 | -0.391 | 0.072 | -0.414 | -5.435 | 0.000 | 0.081 | 12.309 | |

| Res_3 | 0.909 | 0.076 | 0.915 | 11.940 | 0.000 | 0.080 | 12.461 | |

| Tan_2 | -0.183 | 0.067 | -0.168 | -2.744 | 0.007 | 0.125 | 7.999 | |

| Emp_2 | 0.144 | 0.061 | 0.132 | 2.354 | 0.019 | 0.151 | 6.630 | |

| ASSURANCE | 0.556 | 0.104 | 0.473 | 5.345 | 0.000 | 0.060 | 16.659 | |

Testing of Hypothesis

To test the hypothesis, analysis of correlation among variables and multiple regression analysis between antecedent and dependent variables were carried out. Multiple regression analysis normally aims for estimating one dependent variable from the knowledge of several variables. Accordingly, this would enable to find out the strategy of enhancing customer satisfaction and customer loyalty by grasping which factors influence on customer satisfaction and customer loyalty of furniture purchaser in on-line shopping mall, and to which degree it has influence if so (Basias et al., 2013).

In carrying out regression analysis, it may produce wrong interpretation if independent variables are not mutually independent or regression coefficients are estimated incorrectly. In other words, there could exist the problem of multicollinearity. Pearson’s correlation was used in the analysis of correlation, which shows there exist no problem of multicollinearity.

Testing of hypothesis between customer satisfaction and antecedent variable

As the antecedent factor customer satisfaction, Assurance, Tangibility, Responsiveness, Empathy, Responsiveness and Reliability of E-baking service, were set up, and then multiple regression analysis was conducted to test the influence on customer satisfaction. Tables 9-11 are the result of analysis on the significance for individual variables. Each b coefficient appeared (0.556) Assurance of E banking service quality, (-0.183) tangibility of E banking service quality, (0.909) responsiveness of E banking service quality, (0.144) Empathy of E banking service quality, (-0.391) Reliability of E-baking service (Cronin & Taylor, 1992).

| Table 9 Model Summaryb | ||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||

| 1 | 0.940a | 0.884 | 0.882 | 0.34059 | 0.884 | 375.627 | 5 | 246 | 0.000 | 2.135 |

b. Dependent Variable: CS_2

| Table 10 Anovaa | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 217.861 | 5 | 43.572 | 375.627 | 0.000b |

| Residual | 28.536 | 246 | 0.116 | |||

| Total | 246.396 | 251 | ||||

b. Predictors: (Constant), ASSURANCE, Rel_3, Emp_2, Tan_2, Res_3

| Table 11 Multiple Regression Analysis Between Customer Satisfaction and Antecedent Variable | ||||||||

| Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | |||

| B | Std. Error | Beta | Lower Bound | Upper Bound | ||||

| 1 | (Constant) | -0.002 | 0.066 | -0.026 | 0.979 | -0.131 | 0.128 | |

| Rel_3 | -0.391 | 0.072 | -0.414 | -5.435 | 0.000 | -0.532 | -0.249 | |

| Res_3 | 0.909 | 0.076 | 0.915 | 11.940 | 0.000 | 0.759 | 1.059 | |

| Tan_2 | -0.183 | 0.067 | -0.168 | -2.744 | 0.007 | -0.315 | -0.052 | |

| Emp_2 | 0.144 | 0.061 | 0.132 | 2.354 | 0.019 | 0.023 | 0.264 | |

| ASSURANCE | 0.556 | 0.104 | 0.473 | 5.345 | 0.000 | 0.351 | 0.761 | |

Standardized regression coefficient (b) that represents importance of regression coefficient appeared (0.473) Assurance of E banking service quality, (-0.168) tangibility of E banking service quality, (0.915) responsiveness of E banking service quality, (0.132) Empathy of E banking service quality, (-0.414) Reliability of E-baking service. In the result of analysis, absolute value of beta coefficient for Reliability of service quality appeared large and therefore, it is deemed to be the variable of best explanation of all in Table 9 and Table 10.

F-value of regression model was 375.627 (=0.000) proved to be of significance, and Durbin-Watson value was 2.135 deemed to satisfy the assumption of independence. As result of testing, the coefficient of determination (R 2) - one of the measures that show the adequacy of regression estimated from sample data to the observed value appeared .884. Therefore, 88.4 percent of variation on customer satisfaction that was the dependent variable as result of regression analysis was well explained by antecedent variables in Table 12.

| Table 12 Hypothesis Testing and Validation | |||

| Decisions on Hypothesis | Beta Coefficient | Significant P<0.05 | Decisions |

| “Assurance is significantly related to Customer Satisfaction” | 0.556 | 0.000 Significant |

Accepted |

| “Tangibles is significantly related to Customer Satisfaction” | -0.183 | 0.007 Significant |

Accepted |

| “Empathy is significantly related to Customer Satisfaction” | 0.144 | 0.019 Significant |

Accepted |

| “Reliability is significantly related to Customer Satisfaction | -0.391 | 0.000 Not Significant |

Accepted |

| “Responsiveness is significantly related to Customer Satisfaction | 0.909 | 0.000 Significant |

Accepted |

Findings

According to the Table 13, it shows that the mean of Tangibility is 2.4034 that are equal to 2. This means that generally the respondents agree with tangibles, and this can be seen also with Reliability, Responsiveness, Assurance and Empathy which indicates that customers are satisfied and agree with the E services provided by the public banks in Delhi NCR.

| Table 13 Descriptive statistics | ||||||

| Dimensions | N | Minimum | Maximum | Mean | Std Deviation | No of Items |

| Tangibility | 252 | 2.290 | 2.504 | 2.4034 | 0.91016 | 6 |

| Reliability | 252 | 2.012 | 2.266 | 2.1720 | 1.04882 | 3 |

| Responsiveness | 252 | 1.976 | 2.266 | 2.1468 | 0.99689 | 4 |

| Assurance | 252 | 2.179 | 2.611 | 2.3477 | 0.84391 | 18 |

| Empathy | 252 | 2.111 | 2.603 | 2.3915 | 0.90807 | 9 |

| Customer Satisfaction | 252 | 2.258 | 2.381 | 2.3082 | 0.99079 | 3 |

Results and Discussion

Previous studies has shown that all the independent variable (Tangibility, Reliability, Assurance, Empathy, Responsiveness) have significant relationship with customers satisfaction with coefficient alpha < 0.001 and 0.005 (Parasuraman et al., 1988), and support earlier studies in different societies and for different sectors (see for example; Saravana & Rao, 2007; Rahim, Osman & Ramyah., 2010; Pandey & Joshi, 2010; Fah & Kandasamy, 2011; Al Khattab & Aldehayyat, 2011).

This empirical study has shown that there is a positive relationship between all dimensions of SERQUAL.

Hypothesis 1: There is a significant relationship between Reliability and customer satisfaction. The relationship analyzed by linear regression analysis shows that there is a strong positive relationship between the variables (r= -0.391, n= 252, p< 0.001). Hence, hypothesis is accepted.

Hypothesis 2: There is a significant relationship between Tangibility and customer satisfaction. The relationship examined using linear regression analysis shows that there is a strong positive relationship between the variables (r= -0.183, n= 252, p< 0.008). Hence, hypothesis is accepted.

Hypothesis 3: There is a significant relationship between responsiveness and customer satisfaction. Linear regression analysis shows that there is a very strong positive correlation between the variables(r=0.909, n= 252, p<0.001). Thus, hypothesis is accepted.

Hypothesis 4: There is a significant relationship between Assurance and customer satisfaction. After linear regression analysis we can say that there is a very strong positive correlation between the variables (r= 0.556, n= 252, p<0.001). Thus, hypothesis cannot be rejected.

Hypothesis 5: There is a significant relationship between Empathy and customer satisfaction. Linear regression analysis shows there is strong positive correlation between the variables (r=0.144, n=252, p<0.05). Accordingly, hypothesis cannot be rejected.

Ranking of E-Services

The second objective of the research is to know the ranking of important SERVQUAL dimensions of electronic banking. As the banks provide varied services to its customers through e-banking, it becomes important to know that what services are used or preferred most by the customer and which services are least preferred by the customers. E-banking customer’s public banks are enjoying the services provided by their banks.

Our study shows that Assurance, responsiveness are important dimensions followed by Empathy Tangibility and Reliability and they have strong association with customer satisfaction.

Contributions to the Literature

This study contributes to the service quality and customer satisfaction literature in the following principal ways. This research contributes in the existing knowledge by giving a substantive understanding of overall service quality and customer satisfaction in a public banks of Delhi NCR so as to get more precision and understanding of how service quality-related factors can be distinguished from customer satisfaction and how management can combine them based on the priority endorsed by the customer.

The research findings tell that the service quality is a strong driver for customer satisfaction. All five variables of SQ have positive correlation. From the above hypothesis it was found that all service quality dimensions have a positive relationship with customer satisfaction. That means the public banks can increase their Customer Satisfaction level if they may better perform their in all five dimensions. The study indicates that service quality plays an important role for higher customer satisfaction level in public banks of Delhi NCR.

Implications for Industry and Directions for Future Research

The business environment of the public banking sector has changed rapidly as compared to the last decade (Paul & Trehan, 2011). Keep this context in mind, the study presented significant insights for practitioners and managers in the banking industry in general Public banks in particular. Service Quality is a vital part of customer satisfaction not only in banking but also across the entire service sector.

This study, with the help of regression, made an attempt to find out which service quality dimensions are the most significant in their impact on customer satisfaction. There is a difference between the profile and expectations of private sector banks customers in comparison to public sector banks. The findings of the study show that public bank managers must work more upon developing all dimensions. The banking industry and managers should focus on bringing accuracy in their billing and charges, should maintain their records and should work as per designated timings (Narayanasamy et al., 2011).

Conclusion, Limitations and Future Reasearch Direction

This study adopted “SERVQUAL approach” to measure perceived SQ and its impact on customer satisfaction in India (Delhi NCR) Banking Industry. A background with complete questionnaire consists of 43 questions including customer satisfaction variables. The research results demonstrate that the “service quality is a strong driver for customer satisfaction”. Among 5, all quality dimensions, SQ have positive correlation.

The study proposed that the SERVQUAL dimensions would replicate in the banking industry but with certain modifications of structure that are based on the priority of service quality and customer satisfaction elements from the perspective of customers

From the above hypothesis it was found that all service quality dimensions have a positive relationship with customer satisfaction. That means the bankers can considerably increase their CS level if they may better perform their all five dimensions.

There are some limitations of this study. Only DELHI NCR was selected for the survey also only 2 public sector banks were selected. So further research can be conducted in other cities of India, between more public banks. Not only on Public banks the study can also be conducted on Private banks as well. In the first place, this study was confined to e-banking of public banks in Delhi NCR of India. The fast changes adopted by banks to e-banking services –technological developments and innovative marketing practices - the customers' attitudes, perceptions and evaluations of e-banking services are likely to change overtime (Shankar, 2018; Zhao, 2007).

This study opens multiple avenues for further research. There may be additional moderating and mediating factors affecting the E banking’s SERVQUAL dimensions and customer satisfaction to e-banking. Future researchers can identify these moderators through the literature review and expand this study. They may also consider comparison of SERVQUAL dimension between Public and Private Banks and also by incorporating mediators into the model. For example, they may use Demographics as a moderator, and examine this model.

Finally, it is interesting to enhance the study to customer loyalty. And differences between public and private banks in the customer loyalty and satisfaction pattern to E banking SERVQUAL dimensions based on customer demographic profiles. Similar studies can be conducted between different segments of customers (e.g. between young and elderly customers and between different income earning customers) and the comparative results between them can be analyzed. Such studies will provide useful insights to the banks to design E banking SERVQUAL practices targeting specific customer groups.

Author Details

Jitender Kumar, Assistant Professor, School of Business Studies, Sharda University, Plot No. 32-34, Knowledge Park III, Greater Noida, Uttar Pradesh 201310, INDIA Email Id: jitender.kumar1@sharda.ac.in

Monisha, Associate Professor, CPJ College of Higher Studies, OCF Sector A-8, Narela, New Delhi, Delhi 110040, INDIA. Email Id: Mgv.him@gmail.com

Ashish Gupta*, Corresponding Author, Assistant Professor- Marketing Area, Indian Institute of Foreign Trade, New Delhi, IIFT Bhawan, B-21, Qutab Institutional Area, New Delhi 110 016, INDIA, Email Id: ashishgupta@iift.edu

Md. Chand Rashid, Associate Professor, School of Business, Galgotias University, Plot No.2, Sector 17-A, Yamuna Expressway, Gautam Buddh Nagar, Greater Noida, Uttar Pradesh 201310, INDIA, Email Id: mcrashidkhan@gmail.com

Hari Shankar Shyam, Associate Professor, School of Business Studies, Sharda University, Plot No. 32-34, Knowledge Park III, Greater Noida, Uttar Pradesh 201310, INDIA Email Id: harishankar.shyam@sharda.ac.in

Corresponding Author (*) Dr. Ashish Gupta- Assistant Professor, Indian Institute of Foreign Trade, New Delhi, India, Email: ashishgupta@iift.edu

References

- Abdullah, F., Suhaimi, R., Saban, G., & Hamali, J. (2011). Bank service quality (BSQ) index: an indicator of service performance. International Journal of Quality & Reliability Management, 28(5), 542-555.

- Al Khattab, S.A., & Aldehayyat, J.S. (2011). Perceptions of service quality in Jordanian hotels. International Journal of Business and Management, 6(7), 226.

- Arasli, H., Turan Katircioglu, S., & Mehtap-Smadi, S. (2005). A comparison of service quality in the banking industry: Some evidence from Turkish-and Greek-speaking areas in Cyprus. International journal of bank marketing, 23(7), 508-526.

- Basias, N., Themistocleous, M., & Morabito, V. (2013). SOA adoption in e-banking. Journal of Enterprise Information Management, 26(6), 719-739.

- Brun, I., Rajaobelina, L., & Ricard, L. (2014). Online relationship quality: scale development and initial testing. International Journal of Bank Marketing, 32(1), 5-27.

- Cox, J., & Dale, B.G. (2001). Service quality and e-commerce: an exploratory analysis. Managing Service Quality: An International Journal, 11(2), 121-131.

- Cronin Jr, J.J., & Taylor, S.A. (1992). Measuring service quality: a reexamination and extension. Journal of marketing, 56(3), 55-68.

- Dabholkar, P.A. (1995). A contingent framework for predicting causality between customer satisfaction and service quality, Advertisement Consumer Research, 22, 101-108.

- Dabholkar, P.A., Thorpe, D.I., & Rentz, J.O. (1996). A measure of service quality for retail stores: scale development and validation. Journal of the Academy of marketing Science, 24(1), 3.

- Dahiyat, S.E., Akroush, M.N., & Abu-Lail, B.N. (2011). An integrated model of perceived service quality and customer loyalty: an empirical examination of the mediation effects of customer satisfaction and customer trust. International Journal of Services and Operations Management, 9(4), 453-490.

- Fah, L.K., & Kandasamy, S. (2011, May). An investigation of service quality and customer satisfaction among hotels in Langkawi. In Proceedings of International conference on management (ICM 2011), 731-749.

- Gao, Y. & Wei, W. (2004). Measuring Service Quality and Satisfaction of Student in Chinese Business Education. The Sixth Wuhan International Conference on E- business.

- Gronroos, C. (1990). Service Management and Marketing, Lexington Books, Lexington, MA

- Gronroos, C. (2001). The perceived service quality concept–a mistake?. Managing Service Quality: An International Journal, 11(3), 150-152.

- Jayawardhena, C. (2004). Measurement of service quality in internet banking: the development of an instrument, Journal of Marketing Management, 20(1-2), 185-207.

- Khan, M. (2003). ECOSERV: Ecotourists’ quality expectations. Annals of tourism research, 30(1), 109-124.

- Kumar, M., Tat Kee, F., & Charles, V. (2010). Comparative evaluation of critical factors in delivering service quality of banks: An application of dominance analysis in modified SERVQUAL model. International Journal of Quality & Reliability Management, 27(3), 351-377.

- Kumar, M., Tat Kee, F., & Taap Manshor, A. (2009). Determining the relative importance of critical factors in delivering service quality of banks: an application of dominance analysis in SERVQUAL model. Managing Service Quality: An International Journal, 19(2), 211-228.

- Kumar, M., Sujit, K.S., & Charles, V. (2018). Deriving managerial implications through SERVQUAL gap elasticity in UAE banking. International Journal of Quality & Reliability Management, 35(4), 940-964.

- Kurnia, S., & Liu, Y.R. (2008). Electronic commerce within the Chinese banking industry. PACIS 2008 Proceedings, 39.

- Ladhari, R., Brun, I., & Morales, M. (2008). Determinants of dining satisfaction and post-dining behavioral intentions. International Journal of Hospitality Management, 27(4), 563-573.

- Ladhari, R., Ladhari, I., & Morales, M. (2011). Bank service quality: comparing Canadian and Tunisian customer perceptions. International Journal of Bank Marketing, 29(3), 224-246.

- Ladhari, R. (2009). Service quality, emotional satisfaction, and behavioural intentions: A study in the hotel industry. Managing Service Quality: An International Journal, 19(3), 308-331.

- Lee, G.G., & Lin, H.F. (2005). Customer perceptions of e-service quality in online shopping. International Journal of Retail & Distribution Management, 33(2), 161-176.

- Lee, H.H., Fiore, A.M., & Kim, J. (2006). The role of the technology acceptance model in explaining effects of image interactivity technology on consumer responses. International Journal of Retail & Distribution Management, 34(8), 621-644.

- Martínez, J.A., & Martinez, L. (2010). Some insights on conceptualizing and measuring service quality. Journal of Retailing and Consumer Services, 17(1), 29-42.

- Mei, A.W.O., Dean, A.M. & White, C.J. (1999). Analyzing service quality in the hospitality industry, Managing Service Quality, 9(2), 136-143.

- Meuter, M.L., Ostrom, A.L., Roundtree, R.I., & Bitner, M.J. (2000). Self-service technologies: understanding customer satisfaction with technology-based service encounters. Journal of marketing, 64(3), 50-64.

- Narayanasamy, K., Rasiah, D. & Tan, T.M. (2011). The adoption and concerns of e-finance in Malaysia, Electronic Commerce Research, 34(3), 383-400.

- Nunnally, J.C., & Bernstein, I.H. (1994). Psychometric theory (3rd ed.). New York, NY: McGraw-Hill, Inc.

- Pandey, D. & Joshi, P.R. (2010). Service Quality and Customer Behavioral Intentions: A Study in the Hotel Industry, California Journal of Operations Management, 8(2), 72-81.

- Parasuraman, A., & Grewal, D. (2000). The impact of technology on the quality-value-loyalty chain: a research agenda. Journal of the academy of marketing science, 28(1), 168-174.

- Parasuraman, A., Zeithaml, V.A., & Berry, L.L. (1988). Servqual: A multiple-item scale for measuring consumer perc. Journal of Retailing, 64(1), 12-40.

- Parasuraman, A., Zeithaml, V.A., & Berry, L.L. (1985). A conceptual model of service quality and its implications for future research. Journal of Marketing, 49(4), 41-50.

- Paul, J., & Trehan, R. (2011). Enhancing customer base and productivity through e-delivery channels–study of banks in India. International Journal of Electronic Marketing and Retailing, 4(2-3), 151-164.

- Rahim, M., Mahamad, O., & Ramayah, T. (2010). Service quality, customer satisfaction and loyalty: A test of mediation. International Business Research, 3(4), 72.

- Sangeetha, J., & Mahalingam, S. (2011). Service quality models in banking: a review. International Journal of Islamic and Middle Eastern Finance and Management, 4(1), 83-103.

- Santos, J. (2003). E-service quality: a model of virtual service quality dimensions. Managing Service Quality: An International Journal, 13(3), 233-246.

- Seth, N., Deshmukh, S.G., & Vrat, P. (2005). Service quality models: a review. International Journal of Quality & Reliability Management, 22(9), 913-949.

- Shankar, A., (2018). The influence of e-banking service quality on customer loyalty: A moderated mediation approach. International Journal of Bank Marketing. https:// doi.org/10.1108/IJBM-03-2018-0063

- Shekarchizadeh, A., Rasli, A., & Hon-Tat, H. (2011). SERVQUAL in Malaysian universities: perspectives of international students. Business Process Management Journal, 17(1), 67-81.

- Tan, M., & Teo, T.S. (2000). Factors influencing the adoption of Internet banking. Journal of the Association for Information Systems, 1(1), 5.

- Van Riel, A.C., Liljander, V., & Jurriens, P. (2001). Exploring consumer evaluations of e-services: a portal site. International Journal of Service Industry Management, 12(4), 359-377.

- Vaughan, E., & Woodruffe-Burton, H. (2011). The disabled student experience: does the SERVQUAL scale measure up?. Quality Assurance in Education, 19(1), 28-49.

- Zeithaml, V.A. (2002). Service excellence in electronic channels. Managing Service Quality: An International Journal, 12(3), 135-139.

- Zeithaml, V.A., Berry, L.L., & Parasuraman, A. (1996). The behavioral consequences of service quality. Journal of Marketing, 60(2), 31-46.

- Zhao, B.H. (2007). An Empirical Assessment and Application of SERVQUAL in a Mainland Chinese Department Store, Total Quality Management, 13(2), 241-254.